Car wash services market is poised for robust expansion. Propelling its expansion are factors like increased vehicle ownership worldwide and greater consumer awareness about regular maintenance for their cars. Accelerated urbanization and rising disposable incomes fuel this demand further by spurring consumers to allocate more towards premium services that offer convenience and quality.

Technological innovation remains at the core of market disruption. Car wash automation significantly enhances operational efficiencies, cuts labor costs and boosts service quality; environmental sustainability has also become an imperative, driving adoption of waterless cleaning agents and wastewater recycling facilities aimed at meeting eco-sensitive consumer expectations.

The competitive landscape has become more dynamic over the last several years, marked by an ever-evolving shift towards diversified service offerings and strategic partnerships. Operators have expanded beyond traditional cleaning services to offer comprehensive detailing services and tailored cleaning solutions with subscription models designed to foster customer loyalty while guaranteeing steady revenue streams.

Though not without challenges, the market presents its share of hurdles for operators: adhering to stringent environmental regulations and managing substantial initial investments required for state-of-the-art car wash installations can present major hurdles; yet its outlook remains positive, offering ample room for innovation and expansion opportunities - particularly in emerging markets where professional car washing services have yet to gain widespread traction.

Key Takeaways

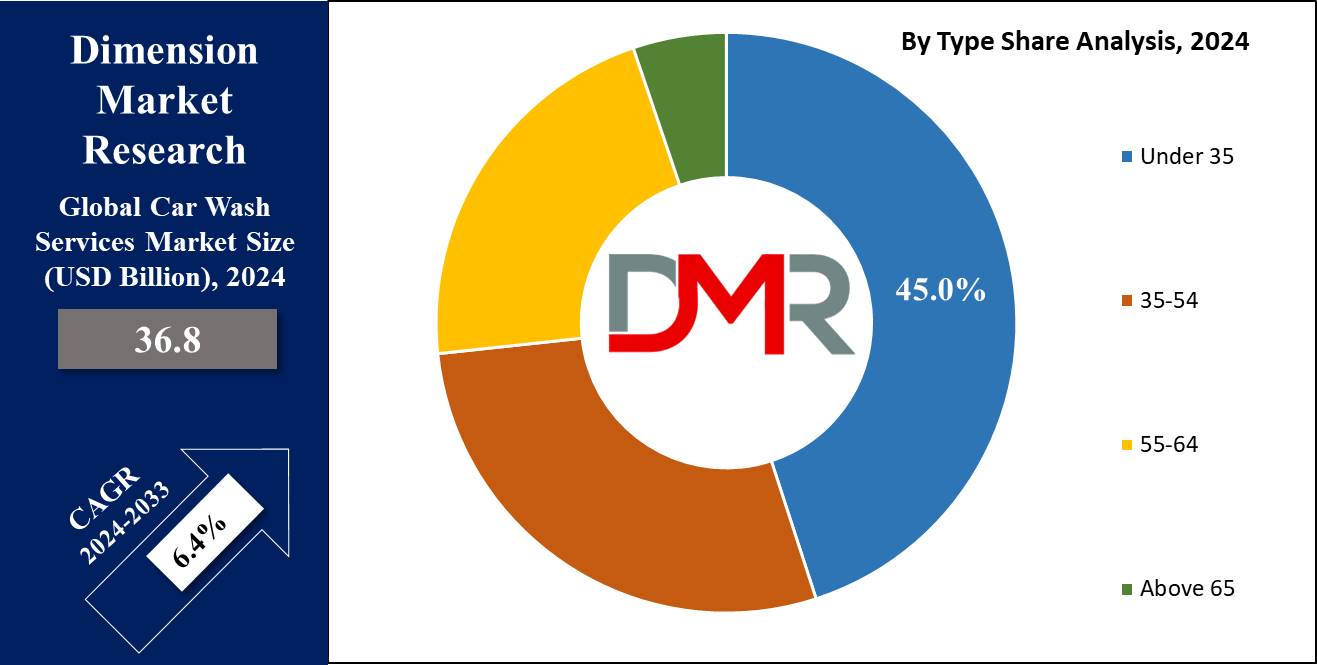

- The global car wash services market is projected to grow from USD 36.4 billion in 2024 to USD 64.5 billion by 2033, with a CAGR of 6.5%.

- Roll-Over/In-Bay systems dominated the Type segment in 2023, holding 51.3% market share due to their efficiency, low space requirements, and suitability for high-traffic locations.

- Cashless Payment was the leading payment method in 2023, driven by consumer preference for convenience, speed, and security, facilitated by mobile banking and contactless technology.

- North America held a 51% market share in 2023, owing to high vehicle ownership rates, convenience preferences, and advanced infrastructure.

- Eco-friendly car wash services present a significant opportunity, as consumers increasingly prioritize sustainability through water-saving technologies and biodegradable chemicals.

Use Cases

- Urban Car Wash Solutions: Roll-Over/In-Bay systems could be installed at urban fuel stations to offer quick space-economical washes for cars in areas of high traffic.

- Cashless Payment Integration: Mobile payment integration will attract that tech-savvy customer segment seeking rapid, secure, contactless payment mechanisms.

- Subscription-Based Car Wash Services: A corporate house can offer subscription-based services to its regular clients that require the least time and, in return, create customer loyalty.

- Environmentally Friendly Car Wash: Firms may install water reclamation systems and use biodegradable chemicals as an added incentive for the environmentally conscious clientele, which will enhance the brand image.

- Franchise Expansion in Emerging Markets: The global car wash service provider can enter more emerging markets by promoting cost-effective, scalable, and green car wash solutions.

Driving Factors

Increased Vehicle Ownership: Catalyst for Market Expansion

Car wash services markets have seen immense growth as vehicle ownership worldwide increases - which correlates directly to demand. As vehicle penetration in developing economies deepens, more consumers require regular vehicle care to preserve value and appearance of their cars.

Growing vehicle ownership expands car wash businesses' customer bases, prompting them to increase service capacity and geographical reach. Global car parc (the total number of cars worldwide) is projected to experience continued increases - creating greater and sustained demand for car wash services.

Consumer Convenience Preference: Revamp of Service Offerings

Today's hectic lifestyle significantly influences consumer behaviors and preferences for convenience drives market expansion for car wash services. Busy professionals, families and individuals with demanding schedules increasingly turn to professional car washes offering timesaving solutions as solutions.

This shift can be seen through the rise in popularity of services located near shopping centers or major transit routes, along with technological enhancements such as mobile applications for scheduling car washes and digital payment options that make these services even more desirable among tech-savvy consumers who prioritize efficiency and speed in service delivery.

Subscription Services: Maximizing Customer Retention and Value

Subscription-based and unlimited wash plans represent an important advance in car wash services market. These models meet consumer desires for convenience and value while offering cost-effective solutions for regular users. Subscription services also encourage frequent usage by providing lower per wash costs; increasing consumer loyalty while creating steady recurring revenues for providers.

Consumers appreciate these plans due to their predictability and affordability; for the market this represents steady cashflow as well as more accurate demand forecasting capabilities which enable resource allocation and strategic planning decisions to be made with greater precision.

Growth Opportunities

Sustainability Innovations: Eco-Friendly Car Wash Solutions

One key opportunity in 2023 lies within the global car wash services market is in developing and marketing eco-friendly car wash services. As environmental concerns increase, consumers increasingly favor businesses which show sustainability - water reclamation systems or biodegradable chemicals being particularly attractive choices in car wash services.

Eco-friendly practices not only attract eco-conscious customers but also comply with stricter environmental regulations - giving businesses that adopt such strategies a competitive advantage in sensitive markets. With sustainable initiatives growing increasingly prominent across industries like car washes, sustainability may become one of the main focuses of differentiation and growth within this space.

Value-added Services: Integration With Other Vehicle Maintenance Services

One strategy for expansion involves offering car wash services alongside vehicle maintenance offerings like oil changes and detailing services, creating a comprehensive care solution that improves customer experience while simultaneously increasing average transaction values and encouraging repeat business.

An holistic approach to vehicle care can transform an ordinary car wash into an all-in-one facility, drawing customers who value efficient service options and increasing revenue and customer retention rates significantly. By increasing cross-promotion opportunities as well as upselling sales opportunities, holistic maintenance facilities can increase both revenue and retention significantly.

Key Trends

Technological Innovations in Robotics and Automation: Robots and Autobots

An emerging trend in the 2023 global car wash services market is automation and robotic systems integration, both of which improve speed, efficiency, labor costs, as well as 24/7 operation to increase profitability in competitive markets. Automated car washes offer consistent quality with reduced wait times that appeal to broader demographics while robotic car washing reduces physical strain for workers resulting in decreased turnover rates and greater job satisfaction among staffers.

Personalizing Services to Deliver an Improved Consumer Experience

Personalization is another prominent trend influencing the car wash industry. As consumer tastes shift, there is an ever-increasing need for customized washing options tailored specifically to each vehicle owner's individual requirements and tastes. This extends far beyond basic carwash services to offer packages including different levels of detailing, protective coatings and fragrance options to meet customer satisfaction and loyalty goals while giving service providers who can adapt quickly a competitive advantage in providing tailored experiences to various budgets and consumers alike.

Digital Integration: Online Booking and Management Systems

Online booking and vehicle management systems have made an immediate and dramatic impactful statement in 2023 about how digital tools will transform car wash services markets. Consumers benefit from easy scheduling of appointments online while providers use these systems to better resource manage, reduce no-shows and optimize operations - ultimately leading to improved business efficiency, retention rates and customer experience.

Restraining Factors

Environment Regulations and Sustainability Challenges Are Limiting Expansion: Impeding Expansion

Water usage and environmental concerns play a substantial role in shaping the car wash services industry. Car washes tend to consume large volumes of water per wash - anything between 15 and 85 gallons can be consumed during one wash depending on technology used (i.e. automated or manual washes). When combined with tight regulations governing water scarcity or strict environmental restrictions, this can impose barriers that inhibit traditional car washes' expansion in certain regions.

Additionally, soapy water discharge can create pollution issues in local ecosystems and water quality; consequently, regulatory pressure may rise forcing car wash operators to invest in expensive water recycling technologies or eco-friendly solutions that may not bring immediate returns on investment, thus impeding market expansion.

Competitor to Home Washing Services: An Affordable Alternative

Home car washing kits that deliver professional-quality results pose an ongoing threat to professional car wash markets, with more vehicle owners opting to do it themselves at home rather than hire professional car washers. As more innovative consumer products provide near professional results at home car washes.

This trend can often be observed more prominently in regions with cost-conscious consumers or where there exists a strong do-it-yourself culture, where home washing kits may offer convenience, cost efficiency and eliminate regular trips to car washes; deterring potential customers from engaging professional services altogether.

Research Scope and Analysis

By Type segment

Roll-Over/In-Bay systems held an overwhelming market share of 51.3% among Type segment of the car wash services market in 2023 for Type segment's Type category of services market, as favored for their efficiency, low space requirements and ability to provide quick yet consistent washes - perfect for locations with heavy vehicle throughput such as urban settings or petrol stations.

Tunnel car wash systems represent a considerable portion of the market. Configured to maximize efficiency, these systems can accommodate higher vehicle volumes per hour when compared with Roll-Over/In-Bay systems. Tunnel systems are popular among busy locations that demand swift yet quality service without compromising service delivery; soft cloth technology and water recycling capabilities continue to advance to deliver more comprehensive cleans while improving operational throughput and user satisfaction.

Self-Service car washes offer cost-effective cleaning options with flexible scheduling and payment options that include contactless and mobile payments - perfect for DIY enthusiasts looking for cost-cutting. Self-Service stations have increasingly integrated more user-friendly interfaces and payment methods such as contactless payments. Consequently, these stations benefit from the increasing DIY trend as consumers become more focused on personalizing the experience while enjoying lower costs overall.

By Mode of Payment

Cashless Payment was the clear leader in 2023 in terms of car wash services market Mode of Payment transactions. Consumers increasingly favor cashless payments because of its convenience, speed, and increased security benefits; credit/debit cards/mobile payments/other digital forms of payment increasingly account for consumer services trends - due in large part to smartphone adoption/mobile banking apps as well as increased awareness regarding contactless payment benefits.

Although cashless systems dominate, cash payments remain relevant in certain segments of the car wash market. Cash remains an effective payment mechanism in areas that lack sophisticated technologies or where consumers prefer not to share personal financial details online, especially where cash transactions remain direct and anonymous. Some consumers even prefer it due to its directness and anonymity: no need for sharing personal banking data! Car washes run independently may favor cash to avoid transaction fees associated with card payments and simplify financial operations, however this trend is gradually diminishing as more businesses and consumers move toward secure and convenient payment solutions, driving further cashless growth within car wash services industry.

The Car Wash Services Market Report is segmented based on the following:

By Type

- Roll-Over/ In-Bay

- Tunnels

- Self-Service

By Mode of Payment

- Cashless Payment

- Cash Payment

Regional Analysis

In 2023, the global car wash services market demonstrated substantial regional variations in growth and market share due to consumer behavior differences, economic conditions, and technological advancement. North America held on to 51% market share due to high vehicle ownership rates, strong preferences for convenience services and advanced infrastructure development.

U.S. and Canadian markets stand out, thanks to widespread access to technologically advanced car wash facilities with subscription-based services that suit consumer preferences for time-efficient solutions. Furthermore, environmental awareness has led to greater adoption of water-efficient eco-friendly technologies, furthering market expansion across both regions.

Europe represents a mature market with steady growth, led primarily by countries such as Germany, France and the UK. Environmental regulations play a significant role here; stringent guidelines encourage car wash operators to adopt water-saving and eco-friendly solutions. Automated car washes remain increasingly popular as consumers demand consistent results that meet consumer standards for quality results.

Asia Pacific's car wash services market is experiencing rapid expansion due to rising vehicle ownership, urbanization and disposable income levels. Markets such as China, India and Japan have expanded car wash networks within urban centers as consumer awareness regarding vehicle maintenance increases and eco-friendly options emerge, contributing significantly to this market's vibrant outlook in this region.

Middle East and Africa regions are gradually growing, particularly urbanized areas like UAE and South Africa where an increasingly affluent population seeks premium car care services. Latin America, meanwhile, is seeing moderate expansion due to increased vehicle ownership as well as gradual economic recovery; however challenges such as economic instability hinder rapid expansion. Brazil and Mexico lead the car wash services market within Latin America where convenient automated solutions have gained significant traction with consumers.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

global car wash services market 2023 can be defined by its key players such as Zips Car Wash, International Car Wash Group (ICW), Autobell Car Wash and others who each play an essential part in shaping industry landscape through innovations, expansion plans and service diversification strategies.

Zips Car Wash stands out among its competition due to its rapid expansion strategy, employing an effective membership model that encourages repeat business and ensures steady revenue. This enhances customer loyalty and gives Zips access to valuable insights into consumer preferences and behaviors, providing insight for optimizing marketing strategies and service offerings.

International Car Wash Group (ICW), known for their global reach, seeks to consolidate a fragmented car wash market through acquisitions and partnerships. By standardizing service quality across their locations, ICW ensures customer satisfaction as well as brand reliability - key components in maintaining competitive edge and maintaining their advantage over their competition.

Autobell Car Wash places great emphasis on environmental sustainability by employing water recycling systems and eco-friendly cleaning agents to meet regulatory standards while appealing to environmentally aware customers, expanding its market presence. This commitment not only meets regulatory compliance but also allows Autobell to broaden its market presence by appealing to them directly.

Companies such as Splash Car Wash and Super Star Car Wash stand out by their commitment to excellent customer service and innovative features such as online booking systems and comprehensive packages that include detailing services.

True Blue Car Wash LLC, Magic Hands Car Wash LLC, Quick Quack Car Wash (QCW), Hoffman Car Wash and Wash Depot Holdings Inc (WDHI) also make significant contributions to market dynamics through regional dominance and unique value propositions, such as speed, quality and price competitiveness.

Some of the prominent players in the Global Car Wash Services Market are:

- Zips Car Wash

- International Car Wash Group (ICW)

- Autobell Car Wash

- Splash Car Wash

- Super Star Car Wash

- True Blue Car Wash, LLC

- Magic Hands Car Wash

- Quick Quack Car Wash

- Hoffman Car Wash

- Wash Depot Holdings Inc.

Recent developments

- In December 2023, Magnolia Wash Holdings underwent a significant transformation by rebranding itself as Whistle Express Car Wash. This strategic rebranding initiative consolidated over 100 car wash locations, previously operated under various local and regional chains, under the single banner of Whistle Express.

- In another significant development in the car wash industry, Mister Car Wash, Inc. expanded its operational footprint in the Minneapolis area in August 2022 through the acquisition of Top Wash. This acquisition included three express exterior car wash services located in Fridley, Anoka, and Champlin—cities within the northern suburbs of Minneapolis.

- In a notable transaction within the car wash sector, El Car Wash, renowned for its rapid and efficient express car wash services, came under the ownership of Warburg Pincus in July 2022. This acquisition by one of the leading global private equity firms underscores the attractiveness and potential profitability of the fast express car wash market in the United States.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 36.8 Bn |

| Forecast Value (2033) |

USD 64.5 Bn |

| CAGR (2024-2033) |

6.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type(Roll-Over/ In-Bay, Tunnels, Self-Service), By Mode of Payment(Cashless Payment, Cash Payment) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Zips Car Wash, International Car Wash Group (ICW), Autobell Car Wash, Splash Car Wash, Super Star Car Wash, True Blue Car Wash, LLC, Magic Hands Car Wash, Quick Quack Car Wash, Hoffman Car Wash, Wash Depot Holdings Inc. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |