Market Overview

The Global

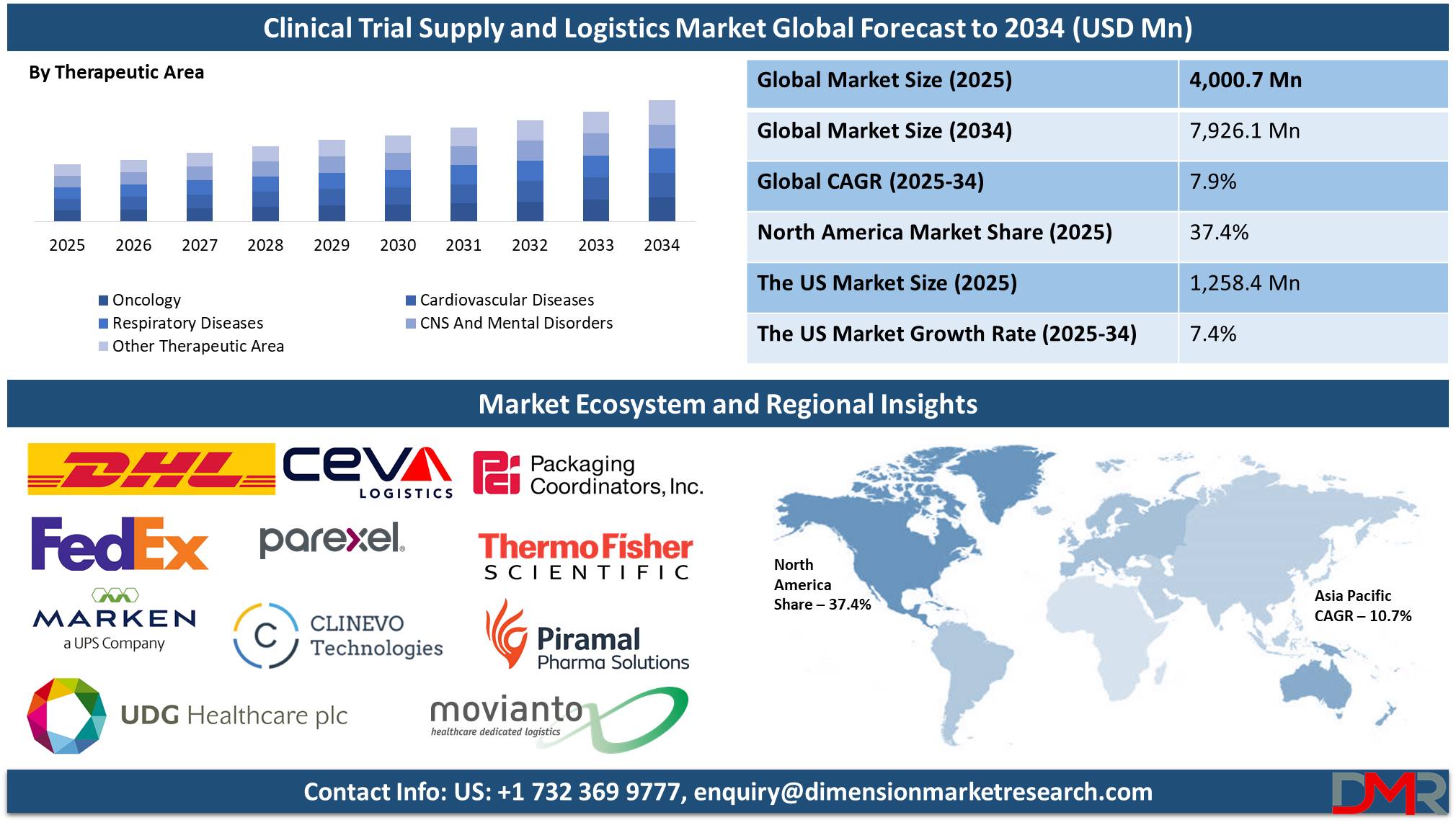

Clinical Trial Supply and Logistics Market size is expected to be valued at

USD 4,000.7 million in 2025, and it is further anticipated to reach a market value of

USD 7,926.1 million by 2034 at a

CAGR of 7.9%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global clinical trials supply and logistics industry is developing at a high growth rate, with an increased number of trials taking place worldwide driving it. Pharmaceutical and biotech companies have been investing a lot in developing drugs, and strong supply chains have become a necessity for them, therefore. Complexity in trials, including multi-country trials and temperature-sensitive shipping and storing requirements, has increased with an increased number of specialist logistics providers. The adoption of direct-to-patient and decentralized trials has reorganized logistics approaches even more. With increased investments in R&D, demand for efficient supply chain management tools continues to rise.

One of the most significant trends in the market is integration with emerging technology such as blockchain, artificial intelligence, and IoT in supply chain management. All such technology tools allow real-time tracking, compliance with laws, and reduced opportunity for a shortage of drugs or counterfeit drugs. Cold chain logistics is an important one, for drugs such as biologics and cell and gene therapies, for whom temperature controls have to be high level. Organizations are investing in digital platforms for optimized management of inventories and reduced wastage, for effective delivery of drugs to clinic locations.

The market is full of high potential with pharmaceutical companies venturing out towards emerging economies such as China, India, and Brazil for extending operations in terms of clinical research. Emerging economies have cost savings, a high patient pool, and rapid approval processes, and hence become a preferred site for trials. With personalized medicine becoming an increasingly growing demand, demand for tailor-made supply chain operations is increasing, taking the market even further. With an increased case of chronic diseases such as cancer and cardiovascular disease, the demand for effective supply and logistics operations is driving an even larger number of trials, supporting demand for effective supply and logistics operations.

The sector, in contrast to opportunity, is challenged with significant restraints, including high-regulation compliance in parts of the world. High infrastructure investments and quality controls in terms of GDP and GMP requirements have to be met in compliance with high standards. Logistics providers encounter disruptions in terms of supply with political concerns, pandemics, and natural disasters in value chains. High cold chain logistics and the use of specific transportation involve additional complications in the market.

North America is in a commanding position with regards to dominating the market with its presence of key pharma companies and developed infrastructure for medical care, and Asia-Pacific is developing at a high growth rate with increased clinical trials in emerging economies. Biologics and biosimilars have spurred demand for state-of-the-art supply chain offerings, driving overall market growth.

The market will have a rosy future with the growing use of automation, digital value chains, and predictive analysis with AI. Environmentally friendly and sustainable packaging for drugs with no loss in integrity and less environmental impact will become a norm with companies embracing them. Pharmaceutical companies and logistics providers collaborating to develop flexible and adaptable value networks will drive market growth. With trials becoming ever more complex and global, effective, technology-driven value chain management will remain a success metric.

The US Clinical Trial Supply and Logistics Market

The US Activated Carbon Market is projected to be valued at USD 1,258.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,396.5 million in 2034 at a CAGR of 7.4%.

The United States clinical trial supply and logistics market is the largest globally, driven by a strong pharmaceutical sector, leading contract research organizations (CROs), and high R&D investments. The U.S. conducts nearly 40% of all global clinical trials, supported by the FDA’s well-structured regulatory framework. With a rise in trials and an emerging demand for personalized therapy, in the future, the market will expand steadily. With the increased use of biologics, and cell and gene therapies, demand for high-tech supply chain offerings, namely, cold chain logistics, for maintaining drug integrity and compliance, grew manifold.

A significant advantage of the U.S. market is its high diversity in demographics, and effective recruitment of subjects in a range of ethnic groups, with increased integrity and efficacy testing of drugs. The market is also enjoying the fruits of technological innovation, including AI-facilitated logistics, blockchain-facilitated tracking of drugs, and computerized software for managing inventories.

In addition, in-home delivery of drugs and decentralized clinical trials (DCTs) are changing planning in the supply chain, enhancing access for patients, and reducing logistic inefficiencies. With continued investments in precision medicine and increased collaboration between pharmaceutical companies and logistics companies, the U.S. clinical trials supply and logistics market will maintain its stronghold, with efficient and compliant delivery of drugs for future trials.

Global Clinical Trial Supply and Logistics Market: Key Takeaways

- Global Market Size Analysis: The Global Clinical Trial Supply and Logistics Market size is estimated to have a value of USD 4,000.7 million in 2025 and is expected to reach USD 7,926.1 million by the end of 2034.

- The US Market Size Insights: The US Clinical Trial Supply and Logistics Market is projected to be valued at USD 1,258.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,396.5 million in 2035 at a CAGR of 7.4%.

- Regional Insights: North America is expected to have the largest market share in the Global Clinical Trial Supply and Logistics Market with a share of about 37.4% in 2025.

- Key Players Insights: Some of the major key players in the Global Clinical Trial Supply and Logistics Market are Thermo Fisher Scientific, Catalent Inc., Parexel International, Almac Group, Marken, Piramal Pharma Solutions, UDG Healthcare, DHL, FedEx, and many others.

- Global Market Growth Rate: The market is growing at a CAGR of 7.9 percent over the forecasted period.

Global Clinical Trial Supply and Logistics Market: Use Cases

- Cold Chain Handling: Ensures safe warehousing and shipping of temperature-sensitive drugs, such as biologics and vaccines, and keeps them effective and in compliance with regulating requirements at phases of a clinical trial.

- Real-Time Monitoring: Uses IoT technology for tracking temperature and location of shipments during clinical trials, providing real-time information for reduced delays, temperature maintenance, and increased transparency in the supply chain.

- Global Distribution: Empowers efficient distribution of clinical trial materials worldwide, supporting multinational trials through sophisticated logistics and compliance with many and sometimes conflicting requirements in a range of countries.

- Patient-Customized Medicine: Logistics companies manage the distribution of personalized therapies to individual subjects in personalized medicine trials, with timely delivery and compliance with trials in a proper manner.

- Emergency Supply Chain Solutions: In critical trials, quick logistics solutions are utilized to respond to unplanned shortages in supplies, allowing for uninterrupted continuity of clinical trials with no loss in compliance and integrity of the product.

Global Clinical Trial Supply and Logistics Market: Stats & Facts

- In 2020, there were 362,481 registered clinical studies, marking a significant growth in the clinical trials sector, driven by increasing demand for new treatments and innovations in healthcare.

- According to Statista the United States accounted for the largest share, leading with 35% of global clinical trial participants, reflecting its central role in clinical research. Poland, Germany, and Russia each contributed 4% of clinical trial participants, while Japan and Canada provided 3%, emphasizing their notable contributions to global clinical research and development.

- Czechia and Ukraine each contributed 2% of participants, while countries like France, India, the UK, Spain, Hungary, Italy, Brazil, Argentina, Romania, and Bulgaria collectively made up 2%, showing their diverse global presence.

- South Korea and China each represented 1% of participants in clinical trials, reflecting their growing significance in the global clinical trial landscape as their research infrastructure strengthened.

- In accordance with WHO The number of registered clinical studies continued to rise, with 399,499 studies recorded in 2021 and 437,533 in 2022, indicating consistent growth in global clinical trial activities. By 2023, the total number of registered clinical studies will reach 453,803, continuing the trend of expansion and highlighting the global demand for clinical research and development in various therapeutic areas.

- As of May 2023, 94% of interventional clinical studies had posted their results, whereas only 6% of observational studies made their results publicly available, reflecting a disparity in data dissemination by WHO.

- Venture capital investments in clinical trial startups reached $4.2 billion in 2023, with a focus on disruptive technologies that aim to streamline clinical research and improve efficiency across the sector.

- Around 80% of clinical trials experience delays or premature termination due to challenges in participant recruitment, with 37% of research sites struggling to enroll enough volunteers, hindering the progress of many studies.

Global Clinical Trial Supply and Logistics Market Dynamic

Driving Factors in the Global Clinical Trial Supply and Logistics Market

Increasing Number of Clinical Trials Globally

The escalating burden of long-term diseases, including cancer, cardiovascular disease, and neurological disease, is creating demand for new drugs and trials. Pharmaceutical and governments' investments in R&D, and with them, an increase in the intensity of clinical trials, is happening. India, Brazil, and China have become key regions for the conduct of trials at lower cost, rich diversity in patient pools, and rapid approval for drugs. Biologic and gene therapy studies expansion is generating demand for high-tech supply options, namely temperature-sensitive shipping and storing of drugs.

Stringent Regulatory Requirements Driving Compliance-Based Logistics Solutions

The U.S. FDA, European Medicine Agency (EMA), and China’s National Medical Products Administration (NMPA) have placed strong requirements for logistics in clinical trials, including maintenance of cold chains, serialization, and tracking of drugs. GMP and GDP compliance is a necessity, and for that reason, pharmaceutical companies have begun partnering with experienced logistics providers. Regulatory requirements make drugs safer and more efficient but require high investments in infrastructure and technology. Automated compliance software, electronic labels, and real-time shipment tracking software have become increasingly embraced in companies to comply with requirements and have continuous operations in all parts of the world with seamless global operations.

Restraints in the Global Clinical Trial Supply and Logistics Market

High Costs Associated with Cold Chain Logistics

Cold chain logistics is imperative for gene therapies, vaccines, and biologics but at a costly price in terms of temperature controls. There is a strong demand for temperature tracking tools, secure stores, and specialized packaging, and it is costly in terms of operations. There is a risk of degradation through temperature deviation, and with it, loss of financial value. There is significant infrastructure investment in terms of ultra-low temperature freezers and real-time tracking tools for companies in terms of holding drugs in integrity. Cold chain logistics is a challenge for CROs and small pharmaceutical companies with lesser financial capacities.

Supply Chain Disruptions and Geopolitical Risks

Global supply chain disruptions, including during the COVID-19 pandemic, political unrest, and trade restrictions, have challenged clinical trial logistics. Deliveries of drugs have been delayed, and key raw materials have become in short supply, with compliance barriers having an impact on timelines and operational risk factors. Varying transportation costs and lack of manpower make planning logistics even more challenging. Pharmaceutical companies and logistics providers must apply contingency planning, including having a diversity of providers and leveraging regional distribution platforms, in an attempt to counter such barriers. Nevertheless, managing uncertain disruptions continues to challenge the industry.

Opportunities in the Global Clinical Trial Supply and Logistics Market

Expansion into Emerging Markets

Pharmaceutical companies have increasingly conducted trials in emerging economies in Asia-Pacific, Latin America, and the Middle East for cost savings and access to a high, treatment-untreated patient population China and India have effective regulatory processes and high recruitment rates, and governments in both countries have been investing in infrastructure and reforming legislation in an attempt to attract more clinical studies. Logistics providers with a strong presence in such regions can benefit from increased demand for clinical trial supply chain management, including import/export compliance, cold storage, and last-mile delivery capabilities.

Rising Demand for Personalized and Precision Medicine

The transition towards personalized therapy, including cell and gene therapies, creates new avenues in the market for clinical trials' supply and logistics. Unlike conventional drugs, these therapies require custom-made capabilities in the supply base, including ultra-cold storage and rapid delivery to clinic settings. Logistics providers are investing in capabilities such as cryogenic shipping and JIT delivery platforms to serve complex therapeutics. As precision therapy continues to expand, companies with flexible and adaptable capabilities in the base will gain a competitive edge in the market.

Trends in the Global Clinical Trial Supply and Logistics Market

Adoption of Advanced Digital Technologies

The logistics and supply base in clinical trials are changing with the integration of new technology including artificial intelligence (AI), blockchain, and the Internet of Things (IoT). AI-powered predictive analysis is improving efficiency in pharmaceutical companies' supply chains, minimizing drug' wastage, and improving the forecasting of inventories. Blockchain technology is offering enhanced traceability, authenticating drugs' genuineness, and improving compliance with regulators through secure and unalterable records of transactions. IoT-facilitated temperature tracking technology is becoming increasingly significant, with real-time tracking offering assurance for temperature-sensitive drugs' integrity. All such technological enhancements are minimizing operational inefficiencies and improving transparency in the supply base.

Rise of Decentralized and Direct-to-Patient Clinical Trials

Decentralized trials (DCTs) are revolutionizing the supply chain with direct-to-patient (DTP) delivery of drugs. Patient-centric trials, and trials in studies of rare diseases, have fueled demand for flexible distribution frameworks in logistics providers. DCTs reduce patient burden through reduced site visits, with drugs and medical consumables delivered directly to subjects. That momentum accelerated post-pandemic, with companies searching for efficient and effective trials in compliance with Good Distribution Practices (GDP). Home trials have also prompted strong supply chain capabilities that can allow real-time tracking and remote monitoring capabilities.

Research Scope and Analysis

By Service

In this segment logistics and distribution s projected to dominate as it holds 27.1% of market share in 2025. The distribution and logistics industries have a strong presence in the supply market for clinical trials, with a key role in the timely and secure delivery of investigation drugs, medical devices, and bio-samples. With trials conducted at many locations, and in most cases, in geographically distant countries, effective logistics become a necessity. With temperature-sensitive shipments, compliance with regulating specifications, and real-time tracking, logistics have become a key constituent of clinical trials' supply service.

Cold chain logistics, in particular, is a strong growth catalyst, with most materials for clinical trials, including biologics, gene and cell therapies, and vaccines, requiring temperature tracking in a restricted environment. There is strong demand for high-tech distribution networks with ultra-cold storage and JIT delivery, and, therefore, high demand for specialist logistics providers. GPS tracking, IoT sensors, and investments in blockchain technology have become a necessity for companies to have transparency and to prevent any sort of disruption in the supply chain.

Adherence to laws and legislation is a contributing role in logistics leadership, with directives under Good Distribution Practice (GDP) governing careful handling protocols for drugs in investigation. Logistics providers must ensure drugs are transported under specific terms and in compliance with region-specific requirements. With the growing use of decentralized clinical trials (DCTs), this industry is even stronger, with direct-to-patient (DTP) distribution channels incurring cutting-edge logistic solutions. As trials go increasingly global and protocols become ever more complex, logistics and distribution form the backbone of clinical trials' supply, allowing for unobstructed delivery of drugs and materials at a range of locations worldwide.

By Phase

Phase I trials have a significant presence in the market for clinical trial supply and logistics as they are projected to hold the highest market share with its high demand for complex supply chain offerings and its critical role in developing drugs. Phase I trials mark the initial stage in testing a new experimental drug in humans and involve careful manipulation, secure shipping, and following stringent guideline requirements. With its experimental nature, Phase I studies have small groups of patients but require high-control environments, and for that reason, logistics become a part of it.

The difficulty in Phase I trials is in providing rapid cycles of drug development, JIT production, and delivering investigation drugs under stringent protocols. Since such trials involve new forms of drugs including biologics, gene therapies, and personalized drugs, cold chain logistics and ultra-low temperature storage become a dominating issue. Pharmaceutical companies and CROs must ensure integrity in terms of drugs under investigation is not compromised during shipping and storing, with minimum degradation concerns.

The high failure at the Phase I level is one of the factors contributing to Phase I's high use in clinical trial logistics. Approximately 30-40% of drugs at Phase I will not pass for lack of efficacy, and safety concerns, and therefore constant efforts at alternative forms' resupply will be in demand. Patient recruitment, escalating studies, and adaptative trials will generate additional demand for quick use of logistics providers. With increased requirements placed in early-phase testing for drugs by regulating agencies, clinical trials' logistics in Phase I will become a larger role, with an eye towards efficient delivery of drugs and regulators' compliance requirements.

By Therapeutic Area

Oncology is projected to be the dominant player in the clinical trials supply and logistics field with its high disease burden and constant development of new anti-cancer drugs. Cancer remains one of the most deadly killers in the world, and pharmaceutical companies and institutes have a strong stake in oncology trials. The multi-faceted development of drugs in oncology, such as chemotherapy, immunotherapy, target therapies, and gene therapies, forms a complex infrastructure for a highly specialized supply base.

Some of the most critical factors in why oncology trials require high logistical support include temperature-sensitive biologics and personalized therapies. There are a variety of therapies for cancer, including monoclonal antibodies and CAR-T cell therapy, that have to be stored and transported at ultra-cold temperatures. Logistics providers have an important role in safeguarding such therapies' effectiveness through complex temperature tracking, cryogenic storing, and channeled distribution.

Also, most trials in oncology have a range of several study locations in a variety of regions, and patient recruitment can become cumbersome. With the growing use of decentralized clinical trials (DCTs) in oncology, direct-to-patient (DTP) delivery models have become increasingly common. With such a model, patient burden is less, specifically for long-term therapy regimens.

Regulatory complexity is one such driving force for the rise in prominence of oncology in clinical trial logistics. With a critical approval mechanism for anti-cancer drugs, logistics companies for clinical trials must follow both Good Manufacturing Practice (GMP) and Good Distribution Practice (GDP) protocols. With the increased demand for personalized therapy and therapy guided through biomarkers, prominence for oncology is even heightened, and it stands out to become the largest sector in the clinical trials supply and logistics market.

By End-User

Pharmaceuticals are expected to represent the biggest end-user industry in the market for clinical trials logistics and supply, with significant investment in developing drugs, geocentric widespread trials, and high demand for specialist providers of logistics. The pharmaceuticals sector carries out most of the clinical trials in the world, and therefore, high demand for efficient supply chains, regulators' compliance, and cold chain logistics arises.

The intensity of operations for pharmaceutical companies requires full-service logistics, including production, packaging, labeling, and distribution. Most pharmaceutical companies have multi-country trials, and, therefore, a global distribution network must coordinate cross-border shipping and respond to changing frameworks of governance. With increased complexity in trials, pharmaceutical companies have begun partnering with logistics companies to coordinate the free flow of drugs under monitored environments in trials.

A key reason for success in the market for pharmaceutical companies is that they have a presence in biologics, biosimilars, and precision medicine. Biologics have increased demand for cold chain logistics, with such drugs requiring high-temperature controls in a bid to maintain efficacy. Pharmaceutical companies have investments in real-time tracking, serialization via blockchain, and computerized software for tracking inventories in a move to prevent shortages in drugs and maintain integrity in trials.

Also, emerging trends in direct-to-patient (DTP) and decentralized trials are driving pharmaceutical supply chains toward innovation. With direct delivery of drugs to subjects in trials and adhering to regulating requirements, such capabilities have become a top concern for pharmaceutical companies. With increased investments in R&D and stricter regulating requirements, the pharmaceutical sector will increasingly drive demand for the market for clinical trials' supply and logistics.

The Clinical Trial Supply and Logistics Market Report is segmented on the basis of the following

By Service

- Logistics & Distribution

- Storage & Retention

- Packaging, Labeling, And Blinding

- Manufacturing

- Comparator Sourcing

- Other Services

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Respiratory Diseases

- CNS And Mental Disorders

- Other Therapeutic Area

By End-User

- Pharmaceuticals

- Biologicals

- Medical Devices

Regional Analysis

North America is expected to dominate this market as it is anticipated to

hold 37.4% of the total market revenue by the end of 2025. North America is in a commanding position in the Clinical Trial Supply and Logistics sector with a combination of several strategic factors at its disposal. North America is rich in a high density of pharmaceutical and biotechnology industries, creating a strong environment for clinical trials to flourish. Having a strong infrastructure in place and state-of-the-art technological capabilities maximizes efficiency in supply chain operations and ensures timely delivery of clinical materials.

The U.S., through its regulatory environments, such as the FDA, puts in place definite guidelines, streamlines the process for trials, and opens doors for increased trials in-country. North America, moreover, has high R&D investments, backed by supportive government programs and funding for developing drugs. Established infrastructure for medical care in the region and a high pool of patients make recruitment and patient maintenance easier for a range of trials, with rapid recruitment and maintenance of patients.

Also, alliances between key industry leaders, CROs, and logistics providers maximize capabilities for managing complex regulative environments and optimizing supply chains. The adoption of state-of-the-art technology, such as IoT and real-time tracking, continues to make supply chains even smarter, with reduced potential for delay and temperature excursion. Consequently, all these factors cumulate in North America becoming a dominant player in the global Clinical Trial Supply and Logistics market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Clinical Trial Supplies and Logistics sector is characterized by presence of prominaent companies including Parexel International, Catalent, Inc., Thermo Fisher Scientific, Inc., and DHL International GmbH competing with one another in terms of service offerings, geographical presence, technological capabilities, and alliances. There is competition in the industry with numerous companies competing for a portion of the market, and high rivalry in competition arises.

Mergers and acquisitions form important strategies through which companies can expand service offerings and geographical presence. Forging alliances with pharmaceutical companies and CROs aids in enhancing presence in the market even more. Investment in technological innovation, including temperature-managed logistics and the use of blockchain for transparency in a supply chain, forms a competitive advantage.

Regional companies, who cater to niche requirements, have a presence in terms of region-wise, leveraging cost-effective offerings in emerging economies for momentum gain. Changing requirements in terms of regions and increased complexity in terms of trials drive innovation in terms of market participants even more.

Some of the prominent players in the Global Clinical Trial Supply and Logistics Market are

- Thermo Fisher Scientific

- Catalent, Inc.

- Parexel International

- Almac Group

- Marken

- Piramal Pharma Solutions

- UDG Healthcare

- DHL

- FedEx

- Movianto

- Packaging Coordinators Inc.

- Ceva Logistics

- Clinevo Technologies

- Other Key Players

Recent Developments

- January 2025: Thermo Fisher Scientific partnered with Pfizer to enhance supply chain transparency through blockchain integration. This collaboration aims to improve drug traceability, minimize counterfeiting risks, and optimize real-time monitoring of investigational drugs in clinical trials. By leveraging blockchain technology, both companies seek to enhance data security, ensure regulatory compliance, and streamline logistics operations across global trial sites.

- December 2024: Catalent, Inc. announced a $150 million investment in cold chain infrastructure expansion. With the increasing demand for biologics, cell and gene therapies, and mRNA-based treatments, Catalent’s investment is focused on enhancing its temperature-controlled storage and distribution facilities. This expansion will support pharmaceutical and biotech companies in ensuring product stability, reducing supply chain risks, and accelerating clinical trial timelines.

- November 2024: DHL International GmbH showcased its innovative IoT-enabled tracking solutions at the Global Clinical Trials Expo in Berlin. DHL introduced advanced real-time shipment monitoring systems integrated with IoT sensors to ensure precise temperature control and location tracking for clinical trial materials. These solutions enhance supply chain visibility, reduce delays, and ensure compliance with regulatory standards for investigational drugs.

- October 2024: Parexel International acquired a minority stake in a leading Indian logistics provider to strengthen its presence in Asia-Pacific. This strategic investment aligns with Parexel’s goal of expanding its footprint in emerging markets, where clinical trial activities are growing rapidly. The partnership aims to improve last-mile delivery, optimize comparator drug sourcing, and enhance regulatory expertise in the region.

- September 2024: The World Clinical Trials Conference held in London emphasized the role of AI in clinical supply chain optimization. Key industry leaders discussed how artificial intelligence is transforming clinical trial logistics through predictive analytics, demand forecasting, and automated inventory management. AI-driven solutions are expected to reduce drug wastage, prevent shortages, and streamline supply chain operations for global trials.

- August 2024: Almac Group collaborated with Moderna to accelerate vaccine trial logistics, focusing on temperature-sensitive materials. This partnership is designed to enhance the efficiency of vaccine distribution for ongoing and future clinical trials. Almac’s expertise in cold chain logistics will support Moderna in maintaining stringent temperature controls, ensuring rapid delivery, and optimizing supply chain resilience for vaccine development programs

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4,000.7 Mn |

| Forecast Value (2033) |

USD 7,926.1 Mn |

| CAGR (2024-2033) |

7.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1,258.4 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Service (Logistics & Distribution, Storage & Retention, Packaging, Labeling, And Blinding, Manufacturing, Comparator Sourcing, Other Services), By Phase (Phase I, Phase II, Phase III, Phase IV), By Therapeutic Area (Oncology, Cardiovascular Diseases, Respiratory Diseases, CNS And Mental Disorders, Other Therapeutic Area), By End-User (Pharmaceuticals, Biologicals, Medical Devices). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Thermo Fisher Scientific, Catalent Inc., Parexel International, Almac Group, Marken, Piramal Pharma Solutions, UDG Healthcare, DHL, FedEx, Movianto, Packaging Coordinators Inc., Ceva Logistics, Clinevo Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |