Blue Hydrogen Market Overview

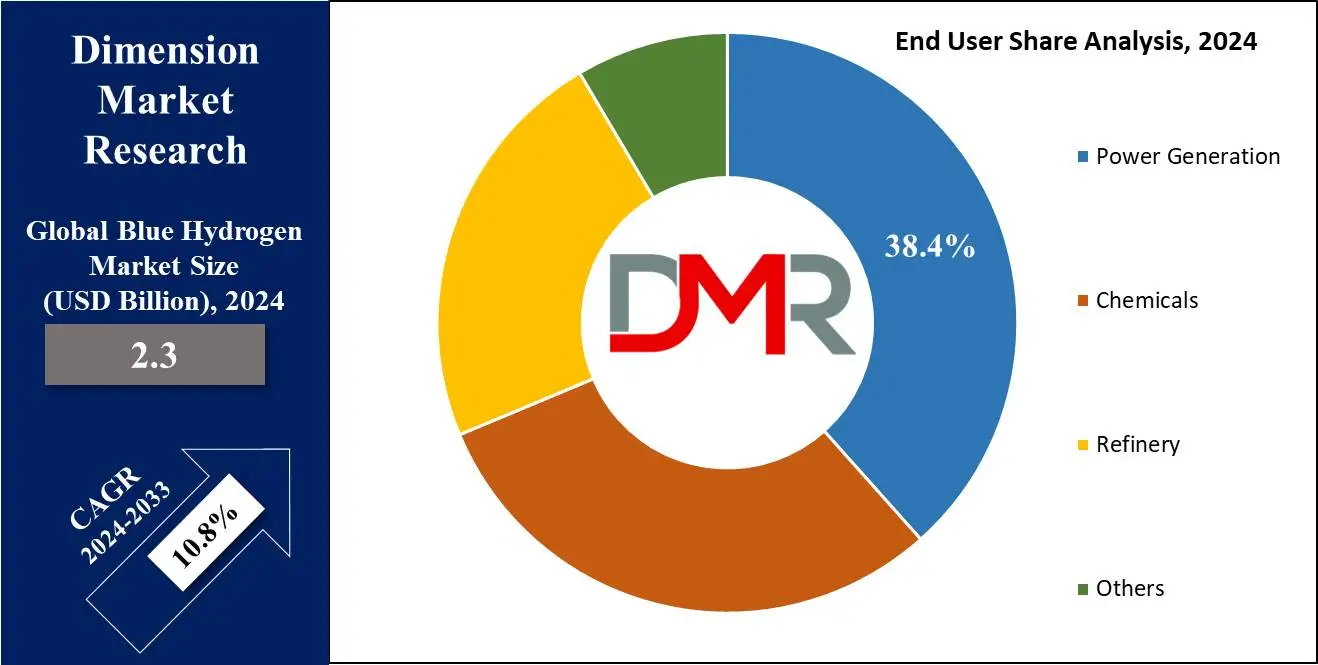

The Global Blue Hydrogen Market is expected to reach a valuation of USD 2.3 billion in 2024 and is anticipated to achieve a remarkable CAGR of 10.8% for the forecast period to reach a value of 5.5 billion in 2033.

Blue hydrogen is created from natural gas and backed by carbon capture and storage. The CO₂ produced during the production process is gathered and permanently stored. As a result, low-carbon hydrogen is produced that emits no CO₂.

Hydrogen is produced using numerous technologies, like steam methane reforming, partial oil oxidation, and auto-thermal reforming. The growing integration of green technology & sustainability practices is also influencing production methods.

Most hydrogen produced at present is used in petroleum refineries and fertilizer manufacturing. Approximately 99% of it comes from fossil fuel reformation, which is the most affordable approach.

Yet, this has no meaningful climate advantages because CO₂ is emitted throughout the process. Some producers are exploring synergy with green ammonia and synthetic natural gas projects to diversify applications.

Key Takeaways

- Market Growth: The Blue Hydrogen Market size is expected to grow by 3.0 billion, at a CAGR of 10.8% during the forecasted period of 2025 to 2033.

- By Technology: The steam methane reforming (SMR) segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Transportation Mode: Pipeline transportation mode is expected to lead the Blue Hydrogen market in 2024.

- By End User: The power generation segment is expected to get the largest revenue share in 2024 in the Blue Hydrogen market.

- Regional Insight: North America is expected to hold a 41.2% share of revenue in the Global Blue Hydrogen Market in 2024.

- Use Cases: Some of the use cases of Blue Hydrogen include industrial processes, transportation, and more.

Use Cases

- Industrial Processes: Blue hydrogen can be utilized as a clean energy source for industries like steel, cement, & chemical manufacturing, minimizing their carbon footprint. Its integration with specialty chemicals, hydrogen peroxide, and oilfield chemicals production is expanding.

- Power Generation: It can be used in power plants to generate electricity with fewer emissions compared to fossil fuels, helping in the transition to a low-carbon energy system. The technology supports innovations like virtual power plant networks and power purchase agreements.

- Transportation: Blue hydrogen can operate hydrogen fuel cell vehicles, including cars, buses, and trucks, providing a sustainable alternative to gasoline and diesel. It also complements the CNG powertrain and biofuel systems, enhancing energy diversification.

- Heating: It can be used for residential and commercial heating, providing a cleaner substitute for natural gas and helping to reduce greenhouse gas emissions in the heating sector through energy storage and micro combined heat and power technologies.

Blue Hydrogen Market Dynamics

Driving Factors

Abundant Natural Gas Reserves

The availability of large natural gas reserves, mainly in regions like North America, provides an affordable feedstock for blue hydrogen production, driving market growth. These reserves are also critical for gasification and biorefinery integration strategies.

Government Climate Policies

Ambitious climate targets and supportive government policies, like those focused on for net-zero emissions and promoting clean energy adoption, are accelerating investments and development in the blue hydrogen market.

Restraints

High Production Costs

The process of capturing & storing

carbon dioxide during blue hydrogen production can be costly, making blue hydrogen less competitive in comparison to other energy sources.

Infrastructure Development

Ambitious climate targets and supportive government policies, like those focused on net-zero emissions and promoting clean energy adoption, are accelerating investments in the blue hydrogen market. Initiatives in

climate risk management and low-GWP refrigerants are further supporting this growth.

Opportunities

Technological Advancements

Innovations in carbon capture and storage (CCS) technologies can minimize production costs and enhance the efficiency of blue hydrogen. Integration with artificial intelligence in oil and gas and generative AI in oil and gas is expected to optimize production processes.

Export Potential

Countries with abundant natural gas resources and established infrastructure, like the U.S., have major opportunities to export blue hydrogen to regions with high clean energy demand, especially within the Kingdom of Saudi Arabia (KSA) and Asian markets.

Trends

Increased Investment in Carbon Capture

There is a major trend of investing in advanced CCS technologies to enhance efficiency and reduce the costs of blue hydrogen production, making it more commercially viable alongside photovoltaic and wind power generator projects.

Government Incentives and Subsidies

Many governments are launching incentives and subsidies for blue hydrogen projects, encouraging private sector investment and accelerating the development of solar panel recycling and green mining ecosystems.

Blue Hydrogen Market Research Scope and Analysis

By Technology

The blue hydrogen market is segmented by technology into steam methane reforming (SMR), gas partial oxidation, and auto thermal reforming, among which SMR is expected to dominate the market in 2024 due to the high demand for low-carbon fuels, which capture & store the carbon dioxide produced during hydrogen generation, protecting greenhouse gas emissions.

As a result, SMR is considered the preferred technology for producing blue hydrogen, as it provides an environmentally friendly alternative by effectively reducing carbon emissions.

Auto thermal reforming (ATR) is also expected to grow significantly due to its affordability and better energy efficiency. ATR combines elements of gas partial oxidation and SMR, converting natural gas and other hydrocarbons into syngas through a blend of steam reforming & partial oxidation.

While gas partial oxidation includes a smaller reactor and faster reactivity, it initially produces less hydrogen per unit of fuel compared to SMR. Still, it is widely used by major players like Shell Group, which employs Shell Gas Partial Oxidation (SGP) technology in blue hydrogen production and maintains over 30 active gasification licenses.

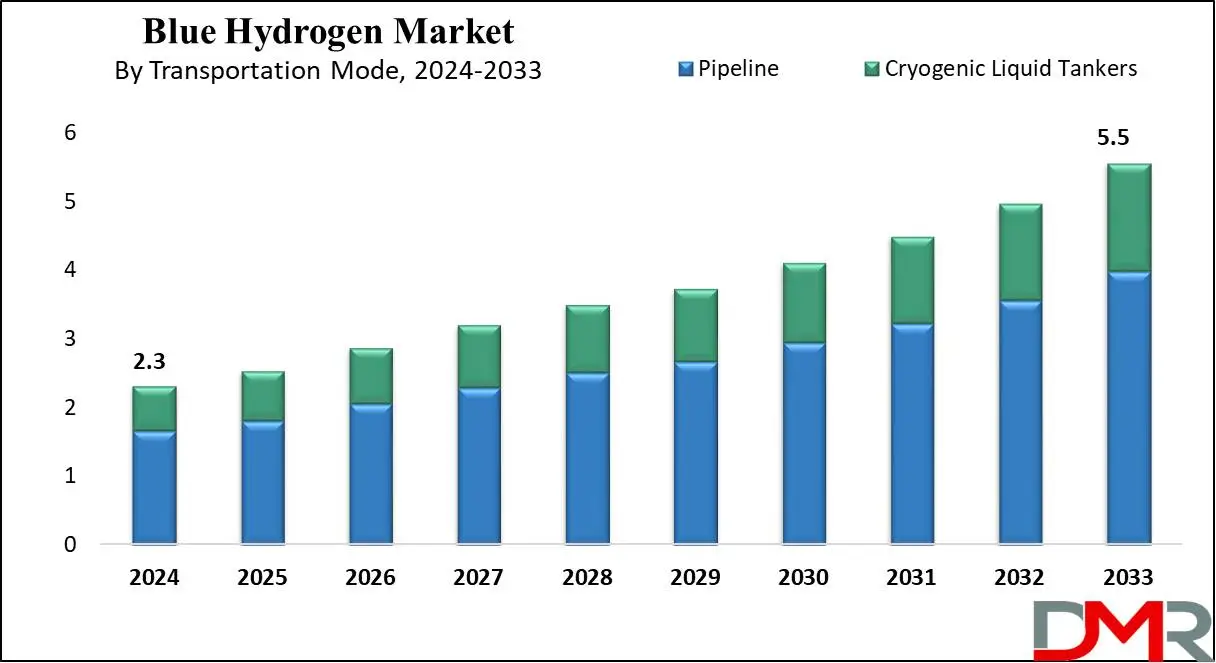

By Transportation Mode

In terms of transportation mode, the blue hydrogen market is divided into pipeline and cryogenic liquid tanker transportation modes. Pipeline transportation is expected to generate the highest revenue in 2024 due to its capacity to move high volumes of gaseous blue hydrogen over long distances affordably, which is particularly beneficial in regions with concentrated high-demand industries like chemical manufacturing, refineries, and power plants.

Further, Cryogenic liquid tanker transportation is expected to grow significantly during the forecast period, mainly in countries like India and Brazil, where blue hydrogen production and consumption are lower. These tankers transport liquid blue hydrogen over long distances, making them ideal for areas lacking pipeline infrastructure.

In addition, the cost of transporting blue hydrogen through cryogenic tankers is lower than pipeline transportation, enhancing their appeal to end-use industries, which is affordable and provides flexibility to drive the increased demand for cryogenic liquid tankers.

By End User

The blue hydrogen generation market is segmented by end users into chemical, refinery, power generation, and others. In 2024, the power generation segment is anticipated to have the largest revenue share, as major industry players like Equinor ASA are focused on decarbonizing their power systems and reducing dependence on fossil fuels. Blue hydrogen, a low-carbon alternative, assists in decarbonizing power generation plants, promoting its use in this sector.

Further, Blue hydrogen also supports the preservation of renewable energy into storable and transportable fuels. It is used in coal-fired power stations and gas turbines to lower carbon emissions, increasing its need for power generation.

Moreover, the refinery segment is expected to grow at a high rate during the forecast period, as petrochemical companies like Exxon Mobil Corp. use steam methane reforming technology to produce hydrogen for their oil and petroleum refineries.

The Blue Hydrogen Market Report is segmented based on the following

By Technology

- Steam Methane Reforming

- Gas Partial Oxidation

- Auto Thermal Reforming

By Transportation Mode

- Pipeline

- Cryogenic Liquid Tankers

By End User

- Power Generation

- Chemicals

- Refinery

- Others

Blue Hydrogen Market Regional Analysis

North America is expected to lead the blue hydrogen market in 2024

with a share of 41.2% due to its large natural gas reserves and higher demand for low-carbon energy. The USA, as the top producer of natural gas globally, and Canada, which follows closely, are well-positioned to use these resources for conserved blue hydrogen production.

The region's push for sustainable energy is fueled by ambitious climate targets, like the ones set by California and New York, and Canada's goal of net-zero emissions by 2050. Furthermore, North America's developed advanced infrastructure for natural gas production, transportation, and distribution can encourage to creation of blue hydrogen projects more efficiently and cost-effectively, which not only supports domestic production but also improves the potential for the United States to export blue hydrogen to countries like Japan and South Korea, which are investing heavily in hydrogen infrastructure.

Further, the Asia Pacific region is expected to be the fastest-growing market for blue hydrogen, driven by higher energy demands and proactive government policies promoting clean energy, where China stands out with its high investments in hydrogen infrastructure and a strong commitment to achieving carbon neutrality by 2060.

Also, other countries in the region, like Japan and South Korea, are expected to drive market growth with their robust efforts in developing hydrogen infrastructure. Despite the promising outlook, the blue hydrogen market is still in its infancy, and its growth will depend on numerous factors, like government policies, infrastructure development, and its cost competitiveness against other energy sources.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Blue Hydrogen Market Competitive Landscape

The competitive landscape of the blue hydrogen market is characterized by high investments from major energy companies focused on reducing carbon emissions. These companies are adopting advanced technologies for efficient hydrogen production & carbon capture.

The market is also experiencing strategic partnerships and collaborations to improve infrastructure and distribution networks. With government incentives & growing environmental concerns, industry players are aiming for scalable and affordable solutions to gain a competitive edge in the evolving blue hydrogen market.

Some of the prominent players in the Global Blue Hydrogen Market are

- Royal Dutch Shell Plc

- Siemens Energy Inc

- Reliance Industries

- Saudi Aramco

- Cummins Inc

- Linde Plc

- Suncor Energy Inc

- Air Products Inc

- Air Liquide

- ATCO Ltd

- Other Key Players

Recent Developments

- In March 2024, MMEX Resources took a major step with its green hydrogen project, submitting a proposal on January 2024, to a Super Major Petroleum and Chemical Company as part of a Call for Tender issued on September 14, 2023. The submission, which focuses on the supply of high volumes of green hydrogen annually, has progressed to the next bid round as of February 2024, which includes collaboration with industry leaders such as Siemens Energy for electrolysis technology and Texas Pacifico & Union Pacific for rail transport, among others.

- In February 2024, BP and BASF announced that the companies signed a license agreement for the use of BASF’s gas treating technology, OAS® white, to capture carbon dioxide (CO2) generated during hydrogen production at BP’s proposed blue hydrogen facility in Teesside, H2Teesside, as it has been supporting H2Teesside since Autumn 2023 and their engineering delivery package is already well advanced.

- In July 2023, Germany’s upgraded hydrogen strategy introduced a focus on imports from Denmark and Norway while securing “blue hydrogen” production from fossil gas using CCS technology to mitigate the related emissions. Clean-burning hydrogen fuel is anticipated to play a significant role in Germany’s energy transition as a feedstock for steelmaking and the chemicals industry, along with heavy-duty transport.

- In February 2023, Linde announced plans to build a USD 1.8 billion blue hydrogen facility on the Texas Gulf Coast, created to supply ammonia production. The blue hydrogen plant located in Beaumont, Texas, is slated to begin production in 2025. Its primary off-taker will be OCI, the Dutch fertilizer manufacturer currently creating a blue ammonia facility in Beaumont, expected to produce 1.1 million mt/year of ammonia.

Blue Hydrogen Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 2.3 Bn |

| Forecast Value (2033) |

USD 5.5 Bn |

| CAGR (2024-2033) |

10.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Steam Methane Reforming, Gas Partial Oxidation, and Auto Thermal Reforming), By Transportation Mode (Pipeline and Cryogenic Liquid Tankers), By End User (Power Generation, Chemicals, Refinery, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Royal Dutch Shell Plc, Siemens Energy Inc, Reliance Industries, Saudi Aramco, Cummins Inc, Linde Plc, Suncor Energy Inc, Air Products Inc, Air Liquide, ATCO Ltd, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Blue Hydrogen Market size is expected to reach a value of USD 2.3 billion in 2024 and is expected to reach USD 5.5 billion by the end of 2033.

North America is expected to have the largest market share in the Global Distribution Transformer Market with a share of about 41.2% in 2024.

Some of the major key players in the Global Blue Hydrogen Market are Royal Dutch Shell Plc, Siemens Energy Inc., Reliance Industries, and others.

The market is growing at a CAGR of 10.8 percent over the forecasted period.