Market Overview

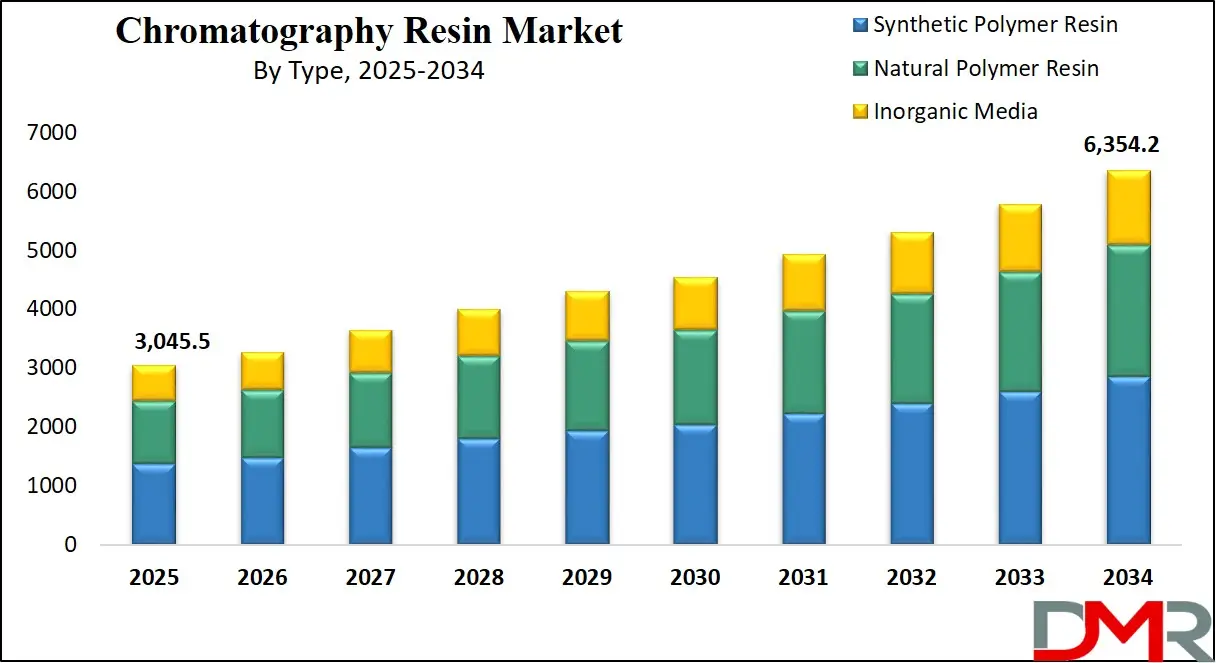

The Global Chromatography Resin Market size is projected to reach

USD 3,045.5 million in 2025 and grow at a compound annual growth rate of

8.5% from there until 2034 to reach a value of

USD 6,354.2 million.

The global chromatography resin market is experiencing steady expansion due to increasing demand across the pharmaceutical, biotech, food, and beverage industries. Chromatography resins are widely utilized in protein purification processes, ion exchange chromatography, affinity chromatography, size exclusion chromatography, and hydrophobic interaction chromatography, which provide highly pure separations. The global chromatography resin market is reaping significant advantages from technological innovations in liquid chromatography and environmental testing, helping fuel its expansion.

By type, the market can be divided into natural resin and synthetic resin, with synthetic resins showing more widespread adoption due to their durability. Applications in environmental analysis and beverage industry processes further contribute to the growth of the global chromatography resin market. Analysis shows that Bio-Rad Laboratories is leading the chromatography resin market with its efforts focused on research and development of advanced chromatography resins. Chromatography resins' wide use in biopharmaceutical manufacturing processes, particularly monoclonal antibody production, has increased worldwide demand for these technologies.

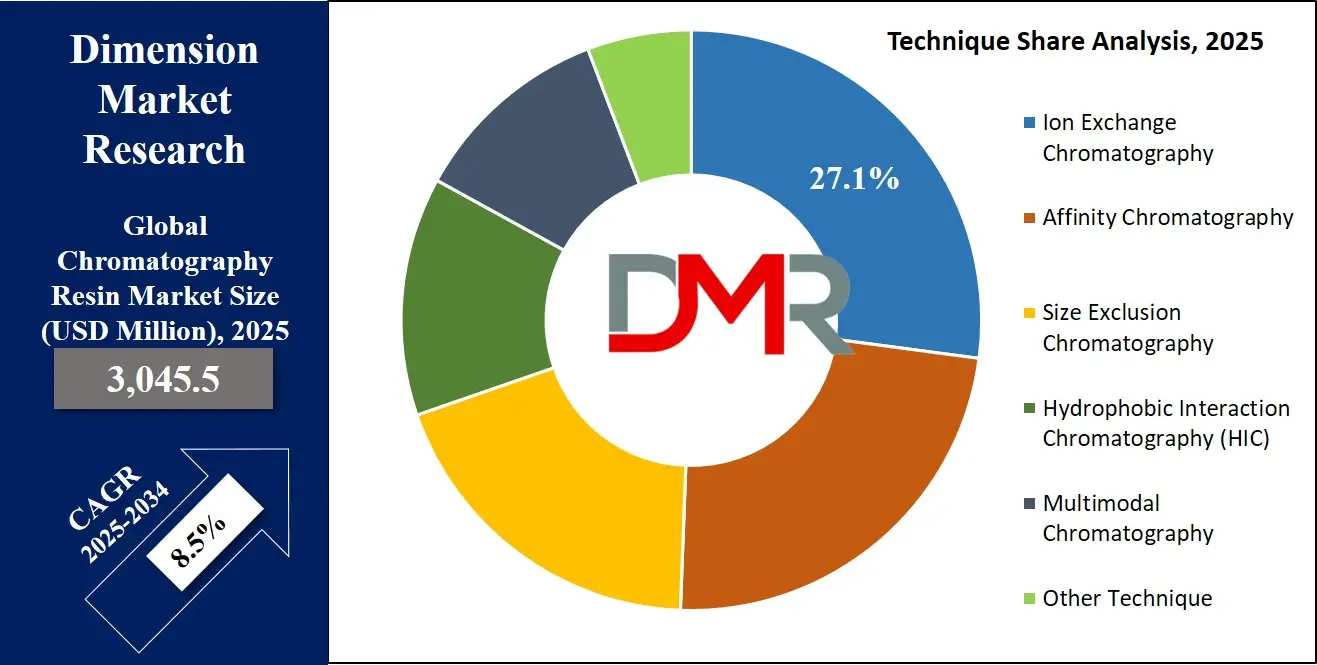

The forecast of the chromatography resin market projects significant expansion through 2025, especially with increased focus on protein analysis and affinity resin development. The chromatography resin industry is also benefiting from advances in equipment for its production, which contributes to an increase in market value and the expansion of market shares for chromatography resin. The market can be further broken down based on technique into three sub-sectors: ion exchange, hydrophobic interaction, and size exclusion, to provide researchers with versatile options.

North America dominates in terms of market share analysis, while Asia-Pacific is anticipated to experience the highest compound annual compound annual compound growth rate. New techniques like mixed-mode chromatography and the adoption of chromatography into personalized medicine should propel this market further. As market players introduce enhanced affinity chromatography solutions and ion exchange resins, the growth of the market should remain robust. The global chromatography resin market size will continue to expand, driven by investments made to promote growth through therapeutic protein research, purification processes, and tailored formulations tailored for emerging needs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Chromatography Resin Market

The US Chromatography Resin Market is poised for dynamic growth, rising from USD 991.2 million in 2025 to USD 1,978.6 million by 2034, fueled by a strong 8.0% compound annual growth rate over the forecast period.

The U.S. chromatography resin market is growing steadily, driven by the leadership of the biotechnology and pharmaceutical industries that hold more than half of global biopharmaceutical revenues. The U.S. enjoys an unmatched high concentration of biopharma R&D centers, especially in California, Massachusetts, and North Carolina. Such demographic strength, combined with high government support and a well-established healthcare infrastructure, speeds up the usage of advanced separation technologies. Trends are pointing towards mounting investments in biologics, personalized medicine, and cutting-edge therapies, all of which largely depend on effective chromatography solutions. The American market is also marked by the high demand for affinity and ion-exchange resins due to the large-scale manufacturing of monoclonal antibodies.

Strategic partnerships among academic institutions and biotech companies also promote sustained innovation, which keeps the market vibrant. With its growing population and increasing chronic disease burden, the nation continues to be a priority market for the manufacture of high-purity biologics. Environmental issues and food safety laws also favor the use of resin in non-pharmaceutical applications. Although there are challenges such as regulatory issues and competitive pricing pressures, U.S.-based producers continue to lead the industry with technological advancements and diversified offerings.

.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Chromatography Resin Market

The Europe Chromatography Resin Market is positioned for significant expansion, projected to grow from

USD 749.19 million in 2025 to

USD 1,613.78 million by 2034, advancing at a robust

CAGR of 8.9%.

The European chromatography resin industry exhibits consistent growth fueled by robust biopharmaceutical sectors in Germany, Switzerland, and the United Kingdom. Europe's demographic advantage comes from a highly skilled scientific workforce, strong healthcare infrastructure, and government-sponsored research initiatives supporting biotechnological development. High-quality resins being encouraged widely for drug approval procedures by the rigorous standards of the European Medicines Agency are a contributing factor. Trends indicate a spike in the development of biosimilars and investment in cell and gene therapies, where chromatography becomes critical to confirming product safety and efficacy.

The region also witnesses large-scale application of resins in environmental monitoring due to tough EU environmental legislation. Europe's nutraceutical and cosmetics sectors' demand for natural and plant-derived products also contributes to chromatography uptake for purifying ingredients. Threats of economic downturns and Brexit-based regulatory shifts created some uncertainty but did not lower research and manufacturing investment substantially. An innovation opportunity is available through resin recycling and reuse technology. Green chemistry methods are central to companies active in Europe and complement sustainability aspirations that drive not only government action and consumer activity.

The Japan Chromatography Resin Market

The Japan Chromatography Resin Market is poised for dynamic growth, rising from USD 152.28 million in 2025 to USD 306.94 million by 2034, fueled by a strong 8.1% compound annual growth rate over the forecast period.

The Japan market for chromatography resins depicts robust growth with the backing of the nation's robust pharmaceutical and research academic systems. Japan has a demographic advantage of having its advanced healthcare units densely concentrated within the country, along with one of the world's highest R&D spending ratios as a percentage of GDP and a highly qualified population.

The growing demand for biopharmaceuticals, especially in addressing an aging population, is underpinning higher use of chromatography technologies. Trends identify a trend towards domestic production of therapeutic proteins and vaccines, reinforcing domestic resin consumption. The biotech industry, driven by government support from the likes of the AMED (Japan Agency for Medical Research and Development), continually advances the boundary of separation science. Outside the healthcare sector, Japan's focus on food safety and precision agriculture increases demand for chromatography uses in the environmental and food industries.

Nevertheless, high production expense and an older workforce may limit long-term growth unless balanced by automation and process improvement. There is increasing interest in sustainable and reusable chromatography materials, indicating Japan's general environmental commitments. Overall, the market is expected to continue steady innovation-driven growth in both industrial and academic fields.

Global Chromatography Resin Market: Key Takeaways

- Global Market Size Insights: The Global Chromatography Resin Market size is estimated to have a value of USD 3,045.5 million in 2025 and is expected to reach USD 6,354.2 million by the end of 2034.

- The US Market Size Insights: The US Chromatography Resin Market is projected to be valued at USD 991.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,978.6 million in 2034 at a CAGR of 8.0%.

- Regional Insights: North America is expected to have the largest market share in the Global Chromatography Resin Market with a share of about 38.7% in 2025.

- Key Players Insights: Some of the major key players in the Global Chromatography Resin Market are Cytiva, Merck KGaA, Bio-Rad, Thermo Fisher, Tosoh, Purolite, Repligen, and many others.

- Global Market Growth Rate Insights: The market is growing at a CAGR of 8.5 percent over the forecasted period of 2025.

Global Chromatography Resin Market: Use Cases

- Residential Plumbing Systems: Chlorinated Polyvinyl Chloride (CPVC) has become a standard material in residential plumbing applications for both hot and cold water distribution, offering exceptional heat resistance, corrosion prevention, and long-term durability making it one of the preferred materials used in modern piping systems.

- Industrial Fluid Handling: CPVC piping systems are integral parts of chemical processing industries, safely transporting aggressive fluids. Their high chemical resistance and corrosionproof nature help extend equipment lifespan while decreasing maintenance needs - ultimately guaranteeing uninterrupted industrial operations under harsh conditions.

- Fire Sprinkler Systems: In fire suppression, CPVC pipes are highly sought-after for fire protection due to their heat resistance, easy installation process and compliance with safety regulations. Their use helps minimize installation costs while offering reliable protection in residential, commercial and industrial fire sprinkler systems.

- Water Treatment Plants: CPVC is an indispensable material in water and wastewater treatment plants. Its exceptional resistance to chlorine, chemicals, and microbial contamination ensures efficient long-term operation. CPVC allows communities global to receive safe drinking water in its purest form.

- Solar Water Heaters: Solar Water Heating systems utilize CPVC pipe as it can endure high temperatures and UV radiation exposure, providing efficient thermal performance, increasing system longevity, and offering eco-friendly energy solutions for residential use.

- Global Chromatography Resin Market: Stats & Facts

- Nature Biotechnology reports that advancements in chromatography resin formulations have reduced purification process times by up to 30% in large-scale biomanufacturing, allowing biopharma companies to improve production efficiency and reduce operational costs significantly.

- PubMed Central highlights that over 70% of biopharmaceutical purification processes rely heavily on chromatography steps, with the selection of high-performance resins being crucial for achieving regulatory-grade product purity and consistent batch quality.

- University of Cambridge research indicates that increasing the usable lifetime of expensive protein A resins from the traditional 100 batches to nearly 200 is a primary focus, potentially cutting costs by millions annually for major pharmaceutical manufacturers.

- MIT Technology Review shares that the rapid growth of gene therapies and personalized medicines has led to a sharp rise in the demand for specialty resins, particularly ion-exchange and affinity resins, capable of handling delicate biomolecules without compromising structure.

- The Biochemical Society states that continuous chromatography systems, powered by high-durability resins, can boost productivity by up to 50%, enabling faster and more cost-effective production of biologics compared to traditional batch-mode chromatography.

- European Pharmaceutical Review notes that dual-function chromatography resins, which combine ion-exchange and hydrophobic interaction properties, are helping pharmaceutical companies reduce the number of purification steps, thereby saving both time and resources.

- Johns Hopkins Medicine underscores the pivotal role chromatography resins play in the diagnostics field, particularly in precision medicine initiatives where efficient biomarker separation is critical for early disease detection and treatment personalization.

- American Society for Microbiology (ASM) details that high-flow, high-strength chromatography resins are becoming essential for pandemic-response manufacturing, ensuring that facilities can produce vaccines at unprecedented speeds without risking resin degradation.

- U.S. Pharmacopeia (USP) emphasizes the growing regulatory scrutiny around resin leachables and extractables, pushing manufacturers to innovate resin materials that minimize contamination risks while ensuring compliance with pharmaceutical standards.

- Harvard Medical School researchers point out that new synthetic polymer-based chromatography resins are enabling the customization of separation protocols, supporting the rapid evolution of biologics, biosimilars, and highly sensitive therapeutic proteins.

- Swiss Federal Institute of Technology (ETH Zurich) found that the development of nanostructured chromatography resins improves mass transfer rates and separation efficiencies by as much as 25%, offering huge performance gains for large-scale purification processes.

- Royal Society of Chemistry (RSC) publications mention that although aqueous two-phase systems are gaining interest for more sustainable purification methods, they still depend heavily on innovative resin supports to achieve the desired separation efficiency.

Global Chromatography Resin Market: Market Dynamics

Driving Factors in the Global Chromatography Resin Market

Expansion of the Biopharmaceutical Industry

The rapid expansion of the global biopharmaceutical market is one of the primary drivers for the growth of the chromatography resin market. Increased investments in biologics, monoclonal antibodies, biosimilars, and vaccines have resulted in an ever-increasing need for efficient purification technologies. Biopharmaceuticals require complex downstream processing steps, and chromatography has long been recognized for its scalability, specificity, and reproducibility.

As more drug discovery efforts target chronic diseases, cancers, autoimmune disorders, and rare genetic conditions, demand for high-grade resins grows exponentially. Further, global health challenges like COVID-19 have accelerated investments in vaccine production capacity and consumption, driving up resin consumption exponentially. Furthermore, as biologics take an ever-increasing share of the pharmaceutical market, the chromatography resin market looks set for sustained long-term expansion.

Rising Regulatory Emphasis on Purity and Quality Standards

Regulators such as the FDA, EMA, and WHO have increased their focus on meeting stringent quality standards for biopharmaceutical products, making high-performance chromatography resins essential. Purification processes must meet stringent purity, safety, and efficacy criteria to be considered compliant with Good Manufacturing Practices (GMP), forcing companies to adopt premium resins with proven performance under GMP guidelines.

Regulations increasingly mandate comprehensive validation data on resin performance, including lifecycle assessments, leachables studies, and extractables profiles. Under such regulatory pressures, resins that provide minimal batch-to-batch variability and efficient contaminant removal have become highly desirable; their quality has become essential to manufacturing workflows.

Restraints in the Global Chromatography Resin Market

High Cost of Premium Chromatography Resins

One of the chief impediments to the growth of the chromatography resin market is its expensive nature, specifically when applied for high-end applications like protein A affinity chromatography. High-performance resin systems may seem expensive for emerging biotech firms and research institutions with limited budgets, due to both initial investment costs and ongoing maintenance fees. Frequent replacement due to fouling, degradation, or limited reuse cycles increases costs further. While technological advancement has improved resin durability, price sensitivity continues to present challenges, especially for cost-sensitive markets such as biosimilars and generics that rely heavily on generics for market penetration.

Supply Chain Challenges and Raw Material Volatility

The chromatography resin market is especially vulnerable to supply chain disruptions and raw material price volatility, creating significant supply chain difficulties and fluctuations that threaten market health. Resins require highly specialized raw materials, such as agarose, synthetic polymers, or biological ligands with complex supply chains for production. Geopolitical tensions, natural disasters, or pandemics have revealed the vulnerabilities of global supply networks, leading to delays in resin production and increased procurement costs.

Supply assurance should also be of top priority for manufacturers as erratic raw material supply can wreak havoc with resin performance and regulatory compliance, leading to supply chain vulnerabilities which not only impact costs but can disrupt end-user production schedules, particularly important considerations in time-sensitive sectors like vaccine production.

Opportunities in the Global Chromatography Resin Market

Emerging Markets in Asia-Pacific and Latin America

Asia-Pacific and Latin American emerging markets provide enormous growth potential for chromatography resin manufacturers. Rapid industrialization, expanding healthcare infrastructure development, and an influx of investments into biotech sectors present excellent growth prospects for these manufacturers. Countries such as China, India, Brazil, and South Korea are making strides to bolster their biopharmaceutical production capacity, biosimilar development capabilities, and vaccine manufacturing capacities.

Regional growth is being propelled by supportive government initiatives, increasing health awareness, and an ever-increasing demand for affordable therapies. Businesses have set up local manufacturing units to take advantage of cost advantages and serve domestic markets more efficiently; this trend creates an enormous market for high-volume, cost-effective chromatography resin applications with enormous revenue expansion potential.

Innovation in Sustainable and Recyclable Resin Technologies

With global industries increasingly prioritizing environmental sustainability, chromatography resin manufacturers can seize an opportunity to make strides forward by creating recyclable, biodegradable, or lower-impact resins. Traditional chromatography processes involve significant resin waste, energy usage, and solvent consumption. Eco-friendly resins with higher reusability cycles, green manufacturing processes, and lower extractable levels have quickly become important points of differentiation in today's marketplace.

Companies investing in eco-friendly resin innovation can not only meet regulatory expectations but also win favor with environmentally aware biopharma customers. Furthermore, as ESG (Environment, Social, Governance) considerations become a priority in corporate decision-making processes, suppliers providing greener resin solutions may be better placed to secure long-term strategic partnerships.

Trends in the Global Chromatography Resin Market

Rising Adoption of Continuous Chromatography Processes

Continuous chromatography processes have become an industry standard in biopharmaceutical manufacturing, replacing batch processes for increased productivity and greater yield consistency. Due to increased demands for faster time-to-market for biologics and vaccines, companies are investing more heavily in continuous manufacturing setups using chromatography resins that can withstand extended cycles without degrading over time.

New-generation resins with improved mechanical stability, faster binding kinetics, and resistance to fouling are experiencing strong demand, not only increasing throughput but also meeting regulatory expectations for process robustness and control. As a result, resin manufacturers are creating materials tailored specifically for continuous flow systems, creating an atmosphere in which performance expectations continually rise.

Surge in Demand for Specialized Resins for Gene Therapies and Vaccines

With the dramatic surge of gene therapy, cell therapy, and mRNA vaccine research over recent years has come a surge in demand for special chromatography resins designed for delicate biomolecules. These molecules require mild purification conditions with high selectivity and extremely low leachables, necessitating the creation of new affinity, ion-exchange, and mixed-mode resins.

Biomanufacturers now seek resin solutions capable of maintaining the structural integrity of sensitive biomolecules while achieving high recovery rates, with innovations like ligand engineering and surface chemistries providing solutions. This trend reflects an overall change in biopharmaceutical production where traditional performance metrics are being revised in response to emerging therapies with complex needs.

Global Chromatography Resin Market: Research Scope and Analysis

By Type Analysis

Synthetic polymer resins are projected to dominate the global chromatography resin market due to their superior mechanical strength, chemical stability, and variety of separation applications. Synthetic resins such as polystyrene-divinylbenzene (PS-DVB) and polymethacrylate variants offer superior physical compression resistance and chemical degradation resistance, even under stringent process conditions. Durability allows them to be utilized in high-pressure environments, enabling faster flow rates and larger throughput without compromising separation efficiency.

Synthetic polymer resins can be engineered with various functional groups, porosity levels, and particle sizes for greater customization of specific molecules such as monoclonal antibodies, nucleic acids, or vaccines. Their excellent performance in terms of ion exchange, hydrophobic interaction, and size exclusion techniques makes them highly attractive solutions for industrial-scale processes.

Additionally, advances in polymer chemistry have enabled tentacle resins and monolithic structures, further improving binding capacities and mass transfer properties of polymers. Synthetic resins also offer greater reusability and longer service life than their natural resin counterparts, contributing to reduced operational expenses over time.

Biopharmaceutical companies favor synthetic resins because of their scalability, regulatory compliance, and reproducibility - qualities especially sought out when producing therapeutics with high value therapeutic potential. As demand for high-performance, high-purity purification increases across pharmaceutical and biotechnology industries, synthetic polymer resins continue to outshine natural alternatives in terms of adoption rates, making them the go-to option for modern chromatography operations globally.

By Technique Analysis

Ion exchange chromatography is anticipated to reign as a dominant segment as the most commonly used technique for biomolecular separations due to its efficiency, scalability, and adaptability for any number of biomolecular applications. This technique uses charge-based separation, providing high selectivity and binding capacity for proteins, peptides, nucleic acids, and other charged biomolecules. Biopharmaceutical industry products require strict control to maintain purity, activity, and yield without compromise. This principle cannot be compromised.

Ion exchange resins both cation and anion types come in a range of formulations that allow users to tailor separation conditions according to molecule size, charge density, and buffer composition. Process developers can take advantage of this flexibility to optimize purification workflows for complex molecules such as monoclonal antibodies, which often require multiple stages of charge-based separation to remove impurities such as host cell proteins, DNA, and aggregates. Ion exchange chromatography can also be cost-effective due to its excellent capacity for reuse and ability to handle large samples at high flow rates, offering manufacturers improved process economics.

Regulatory bodies such as the FDA emphasize reliable and validated purification methods; ion exchange chromatography has long met these standards. Ion exchange chromatography's versatility within Good Manufacturing Practice (GMP) environments cements its place as a primary method in downstream processing. Given the growing need for biologics and personalized therapies that require product variants and contaminants to be separated with precision, ion exchange chromatography remains a prominent solution across global markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

The pharmaceutical and biotechnology sectors are expected to dominate the chromatography resin market due to their heavy reliance on accurate purification processes for product development and manufacturing processes. Chromatography plays an essential role in biopharmaceutical production for purifying complex biological molecules such as monoclonal antibodies, vaccines, recombinant proteins, and gene therapies. These products must meet extremely stringent purity standards - often surpassing 99 percent - to satisfy stringent regulatory approvals and ensure patient safety.

Chromatography resins play an integral part in bioprocessing workflow, from initial capture of target molecules to polishing steps that remove closely related impurities. Pharmaceutical companies rely heavily on advanced resin technologies to increase scalability, reproducibility, and compliance with Good Manufacturing Practice (GMP) guidelines. Biologics' surge, propelled by chronic diseases and personalized medicine, further increases demand for innovative and high-performance resin solutions. Biotechnology startups and research institutions are major consumers of resin solutions, using chromatography to develop novel therapies, biosimilars, and diagnostics.

They increasingly prioritize customized resin options with higher binding capacities, faster processing times, and lower costs. Chromatography plays a pivotal role in vaccine development, an area that saw explosive growth during the COVID-19 pandemic. As pharmaceutical and biotech pipelines become more sophisticated and diverse, their dependence on chromatography resins increases steadily, cementing this sector's leading position in global resin consumption. This trend is likely to continue as new therapeutic modalities such as mRNA vaccines and cell therapies gain regulatory approval and commercial momentum.

The Global Chromatography Resin Market Report is segmented on the basis of the following:

By Type

- Synthetic Polymer Resin

- Polystyrene

- Polyacrylamide

- Natural Polymer Resin

- Agarose

- Cellulose

- Dextran

- Inorganic Media

By Technique

- Ion Exchange Chromatography

- Affinity Chromatography

- Size Exclusion Chromatography

- Hydrophobic Interaction Chromatography (HIC)

- Multimodal Chromatography

- Other Technique

By Application

- Food and Beverage

- Pharmaceutical and Biotechnology

- Water and Environmental Analysis

- Clinical Research

- Academic and Government Research Institutes

- Other Application

Global Chromatography Resin Market: Regional Analysis

Region with the Highest Market Share in this Market

North America is projected to lead the market for chromatography resins as it holds

38.7% of market share by the end of 2025, mainly because of its exceptionally developed biopharmaceutical industry, strong R&D facilities, and stringent regulatory systems that emphasize product quality and safety. The US houses most of the global's top pharmaceutical and biotech corporations, all of which greatly rely on chromatography resins in drug discovery, development, and manufacturing.

Further, generous government support in the form of Operation Warp Speed, high healthcare expenditures, and accelerated research on biologics and vaccines have all strongly influenced resin utilization. Universities and research institutions in the region also perform significant innovation in chromatography technologies, with constant pressure on resin producers to innovate better products. Agencies such as the FDA also apply strict purity and validation requirements, which increase demand for high-performance resins even further.

In addition, North America's early adoption of continuous manufacturing processes in biologics manufacturing and a mature market for biosimilars gives immense, persistent impetus. With an established supply chain, educated human capital, and ongoing technological advancements, North America is the demand and innovation hub for chromatography resins global.

Region with the Highest CAGR in this Market

Asia Pacific is expected to exhibit the highest CAGR in the chromatography resin market on account of increasing industrialization, growing capacity of biopharma production, and rising healthcare expenditure in the region. Economies like China, India, and South Korea are investing largely in biotech parks, vaccine manufacturing units, and biosimilar production, with high demand for sophisticated purification technologies. The cost-conscious manufacturing climate in the region draws large multinational firms searching to set up or expand business, further propelling chromatography resin uptake.

Additionally, the increasing disease burden of chronic conditions and the increasing need for cheap biologics across the large elderly population encourage domestic pharma firms to invest in purification capabilities.

State-level incentives encouraging biotechnology innovation, coupled with pro-regulatory reforms, are boosting market growth. Regional producers are also focusing more intensely on quality gains, driving stronger utilization of specialist resin products. As R&D investments increase and clinical trial volume builds in Asia Pacific, the demand for secure, high-purity resin technologies is expected to increase exponentially, propelling the region toward rapid expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Chromatography Resin Market: Competitive Landscape

The market for chromatography resins global is very competitive and is dominated by a number of key players who are constantly trying to innovate and increase their market share. Firms such as Cytiva (formerly GE Healthcare Life Sciences), Merck KGaA, Bio-Rad Laboratories, and Thermo Fisher Scientific have dominated due to their robust product offerings, huge R&D efforts, and global distribution channels. These market leaders often invest in the creation of next-generation resins with increased binding capacities, enhanced chemical stability, and sustainability aspects to address changing biopharmaceutical requirements.

Strategic partnerships, mergers, and acquisitions are prevalent, enabling companies to expand their technology platform and geographical reach. For instance, collaborations with biotechnology companies for customized resin development are becoming more common. As the market becomes more crowded, Asian-Pacific and European emerging players also enter with niche innovations and competitive pricing, challenging the incumbent brands.

Additionally, companies are positioning themselves to offer customized resin solutions for particular biologics and individualized therapies, indicative of a trend towards more specialized product offerings. Compliance with regulations, product validation, and supply reliability continue to be essential differentiators in this marketplace. With increased demand for the manufacture of biopharmaceuticals and novel modalities such as gene therapies and mRNA vaccines, competition will escalate to prompt innovation as well as consolidation throughout the global chromatography resins market.

Some of the prominent players in the Global Chromatography Resin Market are:

- Cytiva (formerly GE Healthcare Life Sciences)

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Purolite Corporation

- Repligen Corporation

- Mitsubishi Chemical Corporation

- W. R. Grace & Co.

- Avantor, Inc.

- Agilent Technologies, Inc.

- Danaher Corporation

- Sartorius AG

- Bio-Works Technologies AB

- Sepax Technologies, Inc.

- JNC Corporation

- PerkinElmer Inc.

- KNAUER Wissenschaftliche Geräte GmbH

- Shimadzu Corporation

- Phenomenex, Inc.

- Other Key Players

Recent Developments in Global Chromatography Resin Market

April 2025

- Launch of Innovative Resins for Biopharmaceutical Applications: Major players like GE Healthcare and Cytiva have introduced advanced chromatography resins tailored to biopharmaceutical applications, enhancing purification processes in the production of biologics and biosimilars. These resins are designed to increase yield and decrease processing times.

March 2025

- Improvement in Resin Technology for High-throughput Screening: A breakthrough in high-capacity chromatography resins has been announced by Merck KGaA. These resins cater specifically to high-throughput screening, aiming to expedite drug discovery processes while maintaining accuracy and consistency.

February 2025

- Regulatory Approvals for New Resin Forms: Thermo Fisher Scientific received regulatory approvals from FDA for their new series of chromatography resins, which are specifically designed for GMP-compliant processes in pharmaceutical production.

January 2025

- Development of Hybrid Chromatography Resins: In response to the demand for higher selectivity and improved performance, companies such as Bio-Rad Laboratories launched hybrid chromatography resins, which integrate the advantages of multiple technologies for enhanced protein and peptide purification.

Investments in the Chromatography Resin Market

April 2025

- Private Equity Investment in Resin Innovation: Private equity firms have invested heavily in the chromatography resin market, especially in start-ups focused on developing next-generation resins for biotechnology applications. This funding will accelerate the development of new products with advanced properties aimed at high-demand markets like healthcare and pharmaceutical industries.

February 2025

- Strategic Investment by Dow Chemicals: Dow Chemicals committed a significant capital investment to expand its production capacity of chromatography resins, focusing particularly on the Asia-Pacific region, in anticipation of increasing demand in biotechnology sectors.

Collaborations in the Chromatography Resin Market

March 2025

- Collaboration Between Cytiva and Roche: In a major move to enhance protein purification technologies, Cytiva entered into a strategic collaboration with Roche to co-develop advanced chromatography resins. This collaboration aims to address the growing challenges in monoclonal antibody production.

January 2025

- Partnership Between Thermo Fisher Scientific and WuXi AppTec: Thermo Fisher Scientific partnered with WuXi AppTec, a global contract research organization, to jointly develop new chromatography resins aimed at streamlining clinical development processes for biologics. The resins are designed to improve separation efficiency and scalability in large-scale manufacturing.

Expos & Conferences in the Chromatography Resin Market

April 2025

- Chromatography & Bioprocessing Expo 2025 (London, UK): This leading expo showcased groundbreaking innovations in chromatography resins, attracting major industry players and researchers. The event highlighted the latest advancements in resin technology for biopharmaceutical purification.

March 2025

- International Chromatography Symposium 2025 (Tokyo, Japan): Focused on trends in chromatography technologies, this symposium offered deep insights into advancements in chromatography resins used for medical and environmental applications. Keynotes were delivered by leaders from Thermo Fisher Scientific and Merck KGaA.

January 2025

- Biotech Expo 2025 (San Francisco, USA): The Biotech Expo featured a series of workshops and technical discussions on chromatography resins, particularly in the areas of drug development and diagnostics.

Mergers and Acquisitions in the Chromatography Resin Market

March 2025

- Merck Acquires Innovative Resin Manufacturer: Merck KGaA, Darmstadt, Germany, completed the acquisition of a leading chromatography resin manufacturer, Alpha Resin Tech, which specializes in resins for protein purification in research and development laboratories. This acquisition strengthens Merck’s position in the life sciences sector.

February 2025

- Thermo Fisher Scientific Merges with Biochrom Technologies: Thermo Fisher entered into a merger agreement with Biochrom Technologies, a key player in the development of specialty resins. This strategic merger is expected to result in the creation of a unified product line that will drive growth in the chromatography resin market, particularly in the pharmaceutical and biotechnology sectors.

January 2025

- GE Healthcare Acquires Resin Innovator: GE Healthcare acquired Pall Life Sciences, a leading company in the development of advanced chromatography resins for the healthcare and biopharmaceutical industries. This acquisition allows GE Healthcare to strengthen its product portfolio and expand its influence in the global chromatography market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,045.5 Mn |

| Forecast Value (2034) |

USD 6,354.2 Mn |

| CAGR (2025–2034) |

8.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 991.2 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Synthetic Polymer Resin, Natural Polymer Resin, Inorganic Media); By Technique (Ion Exchange Chromatography, Affinity Chromatography, Size Exclusion Chromatography, Hydrophobic Interaction Chromatography (HIC), Multimodal Chromatography, Other Technique); By Application (Food and Beverage, Pharmaceutical and Biotechnology, Water and Environmental Analysis, Clinical Research, Academic and Government Research Institutes, Other Application) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Cytiva, Merck KGaA, Bio-Rad, Thermo Fisher, Tosoh, Purolite, Repligen, Mitsubishi Chemical, W. R. Grace, Avantor, Agilent, Danaher, Sartorius, Bio-Works, Sepax, JNC, PerkinElmer, KNAUER, Shimadzu, and Phenomenex., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|