Market Overview

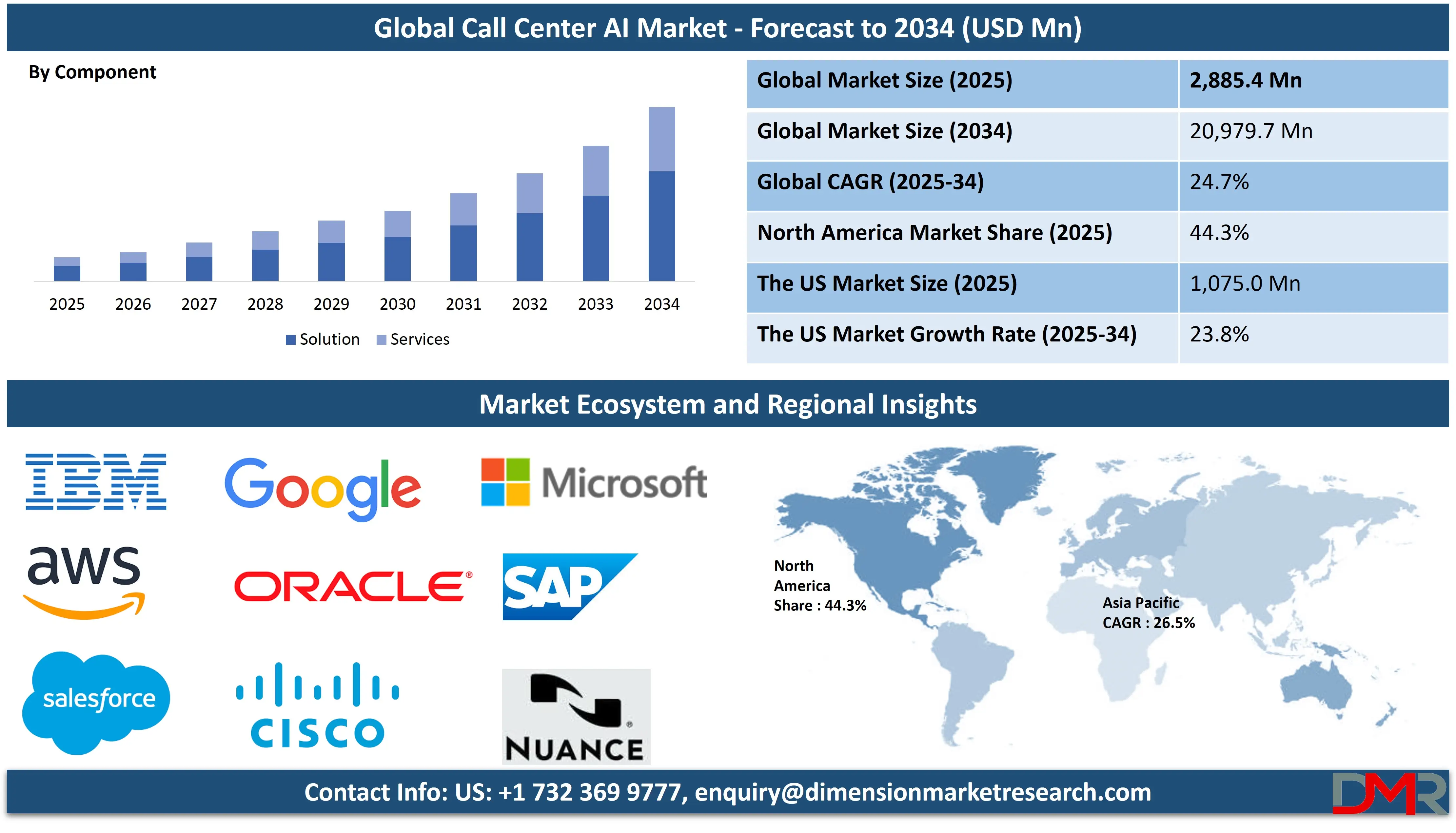

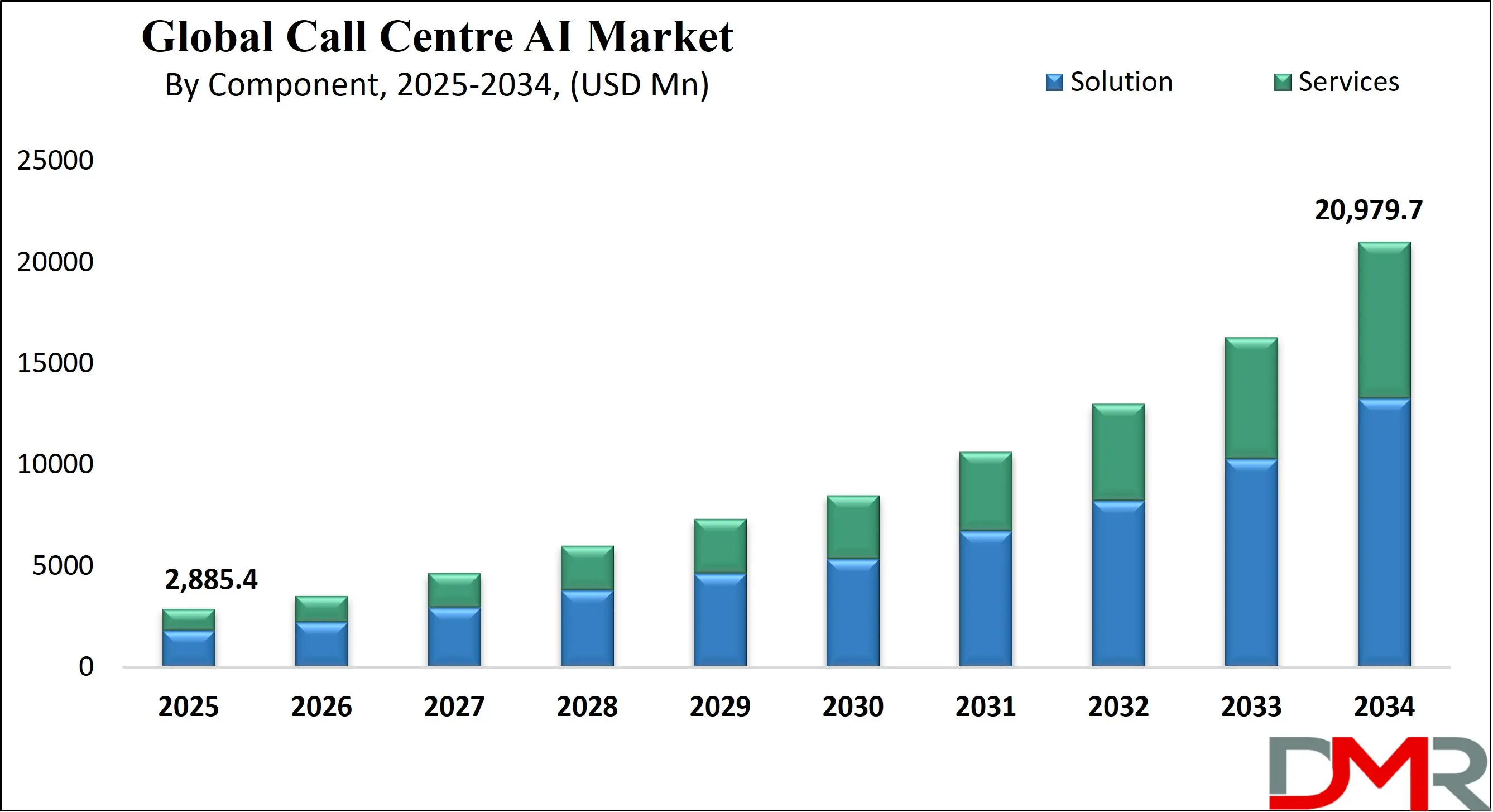

The Global Call Center AI Market is predicted to be valued at USD 2,885.4 million in 2025 and is expected to grow to USD 20,979.7 million by 2034, registering a compound annual growth rate (CAGR) of 24.7% from 2025 to 2034.

Call Center AI refers to the integration of artificial intelligence technologies into customer service operations to automate and enhance call center functions. It utilizes tools such as natural language processing (NLP), machine learning, and voice recognition to manage customer inquiries, provide virtual assistance, analyze sentiment, and route calls intelligently.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These AI-driven systems improve response times, reduce operational costs, and ensure personalized customer interactions. Key applications include AI-powered chatbots, voicebots, predictive analytics, and intelligent call routing. By streamlining repetitive tasks and offering 24/7 support, Call Center AI helps businesses boost efficiency, customer satisfaction, and overall service quality across multiple communication channels.

The global call center AI market is experiencing rapid growth, driven by the increasing demand for automation, enhanced customer service, and operational efficiency. Businesses across industries are embracing AI-powered solutions to streamline their customer support processes and deliver consistent, real-time assistance.

Call center AI integrates advanced technologies like natural language processing, speech recognition, machine learning, and predictive analytics to manage high volumes of customer interactions efficiently. These intelligent systems can understand customer intent, provide instant responses, and route queries to the appropriate human agents when necessary.

The adoption of virtual assistants and AI chatbots is revolutionizing the way organizations handle inbound and outbound communication. AI voice bots and omnichannel engagement platforms are enabling seamless customer experiences across voice, email, live chat, and messaging applications.

Additionally, real-time speech analytics and sentiment analysis are helping call centers monitor performance, improve agent training, and gain actionable insights into customer behavior.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Sectors such as banking, financial services, insurance, e-commerce, healthcare, telecom, and retail are leveraging AI call center software to reduce response time, improve first-call resolution, and enhance customer satisfaction. The growing focus on personalized interactions and proactive customer engagement is accelerating the deployment of AI in contact centers.

Moreover, the integration of cloud-based call center infrastructure and conversational AI tools is allowing organizations to scale their operations while maintaining agility and compliance. As companies seek to offer smarter customer engagement and optimize their workforce, the call center AI market is set to transform the traditional customer service landscape into a more intelligent and data-driven environment.

The US Call Center AI Market

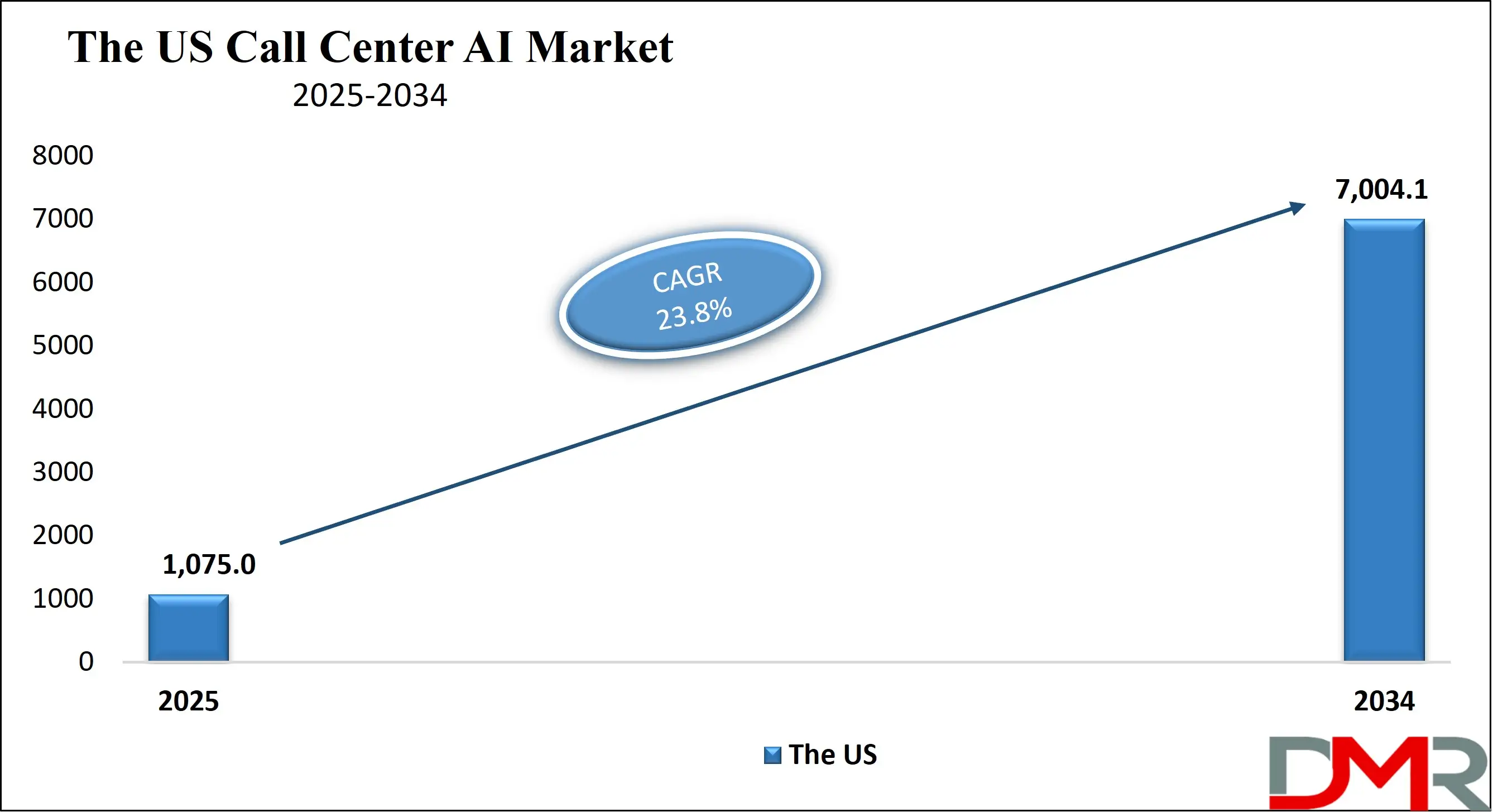

The US Call Center AI Market is projected to be valued at USD 1,075.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7,004.1 million in 2034 at a CAGR of 23.8%.

The US Call Center AI market is driven by rising demand for enhanced customer service experiences, coupled with increasing labor costs in the customer support sector. Enterprises are rapidly adopting AI-powered solutions like intelligent virtual assistants and natural language processing tools to reduce operational expenses and improve call resolution rates.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The integration of cloud computing with AI technologies further enables scalability and flexible deployment. Additionally, the U.S. has a strong ecosystem of AI startups and tech giants investing heavily in conversational AI, machine learning, and predictive analytics, fueling adoption across industries such as banking, telecom, and retail to streamline customer interactions.

A key trend in the U.S. market is the integration of emotion detection and sentiment analysis within AI-driven call centers. Companies are focusing on real-time analytics to assess customer satisfaction and agent performance. There's also a shift toward omnichannel customer engagement, enabling seamless interaction across voice, chat, email, and social media platforms.

The rise of generative AI tools is transforming agent-assist capabilities, enabling faster query resolution. Moreover, the growing use of self-service portals powered by AI is reshaping customer support workflows. Data privacy and compliance are also influencing technology development, with increased attention to ethical AI and secure data handling.

The Japan Call Center AI Market

The Japan Call Center AI Market is projected to be valued at USD 215.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,531.2 million in 2034 at a CAGR of 24.2%.

The primary driver in Japan’s Call Center AI market is its rapidly aging population, which is prompting businesses to adopt automation to maintain service quality despite labor shortages. Enterprises are increasingly relying on AI technologies to ensure 24/7 customer support without overburdening limited human staff. Additionally, Japanese companies value precision and efficiency, key strengths of AI-powered systems such as speech analytics, virtual agents, and robotic process automation.

The government’s promotion of Society 5.0 and investments in smart technologies are accelerating the adoption of AI in customer service operations, particularly across sectors like finance, insurance, and consumer electronics.

In Japan, the integration of AI into call centers is closely aligned with cultural preferences for high-quality, respectful customer interactions. Emotion recognition software and speech synthesis tuned to local linguistic nuances are gaining popularity. There’s a growing emphasis on AI-human collaboration, where virtual agents handle routine queries, while human agents manage complex issues.

The rise of AI-driven customer satisfaction analysis tools is helping organizations refine service delivery. Additionally, adoption of cloud-based AI platforms is expanding, especially among enterprises seeking flexibility and reduced infrastructure costs. Local AI startups are also contributing to innovation, tailoring solutions to domestic market needs.

The Europe Call Center AI Market

The Europe Call Center AI Market is projected to be valued at USD 692.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,781.3 million in 2034 at a CAGR of 23.7%.

The Europe Call Center AI market is propelled by a strong push toward digital transformation in both the public and private sectors. Rising multilingual demands in customer service across countries drive the need for AI solutions capable of supporting diverse languages and regional accents.

Additionally, organizations are adopting AI to ensure operational efficiency amid stringent labor regulations and cost pressures. The European Union’s initiatives to boost AI innovation and support SMEs in adopting advanced technologies are also contributing to market growth. Integration of AI in CRM systems and enhanced analytics capabilities further attract investments from the BFSI, telecom, and healthcare sectors.

Europe is witnessing a rise in conversational AI tools optimized for GDPR compliance, ensuring ethical data handling in customer interactions. Multilingual AI bots are gaining traction, especially in cross-border customer service operations. Sustainability concerns are prompting organizations to implement AI-driven call routing to reduce energy and resource usage. Another emerging trend is the use of AI for real-time translation and language localization.

Moreover, enterprises are exploring AI-powered agent training tools to enhance performance and knowledge retention. Collaboration between governments and tech firms to build AI talent and infrastructure is also shaping the long-term trajectory of the regional market.

Call Center AI Market: Key Takeaways

- Market Overview: The global Call Center AI market is expected to reach a value of USD 2,885.4 million in 2025 and is forecasted to grow significantly, reaching USD 20,979.7 million by 2034, driven by a robust compound annual growth rate (CAGR) of 24.7% over the forecast period.

- By Component: The solutions segment is anticipated to lead the market by the end of 2025, accounting for 61.2% of the overall revenue share.

- By Deployment: Cloud-based deployment is expected to be the most preferred model, representing 67.9% of the total market share by 2025.

- By Application: Predictive call routing is projected to emerge as the top application segment, holding a 28.7% share of the call center AI market by 2025.

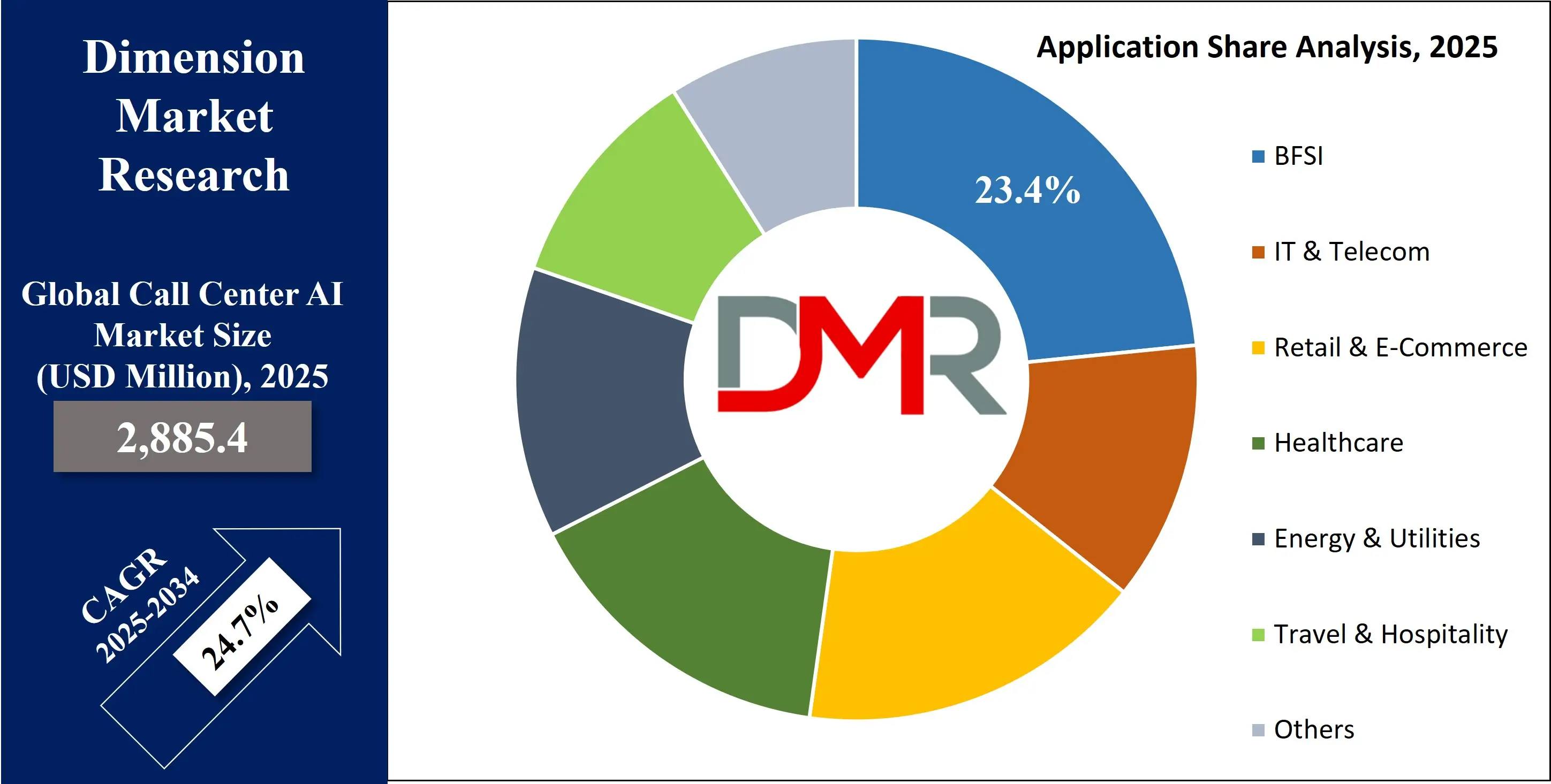

- By End User: The Banking, Financial Services, and Insurance (BFSI) sector is set to be the leading end-user, contributing 23.4% to the total market share by 2025.

- By Region: North America is expected to dominate the global market landscape, capturing the largest regional share of 44.3% by the end of 2025.

Call Center AI Market: Use Cases

- Automated Customer Support: Call Center AI enables 24/7 customer service through AI chatbots and voice assistants. These tools can resolve common queries, reset passwords, track orders, or provide billing info without human intervention, reducing operational costs and improving customer experience through instant responses and reduced wait times.

- Intelligent Call Routing: AI-powered systems analyze customer inputs, which like sentiment, issue type, or purchase history, and route calls to the most suitable agent. This boosts first-call resolution rates and enhances customer satisfaction by minimizing transfers and ensuring that customers reach the best-qualified representative.

- Real-Time Agent Assistance: Call Center AI provides live agents with contextual support during calls. It suggests next-best actions, pulls up relevant knowledge base articles, and even alerts them about compliance breaches. This reduces handling time and improves the quality and consistency of support across the team.

- Sentiment and Emotion Analysis: AI tools analyze the tone, pace, and words used in conversations to detect customer emotions. This allows supervisors to intervene in real-time during critical calls or use the data for post-call training, helping improve service quality and customer retention.

Call Center AI Market: Stats & Facts

- IBM states that businesses receive approximately 265 million customer support calls each year, and AI can help reduce call duration by up to 70% while improving customer satisfaction.

- MIT Technology Review highlights that companies implementing AI in call centers have seen a 60% boost in agent productivity, especially by automating routine queries using virtual assistants.

- Gartner reports that by 2026, one in ten agent interactions will be automated using conversational AI, compared to just 1.6% in 2022.

- Microsoft found that 90% of consumers expect an immediate response to their support inquiries, and AI-enabled systems help meet this expectation by delivering instant replies 24/7.

- Salesforce noted that 51% of service teams are already using AI chatbots, and another 23% plan to adopt them within the next 18 months.

- Google Cloud research shows that contact centers using AI tools such as Dialogflow and Contact Center AI have reduced average handling time by 15–20% and increased first call resolution rates.

- Harvard Business Review mentions that integrating AI in call centers leads to a 20% reduction in employee churn, as agents are less burdened by repetitive tasks.

- Zendesk data shows that companies using AI-powered support saw ticket volume drop by 30% as AI handles low-complexity inquiries effectively.

- PwC survey reveals that 52% of companies are speeding up AI adoption in customer service post-COVID, emphasizing long-term strategic value.

- IBM reports that U.S. companies handle over 50 million customer service calls annually, and deploying AI in call centers can reduce operational costs by up to 30%.

- Gartner estimates that by 2025, 40% of U.S. call center interactions will be handled by AI-driven systems like virtual agents and voicebots, up from just 15% in 2021.

- Microsoft found that 78% of American consumers have interacted with AI-powered customer service tools, and 45% prefer chatbots for basic inquiries.

- MIT Technology Review states that AI implementation in U.S.-based call centers has improved agent efficiency by an average of 50%, particularly through predictive routing and sentiment analysis.

- Google Cloud notes that American call centers using its Contact Center AI experienced a 20–25% drop in average handle time (AHT) and improved CSAT scores by 10–15%.

- Harvard Business Review highlights that call centers in the U.S. that adopted AI tools saw a 30% decrease in employee turnover, attributing it to less stress from repetitive tasks.

- Salesforce data shows that 53% of U.S. service organizations are actively using AI to automate parts of the customer support process, especially through intelligent chatbots and case classification.

- PwC indicates that 72% of U.S. business leaders consider AI in customer engagement a critical investment, with the contact center being a primary focus area post-pandemic.

- Zendesk reports that U.S. companies using AI in customer service reduced ticket backlogs by 35%, enabling human agents to focus on complex issues.

Call Center AI Market: Market Dynamics

Driving Factors in the Call Center AI Market

Rising Demand for Enhanced Customer Experience

The increasing focus on delivering a superior customer experience is a primary driving force in the call center AI market. Businesses are leveraging AI-enabled contact centers to offer 24/7 customer support, personalized interactions, and quicker query resolution. Intelligent virtual assistants and chatbots enhance first-call resolution rates, thereby improving customer satisfaction.

Enterprises across industries are integrating natural language processing (NLP) and machine learning in their voice-based and text-based interactions to deliver seamless experiences. AI-powered sentiment analysis tools are also helping agents identify customer emotions in real-time. This growing dependence on AI to optimize agent performance and enhance customer journey is fueling demand for artificial intelligence in customer service operations.

Cost Reduction and Operational Efficiency

Another key growth driver is the need for cost optimization and operational efficiency across contact center operations. Call center AI solutions reduce dependence on large human agent teams by automating routine inquiries through conversational AI tools. These tools assist in decreasing average handling time and improving first-contact resolution.

Predictive analytics and real-time call monitoring further streamline workforce management, reduce churn, and lower operational overheads. Organizations are also using AI to analyze call transcripts and optimize call routing strategies. With the ability to manage peak loads without additional staffing, AI integration significantly reduces total cost of ownership (TCO) in customer support ecosystems.

Restraints in the Call Center AI Market

High Initial Investment and Integration Costs

Despite its advantages, the adoption of call center AI faces hurdles due to substantial initial investment requirements. Deployment of AI-powered customer engagement platforms involves costs for infrastructure, software licensing, integration with existing CRM systems, and employee training. Small and medium-sized enterprises (SMEs) often struggle with limited budgets, making it challenging to implement end-to-end AI-driven contact center solutions.

Moreover, compatibility issues between legacy telephony systems and modern conversational AI platforms can lead to delays and additional costs. These financial and technical constraints act as significant barriers, slowing the rate of digital transformation in smaller customer support operations.

Data Privacy and Security Concerns

As call center AI platforms process vast volumes of personal and sensitive customer data, concerns surrounding data privacy and cybersecurity pose a major restraint. Voice recognition systems, automated transcription tools, and sentiment detection engines store and analyze user information, making them potential targets for data breaches.

Strict regulations such as GDPR and CCPA impose stringent compliance requirements on AI-enabled call centers. Ensuring secure data storage, robust encryption, and transparent usage policies is both complex and costly. The lack of clarity in AI governance and ethical considerations further deters businesses from full-scale adoption of AI in customer service environments.

Opportunities in the Call Center AI Market

Integration of Multilingual and Omnichannel Capabilities

The growing global nature of customer bases is creating opportunities for multilingual and omnichannel AI support in call centers. With advancements in voice AI and real-time translation technologies, companies can now cater to diverse linguistic audiences through a single intelligent contact center platform.

Call center AI solutions that unify voice calls, emails, chats, and social media into one seamless system enable consistent customer engagement across multiple platforms. This not only enhances customer loyalty but also provides valuable insights from cross-channel analytics. Organizations can leverage AI for unified communications to strengthen brand presence and tap into new regional markets.

Rising Adoption of Cloud-based Contact Center AI

The accelerated shift toward cloud computing offers a significant opportunity for the expansion of the call center AI market. Cloud-native AI solutions enable businesses to scale operations flexibly, deploy services faster, and reduce maintenance costs. These platforms offer real-time updates, remote access, and centralized data management, which are vital in supporting hybrid and remote contact center workforces.

Cloud-based AI tools like automated speech recognition (ASR), intelligent call routing, and robotic process automation (RPA) are gaining popularity due to their agility and lower upfront investments. This trend opens new possibilities for AI vendors and service providers in emerging and mid-tier markets.

Trends in the Call Center AI Market

Rise of Emotion AI and Sentiment Analysis

A major trend reshaping the call center AI market is the growing implementation of emotion AI and real-time sentiment analysis. These tools use advanced machine learning algorithms to detect vocal tone, speech pace, and textual cues to gauge customer emotions during live interactions.

Call centers are increasingly leveraging these tools to tailor conversations dynamically, escalate calls to human agents when necessary, and reduce customer churn. Emotion recognition technology enhances agent coaching and feedback mechanisms, resulting in more empathetic customer service. As organizations aim to personalize experiences further, the demand for emotionally intelligent AI systems continues to rise.

Hyper automation in Contact Centers

Hyperautomation, the integration of AI, machine learning, and robotic process automation (RPA), is emerging as a transformative trend in the call center AI landscape. By automating both front-end and back-end workflows—from answering repetitive queries to updating CRM entries, businesses are drastically reducing manual workload.

AI-driven bots and virtual agents handle Tier 1 support, while RPA manages tasks like ticket categorization and data entry. This synergy enables faster resolutions, minimizes errors, and boosts scalability. With enterprises increasingly aiming to become agile and data-driven, hyper-automation is shaping the future of intelligent customer service ecosystems.

Call Center AI Market: Research Scope and Analysis

By Component Analysis

The solution segment is projected to dominate the global call center AI market by the end of 2025, capturing 61.2% of the total market share. The rise in adoption of AI-powered chatbots, virtual agents, and intelligent IVR systems is fueling the growth of this segment. As enterprises prioritize enhancing customer interactions and reducing operational costs, the deployment of machine learning algorithms and natural language generation processing tools within AI solutions is gaining traction.

This trend is particularly strong among businesses focusing on customer experience optimization. As AI tools continue to evolve, solution providers are integrating advanced analytics and automation features, boosting their demand and positioning them as essential assets in transforming call center operations.

The services segment is expected to witness the highest CAGR in the call center AI market by 2025. Growing demand for consulting services, system integration, and support and maintenance is driving this surge. Companies across sectors are relying on external expertise for seamless deployment of AI platforms, especially in hybrid environments.

The increasing focus on post-deployment optimization and real-time troubleshooting also contributes to the rapid expansion of this segment. As enterprises move toward personalized customer interactions and omnichannel engagement strategies, service providers offering tailored solutions for AI training, model tuning, and infrastructure management are seeing a spike in demand, thus propelling this segment forward with robust growth potential.

By Deployment Analysis

Cloud deployment is expected to dominate the call center AI market by 2025, accounting for 67.9% of the total share. The segment benefits from advantages such as lower infrastructure costs, high scalability, and easier access to real-time updates. Cloud-based AI platforms facilitate seamless integration with CRM systems and enable faster deployment across distributed teams.

With organizations prioritizing remote working models and looking to scale AI initiatives across global operations, cloud deployment emerges as the preferred choice. It allows enterprises to access data-driven insights and deploy intelligent automation tools without heavy capital expenditure, making it essential in the modern digital contact center environment.

The cloud segment is also poised to grow at the highest CAGR in the call center AI market by 2025. The rapid digital transformation of customer support infrastructure, especially among small and medium enterprises, is accelerating the move toward cloud-native AI platforms. These solutions offer greater flexibility, faster implementation, and the ability to rapidly scale based on customer demand.

Additionally, cloud models support AI-enhanced self-service tools, enabling companies to handle large volumes of queries without additional human resources. As companies aim to remain agile and competitive, the demand for cloud-based call center automation tools continues to grow, driving this segment’s exponential expansion.

By Application Analysis

By the end of 2025, predictive call routing is projected to dominate the application landscape of the call center AI market, holding a 28.7% share. The segment is thriving due to its capability to enhance agent efficiency and customer satisfaction by leveraging real-time analytics and behavioral data.

Businesses are prioritizing AI-driven routing algorithms to minimize hold times and increase first-call resolution rates. With the integration of predictive modeling and behavioral segmentation, customer queries are efficiently assigned to the most suitable agents. This targeted approach not only streamlines operations but also aligns with the rising trend of hyper-personalized customer service, making predictive call routing a strategic application area across industries.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Sentiment analysis is expected to register the fastest growth in the call center AI market by 2025. The growing need to gauge customer emotions and refine service delivery in real-time is fueling demand for this segment. Businesses are turning to emotion recognition algorithms and AI-driven voice analytics to extract customer sentiments from calls, emails, and chat interactions.

This helps in proactively managing customer dissatisfaction and enhancing agent performance. The increasing focus on customer retention strategies and brand perception management is also pushing enterprises to invest in advanced sentiment monitoring solutions. With the rising emphasis on empathetic communication and context-aware responses, this segment is set for rapid expansion.

By End User Analysis

The BFSI sector is anticipated to dominate the call center AI market by 2025, securing 23.4% of the total market share. Banks and financial institutions are deploying AI to streamline customer support, detect fraud, and manage high volumes of transactional queries with minimal human intervention.

With AI-powered solutions such as virtual financial advisors, automated KYC verification, and voice biometrics, the sector is enhancing both efficiency and security. The integration of conversational AI tools in mobile banking and customer service portals further supports this dominance. The push toward digital transformation and improved customer service delivery continues to fuel AI investments across the BFSI industry.

The retail and e-commerce sector is projected to grow at the fastest CAGR in the call center AI market by 2025. Driven by rising consumer expectations and intense competition, businesses in this segment are leveraging AI to enable automated product recommendations, personalized promotions, and order status tracking through virtual assistants.

The need to deliver round-the-clock customer support across multiple channels, including chat, voice, and social platforms, which fuels rapid AI adoption. Moreover, AI is transforming post-sales services and returns management processes. The application of real-time inventory analytics, AI-driven FAQs, and customer sentiment tracking contributes to significant growth, positioning this sector as a key growth engine in the AI contact center space.

The Call Center AI Market Report is segmented on the basis of the following:

By Component

By Deployment

By Application

- Workforce Management & Advanced Scheduling

- Journey Orchestration

- Predictive Call Routing

- Sentiment Analysis

- Others

By End User

- BFSI

- IT & Telecom

- Retail & E-Commerce

- Healthcare

- Energy & Utilities

- Travel & Hospitality

- Others

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share in the global call center AI market, with a revenue share of 44.3% by the end of 2025. The region benefits from a highly developed IT infrastructure, widespread adoption of advanced customer engagement technologies, and a strong presence of leading AI solution providers. Enterprises across sectors such as BFSI, telecom, and retail are rapidly deploying AI-driven call center solutions to enhance customer experience and streamline operations.

Furthermore, the growing demand for automation, real-time analytics, and voice recognition tools has accelerated AI investments. The U.S., in particular, is driving the regional market due to high digital maturity, robust R&D activities, and early adoption of conversational AI technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia-Pacific is expected to register the highest CAGR in the call center AI market through 2025. Rapid digital transformation across emerging economies, growing investments in AI infrastructure, and rising demand for cost-effective customer service automation are key growth drivers. Countries like India, China, and the Philippines are leading outsourcing hubs where enterprises are adopting AI-enabled solutions to improve agent productivity and reduce service costs.

Additionally, the increasing penetration of cloud technologies, multilingual customer support requirements, and government-led AI initiatives are fueling regional adoption. With expanding e-commerce, banking, and telecom sectors, Asia-Pacific is poised to become a hotbed for innovation and large-scale deployment of intelligent call center platforms.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Call Center AI Market

- Enhanced Customer Experience: AI revolutionizes customer service by enabling natural language understanding and sentiment analysis. Virtual agents and chatbots handle routine inquiries with speed and accuracy, offering 24/7 support. These systems adapt to customer emotions and intent, delivering personalized, efficient interactions that improve satisfaction and reduce wait times significantly.

- Operational Efficiency and Cost Reduction: AI automates repetitive tasks like call routing, data entry, and ticket generation, reducing workload on human agents. Intelligent systems prioritize and distribute calls based on complexity and agent expertise, leading to faster resolutions. This optimization lowers operational costs and boosts overall productivity in call center operations.

- Advanced Analytics and Insights: AI-driven analytics tools extract actionable insights from call transcripts and customer interactions. These insights help identify common pain points, agent performance gaps, and customer behavior trends. Businesses can use this data to refine training programs, enhance service strategies, and make data-driven decisions for continuous improvement.

- Real-Time Assistance and Agent Augmentation: AI supports human agents by providing real-time suggestions, knowledge base retrieval, and automated response recommendations during live calls. This reduces response times and improves accuracy, especially in complex scenarios. AI-driven agent assist tools bridge knowledge gaps and help deliver consistent, high-quality customer support across all channels.

Competitive Landscape

The competitive landscape of the call center AI market is characterized by the presence of both established tech giants and emerging AI-focused startups. Key players such as Google LLC, IBM Corporation, Microsoft Corporation, Amazon Web Services, Oracle Corporation, and SAP SE are at the forefront, offering robust AI-powered call center solutions with advanced capabilities like natural language understanding, voice recognition, speech analytics, and automated agent assistance. These companies are heavily investing in R&D to enhance conversational AI, improve real-time decision-making, and provide personalized customer engagement tools.

Additionally, firms such as Zendesk, Five9, NICE Ltd., Talkdesk, and Genesys are expanding their offerings to include intelligent virtual agents, predictive analytics, and omnichannel integration. Strategic partnerships, cloud-native platform enhancements, and AI-driven customer experience solutions are central to gaining market share. Startups are focusing on specialized technologies such as sentiment detection, AI-based call routing, and workforce automation.

With the growing demand for AI in customer service operations, vendors are intensifying their efforts in providing scalable, secure, and multilingual AI systems. The shift toward AI-powered customer interaction platforms and smart contact center infrastructure is reshaping the competitive dynamics, encouraging innovation in automated workflows, deep learning integration, and context-aware service capabilities.

Some of the prominent players in the Global Call Center AI Market are

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- Oracle Corporation

- SAP SE

- Salesforce, Inc.

- Cisco Systems, Inc.

- Nuance Communications, Inc.

- NICE Ltd.

- Avaya Inc.

- Genesys Telecommunications Laboratories, Inc.

- Five9, Inc.

- Talkdesk, Inc.

- 8x8, Inc.

- Uniphore Technologies Inc.

- Cognigy GmbH

- Verint Systems Inc.

- Zendesk, Inc.

- Observe.AI

- Other Key Players

Recent Developments

- In March 2025, Synthflow AI secured USD 20.0 million in Series A funding led by Accel to scale its no-code conversational voice agent platform. Designed for ultra-low-latency interactions (under 400 ms), the platform supports over 1,000 enterprises across sectors such as finance, healthcare, and education. (marketwatch.com)

- In April 2025, Verizon, in collaboration with Google Cloud, integrated Gemini AI into its customer service operations. The My Verizon app was upgraded with an intelligent AI assistant providing 24/7 live chat and enhanced call routing, streamlining customer support across multiple channels.

- In May 2025, Salesforce announced that its Agentforce platform, powered by generative AI, now resolves customer queries with 93% accuracy. The system also automates 30–50% of internal tasks, including customer support, code generation, and planning, marking a major shift toward AI-driven operational efficiency.

- In June 2025, Zendesk launched the Zendesk Resolution Platform, which introduced advanced agentic AI capabilities, a no-code Copilot builder for task automation, and a centralized AI Insights Hub to deliver greater visibility and control over AI-assisted operations.

- In February 2025, Sanas partnered with Teleperformance to roll out real-time accent-neutralization software for Indian customer service agents. This AI solution improves speech clarity in global support calls and is part of Teleperformance’s broader USD 13.0 million investment in AI enhancements.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,885.4 Mn |

| Forecast Value (2034) |

USD 20,979.7 Mn |

| CAGR (2025–2034) |

24.7% |

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 1,075.0 Mn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solution, Services), By Application (Workforce Management & Advanced Scheduling, Journey Orchestration, Predictive Call Routing, Sentiment Analysis, Others), By Deployment (Cloud, On Premises), By End User (BFSI, IT & Telecom, Retail & E-Commerce, Healthcare, Energy & Utilities, Travel & Hospitality, Others), and Other Key Players |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., Oracle Corporation, SAP SE, Salesforce, Inc., Cisco Systems, Inc., Nuance Communications, Inc., NICE Ltd., Avaya Inc., Genesys Telecommunications Laboratories, Inc., Five9, Inc., Talkdesk, Inc., 8x8, Inc., Uniphore Technologies Inc., Cognigy GmbH, Verint Systems Inc., Zendesk, Inc., Observe.AI |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Call Center AI Market?

▾ The Global Call Center AI Market size is estimated to have a value of USD 2,885.4 million in 2025 and is expected to reach USD 20,979.7 million by the end of 2034.

Which region accounted for the largest Global Call Center AI Market?

▾ North America is expected to be the largest market share for the Global Call Center AI Market with a share of about 44.3% in 2025.

Who are the key players in the Global Call Center AI Market?

▾ Some of the major key players in the Global Call Center AI Market are IBM Corporation, Google LLC, Microsoft Corporation and many others.

How big is the US Call Center AI Market?

▾ The US Call Center AI Market size is estimated to have a value of USD 1,075.0 million in 2025 and is expected to reach USD 7,004.1 million by the end of 2034.

What is the growth rate in the Global Call Center AI Market?

▾ The market is growing at a CAGR of 24.7% over the forecasted period.