Market Overview

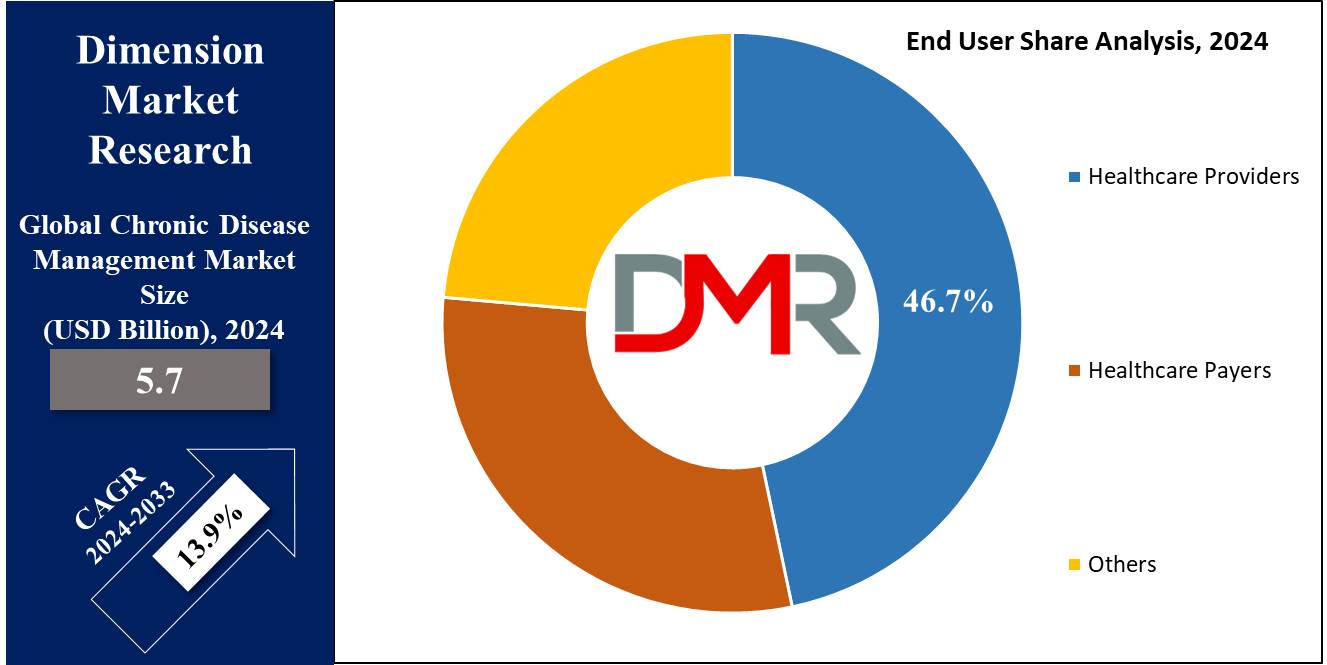

The Global Chronic Disease Management Market is projected to reach USD 5.7 billion in 2024 and grow at a compound annual growth rate of 13.9% from there until 2033 to reach a value of USD 18.4 billion.

Chronic disease management providers make the patient aware of the available payment scenario and assist them with Medicare and Medicaid guidance, which in turn, helps patients to get their respective allowances. If the patients are looking for chronic disease management, there is a major possibility that patients get the appropriate treatments at low prices and also get the benefit of allocated reimbursement, especially as disease management solutions become more integrated across care settings.

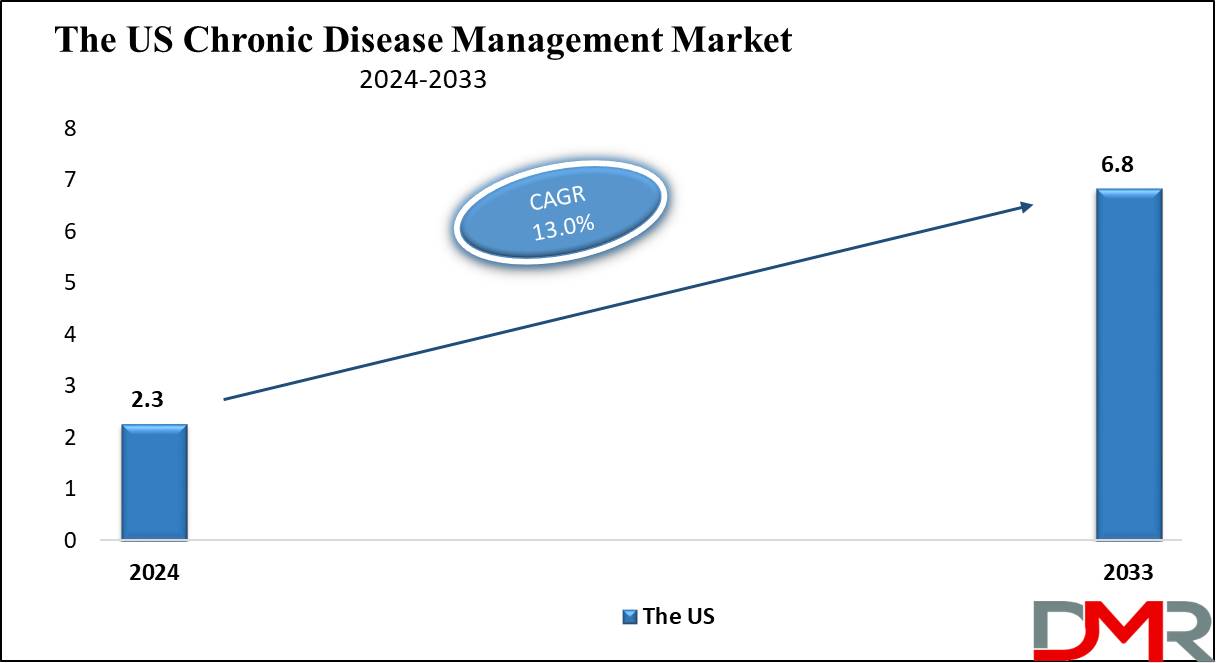

The US Chronic Disease Management Market

The US Chronic Disease Management Market is projected to reach USD 2.3 billion in 2024 at a compound annual growth rate of 13.0% over its forecast period.

The chronic disease management market in the US provides growth opportunities through the development of telehealth, allowing remote patient monitoring and increased access to care. The growth in health data analytics improves customized treatment plans, while government initiatives and funding assistance in innovative solutions, contributing significantly to the wider population health management ecosystem.

In addition, the growing focus on preventive care and lifestyle management further drives the need for effective chronic disease management systems. Further, the key growth driver market is the growth in the adoption of digital health technologies, like

telemedicine and remote monitoring, which improve patient care and accessibility. However, a major restraint is the high costs linked with implementing these advanced systems and concerns over data privacy and security, which can impact broad adoption and integration of digital health management systems.

Key Takeaways

- Market Growth: The Chronic Disease Management Market size is expected to grow by 12.0 billion, at a CAGR of 13.9% during the forecasted period of 2025 to 2033.

- By Offering: The solution segment is anticipated to get the majority share of the Chronic Disease Management Market in 2024.

- By Disease Type: Diabetes segment is expected to be leading the market in 2024

- By End User: The providers segment is expected to get the largest revenue share in 2024 in the Chronic Disease Management Market.

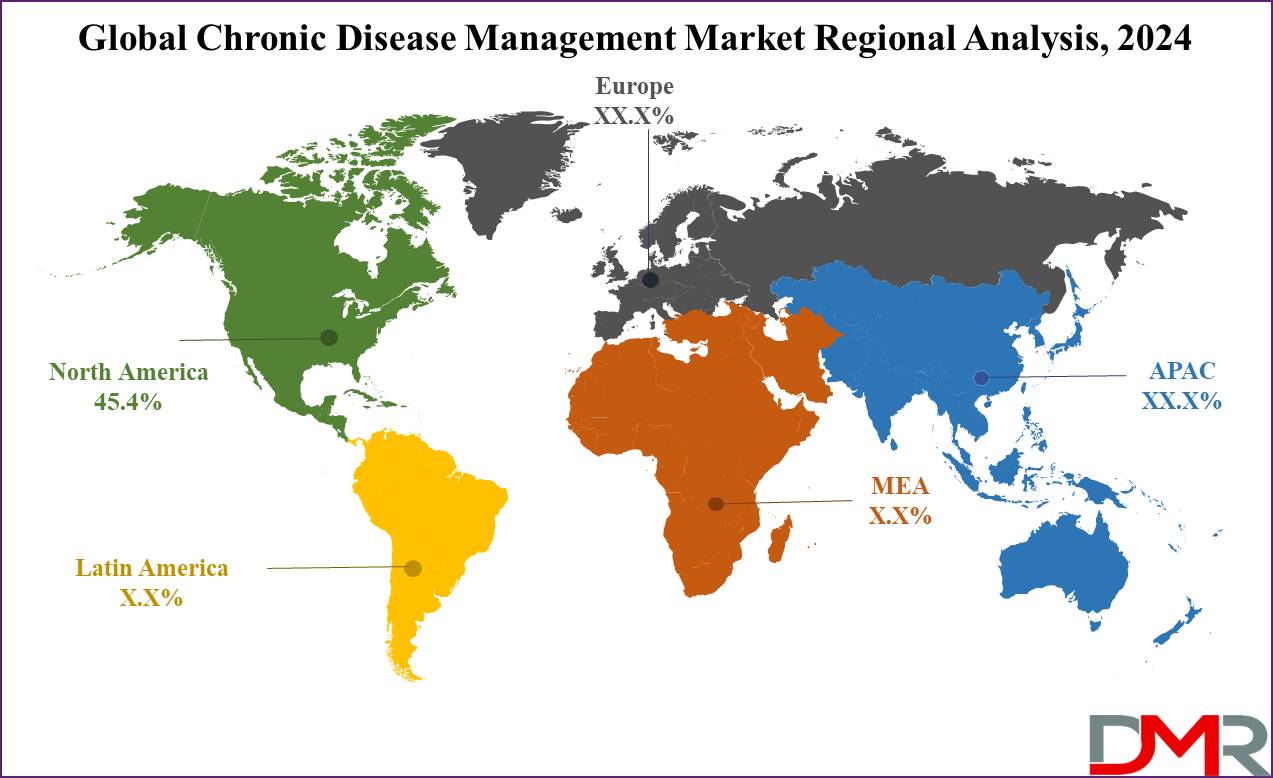

- Regional Insight: North America is expected to hold a 45.4% share of revenue in the Global Chronic Disease Management Market in 2024.

- Use Cases: Some of the use cases of Chronic Disease Management include remote monitoring & telehealth, medication adherence support, and more.

Use Cases

- Remote Monitoring & Telehealth: Patients can use wearable devices & health apps to monitor important signs, like glucose levels or blood pressure, allowing healthcare providers to track progress live and adjust treatments accordingly.

- Personalized Treatment Plans: AI and data analytics can help create personalized care plans by looking into individual patient data, lifestyle, and medical history to optimize treatment strategies.

- Medication Adherence Support: Digital tools, like mobile reminders and smart pillboxes, ensure patients take medications as prescribed, and minimize the risk of complications due to missed doses.

- Patient Education & Self-management: Mobile apps & online platforms provide educational resources to patients, allowing them to better manage their condition by tracking symptoms, lifestyle adjustments, and communicating with healthcare professionals.

Market Dynamic

Driving Factors

Rising Prevalence of Chronic Diseases

The growing rates of conditions such as hypertension, diabetes, and cardiovascular diseases across the world are driving the demand for effective management solutions, pushing the market forward.

Advancements in Digital Health Technologies

Innovations like wearable devices, telemedicine, and AI-powered analytics are making it easy to monitor, track, and manage chronic diseases remotely, improving patient care and fueling market growth.

Restraints

High Cost of Advanced Technologies

Executing and maintaining

digital health tools, wearable devices, and telemedicine platforms can be very costly, limiting adoption, mainly in low-income regions or smaller healthcare facilities.

Data Privacy and Security Concerns

The utilization of digital platforms for chronic disease management includes handling sensitive patient information, creating concerns about data breaches, and compliance with privacy regulations, which can impact broad adoption.

Opportunities

Expansion of Telehealth and Remote Monitoring

The higher adoption of telehealth services opens up opportunities for remote monitoring solutions, enabling healthcare providers to manage chronic diseases more effectively and get to the patients in rural or underserved areas.

Integration of Artificial Intelligence and Big Data

Utilizing

Artificial Intelligence and big data analytics can improve predictive care, enhance personalized treatment plans, and provide proactive disease management, developing numerous opportunities for companies to innovate and provide more efficient healthcare solutions.

Trends

Increased Use of Mobile Health Apps

Patients are highly utilizing mobile apps to track their health data, get medication reminders, and access educational resources, making chronic disease management more convenient and personalized.

Adoption of Value-Based Care Models

Healthcare providers are switching towards value-based care, aiming to enhance patient outcomes and minimize healthcare costs by focusing on long-term disease management and preventive care, rather than episodic treatment.

Research Scope and Analysis

By Offering

In the Chronic Disease Management Market, the solutions segment is expected to hold a significant share of the market in 2024 during the forecast period, driven by various key factors, as large awareness of both cloud-based and on-premises solutions in healthcare is contributing to this growth, as healthcare providers look for effective ways to manage patient care.

In addition, there is a higher demand for shorter hospital stays, which assists in reducing hospitalization costs and boosts the demand for advanced healthcare solutions. Investment in R&D is increasing, leading to the development of more specialized treatment options, further improving the appeal of these solutions. Further, the growth of medical tourism, mainly in developing regions, is also creating new opportunities for companies that provide healthcare solutions.

Furthermore, the major involvement of government bodies across many countries in promoting and supporting the adoption of these technologies is expected to fuel growth. Altogether, these factors are driving the expansion of the solutions segment, as healthcare organizations focus on enhancing patient care while optimizing costs and efficiency during the forecast period.

By Disease Type

The chronic disease management market based on disease type is categorized into diabetes, cardiovascular disease, cancer, asthma, chronic obstructive pulmonary disorder (COPD), and others. Among these, the diabetes segment is set to be the largest revenue contributor in 2024, largely due to the rising prevalence of diabetes, which has been associated to lifestyle changes, unhealthy diets, a lack of physical activity, and higher obesity rates.

The growth in the number of people affected by both type-1 and type-2 diabetes has increased the demand for effective disease management systems. These systems play a major role in controlling the spread and impact of diabetes, supporting healthcare providers to monitor and manage the condition more efficiently. As the occurrence of diabetes constantly grows globally, the need for these solutions is expected to remain strong, further expanding market growth.

Further, the cardiovascular disease segment is anticipated to be the fastest-growing during the forecast period, as the growing incidence of cardiovascular conditions, like aortic aneurysm, stroke, arrhythmia, and other heart-related disorders, is driving this growth. With cardiovascular diseases becoming more common owing to factors like sedentary lifestyles, aging populations, and poor diets, there is a higher need for complete chronic disease management solutions to address these challenges.

As a result, healthcare providers are increasingly adopting systems that help in managing and monitoring cardiovascular conditions, further accelerating the expansion of this segment in the chronic disease management market.

By Deployment

On-premises deployment is set to dominate in terms of revenue in the chronic disease management market in 2024 due to its strong security and control benefits. By keeping sensitive patient data within their infrastructure, healthcare providers maintain complete oversight, ensuring data protection and compliance with specific regulations, which allows for a high level of customization, enabling organizations to customize the system to their distinctive needs.

In addition, managing IT resources locally minimizes the dependency on external vendors, giving organizations greater control over critical system operations. With on-premises deployment, healthcare providers can rapidly respond to changes, scaling their systems to meet the increase in the demands in chronic disease management, which ensures both hardware and software can be adjusted in-house, delivering the flexibility to adapt to transforming healthcare requirements.

For many, the combination of better security, control over IT infrastructure, and the ability to customize the system makes on-premises deployment an ideal solution, mainly for organizations aimed at safeguarding sensitive health data while managing chronic diseases effectively.

By End User

The healthcare provider segment is projected to be the largest revenue contributor in the chronic disease management market in 2024, mainly due to the growth in the prevalence of chronic diseases including cancer, cardiovascular disease, heart disease, asthma, and chronic obstructive pulmonary disease (COPD). As these conditions become more common, the need for healthcare services focused on improving treatment options and more effective management of chronic illnesses constantly grows.

Healthcare providers are vital in delivering these services, which has been highly driven by the growth of the chronic disease management market. In addition, the "others" segment is anticipated to be the fastest-growing during the forecast period, which is driven by the growth in the number of chronic diseases and the growth of the geriatric population, both of which contribute to a higher demand for chronic disease management solutions.

As the aging population is more prone to developing long-term health conditions, there is an increase in the need for complete disease management systems to monitor and treat these conditions effectively. These factors collectively drive the quick expansion of this segment, contributing to the overall growth of the chronic disease management market.

The Chronic Disease Management Market Report is segmented on the basis of the following

By Offering

- Solutions

- Services

- Educational Implementation

- Implementation

- Consulting

- Others

By Disease Type

- Cardiovascular Diseases

- Diabetes

- Cancer

- Asthma

- Chronic Obstructive Pulmonary Disorders

- Others

By Deployment

- Cloud-based

- Web-based

- On-Premises

By End User

- Providers

- Ambulatory Care Centers

- Hospitals, Physician Groups & Integrated Delivery Networks

- Home Healthcare Agencies, Nursing Homes & Assisted Living Facilities

- Diagnostic & Imaging Centers

- Others

- Payers

- Others

Regional Analysis

North America is expected to dominate the chronic disease management market, capturing a substantial share of

45.4% in 2024, which is owing to several factors, like favorable government policies that encourage the development and adoption of innovative healthcare services. In addition, major developments in healthcare infrastructure and government funding for research initiatives play a major role in assisting in the growth of the market.

These elements integrate to create a conducive environment for the introduction of advanced chronic disease management solutions, solidifying North America's position as a global leader in this sector throughout the forecast period. Further, the Asia Pacific region is anticipated to exhibit the fastest growth rate in the chronic disease management market during the same timeframe, which is largely driven by the region's expanding healthcare industry, driven by its large population, mainly in countries like China, India, and Japan.

These nations are funding healthcare enhancement and disease management strategies to address growth in health issues. Meanwhile, the Latin American market is expected to grow at a moderate pace, influenced by changes in healthcare demands and infrastructure development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The chronic disease management market is expanding rapidly as more healthcare providers focus on enhancing patient outcomes and reducing costs. Key players provide a variety of solutions, like remote monitoring devices, digital health platforms, and data-driven analytics for personalized care. Further, the competition in the market is driven by technological developments, the growth of telehealth, and the higher demand for tools that help patient self-management. Companies are also collaborating with healthcare systems to provide integrated care models, making it easy to track, manage, and treat long-term conditions like diabetes and heart disease.

Some of the prominent players in the Global Chronic Disease Management are

- Pegasystems Inc

- Trizetto Corp

- Koninklijke Philips NV

- EXL Healthcare

- AxisPoint Health

- NexJ Health

- Hinduja Global Solution

- WellSky Corp

- ZeOmega

- Zyter Inc

- Other Key Players

Recent Developments

- In September 2024, The Government of Tripura announced a collaboration with the AIIMS New Delhi, and the Centre for Chronic Disease Control (CCDC), to launch the STAR-NCD program, focused on enhancing the prevention, diagnosis, and management of Non-Communicable diseases (NCDs) across the state. Further, it will strengthen out-patient care services, mainly for conditions like high blood pressure, diabetes, and heart disease.

- In June 2024, Mount Sinai Medical Center announced its partnership with the virtual care management platform HealthSnap to assist in chronic disease management programs, which began in March 2024 with Remote Patient Monitoring (RPM) and is currently operational at three Mount Sinai locations in South Florida, with further plans to extend the service to 13 locations by the end of the year.

- In April 2024, the US FDA (Food and Drug Administration) launched a new initiative, Home as a Health Care Hub, to support reimagining the home environment as an integral part of the health care system, to advance health equity for everyone in the country. While many care options are looking to utilize the home as a virtual clinical site, only a few have considered the structural and critical elements of the house that will be needed to absorb this transference of care.

- In February 2024, HealthSnap, and Chronic Care Management (CCM) solution for healthcare providers, unveiled its Series B funding of USD 25 million, which was led by Sands Capital, with new investments from Comcast Ventures, Acronym Venture Capital, and Florida Opportunity Fund. Further, current shareholders, Florida Funders, Asclepius Growth Capital, MacDonald Ventures, and TGH Ventures also participated in the round.

- In January 2024, Amazon Health launched its latest push to enhance care for chronic conditions of “Health Condition Programs", which allows customers to discover digital health benefits to assist in managing chronic conditions like pre-diabetes, diabetes, hypertension, etc. Further, in the initial launch, Amazon Health is partnering with digital health company Omada Health.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 5.7 Bn |

| Forecast Value (2033) |

USD 18.4 Bn |

| CAGR (2024-2033) |

13.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Solutions and Services), By Disease Type (Cardiovascular Diseases, Diabetes, Cancer, Asthma, Chronic Obstructive Pulmonary Disorders, and Others), By Deployment (Cloud-based, Web-based, and On-Premises), By End User (Providers, Payers, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Pegasystems Inc, Trizetto Corp, Koninklijke Philips NV, EXL Healthcare, AxisPoint Health, NexJ Health, Hinduja Global Solution, WellSky Corp, ZeOmega, Zyter Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Chronic Disease Management Market size is expected to reach a value of USD 5.7 billion in 2024 and is expected to reach USD 18.4 billion by the end of 2033.

North America is expected to have the largest market share in the Global Chronic Disease Management Market with a share of about 45.4% in 2024.

The Chronic Disease Management Market in the US is expected to reach USD 2.3 billion in 2024.

Some of the major key players in the Global Chronic Disease Management Market are Pegasystems Inc, Trizetto Corp, Koninklijke Philips NV, and others.

The market is growing at a CAGR of 13.9 percent over the forecasted period.