Market Overview

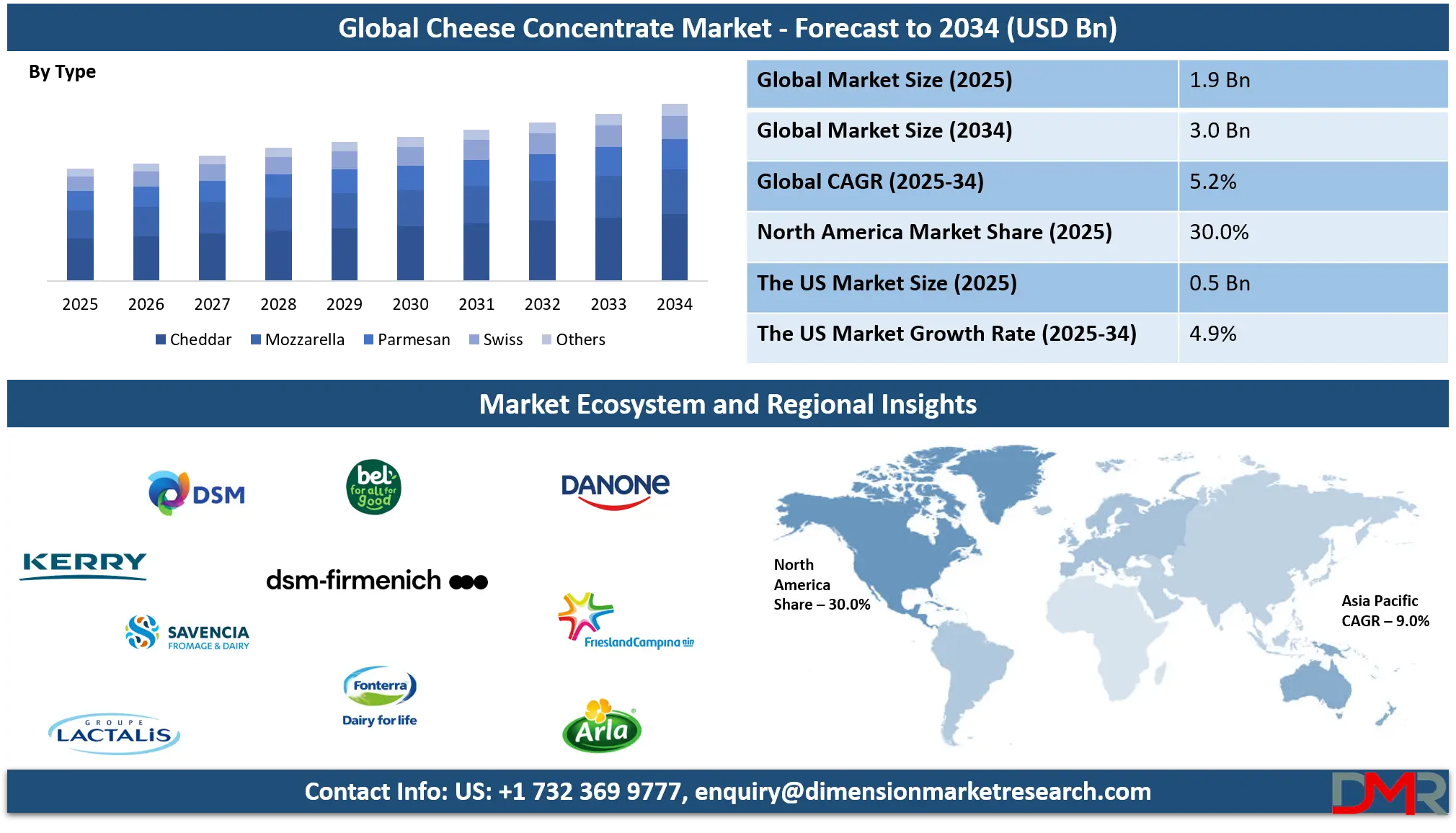

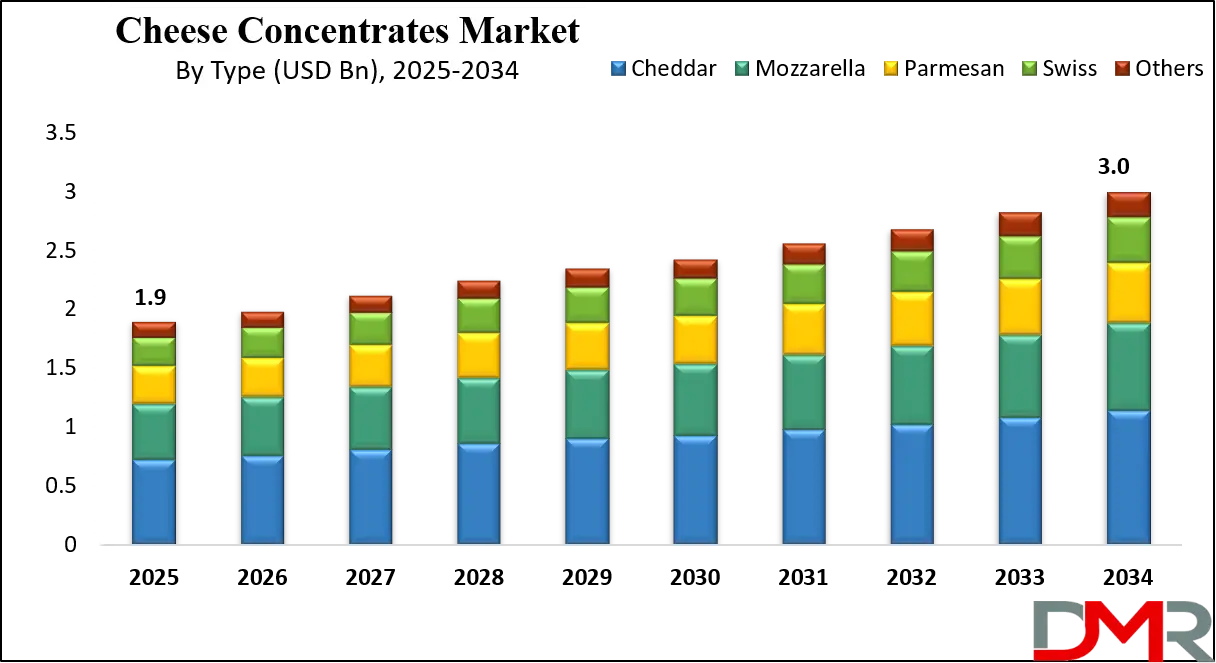

The Global Cheese Concentrates Market size is projected to reach USD 1.9 billion in 2025 and grow at a compound annual growth rate of 5.2% to reach a value of USD 3.0 billion in 2034.

Cheese concentrates are highly concentrated dairy-based ingredients derived from natural cheese through processes such as evaporation, enzymatic treatment, and filtration. They retain essential flavor compounds, proteins, and fats while reducing moisture, making them suitable for diverse food applications. Cheese concentrates are available in multiple forms including powder, paste, and liquid, and are widely used in processed foods, snacks, sauces, bakery products, and ready meals. Within the broader food and beverage industry, cheese concentrates play a critical role in enabling consistent flavor delivery, cost efficiency, and extended shelf life, making them indispensable for large-scale food manufacturers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is influenced by rising global consumption of convenience and processed foods, supported by urbanization and changing lifestyles. Advances in dairy processing technologies have improved flavor stability, solubility, and functional performance, allowing manufacturers to customize concentrates for specific applications. Regulatory emphasis on food safety, labeling transparency, and clean ingredients is shaping product reformulation, while consumer preference for reduced-fat, high-protein, and lactose-free foods is accelerating innovation across product portfolios.

Recent shifts include growing demand for clean-label formulations, plant-forward diets influencing hybrid dairy solutions, and sustainability-driven sourcing practices. Manufacturers are increasingly investing in efficient processing technologies to reduce waste and improve energy usage, supporting long-term market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Cheese Concentrates Market

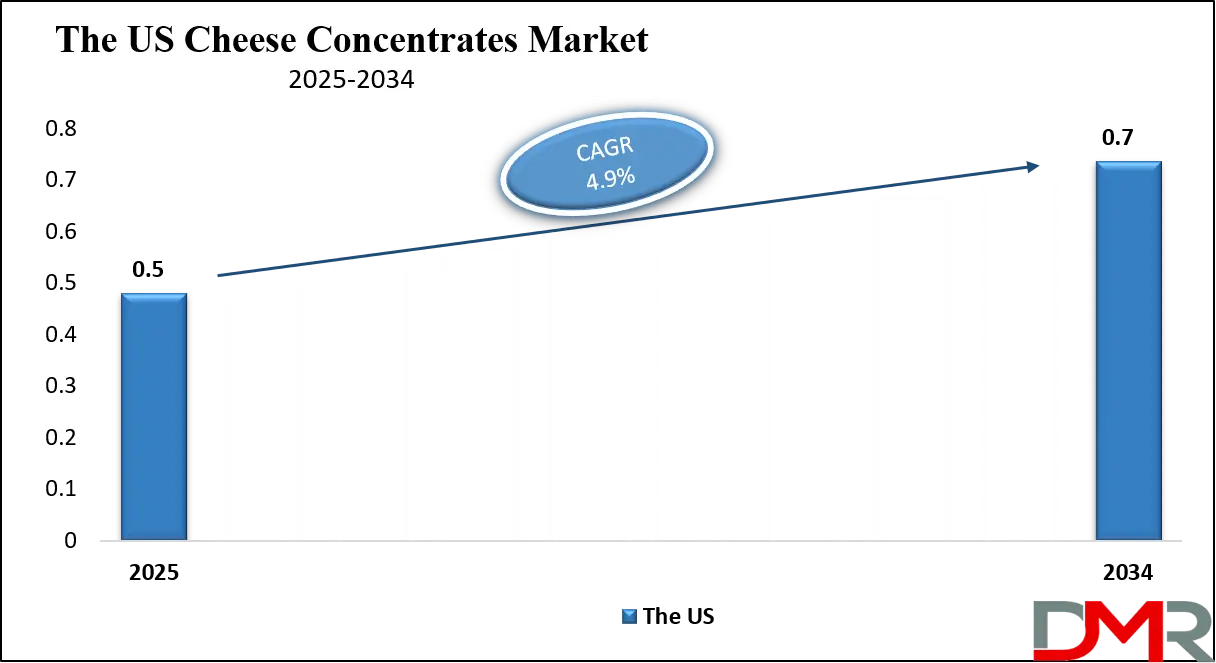

The US Cheese Concentrates Market size is projected to reach USD 500 million in 2025 at a compound annual growth rate of 4.9% over its forecast period.

The United States cheese concentrates market is supported by a mature dairy industry, strong food processing infrastructure, and high per capita cheese consumption. Major food and beverage manufacturers rely on cheese concentrates to ensure flavor consistency across large-scale production. Government food safety regulations and labeling standards influence product development, encouraging compliance-driven innovation. The expansion of quick-service restaurants, ready-to-eat meals, and snack foods further fuels demand. Technological advancements in dairy processing and strong investment in research and development enhance product quality and functional performance. The presence of well-established distribution networks and cold-chain logistics also supports market stability and sustained adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Cheese Concentrates Market

Europe Cheese Concentrates Market size is projected to reach USD 665 million in 2025 at a compound annual growth rate of 5.1% over its forecast period.

Europe represents a well-established market for cheese concentrates, driven by strong culinary traditions and a highly regulated food industry. Stringent food quality and safety standards promote the use of standardized, high-quality cheese ingredients. Regional sustainability initiatives and environmental policies encourage clean-label production and responsible sourcing of dairy inputs. Countries such as Germany, France, and the Netherlands lead adoption due to their advanced dairy sectors and robust processed food industries. Innovation focuses on organic, reduced-salt, and specialty flavor concentrates. The market benefits from cross-border trade within the region and consistent demand from bakery, snack, and ready-meal manufacturers.

Japan Cheese Concentrates Market

Japan Cheese Concentrates Market size is projected to reach USD 95 million in 2025 at a compound annual growth rate of 5.5% over its forecast period.

Japan’s cheese concentrates market is experiencing steady growth due to increasing Western dietary influence and demand for convenience foods. Food manufacturers utilize cheese concentrates to create consistent flavors suited to local taste preferences, which favor mild and balanced profiles. Government support for food innovation and strict quality standards contribute to stable market conditions. Urbanization and busy lifestyles drive demand for ready meals and packaged snacks, supporting concentrate usage. However, cultural preference for traditional foods presents adoption challenges. Despite this, innovation in fusion cuisine, premium packaged foods, and foodservice offerings continues to create growth opportunities.

Cheese Concentrates Market: Key Takeaways

- Market Growth: The Cheese Concentrates Market size is expected to grow by USD 1.0 billion, at a CAGR of 5.2%, during the forecasted period of 2026 to 2034.

- By Type: The cheddar segment is anticipated to get the majority share of the Cheese Concentrates Market in 2025.

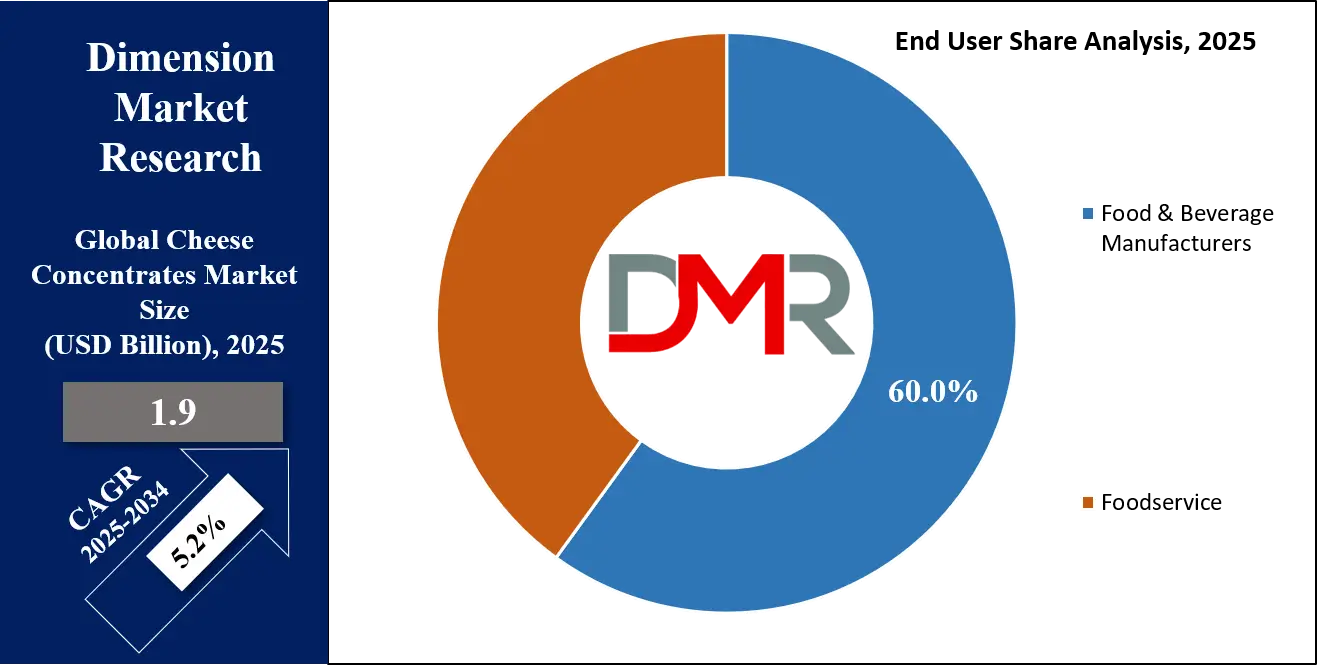

- By End User: The food & beverages manufacturers segment is expected to get the largest revenue share in 2025 in the Cheese Concentrates Market.

- Regional Insight: Europe is expected to hold a 35.0% share of revenue in the Global Cheese Concentrates Market in 2025.

- Use Cases: Some of the use cases of Cheese Concentrates include flavor enhancement, nutritional products, and more.

Cheese Concentrates Market: Use Cases

- Flavor Enhancement: Used to intensify cheese taste in sauces, snacks, and dips while reducing raw cheese usage.

- Processed Food Manufacturing: Ensures uniform flavor and extended shelf life in ready meals and packaged foods.

- Foodservice Applications: Supports consistency and ease of handling in quick-service and HoReCa operations.

- Nutritional Products: Enables formulation of high-protein, low-fat, or lactose-free food products.

Stats & Facts

- United States Department of Agriculture states U.S. cheese production exceeded 13 million metric tons in 2024.

- European Commission reports dairy ingredient exports grew by approximately 4.2% in 2025.

- Japan Ministry of Agriculture notes processed dairy food consumption increased by 3.8% in 2024.

- Food and Agriculture Organization indicates global dairy ingredient demand rose by 4% in 2025.

- United States Census Bureau records processed food manufacturing output growth of 3.5% in 2024.

Market Dynamic

Driving Factors in the Cheese Concentrates Market

Rising Demand for Processed and Convenience Foods

The increasing consumption of processed and convenience foods is a major driver of the cheese concentrates market. Urbanization, dual-income households, and time-constrained lifestyles have led consumers to prefer ready-to-eat and easy-to-prepare foods. Cheese concentrates enable manufacturers to deliver consistent flavor, reduce preparation time, and extend product shelf life. Their versatility across snacks, sauces, bakery products, and frozen meals makes them a preferred ingredient. Additionally, foodservice operators benefit from simplified storage and handling, reinforcing widespread adoption across both retail and institutional channels.

Advancements in Dairy Processing Technologies

Technological innovation in dairy processing has significantly improved the quality and functionality of cheese concentrates. Modern filtration, fermentation, and drying techniques enhance flavor retention, solubility, and nutritional value. These advancements allow manufacturers to develop application-specific concentrates with controlled fat, salt, and protein content. Improved efficiency also reduces production costs and minimizes waste, making concentrates economically attractive. As technology continues to evolve, it supports product differentiation and expands the scope of cheese concentrate applications.

Restraints in the Cheese Concentrates Market

High Production and Processing Costs

High capital investment and operational costs associated with advanced dairy processing technologies act as a restraint on market growth. Equipment for filtration, drying, and quality control requires substantial upfront expenditure, which can be challenging for small and medium-sized producers. Additionally, fluctuations in milk prices and energy costs affect profitability. Compliance with stringent food safety and quality regulations further increases operational complexity, limiting entry for new players and slowing expansion in cost-sensitive markets.

Regulatory and Labeling Challenges

Strict regulatory frameworks governing dairy products can hinder rapid market expansion. Compliance with varying regional standards related to additives, allergens, and nutritional labeling increases product development time and cost. Manufacturers must frequently reformulate products to meet evolving regulations, which can delay market entry. In some regions, consumer skepticism toward processed ingredients also affects adoption, requiring additional transparency and education efforts from producers.

Opportunities in the Cheese Concentrates Market

Expansion in Emerging Markets

Emerging economies present significant growth opportunities for the cheese concentrates market. Rising disposable incomes, urbanization, and growing exposure to Western diets are driving demand for processed foods. Food manufacturers in these regions are increasingly adopting cheese concentrates to improve flavor consistency and production efficiency. Limited local cheese production capacity further enhances the appeal of concentrates. As infrastructure and cold-chain logistics improve, market penetration is expected to accelerate.

Growth of Clean-Label and Functional Foods

The growing consumer preference for clean-label and functional foods offers strong opportunities for cheese concentrate producers. Demand for products with reduced fat, lower sodium, high protein, and minimal additives is increasing. Manufacturers can leverage advanced processing to create concentrates that meet these criteria while maintaining taste and functionality. This trend supports premium pricing and product differentiation, particularly in health-focused and specialty food segments.

Trends in the Cheese Concentrates Market

Clean-Label and Natural Ingredient Focus

Clean-label trends are reshaping the cheese concentrates market as consumers seek transparency and natural ingredients. Manufacturers are reducing artificial additives and emphasizing minimal processing. This trend drives innovation in fermentation and enzymatic processes that preserve natural flavor while meeting labeling expectations. Clean-label concentrates are increasingly used in premium and health-oriented food products.

Customization and Application-Specific Formulations

Customization is becoming a key trend as food manufacturers demand concentrates tailored to specific applications. Customized flavor intensity, texture, and nutritional profiles allow better product differentiation. Advances in processing enable precise control over concentrate characteristics, supporting use in diverse applications such as bakery, snacks, and sauces. This trend enhances value creation and long-term supplier partnerships.

Impact of Artificial Intelligence in Cheese Concentrates Market

- Process Optimization: AI improves efficiency and consistency in concentration and drying operations.

- Quality Monitoring: Artificial Intelligence systems detect flavor and texture deviations in real time.

- Demand Forecasting: Predicts ingredient demand to optimize production planning.

- Product Innovation: Analyzes consumer data to guide flavor and formulation development.

- Supply Chain Management: Enhances inventory control and reduces raw material waste.

Research Scope and Analysis

By Type Analysis

Cheddar cheese concentrates dominate the global cheese concentrates market due to their broad consumer acceptance, strong flavor intensity, and adaptability across multiple food applications. In 2025, cheddar concentrates account for approximately 38% of the global market share, supported by their extensive use in snacks, sauces, dressings, ready meals, and processed foods. The sharp and well-defined flavor profile allows manufacturers to achieve desired taste outcomes using lower quantities, improving cost efficiency without compromising quality.

Cheddar concentrates are especially favored by packaged food producers and foodservice operators seeking consistency across large production volumes. Ongoing innovation in reduced-fat, low-sodium, and clean-label cheddar formulations aligns with evolving consumer preferences for healthier and transparent ingredients. These factors collectively reinforce cheddar’s leadership position and sustained demand across both retail and foodservice channels.

Mozzarella cheese concentrates represent the fastest-growing segment, driven by increasing global consumption of pizzas, baked products, and ready-to-eat meals. Their mild, creamy flavor and superior melting and stretching properties make them highly suitable for convenience foods and foodservice applications. Growing demand from quick-service restaurants, cloud kitchens, and frozen food manufacturers has accelerated adoption, particularly in urban markets.

Mozzarella concentrates offer functional advantages such as uniform melt, improved texture, and consistent performance during high-temperature processing. Manufacturers are investing in innovations that enhance stretchability, mouthfeel, and moisture control to meet application-specific needs. Additionally, the expansion of Western-style diets in emerging economies is boosting mozzarella concentrate usage. These combined factors position mozzarella concentrates as a key growth contributor within the overall market.

By Form Analysis

Powdered cheese concentrates hold approximately 45% of the market share in 2025, making them the leading form segment. Their dominance is driven by advantages such as long shelf life, ease of storage, and high versatility across food applications. Powder forms are widely used in snacks, seasonings, bakery mixes, and instant food products due to their stability and ease of incorporation into dry formulations. Lower transportation and handling costs further enhance their attractiveness for large-scale food manufacturers.

Technological advancements in spray drying and encapsulation have significantly improved flavor retention, solubility, and heat stability. These improvements allow powdered concentrates to deliver consistent taste while maintaining nutritional integrity. As demand for convenience foods and scalable production continues to rise, powdered cheese concentrates remain the preferred choice across multiple end-use industries.

Paste cheese concentrates are experiencing rapid growth, primarily due to increasing demand from sauces, dips, spreads, and ready-meal applications. Their semi-solid texture allows smooth blending and uniform dispersion, making them ideal for wet and semi-wet food formulations. Paste concentrates deliver strong flavor impact while maintaining desirable mouthfeel and texture consistency. They are particularly favored in premium food products and foodservice environments where immediate usability and flavor control are essential.

Growth in the quick-service restaurant sector and rising demand for freshly prepared foods have further supported adoption. Additionally, paste concentrates enable manufacturers to customize flavor intensity and viscosity for specific applications. As product innovation continues and consumer demand for indulgent yet convenient foods rises, paste cheese concentrates are expected to witness sustained growth.

By Application Analysis

Processed food products account for nearly 42% of the cheese concentrates market share in 2025, reflecting their extensive use in ready meals, frozen foods, canned products, and packaged snacks. Cheese concentrates provide manufacturers with consistent flavor delivery, cost optimization, and scalability, which are critical in high-volume processed food production. They help reduce dependency on natural cheese while offering improved shelf stability and simplified storage. Rising global demand for convenient, ready-to-eat foods driven by urbanization and busy lifestyles continues to strengthen this segment.

Additionally, advancements in processing technologies allow cheese concentrates to maintain flavor integrity during cooking and reheating. These functional and economic benefits make cheese concentrates indispensable in processed food manufacturing, sustaining this segment’s leading position.

The snacks and savory products segment is expanding rapidly due to changing eating habits and increased preference for on-the-go snacking. Cheese concentrates are widely used to deliver bold, consistent flavors in chips, extruded snacks, crackers, and savory bakery items. Their strong flavor potency enables effective seasoning while maintaining product stability and shelf life.

Innovation in flavor combinations and regional taste profiles has further boosted demand in this segment. Manufacturers favor cheese concentrates for their ease of application and ability to withstand high-temperature processing during snack production. Growth in premium and flavored snack categories, along with rising consumption in emerging markets, continues to drive adoption. As snacking becomes a dominant dietary trend, cheese concentrates play a critical role in meeting flavor and performance expectations.

By End User Analysis

Food and beverage manufacturers represent the dominant end-user segment in the cheese concentrates market, accounting for approximately 60% of total market share in 2025. This dominance is driven by large-scale production requirements, where consistency, cost efficiency, and shelf stability are critical. Cheese concentrates allow manufacturers to standardize flavor profiles across batches while reducing dependency on natural cheese, which is subject to price volatility and storage constraints.

Their use is widespread across processed foods, snacks, sauces, bakery items, and ready meals. Advanced formulations enable precise control over fat, salt, and protein content, supporting clean-label and health-focused product lines. Continuous innovation and long-term supply agreements further strengthen adoption among manufacturers, reinforcing this segment’s leadership position.

The foodservice segment is the fastest-growing end user, driven by the expansion of quick-service restaurants, cafés, cloud kitchens, and catering services. Cheese concentrates are favored in foodservice operations due to their ease of handling, reduced preparation time, and consistent flavor delivery across multiple outlets. They help operators maintain uniform taste standards while managing costs and minimizing food waste. Rising demand for pizzas, burgers, sauces, and ready-to-serve meals has accelerated usage in both organized and unorganized foodservice sectors.

Additionally, growth in urban dining, takeaway, and delivery-based food models has increased reliance on concentrated ingredients that offer operational efficiency. As foodservice chains continue to scale globally, cheese concentrates are becoming a core ingredient in menu standardization strategies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Cheese Concentrates Market Report is segmented on the basis of the following:

By Type

- Cheddar

- Mozzarella

- Parmesan

- Swiss

- Others

By Form

By Application

- Processed Food Products

- Snacks & Savory Products

- Sauces, Dips & Dressings

- Bakery & Ready Meals

By End User

- Food & Beverage Manufacturers

- Foodservice (HoReCa)

Regional Analysis

Leading Region in the Cheese Concentrates Market

Europe leads the global cheese concentrates market, holding an estimated 35% market share in 2025, supported by a highly developed dairy ecosystem and long-established cheese consumption culture. The region benefits from advanced dairy processing infrastructure, strong supply chain integration, and consistent access to high-quality raw milk. Stringent food safety, quality, and labeling standards encourage the use of standardized cheese concentrates in large-scale food manufacturing.

High demand for processed foods, bakery products, sauces, and ready meals across Western and Central Europe further supports market leadership. Sustainability initiatives and environmental regulations have accelerated innovation in clean-label, organic, and reduced-sodium cheese concentrates. Additionally, manufacturers in Europe actively invest in research and development to enhance flavor performance and nutritional profiles. These factors collectively reinforce Europe’s dominant position and sustained leadership in the global cheese concentrates market.

Fastest Growing Region in the Cheese Concentrates Market

Asia-Pacific is the fastest-growing region in the cheese concentrates market, driven by rapid urbanization, rising disposable incomes, and changing dietary preferences. Expanding middle-class populations are increasingly adopting Western-style diets, boosting demand for pizzas, snacks, bakery items, and ready-to-eat foods that utilize cheese concentrates. Growth in food processing industries and quick-service restaurant chains across emerging economies has accelerated ingredient demand.

Governments in several countries are supporting food manufacturing through infrastructure development and investment incentives, improving production capacity and supply chain efficiency. Additionally, increasing exposure to international cuisines and the expansion of modern retail formats are enhancing consumer acceptance of cheese-based products. These combined factors are driving strong growth momentum for cheese concentrates across the Asia-Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The cheese concentrates market is characterized by moderate to high entry barriers due to capital-intensive processing requirements and strict regulatory compliance. Competitive strategies focus on product innovation, clean-label reformulation, and application-specific solutions. Companies invest heavily in research and development to improve flavor performance and functionality. Strategic partnerships with food manufacturers and long-term supply agreements enhance market positioning. Operational efficiency, supply chain reliability, and sustainability initiatives are key differentiators shaping competitive dynamics.

Some of the prominent players in the global Cheese Concentrates are:

- Lactalis Group

- Arla Foods

- Kerry Group

- DSM-Firmenich

- Fonterra Co-operative Group

- FrieslandCampina

- Savencia Fromage & Dairy

- Chr. Hansen Holding

- Glanbia plc

- Danone

- Bel Group

- Associated British Foods (ABF Ingredients)

- Royal DSM

- Saputo Inc.

- Emmi Group

- Valio Ltd

- Ingredion Incorporated

- Cargill Incorporated

- Tate & Lyle

- Corbion

- Other Key Players

Recent Developments

- In October 2024, Arla Foods Ingredients announced a significant investment to expand its cheese concentrate production capacity in Europe. The investment aimed to support rising demand from processed food and foodservice sectors. The expansion included advanced filtration and drying technologies to improve efficiency and reduce environmental impact. This move reinforced Arla’s focus on innovation, sustainability, and meeting growing global demand for high-quality dairy ingredients.

- In March 2024, Kerry Group launched a new range of clean-label cheese concentrates designed for reduced-sodium snack applications. The launch focused on maintaining flavor intensity while meeting health-conscious consumer demand. The product line targets snack manufacturers seeking natural ingredients with improved processing performance. Kerry emphasized sustainable sourcing and advanced fermentation techniques to enhance flavor retention, positioning the launch as a strategic move to strengthen its ingredient solutions portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.9 Bn |

| Forecast Value (2034) |

USD 3.0 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By ACaaS Deployment (Hosted, Managed, Hybrid), By Authentication Method (Single-Factor, Multi-Factor, Mobile Credential/Bluetooth LE), By Connectivity Technology (RFID/NFC, Smart Cards, Bluetooth Low Energy, Ultra-Wideband), By Technology (Authentication Systems, Detection Systems, Alarm Panels, Communication Devices, Perimeter Security Systems), By End-Use Vertical (Commercial Buildings, Industrial & Manufacturing, Government & Public Sector, Military & Defense, Transport & Logistics, Healthcare, Residential & Smart Homes, Education & Research, Energy & Utilities, Hospitality & Entertainment, Retail & Customer-Facing, Financial Institutions, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Lactalis Group, Arla Foods, Kerry Group, DSM-Firmenich, Fonterra Co-operative Group, FrieslandCampina, Savencia Fromage & Dairy, Chr. Hansen Holding, Glanbia plc, Danone, Bel Group, Associated British Foods (ABF Ingredients), Royal DSM, Saputo Inc., Emmi Group, Valio Ltd, Ingredion Incorporated, Cargill Incorporated, Tate & Lyle, Corbion, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Cheese Concentrates Market?

▾ The Global Cheese Concentrates Market size is expected to reach a value of USD 1.9 billion in 2025 and is expected to reach USD 3.0 billion by the end of 2034.

Which region accounted for the largest Global Cheese Concentrates Market?

▾ Europe is expected to have the largest market share in the Global Cheese Concentrates Market, with a share of about 35.0% in 2025.

How big is the Cheese Concentrates Market in the US?

▾ The US Cheese Concentrates market is expected to reach USD 0.5 billion by 2025.

Who are the key players in the Cheese Concentrates Market?

▾ Some of the major key players in the Global Cheese Concentrates Market include Danone, Lactalis, DSM, and others

What is the growth rate in the Global Cheese Concentrates Market?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period