A breast pump is an essential medical device for lactating women, allowing them to efficiently express milk, particularly when breastfeeding directly is challenging due to work, travel, or other commitments. Two main types of breast pumps are available: open-system pumps, which allow milk to flow freely through the system, and closed-system pumps, which have barriers to prevent milk from entering the pump mechanism, offering more hygienic options.

Companies in this market are driving innovation by expanding their product lines with features like wearable and double electric

pumps, designed for greater convenience and efficiency.

This expansion meets the needs of modern lifestyles, offering discreet, hands-free solutions that support on-the-go usage. To further enhance their reach, many manufacturers collaborate with healthcare providers and conduct awareness campaigns to inform users about the benefits and usage of breast pumps.

The market’s growth is significantly fueled by the rise in employment among women, making breast pumps a practical solution for those who wish to continue breastfeeding while working.

Breast pumps provide flexibility, allowing women to express and store milk, which ensures a steady supply for infants when direct breastfeeding isn't possible. Wearable pumps are particularly popular among working women due to their convenience, comfort, and discretion. Additionally, rising global birth rates and an increasing population contribute to the demand for breast pumps as more mothers seek effective breastfeeding solutions.

Key Takeaways

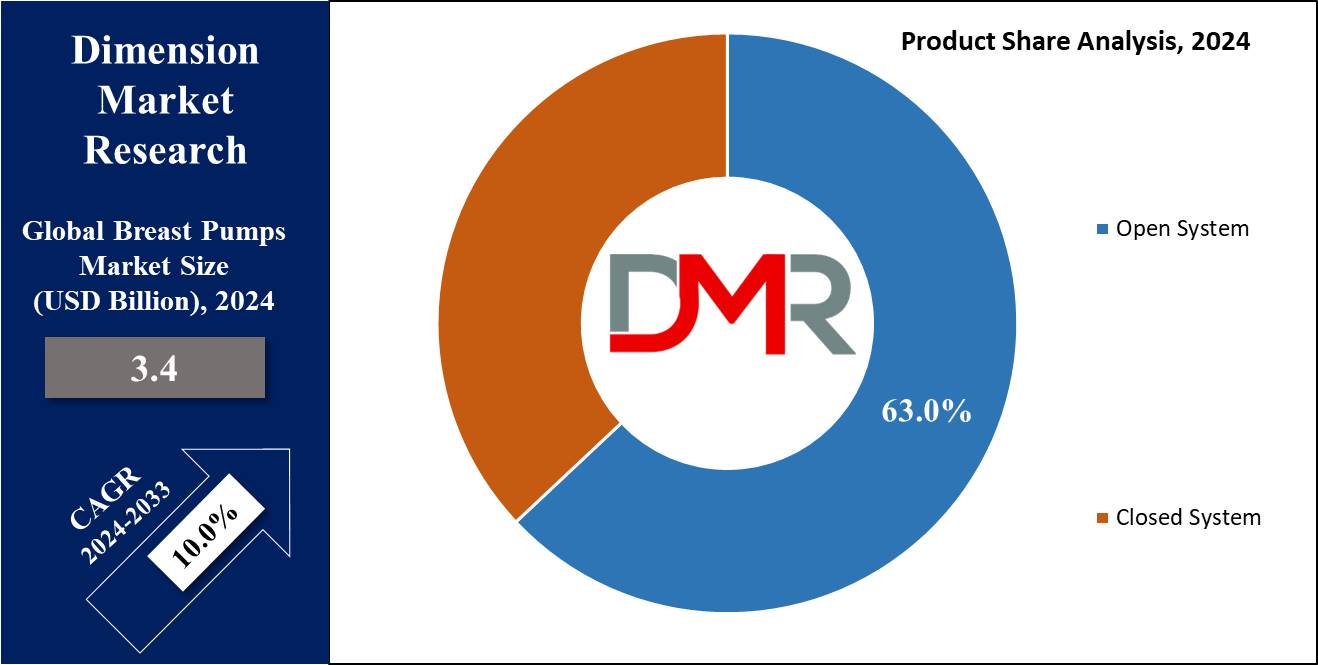

- Market Size & Share: Global Breast Pumps Market size is estimated to reach USD 3.4 Billion in 2024 and is further anticipated to value USD 8.0 Billion by 2033, at a CAGR of 10.0%.

- Product Analysis: Closed-system breast pumps featuring barriers that block milk from flowing directly into their motor were estimated to account for 63% of market share by 2023

- Technology Analysis: Electric pumps were the clear market leader with approximately 58% share in 2023

- Application Analysis: Personal-use breast pumps held 67% market share due to an increasing number of working mothers needing private solutions for pumping their breasts at work.

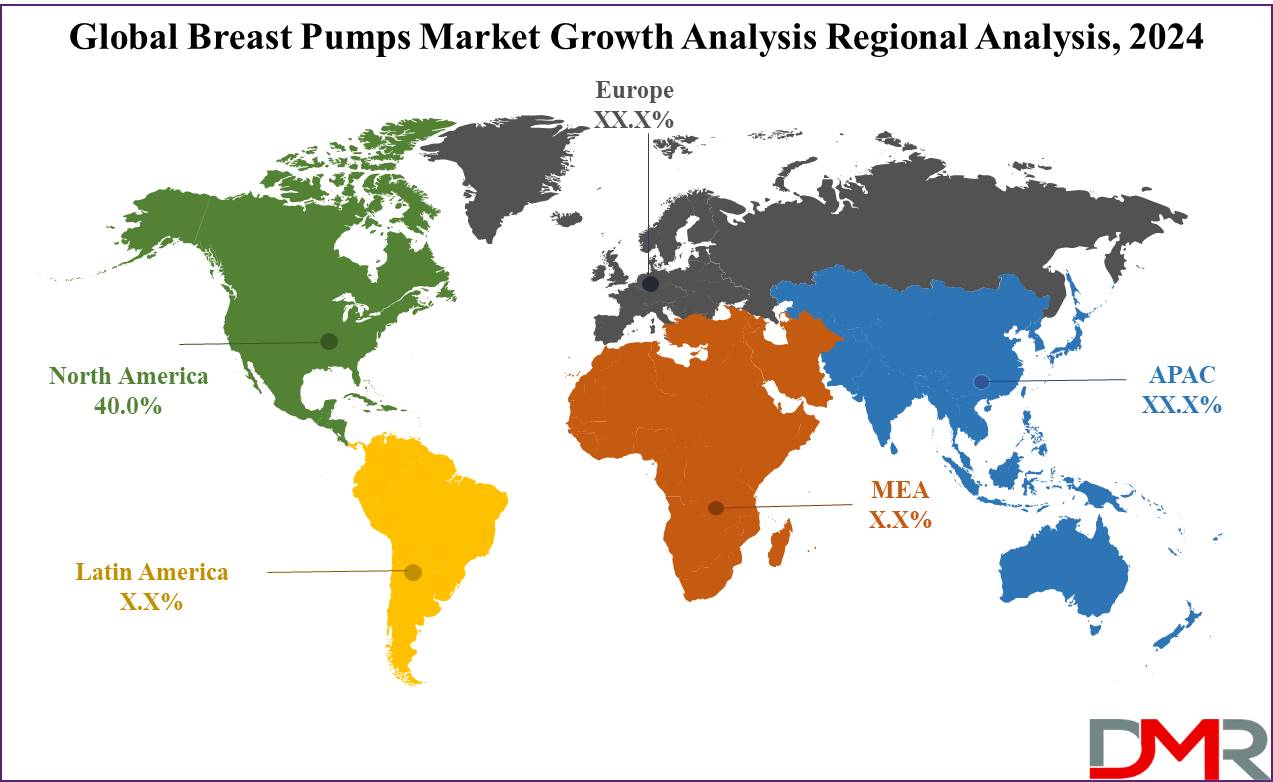

- Regional Analysis: North America dominates the breast pumps market globally, accounting for an approximate 40% market share by 2023.

Use Cases

- Support for Working Mothers: Breast pumps are invaluable for working mothers who want to continue breastfeeding after returning to work. By pumping milk during breaks, mothers can maintain milk supply and provide their babies with breast milk even when they’re not present. This supports breastfeeding continuity while balancing work responsibilities.

- Managing Milk Supply: Some women use breast pumps to manage their milk supply, particularly if they experience oversupply or undersupply. Regular pumping can help stimulate milk production in cases of low supply, while controlled pumping can ease discomfort and prevent issues like engorgement in cases of oversupply.

- Storing Milk for Future Use: Breast pumps allow mothers to store milk for later use, which is helpful for situations where they might be unavailable, such as travel or overnight trips. This ensures that infants have a steady supply of breast milk and mothers have more flexibility in planning their schedules.

- Support for Babies with Feeding Challenges: For babies who have difficulty latching or sucking, breast pumps enable mothers to express milk and provide it through a bottle. This method ensures that the infant receives the nutritional benefits of breast milk even if breastfeeding is challenging.

- Relief for Health Issues: Breast pumps can be a solution for mothers experiencing issues like mastitis, clogged ducts, or sore nipples. Pumping milk can help alleviate pain, prevent engorgement, and encourage healing, making breastfeeding a more comfortable experience for mothers.

Report Dynamics

Drivers

Breast pumps market growth is being propelled forward by an increased global population of working women who must balance professional responsibilities with motherhood while breastfeeding their infants while away. Rising employment rates among women further support this trend while the demand for convenient milk storage solutions also encourage market expansion.

Furthermore, growing awareness about breastfeeding benefits as well as government initiatives supporting maternal health add further impetus to market expansion.

Trend

One prominent trend in the breast pumps market is a shift towards wearable and hands-free devices. These innovations provide mothers with greater convenience by enabling discreet pumping without interrupting daily activities. Demand has surged significantly for portable, lightweight, silent models as busy mothers search for solutions tailored specifically to their lifestyles.

Featuring smartphone app connectivity for tracking as well as multiple suction settings to meet individual user preferences and thus further fuel this trend towards personalized high tech breast pump options.

Restraint

Restrictions One of the primary barriers to the breast pump market is its high cost, especially wearable and hospital-grade devices, making them out of reach for many consumers.

They may not be affordable for everyone in low-income regions and their complex use may turn off some mothers who would rather opt for simpler manual alternatives instead of electric breast pumps; concerns regarding maintenance, battery life and frequent cleaning of components have an additional limiting factor on market growth in certain regions.

Opportunity

Opportunity The breast pump market provides substantial growth opportunities in emerging economies where awareness of breastfeeding's health benefits is growing. Improvements to healthcare infrastructure and increased maternal healthcare support may spur demand for breast pumps in these regions.

While government initiatives promoting breastfeeding as well as local and international players entering developing markets create the possibility for innovative yet cost-effective product offerings to expand this global market. Furthermore, online retail channels now make them accessible to a wider range of consumers globally.

Research Scope and Analysis

Product Analysis

The breast pump market can be divided into open and closed systems, each offering distinctive features to meet user needs. Closed-system breast pumps featuring barriers that block milk from flowing directly into their motor were estimated to account for

63% of market share by 2023 due to their hygienic features and reduced maintenance requirements, which many users preferred. Hospitals and healthcare professionals in particular often favor closed systems due to reduced contamination risks from external bacteria or mold.

On the other hand, open-system breast pumps do not offer this protective shield, making them simpler in design and more cost-effective. While open-system pumps may be popular among certain users for personal use, they require more regular cleaning and maintenance compared with closed systems; as consumer awareness regarding hygiene and safety increases, demand is expected to surge; manufacturers therefore continue developing innovations within closed systems pumps in order to enhance convenience and performance for lactating mothers.

Technology Analysis

The breast pump market can be divided into manual pumps, battery-powered pumps and electric pumps designed to meet different user needs and preferences. Electric pumps were the clear market leader with approximately 58% share in 2023 - preferred by working mothers and healthcare institutions alike for their efficiency, ease of use, frequent pumping sessions that save time compared to manual pumps, as well as their features such as adjustable suction levels, double pumping capability and portability that ensure ultimate convenience for frequent users.

Battery-powered pumps, while less powerful than electric models, are highly sought-after by mothers seeking an affordable and portable option. Manual pumps remain an economical choice and appeal to users looking for lightness, quietness, and low-maintenance.

But due to an increase in women entering employment and a preference for efficiency solutions such as electric breast pumps will likely remain dominance within the market as consumer demand for advanced and time-saving solutions continues to expand.

Application Analysis

In 2023, the breast pump market was divided into personal-use and hospital-grade segments. Of these two groups, personal-use breast pumps held 67% market share due to an increasing number of working mothers needing private solutions for pumping their breasts at work.

Portable wearable and wearable options made up the personal-use segment with more convenience, ease of use and varied price points to fit different consumer budgets; awareness campaigns about breastfeeding benefits as well as government programs supporting lactation solutions have only furthered demand in this segment.

Hospital-grade pumps are popular choices in healthcare settings due to their powerful suction capabilities and hygienic design, often shared among multiple users and thus ideal for hospital and clinical settings such as neonatal intensive care units or maternity wards. With increased consumer demand for portable, accessible, and efficient solutions expected in future decades, personal-use breast pumps may maintain their market lead.

The Global Breast Pumps Market Report is segmented based on the following

By Product

- Open System

- Closed System

By Technology

- Manual Pumps

- Battery Powered Pumps

- Electric Pumps

By Application

- Personal Use

- Hospital Grade

Regional Analysis

North America dominates the breast pumps market globally, accounting for an approximate

40% market share by 2023. This dominance can be explained by factors like the high employment rate among women, widespread awareness of breastfeeding benefits and supportive healthcare policies that promote breastfeeding and lactation support.

Advanced healthcare infrastructure and substantial investments in product innovation help propel North America forward, with similar infrastructure supporting Europe as well. Meanwhile, Asia-Pacific region is seeing rapid expansion fueled by higher birth rates, disposable income growth, and increasing awareness about breastfeeding solutions.

By Region and Countries

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key players in the breast pumps market are focusing on innovative product development and strategic collaborations to enhance their product portfolios. Many leading companies are introducing advanced, user-friendly designs, such as wearable and smart pumps, to cater to the growing demand from working mothers. In addition to technology improvements, some companies are expanding distribution channels, particularly in emerging markets, to increase accessibility.

Others are focused on raising product awareness through healthcare partnerships and consumer education campaigns. Competitive pricing strategies and post-purchase support also help these players secure a larger market share, aiming to meet the needs of diverse consumer segments globally.

Some of the prominent players in the global Breast Pumps Market are

- Ameda AG

- Bailey Medical

- Medela AG

- Philips

- Hygeia Health

- Lansinoh Laboratories

- Buettner Frank GmbH

- Linco Baby Merchandise Works Co., Ltd.

- Whittlestone, Inc.

- Koninklijke Philips N.V.

Recent Development

- Ameda AG (September 2023): Ameda launched an upgraded version of its portable breast pump, integrating quieter operation and improved suction technology. This new model aims to enhance convenience and comfort for mothers on-the-go, catering to the growing demand for discreet, efficient pumping solutions.

- Bailey Medical (August 2023): Bailey Medical expanded its product line with a new double electric breast pump designed for hospital use. This launch addresses the increasing need for efficient, high-performance pumps that support breastfeeding mothers in medical settings.

- Medela AG (July 2023): Medela unveiled a partnership with a global healthcare provider to distribute its closed-system breast pumps across emerging markets. This initiative is part of Medela’s mission to make high-quality breastfeeding solutions more accessible worldwide.

- Philips (October 2023): Philips introduced an AI-powered breast pump that adapts suction levels based on user comfort, setting a new standard for personalized breast pump technology. The innovation aligns with the trend toward user-centric, technology-enhanced breastfeeding solutions.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3.1 Bn |

| Forecast Value (2033) |

USD 7.1 Bn |

| CAGR (2024-2033) |

9.6 % |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Open System, Closed System) By Technology (Manual Pumps, Battery Powered Pumps, Electric Pumps) By Application ( Personal Use, Hospital Grade) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Ameda AG, Bailey Medical, Medela AG, Philips, Hygeia Health, Lansinoh Laboratories, Buettner Frank GmbH, Linco Baby Merchandise Works Co., Ltd., Whittlestone, Inc., Koninklijke Philips N.V. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |