Market Overview

The Global Cloud Storage Market is poised for exponential growth, projected to soar from

USD 138.0 billion in 2025 to an impressive

USD 562.8 billion by 2034, expanding at a robust

CAGR of 16.9% during the forecast period. This surge is driven by the escalating demand for scalable data storage solutions, the rising adoption of hybrid cloud infrastructure, and the growing emphasis on business continuity and disaster recovery. As enterprises accelerate their digital transformation journeys, cloud storage is emerging as a cornerstone for secure data management, real-time analytics, and cost-effective IT operations.

Cloud storage is a model of computer data storage in which digital information is stored in logical pools, said to be on "the cloud," and typically managed by a hosting provider. These cloud providers are responsible for keeping the data available and accessible, and the physical environment protected and maintained. Cloud storage allows users and enterprises to store files and data on remote servers accessed via the internet, offering enhanced flexibility, real-time access, and scalability.

It eliminates the need for local storage infrastructure, providing cost-effective and secure alternatives for storing and retrieving data across a wide range of devices and geographies. The technology leverages distributed server networks, redundancy systems, and advanced encryption protocols to ensure data integrity, disaster recovery, and continuous availability, making it an essential component of modern IT architecture.

The global cloud storage market refers to the globally ecosystem of cloud-based storage services and solutions that cater to businesses and individuals by providing remote data storage, backup, and access capabilities. This market encompasses various deployment models including public, private, and hybrid clouds, serving diverse industry verticals such as IT and telecom, BFSI, healthcare, media and entertainment, education, and government. As enterprises generate vast amounts of unstructured data, the need for dynamic, scalable, and cost-efficient storage solutions is intensifying. Cloud storage solutions have become indispensable for enabling remote workforces, supporting big data analytics, and ensuring seamless business operations in today’s digital-first economy.

Technological advancements such as artificial intelligence, machine learning, and edge computing are further enhancing the capabilities of cloud storage platforms. These innovations enable smarter data categorization, faster retrieval, improved security analytics, and intelligent lifecycle management, making cloud storage an intelligent and adaptive resource. Moreover, the integration of containerized applications and microservices architectures is driving a new wave of demand for storage solutions that can support agile development and deployment cycles. The increased adoption of cloud-native technologies and DevOps practices is also shaping the evolution of the cloud storage landscape, pushing vendors to offer more flexible, interoperable, and developer-friendly storage environments.

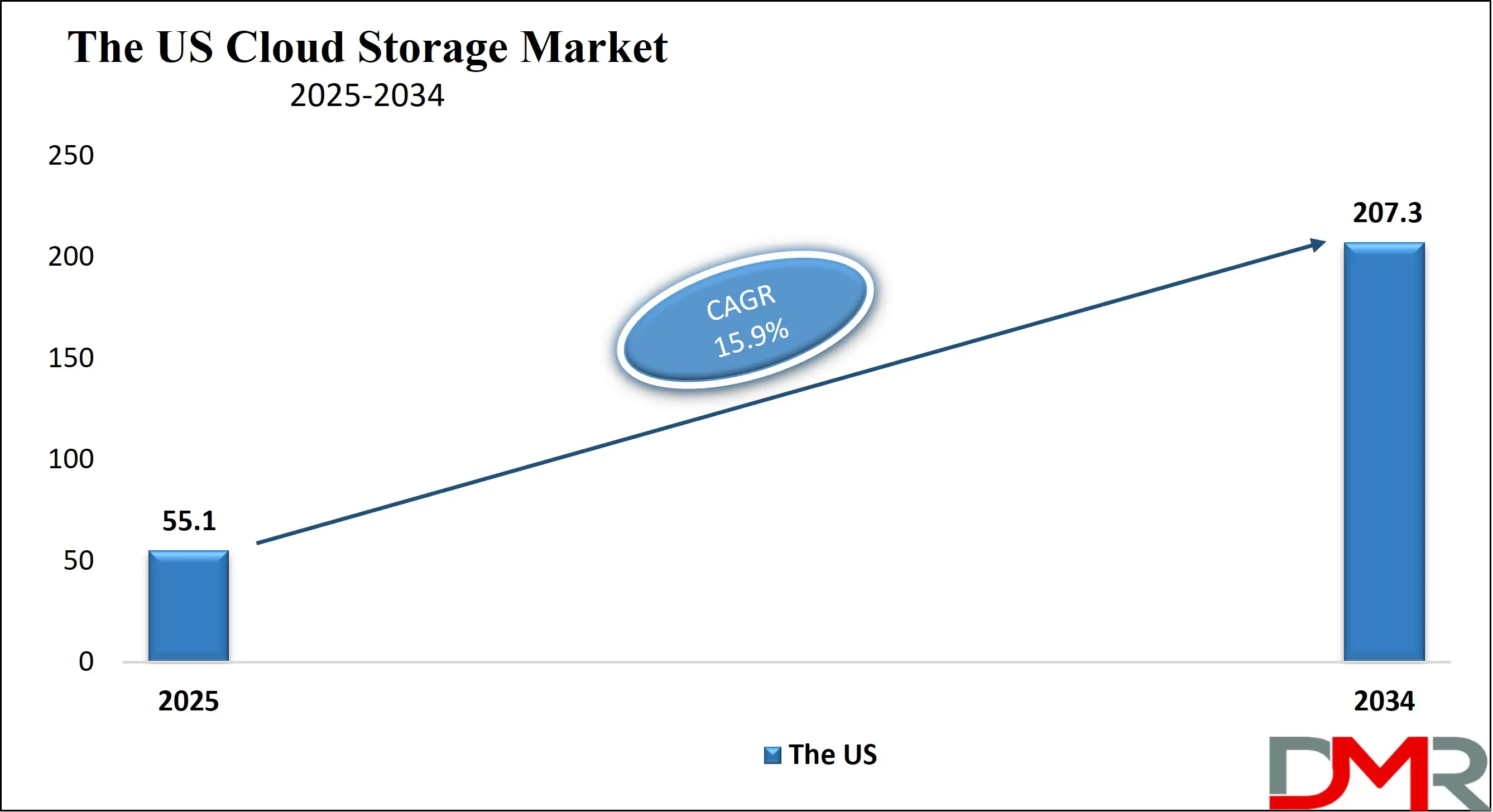

The US Cloud Storage Market

The U.S. Cloud Storage Market size is projected to be valued at USD 55.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 207.3 billion in 2034 at a CAGR of 15.9%.

The U.S. cloud storage market is a dynamic and rapidly evolving segment, fueled by the nation's strong digital infrastructure, high cloud adoption rates, and technological innovation. Large and small American enterprises are transitioning from traditional on-premise storage to cloud-based systems to achieve greater agility, scalability, and operational efficiency. The market is shaped by the presence of leading global cloud providers such as Amazon Web Services, Microsoft Azure, Google Cloud Platform, and IBM Cloud, all of which offer a wide range of services, including object storage, file storage, and block storage tailored to meet diverse business needs.

Across industries such as healthcare, banking, retail, media, and manufacturing, there is a growing reliance on cloud storage to support data-intensive applications and remote work environments. The demand for real-time data access, secure collaboration, and business continuity has made cloud storage a strategic investment for organizations. In particular, the adoption of hybrid and multi-cloud environments is on the rise, as companies seek to optimize performance while maintaining data security and compliance with industry regulations. This hybrid approach allows for greater control and customization, especially for enterprises with complex or sensitive data requirements.

The European Cloud Storage Market

The European cloud storage market size is projected to reach a value of USD 29.6 billion in 2025, with a compound annual growth rate (CAGR) of 14.2%. This growth trajectory is primarily driven by several key factors, including the increasing adoption of digital technologies across various sectors, the growing demand for scalable and flexible storage solutions, and the region’s emphasis on data privacy and security compliance.

One of the main drivers behind this significant growth is the ongoing digital transformation initiatives across industries in Europe. Businesses are increasingly moving towards cloud infrastructure to improve operational efficiency, reduce capital expenditures, and ensure business continuity. Cloud storage enables organizations to store vast amounts of data without the need for heavy investments in physical hardware, offering a flexible and scalable solution to meet growing data demands.

Industries such as finance, healthcare, retail, and manufacturing are particularly focused on leveraging cloud storage to optimize their operations and enhance data management, which in turn is fueling the market’s expansion. Additionally, Europe’s strong regulatory environment, characterized by frameworks like the General Data Protection Regulation (GDPR), has further accelerated the adoption of cloud storage solutions. With stringent data protection and privacy laws in place, businesses are increasingly turning to cloud storage providers that offer enhanced security features, data encryption, and compliance with local and international standards.

The Japanese Cloud Storage Market

The cloud storage market size in Japan is expected to reach USD 8.9 billion in 2025, with a CAGR of 10.5% during the forecast period. This growth is driven by several key factors including Japan's robust technological infrastructure, its industrial landscape, government initiatives for digital transformation, and increasing demand for data storage solutions across various sectors.

Japan has long been a global leader in technology, particularly in industries such as electronics, automotive, and manufacturing. As these industries continue to digitalize, there is a corresponding rise in the demand for cloud storage solutions to handle the ever-growing volumes of data generated by IoT devices, sensors, and smart systems. For instance, in the automotive industry, the shift towards connected vehicles and autonomous driving technologies generates vast amounts of data that need to be securely stored, processed, and analyzed, driving cloud storage adoption.

In addition, Japan’s cloud storage market benefits from the country’s highly developed IT infrastructure. With extensive fiber-optic networks, high-speed internet access, and state-of-the-art data centers, Japan is well-equipped to support the growing demand for cloud storage services. As more businesses in Japan transition to digital-first strategies, the need for scalable and flexible storage solutions is increasing. Cloud storage offers businesses the ability to scale up or down depending on data requirements without the need for heavy upfront investments in on-premises infrastructure.

Global Cloud Storage Market: Key Takeaways

- Market Value: The global cloud storage size is expected to reach a value of USD 562.8 billion by 2034 from a base value of USD 138.0 billion in 2025 at a CAGR of 16.9%.

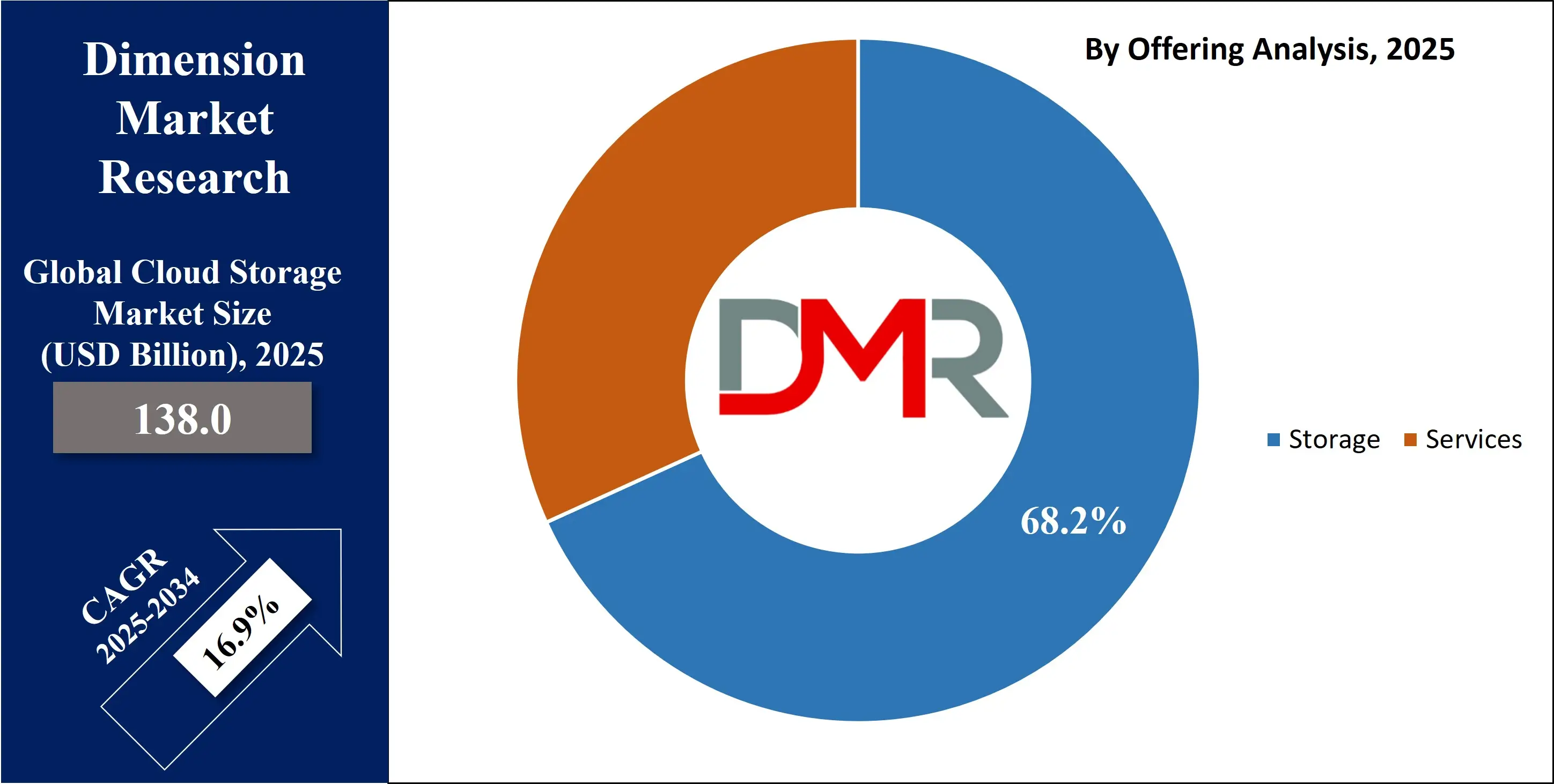

- By Offering Segment Analysis: Storage offerings are poised to consolidate their dominance in the offering type segment, capturing 68.2% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are anticipated to maintain their dominance in the organization type segment, capturing 73.8% of the total market share in 2025.

- By Deployment Model Segment Analysis: Public Cloud deployment model is expected to maintain its dominance in the deployment model type segment, capturing 45.2% of the total market share in 2025.

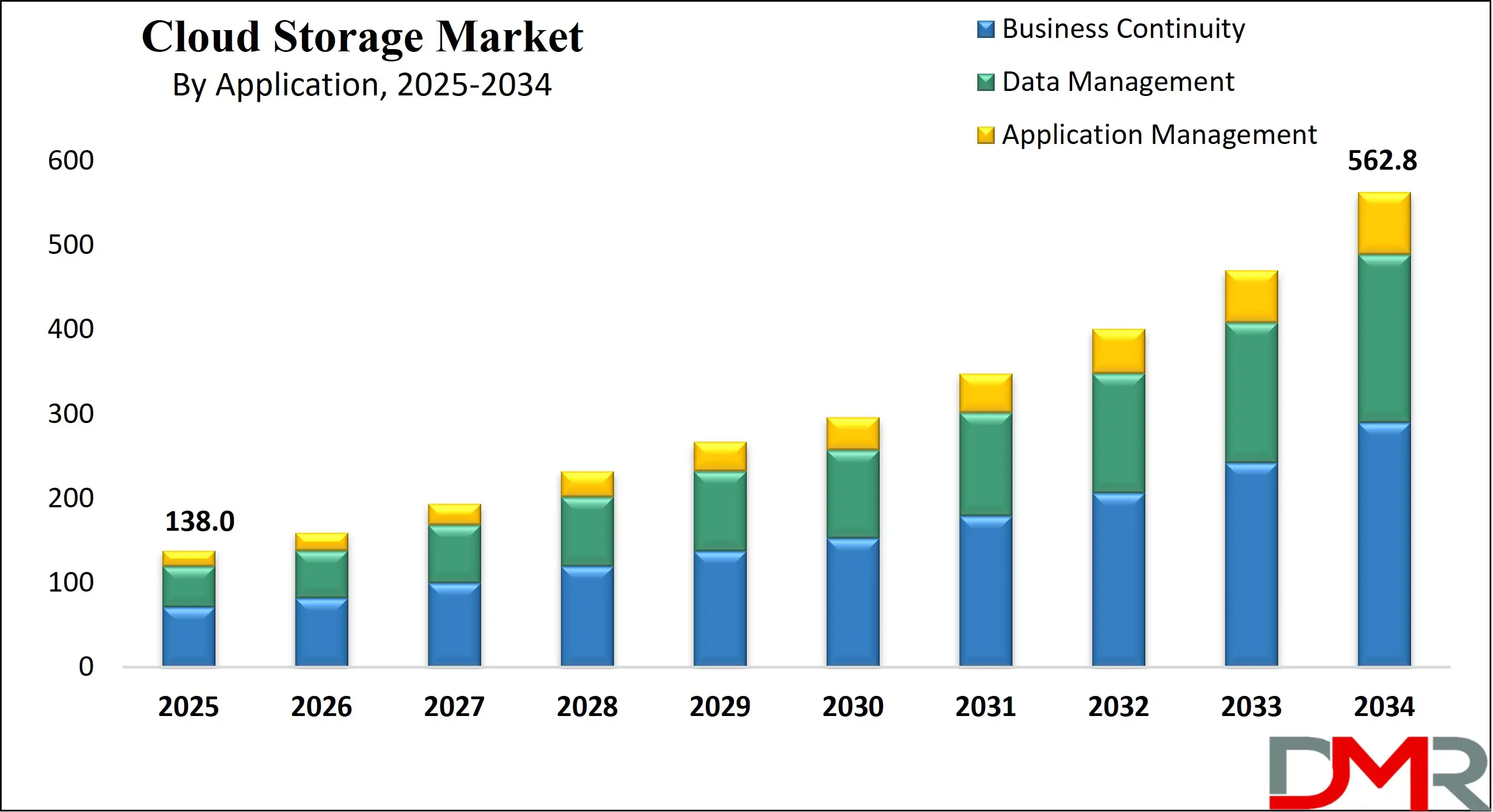

- By Application Type Segment Analysis: Business Continuity applications are poised to consolidate their market position in the application type segment, capturing 51.5% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry is anticipated to maintain its dominance in the industry vertical segment, capturing 31.8% of the total market share in 2025.

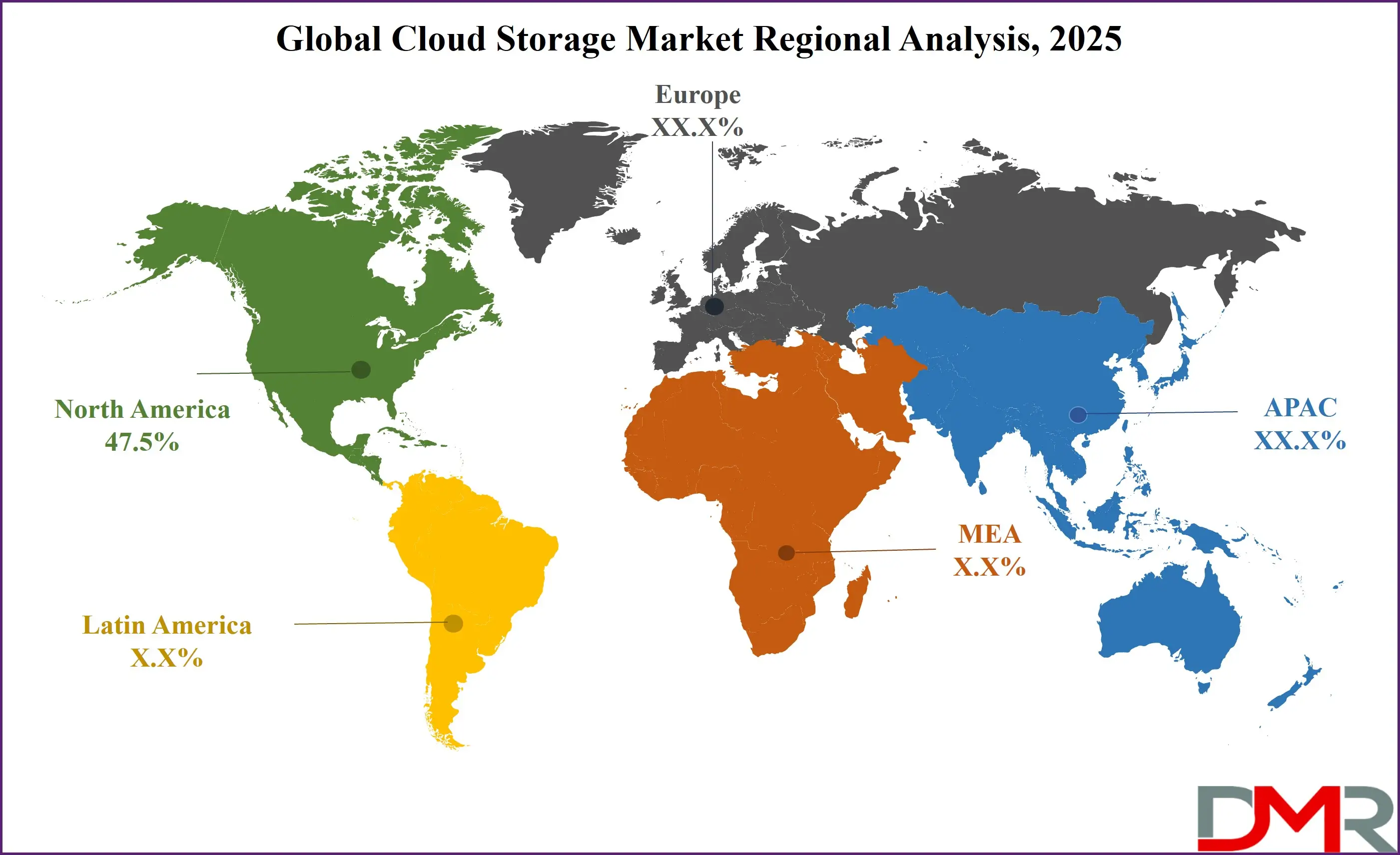

- Regional Analysis: North America is anticipated to lead the global cloud storage market landscape with 47.5% of total global market revenue in 2025.

- Key Players: Some key players in the global cloud storage market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Dell Technologies, Hewlett Packard Enterprise (HPE), NetApp, Dropbox, Box, Inc., Wasabi Technologies, Backblaze, Tencent Cloud, Huawei Cloud, Citrix Systems, Fujitsu, Rackspace Technology, Hitachi Vantara, VMware, and Other Key Players.

Global Cloud Storage Market: Use Cases

- Enterprise Data Backup and Disaster Recovery: Cloud storage plays a pivotal role in enabling businesses to implement robust data backup and disaster recovery strategies. Enterprises across the globe are leveraging cloud-based platforms to automatically back up mission-critical data in real time, ensuring business continuity in the event of cyberattacks, system failures, or natural disasters. With redundant data replication, cross-region storage, and automated recovery workflows, companies can minimize downtime and safeguard sensitive information. The ability to scale storage resources dynamically also helps reduce operational costs while enhancing data resilience and compliance with industry regulations such as GDPR and HIPAA.

- Media and Content Distribution: In the media, entertainment, and gaming sectors, cloud storage is revolutionizing how large digital assets are stored, managed, and delivered. Companies are utilizing content delivery networks (CDNs) powered by cloud storage to distribute high-definition video, audio, and game files seamlessly across global audiences. The cloud ensures low-latency streaming, optimized bandwidth usage, and support for massive concurrent user access. This use case also benefits from intelligent content caching, version control, and collaboration tools for production teams working remotely. With the growing demand for digital content and immersive experiences, cloud storage serves as the backbone of modern content workflows.

- Big Data Analytics and Business Intelligence: Organizations are using cloud storage to power their big data and analytics platforms, enabling real-time data ingestion, processing, and visualization. Cloud-based object storage services provide the scalability and performance needed to store massive volumes of structured and unstructured data from sources like IoT devices, CRM systems, and web platforms. By integrating with analytics engines and AI/ML models, businesses can extract actionable insights, forecast trends, and make data-driven decisions faster. This use case is particularly vital in sectors such as finance, healthcare, retail, and logistics, where the ability to analyze and respond to changing data patterns is a competitive advantage.

- Collaboration and Remote Workforce Enablement: With the shift toward remote and hybrid work environments, cloud storage has become essential for enabling secure and efficient team collaboration. Platforms like Google Drive, Dropbox, and Microsoft OneDrive offer real-time file sharing, access control, and version tracking, making it easier for distributed teams to work together seamlessly. Companies are also integrating cloud storage with productivity tools, project management apps, and communication platforms to streamline workflows. The use of encrypted cloud environments, role-based permissions, and multi-factor authentication ensures that data remains secure while being accessible from any device or location.

Global Cloud Storage Market: Stats & Facts

European Union (EU) Cloud Adoption and Data Insights - Source: Digital Strategy and EU Institutions

- Cloud Data Flow in EU (2024): The volume of cloud data flows across EU Member States was estimated at 46,000 Petabytes (PB), with 36,600 PB flowing to cloud and edge capabilities within the EU.

- Economic Value of Cloud Data Flows: Estimated at €77 billion in 2024, projected to increase to €328 billion by 2035.

- EU Cloud Adoption Rate (2023): Approximately 78% of large enterprises in the EU adopted cloud computing services.

- EU Cloud Adoption by Enterprise Size (2023):

- 59% of medium-sized enterprises adopted cloud computing.

- 42% of small enterprises adopted cloud computing.

- EU Cloud Adoption by Service Model (2023): Over 95% of EU enterprises using cloud services utilized the Software as a Service (SaaS) model.

- EU Data Center Energy Consumption (2023): Data centers in Ireland consumed 21% of the country’s total electricity, an increase from 5% in 2015.

- EU Cloud Adoption Target: By 2030, 75% of European businesses are expected to use cloud-edge technologies for their activities.

- EU Edge Node Deployment Target: The EU plans to deploy 10,000 climate-neutral and highly secure edge nodes by 2030.

- EU Public Sector Cloud Adoption - Source: TechInsights and European Union

- Public Sector Cloud Adoption (2023):

- 36% of public sector organizations in the EU used cloud computing.

- An additional 29% were planning to adopt it.

- Public Sector Cloud Adoption Rate by Service Model: 95% of EU public sector cloud users opted for Software as a Service (SaaS).

U.S. Cloud Adoption Insights - Source: Government & Industry Reports

- Federal Cloud Spending: The U.S. federal government is projected to spend over $13 billion annually on cloud services by 2025.

- State and Local Government Cloud Adoption: As of 2021, 70% of state and local government executives in the U.S. preferred cloud environments for hosting citizen and mission data.

- Public Sector Cloud Adoption (2023): 36% of public sector organizations in the U.S. were using cloud computing, with another 29% planning to do so.

Global Cloud Adoption and Data Usage - Source: World Bank, PWC, HostingAdvice

- Global Cloud Data Generation: Less than 1% of the data generated globally was analyzed and used, indicating significant untapped potential.

- Global Cloud Adoption Rate: 54% of companies in the EMEA (Europe, Middle East, and Africa) region had adopted cloud computing in all or most parts of their business by 2023.

- Cloud Spending Increase (EMEA, 2023): 74% of companies in the EMEA region reported plans to increase their cloud spending.

- Cloud Strategy Adoption (EMEA, 2023): 42% of companies in the EMEA region had an enterprise-wide cloud strategy.

- Global Cloud Storage Usage: Approximately 92.6% of workers use cloud storage to store office data.

- Personal Cloud Storage Usage: Around 73% of individuals use cloud storage for personal data, such as documents and photos.

- Corporate Cloud Data: 60% of corporate data is stored in the cloud, a significant increase from 30% a decade ago.

EU Cloud Industry Adoption & Growth - Source: StackScale, TechMonitor

- EU Cloud Adoption by Country (2018): Finland, Sweden, and Denmark had the highest rates of cloud computing adoption among EU countries.

- EU Cloud Adoption by Industry (2023): The most common industry for cloud adoption in the EU was IT & Technology, followed by BFSI (Banking, Financial Services, and Insurance).

- EU Cloud Growth Forecast: The EU is forecasted to see a continued increase in cloud adoption, driven by advancements in edge computing and AI integration.

Global Personal and Enterprise Cloud Storage Trends - Source: HostingAdvice, Bacancy Technology

- Personal Cloud Storage Preference: Over 65% of users prefer personal cloud storage over local storage due to its high data limits and automatic syncing features.

- Large Enterprises Cloud Adoption Goal: By 2025, large enterprises aim to employ 60% of their workloads in cloud environments.

- Global Corporate Data in Cloud: About 60% of corporate data is currently stored in the cloud.

- Cloud Adoption Rate by Companies (EMEA, 2023): 73% of businesses in the EMEA region that had not yet adopted cloud computing planned to do so within the next two years.

Global Cloud Storage Market: Market Dynamics

Global Cloud Storage Market: Driving Factors

Surge in Data Generation across IndustriesThe exponential increase in structured and unstructured data from diverse sources such as social media, IoT devices, e-commerce platforms, and enterprise systems is fueling the demand for scalable storage infrastructure. Organizations are turning to cloud storage to manage large volumes of data efficiently, while also leveraging it for real-time analytics, customer insights, and operational optimization. This surge is driving adoption across sectors including healthcare, BFSI, retail, and manufacturing, where data accessibility, redundancy, and on-demand scalability are critical for business continuity and innovation.

Growing Demand for Cost-Efficient Storage Solutions

Cloud storage eliminates the need for heavy upfront investments in physical infrastructure, offering a pay-as-you-go model that significantly reduces capital expenditure. This is especially attractive to small and mid-sized enterprises (SMEs) looking to optimize IT spending while accessing enterprise-grade security, uptime, and flexibility. Providers offering tiered storage, cold storage, and automated data lifecycle management help businesses fine-tune storage based on usage and importance, making cloud a highly cost-efficient alternative to traditional data centers.

Global Cloud Storage Market: Restraints

Data Privacy and Compliance Concerns

Despite rapid adoption, many enterprises remain cautious due to growing concerns around data sovereignty, privacy regulations, and cross-border data transfers. Compliance with frameworks such as GDPR, HIPAA, and CCPA imposes complex requirements that vary by region and industry. For global organizations, ensuring that data stored in the cloud adheres to local legal standards can be both challenging and costly, especially when using public cloud platforms hosted in multiple jurisdictions.

Security Risks and Vendor Lock-in

Security remains a significant barrier, as cloud environments are susceptible to cyberattacks, ransomware, and unauthorized access. While most providers offer robust security features, misconfigurations, lack of encryption, or weak access controls can still expose sensitive data. Additionally, vendor lock-in limits flexibility, making it difficult and expensive to switch providers or integrate with third-party systems. These issues can hinder cloud migration strategies and long-term scalability plans for some businesses.

Global Cloud Storage Market: Opportunities

Rising Adoption of Hybrid and Multi-Cloud Strategies

Enterprises are adopting hybrid cloud and multi-cloud storage architectures to balance performance, security, and regulatory compliance. These models allow businesses to retain critical data on private cloud or on-premise systems, while leveraging public cloud for scalability and flexibility. The growing ecosystem of cloud orchestration tools and interoperability standards presents immense opportunity for cloud vendors to innovate and offer more integrated, agile storage solutions.

Expansion into Emerging Markets

Rapid digital transformation in emerging economies such as India, Brazil, South Africa, and Southeast Asia is opening up new opportunities for cloud storage providers. As businesses in these regions adopt cloud-first strategies and governments invest in digital infrastructure, there is a strong demand for localized cloud services, low-latency storage, and region-specific data compliance solutions. The increasing penetration of 5G and mobile internet further accelerates the need for cloud-based storage and collaboration tools.

Global Cloud Storage Market: Trends

Integration of AI and Machine Learning in Storage Management

Cloud storage is evolving beyond simple data hosting to become an intelligent platform for automated storage management. AI and ML are being integrated to optimize storage utilization, predict capacity needs, automate tiering, and detect anomalies or breaches in real time. These smart storage solutions enhance both performance and security while reducing manual intervention and operational costs.

Demand for Sustainable and Green Cloud Storage

As environmental concerns grow, cloud providers are under pressure to adopt green IT practices. This has led to a rising trend of sustainable cloud storage, where data centers are powered by renewable energy, use energy-efficient cooling systems, and implement carbon reduction initiatives. Enterprises seeking to meet ESG goals favor cloud partners that prioritize eco-friendly data storage, pushing the market toward greener innovation.

Global Cloud Storage Market: Research Scope and Analysis

By Offering Analysis

In the global cloud storage market, storage offerings are expected to maintain a commanding lead in the offering type segment, projected to account for 68.2% of the total market share in 2025. This dominance is largely driven by the ever-growing need for scalable, cost-effective, and accessible storage solutions that cater to a wide range of industries. Enterprises are relying on cloud-based storage to support critical operations such as data archiving, backup and recovery, file synchronization, and unstructured data management.

As digital transformation accelerates globally, businesses are prioritizing flexible infrastructure that can seamlessly adapt to varying workloads, user demands, and compliance requirements. Storage offerings, particularly object storage and file storage, are being widely adopted for their versatility, performance, and support for high-availability systems.

The services segment in the global cloud storage market plays a vital role in complementing storage infrastructure by delivering the technical expertise, operational support, and strategic guidance that enterprises need to successfully deploy and manage cloud-based environments. As organizations transition from traditional IT systems to cloud-centric architectures, the complexity of integration, data migration, governance, and optimization increases significantly. This is where cloud storage services become indispensable, providing a framework that ensures seamless adoption, efficient performance, and long-term scalability of cloud storage solutions.

The services segment of the global cloud storage market serves as a critical enabler for organizations looking to adopt, scale, and refine their cloud strategies. As enterprises seek to unlock the full value of cloud storage technologies, service providers are stepping in to deliver specialized expertise and comprehensive operational support. These services span the full lifecycle of cloud adoption, from initial assessments and architectural design to long-term infrastructure management and optimization, making them essential for modern digital transformation efforts.

By Organization Size Analysis

Large enterprises are projected to retain a significant hold on the global cloud storage market by organization size, accounting for 73.8% of the total market share in 2025. This dominance can be attributed to their expansive digital infrastructure, high-volume data generation, and greater financial resources that enable large-scale cloud adoption. These organizations typically operate across multiple regions and sectors, requiring scalable and secure cloud storage solutions that support real-time data access, compliance with international regulations, and seamless collaboration across departments.

Their reliance on cloud storage extends beyond basic archiving to complex use cases such as predictive analytics, machine learning model training, large-scale content delivery, and disaster recovery planning. With a focus on business continuity and operational efficiency, large enterprises also invest heavily in hybrid and multi-cloud strategies that blend public and private storage solutions to ensure agility, control, and cost optimization.

In contrast, small and medium-sized enterprises are gradually increasing their footprint in the cloud storage market as cloud technologies become more accessible and affordable. While historically challenged by limited IT budgets and in-house expertise, SMEs are now leveraging pay-as-you-go cloud models and simplified cloud management platforms that reduce upfront costs and lower the barrier to entry. These businesses often seek cloud storage for practical needs such as data backup, document sharing, and secure remote access.

As digital-first approaches become more widespread among SMEs, cloud storage is being recognized as a vital enabler for growth, allowing these companies to scale their operations, embrace remote work models, and compete in digital marketplaces. Vendors are also targeting this segment with tailored solutions offering user-friendly interfaces, integrated security features, and compliance-ready storage environments that meet the evolving demands of small businesses in sectors such as e-commerce, healthcare, education, and professional services.

By Deployment Model Analysis

The public cloud deployment model is anticipated to lead the global cloud storage market by deployment type, expected to capture 45.2% of the total market share in 2025. This widespread adoption is largely driven by the flexibility, scalability, and cost-efficiency that public cloud platforms offer to businesses of all sizes. Organizations are drawn to public cloud environments due to their ability to eliminate the need for extensive on-premises infrastructure, enabling rapid deployment and global accessibility. The ease of provisioning storage resources on-demand allows enterprises to manage dynamic workloads more efficiently while benefiting from continuous updates, advanced security protocols, and support for multi-tenant architectures.

Public cloud providers like AWS, Microsoft Azure, and Google Cloud offer diverse storage solutions such as object storage, block storage, and archive storage, making them highly adaptable for applications like backup and recovery, media streaming, web hosting, and big data analytics. The integration of artificial intelligence, data redundancy, and disaster recovery features further enhances the attractiveness of public cloud storage, especially for industries seeking elasticity and speed in their digital transformation journey.

On the other hand, private cloud deployment models continue to gain traction among organizations that prioritize greater control, security, and compliance over their data infrastructure. Private cloud environments are particularly favored by heavily regulated industries such as banking, government, and healthcare, where data sovereignty and customized security configurations are essential. These deployment models are hosted either on-premises or through dedicated third-party infrastructure, offering a single-tenant architecture that ensures a high level of isolation and governance.

Organizations leveraging private cloud storage benefit from greater customization options, performance predictability, and integration with legacy systems. This model supports mission-critical workloads and allows businesses to tailor their environments to meet specific regulatory requirements, such as GDPR or HIPAA, without sacrificing scalability.

By Application Analysis

Business continuity applications are expected to secure a dominant position within the global cloud storage market by application type, projected to account for 51.5% of the total market share in 2025. This stronghold is primarily driven by the growing need for uninterrupted business operations, robust disaster recovery solutions, and reliable data backup systems in an digitized and risk-prone world. As organizations expand their digital footprints, the potential impact of cyberattacks, system failures, and natural disasters has significantly increased, making business continuity planning a critical investment area. Cloud storage platforms enable companies to implement efficient backup and recovery mechanisms that offer fast data restoration, geographical redundancy, and real-time failover capabilities.

These features help businesses reduce downtime, maintain data integrity, and ensure operational resilience across various functions, from customer support to financial transactions. Industries such as finance, healthcare, and e-commerce, where service disruptions can result in major revenue losses and reputational damage, are particularly reliant on cloud-based continuity applications to meet both compliance mandates and customer expectations.

In parallel, data management applications are carving out a significant and expanding role in the cloud storage market, driven by the exponential growth of structured and unstructured data across organizations. These applications go beyond simple storage to provide intelligent solutions for organizing, classifying, analyzing, and optimizing data throughout its lifecycle. Cloud-based data management enables enterprises to manage massive datasets across diverse environments, facilitating seamless access, governance, and integration with analytics tools.

Features such as metadata tagging, data versioning, and tiered storage empower businesses to make more informed decisions, extract insights from big data environments, and improve operational efficiency. This is especially valuable in sectors like retail, telecommunications, and manufacturing, where real-time data visibility can enhance supply chain performance, customer engagement, and predictive maintenance strategies.

By Industry Vertical Analysis

The BFSI industry is set to maintain a commanding lead in the global cloud storage market by industry vertical, capturing 31.8% of the total market share in 2025. This leadership is primarily driven by the industry's growing reliance on secure, scalable, and compliant data infrastructure to support critical financial operations. Banks, insurance firms, and financial service providers generate vast amounts of sensitive customer data, transaction records, and regulatory documentation daily, necessitating robust cloud storage solutions that ensure data availability, integrity, and protection.

The need for uninterrupted access to real-time data for fraud detection, digital banking services, risk modeling, and portfolio management has significantly boosted cloud adoption in the BFSI sector. Moreover, regulatory pressures such as Basel III, GDPR, and PCI-DSS are compelling financial institutions to implement cloud environments that offer advanced encryption, access control, and audit trails to ensure strict compliance and data sovereignty. As digital banking channels and fintech innovations continue to expand, BFSI organizations are embracing hybrid cloud strategies that balance security and agility, helping them improve customer experience and accelerate time-to-market for new services.

In contrast, the IT and IT-enabled services sector is rapidly evolving as a critical adopter of cloud storage, with demand fueled by high-volume data transactions, distributed workforces, and cloud-native development practices. This segment encompasses a wide range of operations, including software development, application testing, IT consulting, and business process outsourcing, all of which depend on seamless data exchange, collaboration, and remote access capabilities.

Cloud storage enables IT and ITES firms to centralize code repositories, store large application datasets, and support agile workflows with minimal latency and maximum uptime. The flexibility to scale storage resources up or down based on project demands allows these companies to manage costs effectively while maintaining high-performance environments. Furthermore, cloud platforms provide automated version control, continuous integration tools, and secure data sharing frameworks that support dynamic project collaboration across global teams.

The Cloud Storage Market Report is segmented on the basis of the following

By Offering

- Storage

- Object Storage

- Block Storage

- File Storage

- Services

- Training & Consulting

- Integration & Implementation

- Support & Maintenance

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Business Continuity

- Backup & Recovery

- Data Archiving

- Data Management

- Big Data & Analytics

- Database Storage Management

- Application Management

- Content Delivery & Distribution

- Other Applications

By Industry Vertical

- Banking, Financial Services, and Insurance

- Fraud Detection & Risk Management

- Global Expansion & Compliance

- Customer Personalization

- Other Application Areas

- IT & ITES

- Scalable Development Environments

- Global Collaboration

- Automated Testing & Continuous Integration

- Others

- Telecommunications

- Network Function Virtualization (NFV)

- Edge Computing

- IoT Data Management

- Others

- Healthcare & Life Sciences

- Secure Health Data Sharing

- Telemedicine & Remote Patient Monitoring

- Interoperability & Health Information Exchange

- Others

- Media & Entertainment

- Scalable Content Distribution

- Collaborative Content Creation

- Flexible Digital Asset Management

- Others

- Retail & Consumer Goods

- Personalized Customer Experiences

- Inventory Optimization

- Unified Commerce

- Others

- Manufacturing

- Digital Twin

- 3D Printing

- Quality Control & Process Optimization

- Others

- Government & Utilities

- E-government Services

- Smart City Initiatives

- Emergency Response & Crisis Management

- Others

- Energy & Utilities

- Grid Optimization with Big Data

- Asset Performance Management

- Energy Consumption Analytics

- Others

- Other Verticals

Global Cloud Storage Market: Regional Analysis

Region with the Largest Revenue Share

North America is poised to dominate the global cloud storage market, capturing 47.5% of the total global market revenue in 2025. This dominance can be attributed to several factors, including the region's well-established technological infrastructure, high adoption rate of cloud technologies, and the presence of major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). The strong demand for cloud storage solutions in North America stems from the region's large base of enterprises across various industries, including finance, healthcare, retail, and IT, all of which generate and rely on vast amounts of data that need to be stored, secured, and accessed efficiently.

As businesses continue to expand their digital ecosystems and migrate workloads to the cloud, the need for scalable, cost-effective storage solutions is more pressing than ever. Moreover, North America benefits from its advanced technological infrastructure, including high-speed internet access, data centers with cutting-edge capabilities, and innovation hubs driving new developments in cloud storage technologies. The U.S. market, in particular, has been a pioneer in cloud adoption, with businesses leveraging cloud storage not only for data backup and recovery but also for advanced use cases such as big data analytics, artificial intelligence, and real-time data processing.

Region with significant growth

Asia Pacific is projected to experience the highest compound annual growth rate (CAGR) in the global cloud storage market. This growth can be attributed to the region's rapid digital transformation, increasing adoption of cloud technologies across various industries, and the growing need for data storage solutions to support the expanding digital economies in countries like China, India, Japan, and Southeast Asia. With a large and diverse population, the Asia Pacific region is witnessing a significant rise in internet penetration, mobile device usage, and cloud-based applications, all of which contribute to the growing demand for cloud storage services.

Several factors are driving this surge in cloud storage adoption. First, businesses across the region are looking to scale their operations with cloud-based infrastructure, reducing reliance on traditional on-premises storage systems. The flexibility, scalability, and cost-effectiveness offered by cloud storage make it an attractive option for both large enterprises and small and medium-sized enterprises (SMEs) seeking to improve operational efficiency and optimize IT costs. In particular, industries such as e-commerce, manufacturing, financial services, and healthcare are leveraging cloud storage to handle large volumes of data, improve business continuity, and enhance data security.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cloud Storage Market: Competitive Landscape

The global competitive landscape of the cloud storage market is marked by the presence of several large-scale, well-established players, as well as emerging service providers offering specialized solutions. The competitive dynamics in this space are shaped by factors such as technological advancements, market consolidation, innovation in storage solutions, and geographic expansion. Major players in the market include tech giants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and IBM Cloud, all of which hold significant market shares due to their vast infrastructure, diversified offerings, and global reach.

These industry leaders dominate the cloud storage landscape by providing a wide range of storage solutions, including object storage, file storage, and block storage, which are designed to meet the diverse needs of different industries. Their offerings are enhanced by cutting-edge technologies like artificial intelligence (AI), machine learning, and automation, enabling organizations to manage vast amounts of data with greater efficiency, security, and scalability. These providers have made significant investments in expanding their data center networks across regions to improve service availability, performance, and data compliance, further cementing their leadership in the cloud storage space.

Some of the prominent players in the Global Cloud Storage are

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- Dell Technologies

- Hewlett-Packard Enterprise (HPE)

- NetApp

- Dropbox

- Box, Inc.

- Wasabi Technologies

- Backblaze

- Tencent Cloud

- Huawei Cloud

- Citrix Systems

- Fujitsu

- Rackspace Technology

- Hitachi Vantara

- VMware

- Other Key Players

Global Cloud Storage Market: Recent Developments

- March 2025: Amazon Web Services (AWS) acquired Cloud Storage Solutions Inc., a provider of data management and backup solutions, to enhance its storage portfolio and offer more robust disaster recovery and data protection services to its customers.

- February 2025: Microsoft Azure acquired DataCloud Systems, a cloud storage startup focused on hybrid cloud solutions, to strengthen its position in the hybrid cloud and multi-cloud management space.

- December 2024: Google Cloud acquired FileStream Technologies, a provider of advanced file storage management solutions, aiming to integrate their file management tools with Google’s cloud platform to improve collaboration and file-sharing capabilities.

- October 2024: IBM Cloud acquired QuantumData Solutions, a leader in quantum storage technologies, to bolster its hybrid cloud and data security offerings for enterprise clients focusing on high-performance computing.

- July 2024: Oracle Cloud acquired CloudEdge Storage, a company specializing in data archiving and long-term storage solutions, to enhance its cloud storage offerings for regulated industries like healthcare and finance.

- June 2024: Box, Inc. merged with VastData Storage, a leading provider of scalable storage solutions, to create a new powerhouse in cloud storage solutions designed for media, entertainment, and large enterprise environments.

- April 2024: Dropbox acquired DataSync Technologies, a provider of cloud-based backup and data recovery solutions, to strengthen its position as a leading provider of cloud collaboration tools with enhanced security and data protection features.

- February 2024: Alibaba Cloud acquired CloudVault, a startup focused on building secure, encrypted cloud storage solutions, to enhance its security infrastructure and cater to global clients looking for compliance-driven storage options.

- November 2023: Wasabi Technologies merged with DataSafe Systems, a provider of low-cost and high-speed cloud storage services, to expand its reach in the enterprise market by offering a more comprehensive suite of storage solutions.

- August 2023: Tencent Cloud acquired StreamLine Data Solutions, a company specializing in real-time data storage and streaming services, to boost its cloud storage capabilities for industries requiring high-throughput data access, such as gaming and media streaming.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 138.0 Bn |

| Forecast Value (2034) |

USD 562.8 Bn |

| CAGR (2025–2034) |

16.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 55.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Storage and Services), By Organization Size (Small & Medium Enterprises (SMEs) and Large Enterprises), By Application (Business Continuity, Data Management, and Application Management) and By Industry Vertical (Banking, Financial Services, and Insurance, IT & ITES, Telecommunications, Healthcare & Life Sciences, Media & Entertainment, Retail & Consumer Goods, Manufacturing, Government & Utilities, Energy & Utilities and Other Verticals) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Dell Technologies, Hewlett Packard Enterprise (HPE), NetApp, Dropbox, Box, Inc., Wasabi Technologies, Backblaze, Tencent Cloud, Huawei Cloud, Citrix Systems, Fujitsu, Rackspace Technology, Hitachi Vantara, VMware, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global cloud storage market size is estimated to have a value of USD 138.0 billion in 2025 and is expected to reach USD 562.8 billion by the end of 2034.