Market Overview

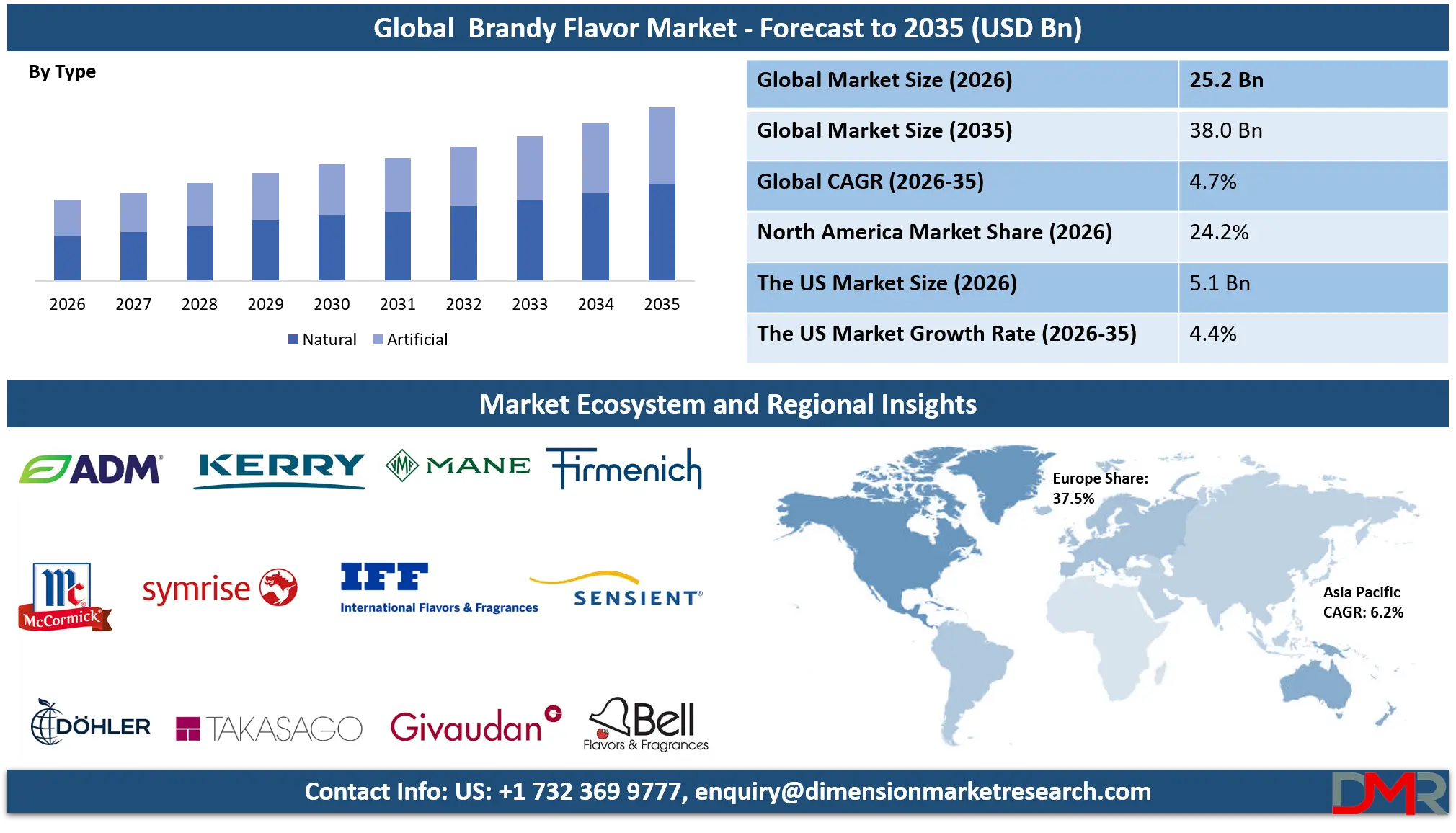

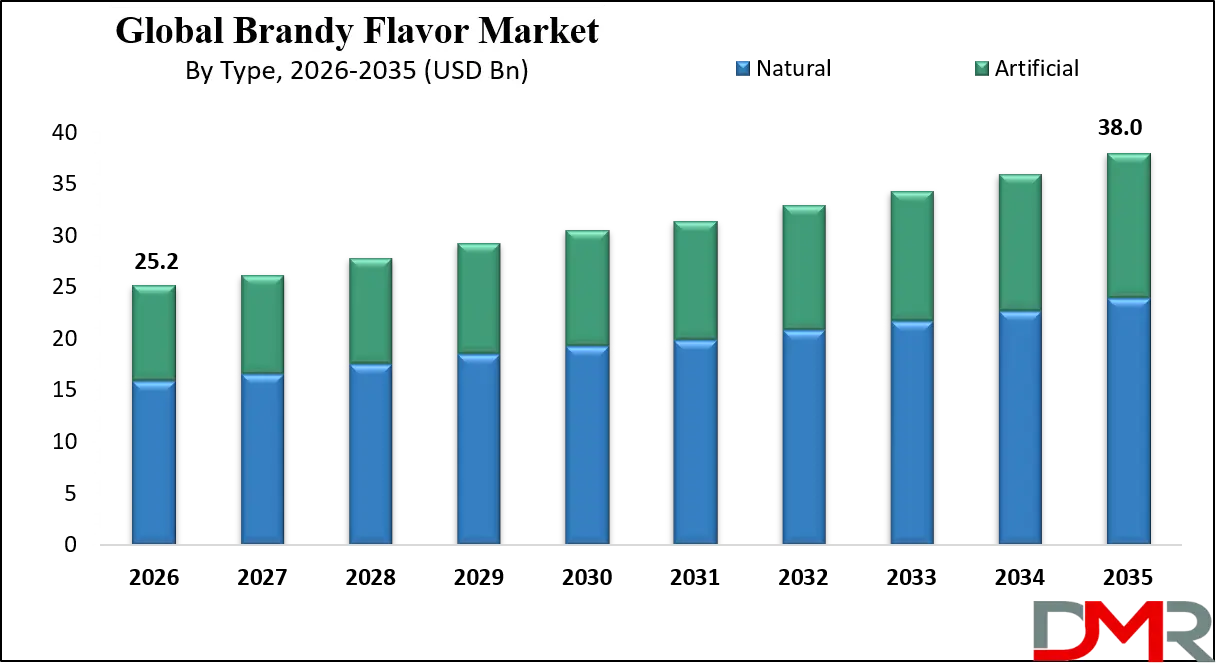

The global Brandy Flavor market is projected to reach USD 25.2 billion in 2026 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2026 to 2035, reaching an estimated USD 38.0 billion by 2035. This sustained growth trajectory is fueled by the increasing consumer demand for premium and sophisticated taste experiences across multiple product categories. Brandy flavor, characterized by its rich, complex notes of oak, vanilla, dried fruit, and spice, represents a paradigm shift from basic sweeteners to nuanced, adult-oriented flavor profiles, seamlessly merging indulgence with perceived quality.

Unlike single-note flavorings, brandy flavors are multifunctional taste enhancers that impart depth, warmth, and maturity to products while often serving as a key differentiator in crowded markets. This dual function enhances product appeal and allows for premium positioning. The market's expansion is underpinned by a powerful confluence of drivers: the rising popularity of craft and artisanal food & beverages, growing consumer interest in "alcohol-inspired" non-alcoholic alternatives, technological advancements in flavor encapsulation and extraction, and the global premiumization trend across consumables.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The evolution of brandy flavor is characterized by rapid diversification in formulation and application. Innovations such as cold-press extraction techniques preserving delicate top notes, spray-dried flavor powders for dry mix applications, and clean-label, natural flavor solutions are unlocking new product development possibilities. Concurrently, digitalization through AI-driven flavor matching and predictive consumer preference analytics is streamlining R&D, optimizing flavor profiles for target demographics, and enabling faster time-to-market.

While the market faces headwinds from volatile raw material costs (especially for natural cognac and Armagnac extracts), stringent regulatory landscapes for flavor labeling, and the need for specialized R&D expertise, the long-term value proposition is compelling. Cost-in-use for high-impact flavorings is favorable, and its value extends beyond taste to include enhanced brand premiumness, flavor stability, and regulatory compliance. Supported by robust consumer trends like the "sober curious" movement and the premiumization of at-home dining, brandy flavor is transitioning from a niche ingredient to a mainstream component of sophisticated product development, positioning itself as a central pillar of the global flavor and fragrance industry through 2035.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

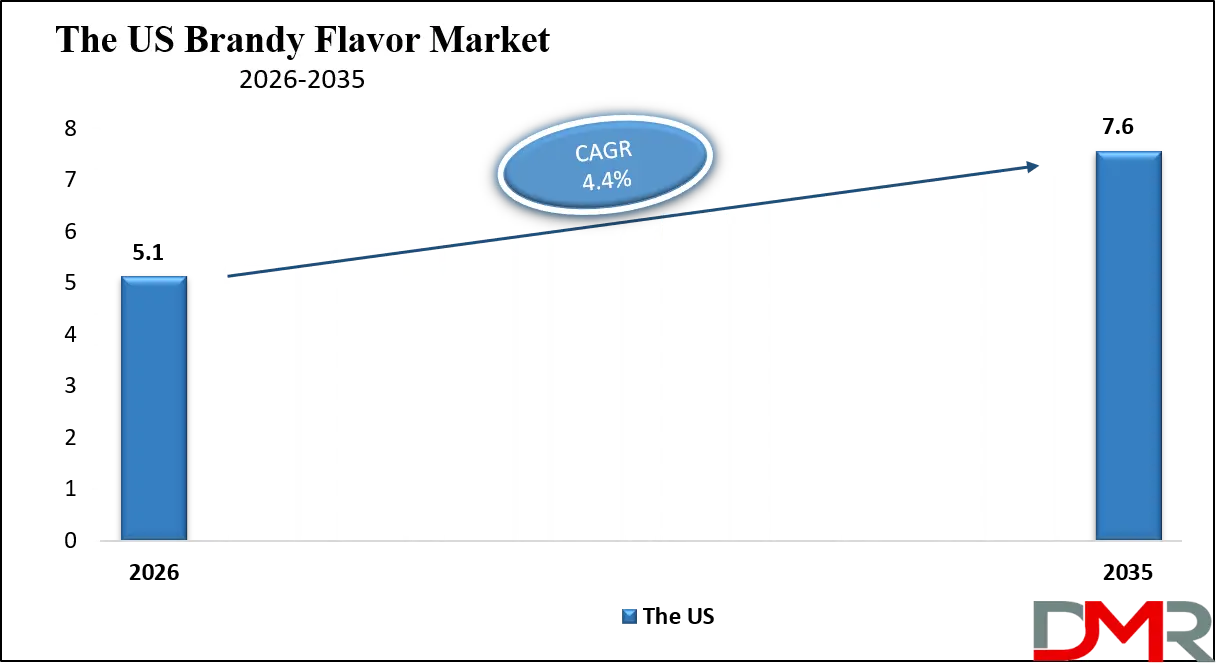

The US Brandy Flavor Market

The U.S. Brandy Flavor Market is projected to reach USD 5.1 billion in 2026 and grow at a CAGR of 4.4%, reaching USD 7.6 billion by 2035. The United States market is a dynamic engine of innovation and adoption, driven by a potent mix of culinary experimentation, the non-alcoholic beverage boom, and a mature, trend-sensitive food industry. The growth of premium mocktails and spirit-free alternatives serves as a foundational catalyst, creating significant demand for complex, non-alcoholic flavor systems that mimic the depth of traditional spirits.

California continues to set the pace with its wine and culinary culture, which readily adopts and experiments with sophisticated flavors. Beyond consumer trends, a powerful driver is the foodservice sector's (HoReCa) continuous innovation in dessert menus, sauces, and signature beverages. Major restaurant chains, boutique bakeries, and craft soda manufacturers are increasingly specifying high-quality brandy flavors to create unique, signature offerings that command higher price points.

The innovation landscape is vibrant. Companies like International Flavors & Fragrances (IFF) and Givaudan are developing advanced natural flavor compounds that accurately replicate aged brandy notes without alcohol. Startups in the non-alcoholic spirit space are entirely built around sophisticated flavor blends featuring brandy as a core note. Furthermore, the convergence of brandy flavor with gourmet home cooking trends, premium ice creams, and luxury chocolates is creating a holistic ecosystem where this flavor profile enhances multiple indulgence occasions. This blend of consumer curiosity, culinary demand, and technological prowess solidifies the U.S. as a global leader in both brandy flavor innovation and commercial application.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Brandy Flavor Market

The Europe Brandy Flavor Market is projected to be valued at approximately USD 9.4 billion in 2026 and is projected to reach around USD 14.2 billion by 2035, growing at a CAGR of about 4.7% from 2026 to 2035. Europe is the established historical and quality leader in brandy flavor, with a market maturity built on centuries of brandy production (Cognac, Armagnac) and high culinary standards. The region's Protected Geographical Indication (PGI) status for its brandies creates a benchmark for authentic flavor profiles, driving demand for high-quality, natural extracts in premium applications.

National culinary traditions amplify this effect. France's unparalleled patisserie and confectionery sector utilizes brandy flavors in chocolates, creams, and desserts. Germany's traditional baked goods (like Stollen) and Italy's panettone and liqueur chocolates have long incorporated these flavors. Europe's strength lies in its integrated supply chain, where longstanding flavor houses (Firmenich, Symrise, Mane) collaborate closely with local distilleries to source authentic concentrates and develop region-specific applications.

The region also leads in the premiumization of everyday products. Brandy flavor is increasingly found in upscale dairy products (cream liqueur-style yogurts, brandy-infused butter creams), gourmet sauces, and ready-to-drink (RTD) coffee beverages. Furthermore, EU-funded research into sustainable extraction methods and biotechnology for flavor production consistently advances next-generation, clean-label solutions. This combination of deep-rooted culinary tradition, stringent quality expectations, and a culture of premium food production ensures Europe's sustained dominance in market value and high-end applications.

The Japan Brandy Flavor Market

The Japan Brandy Flavor Market is projected to be valued at USD 203 million in 2026. It is further expected to witness subsequent growth in the upcoming period, holding USD 268 million in 2035 at a CAGR of 3.2%.

Japan represents a niche yet stable market within the global brandy flavor industry. Demand in the country is primarily driven by the use of brandy flavors in premium food and beverage applications, including flavored alcoholic drinks, bakery products, confectionery, and desserts. Japanese consumers place strong emphasis on quality, authenticity, and refined taste profiles, which supports the continued adoption of sophisticated flavor formulations such as brandy.

The market benefits from Japan’s well-developed food processing and beverage industries, along with ongoing innovation in ready-to-drink beverages and Western-style desserts. Additionally, the influence of global culinary trends and premiumization has encouraged manufacturers to incorporate brandy flavors into both traditional and modern product offerings. However, the market remains relatively mature, with growth occurring at a moderate and steady pace rather than rapid expansion.

Compared with major regions such as Europe, Japan holds a smaller share of the global market, but it remains strategically important due to its high standards for flavor quality and consistency. Suppliers operating in Japan often focus on natural ingredients, clean-label formulations, and customization, aligning with local regulatory and consumer preferences.

Overall, the Japan brandy flavor market is characterized by stability, premium positioning, and gradual growth, offering reliable opportunities for flavor manufacturers targeting high-value applications rather than high-volume expansion.

Global Brandy Flavor Market: Key Takeaways

- Market Growth from Premiumization: The market is set to more than double from USD 25.2 billion in 2026 to USD 38.0 billion by 2035 (CAGR 4.7%), primarily driven by the global premiumization trend across food, beverage, and confectionery, where complex, adult-oriented flavors command higher margins.

- Non-Alcoholic Beverages as the Growth Frontier: The non-alcoholic beverage segment will exhibit the highest CAGR, fueled by the "sober curious" movement, demand for sophisticated zero-proof alternatives, and innovation in RTD mocktails and spirit-free aperitifs.

- Ingredient Diversification Beyond Natural Extracts: While natural brandy extracts maintain dominance in premium applications for authenticity, nature-identical and artificial flavors are capturing the large-scale, cost-sensitive FMCG segment due to their stability and competitive pricing.

- From Ingredient to Culinary Solution: The competitive edge is shifting from selling standalone flavors to providing application-specific solutions, complete with formulation support, stability testing, and matching flavor systems for different product matrices (high-fat, high-acid, baked).

- The Rise of Clean-Label and Sustainability: Leading manufacturers are increasingly focusing on natural flavor sourcing, organic certification, and sustainable production processes, responding to consumer demand for transparency and environmental responsibility.

Global Brandy Flavor Market: Use Cases

- Premium Non-Alcoholic Sparkling Wines: Brandy flavor is used to add the necessary depth, body, and aged character to alcohol-removed sparkling wines, creating a convincing and sophisticated celebratory alternative.

- Gourmet Sauce and Glaze Enhancement: High-end culinary sauces, pan sauces, and glazes for meats and desserts incorporate brandy flavor to build complexity and a restaurant-quality taste profile without the alcohol cook-off step.

- Luxury Confectionery Fillings: Artisan chocolatiers use natural brandy flavor in truffle ganaches, cream centers, and pralines to create adult-oriented, indulgent products with a nuanced flavor story.

- Dessert and Bakery Applications: Brandy flavor is infused into Christmas puddings, fruitcakes, tiramisu-style creams, and buttercream frostings to provide characteristic warmth and richness.

- Dairy and Ice Cream Innovation: Premium ice cream brands and dairy companies launch limited-edition flavors like "Brandy Butter," "Christmas Pudding," or "Cognac & Hazelnut," leveraging the flavor's association with comfort and indulgence.

Global Brandy Flavor Market: Stats & Facts

World Health Organization (WHO)

- Alcohol accounts for over 3 million deaths globally each year.

- Alcohol consumption represents over 5% of the global disease burden.

- Spirits account for a significant share of total alcohol intake in Europe.

- Recorded alcohol consumption is highest in the European region.

Eurostat (European Union Statistical Office)

- Over 70% of adults in the EU consume alcohol at least once a year.

- More than one-quarter of EU adults consume alcohol weekly.

- Spirits represent one of the top three alcohol categories in value sales in the EU.

- Alcohol-related excise duties generate tens of billions of euros annually for EU governments.

Food and Agriculture Organization (FAO – United Nations)

- Global fruit production exceeds 900 million metric tons annually, supporting distilled spirit inputs.

- Grapes remain one of the top fruit crops by economic value worldwide.

- Europe accounts for the largest share of global grape processing.

- Processed fruit derivatives are a key input in alcoholic flavor formulations.

United States Alcohol and Tobacco Tax and Trade Bureau (TTB)

- Distilled spirits are subject to federal excise taxation per proof gallon.

- Flavoring substances are regulated additives in distilled spirit formulations.

- Brandy is legally defined as a spirit distilled from wine or fermented fruit mash.

- Flavored spirits must meet labeling and formulation compliance standards.

US Department of Agriculture (USDA)

- Distilled spirits exports exceed multiple billions of dollars annually.

- Alcoholic beverages are among the top U.S. value-added agricultural exports.

- Flavoring ingredients fall under food safety and agricultural commodity oversight.

Codex Alimentarius Commission (FAO/WHO)

- Codex establishes international standards for food flavoring substances.

- Flavoring agents used in beverages must meet global safety thresholds.

- Alcoholic beverage flavorings are regulated under general food additive provisions.

European Food Safety Authority (EFSA)

- Flavoring substances must pass toxicological and exposure assessments.

- Only authorized flavor compounds may be used in food and beverages in the EU.

- Natural flavoring substances require source validation and purity standards.

International Organisation of Vine and Wine (OIV)

- Europe represents the largest share of global wine and brandy production.

- Wine-based spirits contribute significantly to value-added agricultural output.

- Aging and processing influence flavor profile development in brandy products.

Japan Ministry of Health, Labour and Welfare

- Alcoholic beverages are regulated under food sanitation laws.

- Flavor additives must comply with positive-list ingredient systems.

- Imported flavoring substances require safety documentation and approval.

World Trade Organization (WTO)

- Alcoholic beverages are among the most traded processed food products globally.

- Flavoring ingredients are classified under food preparation trade codes.

Global Brandy Flavor Market: Market Dynamic

Driving Factors in the Global Brandy Flavor Market

Premiumization and Experiential Consumption

Global consumer shift towards premium, authentic, and experiential food & beverage products is the primary driver. Consumers are seeking indulgence and sophistication, favoring products with complex, adult flavor profiles. This trend elevates brandy flavor from a niche ingredient to a key component in luxury chocolates, artisanal baked goods, craft sodas, and premium dairy, directly favoring its adoption.

Growth of the Non-Alcoholic and "Better-for-You" Segments

The rapid expansion of the non-alcoholic beverage sector and demand for "alcohol-inspired" experiences without alcohol create a massive new application area. Technological advancements in flavor masking and balancing allow for the creation of convincing, high-quality non-alcoholic spirits and ready-to-drink mocktails where brandy flavor is central.

Restraints in the Global Brandy Flavor Market

High Cost and Supply Volatility of Natural Inputs

The upfront cost of high-quality natural brandy extracts, especially those from specific regions like Cognac, remains significantly higher than standard flavorings. This presents a barrier for cost-sensitive manufacturers. Furthermore, the supply of these natural extracts is subject to the volatility of grape harvests and spirit production, creating pricing and availability risks.

Regulatory Complexity and Labeling Challenges

The brandy flavor market operates under a complex web of regional regulations defining "natural," "nature-identical," and "artificial." Navigating these rules for global product launches is costly and time-consuming. Mislabeling risks can lead to recalls and brand damage, creating caution among manufacturers.

Opportunities in the Global Brandy Flavor Market

Explosion of Plant-Based and Free-From Indulgence

The growing market for plant-based dairy and confectionery presents a colossal opportunity. Brandy flavor can add the necessary depth and "indulgent" character to vegan desserts, cheeses, and ice creams, helping overcome potential flavor gaps associated with plant-based ingredients.

Customization for Regional Taste Preferences

The opportunity exists to develop regionally tailored brandy flavor variants less sweet for European palates, more vanilla-forward for North America, or slightly spiced for certain Asian markets. This deep localization can drive adoption in high-growth emerging economies.

Trends in the Global Brandy Flavor Market

Hyper-Authenticity and Storytelling

The trend is moving beyond generic "brandy" notes to region-specific profiles (Cognac vs. Armagnac vs. Pisco), allowing for authentic flavor storytelling on packaging. Consumers are increasingly interested in the origin and craftsmanship behind the flavor.

Clean-Label and Processing Transparency

Demand is soaring for natural flavors with simple, recognizable sourcing stories (e.g., "Brandy Flavor from Cognac Grapes"). Techniques like cold-press extraction that avoid solvents are gaining prominence, aligning with clean-label demands.

Global Brandy Flavor Market: Research Scope and Analysis

By Type Analysis

Natural Brandy Flavors are projected to dominate the global market in value, holding an estimated 58.0% revenue share through the forecast period. This dominance is anchored in the unparalleled demand for clean-label, authentic ingredients from premium product manufacturers. Superior sensory profiles, capturing the full complexity of oak, fruit, and spice notes from actual spirit distillation, deliver the authenticity critical for high-end applications. Their use is a key marketing claim ("with natural brandy flavor") that supports premium positioning and resonates with discerning consumers. Furthermore, natural flavors benefit from the established supply chains of the European spirit industry, ensuring access to high-quality concentrates, though at a significant price premium.

Their primary application lies in products where authenticity is paramount, and cost is less sensitive. This includes luxury chocolates, premium ice creams, high-end non-alcoholic spirits, gourmet sauces, and artisanal baked goods. Continuous advancements in extraction and concentration technologies are improving yield and preserving volatile top notes, enhancing quality. While nature-identical and artificial flavors compete on cost and stability, natural brandy flavor's combination of regulatory favor (clean-label), marketing power, and authentic taste solidifies its position as the benchmark for quality in the market, particularly in new product development targeting affluent consumers.

By Form Analysis

Liquid brandy flavors are the undisputed dominant form segment in the global market, accounting for the majority of both volume and value consumption. Their leadership is rooted in superior versatility, ease of use, and seamless integration across a wide range of food and beverage applications. Liquid formats align closely with the market’s largest end uses, including alcoholic and non-alcoholic beverages, dairy products, sauces, and confectionery fillings. Their compatibility with existing liquid processing systems makes them the preferred choice for large-scale manufacturers.

From an R&D perspective, liquid brandy flavors serve as the primary development format. They allow for precise dosing, rapid sensory adjustment, and efficient scalability, which are critical during pilot trials and commercial production. In addition, liquid forms provide faster flavor release and more accurate replication of authentic brandy sensory profiles, including warmth, oak notes, and dried fruit nuances. These advantages make liquid flavors especially valuable in premium beverage formulations and high-margin applications.

The dominance of liquid formats is further reinforced by their familiarity and practicality within the HoReCa sector, where chefs, bartenders, and beverage developers rely on easy-to-blend flavor systems for customization and consistency. While Powdered and Encapsulated forms play essential roles in specific use cases such as dry mixes, bakery products, and shelf-stable formulations, their applications remain specialized rather than universal. These formats are typically selected for functional reasons such as heat stability or controlled release. Consequently, liquid brandy flavors remain the foundational and volume-leading format, shaping formulation standards and innovation priorities across the market.

By Functionality Analysis

The functionality of imparting Alcoholic Notes represents the dominant and defining segment of the brandy flavor market. This functionality is the core reason for the market’s existence, as brandy flavors are fundamentally designed to replicate the distinctive sensory characteristics of aged grape spirits. These include warmth, oak, vanilla, caramelized sugar, dried fruit, and subtle smoky undertones. Delivering an authentic alcoholic note without necessarily adding alcohol is the primary value proposition for both food and beverage manufacturers.

This functionality is particularly critical in applications such as spirits standardization, liqueurs, RTD cocktails, premium chocolates, and gourmet desserts, where consumers expect a recognizable and sophisticated brandy profile. The ability to consistently reproduce these complex sensory attributes at scale is a key driver of supplier differentiation and long-term customer relationships.

Secondary functionalities such as Flavor Masking and Aroma Enhancement play important but supportive roles. Flavor masking is increasingly used in challenging formulations, including plant-based foods, protein beverages, and functional nutrition products, where off-notes can interfere with desired sensory outcomes. Aroma enhancement is often employed to elevate or fine-tune the perception of the alcoholic note, adding depth and complexity without increasing dosage levels.

However, these functionalities exist to enable or optimize the delivery of the primary alcoholic note rather than replace it. The market’s innovation focus, sensory evaluation standards, and customer demand remain firmly anchored in the effective and authentic delivery of alcoholic brandy characteristics.

By Product Claim Analysis

The Natural product claim is the most dominant and influential segment in the brandy flavor market, shaping competitive strategy, R&D investment, and marketing communication across the industry. Natural positioning has become a baseline expectation in many developed markets, particularly in Europe and North America, where regulatory scrutiny and consumer awareness around ingredient sourcing are high. As a result, the pursuit of natural brandy flavors drives continuous innovation in extraction techniques, fermentation processes, and biotechnology-enabled flavor development.

The “Natural” claim often serves as an umbrella that encompasses related concepts such as clean-label, non-synthetic, and minimally processed, making it central to product marketability and premium pricing. Manufacturers increasingly prioritize natural certification to strengthen brand credibility and align with wellness-oriented consumer values, even in indulgent categories like confectionery and alcoholic beverages.

While No Alcohol Content is the fastest-growing claim segment, driven by the rapid expansion of non-alcoholic and low-alcohol beverages, it remains a functional subset rather than a strategic replacement for natural positioning. Similarly, Kosher and Halal certifications are critical for regulatory access and cultural compliance in specific regions but do not dictate overall market direction.

Ultimately, naturalness defines the competitive paradigm of the brandy flavor market. Whether achieved through traditional extraction, controlled fermentation, or advanced biotechnological methods, the Natural claim remains the primary lens through which value creation, innovation, and long-term differentiation are pursued.

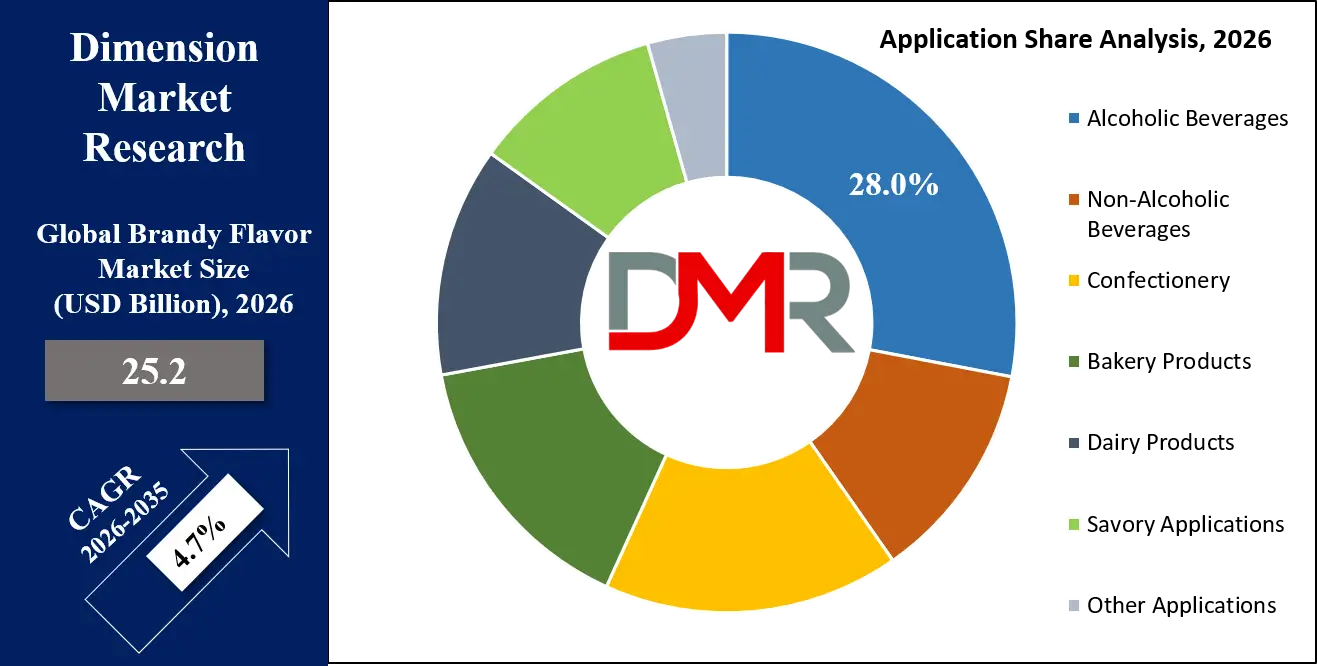

By Application Analysis

Alcoholic Beverages are poised to remain the largest application segment, expected to capture over 28.0% of the market revenue by 2030. The commercial logic is rooted in tradition and innovation: brandy flavor is used to enhance, standardize, or create new spirit categories. It functions as a key component in pre-mixed cocktails (RTDs), flavored spirits, and lower-ABV aperitifs, where it adds desired notes without the full cost and time of barrel aging.

This segment is the epicenter of flavor innovation for next-generation beverages. Driven by consumer desire for novelty and convenience, manufacturers are launching brandy-flavored cream liqueurs, brandy-cask-finished spirit alternatives, and sophisticated ready-to-drink formats. The technical requirement is high, requiring flavors that are stable in ethanol, resistant to oxidation, and harmonious with other ingredients. Consequently, flavors for alcoholic beverages command significant R&D investment, justified by their role in creating scalable, consistent, and innovative products that drive growth in the mature spirits market.

Confectionery ranks as the second-largest application segment and is a key driver of volume. It encompasses a wide range from mass-market hard candies and chocolates to premium artisan creations. The value here is in adding a mature, indulgent note that differentiates products from purely fruity or sweet offerings. The challenge has been achieving heat stability for applications like baked confections and cost-effective dosage for high-volume items.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Food & Beverage Manufacturers are anticipated to dominate the brandy flavor market, accounting for 68.3% of total revenue throughout the forecast period. This dominance is structurally inherent. These manufacturers, including global FMCG companies, dairy processors, confectionery giants, and beverage producers, possess the scale, R&D capability, and market reach to develop and launch products featuring complex flavors. They face intense competition and a need for continuous portfolio renovation, making unique flavors like brandy a critical tool for new product development (NPD).

Financially, these organizations have dedicated flavor procurement budgets and the technical staff to integrate specialized ingredients. They benefit from the brand equity and premium price points achievable with sophisticated flavor stories. The drive for clean-label and natural positioning provides additional impetus to source high-quality natural flavors. Large chocolate, bakery, and dairy corporations are leading the charge, specifying brandy flavor for seasonal and premium lines, thereby pulling the entire flavor supply chain forward.

The HoReCa (Hotels, Restaurants, Cafés) Sector is the second-largest end-user segment and exhibits strong growth potential. Demand is driven by the need for signature menu items, dessert specials, and unique beverage offerings. Pastry chefs and mixologists use brandy flavor (in liquid or powder form) to efficiently impart depth to sauces, mousses, glazes, and non-alcoholic cocktails, ensuring consistency and avoiding alcohol licensing issues in some applications.

The Global Brandy Flavor Market Report is segmented on the basis of the following:

By Type

- Natural

- Cognac Extract

- Armagnac Extract

- Other Brandy/Grape Spirit Extracts

- Artificial

By Form

- Liquid

- Powder

- Encapsulated

By Functionality

- Alcoholic Notes

- Flavor Masking

- Aroma Enhancement

By Product Claim

- Natural

- Clean-label

- No Alcohol Content

- Kosher/Halal Compliant

By Application

- Alcoholic Beverages

- Spirits & Liqueurs

- Ready-to-Drink (RTD) Cocktails

- Fortified Wines

- Non-Alcoholic Beverages

- Zero-Proof Spirits & Mocktails

- Craft Sodas

- Other Non-Alc Beverages

- Confectionery

- Chocolate

- Sugar Confectionery

- Gum

- Bakery Products

- Cakes, Pastries & Desserts

- Sweet Goods & Fillings

- Dairy Products

- Ice Cream & Frozen Desserts

- Yogurt & Creams

- Flavored Milk Drinks

- Savory Applications

- Sauces, Dressings & Glazes

- Prepared Meals

- Other Applications

By End User

- Food & Beverage Manufacturers

- HoReCa (Hotels, Restaurants, Cafés)

- Retail (Consumer Packaging)

Impact of Artificial Intelligence in the Global Brandy Flavor Market

- Predictive Flavor Profiling & Consumer Preference Mapping: Artificial Intelligence algorithms analyze vast datasets of consumer reviews, social media sentiment, and sales data to predict emerging taste preferences and optimize brand flavor profiles (e.g., more vanilla, less wood) for specific demographics and regions.

- Accelerated R&D through Generative Flavor Design: AI-powered platforms can model molecular interactions and suggest new flavor compound combinations or encapsulation methods to enhance stability in challenging applications like high-heat baking or acidic beverages.

- Supply Chain Optimization and Traceability: AI models forecast raw material (e.g., grape marc) availability and pricing volatility, optimizing procurement. Blockchain/AI integration creates transparent traceability from orchard to flavor concentrate.

- Quality Control via Machine Vision and E-Noses: Automated systems using machine vision and electronic nose sensors can continuously monitor production batches for flavor consistency and detect any deviation from the standard sensory profile, ensuring unparalleled quality control.

- Personalized Nutrition and Flavor Recommendation Engines: For B2C platforms or smart kitchen appliances, AI could recommend recipes or commercial products featuring brandy flavor based on a user's stated taste preferences, dietary restrictions, and past consumption behavior.

Global Brandy Flavor Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to dominate this market as it holds 37.5% of the market share in 2026, because it is the historic heartland of brandy production and consumption. The region possesses a critical combination of deep-rooted culinary traditions that incorporate brandy flavors, the highest concentration of premium spirit producers (Cognac, Armagnac), and consumers with a sophisticated palate for authentic taste. This creates a strong, established demand base across both artisanal and industrial segments.

Crucially, this cultural driver is reinforced by a stringent regulatory framework (PGI) that protects and promotes authentic regional flavors, creating a premium market for natural extracts. This environment has nurtured a mature ecosystem of world-leading flavor houses, specialist extract producers, and application experts. The revenue lead is thus built on a foundation of high-value transactions in the premium chocolate, patisserie, dairy, and beverage sectors, where authenticity commands a significant price premium.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific achieves the highest CAGR because it represents the planet's most powerful convergence of rapidly evolving consumer tastes and massive manufacturing scale. The region is home to the world's fastest-growing middle class, eager to adopt global, premium food experiences. This is compounded by the increasing Westernization of diets and the rise of social media-driven food trends, pushing sophisticated flavors to the top of product developers' agendas. The growth catalyst is the scale of local FMCG innovation.

While Europe's market is tradition and quality-led, Asia-Pacific's is volume-led and adaptation-focused. Local flavor manufacturers are adept at creating cost-optimized, crowd-pleasing brandy flavor variants for mass-market bakery, confectionery, and dairy products. However, this market is in a growth stage. Challenges like lower spending per unit on flavorings and a focus on value-engineering have initially capped the revenue per unit, but the sheer volume of applications makes it the fastest-growing region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Brandy Flavor Market: Competitive Landscape

The competitive landscape is dynamic and tiered, characterized by intense R&D focus and strategic specialization. Global Flavor & Fragrance Titans Companies like Givaudan, International Flavors & Fragrances (IFF), Firmenich, Symrise, and Mane leverage their massive R&D budgets, global application labs, and deep understanding of regional taste preferences. Their strategy is to offer a full portfolio from ultra-premium natural extracts to cost-effective compounded flavors, supported by comprehensive technical service.

Specialist natural extract producers, such as Döhler, Kerry Group, and Archer Daniels Midland (ADM) through its Wild Flavors division, compete on authenticity, sustainable sourcing, and clean-label solutions. They often have strong ties to agricultural raw material sources and focus on the premium segment of the market.

The competitive battleground is shifting from a purely ingredient-centric competition to a solutions-and-partnership competition. Winning requires: strong application expertise in key growth segments (e.g., non-alcoholic beverages, plant-based), a robust pipeline of clean-label and natural options, co-development partnerships with major manufacturers, and global regulatory support. Mergers and acquisitions, like F&F giants acquiring biotech startups for novel production methods, are ongoing as players strive to offer innovative and sustainable flavor solutions.

Some of the prominent players in the Global Brandy Flavor Market are:

- Givaudan SA

- International Flavors & Fragrances Inc. (IFF)

- Firmenich SA

- Symrise AG

- MANE

- Takasago International Corporation

- Sensient Technologies Corporation

- Kerry Group plc

- Döhler GmbH

- Archer Daniels Midland Company (ADM)

- T. Hasegawa Co., Ltd.

- Huabao International Holdings Ltd.

- McCormick & Company, Inc.

- Frutarom (IFF)

- Robertet SA

- Bell Flavors & Fragrances

- Treatt plc

- Synergy Flavors (Carbery Group)

- Wixon, Inc.

- Flavorchem Corporation

- Other Key Players

Recent Developments in the Global Brandy Flavor Market

- February 2026: Givaudan and a Major Cognac House Announce Exclusive Sourcing Partnership. The long-term agreement guarantees the supply of unique wine distillate for creating the most authentic natural Cognac flavor extracts for the premium food & beverage market.

- January 2026: IFF Launches "Zero-Proof Spirits Platform" with Signature Brandy Flavor Library. The new platform provides beverage manufacturers with pre-optimized flavor systems, including multiple brandy profile variants, specifically designed for alcohol-removed and spirit-free applications.

- December 2024: World's First AI-Designed Brandy Flavor for Vegan Dairy Launched. A European biotech startup, using generative AI, developed a novel nature-identical flavor compound that perfectly mimics aged brandy notes and remains stable in high-protein, plant-based dessert matrices.

- November 2024: Symrise Achieves Carbon-Neutral Certification for its Natural Flavor Extraction Line. The certification, including its brandy flavor extracts, responds to growing demand from CPG companies for ingredients that support their Scope 3 emission reduction goals.

- October 2024: The Flavor and Extract Manufacturers Association (FEMA) Publishes Updated GRAS Guidelines for Spirit-Type Flavors. The publication provides clearer pathways for the safety assessment of new and innovative flavor ingredients derived from or mimicking distilled spirits.

- September 2024: A Consortium of Chocolate Manufacturers Launches a Fund for Sustainable Brandy Flavor Sourcing. The $50 million fund is dedicated to supporting sustainable viticulture and distillation practices in the Cognac and Armagnac regions, ensuring long-term supply chain resilience for natural flavors.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 25.2 Bn |

| Forecast Value (2034) |

USD 38.0 Bn |

| CAGR (2025–2034) |

4.7% |

| The US Market Size (2025) |

USD 5.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Natural, Artificial), By Form (Liquid, Powder, Encapsulated), By Functionality (Alcoholic Notes, Flavor Masking, Aroma Enhancement), By Product Claim (Natural, Clean-label, No Alcohol Content, Kosher/Halal Compliant), By Application (Alcoholic Beverages, Non-Alcoholic Beverages, Confectionery, Bakery Products, Dairy Products, Savory Applications, Other Applications), By End User (Food & Beverage Manufacturers, HoReCa, Retail) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Givaudan SA, International Flavors & Fragrances Inc. (IFF), Firmenich SA, Symrise AG, MANE, Takasago International Corporation, Sensient Technologies Corporation, Kerry Group plc, Döhler GmbH, Archer Daniels Midland Company (ADM), T. Hasegawa Co., Ltd., Huabao International Holdings Ltd., McCormick & Company, Inc., Frutarom (IFF), Robertet SA, Bell Flavors & Fragrances, Treatt plc, Synergy Flavors (Carbery Group), Wixon, Inc., Flavorchem Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Brandy Flavor Market?

▾ The Global Brandy Flavor Market size is estimated to have a value of USD 25.2 billion in 2026 and is expected to reach USD 38.0 billion by the end of 2035.

What is the growth rate in the Global Brandy Flavor Market?

▾ The market is growing at a CAGR of 4.7 percent over the forecasted period of 2026 to 2035.

What is the size of the US Brandy Flavor Market?

▾ The US Brandy Flavor Market is projected to be valued at USD 5.1 billion in 2026. It is expected to reach USD 7.6 billion in 2035, growing at a CAGR of 4.4%.

Which region accounted for the largest Global Brandy Flavor Market?

▾ Europe is expected to have the largest market share in the Global Brandy Flavor Market, driven by its deep-rooted culinary traditions, premium spirit production, and demand for authentic, natural ingredients.

Who are the key players in the Global Brandy Flavor Market?

▾ Some of the major key players in the Global Brandy Flavor Market are Givaudan SA, International Flavors & Fragrances Inc. (IFF), Firmenich SA, Symrise AG, MANE, and Kerry Group plc, among others.