Market Overview

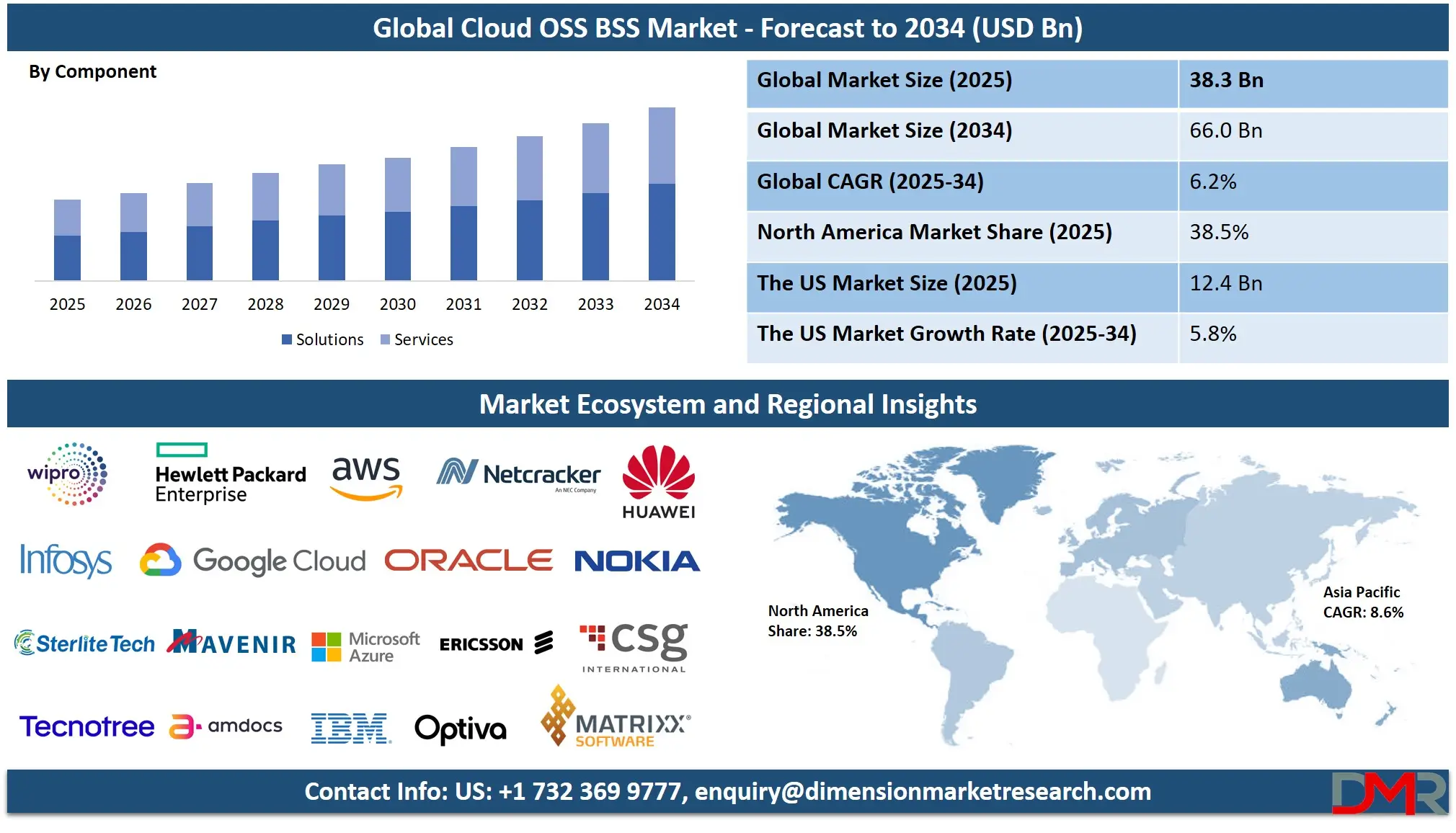

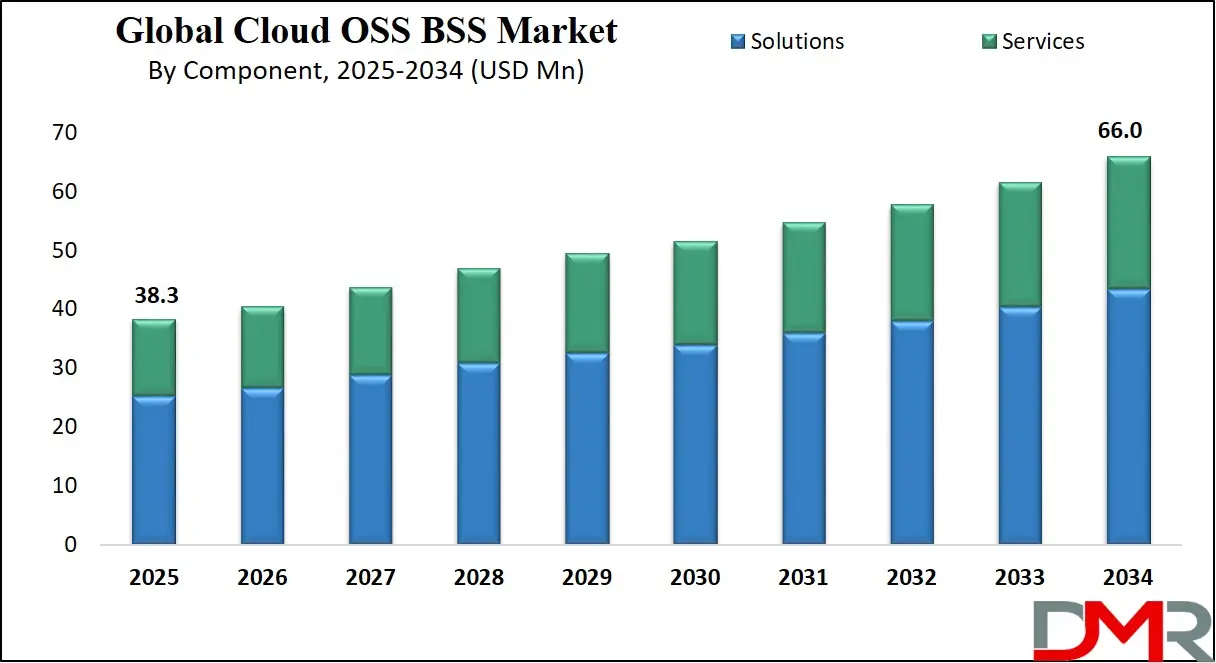

The Global Cloud OSS BSS Market is forecast to reach USD 38.3 billion in 2025 and is poised to expand at a robust CAGR of 6.2% from 2025 to 2034, reaching an estimated USD 66.0 billion by 2034, driven by rapid cloud-native OSS/BSS adoption, 5G network deployment, digital transformation of telecom operators, rising demand for scalable billing and revenue management systems, network orchestration, service assurance, AI-enabled operations, and the growing shift toward public and hybrid cloud-based telecom IT platforms.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Cloud OSS/BSS serves as the intelligent, automated core of modern telecom operations, enabling end-to-end service orchestration, real-time billing for dynamic services, and AI-driven customer experience management. This model directly addresses the global challenge of escalating network intricacy, shrinking service launch cycles, and heightened customer expectations in an increasingly digital-first world. The seamless convergence of OSS (network-facing) and BSS (business/customer-facing) functions on unified cloud platforms dismantles traditional silos, fostering unprecedented operational agility and data-driven decision-making.

Technological breakthroughs are the cornerstone of this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive network maintenance, blockchain for immutable billing and settlement, containerized network functions (CNFs) for rapid service deployment, and standardized Open APIs for ecosystem integration are collectively transforming the market into a scalable, efficient, and innovation-centric ecosystem.

Furthermore, the proliferation of microservices architectures allows CSPs to independently update, scale, and manage specific OSS/BSS functions, dramatically reducing vendor lock-in and accelerating innovation cycles. The market's momentum is further amplified by global initiatives for national broadband expansion, 5G spectrum auctions, and governmental pushes for digital inclusion, which mandate more flexible and cost-effective operational frameworks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

However, this transformative journey is not without significant hurdles. Persistent challenges include the high cost and complexity of migrating from deeply entrenched legacy systems, acute concerns regarding data sovereignty and regulatory compliance (e.g., GDPR, CCPA), evolving cybersecurity threats, and a pronounced scarcity of skilled professionals adept in both cloud and telecom domains. Despite these headwinds, the inexorable convergence of cloud-native technologies, AI-driven automation, and the strategic imperative for telecom modernization firmly establishes the cloud OSS/BSS market as the central nervous system for the next decade of global telecommunications innovation and growth.

The US Cloud OSS BSS Market

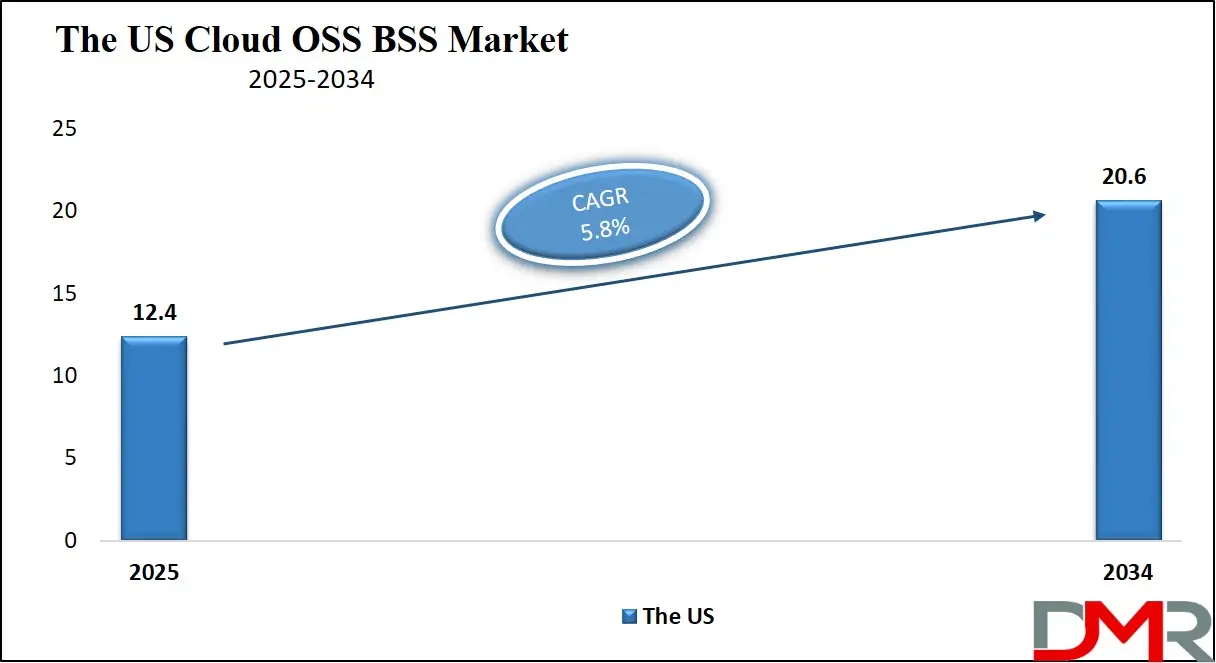

The U.S. Cloud OSS BSS Market stands as the global vanguard, projected to reach USD 12.4 billion in 2025 and expand at a CAGR of 5.8% to achieve USD 20.6 billion by 2034.

The United States' leadership is unequivocal, underpinned by its world-leading 5G deployment velocity, the presence of hyperscale cloud behemoths (AWS, Microsoft Azure, Google Cloud), and a competitive landscape of tier-1 CSPs like AT&T, Verizon, and T-Mobile that are aggressively investing in digital transformation. Over 80% of major U.S. CSPs have initiated strategic roadmaps to migrate their core OSS/BSS functions to cloud-native architectures, primarily to support advanced 5G use cases such as network slicing for enterprise verticals, ultra-reliable low-latency communications (URLLC), and massive machine-type communications (mMTC).

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Federal initiatives, including the FCC's push for nationwide broadband and 5G security frameworks, alongside substantial private investments, are catalyzing the rapid scaling of cloud OSS/BSS solutions. These platforms are critical for enabling AI-driven network automation, real-time charging systems for on-demand services, and unified customer data platforms (CDPs) that deliver hyper-personalized experiences. The U.S. market benefits from a mature fintech and digital services ecosystem, which pressures CSPs to offer similarly agile, digitally-native customer interfaces and billing models.

Reimbursement structures and a strong venture capital landscape further fuel innovation, with numerous startups and established vendors developing specialized AI/ML applications for revenue assurance, fraud management, and autonomous network operations. This confluence of advanced infrastructure, regulatory support, and competitive intensity solidifies the U.S. position as the epicenter of cloud OSS/BSS innovation and adoption, setting a global benchmark for operational transformation in the telecom industry.

The Europe Cloud OSS BSS Market

Europe’s Cloud OSS BSS market size is estimated at around USD 9.6 billion in 2025 and is projected to grow to approximately USD 16.5 billion by 2034, registering a CAGR of about 6.4%.

Europe's progression is characterized by a unique blend of stringent regulatory oversight, a strong commitment to data sovereignty (GDPR), and concerted EU-wide digital initiatives such as the Digital Decade policy and the push for Open RAN architectures. Major telecommunications operators across the region including Vodafone Group, Deutsche Telekom, Orange, and BT Group are at the forefront, executing ambitious cloud migration strategies to replace legacy stacks with agile, vendor-agnostic platforms. This drive is essential not only for 5G monetization but also for meeting the EU's goals of network resilience, security, and fostering a competitive single market.

National health services and public-sector digitalization projects further stimulate demand, as CSPs are required to support critical infrastructure with reliable, secure, and scalable operational platforms. Funding instruments like the Digital Europe Programme and Horizon Europe actively co-invest in R&D for AI-powered network management and secure cloud communications, accelerating vendor innovation and pilot deployments.

A defining trend in Europe is the emphasis on multi-cloud and hybrid cloud strategies, allowing CSPs to balance the scalability of public clouds with the control of private infrastructures for sensitive workloads. Additionally, the region's focus on sustainability (Green Deal) is pushing vendors to develop energy-efficient cloud OSS/BSS solutions that help reduce the carbon footprint of network operations. With its balanced approach of innovation within a robust governance framework, Europe is cementing its role as a mature and strategically vital market for cloud OSS/BSS adoption.

The Japan Cloud OSS BSS Market

The Cloud OSS BSS market in Japan is valued at around USD 1.9 billion in 2025 and is expected to reach nearly USD 3.3 billion by 2034, expanding at a CAGR of roughly 6.8% the highest among developed nations.

Japan's accelerated growth is fueled by its rapid and dense 5G deployment, a national vision for "Society 5.0" (a super-smart society), and a pressing need to manage an aging population's connectivity needs through advanced telemedicine, remote care, and smart city applications. The Ministry of Internal Affairs and Communications (MIC) plays a pivotal role, actively promoting telecom digitalization through supportive policies and funding for R&D in beyond-5G (B5G) and 6G technologies, where cloud-native OSS/BSS will be foundational.

Japan's domestic technology powerhouses NTT Docomo, Rakuten Mobile, NEC, and Fujitsu are not just adopters but also global innovators. Rakuten's pioneering fully virtualized, cloud-native mobile network serves as a global proof-of-concept, demonstrating the operational and cost benefits of a born-in-the-cloud OSS/BSS stack. The market is distinguished by its integration of cutting-edge robotics, automation, and precision engineering into network operations, leading to early adoption of AI for "zero-touch" autonomous network management and predictive customer service.

Furthermore, Japan's focus on high-density urban environments (Tokyo, Osaka) and unique challenges like natural disaster resilience drive demand for exceptionally robust, fault-tolerant, and rapidly restorable cloud OSS/BSS systems. The confluence of strong governmental support, technological prowess, and unique societal drivers positions Japan not merely as an adopter, but as a leading global exporter of cloud OSS/BSS paradigms and solutions.

Global Cloud OSS BSS Market: Key Takeaways

- Exponential Market Expansion: The market is set to more than triple in size, from USD 38.3 billion in 2025 to USD 66.0 billion by 2034, underscoring its critical role as the operational backbone for the global telecom industry's future.

- High-Growth Trajectory: A sustained CAGR of 6.2% signals persistent, strong demand driven by continuous 5G/6G evolution, IoT explosion, and the unrelenting need for operational efficiency and new service agility.

- U.S. Market Leadership: With a value of USD 12.4 billion in 2025 growing to USD 20.6 billion by 2034 (CAGR 5.8%), the U.S. remains the dominant force, powered by hyperscale cloud partnerships and aggressive CSP digital transformation agendas.

- North American Regional Insights: Commanding an estimated 38.5% of global revenue share in 2025, North America's dominance is rooted in first-mover advantage in 5G, a mature digital economy, and the presence of the world's leading cloud and telecom software vendors.

- Technology Innovation as Core Driver: Breakthroughs in AI/ML (for autonomous operations), microservices, containerization (Kubernetes), and Open APIs are not just enhancing but fundamentally redefining the capabilities and economics of OSS/BSS.

- Business Imperative for Agility: The major driver is the business need for CSPs to evolve from connectivity providers to digital service platforms, necessitating OSS/BSS that can support real-time orchestration, personalized billing, and seamless partner ecosystem integration.

Global Cloud OSS BSS Market: Use Cases

- Dynamic 5G Network Slicing Lifecycle Management: Cloud OSS enables the automated, on-demand creation, real-time performance monitoring, SLA assurance, and eventual decommissioning of dedicated, virtualized network slices for enterprise clients.

- AI-Ops for Predictive Fault Resolution: Machine learning models within cloud OSS ingest terabytes of performance metrics, log files, and topology data to predict network element failures or performance degradation hours or days in advance, triggering automated remediation workflows before customers are impacted.

- Unified, Real-Time Customer Engagement Platform: Cloud BSS consolidates data from network usage, CRM, support tickets, and social media to create a 360-degree customer view. It enables contextual, real-time interactions such as offering a mobile data top-up via app notification the moment a user approaches their limit, with one-click purchase.

- End-to-End Automated Service Fulfillment: For a new Fiber-to-the-Home (FTTH) customer, cloud OSS/BSS automates the entire journey: order validation, service design, resource assignment (port on OLT), provisioning commands to network devices, activation, and generation of the first invoice all without manual intervention.

- Converged Charging for Hybrid Services: Cloud BSS implements a real-time charging system that can simultaneously handle prepaid and postpaid models, and bill for complex, hybrid service bundles e.g., a single plan including 5G data, cloud gaming credits, IoT sensor connectivity, and a premium video streaming subscription.

Global Cloud OSS BSS Market: Stats & Facts

TM Forum (Industry Standards & Collaboration Body)

- Up to 72% of enabling and service creation revenue from 5G is dependent on OSS/BSS transformation.

- 67% of total revenue from 5G use cases beyond enhanced mobile broadband is reliant on OSS/BSS transformation.

- 63% of connectivity‑related revenue for non‑traditional 5G services depends on OSS/BSS transformation.

GSMA (Global System for Mobile Communications Association / GSMA Intelligence)

- The total number of 5G connections exceeded 1.5 billion worldwide.

- 5G connections are projected to increase to 5.5 billion by 2030.

- 5G networks are expected to cover approximately one‑third of the world’s population by 2025.

- Mobile technologies contribute nearly 5.8% of global GDP.

- There are over 320 million mobile internet subscribers in North America, with a significant share on 5G.

- Globally, over 10 billion connected devices (IoT/M2M) are supported by telecom networks.

ITU (International Telecommunication Union)

- Over 50% of the global population was using the internet in the latest reported period.

- Mobile broadband penetration reached more than 70% globally.

- Fixed broadband subscriptions exceeded 1.2 billion worldwide.

- Telecom sector capital expenditure (CapEx) continues to grow annually, reflecting investments in network modernization and OSS/BSS systems.

OECD (Organisation for Economic Co‑operation and Development)

- OECD countries average over 90% mobile broadband subscription penetration.

- On average, fixed broadband penetration in OECD countries exceeds 40% of the population.

- Telecom traffic per user is increasing at double‑digit annual rates, driven by video, cloud services, and IoT usage.

UN Broadband Commission

- Broadband internet access is available to over 90% of the global population via mobile or fixed networks.

- Affordable broadband is available in more than 80% of developing countries, driving enterprise and consumer demand for advanced telecom systems.

- Global data consumption per capita has increased several fold over the last 5 years.

ETSI (European Telecommunications Standards Institute)

- Cloud native network functions (CNFs) and microservices architecture adoption has accelerated in European telecom networks.

- Edge computing platforms tied to OSS/BSS systems are being deployed by major operators in Europe and Asia‑Pacific.

Federal Communications Commission (FCC, United States)

- Broadband adoption in the U.S. exceeds 90% of households.

- Average downstream broadband speeds have grown multiple times in the past decade, intensifying demand on OSS/BSS for service assurance.

- Telecom industry investment in digital infrastructure (including OSS/BSS) continues to rise year over year.

European Commission (Digital Economy & Society Index)

- Over 80% of European businesses use cloud computing services.

- More than 60% of European enterprises have adopted digital transformation strategies, pushing demand for cloud OSS/BSS.

- Telecom services reliability and quality metrics rank among top priorities for national regulators across EU member states.

National Telecom Regulators

- Major markets such as Japan and South Korea report broadband penetration rates above 95%.

- Mobile broadband data usage per subscriber has doubled in multiple advanced markets over the last 3‑5 years.

- Fixed broadband average speeds in leading digital economies exceed 100 Mbps, increasing pressure on service assurance OSS/BSS components.

ISO/IEC (International Organization for Standardization / IT Standards)

- Quality of Service (QoS) frameworks are embedded in OSS/BSS interoperability standards.

- Security management standards for telecom operations are integrated into OSS platforms.

- Service management and orchestration requirements are standardized across provider ecosystems, enabling efficient cloud OSS/BSS adoption.

Global Cloud OSS BSS Market: Market Dynamic

Driving Factors in the Global Cloud OSS BSS Market

Explosion of 5G and Multi-Technology Network Complexity

The global rollout of 5G is not a simple network upgrade; it introduces a paradigm of network virtualization, slicing, and distributed edge computing. This, layered atop existing 4G, fixed-line, and IoT networks, creates a management labyrinth of unprecedented scale. Cloud-native OSS/BSS, with its inherent elasticity, microservices architecture, and automation capabilities, is the only viable solution to efficiently orchestrate resources, assure service quality, and rapidly provision services across this heterogeneous environment. The business case is clear: without it, CSPs cannot monetize their massive 5G investments.

Imperative for Operational & Capital Expenditure (OPEX/CAPEX) Optimization

Facing margin pressures and intense competition, CSPs are driven to transform their cost structures. Legacy OSS/BSS systems are expensive to maintain, scale, and integrate. Migrating to a cloud-based, as-a-service model converts large upfront CAPEX into predictable, scalable OPEX. More importantly, it unlocks massive OPEX savings through the automation of manual, error-prone processes (e.g., ticket handling, service provisioning) and enables more efficient resource utilization, directly improving profitability.

Restraints in the Global Cloud OSS BSS Market

Monumental Legacy System Integration and Transformation Risk

The single greatest impediment is the "brownfield" reality of telecom networks. Decades-old, monolithic OSS/BSS systems are deeply woven into operational fabric. Migrating or integrating them with new cloud platforms is a multi-year, high-risk, and exceptionally costly endeavor fraught with potential for service disruption, data loss, and integration failures. The perceived risk and complexity often lead to paralysis or overly cautious, slow migration strategies.

Stringent Data Governance, Security, and Regulatory Compliance Mandates

Telecom operators are custodians of highly sensitive subscriber data and critical national infrastructure. Migrating this to cloud environments raises acute concerns about data residency, privacy (under regulations like GDPR, CCPA, and India's PDPB), and protection against sophisticated cyber-attacks. Navigating the patchwork of global and regional regulations requires significant legal and technical overhead, and a single compliance failure can result in massive fines and reputational damage, making CSPs inherently cautious.

Opportunities in the Global Cloud OSS BSS Market

AI and Advanced Analytics for Autonomous Operations and New Revenue

The integration of sophisticated AI/ML presents a transformative opportunity beyond basic automation. AI can enable self-healing networks, predictive customer care, hyper-personalized marketing, and intelligent revenue assurance. This shifts the role of OSS/BSS from a system of record to a system of intelligence, creating new revenue streams through premium AI-driven services for enterprise customers and unlocking untapped value from operational data.

Massive Untapped Potential in Emerging Markets and for MVNOs/Ecosystem Players

Emerging economies in Asia-Pacific, Africa, and Latin America are leapfrogging legacy technologies, creating a greenfield opportunity for cost-effective, scalable cloud OSS/BSS deployments. Similarly, the rise of Mobile Virtual Network Operators (MVNOs), private network operators, and digital enterprises entering the connectivity space represents a burgeoning new customer segment. These players lack legacy baggage and seek agile, off-the-shelf, cloud-native OSS/BSS solutions to launch services rapidly, representing a high-growth vector for vendors.

Trends in the Global Cloud OSS BSS Market

Ubiquitous Adoption of Open APIs and Ecosystem-Driven Business Models

The industry is rallying around open, standardized APIs (e.g., from TM Forum, GSMA's CAMARA project) to break monolithic stacks into composable functions. This allows CSPs to mix and best-of-breed vendors, foster innovation by exposing network capabilities to third-party developers, and seamlessly integrate with partners in adjacent industries (fintech, cloud gaming, automotive). The trend is moving OSS/BSS from a closed system to an open, participative business platform.

Convergence of OSS and BSS into a Unified, Context-Aware Platform

The artificial wall between network operations (OSS) and business/customer operations (BSS) is collapsing. Next-generation cloud platforms are unifying these domains, enabling real-time, closed-loop processes. For example, a network quality degradation (OSS event) can automatically trigger a customer apology credit (BSS action), or a customer's purchase of a high-bandwidth gaming service (BSS event) can automatically trigger network QoS prioritization (OSS action). This convergence is key to delivering context-aware, seamless customer experiences.

Global Cloud OSS BSS Market: Research Scope and Analysis

By Component Analysis

The Solutions segment overwhelmingly dominates the Global Cloud OSS BSS Market by component, commanding approximately 65.7% of the market share in 2025. This dominance is driven by the foundational necessity for core software platforms that enable digital transformation. Within Solutions, the Business Support System (BSS) sub-segment, particularly Billing & Revenue Management, holds the largest revenue share. This is due to the urgent, revenue-critical need for CSPs to replace legacy billing systems incapable of handling 5G's dynamic pricing models, network slicing monetization, and IoT micro-transactions.

The shift from simple connectivity billing to complex digital service monetization creates massive, non-discretionary spending. Following BSS, the Service Management & Orchestration sub-segment within OSS is experiencing the highest growth rate. As the operational engine for launching and assuring new services like edge computing and 5G network slices, its strategic importance is paramount.

The demand for these solutions is universal across all operator types and regions, as they form the essential, revenue-generating core of a CSP's digital business. While Services (Professional and Managed) are crucial for implementation and are growing rapidly with market complexity, they inherently follow the sale of the core solution platforms, cementing the Solutions segment's primary position in market value.

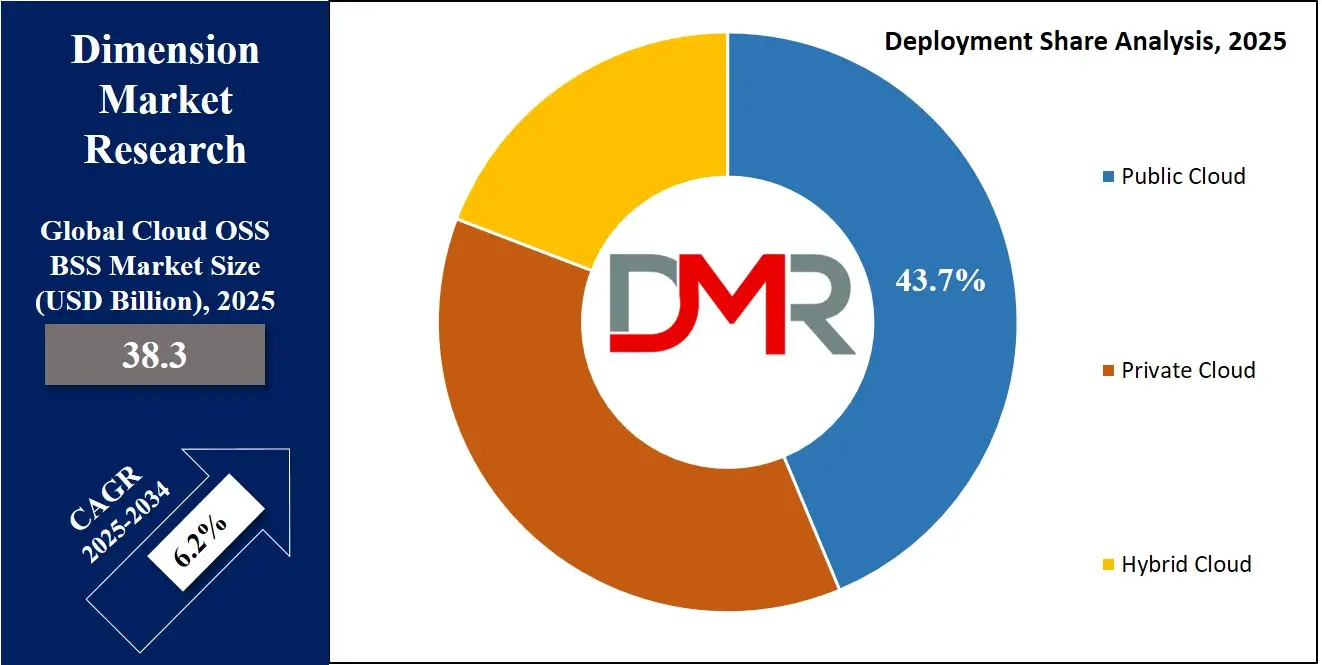

By Deployment Analysis

The Public Cloud deployment model is the dominant force in the market, projected to hold over 43.7% of the global share by 2025. This supremacy is directly attributed to the strategic partnerships formed between CSPs and hyperscale providers Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. These providers offer un-matched advantages: global scalability, relentless innovation in adjacent technologies (AI/ML, data analytics), robust security postures, and a compelling OPEX-based economic model that reduces upfront capital expenditure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

CSPs are leveraging public clouds primarily for customer-facing BSS applications, data lakes, AI/ML workloads, and new service platforms where speed-to-market and elastic scaling are critical. The dominance of the public cloud is most pronounced among greenfield operators and MVNOs, who build their entire stack cloud-natively, and among Tier-1 CSPs for non-mission-critical, innovation-centric workloads. While Hybrid Cloud is the strategic model for the vast majority of large incumbents allowing them to keep sensitive network core functions in private environments it is the public cloud's agility, ecosystem, and economic efficiency that drive its leading market share, making it the default choice for new digital service platforms and IT modernization.

By Enterprise Size Analysis

Large Enterprises (Tier 1 CSPs) are the unequivocal dominators in this segment, accounting for roughly 55-60.2% of total market revenue. Their dominance is rooted in scale, financial capacity, and strategic imperative. Operators like Verizon, AT&T, Deutsche Telekom, and China Mobile operate networks of immense complexity and serve tens to hundreds of millions of customers. Their digital transformation programs represent multi-billion-dollar, multi-year investments in replacing entire legacy OSS/BSS stacks with integrated cloud-native suites.

They are the primary customers for large-scale, end-to-end transformation projects offered by vendors like Amdocs, Ericsson, and Huawei. Their spending drives the market, as they require the most advanced capabilities for network automation, real-time charging, and ecosystem orchestration to maintain competitive leadership and comply with stringent regulations.

While Medium-Sized Enterprises (Tier 2/3 CSPs, MVNOs) represent the highest growth segment due to their agility and greenfield opportunities, their individual contract values are significantly smaller. The aggregate spending of the globe's approximately 50-100 Tier 1 operators vastly outweighs that of thousands of smaller players, securing their position as the market's revenue anchor.

By Operator Type Analysis

Mobile Operators constitute the dominant operator type, representing nearly 61.2% of the market demand. This dominance is fundamentally propelled by the global rollout and monetization pressure of 5G networks. The transition to 5G Standalone (SA) cores, which enable advanced services like network slicing and ultra-low-latency communications, requires a complete overhaul of OSS/BSS architectures. Mobile operators face the most immediate and pressing need for cloud-native solutions to manage this unprecedented complexity and to create new revenue streams beyond flat-rate data plans.

The segment includes both Mobile Network Operators (MNOs) making massive infrastructure investments and a rapidly proliferating number of Mobile Virtual Network Operators (MVNOs) leveraging cloud OSS/BSS to launch agile, niche services. While Fixed Operators (like ISPs and cable companies) are significant adopters, driven by fiber expansion and the need for better customer experience platforms, their transformation cycle is generally less urgent than the 5G-driven revolution in mobile. Converged Operators (offering fixed-mobile bundles) are also major spenders, as they require unified platforms to manage cross-product customer journeys, but they are fewer in number globally. Thus, the sheer scale of the mobile ecosystem and the catalytic effect of 5G cement mobile operators' position as the primary market driver.

The Global Cloud OSS BSS Market Report is segmented on the basis of the following:

By Component

- Solutions

- Operations Support System

- Network Management

- Fault Management

- Configuration Management

- Performance Management

- Security Management

- Service Management & Orchestration

- Resource Management

- Business Support System

- Billing & Revenue Management

- Convergent Billing

- Mediation

- Charging Systems

- Fraud Management

- Partner Settlement

- Product & Catalog Management

- Customer Management

- Customer Relationship Management (CRM)

- Order Management

- Self-Service Portals

- Customer Analytics

- Services

- Professional Services

- Consulting

- Integration & Deployment Services

- Training, Support, & Maintenance Service

- Managed Services

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise Size

- Large Enterprises (Tier 1 CSPs)

- Medium-Sized Enterprises (Tier 2/3 CSPs, MVNOs)

- Small Enterprises

By Operator Type

- Mobile Operator

- Fixed Operator

- Internet Service Providers (ISPs)

- Cable Network Operators

- Satellite Communication Provider

Impact of Artificial Intelligence in the Global Cloud OSS BSS Market

- AI for Predictive and Prescriptive Network Analytics: Moving beyond dashboards, AI models analyze historical and real-time network telemetry to not only predict failures (predictive) but also recommend specific, optimized remedial actions (prescriptive), moving towards truly self-healing networks and slashing Mean Time to Repair (MTTR).

- AI-Powered Hyper-Personalization and Next-Best-Action in BSS: AI algorithms process vast datasets on individual customer behavior, lifecycle stage, and network usage to predict churn with high accuracy and proactively offer personalized retention plans, upsell/cross-sell opportunities, and tailored service recommendations in real-time across all channels.

- Intelligent Process Automation (IPA) for End-to-End Workflows: AI automates complex, multi-step processes that require judgment. For example, it can automatically handle a fault ticket: analyze logs, correlate with topology, identify the root cause, execute a standard fix, verify resolution, and update the ticket all without human intervention, transforming operational efficiency.

- AI-Driven Advanced Revenue Assurance and Fraud Management: Machine learning models continuously learn normal transaction patterns and can detect sophisticated, evolving fraud schemes (e.g., subscription fraud, Wangiri attacks) and subtle revenue leakage points that rule-based systems miss, protecting millions in potential lost revenue.

- AI-Enhanced Self-Optimizing Networks (SON) and Closed-Loop Operations: AI is the brain of advanced SON, enabling networks to not just react but learn and optimize continuously. It can autonomously adjust radio parameters, balance loads, and optimize energy consumption based on predicted traffic patterns, creating a closed loop between OSS analytics and network control.

Global Cloud OSS BSS Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to command the global market with a 38.5% revenue share in 2025, a dominance expected to persist through the forecast period. This leadership is built on a formidable foundation: the world's most advanced and commercially deployed 5G networks, the headquarters of all major hyperscale cloud providers (AWS, Microsoft, Google), and a concentration of leading CSPs and OSS/BSS software vendors (Amdocs, Oracle, CSG).

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region's culture of rapid technological adoption, coupled with intense market competition, forces CSPs to continuously innovate their operational stacks. Supportive, albeit complex, regulatory environments and high levels of investment in R&D further cement North America's role as the primary market for both adoption and innovation in cloud OSS/BSS. The U.S., in particular, serves as the global testing ground for cutting-edge use cases like enterprise network slicing and AI-driven autonomous operations.

Region with the Highest CAGR

Asia-Pacific (APAC) is poised to exhibit the highest CAGR globally, making it the most dynamic and fastest-growing market. This explosive growth is fueled by a powerful confluence of factors: the sheer scale of population and subscriber base, aggressive 5G rollouts in leading nations (China, South Korea, Japan), massive digital transformation initiatives (Digital India, Thailand 4.0), and acute pressure to bridge the urban-rural digital divide. The region presents a dual market: highly advanced economies demanding sophisticated solutions, and emerging economies offering greenfield opportunities for cost-effective, scalable cloud OSS/BSS.

Government-led digital infrastructure projects and the rise of super-app ecosystems (e.g., Grab, Gojek, WeChat) that rely on tight telco partnerships are creating unique demand drivers. APAC's growth is not just in volume but also in innovation, with local vendors and CSPs often pioneering novel, scalable solutions for massive user bases.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cloud OSS BSS Market: Competitive Landscape

The Global Cloud OSS BSS Market is characterized as moderately fragmented with high competitive intensity, featuring a diverse and evolving ecosystem of players like Amdocs, Netcracker (NEC), Ericsson, Huawei, Nokia dominate with comprehensive, often end-to-end portfolios. Their strength lies in deep domain expertise, long-standing CSP relationships, and the ability to manage large-scale, complex transformations. They are aggressively transitioning their own offerings to cloud-native architectures.

Oracle Communications, CSG International, Optiva, MATRIXX Software are leaders in specific domains like convergent charging, billing, and revenue management. They compete on deep functionality, agility, and often a more focused approach than the full-suite giants.

Hyperscale cloud providers Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP) are becoming increasingly pivotal. They provide the foundational cloud infrastructure, a vast array of AI/ML and data services, and are building telecom-specific vertical solutions (e.g., AWS for Telco, Azure for Operators). Their role shifts from mere infrastructure to strategic innovation partners.

Competition is multifaceted, based on technological prowess (AI, cloud-native), ecosystem strength (partnerships, APIs), domain expertise, and the ability to deliver tangible business outcomes (revenue growth, OPEX reduction). Strategic partnerships and acquisitions are frequent as players jockey to fill portfolio gaps and gain market access.

Some of the prominent players in the Global Cloud OSS BSS Market are

- Amdocs

- Netcracker Technology (NEC Corporation)

- Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Oracle Corporation

- CSG Systems International, Inc.

- Optiva Inc.

- MATRIXX Software

- International Business Machines Corporation (IBM)

- Amazon Web Services, Inc. (AWS)

- Microsoft Corporation (Azure)

- Google LLC (Google Cloud)

- Mavenir Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Tecnotree

- Sterlite Technologies Limited

- Infosys Limited

- Wipro Limited

- Other Key Players

Recent Developments in the Global Cloud OSS BSS Market

- November 2025: AWS launches 'Telco AI/ML Foundry' and specialized OSS/BSS blueprints. AWS introduced a comprehensive suite of pre-trained AI/ML models and reference architectures specifically for telecom OSS/BSS workloads. This includes blueprints for predictive maintenance, intelligent revenue assurance, and customer churn modeling, significantly lowering the barrier for CSPs to deploy AI-driven operations on its cloud.

- October 2025: Amdocs and Google Cloud announce deep strategic alliance for AI-native BSS. The partnership aims to co-develop a new generation of cloud-native, AI-infused customer engagement and monetization platforms. The solution will leverage Google's Vertex AI and BigQuery to enable real-time, hyper-personalized customer experiences and dynamic service pricing, directly integrated with Amdocs' market-leading CES and billing suites.

- September 2025: Ericsson completes acquisition of 'CloudSphere', a cloud-native service orchestration specialist. This acquisition bolsters Ericsson's orchestration portfolio with CloudSphere's advanced, intent-based automation and multi-domain service orchestration technology, strengthening Ericsson's offering for managing complex 5G and edge service lifecycles.

- August 2025: Nokia launches 'Network as Code' platform with integrated developer BSS. Nokia's platform exposes network capabilities (location, quality-on-demand) as developer-friendly APIs. A key component is a new cloud BSS layer that allows CSPs to easily create, manage, and monetize these API-based services, enabling a developer ecosystem and new business models.

- July 2025: Major Japanese CSP 'Y Mobile' completes full-scale BSS migration to public cloud. Y Mobile announced the successful migration of its entire BSS stack, serving over 20 million subscribers, to a public cloud provider. The move resulted in a reported 40% reduction in IT operational costs and reduced time-to-market for new digital service bundles from months to weeks.

- June 2025: TM Forum Catalyst project demonstrates industry-first 'Zero-Touch Service Fulfillment & Assurance'. A global Catalyst project involving HPE, Optiva, and several CSPs showcased a fully automated, AI-driven proof-of-concept. The demo illustrated a customer ordering a complex 5G service online, with the cloud OSS/BSS automatically designing, provisioning, activating, and initiating billing all without human intervention, from order to cash in under 10 minutes.

- May 2025: Salesforce announces deepened integration with major telecom cloud BSS platforms. Salesforce unveiled enhanced connectors and co-developed solutions with leading BSS vendors, aiming to create a seamless flow between the telco's BSS (for billing, product catalog) and the Salesforce Customer 360 platform, providing a unified view for sales and service teams.

- April 2025: A consortium of Middle Eastern CSPs forms a joint venture for a shared, regional cloud OSS. Leading operators from the GCC region announced a joint venture to build and operate a shared, cloud-native OSS platform for core network functions. This collaborative model aims to reduce individual CAPEX, accelerate innovation, and improve regional network interoperability.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 38.3 Bn |

| Forecast Value (2034) |

USD 66.0 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 12.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solutions, and Services); By Deployment (Public Cloud, Private Cloud, and Hybrid Cloud); By Enterprise Size (Large Enterprises, Medium-Sized Enterprises, and Small Enterprises); By Operator Type (Mobile Operators, Fixed Operators, and Satellite Communication Providers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amdocs, Netcracker Technology (NEC Corporation), Ericsson, Huawei Technologies Co., Ltd., Nokia Corporation, Oracle Corporation, CSG Systems International, Optiva Inc., MATRIXX Software, IBM, Amazon Web Services (AWS), Microsoft (Azure), Google Cloud, Mavenir Systems, Hewlett Packard Enterprise (HPE), Tecnotree, Sterlite Technologies Limited, Infosys Limited, and Wipro Limited, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Cloud OSS BSS Market?

▾ The Global Cloud OSS BSS Market was valued at USD 38.3 billion in 2025 and is projected to reach USD 66.0 billion by 2034.

What is the growth rate of the Global Cloud OSS BSS Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period from 2025 to 2034.

What is the size of the US Cloud OSS BSS Market?

▾ The US Cloud OSS BSS Market is projected to be worth USD 12.4 billion in 2025 and is expected to grow to USD 20.6 billion by 2034, at a CAGR of 5.8%.

Which region holds the largest share in the Global Cloud OSS BSS Market?

▾ North America is the dominant region, accounting for approximately 38.5% of the global market share in 2025, driven by advanced 5G deployment and the presence of major cloud and telecom software companies.

Who are the key players in the Global Cloud OSS BSS Market?

▾ Prominent players include Amdocs, Netcracker (NEC), Ericsson, Huawei, Nokia, Oracle, CSG, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, among others.