Market Overview

The

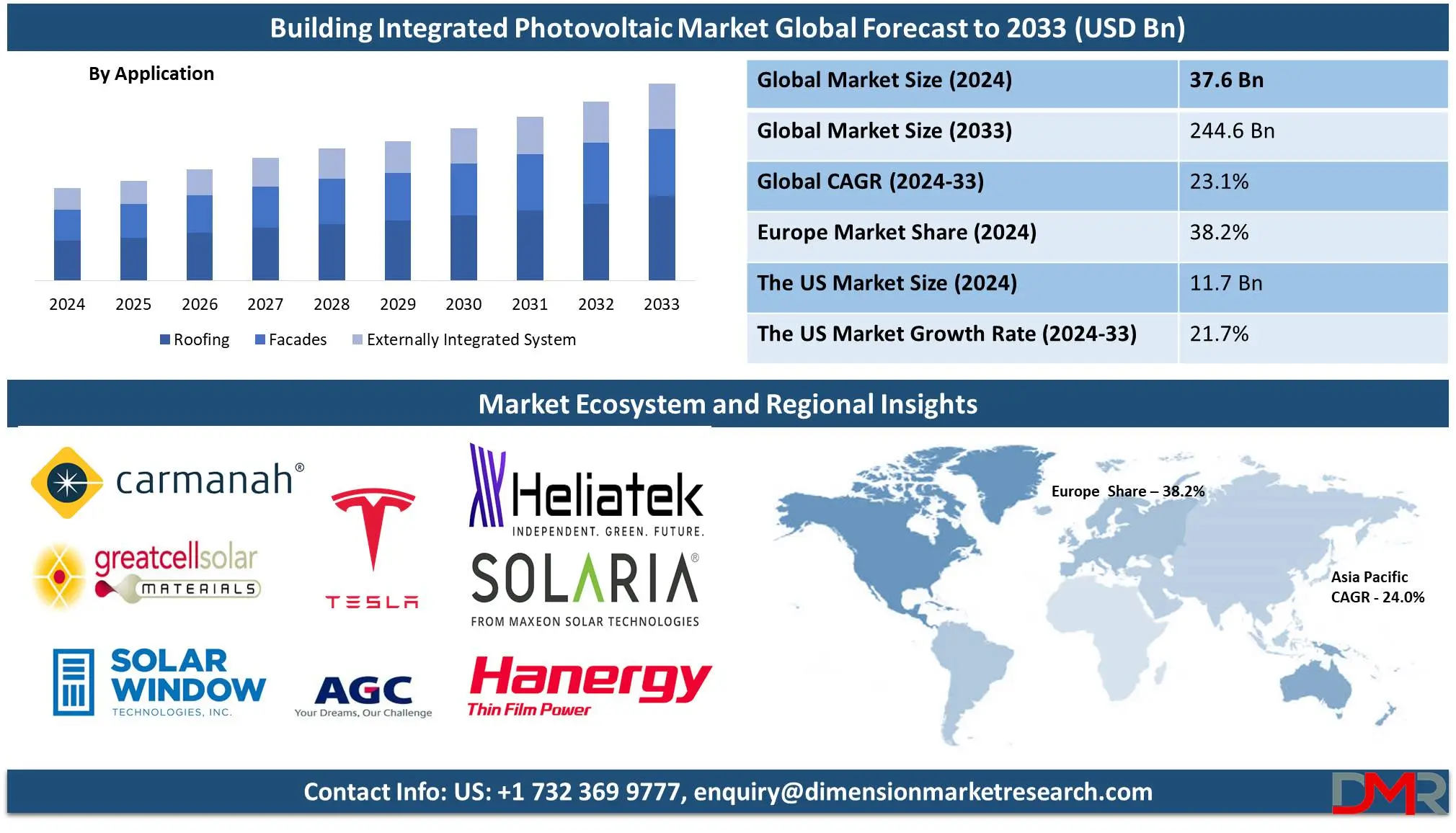

Global Building Integrated Photovoltaic Market size is expected to reach a value of

USD 37.6 billion in 2024, and it is further anticipated to reach a market value of

USD 244.6 billion by 2033 at a

CAGR of 23.1%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Building Integrated Photovoltaic (BIPV) market represents a dynamic integration of renewable energy and modern construction. BIPV systems incorporate photovoltaic materials into structures of buildings, for example, rooftops, façades, or windows, to support the dual roles of providing structural support and energy generation. The innovation brings an aspect of architecture, beauty, and efficiency, as it helps in minimizing the dependence on conventional power generation methods.

Governments and regulatory authorities globally are encouraging the use of BIPV by adopting policies to promote sustainable development and reduce greenhouse gas emissions. The rising demand for green buildings, coupled with increasing awareness about the potential of renewable energy, has placed BIPV at the forefront of this market. As urbanization increases, the BIPV market is likely to take the lead in determining the future of energy-efficient infrastructure.

The global building-integrated photovoltaic market has witnessed remarkable technological advancements, transforming the scope and efficiency of these systems. Photovoltaic technology improvements, including thin-film and organic photovoltaic materials, have greatly enhanced the flexibility of BIPV systems to various architectural designs. Transparent solar cells, semi-transparent modules, and colored PV materials are now easily integrated with building aesthetics, eliminating the earlier problem of visual incongruence. In addition, the development of smart energy systems, such as energy storage and grid integration, has enhanced the attractiveness of BIPV due to the provision of a reliable source of energy.

The pursuit of tandem solar cells and bifacial modules is also driving further efficiency gains and, therefore, more energy production in even the most constrained urban settings. These technological advances, combined with declining manufacturing costs, have democratized access to BIPV for both commercial and residential sectors. The market is mainly developed in regions such as Europe, North America, and Asia-Pacific, where government initiatives and subsidies actively support BIPV deployment.

In 2025, the market is characterized by heightened competition among key players, leading to product innovations and improved customer solutions. Simultaneously, challenges such as high initial installation costs and special expertise requirements are being addressed through partnerships between construction firms, PV manufacturers, and policymakers.

The US Building Integrated Photovoltaic Market

The US Building Integrated Photovoltaic market is projected to be valued at USD 11.7 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 68.5 billion in 2033 at a CAGR of 21.7%.

The US is rapidly positioning itself as a major player in the global BIPV market, driven by a combination of technological innovation, supportive policy frameworks, and increasing consumer demand for sustainable solutions. Commitments toward renewable energy have made BIPV a leading contributor to the country's green building movement. Federal incentives, such as the Investment Tax Credit (ITC), and state-level renewable energy mandates have contributed to an encouraging environment for BIPV adoption. Technological development in the U.S. BIPV market has played a vital role in the development of this market.

In addition, collaborations between tech giants, research institutions, and construction firms have accelerated the development of smart energy management systems in this region, which can seamlessly integrate BIPV solutions with energy storage and grid infrastructure. The current state of the US BIPV market is characterized by a steady upward trend, driven by increased investments in renewable energy and growing awareness of the economic and environmental benefits of BIPV systems. While commercial buildings still lead the market in terms of scale of energy consumption, the residential sector is catching up fast as people seek to recover energy costs and reduce their carbon footprint.

As the US continues to pursue its renewable energy targets and modernize its infrastructure, the BIPV market is expected to expand significantly. Through utilizing its technological prowess, policy support, and increasing consumer interest, the US is poised to become a global leader in BIPV, establishing benchmarks for sustainable construction and energy efficiency.

Key Takeaways

- Market Value: The global building integrated photovoltaics market size is expected to reach a value of USD 244.6 billion by 2033 from a base value of USD 37.6 billion in 2024 at a CAGR of 23.1%.

- By Technology: Crystalline Silicon is projected to maintain its dominance in the technology type segment, capturing 70.9% of the market share in 2024.

- By Application Type: Roofing is expected to dominate the application type segment in the global building-integrated photovoltaic market, holding 66.9% of the market share in 2024.

- By Region: Europe leads the global building integrated photovoltaic landscape with 38.2% of total global market revenue and it is further anticipated to maintain its dominance by the end of 2024.

- Key Players: Some major key players in the global building-integrated photovoltaic market are, SolarWindow Technologies Inc., AGC Inc., Hanergy Mobile Energy Holding Group Limited, The Solaria Corporation, and Other Key Players.

Use Cases

- Residential Housing: Building integrated photovoltaics (BIPV) in residential housing is revolutionizing the concept of sustainable living. BIPV systems may even meet, the energy demands of a family household in highly appealing regions in the US, Europe, or Asia, lowering electricity costs.

- Commercial Buildings: Commercial buildings are suitable for BIPV due to their huge surface areas and large energy requirements. Office complexes, shopping malls, and schools can install BIPV facades, windows, and roofing systems to generate renewable energy and save on energy consumption.

- Public Infrastructure: Public infrastructure like train stations and airports can use BIPV facades or roofing, which reduces operational costs, and boasts commitment to green initiatives. BIPV systems offer both electricity supply and a source of education for students.

- Industrial Applications: Warehouses, factories, and logistics centers can install BIPV systems to produce considerable quantities of renewable energy, bringing lower operational costs and lower carbon emissions. With large, flat roofs, industrial buildings are considered ideal for the integration of high-efficiency solar power.

Market Dynamic

Trends

Agricultural Integration and Design AestheticsOne of the major trends in the building-integrated photovoltaics market is that there is growing interest in architectural integration, which allows buildings to integrate energy generation with innovative design. Unlike traditional solar panels, BIPV materials are not mounted externally on a building roof, facade, or window, but seem to be embedded in the structural elements of the building. This energy-friendly step in building design ensures that the aesthetic appeal of the buildings is maintained or even improved. The new BIPV solutions range from transparent solar panels, and semi-transparent modules, to colored photovoltaic materials that architects can tailor to suit a building's look.

For instance, clear solar glass could be used as an alternative to ordinary windows while generating energy with natural light. The colored PV tiles can replicate traditional roofing material appearances and will therefore blend perfectly with different architectural styles. Focus on design aesthetics makes BIPV the most popular choice within high-end residential and commercial building structures where appearance is a key driving force.

Second, the market for BIPV has become more extensive since it can now be retrofitted into established building structures. Architectural integration trends ensure that BIPV systems are aesthetically as well as functionally viable, creating an avenue to wider acceptance within modern urban designs.

Advancements in Photovoltaic Technology in BIPV

Technological innovation is at the heart of the BIPV market’s rapid growth, which results from developments in photovoltaic materials and systems, hence improvements in performance, efficiency, and adaptability. Traditional crystalline silicon panels were the hallmark of solar technology until recently when it was supplemented or even replaced by newer cutting-edge alternatives like thin-film and organic photovoltaic materials, which can easily be used with greater flexibility in application and design for smooth integration with building components. For instance, thin-film photovoltaics are thin, lightweight, and flexible to adhere to a variety of architectural curvatures in modern architecture.

Perovskite solar cells are the newest technology on the block; it has very high efficiency but with lower cost, and therefore potentially outcompete traditional material sources. Advances in bifacial solar panels and tandem cell technology are also improving energy yield by capturing sunlight from multiple angles or spectrums. These innovations not only improve the functional capacity of BIPV systems but also reduce their cost, making them more accessible. As photovoltaic technologies continue to evolve, they are opening up new opportunities for BIPV in both new constructions and retrofits, transforming buildings into sustainable energy hubs.

Growth Drivers

Government Policies and Incentives

Supportive government policies and financial incentives are critical drivers of the BIPV market. Governments globally recognize the importance of renewable energy in reducing carbon emissions, thus achieving the sustainable development goals. As a result, several programs have been implemented to ensure that BIPV adoption becomes financially and logistically viable both for individuals and organizations.

In developing countries, governments have also introduced subsidy packages, low-interest loans, and tax rebates to attract the deployment of renewable energy sources. Many other countries have also launched feed-in tariffs and net metering policies to make it feasible for BIPV system owners to sell surplus power back to the grid. Such policies can facilitate a suitable environment for BIPV to support the world's energy transition while being conducive to the pursuit of green buildings.

Sustainability Goals Boosting BIPV Adoption

Increased concern over environmental issues is also pushing homeowners into using renewable energies. From a design perspective, BIPV uniquely merges aesthetics with functionality, appealing to eco-conscious consumers. BIPV has emerged as a preferred choice in green building practices, where sustainability metrics such as energy efficiency, carbon neutrality, and renewable energy integration are increasingly prioritized. This increasing urgency to address climate change and reduce global carbon emissions has made sustainability the central focus of governments, industries, and individuals.

Sustainability initiatives, such as the Paris Agreement and national renewable energy targets, further emphasize the integration of renewable energy solutions into everyday infrastructure. Meeting these goals, BIPV systems significantly contribute to reducing fossil fuel dependency, curbing emissions, and paving the way for a cleaner, greener future. The market's alignment with these sustainability objectives ensures its continued growth and relevance.

Growth Opportunities

Expansion in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth potential for the Building Integrated Photovoltaic (BIPV) market, fueled by rapid urbanization and infrastructural investments. As this region rapidly builds new facilities to accommodate new and growing populations, the increasing energy needs require much more efficient and green buildings. Countries like India and China have set very ambitious renewable energy targets and also provide huge subsidies and tax benefits to encourage the adoption of solar energy, including BIPV systems.

Moreover, the development of smart cities in such regions also corresponds with the integration of BIPV as a sustainable energy source. For example, India's Smart Cities Mission and other initiatives in Southeast Asia and Africa focus on incorporating renewable energy into urban infrastructure. Also, most of these countries have sufficient access to solar energy, which increases the efficiency and viability of BIPV systems.

Technological Innovations and Retrofitting Opportunities

Photovoltaic technology development unlocks new doors in the BIPV market driven by continuous enhancement in terms of efficiency, reduction in cost, and enlargement of applications. Innovations such as perovskite solar cells are considered for their high efficiency and low-cost benefits. Besides this, advancements in tandem technologies and transparent PV modules improve design flexibility for BIPV systems and make integration possible with almost any type of building material from glass to tiles, and tiles to facades. This flexibility is quite attractive for architects and developers in their pursuit of building energy-efficient yet aesthetically pleasing buildings.

Furthermore, improvements in energy storage solutions and smart grid integration are adding to the value proposition of BIPV systems, making them more reliable and efficient. As technology continues to advance, retrofitting and new applications will be key drivers for the long-term expansion of the market. Another key growth driver will be the retrofitting of BIPV into existing buildings. Retrofitting brings two advantages, such as making an older structure more energy efficient without detracting from its aesthetics and enhancing them further.

Restraints

High Initial Installation Costs

One of the major constraints is the high installation costs for BIPV systems in widespread adoption. BIPV systems are a more expensive version of traditional photovoltaic technologies, as they tend to integrate PV materials directly within building components in the form of facades, roofs, or windows. The cost of these specialized materials, installation labor, and necessary adjustments to existing building infrastructure can be substantial.

It is a considerable challenge, mainly in markets with limited financial resources, where buyers tend to be resistant to investing in long-term energy solutions. Although BIPV systems ultimately save energy in the long run the payback period might be longer compared to conventional solar panels. Additionally, the financial cost impacts areas where incentives or subsidies from the government are low, or the solar technology market is still developing.

Technical and Integration Challenges

Technical integration of BIPV systems into existing architectural structures is quite challenging. In contrast to the conventional solar panels mounted on rooftops or installed on external surfaces, BIPV systems are integrated directly into the building's design in windows, facades, or roofing materials. It would require high accuracy and professionalism so that the solar photovoltaic materials can be integrated into the structure in such a manner that the building retains its aesthetic appeal, safety, and durability.

The most significant technical challenge is integrating the electrical output of BIPV systems into the existing power grid and energy management system of the building. Electrical wiring, energy storage systems, and inverters must be designed to ensure efficient and safe operation with integrated photovoltaic elements.

Research Scope and Analysis

By Technology

Crystalline Silicon is projected to maintain its dominance in the technology type segment, capturing 70.9% of the market share in 2024 due to its high efficiency, reliability, and well-established manufacturing processes. These advantages make Crystalline Silicon the preferred choice for BIPV applications, where both performance and long-term durability are crucial. In particular, monocrystalline silicon is famous for its high energy conversion efficiency and long life. This makes it suitable for integration into building materials where space and sunlight exposure may be limited.

The advancements in Crystalline Silicon technology, such as bifacial panels that capture sunlight from both sides and improvements in efficiency, are continuously driving its market share. Crystalline Silicon panels also boast a proven recognition in terms of performance and lifespan, with many panels lasting upwards of more than two decades, which appeals to both residential and commercial property owners looking for long-term sustainability. As BIPV systems become more popular, the versatility and high efficiency of Crystalline Silicon ensure its dominant position, especially in regions where solar energy adoption is rapidly growing.

By Application Type

Roofing is expected to dominate the application type segment in the global building-integrated photovoltaic market, holding 66.9% of the market share in 2024 due to the significant advantages that BIPV roofing systems offer in terms of both energy generation and space optimization. Roofs are generally the best-suited surface for installing photovoltaic systems because it is exposed to a lot of sunlight, making them an excellent source for effective energy generation. As buildings have started to integrate green technologies, placing photovoltaic cells in the roofing material seems to be the best way of generating clean energy without using additional space.

BIPV roofing solutions, which include photovoltaic tiles and shingles, allow buildings to generate renewable energy while maintaining aesthetic appeal. These solutions are particularly appealing in both new constructions and retrofitting projects, where space limitations may hinder the use of traditional solar panel installations. Moreover, BIPV roofing systems not only serve as energy producers but also function as integral parts of the building’s structure, offering additional benefits such as improved insulation and weather resistance. This is complemented by an increase in the demand for renewable energy solutions and, above all, a shift towards energy-efficient and net-zero buildings. This drives the growing application of BIPV roofing as it advances further with its designs, efficiency, and reduced cost.

By End User

The residential is anticipated to be the market leader in the end-user segment with a significant share of 34.7% in 2024. This can be attributed to various key drivers responsible for the growth of BIPV systems in residential buildings. As the residents become more aware of the negative impacts of conventional energy sources and the necessity for sustainable living, the demand for renewable energy sources, including BIPV, is rapidly growing. In the case of residential property, especially in urban regions, BIPV systems are increasingly being used as a way of reducing energy costs and lowering their carbon footprint.

Among the key factors is the increase in electricity costs, which makes homeowners more responsive to alternative energy sources, such as solar power. BIPV systems that are integrated into the building's structure, such as roof or window integration and facade integration, provide an aesthetic solution for generating clean energy by homeowners without occupying space. Its appeal in residential applications is further enhanced by its potential for energy independence. Homeowners can reduce their reliance on grid power while generating electricity on site thus mitigating the impact of rising utility rates and enhancing energy security.

The Building Integrated Photovoltaic Market Report is segmented on the basis of the following

By Technology

- Crystalline Silicon

- Monocrystalline

- Polycrystalline

- Thin Film

- Thin Film A-SI PV Panel

- Thin Film CDTE PV Panel

- Thin Film CIGS PV Panel

- Concentrated PV Panels

By Application

- Roofing

- Tiles

- Shingles

- Skylights

- Laminates

- Metal Seam

- Facades

- Windows

- Curtain Walls

- Awnings

- Others

- Externally Integrated Systems

- Shading

- Balustrades

- Canopy

By End User

- Residential

- Commercial

- Industrial

Regional Analysis

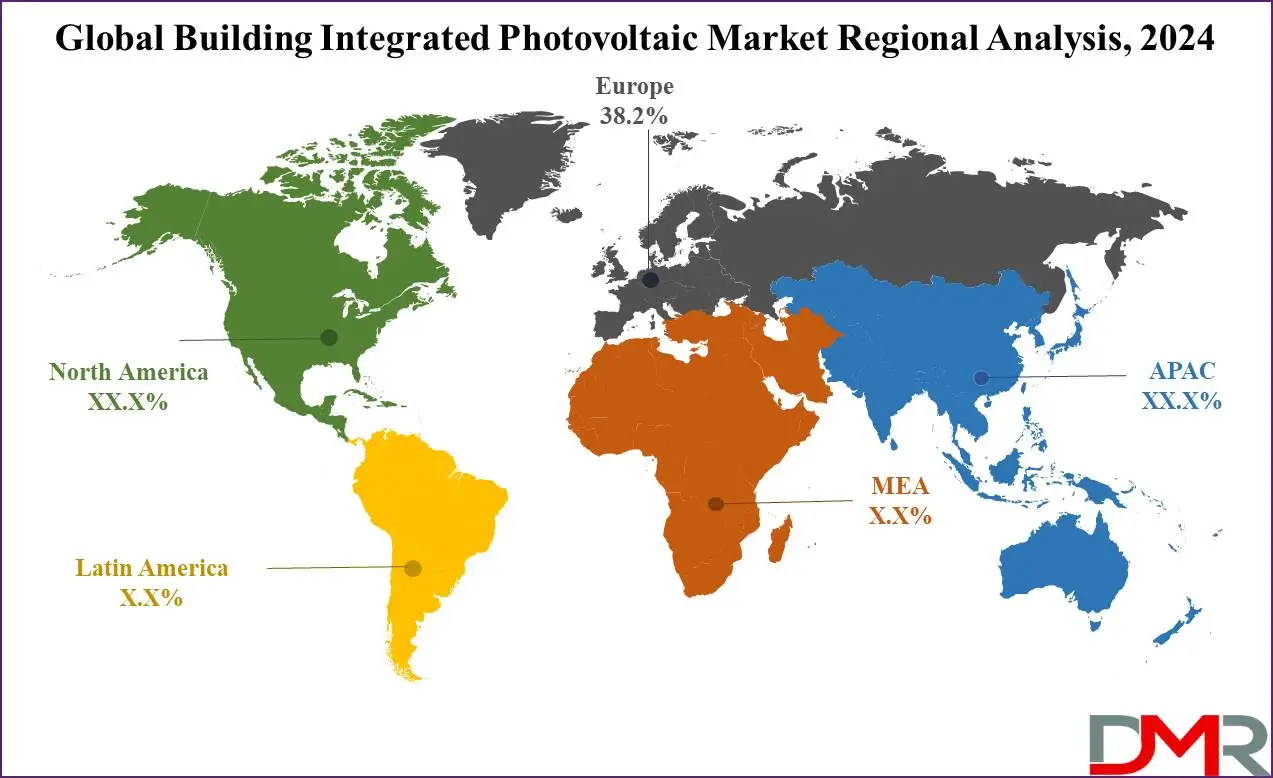

Europe is expected to continue dominating the global market for Building Integrated Photovoltaic (BIPV), with its share in the total revenue amounting to

38.2% by 2024. This is because of the region's striving commitment to sustainability and renewable energy, driven mainly by the ambitious climate goals set within the European Green Deal, which aims to achieve net-zero emissions by 2050. Europe's leading countries, including Germany, France, the Netherlands, and the UK, play a significant role in embracing energy-efficient building practices, where BIPV systems are increasingly integrated into new and retrofitted buildings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technological innovation is another key factor, with European companies leading the development of advanced BIPV solutions such as transparent solar panels and solar windows. As cities across Europe move toward becoming smart, sustainable urban centers, the adoption of BIPV in building design continues to rise. These combined factors ensure that Europe remains at the forefront of the global BIPV market, shaping its growth and technological advancements.

Europe's dominance is driven by the adoption of sustainable building practices. The European Union has set renewable energy targets within the European Green Deal, where carbon emissions need to be cut and net-zero energy systems should be established by 2050. In addition, Europe has been a stronghold of green architecture and energy-efficient buildings for a longer time. Countries like Germany, France, the Netherlands, and the UK have an effective market for sustainable construction.

Another contributing factor is the prevalence of technological innovation. European companies lead the way in developing advanced BIPV solutions, such as transparent solar panels, solar windows, and building-integrated solar roofs. As cities in Europe become smarter and more sustainable, new constructions and retrofitting projects with BIPV systems continue to have a high demand. All these factors combine to ensure that Europe will maintain its leading position in the global BIPV market, ensuring further growth and technological development in the sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Building Integrated Photovoltaic (BIPV) market is characterized by a dynamic competitive landscape with the presence of well-established solar energy companies and innovative startups driving the advancement of photovoltaic technology. The companies leading the integration of photovoltaic systems into building materials, such as windows, facades, and roofs, are Tesla, SolteQ, Saint-Gobain, Onyx Solar, and SunPower. These companies are now focusing on product innovation to make BIPV solutions more efficient, aesthetic, and cost-effective. For instance, companies specializing in glass-based transparent solar panels include Onyx Solar.

Partnerships and collaborations are frequent in this market, as companies collaborate to leverage their strengths in solar technology, building design, and energy storage solutions. In this regard, collaborative approaches fuel the development of more efficient and cost-effective BIPV products. In 2025, the market is characterized by heightened competition among key players, leading to product innovations and improved customer solutions. Simultaneously, challenges such as high initial installation costs and special expertise requirements are being addressed through partnerships between construction firms, PV manufacturers, and policymakers.

Some of the prominent players in the Global Building Integrated Photovoltaic Market are

- SolarWindow Technologies, Inc.

- AGC Inc.

- Hanergy Mobile Energy Holding Group Limited

- The Solaria Corporation

- Heliatek GmbH,

- Carmanah Technologies Corp.

- Greatcell

- Tesla

- BELECTRIC

- Ertex solartechnik GmbH

- Other Key Players

Recent Developments

- December 2024: The Indian government mandated that starting June 2026; all clean energy projects must utilize solar photovoltaic (PV) modules made from domestically produced cells. This policy aims to reduce reliance on imported Chinese solar components and bolster India's solar manufacturing capabilities.

- August 2024: Bee Solar and Chinese manufacturer Huasun entered into a strategic partnership to collaborate on photovoltaic panel components. This collaboration is part of a broader effort to balance Europe's reliance on affordable Chinese solar components, aiming to support decarbonization goals.

- August 2024: Mitrex Building Integrated Solar Technology commenced the installation of Ontario's largest integrated vertical solar photovoltaic (PV) wall. This innovative project aims to enhance energy efficiency and sustainability in urban environments by integrating solar technology directly into building structures.

- July 2024: German companies accelerated the adoption of solar energy to mitigate high electricity costs and reduce carbon emissions. A notable example includes a metal products factory in Thuringia investing €2.3 million in solar panels, expanding the project to power 900 households in addition to the factory.

- January 2024: The U.S. Department of Energy's Solar Energy Technologies Office released a comprehensive strategy to promote Building-Integrated Photovoltaics (BIPV). This initiative aims to expand solar energy applications beyond traditional rooftop installations by integrating photovoltaic materials directly into building components such as facades, windows, and skylights.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 37.6 Bn |

| Forecast Value (2034) |

USD 244.6 Bn |

| CAGR (2025-2034) |

23.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 11.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Crystalline Silicon and Thin Film), By Application (Roofing, Facades and Externally Integrated Systems), By End User (Residential, Commercial and Industrial) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

SolarWindow Technologies Inc, AGC INC, Hanergy Mobile Energy Holding Group Limited, The Solaria Corporation, Heliatek GmbH and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global building-integrated photovoltaic Market?

▾ The global building-integrated photovoltaic market size is estimated to have a value of USD 37.6 billion in 2024 and is expected to reach USD 244.6 billion by the end of 2033.

What is the size of the US building integrated photovoltaic market?

▾ The US building integrated photovoltaic market is projected to be valued at USD 11.7 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 68.5 billion in 2033 at a CAGR of 21.7%.

Which region accounted for the largest global building-integrated photovoltaic market?

▾ Europe is expected to have the largest market share in the global building-integrated photovoltaic market with a share of about 38.2% in 2024.

Who are the key players in the global building-integrated photovoltaic market?

▾ Some of the major key players in the global building-integrated photovoltaic market SolarWindow Technologies Inc., AGC Inc., Hanergy Mobile Energy Holding Group Limited, The Solaria Corporation, and many others.

What is the growth rate in the global building-integrated photovoltaic market?

▾ The market is growing at a CAGR of 23.1 percent over the forecasted period.