.

Furthermore, unlike metals, it won't rust or corrode, which makes it long-lasting and highly durable; due to these advantages, carbon fiber has quickly become one of the go-to materials of modern technology and continues to gain popularity. Despite these benefits, carbon fiber is increasingly utilized and used leading to its popularity exponentially!

Carbon fiber's popularity has grown rapidly due to its unique qualities of weight reduction and durability, particularly its use by auto manufacturers to make vehicles lighter for improved fuel economy and faster speeds, airplane manufacturers incorporating more carbon fiber into their designs to reduce weight, lower fuel consumption, and increase safety, while other industries, such as construction and medical devices, adopt its unique properties. As more industries recognize its value, demand continues to surge.

One of the newest trends is carbon fiber's increasing presence in electric vehicles (EVs). Since EVs rely heavily on batteries that weigh heavily, using lightweight carbon fiber helps increase efficiency and range. Sports industry components, like bicycles, tennis rackets, golf clubs, and tennis racquets made from carbon fiber have also seen an upswing; in fashion and luxury products like watches, wallets, and phone cases as futuristic looks become popular, use carbon fiber beyond just high tech industries. These developments demonstrate how carbon fiber has moved beyond high-tech industries into everyday products across a variety of fields, both industries and industries traditionally associated with high-technology products only.

New technologies are transforming carbon fiber's strength and versatility. Scientists are exploring ways to recycle it to increase its sustainability and decrease waste production. Hybrid materials combining carbon fiber with other strong materials like titanium are being developed as hybrid materials that produce even stronger structures with greater flexibility. Manufacturing advances have made carbon fiber more cost-effective so more companies are adopting it into their products, helping reach new levels of efficiency and performance for carbon fiber.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Also, companies like Tesla and BMW have introduced carbon fiber components into mass-market cars, making carbon fiber more accessible for consumers. Aviation has also seen major advances; more airlines are using carbon fiber to make planes lighter and more fuel-efficient; in sports, athletes are breaking records using carbon fiber equipment from running shoes to racing bikes—evidence that carbon fiber is shaping modern industries while pushing the boundaries of technology.

These events highlight how carbon fiber is revolutionizing modern industries while expanding technology boundaries. Carbon fiber is expected to play a major role in future research and development efforts, and industries looking for stronger, lighter materials should recognize its significance. Manufacturing costs continue to decrease while recycling methods expand—expanding its use into space travel applications as well as smart materials showing it isn't simply a trend but key material of innovation in its own right. Its continuous development demonstrates this fact.

The US Carbon Fiber Market

The US Carbon Fiber Market is projected to reach USD 1.6 billion in 2025 at a compound annual growth rate of 10.6% over its forecast period.

The US has strong growth opportunities in the carbon fiber market, driven by advancements in aerospace, defense, and electric vehicles. Increasing demand for lightweight, fuel-efficient aircraft and high-performance EVs boosts adoption. Expanding wind energy projects and investments in recycling technologies further assist market growth. Government initiatives and research in sustainable composites improve future opportunities.

Further, the market is driven by strong demand from the aerospace, defense, and automotive industries, mainly with the rise of electric vehicles and lightweight aircraft. Advancements in wind energy and increasing investments in recycling technologies also fuel growth. However, high production costs and complex manufacturing processes remain key restraints, limiting widespread adoption. Supply chain challenges and the need for cost-effective recycling solutions further impact market expansion.

Carbon Fiber Market: Key Takeaways

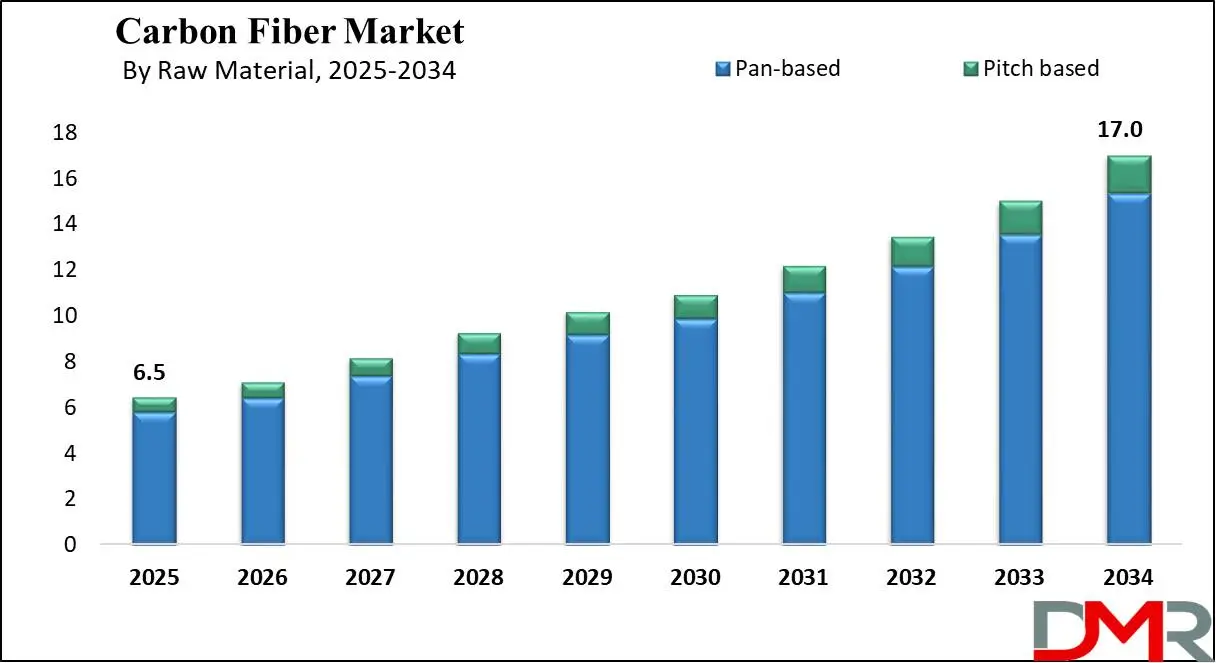

- Market Growth: The Carbon Fiber Market size is expected to grow by 9.9 billion, at a CAGR of 11.3%, during the forecasted period of 2026 to 2034.

- By Raw Material: The Pan-based segment is anticipated to get the majority share of the Carbon Fiber Market in 2025.

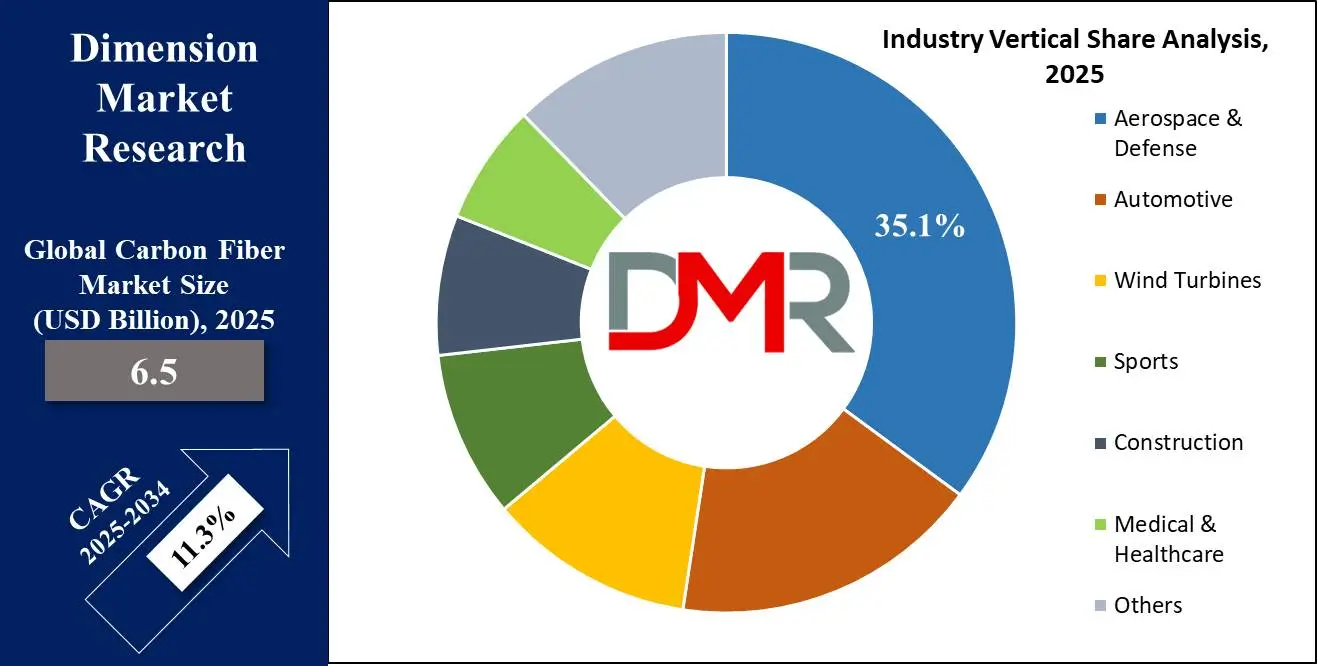

- By Industry Vertical: The Aerospace & Defense segment is expected to get the largest revenue share in 2025 in the Carbon Fiber Market.

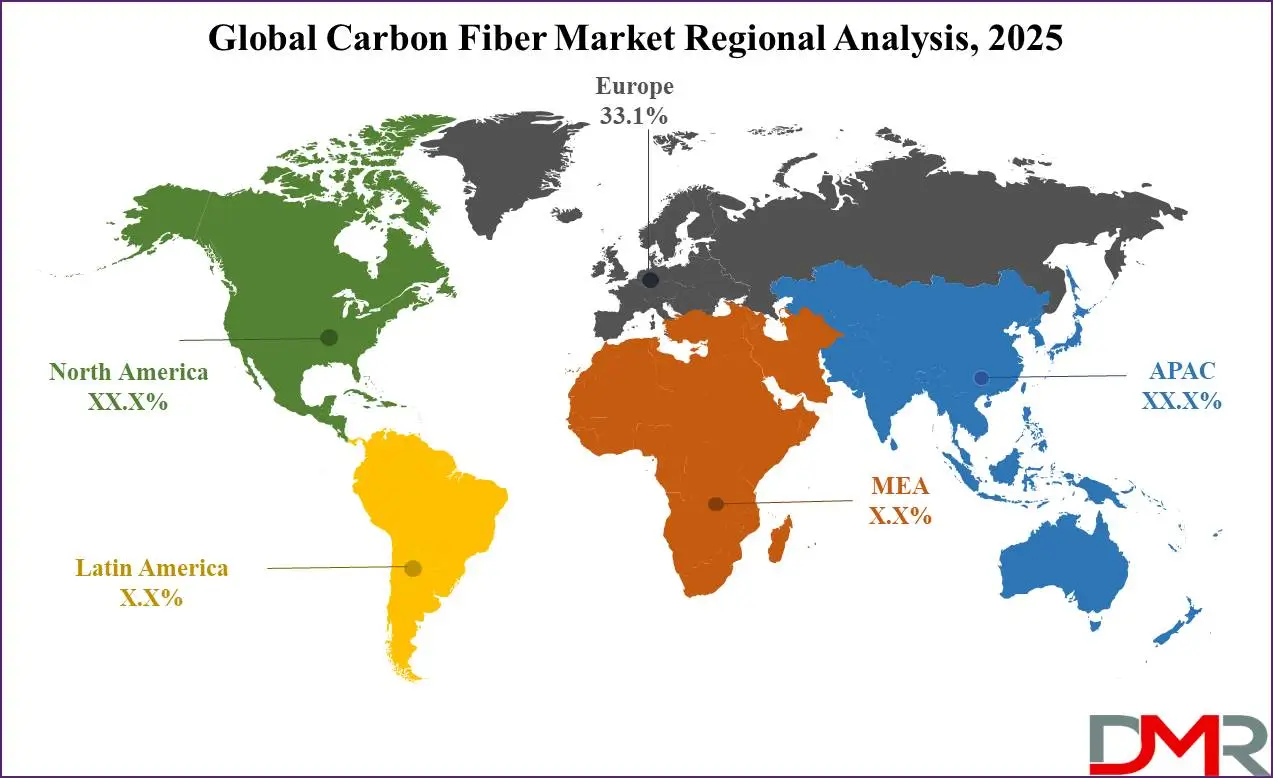

- Regional Insight: Europe is expected to hold a 33.1% share of revenue in the Global Carbon Fiber Market in 2025.

- Use Cases: Some of the use cases of Carbon Fiber include sports equipment, automotive industry, and more.

Carbon Fiber Market: Use Cases

- Automotive Industry: Carbon fiber is used in sports cars, race cars, and electric vehicles to minimize weight and improve speed, fuel efficiency, and safety. High-end brands like Ferrari, McLaren, and Tesla use carbon fiber for body panels, chassis, and interiors. Lighter cars mean better performance and lower emissions.

- Aerospace & Aviation: Modern airplanes like the Boeing 787 and Airbus A350 use carbon fiber to minimize weight, which improves fuel efficiency and durability. It is also used in spacecraft and satellites to withstand extreme conditions, which makes air travel more efficient and space missions more reliable.

- Sports Equipment: Carbon fiber is used in tennis rackets, golf clubs, bicycles, and even prosthetic limbs for athletes. Its lightweight and high-strength properties support improving performance, speed, and durability. Professional athletes prefer carbon fiber gear for better control and reduced fatigue.

- Military & Defense: Utilized in body armor, helmets, drones, and stealth aircraft, carbon fiber enhances protection and mobility. It is strong yet lightweight, making equipment easier to carry while maintaining high durability. The military also uses carbon fiber to develop advanced, high-speed vehicles.

Stats & Facts

- According to U.S. Commerce Services, the European composites market accounted for 22% of the global market volume in 2022, reaching 2.8 million tons and a total market value of USD 7.2 billion, making it a key industry for U.S. manufacturers expanding globally. Despite this, the industry saw a 6% decline compared to 2021 due to semiconductor shortages, supply chain disruptions, the Ukraine war, and rising raw material costs, though technological advancements and new industry applications continued to drive growth.

- Further, the market is highly fragmented, with many small firms, but 80-90% of total production comes from just 10-20% of companies, reflecting the dominance of a few key players. Market growth follows economic trends, as different European nations specialize in various composite applications across industries like automotive, aerospace, construction, and renewable energy.

- As per reports of U.S. Commerce Services, Glass fiber-reinforced plastics (GRP) dominate the European composites market, holding a 95% market share, making it the most widely used composite material. Meanwhile, carbon fiber-reinforced composites, despite having only a 2% market share, are growing rapidly, with 57 kilotons produced in 2022. Significant market opportunities exist for recycled carbon fibers, driven by demand for lightweight and sustainable materials.

- In addition, Natural fiber composites (flax, hemp, jute, kenaf) are gaining traction due to environmental benefits and the EU’s focus on climate action, with 90 kilotons produced in 2022. The leading producers are located in Germany, France, Italy, and the Netherlands, reflecting Europe’s push toward bio-based materials. Also, Thermoplastic composites surpassed thermosets in market share, growing to 58.2% (1,586 kilotons) in 2022, while thermoset composites declined slightly to 41.8% (1,138 kilotons). The increasing preference for thermoplastics is driven by recyclability, durability, and ease of processing, making them a favored choice in various industries.

- The U.S. Commerce Services also reported that Recycled carbon fibers and bio-based composites are emerging as sustainable alternatives, particularly in sectors like automotive and aerospace, where lightweight, high-performance, and eco-friendly materials are in demand. Meanwhile, supply chain disruptions and raw material shortages have pushed European manufacturers to explore alternative materials and localized production strategies, ensuring long-term industry stability and reducing dependence on global supply chains.

Market Dynamic

Driving Factors in the Carbon Fiber Market

Rising Demand in Automotive & Aerospace Industries

The automotive and aerospace sectors are major growth drivers for the carbon fiber market. Car manufacturers are mainly using carbon fiber to reduce vehicle weight, improving fuel efficiency and performance, primarily in electric vehicles (EVs). Lighter cars extend battery life, making them more sustainable and cost-effective. Similarly, the aerospace industry benefits from carbon fiber’s lightweight and high-strength properties, allowing aircraft to consume less fuel while improving durability. With stricter fuel efficiency regulations and growing environmental concerns, more companies are adopting carbon fiber to meet industry standards. As demand for high-performance, lightweight materials increases, carbon fiber continues to gain widespread adoption.

Advancements in Manufacturing & Sustainability

Technological advancements in carbon fiber production are making the material more affordable and accessible. New manufacturing techniques, such as automated fiber placement (AFP) and 3D printing with carbon fiber, are reducing production costs and waste. Additionally, main efforts in carbon fiber recycling are addressing sustainability concerns, and making the material more environmentally friendly. Industries such as construction and renewable energy are also beginning to adopt carbon fiber for its durability and efficiency in wind turbines and infrastructure projects. As manufacturing efficiency improves and eco-friendly solutions emerge, the carbon fiber market is expected to expand rapidly across multiple industries.

Restraints in the Carbon Fiber Market

High Production Costs & Expensive Raw Materials

One of the biggest restraints in the carbon fiber market is its high production cost. The manufacturing process is complex, demanding advanced technology, high temperatures, and specialized materials, making it expensive compared to alternatives like aluminum or steel. Raw materials like polyacrylonitrile (PAN) are costly, further increasing the overall price, which limits its adoption in mass-market applications, as only premium industries like aerospace and luxury automotive can afford it. The high cost also affects industries like construction and consumer goods, where cheaper materials are preferred. Until production costs decrease, widespread adoption of carbon fiber will remain a challenge.

Recycling Challenges & Environmental Concerns

Despite its durability, carbon fiber is difficult to recycle, which creates sustainability concerns. Unlike metals, which can be melted down and reused, carbon fiber composites are harder to break down and repurpose without losing their strength. Current recycling methods are expensive and inefficient, limiting the circular economy for carbon fiber products, which creates waste disposal issues, mainly in industries like aerospace and automotive, where large amounts of carbon fiber are used. Governments and environmental agencies are pushing for better recycling solutions, but until cost-effective methods are developed, the environmental impact remains a significant barrier to growth.

Opportunities in the Carbon Fiber Market

Expansion in Renewable Energy & Infrastructure

The rise in the focus on renewable energy presents a major opportunity for the carbon fiber market. Wind turbine manufacturers are mainly using carbon fiber in blades to make them lighter, stronger, and more efficient, helping to generate more power. The construction industry is also exploring carbon fiber for earthquake-resistant buildings, bridges, and reinforcement materials due to its high strength and corrosion resistance. As governments invest in green energy and sustainable infrastructure, the need for advanced materials like carbon fiber is expected to rise, which provides significant growth potential.

Increasing Adoption in Consumer & Wearable Technology

Carbon fiber is gaining traction in consumer goods, including high-end electronics, sports equipment, and fashion accessories. Lightweight and durable carbon fiber phone cases, watches, and eyewear are becoming popular among premium brands. The wearables industry is also experimenting with carbon fiber for smart clothing and advanced prosthetics, providing users with strength and flexibility. As manufacturers develop more affordable production techniques, carbon fiber is expected to enter mass-market products, which opens up new possibilities beyond industrial applications.

Trends in the Carbon Fiber Market

Growth of Recycled Carbon Fiber for Sustainability

With the growing environmental concerns, the carbon fiber industry is shifting towards recycling and sustainability. Companies are developing new processes to recover and reuse carbon fiber from old aircraft, cars, and industrial waste. Recycled carbon fiber offers a more cost-effective and eco-friendlier alternative to virgin carbon fiber, making it attractive for industries like automotive and consumer goods. Governments and environmental agencies are also encouraging sustainable materials, pushing manufacturers to invest in green solutions. As recycling technology improves, the availability of high-quality recycled carbon fiber is expected to rise, which helps minimize waste while making carbon fiber more accessible to different markets.

Advanced Carbon Fiber Composites for Next-Gen Applications

New composite materials combining carbon fiber with advanced polymers and metals are being developed for improved strength and flexibility. Hybrid carbon fiber composites, such as Carbotitanium and Thermoplastic Carbon Fiber, are gaining popularity for their enhanced durability and ease of manufacturing. These composites are being used in aerospace, automotive, and even medical implants due to their superior performance. Additionally, automation and 3D printing technologies are enabling more efficient carbon fiber production. As material science advances, these next-gen composites will drive further innovation and expand the use of carbon fiber across industries.

Research Scope and Analysis

By Raw Material Analysis

The PAN segment will lead the carbon fiber market in 2025, holding a dominant share of 90.2%. PAN-based carbon fiber is preferred due to its high strength, lightweight nature, and superior durability, making it essential for industries like aerospace, automotive, and renewable energy. As the need for fuel-efficient vehicles and lightweight aircraft increases, PAN-based carbon fiber remains the top choice for manufacturers. It also plays a key role in wind turbine blades, helping the renewable energy sector grow. Continuous research in cost-effective production and recycling methods is further boosting its adoption. With expanding applications and technological advancements, the PAN segment will continue driving market growth, ensuring a steady supply of high-performance carbon fiber worldwide.

Further, the pitch segment will experience significant growth over the forecast period due to its unique properties and expanding applications. Pitch-based carbon fiber offers exceptional thermal and electrical conductivity, making it ideal for specialized industries like aerospace, energy, and high-performance engineering. Unlike PAN-based carbon fiber, pitch-based fibers are used in applications requiring superior heat resistance, such as thermal insulation and friction materials. Growing demand for advanced materials in space exploration, electronics, and infrastructure is driving its adoption. As research improves its manufacturing efficiency and cost-effectiveness, the pitch segment is set to play a key role in the overall expansion of the carbon fiber market in the coming years.

By Fiber Type Analysis

The virgin carbon fiber segment plays a vital role in the growth of the carbon fiber market due to its unmatched strength, lightweight properties, and high durability. Unlike recycled carbon fiber, virgin carbon fiber offers superior performance, making it the preferred choice for industries like aerospace, automotive, and sports equipment. It is mainly used in aircraft, high-performance cars, and wind turbines, where strength and reliability are critical. As industries focus on fuel efficiency, electric vehicles, and renewable energy, the need for virgin carbon fiber continues to rise. Although expensive, advancements in production technology are helping reduce costs, further driving its adoption. With the growing applications and technological progress, the virgin fiber segment will remain essential in market expansion.

Further, the recycled carbon fiber segment is becoming a key driver of growth in the carbon fiber market due to its cost-effectiveness and environmental benefits. As industries focus on sustainability, recycled carbon fiber offers a solution by reducing waste and lowering production costs compared to virgin fiber. It is mainly used in automotive, construction, and consumer goods, where ultra-high strength is not always required. With increasing government regulations on waste management and carbon emissions, companies are investing in recycling technologies to make carbon fiber more sustainable. As the need for lightweight and eco-friendly materials grows, the recycled carbon fiber segment will continue to expand, supporting the market’s overall development while promoting a circular economy.

By Modulus Analysis

The standard modulus carbon fiber segment plays a major role in the growth of the carbon fiber market due to its balanced strength, flexibility, and cost-effectiveness. It is a primarly used type of carbon fiber, making up a major share of applications in industries like aerospace, automotive, sports, and wind energy. Standard modulus fibers provide high tensile strength and lightweight properties, making them ideal for manufacturing aircraft parts, car components, bicycle frames, and sporting equipment.

Their affordability in comparison to high and ultra-high modulus fibers makes them the preferred choice for large-scale production. As industries push for fuel efficiency, sustainability, and performance improvements, the need for standard modulus carbon fiber continues to rise. With developments in production technology and expanding applications, this segment will remain a key driver of market growth, ensuring the widespread adoption of carbon fiber across various industries while balancing performance and cost.

Further, the high-modulus carbon fiber segment is vital for the growth of the carbon fiber market due to its exceptional stiffness, strength, and durability. It is broadly used in aerospace, defense, and high-performance sports equipment, where precision and reliability are essential. Compared to standard carbon fiber, high-modulus fiber provides greater rigidity, making it ideal for applications like satellite structures, fighter jets, and advanced sporting gear. Although more expensive, its superior performance justifies the cost in critical applications. As industries constantly demand stronger, lighter, and more efficient materials, the high-modulus carbon fiber segment will see steady growth, playing a key role in advancing modern engineering and technology.

By Product Type Analysis

The long carbon fiber segment plays a key role in the growth of the carbon fiber market due to its superior strength, durability, and flexibility. Long carbon fibers are mainly used in industries like aerospace, automotive, and construction, where strong yet lightweight materials are essential. These fibers provide excellent load-bearing capacity, making them ideal for manufacturing aircraft components, car bodies, and structural reinforcements in buildings. Their ability to improve fuel efficiency in vehicles and reduce material weight in critical applications drives their increasing demand.

Compared to short fibers, long carbon fibers offer better mechanical properties, improving product performance and lifespan. As industries look for lightweight, high-strength solutions, the adoption of long carbon fibers continues to grow. Developments in production technologies and cost-reduction efforts further support their expansion. With a rising focus on efficiency and sustainability, long carbon fibers will remain a significant contributor to the market’s growth.

Further, the short carbon fiber segment plays an important role in the growth of the carbon fiber market by providing a cost-effective and versatile solution for various industries. These fibers are commonly used in injection molding, 3D printing, and composite materials for automotive, electronics, and construction applications. While not as strong as long fibers, short carbon fibers still provide excellent lightweight and durable properties, improving product performance. Their ease of processing and lower cost make them ideal for mass production, mainly in consumer goods and industrial applications. As demand for lightweight, affordable, and high-performance materials grows, the short carbon fiber segment will continue to expand, supporting market growth across multiple sectors.

By Industry Vertical Analysis

Aerospace & defense segment will lead the carbon fiber market in 2025, holding a 35.1% share, which depends heavily on carbon fiber due to its exceptional strength, lightweight nature, and resistance to extreme conditions. Aircraft manufacturers use carbon fiber to reduce weight, enhancing fuel efficiency and overall performance in commercial and military planes. In defense, carbon fiber is used for lightweight armor, drones, and high-speed military vehicles, improving agility and durability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Space exploration also benefits from carbon fiber’s heat resistance and structural strength in satellites and spacecraft. As the need for fuel-efficient aircraft, advanced defense systems, and space missions grows, the aerospace and defense segment will continue driving market expansion. With ongoing innovations and increasing global investments in aviation and defense technologies, carbon fiber’s role in this sector is set to become even more vital in the coming years.

Further, the medical and healthcare segment will experience significant growth over the forecast period due to carbon fiber’s strength, lightweight nature, and biocompatibility. Carbon fiber is being highly used in medical applications like prosthetics, orthopedic implants, surgical instruments, and imaging equipment. Its durability and corrosion resistance make it ideal for long-lasting medical devices, improving patient comfort and mobility. In diagnostic imaging, carbon fiber minimizes interference, enhancing the quality of X-rays and MRIs. As healthcare advances and demand for high-performance medical equipment rises, the use of carbon fiber in this sector will continue to grow, driving market expansion and innovation in medical technology.

The Carbon Fiber Market Report is segmented on the basis of the following

By Raw Material

By Fiber Type

- Virgin Carbon Fiber

- Recycled Carbon Fiber

By Modulus

- Standard

- Intermediate

- High

By Product Type

By Industry Vertical

- Automotive

- Aerospace & Defense

- Wind Turbines

- Sports

- Construction

- Medical & Healthcare

- Others

Regional Analysis

Leading Region in the Carbon Fiber Market

Europe is set to lead the carbon fiber market in 2025, holding a 33.1% share. The region's strong presence in aerospace, automotive, and renewable energy industries drives high demand for carbon fiber. Leading aircraft manufacturers like Airbus rely on carbon fiber to build lightweight, fuel-efficient planes, while the automotive sector uses it for electric vehicles and high-performance sports cars.

Europe is also investing significantly in wind energy, where carbon fiber is essential for manufacturing large, durable turbine blades. Strict environmental regulations and a focus on sustainability encourage the use of recycled carbon fiber in various applications. In addition, ongoing research and development, along with government initiatives supporting advanced materials, contribute to market growth. With continuous technological advancements and growth in demand across industries, Europe will remain a key player in expanding the global carbon fiber market in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Carbon Fiber Market

North America is expected to experience significant growth in the carbon fiber market over the forecast period due to strong demand from the aerospace, defense, and automotive industries. The presence of major aircraft manufacturers like Boeing, along with increasing defense investments, drives the need for lightweight, high-strength materials. The growing electric vehicle market also fuels demand, as automakers use carbon fiber to improve efficiency and performance. In addition, advancements in wind energy and sports equipment contribute to market expansion. With constant research, technological innovation, and government support for advanced materials, North America will remain a key region for carbon fiber growth in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The carbon fiber market is highly competitive, with key players constantly innovating to improve product strength, reduce costs, and expand applications. Major companies like Toray Industries, Hexcel Corporation, and Mitsubishi Chemical lead the industry, supplying carbon fiber for aerospace, automotive, and industrial uses. New entrants and regional manufacturers are also emerging, focusing on recycled carbon fiber and advanced composites.

As demand rises for electric vehicles, renewable energy, and defense, companies are investing in research, automation, and sustainability. However, high production costs and recycling challenges remain barriers. Partnerships, mergers, and technological advancements are shaping the industry, with companies striving to gain a competitive edge by improving efficiency and expanding global reach. The market is expected to grow rapidly with increasing applications.

Some of the prominent players in the Global Carbon Fiber are:

- Toray Industries Inc

- SGL Carbon

- Hexcel Corp

- Tenjin Ltd

- Solvay

- Mitsubishi Chemical Carbon Fiber and Composites

- DowAksa

- Hyosung Advanced Materials

- Zoltek

- Nippon Graphite Fiber Corp

- BASF SE

- Carbon CompositIndes e.V

- Suzhou Sinoma Advanced Materials Co., Ltd.

- Carbon Nexus

- Tairyfil Carbon Fiber

- KAIYI Carbon Co., Ltd

- ESE Carbon

- RTP Company

- Other Key Players

Recent Developments

- In March 2025, Mercedes announced that their 2025 car, the W16, will use innovative sustainable carbon fiber composites, marking the first time that this has been done in Formula 1. With carbon fiber composites forming approximately 75% of the team’s race car materials assist in achieving both performance and safety innovations in this area and offer a major opportunity to reduce the carbon footprint of the car while also acting as another step in the Silver Arrows’ goal to achieve Net Zero across all scopes by 2040.

- In February 2025, Apply Carbon (Plouay, France), part of Procotex Corp. (Belgium), announced a major financial investment to strengthen the circular supply chain for carbon and aramid fibers. Following a multi-million euro investment in 2023, the company established a 16,500-square-meter recycling facility, producing over 2,500 metric tons annually, with a capacity exceeding 4,000 metric tons. Backed by a strong supplier network and quality focus, Apply Carbon maintains a 3,000-metric-ton raw material stock to ensure consistency, reliability, and supply security.

- In February 2025, NCC has completed the design phase for the UK’s new carbon fiber development lines, funded by the Department of Science Innovation and Technology’s Infrastructure Fund, which strengthens UK carbon fiber capabilities, providing a manufacturing testbed for sustainable development, supply chain resilience, and investment security. With carbon fiber playing a key role in the net-zero transition, global demand is expected to rise 18% by 2030, potentially exceeding supply by 200 kt, presenting a significant industrial opportunity for the UK.

- In January 2025, Spirit AeroSystems Holdings, Inc. sold Fiber Materials Inc. (FMI), based in Biddeford, Maine, and Woonsocket, Rhode Island, to Tex Tech Industries, Inc. for USD 165 million in cash, as acquiring FMI enhances their portfolio of thermally protective materials. FMI’s advanced capabilities will help Tex-Tech better meet the demanding material needs of the expanding space and defense industries, making the acquisition both a strategic and complementary addition to their business.

- In November 2024, M Carbon Fiber unveiled the commencement of its 50-ton per year plasma oxidation qualification line project, which marks a critical step in demonstrating 4M’s patented oxidation technology, which promises to revolutionize the carbon fiber industry by significantly improving efficiency, reducing costs, and enhancing material properties. The USD 4.5 million project, which has already secured initial funding, will serve as a platform to showcase the scalability of 4M’s groundbreaking plasma oxidation process. With this line, 4M will be able to produce material for large-scale qualification projects, a key factor in securing licensing agreements and equipment sales.