Market Overview

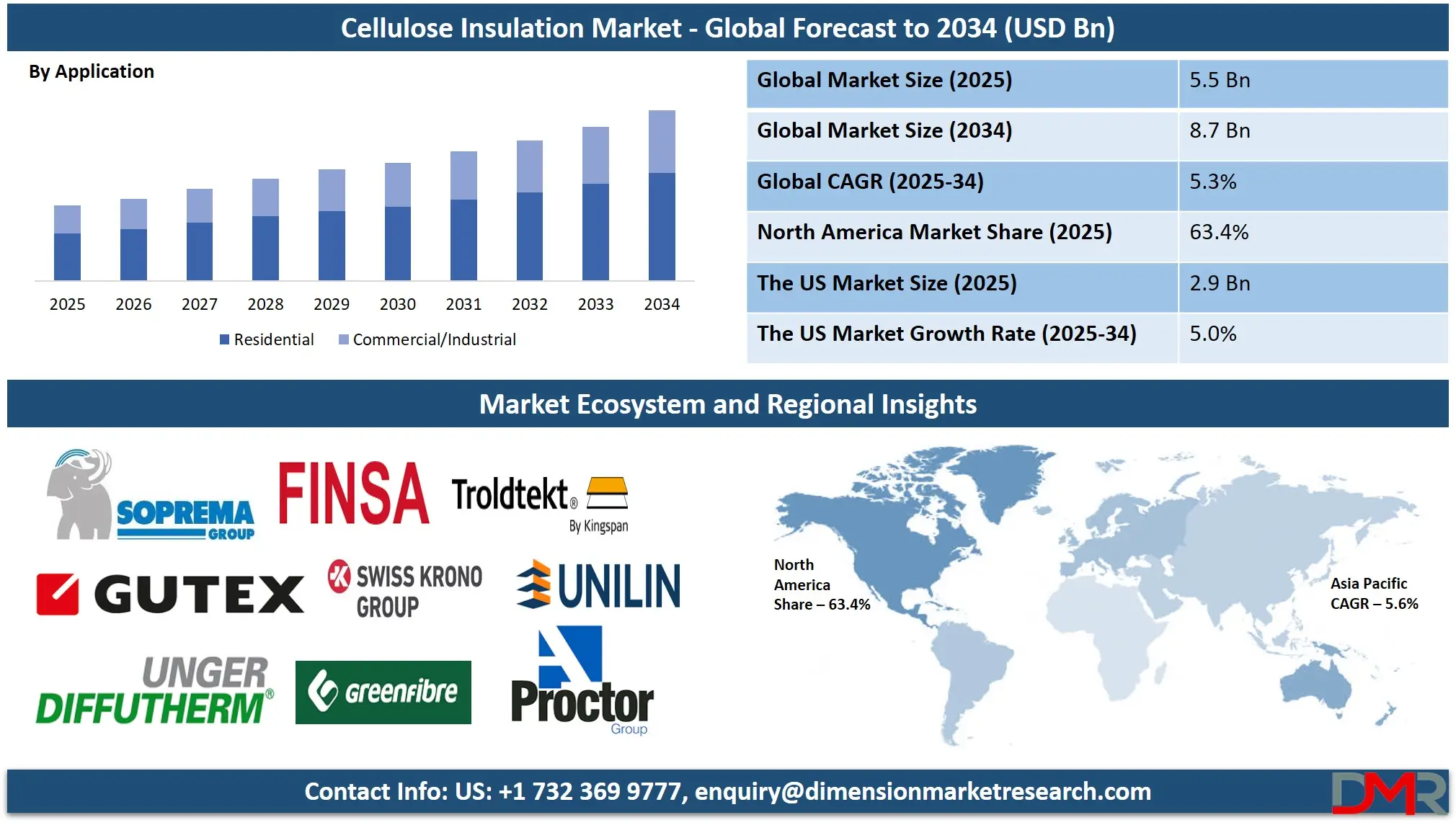

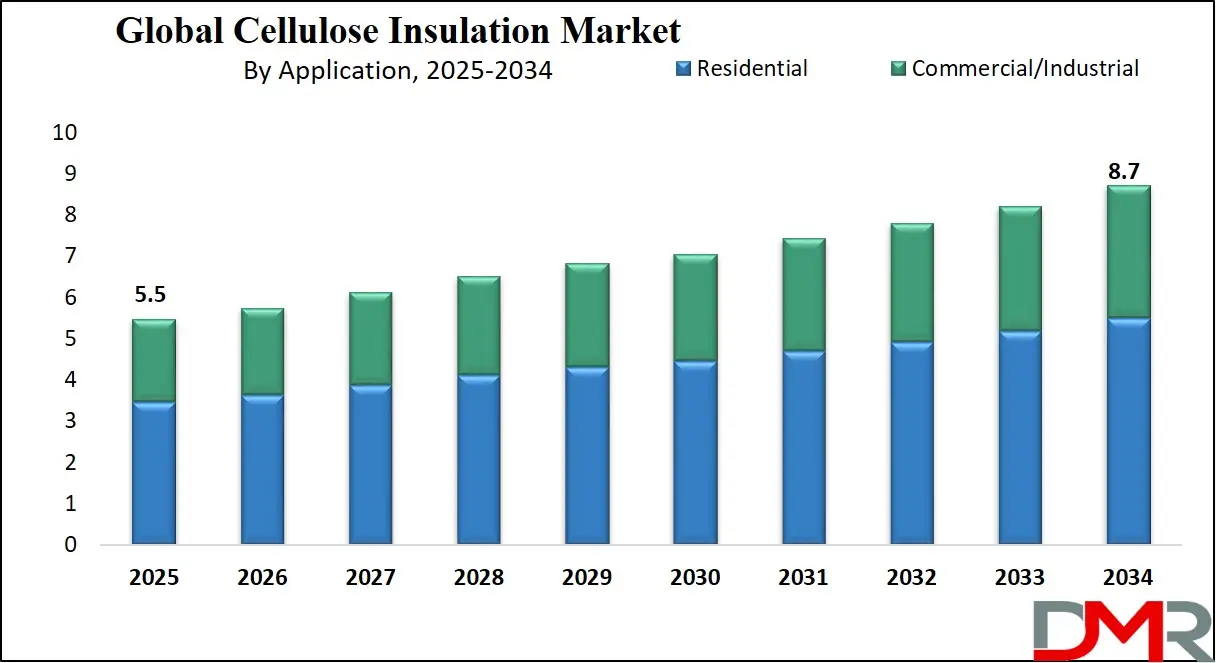

The Global Cellulose Insulation Market size is expected to be valued at

USD 5.5 billion in 2025, and it is further anticipated to reach a market value of

USD 8.7 billion by 2034 at a

CAGR of 5.3%.

The global cellulose insulation market is an emerging sector within the building materials industry, focused on producing and applying cellulose-based materials used for thermal and acoustic insulation in residential, commercial, and industrial buildings. Cellulose insulation typically made from recycled paper treated with fire retardants to improve its performance and safety has seen significant growth due to its sustainable attributes such as energy-saving features as well as rising environmental awareness among both consumers and manufacturers. Energy-efficient homes and buildings are one of the primary factors driving the growth of the cellulose insulation market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Cellulose insulation's impressive thermal performance helps regulate indoor temperatures by minimizing heat transfer between rooms, helping homeowners save on energy consumption costs by preventing heat loss during winter and minimizing heat gain during summer, making it a cost-effective way of cutting energy consumption and utility bills.

The market is also driven by increasing regulatory pressures on energy efficiency standards and building codes across the globe, with many governments adopting stringent regulations and incentives designed to encourage energy-saving materials and practices, driving further demand for insulation products such as cellulose insulation. Building codes across North America and Europe mandate new buildings to meet certain energy efficiency standards which have led to greater adoption of cellulose insulation as part of energy-saving initiatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Overall, the global cellulose insulation market is being propelled forward by rising consumer demand for eco-friendly building materials that use less energy and materials and meet energy regulations. As environmental awareness rises and energy regulations tighten further, its adoption should increase accordingly. While moisture sensitivity and fire risks remain, challenges are associated with its installation methods and product formulations. Ongoing innovations help combat them so cellulose insulation remains a viable choice in global building materials markets.

The US Cellulose Insulation Market

The US Cellulose Insulation Market is projected to be valued at USD 2.9 billion in 2025. It is further expected to witness subsequent growth in the upcoming period as it will hold USD 4.5 million in 2034 at a CAGR of 5.0%.

The US cellulose insulation market is a significant and lucrative segment of the building materials industry, driven by rising consumer interest in energy-saving and eco-friendly building products. Cellulose insulation in the US is widely used for thermal and acoustic insulation purposes in residential, commercial, and industrial buildings. Cellulose insulation, made from recycled paper products such as newspapers and treated with flame retardants and other chemicals, is widely recognized for its ability to reduce energy usage while improving comfort within buildings. Its market growth can be attributed to expanding consumer awareness of sustainability issues as well as government regulations encouraging energy efficiency.

Several factors drive the growing adoption of cellulose insulation in the US. The push for energy-efficient buildings has led to a greater emphasis on proper insulation, which can reduce heating and cooling costs by up to 20.0%. Additionally, cellulose insulation aligns with sustainability goals as it is primarily made from recycled newspaper and treated with fire retardants to enhance safety. Government policies and building regulations supporting energy conservation further contribute to market expansion by encouraging the use of high-performance insulation materials.

Moreover, the US cellulose insulation market is expected to continue its upward trajectory, driven by increasing construction activities, heightened environmental awareness, and supportive government policies. With advancements in product technology and growing consumer preference for sustainable materials, cellulose insulation is likely to play a crucial role in the future of energy-efficient and eco-friendly buildings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Cellulose Insulation: Key Takeaways

- Market Value: The global cellulose insulation market size is expected to reach a value of USD 8.7 billion by 2034 from a base value of USD 5.5 billion in 2025 at a CAGR of 5.3%.

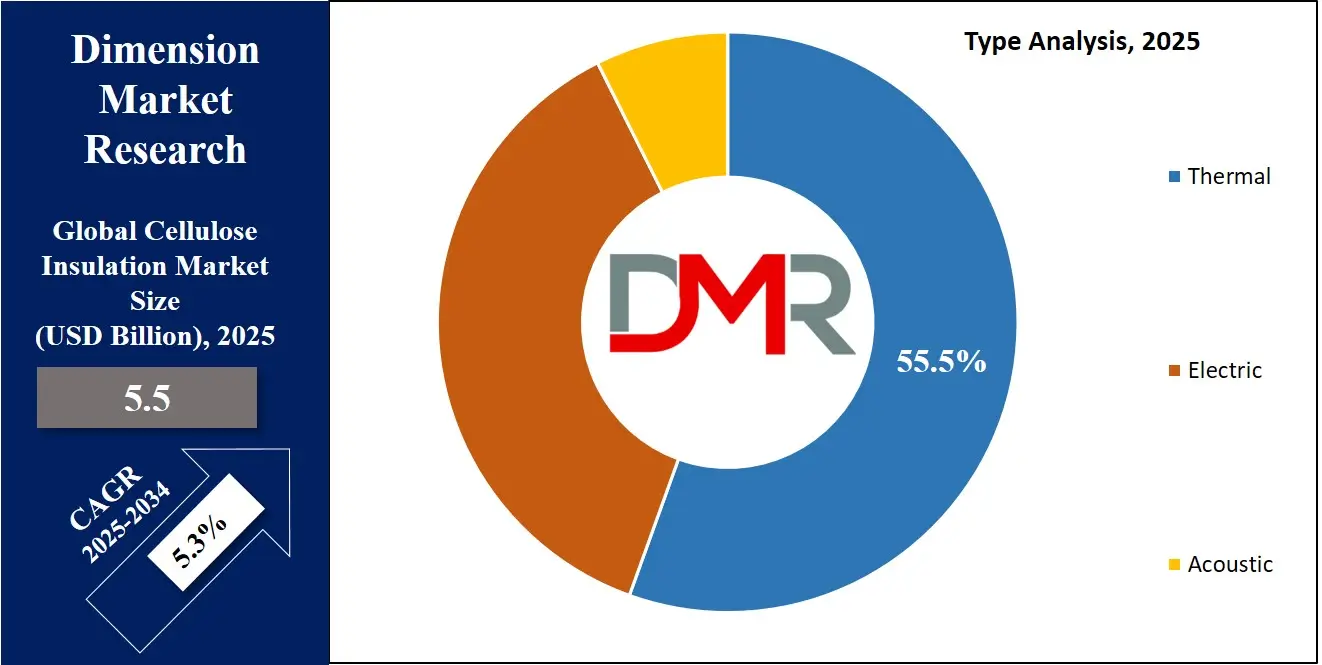

- By Type Segment Analysis: Thermal Insulation is anticipated to lead in the type segment, capturing 55.5% of the market share in 2025.

- By Application Segment Analysis: Residential is poised to consolidate its market position in the application type segment capturing 63.1% of the total market share in 2025.

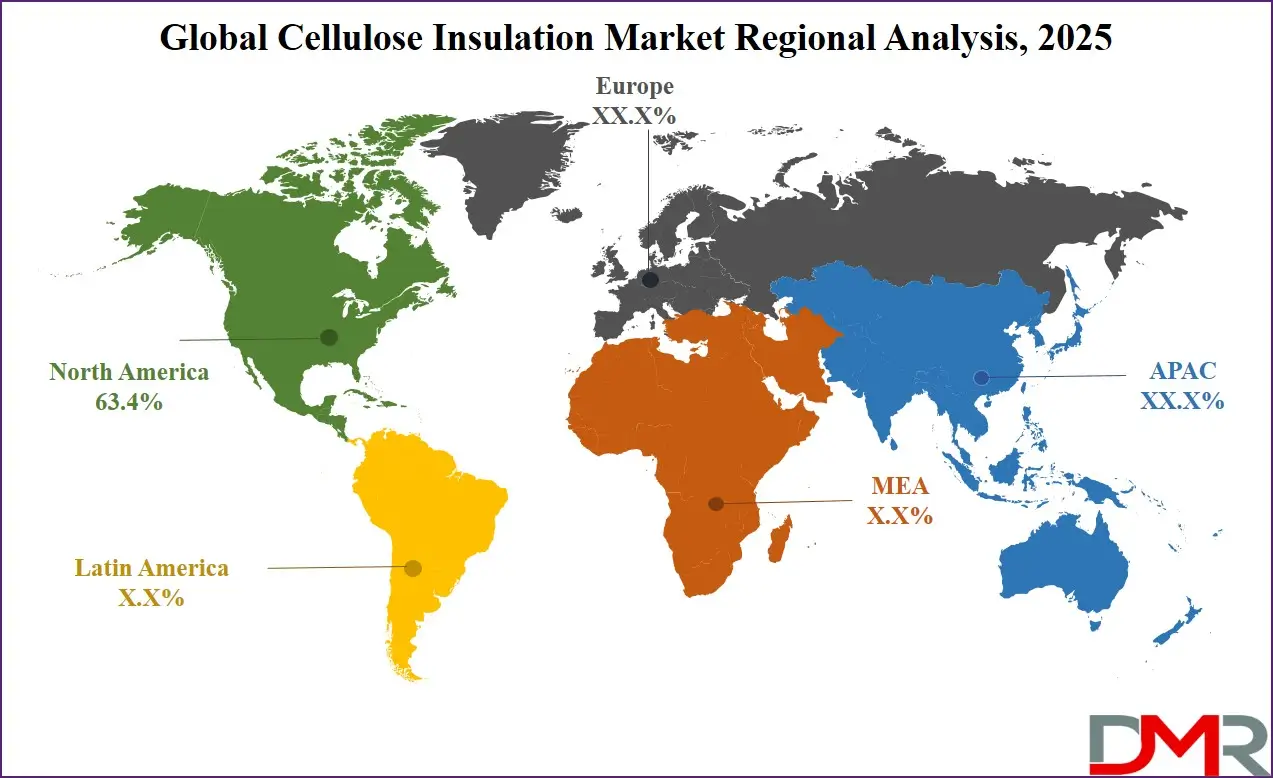

- Regional Analysis: North America is anticipated to lead the global cellulose insulation landscape with 63.4% of total global market revenue in 2025.

- Key Players: Some major key players in the global cellulose insulation market are SOPREMA GROUP (Pavatex), GUTEX, UNGER-DIFFUTHERM, FINSA (FIBRANATUR), Kronoply, GREEN FIBER, Troldtekt, Unilin, PROCTOR GROUP, and Other Key Players.

Global Cellulose Insulation Market: Use Cases

- Residential Buildings: Cellulose insulation is widely used in residential buildings to improve thermal performance and reduce energy consumption. It is applied in attics, walls, and floors to prevent heat transfer, keeping homes warmer in winter and cooler in summer. This helps homeowners lower heating and cooling costs, offering a cost-effective and environmentally friendly solution. The high recycled content of cellulose insulation also aligns with the growing trend toward sustainable and green building practices in residential construction.

- Commercial Buildings: In commercial buildings, cellulose insulation is used to enhance energy efficiency, reduce operating costs, and meet energy codes and regulations. It is commonly installed in wall cavities, ceilings, and attics to provide superior thermal and acoustic insulation. Commercial spaces, particularly office buildings, retail spaces, and educational institutions, benefit from cellulose's ability to control indoor temperature fluctuations and reduce noise between rooms, creating a more comfortable and productive environment.

- Retrofit and Renovation Projects: Cellulose insulation is an ideal material for retrofit and renovation projects, especially in older homes and buildings. As energy efficiency standards become more stringent, building owners and contractors turn to cellulose insulation to improve the thermal and acoustic properties of existing structures. Its ability to be blown into cavities or used as loose-fill insulation makes it a versatile option for retrofitting walls, attics, and floors without the need for significant structural modifications. This makes cellulose insulation a popular choice for homeowners and businesses looking to upgrade their properties while maintaining sustainability.

- Soundproofing Applications: Cellulose insulation is highly effective at reducing sound transmission, making it a preferred choice for soundproofing applications. It is used in walls, ceilings, and floors to minimize noise from external sources and between rooms within a building. This makes it particularly valuable in applications such as multi-family housing, hotels, office buildings, and entertainment venues, where sound control is crucial for comfort and privacy. The natural density and structure of cellulose insulation provide excellent acoustic properties, making it a reliable option for noise reduction.

Global Cellulose Insulation Market: Stats & Facts

- According to the US Department of Energy (DOE), cellulose insulation, made from recycled paper products, is an environmentally friendly option that provides effective thermal and acoustic insulation. The DOE's Energy Saver guide highlights that cellulose insulation can help homeowners save up to 20% on heating and cooling costs.

Market Dynamic

Global Cellulose Insulation Market: Driving Factors

Growing Demand for Energy-Efficient BuildingsThe global cellulose insulation market is experiencing significant expansion, driven by an increasing need for energy-efficient buildings globally. Governments and regulatory bodies around the globe are emphasizing reducing energy consumption across residential, commercial, and industrial structures, driven by environmental considerations, carbon emission cuts, and rising energy costs, as well as rising carbon costs with insulation materials that improve performance while being sustainable and cost-effective gaining ground among builders and homeowners as a result cellulose insulation has quickly become a preferred choice. Cellulose insulation has become well-known for its ability to increase thermal efficiency in buildings, helping maintain stable indoor temperatures while decreasing heating and cooling system use.

Increasing Adoption of Sustainable and Eco-Friendly Building Materials

Sustainability is one of the primary drivers behind the expansion of the cellulose insulation market. As environmental concerns increase, governments, industries, and consumers mainly prioritize eco-friendly materials that will help lower their carbon footprints. Cellulose insulation with its recycled content of up to 85.0% post-consumer paper waste, and high recycled content helps significantly decrease landfill waste while reducing the environmental impact of production. When compared with traditional insulation materials like fiberglass and foam insulation, its energy-efficient manufacturing process is an attractive option for sustainable construction projects. Governments and regulatory bodies globally are encouraging the use of environmentally sustainable building materials through stringent environmental policies and green building programs.

Global Cellulose Insulation Market: Restraints

Moisture Sensitivity and Mold Growth Risk

One of the key challenges of the global cellulose insulation market is its moisture sensitivity, which can lead to mold growth and decrease insulation performance. Compared with synthetic materials like fiberglass or foam insulation, cellulose insulation's primary constituent material like recycled paper makes it more susceptible to moisture absorption when exposed to high humidity or water leakage, potentially leading to lower thermal efficiency. This presents significant difficulties for regions experiencing high humidity levels, heavy rainfall, or frequent flooding where moisture-related issues become prevalent. Moisture in insulation materials can cause structural damage over time, as cellulose insulation absorbs water to become heavier and may settle or compress over time, decreasing its effectiveness and leaving gaps that allow heat transfer.

Flammability Concerns and Fire Safety Regulations

One of the primary impediments to the global cellulose insulation market is concerns over flammability and fire safety regulations. Composed of recycled paper fibers, cellulose insulation carries inherent combustibility risks that have created concerns among builders, homeowners, and regulatory bodies. Even after treatment with fire retardant chemicals such as boric acid or ammonium sulfate, many still perceive it as more combustible than non-combustible alternatives like fiberglass or mineral wool insulation. This leads to stricter regulations that make competing more challenging in certain regions compared with noncombustible alternatives like fiberglass or mineral wool insulation. Concerns have been raised over the long-term effectiveness of fire retardants used in cellulose insulation, specifically due to exposure to humidity, air circulation, and settling.

Global Cellulose Insulation Market: Opportunities

Rising Demand for Green Building Certifications and Sustainable Construction

One significant opportunity for the global cellulose insulation market comes from increased demand for sustainable building certifications and practices. As governments, businesses, and consumers prioritize environmental sustainability, construction companies are turning towards eco-friendly materials that reduce energy usage and greenhouse emissions.

Environmental building certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and ENERGY STAR have become highly desirable among both residential and commercial construction projects. These credentials encourage using materials with higher recycled content and reduced carbon footprint, which makes cellulose insulation an appealing option compared with more traditional options such as fiberglass or foam insulation.

Technological Advancements in Cellulose Insulation Manufacturing

One major opportunity in the global cellulose insulation market lies in manufacturing technologies that enhance the performance, durability, and installation efficiency of the material. As demand for high-performance insulation rises, manufacturers are investing in new processing techniques, fire-resistant treatments, and moisture-resistant formulations to overcome traditional limitations of cellulose insulation and make it more cost-competitive against materials like fiberglass spray foam and mineral wool. One of the key technological developments is hybrid cellulose insulation, which combines recycled cellulose fibers with other high-performance materials to improve thermal resistance (R-value), fireproofing, and moisture control.

Global Cellulose Insulation Market: Trends

Growing Adoption of Eco-Friendly and Biodegradable Insulation Materials

The growing interest in eco-friendly and biodegradable insulation materials as part of an effort towards more eco-friendly construction practices has raised concerns over climate change, carbon emissions, and non-renewable resource depletion which are driving builders, developers, and homeowners toward eco-friendly insulation alternatives such as fiberglass insulation crafted from up to 85.0% recycled paper fibers or plant-based fibers which align well with the industry shift toward low carbon, non-toxic building materials that promote sustainability. Cellulose insulation's eco-friendly nature aligns perfectly with this movement towards green construction methods while its non-toxic nature makes it perfect as low low-carbon building material choice for sustainable construction projects.

Expansion of the Retrofit and Home Renovation Market

One notable trend in the global cellulose insulation market is its growing adoption for retrofit and home renovation projects. As existing buildings undergo energy-efficiency upgrades, particularly older housing stock, there has been a major focus on eco-friendly and cost-effective insulation materials like cellulose. Energy retrofitting, the practice of increasing energy efficiency in older buildings, is becoming more popular across both residential and commercial settings. As older buildings are less energy-efficient, homeowners and building managers are looking for ways to enhance insulation for reduced energy consumption, lower utility bills, and improved comfort. Retrofit markets are rapidly growing due to aging infrastructure, rising energy costs, and government incentives for energy-efficient home upgrades.

Global Cellulose Insulation Market: Research Scope and Analysis

By Type

Thermal Insulation is anticipated to lead in the type segment, capturing 55.5% of the market share in 2025. This can be attributed to rising consumer demand for energy-efficient solutions in residential, commercial, and industrial settings due to growing environmental awareness. Thermal insulation plays a vital role in energy conservation by acting as a barrier against heat flow within buildings thereby making buildings more energy-efficient while helping maintain desired indoor temperatures. Climate change awareness and the desire to reduce carbon emissions have upsurged the adoption of energy-efficient materials, with thermal insulation playing an instrumental role. Governments around the globe have introduced stricter energy codes and building regulations to promote insulation materials which help lower heating and cooling costs.

The thermal performance of insulation materials is of critical importance in both residential and commercial buildings, where controlling indoor temperatures is integral for occupant comfort and energy savings. Furthermore, insulation improves building durability as it reduces HVAC system stressors leading to longer-lasting infrastructure. Cellulose insulation and other high R-value materials such as fiberglass are ideal choices for energy-efficient building construction. This trend is especially prominent among emerging economies with rapid urbanization growth that places energy efficiency as a top priority.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application

Residential is poised to consolidate its market position in the application type segment capturing

63.1% of the total market share in 2025. This dominance can be attributed to several factors that demonstrate their increasing importance in construction and home renovation projects, such as increasing consumer awareness of sustainability issues, the need for energy savings measures, as well as government incentives that encourage eco-friendly upgrades. Cellulose insulation usage among these applications has grown rapidly as more homeowners recognize its energy-saving qualities and opt for energy-efficient upgrades. One factor driving the popularity of cellulose insulation in residential applications is an emphasis on energy efficiency. As energy costs continue to rise, homeowners are investing in insulation solutions that will lower heating and cooling expenses.

Cellulose insulation's high thermal resistance (R-value) offers effective yet cost-efficient insulation solutions for homeowners seeking to reduce energy consumption. Its sustainable qualities play a pivotal role in driving its popularity among residential homeowners. As homeowners become more environmentally aware, they are searching for eco-friendly building materials that align with their values. Cellulose insulation offers an eco-friendly option over synthetic fiberglass or foam insulation materials, including biodegradable and recyclable forms such as fiberglass. Furthermore, cellulose is treated with fire retardants that don't harm the environment, further strengthening its appeal as an environmentally conscious building material.

The Cellulose Insulation Market Report is segmented on the basis of the following

By Type

- Thermal

- Electric

- Acoustic

By Application

- Residential

- Commercial/Industrial

Global Cellulose Insulation Market: Regional Analysis

North America is poised to lead the global cellulose insulation landscape with 63.4% of total global market revenue in 2025. This leadership can be attributed to several factors, including stringent energy efficiency regulations and increasing consumer awareness about eco-friendly building materials, along with growing consumer demand for eco-friendly insulation solutions. North America's emphasis on energy conservation in both residential and commercial construction has contributed greatly to the widespread acceptance of cellulose insulation solutions in these sectors.

One key driver of North American market growth lies within its stringent building energy codes set forth by government authorities. United States government bodies like the Department of Energy (DOE) and Environmental Protection Agency (EPA) actively encourage energy-efficient building practices through programs like ENERGY STAR(r) and the Better Buildings Initiative.

These regulations promote the use of high-performance insulation materials such as cellulose insulation, which offers superior thermal resistance and soundproofing properties compared to conventional fiberglass insulation. Furthermore, initiatives like California's Title 24 Energy Code mandate higher energy efficiency standards that increase demand for eco-friendly insulation materials.

North America's residential construction sector is witnessing a rise in cellulose insulation demand, particularly among single-family and multi-unit residential buildings. Amid mounting concerns over air quality and environmental sustainability, homeowners and builders are opting for non-toxic, fireproof recycled insulation such as cellulose. Cellulose's ability to limit heat loss while increasing indoor comfort makes it an attractive choice for modern energy-efficient homes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cellulose Insulation Market: Competitive Landscape

The global cellulose insulation market is marked by numerous key players who strive to expand their market positions through product innovation, strategic partnerships, and sustainability initiatives. Their goals include expanding market reach while simultaneously meeting consumer demand for eco-friendly and energy-efficient insulation solutions. Greenfiber stands out as one of the leading companies in cellulose insulation by upholding an exceptional commitment to sustainability.

Producing high-performance cellulose insulation made from recycled paper fibers that contribute to energy efficiency for both residential and commercial buildings, Greenfiber highlights continuous innovation and eco-friendly manufacturing processes to maintain a competitive advantage within the market. Furthermore, its established distribution network ensures it can meet rising demands across various regions.

Some of the prominent players in the Global Cellulose Insulation are

- Applegate Insulation

- American Fiber Green Products Inc.

- Cellulose Insulation Manufacturers Association (CIMA)

- GreenFiber LLC

- International Cellulose Corporation

- Nu-Wool Co., Inc.

- US GreenFiber, LLC

- Advanced Fiber Technology

- National Fiber

- Fiberlite Technologies, Inc.

- ThermoCell Industries Corporation

- Hamilton Manufacturing Inc.

- Central Fiber Corporation

- Cocoon Insulation

- EnergyGuard Polyiso Insulation

- Nature-Tech Solutions

- Recycled Materials, Inc.

- Eagle Cellulose Insulation

- Weatherization Partners Ltd.

- FiberAmerica, Inc.

- Other Key Players

Global Cellulose Insulation Market: Recent Developments

- May 2024: Mannok, a leading manufacturer of building materials, launched a new addition to its extensive insulation range. This innovation was designed to meet the growing demand for high-performance, energy-efficient insulation solutions in the construction industry. The new product boasts enhanced thermal properties, ensuring superior heat retention and reduced energy consumption in buildings.

- February 2024: Saint-Gobain acquired the business assets of International Cellulose Corporation (ICC), a manufacturer of commercial specialty insulation products, including spray-on thermal and acoustical finishing systems. This acquisition allows Saint-Gobain to reinforce its leadership position in light and sustainable construction by offering fireproofing and insulation solutions that enhance energy conservation and efficiency in commercial spaces.

- July 2023: Kingspan Group announced its plan to acquire a majority of Steico SE's shares, a key manufacturer of wood fiber insulation. This acquisition, pending regulatory clearance and scheduled for early 2024, aims to enhance Kingspan's portfolio in sustainable building materials.

- February 2023: Greenfiber, the largest manufacturer and marketer of cellulose insulation in North America, rebranded as "Greenfiber® Creators of SANCTUARY." This rebranding reflects the company's commitment to providing a more comfortable, quieter, and greener future through its insulation products.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.5 Bn |

| Forecast Value (2034) |

USD 8.7 Bn |

| CAGR (2025–2034) |

5.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Thermal, Electrical, and Acoustic), and By Application (Residential, and Commercial/Industrial) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

SOPREMA GROUP (Pavatex), GUTEX, UNGER-DIFFUTHERM, FINSA (FIBRANATUR), Kronoply, GREEN FIBER, Troldtekt, Unilin, PROCTOR GROUP, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the global cellulose insulation market?

▾ The global cellulose insulation market size is estimated to have a value of USD 5.5 billion in 2025 and is expected to reach USD 8.7 billion by the end of 2034.

What is the size of the US cellulose insulation market?

▾ The US cellulose insulation market is projected to be valued at USD 2.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.5 billion in 2034 at a CAGR of 5.0%.

Which region accounted for the largest global cellulose insulation market?

▾ North America is expected to have the largest market share in the global cellulose insulation market with a share of about 63.4% in 2025.

Who are the key players in the global cellulose insulation market?

▾ Some of the major key players in the global cellulose insulation market are SOPREMA GROUP (Pavatex), GUTEX, UNGER-DIFFUTHERM, FINSA (FIBRANATUR), Kronoply, GREEN FIBER, Troldtekt, Unilin, PROCTOR GROUP, and many others.