Market Overview

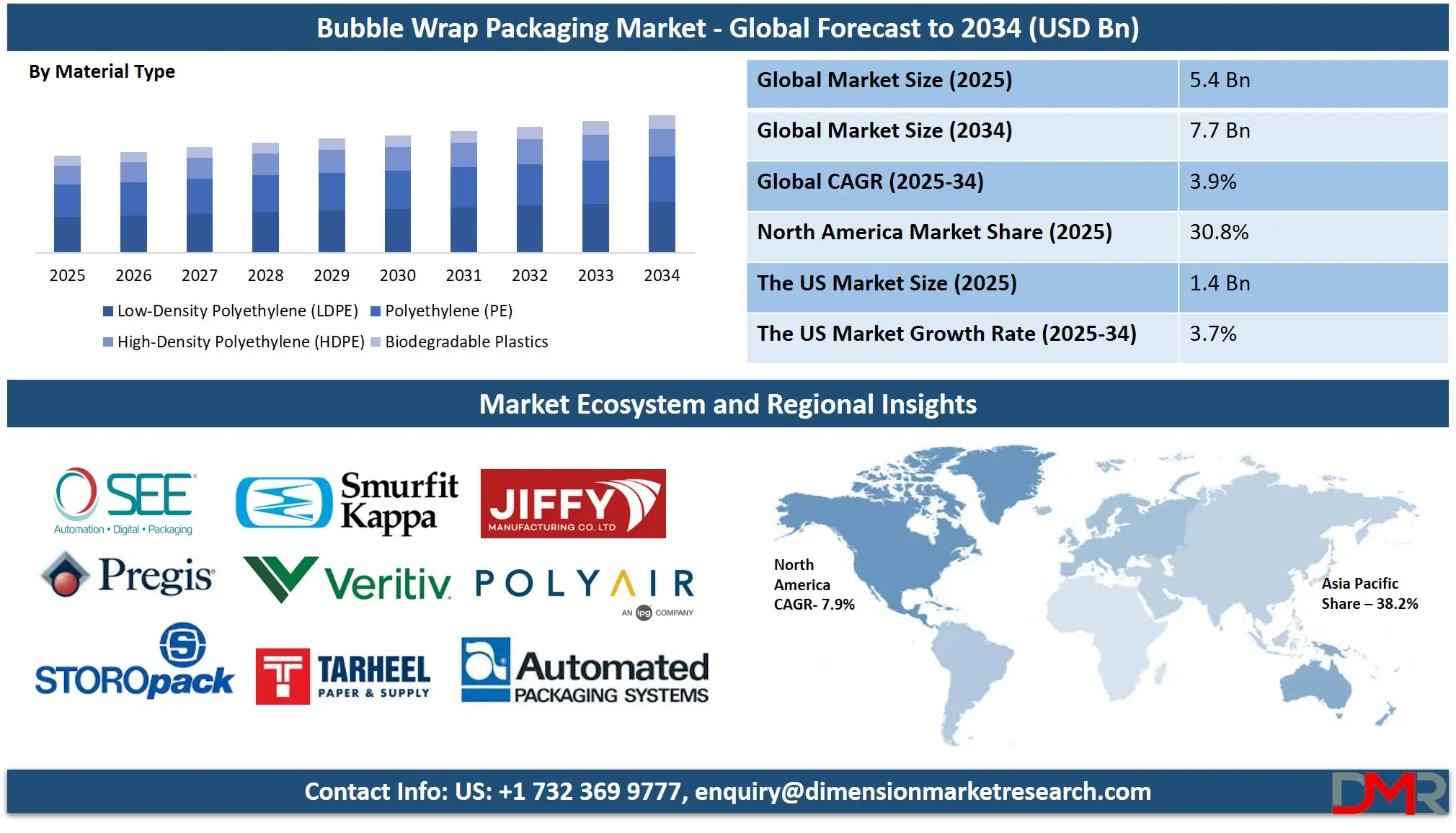

The Global Bubble Wrap Packaging Market is expected to be valued at USD 5.4 billion in 2025, and it is further anticipated to reach a market value of USD 7.7 billion by 2034 at a CAGR of 3.9%.

The global bubble wrap packaging market is an integral component of the protective packaging industry, driven by increasing demand across various sectors such as e-commerce, electronics, pharmaceuticals, and consumer goods. Bubble wrap is an ultra-light yet flexible material used to cushion fragile items during transport. Featuring air-filled pockets to absorb shocks and vibrations to help avoid breakages of delicate products during storage or transportation. As manufacturing technologies advance and more eco-friendly alternatives become popular, they are revolutionizing the bubble wrap packaging market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Traditional polyethylene bubble wraps are now being replaced with biodegradable and recyclable versions to meet sustainability goals and regulatory requirements. Manufacturers are continually innovating by creating customized bubble wrap designs such as anti-static or perforated options designed specifically for industry needs. Logistics and transportation markets continue to experience tremendous expansion, due to the importance placed on product safety. Yet environmental considerations and a lack of alternative protective packaging materials could potentially affect the future dynamics of this industry.

Globalization and cross-border e-commerce expansion have led to a rise in demand for bubble wrap packaging. Both large-scale retailers and small businesses looking for solutions that ensure their products reach customers safely. Due to its versatility bubble wrap can adapt to different product sizes and fragility levels. It has quickly become the go-to option for businesses that aim to minimize product returns while simultaneously improving customer satisfaction. Its cost-effectiveness and user-friendliness make it an attractive solution for both large manufacturers as well as small enterprises, including those involved in the booming

Bubble Tea industry, where delicate cup lids and containers require protective wrapping.

Technological innovations within the packaging industry have also played an essential role in expanding and improving the functionality and efficiency of bubble wrap packaging. Advancements such as air retention technology, helping maintain cushioning performance over extended periods, and self-sealing bubble wrap, eliminating additional glues or tapes from its use, have greatly enhanced protective packaging effectiveness. Likewise, advances in automated packaging machinery have simplified wrapping products, streamlining high-volume shipping operations more efficiently, increasing efficiency, and driving market growth. In sectors such as

Automotive Wrap Films, which involve delicate and high-value vinyl films, bubble wrap packaging offers an added layer of defense during transport and storage.

The US Bubble Wrap Packaging Market

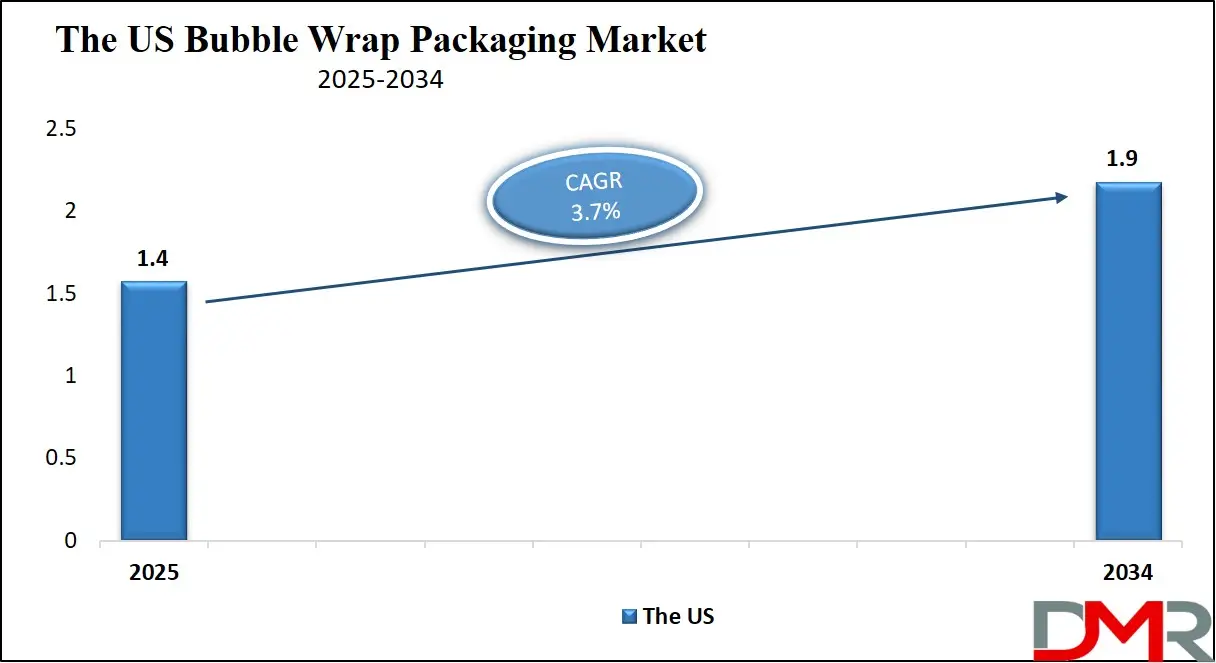

The US Bubble Wrap Packaging Market is projected to be valued at

USD 1.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding

USD 1.9 billion in 2034 at a

CAGR of 3.7%.

The US bubble wrap packaging market is an integral component of its protective packaging industry, driven by rapid e-commerce growth, logistics expansion, and an increasing need for safe product transportation. With the US being one of the world's biggest consumer markets, demand for reliable packaging solutions has increased in industries like electronics, pharmaceuticals, and consumer goods. Bubble wrap packaging, known for its lightweight, cost-effective cushioning properties, and widespread adoption due to online shopping platforms and doorstep delivery preferences, has quickly become an indispensable material in protecting fragile items during shipping and handling operations.

The US bubble wrap packaging market innovations have evolved as companies strive to ensure operational efficiencies and damage-free product delivery. Manufacturers are offering advanced cushioning solutions like self-inflating bubble wrap, high-retention air pockets, and multilayered protective films to increase cushioning performance. Automation integration into packaging lines has greatly simplified wrapping processes, cutting labor costs, and increasing the productivity of high-volume shipping operations.

Businesses seeking packaging solutions that meet specific industry requirements have seen an upsurge in demand for customized bubble wrap options with anti-static qualities for electronic components and perforated rolls for easier handling, such as anti-static versions of anti-static bubble wrap or perforated rolls with perforations for easier handling.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Bubble Wrap Packaging Market: Key Takeaways

- Market Value: The global bubble wrap packaging market size is expected to reach a value of USD 7.7 billion by 2034 from a base value of USD 5.4 billion in 2025 at a CAGR of 3.9%.

- By Product Type Segment Analysis: High-Grade Bubble Wraps are anticipated to lead in the product type segment, capturing 32.4% of the market share in 2025.

- By Material Type Segment Analysis: Low-density polyethylene (LDP) is poised to consolidate its market position in the material type segment capturing 37.2% of the total market share in 2025.

- By End-User Type Segment Analysis: E-commerce & Retail is expected to maintain its dominance in the end-user type segment, accounting for 37.4% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global bubble wrap packaging market landscape with 38.2% of total global market revenue in 2025.

- Key Players: Some key players in the global bubble wrap packaging market are Sealed Air Corporation, Pregis Corporation, Storopack Hans Reichenecker GmbH, Smurfit Kappa Group, Veritiv Corporation, and Other Key Players.

Global Bubble Wrap Packaging Market: Use Cases

- E-Commerce and Retail Shipping: The surge in online shopping has significantly increased the demand for bubble wrap packaging to protect fragile items such as electronics, glassware, and cosmetics during transit. Retailers and logistics providers use bubble wrap to minimize damage, reduce return rates, and enhance customer satisfaction by ensuring products arrive in perfect condition.

- Electronics and Semiconductor Protection: Sensitive electronic components and semiconductor devices require anti-static bubble wrap to prevent damage from electrostatic discharge. The protective packaging helps cushion delicate parts during shipping and storage, ensuring that high-value electronics like smartphones, laptops, and circuit boards remain intact.

- Pharmaceutical and Medical Equipment Packaging: Bubble wrap is widely used in the pharmaceutical sector to protect medicines, vials, and medical devices from shocks and temperature variations during transportation. With stringent regulations for product safety, the industry relies on high-quality protective packaging to maintain the integrity of sensitive medical shipments.

- Automotive and Industrial Component Shipping: The automotive and manufacturing industries utilize bubble wrap to safeguard precision parts, machinery, and spare components from physical damage and corrosion during logistics. Heavy-duty bubble wrap with reinforced layers helps protect large, delicate, and high-value industrial products from impact and vibrations.

Global Bubble Wrap Packaging Market: Stats & Facts

- According to Eurostat, the statistical office of the European Union, the recycling rate of packaging waste in the EU stood at 65.4% in 2022, reflecting a slight increase from 64.0% in 2021. This indicates a positive trend towards improved recycling practices within the EU.

- In 2022, the EU generated an average of 150 kg of packaging waste per inhabitant, with Ireland and Italy reporting the highest amounts at 233.8 kg and 232.4 kg per person, respectively. Bulgaria reported the lowest at 78.8 kg per inhabitant.

- The European Commission has proposed new rules aiming to reduce packaging waste by 5.0% by 2030, 10.0% by 2035, and 15.0% by 2040, compared to 2018 levels. These targets are part of broader efforts to make all packaging recyclable in an economically viable way by 2030 and to decrease the use of virgin materials in packaging, aligning with the EU's climate neutrality goals by 2050.

- In the United Kingdom, the Environment Agency's National Packaging Waste Database provides aggregated packaging data reported under the Packaging Waste (Data Reporting) Regulations 2023. This data includes detailed information on packaging materials and types, contributing to the UK's extended producer responsibility initiatives for packaging waste management.

Global Bubble Wrap Packaging Market: Market Dynamic

Global Bubble Wrap Packaging Market: Driving Factors

Rising E-Commerce and Online Retail Growth

E-commerce's rapid expansion has been one of the primary drivers behind the global bubble wrap packaging market's surge. As more consumers opt for online shopping, businesses must focus on secure and efficient packaging solutions to protect goods during transit, with lightweight shock-absorbing properties making bubble wrap an excellent solution. Furthermore, digital marketplaces and internet penetration have further spurred this need for protective packaging across various product categories.

Fulfillment centers and third-party logistics services have led to meeting customer demand for faster and more reliable shipping, necessitating effective protective packaging solutions. E-commerce giants such as Amazon, Alibaba, and Flipkart are investing heavily in innovative packaging strategies to minimize product returns while increasing customer satisfaction.

Growing Demand for Protective Packaging in the Electronics Industry

As global production and consumption of electronic devices continue to expand, demand for bubble wrap packaging has risen. As smartphones, laptops, tablets, and wearables become sophisticated and fragile, manufacturers and retailers are prioritizing protective solutions such as bubble wrap cushioning properties to prevent damage during shipping and handling processes. Its cushioning properties help absorb shocks and vibrations to protect delicate electronic components reaching customers in optimal condition which makes it an integral component in electronics supply chains globally.

Technological advances in electronics have led to smaller, and lighter devices with increased value that require advanced protective packaging solutions. Manufacturers are opting for multi-layered bubble wrap as an efficient means of product safety without adding excessive weight during shipment. Global supply chains continue to expand with a greater need for quality protective packaging shipments driving further growth of this market segment.

Global Bubble Wrap Packaging Market: Restraints

Environmental Concerns and Sustainability Regulations

Traditional bubble wrap is made largely from polyethylene plastic which contributes to environmental pollution, while increasing global awareness about its effect on marine ecosystems and landfills is leading to stricter policies against single-use plastic use, thus decreasing demand for conventional bubble wrap packaging solutions. Many countries and regions, including Europe, North America, and Canada have implemented regulations and initiatives aimed at decreasing plastic consumption while encouraging eco-friendly alternatives.

Policies like plastic bans, extended producer responsibility (EPR), and recycling mandates are encouraging manufacturers to switch towards biodegradable or recyclable bubble wrap materials. However, transitioning away from plastic-based bubble wrap presents costs, production scalability issues, and performance limitations as these alternatives may not provide cushioning and durability comparable to plastic alternatives.

Availability of Alternative Protective Packaging Solutions

The increasing availability and adoption of alternative protective packaging materials represent a serious restraint on the global bubble wrap packaging market. Industries reliant on protective packaging such as e-commerce, electronics, and pharmaceuticals are increasingly exploring options such as molded pulp, foam inserts, corrugated wraps, air pillows, and paper cushioning which often provide similar or superior protection while meeting environmental concerns more effectively than plastic alternatives.

Companies looking to maximize packaging optimization and waste reduction are adopting smart packaging practices with integrated cushioning techniques, decreasing their reliance on standalone protective materials like bubble wrap. Many are investing in advanced packaging solutions requiring minimal void fill or protective layers, further decreasing dependence on traditional cushioning materials like bubble wrap. Meanwhile, advancements in packaging automation and machine learning-driven design enable businesses to use advanced protective solutions, limiting generic bubble wrap usage.

Global Bubble Wrap Packaging Market: Opportunities

Growing Demand for Sustainable and Biodegradable Bubble Wrap

Due to increasing environmental concerns and stricter regulations on plastic waste, demand has skyrocketed for biodegradable, recyclable, and reusable protective solutions like biodegradable bubble wrap made with plant-based resins, recycled polyethylene or compostable materials creating a market opportunity for manufacturers who develop sustainable bubble wrap options made from such eco-friendly sources. Companies are investing heavily in research and development to produce eco-friendly alternatives to bubble wrap that offer similar protective qualities but are better for the environment.

Biodegradable bubble wrap made from materials like cornstarch and recycled paper has seen rapid adoption, giving businesses a greener packaging option without compromising product safety. As more brands commit to sustainable practices to meet corporate social responsibility (CSR) goals and consumer preferences, the adoption of eco-friendly bubble wrap should increase significantly.

Expansion of E-Commerce and Cross-Border Trade

With the continuous rise in online shopping, the demand for protective packaging has increased significantly for fragile or high-value items like electronics, glassware, cosmetics, or pharmaceuticals. Furthermore, logistics providers and retailers require efficient packaging solutions to deliver these goods undamaged to their customers, creating a strong demand for bubble wrap solutions from vendors like Mail Boxes and others. Cross-border trade, driven by increased globalization and improved logistics infrastructure, has further amplified the need for protective packaging.

Direct-to-consumer (DTC) brands and subscription box services have contributed significantly to the expansion of the bubble wrap market. More companies shipping directly to consumers rely on protective packaging solutions such as bubble wrap to enhance unboxing experiences while protecting goods safely. Custom-colored or branded bubble wrap options have become popular among e-commerce businesses looking for ways to add aesthetics while maintaining product protection.

Global Bubble Wrap Packaging Market: Trends

Adoption of Smart and Sustainable Packaging Solutions

Amid mounting environmental concerns and stricter regulations on plastic waste, manufacturers are developing eco-friendly bubble wrap alternatives such as biodegradable, recyclable, and compostable options to meet consumer demands for environmentally responsible packaging while maintaining product safety. Innovations in technology are driving the need for packaging solutions. Self-sealing bubble wrap, air retention technology, and perforated rolls for easier handling have become the highlighted features among businesses seeking efficient packaging solutions.

Manufacturers are exploring innovations such as temperature-sensitive or tamper-evident bubble wrap in industries like pharmaceuticals and electronics where product integrity is crucial. As part of their efforts towards sustainability, many e-commerce and retail businesses are reconsidering their packaging strategies. Businesses are adopting right-sized boxes with minimal waste materials to minimize environmental impact while improving logistics efficiency.

Increased Use of Recyclable and Reusable Bubble Wrap

Many companies are adopting reusable bubble wrap as part of their sustainability initiatives, with logistics providers and retailers adopting models where protective materials like bubble wrap are collected and reused in their supply chain. This trend is particularly evident within industries like electronics, automotive, and industrial equipment where products require sturdy packaging for multiple shipping cycles. Closed-loop recycling systems have only added to this trend.

Packaging manufacturers have started offering take-back programs and partnerships with recycling facilities to ensure used bubble wrap can be processed and repurposed effectively, and some businesses have even experimented with biodegradable additives that help traditional bubble wrap break down more efficiently without leaving behind harmful microplastics. As regulatory bodies push for eco-friendly packaging practices, recyclable and reusable bubble wrap should become increasingly prevalent.

Global Bubble Wrap Packaging Market: Research Scope and Analysis

By Product Type

High-grade bubble wrap is expected to lead the product type segment, accounting for 32.4% of the market share in 2025. This dominance can be attributed to its superior protective qualities, making it the go-to solution for industries that demand enhanced cushioning and durability, such as electronics, pharmaceuticals, and automotive manufacturing which rely heavily on this advanced form of protective wrapping to safeguard fragile goods in transit or storage.

Sectors like these require advanced solutions that offer greater burst resistance as well as multiple layers of cushioning with antistatic or moisture-resistant properties which regular bubble wrap may lack. E-commerce giants and third-party logistics providers are using premium protective packaging materials in their supply chains to reduce product returns while simultaneously improving customer satisfaction.

General Grade Bubble Wraps are expected to experience steady expansion due to rising demand in various industries. General-grade is an economical and versatile packaging solution for businesses without specific protective properties yet still require reliable cushioning. Businesses such as small and medium-sized enterprises (SMEs), local retailers, and consumer goods manufacturers often rely on it as part of everyday packaging needs, which has contributed significantly to its steady market expansion.

Sustainability initiatives within the packaging industry are prompting manufacturers to introduce eco-friendly versions of general-grade bubble wrap. As businesses seek greener packaging alternatives, these eco-friendly options should support the continued growth of this segment while simultaneously addressing environmental concerns.

By Material Type

Low Density Polyethylene (LDP) is poised to consolidate its market position in the material type segment capturing 37.2% of the total market share in 2025. This can be attributed to its superior flexibility, lightweight nature, and superior cushioning properties, making LDPE an ideal material for bubble wrap production. LDPE's soft yet durable structure enhances impact resistance providing reliable protection for fragile items during shipping and storage. LDPE's market leadership can also be attributed to its ease of processing and cost-effectiveness for large-scale production.

Manufacturers favor it due to its compatibility with extrusion processes and ability to create multi-layered bubble wraps with enhanced protective features. Furthermore, its variety of thicknesses makes LDPE suitable for customization based on product protection needs, while its moisture and chemical resistance reinforce its demand in industries needing long-term packaging solutions.

Polyethylene (PE) will experience steady growth due to its widespread usage in protective packaging applications. Polyethylene's versatility and wide availability make it suitable for bubble wrap products of various grades including general-grade and high-performance versions. Demand for lightweight yet strong packaging materials, particularly among e-commerce and logistics businesses, is expected to contribute significantly to the expansion of polyethylene. PE bubble wrap has proven its utility for shipping consumer goods, automotive parts, and industrial equipment for many years, maintaining its relevance within the market. Furthermore, advances in polymer technology have resulted in new formulations offering better puncture resistance, increased clarity, and increased reusability.

By End User

E-Commerce & Retail is projected to maintain its leadership in the end-user segment, capturing 37.4% of the market share in 2025. This growth can be attributed to internet penetration, mobile commerce, and the rise of direct-to-consumer (DTC) brands. As consumers increasingly turn to doorstep delivery for everything from clothing and cosmetics to fragile items like glassware and home decor, protective packaging solutions like bubble wrap have seen unprecedented demand.

Amazon, Alibaba, and Walmart's rapid global expansion has significantly contributed to a rising demand for secure packaging materials such as bubble wrap. Its lightweight structure, cost-effectiveness, and excellent cushioning properties that protect products in transit as well as increasing subscription box popularity have further solidified bubble wrap's role as an invaluable way to ensure product safety.

Electronics & Electricals sector is poised for steady expansion due to the rising global demand for consumer electronics, smart devices, and electrical components. With the increased adoption of smartphones, laptops, tablets, wearables, and other high-value electronic devices by consumers and retailers globally, manufacturers and retailers are prioritizing robust packaging solutions that offer protection from shocks, vibrations, and static damage.

Bubble wrap particularly with its anti-static and high-grade variants plays a pivotal role in protecting delicate electronic components during transport and storage. Due to semiconductor manufacturing expansion, increased exports, online electronics retail sales boom, and the proliferation of the Internet of Things (IoT) and smart home devices, protective packaging solutions for delicate products will continue to increase exponentially.

The Bubble Wrap Packaging Market Report is segmented based on the following

By Product Type

- High-Grade Bubble Wraps

- General Grade Bubble Wraps

- Temperature-controlled Controlled Bubble Wraps

- Limited Grade Bubble Wraps

- Others

By Material

- Low-Density Polyethylene (LDPE)

- Polyethylene

- High-Density Polyethylene (HDPE)

- Biodegradable Plastics

By End-User

- E-Commerce and Retail

- Electronics and Electricals

- Automotive

- Pharmaceuticals and Healthcare

- Food and Beverages

- Industrial Manufacturing

Global Bubble Wrap Packaging Market: Regional Analysis

The region with the largest Revenue Share

Asia Pacific is anticipated to lead the global bubble wrap packaging market landscape with

38.2% of total global market revenue in 2025. The region's dominance can be attributed to rapidly expanding e-commerce industries, increasing industrialization rates, and strong manufacturing bases such as those found in China, India, Japan, and South Korea that are home to many world-leading e-commerce platforms including Alibaba, Flipkart, and Rakuten. Asia Pacific is also home to an expansive electronics and automotive manufacturing industry, serving as a global hub for smartphone, semiconductor, and auto component production.

Domestic manufacturing activities and global supply chains have further contributed to Asia's rising need for quality bubble wrap packaging materials. Urbanization and rising disposable incomes in emerging economies in Southeast Asian nations have driven increased consumer spending on electronics, home appliances, and retail goods. Businesses are investing in efficient packaging solutions to enhance logistics, reduce product damage, and meet customer expectations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region with the highest CAGR

North America is poised for steady expansion in the bubble wrap packaging market due to the region's thriving e-commerce, retail, and electronics sectors. Logistics and supply chain infrastructure contribute significantly to North America's growing need for bubble wrap. Businesses focusing on optimizing packaging to minimize damage prevention costs have seen an increasing shift towards innovative protective packaging solutions such as biodegradable or recyclable bubble wrap for cost efficiency.

Sustainability trends are also having a strong influence, with major corporations adopting eco-friendly practices to meet consumer preferences or regulatory requirements. The production of smart devices, wearable, and computing hardware has increased, necessitating high-performance protective packaging materials like bubble wrap to protect delicate components. Industries like electric vehicles (EVs), renewable energy sources, and medical devices also help fuel this demand for bubble wrap to safeguard sensitive components.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Bubble Wrap Packaging Market: Competitive Landscape

The global bubble wrap packaging market is marked by intense competition among its leading companies, each vying for market share through strategic innovations, mergers, and expansions. Notable market players include Sealed Air Corporation, Pregis LLC, Smurfit Kappa, Storopack Hans Reichenecker GmbH, and Veritiv Corporation which all operate with global distribution networks providing their extensive product lines as a resource to serve evolving industry demands such as e-commerce, electronics, automotive manufacturing and pharmaceutical needs.

Sustainability has emerged as a critical differentiator among market players, prompting businesses to develop eco-friendly and recyclable bubble wrap solutions. Sealed Air Corporation led this charge, pioneering biodegradable and recyclable bubble wrap to align with global sustainability trends. Pregis LLC invested heavily in sustainable packaging materials as well as automated systems designed to increase efficiency and reduce waste. Other players such as Smurfit Kappa and Storopack developed paper-based protective packaging alternatives appealing to environmentally conscious consumers while meeting stringent regulations.

Regional dynamics also have a substantial effect on shaping the competitive landscape. While North America and Europe remain bastions for established packaging companies, Asia Pacific is witnessing the rapid emergence of local manufacturers offering cost-effective solutions in price-sensitive markets such as China, India, and South Korea. Market players are turning their focus toward strategic partnerships and acquisitions to strengthen their market standing. Companies are working with logistics providers, retailers, and industrial manufacturers to offer customized protective packaging solutions. Investments in automation and digital packaging technologies have also helped businesses meet demand for fast yet secure packaging solutions quickly.

Some of the prominent players in the global bubble wrap packaging market are

- Sealed Air Corporation

- Pregis Corporation

- Storopack Hans Reichenecker GmbH

- Smurfit Kappa Group

- Veritiv Corporation

- Tarheel Paper & Supply Company

- Jiffy Packaging Co. Ltd.

- Inflatable Packaging, Inc.

- Polyair Inter Pack Inc.

- Automated Packaging Systems, Inc.

- Free-Flow Packaging International, Inc. (FP International)

- Green Packaging Group

- Other Key Players

Recent Developments

- October 2024: Estonian startup RAIKU announced a collaboration with LVMH – Moët Hennessy Louis Vuitton, the world's largest luxury goods conglomerate. This partnership aims to integrate RAIKU's 100.0% natural packaging material into the luxury sector, reflecting a growing trend among high-end brands to adopt eco-friendly materials in their packaging strategies.

- February 2024: Furniture Industries Service (FIS) developed recycled kraft paper bubble wrap to meet consumer demand for environmentally conscious packaging without compromising product protection

- January 2024: Antalis acquired 100 metros of Soluções de Embalagem, Unipessoal, a leading packaging distribution company in Portugal, further expanding its footprint in the European packaging market.

- September 2023: Go Do Good Studio, a material innovation startup based in Pune, India, created a flexible film using algae collected from India's coastal regions, offering a sustainable alternative for various packaging applications.

- August 2023: Ranpak introduced the Wrap 'n Go converter in North America, an easy-to-use, and retail-grade protective honeycomb paper with a self-adjusting tensioning mechanism for smoothness, enhancing packaging efficiency and sustainability.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.4 Bn |

| Forecast Value (2034) |

USD 7.7 Bn |

| CAGR (2025–2034) |

3.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (General Grade Bubble Wraps, High-Grade Bubble Wraps, Limited Grade Bubble Wraps, Temperature Controlled Bubble Wraps, and Others), By Material Type (Polyethylene (PE), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), and Biodegradable Plastic), By End-User Industry (E-Commerce and Retail, Electronics and Electricals, Automotive, Pharmaceuticals and Healthcare, Food and Beverages, and Industrial Manufacturing) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Sealed Air Corporation, Pregis Corporation, Storopack Hans Reichenecker GmbH, Smurfit Kappa Group, Veritiv Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global bubble wrap packaging market?

▾ The global bubble wrap packaging market size is estimated to have a value of USD 5.4 billion in 2025 and is expected to reach USD 7.7 billion by the end of 2034.

What is the size of the US bubble wrap packaging market?

▾ The US bubble wrap packaging market is projected to be valued at USD 1.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.9 billion in 2034 at a CAGR of 3.7%.

Which region accounted for the largest global bubble wrap packaging market?

▾ Asia Pacific is expected to have the largest market share in the global bubble wrap packaging market with a share of about 38.2% in 2025.

Who are the key players in the global bubble wrap packaging market?

▾ Some of the major key players in the global bubble wrap packaging market are Sealed Air Corporation, Pregis Corporation, Storopack Hans Reichenecker GmbH, Smurfit Kappa Group, Veritiv Corporation, and many others.

What is the growth rate in the global bubble wrap packaging market?

▾ The market is growing at a CAGR of 3.9 percent over the forecasted period.