Market Overview

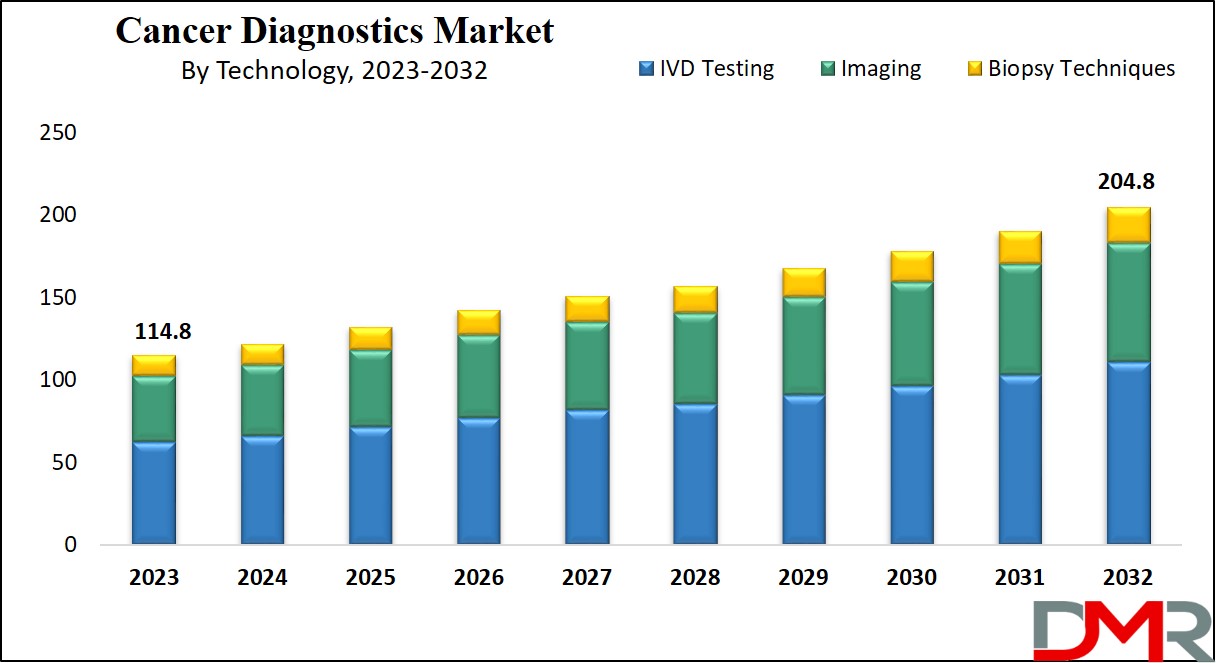

The Global Cancer Diagnostics Market is expected to hold a market value of USD 114.8 billion in 2023 and is projected to show subsequent growth with a market value of USD 204.8 billion by the end of 2032 at a CAGR of 6.6%.

The global cancer diagnostics marketplace consists of an extensive variety of products and services aimed at detecting, diagnosing, and tracking cancer on an international scale. This expansive market includes numerous diagnostic technologies consisting of molecular diagnostics, imaging modalities, in vitro diagnostics (IVD) checks, and pathology-based totally techniques. The advent of next generation cancer diagnostics has further improved sensitivity, specificity, and timeliness of cancer detection.

The marketplace gives various packages particular to various cancer sorts, including breast, colorectal, cervical, lung, blood, and pancreatic cancers. This diversity necessitates precise diagnostic processes and technology encouraged by using dynamic factors like technological improvements, demographic shifts, financial situations, healthcare policies, opposition, and converting customer awareness, the worldwide cancer diagnostics market is characterized by consistent evolution.

Also, the global rise in cancer prevalence is a significant driver of market growth. According to the Pan American Health Organization (PAHO), an estimated 20 million new cases and 10 million deaths are expected in 2023, with annual cases projected to reach 30 million by 2040.

The growing need for advanced diagnostic options to enable early detection, improve disease management, and reduce mortality rates is propelling market expansion. Statistics reveal that one in six women and one in five men are likely to develop cancer during their lifetime, further emphasizing the demand for innovative diagnostic solutions, including

companion diagnostics that aid in personalized treatment strategies and cancer immunotherapy planning.

In 2020, the 5-year cancer prevalence was approximately 50.5 million cases, highlighting the critical need for effective diagnostic and treatment strategies. Personalized medicine is poised to revolutionize cancer diagnosis and care delivery by utilizing a comprehensive data-driven approach to treatment planning.

Leading companies in this sector are heavily investing in precision medicine initiatives, while providers of molecular decision support systems are integrating genomic and clinical data to enhance precision medicine practices. Despite these advancements, the high costs of cancer diagnostic tests remain a barrier, imposing a significant financial strain on patients and their families.

Key Takeaways

- In 2023, IVD testing dominated the technology segment as it holds 54.1% of the market share.

- Projections indicate a rapid advancement in breast cancer diagnostics during the estimated period followed by Lung Cancer diagnostics which shows the highest growth potential after that.

- Factors such as medical tourism, increased awareness, and investments in private diagnostic institutes are driving industry growth in the North American region as it also holds 41.7% of the market share in 2023 and dominates the cancer diagnostics market.

Market Dynamic

The global cancer diagnostics market is shaped by various factors that steer its growth, trends, challenges, and opportunities within the industry. The ongoing advancement in diagnostic technologies, like molecular diagnostics and artificial intelligence continually enhances the accuracy and efficiency, impacting the cancer diagnostics market.

Aging populations globally contribute to an increased incidence of most cancers, influencing the demand for diagnostic offerings and shaping market dynamics. Changes in healthcare regulations, regulatory approvals, and reimbursement rules drastically affect the adoption of recent diagnostic technology and make contributions to market dynamics.

Economic conditions, which include recessions or boom intervals, affect healthcare budgets, and affected persons get the right of entry to diagnostics, studies, and development investments, thereby influencing market dynamics.

Increased consciousness about most cancers, coupled with training about early detection and advanced diagnostic technologies, influences consumer conduct and adjusts the demand for particular exams and offerings. The shift in the direction of personalized treatment, guided by using molecular diagnostics and genetic profiling, transforms the cancer diagnostics market.

Driver

The rising incidence of cancer worldwide drives the growth of the cancer diagnostics market. Early detection plays a pivotal role in effective treatment and improved survival rates, prompting substantial investments in advanced diagnostic technologies. Public health campaigns and awareness initiatives are encouraging regular screenings, which further boost demand for diagnostic tools.

Additionally, breakthroughs in imaging techniques, biomarker identification, and molecular diagnostics are revolutionizing cancer detection, making it more precise and timely. As healthcare systems focus on reducing the burden of cancer through early intervention, the market is poised for significant expansion.

Trend

Liquid biopsy is emerging as a transformative trend in the cancer diagnostics market. This minimally invasive method, which detects cancer biomarkers from blood samples, offers faster results, reduced patient discomfort, and real-time monitoring of treatment progress. Liquid biopsies are increasingly incorporated into personalized medicine approaches, tailoring therapies to the unique genetic profiles of tumors.

With continuous advancements in research, this technology is expanding its application across various cancer types, reshaping oncology diagnostics. Its growing adoption signifies a major shift toward more convenient, accurate, and patient-friendly diagnostic solutions, especially within the framework of next generation cancer diagnostics and

cancer immunotherapy assessment.

Restraint

The elevated costs of advanced cancer diagnostic technologies, such as genomic testing and state-of-the-art imaging, represent a key barrier to market growth. Patients in low- and middle-income regions often face financial constraints, limiting their access to accurate diagnostics. Furthermore, insufficient healthcare infrastructure and a shortage of trained professionals in these areas exacerbate the issue.

Overcoming these challenges demands concerted efforts, including subsidies, public-private partnerships, and expanded training programs. Addressing these constraints is critical for ensuring equitable access to advanced cancer diagnostic tools worldwide.

Opportunity

The focus on personalized medicine and genomics offers immense opportunities for the cancer diagnostics market. Innovations in genetic profiling and molecular diagnostics allow for the identification of precise biomarkers and mutations, enabling targeted and highly effective therapies. Substantial investments from governments and private entities in precision oncology are driving demand for advanced diagnostic tools.

The integration of

artificial intelligence (AI) and

machine learning into diagnostics further enhances accuracy and predictive capabilities. Companies that prioritize affordable and scalable genomic solutions are well-positioned to leverage this opportunity, driving growth and improving patient care globally.

Research Scope and Analysis

By Product

In terms of product, consumables dominate this segment as they hold 61.2% of the market share in 2023 and are expected to show subsequent growth in the forthcoming period of 2023 to 2032. Consumables, including antibodies, kits, reagents, and probes, play a important function in diagnostic laboratories, imparting ordinary and repeated use in various programs throughout numerous testing techniques. Consumables, inclusive of antibodies, kits, reagents, and probes, are automatically used in diagnostic laboratories for more than one tests.

The nature of diagnostic testing often involves the repeated use of consumables, contributing to their consistent demand. Consumables are crucial for achieving diagnostic accuracy and precision, aligning with the set standards of ongoing research and development efforts in the field. Their role in standardization, quality control, and suitability for high-volume testing scenarios further solidifies their dominance.

Additionally, the cost structure of diagnostic laboratories, where consumables often constitute a significant portion of expenses, underscores their central position in the cancer diagnostics market. In other words, consumables emerge as an integral part of this market, providing essential support to the diagnostic workflow and contributing significantly to the reliability and efficiency of cancer diagnostics which drives the growth of this market.

By Technology

In Vitro Diagnostics (IVD) testing asserts its dominance in this segment as it holds 54.1% of the market share in 2023 and is expected to show subsequent growth in the forthcoming period of 2023 to 2032. Its dominance in this segment can be attributed to its huge range of applications, as IVD testing is utilized in numerous levels of most cancer detection and tracking, encompassing screening, diagnosis, analysis, and treatment selection.

Distinguished through diverse testing strategies, such as Polymerase Chain Reaction, In Situ Hybridization, Immunohistochemistry, Next-generation Sequencing, Immunoassays, and the

Flow Cytometry, IVD presents a comprehensive and multifaceted approach to cancer diagnostics.

Ongoing technological improvements within the IVD domain, which include the development of more sensitive assays, factor-of-care testing, and integration with virtual health technology, underscore its endured dominance inside most cancer diagnostics markets. Additionally, the value-effectiveness of IVD tests positions them as a favored choice, in particular in comparison to certain imaging strategies or invasive procedures.

So, the dominance of IVD in the cancer diagnostics market is a testament to its versatility, accuracy, suitability for molecular diagnostics, habitual screening programs, extensive adoption in scientific laboratories, regulatory guidance, technological improvements, and price effectiveness. These elements together function IVD as a critical and valuable component in most cancer diagnostics markets.

By Application

Breast cancer diagnostics holds a prominent position in the cancer diagnostics market based on application, and its dominance can be attributed to several key factors. Breast cancer dominates this segment as the rising number of patients diagnosed with cancer globally, contributes to the increased demand for diagnostic tests such as mammography, biopsy, and molecular for its diagnostics.

The emphasis on early detection is vital for a successful treatment that is in addition reinforced by means of screening packages and attention campaigns, especially highlighting the significance of routine mammography.

The effectiveness of screening technologies, drastically mammography, performs a critical function in the early identification of breast cancer instances. Molecular diagnostics, with the ability to identify specific genetic markers and molecular subtypes, also play a significant role, continually advancing accuracy and precision. Also, the rise in campaigns and educational initiatives has heightened awareness among individuals to undergo diagnostic tests for early detection.

By End User

Based on the end user, diagnostic laboratories exert clear dominance in this segment as they hold the highest market share in 2023 and are anticipated to show the following growth in the upcoming years as well. Diagnostics laboratories occupy a dominant position in the cancer diagnostics market, owing to a combination of factors that are responsible for their dominance in this segment.

Equipped with specialized instruments and expert healthcare professionals who focus on diagnostic testing, these laboratories excel in performing diverse tests, including intricate molecular and genetic analyses crucial for cancer diagnostics.

Offering comprehensive testing services, encompassing pathology, imaging, molecular diagnostics, and specialized tests, diagnostics laboratories stand out as one-stop solutions for varied diagnostic needs. Equipped with advanced technologies and instrumentation, they ensure accuracy in cancer diagnostics, employing techniques such as PCR and next-generation sequencing.

Flexibility in customizing tests, quick turnaround times, collaborative relationships with healthcare providers, adherence to quality standards, cost-effectiveness, and active contributions to research and development collectively position diagnostics laboratories as pivotal players in the landscape of cancer diagnostics.

The Cancer Diagnostics Market Report is segmented on the basis of the following

By Product

- Consumables

- Antibodies

- Kits & Reagents

- Probes

- Others

- Instruments

- Pathology Based Instrument

- Slide Staining Systems

- Tissue Processing Systems

- PCR Instrument

- Microarrays

- Others

- Imaging Instruments

- CT Systems

- Ultrasound Systems

- MRI Systems

- Mammography Systems

- Nuclear Imaging Systems

- Biopsy Instruments

By Technology

- IVD Testing

- Polymerase Chain Reaction

- In Situ Hybridization

- Immunohistochemistry

- Next-generation Sequencing

- Immunoassays

- Flow Cytometry

- Others

- Imaging

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Position Emission Tomography (PET)

- Mammography

- Ultrasounds

- Others

- Biopsy Technique

By Application

- Breast Cancer

- Colorectal Cancer

- Cervical Cancer

- Lund Cancer

- Blood Skin

- Pancreatic Cancer

- Others

By End User

- Diagnostics Laboratories

- Hospital & Clinics

- Diagnostic Imaging Centers

- Research Institutes

Regional Analysis

North America has held a leading position in the global cancer diagnostics market as it

holds 41.7% of the market share in 2023, driven by a combination of various key factors. The area, especially the US, sticks out because of its high healthcare expenditure, facilitating big investments in advanced diagnostic technologies.

Boasting a sophisticated healthcare infrastructure and robust research and development surroundings, North America is a hub for technological innovation in most cancer diagnostics.

Early adoption of precision medicine and a huge, old populace contributed to a huge demand for advanced diagnostic gear. The supportive regulatory surroundings and the presence of essential global market gamers similarly solidify North America's dominance in the cancer diagnostics marketplace.

While different areas play widespread roles, North America's prominence is rooted in its monetary electricity, technological leadership, and commitment to advancing healthcare. North America's dominance within the global cancers diagnostics marketplace is sustained through high healthcare expenditure, advanced infrastructure, technological innovation, a robust studies atmosphere, early adoption of precision medication, and a supportive regulatory environment.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The international cancer diagnostics market is characterized by a dynamic and aggressive landscape, with key players using innovation and shaping enterprise developments. Leading agencies in this market like Roche Diagnostics, Siemens Healthineers, Abbott Laboratories, Thermo Fisher Scientific, and PerkinElmer provide a wide variety of diagnostic solutions, encompassing molecular and tissue diagnostics, clinical era, and genomics.

Several tendencies and factors have an impact on the aggressive dynamics of this marketplace like the ongoing advancements in molecular diagnostics, exemplified by technology like subsequent-generation sequencing and liquid biopsy, preserve to play a crucial position in cancer diagnostics.

The trend closer to customized medication is shaping the improvement of centered treatment options and associated diagnostics, enhancing treatment efficacy. The integration of artificial intelligence and machine mastering into diagnostic gear is enhancing the accuracy and performance of most cancer detection.

Some of the prominent players in the Global Cancer Diagnostic Market are

- Agilent Technologies Inc.

- Thermo Fisher Scientific Inc.

- Illumina Inc.

- Becton, Dickinson and Company

- GE Healthcare

- QIAGEN N.V.

- Abbott Laboratories Inc.

- Roche Diagnostics

- Siemens Healthcare

- Philips Healthcare

- R. Bard Inc.

- bioMérieux SA

- NeoGenomics Laboratories Inc.

- Volpara Solutions Limited

- Hologic Inc.

- Canon Medical Systems Corporation

- Other Key Players

Recent Developments

- In November 2023, Universal DX (UDX) announced a strategic collaboration with Quest Diagnostics to bring an advanced colorectal cancer screening blood test to patients and providers in the United States. This collaboration is part of UDX's mission to transform cancer into a curable disease, emphasizing the importance of innovative diagnostic approaches in cancer screening.

- In 2023, EDX Medical announced a collaboration with Thermo Fisher Scientific to develop innovative cancer tests for global healthcare markets. This collaboration emphasizes the commitment to advancing cancer diagnostic solutions and introducing novel approaches to cancer detection and diagnosis sources.

- DELFI Diagnostics has recently introduced FirstLook Lung, a novel approach to enhance lung cancer screening through a routine blood test. Launched in October 2023, FirstLook Lung aims to provide an accessible and accurate method for detecting lung cancer. This innovative diagnostic tool adds to the evolving landscape of cancer diagnostics, potentially offering a less invasive alternative for early detection.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 114.8 Bn |

| Forecast Value (2032) |

USD 204.8 Bn |

| CAGR (2023-2032) |

6.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Consumables, Instruments, Imaging Instruments and Biopsy Instruments), By Technology (IVD Testing, Imaging and Biopsy Technique), By Application (Breast Cancer, Colorectal Cancer, Cervical Cancer, Lund Cancer, Blood Skin, Pancreatic Cancer and Others), By End User (Diagnostics Laboratories, Hospital & Clinics, Diagnostic Imaging Centers and Research Institutes) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Agilent Technologies Inc., Thermo Fisher Scientific Inc., Illumina Inc., Becton, Dickinson and Company, GE Healthcare, QIAGEN N.V., Abbott Laboratories Inc., Roche Diagnostics, Siemens Healthcare, Philips Healthcare, R. Bard Inc., bioMérieux SA, NeoGenomics Laboratories Inc., Volpara Solutions Limited, Hologic Inc., Canon Medical Systems Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global cancer diagnostics market size accounted for USD 114.8 billion in 2023 and it is expected to

reach around USD 204.8 billion by 2032.

The CAGR of the global cancer diagnostics market is 6.6%.