Market Overview

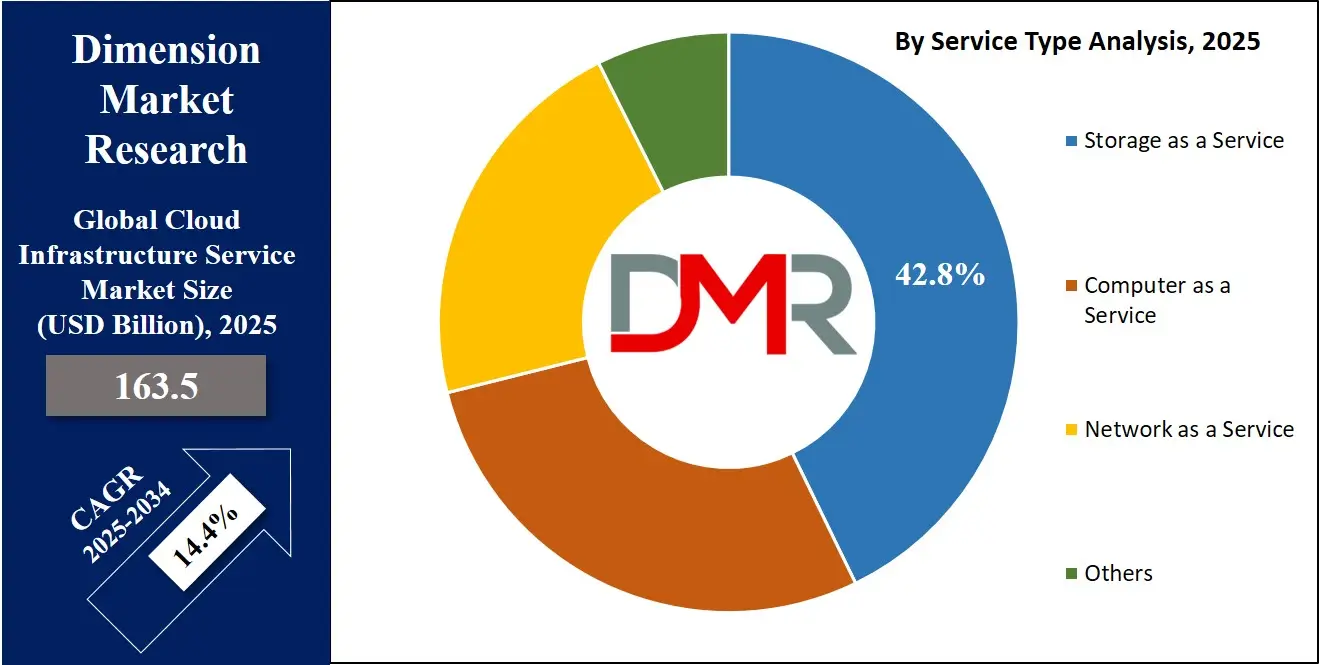

The Global Cloud Infrastructure Services Market size is projected to grow from

USD 163.5 billion in 2025 to

USD 549.5 billion by 2034, expanding at a

CAGR of 14.4%. Growth is driven by accelerated cloud computing adoption, hyperscale data center investments, and rising demand for IaaS and PaaS solutions.

Cloud infrastructure services refer to a broad range of computing services that provide businesses with access to virtualized resources over the internet. These services typically include servers, storage, networking, databases, and software, all hosted in large-scale data centers managed by third-party providers. By leveraging cloud infrastructure, organizations eliminate the need for maintaining expensive on-premises hardware and gain the ability to scale their IT resources dynamically based on demand.

Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) are the foundational components of this ecosystem, enabling businesses to build, deploy, and manage applications quickly without the complexities of hardware management. Cloud infrastructure services support greater agility, foster innovation, and enable efficient disaster recovery while offering robust cloud security measures to protect sensitive data. Additionally, these services are vital to supporting new-age technologies like artificial intelligence (AI), Internet of Things (IoT), big data analytics, and blockchain, forming the backbone of modern digital enterprises.

The global cloud infrastructure services market is undergoing a rapid evolution as businesses across industries embrace cloud computing to achieve operational efficiency and competitive advantage. Enterprises are moving their workloads to cloud environments to enhance scalability, reduce capital expenditures, and accelerate their digital transformation journeys.

Rising adoption of hybrid cloud models, the proliferation of Software-as-a-Service (SaaS) solutions, and the need for real-time data processing are further propelling market demand. Hyperscale data centers are expanding across major regions, supported by significant investments from leading players like Amazon Web Services, Microsoft Azure, Google Cloud, and Alibaba Cloud. As organizations strive for more agile IT frameworks, the integration of multi-cloud strategies and edge computing capabilities is reshaping the traditional IT infrastructure landscape.

Another critical driver of the cloud infrastructure services market is the growing emphasis on cybersecurity, regulatory compliance, and data sovereignty. With the rise of remote work and interconnected global operations, businesses face growing threats from cyberattacks, making cloud security a top priority. Providers are investing heavily in advanced encryption techniques, AI-driven security analytics, and zero-trust architecture models to meet these challenges. Moreover, data localization laws in various countries are prompting cloud service providers to establish regional data centers, thereby expanding their global footprint. Enterprises also strongly prefer customizable and industry-specific cloud solutions, such as those designed for healthcare, finance, manufacturing, and government sectors, which offer customized compliance features and optimized performance.

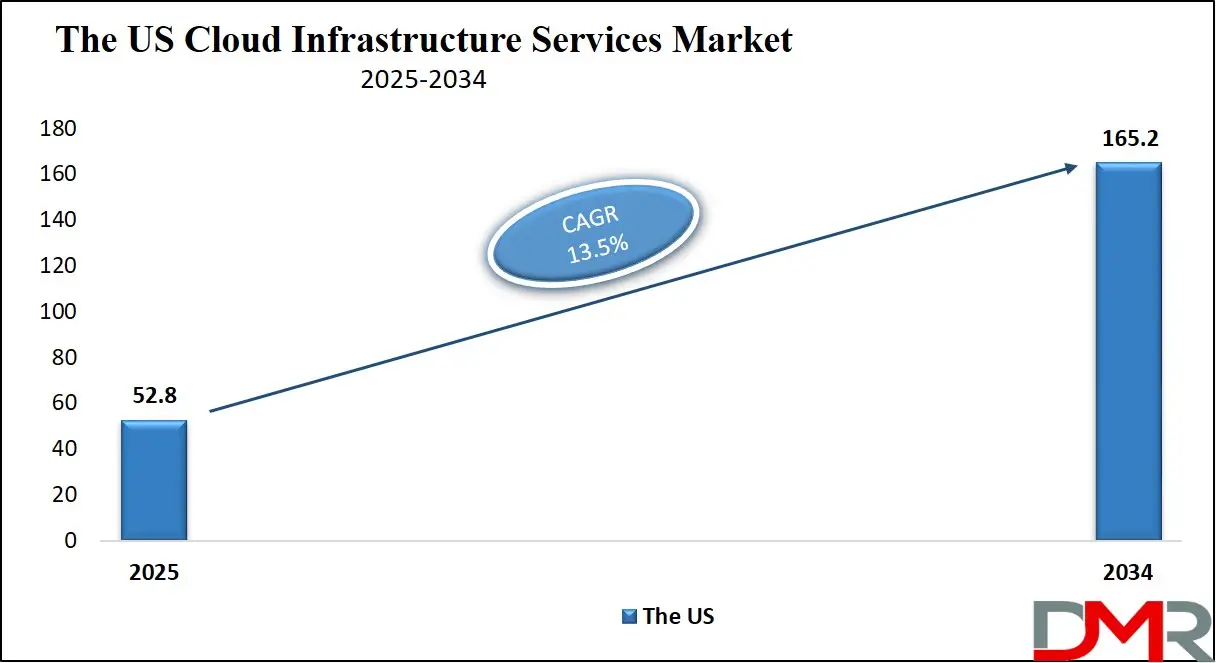

The US Cloud Infrastructure Services Market

The U.S. Cloud Infrastructure Services Market size is projected to be valued at USD 52.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 165.2 billion in 2034 at a CAGR of 13.5%.

The U.S. cloud infrastructure services market is evolving remarkably, driven by businesses deepening reliance on digital technologies and cloud-based solutions. Companies across industries are migrating their critical workloads to the cloud, seeking the scalability, agility, and cost-efficiency that Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) offerings provide. The demand for flexible IT infrastructure intensifies as enterprises prioritize digital transformation initiatives to stay competitive in a rapidly changing economic landscape. Hybrid cloud models are becoming the preferred choice for many organizations, blending the benefits of public and private cloud environments to deliver greater control, security, and compliance.

Major cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud dominate the U.S. landscape, continuously expanding their regional data center networks to support growing demand. These hyperscalers are not only focusing on capacity but are also investing in advanced technologies such as artificial intelligence integration, machine learning platforms, Internet of Things (IoT) connectivity, and serverless computing models.

The market is also witnessing an upsurge in multi-cloud strategies, as enterprises diversify their cloud partnerships to optimize performance, reduce vendor lock-in, and enhance resilience. Meanwhile, edge computing is gaining momentum, with companies deploying localized data centers to enable faster processing and lower latency for mission-critical applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Cloud Infrastructure Services Market

The European cloud infrastructure services market is poised for significant growth, with an estimated market size of

USD 32.7 billion in 2025 and a projected

CAGR of 13.5% through 2034. The markets expansion is driven by the rapid adoption of cloud-based solutions across various industries, including finance, healthcare, manufacturing, and telecommunications, as businesses seek to modernize their IT infrastructure for greater efficiency, scalability, and innovation. As digital transformation accelerates, demand for IaaS, PaaS, and SaaS solutions is on the rise, with enterprises moving their workloads to the cloud to drive agility and reduce operational costs.

Europes cloud infrastructure market is also being shaped by growing investments in cloud-native applications, AI-powered technologies, big data analytics, and IoT solutions. Countries such as the UK, Germany, and France are leading the way, with significant adoption of hybrid and multi-cloud strategies, allowing businesses to integrate a mix of public and private cloud environments to meet specific needs. Additionally, the regions strong regulatory environment, particularly the General Data Protection Regulation (GDPR), is driving demand for secure, compliant cloud infrastructure solutions.

As Europe continues to prioritize innovation and digital services, the need for secure and high-performance cloud solutions grows, supported by developments in edge computing, 5G networks, and cybersecurity. This expanding demand across both enterprise and public sector markets ensures that Europe will remain a critical player in the global cloud infrastructure services market, with strong growth anticipated throughout the forecast period.

The Japanese Cloud Infrastructure Services Market

The Japanese cloud infrastructure services market is set for substantial growth, with an estimated market size of USD 13.0 billion in 2025 and a projected CAGR of 14.2% through 2034. Japans market expansion is driven by the countrys strong commitment to digital transformation, with enterprises across various sectors adopting cloud-based solutions for scalability, efficiency, and innovation. The demand for cloud-native applications, AI, and IoT is intensifying as businesses aim to modernize their IT infrastructure and integrate advanced technologies into their operations.

Key sectors such as manufacturing, finance, and telecommunications are at the forefront of Japans cloud adoption, leveraging cloud infrastructure to enhance operational agility, reduce costs, and enable faster innovation. The rise of 5G networks and edge computing further boosts the need for high-performance cloud platforms, as businesses look to capitalize on real-time data processing and next-generation connectivity.

Moreover, Japans focus on cybersecurity and data privacy is driving the demand for secure and compliant cloud services. With growing investments in hybrid cloud and multi-cloud strategies, businesses are seeking flexible, secure, and scalable solutions that meet both operational needs and regulatory requirements. As Japan continues to evolve as a digital hub in Asia, the cloud infrastructure services market is expected to maintain strong growth, propelled by technological advancements and its ongoing efforts toward creating smarter, more connected cities.

Global Cloud Infrastructure Services Market: Key Takeaways

- Market Value: The global cloud infrastructure services size is expected to reach a value of USD 549.5 billion by 2034 from a base value of USD 163.5 billion in 2025 at a CAGR of 14.4%.

- By Service Type Segment Analysis: Storage as a Service type is poised to consolidate its dominance in the service type segment, capturing 42.8% of the total market share in 2025.

- By Deployment Segment Analysis: Public Cloud deployment model is expected to maintain its dominance in the deployment type segment, capturing 61.5% of the total market share in 2025.

- By Enterprise Size Segment Analysis: Large Enterprises are anticipated to maintain their dominance in the enterprise type segment, capturing 78.2% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The IT & Telecom industry is anticipated to maintain its dominance in the industry vertical segment, capturing 41.3% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global cloud infrastructure services market landscape with 38.4% of total global market revenue in 2025.

- Key Players: Some key players in the global cloud infrastructure services market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Tencent Cloud, Salesforce, SAP, Hewlett Packard Enterprise (HPE), VMware, Dell Technologies, Cisco Systems, Fujitsu, Rackspace Technology, DigitalOcean, OVHcloud, Huawei Cloud, NTT Communications, Baidu AI Cloud, and Other Key Players.

Global Cloud Infrastructure Services Market: Use Cases

- Enterprise Cloud Migration and IT Modernization: Enterprises across the globe are shifting from legacy IT systems to cloud-based environments to drive efficiency, scalability, and innovation. Cloud infrastructure services provide the foundational layer for organizations to migrate complex workloads, modernize applications, and adopt cloud-native architectures. With Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) models, businesses can avoid hefty capital expenditures on hardware while achieving faster deployment times and improved operational agility. Cloud computing adoption enables seamless integration with artificial intelligence (AI), big data analytics, and Internet of Things (IoT) ecosystems, supporting end-to-end digital transformation initiatives.

- Development and Deployment of Cloud-Native Applications: The cloud infrastructure ecosystem has become essential for businesses developing next-generation applications that are agile, scalable, and resilient. Organizations are leveraging microservices architecture, containerization technologies like Kubernetes, and serverless computing models to build cloud-native applications. Cloud platforms offer automated scaling, continuous integration/continuous deployment (CI/CD) pipelines, and robust API management, reducing time-to-market significantly. As the demand for personalized digital experiences grows, industries such as finance, e-commerce, and healthcare are adopting cloud-native development to enhance customer engagement, data processing capabilities, and operational flexibility.

- Disaster Recovery, Data Backup, and Business Continuity: Cloud infrastructure services play a crucial role in disaster recovery planning and data resilience strategies for modern enterprises. Companies are using cloud-based solutions to back up critical data and applications in geographically dispersed data centers, ensuring business continuity even in the event of cyberattacks, hardware failures, or natural disasters. Solutions such as Disaster Recovery-as-a-Service (DRaaS) and Backup-as-a-Service (BaaS) provide cost-effective, scalable, and secure alternatives to traditional recovery systems. Enhanced cloud security frameworks, real-time replication, and automated failover mechanisms help organizations safeguard their data assets, maintain compliance, and minimize downtime risks.

- Enabling Edge Computing and Real-Time Data Processing: As industries like manufacturing, automotive, healthcare, and telecommunications embrace the Internet of Things (IoT) and AI-driven solutions, the need for low-latency, real-time data processing is surging. Cloud infrastructure services are evolving to support edge computing architectures, wherein data is processed closer to the source of generation. By integrating edge computing with centralized cloud platforms, businesses can reduce latency, optimize bandwidth usage, and achieve faster decision-making. This use case is particularly important for applications such as autonomous vehicles, smart factories, remote healthcare monitoring, and real-time financial services, where milliseconds can define the success of operations.

Global Cloud Infrastructure Services Market: Stats & Facts

U.S. Federal Government – Cloud Computing Strategy (and Bureau of Economic Analysis)

- Cloud-First Policy: The U.S. governments Cloud First policy mandates federal agencies to prefer cloud-based solutions for IT procurement.

- Cloud Adoption in U.S. Government: By 2023, more than 60% of federal agencies had adopted cloud computing for mission-critical systems.

- U.S. Cloud Infrastructure Spending: In 2021, U.S. federal government cloud spending reached approximately USD 6.5 billion.

- GDP Contribution: Cloud computing accounted for an estimated 8.2% of the U.S. GDP in 2023, highlighting its significant economic contribution.

- Cloud-Enabled Services: Over 70% of U.S. government agencies use the cloud to enable digital services and drive innovation.

- Multi-Cloud and Hybrid Adoption: Over 80% of U.S. enterprises report using a multi-cloud or hybrid cloud environment.

- Data Centers: The U.S. houses over 50% of the worlds data centers, which are essential for cloud infrastructure.

- Cloud-First Mandates: The Federal Cloud Computing Strategy promotes cloud-first procurement practices to improve operational efficiency.

Canada – Cloud Computing Insights (and National Statistics)

- Cloud Adoption: By 2023, 88% of Canadian businesses had adopted some form of cloud technology, with hybrid cloud adoption growing rapidly.

- Cloud Usage in SMEs: 70% of small and medium-sized enterprises (SMEs) in Canada now rely on cloud infrastructure for business operations.

- Cloud Service Growth: Canadian cloud service revenue grew by over 15% annually from 2020 to 2023.

- Cybersecurity Concerns: 43% of Canadian businesses identified data privacy and security as primary concerns when adopting cloud infrastructure.

- Government Cloud Spending: Canadas government allocated USD 2.3 billion for cloud transformation initiatives in 2022.

- Containerization Adoption: 15% of Canadian organizations adopted containers for infrastructure management by 2023.

Japan – Cloud Services Market

- Cloud Adoption: 80% of large Japanese enterprises have migrated at least part of their operations to the cloud.

- Data Center Demand: The demand for data centers in Japan is expected to grow at a 12% CAGR until 2025, driven by increased cloud infrastructure needs.

- Hybrid Cloud: 55% of organizations in Japan have adopted a hybrid cloud approach, combining both on-premises and cloud solutions.

- Government Cloud Push: Japans government invested over ¥500 billion in cloud infrastructure to modernize public services and enhance data management by 2024.

- Private Cloud Growth: Japanese enterprises are increasingly opting for private cloud, with 44% of large firms using this model.

European Union – Cloud Infrastructure (Eurostat & EU Digital Agenda)

- Cloud Usage in Enterprises: Over 70% of European enterprises utilize cloud-based services, with 40% using public cloud solutions.

- Public Sector Cloud: The EU has committed to a €1 billion investment in cloud adoption for public sector agencies by 2025.

- Enterprise Adoption: 68% of European enterprises that have adopted cloud services have integrated them into critical business operations.

- Cloud Data Centers: Europes cloud data center market is expected to grow at a rate of 10% annually, reaching USD 20 billion by 2025.

- Regulatory Support for Cloud: The EUs General Data Protection Regulation (GDPR) directly influences cloud security and data privacy policies across Europe.

- Cloud Transformation: The EU aims to achieve 100% cloud adoption by all public administrations by 2025, part of its Digital Europe Program.

Australia – Cloud Infrastructure and Digital Economy

- AI and Cloud Impact: Cloud computing and artificial intelligence are projected to contribute over USD 600 billion to Australias economy by 2030.

- Data Sovereignty: 58% of Australian enterprises prefer local cloud data centers to meet data sovereignty and compliance requirements.

- Cloud Adoption: 72% of Australian businesses use some form of cloud infrastructure for critical operations.

- Government Cloud Spending: The Australian government spent approximately USD 1.2 billion on cloud-related services and digital transformation in 2022.

- Cloud Provider Preference: 46% of Australian firms prefer multi-cloud solutions for flexibility and redundancy.

India – Cloud Infrastructure Growth (Government and IT Ministry)

- Cloud Adoption in SMEs: Over 75% of Indian SMEs have moved at least one business function to the cloud.

- Cloud-First Policy: Indias government announced a cloud-first policy for all government departments in 2021 to enhance service delivery and reduce costs.

- Cloud Infrastructure Investment: The Indian government allocated $3 billion for cloud computing infrastructure in 2023 as part of its Digital India program.

- Cloud and Digital Transformation: 68% of Indian businesses say that cloud adoption has accelerated their digital transformation strategies.

United Kingdom – Cloud Services Insights (UK Government and National Statistics)

- Cloud Services Adoption: Around 65% of UK-based enterprises use cloud infrastructure for business continuity and scalability.

- Public Sector Cloud: The UK government plans to spend £1 billion on cloud and digital modernization projects over the next three years.

- Cloud Security Focus: 55% of UK organizations prioritize cloud security as a significant concern when adopting cloud services.

- Hybrid Cloud Growth: 45% of UK businesses use hybrid cloud models to leverage both public and private cloud resources.

- Enterprise Cloud Spending: The UK enterprise cloud services market was valued at £10 billion in 2023, showing steady growth.

Singapore – Cloud Adoption and Digital Transformation

- Cloud-First Policy: Singapores government introduced the Cloud-First policy to accelerate the adoption of cloud infrastructure in public sector agencies.

- Enterprise Cloud Usage: Over 75% of Singaporean enterprises utilize some form of cloud service, including public, private, or hybrid models.

- Data Center Market: The data center market in Singapore is expected to grow by 10% annually, driven by cloud and digital services.

- Government Cloud Spending: The Singapore government invested over SGD 500 million in cloud infrastructure by 2024 for e-governance.

United Nations – Cloud Computing for Development (UNCTAD Reports)

- Cloud for Sustainable Development: Cloud computing is recognized as a key enabler for sustainable development goals (SDGs), especially in improving public service delivery in developing nations.

- Global Cloud Adoption Trends: A UNCTAD report noted that cloud computing adoption among developing countries increased by 30% from 2020 to 2023.

- Cloud for Disaster Management: Cloud services play a key role in disaster management, where global organizations store and manage real-time disaster data in the cloud.

Global Cloud Infrastructure Services Market: Market Dynamics

Global Cloud Infrastructure Services Market: Driving Factors

Increased Adoption of Digital Transformation Initiatives

As organizations globally strive to stay competitive, digital transformation has become a top priority. Cloud infrastructure services are at the heart of this transformation, enabling businesses to modernize their IT systems, leverage new technologies, and drive innovation. The rise in demand for cloud computing, data analytics, AI integration, and IoT applications is pushing enterprises to migrate workloads to the cloud. This shift toward digital-first operations ensures that businesses can scale dynamically, improve efficiency, and offer enhanced customer experiences. The accessibility, flexibility, and cost-efficiency of cloud infrastructure are key drivers of this trend, as companies rely on cloud-native applications and multi-cloud environments to maintain a competitive edge.

Expansion of Hyperscale Data Centers and Cloud Services

The rapid growth of hyperscale data centers is another driving factor fueling the global cloud infrastructure services market. Large cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are investing heavily in building and expanding data centers globally to meet the growing demand for Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) solutions.

These expansions enable providers to deliver faster, more reliable services with higher storage capacity and better performance. Additionally, the rise of 5G networks is expected to further increase the demand for data processing capabilities, pushing the need for robust, scalable, and geographically distributed cloud infrastructure.

Global Cloud Infrastructure Services Market: Restraints

Data Security and Privacy Concerns

One of the biggest challenges faced by the global cloud infrastructure services market is ensuring the security and privacy of data. With the growing number of cyberattacks, ransomware, and data breaches, organizations are cautious about storing sensitive information on the cloud. The lack of control over data stored off-premises makes businesses vulnerable to privacy violations and security risks. Despite advancements in cloud security protocols, data encryption, and multi-factor authentication, concerns over compliance with local regulations and international data protection laws, such as the GDPR, continue to hinder adoption, especially in sectors like healthcare, finance, and government.

Vendor Lock-In and Multi-Cloud Complexity

While cloud infrastructure provides flexibility, organizations often face challenges related to vendor lock-in, which restricts their ability to switch providers or scale their cloud environments freely. With many cloud service providers offering proprietary technologies and platforms, migrating data or applications between cloud environments can be complex and costly. This issue becomes even more pronounced when businesses use multiple cloud providers, which can lead to complications in managing and integrating different services. The complexity of multi-cloud environments can create operational inefficiencies and increase the risk of service disruptions, making it a significant restraint for businesses seeking seamless cloud adoption.

Global Cloud Infrastructure Services Market: Opportunities

Growth of Edge Computing and Real-Time Data Processing

The growing demand for real-time data processing and low-latency applications presents a significant opportunity for the global cloud infrastructure services market. As industries such as automotive, manufacturing, and healthcare deploy IoT devices and AI technologies, they require cloud solutions that can process data closer to the point of generation. Edge computing is emerging as a key enabler of these capabilities, offering the potential for faster decision-making and improved operational efficiency. By combining cloud infrastructure with edge computing, businesses can create hybrid architectures that optimize performance and reduce latency for mission-critical applications.

Cloud-Native Application Development and Innovation

The rapid shift toward cloud-native application development is opening up a range of opportunities for cloud infrastructure providers. The rise of containerization, microservices, and serverless computing allows businesses to build scalable and flexible applications that can be quickly deployed and updated. This opportunity is particularly prominent in sectors such as finance, retail, and telecommunications, where organizations are looking to innovate and improve customer experiences. As businesses demand faster deployment cycles and greater scalability, cloud infrastructure services will play a pivotal role in enabling cloud-native solutions that support ongoing innovation and rapid market response.

Global Cloud Infrastructure Services Market: Trends

Intense Competition among Cloud Service Providers

The global cloud infrastructure services market is highly competitive, with major players like AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud dominating the landscape. While this competition fosters innovation and drives down prices, it also creates challenges for smaller players and new entrants trying to capture market share. The constant pressure to innovate and meet the evolving needs of enterprises can lead to market saturation and margin erosion, making it difficult for businesses to differentiate their offerings. Additionally, the growing complexity of cloud solutions and the need for specialized expertise can make it hard for less-established players to compete effectively.

Regulatory and Compliance Issues

As the global market for cloud infrastructure services expands, regulatory and compliance issues present a significant threat. Governments globally are implementing stricter data sovereignty and privacy laws, which can complicate the deployment and management of cloud infrastructure across different regions. Cloud providers must navigate a complex landscape of legal requirements, such as data protection regulations and industry-specific standards. Failure to comply with these regulations can lead to hefty fines, legal repercussions, and a loss of customer trust. The dynamic nature of these regulations adds complexity to the global cloud infrastructure market, making it harder for businesses to scale their operations without running into compliance issues.

Global Cloud Infrastructure Services Market: Research Scope and Analysis

By Service Type Analysis

Storage as a Service (STaaS) is poised to retain its leadership position in the cloud infrastructure services market, expected to capture 42.8% of the total market share in 2025. This growth reflects the growing demand for scalable and flexible storage solutions. As businesses continue to generate vast amounts of data, traditional on-premises storage systems are becoming outdated and inefficient. STaaS enables organizations to store data in the cloud, offering significant cost savings, enhanced security, and seamless scalability.

The rise of data-driven applications, including big data analytics, AI-powered solutions, and IoT systems, is accelerating the need for cloud infrastructure services. With this model, businesses no longer need to worry about managing physical hardware, as they can easily scale their storage capacity in response to growing demands. Additionally, the integration of backup-as-a-service, disaster recovery solutions, and data protection features further strengthens STaaS as an essential offering within the cloud ecosystem. This segment is popular in industries where data storage and security are critical, such as in healthcare, finance, and e-commerce, making it a key contributor to the overall cloud market.

On the other hand, Computer as a Service (CaaS) is emerging as a significant cloud offering that provides businesses with virtualized computing resources over the internet. While not as widely adopted as STaaS, the demand for CaaS is steadily growing, driven by the need for on-demand computing power and cost-effective IT infrastructure. Through CaaS, businesses can access computing resources like virtual machines, processing power, and storage without investing in expensive physical hardware. This model provides businesses with flexibility and agility, as computing power can be scaled up or down based on fluctuating requirements.

The adoption of cloud-native applications and growing workloads related to AI, machine learning, and high-performance computing are expected to propel the demand for CaaS, especially in technology and research-driven sectors. With CaaS, organizations can focus on their core competencies without worrying about infrastructure maintenance or hardware limitations, making it an appealing option for startups, small businesses, and enterprises looking for high-performance computing capabilities without the heavy upfront capital expenditure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Deployment Analysis

The Public Cloud deployment model is set to retain its dominant position in the cloud infrastructure services market, with an anticipated share of 61.5% of the total market in 2025. This widespread adoption can be attributed to the significant cost advantages, flexibility, and scalability that the public cloud offers to organizations across industries. As businesses face growing pressure to enhance operational efficiency, reduce IT overhead, and scale quickly to meet market demands, the public cloud has emerged as an ideal solution.

Public cloud platforms, provided by major vendors such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, allow businesses to access computing resources, storage, and services on demand without having to invest heavily in physical infrastructure. This model also benefits organizations by providing pay-as-you-go pricing models, which ensure they only pay for the resources they use, further promoting cost efficiency. The growing reliance on cloud-based applications, AI, machine learning, and big data analytics is further driving the demand for public cloud services, as it supports quick deployment, high availability, and access to innovative technologies.

In contrast, the Private Cloud deployment model is also experiencing steady growth, though it holds a smaller share compared to the public cloud. The private cloud offers more control, security, and customization, making it a preferred choice for industries that handle highly sensitive data, such as healthcare, finance, and government. While private cloud services require significant upfront investment in infrastructure and ongoing maintenance costs, they provide organizations with greater control over their data and a more secure environment. For businesses that prioritize compliance, data sovereignty, and privacy, the private cloud offers customized solutions that ensure strict regulatory requirements are met.

Many large enterprises are opting for a hybrid cloud approach, combining private and public cloud environments to leverage the benefits of both models, scalability and cost-efficiency from the public cloud, and control and security from the private cloud. This hybrid approach is fueling a shift toward integrated solutions, where businesses can deploy sensitive workloads on the private cloud while running less critical applications on the public cloud, optimizing performance and cost-effectiveness. As the demand for data security, compliance standards, and industry-specific requirements continues to rise, the private cloud model will remain a crucial part of the market, albeit with a more niche and specialized focus.

By Enterprise Size Analysis

Large Enterprises are expected to continue their dominance in the cloud infrastructure services market, accounting for 78.2% of the total market share in 2025. This is largely due to their greater access to resources, larger-scale operations, and the complex IT needs that come with managing large volumes of data and critical workloads. These enterprises benefit from the ability to invest in robust and highly scalable cloud infrastructure solutions that enable them to improve operational efficiency, reduce IT costs, and maintain a competitive advantage in a fast-evolving market. The growing adoption of enterprise-grade cloud solutions, including IaaS, PaaS, and SaaS, allows large enterprises to streamline operations, innovate faster, and enhance customer experiences.

Furthermore, these businesses are typically early adopters of advanced cloud technologies such as AI, machine learning, and big data analytics, which require significant computational resources and secure, scalable cloud environments. With their need for high availability, disaster recovery, and seamless integration across global operations, large enterprises will continue to drive demand for sophisticated cloud infrastructure services, ensuring that they remain at the forefront of digital transformation.

On the other hand, Small and Medium Enterprises (SMEs) are also adopting cloud infrastructure services, albeit on a smaller scale compared to large enterprises. While SMEs generally have more limited budgets and fewer resources, the rise of affordable cloud solutions, such as pay-as-you-go models and subscription-based services, has made cloud technology more accessible.

The flexibility and scalability of cloud services are particularly attractive to SMEs, as they enable them to compete with larger organizations without the need for significant upfront capital investments in IT infrastructure. SMEs are leveraging cloud services to gain agility, streamline operations, and improve productivity, especially through the adoption of SaaS applications for customer relationship management, financial management, and supply chain optimization. As cloud providers continue to enhance the accessibility and customization of their offerings, SMEs are expected to migrate their operations to the cloud.

Moreover, the rise of cloud security solutions and compliance tools is helping SMEs overcome initial concerns about data privacy and security, further fueling their adoption of cloud services. Although they represent a smaller portion of the market compared to large enterprises, SMEs are poised to be an important growth segment in the evolving cloud infrastructure services landscape.

By Industry Vertical Analysis

The IT & Telecom industry is expected to maintain its dominant position in the cloud infrastructure services market, capturing 41.3% of the total market share in 2025. This is primarily driven by the growing demand for high-performance computing, data storage, and network scalability required by telecom and IT companies. As the world continues to embrace digital transformation, these industries are at the forefront of cloud adoption, utilizing cloud infrastructure to enhance their service offerings and improve operational efficiencies.

Telecom providers, in particular, rely on cloud services to deliver more flexible and scalable solutions to customers, including virtualized network functions, 5G networks, and edge computing. Cloud infrastructure also enables IT & Telecom businesses to manage vast amounts of data, optimize data center operations, and support new technologies such as IoT, AI, and big data analytics. The industry's rapid evolution towards providing cloud-based services, like SaaS, IaaS, and PaaS, requires a robust and dynamic infrastructure that only the cloud can offer.

As the demand for connectivity, faster data processing, and on-demand services continues to rise, IT & Telecom companies are expected to continue investing in cloud infrastructure, further consolidating their dominant share in the market.

Similarly, the BFSI (Banking, Financial Services, and Insurance) industry is also experiencing significant growth in its adoption of cloud infrastructure services. As financial institutions face growing pressure to digitize their operations, meet stringent regulatory requirements, and enhance security, cloud infrastructure provides the scalability and flexibility needed to address these challenges. The BFSI sector is leveraging cloud-based solutions to streamline operations, improve customer service, and enhance data analytics capabilities. Cloud technologies help financial institutions offer services such as online banking, digital wallets, and mobile payment systems, which are crucial for staying competitive in today’s digital-first economy.

Additionally, the growing importance of cybersecurity and compliance in the financial sector is leading many BFSI organizations to migrate their critical workloads to the cloud, where they can leverage advanced security features, data encryption, and secure access management systems. As cloud adoption in the BFSI industry continues to grow, it offers greater agility, operational efficiency, and innovation, which are essential for financial institutions to stay ahead of market demands and regulatory changes. Thus, while IT & Telecom leads the market in terms of cloud infrastructure adoption, BFSI’s growing reliance on cloud technology reflects the evolving role of cloud services in ensuring business continuity, security, and customer satisfaction in the financial services sector.

The Cloud Infrastructure Services Market Report is segmented on the basis of the following:

By Service Type

- Computer as a Service

- Storage as a Service

- Network as a Service

- Others

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise Size

- Large Enterprises

- Small And Medium-Sized Enterprises (SMEs)

By Industry Vertical

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Government

- Others

Global Cloud Infrastructure Services Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to maintain its leadership position in the global cloud infrastructure services market, with a projected share of 38.4% of the total market revenue by 2025. This dominance can be attributed to the region’s strong technology infrastructure, early adoption of cloud services, and the presence of some of the world’s leading cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. The U.S., in particular, has been a trailblazer in cloud adoption, with businesses of all sizes leveraging cloud infrastructure for scalability, cost-efficiency, and innovation.

The region’s advanced data centers, coupled with extensive internet connectivity, facilitate seamless cloud operations for enterprises across various sectors, including IT, finance, healthcare, and manufacturing. Furthermore, North America’s leadership in cloud infrastructure services is bolstered by the growing adoption of AI, machine learning, big data analytics, and IoT applications, all of which require robust cloud-based platforms for processing and storage. As industries rely on these technologies for digital transformation, the demand for cloud infrastructure services continues to rise.

Region with significant growth

Asia Pacific is poised to experience the highest growth rate in the global cloud infrastructure services market, driven by rapid digital transformation, a surge in cloud adoption, and expanding technology infrastructure across the region. The region’s market is particularly fueled by the growing demand for cloud-based solutions in emerging economies like India, China, and Southeast Asia, where digitalization efforts are accelerating across industries such as e-commerce, financial services, healthcare, and manufacturing.

The rapid expansion of smart cities, the growing penetration of 5G networks, and the rise of technologies like AI, big data analytics, and IoT are significantly contributing to the surge in demand for cloud infrastructure in the region. With businesses leveraging these advanced technologies, the need for scalable cloud platforms to support data processing and storage is becoming more critical. Additionally, the rapid adoption of cloud-native applications and software-as-a-service (SaaS) solutions by enterprises in Asia Pacific is further driving the need for robust cloud infrastructure.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cloud Infrastructure Services Market: Competitive Landscape

The global competitive landscape in the cloud infrastructure services market is highly dynamic and characterized by the presence of several key players, each vying for dominance through strategic initiatives, technological advancements, and service diversification. Major global cloud providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are at the forefront of this competitive arena, offering comprehensive and innovative cloud solutions that cater to enterprises, governments, and SMEs alike. These industry giants are constantly innovating, focusing on delivering scalable, flexible, and cost-effective cloud infrastructure services that meet the growing demand for IaaS, PaaS, and SaaS.

AWS leads the market in terms of both market share and cloud infrastructure services, thanks to its robust portfolio of services, global presence, and continuous innovation in areas like machine learning, artificial intelligence, and big data analytics. Microsoft's Azure platform is another dominant player, leveraging its strong enterprise customer base and integration with Microsoft software products, particularly Office 365, Windows Server, and SQL Server, which makes it a preferred choice for businesses seeking seamless cloud migration. Google Cloud, known for its cutting-edge offerings in data analytics, machine learning, and AI, is also gaining momentum as it continues to develop specialized solutions for industries such as healthcare, finance, and media.

Some of the prominent players in the Global Cloud Infrastructure Services are:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- Tencent Cloud

- Salesforce

- SAP

- Hewlett-Packard Enterprise (HPE)

- VMware

- Dell Technologies

- Cisco Systems

- Fujitsu

- Rackspace Technology

- DigitalOcean

- OVHcloud

- Huawei Cloud

- NTT Communications

- Baidu AI Cloud

- Other Key Players

Global Cloud Infrastructure Services Market: Recent Developments

- April 2025: Microsoft acquired Nuance Communications, a leader in AI-driven healthcare cloud solutions, expanding its cloud offering in the healthcare sector.

- March 2025: Amazon Web Services (AWS) acquired Xenon Technologies, a cloud infrastructure management company, to enhance its cloud services and improve automation for enterprise customers.

- February 2025: Google Cloud announced the acquisition of Siemplify, a leader in security orchestration, automation, and response (SOAR) solutions, to bolster its security offerings within its cloud ecosystem.

- January 2025: Oracle acquired Cerner Corporation, a leading health-tech company, to accelerate the deployment of its cloud-based healthcare solutions.

- December 2024: IBM acquired Sentaca, a cloud-native services provider, to enhance its hybrid cloud offerings and help businesses transition more seamlessly to the cloud.

- November 2024: Alibaba Cloud acquired Sunline Tech, a Chinese fintech company, to strengthen its position in the cloud-based financial services market across Asia.

- October 2024: Salesforce completed its acquisition of Slack Technologies, a major player in team collaboration software, to integrate its capabilities into the Salesforce cloud platform for better enterprise communication and productivity.

- September 2024: VMware was acquired by Broadcom, with a focus on enhancing Broadcom’s cloud infrastructure capabilities, strengthening its position in the enterprise cloud services market.

- August 2024: DigitalOcean acquired Cloudways, a managed cloud hosting provider, to expand its cloud services offering for small and medium-sized enterprises (SMEs).

- July 2024: Hewlett-Packard Enterprise (HPE) acquired Zerto, a leader in cloud data protection and disaster recovery, to enhance its hybrid cloud infrastructure solutions and disaster recovery services.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 163.5 Bn |

| Forecast Value (2034) |

USD 549.5 Bn |

| CAGR (2025–2034) |

14.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 52.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Computer as a Service, Storage as a Service, Network as a Service, and Others), By Deployment (Public Cloud, Private Cloud, and Hybrid Cloud), By Enterprise Size (Large Enterprises and Small and Medium-Sized Enterprises (SMEs)), By Industry Vertical (BFSI, IT & Telecom, Retail, Healthcare, Government, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Tencent Cloud, Salesforce, SAP, Hewlett Packard Enterprise (HPE), VMware, Dell Technologies, Cisco Systems, Fujitsu, Rackspace Technology, DigitalOcean, OVHcloud, Huawei Cloud, NTT Communications, Baidu AI Cloud., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the global cloud infrastructure services market?

▾ The global cloud infrastructure services market size is estimated to have a value of USD 163.5 billion in 2025 and is expected to reach USD 549.5 billion by the end of 2034.

What is the size of the US cloud infrastructure services market?

▾ The US cloud infrastructure services market is projected to be valued at USD 52.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 165.2 billion in 2034 at a CAGR of 13.5%.

Which region accounted for the largest global cloud infrastructure services market?

▾ North America is expected to have the largest market share in the global cloud infrastructure services market, with a share of about 38.4% in 2025.

Who are the key players in the global cloud infrastructure services market?

▾ Some of the major key players in the global cloud infrastructure services market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Tencent Cloud, Salesforce, SAP, Hewlett Packard Enterprise (HPE), VMware, Dell Technologies, Cisco Systems, Fujitsu, Rackspace Technology, DigitalOcean, OVHcloud, Huawei Cloud, NTT Communications, Baidu AI Cloud, and Other Key Players.

What is the growth rate of the global cloud infrastructure services market?

▾ The market is growing at a CAGR of 14.4 percent over the forecasted period.