Market Overview

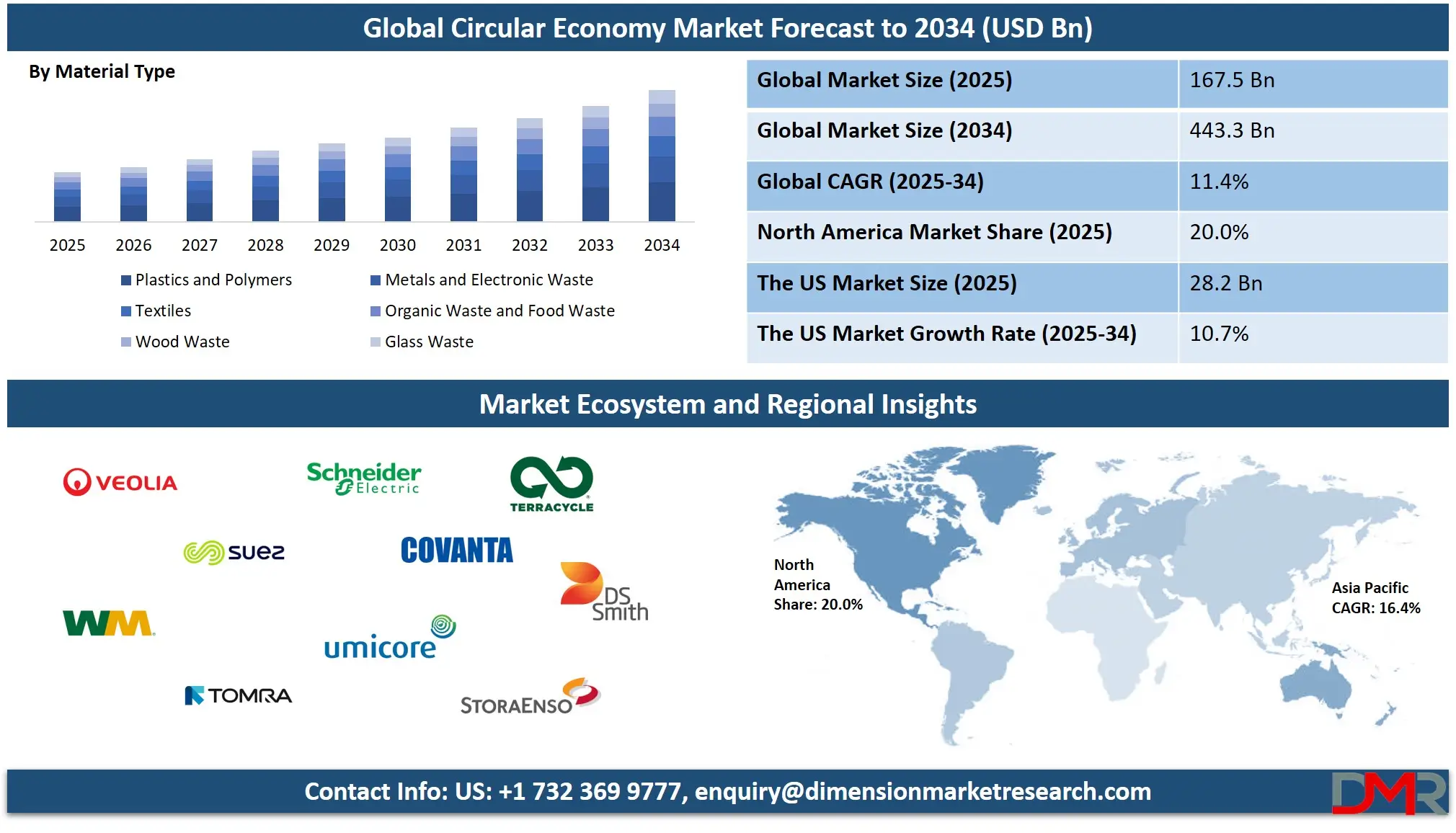

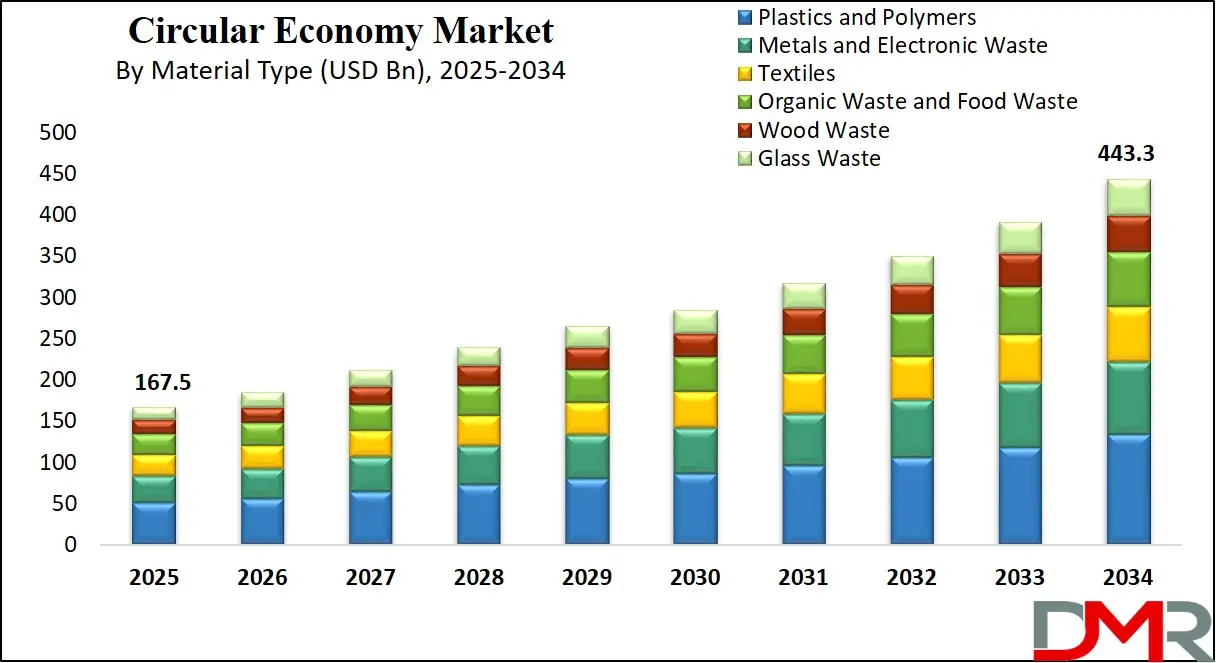

The Global Circular Economy Market is projected to grow from USD 167.5 billion in 2025 to USD 443.3 billion by 2034, reflecting an 11.4% CAGR driven by resource efficiency initiatives, recycling innovation, sustainable materials demand and rising adoption of circular business models.

Circular economy is an economic system focused on regenerating resources by designing products for durability, repairability, reuse and efficient material recovery rather than following the traditional linear pattern of take use and dispose. It emphasizes closed loop processes where waste becomes a valuable input for new production cycles which helps reduce environmental pressure while increasing resource efficiency.

Through better product design extended lifecycles recycling innovation and responsible consumption the circular model supports sustainable growth by minimizing raw material extraction and maximizing the value retained within materials products and systems.

The global circular economy market represents the collective economic activities technologies and services that enable circular production and consumption across industries such as packaging automotive textiles construction electronics and consumer goods. It spans recycling solutions remanufacturing platforms reverse logistics digital tracking systems sustainable material engineering and product as a service models that replace one time purchasing with long term access.

Governments corporations and consumers are increasingly shifting toward circular systems as regulations tighten around waste management carbon neutrality and responsible resource use which is contributing to rapid market expansion.

The market is accelerating due to rising pressure on global supply chains resource scarcity and high landfill costs which encourage companies to adopt circular strategies to reduce operational risks and improve material security. Growing investments in recycling infrastructure renewable materials design for disassembly and automation driven sorting technologies are reshaping how industries recover and utilize resources.

The combination of regulatory support technological innovation and sustainability targets among leading corporations is turning the circular economy into a foundational pillar of future industrial transformation and long term environmental resilience.

The US Circular Economy Market

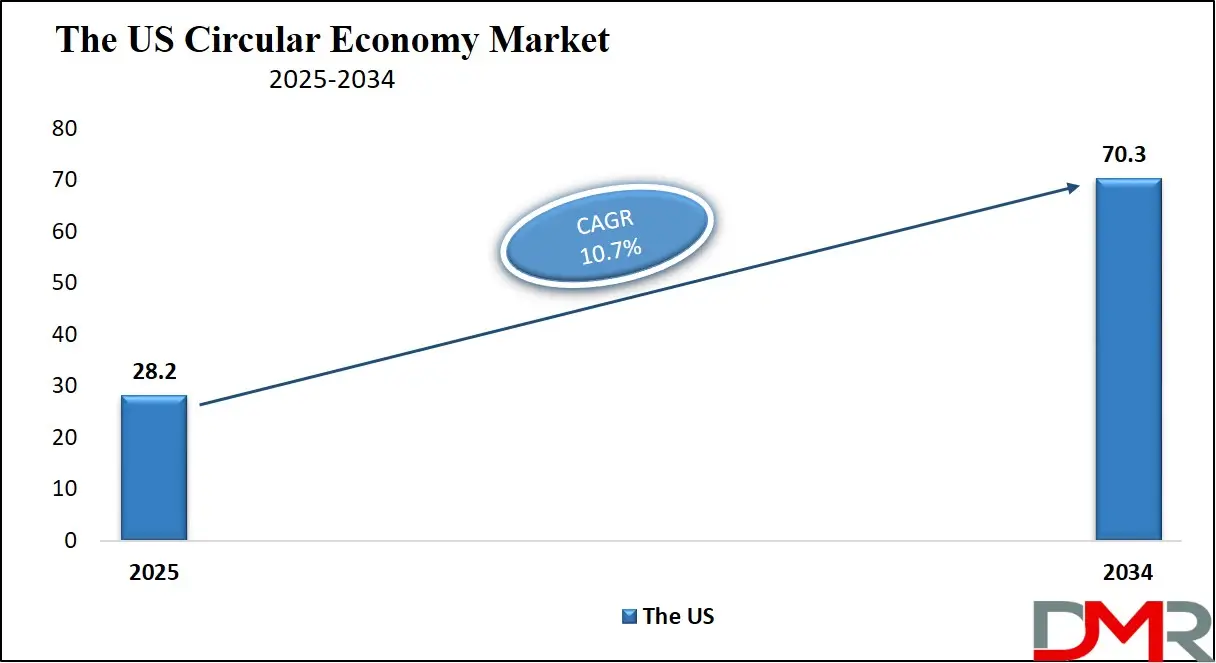

The U.S. Circular Economy market size is projected to be valued at USD 28.2 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 70.3 billion in 2034 at a CAGR of 10.7%.

The US circular economy market is evolving rapidly as industries shift from linear production toward resource efficiency, material recovery and low-waste manufacturing. Companies across packaging, electronics, automotive, construction and consumer goods are investing heavily in recycling technologies, remanufacturing systems, closed-loop supply chains and sustainable product design to reduce dependency on virgin resources.

Growing federal and state regulations focused on waste reduction, extended producer responsibility, sustainable materials management and carbon neutrality are accelerating the transition. The rise of advanced recycling, digital tracking tools, reverse logistics networks, refurbished product ecosystems and industrial symbiosis models is further strengthening the circular economy landscape in the United States.

Market growth is also fueled by increasing consumer demand for eco-friendly products, corporate sustainability commitments, and nationwide initiatives promoting zero waste, circular manufacturing and regenerative production practices. Investments in composting facilities, bioplastics, textile recycling, battery recovery systems and circular packaging solutions are expanding across major states like California, New York, Washington and Massachusetts.

The integration of AI-enabled sorting, automation in waste processing, product-as-a-service models, material innovation and urban mining is helping US industries capture higher material value while reducing landfill dependence. As a result, the US circular economy market is emerging as a key driver of sustainable industry transformation, green job creation and long-term environmental resilience.

Europe Circular Economy Market

Europe’s circular economy market, valued at USD 67.0 billion in 2025 with a CAGR of 10.5%, reflects the region’s strong regulatory commitment to waste reduction, resource efficiency, and low-carbon industrial transformation. The European Union’s Circular Economy Action Plan, extended producer responsibility frameworks, and strict recycling mandates have pushed industries to redesign products, adopt secondary raw materials, and integrate closed-loop manufacturing systems. Countries such as Germany, the Netherlands, and the Nordic nations continue to lead through advanced waste-to-resource infrastructure, high recycling rates, and early adoption of circular procurement policies that encourage businesses to shift away from linear models.

Growth is also supported by rising corporate sustainability goals, increasing investment in green technologies, and strong consumer preference for eco-efficient products. Europe’s focus on digitalization, including AI-enabled waste sorting, traceability platforms, and smart material recovery systems, further accelerates adoption across key verticals such as packaging, automotive, electronics, and construction. With expanding public-private partnerships and innovation hubs, the region is positioned to maintain its leadership in scaling circular solutions globally while advancing toward carbon neutrality and resource independence.

Japan Circular Economy Market

Japan’s circular economy market, valued at USD 11.8 billion in 2025 with a CAGR of 9.2%, is driven by the country’s longstanding focus on resource efficiency, material recovery, and waste minimization. Japan faces significant resource scarcity, which has accelerated national strategies centered on recycling innovation, eco-design, and extending product lifecycles.

Government policies such as the Basic Act for Establishing a Sound Material-Cycle Society and strict recycling laws for plastics, electronics, and automotive components have encouraged industries to adopt high-performance recovery systems and promote reuse-oriented manufacturing practices. Japan’s strong culture of consumer participation in waste segregation further enhances material recovery rates and supports a well-structured circular ecosystem.

Growth is also supported by advancements in robotics, automation, and AI-based waste sorting technologies, which help improve the purity of recycled materials and reduce operational costs. Sectors such as electronics, automotive, and packaging are rapidly integrating circular design principles to reduce environmental impact and enhance supply chain resilience.

Japan’s increasing investments in chemical recycling, hydrogen-based clean energy, and biodegradable materials are strengthening its position as a technology-led circular economy innovator. With expanding collaborations between government, corporations, and academic institutions, Japan is poised to scale advanced circular models that contribute to both sustainability goals and long-term economic stability.

Global Circular Economy Market: Key Takeaways

- Market Value: The global Circular Economy market size is expected to reach a value of USD 443.3 billion by 2034 from a base value of USD 167.5 billion in 2025 at a CAGR of 11.4%.

- By Material Type Segment Analysis: Plastics and Polymers are expected to maintain their dominance in the material type segment, capturing 30.0% of the total market share in 2025.

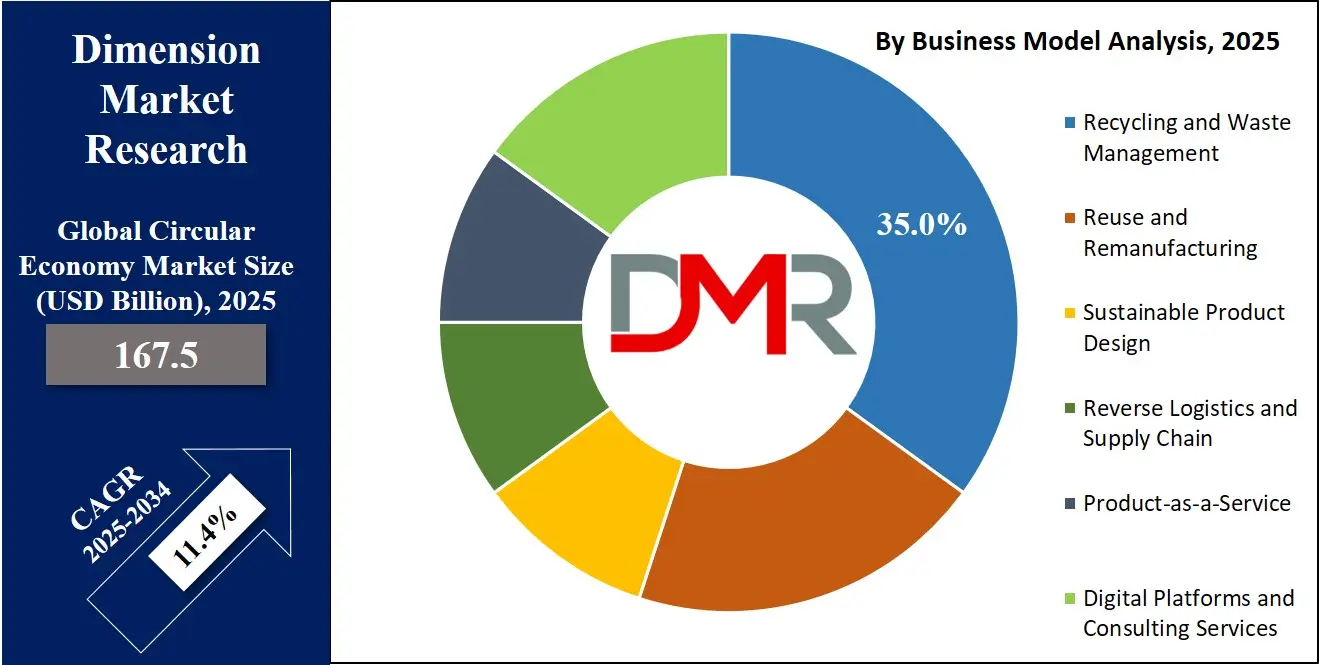

- By Business Model Segment Analysis: Recycling and Waste Management models are anticipated to dominate the business model segment, capturing 35.0% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The Packaging Industry will capture the maximum share in the industry vertical segment, capturing 20.0% of the market share in 2025.

- Regional Analysis: Europe is anticipated to lead the global Circular Economy market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Circular Economy market are Veolia, SUEZ, Waste Management Inc., TOMRA, Schneider Electric, Umicore, TerraCycle, Covanta, DS Smith, Stora Enso, Brambles (CHEP), SIMS Limited, Republic Services, Remondis, Paprec Group, Enel X, Renewi, Loop Industries, and Others.

Global Circular Economy Market: Use Cases

- Recycling and Resource Recovery Optimization: Global industries are adopting advanced recycling technologies to increase material recovery rates and reduce reliance on virgin resources. Automated sorting systems, chemical recycling, urban mining and closed-loop recycling programs allow manufacturers to reclaim plastics, metals, textiles and electronic components with higher efficiency. This use case strengthens resource circularity, minimizes landfill waste and supports sustainable materials management across packaging, electronics and automotive sectors.

- Circular Product Design and Sustainable Manufacturing: Companies are redesigning products for durability, repairability and modularity to extend product lifecycles and reduce waste generation. Design for disassembly, eco-friendly materials, lightweight components and regenerative manufacturing practices help improve resource efficiency and lower environmental impact. This approach enables businesses to integrate circular economy principles into core production processes and create long-lasting, low-waste products.

- Product-as-a-Service and Sharing Models: Organizations are shifting from traditional ownership to usage-based models such as leasing, rental platforms and product-as-a-service. These models reduce consumption of new goods while maximizing asset utilization and lifecycle value. In sectors like electronics, mobility, industrial equipment and home appliances, circular service models help reduce waste, increase refurbishment opportunities and support sustainable consumption patterns.

- Reverse Logistics and Remanufacturing Systems: Efficient reverse logistics networks are being used to collect, sort and return products for reuse, refurbishment or remanufacturing. This approach supports material recovery, lowers production costs and reduces pressure on supply chains by extending the functional life of existing products. Remanufacturing is growing across automotive components, heavy machinery, consumer electronics and industrial tools, contributing to a more resilient and circular global value chain.

Impact of Artificial Intelligence on the global Circular Economy market

Artificial intelligence is becoming a transformative force in the global circular economy market by accelerating resource efficiency, improving waste processing accuracy and enabling smarter material recovery systems. AI-powered sorting technologies in recycling facilities can identify plastics, metals, textiles and complex materials with near-perfect precision, significantly increasing recycling yields and reducing contamination rates.

In manufacturing and supply chains, machine learning optimizes production processes, predicts material flows and identifies opportunities to reuse components or extend product lifecycles. AI-driven digital platforms also enhance real-time tracking of products and materials, supporting closed-loop systems and circular supply chain transparency.

Artificial intelligence further strengthens circular business models by improving demand forecasting, enabling predictive maintenance and facilitating product-as-a-service models that rely on accurate usage data. Companies can use AI analytics to design more durable and repairable products, reduce waste at source and adopt regenerative design principles. Additionally, AI supports carbon footprint reduction, improves sustainability reporting and accelerates compliance with global waste and resource regulations. By connecting recycling infrastructure, manufacturers, logistics networks and consumers through intelligent systems, AI is helping scale circular solutions across industries and is emerging as a key driver of sustainable economic transformation.

Global Circular Economy Market: Stats & Facts

- OECD countries generated more than 770 million tonnes of municipal solid waste in 2023.

- Average municipal waste generation in OECD countries reached 552 kg per person in 2023.

- The share of municipal waste landfilled in OECD countries declined to 40% in 2023, down from 53% in 2010.

- Recycling accounted for 24% and composting 11% of municipal waste in OECD countries in 2023.

- E-waste remained one of the fastest-growing waste streams across OECD nations in 2023.

- Only 22% of global e-waste was formally collected and recycled in 2022 according to OECD reporting.

- E-waste generation has grown five times faster than documented recycling rates since 2010.

- Per-capita plastic and ferrous metal waste increased significantly across OECD economies after 2010.

- OECD material productivity reached about 2.9 euros per kg in 2023, compared to 2 euros per kg in 2000.

- Most OECD countries expanded extended producer responsibility or product stewardship systems by 2023.

- Eurostat / European Commission / EU

- The EU’s circular material use rate reached 11.8% in 2023.

- The EU’s circular material use rate increased to 12.2% in 2024, the highest so far.

- The circularity rate for metal ores in the EU reached 24.7% in 2023, the highest among material categories.

- Non-metallic minerals in the EU recorded a circularity rate of 13.6% in 2023.

- Biomass materials in the EU had a circularity rate of 10.1% in 2023.

- Fossil-energy materials in the EU showed a circularity rate of 3.4% in 2023.

- Several EU countries were identified as at risk of missing their 2025 municipal and packaging recycling targets in 2023 assessments.

- The EU recorded a material footprint of 14.1 tonnes per capita in 2023.

- EU raw material consumption in 2023 consisted of 54% non-metallic minerals, 23% biomass, 18% fossil-energy materials, and 5% metal ores.

- The EU imported 47.2% of its metal raw materials and 73.3% of fossil energy materials in 2023.

- Nearly 4,000 scientific articles related to the circular economy were published in Europe in 2023.

- The European Investment Bank allocated EUR 3.8 billion toward circular-economy projects between 2019 and 2023.

- Annual financing needs for circular-economy transformation in the EU are estimated at EUR 55 billion per year.

Global Circular Economy Market: Market Dynamics

Global Circular Economy Market: Driving Factors

Rising Focus on Resource Efficiency and Waste Reduction

Industries globally are prioritizing resource efficiency to reduce dependency on virgin raw materials and minimize operational costs. Growing landfill pressure, material scarcity and sustainability mandates are pushing companies to adopt recycling systems, closed-loop manufacturing and regenerative production methods. This shift supports higher material recovery, cleaner production cycles and long-term environmental stewardship within the circular economy ecosystem.

Strengthening Regulatory Support for Sustainable Production

Governments are enforcing stricter regulations related to waste management, extended producer responsibility, sustainable packaging and carbon-neutral operations. Incentives for recycling infrastructure, eco-design and low-waste manufacturing are accelerating adoption of circular models across packaging, automotive, electronics and construction markets. These regulatory frameworks encourage industries to transition from linear systems to more circular value chains.

Global Circular Economy Market: Restraints

Limited Recycling Infrastructure and Material Recovery Inefficiencies

Many regions lack advanced recycling facilities capable of processing mixed materials, composite products and complex electronic waste. Inefficiencies in sorting technologies, inconsistent waste collection systems and lack of standardized material streams hinder effective circular operations. This infrastructure gap restricts recovery rates and slows global progress toward circular manufacturing.

High Implementation Costs for Circular Business Models

Transitioning to circular processes often requires significant investment in redesigning products, reconfiguring supply chains, deploying reverse logistics systems and adopting digital tracking platforms. Smaller businesses struggle with initial capital requirements, compliance costs and operational adjustments, which limits widespread adoption of circular practices in developing markets.

Global Circular Economy Market: Opportunities

Growth in Digital Platforms and Smart Circular Technologies

Emerging digital tools such as AI-enabled sorting, IoT material tracking, blockchain verification and digital product passports are opening new opportunities for circular innovation. These technologies help companies monitor product lifecycles, optimize resource flows and enhance transparency in supply chains, enabling scalable circular solutions across global markets.

Expansion of Remanufacturing and Refurbished Product Ecosystems

Demand for refurbished electronics, remanufactured automotive components and reused industrial equipment is increasing due to cost savings and sustainability benefits. Companies can capture new revenue streams by developing repair networks, refurbishment centers and modular product designs that extend lifecycle value. This creates strong potential for growth in high-value circular business models.

Global Circular Economy Market: Trends

Shift toward Circular Packaging and Sustainable Materials

Brands across FMCG, e-commerce and retail are adopting recyclable materials, biodegradable packaging and reusable container systems. Innovations in bioplastics, fiber-based materials and low-impact alternatives are transforming packaging supply chains. This trend is driven by consumer demand for eco-friendly products and corporate commitments to plastic reduction.

Rise of Product-as-a-Service and Sharing Models

Industries are transitioning from ownership-based consumption to service-based access models to reduce waste and improve asset utilization. Leasing, subscription models, mobility-as-a-service and shared equipment platforms are gaining traction across electronics, transportation and industrial sectors. This shift supports circular consumption patterns and enhances material efficiency across global markets.

Global Circular Economy Market: Research Scope and Analysis

By Material Type Analysis

Plastics and polymers are expected to remain the dominant material type segment in the global circular economy market, capturing 30% of the total share in 2025 due to their extensive use in packaging, consumer goods, automotive parts, textiles and electrical applications.

Growing environmental concerns, strict regulations on single-use plastics and rising industry commitments toward recycled content are accelerating investments in mechanical and chemical recycling, bio-based polymers and closed-loop packaging systems. As companies prioritize resource efficiency and sustainable materials, plastics and polymers continue to lead circular strategies across global industries.

Metals and electronic waste also form a major segment of the circular economy market because of the high recovery value of metals such as copper, aluminum, lithium, gold and rare earth elements. The surge in electronics consumption, electric vehicle adoption and industrial automation is generating large volumes of e-waste that require efficient recycling systems. Advanced shredding technologies, urban mining, hydrometallurgical recovery and AI-enabled sorting are helping industries extract valuable materials, reduce landfill disposal and improve circular material flows.

This segment is gaining importance as manufacturers seek secure, sustainable and cost-effective sources of critical raw materials.

By Business Model Analysis

Recycling and waste management models are projected to dominate the business model segment, capturing 35% of the total market share in 2025 due to the strong global push for resource recovery, landfill reduction and sustainable material circulation. Governments, industries and municipalities are investing heavily in advanced recycling infrastructure, automated sorting systems, waste-to-energy plants, chemical recycling technologies and large-scale material recovery facilities to manage rising volumes of plastics, packaging waste, metals, e-waste and organic waste.

As circular economy regulations tighten and companies adopt recycled content targets, the demand for efficient recycling pathways continues to grow. This model also supports cleaner production systems, reduces raw material dependency and helps organizations meet sustainability targets, ensuring its continued leadership in the circular economy ecosystem.

Reuse and remanufacturing models also play a significant role in the circular economy market as industries increasingly aim to extend the lifecycle of products and components. This segment involves refurbishing machinery, remanufacturing automotive parts, restoring electronics, rebuilding industrial equipment and developing modular designs that allow easier repair and replacement.

Companies prefer reuse and remanufacturing because they help reduce production costs, lower material consumption, minimize waste generation and create high-value secondary markets. With growing consumer interest in refurbished products, expansion of repair networks and rising adoption of product life extension strategies, this segment is gaining momentum and strengthening overall circularity across manufacturing, automotive, electronics and industrial sectors.

By Industry Vertical Analysis

The packaging industry will capture the highest share in the industry vertical segment, accounting for 20% of the market in 2025 as global brands, retailers and manufacturers shift toward recyclable, reusable and low-impact packaging materials. Rising regulations on single-use plastics, mandatory recycled content requirements and corporate sustainability commitments are pushing companies to adopt circular packaging solutions such as fiber-based materials, compostable alternatives, refill models and closed-loop plastic systems.

The rapid growth of e-commerce, food delivery and consumer goods sectors also increases packaging demand, further accelerating investments in material recovery, innovative design for recyclability and large-scale recycling infrastructure. As businesses aim to reduce waste generation and improve resource efficiency, the packaging industry continues to be the primary driver of circular economy adoption globally.

The automotive industry also plays a major role in the circular economy market due to the high potential for component reuse, remanufacturing and material recovery. Modern vehicles contain significant quantities of metals, plastics, electronics, batteries and critical minerals, making them ideal for circular processes. Automakers are increasingly embracing remanufactured engines, refurbished transmissions, recycled aluminum, recovered polymers and closed-loop battery recycling programs as they work toward sustainability targets and resource security.

The shift to electric vehicles is further boosting demand for recycling systems that can recover lithium, nickel, cobalt and other valuable materials from end-of-life batteries. With rising pressure to reduce production emissions and enhance lifecycle efficiency, the automotive sector is rapidly adopting circular design principles, modular components and extended product lifecycle strategies to support long-term environmental and economic resilience.

The Circular Economy Market Report is segmented on the basis of the following:

By Material Type

- Plastics and Polymers

- Metals and Electronic Waste

- Textiles

- Organic Waste and Food Waste

- Wood Waste

- Glass Waste

By Business Model

- Recycling and Waste Management

- Reuse and Remanufacturing

- Sustainable Product Design

- Reverse Logistics and Supply Chain

- Product-as-a-Service

- Digital Platforms and Consulting Services

By Industry Vertical

- Packaging Industry

- Automotive Industry

- Electronics Industry

- Textile and Fashion Industry

- Construction and Building Materials Industry

- Food and Agriculture Industry

- Consumer Goods and Logistics Industry

Global Circular Economy Market: Regional Analysis

Region with the Largest Revenue Share

Europe is expected to lead the global circular economy market with 40% of total revenue in 2025 due to its strong regulatory framework, ambitious sustainability targets and early adoption of circular business models across key industries. The region benefits from the EU Circular Economy Action Plan, strict waste management directives, extended producer responsibility schemes and aggressive policies promoting recycling, eco-design, material recovery and carbon-neutral production.

European countries are investing heavily in advanced recycling facilities, digital product passports, circular packaging systems, refurbished goods markets and closed-loop manufacturing across automotive, electronics, textiles and construction sectors. With strong government support, high consumer awareness and active participation from major industries, Europe continues to set the global benchmark for circular economy innovation and large-scale implementation.

Region with significant growth

Asia Pacific is emerging as the region with the most significant growth in the global circular economy market, driven by rapid industrialization, rising waste generation, expanding urban populations and increasing government initiatives focused on sustainability. Countries such as China, Japan, South Korea and India are investing heavily in recycling infrastructure, waste-to-energy systems, circular packaging solutions and resource recovery technologies to address environmental pressures and material scarcity.

The region’s booming manufacturing, electronics, automotive and consumer goods sectors are accelerating the adoption of circular business models such as remanufacturing, refurbished products, closed-loop supply chains and advanced material recovery. Growing private sector participation, stronger policy frameworks and rising awareness of sustainable consumption are further positioning Asia Pacific as the fastest-growing region in the circular economy landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Circular Economy Market: Competitive Landscape

The global circular economy market features a highly competitive landscape driven by companies continuously innovating to integrate sustainable materials, recycling technologies, and resource-efficient solutions into their portfolios. Competition is intensifying as players focus on closing material loops, expanding waste-to-value operations, and adopting advanced digital tools such as AI, IoT, and blockchain to enhance traceability and optimize resource flows.

Market participants are increasingly forming strategic partnerships, entering new geographic regions, and investing in R&D to strengthen their sustainability capabilities. Additionally, regulatory pressure and shifting consumer expectations are pushing companies to differentiate through eco-design, circular supply chain models, and carbon-neutral operations, resulting in a dynamic and rapidly evolving competitive ecosystem.

Some of the prominent players in the global Circular Economy market are

- Veolia

- SUEZ

- Waste Management Inc.

- TOMRA

- Schneider Electric

- Umicore

- TerraCycle

- Covanta

- DS Smith

- Stora Enso

- Brambles (CHEP)

- SIMS Limited

- Republic Services

- Remondis

- Paprec Group

- Enel X

- Renewi

- Loop Industries

- Plastic Energy

- Interface Inc.

- Other Key Players

Global Circular Economy Market: Recent Developments

- October 2025: Redwood Materials raised USD 350 million from major investors including Eclipse Ventures and Nvidia to accelerate the expansion of its battery recycling and critical-material recovery operations.

- August 2025: Remondis completed the takeover of Siemer, a German sorting and recycling company, enhancing its capabilities in plastics and packaging waste processing.

- August 2025: Remondis acquired an 80% stake in French recycling company Schroll, strengthening its position in the European waste-management and circular-economy ecosystem.

- July 2025: Veolia announced a £70 million project to build the UK’s first closed-loop “tray-to-tray” PET recycling facility in Shropshire to increase domestic recycled-plastic output.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 167.5 Bn |

| Forecast Value (2034) |

USD 443.3 Bn |

| CAGR (2025–2034) |

11.4% |

| The US Market Size (2025) |

USD 28.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material Type (Plastics and Polymers, Metals and Electronic Waste, Textiles, Organic Waste and Food Waste, Wood Waste, Glass Waste), By Business Model (Recycling and Waste Management, Reuse and Remanufacturing, Sustainable Product Design, Reverse Logistics and Supply Chain, Product-as-a-Service, Digital Platforms and Consulting Services), By Industry Vertical (Packaging Industry, Automotive Industry, Electronics Industry, Textile and Fashion Industry, Construction and Building Materials Industry, Food and Agriculture Industry, Consumer Goods and Logistics Industry). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Veolia, SUEZ, Waste Management Inc., TOMRA, Schneider Electric, Umicore, TerraCycle, Covanta, DS Smith, Stora Enso, Brambles (CHEP), SIMS Limited, Republic Services, Remondis, Paprec Group, Enel X, Renewi, Loop Industries, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global Circular Economy market size is estimated to have a value of USD 167.5 billion in 2025 and is expected to reach USD 443.3 billion by the end of 2034.

The US Circular Economy market is projected to be valued at USD 28.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 70.3 billion in 2034 at a CAGR of 10.7%.

Europe is expected to have the largest market share in the global Circular Economy market, with a share of about 40.0% in 2025.

Some of the major key players in the global Circular Economy market are Veolia, SUEZ, Waste Management Inc., TOMRA, Schneider Electric, Umicore, TerraCycle, Covanta, DS Smith, Stora Enso, Brambles (CHEP), SIMS Limited, Republic Services, Remondis, Paprec Group, Enel X, Renewi, Loop Industries, and Others.

The market is growing at a CAGR of 11.4 percent over the forecasted period.