Market Overview

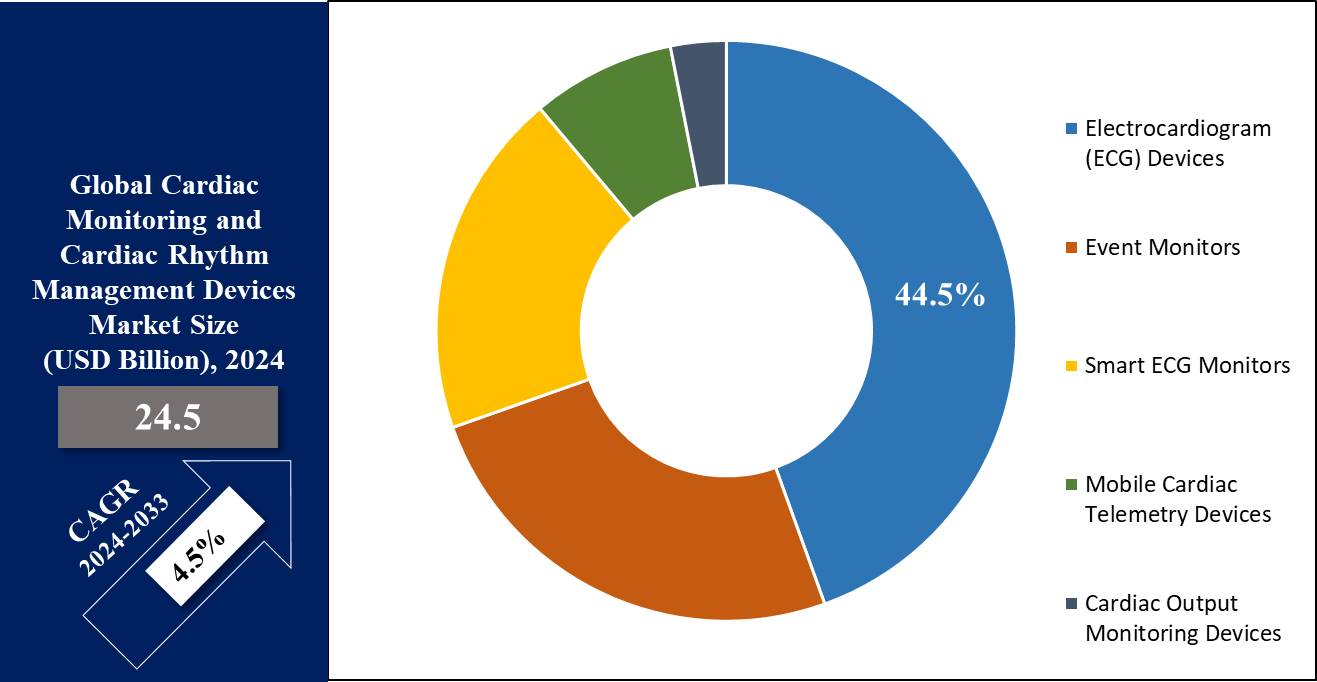

The Global Cardiac Monitoring and Cardiac Rhythm Management Devices Market size is expected to be valued at USD 24.5 billion in 2024 which is further anticipated to reach USD 36.2 billion in 2033 at a CAGR of 4.5% for the forecasted period of 2024 to 2033.

The global market of the Cardiac Monitoring and Rhythm Management Devices includes a versatile range of devices and services that play a pivotal role in diagnosing, monitoring, and treating cardiac abnormalities.

Cardiac Rhythm Management (CRM) devices, which include pacemakers and implantable cardioverter-defibrillators (ICDs) have a positive impact in curing arrhythmias. Pacemakers which are implanted to regulate the electrical activity of the heart and ICDs, which monitor and send shocks for life-threatening arrhythmias, are, in a nutshell, for the well-being of the patient.

Innovations in areas such as wireless communication and algorithmic intelligence are powered by technological progress which greatly improves the effectiveness of implantable devices that are used to prevent cardiac events and promote good cardiac health.

Moreover, ECG devices are available on the market that ensure different monitoring capacities such as resting, stress, and Holter monitoring as well as event monitors and smart ECG monitors which help in remote monitoring. Beyond these, mobile cardiac telemetry devices and cardiac output monitoring devices expand the range of devices available in this sector.

Key Takeaways

- Market Value: The Global Cardiac Monitoring and Cardiac Rhythm Management Devices Market is projected to reach USD 36.2 billion by 2033, growing at a CAGR of 4.5% from 2024.

- Market Definition: The Global Cardiac Monitoring and Cardiac Rhythm Management Devices Market encompasses devices for the diagnosis, monitoring, and treatment of heart disease, driven by technological advancements and the rising incidence of cardiovascular diseases across the globe.

- Cardiac Monitoring Devices Segment Analysis: Electrocardiogram (ECG) Devices are expected to show dominance in this segment with 44.5% of the market share in 2024.

- Cardiac Rhythm Management Devices Segment Analysis: Defibrillators is projected to show their dominance in the cardiac rhythm management devices segment in this market with 53.1% of the market share in 2024.

- Application Segment Analysis: Arrhythmias are expected to dominate the application segment in this market with the highest market share in 2024.

- End User Segment Analysis: Hospitals & Clinics are projected to dominate this market based on end users with the highest market share in 2024.

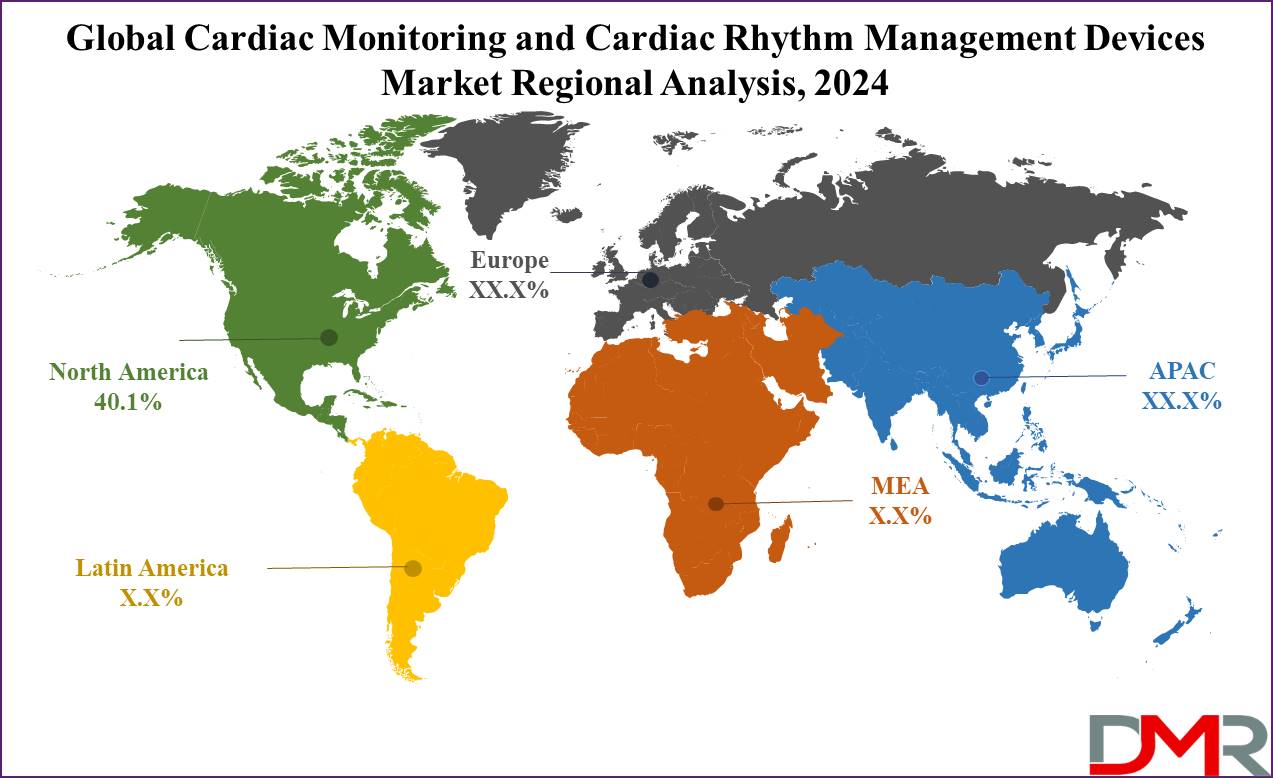

- Regional Analysis: North America is predicted to dominate the global cardiac monitoring and cardiac rhythm management devices market with 40.1% of the market share in 2024.

Use Cases

- Early Detection: Continuous monitoring with ECG devices allows early detection of arrhythmias, permitting well-timed intervention to prevent negative cardiac events and enhance patient outcomes.

- Remote Patient Monitoring: Wearable cardiac telemetry devices facilitate remote monitoring of patients with chronic conditions, enabling healthcare providers to tune cardiac health trends and intervene proactively.

- Post-Operative Care: Implantable cardiac rhythm management devices offer post-operative tracking and therapy, making optimal recovery for patients present process cardiac surgeries which include pass or valve replacement.

- Athlete Screening: Holter monitors and stress ECG devices are used for athlete screening, detecting cardiac abnormalities that can predispose athletes to sudden cardiac activities at some point of high-intensity physical exertion.

- Heart Failure Management: Cardiac output monitoring devices assist in optimizing fluid status and hemodynamic management in patients with heart failure, decreasing hospital readmissions.

Cardiac Monitoring and Cardiac Rhythm Management Devices Market Dynamic

Trends

Integration of Artificial Intelligence

Integration of AI algorithms into ECG machines improves diagnostic ability and allows for timely prediction of cardiovascular complications. The market is witnessing a trend towards the integration of wearable technology with ECG devices, permitting non-stop tracking and real-time data transmission, thereby improving patient compliance and facilitating faraway management of cardiac conditions.

Wearable Technology Adoption

The increasing demands for wearable ECG monitors and mobile telemetry devices are an indication of the transition from time-based cardiac monitoring into continuous real-time monitoring. This promotes the patient's engagement by syncing their care to health actions and care decisions.

Growth Drivers

Increasing Cardiovascular Disease Prevalence

Rapidly increasing cases of heart diseases across the globe implies that more and more such patients may need cardiac monitoring to be able to catch them when they are in the early stage as early detection and non-stop tracking are critical for the effective management and prevention of cardiac occasions.

Technological Advancements

Continuous technological innovations in ECG device technology, such as electronic convergence of ECG devices with more user-friendly designs, more wireless connectivity, and cloud-based ECG data storage, are the reason for the market growth, as the results are more useful and pleasurable for the user.

Growth Opportunities

Remote Patient Monitoring Expansion

The development of

telemedicine and

remote patient monitoring provides pathways for extending the marketplace’s sphere, including remote areas that are underserved and

home healthcare settings. The need for non-stop monitoring of patients with chronic cardiac situations outside conventional healthcare settings projects a significant growth opportunity for this market.

Emerging Markets Penetration

The lack of developed markets in developing regions acts as a fertile ground for growth as the healthcare infrastructure improves and cardiac health awareness rises, creating a growing need for monitoring devices. Expanding into emerging markets offers huge growth opportunities, fueled by using growing healthcare infrastructure development, rising disposable earnings, and growing consciousness about the significance of cardiac health in areas with excessive cardiovascular disease burden.

Restraints

High Cost of Advanced Devices

Affordability continues to pose problems, particularly in acquiring state-of-the-art ECG machines with superior functionality. Obviously, these machines are beyond the reach of some healthcare institutions and regions.

Regulatory Hurdles

A stronger regulatory framework, including AI-driven diagnostics and remote monitoring technologies, could obstruct the speed of innovations and the time of entry into the market by some of the product manufacturers, which can affect the growth of the market itself.

Cardiac Monitoring and Cardiac Rhythm Management Devices Market Research Scope and Analysis

By Cardiac Monitoring Devices

Electrocardiogram (ECG) devices are projected to dominate the global market for cardiac monitoring and rhythm management devices in the context of cardiac monitoring devices with 44.5% of market share in 2024 because of their versatility, effectiveness, and extensive applicability throughout numerous healthcare settings.

Resting ECG gadgets, pressure ECG gadgets, Holter monitors, and event monitors cater to exceptional diagnostic needs, providing comprehensive solutions for detecting and monitoring cardiac rhythm abnormalities. The accessibility of ECG devices in hospitals, clinics, and ambulatory settings helps activate the prognosis and tracking of patients with suspected or recognized cardiac conditions.

Furthermore, ECG devices are available in different lead configurations, such as single lead, 3-6 lead, and 12 lead, providing flexibility to healthcare companies based on the medical scenario and degree of detail required.

Additionally, improvements in technology have caused the improvement of smart ECG video display units and mobile cardiac telemetry devices, enabling continuous remote monitoring and real-time transmission of ECG data for timely intervention.

Moreover, the non-invasive nature of ECG testing, coupled with its verified efficacy in diagnosing arrhythmias and different cardiac abnormalities, solidifies its dominance in the global market for cardiac monitoring and cardiac rhythm management devices.

By Cardiac Rhythm Management Devices

Defibrillators are expected to dominate the cardiac rhythm management devices segment in this market as they hold 53.1% of the market share in 2024 as a result of their essential function in handling life-threatening cardiac arrhythmias.

Implantable cardioverter defibrillators (ICDs) are especially distinguished, providing continuous tracking and automated delivery of life-saving shocks to restore a normal coronary heart rhythm in cases of ventricular fibrillation or ventricular tachycardia.

Transvenous ICDs, in conjunction with subcutaneous ICDs, cater to different patients' needs, supplying alternatives for implantation primarily based on individual anatomical considerations and clinical requirements. Moreover, the combination of cardiac resynchronization therapy (CRT) with defibrillation capabilities, in addition, enhances the utility of these devices in coronary heart failure patients with conduction abnormalities.

External defibrillators, which include computerized and semi-computerized versions, expand defibrillation competencies beyond medical settings, enabling rapid response in out-of-clinic cardiac arrest situations.

Wearable cardioverter defibrillators provide progressive solutions for continuous tracking and brief defibrillation aid in high-risk patients expecting long-term device implantation or those ineligible for permanent implantable devices.

Overall, the flexibility, efficacy, and wide-ranging applicability of defibrillators in dealing with cardiac arrhythmias underscore their dominance in the global market for cardiac rhythm management devices.

By Application

Arrhythmias are projected to dominate the global cardiac monitoring & cardiac rhythm management (CRM) devices market due to their incidence and clinical importance. Arrhythmias take the lead position in the market concerning cardiac monitoring and cardiac rhythm management devices as their prevalence and clinical significance are really high.

The spectrum of arrhythmias covers a wide range of irregular heart rhythms which may be benign or even fatal. These anatomical anomalies typically necessitate continuous monitoring and intervention to prevent the complications of stroke, heart failure, and sudden cardiac arrest.

Arrhythmia detection and diagnosis are accomplished with the assistance of cardiac monitoring devices, including Holter monitors, event recorders, and implantable loop recorders, that record the heart’s electrical activity over necessary time periods.

In fact, wearable technology development and mobile health applications have created the possibility of remotely and rapidly examining arrhythmias and consequently providing the proper medical care, and improving patients’ outcomes.

Furthermore, the number of aging people, the expanding prevalence of cardiovascular risk factors, and rising awareness about arrhythmias currently create an opportune niche for cardiac monitoring devices that perfectly fit this user population.

By Procedure

Invasive procedures dominate the global market for cardiac monitoring and cardiac rhythm management devices with the highest market share in 2024, due to their efficacy in diagnosing and treating complicated cardiovascular conditions.

Invasive approaches, inclusive of cardiac catheterization and electrophysiology research, provide direct access to the heart's interior, allowing for specific measurements and interventions. These techniques are often executed in specialized cardiac catheterization laboratories prepared with superior imaging technology and monitoring devices.

Additionally, invasive strategies enable the positioning of implantable devices like pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices, which play a critical function in handling diverse cardiac rhythm disorders.

Furthermore, invasive procedures offer the advantage of real-time monitoring and intervention, facilitating immediate adjustments to optimize patient outcomes. Despite the invasive nature of these processes, improvements in minimally invasive techniques have caused decreased patient outcomes, shorter recovery times, and advanced safety profiles, further driving their adoption.

Overall, the superior diagnostic and healing abilities of invasive procedures cause them to be the favored choice for handling complex cardiac situations, thereby dominating the segment in the international market for cardiac monitoring and cardiac rhythm management gadgets.

By End User

The healthcare industry and cardiac monitoring and cardiac rhythm management device market are projected to be dominated by hospital systems and clinics in 2024. This is attributed to many factors, as Hospitals are the primary place of service for patients with cardiovascular conditions, where they can receive the full range of diagnostic, treatment, and monitoring services.

They deal with a large number of cardiac issues, including routine check-ups or more complex surgery cases on the heart that require advanced monitoring equipment. Moreover, hospitals will likely have high-level cardiac care units that have the necessary equipment for the continuous monitoring of cardiac rhythms as well as other cardiac conditions, making them the top customers for such devices.

In addition, healthcare professionals in the hospitals are equipped with the right tools for interpreting the data from

medical devices, hence avoiding unnecessary delays or misdiagnoses, and promoting patients' health conditions. Also, hospitals frequently undertake procurement and have medical device budget allocations, thus enabling them to spend on updated units for cardiac monitoring and rhythm management.

The Global Cardiac Monitoring and Cardiac Rhythm Management Devices Market Report is segmented based on the following

By Cardiac Monitoring Devices

- Electrocardiogram (ECG) Devices

- By Type

- Resting ECG Devices

- Stress ECG Devices

- Holter Monitors

- Event Monitors

- By Lead

- Single Lead

- 3-6 Lead

- 12 Lead

- Event Monitors

- By Type

- Loop memory monitor

- Patch recorders.

- Symptom event monitor

- Implanted loop recorders

- By Technology

- Manual Event Monitors

- Autodetect Monitors

- Smart ECG Monitors

- Mobile Cardiac Telemetry Devices

- Cardiac Output Monitoring Devices

By Cardiac Rhythm Management Devices

- Defibrillators

- Implantable Cardioverter Defibrillators

- Transvenous Implantable Cardioverter Defibrillators (T-ICDs)

- Biventricular Implantable Cardioverter

- Defibrillators/Cardiac Resynchronization Therapy Defibrillators

- Dual-Chamber Implantable Cardioverter Defibrillators

- Single-Chamber Implantable Cardioverter Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillators

- External Defibrillators

- Automated External Defibrillators

- Semi-Automated External Defibrillators

- Fully Automated External Defibrillators

- Manual External Defibrillators

- Wearable Cardioverter Defibrillators

- Pacemakers

- By Implantability

- Implantable Pacemakers

- External Pacemakers

- By Type

- Dual-Chamber Pacemakers

- Single-Chamber Pacemaker

- Biventricular/CRT Pacemakers

By Application

- Arrhythmias

- Myocardial Infarction

- Bradycardia

- Tachycardia

- Heart Failure

- Others

By Procedure

By End User

- Hospitals & Clinics

- Ambulatory surgical centers

- Others

Cardiac Monitoring and Cardiac Rhythm Management Devices Market Regional Analysis

North America is projected to dominate the global market for cardiac monitoring and cardiac rhythm management devices with the highest market share of about 40.1% in 2024, and is further projected to show a subsequent growth rate in the upcoming year as well because of numerous key elements. This region boasts advanced healthcare infrastructure and a high prevalence of cardiovascular diseases, which drives the need for these devices.

Additionally, favorable compensation policies and extensive healthcare spending further stimulate market growth. North America is also home to several outstanding medical device producers, research institutions, and healthcare centers, fostering a robust atmosphere for innovation and product improvement within the discipline of cardiac monitoring and rhythm control.

Furthermore, stringent regulatory frameworks, mainly within the United States, ensure excessive requirements of best practices and safety for those devices, instilling confidence among healthcare experts and patients alike.

Moreover, the region's massive population base, coupled with increasing awareness about the importance of early detection and management of cardiac situations, contributes to sustained market expansion.

Overall, North America's combination of strong demand, a supportive regulatory environment, innovative surroundings, and healthcare infrastructure positions it as the leading marketplace for cardiac monitoring and cardiac rhythm management devices on a global scale.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Cardiac Monitoring and Cardiac Rhythm Management Devices Market Competitive Landscape

The global market for cardiac monitoring and cardiac rhythm management devices is fiercely aggressive, driven using technological advancements, regulatory necessities, and the constant need for innovative solutions to address cardiovascular illnesses.

Major players in this panorama encompass established medical device companies such as Medtronic, Abbott Laboratories, Boston Scientific Corporation, and Philips Healthcare, amongst others.

These businesses invest heavily in research and development to introduce products like implantable cardioverter-defibrillators (ICDs), pacemakers, cardiac video display units, and wearable cardiac gadgets. Moreover, strategic collaborations, mergers, and acquisitions are common strategies followed by key players to extend their marketplace presence and improve their product portfolios.

Additionally, rising gamers and startups that specialize in niche segments or novel technologies, in addition, new players in this market are continuously innovating and differentiating their offerings to keep their marketplace positions. Regulatory compliance, product quality, pricing strategies, and distribution networks additionally play significant roles in shaping the competitive landscape of the global cardiac monitoring and cardiac rhythm control device market.

Some of the prominent players in the global Cardiac Monitoring and Cardiac Rhythm Management Devices Market are

- Physio-Control Inc.

- Schiller

- Medtronic

- Abbott

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- BIOTRONIK

- Progetti Srl

- LivaNova Plc

- Other Key Players

Recent Developments

- In February 2024, KYMIRA Ltd, with support from Innovate UK, aims to develop a smart garment called PRACTISE to aid in early diagnosis of heart disease, potentially preventing some of the 100,000 UK arrhythmia-related deaths annually.

- In January 2024, Medtronic India partners with Cardiac Design Labs to introduce Padma Rhythms, an external loop recorder (ELR) patch, aiming to enhance heart monitoring and diagnosis accessibility in India.

- In September 2023, Abbott Laboratories announced a USD 4.9 billion acquisition of Lifetech, a leading developer of implantable CRM devices. This move bolsters Abbott's existing CRM portfolio of pacemakers, defibrillators, and leadless pacing systems.

- In October 2023, Boston Scientific launched their next-generation CRM system featuring a cutting-edge pacemaker, an advanced defibrillator, and a leadless pacing solution. This system promises improved patient outcomes and reduced complications.

- In November 2023, Biotronik acquired MicroPort Innovation gaining access to their advanced CRM technology portfolio. While the financial details remain undisclosed, this acquisition strengthens Biotronik's position within the CRM market.

Cardiac Monitoring and Cardiac Rhythm Management Devices Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 24.5 Bn |

| Forecast Value (2033) |

USD 36.3 Bn |

| CAGR (2024-2033) |

4.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Cardiac Monitoring Devices (Electrocardiogram (ECG) Devices, Event Monitors, Smart ECG Monitors, Mobile Cardiac Telemetry Devices, and Cardiac Output Monitoring Devices), By Cardiac Rhythm Management Devices (Defibrillators, and Pacemakers), By Application (Arrhythmias, Myocardial Infarction, Bradycardia, Tachycardia, Heart Failure, and Others), By Procedure (Invasive, and Non-invasive), By End User (Hospitals & Clinics, Ambulatory surgical centers, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF, Clariant, DIC Corporation, Heubach GmbH, Sudarshan Chemical Industries Ltd., Ferro Corporation, Trust Chem Co. Ltd, DCL Corporation, Toyocolor Co. Ltd., and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global Cardiac Monitoring and Cardiac Rhythm Management Devices Market size is estimated to have a value of USD 24.5 billion in 2024 and is expected to reach USD 36.3 billion by the end of 2033.

North America is expected to be the largest market share for the Global Cardiac Monitoring and Cardiac Rhythm Management Devices Market with a share of about 40.1% in 2024.

Some of the major key players in Global Cardiac Monitoring and Cardiac Rhythm Management Devices are Physio-Control Inc., Schiller, Medtronic, Abbott, and many others.

The market is growing at a CAGR of 4.5 percent over the forecasted period.