Market Overview

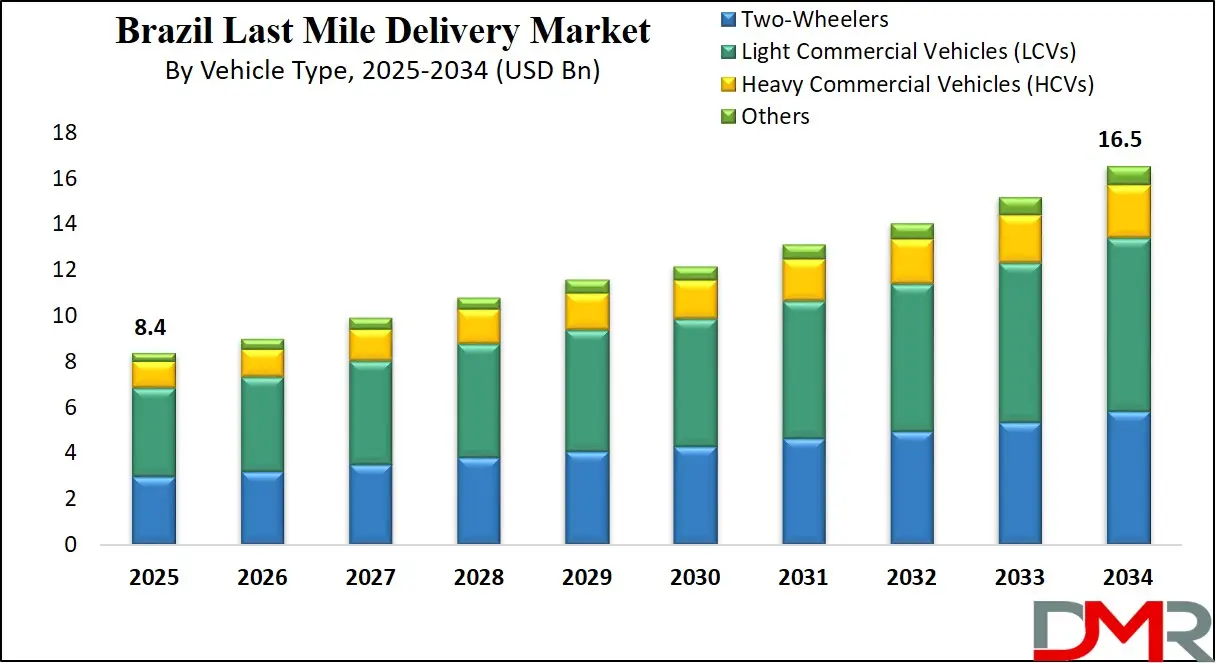

The Brazil last mile delivery market is projected to reach

USD 8.4 billion in 2025 and is anticipated to grow to

USD 16.5 billion by 2034, expanding at a

CAGR of 7.8%. Growth is driven by rising e-commerce penetration, urban logistics innovation, and increasing demand for fast and flexible delivery solutions.

Last mile delivery refers to the final stage of the supply chain process where goods are transported from a distribution hub or fulfillment center directly to the end consumer. It is a critical component of the logistics ecosystem, often determining the overall customer experience. This segment typically involves short-distance transportation and emphasizes speed, efficiency, and convenience. It includes a variety of delivery methods such as on-demand couriers, electric vehicles, and micro-fulfillment centers, especially in urban areas where traffic congestion and address density pose logistical challenges.

The growth of e-commerce and customer expectations for same-day or next-day delivery have significantly increased the importance of optimized last mile logistics. Companies operating in this segment continually invest in advanced routing algorithms, real-time tracking technologies, and alternative delivery solutions to meet rising consumer demands and reduce operational costs.

The Brazil last mile delivery market is rapidly evolving, fueled by surging e-commerce activity, urbanization, and increasing smartphone penetration. As one of Latin America's largest economies, Brazil's vast geography and uneven infrastructure present both opportunities and logistical complexities. The market encompasses a diverse range of delivery providers including national postal services, tech-driven startups, and established logistics companies, all competing to ensure faster and more reliable final-mile services. The rise of app-based ordering platforms, particularly in food and retail delivery, has expanded the scope of last-mile logistics beyond traditional courier services to include real-time, hyperlocal delivery models.

Innovative solutions such as crowdshipping, electric vehicle fleets, and drone experimentation are beginning to emerge in Brazil’s urban centers as firms attempt to overcome challenges related to congestion, high delivery costs, and poor road infrastructure in remote regions. The market is also shaped by regional consumer behaviors, with metropolitan areas like São Paulo and Rio de Janeiro leading adoption due to higher digital engagement and retail density. As sustainability becomes a key focus, green logistics practices and smart city initiatives are expected to play a growing role in shaping the future of last-mile delivery in Brazil.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Brazil Last Mile Delivery Market: Key Takeaways

- Market Value: The Brazilian last-mile delivery market size is expected to reach a value of USD 16.5 billion by 2034 from a base value of USD 8.4 billion in 2025 at a CAGR of 7.8%.

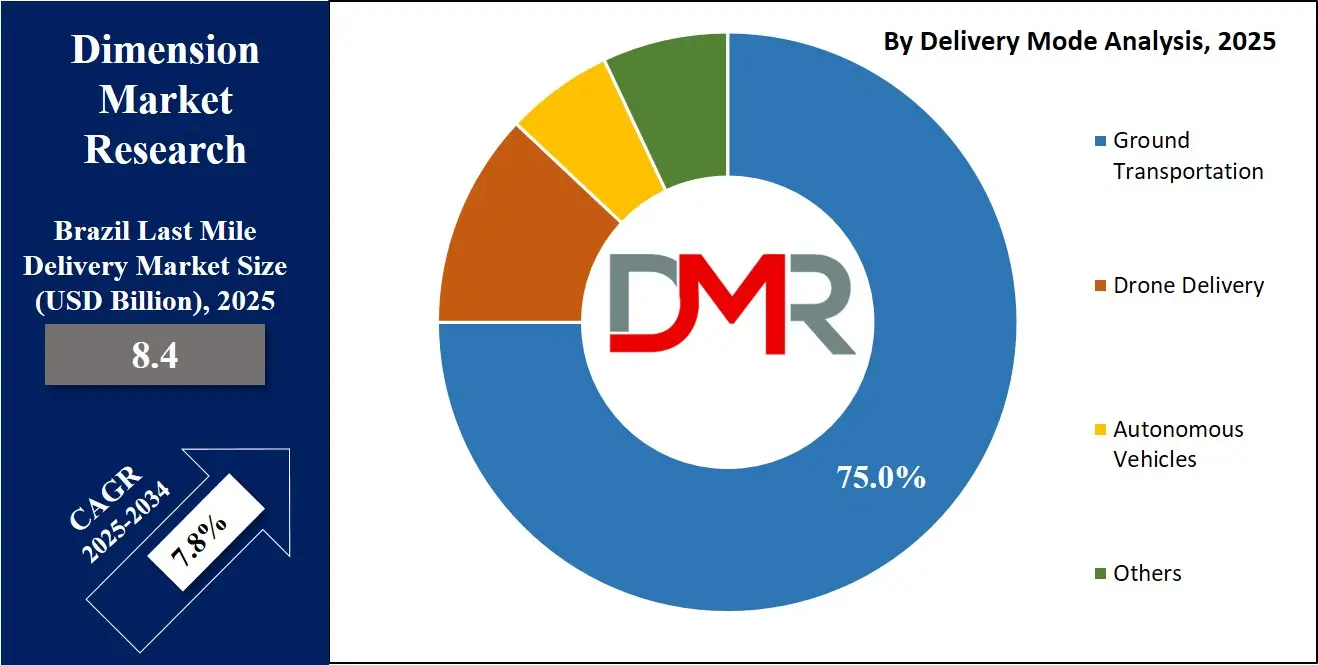

- By Delivery Mode Segment Analysis: Ground Transportation is anticipated to maintain its dominance in the delivery mode segment, capturing 75.0% of the total market share in 2025.

- By Vehicle Type Segment Analysis: Light Commercial Vehicles (LCVs) are poised to consolidate their dominance in the vehicle type segment, capturing 46.0% of the total market share in 2025.

- By Service Time Segment Analysis: B2C service types are expected to maintain their dominance in the service time segment, capturing 68.0% of the total market share in 2025.

- By Delivery Time Frame Segment Analysis: Next-day Delivery will lead in the delivery time frame segment, capturing 39.0% of the market share in 2025.

- By Application Segment Analysis: The E-commerce/Retail applications are anticipated to maintain their dominance in the application segment, capturing 57.0% of the total market share in 2025.

- By End-User Segment Analysis: Retail Customers will lead the end-user segment, capturing 63.0% of the market share in 2025.

- Key Players: Some key players in the Brazilian last-mile delivery market are Correios, iFood, Rappi, Zé Delivery, Total Express, Jadlog, Motoboy.com, Uello, Tembici, Yellow, Vuxx, Mottu, Courri, Flash Courier, Appétit Delivery, and Other Key Players.

Brazil Last Mile Delivery Market: Use Cases

- E-commerce Fulfillment in Urban Centers: With the explosive growth of online retail in Brazil, major cities like São Paulo, Rio de Janeiro, and Belo Horizonte have become critical hubs for e-commerce last-mile delivery. Retailers and marketplaces such as Magazine Luiza and Mercado Livre rely on a network of fulfillment centers and micro-warehouses strategically placed near high-demand zones. The use of route optimization software, real-time GPS tracking, and flexible delivery time slots allows for same-day or next-day delivery, catering to the rising expectations of Brazilian consumers. This urban logistics model reduces delivery time and cost per parcel while addressing traffic congestion through electric bikes and compact delivery vehicles.

- On-Demand Food and Beverage Delivery: Brazil’s vibrant food delivery ecosystem, driven by platforms like iFood, Zé Delivery, and Rappi, showcases the rapid evolution of hyperlocal last-mile logistics. These platforms leverage gig economy couriers and geo-mapping technologies to ensure under-30-minute delivery in metropolitan areas. The segment thrives on dynamic order batching, real-time delivery tracking, and AI-driven dispatching that matches demand spikes during lunch and dinner hours. Moreover, alcohol delivery services have become a fast-growing vertical, particularly in urban nightlife districts, driving further investments in temperature-controlled transport and rapid response logistics solutions.

- Logistics for Remote and Underserved Regions: Covering a vast and diverse territory, Brazil faces unique challenges in delivering to rural and remote areas, particularly in the North and Northeast. Companies like Correios and Jadlog serve these areas using hybrid delivery models that include river transport, drones (pilot projects), and contracted local couriers. These last mile delivery strategies aim to bridge infrastructure gaps while ensuring inclusivity in e-commerce access. For instance, multi-modal logistics chains are used to transport goods first by truck or boat and then by foot or motorcycle in hard-to-reach areas. This model ensures digital retail penetration in remote communities, supporting inclusive economic growth.

- B2B and Medical Supply Last Mile Services: Beyond B2C, the last mile delivery market in Brazil is expanding rapidly in the B2B and healthcare segments. Logistics providers like Total Express and Flash Courier have tailored services for delivering time-sensitive goods such as pharmaceuticals, lab samples, and medical devices. These services demand high compliance with cold chain logistics, secure handling, and GPS tracking for chain-of-custody verification. In densely populated healthcare zones, same-day delivery and scheduled routing are essential for clinics and pharmacies to maintain stock levels, especially for critical and high-value medications. This use case highlights the growing importance of reliability, traceability, and regulatory alignment in Brazil’s medical last mile delivery landscape.

Brazil Last Mile Delivery Market: Stats & Facts

- Instituto Brasileiro de Geografia e Estatística (IBGE – Monthly Survey of Services)

- Transportation services volume rose 0.5% in April 2025, contributing to a 0.2% overall increase in services compared to March 2025, marking the 13th consecutive monthly gain.

- In June 2024, transportation activity in services grew 1.8% month-over-month, pushing the services sector to its highest level on record—14.3% above pre-pandemic levels (February 2020).

- Between March and April 2024, the transportation segment increased 1.7%, driving a 0.5% monthly rise in overall services; inter-annual growth reached 5.6%.

- In April 2023, transportation services posted a 1.0% monthly increase, reflecting strong momentum in urban and regional logistics.

- IBGE (Regional Transport & Passenger Data)

- Passenger transportation volume (road, bus, air) grew 1.8% in April 2025 versus March, marking the third consecutive monthly increase and standing 4.6% above February 2020 levels.

- Cargo transportation volume declined 0.3% in April 2025 month-over-month but remained 34.8% higher than February 2020 levels.

- In April 2024, cargo transport volume rose 0.2%, with annual growth reaching 5.2%.

- Freight transportation activity stood 33.4% higher than pre-pandemic levels by the end of Q1 2024.

- IBGE (Service Sector Growth & Impact)

- The services sector rose 1.7% in June 2024 compared to May, driven by a 1.8% rise in transportation-related services.

- By July 2024, service activities linked to logistics had risen 13.1% compared to the same period in 2023.

- In March 2023, the transport segment accounted for over 30% of all service sector growth.

- Correios (Empresa Brasileira de Correios e Telégrafos)

- In 2021, Correios generated BRL 21.3 billion in revenue.

- Correios recorded BRL 3.7 billion in net income for the year.

- The company operated in all 5,570 Brazilian municipalities, showcasing complete national coverage.

- Correios employed approximately 109,000 staff across the country.

- Over 200 million deliveries were completed by Correios in urban centers in 2021.

- E-commerce and Logistics – IBGE & Public Data (E-bit Insight 2017)

- In H1 2017, 25.5 million Brazilian consumers made online purchases.

- Approximately 50 million orders were placed online during the same period, showing 10.3% year-over-year growth.

- 38% of online retailers in Brazil offered free standard shipping.

- The average delivery fee paid by consumers was BRL 29.93 per order.

- 84% of all orders in 2017 were fulfilled through home delivery.

- Nearly 70% of urban logistics firms stated that last-mile operations comprised over half of their operating costs.

Brazil Last Mile Delivery Market: Market Dynamics

Brazil Last Mile Delivery Market: Driving Factors

Surge in E-commerce and Mobile Shopping AdoptionBrazil’s booming e-commerce ecosystem, fueled by increasing smartphone penetration and digital payment adoption, is a key driver of last-mile delivery demand. Consumers in both urban and semi-urban areas are shifting toward mobile-first shopping behaviors, which has created pressure on retailers and logistics companies to offer faster, more flexible delivery options. Platforms like Mercado Livre and Magalu have significantly expanded their logistics networks to support this demand, accelerating the development of last-mile capabilities across major cities.

Growing Investments in Urban Logistics Infrastructure

Public and private sector investments in urban infrastructure, including smart traffic systems, local fulfillment hubs, and better road connectivity, are enhancing the efficiency of last mile delivery in Brazil. These developments reduce delivery times and logistics costs, particularly in densely populated areas. Companies are leveraging last-mile fleet management software and electric delivery vehicles to align with Brazil’s sustainability goals and optimize urban distribution networks.

Brazil Last Mile Delivery Market: Restraints

Infrastructure Gaps in Remote and Rural Areas

Brazil’s vast geography presents significant logistical challenges, particularly in northern and inland regions where road infrastructure is underdeveloped or inconsistent. Poor connectivity leads to delayed deliveries, increased fuel consumption, and higher operational costs for logistics providers. These limitations hinder service expansion beyond major urban centers and reduce the scalability of last mile operations in remote territories.

High Last Mile Delivery Costs

The cost of last mile logistics in Brazil remains one of the most expensive stages of the delivery cycle. Factors such as fuel price volatility, high vehicle maintenance costs, and complex route planning in traffic-heavy cities increase the burden on logistics companies. This cost intensity makes it difficult for small and medium-sized enterprises to offer competitive delivery services, impacting market participation.

Brazil Last Mile Delivery Market: Opportunities

Expansion of Hyperlocal Delivery Models

There is a rising opportunity to develop hyperlocal delivery networks in Brazil’s tier-2 and tier-3 cities. With increased internet access and consumer demand for rapid delivery in emerging markets like Goiânia and Curitiba, logistics startups can scale through crowdsourced delivery models and local courier partnerships. These localized ecosystems not only ensure faster delivery turnaround but also promote job creation through the gig economy.

Integration of Green Logistics and Electric Fleets

The growing environmental consciousness among Brazilian consumers and regulatory push toward emissions control are opening doors for sustainable last mile solutions. Logistics firms have the opportunity to invest in electric delivery bikes, low-emission vans, and eco-friendly packaging. Government subsidies and sustainability-driven brand loyalty further incentivize adoption of green logistics practices in the last mile segment.

Brazil Last Mile Delivery Market: Trends

Rise of Smart Warehousing and Micro-Fulfillment Centers

To speed up order fulfillment, many e-commerce players in Brazil are deploying micro-fulfillment centers within city limits. These compact storage hubs, often supported by automation and AI, allow for real-time inventory access and quicker dispatch to nearby locations. The trend reflects the shift toward decentralization in supply chain management, minimizing delivery windows and enhancing customer satisfaction.

Growing Use of AI and Route Optimization Technologies

Advanced technologies such as artificial intelligence, machine learning, and predictive analytics are becoming integral to Brazil’s last mile delivery operations. Companies are using route optimization tools to reduce travel time, fuel use, and delivery failures. Additionally, AI-driven customer communication systems help in managing real-time delivery updates and improving service transparency, aligning with the market’s demand for efficient and data-driven logistics solutions.

Brazil Last Mile Delivery Market: Research Scope and Analysis

By Delivery Mode Analysis

In Brazil’s last mile delivery market, ground transportation continues to dominate the delivery mode segment and is expected to account for approximately 75.0% of the total market share in 2025. This dominance is largely attributed to the country’s widespread use of motorcycles, vans, and trucks, which are well-suited for navigating the dense urban environments of cities like São Paulo, Rio de Janeiro, and Porto Alegre. Ground transportation offers flexibility in handling a wide range of parcel sizes and supports cost-effective delivery routes across both metropolitan and semi-urban areas. Moreover, the availability of local courier networks, combined with investments in route optimization technologies and electric vehicle adoption, is further enhancing the scalability and efficiency of ground-based last mile logistics.

On the other hand, drone delivery remains in its early stages in Brazil but is beginning to gain attention as an emerging segment with future potential. Though still limited by regulatory frameworks, infrastructure readiness, and weather dependencies, drones offer a promising solution for delivering lightweight goods in hard-to-reach or congested areas. Pilot projects have been initiated, particularly for use cases in rural regions or for urgent medical supply transport, where traditional ground delivery is slow or costly. As drone technology advances and airspace regulations evolve, this mode could gradually complement existing delivery systems, especially in areas where traditional logistics face significant bottlenecks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Vehicle Type Analysis

In Brazil’s last mile delivery market, light commercial vehicles (LCVs) are set to maintain a strong hold on the vehicle type segment, accounting for an estimated 46.0% of the total market share in 2025. These vehicles, including vans and small trucks, are favored for their ability to transport larger volumes of goods while navigating urban road networks efficiently. LCVs are particularly well-suited for e-commerce deliveries, B2B logistics, and retail distribution within city limits. Their cargo capacity, fuel efficiency, and relatively low operating costs make them a practical choice for mid-size delivery operations. Additionally, companies are increasingly incorporating electric and hybrid LCVs into their fleets to align with sustainability goals and reduce emissions in crowded metropolitan areas.

Two-wheelers, especially motorcycles, play a crucial role in Brazil’s fast-paced last mile ecosystem, particularly for food delivery, small parcel drop-offs, and on-demand courier services. Their agility in maneuvering through congested traffic and ability to access narrow urban alleys make them ideal for time-sensitive and short-distance deliveries. Platforms like iFood, Rappi, and Zé Delivery heavily rely on motorcycles to meet customer expectations for rapid service, especially in high-density urban zones. The low initial investment and maintenance cost of two-wheelers also make them a popular option among gig economy drivers, further fueling their widespread use in Brazil’s dynamic last mile delivery network.

By Service Type Analysis

In the Brazil last mile delivery market, B2C service types are projected to lead the service time segment, commanding around 68.0% of the total market share in 2025. This dominance is largely driven by the rapid growth of e-commerce, online grocery, and food delivery platforms, which cater directly to end consumers. The increasing demand for fast, reliable, and flexible home delivery options has encouraged retailers and logistics providers to prioritize direct-to-customer operations.

With consumers expecting same-day or next-day service, especially in major urban centers, B2C delivery models have evolved to include real-time tracking, delivery slot scheduling, and mobile-based interaction. The convenience and personalization of B2C logistics have made it the preferred service model, especially as digital shopping continues to expand across Brazil’s population.

In contrast, the B2B segment in last mile delivery, while smaller in share, plays a vital role in maintaining supply chains across industries such as retail, healthcare, and manufacturing. B2B last mile services typically involve the scheduled or on-demand delivery of goods between businesses, such as restocking retail outlets, supplying pharmacies, or distributing office equipment. These deliveries often require higher reliability, bulk transportation, and strict adherence to delivery windows.

Though not as fast-paced as B2C, the B2B segment demands operational precision and often includes value-added services such as warehousing support and reverse logistics. As digital supply chain integration and just-in-time inventory models gain traction in Brazil, the B2B last mile delivery segment is expected to witness steady growth, supported by technology adoption and rising inter-business commerce.

By Delivery Time Frame Analysis

Next-day delivery is set to dominate Brazil’s last mile delivery market in the delivery time frame segment, accounting for approximately 39.0% of the total market share in 2025. This growth reflects the balance between consumer demand for fast service and the operational feasibility for logistics providers. Next-day delivery has become the standard expectation for a wide range of online purchases, particularly in electronics, fashion, and household products. Major e-commerce players and retailers are investing in regional distribution centers and advanced inventory management systems to ensure consistent next-day service across key metropolitan areas. The model offers a practical compromise, allowing companies to optimize routes and control costs while still meeting customer expectations for timely deliveries.

Same-day delivery, while representing a smaller portion of the market, is gaining momentum, particularly in dense urban areas where consumers prioritize speed and convenience. This delivery model is widely used by food delivery platforms, pharmacies, and convenience-based retail services. It relies heavily on technology-enabled logistics, including real-time inventory visibility, dynamic dispatching, and local fulfillment hubs.

Companies offering same-day delivery face the challenge of higher operational costs and tighter time constraints, but the appeal of immediate gratification continues to drive demand among urban consumers. As competition intensifies and logistics networks become more sophisticated, same-day delivery is expected to expand further into retail categories beyond food and essentials, offering a premium service tier in Brazil’s evolving last mile landscape.

By Application Analysis

E-commerce and retail applications are expected to dominate the Brazil last mile delivery market, capturing around 57.0% of the total market share in 2025. This segment has seen exponential growth driven by the rapid digitization of retail and the widespread adoption of online shopping platforms across the country. Major online marketplaces and brick-and-mortar retailers expanding into e-commerce have heavily invested in logistics capabilities to offer faster and more reliable deliveries. The growth of fashion, electronics, and beauty product categories has further strengthened the demand for last mile fulfillment services.

Efficient delivery logistics, real-time tracking, easy returns, and flexible delivery windows have become standard in the e-commerce and retail space, compelling logistics providers to continuously innovate in order to meet customer expectations and reduce fulfillment times.

Grocery and food delivery has also emerged as a major driver in the last mile logistics ecosystem, especially in Brazil’s metropolitan regions. Accelerated by shifting consumer habits and the rise of app-based ordering platforms, grocery and food delivery services now demand hyperlocal, high-frequency logistics operations. Platforms like iFood and Zé Delivery have revolutionized how consumers receive daily essentials, leveraging gig economy couriers, localized warehouses, and smart routing technology to enable under-30-minute deliveries.

This segment requires tight time management, temperature-sensitive handling, and high delivery density, making it operationally complex yet highly lucrative. As consumer preferences tilt toward convenience and immediacy, the grocery and food delivery segment is expected to witness sustained growth, further intensifying competition and innovation in the Brazilian last mile delivery market.

By End-User Analysis

Retail customers are projected to lead the end-user segment in Brazil’s last mile delivery market, holding approximately 63.0% of the total market share in 2025. This segment’s dominance is largely attributed to the surge in online shopping and the growing expectation for fast, convenient, and reliable home deliveries. Brazilian consumers have increasingly embraced e-commerce platforms for purchasing everything from electronics to clothing and household essentials, pushing logistics providers to tailor services specifically for individual end-users.

Features like real-time tracking, doorstep delivery, flexible scheduling, and user-friendly return policies have become standard in servicing retail customers, making them the focal point of last mile logistics strategies. The rise of mobile-first commerce and digital payment adoption further strengthens this segment’s position, especially in urban centers where delivery networks are more advanced.

Small and medium-sized enterprises, or SMEs, represent another important segment within the last mile delivery market, particularly as these businesses expand their digital presence and adopt direct-to-consumer models. SMEs rely on third-party logistics providers and delivery platforms to manage the complexity of last mile operations without the need for heavy infrastructure investment. From local bakeries offering app-based deliveries to boutique retailers serving niche markets, SMEs benefit from scalable and customizable logistics solutions that support business growth.

While they may not match the delivery volumes of large corporations, SMEs contribute significantly to the diversity and geographic reach of last mile services in Brazil. As digital tools become more accessible and affordable, more SMEs are expected to integrate delivery services into their operations, expanding this segment’s role in the market.

The Brazil Last Mile Delivery Market Report is segmented on the basis of the following

By Delivery Mode

- Ground Transportation

- Drone Delivery

- Autonomous Vehicles

- Others

By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Two-Wheelers

- Heavy Commercial Vehicles (HCVs)

- Others

By Service Type

By Delivery Time Frame

- Next-day Delivery

- Same-day Delivery

- Standard (2-5 days)

By Application

- E-commerce/Retail

- Grocery & Food Delivery

- Healthcare & Pharmaceuticals

- Documents & Parcels

- Others

By End-User

- Retail Customers

- SMEs

- Large Enterprises

Brazil Last Mile Delivery Market: Competitive Landscape

The competitive landscape of Brazil’s last mile delivery market is highly dynamic and fragmented, featuring a mix of national postal operators, global logistics firms, digital-first delivery startups, and on-demand service platforms. Dominant players like Correios continue to hold a strong presence, especially in nationwide delivery coverage, while tech-driven platforms such as iFood, Rappi, and Zé Delivery lead in hyperlocal and rapid delivery segments. Logistics firms like Total Express, Jadlog, and Flash Courier have expanded their urban distribution capabilities to cater to growing e-commerce demands.

At the same time, innovative startups such as Mottu, Uello, and Shippify are disrupting the market with gig economy models, last mile automation, and real-time delivery tracking systems. Competition is further intensified by increasing investment in electric vehicle fleets, micro-fulfillment centers, and AI-based logistics optimization tools. The market is witnessing a trend toward strategic partnerships, tech adoption, and service differentiation as companies strive to improve speed, cost-efficiency, and customer satisfaction in Brazil’s evolving delivery ecosystem.

Some of the prominent players in the Brazilian last-mile delivery market are

- Correios

- iFood

- Rappi

- Zé Delivery

- Total Express

- Jadlog

- Motoboy.com

- Uello

- Tembici

- Yellow

- Vuxx

- Mottu

- Courri

- Flash Courier

- Appétit Delivery

- Robin Food Delivery

- B2Log

- Flexsas

- Shippify

- Lalamove

- Other Key Players

Brazil Last Mile Delivery Market: Recent Developments

- Product Launches

- June 2025: Uber and iFood announced a strategic integration in Brazil where iFood users will be able to book Uber rides directly via their app, and Uber customers will gain access to food, grocery, pharmacy, and convenience delivery through Uber, enhancing cross-platform logistics services.

- Mergers & Acquisitions

- May 2025: Prosus-backed iFood acquired full ownership of Box Delivery in a deal expected to reshape Brazil’s food delivery competitive landscape.

- April 2023: Rappi completed the acquisition of Brazilian last-mile delivery startup Box Delivery, aiming to bolster its presence in restaurant and retail delivery.

- Funding Rounds

- September 2023: São Paulo-based motorcycle rental and delivery services startup Mottu raised USD 50 million in a Series C round to scale its last-mile logistics ecosystem.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.4 Bn |

| Forecast Value (2034) |

USD 16.5 Bn |

| CAGR (2025–2034) |

7.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Delivery Mode (Ground Transportation, Drone Delivery, Autonomous Vehicles, and Others), By Vehicle Type (Light Commercial Vehicles, Two-Wheelers, Heavy Commercial Vehicles, and Others), By Service Type (B2C, B2B, and C2C), By Delivery Time Frame (Next-day Delivery, Same-day Delivery, and Standard [2–5 days]), By Application (E-commerce/Retail, Grocery & Food Delivery, Healthcare & Pharmaceuticals, Documents & Parcels, and Others), and By End-User (Retail Customers, SMEs, and Large Enterprises). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Correios, iFood, Rappi, Zé Delivery, Total Express, Jadlog, Motoboy.com, Uello, Tembici, Yellow, Vuxx, Mottu, Courri, Flash Courier, Appétit Delivery, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Brazil last-mile delivery market?

▾ The Brazil last-mile delivery market size is estimated to have a value of USD 8.4 billion in 2025 and is expected to reach USD 16.5 billion by the end of 2034.

Who are the key players in the Brazil last-mile delivery market?

▾ Some of the major key players in the Brazil last-mile delivery market are Correios, iFood, Rappi, Zé Delivery, Total Express, Jadlog, Motoboy.com, Uello, Tembici, Yellow, Vuxx, Mottu, Courri, Flash Courier, Appétit Delivery, and Other Key Players.

What is the growth rate of the Brazil last-mile delivery market?

▾ The market is growing at a CAGR of 7.8 percent over the forecasted period.