Market Overview

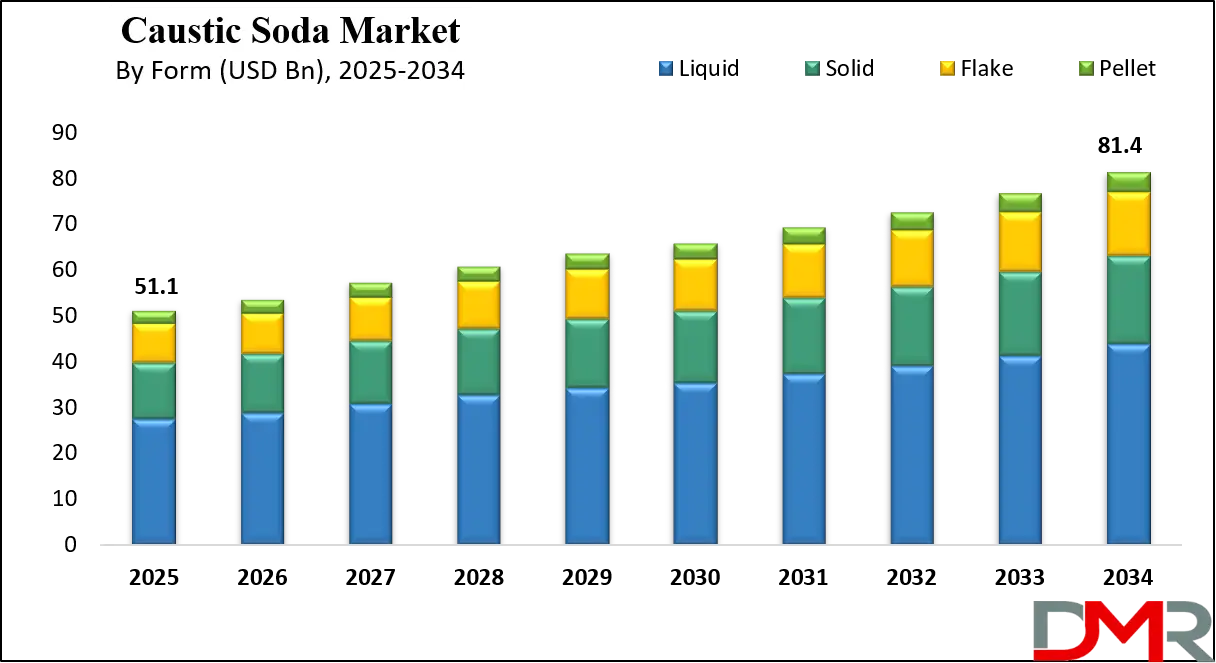

The Global Caustic Soda Market size is projected to reach USD 51.1 billion in 2025 and grow at a compound annual growth rate of 5.3% from there until 2034 to reach a value of USD 81.4 billion.

Caustic soda, also known as sodium hydroxide, is a highly versatile and widely used chemical in various industries. It is a white, odorless solid that is highly soluble in water and forms a strong alkaline solution. Caustic soda is commonly produced using the chlor-alkali process, which also generates chlorine and hydrogen as co-products. Its key applications include paper and pulp manufacturing, textiles, soaps and detergents, water treatment, aluminum production, and petroleum refining. Due to its reactive nature, it is often used to neutralize acids and remove impurities in industrial processes.

The demand for caustic soda has steadily increased in recent years due to growing industrialization and urban development worldwide. Industries like textiles and chemicals continue to be major consumers, especially in developing economies where manufacturing activities are expanding. The rise in demand for paper-based packaging due to environmental concerns about plastic has also contributed to increased caustic soda use. Water treatment is another key driver, as more countries focus on improving access to clean water, which often involves chemical treatment using caustic soda.

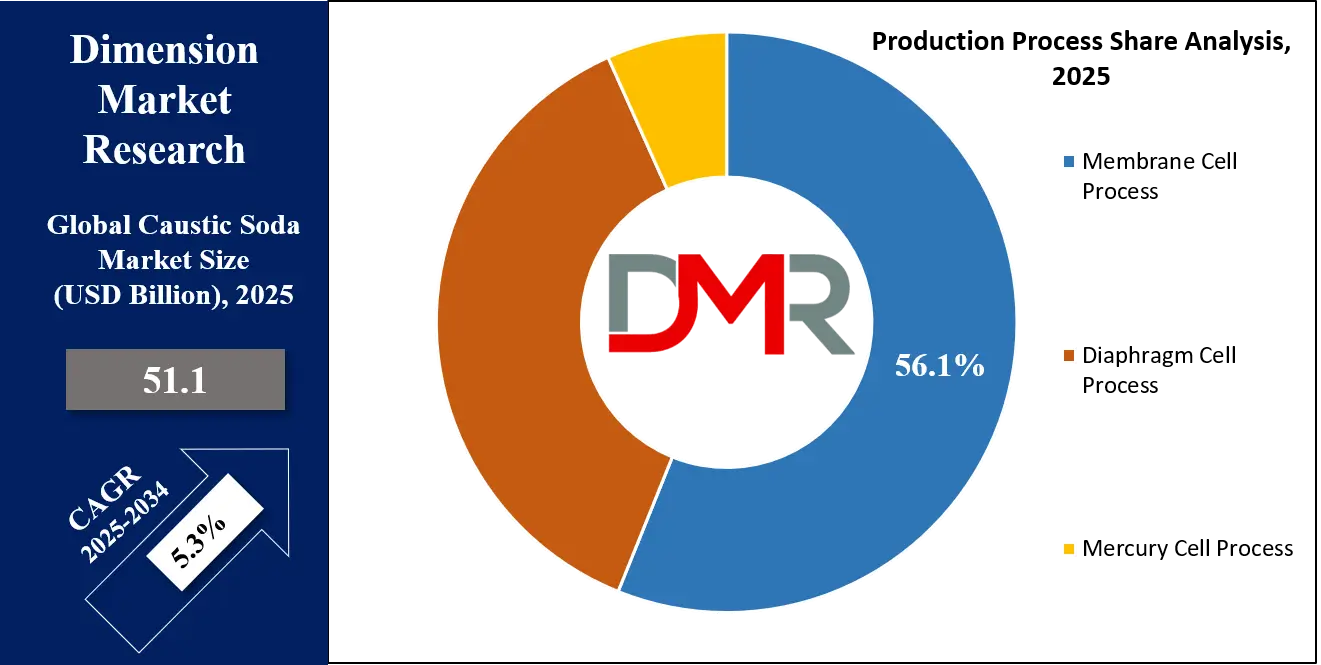

One notable trend in the caustic soda market is the shift toward membrane cell technology in its production. This method is considered more energy-efficient and environmentally friendly compared to older techniques like diaphragm and mercury cell processes. This shift is being driven by stricter environmental regulations and the global push toward sustainable chemical manufacturing. The production process also plays a crucial role in determining the purity of caustic soda, which affects its suitability for different end uses.

In recent years, several global events have influenced the caustic soda market. These include fluctuations in raw material prices, geopolitical tensions affecting energy supplies, and supply chain disruptions caused by events such as the COVID-19 pandemic. These factors have sometimes led to inconsistent production and pricing, impacting manufacturers and buyers across various sectors. Despite these challenges, long-term demand remains stable due to the essential nature of caustic soda in industrial operations.

Environmental concerns have also pushed companies to invest in cleaner production and waste management processes. With caustic soda being a highly reactive substance, handling and storage require strict safety measures. Regulatory compliance related to emissions, chemical waste disposal, and worker safety are becoming more critical, especially in regions with tough environmental policies. This has encouraged the development of safer, more efficient technologies across the value chain.

Looking ahead, the caustic soda market is expected to continue evolving as industries modernize and adopt sustainable practices. Research is underway to develop alternative processes that reduce energy use and carbon emissions. Digital technologies like automation and real-time monitoring are being applied to improve production efficiency and safety. These innovations, along with ongoing industrial demand, are likely to shape the future of the caustic soda industry in the years to come.

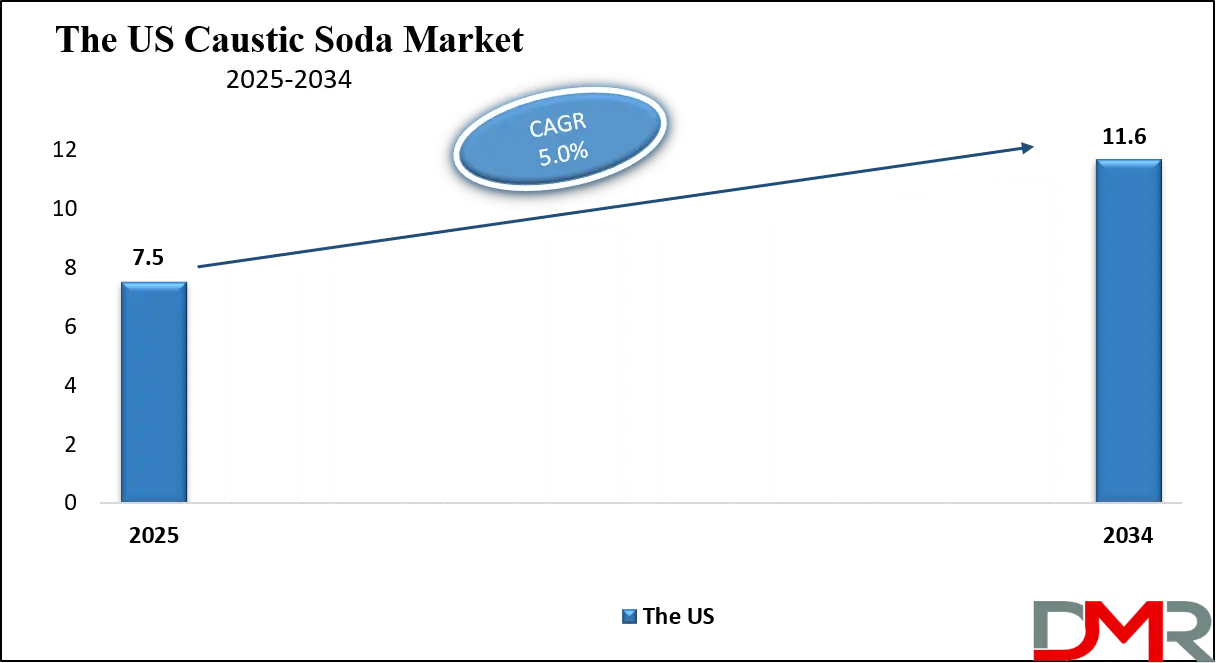

The US Caustic Soda Market

The US Caustic Soda Market size is projected to reach USD 7.5 billion in 2025 at a compound annual growth rate of 5.0% over its forecast period.

The US plays a major role in the global caustic soda market as one of the leading producers and exporters. With a strong manufacturing base and abundant raw materials like salt and energy, the US has established efficient and large-scale production facilities. The country also benefits from advanced membrane cell technologies, ensuring high product quality and low environmental impact.

Caustic soda produced in the US is widely used in domestic industries such as paper, textiles, aluminum, and chemicals, and is also exported to countries across Europe, Asia, and Latin America. The US market is supported by stable demand, innovation in sustainable production, and strong trade infrastructure, making it a key player in maintaining global supply and price stability.

Europe Caustic Soda Market

Europe Caustic Soda Market size is projected to reach USD 7.7 billion in 2025 at a compound annual growth rate of 5.2% over its forecast period.

Europe holds a significant position in the caustic soda market, driven by its strong chemical manufacturing sector and strict environmental regulations. European countries focus on producing high-quality caustic soda using energy-efficient technologies like membrane cell processes. The region’s demand is mainly supported by industries such as paper, textiles, water treatment, and chemicals. With increasing emphasis on sustainability, European producers are investing in cleaner technologies and circular economy practices.

Europe also imports and exports caustic soda within the region and to nearby markets, maintaining active trade relationships. Regulatory frameworks in Europe push for safer production and handling, influencing global best practices. Overall, Europe plays a key role in promoting environmentally responsible production while meeting industrial demand both locally and globally.

Japan Caustic Soda Market

Japan Caustic Soda Market size is projected to reach USD 2.6 billion in 2025 at a compound annual growth rate of 6.1% over its forecast period.

Japan plays an important role in the caustic soda market, particularly in the Asia-Pacific region, through its advanced manufacturing capabilities and high standards for quality and safety. Japanese producers use energy-efficient and environmentally friendly technologies, such as membrane cell processes, to maintain clean and sustainable production. Caustic soda in Japan is widely used in industries like electronics, chemicals, textiles, and water treatment.

The country’s strong industrial base and focus on innovation help maintain steady domestic demand. Japan also exports caustic soda to nearby countries, supporting regional supply chains. Despite limited natural resources, Japan's efficiency, technological expertise, and strict environmental policies make it a reliable and influential participant in the global caustic soda market, especially for high-purity and specialty applications.

Caustic Soda Market: Key Takeaways

- Market Growth: The Caustic Soda Market size is expected to grow by USD 27.8 billion, at a CAGR of 5.3%, during the forecasted period of 2026 to 2034.

- By Form: The Liquid segment is anticipated to get the majority share of the Caustic Soda Market in 2025.

- By Production Process: The Member Cell Process segment is expected to get the largest revenue share in 2025 in the Caustic Soda Market.

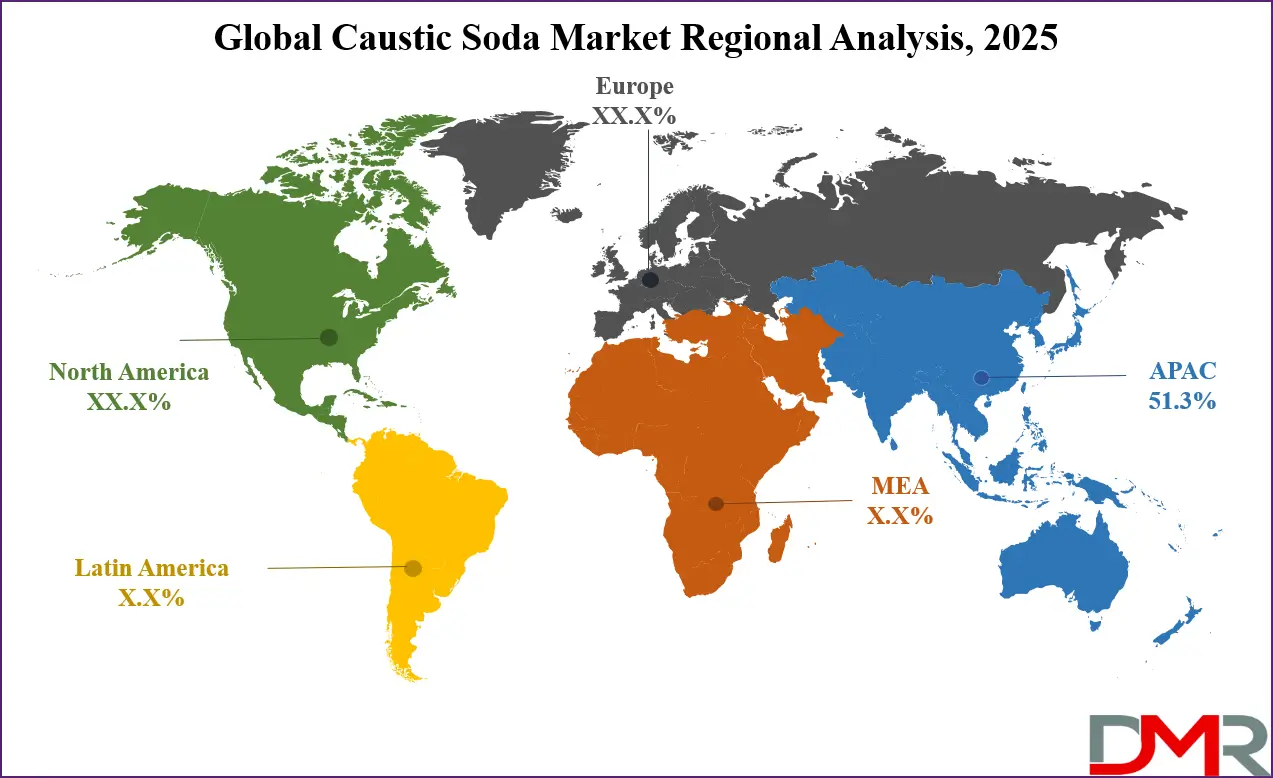

- Regional Insight: Asia Pacific is expected to hold a 51.3% share of revenue in the Global Caustic Soda Market in 2025.

- Use Cases: Some of the use cases of Caustic Soda include water treatment, textile processing, and more.

Caustic Soda Market: Use Cases

- Pulp and Paper Industry: Caustic soda is used to break down wood chips during the pulping process, helping to separate lignin from cellulose fibers. This process makes the fibers suitable for making paper products. It also helps in bleaching and improving the brightness of the paper.

- Textile Processing: In the textile industry, caustic soda is essential for treating cotton fabrics through a process called mercerization. This treatment improves dye absorption, strength, and texture of the fabric. It is also used to remove waxes, oils, and impurities from raw fibers.

- Water Treatment: Caustic soda helps control the pH level of water in both industrial and municipal treatment plants. It neutralizes acidic water and prevents corrosion in pipelines. It also aids in removing heavy metals and impurities from water.

- Soap and Detergent Manufacturing: It is a key ingredient in the saponification process, which converts fats and oils into soap. Caustic soda is also used to produce liquid detergents and cleaning agents. It helps in breaking down grease and improving the cleaning power of products.

Market Dynamic

Driving Factors in the Caustic Soda Market

Rising Demand from Core Industrial Sectors

One of the major growth drivers for the caustic soda market is the continuous demand from essential industrial sectors such as pulp and paper, textiles, water treatment, and chemicals. These industries rely on caustic soda for critical processes like bleaching, neutralization, and refining. With rising urbanization and manufacturing activities, especially in developing countries, these sectors are experiencing steady expansion. The increase in packaged goods has also boosted paper production, further fueling demand.

Additionally, stricter water quality standards across countries are pushing municipal and industrial facilities to enhance water treatment processes, where caustic soda plays a key role. The combination of regulatory pressure and industrial growth ensures stable and rising consumption. These factors collectively provide a strong foundation for market expansion.

Shift Toward Environmentally Friendly Production Technologies

Environmental concerns and regulatory policies are encouraging caustic soda producers to adopt cleaner and more energy-efficient production technologies, particularly membrane cell processes. This shift is not only reducing the environmental impact of manufacturing but also improving product quality and reducing long-term operational costs. As sustainability becomes a business priority, companies adopting green production methods are gaining a competitive edge and attracting partnerships.

The growing importance of corporate responsibility and green certifications is influencing customer choices and investments in the chemical industry. These trends are supporting the development and modernization of manufacturing facilities, especially in regions with strict environmental rules. The demand for low-carbon and sustainably produced chemicals is expected to further drive market transformation. This focus on sustainable innovation is becoming a key growth engine.

Restraints in the Caustic Soda Market

Health, Safety, and Environmental Concerns

Caustic soda is a highly corrosive and reactive chemical that poses significant health and safety risks during handling, storage, and transportation. Accidental exposure can lead to severe injuries, including chemical burns and respiratory issues, which increases the need for strict safety protocols and protective equipment. In many countries, these risks are governed by stringent regulations, which raise compliance costs for manufacturers and end users.

Additionally, improper disposal or spillage can cause environmental damage, affecting soil and water quality. These concerns limit the use of caustic soda in certain applications and require costly mitigation systems. Such regulatory and safety challenges often discourage small-scale users from adopting it. Overall, these concerns can slow down market growth, especially in environmentally sensitive regions.

Volatility in Raw Material and Energy Costs

The production of caustic soda is energy-intensive and heavily dependent on the availability and cost of electricity and salt, its primary raw material. Fluctuations in energy prices can significantly affect production costs and profitability, especially in regions where electricity prices are high or unstable.

Similarly, supply disruptions in raw materials due to geopolitical tensions, climate impacts, or trade restrictions can lead to inconsistent output and pricing pressure. This unpredictability makes long-term planning difficult for producers and buyers alike. In highly competitive markets, cost volatility reduces the ability to maintain stable pricing, affecting demand from price-sensitive sectors. Such instability discourages investment in new capacity and technology upgrades. These economic pressures can act as a serious restraint on the overall market.

Opportunities in the Caustic Soda Market

Expansion in Emerging Economies

Emerging economies offer a strong opportunity for growth in the caustic soda market due to increasing industrialization, urbanization, and infrastructure development. Sectors such as textiles, paper, aluminum, and water treatment are rapidly expanding in countries across Asia-Pacific, the Middle East, Africa, and Latin America. These regions are investing heavily in manufacturing facilities and utility services, which require significant volumes of caustic soda.

Additionally, supportive government policies and lower production costs attract global companies to set up operations in these markets. The rising need for improved sanitation and water purification systems also boosts caustic soda demand. As local industries grow and modernize, the need for reliable chemical supplies will increase. This trend presents long-term opportunities for both local and international suppliers.

Innovation in Eco-Friendly and Energy-Efficient Technologies

The push for sustainable manufacturing is creating opportunities for innovation in caustic soda production technologies. Companies are investing in advanced systems such as membrane cell technology, which offer lower emissions, reduced energy consumption, and improved safety. These innovations align with stricter environmental regulations and growing consumer demand for greener products.

There is also potential for digital solutions like automation and process monitoring to improve efficiency and reduce waste. Research into alternative materials and renewable energy use in production processes is gaining momentum. By adopting such solutions, producers can differentiate themselves and capture market share in sustainability-focused regions. These developments not only improve operational performance but also open new business models and partnerships. Overall, sustainability-focused innovation is a key growth opportunity for the industry.

Trends in the Caustic Soda Market

Automation and Digital Integration in Production

Modern caustic soda manufacturing is seeing a surge in automation and digital controls. Companies are increasingly using real-time monitoring, predictive maintenance, and automated electrolysis systems to optimize production efficiency and reduce human error. Advanced membrane cell electrolyzers are now being enhanced with smart controls, boosting purity, lowering energy use, and allowing remote oversight. These digital tools also support seamless operations, reduce downtime, and help manufacturers hit performance goals and environmental standards.

Sustainability and Green Technology Transition

There is a clear shift toward environmentally friendly practices in the caustic soda market. Industry players are investing in membrane cell and diaphragm cell technologies to replace older, high-emission methods. This change helps cut energy needs, reduce pollutants, and produce higher-purity output. Other green strategies include recycling caustic streams, using renewable energy, and recovering chemicals from waste. This move not only meets tighter environmental regulations but also attracts eco-conscious customers and opens doors to new, greener markets.

Research Scope and Analysis

By Form Analysis

Liquid form, leading the caustic soda market in 2025 with a share of 53.7%, is expected to dominate due to its ease of handling, fast solubility, and wide usage across various industries. It is commonly used in large-scale applications such as water treatment, pulp and paper manufacturing, and chemical processing, where continuous flow and immediate reactivity are essential. The liquid form requires less packaging and is often delivered in bulk, reducing transportation and storage costs for industries.

This form is particularly favored in industries that need large, consistent volumes of caustic soda for neutralization, cleaning, or refining. Growing industrial activities, especially in developing regions, and increasing investments in chemical infrastructure are further boosting demand. With rising usage in both municipal and industrial water treatment facilities and efficient logistics support, the liquid form is expected to maintain its leading position in the global caustic soda market throughout the forecast period.

Flakes form, having significant growth over the forecast period, is gaining traction due to its convenience in small-scale and precision-based applications. It is widely used in industries like soap and detergent manufacturing, textiles, and pharmaceuticals, where controlled dosage and safe handling are required. The flake form offers better shelf life and is easier to store in dry conditions compared to its liquid counterpart.

This makes it ideal for industries in remote or smaller setups without bulk chemical handling systems. Increasing demand from specialty chemical producers and growing use in laboratory and small-batch industrial processes are supporting its expansion. As more businesses focus on packaged and high-purity chemical forms, flakes are becoming a preferred choice. The steady rise in end-user industries and growing export opportunities are set to drive the market share of caustic soda flakes across various regions in the coming years.

By Production Process Analysis

Membrane cell process, leading the caustic soda market in 2025 with a share of 56.1%, will remain at the forefront due to its energy efficiency, high product purity, and low environmental impact. This method uses selective membranes that allow only certain ions to pass through, producing caustic soda with fewer impurities compared to traditional processes. It is widely preferred in regions with strict environmental regulations, especially in Europe, North America, and parts of Asia.

As industries aim to lower emissions and reduce operational costs, the membrane cell process becomes a more attractive option. Its ability to minimize the use of harmful chemicals and produce consistent quality output also strengthens its market appeal. With rising awareness of sustainable chemical production and increasing global investments in clean technologies, this method is set to drive substantial growth and maintain its leadership in the caustic soda production landscape.

Diaphragm cell process, having significant growth over the forecast period, is gaining attention for its cost-effectiveness and suitability for large-volume production. Though it produces caustic soda with slightly lower purity, it remains a widely used method in developing regions due to its lower setup costs and reliable output. This process supports industries where ultra-high purity is not a strict requirement, such as textiles, paper, and general chemical manufacturing.

Continuous demand from these sectors, especially in emerging economies, is helping maintain its relevance. Manufacturers using diaphragm technology are also exploring ways to improve efficiency and reduce brine contamination. As infrastructure expands and more production facilities come online in cost-sensitive markets, diaphragm cell systems are expected to see steady growth. Their ability to balance cost and capacity makes them a practical choice for companies seeking dependable and scalable production solutions.

By Application Analysis

Organic and inorganic chemicals application, leading the caustic soda market in 2025 with a share of 26.5%, will continue to be a key growth driver due to its foundational role in various chemical synthesis processes. Caustic soda is widely used as a reactant and pH regulator in the production of numerous chemicals, including solvents, plastics, dyes, adhesives, and pharmaceuticals. Its ability to support neutralization, purification, and separation processes makes it essential in both bulk and specialty chemical manufacturing.

The ongoing expansion of the global chemical industry, especially in regions like Asia Pacific and the Middle East, is boosting demand. Inorganic chemical production also relies heavily on caustic soda for processes such as metal treatment and catalyst preparation. With increasing industrial activity and a growing focus on high-performance materials, this segment is set to hold a stable and influential position throughout the forecast period.

Water treatment application, having significant growth over the forecast period, is emerging as one of the most critical areas for caustic soda usage due to the rising need for clean and safe water. Used to adjust pH levels, remove heavy metals, and aid in coagulation, caustic soda plays a central role in both municipal and industrial water treatment systems. With growing urban populations and stricter regulations around wastewater discharge, demand is steadily rising across developed and developing regions alike.

Industries such as oil and gas, food processing, and manufacturing also rely on treated water for operations, further increasing usage. Governments and private players are investing in large-scale water infrastructure and upgrading old systems, especially in water-stressed regions. This ongoing focus on environmental safety and public health is making water treatment a fast-growing and sustainable application for caustic soda across global markets.

The Caustic Soda Market Report is segmented on the basis of the following:

By Form

- Liquid Caustic Soda

- Solid Caustic Soda

- Flake Caustic Soda

- Pellet Caustic Soda

By Production Process

- Membrane Cell Process

- Diaphragm Cell Process

- Mercury Cell Process

By Application

- Pulp & Paper

- Organic & Inorganic Chemicals

- Textiles

- Soap & Detergents

- Water Treatment

- Alumina Processing

- Others

Regional Analysis

Leading Region in the Caustic Soda Market

Asia Pacific, leading the caustic soda market in 2025 with a share of 51.3%, continues to be the most dominant and fastest-growing region. The strong presence of manufacturing industries such as textiles, paper, chemicals, and aluminum in countries like China, India, South Korea, and Southeast Asian nations is driving significant demand. Rapid industrialization, growing urban populations, and infrastructure development are further boosting the need for water treatment and cleaning chemicals, where caustic soda plays a key role.

Favorable government policies, lower production costs, and abundant raw materials support large-scale production across the region. In addition, ongoing investment in membrane cell technology and sustainable practices is helping regional producers meet both domestic and export demands. The rising environmental awareness is also encouraging industries to adopt cleaner processes, further increasing caustic soda consumption. With strong end-use sector growth, expanding manufacturing bases, and improving production efficiency, Asia Pacific is expected to remain a crucial growth engine for the global caustic soda market throughout the year and beyond.

Fastest Growing Region in the Caustic Soda Market

Latin America is showing significant growth in the caustic soda market over the forecast period due to rising demand from key industries like pulp and paper, textiles, and water treatment. Countries such as Brazil, Mexico, and Argentina are increasing their industrial output, which is driving the need for basic chemicals like caustic soda in refining, cleaning, and neutralizing processes.

Growth in infrastructure projects and improved access to clean water are also boosting caustic soda consumption across the region. With investments in modern chemical production facilities and a growing focus on industrial expansion, Latin America is estimated to play a more important role in supporting regional supply and long-term market development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The caustic soda market is highly competitive, with many producers operating across the globe to meet strong industrial demand. The competition is shaped by factors like production capacity, product quality, pricing, and access to raw materials. Companies that can produce caustic soda efficiently, with lower energy use and fewer emissions, often have a competitive edge.

Environmental regulations are also influencing the market, encouraging cleaner production technologies. Players are focusing on expanding their reach in growing economies and building long-term contracts with key industries like textiles, chemicals, and water treatment. In addition, supply chain strength and the ability to maintain consistent delivery have become important due to recent global disruptions. Innovation and sustainability are becoming key strategies in this evolving market.

Some of the prominent players in the global Caustic Soda are:

- Olin Corporation

- Occidental Petroleum Corporation (OxyChem)

- Westlake Corporation

- Tata Chemicals Limited

- Dow Inc.

- INEOS Group

- BASF SE

- Solvay S.A.

- Formosa Plastics Corporation

- Aditya Birla Chemicals

- Shin-Etsu Chemical Co., Ltd.

- Kemira Oyj

- PPG Industries, Inc.

- Hanwha Solutions Corporation

- Xinjiang Zhongtai Chemical Co., Ltd.

- LG Chem Ltd.

- Tokuyama Corporation

- SABIC

- Axiall Corporation

- Vynova Group

- Other Key Players

Recent Developments

- In April 2025, DCM Shriram Ltd. expanded its production capacity by commissioning a new 300 TPD caustic soda flakes plant at its Jhagadia complex in Bharuch, Gujarat, bringing the site’s total capacity to 900 TPD. This positions it among India’s largest single-location producers of caustic soda flakes. The new unit mirrors the plant launched in October last year, enabling streamlined operations. Both facilities are designed as flexi-fuel plants, enhancing efficiency and operational flexibility across the complex.

- In December 2024, The Chemours Company announced that PCC Group will build and operate a new chlor-alkali facility at Chemours’ TiO₂ plant site in DeLisle, Mississippi. Under a chlorine supply agreement, subject to customary conditions, the plant will feature advanced, energy-efficient technology and is expected to reach a nameplate capacity of 340,000 metric tons annually. Caustic soda, a co-product, will be sold by PCC both to strategic partners and in the open market. Construction begins in 2026, with operations starting in 2028.

- In October 2024, Brenntag, a global leader in chemical distribution, has become the first distributor in the Netherlands and Belgium to switch entirely too sustainably produced caustic soda. Partnering with Nobian, Brenntag now sources caustic soda made through chlor-alkali electrolysis powered by 100% renewable wind and solar energy. This move supports Brenntag’s leadership in sustainable practices within the chemical industry. Caustic soda is vital in producing aluminum, paper, water treatment chemicals, pharmaceuticals, food ingredients, and personal care products. More regions are expected to follow.

- In October 2024, Nobian and Brenntag signed a long-term agreement for the supply of ISCC PLUS-certified caustic soda, reinforcing their ongoing partnership. This collaboration highlights both companies' shared commitment to offering low-carbon, sustainable chemical solutions. By delivering certified caustic soda, they aim to support the market’s transition toward greener products and processes, further contributing to environmental responsibility and reduced carbon emissions across the chemical supply chain.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 51.1 Bn |

| Forecast Value (2034) |

USD 81.4 Bn |

| CAGR (2025–2034) |

5.3% |

| The US Market Size (2025) |

USD 7.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Form (Liquid Caustic Soda, Solid Caustic Soda, Flake Caustic Soda, and Pellet Caustic Soda), By Production Process (Membrane Cell Process, Diaphragm Cell Process, and Mercury Cell Process), By Application (Pulp & Paper, Organic & Inorganic Chemicals, Textiles, Soap & Detergents, Water Treatment, Alumina Processing, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Olin Corporation, Occidental Petroleum Corporation (OxyChem), Westlake Corporation, Tata Chemicals Limited, Dow Inc., INEOS Group, BASF SE, Solvay S.A., Formosa Plastics Corporation, Aditya Birla Chemicals, Shin-Etsu Chemical Co., Ltd., Kemira Oyj, PPG Industries, Inc, Hanwha Solutions Corporation, Xinjiang Zhongtai Chemical Co., Ltd., LG Chem Ltd., Tokuyama Corporation, SABIC, Axiall Corporation, Vynova Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Caustic Soda Market size is expected to reach a value of USD 51.1 billion in 2025 and is expected to reach USD 81.4 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Caustic Soda Market, with a share of about 51.3% in 2025

The Caustic Soda Market in the US is expected to reach USD 7.5 billion in 2025.

Some of the major key players in the Global Caustic Soda Market are Olin Corporation, Occidental Petroleum Corporation (OxyChem), Westlake Corporation, and others

The market is growing at a CAGR of 5.3 percent over the forecasted period.