Market Overview

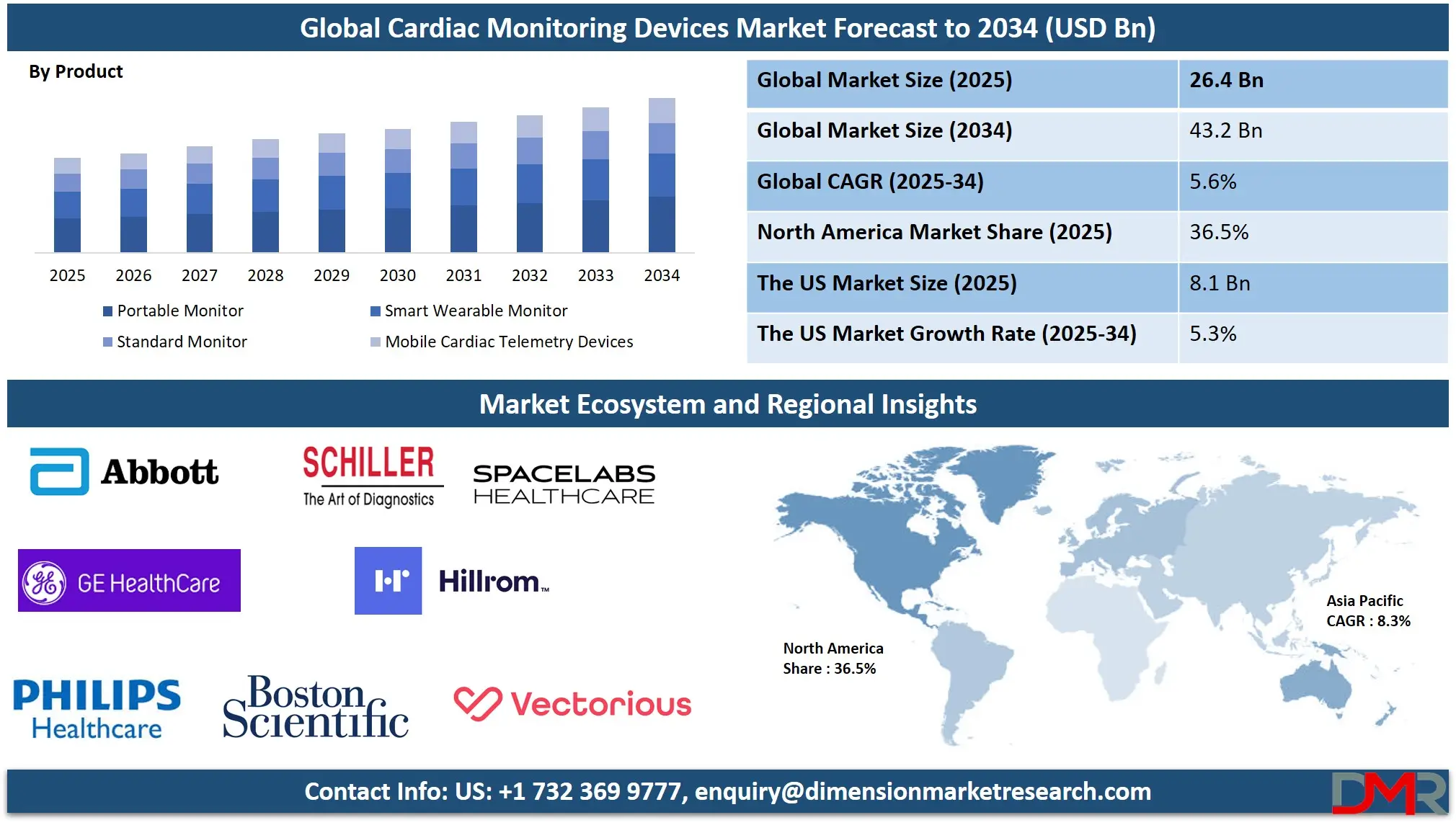

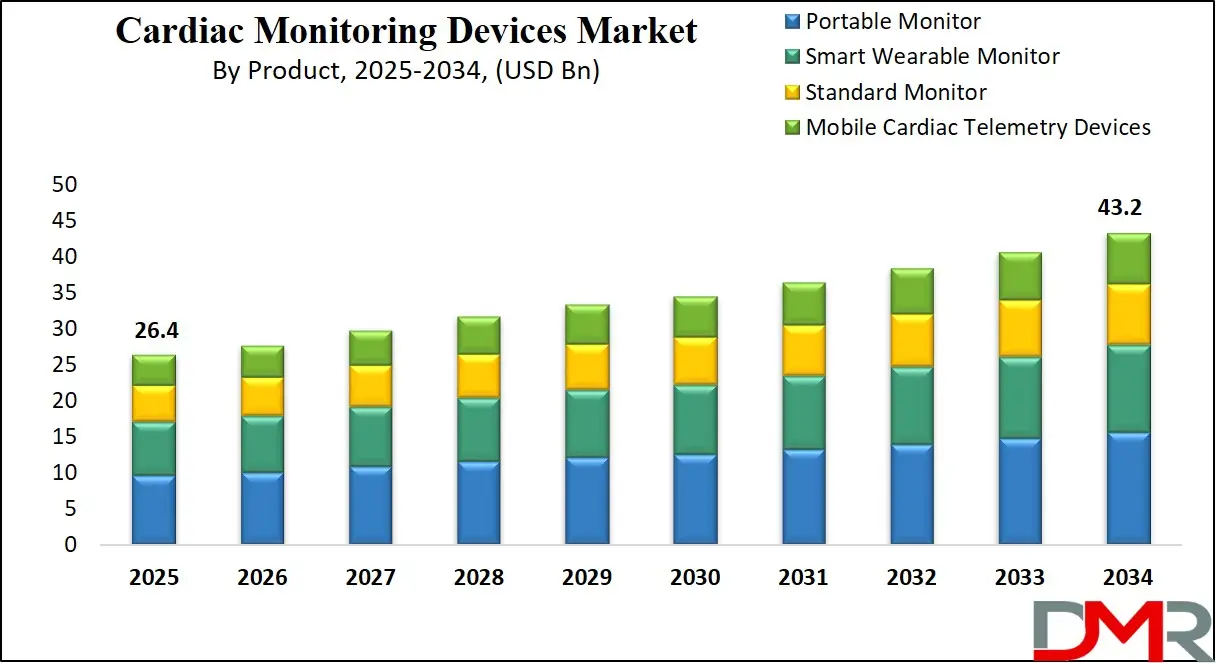

The Global Cardiac Monitoring Devices Market is predicted to be valued at USD 26.4 billion in 2025 and is expected to grow to USD 43.2 billion by 2034, registering a compound annual growth rate (CAGR) of 5.6% from 2025 to 2034.

Cardiac monitoring devices are medical tools designed to continuously or intermittently track and record the heart’s electrical activity, rhythm, and performance. They help detect abnormalities such as arrhythmias, ischemia, and other cardiovascular disorders. These devices range from hospital-based systems, such as multi-parameter monitors and Holter monitors, to portable and wearable solutions, enabling real-time or remote patient monitoring.

Data from cardiac monitors supports timely diagnosis, treatment planning, and long-term heart health management. Common applications include post-surgery care, chronic heart disease management, and emergency diagnostics. Advancements in wireless technology and AI have enhanced accuracy, portability, and patient comfort in modern cardiac monitoring solutions.

The global cardiac monitoring devices market is experiencing steady growth, driven by the increasing prevalence of cardiovascular diseases, rising awareness about preventive healthcare, and advancements in diagnostic technology. These devices are essential for continuous heart monitoring, enabling early detection of arrhythmias, ischemic episodes, and other cardiac abnormalities.

Technological innovations, such as wireless connectivity, wearable heart monitors, and AI-based diagnostic tools, are transforming patient care by improving accuracy, portability, and data accessibility. The shift toward remote patient monitoring and telecardiology has further expanded the adoption of portable ECG devices, Holter monitors, and implantable cardiac event recorders in both hospital and homecare settings.

The growing demand is fueled by aging populations, lifestyle-related risk factors, and increasing healthcare expenditure on cardiac diagnostics. Healthcare providers are integrating advanced multi-parameter patient monitors and mobile cardiac telemetry devices to streamline diagnosis, improve patient outcomes, and support continuous post-treatment surveillance for high-risk patients.

The market is also benefiting from collaborations between medical device manufacturers, technology companies, and healthcare providers to develop innovative cardiac monitoring solutions. With an emphasis on personalized medicine and preventive care, the industry is expected to witness significant adoption of smart wearable cardiac monitoring devices, driving long-term market expansion.

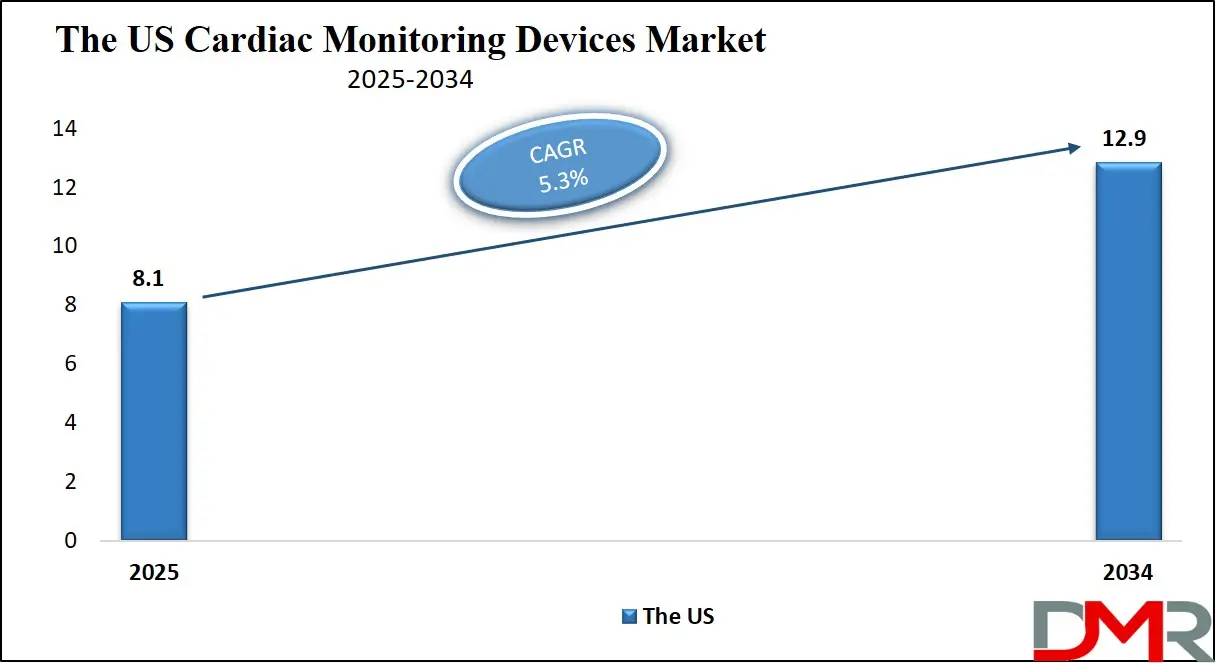

The US Cardiac Monitoring Devices Market

The US Cardiac Monitoring Devices Market is projected to be valued at USD 8.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.9 billion in 2034 at a CAGR of 5.3%.

The U.S. market is driven by advanced healthcare infrastructure, high adoption of wearable and implantable monitoring devices, and strong insurance coverage for preventive cardiac care. Rising cardiovascular disease prevalence and a growing elderly population fuel demand for continuous monitoring solutions. The integration of AI, predictive analytics, and cloud-based systems in cardiac devices enhances clinical accuracy and supports telemedicine adoption. Government initiatives promoting early diagnosis and preventive health screenings further strengthen market growth.

In addition, the presence of major medtech companies fosters innovation and rapid product launches, making the U.S. one of the most technologically advanced markets for cardiac monitoring devices.

The U.S. market is witnessing a shift toward patient-centric, remote monitoring solutions integrated with telehealth platforms. Wearable devices with multi-parameter capabilities, such as ECG, heart rate, and oxygen saturation, are gaining popularity. AI-driven diagnostics and predictive analytics are being incorporated into devices for early detection of arrhythmias and heart disease.

Cloud-based systems enable real-time physician access and collaborative care. Growing partnerships between device manufacturers and digital health companies are accelerating innovation. The demand for personalized healthcare, preventive monitoring, and post-operative remote care is shaping the U.S. cardiac monitoring devices market, with an increasing focus on data security and regulatory compliance.

The Japan Cardiac Monitoring Devices Market

The Japan Cardiac Monitoring Devices Market is projected to be valued at USD 1.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.8 billion in 2034 at a CAGR of 4.5%.

Japan’s market growth is fueled by its aging population and the high prevalence of cardiovascular diseases. The country’s strong healthcare infrastructure and government-backed health programs promote early detection and treatment of cardiac conditions. Hospitals and specialty clinics are increasingly adopting advanced monitoring solutions, including implantable devices and smart wearables, to improve diagnostic accuracy.

Rising public awareness of preventive healthcare is encouraging more patients to opt for continuous monitoring. Technological innovations from Japanese electronics and medtech companies, including miniaturized sensors and AI-driven ECG analysis, further drive adoption. Collaboration between hospitals and manufacturers is accelerating the integration of cutting-edge cardiac monitoring technologies.

In Japan, wearable and portable cardiac monitoring devices are becoming increasingly popular due to their convenience and non-invasive nature. Remote patient monitoring platforms are gaining traction, supported by robust broadband and mobile network infrastructure. AI-enabled ECG interpretation is being widely adopted to enhance early detection capabilities. The integration of cardiac devices with smartphones and health apps is fostering patient engagement and adherence to monitoring schedules.

Additionally, Japan’s focus on minimally invasive surgical procedures has increased the demand for post-operative monitoring devices. As healthcare digitization advances, Japan is emerging as a leader in the adoption of smart, connected cardiac monitoring solutions.

The Europe Cardiac Monitoring Devices Market

The Europe Cardiac Monitoring Devices Market is projected to be valued at USD 4.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.1 billion in 2034 at a CAGR of 4.8%.

Europe Cardiac Monitoring Devices market growth is driven by strong healthcare systems, widespread adoption of telemedicine, and government initiatives promoting preventive care. The increasing incidence of cardiovascular diseases, particularly among aging populations, fuels demand for continuous monitoring solutions. Hospitals and diagnostic centers are adopting portable and wearable devices for both acute and chronic cardiac conditions.

Favorable reimbursement policies in several countries support device accessibility. Additionally, European manufacturers are actively innovating in wireless ECG systems, implantable loop recorders, and cloud-based monitoring platforms. Growing awareness campaigns on heart health, coupled with the rising demand for remote care, are further boosting the adoption of cardiac monitoring devices.

The Europe Cardiac Monitoring Devices market is seeing rapid adoption of connected cardiac monitoring systems integrated with AI-based analytics. Wearable devices with ECG, activity tracking, and arrhythmia detection are increasingly used for both clinical and personal health monitoring. The shift toward home-based healthcare is accelerating the demand for portable, user-friendly devices. Cross-border telehealth services are expanding, enabling cardiac specialists to remotely monitor patients in different countries. Cloud-based data platforms are facilitating large-scale cardiovascular research.

Additionally, there is a growing focus on eco-friendly device manufacturing and recycling programs in Europe, aligning with regional sustainability goals while meeting the rising demand for advanced cardiac monitoring solutions.

Cardiac Monitoring Devices Market: Key Takeaways

- Market Overview: The global cardiac monitoring devices market is projected to reach USD 26.4 billion in 2025 and is anticipated to grow to USD 43.2 billion by 2034, registering a CAGR of 5.6% during the forecast period.

- By Device Type Analysis: Cardiovascular devices are expected to lead the global cardiac monitoring devices market in 2025, representing 26.4% of the total market share.

- By Product Analysis: Portable monitors are anticipated to capture the largest share in 2025, accounting for 28.1% of the global market for cardiac monitoring devices.

- By Application Analysis: Arrhythmia monitoring is forecasted to dominate the application segment in 2025, holding 24.7% of the total market share.

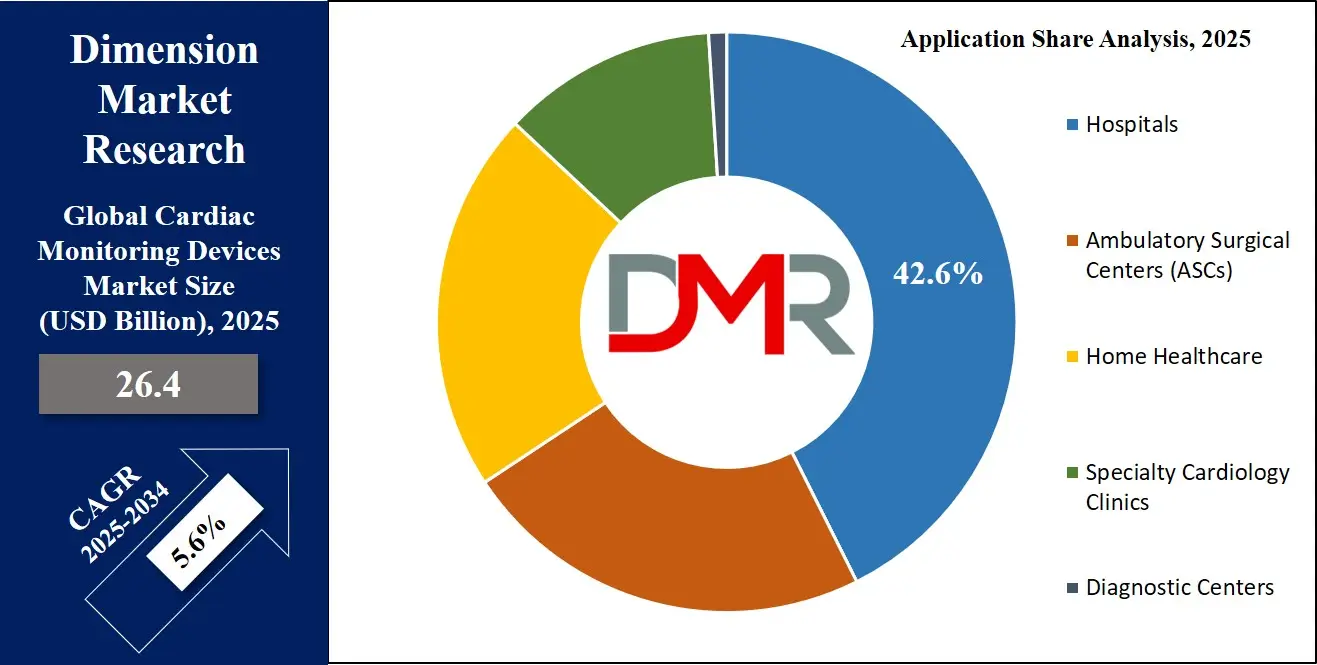

- By End User Analysis: Hospitals are predicted to remain the leading end-user segment by 2025, commanding 42.6% of the market share.

- Region with the Largest Share: North America is expected to maintain the largest regional share of the cardiac monitoring devices market with revenue share of 36.5% in 2025.

Cardiac Monitoring Devices Market: Use Cases

- Arrhythmia Detection and Management: Continuous ECG monitoring helps detect irregular heart rhythms in real-time, enabling physicians to diagnose conditions like atrial fibrillation early. Patients benefit from timely treatment, reduced hospitalizations, and improved quality of life through wearable and implantable devices integrated with AI-based detection algorithms.

- Post-Operative Cardiac Care: Cardiac monitoring devices are used after surgeries to track recovery progress and detect complications such as arrhythmias or heart failure. Remote monitoring allows healthcare teams to observe patients’ vitals continuously, reducing hospital stay duration while ensuring safety and faster intervention if abnormalities are detected.

- Remote Heart Health Management: Portable and wearable monitors enable patients to check their heart activity at home. Real-time data transmission to healthcare providers ensures prompt medical guidance, reduces the need for in-person visits, and supports chronic disease management for conditions like hypertension and ischemic heart disease.

- Athlete Performance and Safety Monitoring: Professional athletes use cardiac monitoring devices to track heart rate, stress levels, and recovery patterns during training. Early detection of abnormal rhythms helps prevent sports-related cardiac incidents. Data-driven insights optimize performance while ensuring safety in high-intensity physical activities and competitions.

- High-Risk Pregnancy Monitoring: Pregnant women with cardiovascular risks benefit from wearable monitors that track heart rate and detect stress-related cardiac events. Continuous monitoring allows obstetricians to manage maternal and fetal health proactively, reducing complications and improving outcomes for both mother and baby during pregnancy.

Cardiac Monitoring Devices Market: Stats & Facts

- World Health Organization (WHO) reports that cardiovascular diseases cause approximately 17.9 million deaths each year, and conditions like arrhythmias and heart failure often require the use of ECG monitors, Holter devices, or implantable cardiac monitors for ongoing management.

- Centers for Disease Control and Prevention (CDC) states that atrial fibrillation (AFib) affects 12.1 million people in the U.S. by 2030, making continuous ECG monitoring and mobile cardiac telemetry critical for early detection and stroke prevention.

- American Heart Association (AHA) highlights that sudden cardiac arrest claims more than 356,000 lives annually in the U.S., with cardiac event monitors and wearable ECG devices being essential in identifying high-risk patients.

- National Institutes of Health (NIH) notes that approximately 6.2 million American adults are living with heart failure, and remote cardiac monitoring devices are often prescribed to track arrhythmias, fluid status, and heart rate variability.

- European Society of Cardiology (ESC) reports that bradyarrhythmias requiring pacemaker implantation have an incidence of 0.5–0.8 per 1,000 people per year, many of whom benefit from implantable loop recorders before diagnosis.

- PubMed Central (PMC) research shows that mobile cardiac telemetry can detect clinically significant arrhythmias in 61% of monitored patients, compared to 23–24% detection rates for traditional event or Holter monitors.

- Johns Hopkins Medicine states that ventricular tachycardia accounts for up to 10% of sudden cardiac arrest cases in structurally normal hearts, and continuous ECG or implantable monitoring is often needed to confirm the diagnosis.

- National Library of Medicine (NLM) data indicates that 24-hour Holter monitoring can detect arrhythmias in 15–39% of symptomatic patients, while extended monitoring of 7–14 days increases detection rates to over 60%.

- Heart Rhythm Society (HRS) notes that about 1 in 4 ischemic strokes occur in patients with undiagnosed atrial fibrillation, and long-term cardiac monitoring improves AFib detection rates by up to threefold.

- Mayo Clinic reports that implantable loop recorders can continuously monitor heart rhythms for up to 3 years, providing diagnostic yields as high as 73% in patients with unexplained syncope.

Cardiac Monitoring Devices Market: Market Dynamics

Driving Factors in the Cardiac Monitoring Devices Market

Rising Cardiovascular Disease Burden

The increasing prevalence of cardiovascular disorders, including arrhythmia, coronary artery disease, and heart failure, is significantly driving demand for cardiac monitoring devices. An aging population and lifestyle factors such as sedentary habits and poor diet contribute to higher disease incidence. Healthcare providers are prioritizing early diagnosis through continuous heart monitoring to reduce hospitalizations and improve survival rates.

Cardiac monitoring devices offer advanced detection, enabling timely treatment and reducing long-term healthcare costs. Portable and wearable devices further expand accessibility, allowing patients to monitor their condition at home. This demand surge encourages manufacturers to innovate, resulting in devices with enhanced accuracy, real-time data sharing, and integration with AI-powered analytics for superior cardiac health management.

Technological Advancements in Remote Monitoring

Innovations in cardiac monitoring technology, such as AI-driven diagnostics, wireless telemetry, and smartphone integration, are fueling market expansion. These advancements allow continuous monitoring without limiting patient mobility, supporting the trend toward remote healthcare delivery. Cloud-based data storage and real-time physician alerts improve care coordination and patient outcomes.

Wearable sensors with ECG, heart rate, and arrhythmia detection capabilities are becoming increasingly popular among both patients and clinicians. Miniaturization and extended battery life enhance device usability, making them suitable for long-term monitoring. Additionally, integration with telemedicine platforms facilitates follow-up consultations without physical visits, improving efficiency and patient satisfaction while reducing healthcare costs.

Restraints in the Cardiac Monitoring Devices Market

High Cost of Advanced Monitoring Devices

The cost of advanced cardiac monitoring devices, particularly implantable and wearable models with AI and remote access features, remains a challenge for widespread adoption. Hospitals and healthcare providers in developing regions face budget constraints that limit access to cutting-edge solutions. Maintenance costs, software subscriptions, and device replacement further add to the financial burden.

Patients in low-income areas may find these devices unaffordable, especially when insurance coverage is limited. This pricing gap hampers equitable access to advanced cardiac monitoring technologies. Manufacturers are under pressure to develop cost-effective solutions without compromising quality, balancing innovation with affordability to expand market reach globally.

Data Privacy and Cybersecurity Concerns

With the integration of cloud-based systems and wireless data transmission, cardiac monitoring devices are increasingly vulnerable to data breaches and cybersecurity threats. Sensitive patient information, including ECG reports and diagnostic data, must be securely stored and transmitted to comply with healthcare regulations. Concerns over unauthorized access and hacking incidents can slow adoption among patients and healthcare providers.

Regulatory bodies impose strict compliance measures, adding complexity for manufacturers. Ensuring robust encryption, secure authentication, and compliance with global standards such as HIPAA and GDPR is critical to addressing these concerns. Failure to safeguard patient data can lead to legal consequences, loss of trust, and reduced adoption rates.

Opportunities in the Cardiac Monitoring Devices Market

Expansion of Home Healthcare Solutions

The growing trend toward home-based cardiac monitoring presents significant opportunities for market expansion. Patients prefer non-invasive, portable devices that allow them to monitor their heart health without frequent hospital visits. Advances in wireless technology, AI-enabled analytics, and compact design are making home healthcare more accessible. Insurance companies and healthcare providers are increasingly covering remote monitoring services, boosting adoption rates.

Manufacturers can tap into this opportunity by developing user-friendly, cost-effective devices with real-time physician connectivity. Home monitoring solutions also help reduce healthcare system burdens by lowering hospital admissions, enabling better resource allocation, and empowering patients to take a proactive role in managing their heart health.

Integration with AI and Predictive Analytics

The integration of artificial intelligence and predictive analytics in cardiac monitoring devices is opening new avenues for growth. AI-powered algorithms can detect subtle heart rhythm changes that may precede serious cardiac events, enabling preventive interventions. Predictive analytics also help physicians personalize treatment plans based on patient-specific data trends.

The combination of wearable devices, IoT connectivity, and machine learning enables continuous health assessment and early warning systems. Partnerships between medtech companies and AI software developers are accelerating the development of advanced diagnostic solutions. This integration not only enhances clinical accuracy but also increases patient confidence in using these devices for long-term monitoring.

Trends in the Cardiac Monitoring Devices Market

Shift toward Wearable Cardiac Monitoring Solutions

Wearable cardiac monitoring devices, such as smartwatches, patches, and fitness trackers with ECG capabilities, are gaining popularity. These solutions allow discreet, continuous heart monitoring without interfering with daily activities. Their adoption is driven by health-conscious consumers, telemedicine expansion, and insurance coverage for preventive care. Wearable devices offer multi-parameter tracking, including oxygen saturation and activity levels, enhancing their clinical value.

Miniaturization, improved sensor accuracy, and longer battery life are boosting user acceptance. As consumers increasingly seek personalized health insights, wearable cardiac monitoring devices are emerging as a key growth driver in both the clinical and consumer health segments of the market.

Growth of Cloud-Based Remote Cardiac Monitoring

Cloud-based cardiac monitoring systems are transforming how patient data is stored, accessed, and analyzed. These platforms allow real-time data sharing between patients and physicians, enabling faster decision-making and improved treatment outcomes. Remote monitoring is particularly valuable for chronic disease management and post-operative care. Cloud integration also facilitates AI-based diagnostics and predictive modeling, enhancing the accuracy of arrhythmia detection.

Additionally, cloud-based systems support large-scale health data analytics for research purposes. The trend toward remote monitoring is further accelerated by global healthcare digitization initiatives, ensuring that cloud-based solutions will continue to play a central role in the cardiac monitoring devices market.

Cardiac Monitoring Devices Market: Research Scope and Analysis

By Device Type Analysis

Cardiovascular devices are predicted to dominate the global cardiac monitoring devices market by the end of 2025, accounting for 26.4% of the market share. Their dominance is driven by their pivotal role in diagnosing and managing heart conditions, offering precision diagnostics for cardiovascular diseases. Increasing prevalence of heart-related disorders, growing adoption in hospitals, and advancements in real-time monitoring technologies contribute to their leadership.

Integration with telemedicine platforms and improved portability enhance accessibility in both developed and emerging markets. Furthermore, their compatibility with advanced imaging systems ensures comprehensive cardiac assessment. This segment benefits from strong demand in critical care units, emergency departments, and ambulatory settings, solidifying its position as the most preferred device type in the market.

Implantable cardiac monitoring devices are expected to grow at the highest CAGR by the end of 2025, owing to their ability to provide continuous and long-term monitoring for arrhythmias and other heart conditions. These devices are minimally invasive, offering superior diagnostic accuracy compared to conventional monitors.

Rising adoption among patients with unexplained syncope, increased incidence of atrial fibrillation, and growing demand for early detection of cardiac anomalies fuel this growth. Integration with cloud-based data storage enables remote physician access and timely interventions. Enhanced battery life, smaller device size, and improved wireless connectivity are further boosting patient compliance and physician preference, making them the most promising growth segment in the cardiac monitoring devices market.

By Product Analysis

Portable monitors are projected to hold the largest market share by the end of 2025, capturing 28.1% of the global cardiac monitoring devices market. These devices offer high convenience for both patients and healthcare professionals by enabling real-time, on-the-go heart monitoring. Their lightweight, compact design and ease of use make them ideal for home healthcare and ambulatory settings.

Increasing demand for remote patient monitoring, rising preference for preventive cardiac care, and integration with smartphone applications support their market leadership. Portable monitors are widely used for post-operative care, chronic heart disease management, and fitness monitoring. Their cost-effectiveness and compatibility with wearable accessories further strengthen their dominance in the market.

Smart wearable monitors are anticipated to grow at the highest CAGR by the end of 2025, driven by technological innovations and consumer adoption in preventive healthcare. These devices provide continuous heart rate tracking, arrhythmia detection, and integration with AI-based analytics. Their widespread adoption is boosted by rising health consciousness, expanding fitness tracker penetration, and insurance support for preventive monitoring.

Smart wearables enable real-time data sharing with physicians and health platforms, improving early detection and intervention rates. Bluetooth and cloud synchronization enhance convenience for users. Continuous advancements in design, improved battery life, and incorporation of multi-sensor capabilities make smart wearable monitors the fastest-growing segment in the cardiac monitoring devices market.

By Application Analysis

Arrhythmia monitoring is projected to dominate the application segment by the end of 2025, accounting for 24.7% of the global market share. This dominance is driven by the increasing global incidence of atrial fibrillation, ventricular tachycardia, and other heart rhythm disorders. Continuous monitoring solutions allow physicians to detect irregularities early, reducing hospitalization risks and improving treatment outcomes.

Advanced ECG devices, wearable monitors, and implantable loop recorders are widely utilized for arrhythmia detection in both acute and chronic cases. The rising elderly population, growing awareness about preventive diagnosis, and integration of AI-based detection systems further fuel adoption, securing arrhythmia monitoring’s leading position in the cardiac monitoring devices market.

Post-operative cardiac monitoring is expected to grow at the highest CAGR by the end of 2025, driven by the need for continuous observation after cardiac surgeries and interventions. These systems enable early detection of complications such as arrhythmias, bleeding, or cardiac arrest in recovery phases. Hospitals and specialty clinics increasingly rely on advanced telemetry and wearable devices to provide patient mobility while ensuring safety.

Integration with central monitoring stations allows healthcare teams to intervene promptly. The rising number of cardiac surgeries worldwide, coupled with the shift toward minimally invasive procedures requiring shorter hospital stays, is further accelerating adoption in post-operative monitoring applications.

By End User Analysis

Hospitals are projected to dominate the end-user segment by the end of 2025, securing 42.6% of the market share. They serve as primary centers for advanced cardiac diagnostics, surgery, and post-operative monitoring. Hospitals benefit from access to comprehensive cardiac monitoring systems, including portable monitors, telemetry units, and implantable devices. Increased funding for cardiac care infrastructure, availability of skilled cardiologists, and adoption of AI-enabled monitoring technologies enhance their market position.

Moreover, hospitals manage high patient volumes, making them a central hub for both emergency and routine cardiac monitoring services. Their role in integrating telehealth for remote monitoring strengthens their leadership in the global cardiac monitoring devices market.

Home healthcare is anticipated to record the fastest growth rate by the end of 2025, driven by the rising preference for patient-centric, cost-effective care solutions. Portable and wearable cardiac monitoring devices enable patients to track heart health from home, reducing hospital visits. Remote patient monitoring platforms integrate real-time data transmission, allowing physicians to oversee patient conditions without physical consultations.

Growing awareness of preventive healthcare, supportive insurance policies, and technological advancements in compact monitoring devices support this trend. The increasing geriatric population and prevalence of chronic heart conditions further boost demand for home-based cardiac monitoring solutions.

The Cardiac Monitoring Devices Market Report is segmented on the basis of the following:

By Device Type

- Cardiovascular Devices

- Multi-Parameter ECG Monitors

- Patient Monitoring Devices

- Ambulatory Cardiac Monitoring

- Cardiac Monitors

- Implantable Cardiac Monitoring Devices

By Product

- Portable Monitor

- Smart Wearable Monitor

- Standard Monitor

- Mobile Cardiac Telemetry Devices

By Application

- Arrhythmia

- Post-Operative Cardiac Monitoring

- Coronary Heart Diseases

- Sudden Cardiac Arrest

- Stroke

- Congenital Heart Diseases

- Heart Failure

- Pulmonary Hypertension

- Heart Function

- Pulmonary Artery Pressure

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Home Healthcare

- Specialty Cardiology Clinics

- Diagnostic Centers

Regional Analysis

Region with the largest Share

North America is expected to hold the largest share of the cardiac monitoring devices market with a revenue share of 36.5% by the end of 2025. The region benefits from advanced healthcare infrastructure, high adoption of innovative medical technologies, and strong government initiatives promoting preventive cardiac care. Increasing prevalence of heart diseases, growing elderly population, and availability of reimbursement programs drive market expansion.

Major industry players headquartered in the U.S. and Canada foster continuous product innovations, from AI-enabled wearable devices to remote monitoring platforms. Furthermore, strong awareness campaigns and well-established telemedicine networks contribute to high adoption rates, solidifying North America’s position as the leading region in the market.

Region with Highest CAGR

The Asia-Pacific region is predicted to record the highest CAGR by the end of 2025, fueled by rapid healthcare infrastructure development, rising disposable incomes, and growing awareness of heart health. Countries like China, India, and Japan are witnessing increased adoption of portable and wearable cardiac monitors due to expanding telemedicine services and urbanization.

The rising incidence of cardiovascular diseases in younger populations, coupled with government initiatives for preventive healthcare, is further boosting demand. Increasing collaborations between global manufacturers and local distributors, along with technological advancements tailored for regional needs, contribute to the rapid growth of the cardiac monitoring devices market in Asia-Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Cardiac Monitoring Devices Market

- Enhanced Diagnostic Accuracy: Artificial intelligence is revolutionizing cardiac monitoring devices by enabling precise, automated interpretation of ECG and other heart-related data. AI algorithms can detect subtle abnormalities, including early-stage arrhythmias, that may go unnoticed during manual analysis. This improves diagnostic confidence for physicians and outcomes for patients.

- Predictive Health Insights: Machine learning models analyze historical and real-time cardiac data to predict potential heart events before they occur. Predictive analytics enables proactive interventions, reducing hospitalization rates and improving patient quality of life. This is particularly valuable for managing chronic heart conditions and post-surgery recovery.

- Personalized Patient Care: AI-powered monitoring devices can tailor alerts, thresholds, and recommendations based on individual patient profiles. By analyzing lifestyle data, comorbidities, and genetic factors, AI supports personalized treatment plans. This customization improves patient compliance and engagement in long-term cardiac health management programs.

- Workflow Optimization for Clinicians: AI integration streamlines healthcare workflows by filtering and prioritizing alerts, reducing physician workload, and enabling faster decision-making. Automated report generation and cloud-based analytics support telehealth consultations, allowing clinicians to focus on high-priority cases while maintaining continuous patient oversight.

Competitive Landscape

The global cardiac monitoring devices market is highly competitive, with manufacturers focusing on innovation, technological integration, and strategic collaborations to strengthen their positions. Leading players are investing in AI-powered cardiac diagnostics and predictive analytics in cardiology to enhance accuracy and enable early detection of heart-related conditions.

Companies are expanding their portfolios with wearable ECG devices, portable heart rate monitors, and implantable loop recorders to cater to both hospital cardiac care devices and home-based heart monitoring needs. Strategic mergers and acquisitions are common, aiming to integrate telecardiology platforms and cloud-based heart health platforms for seamless remote patient monitoring solutions. Emerging players are targeting niche segments like post-surgery cardiac recovery tracking and wireless heart monitoring systems, driven by rising demand for continuous cardiac rhythm tracking.

The competitive environment is also shaped by regulatory approvals, clinical trial successes, and the ability to offer cost-effective, connected heart health devices without compromising quality. Market leaders are leveraging real-time heart data analytics to provide advanced ECG interpretation tools, catering to specialty cardiology equipment demand in diagnostic centers and ambulatory settings. With growing awareness of cardiovascular health management, the competition is expected to intensify, fostering faster adoption of next-generation cardiac telemetry systems globally.

Some of the prominent players in the Global Cardiac Monitoring Devices Market are:

- Medtronic plc

- Abbott Laboratories

- GE HealthCare Technologies Inc.

- Philips Healthcare

- Boston Scientific Corporation

- Nihon Kohden Corporation

- Hillrom (Baxter International Inc.)

- Schiller AG

- Spacelabs Healthcare

- Biotronik SE & Co. KG

- AliveCor, Inc.

- iRhythm Technologies, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Asahi Kasei Corporation

- Fukuda Denshi Co., Ltd.

- OSI Systems, Inc.

- Cardiac Science Corporation

- Lepu Medical Technology (Beijing) Co., Ltd.

- ACS Diagnostics, Inc.

- Vectorious Medical Technologies Ltd.

- Other Key Players

Recent Developments

- January 2025: EBR Systems, Inc. announced that the FDA had scheduled a Pre-Approval Inspection for its WiSE CRT System, the world's only wireless cardiac pacing device, starting January 14, 2025, vital for regulatory compliance and commercial launch.

- June 2025: CardioInsight, a pioneer in noninvasive cardiac mapping, secured FDA clearance for its new real-time electrophysiology mapping algorithm, advancing precision diagnostics and boosting adoption of noninvasive mapping in atrial arrhythmia treatment.

- April 2025: BioTelemetry introduced its next-generation wearable patch ECG monitor, featuring extended battery life and cloud-based analytics, to enhance remote arrhythmia detection and improve physician workflows in outpatient cardiac surveillance.

- May 2024: Implicity, a leader in remote patient monitoring and cardiac data management solutions, announced it received 510(k) clearance from the FDA for its innovative algorithm, SignalHF1, enhancing its remote monitoring capabilities.

- May 2024: The FDA launched the Medical Device Development Tools (MDDT) program to streamline medical device development by establishing a portfolio of qualified tools for data collection, eliminating the need for case-by-case evaluations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 26.4 Bn |

| Forecast Value (2034) |

USD 43.2 Bn |

| CAGR (2025–2034) |

5.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Device Type (Cardiovascular Devices, Multi-Parameter ECG Monitors, Patient Monitoring Devices, Ambulatory Cardiac Monitoring, Cardiac Monitors, Implantable Cardiac Monitoring Devices), By Product (Portable Monitor, Smart Wearable Monitor, Standard Monitor, Mobile Cardiac Telemetry Devices), By Application (Arrhythmia, Post-Operative Cardiac Monitoring, Coronary Heart Diseases, Sudden Cardiac Arrest, Stroke, Congenital Heart Diseases, Heart Failure, Pulmonary Hypertension, Heart Function, Pulmonary Artery Pressure), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Home Healthcare, Specialty Cardiology Clinics, Diagnostic Centers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Medtronic plc, Abbott Laboratories, GE HealthCare Technologies Inc., Philips Healthcare, Boston Scientific Corporation, Nihon Kohden Corporation, Hillrom (Baxter International Inc.), Schiller AG, Spacelabs Healthcare, Biotronik SE & Co. KG, |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cardiac Monitoring Devices Market size is estimated to have a value of USD 26.4 billion in 2025 and is expected to reach USD 43.2 billion by the end of 2034.

North America is expected to be the largest market share for the Global Cardiac Monitoring Devices Market with a share of about 36.5% in 2025.

Some of the major key players in the Global Cardiac Monitoring Devices Market are Medtronic plc, Abbott Laboratories, Philips Healthcare, and many others.

The market is growing at a CAGR of 5.6% over the forecasted period.

The US Cardiac Monitoring Devices Market size is estimated to have a value of USD 8.1 billion in 2025 and is expected to reach USD 12.9 billion by the end of 2034.