Market Overview

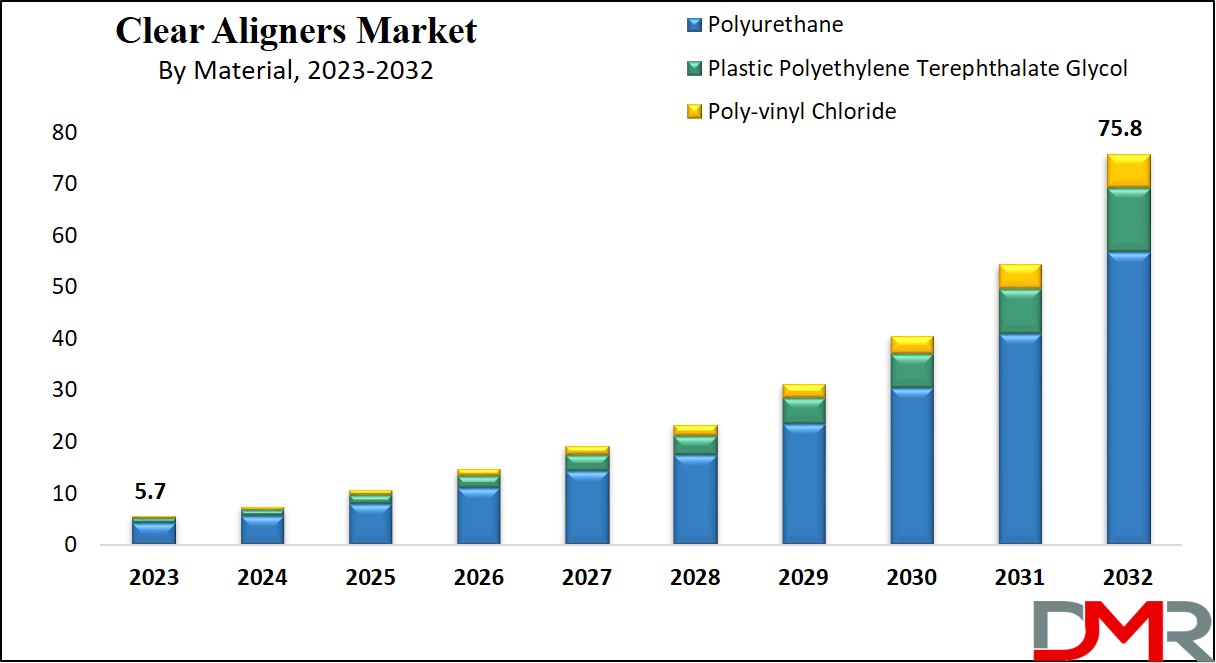

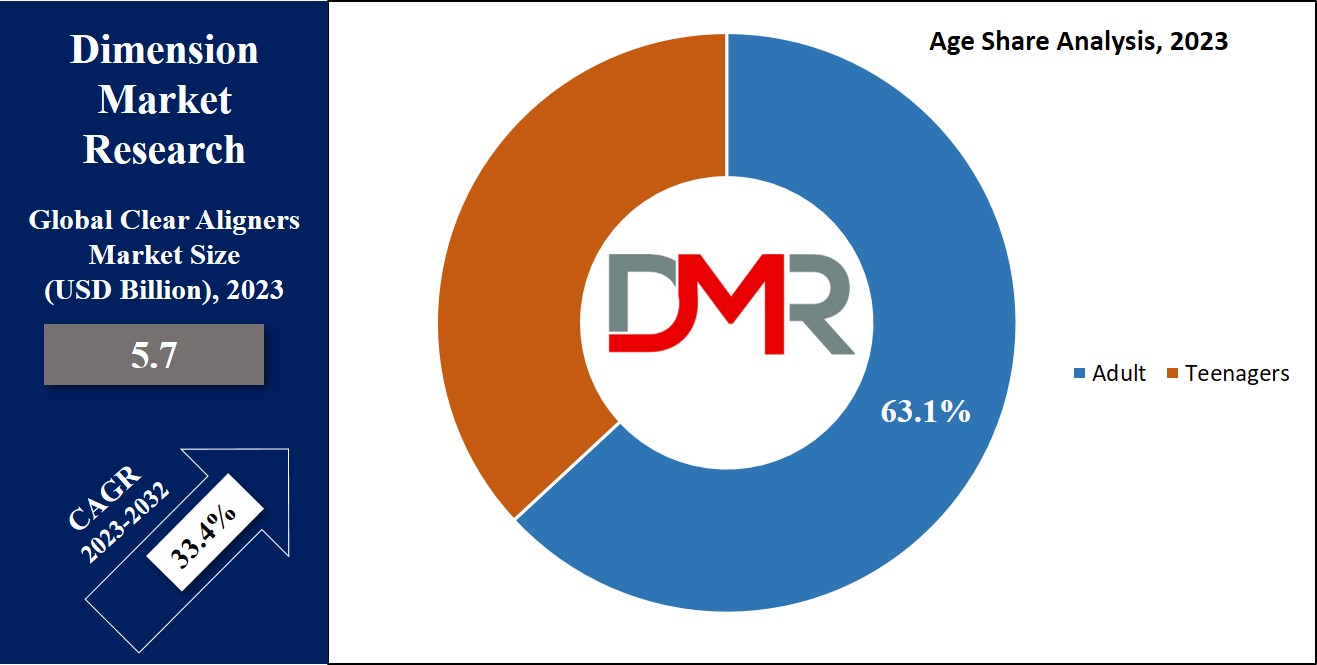

The Global Clear Aligners Market is expected to hold a market value of USD 5.7 billion in 2023 and is projected to show subsequent growth with a market value of USD 75.8 billion at a CAGR of 33.4% by the end of 2032.

The global clean aligners marketplace is a dynamic industry engaged in producing, distributing, and utilizing almost invisible orthodontic devices designed to straighten enamel and correct malocclusions. This marketplace includes manufacturers employing substances like polyurethane and plastic polyethylene terephthalate glycol, and dental professionals prescribing and administering remedies, for patients searching for aesthetically attractive orthodontic answers.

Technological improvements, which include 3D impact systems and CAD/CAM appliances, contribute to the precision and customization of clear aligners which raise the increase of this market. The worldwide clear aligners market highlights the evolving panorama of orthodontic care, reflecting customer options, technological improvements, and the increasing accessibility of orthodontic solutions worldwide.

Clear aligners are discreet

dental equipment used to treat mild to moderate orthodontic issues. Due to rising prevalence rates of malocclusions, clear aligners have become increasingly sought after for their effectiveness in tooth alignment. Align Technology Inc's Q4 2023 report notes that Invisalign had reached an international doctor utilization rate of 7.1 cases per doctor during this period.

Demand for clear aligners has been driven higher by technological innovations, rising per capita healthcare

expenditure and positive economic trends. Key market players have expanded their presence into developing nations to meet growing demand for aesthetic dental solutions that boost market expansion.

As one 2020 study conducted by BMC Oral Health reported, Chinese adults spent an average of USD 20.54 per capita on dental care expenses with over 90% coming out of pocket expenses. Rising adult populations and growing dental expenditures are expected to accelerate adoption of clear aligners globally and support global market expansion.

Key Takeaways

- Clear Aligners Market is projected to reach USD 75.8 billion at a CAGR of 33.4% by the end of 2032.

- Based on age, the adult segment has accounted for the revenue share of 63.1% in 2023.

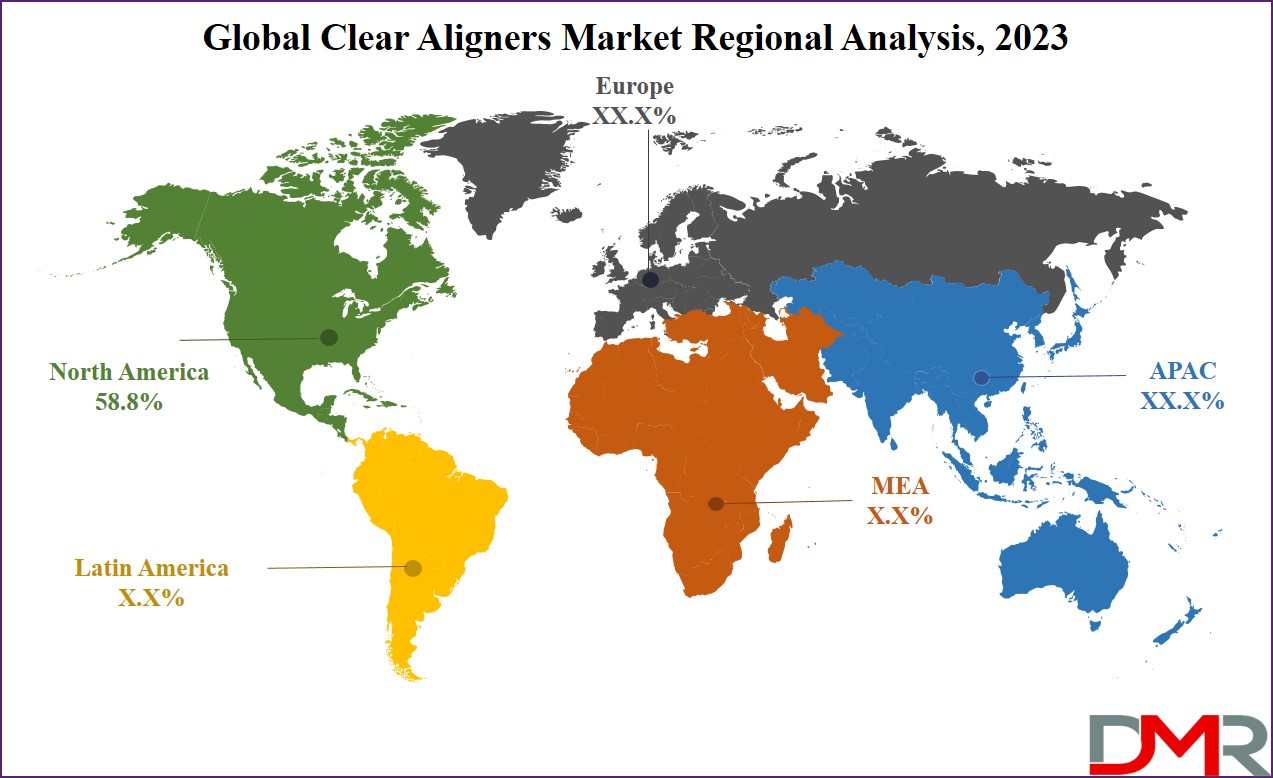

- North America dominates this market as this region had the highest revenue share of about 58.8% in 2023.

- In terms of end users, the dental and orthodontal clinics segment holds a 64.2% revenue share in 2023 and is projected to show subsequent growth in the upcoming years as well.

Market Dynamic

The clear aligners market is witnessing significant advancements driven by cutting-edge technologies, including 3D impression systems, additive fabrication, and digital scanning. These innovations contribute to the efficiency and predictability of orthodontic treatments, offering patients more accurate and customized solutions.

Material breakthroughs, which include Nickel and Copper-Titanium wires, together with thermoformed

plastic materials, in addition, enhance the improvement of clean aligners via enhancing their accuracy and customization.

Notably, clear aligners prioritize wearer consolation, flexibility, and aesthetics, imparting a discreet opportunity to standard braces. However, the market faces challenges, along with the excessive price of clean aligners, which limits the accessibility of clean aligners to a broader populace. Additionally, the confined availability of dentists, especially in densely populated regions, poses a hurdle to the full-size adoption of clean aligners.

Despite demanding situations, the market presents promising opportunities as the ongoing technological advancements hold the key, with the creation of innovative clean aligners that are expected to gas the growth of the marketplace. Increased awareness, driven by public and government initiatives, may result in a higher number of individuals opting for clear aligner treatments and pushing the growth of the market.

Driver

The Clear Aligners market is being driven by an increase in non-invasive aesthetic dental treatments, with clear aligners providing discreet yet comfortable orthodontic solutions that appeal to both adults and teenagers. Awareness of dental health and its psychological ramifications have led to greater public appreciation of aligners.

Technological innovations like 3D printing and AI based treatment planning have made them even more efficient and tailored to individual patient outcomes, further expanding their popularity. Teledentistry platforms have also made clear aligners more accessible, particularly in remote regions. As cosmetic dentistry becomes a global trend, clear aligner adoption continues to skyrocket - driving market expansion significantly.

Trend

Integration of Advanced Technologies One key trend affecting the Clear Aligners Market is the increasing integration of advanced technologies such as

artificial intelligence,

3D imaging, and augmented reality into designs and manufacturing processes to create more precise aligners tailored specifically for individual needs.

AI powered diagnostics and simulation tools enable patients to visualize treatment outcomes before beginning therapy, increasing trust and satisfaction. Remote monitoring via smartphone apps enables orthodontists to track progress without frequent in-person visits thereby improving convenience for both parties involved. Eco friendly aligner materials also satisfy sustainability-conscious consumers.

Together these advancements are revolutionizing orthodontics while creating more personalised and efficient treatment landscapes.

Restraint

The high cost of clear aligner treatments remains an impediment to market growth. Although they offer several advantages over traditional braces, aligners often require significant upfront investments that may put them out of reach for many individuals in lower and middle income regions.

Insurance coverage for orthodontic treatments remains limited in many markets, further dissuading potential adopters. High production costs associated with manufacturing aligners contribute to their premium pricing; providers are exploring cost cutting production methods and payment plans but affordability remains a pressing challenge that could limit adoption among cost conscious demographics.

Opportunity

Emerging markets present significant growth prospects for the Clear Aligners Market. Rising disposable incomes, rising awareness of dental aesthetics and improved access to orthodontic care are driving forces in these regions. Governments and private entities alike are making substantial investments in healthcare infrastructure, making advanced dental treatments more readily available.

Furthermore, young populations in emerging economies are adopting cosmetic dentistry due to social media influencers and shifting beauty standards. Manufacturers can take advantage of this potential by offering cost-effective solutions tailored to local needs, and using digital marketing techniques to inform consumers. Moving into uncharted markets should lead to exponential growth.

Research Scope and Analysis

By Age

In terms of age, adults dominate this segment as

held 63.41% of the market share in 2023 and are further anticipated to show subsequent growth in the upcoming years as well. Adults dominate this segment as clear aligners, being nearly invisible, align with their desire for a less noticeable treatment, allowing adults to address orthodontic issues discreetly.

Adults, especially those in professional or social settings, prioritize orthodontic solutions that are inconspicuous. The rising awareness and acceptance of orthodontic treatments, including clear aligners, have grown among adults, contributing to the rising demand for clear aligners among adults.

Moreover, this flexibility is advantageous for adults with varied schedules and commitments. Adults are generally more aware of the long-term health benefits of orthodontic treatments. Beyond aesthetics, correcting misalignments contributes to overall oral health, addressing issues such as temporomandibular joint (TMJ) disorders or difficulty in maintaining proper oral hygiene.

By Material

Based on material, polyurethane dominates this segment as it holds 74.9% of the market share in 2023 and is anticipated to show promising growth in the upcoming period of 2023 to 2032. The dominance of polyurethane in clear aligners can be attributed to the inherent flexibility that lets it to without difficulty conform to the converting alignment of enamel without the course of orthodontic remedy. Its durability ensures that the aligners can withstand the forces exerted at some stage in adjustments, contributing to the sturdiness of the treatment.

With general biocompatibility, polyurethane is well-tolerated by way of the human body which is vital for orthodontic packages in which the material comes into direct contact with oral tissues, decreasing the risk of allergic reactions and unfavorable consequences.

Polyurethane's optical clarity makes clear aligners almost invisible whilst worn. This transparency complements the aesthetic attraction of the aligners, aligning with patient options for discreet and minimally substantive orthodontic solutions.

Furthermore, polyurethane's malleability enables clean molding, facilitating the manufacturing of clean aligners with specific shapes and contours. This ease of production contributes to production performance and scalability. This cloth's capability to be customized ensures that clear aligners health the particular contours of a person's teeth. This customization enhances the affected patient's comfort, minimizing inflammation and discomfort associated with orthodontic treatment.

By End User

Dental and orthodontic clinics emerge as dominant players in this segment as they hold clear dominance in 2023 and are expected to show subsequent growth in the forecasted period of 2023 to 2032.

Dental and orthodontic clinics dominate this segment as they are staffed with professionals, particularly orthodontists, who possess specialized knowledge in oral health which is crucial for accurately assessing and prescribing orthodontic treatments and establishing them as a key influencer in the adoption of clear aligners. With a specific focus on oral health, dental and orthodontic clinics adopt a patient-centric approach.

Orthodontists within these settings can craft personalized treatment plans tailored to individual patient needs, leveraging the benefits of clear aligners. These clinics also offer a spectrum of dental services, creating a centralized hub for comprehensive oral health care. Routine dental check-ups provide opportunities to introduce orthodontic treatments, including the option of clear aligners.

Moreover, equipped with cutting-edge diagnostic tools such as 3D scanners and imaging technology, dental and orthodontic clinics possess the infrastructure necessary for precise planning and monitoring of clear aligner treatments.

The long-standing relationships between clinics and their patients foster trust and familiarity. This connection facilitates discussions about orthodontic treatments, making patients more receptive to the advantages of clear aligners and increasing adoption rates.

The Clear Aligners Market Report is segmented based on the following

By Age

By Material

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Poly-vinyl Chloride

By End User

- Dental & Orthodontics Clinics

- Hospitals

- Others

Regional Analysis

North America dominates the global clear aligners m market as it

holds 58.8% of the market share in 2023 and is projected to show following growth in the forthcoming years. North America's prominence in the international clean aligners market may be attributed to a high level of consciousness and attractiveness of orthodontic treatment, such as clear aligners. Both consumers and healthcare professionals in this market have embraced those treatments, contributing to its multiplied call.

This area additionally serves as a hub for dental era innovation, pioneering new tendencies along with 3-D scanning, digital treatment-making plans, and the use of state-of-the-art materials have significantly propelled the growth of the clear aligners marketplace in North America.

Moreover, North America has been at the vanguard of adopting new and superior teledentistry answers because it gives faraway consultations, treatment planning, and monitoring that aligns properly with patient options, fostering the massive adoption of clear aligners.

Additionally, this area boasts a sturdy healthcare infrastructure with well-mounted dental clinics and orthodontic practices. This, coupled with the provision of skilled professionals and advanced facilities, helps the extensive adoption of clear aligners.

The presence of insurance for orthodontic treatments, consisting of clear aligners, can affect marketplace dynamics. In North America, the supply of insurance alternatives and flexible charge plans complements the affordability of those treatments for a bigger section of the population.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global clear aligners market provides a dynamic competitive panorama, characterized via key players striving for market dominance. Competition inside the clear aligners area revolved around pivotal factors which includes continuous product innovation, strategic pricing, expansive distribution networks, and impactful advertising and marketing campaigns.

The marketplace additionally experienced transformative shifts with the upward push of teledentistry models and a direct-to-consumer technique, disrupting conventional marketplace dynamics.

Leading organizations in this market like Align Technology, Inc., a trailblazer renowned for its Invisalign emblem, are heavily investing in studies and improvement to benefit an aggressive part over different agencies.

Other good-sized contenders blanketed Dentsply Sirona, providing the SureSmile Aligner System, and 3M Company, contributing to the marketplace with its Clarity Aligners. Danaher Corporation, operating thru its subsidiary Ormco, additionally plays a vital role in market dynamics with products like Insignia and Spark.

Some of the prominent players in the Global Clear Aligners Market are

- Align Technology

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

- Other Key Players

Recent Developments

- In May 2023, SmileDirect Club announced the US debut of its patented SmileMaker platform, leveraging AI technology to capture precise 3D scans of teeth. This advancement aims to streamline the clear aligner treatment process for consumers.

- In April 2023, Henry Schein Inc. forged a partnership with Biotech Dental Group to enhance its digital workflow, offer clear aligner solutions to customers, and elevate clinical outcomes for dental professionals.

- In 2023, Rejove Clinique, known for its expertise in dental, skin, and hair treatments, has introduced 'Rejove Aligners.' These next-generation clear aligners contribute to professional and advanced orthodontic treatment. With a vision to provide flawless and accessible solutions for a brighter smile, Rejove Aligners adds to the growing landscape of clear aligner options available to individuals seeking discreet and effective orthodontic solutions.

- In February 2022, Bausch Health Companies Inc., along with its oral health care division, OraPharma, unveiled the OraFit custom clear aligner system in the U.S. market. Invisalign-trained, the OraFit aligner system is specifically designed to address malocclusion.

- In August 2022, Orthobrain, a growth system specializing in orthodontics based in Ohio, introduced SimplyClear, a comprehensive solution for orthodontic advancement. This innovative system integrates top-notch clear aligners with a proven support model, aiming to drive successful orthodontic programs and ensure sustained revenue growth in the long term.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 5.7 Bn |

| Forecast Value (2032) |

USD 75.8 Bn |

| CAGR (2023-2032) |

33.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Age (Adults and Teenagers), By Material (Polyurethane, Plastic Polyethylene Terephthalate Glycol and Poly-vinyl Chloride), By End User (Dental & Orthodontics Clinics, Hospitals and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Align Technology, Dentsply Sirona, Institute Straumann, Envista Corporation, 3M ESPE, Argen Corporation, Henry Schein Inc, TP Orthodontics Inc, SmileDirect Club, Angel Aligner, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |