Market Overview

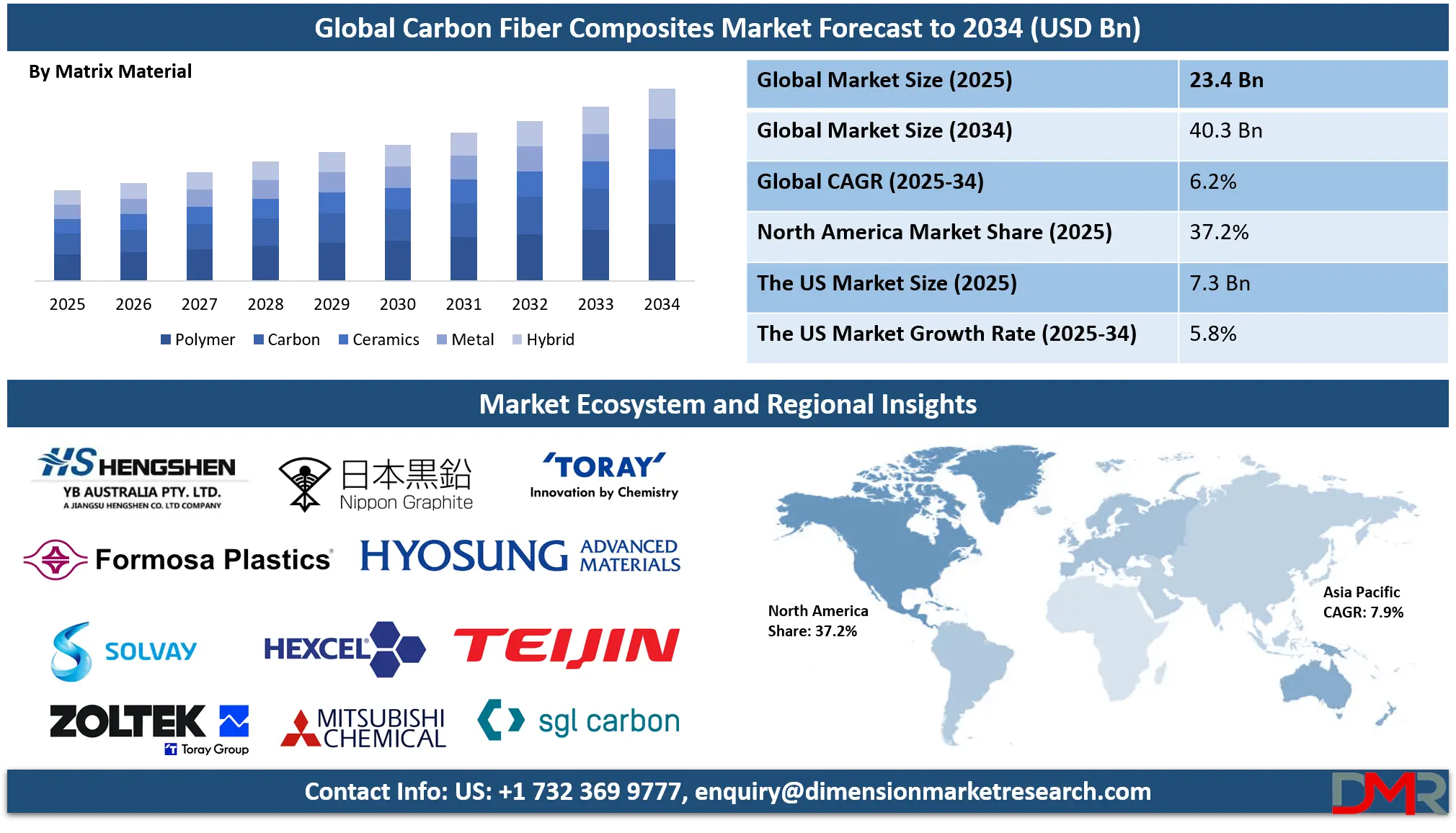

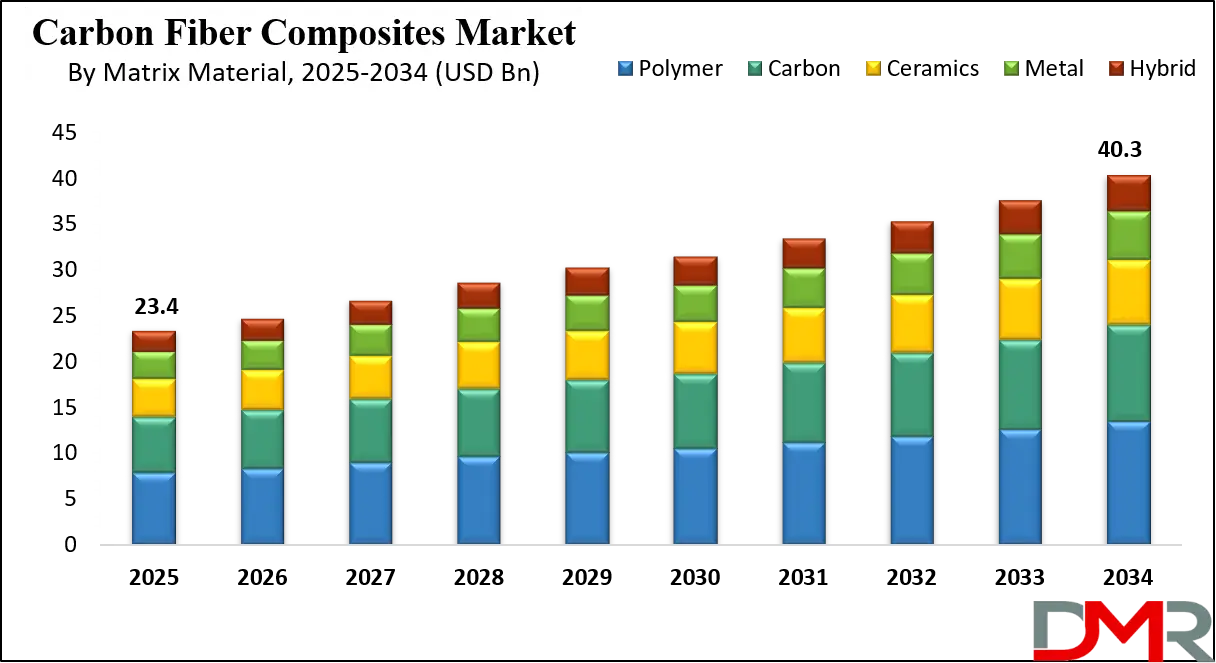

The Global Carbon Fiber Composites Market is anticipated to achieve a valuation of USD 23.4 billion by 2025, driven by rising adoption across aerospace, automotive, wind energy, and sporting goods sectors. The market is further expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2034, ultimately reaching an estimated size of USD 40.3 billion. This growth trajectory is fueled by increasing demand for lightweight, high-strength materials, advancements in manufacturing technologies, and the expanding scope of sustainable composite applications across industries.

The global carbon fiber composites market is entering a transformative phase, underpinned by rising demand for advanced lightweight materials in multiple industries. Aerospace continues to be the most critical end-use, with airframe manufacturers integrating carbon composites in fuselage panels, engine nacelles, and wing components.

Composites can reduce aircraft weight by 20–30%, directly improving fuel efficiency and lowering emissions, aligning with global aviation decarbonization goals. In parallel, the automotive sector is accelerating adoption, particularly in electric vehicles, where reduced vehicle weight enhances battery performance and extends driving range. Leading automakers are also turning to hybrid composites that combine carbon with polymers or metals for strength optimization.

Wind energy is another driver, as turbine blade lengths exceed 80–100 meters and demand high stiffness-to-weight ratios. Carbon composites extend operational life, reduce fatigue cracking, and improve turbine efficiency. Sports and leisure industries from high-performance bicycles and golf clubs to tennis racquets continue to use composites for their strength and vibration-damping qualities. Civil engineering applications, such as composite bridges and reinforcement systems, provide infrastructure resilience against earthquakes and corrosion, while marine industries are leveraging composites for lightweight hulls with reduced fuel consumption.

Despite these trends, high production costs remain a limiting factor. Carbon fiber composites cost five to ten times more than steel and nearly double aluminum, primarily due to energy-intensive fiber production. Limited recycling infrastructure compounds the challenge, as most end-of-life composites are landfilled or incinerated. Opportunities, however, are emerging in recycling innovations such as pyrolysis, solvolysis, and bio-based resin systems, which promise greater sustainability. Government-backed initiatives in Europe, the U.S., and Japan are focusing on reducing cost curves and enhancing recyclability.

Growth prospects are strongest in Asia-Pacific, driven by industrial expansion, while Europe remains focused on sustainability and North America on defense and aerospace leadership. The global outlook suggests composites will transition from niche to mainstream applications, reshaping material science and industrial ecosystems worldwide.

The US Carbon Fiber Composites Market

The US Carbon Fiber Composites Market is projected to reach USD 7.3 billion in 2025 at a compound annual growth rate of 5.8% over its forecast period.

The U.S. carbon fiber composites market is strategically positioned due to strong government funding, a culture of research excellence, and industrial demand across aerospace, defense, and clean energy. According to the Department of Energy, U.S. transportation contributes nearly 29% of national greenhouse gas emissions, prompting aggressive adoption of lightweight materials. The DOE supports this shift through the Institute for Advanced Composites Manufacturing Innovation (IACMI), a public-private partnership that targets cost reductions of 25%, energy savings of 50%, and recyclability levels up to 80%. These targets are vital for scaling composites in automotive and aerospace production.

Oak Ridge National Laboratory (ORNL) plays a central role, pioneering nanofiber and graphene-reinforced carbon fibers that achieve 50% higher tensile strength and double fracture toughness. Such advances expand composites’ applicability in high-stress environments, including defense aircraft and submarines. The U.S. Department of Defense and NASA are also major adopters, investing in lightweight materials to enhance performance in next-generation spacecraft, fighter jets, and unmanned aerial vehicles.

Civil applications are also growing. The University of Maine’s “Bridge-in-a-Backpack” program demonstrates rapid, sustainable infrastructure deployment using carbon composites, reducing construction time and extending service life. The U.S. Navy’s composite-based ship hulls extend operational durability and reduce maintenance costs. In the automotive sector, U.S. companies are deploying CFRP in electric vehicle frames, hydrogen fuel tanks, and battery enclosures.

With a large, skilled workforce, an advanced R&D ecosystem, and federal incentives under the Bipartisan Infrastructure Law and Inflation Reduction Act, the U.S. is expanding domestic composites production.

The Europe Carbon Fiber Composites Market

The Europe Carbon Fiber Composites Market is estimated to be valued at USD 3.5 billion in 2025 and is further anticipated to reach USD 5.9 billion by 2034 at a CAGR of 6.2%.

Europe’s carbon fiber composites market is strongly influenced by sustainability frameworks and circular economy policies. The European Commission’s Green Deal and Fit-for-55 strategy mandate a 55% reduction in CO₂ emissions by 2030, pushing industries to adopt lightweight, durable composites. Programs such as CycleFiber, supported by Horizon Europe funding, have already demonstrated 43% energy savings, 42% material cost reduction, and over 20% waste reduction through advanced recycling and efficient manufacturing. This strengthens Europe’s competitive advantage in sustainable materials.

The aerospace sector, led by Airbus and Dassault, integrates CFRP in fuselage and wing structures to reduce fuel use. Automotive companies such as BMW, Audi, and Volkswagen use composites in EVs to achieve strict emission compliance and longer battery range. Wind energy is another growth engine, with European leaders Vestas and Siemens Gamesa deploying carbon composites in long turbine blades to maximize energy yield. Civil infrastructure applications are supported by EU programs focused on resilient construction materials that reduce maintenance costs and enhance durability.

Challenges persist, with carbon composites costing 30–40% more than metals and recyclability rates still under 15%. Many SMEs lack access to advanced processes like resin transfer molding (RTM) and automated fiber placement (AFP). However, EU funding, university-industry collaborations, and large-scale pilot projects are addressing these barriers. This growth will be anchored by aerospace, automotive electrification, and renewable energy expansion.

The Japan Carbon Fiber Composites Market

The Japan Carbon Fiber Composites Market is projected to be valued at USD 1.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.5 billion in 2034 at a CAGR of 5.8%.

Japan remains a global powerhouse in carbon fiber composites, driven by its manufacturing expertise, government policies, and corporate leadership. The Ministry of Economy, Trade, and Industry (METI) promotes composites adoption through initiatives supporting carbon neutrality and advanced materials research. Japan Aerospace Exploration Agency (JAXA) incorporates composites into launch vehicles and aircraft, enhancing efficiency and payload capabilities. Aerospace collaborations with Boeing and Airbus further cement Japan’s leadership in high-performance CFRP supply.

Automotive adoption is also accelerating, as Toyota, Nissan, and Honda integrate carbon composites in EV frames, hydrogen tanks, and structural reinforcements to meet strict fuel efficiency and emissions standards. Japanese manufacturers Toray Industries and Mitsubishi Chemical Group dominate global supply, producing advanced fibers and resins while pioneering closed-loop recycling. Mitsubishi’s recycling technologies allow reclaimed fibers to achieve near-virgin properties, addressing sustainability challenges and lowering lifecycle costs.

Civil engineering applications are prominent due to Japan’s vulnerability to earthquakes and typhoons. Composite reinforcement bars, bridges, and tunnels provide durability and seismic resistance while reducing maintenance costs. Marine industries are also expanding usage for lightweight vessels and offshore wind structures. Industrial clusters in Kansai and Ishikawa/Toyama ensure strong R&D, skilled labor, and integrated supply chains.

With strong government backing, innovation in recycling, and leadership in aerospace and automotive integration, Japan is positioned to remain a global leader in the composites sector, driving both domestic and international growth.

Global Carbon Fiber Composites Market: Key Takeaways

- Global Market Size Insights: The Global Carbon Fiber Composites Market size is estimated to have a value of USD 23.4 billion in 2025 and is expected to reach USD 40.3 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 6.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Carbon Fiber Composites Market is projected to be valued at USD 7.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.2 billion in 2034 at a CAGR of 5.8%.

- Regional Insights: North America is expected to have the largest market share in the Global Carbon Fiber Composites Market with a share of about 37.2% in 2025.

- Key Players: Some of the major key players in the Global Carbon Fiber Composites Market are Toray Industries, Inc., Hexcel Corporation, Teijin Limited, Mitsubishi Chemical Carbon Fiber & Composites (MCCFC), SGL Carbon SE, Solvay S.A., Zoltek Corporation, Hyosung Advanced Materials, Formosa Plastics Corporation, and many others.

Global Carbon Fiber Composites Market: Use Cases

- Aerospace & Defense: Carbon fiber composites are used in aircraft fuselages, wings, and defense drones to cut weight, enhance fuel efficiency, and improve structural performance. Their durability against fatigue and corrosion helps extend service life while supporting global aviation decarbonization and military modernization efforts.

- Automotive & Electric Vehicles: Composites are integrated into vehicle body panels, chassis, and battery enclosures to reduce weight, improve crash performance, and extend EV range. Automakers increasingly adopt CFRP for lightweighting strategies that meet fuel-efficiency standards and support the transition toward carbon-neutral mobility.

- Wind Energy: Carbon composites are critical in manufacturing extra-long wind turbine blades, offering high stiffness-to-weight ratios. They enable turbines to withstand extreme weather conditions, extend blade life, and generate more power, supporting renewable energy expansion and global targets for carbon-neutral electricity production.

- Civil Engineering & Infrastructure: Composite reinforcement bars, bridge arches, and tunnel linings are used to improve durability and seismic resistance in infrastructure projects. Their corrosion resistance and lightweight properties reduce maintenance costs while ensuring longer service life, particularly in earthquake-prone or marine environments.

- Sports & Leisure Equipment: Lightweight, vibration-damping composites enhance performance in bicycles, tennis racquets, golf clubs, and skis. Their ability to provide superior strength and flexibility enables athletes to achieve higher speed, precision, and comfort, making CFRP the preferred choice in professional and recreational sports.

Global Carbon Fiber Composites Market: Stats & Facts

Institute for Advanced Composites Manufacturing Innovation (IACMI)

- IACMI’s technical goals include 25% lower cost for carbon-fiber reinforced plastics (CFRP).

- IACMI targets a 50% reduction in CFRP embodied energy.

- IACMI aims for 80% recyclability of CFRP into useful products.

Oak Ridge National Laboratory (ORNL)

- ORNL reported a ~50% improvement in tensile strength of composites using nanofiber interlayers.

- ORNL reported a nearly two-fold increase in toughness (durability) using the nanofiber technique.

- ORNL used a 5-million-atom molecular simulation to study reinforcement mechanisms for carbon-fiber composites.

- ORNL notes access to Frontier a 2-exaflops leadership-class supercomputer for these simulations.

U.S. Department of Energy (DOE) CFRP Bandwidth / Energy Study

- DOE’s bandwidth study indicates the four structural application areas (automotive, wind energy, aerospace, pressure vessels) account for about 51% of the CFRP market (by the study boundary).

- DOE estimates an additional ~4.94 TBtu per year of on-site energy savings is achievable through applied R&D adoption (bandwidth study).

- DOE’s analysis indicates it is potentially feasible to reduce CFRP manufacturing energy consumption by up to 91% compared with typical (2010) practices if state-of-the-art and R&D options are fully implemented.

National Renewable Energy Laboratory (NREL)

- NREL’s blade cost model covers wind turbine blades in the 30–100 metre length range and is used to analyze designs up to 100 m.

- The NREL cost model computes costs for three representative blades: ~33 m, ~63 m, and 100 m reference designs (WindPACT / IEA / SNL reference blades used in the study).

- NREL notes vacuum-assisted resin transfer molding (VARTM) is the most commonly adopted manufacturing method for modern multimegawatt blades (industry reference in the report).

NASA

- NASA-related research (tow-steered composites) shows tow-steered laminates can reduce structural weight by ~10% versus conventional composite designs.

- NASA-linked studies report that such tow-steered designs can cut fuel burn by ~0.4% (prototype/scale study context).

- A NASA SWEET-15 tow-steered test article study reported a 6.4% wing-box weight reduction for the scaled test configuration.

European Union / Eurostat / European Commission

- Eurostat / EU targets (2023) call for an additional 11.7% reduction in energy consumption across the EU by 2030 compared with the 2020 reference scenario.

European Environment Agency (EEA)

- The EU’s Circular Economy Action Plan targets a substantial rise in circularity; the EEA reports an objective to double the circular material use rate (CMUR) in the coming decade (policy target context).

International Energy Agency (IEA)

- IEA reported that transport sector CO₂ emissions reached nearly 8 Gt CO₂ in 2022 (transport as a major emissions source).

- IEA data show over 10 million electric vehicles sold globally in 2022, representing roughly 14% of all car sales that year.

Intergovernmental Panel on Climate Change (IPCC)

- IPCC (WG3 transport chapter) notes the transport sector accounts for roughly 15% of total global GHG emissions and about 23% of global energy-related CO₂ emissions (chapter summary context).

U.S. Environmental Protection Agency (EPA)

- EPA reports transportation accounted for ~28% of total U.S. greenhouse-gas emissions in 2022 (the largest single sector in the U.S. inventory).

- Within U.S. transportation emissions, light-duty vehicles represented ~57% of the sector’s emissions (EPA breakdown).

U.S. Department of Transportation (DOT) Report to Congress

- The U.S. DOT report indicates the transportation sector represents roughly one-third (~33%) of total U.S. GHG emissions in some agency analyses (reporting and scope differences vs EPA noted).

European Union Cycle / Horizon projects (program outputs summarized by EC partners)

- EU-funded composite/circularity pilots (project cluster summaries) report pilot achievements such as >20% reductions in manufacturing waste and >40% energy/material efficiency improvements in targeted demo lines (aggregate project results across Horizon/innovation pilots).

Japan Ministry of Economy, Trade and Industry (METI)

- METI estimates the theoretical maximum potential for CO₂ circular use (i.e., carbon recycled into products used domestically) in Japan by 2050 is roughly 100–200 million tonnes (maximum scenario for carbon recycling use).

European Union Aviation Safety Agency (EASA)

- EASA guidance notes that acceptable means for certification and airworthiness of composite aircraft structures are provided and that composites are explicitly addressed in certification frameworks (regulatory/statutory guidance point).

Federal Aviation Administration (FAA)

- FAA/aviation safety research documents note that over 80% of inspections on large transport-category aircraft are visual inspections (inspection practice statistic).

Global Carbon Fiber Composites Market: Market Dynamics

Driving Factors in the Global Carbon Fiber Composites Market

Rising Demand from the Aerospace and Defense Sector

A major growth driver for the carbon fiber composites market is the strong demand from the aerospace and defense industries. Aircraft manufacturers like Boeing and Airbus rely extensively on carbon fiber composites to manufacture wings, fuselages, and interiors due to their lightweight, high tensile strength, and resistance to fatigue. The U.S. Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) encourage the adoption of materials that can improve operational efficiency and reduce emissions, which directly accelerates composite integration.

Furthermore, defense agencies are increasingly using carbon fiber composites in drones, military vehicles, and protective gear to enhance performance and reduce fuel costs in logistics. In addition, space exploration initiatives, including NASA’s Artemis program and Europe’s space missions, are driving demand for ultra-lightweight composites that can withstand extreme environments. The combination of fuel efficiency needs, regulatory mandates, and defense modernization programs ensures that aerospace and defense will continue to be a cornerstone driver of market expansion.

Accelerated Growth of Renewable Energy and EV Adoption

The global shift toward renewable energy and electric mobility is another strong growth driver. Wind turbine blades increasingly rely on carbon fiber composites due to their superior fatigue resistance and ability to support longer, more efficient blade designs. According to the International Renewable Energy Agency (IRENA), wind energy is set to play a critical role in global energy transitions, directly fueling composite consumption.

Meanwhile, the electric vehicle (EV) industry requires lightweight materials to extend driving ranges and improve energy efficiency. Governments are actively promoting EV adoption with incentives and stricter emission norms, compelling automakers to incorporate carbon fiber composites into battery enclosures, structural frames, and body panels.

Furthermore, infrastructure for EV charging and renewable projects also boosts demand for composite-reinforced parts. Together, the growing commitment to decarbonization and clean energy ensures carbon fiber composites remain integral to meeting sustainability goals while enabling industries to achieve higher performance and efficiency benchmarks.

Restraints in the Global Carbon Fiber Composites Market

High Cost of Production and Raw Materials

One of the most significant restraints hampering the growth of the carbon fiber composites market is the high production cost associated with raw materials and processing. Carbon fiber is primarily derived from polyacrylonitrile (PAN) precursors, which are energy-intensive and costly to produce. The complex processes of stabilization, carbonization, and surface treatment add significant expenses, making composites far more expensive than traditional metals such as steel and aluminum. This restricts their use to high-value applications like aerospace and premium automotive segments, while mass adoption in mainstream vehicles and infrastructure remains limited.

Additionally, manufacturing requires specialized equipment and skilled labor, further elevating costs. These financial constraints pose a major barrier for industries in developing regions, where cost competitiveness is critical. Unless innovations in precursor materials, scalable production, and recycling significantly reduce costs, the widespread penetration of carbon fiber composites into price-sensitive markets will remain restricted, slowing overall growth potential despite strong performance advantages.

Complex Manufacturing and Supply Chain Challenges

Another key restraint is the complexity of manufacturing and the vulnerability of the carbon fiber composites supply chain. Producing high-quality composites requires precise temperature control, cleanroom environments, and advanced autoclave or press systems, which limit scalability and increase capital expenditure.

Additionally, the global supply chain for precursor fibers is concentrated in a few regions, such as Japan and the U.S., leading to supply bottlenecks and price fluctuations when demand surges. The COVID-19 pandemic highlighted these vulnerabilities, disrupting aerospace and automotive supply chains and delaying production timelines.

Moreover, industries face a shortage of trained technicians and engineers skilled in composite design, fabrication, and quality assurance, creating a talent gap that further slows adoption. Logistics challenges, including transporting large composite components like wind turbine blades, also pose limitations. Unless these supply chain and manufacturing bottlenecks are resolved through automation, localized production, and workforce development, the industry will continue to face hurdles in scaling up production efficiently.

Opportunities in the Global Carbon Fiber Composites Market

Expansion in Emerging Economies and Infrastructure Applications

A significant growth opportunity lies in the expansion of carbon fiber composites in emerging economies across Asia-Pacific, Latin America, and the Middle East. Countries like India, China, and Brazil are investing heavily in infrastructure, urban mobility, and renewable energy, which creates new avenues for composite adoption. For instance, bridges, stadiums, and high-rise structures are beginning to integrate composites for reinforcement, corrosion resistance, and extended durability compared to steel and concrete.

Additionally, the construction of new wind farms in Asia and Africa amplifies demand for long-span turbine blades made with carbon fiber composites. With governments offering subsidies and foreign direct investment to promote advanced materials, companies can penetrate these markets at scale. Civil engineering, marine, and public transportation are poised to become secondary growth drivers outside of aerospace and automotive. As sustainability standards increase, emerging economies provide fertile ground for manufacturers to expand operations, reduce costs with localized production, and capture significant untapped market potential.

Technological Innovation and Recycling Breakthroughs

Another major opportunity lies in ongoing innovation in materials and recycling technologies. Current research focuses on reducing reliance on petroleum-based precursors by developing bio-based polyacrylonitrile (PAN) fibers and lignin-derived composites, making production more sustainable and cost-efficient. Companies are also advancing thermoplastic carbon fiber composites, which are easier to mold, weld, and recycle compared to thermosets.

Recycling breakthroughs, such as solvolysis and pyrolysis methods, are enabling the recovery of high-quality carbon fibers from end-of-life aircraft, vehicles, and wind turbine blades. This circular approach not only reduces waste but also lowers raw material costs, making composites more competitive with metals and alloys. Innovations in digital manufacturing, AI-based process optimization, and robotics also promise to cut cycle times and enhance consistency in composite part fabrication. These breakthroughs open new opportunities in mainstream automotive and consumer electronics markets, ensuring that carbon fiber composites continue to expand their footprint across industries while aligning with global circular economy goals.

Trends in the Global Carbon Fiber Composites Market

Lightweighting and Sustainability Integration

One of the most dominant trends shaping the carbon fiber composites market is the rapid adoption of lightweight materials across aerospace, automotive, wind energy, and sporting goods industries. Governments worldwide are tightening emission regulations, and OEMs are under mounting pressure to meet carbon neutrality goals. For instance, automotive manufacturers are replacing steel and aluminum with carbon fiber composites to improve fuel efficiency and extend EV battery ranges. Similarly, aerospace companies use composites to reduce structural weight, resulting in better aerodynamics and lower fuel consumption.

Sustainability is also becoming central, with advancements in recycling processes for thermoplastic composites gaining momentum. Initiatives to develop bio-based precursors and circular economy models for composite waste management are also creating pathways toward greener production. This trend is further reinforced by strategic collaborations between material suppliers, universities, and OEMs to integrate digital simulation tools, AI-driven manufacturing, and automation in composite production, thereby reducing cost and complexity. Together, lightweighting and sustainability make carbon fiber composites indispensable in future material innovation.

Shift Toward High-Volume Manufacturing

Another key trend in the carbon fiber composites market is the push toward scalable, high-volume manufacturing processes. Historically, the use of carbon fiber composites has been restricted due to long cycle times and high processing costs, particularly in sectors like automotive.

However, with the introduction of automated prepreg layup systems, resin transfer molding (RTM), and thermoplastic processing technologies, companies are accelerating production to meet mass-market demand. For example, the automotive sector is investing heavily in robotic infusion and press-molding methods to produce lightweight vehicle parts more quickly without compromising structural integrity. The aerospace sector is also adopting advanced additive manufacturing techniques to create complex composite parts with greater design flexibility.

These changes are creating a shift from niche, high-performance applications to mainstream adoption in civil engineering, marine, and renewable energy. As high-volume processes become more cost-competitive, the industry is poised to break barriers in affordability, enabling composites to challenge traditional metals and plastics across multiple industries.

Global Carbon Fiber Composites Market: Research Scope and Analysis

By Matrix Material Analysis

Polymer matrix composites are projected to dominate the carbon fiber composites market, primarily due to their versatility, lightweight nature, and cost-effectiveness in high-performance applications. Epoxy, polyester, and thermoplastic resins serve as the leading matrices, offering excellent mechanical strength, corrosion resistance, and high fatigue tolerance, making them ideal for aerospace, automotive, wind energy, and sporting goods applications. Unlike carbon, ceramic, or metal matrices, polymer matrices are highly processable, supporting advanced manufacturing methods such as prepreg layup, resin infusion, and compression molding.

This adaptability enables large-scale production of lightweight structural components, significantly reducing weight while maintaining strength. In aerospace and defense, polymer composites are extensively used in fuselages, wings, and military vehicles, while the automotive sector relies on them for electric vehicle (EV) structures to enhance energy efficiency. Wind turbine manufacturers also adopt polymer matrix composites to improve blade durability and lifespan. Carbon matrix composites, although critical in jet engines and missile systems due to their heat resistance, remain limited by cost and application scope.

Similarly, ceramic and metal matrices are a niche for high-temperature or wear-resistant parts. Hybrid matrices are gaining traction, especially for multi-functional performance, but remain in developmental stages. Overall, the superior performance-to-weight ratio, lower costs, and broader applicability of polymer matrix composites secure their dominant position across industries.

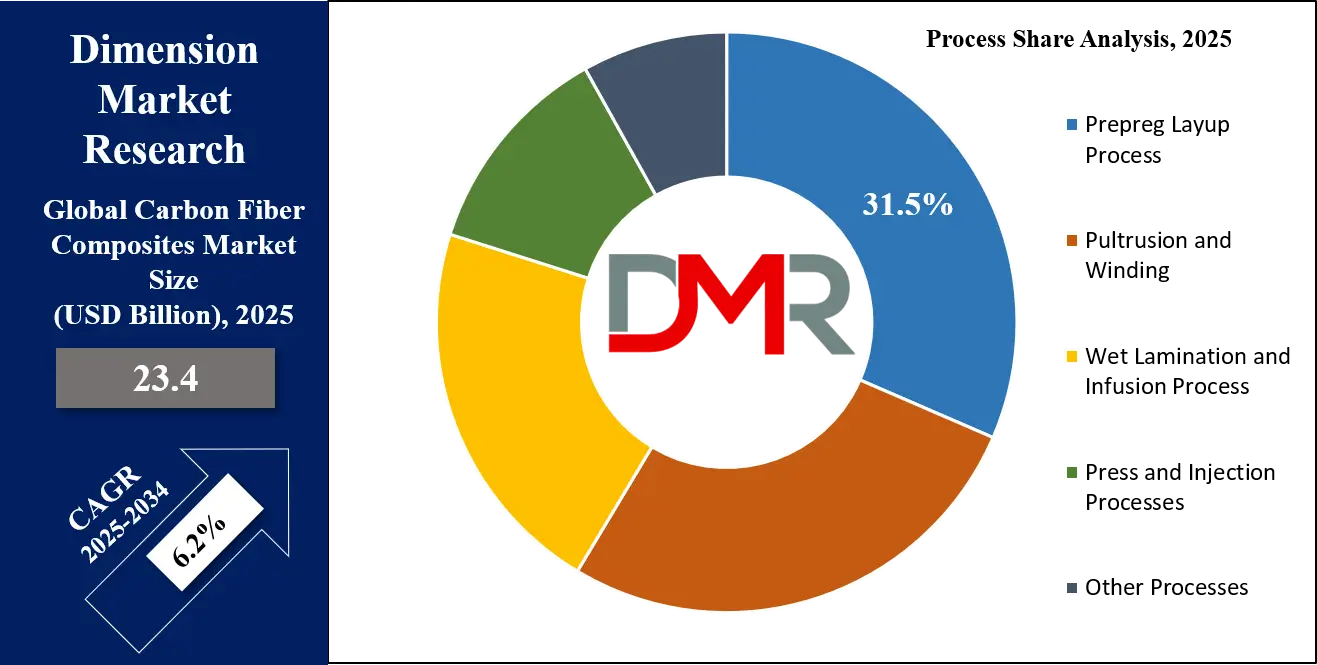

By Process Analysis

The prepreg layup process is anticipated to hold the dominant position in the carbon fiber composites market, primarily driven by its extensive adoption in aerospace and defense applications where quality, precision, and certification standards are paramount. Prepregs, which are carbon fibers pre-impregnated with resin, ensure uniform resin distribution, high fiber alignment, and superior structural integrity compared to other processes. This results in lightweight yet extremely strong components suitable for critical aircraft parts such as fuselage panels, wing structures, tail assemblies, and engine nacelles.

Aerospace OEMs like Boeing and Airbus rely heavily on prepreg layup to meet stringent regulatory standards and performance requirements, securing their leadership in the segment. While pultrusion and filament winding are important for wind turbine blades, pipes, and industrial profiles due to their cost efficiency and continuous production capabilities, they do not match the precision required in aerospace. Wet lamination and infusion processes are more common in automotive and marine industries, offering cost-effective solutions for non-critical components.

Press and injection processes are gaining traction with thermoplastic composites due to their recyclability and faster cycle times, yet they remain supplementary to prepreg applications. The dominance of the prepreg layup process is reinforced by long-standing aerospace certifications, unmatched structural performance, and its ability to meet fuel efficiency and lightweighting goals. Although other processes are growing, prepreg continues to be the benchmark for high-end composite manufacturing, making it the largest and most influential process type.

By End-User Analysis

The aerospace and defense sector is poised to remain the largest end-user of carbon fiber composites, accounting for the highest market share due to its stringent performance requirements, safety regulations, and demand for lightweight materials. Aircraft manufacturers such as Boeing, Airbus, Lockheed Martin, and defense contractors have integrated carbon fiber composites extensively into commercial jets, military aircraft, helicopters, and spacecraft. These composites reduce overall aircraft weight by up to 20–30%, significantly improving fuel efficiency, range, and payload capacity, while simultaneously lowering emissions to meet strict environmental targets.

In military applications, carbon fiber composites are vital for advanced fighter jets, drones, and missile systems where strength, stealth, and resistance to extreme conditions are essential. The automotive industry is the second-largest consumer, with rising electric vehicle adoption driving demand for lightweight composite structures that extend battery range.

Wind turbine manufacturers also utilize carbon fiber composites for long, durable blades that can withstand harsh environmental conditions, supporting renewable energy expansion. Sports and leisure applications, such as bicycles, tennis rackets, and golf clubs, contribute to premium demand, while marine and civil engineering use composites for corrosion resistance and structural reinforcement.

Despite these emerging applications, aerospace and defense dominate due to the unmatched safety, efficiency, and durability needs in aviation and military platforms. Continuous advancements in prepreg technology, thermoplastic composites, and next-generation aerospace programs reinforce the segment’s leadership, ensuring that aerospace and defense will remain the anchor of the carbon fiber composites market in the long term.

The Global Carbon Fiber Composites Market Report is segmented on the basis of the following:

By Matrix Material

- Polymer

- Thermosetting

- Thermoplastic

- Carbon

- Ceramics

- Metal

- Hybrid

By Process

- Prepreg Layup Process

- Pultrusion and Winding

- Wet Lamination and Infusion Process

- Press and Injection Processes

- Other Processes

By End-user

- Aerospace & Defense

- Automotive

- Wind Turbines

- Sports & Leisure

- Civil Engineering

- Marine Applications

- Other Applications

Impact of Artificial Intelligence in the Global Carbon Fiber Composites Market

- AI-Driven Material Innovation: AI accelerates material discovery by simulating thousands of fiber-matrix combinations, optimizing weight-to-strength ratios, and reducing R&D cycles, enabling the creation of next-generation carbon fiber composites with improved performance, cost efficiency, and rapid scalability across industries.

- Predictive Maintenance in Manufacturing: AI-powered predictive analytics enhance composite production by monitoring machinery in real time, detecting anomalies, and preventing breakdowns. This minimizes downtime, reduces scrap rates, improves yield consistency, and ensures reliable, large-scale carbon fiber composite manufacturing operations.

- Smart Process Optimization: Machine learning models refine resin infusion, curing cycles, and fiber orientation. These AI-driven optimizations reduce defects, improve mechanical performance, cut production costs, and enable precise control over complex carbon fiber composite manufacturing workflows.

- Automated Quality Assurance: AI-enabled computer vision systems detect fiber misalignment, voids, or delamination in real time, ensuring flawless structural integrity. This reduces manual inspection dependence, increases speed, and guarantees compliance with aerospace and automotive quality benchmarks.

- AI-Powered Demand Forecasting: AI integrates industrial, economic, and sustainability data to predict global demand for carbon fiber composites. This ensures better supply chain visibility, inventory control, and raw material allocation, enabling manufacturers to align production with market needs.

Global Carbon Fiber Composites Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global carbon fiber composites market as it holds 37.2% of market share by the end of 2025, primarily driven by its mature aerospace and defense industries, which account for the largest share of composite consumption worldwide. The U.S., home to industry giants such as Boeing, Lockheed Martin, and Northrop Grumman, relies extensively on carbon fiber composites for fuselage structures, wings, and military aircraft to reduce weight while meeting stringent performance standards.

The region also hosts a strong automotive industry, with companies like General Motors, Tesla, and Ford integrating lightweight composites to improve fuel efficiency and extend the range of electric vehicles. Moreover, the U.S. Department of Energy and other agencies provide significant funding to advance composite technologies, particularly for renewable energy, including wind turbine blades and energy storage applications.

Additionally, North America benefits from a robust ecosystem of research universities, advanced manufacturing clusters, and established players such as Hexcel Corporation, Toray Composite Materials America, and Owens Corning, ensuring leadership in innovation and production capacity. The adoption of AI-driven process optimization, automation, and Industry 4.0 practices has further enhanced efficiency in composite production.

Moreover, the U.S. military’s ongoing modernization programs and investments in next-generation aircraft and drones sustain long-term demand. Environmental regulations and decarbonization initiatives also drive adoption across transportation sectors. Collectively, these factors position North America as the most dominant market for carbon fiber composites, with a stable supply chain, cutting-edge technological base, and government support reinforcing its leadership role.

Region with the Highest CAGR

Asia Pacific is expected to record the highest CAGR in the global carbon fiber composites market, fueled by rapid industrialization, infrastructure development, and the expanding manufacturing base of aerospace, automotive, and renewable energy sectors. China, Japan, and South Korea lead the region’s growth, with China investing heavily in indigenous aerospace programs such as COMAC’s C919 aircraft, which increasingly integrates carbon fiber composites to compete with Western counterparts. Furthermore, China’s role as the global hub for wind energy production drives massive demand for composites in turbine blades, aligning with its renewable energy expansion targets.

Japan and South Korea are advancing composite usage in automotive and electronics, with Toyota, Hyundai, and Panasonic innovating lightweight solutions for electric vehicles and consumer goods. Asia Pacific also benefits from relatively lower production costs, abundant raw material processing capacity, and favorable government policies encouraging high-performance material adoption. India, emerging as a key player, is leveraging composites in defense, aerospace, and infrastructure, supported by “Make in India” initiatives and partnerships with global composite manufacturers.

Moreover, the Asia Pacific automotive sector, which dominates global production volumes, is accelerating composite integration to meet stricter fuel efficiency and emissions standards. The rapid rise of electric vehicles, coupled with urbanization-driven demand for lightweight transport solutions, amplifies growth potential. Wind energy investments across China and India further boost demand for large composite structures. With strong government backing, cost advantages, and expanding domestic aerospace and automotive production, the Asia Pacific is set to achieve the fastest growth rate globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Carbon Fiber Composites Market: Competitive Landscape

The global carbon fiber composites market is highly competitive, characterized by a mix of multinational giants and regional players focusing on innovation, cost reduction, and strategic partnerships. Key players include Toray Industries, Hexcel Corporation, SGL Carbon, Mitsubishi Chemical Carbon Fiber and Composites, Solvay, and Teijin Limited, all of which maintain strong footprints across aerospace, automotive, and renewable energy applications. These companies leverage advanced R&D capabilities to enhance mechanical performance, reduce production cycle times, and expand composite applications into emerging industries such as hydrogen storage and urban air mobility.

Partnerships and joint ventures are a common strategy, with aerospace companies collaborating with composite producers to secure long-term supply contracts. For example, Toray Industries has long-term agreements with Boeing, while Hexcel supplies Airbus and Lockheed Martin. Regional companies in China and India are rapidly expanding their presence, supported by government-backed manufacturing initiatives, intensifying global competition. Mergers and acquisitions are also shaping the market, as companies consolidate expertise to scale production and reduce costs.

The industry is also witnessing strong integration of artificial intelligence and automation, improving defect detection, process optimization, and predictive maintenance in composite manufacturing. Sustainability has emerged as a competitive factor, with leading players investing in recyclable composites and green manufacturing methods to meet regulatory and customer demands. With rising applications across aerospace, EVs, renewable energy, and defense, competition remains intense, pushing companies to balance innovation, scalability, and affordability to strengthen their global market position.

Some of the prominent players in the Global Carbon Fiber Composites Market are:

- Toray Industries, Inc.

- Hexcel Corporation

- Teijin Limited

- Mitsubishi Chemical Carbon Fiber & Composites (MCCFC)

- SGL Carbon SE

- Solvay S.A.

- Zoltek Corporation

- Hyosung Advanced Materials

- Formosa Plastics Corporation

- Nippon Graphite Fiber Co., Ltd.

- DowAksa Advanced Composites Holdings

- Jiangsu Hengshen Co., Ltd.

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Park Aerospace Corp.

- Gurit Holding AG

- Plasan Carbon Composites

- Albany International Corp.

- TCR Composites, Inc.

- ELG Carbon Fibre Ltd.

- Weihai Guangwei Composites Co., Ltd.

- Other Key Players

Recent Developments in the Global Carbon Fiber Composites Market

August 2025

- Toray Industries announced plans to expand its carbon fiber composite production capacity in North America to meet rising aerospace and automotive demand.

- Hexcel Corporation unveiled advanced carbon fiber prepregs at the SAMPE Conference 2025 in Seattle, focusing on lightweight solutions for next-gen aircraft.

July 2025

- SGL Carbon signed a strategic partnership with BMW Group to co-develop carbon composite parts for electric vehicle platforms.

- Mitsubishi Chemical Group invested in a new R&D center in Japan dedicated to hybrid carbon fiber composites for renewable energy applications.

June 2025

- Solvay announced a collaboration with Airbus for next-generation carbon fiber composites targeting hydrogen-powered aircraft.

- Teijin Limited showcased its thermoplastic carbon fiber solutions at the JEC World 2025 exhibition in Paris, emphasizing recyclability.

May 2025

- DowAksa secured funding from the Turkish government to expand carbon fiber production for the aerospace and defense industries.

- Hyosung Advanced Materials announced the development of high-strength carbon fibers tailored for wind turbine blades.

April 2025

- Hexcel and Spirit AeroSystems announced a joint venture to produce advanced aerospace carbon composites.

- Toray Industries participated in the International Composites Expo 2025, highlighting innovations in lightweight automotive structures.

March 2025

- SGL Carbon introduced recycled carbon fiber solutions for industrial applications, aiming to improve circular economy initiatives.

- Teijin Automotive Technologies expanded its U.S. operations with new facilities focused on carbon composite parts for electric vehicles.

February 2025

- Mitsubishi Chemical Group announced the acquisition of a carbon composites start-up specializing in AI-driven process optimization.

- Solvay presented new high-performance resins compatible with carbon composites at the AeroTech Conference 2025.

January 2025

- Hexcel Corporation completed its merger with a European composite materials supplier to strengthen its automotive footprint.

- Toray Industries launched a carbon fiber innovation program in collaboration with NASA for space-grade materials.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 23.4 Bn |

| Forecast Value (2034) |

USD 40.3 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 7.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Matrix Material (Polymer, Carbon, Ceramics, Metal, and Hybrid), By Process (Prepreg Layup Process, Pultrusion and Winding, Wet Lamination and Infusion Process, Press and Injection Processes, and Other Processes), By End-user (Aerospace & Defense, Automotive, Wind Turbines, Sports & Leisure, Civil Engineering, Marine Applications, and Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Toray Industries, Inc., Hexcel Corporation, Teijin Limited, Mitsubishi Chemical Carbon Fiber & Composites (MCCFC), SGL Carbon SE, Solvay S.A., Zoltek Corporation, Hyosung Advanced Materials, Formosa Plastics Corporation, Nippon Graphite Fiber Co. Ltd., DowAksa Advanced Composites Holdings, Jiangsu Hengshen Co. Ltd., Zhongfu Shenying Carbon Fiber Co. Ltd., Park Aerospace Corp., Gurit Holding AG, Plasan Carbon Composites, Albany International Corp., TCR Composites, Inc., ELG Carbon Fibre Ltd., Weihai Guangwei Composites Co., Ltd., and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |