Market Overview

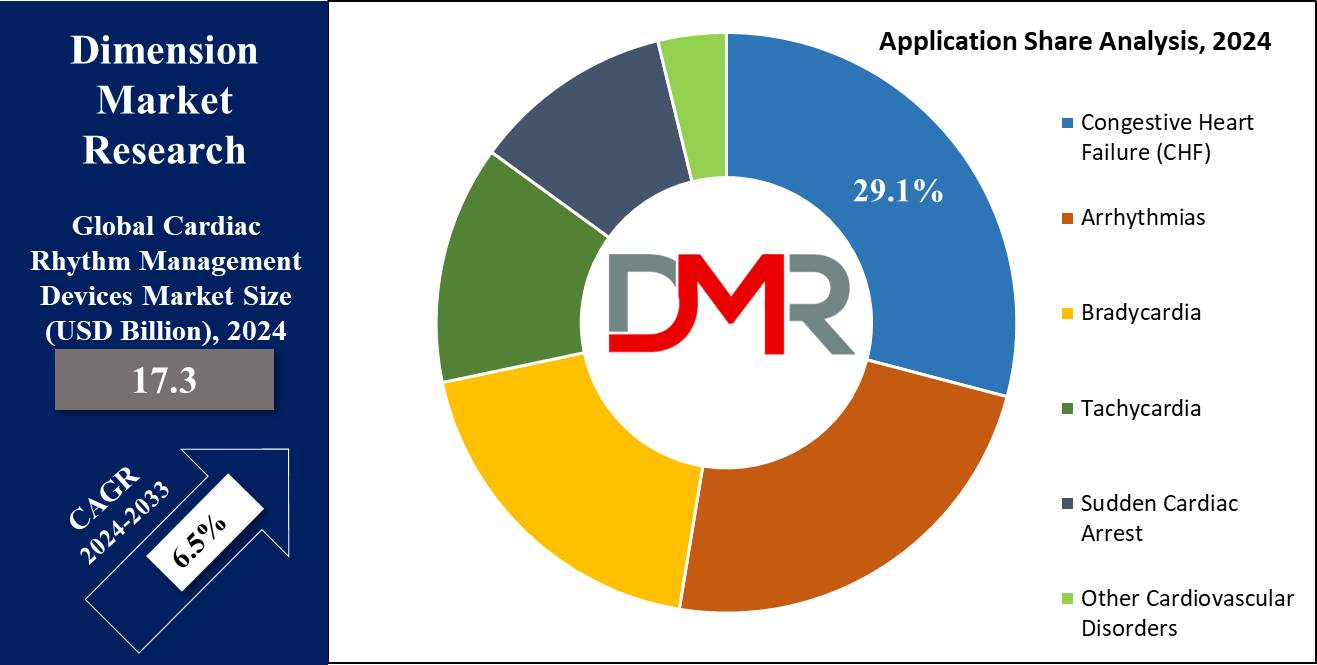

The Global Cardiac Rhythm Management Devices Market size is expected to reach a value of USD 17.3 billion in 2024, and it is further anticipated to reach a market value of USD 31.0 billion by 2033 at a CAGR of 6.5%.

Cardiac rhythm management devices are a large market for the treatment of heart rhythm disorder that includes arrhythmias, bradycardia, or tachycardia. These

medical devices maintain and restore abnormal heartbeat by either internal or external devices. The global cardiac rhythm management device market size has been valued considerably in the recent past and is expected to craft an impressive growth rate throughout the forecast period, reflecting broader trends within the cardiac devices industry and the expanding electrophysiology market.

The existing product categories include pacemakers, implantable cardioverter defibrillators, cardiac resynchronization therapy devices, and external defibrillators. Of such, the current extensively used ICDs and CRT devices are famously known and effective for their usage in the management of complicated cardiac arousing disorders.

Some of them include enhanced cardiac rhythm management systems and remote monitoring products, which are the key drivers in this market. Further, one of the key trends that define the rhythm management devices market globally is the increasing rate of cardiac diseases, including CHF and sudden cardiac arrest. Medtronic, Boston Scientific Corporation, Abbott Laboratories, and other market players are gradually introducing new products to satisfy the growing demand for CRM devices.

The intensity of using these devices is increasing in cardiac care centers, hospitals, and ambulatory surgical centers, all these factors are fueling the market growth. The global cardiac rhythm management devices market is expected to experience marked growth due to rising awareness of arrhythmia standards and a progressively more defined and sophisticated healthcare system in developed and developing nations in the forecast period.

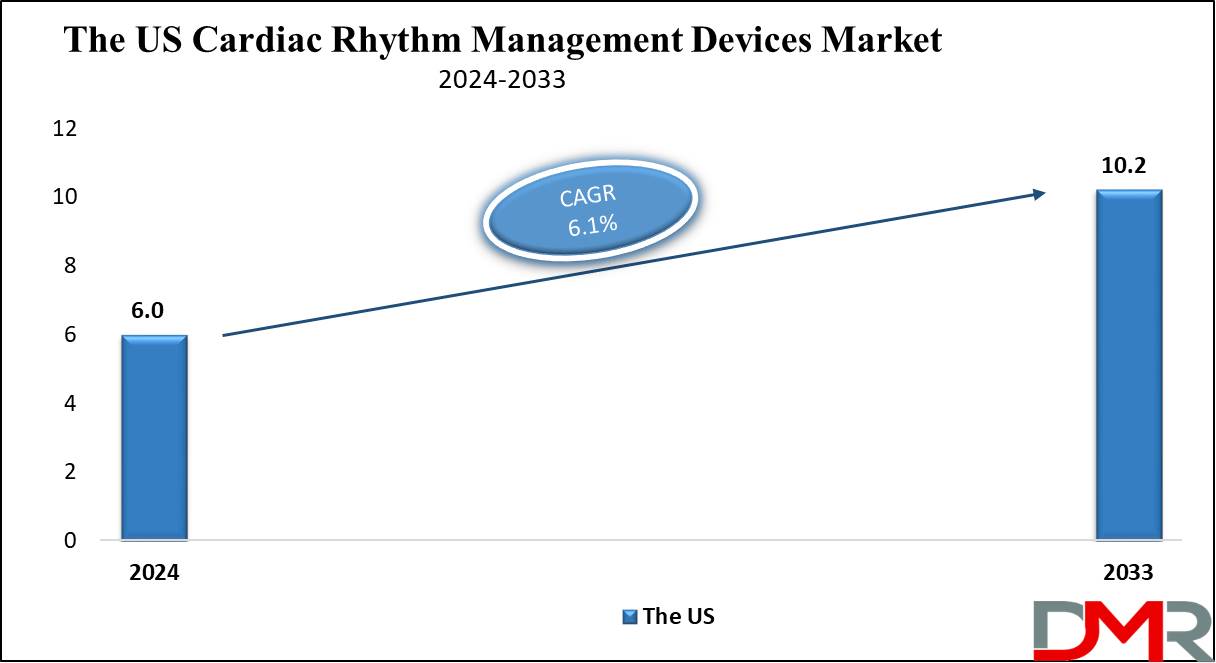

The US Cardiac Rhythm Management Devices Market

The US Cardiac Rhythm Management Devices Market is projected to be valued at USD 6.0 billion in 2024 which is further expected to witness subsequent growth as it reaches USD 10.2 billion in 2033 at a CAGR of 6.1%.

This market has expanded sufficiently to become a significant segment of the healthcare industry in the United States because of the sped-up advancement of technology in medical devices and the higher rate of cardiac diseases. The size of rhythm management devices is on the increase, though it presently harbors an absolute high rate of ICDs and CRT devices among the U.S. populace.

Newer products in the US market reveal increasing customer need for remote cardiac monitoring systems and make them capable of healing heart rhythm disorders more efficiently and even from afar. This is accompanied by wide dissemination of WCDs, especially for those patients who cannot be considered for an implantable device at the moment.

The trends seen in the recent past in the U.S. market include higher incremental sales of the next-generation pacemakers with leadless technology, which come in smaller and better forms. The above advancements are improving the overall quality of patient care by lowering infection-prone possibilities and boosting cardiac rhythm detection.

Healthcare facilities in the United States coupled with considerable health insurance also help in getting access to more advanced cardiac arrhythmia treatments that have helped the Cardiac Rhythm Management devices market in the United States. Other drivers of this market include the rising incidence of heart rhythm disorders and rising elderly demography.

Key Takeaways

- Global Market Value Insights: The Cardiac Rhythm Management Devices Market is expected to reach USD 17.3 billion in 2024 globally which is expected to rise up to USD 31.0 billion in 2033.

- The US Market Value: The US Cardiac Rhythm Management Devices Market estimate is USD 6.0 Billion for the year 2024. It is expected to grow further in the future period as it is likely to reach USD 10.2 billion in 2033 at a CAGR of 6.1%.

- By Product Segment Insights: Cardiac defibrillators are expected to lead the product segment of this market and contribute to 45.9% market share in 2024.

- By Application Segment Insights: Congestive heart failure (CHF) is anticipated to dominate the application segment of this market with 29.1% of the market share in 2024.

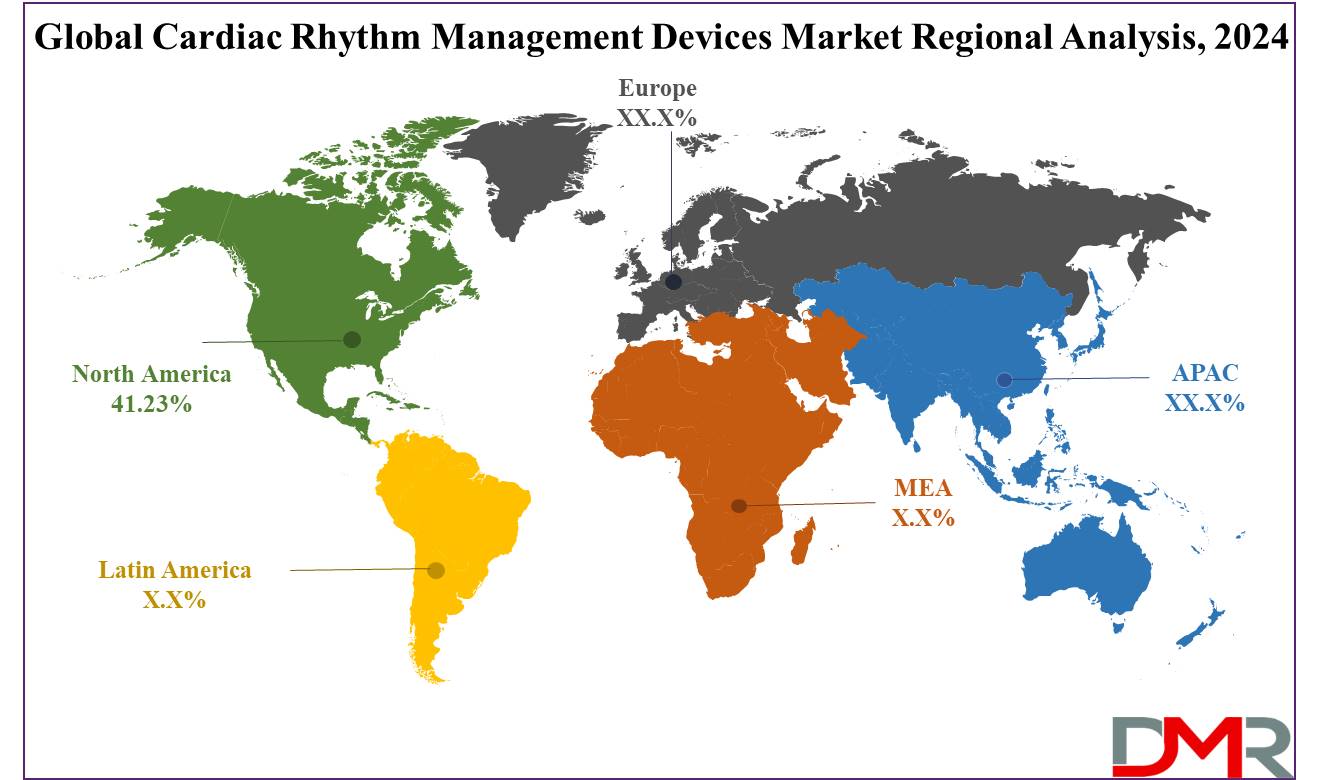

- Regional Insights: North America is expected to dominate this market with a market share of about 41.23% in 2024.

- Key Players: Some of the major key players in the Global Cardiac Rhythm Management Devices Market are Medtronic, Boston Scientific Corporation, Biotronik, Asahi Kasei Corporation, Philips Healthcare, and many others.

- Global Growth Rate: The market is growing at a CAGR of 6.5 percent over the forecasted period.

Use Cases

- Sudden Cardiac Arrest: Defibrillators include ICDs and external defibrillators. These devices work by delivering a controlled electric shock to the heart of a patient suffering from SCA to restore normal heart rhythm and prevent death due to sudden arrhythmic events.

- Congestive Heart Failure: Cardiac resynchronization therapy devices, like CRT-D and CRT-P, are used for patients with CHF to improve the effectiveness and coordination of the heart. These devices make the heart's ventricles pump together to improve blood flow to lighten the load on the heart and help alleviate the symptoms of CHF.

- Atrial Fibrillation: Pacemakers are indicated in patients with AFib, a kind of arrhythmia where the heartbeat is irregular. These devices serve to regulate the heart rate and normalize it, minimizing the risk of stroke.

- Post-Surgical Monitoring: For this reason, patients are often discharged with either external pacemakers or implantable loop recorders in order to monitor heart rhythms for abnormalities that may arise after surgery.

Market Dynamic

Trends

Advancement in Remote Cardiac Monitoring Technology

The embedding of remote monitoring technology in devices such as pacemakers, implantable cardioverter defibrillators, and cardiac resynchronization therapy devices is a key trend in cardiac rhythm management devices. These systems help healthcare providers monitor heart rhythm and functionality of the device in patients in real-time, thereby reducing on-site consulting events substantially, along with the events associated with hospitalization.

Thus, the increase in convenience and safety through remote monitoring stirs their adoption rate for the treatment of chronic conditions, such as CHF and atrial fibrillation, shaping the future of cardiac rhythm management.

Miniaturization of Devices and Leadless Pacemakers

Another major trend is the miniaturization of cardiac rhythm management devices, with leadless pacemakers being some sort of breakthrough within the market. Traditional pacemakers require leads, or wires, to be connected to the device directly to the heart; these can further result in complications like infections and lead displacement.

A leadless pacemaker negates these risks altogether by being smaller, more efficient, and even less invasive. Increased efficiency with small size is a trend that enhances patient comfort and reduces surgical complications, thereby making this leadless variant of pacemakers increasingly popular in developed and emerging markets.

Growth Drivers

Rising Prevalence of Cardiovascular Diseases (CVDs)

The global prevalence of cardiovascular diseases, such as arrhythmias, heart failure, and sudden cardiac arrest, forms one of the major drivers for growth in the cardiac rhythm management devices market. As per the World Health Organization, cardiovascular diseases are the leading cause of death worldwide. Increasing adoption of

health informatics solutions is further enhancing patient monitoring, data management, and personalized treatment, thereby supporting the expansion of the cardiac rhythm management devices market.

As a result of this growing burden, especially in aging populations and in those with lifestyle-related risk factors such as hypertension and diabetes, the demand for cardiac rhythm management devices has increased spontaneously. Among these conditions, major devices were ICDs, CRT devices, and Pacemakers considered the major driving factors for the market.

Technological Innovations and Device Improvements

The cardiac rhythm management device market is constantly advanced by the improvements in medical device technology. Examples of new designs currently under development include wireless and leadless pacemakers, wearable cardioverter defibrillators, and next-generation ICDs, to name just a few, which make these devices safer, more effective, and easier to implant.

Integration of remote monitoring systems allows physicians to better monitor patients' heart rhythms and the performance of their devices for improved patient care. These technological enhancements not only make the devices more attractive for healthcare providers but also improve patient outcomes, thereby acting to further drive the market.

Growth Opportunities

Emerging Markets and Expanding Healthcare Infrastructure

Growing economies such as the Asia-Pacific region and Latin America are set to provide great business opportunities for the cardiac rhythm management devices market. They are some of the areas where the rates of cardiovascular diseases are progressively rising due to factors such as aging people, rising density of population in urban areas, and alteration of their ways of living.

The need for efficient cardiac care and CRM devices increases as the established health systems of these areas develop. Autonomous and healthcare industry bodies are actively working on the capacity enhancement of cardiac care centers and integrating the most recent technologies to help the market’s growth.

Increasing Adoption of Wearable and Home-Based Cardiac Monitoring Devices

The increasing usage of wearable cardioverter defibrillators (WCDs) and the home monitoring segment is another major growth factor in the market. The use of such devices makes it possible to assess cardiac rhythms and diagnose arrhythmias before requiring hospital-based care.

These devices are easy to use and can be easily accessed and hence, can be of great importance in remote areas where there are no modern hospitals. Also, trends like early identification of the merits of detection, and prevention of cardiac events, are spurring a faster deployment of these wearable devices in the market.

Restraints

High Cost of Devices and Procedures

one of the major challenges affecting the growth and development of the Cardiac Rhythm Management Devices market is the high costs that are typically associated with the particular devices and procedures implemented for the implantation of such machinery. ICDs, CRT devices, and pacemakers are costly devices, most of which cannot be afforded by a majority of population in the low-income areas.

Due to the high costs of these devices and the relatively low insurance coverage that still prevails in most global regions, especially in emerging nations, the use of such devices remains relatively low. This pricing barrier is something that has continuously presented a major problem in the deployment of such effective technologies.

Stringent Regulatory Requirements

The strict regulatory requirement for the approval of medical devices extends the timelines for introducing new and innovative cardiac rhythm management devices into the market. The regulatory bodies like the FDA in the U.S., and EMA in Europe, put stringent safety and efficacy requirements that are to be achieved by the manufacturers before commercialization.

While these regulations are very important in ensuring the safety of the patients, they are bound to raise the time and cost of bringing new products to the market. Access will be difficult for the smaller manufacturers, which means delaying the availability of the newest devices.

Research Scope and Analysis

By Product

Defibrillators are projected to dominate the product segment of the

cardiac monitoring and cardiac rhythm management devices market as it holds

45.9% of the market share in 2024. In the product segment cardiac rhythm management devices are imparted to defibrillators due to their critical role in treating dangerous cardiac arrhythmias and protecting against sudden cardiac death.

The increasing prevalence of sudden cardiac arrest, a condition wherein the intervention required to save a patient's life needs to take place within less time, is the main reason for this dominance. Defibrillators, mainly ICDs, efficiently achieve this through automatically detecting abnormal heart rhythms and applying electric shocks to restore a normal rhythm.

Automation in public places, due to the increased use of AEDs in airports, schools, and sports arenas, is yet another major contributor to the leading position of defibrillators. These types of external defibrillators have been designed for their ease of use by non-medical personnel, greatly expanding their adoption. This is further supported by the fact that patients who are not immediate candidates for ICDs have alternative solutions for constant monitoring and protection, such as wearable cardioverter defibrillators (WCDs), in cases of sudden cardiac arrest.

The development of some fully automated external defibrillators and new-generation ICDs with wireless monitoring capabilities increases their usage and efficacy. Growing awareness about the necessity to act fast in cardiac arrest also serves as a driving factor for the global defibrillator market. Given the lifesaving potential and versatility for a wide range of heart rhythm disorders, defibrillators hold the largest share. They possibly might continue to dominate the cardiac rhythm management devices market during the forecast period.

By Application

Congestive heart failure (CHF) is anticipated to dominate the application segment of the cardiac rhythm management devices market with 29.1% of the market share in 2024. As the global burden of CHF was highest, it dominated the cardiac rhythm management devices application segment. Congestive heart failure is a condition wherein the heart cannot pump blood into the body and sets up congestion, thereby causing fluid buildup and oxygenation of body organs.

This progressive nature of the disease course of CHF often requires the continued assistance of cardiac resynchronization therapy devices, CRT-D and CRT-P, specifically designed to increase the effectiveness of the heart in patients with impaired cardiac function. Some of the reasons for the growing burden of CHF include an aging population, as well as a greater prevalence of hypertension, coronary artery disease, and diabetes, all major contributing risk factors for CHF.

CRT has been shown to significantly symptomatically and clinically improve symptoms, decrease hospitalization, and improve the quality of life of CHF patients, and it therefore remains one of the leading applications for cardiac rhythm management devices. Further development of implantable devices for CHF, including biventricular pacemakers and defibrillators, expands even more options now available to patients and practitioners.

Both of these devices co-ordinate the contractions of both the heart's ventricles to improve the pumping of blood and monitor and provide therapeutic intervention for other heart rhythm disorders including ventricular tachycardia and fibrillation. As CHF continues to be a considerable percentage of the cardiac rhythm management devices market globally, it is believed that demand for CRT devices and their treatments should drive the market during the forecast period.

By End User

Hospitals are projected to dominate the end-user segment of the cardiac rhythm management devices market with the highest market share in 2024. The hospitals dominate the cardiac rhythm management devices market in the end-user segment, as they are the significant centers for diagnosing, treating, and managing cardiac rhythm disorders.

For example, a hospital is a primary healthcare system that is fully equipped with the most advanced medical instruments and technologies that may be required either to implant or to monitor and control various pacemakers, defibrillators, CRT-D, and CRT-P devices. The increasing sophistication of cardiac rhythm management procedures does call for high knowledge and skill, which usually characterizes care available in a hospital setting with specialized infrastructure that supports it. Besides that, hospitals are the immediate concern for such emergent conditions like SCA or Heart Failure.

In such cases, defibrillators, such as external defibrillators and ICDs, become highly important for immediate intervention. Cardiac care centers that operate within a hospital provide service and treatment for a variety of cardiac disorders, ranging from arrhythmias to CHF.

Furthermore, the growing population of remotely monitored patients with implanted devices, like pacemakers and ICDs, is being supported majorly within hospital networks. These monitoring systems provide continuous operational oversight over the patient's heart rhythm and can identify any timely interventions if any abnormality is found or detected.

Moreover, the complete health infrastructure with highly skilled medical work further establishes hospitals as one of the major end-users of cardiac rhythm management devices. Since the demand for advanced cardiac care has been constantly on the rise, the market share in hospitals will probably continue to be monopolized in the forecast period.

The Cardiac Rhythm Management Devices Market Report is segmented on the basis of the following

By Product

- Defibrillators

- Implantable Cardioverter Defibrillators (ICD)

- Single-chamber ICDs (S-ICD)

- Dual-chamber ICDs (T-ICD)

- Biventricular ICDs

- External Defibrillator

- Manual External Defibrillator

- Automatic External Defibrillator

- Semi-Automated External Defibrillator

- Fully Automated External Defibrillator

- Wearable Cardioverter Defibrillator

- Pacemakers

- Implantable Pacemakers

- Single-Chamber Pacemakers

- Dual-Chamber Pacemakers

- Biventricular Pacemakers (for CRT)

- External Pacemakers

- Temporary Pacemakers

- Transcutaneous Pacemakers

- Cardiac Resynchronization Therapy (CRT)

- Cardiac Resynchronization Therapy Devices- Defibrillator

- Cardiac Resynchronization Therapy Devices- Pacemakers

By Application

- Congestive Heart Failure (CHF)

- Arrhythmias

- Atrial Fibrillation (AFib)

- Ventricular Fibrillation (VF)

- Atrial Flutter

- Ventricular Tachycardia (VT)

- Bradycardia

- Tachycardia

- Sudden Cardiac Arrest

- Other Cardiovascular Disorders

By End-user

- Hospitals

- General Hospitals

- Specialized Cardiac Hospitals

- Cardiac Care Centers

- Ambulatory surgical centers

- Other End User

Regional Analysis

North America is projected to dominate the cardiac rhythm management devices market as it is anticipated to hold

41.23% of the total market share in 2024. The cardiac rhythm management devices market is dominated by North America, especially the United States, due to specific key factors.

Some of the main reasons include the high prevalence of cardiovascular diseases or cardiovascular disorders, especially arrhythmias, heart failure, and sudden cardiac arrest. These conditions are highly incident among the aging population in North America, thereby increasing demand for cardiac rhythm management devices including pacemakers, ICDs, and CRT devices.

A sedentary lifestyle, unhealthy diet, and highly stressed life further add to the ever-increasing incidences of cardiovascular diseases in the region. Dominance in North America is also driven by the established healthcare infrastructure and reimbursement policies. Advanced medical technologies and specialized cardiac care centers provide excellent access to cardiac rhythm management devices for patients in the U.S. and Canada.

Moreover, insurance coverage for these devices, particularly for implantable devices such as ICDs and CRT devices, ensures a greater segment of the population can afford treatment. The presence of major pharmaceutical market players such as Medtronic, Boston Scientific Corporation, and Abbott Laboratories contributes to the region's competitive advantage.

Headquartered in North America, these companies were among the pioneers in technologically advanced heart rhythm management devices and are continuously launching new and advanced products that improve clinical outcomes for patients. These mentioned aspects ensure North America's position as leading the cardiac rhythm management devices market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The cardiac rhythm management devices market is highly competitive, and several key players are likely to compete with each other based on market shares. Leading companies dominate the market with large product portfolios and continuous investment in R&D activities, including Medtronic, Boston Scientific Corporation, and Abbott Laboratories. These companies offer a wide range of pacemakers, implantable cardioverter defibrillators, and cardiac resynchronization therapy devices that address various needs in patients with cardiac arrhythmias, among other heart conditions.

For example, the leading market share of Medtronic can be attributed to the company's innovative product offerings, such as leadless pacemakers and remote monitoring systems, both enabling healthcare providers to monitor patients with heart rhythm disorders from a distance. On the other hand, Boston Scientific is another key player in the market; it has introduced next-generation ICDs and CRT devices, setting new standards for safety and efficiency.

Meanwhile, Abbott Laboratories was also able to contribute decisively with its state-of-the-art pacemaker and defibrillator technologies, improving quality patient care by focusing on wireless and leadless solution developments. Mergers and acquisitions also form part of the competitive nature in changing the dynamics at play, as companies expand their product offerings and presence in various regions.

The key strategies for these companies also involve strategic collaboration and partnership with healthcare institutions and research organizations to maintain an edge in market competition.

Some of the prominent players in the Global Cardiac Rhythm Management Devices Market are

- Medtronic

- Boston Scientific Corporation

- Biotronik

- Asahi Kasei Corporation

- Philips Healthcare

- Defibtech, LLC.

- Cardiac Science

- Stryker

- CU Medical System Inc.

- LivaNova Plc

- Abbott

- Microport

- Other Key Players

Recent Developments

- September 2024: Medtronic introduced its latest leadless pacemaker equipped with remote monitoring capabilities. This device is designed to enhance patient safety and improve long-term outcomes by enabling continuous heart rhythm tracking.

- August 2024: Boston Scientific Corporation received FDA approval for its next-generation ICD, featuring wireless technology for more precise and less invasive treatment of cardiac arrhythmias.

- July 2024: Abbott Laboratories launched an upgraded version of its CRT-D system, offering improved heart synchronization for patients with congestive heart failure (CHF). The device also includes an advanced remote monitoring system.

- June 2024: Biotronik announced the expansion of its portfolio with a new wearable cardioverter defibrillator (WCD), aimed at patients who are at high risk of sudden cardiac arrest but do not qualify for implantable devices.

- May 2024: Medtronic unveiled its new line of ICDs with smart algorithms to detect and prevent arrhythmias before they escalate into serious heart conditions.

- April 2024: Abbott Laboratories entered into a strategic partnership with leading healthcare institutions to accelerate the development of next-gen CRT devices that offer better outcomes for patients with advanced heart failure.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 17.3 Bn |

| Forecast Value (2033) |

USD 31.0 Bn |

| CAGR (2024-2033) |

6.5% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 6.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Defibrillators, Pacemakers, and Cardiac Resynchronization Therapy (CRT)), By Application (Congestive Heart Failure (CHF), Arrhythmias, Bradycardia, Tachycardia, Sudden Cardiac Arrest, and Other Cardiovascular Disorders), By End-user (Hospitals, Cardiac Care Centers, Ambulatory surgical centers, and Other End User) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Medtronic, Boston Scientific Corporation, Biotronik, Asahi Kasei Corporation, Philips Healthcare, Defibtech, LLC., Cardiac Science, Stryker, CU Medical System Inc., LivaNova Plc, Abbott, Microport, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cardiac Rhythm Management Devices Market size is estimated to have a value of USD 17.3 billion in 2024 and is expected to reach USD 31.0 billion by the end of 2033.

The US Cardiac Rhythm Management Devices Market is projected to be valued at USD 6.0 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 10.2 billion in 2033 at a CAGR of 6.1%.

North America is expected to have the largest market share in the Global Cardiac Rhythm Management Devices Market with a share of about 41.23% in 2024.

Some of the major key players in the Global Cardiac Rhythm Management Devices Market are Medtronic, Boston Scientific Corporation, Biotronik, Asahi Kasei Corporation, Philips Healthcare, and many others.

The market is growing at a CAGR of 6.5 percent over the forecasted period.