Market Overview

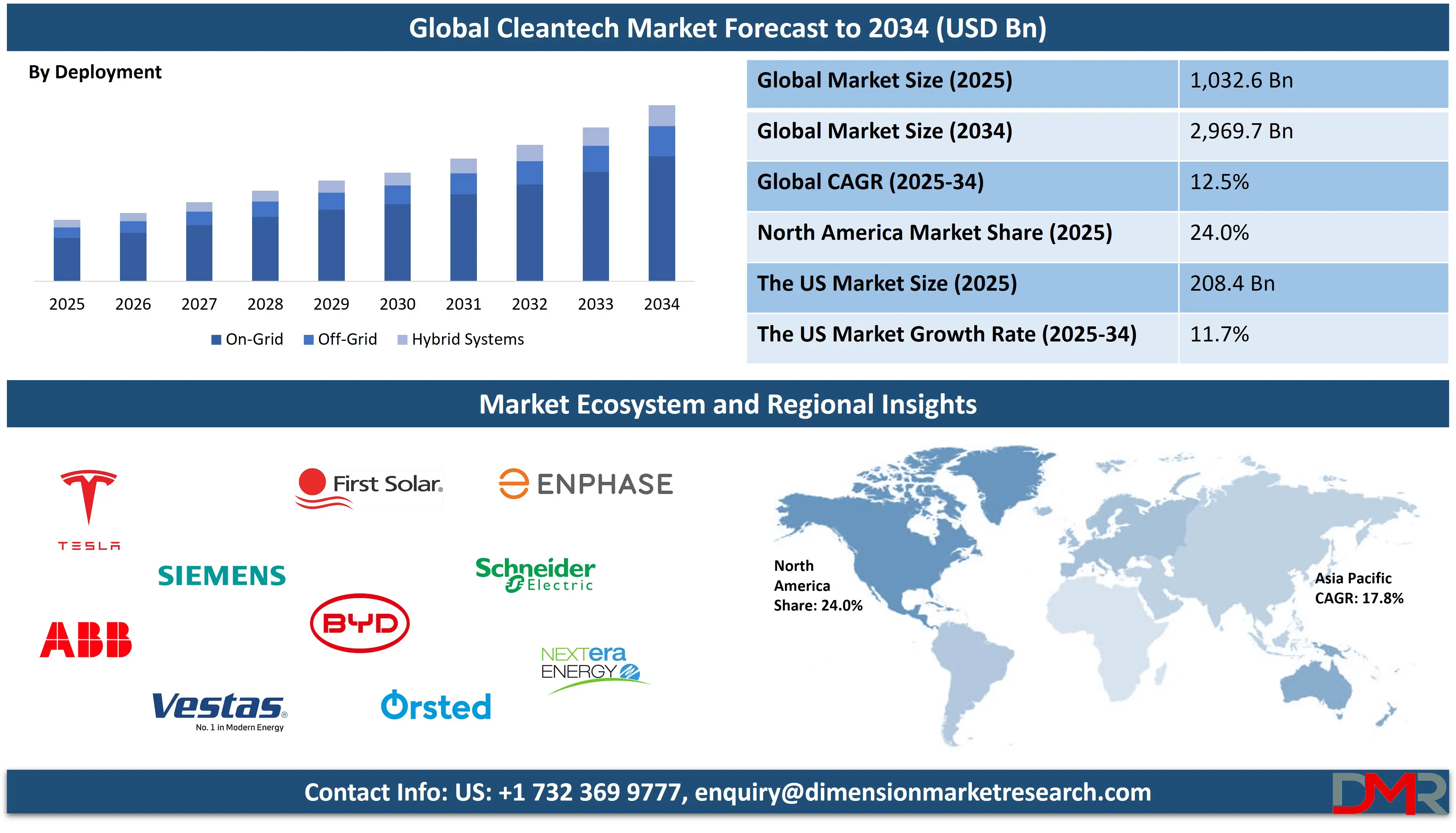

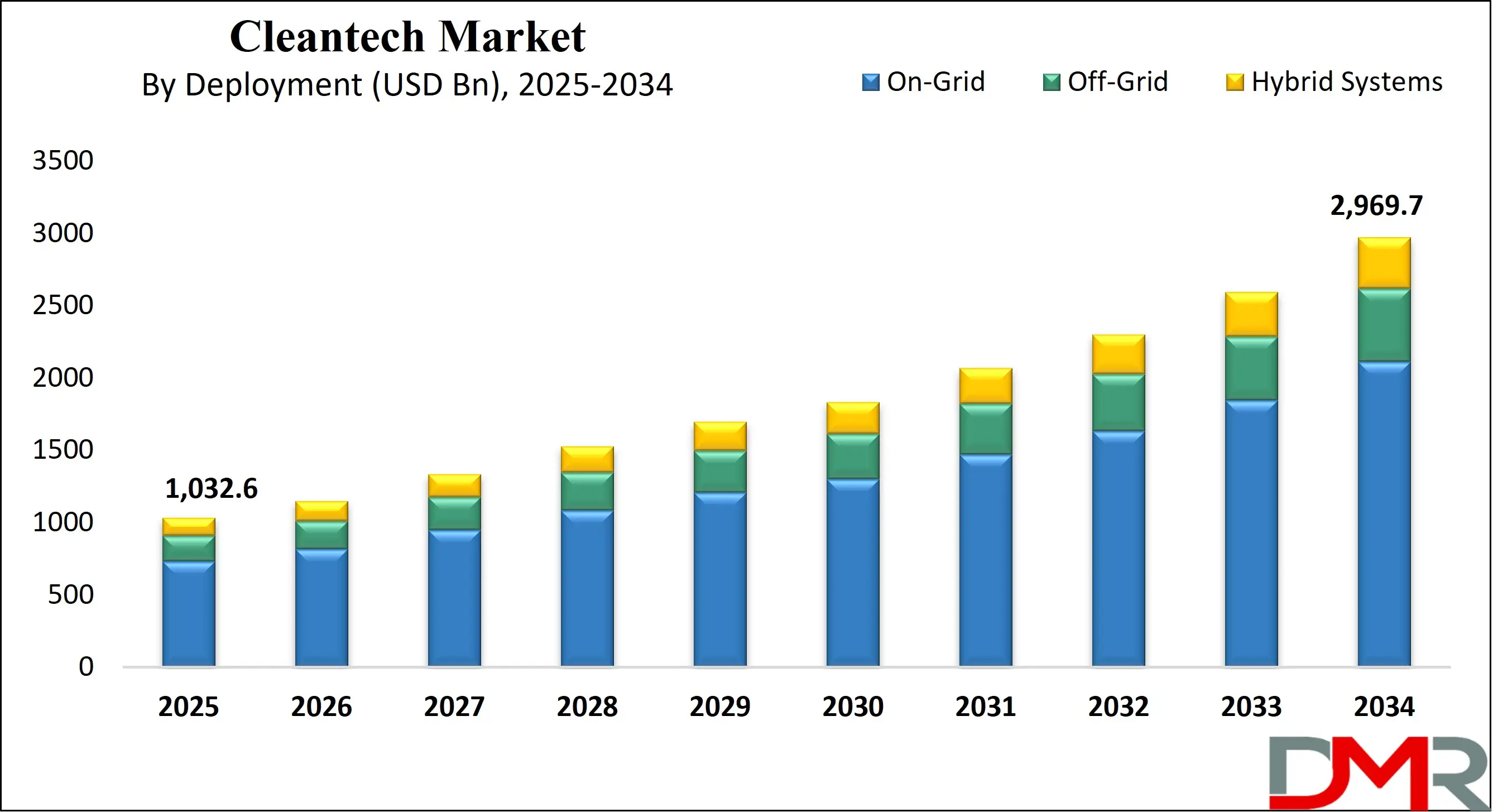

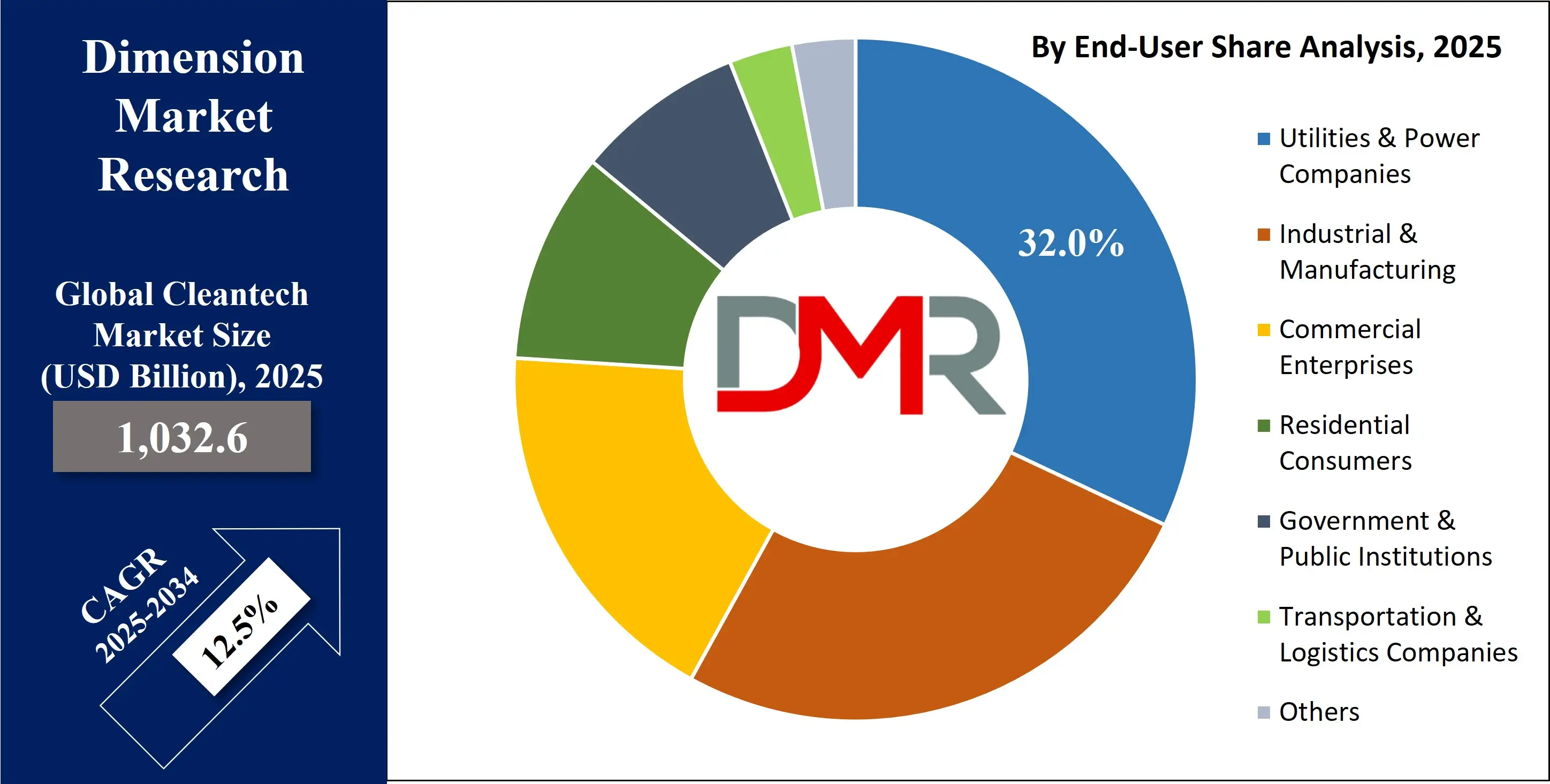

The Global Cleantech Market is projected to reach USD 1,032.6 billion in 2025 and is expected to grow to USD 2,969.7 billion by 2034, advancing at a CAGR of 12.5%. This growth reflects accelerating demand for clean energy technologies, sustainable infrastructure, low carbon solutions, and advanced environmental technologies across power, mobility, industrial, and resource management sectors.

Cleantech refers to a broad ecosystem of environmentally sustainable technologies designed to reduce emissions, minimize resource consumption, and enhance energy efficiency across industrial, commercial, and residential landscapes. It integrates advanced renewable energy systems, next generation energy storage, low carbon transportation, precision water treatment, circular economy innovations, and digital optimization tools to create solutions that support climate resilience and ecological balance.

The concept goes beyond environmental protection and focuses on long term economic viability by promoting clean energy adoption, resource recovery, smart energy management, and carbon reduction pathways that enable industries to transition toward a greener and more competitive future.

The global cleantech market represents a rapidly expanding industry driven by the global shift toward sustainable development, carbon neutrality targets, and the growing demand for clean energy technologies across major economies.

This market covers a wide spectrum of solutions such as solar and wind power, electric mobility, smart grids, hydrogen production, energy efficient building systems, advanced recycling technologies, and digital platforms for monitoring and optimization. Increasing investments from governments and private organizations, integrated with stricter environmental regulations and rising energy security concerns, have accelerated the deployment of climate friendly technologies across both developed and emerging regions.

As countries integrate renewable capacity, modernize infrastructure, and adopt low carbon technologies, the global cleantech market continues to play a pivotal role in transforming energy systems and industrial operations. The market is supported by innovations in battery storage, carbon capture solutions, and green hydrogen which enable deeper decarbonization across sectors such as power generation, transportation, manufacturing, and water management.

The rise of smart energy networks, data driven sustainability solutions, and circular economy models further enhances the market’s growth trajectory by enabling cost effective, efficient, and scalable pathways toward a cleaner and more resilient global economy.

The US Cleantech Market

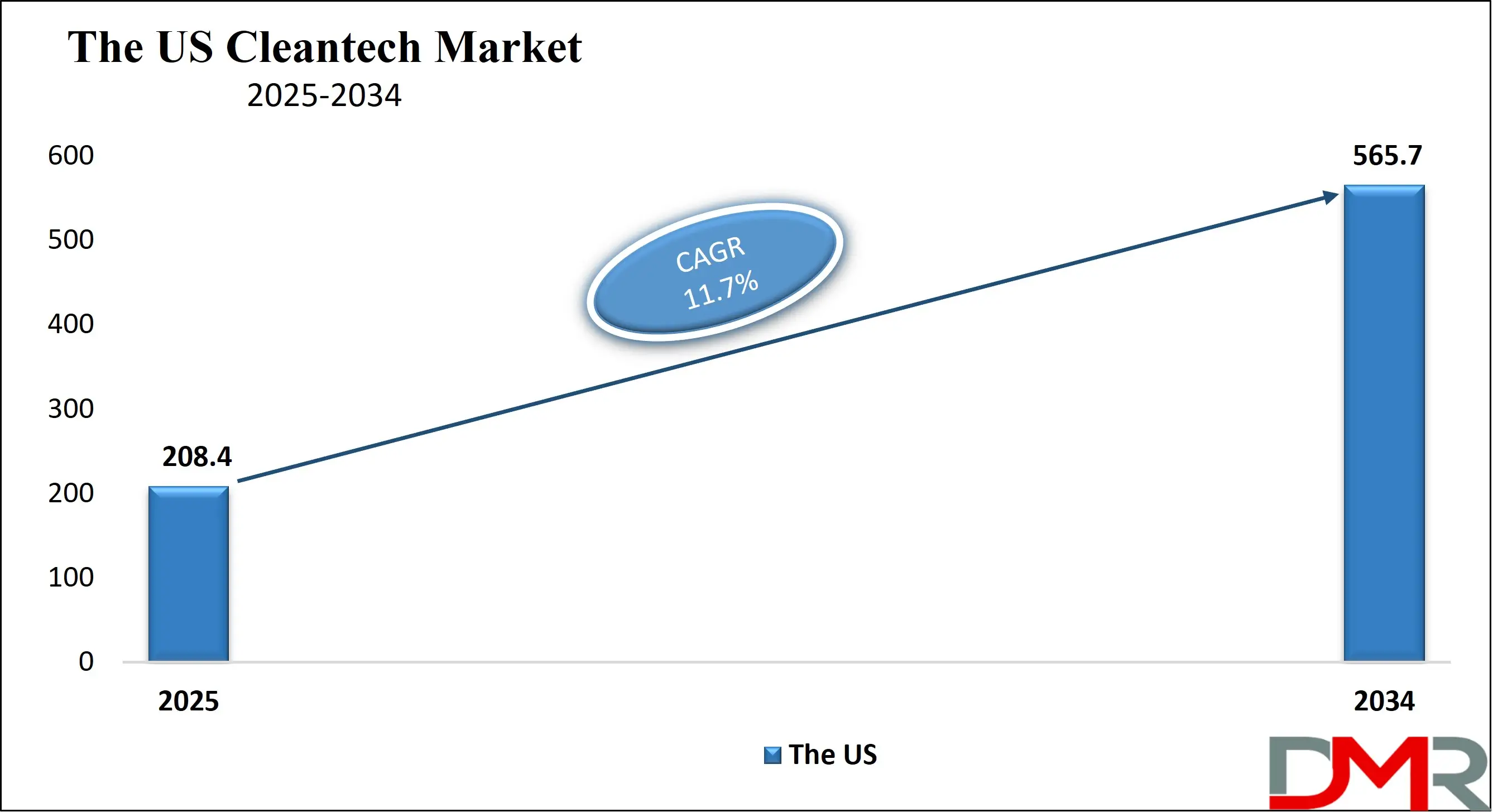

The U.S. Cleantech market size is projected to be valued at USD 208.4 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 565.7 billion in 2034 at a CAGR of 11.7%.

The US cleantech market is undergoing rapid expansion as the country accelerates its transition toward clean energy, low carbon transportation, and sustainable industrial systems. Strong federal incentives, renewable energy targets, and large scale investments in solar, wind, battery storage, and green hydrogen are reshaping the national energy landscape.

Growth is further supported by widespread deployment of electric vehicles, modernization of the power grid, digital energy management platforms, and advanced water treatment technologies. Rising corporate sustainability commitments, increasing carbon reduction strategies, and the push for energy security are driving demand for climate friendly technologies across utilities, manufacturing, commercial real estate, and logistics networks.

In addition to clean power generation, the US cleantech market is seeing strong momentum in next generation battery technologies, carbon capture and storage solutions, circular economy innovations, and energy efficient building systems. States such as California, Texas, New York, and Colorado continue to lead in renewable installations and EV adoption, while industrial regions are investing heavily in electrification and low carbon process technologies.

Federal programs supporting domestic manufacturing of solar panels, EV batteries, Smart Grid Sensors, and hydrogen equipment are strengthening local supply chains and elevating the nation’s technology competitiveness. The rapidly expanding ecosystem of smart grid solutions, advanced recycling platforms, and climate tech startups is further positioning the United States as a leading global hub for innovation in clean energy, resource efficiency, and sustainable infrastructure.

Europe Cleantech Market

Europe’s cleantech market is projected to reach USD 278.8 billion in 2025, reflecting the region’s deep commitment to accelerating its clean energy and decarbonization agenda. Driven by strong regulatory frameworks, ambitious climate targets, and large-scale investments under the EU Green Deal, Europe continues to expand renewable energy capacity across solar, offshore wind, hydropower, and green hydrogen.

Countries like Germany, the UK, Denmark, and Spain are pushing aggressive renewable energy installations, while the region also leads in electric mobility adoption, circular economy solutions, and industrial decarbonization initiatives. This strong policy support, combined with advanced manufacturing capabilities and sustained funding for green infrastructure, positions Europe as one of the most mature and innovation-driven cleantech ecosystems globally.

The market is further expected to grow at a CAGR of 11.2%, supported by rising corporate sustainability commitments, increased electrification of transport and industry, and rapid digitalization of energy systems. Europe is witnessing widespread deployment of smart grids, large battery storage systems, carbon accounting platforms, and energy-efficient building technologies, which collectively strengthen regional demand.

Additionally, the push for energy independence, accelerated after recent geopolitical disruptions, is prompting even faster expansion of domestic renewable generation and green hydrogen production. With strong momentum and consistent policy-driven investments, Europe is on track to remain one of the fastest-growing regions in the global cleantech landscape over the coming decade.

Japan Cleantech Market

Japan’s cleantech market is projected to reach USD 62.0 billion in 2025, reflecting the country’s steady transition toward a low-carbon energy ecosystem driven by its long-term commitment to carbon neutrality and energy security. Japan is rapidly expanding renewable energy deployment, particularly solar PV, offshore wind, and geothermal—areas where it has strong technological expertise.

The government’s focus on modernizing aging energy infrastructure, promoting smart grids, and integrating advanced energy-efficient technologies across residential, commercial, and industrial sectors is further accelerating market demand. In addition, Japan’s leadership in hydrogen technology, fuel cells, and waste-to-energy solutions continues to strengthen its position as a high-innovation cleantech hub in Asia.

The market is expected to grow at a CAGR of 9.5%, supported by rising investments in decentralized energy systems, battery storage, electric mobility, and industrial decarbonization technologies. Japan’s Green Growth Strategy, incentives for clean mobility adoption, and push for next-generation grid resilience are shaping long-term market expansion.

Corporations are increasingly adopting clean energy procurement frameworks and digital sustainability solutions to meet ESG-driven targets, further boosting cleantech adoption. As Japan enhances domestic renewable capacity and accelerates hydrogen integration into power generation and mobility, the cleantech market is set to maintain strong, stable, and innovation-led growth through the next decade.

Global Cleantech Market: Key Takeaways

- Market Value: The global Cleantech market size is expected to reach a value of USD 2,969.7 billion by 2034 from a base value of USD 1,032.6 billion in 2025 at a CAGR of 12.5%.

- By Solution Analysis: Hardware solutions are anticipated to dominate the solution segment, capturing 68.0% of the total market share in 2025.

- By Technology Segment Analysis: Renewable Energy Technologies will account for the maximum share in the technology segment, capturing 38.0% of the total market value.

- By Deployment Segment Analysis: On-Grid will dominate the deployment segment, capturing 71.0% of the market share in 2025.

- By Application Segment Analysis: Power Generation applications are expected to maintain their dominance in the application segment, capturing 34.0% of the total market share in 2025.

- By End-User Segment Analysis: Utilities & Power Companies will dominate the end-user segment, capturing 32.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global Cleantech market landscape with 39.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Cleantech market are Tesla, Siemens, ABB, Vestas, First Solar, BYD, Enphase Energy, Schneider Electric, Orsted, NextEra Energy, Plug Power, Bloom Energy, SunPower Corporation, and Others.

Global Cleantech Market: Use Cases

- Renewable Power Generation Expansion: Cleantech plays a central role in accelerating large scale renewable energy deployment through solar PV farms, offshore and onshore wind projects, and hybrid renewable systems supported by advanced energy storage. Utilities and independent power producers are adopting clean energy technologies to reduce grid emissions, enhance energy security, and meet decarbonization targets. The growing integration of smart inverters, digital monitoring platforms, and grid balancing solutions enables stable and efficient renewable power generation across global markets.

- Electric Mobility and Charging Infrastructure: The global shift toward electric vehicles is creating strong demand for cleantech solutions focused on charging networks, battery technologies, and fleet electrification. Automakers, logistics companies, and public transport operators increasingly rely on clean transportation technologies to reduce fuel dependency and lower lifecycle emissions. Fast charging hubs, smart charging software, and grid integrated EV infrastructure are transforming mobility ecosystems and supporting the rapid expansion of low carbon transportation.

- Industrial Decarbonization and Energy Efficiency: Industries across manufacturing, chemicals, metals, and oil and gas are adopting cleantech solutions to cut operational emissions, optimize energy use, and transition to low carbon production systems. Key applications include electrified processes, high efficiency heat pumps, advanced automation, and waste heat recovery systems. Digital energy management platforms, sensor based monitoring, and predictive analytics help enterprises reduce energy intensity, improve resource efficiency, and align with sustainability and carbon neutrality goals.

- Circular Economy and Resource Recovery: Cleantech technologies are enabling advanced recycling, waste to energy systems, and material recovery solutions that support circular economy practices globally. Waste management operators and municipalities are adopting chemical recycling, anaerobic digestion, and energy recovery solutions to minimize landfill usage and promote sustainable resource utilization. Innovations in water recycling, biomass conversion, and sustainable materials further enhance environmental performance and help regions address waste reduction, resource scarcity, and climate resilience challenges.

Impact of Artificial Intelligence on the global Cleantech market

Artificial intelligence is transforming the global cleantech market by accelerating efficiency, improving prediction accuracy, and enabling smarter, low-carbon operations across energy, mobility, water, and industrial systems. AI driven analytics enhance renewable energy optimization by forecasting solar and wind output, improving grid integration, and reducing intermittency challenges. Machine learning models help utilities balance supply and demand, optimize battery storage cycles, detect grid faults, and manage distributed energy resources with real time precision. This leads to higher renewable uptake, reduced curtailment, and improved energy reliability.

AI also plays a major role in electric mobility through smart charging management, fleet optimization, and predictive maintenance for EV infrastructure. In industrial decarbonization, AI powered process controls improve energy efficiency, reduce emissions, and streamline resource usage across manufacturing, chemicals, metals, and heavy industries. Water and waste management systems use AI for leak detection, contamination monitoring, automated sorting, and advanced recycling workflows that improve recovery rates. Carbon capture and monitoring systems apply AI for real time emissions tracking, carbon accounting, and performance optimization. Overall, artificial intelligence enhances the scalability, cost effectiveness, and impact of cleantech solutions, accelerating global progress toward a lower carbon and resource efficient economy.

Global Cleantech Market: Stats & Facts

- International Energy Agency (IEA)

- In the first half of 2024, more than 40 countries earmarked USD 290 billion in clean energy support through government policies.

- Global energy investment in 2024 is expected to exceed USD 3 trillion, with USD 2 trillion flowing into clean energy technologies and infrastructure.

- Energy-related CO₂ emissions grew by 1.1 percent in 2023, with the increase significantly limited by rapid global clean energy deployment.

- Eurostat (European Commission)

- The share of renewables in the EU’s gross final energy consumption reached 24.5 percent in 2023, continuing its upward trajectory.

- Renewable energy accounted for 45.3 percent of the EU’s gross electricity consumption in 2023.

- Renewables made up 26.2 percent of energy used for heating and cooling in the EU in 2023.

- In the EU transport sector, renewables represented 10.8 percent of final energy consumption in 2023.

- European Commission (Competitiveness Progress Report 2025)

- Renewable energy jobs in the EU reached 1.8 million in 2023, reflecting strong growth in solar, wind, and energy efficiency sectors.

- Renewable sources supplied 48 percent of the EU’s electricity mix in 2024, up from 45 percent in 2023.

- Half of the EU member states increased public research and innovation spending on net-zero technologies in 2023, with overall R&I support projected to rise by 9 percent.

- IRENA (International Renewable Energy Agency)

- Europe recorded 2.05 million renewable energy jobs in 2023, with approximately 1.81 million of these located in EU-27 countries.

- UNEP / Global Alliance for Buildings and Construction (GlobalABC)

- In 2023, the global buildings and construction sector accounted for 32 percent of worldwide energy demand and 34 percent of global CO₂ emissions.

- Operational energy use in global buildings represented around 30 percent of global final energy consumption in 2023, and when including material-related emissions, the share rose to 34 percent.

Global Cleantech Market: Market Dynamics

Global Cleantech Market: Driving Factors

Accelerating Renewable Energy Adoption

The global cleantech market is strongly driven by the rapid expansion of solar, wind, and hybrid renewable systems as countries pursue clean energy transitions and carbon neutrality targets. Falling technology costs, supportive government incentives, and large scale investments from utilities are boosting the deployment of renewable energy technologies globally. Digital optimization tools, smart grid solutions, and advanced energy storage further strengthen the shift toward sustainable power generation, improving system efficiency and long term energy security.

Growth in Electric Mobility and Clean Transportation

Rising demand for electric vehicles, charging networks, and fleet electrification is creating strong momentum for clean transportation technologies. Governments and private operators are investing in EV infrastructure, battery innovation, and hydrogen mobility to cut emissions and reduce dependency on fossil fuels. This shift toward low carbon mobility fuels the adoption of smart charging platforms, lightweight materials, digital routing tools, and clean mobility solutions across urban and industrial environments.

Global Cleantech Market: Restraints

High Initial Capital Requirements

Despite falling technology costs, cleantech projects often require substantial upfront investment in renewable plants, battery energy storage systems, and advanced manufacturing capabilities. These financial barriers limit adoption in emerging markets and small enterprises, especially where access to long term financing is limited. Infrastructure challenges, grid modernization needs, and long payback periods further slow the scale up of sustainable technologies.

Supply Chain Constraints and Resource Limitations

The cleantech market faces constraints due to material shortages, manufacturing bottlenecks, and geopolitical uncertainties affecting critical minerals like lithium, cobalt, and rare earth elements. These materials are essential for solar modules, EV batteries, fuel cells, and power electronics. Disruptions in global supply chains impact production timelines, cost stability, and technology deployment, creating uncertainty for large scale clean energy expansion.

Global Cleantech Market: Opportunities

Scaling Green Hydrogen and Fuel Cell Technologies

The emergence of green hydrogen as a clean fuel offers significant opportunities for decarbonizing heavy industry, long haul transport, and energy storage. Investments in electrolyzers, hydrogen distribution networks, and fuel cell systems are opening new pathways for clean energy applications. As renewable capacity increases, green hydrogen production becomes more competitive, enabling large scale integration into industrial, mobility, and power sectors.

AI and Digital Platforms for Sustainability Optimization

Artificial intelligence and advanced digital tools present major opportunities to enhance cleantech performance through predictive analytics, automated monitoring, and real time optimization. AI enabled energy management systems improve grid stability, battery efficiency, and renewable forecasting accuracy. Digital platforms for carbon accounting, smart metering, and resource tracking support better decision making and accelerate the adoption of low carbon technologies across industries.

Global Cleantech Market: Trends

Rise of Circular Economy and Waste Valorization

Circular economy practices are becoming a defining trend as industries adopt advanced recycling, waste to energy solutions, and material recovery technologies. Chemical recycling, biomass conversion, and closed loop manufacturing reduce landfill waste and promote sustainable resource utilization. Global efforts to reduce plastic waste and improve recycling infrastructure are driving innovation across cleantech value chains.

Decentralized Energy Systems and Microgrids

Decentralized energy models are emerging as a major trend as businesses and communities adopt microgrids, rooftop solar systems, and distributed storage solutions. These systems improve resilience, reduce transmission losses, and support greater integration of renewable energy. Digital grid technologies, peer to peer energy trading, and community solar models are reshaping energy distribution and empowering local renewable adoption.

Global Cleantech Market: Research Scope and Analysis

By Solution Analysis

Hardware solutions are anticipated to dominate the solution segment, capturing 68.0% of the total global cleantech market share in 2025. This leadership is fueled by large-scale investments in renewable infrastructure, including solar panels, wind turbines, EV charging stations, energy-efficient industrial systems, and advanced storage technologies. These systems involve substantial manufacturing, installation, and maintenance activity, which drives higher revenue contribution. Growing electrification programs, clean-energy transition policies, and utility-scale project deployments further reinforce the strong demand for hardware offerings in this market.

Software solutions form the complementary digital layer that enhances the performance and reliability of clean energy hardware. This segment includes intelligent energy management platforms, real-time monitoring tools, predictive maintenance systems, carbon tracking applications, and AI-enabled optimization engines that help reduce energy losses and operational downtime. While smaller in direct revenue contribution, software drives high strategic value by improving efficiency, enabling automation, and supporting scalable clean energy operations across utilities, industries, and commercial facilities.

By Technology Analysis

Renewable energy technologies will account for the largest share of the technology segment, capturing 38.0% of the total market value in 2025. Their dominance is driven by massive global investments in solar PV, onshore and offshore wind, hydropower modernisation, and emerging bioenergy and geothermal solutions.

Rapid cost reductions in solar and wind equipment, government incentives, renewable portfolio standards, and corporate sustainability targets are accelerating adoption at an unprecedented scale. Utility-scale solar farms, high-capacity wind projects, and hybrid renewable installations continue to expand, making renewable energy the backbone of the global clean transition and the most influential technology category in the cleantech landscape.

Energy storage technologies are steadily gaining prominence as they provide the essential flexibility, grid stability, and system reliability required to integrate large amounts of renewable power. This segment includes advanced lithium-ion batteries, solid-state innovations, flow battery systems, pumped hydro storage, thermal storage units, and compressed air solutions that help smooth fluctuations in supply and improve energy availability.

The growing need for peak load management, energy arbitrage, backup power, and decentralized storage systems across utilities, commercial facilities, and residential customers is accelerating deployment. As grids become more renewable-heavy, storage is becoming one of the most strategic enablers of long-term energy security and operational efficiency.

By Deployment Analysis

On-grid systems will dominate the deployment segment, capturing 71.0% of the market share in 2025 as most global cleantech projects continue to be integrated directly into national and regional power networks. The expansion of utility-scale solar farms, large wind installations, grid-connected battery storage, and centralized renewable generation is driving this dominance.

Governments and utilities are increasing investments in smart grid upgrades, transmission expansion, and digital grid management, which further strengthens the preference for on-grid solutions. These systems offer higher efficiency, predictable power delivery, and seamless distribution across residential, commercial, and industrial consumers, making on-grid infrastructure the backbone of the global clean energy transition.

Off-grid systems are witnessing rising adoption as they address remote, rural, and underserved regions where grid extension is either economically unviable or technically challenging. This segment benefits from the growing demand for energy independence, microgrids, stand-alone solar home systems, and decentralized renewable units that ensure reliable electricity without grid dependency.

Off-grid solutions are increasingly used in mining sites, islands, telecom towers, agriculture operations, and disaster-prone regions that require uninterrupted power and resilience. Technological improvements in compact solar units, battery storage, hybrid microgrids, and portable clean-energy devices are accelerating uptake, positioning off-grid ecosystems as a crucial enabler of inclusive and sustainable electrification.

By Application Analysis

Power generation applications are expected to maintain their dominance in the application segment, capturing 34.0% of the total market share in 2025 as global economies continue shifting from fossil-fuel-based systems toward large-scale renewable generation. Utility-scale solar farms, onshore and offshore wind parks, bioenergy plants, geothermal units, and hybrid renewable systems are driving this leadership.

Governments are expanding clean energy targets, corporate buyers are increasing renewable power purchase agreements, and grid operators are modernizing transmission networks to accommodate high-capacity green power. This sustained momentum positions power generation as the core pillar of the cleantech ecosystem, supporting energy security, decarbonization mandates, and long-term sustainability goals globally.

Energy storage applications are becoming increasingly essential as they enhance the reliability and flexibility of modern energy systems. Storage solutions are being deployed to balance renewable intermittency, ensure peak load management, support backup power needs, and enable decentralized energy ecosystems across residential, commercial, and industrial sectors.

Technologies such as advanced lithium-ion batteries, flow batteries, thermal storage, and mechanical storage systems are expanding rapidly as grids become more renewable-heavy. The adoption of distributed storage, virtual power plants, and behind-the-meter batteries is accelerating, making energy storage a strategic enabler of grid modernization and a foundational component of next-generation clean energy infrastructure.

By End-User Analysis

Utilities and power companies will dominate the end-user segment, capturing 32.0% of the market share in 2025 as they remain the primary drivers of large-scale clean energy deployment globally. These entities are leading the transition from conventional fossil-based grids to renewable-centric power systems by investing heavily in utility-scale solar farms, wind parks, hydropower modernization, and long-duration grid storage.

Regulatory mandates, decarbonization commitments, and the need to upgrade aging transmission and distribution networks are accelerating their role in cleantech adoption. Utilities are also expanding smart grid initiatives, digital energy management platforms, and grid-connected microgrids, positioning them at the core of global clean energy transformation and large-scale climate action.

Industrial and manufacturing users are rapidly increasing their adoption of cleantech solutions as part of operational efficiency goals, cost optimization, and emissions-reduction strategies. This segment is investing in energy-efficient machinery, electrified heating processes, on-site solar and storage systems, waste-heat recovery units, and hydrogen-based industrial fuel solutions to reduce reliance on fossil-intensive operations.

Many manufacturers are integrating carbon-accounting software, circular economy systems, and resource-efficient production technologies to meet ESG requirements and global supply-chain standards. As industries face rising energy costs and tightening sustainability regulations, cleantech integration is becoming essential for maintaining competitiveness, resilience, and long-term growth.

The Cleantech Market Report is segmented on the basis of the following:

By Solution

- Hardware

- Software

- Solution

By Technology

- Renewable Energy Technologies

- Solar PV

- Wind (Onshore, Offshore)

- Hydropower

- Bioenergy

- Geothermal

- Energy Storage Technologies

- Battery Storage (Li-ion, Flow, Solid-State)

- Thermal Storage

- Mechanical Storage (Pumped Hydro, CAES)

- Clean Transportation Technologies

- Electric Vehicles

- Charging Infrastructure

- Hydrogen Mobility

- Energy Efficiency Technologies

- Heat Pumps

- Smart Meters & Sensors

- Efficient HVAC & Lighting

- Carbon Capture & Storage Technologies

- Point-Source Capture

- Direct Air Capture

- Carbon Utilization

- Hydrogen & Fuel Cell Technologies

- Electrolyzers

- Fuel Cells

- Hydrogen Storage

- Water & Wastewater Treatment Technologies

- Desalination

- Advanced Filtration & Membranes

- Wastewater Recycling

- Waste-to-Energy Technologies

- Anaerobic Digestion

- Incineration with Energy Recovery

- Gasification

- Advanced Recycling & Circular Economy Solutions

- Chemical Recycling

- Material Recovery

- Industrial Decarbonization Technologies

- Electrified Processes

- Low-Carbon Heat Systems

- Digital Cleantech Platforms

- Energy Management Systems

- Carbon Accounting Software

By Deployment

- On-Grid

- Off-Grid

- Hybrid Systems

By Application

- Power Generation

- Energy Storage

- Transportation & Mobility

- Industrial Decarbonization

- Commercial Buildings

- Residential Buildings

- Water Treatment

- Waste Management

- Agriculture & Food Systems

- Carbon Management

By End-User

- Utilities & Power Companies

- Industrial & Manufacturing

- Commercial Enterprises

- Residential Consumers

- Government & Public Institutions

- Transportation & Logistics Companies

- Agriculture Producers

- Waste Management Operators

Global Cleantech Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global cleantech market landscape with 39.0% of total global market revenue in 2025, driven by massive renewable energy expansion, aggressive decarbonization policies, and large-scale infrastructure investments across China, India, Japan, and Southeast Asia. The region is rapidly accelerating adoption of solar PV, onshore and offshore wind, grid-scale battery storage, electric mobility, hydrogen production, and smart energy systems to meet its rising energy demand and climate commitments. Government-backed clean energy targets, manufacturing strength in solar modules and batteries, and increasing private sector investments further position Asia Pacific as the fastest-growing hub for cleantech innovation, deployment, and supply-chain development globally.

Region with significant growth

Europe is projected to witness significant growth in the global cleantech market, supported by its strong regulatory push for carbon neutrality, rapid adoption of renewable energy systems, and accelerated investments in green infrastructure. The region’s strict climate laws, expansion of offshore wind capacity, leadership in hydrogen technologies, and rising penetration of electric vehicles are fueling substantial market momentum. Additionally, the EU Green Deal, large-scale funding for energy efficiency upgrades, and rapid digitalization of grids are enhancing market competitiveness and innovation. With increasing corporate sustainability commitments and a mature clean energy ecosystem, Europe is positioned as one of the fastest-growing regions in the global cleantech landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cleantech Market: Competitive Landscape

The global cleantech market features a highly competitive and rapidly evolving landscape driven by leading renewable energy developers, energy storage innovators, electric mobility pioneers, and digital sustainability solution providers. Companies such as Tesla, Siemens, ABB, Vestas, First Solar, BYD, Enphase Energy, Schneider Electric, Orsted, and NextEra Energy dominate through large-scale clean energy projects, advanced battery technologies, grid modernization tools, and smart energy platforms.

The market is also shaped by strong participation from hydrogen technology firms, waste-to-energy players, and circular economy solution providers, creating a diverse ecosystem of global and regional competitors. Continuous innovation, cost optimization, and strategic investments in solar, wind, EV infrastructure, carbon management, and industrial decarbonization technologies are intensifying competition, positioning the cleantech market as one of the most dynamic and transformative sectors in the global economy.

Some of the prominent players in the global Cleantech market are

- Tesla

- Siemens

- ABB

- Vestas

- First Solar

- BYD

- Enphase Energy

- Schneider Electric

- Orsted

- NextEra Energy

- Plug Power

- Bloom Energy

- SunPower Corporation

- LG Energy Solution

- GE Vernova

- Canadian Solar

- JinkoSolar

- AES Corporation

- Veolia

- Engie

- Other Key Players

Global Cleantech Market: Recent Developments

- November 2025: Ørsted announced the commercial rollout of its new low-noise offshore wind technology platform Osonic, designed to enhance operational efficiency and reduce environmental impact across its global offshore wind fleet.

- September 2025: QuantE Energy raised USD 500,000 in seed funding from TDV Partners and angel investors to scale its community solar pilots and strengthen its portfolio of modular clean-energy solutions.

- August 2025: Stark entered into a strategic acquisition agreement to acquire Siemens Energy’s UK Energy Services business, expanding its capabilities in smart metering, digital energy intelligence, and grid-focused clean technologies.

- March 2025: Ørsted brought its Gode Wind 3 offshore wind farm online in the German North Sea, adding significant renewable generation capacity and strengthening Europe’s clean energy infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,032.6 Bn |

| Forecast Value (2034) |

USD 2,969.7 Bn |

| CAGR (2025–2034) |

12.5% |

| The US Market Size (2025) |

USD 208.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (Hardware, Software, Solution), By Technology (Renewable Energy Technologies, Energy Storage Technologies, Clean Transportation Technologies, Energy Efficiency Technologies, Carbon Capture & Storage Technologies, Hydrogen & Fuel Cell Technologies, Water & Wastewater Treatment Technologies, Waste-to-Energy Technologies, Advanced Recycling & Circular Economy Solutions, Industrial Decarbonization Technologies, Digital Cleantech Platforms), By Deployment (On-Grid, Off-Grid, Hybrid Systems), By Application (Power Generation, Energy Storage, Transportation & Mobility, Industrial Decarbonization, Commercial Buildings, Residential Buildings, Water Treatment, Waste Management, Agriculture & Food Systems, Carbon Management), and By End-User (Utilities & Power Companies, Industrial & Manufacturing, Commercial Enterprises, Residential Consumers, Government & Public Institutions, Transportation & Logistics Companies, Agriculture Producers, Waste Management Operators). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Tesla, Siemens, ABB, Vestas, First Solar, BYD, Enphase Energy, Schneider Electric, Orsted, NextEra Energy, Plug Power, Bloom Energy, SunPower Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global Cleantech market size is estimated to have a value of USD 1,032.6 billion in 2025 and is expected to reach USD 2,969.7 billion by the end of 2034.

The US Cleantech market is projected to be valued at USD 208.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 565.7 billion in 2034 at a CAGR of 11.7%.

Asia Pacific is expected to have the largest market share in the global Cleantech market, with a share of about 39.0% in 2025.

Some of the major key players in the global Cleantech market are Tesla, Siemens, ABB, Vestas, First Solar, BYD, Enphase Energy, Schneider Electric, Orsted, NextEra Energy, Plug Power, Bloom Energy, SunPower Corporation, and Others.

The market is growing at a CAGR of 12.5 percent over the forecasted period.