Market Overview

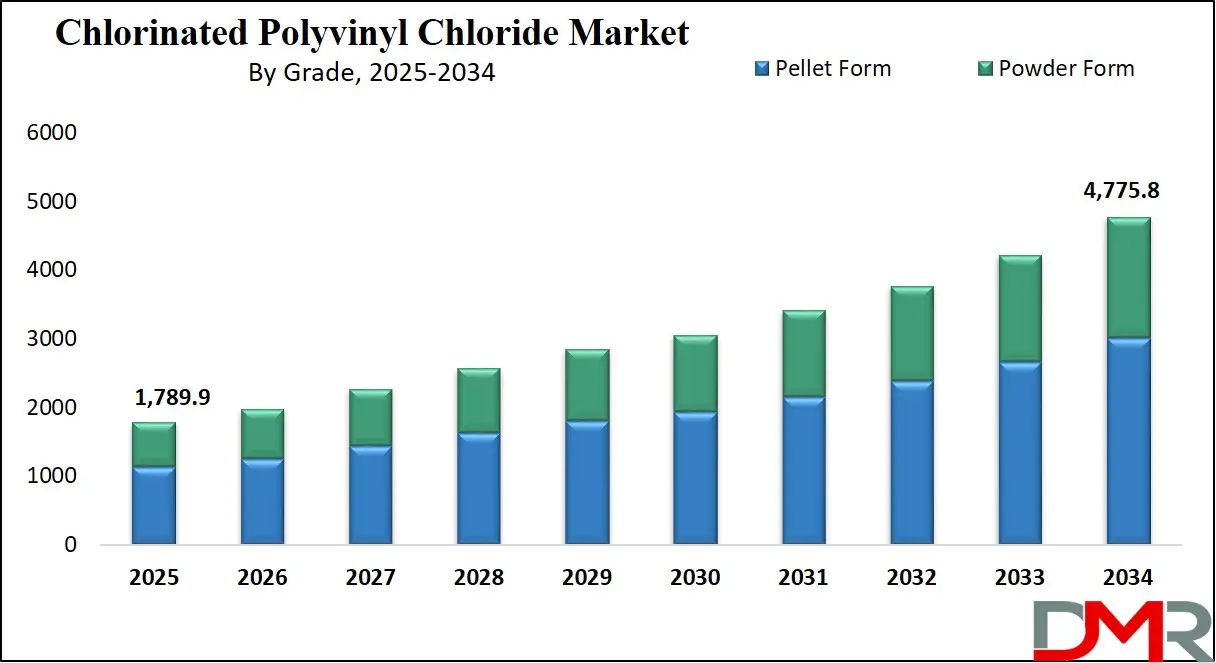

The Global Chlorinated Polyvinyl Chloride Market size is projected to reach

USD 1,789.9 million in 2025 and grow at a compound annual growth rate of

11.5% from there until 2034 to reach a value of

USD 4,775.8 million.

The global chlorinated polyvinyl chloride (CPVC) market is experiencing a steady rise spurred by the increased demand for thermoplastic piping solutions in the construction and industrial sectors. CPVC's superior resistance to heat, corrosion, and chemicals makes it well-suited for plumbing, fire sprinkler systems, and chemical handling.

One major trend is the increasing demand for CPVC in green building applications. With its durability, energy efficiency, and recyclability, CPVC is replacing conventional piping systems increasingly. Increasing residential and commercial construction in developing countries is also driving demand. Marketers are investing in technological development to provide better performance, for example, UV resistance and pressure resistance.

A potential exists in the expanding industrialization in Asia-Pacific and the Middle East. The explosion of chemical processing, water treatment facilities, and energy production industries offers a rich avenue for the expansion of CPVC. Additionally, heightened fire protection regulations around the global are driving demand for CPVC-based fire sprinkler systems.

Nonetheless, a key constraint is volatility in the prices of raw materials, notably chlorine and ethylene, affecting production costs. Concerns relating to the environment about PVC-based products and compliance issues in particular markets also restrain wider adoption.

With buoyant demand from the construction, chemical, and electrical industries, combined with positive regulatory advancements in fire protection systems, the market for CPVC is set for long-term growth, especially in emerging economies where infrastructure spending is picking up pace.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Chlorinated Polyvinyl Chloride Market

The US Chlorinated Polyvinyl Chloride Market is projected to reach

USD 466.6 million in 2025 at a compound annual growth rate of

10.8% over its forecast period.

The U.S. CPVC market is a key area globally, backed by the massive construction industry in the country, old water infrastructure, and stringent building regulations. The U.S. market will continue to grow steadily, driven by residential plumbing and commercial fire protection system demand. With more than 80% urbanization and a population of over 330 million, there is ongoing demand for advanced plumbing solutions, retrofitting, and energy-efficient infrastructure, all applications where CPVC is superior.

CPVC’s appeal in the U.S. lies in its superior corrosion resistance, ease of installation, and performance in high-temperature applications. The replacement of aging galvanized steel and copper piping in older buildings is driving adoption. CPVC is also the material of choice for National Fire Protection Association (NFPA)-compliant fire sprinkler systems due to its proven reliability and compliance with safety standards.

The demographic strength of the country lies in a vast pool of homeowners, an aging building stock, and a labor force committed to green building principles. Federal incentives for green buildings further encourage the use of CPVC in LEED-certified buildings.

Domestic market challenges, though, are represented by price fluctuations in chlorine supply and the availability of substitute thermoplastics such as PEX. Despite this, CPVC producers based in the U.S. are investing in scale-up in production and technology enhancement, underpinning the nation's leadership in product adoption and innovation. The U.S. market is poised to gain considerably from infrastructure modernization bills and climate-resilient construction initiatives, cementing its central role in the international CPVC market.

The European Chlorinated Polyvinyl Chloride Market

The European Chlorinated Polyvinyl Chloride Market is expected to achieve a market size of USD 440.3 million by 2025. This figure is projected to grow at a compound annual growth rate (CAGR) of 8.9%, reaching USD 948.5 million by the end of 2034.

Europe's chlorinated polyvinyl chloride (CPVC) market is growing steadily, supported by sustainable construction projects, stringent fire safety standards, and increasing refurbishment activity on aging infrastructure. Germany, the UK, France, and Italy are major consumers, especially in applications requiring long-lasting piping systems and fire-protection installations.

One of the key drivers is the European Union's Green Deal, which is encouraging sustainable building practices. The long lifespan of CPVC, its recyclability, and the low environmental impact during use also fit with this policy. Beyond that, tightened building codes have made CPVC more important to fire sprinkler systems in commercial and multi-family buildings.

Europe's population strength is a double-digit figure of more than 740 million, with many of them settled in urban areas where modern infrastructure and replacements are essential. The continent also boasts one of the highest rates of renovation and retrofitting globally, making it a healthy market for CPVC use.

However, the market faces challenges from the growing demand for bio-based and fully recyclable materials, which may push CPVC manufacturers toward innovation in green chemistry. Inconsistent raw material supply from outside the EU and regulatory complexities surrounding plastics are also ongoing hurdles.

However, the CPVC market in Europe is well-positioned for growth, driven by its integration into sustainable urban planning, strong demand for public infrastructure modernization, and technological innovation in the construction and industrial segments.

The Japan Chlorinated Polyvinyl Chloride Market

The Japan Chlorinated Polyvinyl Chloride Market is projected to reach USD 89.5 million by 2025, with a CAGR of 9.1%. By the end of the forecast period, this growth trajectory will push the market size to USD 196.0 million in 2034.

Japan’s chlorinated polyvinyl chloride (CPVC) market is characterized by advanced technology adoption, high safety standards, and a strong emphasis on durable infrastructure. The Japanese market is expected to grow at a moderate pace, supported by demand in construction, manufacturing, and public utilities. CPVC’s fire-retardant properties and chemical resistance make it suitable for Japan’s earthquake-prone urban environment, where building materials must ensure both resilience and safety.

Japan's demographic advantage lies in its dense urban population, with over 90% of its 125 million residents living in cities. This concentration drives the need for compact, reliable, and long-lasting piping and fire protection systems core applications of CPVC. The country’s aging infrastructure and consistent retrofitting efforts in both residential and commercial spaces fuel ongoing demand.

CPVC’s use in water distribution systems is growing as municipalities upgrade older metal piping with more sustainable, corrosion-resistant alternatives. In the industrial segment, CPVC is used in electronics manufacturing and chemical plants, aligning with Japan’s high-tech industrial base.

However, challenges persist due to Japan’s rigorous environmental regulations on plastics and growing consumer awareness of eco-friendly materials. These factors could slow down CPVC adoption unless manufacturers invest in greener production techniques.

Still, Japan’s commitment to high-performance materials, combined with its focus on safety, longevity, and minimal maintenance, ensures CPVC will remain a strategic choice for many sectors. Ongoing investments in disaster-resistant infrastructure and smart cities further underscore its market relevance in the region.

Global Chlorinated Polyvinyl Chloride Market: Key Takeaways

- Global Market Share Insights: The Global Chlorinated Polyvinyl Chloride Market size is estimated to have a value of USD 1,789.9 million in 2025 and is expected to reach USD 4,775.8 million by the end of 2034.

- The US Market Share Insights: The US Chlorinated Polyvinyl Chloride Market is projected to be valued at USD 466.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,174.1 million in 2034 at a CAGR of 8.0%.

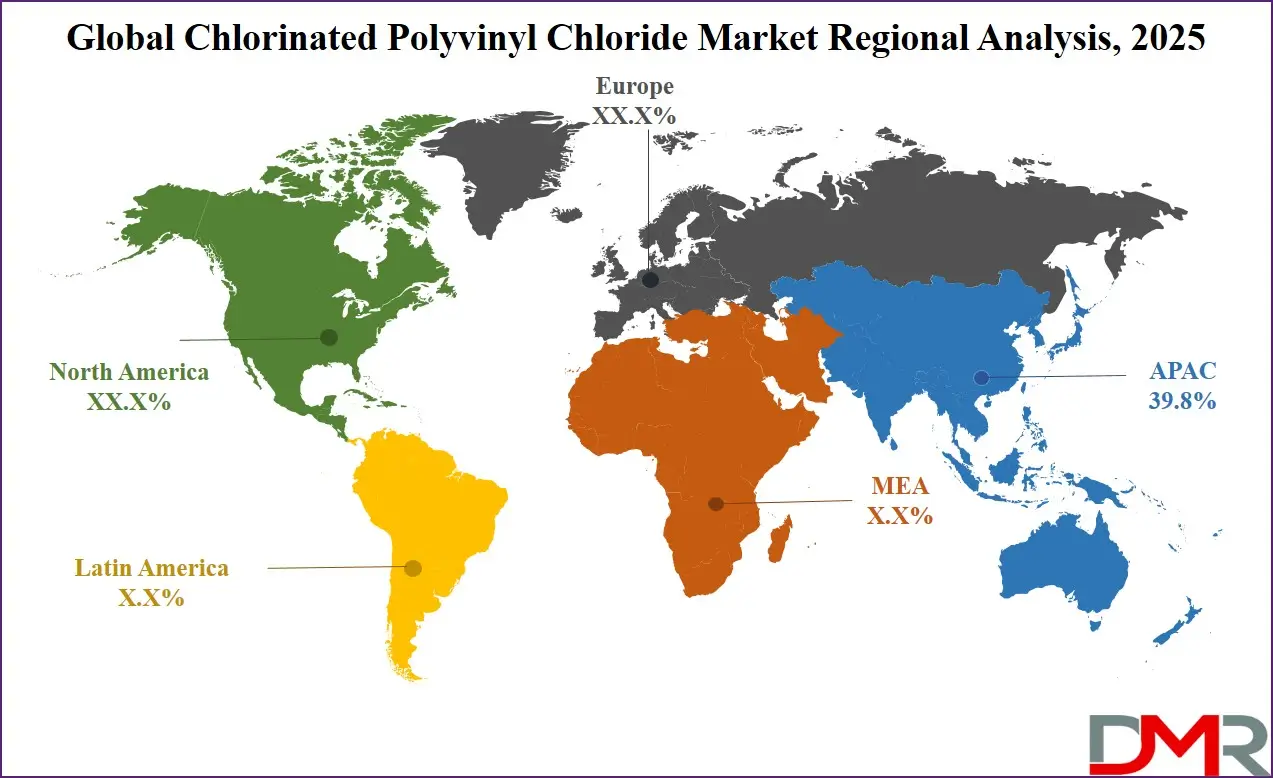

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Chlorinated Polyvinyl Chloride Market with a share of about 39.8% in 2025.

- Key Players: Some of the major key players in the Global Chlorinated Polyvinyl Chloride Market are Lubrizol Corporation, Sekisui Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., Kaneka Corporation, Shandong Xuye New Materials Co., Ltd., Axiall Corporation (now part of Westlake Chemical), Westlake Chemical Corporation, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 11.5 percent over the forecasted period of 2025.

Global Chlorinated Polyvinyl Chloride Market: Use Cases

- Hot Water Piping Systems: CPVC pipes are an excellent choice for residential and commercial hot water systems due to their heat resistance, durability, corrosion-resistance, and ease of maintenance compared to metal piping, providing long-term reliability and energy efficiency in plumbing infrastructure.

- Fire Sprinkler Systems: CPVC's inherent fire resistance makes it an excellent material choice for fire protection systems in schools, hospitals, and offices, providing cost-effective, lightweight protection with high occupancy structures. This application it meets global fire safety standards.

- Chemical Handling Equipment: Chemical Handling Equipment. Due to its excellent resistance against acids, bases, and other corrosive chemicals, CPVC tubing is widely utilized for fluid transport in chemical plants and laboratories for safe fluid transport without leakage concerns or long-term system integrity issues under extreme industrial conditions.

- Industrial Wastewater Transport: CPVC pipe provides efficient transport of aggressive industrial wastewater in manufacturing plants, offering superior corrosion resistance over metals and standard PVC, providing durability, safety, and reduced maintenance requirements in waste discharge systems in chemically reactive environments.

- Power Cable Insulation and Casing: Power Cable Insulation and Casing. Used extensively in electrical systems, CPVC provides excellent thermal stability and insulation properties for power cables. This protects their wiring in industrial and commercial properties against heat, moisture, mechanical damage, and increased operational efficiencies, thus improving both safety and operational efficiencies.

Global Chlorinated Polyvinyl Chloride Market: Market Dynamics

Driving Factors in the Global Chlorinated Polyvinyl Chloride Market

Expanding Infrastructure Development in Emerging Economies

The rapid urbanization and industrialization in emerging economies, particularly in Asia-Pacific and Latin America, are propelling infrastructure development, thereby driving CPVC demand. Governments in countries like India, China, and Brazil are investing heavily in building water supply systems, sewage networks, and affordable housing projects. CPVC's advantages, such as ease of installation, low maintenance, and resistance to corrosion and high temperatures, make it a preferred material for these infrastructure projects. For example, India's "Smart Cities Mission" and China's "New Urbanization Plan" emphasize the development of sustainable and resilient urban infrastructure, where CPVC plays a crucial role.

Moreover, international funding agencies and public-private partnerships are supporting infrastructure projects in these regions, further boosting CPVC adoption. As these economies continue to grow, the demand for reliable and cost-effective piping solutions like CPVC is expected to rise, solidifying its market position.

Stringent Fire Safety Regulations

Increasing awareness of fire safety and the implementation of stringent regulations are driving the adoption of CPVC in fire protection systems. CPVC's inherent flame retardancy, low smoke generation, and compliance with international fire safety standards make it an ideal material for fire sprinkler systems in residential, commercial, and industrial buildings. Regulatory bodies in regions like North America and Europe mandate the use of certified fire-resistant materials, thereby encouraging the use of CPVC in new constructions and retrofitting projects. Additionally, insurance companies often offer incentives for buildings equipped with approved fire suppression systems, further promoting CPVC adoption.

Manufacturers are also developing specialized CPVC formulations tailored for fire protection applications, enhancing system reliability and performance. As fire safety continues to be a critical concern globally, the demand for CPVC in this segment is poised for significant growth.

Restraints in the Global Chlorinated Polyvinyl Chloride Market

Environmental and Health Concerns

Despite its advantages, CPVC faces scrutiny over environmental and health concerns associated with its production and disposal. The manufacturing process involves chlorination, which can release harmful byproducts if not properly managed. Additionally, the incineration of CPVC waste can produce toxic gases like dioxins, posing environmental and health risks. These issues have led to increased regulatory oversight and public opposition in certain regions, potentially limiting its adoption.

As global sustainability awareness grows, pressure is mounting on manufacturers to adopt cleaner production methods and improve end-of-life recyclability. The use of additives such as chlorine and traditional stabilizers, like lead-based compounds, has drawn criticism from environmental groups and policymakers.

Some regions have already implemented bans or restrictions on such additives, pushing companies to redesign their formulations, often at significant cost. Additionally, public perception of plastic-based materials in general is shifting due to the global plastic waste crisis, and CPVC, as a synthetic polymer, is not immune to this scrutiny. As a result, despite CPVC's technical and cost advantages, these environmental and health-related concerns may act as a restraint on market growth unless the industry adopts transparent, sustainable practices and communicates them effectively to both regulators and consumers.

Competition from Alternative Materials

CPVC faces growing competition from alternative materials that offer comparable or superior performance in specific applications, potentially restraining its market expansion. Materials such as cross-linked

polyethylene (PEX), polypropylene random copolymer (PPR), and stainless steel are increasingly being used in piping systems due to their specific advantages in flexibility, chemical resistance, and mechanical strength. For instance, PEX pipes are easier to install in complex layouts due to their flexibility, while stainless steel offers exceptional durability and aesthetic appeal in visible installations. In industrial settings, high-density polyethylene (HDPE) is preferred for its impact resistance and fusion-welded joints, which reduce leakage risks.

Moreover, these alternative materials often face fewer environmental concerns, especially when produced using advanced, non-toxic processes. The growing availability of these alternatives in both developed and emerging markets, along with competitive pricing and favorable perception, could limit CPVC’s market penetration. Manufacturers must therefore innovate and differentiate their CPVC offerings by emphasizing performance enhancements, sustainability, and lifecycle cost advantages to remain competitive in a diversified material landscape.

Opportunities in the Global Chlorinated Polyvinyl Chloride Market

Penetration into Untapped Markets

There exists substantial growth potential for CPVC in untapped markets across Africa, the Middle East, and Southeast Asia. These regions are witnessing increased investments in infrastructure, urban development, and industrialization, creating a demand for reliable piping solutions. However, the adoption of CPVC in these markets remains relatively low due to factors like limited awareness and availability.

By establishing local manufacturing facilities, forming strategic partnerships, and conducting educational campaigns, CPVC manufacturers can effectively penetrate these markets. For instance, setting up joint ventures with local companies can facilitate market entry and compliance with regional regulations. Additionally, offering training programs for installers and contractors can enhance product acceptance and usage. Capitalizing on these opportunities can significantly expand CPVC's global footprint and revenue streams.

Development of Eco-friendly CPVC Variants

The growing emphasis on sustainability presents an opportunity for the development of eco-friendly CPVC variants. Consumers and regulators are increasingly demanding materials with reduced environmental impact, prompting manufacturers to innovate. Research is underway to create CPVC formulations with bio-based plasticizers, lead-free stabilizers, and enhanced recyclability. Such advancements can improve CPVC's environmental profile, making it more appealing in green building projects and industries with strict sustainability criteria.

Moreover, obtaining certifications like Environmental Product Declarations (EPDs) and meeting standards like the Restriction of Hazardous Substances (RoHS) can enhance market competitiveness. By aligning product development with sustainability goals, CPVC manufacturers can tap into new market segments and meet the evolving needs of environmentally conscious consumers.

Trends in the Global Chlorinated Polyvinyl Chloride Market

Surge in Sustainable Construction Practices

The global construction industry is increasingly embracing sustainable building practices, leading to a significant uptick in the demand for eco-friendly materials like CPVC. CPVC's attributes such as corrosion resistance, durability, and thermal stability make it an ideal choice for green buildings aiming for certifications like LEED. Its long service life reduces the need for frequent replacements, thereby minimizing environmental impact. Moreover, CPVC's recyclability aligns with the circular economy principles, further enhancing its appeal in sustainable construction. This trend is particularly pronounced in regions like Europe and North America, where stringent environmental regulations and consumer awareness drive the adoption of green materials.

Consequently, manufacturers are investing in R&D to develop CPVC variants with improved environmental profiles, such as lead-free formulations and bio-based additives. This shift not only meets regulatory requirements but also caters to the growing consumer preference for sustainable products, positioning CPVC as a material of choice in the evolving construction landscape.

Technological Advancements in CPVC Production

Technological innovations are reshaping the CPVC market, enhancing product performance and expanding application areas. Advancements in polymerization techniques have led to the development of CPVC grades with superior heat resistance, impact strength, and processability. These improvements enable CPVC to meet the demanding requirements of various industries, including chemical processing, power generation, and high-rise construction. For instance, the introduction of CPVC formulations with enhanced UV resistance has opened new avenues in outdoor applications, such as irrigation systems and solar panel installations.

Additionally, automation and digitalization in manufacturing processes have improved product consistency and reduced production costs, making CPVC more competitive against alternative materials. Collaborations between CPVC manufacturers and technology providers are fostering the development of innovative solutions, such as antimicrobial CPVC pipes for healthcare facilities and CPVC composites for automotive components. These technological strides not only broaden CPVC's application spectrum but also reinforce its position as a high-performance material in the global market.

Global Chlorinated Polyvinyl Chloride Market: Research Scope and Analysis

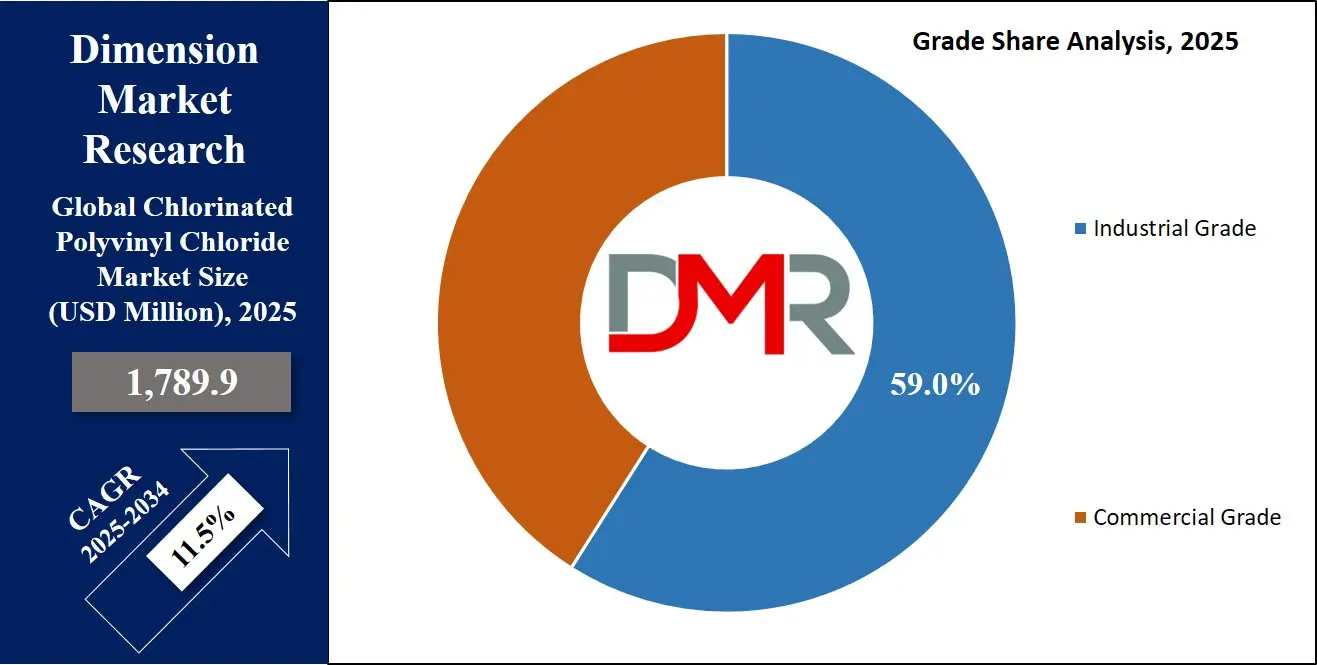

By Grade Analysis

Industrial grade CPVC is expected to maintain a leading position in the global market because of its better mechanical and chemical resistance properties, which make it a must for challenging applications in chemical processing, wastewater treatment, and industrial fluid handling. This CPVC grade is designed to resist high pressure, extreme temperatures, and harsh chemical environments, properties that are critical in industrial infrastructure. In contrast to potable or general-purpose CPVC, the industrial grade has greater tensile strength and impact resistance, with long service life in corrosive and high-stress environments.

Additionally, the fast growth of industrialization in developing economies like India, China, and Brazil is raising the demand for strong piping and ducting solutions, further propelling this segment's growth. Increased investments in factories, oil and gas processing plants, and water recycling plants have intensified the industrial usage of CPVC.

Additionally, laws that require the implementation of non-metallic, corrosion-proof materials in delicate operations, especially in food processing and pharmaceuticals, are propelling the growth of CPVC in industry. With globalwide industries looking for dependable, maintenance-free piping systems that reduce downtime and repair expenses, industrial-grade CPVC emerges as the best option based on its synergy of strength, chemical inertness, and heat efficiency. Such benefits make it the top pick in various industries, making it the market's number one grade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Form Analysis

CPVC pellet form will be the largest player in the global market because it provides utmost ease of transport, storage, and processing across various manufacturing settings. This product enables greater manufacturing efficiency and consistency in extrusion and injection-molding operations that are critical when manufacturing pipes, fittings, sheets, and valves. Pellets are more favored by manufacturers than powder because they are flowable and can melt evenly, minimizing wastage of material and improving product quality. During compounding, pellets facilitate more precise mixing with additives, pigments, and stabilizers, producing products that have certain technical specifications with high reproducibility.

Additionally, pelletized CPVC provides cleaner and safer handling in automated manufacturing processes, reducing airborne dust that may be harmful to health and contaminate equipment. This is a major factor in industries with high safety and environmental requirements. Logistically, pellets are simpler to pack, store, and transport without fear of agglomeration or loss, compared to powder products that have additional protective handling requirements.

Rising automation and standardization of global production facilities, particularly in Europe and North America, have prompted demands for materials that make the processes simpler. Furthermore, the globalwide trend toward prefabricated and modular piping components further increases the demand for pellet-form CPVC, further solidifying its market leadership as the intermediate form of choice for high-volume manufacturing.

By Production Process Analysis

The solvent process is the most likely dominant manufacturing process for chlorinated polyvinyl chloride because of its ability to have accurate control over polymer properties and chlorine content, which leads to consistent product performance in different applications. The solvent process consists of dissolving PVC in a solvent and chlorinating it, leading to homogeneous chlorine incorporation and giving CPVC of high molecular weight and higher thermal stability.

As compared to the aqueous suspension process, the solvent process permits manufacturers to make the CPVC's chemical and physical properties closer to ideal, according to specific industry requirements. This accuracy is especially important in applications needing strict quality control, e.g., fire protection systems and industrial piping.

Also, the solvent process is desirable for manufacturing CPVC grades of high clarity and improved surface finish—properties needed in visible plumbing and architectural applications. Even though it involves greater operational expense through solvent recovery and environmental control, the process provides batch-to-batch consistency, which is essential for upholding performance levels in high-end products.

In addition, the solvent process allows CPVC with greater chlorine content to be produced, which equates to improved heat resistance and flame retardancy. As regulatory bodies globalwide enforce tighter fire and safety requirements in the construction and industrial applications, the solvent-processing of CPVC will grow due to this ability to adhere to specific requirements and regulations. Such has become the key factor for the solvent method's dominance of the CPVC manufacturing industry.

By Application Analysis

Pipes and fittings expected to account for the most prevalent use of CPVC in the globalwide market because the material is unequaled in its ability to transport fluids both in residential and industrial applications. CPVC is resistant to hot temperatures, corrosion, and chemicals, which make it perfect for hot and cold water distribution systems, fire protection sprinkler systems, and industrial fluid handling, all of which are highly dependent on long-lasting piping solutions. The building spree, particularly across Asia-Pacific and the Middle East, has necessitated higher use of dependable plumbing systems, radically expanding the market for CPVC pipe and fitting segments.

Metal piping is far heavier, maintains, and costing, scaling, pitting, and corroding less, not to mention improving the system life and lowering the overall cost of operation. In addition, CPVC piping is simpler to install, and solvent welding technology provides for sturdy, leak-resistant joints that use no welding or threading tools.

This has proved particularly attractive to contractors and builders seeking quick, large-scale implementation in residential, commercial, and institutional applications. Increased focus on sustainable infrastructure also is promoting CPVC use through its energy-efficient manufacturing and recyclability. Combined with growing governmental requirements for non-metallic plumbing in healthcare, hospitality, and schools, piping and fittings remain the most used and application-sensitive type of CPVC in the global market.

By End User Analysis

The construction sector is expected to dominates the CPVC end-user segment due to the material’s extensive utilization in residential, commercial, and institutional infrastructure projects around the global. CPVC’s characteristics such as resistance to heat, flame, and corrosion align well with the stringent requirements of modern construction systems, especially in plumbing, HVAC piping, and fire protection. The surge in global urbanization and government-backed housing and infrastructure initiatives, particularly in developing nations like India, China, and Brazil, has dramatically boosted CPVC consumption.

CPVC is increasingly replacing traditional metal pipes in building construction due to its cost-effectiveness, longer lifespan, and ease of installation, enabling construction companies to deliver faster, safer, and more efficient plumbing solutions. In commercial settings such as malls, hospitals, and hotels, CPVC’s ability to handle high-pressure and high-temperature water systems makes it indispensable. Additionally, with green building certifications such as LEED emphasizing material efficiency and reduced environmental footprint, CPVC has become a preferred piping material due to its relatively low lifecycle emissions and recyclability.

The growth of modular construction and prefabricated building components, which benefit from standardized, lightweight materials like CPVC, is another major factor contributing to the segment's dominance. As smart city initiatives and vertical housing expand globally, the demand for reliable, scalable, and code-compliant piping systems further ensures CPVC's central role in the construction industry.

The Global Chlorinated Polyvinyl Chloride Market Report is segmented on the basis of the following:

By Grade

- Industrial Grade

- Commercial Grade

By Form

By Production Process

- Aqueous Suspension Method

- Solvent Method

- Solid Phase Method

By Application

- Plumbing Systems

- Fire Protection Systems

- Chemical & Industrial Equipment

- Power Cable Casing

- Adhesives & Coatings

- Other Application

By End-Use Industry

- Construction

- Chemical Processing

- Electrical & Electronics

- Agriculture

- Industrial Manufacturing

Global Chlorinated Polyvinyl Chloride Market: Regional Analysis

Region with the Highest Market Share in the Global Chlorinated Polyvinyl Chloride (CPVC) Market

Asia-Pacific is projected to dominate the global CPVC market as it holds

39.8% of market share by the end of 2025, primarily due to rapid urbanization, extensive infrastructure development, and the expanding industrial base across emerging economies such as China, India, and Southeast Asian countries. The region's construction boom, fueled by government-backed affordable housing projects, smart city initiatives, and public infrastructure upgrades, has led to a sharp rise in demand for CPVC pipes and fittings, particularly for hot and cold water systems.

Moreover, growing environmental and safety regulations in countries like Japan and South Korea are encouraging a shift from metal and traditional PVC systems to CPVC, which offers superior heat and chemical resistance. India, a significant growth engine in the region, has witnessed strong domestic manufacturing of CPVC resins and compounds, driven by joint ventures like DCW-Sekisui and Lubrizol's investments. In addition, lower labor costs and supportive policies have attracted global CPVC producers to establish production and distribution networks in the region, ensuring a strong supply chain ecosystem.

The availability of raw materials, expanding middle-class population, and rise in industrialization further contribute to Asia- Pacific's leadership in the global CPVC market.

Region with the Highest CAGR in the Global Chlorinated Polyvinyl Chloride (CPVC) Market

North America is expected to register the highest CAGR in the CPVC market due to its increasing adoption of advanced building materials in construction, heightened fire safety regulations, and a growing preference for sustainable piping solutions. CPVC is gaining traction in residential and commercial sectors as a replacement for aging metal piping systems, owing to its lower maintenance, durability, and ease of installation.

In the U.S., retrofitting of outdated infrastructure and the expansion of healthcare, education, and commercial buildings are major contributors to the rising CPVC demand. Additionally, strict plumbing codes and NFPA-compliant fire safety norms are driving the usage of CPVC in fire sprinkler systems. The presence of major CPVC producers like Lubrizol and Westlake in the U.S. further accelerates innovation and supply responsiveness. Technological advancements and a skilled construction workforce facilitate faster adoption of CPVC, while rising awareness of lifecycle cost benefits over copper piping continues to fuel market growth across the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Chlorinated Polyvinyl Chloride Market: Competitive Landscape

The global CPVC market is highly competitive, with a mix of multinational corporations and regional manufacturers driving innovation, capacity expansion, and strategic alliances. Key players include The Lubrizol Corporation (a Berkshire Hathaway company), Sekisui Chemical Co., Ltd., Westlake Corporation, Kaneka Corporation, and Shandong Xiangsheng New Materials Technology.

These companies dominate the market through vertically integrated operations, robust R&D capabilities, and widespread distribution networks. Lubrizol, a pioneer in CPVC technology, maintains a stronghold via its FlowGuard®, BlazeMaster®, and Corzan® brands, widely adopted in plumbing, fire protection, and industrial systems. Westlake’s acquisition of Axiall Corporation strengthened its market presence in North America and diversified its product offerings.

Meanwhile, Asian manufacturers such as Shandong Xiangsheng and Shandong Tianchen Chemical focus on scaling production and offering competitive pricing to meet the surging demand in regional markets. Strategic partnerships, especially between global chemical firms and local compounding companies, are on the rise to expand geographical reach and enhance technical expertise.

Sustainability, recyclability, and fire-retardant innovations are key focus areas in ongoing product development. As regulatory standards tighten and demand surges in infrastructure and industrial sectors, competition is intensifying, prompting companies to invest in localization, capacity upgrades, and differentiated product portfolios to gain a competitive edge.

Some of the prominent players in the Global Chlorinated Polyvinyl Chloride Market are:

- Lubrizol Corporation

- Sekisui Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Kaneka Corporation

- Shandong Xuye New Materials Co., Ltd.

- Axiall Corporation (now part of Westlake Chemical)

- Westlake Chemical Corporation

- Grasim Industries Limited (Aditya Birla Group)

- KEM ONE

- Hanwha Solutions Corporation

- PolyOne Corporation (now Avient Corporation)

- BASF SE

- Ineos ChlorVinyls

- Arkema Group

- China National Chemical Corporation (ChemChina)

- Tangshan Dacheng Chemical Co., Ltd.

- Panjin Changrui Chemical Industry Co., Ltd.

- Sundow Polymers Co., Ltd.

- Fusion Industries Limited

- Finolex Industries Ltd.

- Other Key Players

Recent Developments in the Global Chlorinated Polyvinyl Chloride Market

- April 2025: Lubrizol Corporation to showcase sustainable, corrosion-resistant CPVC innovations at ACHEMA 2025 in Frankfurt, targeting European chemical processors with recyclable solutions for industrial fluid handling applications.

- April 2025: Shandong Xiangsheng New Materials to expand CPVC resin output by 40 kilotons/year at its Dezhou facility, with operations scheduled to begin in Q1 2026.

- February 2025: Kaneka Corporation partnered with Mitsubishi Chemical Group to co-develop solvent-free CPVC grades for high-performance medical piping applications, enhancing sustainability and compliance.

- February 2025: Westlake Corporation launched the “SmartFlow CPVC” initiative, investing USD 38 million in AI-driven production lines to boost precision, cut waste, and optimize energy use at its Texas facility.

- November 2024: DCW Limited and Sekisui Chemical inaugurated a new CPVC compounding plant in Tamil Nadu, India, to support growing demand in South Asia and the Middle East.

- November 2024: CPVC Global Expo 2024 in Shanghai spotlighted circular economy innovations, with key players like Lubrizol and Westlake exploring CPVC’s role in net-zero building frameworks and recycling technologies.

- August 2024: Astral Limited invested USD 12 million in upgrading its Gujarat CPVC extrusion plant, focusing on pellet-form enhancements and improved thermal resistance for high-performance piping applications.

- August 2024: Sekisui Specialty Chemicals signed a long-term distribution deal with IMCD Group to strengthen CPVC compound access across European and African markets.

- May 2024: Vinyl Institute of Canada hosted the North American PVC & CPVC Conference 2024 in Toronto, addressing fire safety standards, regulatory updates, and CPVC innovation trends.

- May 2024: Shandong Tianchen Chemical adopted a low-VOC solvent process for CPVC production to meet increasing demand from Europe and Japan for eco-friendly thermoplastics.

- March 2024: Lubrizol Corporation expanded its Ohio-based CPVC R&D center to develop sustainable additives and next-gen chlorination techniques aimed at reducing energy consumption by 20%.

- March 2024: Shree Venkatesh International signed an MoU with UAE’s PetroLink to deliver localized CPVC piping solutions for GCC infrastructure development projects.

- January 2024: Westlake Epoxy and Vinyls acquired a minority stake in a Vietnamese CPVC compounder to support its ASEAN expansion in the infrastructure and healthcare sectors.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,789.9 Mn |

| Forecast Value (2034) |

USD 4,775.8 Mn |

| CAGR (2025–2034) |

11.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 466.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Grade (Industrial Grade, Commercial Grade), By Form (Pellet Form, Powder Form), By Production Process (Aqueous Suspension Method, Solvent Method, Solid Phase Method), By Application (Plumbing Systems, Fire Protection Systems, Chemical & Industrial Equipment, Power Cable Casing, Adhesives & Coatings, Other Application), By End-Use Industry (Construction, Chemical Processing, Electrical & Electronics, Agriculture, Industrial Manufacturing) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Lubrizol Corporation, Sekisui Chemical Co. Ltd., Shin-Etsu Chemical Co. Ltd., Kaneka Corporation, Shandong Xuye New Materials Co., Ltd., Axiall Corporation (now part of Westlake Chemical), Westlake Chemical Corporation, Grasim Industries Limited (Aditya Birla Group), KEM ONE, Hanwha Solutions Corporation, PolyOne Corporation (now Avient Corporation), BASF SE, Ineos ChlorVinyls, Arkema Group, China National Chemical Corporation (ChemChina), Tangshan Dacheng Chemical Co., Ltd., Panjin Changrui Chemical Industry Co., Ltd., Sundow Polymers Co., Ltd., Fusion Industries Limited, Finolex Industries Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|