Market Overview

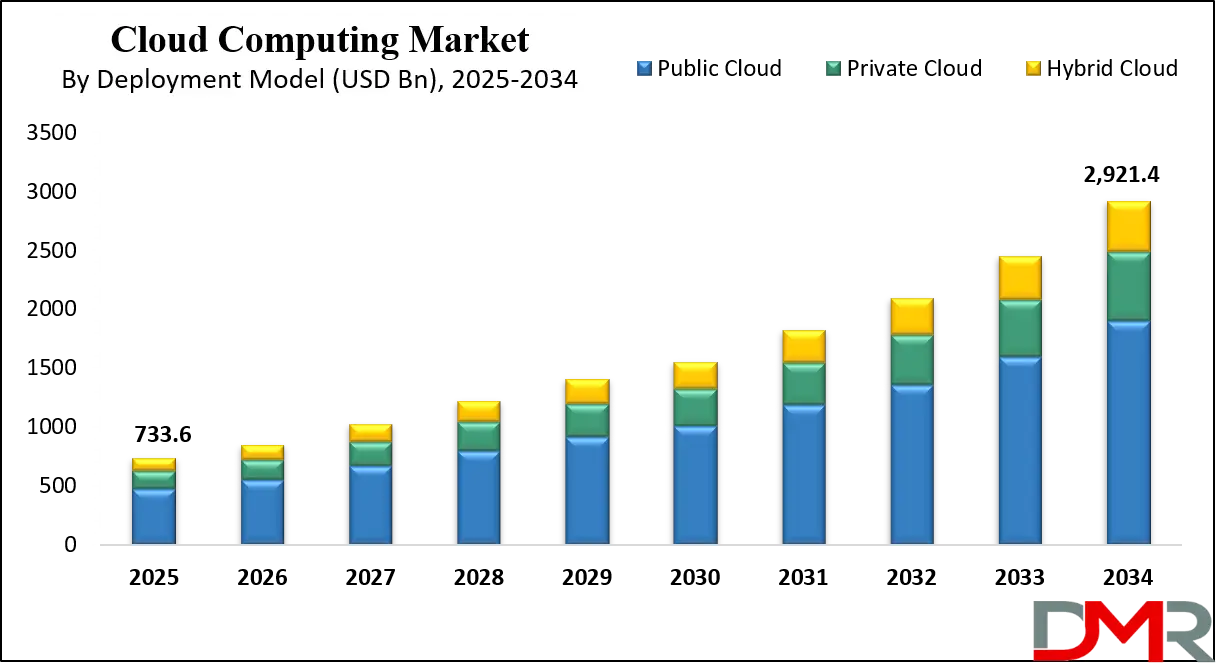

The global cloud computing market is projected to reach USD 733.6 billion in 2025 and is expected to grow significantly to USD 2,921.4 billion by 2034, registering a robust CAGR of 16.6%. This growth is driven by increasing enterprise adoption of SaaS, IaaS, and PaaS solutions, rising demand for digital transformation, scalable IT infrastructure, and advanced technologies such as AI, big data analytics, and IoT.

Cloud computing refers to the delivery of computing resources such as storage, servers, networking, databases, analytics, and software over the internet, allowing businesses and individuals to access scalable IT infrastructure without the need for physical hardware investment. It enables organizations to optimize operations, reduce costs, and improve efficiency by offering flexible on demand access to digital tools and services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This technology has become a key enabler of digital transformation as it supports advanced technologies including artificial intelligence, big data analytics, edge computing, and the Internet of Things, thereby empowering enterprises to innovate and compete in dynamic markets.

The global cloud computing market is experiencing rapid expansion driven by the rising adoption of digital services, increasing demand for data storage, and the acceleration of enterprise cloud migration strategies. Organizations across industries are leveraging public, private, and hybrid cloud models to improve agility, streamline workflows, and meet evolving customer expectations. Cloud providers are continuously enhancing their offerings with advanced security solutions, multi cloud integration, and automation tools, making cloud ecosystems more robust and appealing to enterprises of all sizes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, the growth of the global market is strongly influenced by the widespread use of software as a service applications, the surge in remote work culture, and the increasing reliance on data driven decision making. Emerging economies are witnessing significant adoption of infrastructure as a service and platform as a service solutions due to cost effectiveness and scalability. With rising investments in 5G networks, edge data centers, and AI powered applications, the cloud computing market is poised to remain a cornerstone of enterprise IT strategies and global digital transformation initiatives.

The US Cloud Computing Market

The U.S. Cloud Computing market size is projected to be valued at USD 246.8 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 907.9 billion in 2034 at a CAGR of 15.6%.

The US cloud computing market is one of the most mature and technologically advanced ecosystems, driven by high digital adoption, strong IT infrastructure, and the dominance of hyperscale providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. Enterprises across industries including banking, healthcare, retail, and government are rapidly migrating workloads to public, private, and hybrid cloud models to achieve scalability, cost efficiency, and enhanced data security.

The market is witnessing strong momentum due to the integration of artificial intelligence, machine learning, big data analytics, and IoT solutions, which are reshaping business models and enabling organizations to innovate faster while maintaining compliance with stringent data protection standards.

The rapid expansion of edge computing, 5G networks, and cloud native applications is further accelerating adoption across the US. Small and medium enterprises are increasingly embracing SaaS platforms for agility and cost optimization, while large enterprises are investing in hybrid and multi-cloud strategies to reduce vendor lock-in and achieve operational resilience. Rising investments in cybersecurity, disaster recovery, and data center modernization are also propelling the US cloud computing landscape. With a robust ecosystem of technology vendors, service providers, and cloud startups, the US market continues to set global benchmarks for innovation, digital transformation, and enterprise cloud adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Cloud Computing Market

The Europe cloud computing market is projected to reach USD 183.4 billion in 2025, accounting for a significant share of the global landscape. This growth is largely driven by the widespread adoption of SaaS, IaaS, and PaaS solutions across industries such as BFSI, government, healthcare, and telecommunications. European enterprises are prioritizing digital transformation to enhance operational agility, optimize IT infrastructure, and deliver superior customer experiences.

Additionally, the region’s stringent regulatory framework, including GDPR, is shaping the way cloud providers design and deliver services, ensuring compliance with data protection and sovereignty requirements. This regulatory environment has also led to the rise of sovereign cloud initiatives and strong demand for hybrid and multi cloud strategies.

With a forecasted CAGR of 15.4%, the European market is expected to maintain steady growth throughout the next decade. Increasing investments in AI powered cloud platforms, 5G networks, and edge computing are accelerating the region’s adoption of advanced cloud services. SMEs are embracing public cloud solutions for scalability and cost efficiency, while large enterprises are focusing on hybrid cloud models to balance compliance, performance, and flexibility.

Furthermore, the European Union’s push toward digital innovation and sustainability initiatives is encouraging industries to integrate cloud computing for energy optimization, smart city development, and data driven decision making, positioning Europe as a dynamic and competitive hub in the global cloud ecosystem.

Japan Cloud Computing Market

The Japan cloud computing market is estimated to reach USD 41.3 billion in 2025, reflecting its growing importance within the global cloud ecosystem. This expansion is supported by the rapid digitalization of industries such as manufacturing, automotive, BFSI, and healthcare, where enterprises are increasingly shifting to cloud platforms to enhance productivity and resilience.

Japan’s strong focus on smart city initiatives, automation, and connected technologies is further fueling demand for cloud services, particularly IaaS and SaaS. Additionally, the country’s reputation for advanced technology adoption and innovation provides fertile ground for the integration of cloud computing with artificial intelligence, robotics, and IoT, making it a key driver of digital transformation.

With a projected CAGR of 13.7%, Japan’s cloud computing market is poised for steady long term growth. Enterprises are adopting hybrid and multi cloud strategies to balance security, compliance, and flexibility while meeting the growing demand for data driven services. Government backed digital transformation programs, coupled with heavy investments in 5G infrastructure and edge computing, are further propelling adoption across public and private sectors.

SMEs are increasingly leveraging cost effective cloud solutions to expand their digital presence, while large enterprises are modernizing legacy systems to remain globally competitive. This combination of technological advancement, policy support, and industry wide adoption is expected to position Japan as a leading regional hub for cloud innovation.

Global Cloud Computing Market: Key Takeaways

- Market Value: The global Cloud Computing market size is expected to reach a value of USD 2,921.4 billion by 2034 from a base value of USD 733.6 billion in 2025 at a CAGR of 16.6%.

- By Service Model Segment Analysis: Software as a Service (SaaS) is anticipated to dominate the service model segment, capturing 55.0% of the total market share in 2025.

- By Deployment Model Segment Analysis: Public Cloud is expected to maintain its dominance in the deployment model segment, capturing 65.0% of the total market share in 2025.

- By Organization Size Analysis: Large Enterprises will dominate the organization size, capturing 70.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry will account for the maximum share in the industry vertical segment, capturing 20.0% of the total market value.

- Regional Analysis: North America is anticipated to lead the global Cloud Computing market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Cloud Computing market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others.

Global Cloud Computing Market: Use Cases

- Digital Transformation in Banking and Financial Services: Cloud computing is transforming the BFSI sector by enabling secure and scalable infrastructure for core banking, mobile payments, fraud detection, and risk management. Financial institutions are adopting SaaS and IaaS solutions to modernize legacy systems, enhance customer experiences, and comply with strict regulatory frameworks. Advanced analytics and AI powered by cloud platforms allow banks to offer personalized services and improve operational efficiency.

- Healthcare Data Management and Telemedicine: The healthcare and life sciences industry leverages cloud platforms to manage electronic health records, streamline clinical workflows, and enable real time data sharing. Cloud computing supports telemedicine platforms, remote diagnostics, and AI driven drug discovery, improving patient outcomes while reducing costs. With HIPAA-compliant security and hybrid cloud models, providers ensure both data privacy and scalability.

- Retail and E commerce Scalability: Cloud computing helps retail and consumer goods companies manage seasonal demand spikes, streamline supply chains, and deliver seamless omnichannel experiences. E-commerce platforms use cloud based AI, machine learning, and big data analytics to understand consumer behavior and optimize inventory. SaaS applications and cloud native tools enhance customer engagement through personalized recommendations and digital payment solutions.

- Government and Smart City Initiatives: Governments worldwide are adopting cloud technologies to improve public sector efficiency, enable digital citizen services, and build smart city ecosystems. Cloud computing supports applications such as traffic monitoring, digital identity management, and emergency response systems. Hybrid and public cloud models provide secure, scalable, and cost effective solutions that empower authorities to implement e governance and data driven decision making.

Impact of Artificial Intelligence on Cloud Computing Market

Artificial intelligence is significantly shaping the cloud computing market by enabling smarter, faster, and more scalable solutions across industries. Cloud platforms are increasingly integrating AI and machine learning to optimize data processing, automate workflows, and deliver predictive analytics for businesses. This convergence allows organizations to leverage AI powered applications such as chatbots, fraud detection, and real time decision making without investing heavily in on premise infrastructure.

Additionally, AI enhances cloud security through advanced threat detection and risk management while improving efficiency in resource utilization. As enterprises demand more intelligent, agile, and data driven services, the synergy between AI and cloud computing continues to drive innovation and fuel global digital transformation.

Global Cloud Computing Market: Stats & Facts

Eurostat — Cloud computing in EU enterprises (2023)

- 45.2 % of EU enterprises purchased cloud computing services in 2023 (up from 41 % in 2021, a rise of 4.2 percentage points)

Among cloud buyers in 2023

- 82.7 % used cloud for email

- 68 % used it for file storage

- 66.3 % used office software

- 61 % used security software

- 51.6 % used finance and accounting applications

- 43 % hosted databases

- 25.9 % used ERP via cloud

- 25.0 % used CRM via cloud

- 26.1 % purchased PaaS for app development/testing/deployment

- 25.4 % bought computing power for running their own software

Sector-wise adoption in 2023:

- Information & communication: 79 %

- Professional, scientific & technical activities: 62.4 %

- Real estate showed the largest growth since 2021, increasing by 7.5 percentage points

By enterprise size in 2023 vs. 2021:

- Large enterprises: 77.6 % (up 6 points)

- Medium enterprises: 59 % (up from 53 %)

- Small enterprises: 41.7 % (up 3.8 points)

Country extremes:

- Highest adoption—Finland 78.3 %, Sweden 71.6 %, Denmark 69.5 %, Malta 66.7 %

- Lowest adoption—Greece 23.6 %, Romania 18.4 %, Bulgaria 17.5 %

- Cloud service types purchased (2023):

- At least one SaaS: 95.8 %

- At least one IaaS: 74.2 %

Dependence level:

- Among all EU enterprises, 34 % showed high dependence on cloud (i.e., purchased sophisticated services)

- Highest “high dependence” countries: Finland 63.6 %, Denmark 62.8 %, Sweden 56.1 %, Netherlands 52.3 %

- Among cloud users: 75.3 % bought sophisticated services, 10.4 % bought intermediate-level, 12.9 % basic only

- Among large firms: 83.6 % of cloud users purchased sophisticated services; medium firms: 77.4 %; small firms: 74.2 %

Statistics Canada — Survey of Digital Technology and Internet Use (2023)

- 48 % of Canadian businesses used cloud computing in 2023 (an increase of 3 percentage points since 2021)

- In the Information & cultural industries sector, cloud use reached 81 % in 2023

UK Government (Find a Tender) — G-Cloud Program (2024)

- Central and wider UK public sector expenditure via G-Cloud in FY 2023/24 was £3.1 billion

- The UK public-sector public-cloud market was estimated at £6 billion in 2024

United States – Federal Statistics (2021–2025

- As of FY 2019–20, 200 cloud service products were authorized under FedRAMP, up from 100 authorizations between FY 2013–18

- Technology Modernization Fund (TMF) Investments (2022–2025)

- June 2025: FTC received USD 14.6 million to build a scalable cloud environment with AI-powered analytical tools for faster data processing

- September 2023: FTC received USD 1.1 million to modernize systems using a cloud-based PaaS with identity management and MFA

Global Cloud Computing Market: Market Dynamics

Global Cloud Computing Market: Driving Factors

Rising Enterprise Digital Transformation

The increasing push toward digital transformation is a key driver of the cloud computing market. Enterprises are migrating workloads from on-premises systems to cloud environments to achieve scalability, agility, and cost optimization. The adoption of SaaS, IaaS, and PaaS solutions helps organizations accelerate innovation, streamline business operations, and deliver personalized digital experiences to customers.

Expansion of Data Intensive Technologies

The growing use of artificial intelligence, big data analytics, and the Internet of Things is fueling demand for scalable computing resources. Cloud platforms provide flexible infrastructure to process vast volumes of unstructured data, enabling real-time insights and predictive analytics. This is particularly vital for industries such as healthcare, retail, and BFSI that rely on data-driven decision-making.

Global Cloud Computing Market: Restraints

Data Security and Compliance Challenges

One of the major restraints for the cloud computing market is the concern over data breaches, privacy risks, and regulatory compliance. Organizations handling sensitive information in sectors like healthcare and banking face stringent security requirements, which may slow down cloud adoption. Ensuring compliance with standards such as GDPR and HIPAA remains a critical challenge.

High Dependence on Network Connectivity

Cloud services rely heavily on stable and high-speed internet connectivity. In regions with limited digital infrastructure or unreliable networks, businesses struggle to achieve consistent performance. Latency issues and downtime risks hinder smooth operations, particularly for applications requiring real time processing such as telemedicine or online banking.

Global Cloud Computing Market: Opportunities

Growth of Hybrid and Multi-Cloud Models

The rising adoption of hybrid and multi cloud strategies presents significant opportunities in the cloud computing market. Enterprises are increasingly seeking flexibility by combining public and private cloud environments to optimize workloads, reduce vendor lock in, and improve disaster recovery. This model is particularly appealing for large enterprises managing sensitive data and complex applications.

Emergence of Cloud in Emerging Economies

Developing regions such as Asia Pacific, Latin America, and the Middle East are witnessing rapid digital adoption. SMEs in these regions are embracing cloud services due to cost effectiveness, scalability, and easy access to advanced technologies. Expanding internet penetration and government backed digitalization programs are further accelerating cloud adoption in emerging economies.

Global Cloud Computing Market: Trends

Integration of Cloud with Artificial Intelligence

A major trend shaping the market is the convergence of AI and cloud computing. Cloud providers are embedding AI-powered tools into their platforms to support advanced use cases such as predictive analytics, automated customer service, and intelligent cybersecurity. This integration enables enterprises to unlock greater value from data while enhancing operational efficiency.

Rising Focus on Edge Cloud Deployments

With the rise of IoT devices and 5G networks, edge cloud solutions are gaining prominence. By processing data closer to the source, edge computing reduces latency and improves real time decision making. This trend is particularly relevant for applications in autonomous vehicles, smart cities, and industrial automation, where speed and reliability are critical.

Global Cloud Computing Market: Research Scope and Analysis

By Service Model Analysis

Software as a Service is projected to remain the leading segment in the global cloud computing market, accounting for nearly 55% of the total market share in 2025. Its dominance is driven by the increasing adoption of subscription-based applications across industries such as banking, healthcare, retail, and IT services. SaaS solutions allow enterprises to reduce upfront costs, enhance scalability, and gain easy access to advanced software without complex infrastructure investments. The rising demand for collaboration tools, customer relationship management, enterprise resource planning, and content management systems is further accelerating the SaaS market, especially with the growth of remote work and digital workplace ecosystems.

Platform as a Service also plays a critical role in the cloud computing market by providing developers with a ready-to-use environment to build, test, and deploy applications efficiently. PaaS offerings reduce the complexity of software development by integrating middleware, databases, and development frameworks into a single cloud platform.

This segment is increasingly popular among enterprises aiming to innovate faster, support microservices architecture, and adopt DevOps practices. The growing use of PaaS for AI-powered applications, big data analytics, and IoT solutions highlights its importance as businesses continue to seek faster time to market and greater flexibility in application development.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Deployment Model Analysis

Public cloud is expected to maintain its dominance in the deployment model segment, accounting for around 65% of the total market share in 2025. Its leadership is supported by the widespread adoption of cost effective and highly scalable cloud services offered by providers such as AWS, Microsoft Azure, and Google Cloud. Public cloud solutions allow enterprises of all sizes to access computing resources on demand, avoid heavy capital expenditure, and benefit from continuous software updates and security enhancements.

Industries such as retail, BFSI, and IT services are increasingly leveraging public cloud platforms to support digital transformation initiatives, remote workforce management, and real time data processing. The growing reliance on SaaS applications and the rapid rise of start ups and SMEs are further strengthening the demand for public cloud deployments worldwide.

Private cloud, on the other hand, serves organizations that prioritize data security, regulatory compliance, and greater control over their IT infrastructure. It provides a dedicated environment tailored to the specific needs of a single enterprise, making it particularly attractive for sectors such as healthcare, government, and banking that handle sensitive data.

Private cloud allows businesses to achieve scalability and flexibility while maintaining stricter governance and customization options compared to the public cloud. Although it holds a smaller share of the overall market, private cloud continues to gain traction among large enterprises seeking a balance between performance, compliance, and data sovereignty.

By Organization Size Analysis

Large enterprises are projected to dominate the organization size segment in the global cloud computing market, capturing nearly 70% of the total share in 2025. This dominance is attributed to their ability to make significant investments in advanced IT infrastructure and cloud migration strategies.

Large organizations across industries such as BFSI, telecommunications, and healthcare are leveraging SaaS, IaaS, and PaaS solutions to optimize operations, enhance customer engagement, and drive digital transformation at scale. With complex business models and global operations, large enterprises prefer hybrid and multi cloud strategies to ensure flexibility, business continuity, and resilience against disruptions. Their strong focus on cybersecurity, compliance, and data management further accelerates cloud adoption within this segment.

Small and medium enterprises are also playing a vital role in the growth of the cloud computing market as they increasingly adopt cloud services for cost efficiency and operational agility. SMEs rely on SaaS platforms for business applications such as CRM, HRM, and accounting, which reduce IT maintenance costs and improve productivity.

The pay as you go pricing model offered by public cloud providers allows smaller firms to scale resources according to demand without heavy capital expenditure. Growing digitalization of SMEs, particularly in emerging economies, is fueling demand for cloud computing, making this segment a key contributor to the overall market expansion despite holding a smaller share compared to large enterprises.

By Industry Vertical Analysis

The BFSI industry is set to account for the largest share in the industry vertical segment, capturing around 20% of the total market value in 2025. This dominance comes from the sector’s rapid adoption of cloud computing for core banking, mobile payments, digital wallets, fraud detection, and regulatory compliance. Financial institutions are increasingly shifting to cloud based platforms to modernize legacy systems, reduce operational costs, and deliver personalized digital services.

Cloud computing also enables real time analytics and AI driven risk assessment, which enhance decision making and improve customer experience. The strong emphasis on cybersecurity and disaster recovery further strengthens cloud adoption across banking, insurance, and financial services.

The energy and utilities sector is also leveraging cloud computing to improve efficiency, reliability, and sustainability in operations. Cloud platforms enable better management of smart grids, predictive maintenance of infrastructure, and real time monitoring of energy consumption. Utilities are adopting cloud based IoT and big data analytics solutions to optimize power distribution and integrate renewable energy sources.

The scalability and flexibility of cloud computing also support regulatory compliance and customer centric digital services such as online billing and energy usage insights. While this segment accounts for a smaller share compared to BFSI, it is becoming increasingly important as energy companies embrace digital transformation and smart energy initiatives.

The Cloud Computing Market Report is segmented on the basis of the following:

By Service Model

- Infrastructure as a Service (IaaS)

- Platform as a Service (Paas)

- Software as a Service (SaaS)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- BFSI

- Energy & Utilities

- Government & Public Sector

- Telecommunications

- Retail & Consumer Goods

- Media & Entertainment

- IT & ITeS

- Healthcare & Life Science

- Others

Global Cloud Computing Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global cloud computing market, capturing around 40% of total revenue in 2025. The region’s dominance is driven by the strong presence of major cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud, along with high digital adoption across industries including BFSI, healthcare, retail, and government. Enterprises in the United States and Canada are at the forefront of cloud migration, leveraging SaaS, IaaS, and PaaS solutions to support digital transformation, remote workforce management, and advanced analytics.

Additionally, robust IT infrastructure, heavy investments in AI, 5G, and edge computing, and stringent focus on cybersecurity and compliance continue to fuel market growth, making North America the most mature and competitive cloud ecosystem globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

Asia Pacific is emerging as the fastest growing region in the global cloud computing market, driven by rapid digitalization, expanding internet penetration, and strong government initiatives supporting cloud adoption. Countries such as China, India, Japan, and South Korea are witnessing a surge in demand for SaaS, IaaS, and PaaS solutions across industries like e commerce, BFSI, healthcare, and manufacturing.

The region’s growing base of SMEs, coupled with rising investments in 5G, edge computing, and AI powered cloud services, is accelerating adoption at a remarkable pace. With increasing focus on cost efficiency, scalability, and digital innovation, Asia Pacific is expected to record the most significant growth trajectory in the global market over the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cloud Computing Market: Competitive Landscape

The global cloud computing market features a highly competitive landscape dominated by technology giants such as Amazon Web Services, Microsoft Azure, and Google Cloud, which collectively command a significant portion of market revenue. Alongside these leaders, players like IBM Cloud, Oracle Cloud, Alibaba Cloud, and Salesforce are strengthening their positions through innovations, strategic partnerships, and regional expansions.

Emerging providers such as Tencent Cloud, Huawei Cloud, Snowflake, and DigitalOcean are also gaining traction by catering to niche applications and cost effective solutions. Intense competition is driving continuous advancements in AI integration, hybrid cloud offerings, cybersecurity enhancements, and multi cloud strategies, creating a dynamic environment where both global leaders and regional players are shaping the market’s future growth.

Some of the prominent players in the global cloud computing market are:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- Salesforce

- SAP

- VMware

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems

- Fujitsu

- Rackspace Technology

- Tencent Cloud

- Baidu AI Cloud

- Huawei Cloud

- DigitalOcean

- Snowflake

- Workday

- Other Key Players

Global Cloud Computing Market: Recent Developments

- August 2025: Capgemini inked an agreement to acquire Cloud4C, a managed services specialist in hybrid and sovereign cloud environments enriched with low-code, AI-ready platforms.

- July 2025: CoreWeave announced plans to acquire Core Scientific in a USD 9 billion all-stock deal, giving CoreWeave access to 1.3 GW of power capacity and enhancing its AI-focused data center infrastructure.

- July 2025: AWS introduced Amazon Bedrock AgentCore, a modular platform that streamlines development and deployment of AI agents with features like runtime, memory, identity, gateway, and code interpreter for Python and JavaScript environments.

- July 2025: AWS also launched Amazon Q Developer, enabling natural language queries across AWS services such as S3, DynamoDB, and CloudWatch directly from the console, Slack, Teams, and mobile app.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 733.6 Bn |

| Forecast Value (2034) |

USD 2,921.4 Bn |

| CAGR (2025–2034) |

16.6% |

| The US Market Size (2025) |

USD 246.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Model (Infrastructure as a Service, Platform as a Service, Software as a Service), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical (BFSI, Energy & Utilities, Government & Public Sector, Telecommunications, Retail & Consumer Goods, Media & Entertainment, IT & ITeS, Healthcare & Life Science, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Cloud Computing market?

▾ The global Cloud Computing market size is estimated to have a value of USD 733.6 billion in 2025 and is expected to reach USD 2,921.4 billion by the end of 2034.

What is the size of the US Cloud Computing market?

▾ The US Cloud Computing market is projected to be valued at USD 246.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 907.9 billion in 2034 at a CAGR of 15.6%.

Which region accounted for the largest global Cloud Computing market?

▾ Which region accounted for the largest global Cloud Computing market?

Who are the key players in the global Cloud Computing market?

▾ Some of the major key players in the global Cloud Computing market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others

What is the growth rate of the global Cloud Computing market?

▾ The market is growing at a CAGR of 16.6 percent over the forecasted period.