Market Overview

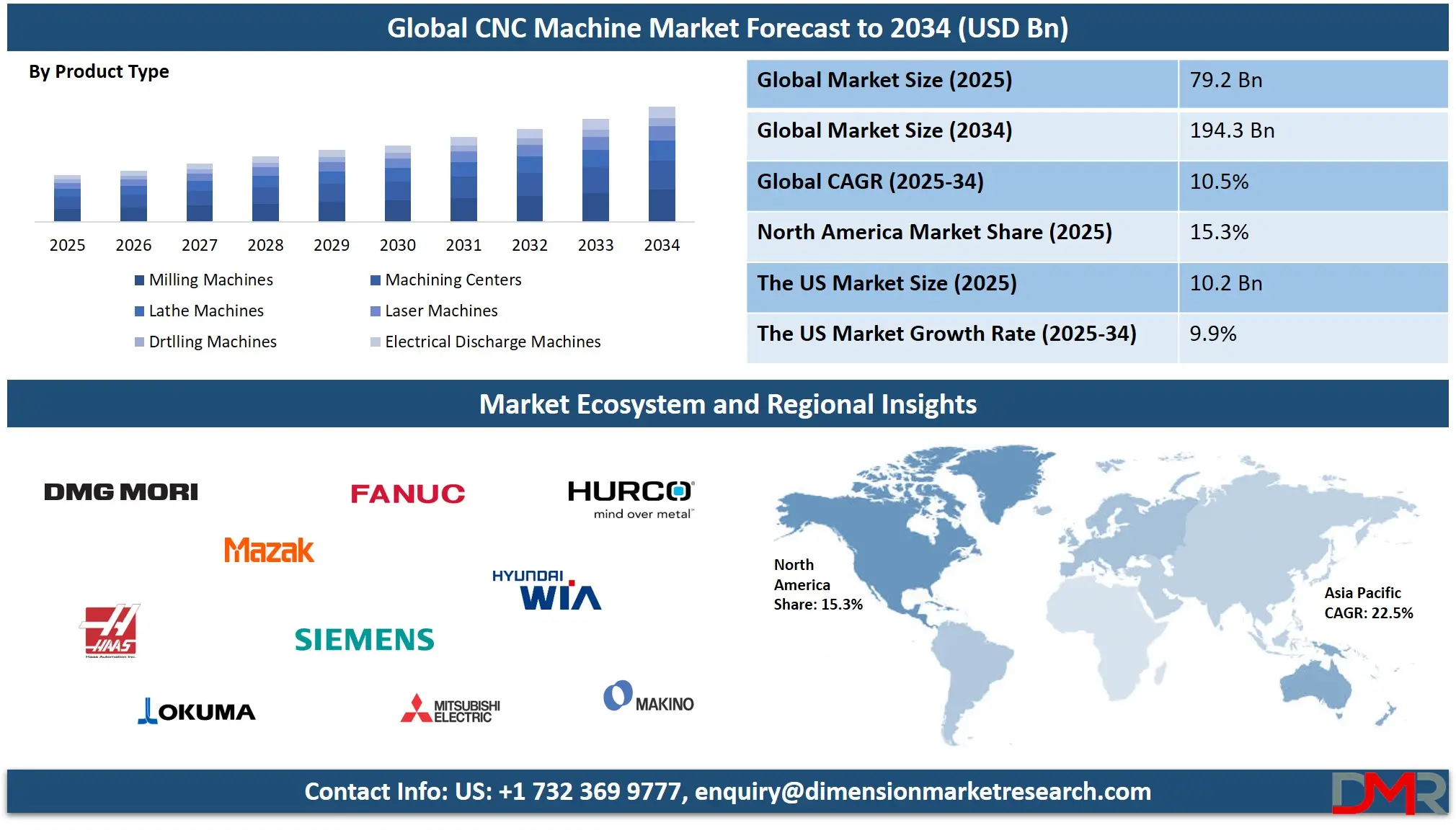

The Global CNC Machine Market is projected to reach USD 79.2 billion in 2025 and is expected to grow to USD 194.3 billion by 2034, expanding at a CAGR of 10.5%. Growth is driven by growing demand for precision machining, industrial automation, multi-axis CNC systems, and adoption of smart manufacturing solutions across automotive, aerospace, and metal fabrication industries.

A CNC machine, or Computer Numerical Control machine, is a sophisticated manufacturing tool that uses programmed software to control the movement of tools and machinery for precise cutting, milling, drilling, and shaping of materials. These machines operate based on numerical input codes, allowing for automation of complex manufacturing tasks with high accuracy and repeatability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

CNC machines are widely used in industries such as automotive, aerospace, electronics, and medical device manufacturing, offering enhanced productivity, reduced human error, and consistent product quality. By integrating robotics, sensors, and real-time monitoring, CNC technology continues to evolve with innovations in multi-axis machining, hybrid manufacturing, and smart factory solutions.

The global CNC machine market is undergoing a transformative phase driven by growing industrial automation, rapid growth in precision engineering, and the rising demand for efficient and scalable production methods. As manufacturers across various sectors strive to meet high-performance standards and cost-efficiency targets, CNC machines have become indispensable tools.

The convergence of digital manufacturing, IoT integration, and AI-powered predictive maintenance has significantly elevated the capabilities of CNC systems, enabling real-time performance optimization and extended machine lifecycles. Emerging economies are embracing CNC technology to modernize their manufacturing infrastructure, creating vast growth opportunities for global and regional vendors alike.

Advanced CNC machines are also seeing rising adoption across aerospace and defense sectors due to their ability to fabricate complex geometries and critical components with micron-level precision.

These sectors demand high compliance with performance and quality standards, making CNC systems crucial in producing turbine blades, structural components, and composite materials. Additionally, the automotive industry is leveraging 5-axis CNC machines and laser-based machining solutions to streamline the production of engine parts, gear systems, and electric vehicle components. With the shift toward lightweight materials and EV-driven innovation, CNC technologies are being redefined by adaptive software and high-speed machining capabilities.

Furthermore, as smart manufacturing becomes the cornerstone of Industry 4.0, the CNC machine market is seeing increased investment in digital twin technologies, cloud-based CNC programming, and automated tool change systems. These advancements are enabling seamless data exchange between factory floors and design centers, improving production agility and minimizing downtime. Customization, remote diagnostics, and energy-efficient machining solutions are becoming key differentiators as manufacturers seek to balance productivity with sustainability. The global CNC landscape is thus evolving into a highly connected and intelligent ecosystem that caters to both mass production and specialized, low-volume manufacturing needs.

The US CNC Machine Market

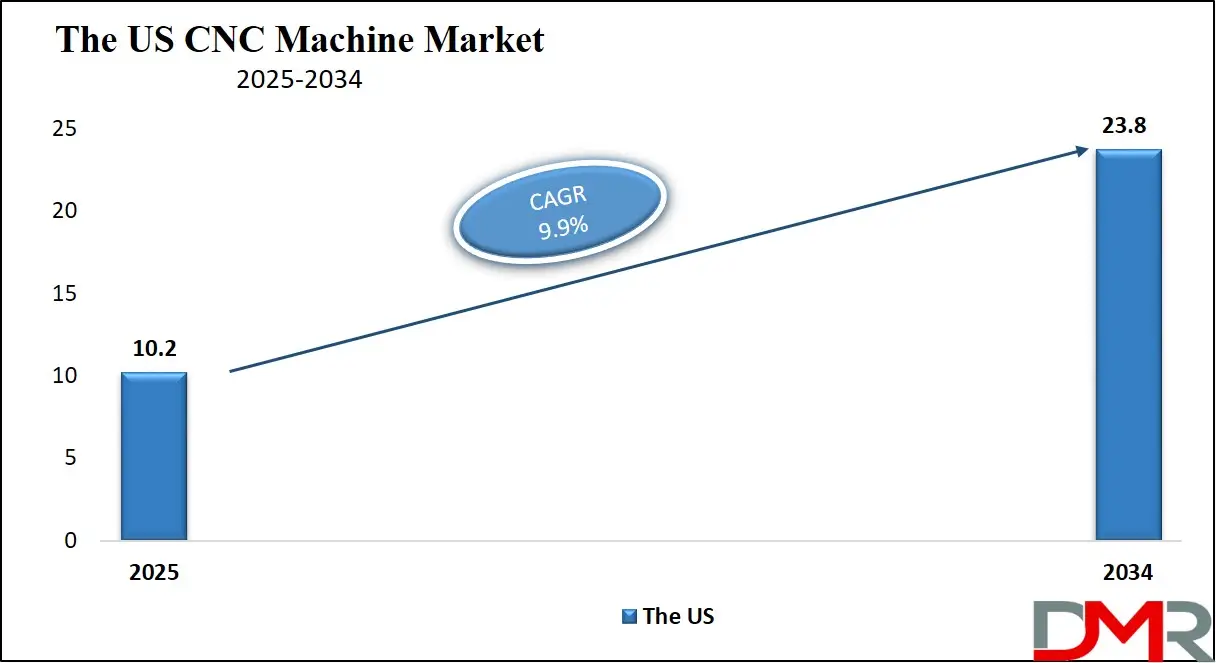

The U.S. CNC Machine Market size is projected to be valued at USD 10.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 23.8 billion in 2034 at a CAGR of 9.9%.

The U.S. CNC machine market represents a mature yet dynamically evolving segment within the global manufacturing ecosystem. With its strong foundation in advanced manufacturing, the U.S. continues to lead in adopting next-generation CNC technologies such as 5-axis machining, adaptive control systems, and integration with IoT for real-time monitoring.

The countrys highly developed industrial infrastructure, integrated with a skilled workforce and robust R&D investments, supports a diverse application base spanning automotive, aerospace, medical devices, and defense sectors. American manufacturers are leveraging CNC automation to improve operational efficiency, minimize material waste, and achieve tighter tolerances for complex components.

In response to growing reshoring trends and the push for localized production, U.S.-based industries are prioritizing CNC solutions that enhance flexibility and scalability in production. Integration of CAD/CAM software, hybrid CNC machines combining additive and subtractive processes, and AI-powered predictive maintenance are gaining traction as companies aim to build smart, connected factories.

Moreover, government initiatives supporting digital transformation in manufacturing and workforce upskilling are reinforcing the adoption of CNC systems across small and mid-sized enterprises. As sustainability and energy efficiency become central to industrial operations, CNC machines designed for low energy consumption and minimal environmental impact are also witnessing increased demand in the U.S. market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European CNC Machine Market

Europes CNC machine market is projected to reach approximately

1.9 billion USD in 2025, reflecting its strong position as a key manufacturing hub within the global landscape. The regions industrial base, which includes powerhouse economies like Germany, France, and Italy, is characterized by high demand for precision machining in sectors such as automotive, aerospace, defense, and industrial equipment.

These industries rely on CNC machines to produce complex, high-quality components with tight tolerances and enhanced efficiency. The ongoing shift toward digital manufacturing and Industry 4.0 adoption further drives investment in advanced CNC technologies, including multi-axis machining, AI-powered controls, and IoT-enabled monitoring systems.

The market is expected to grow at a robust compound annual growth rate of 9.0%, underscoring rapid modernization and expansion across various manufacturing sectors. This impressive growth is fueled by growing government support for innovation, automation, and sustainable manufacturing practices. Additionally, the rise in customized and small-batch production demands flexible CNC machining solutions, which manufacturers across Europe are actively adopting. As companies focus on reducing production cycles and improving product quality, the demand for smart CNC machines integrated with real-time analytics and adaptive control technologies is accelerating, securing Europes position as a vital and fast-growing market in the global CNC machine ecosystem.

The Japanese CNC Machine Market

Japans CNC machine market is projected to reach approximately 0.3 billion USD by 2025, reflecting its status as a mature and technologically advanced manufacturing hub. The countrys strong industrial base, which includes sectors such as automotive, electronics, precision engineering, and robotics, relies heavily on CNC machines to maintain high standards of quality and efficiency. Japanese manufacturers focus on producing highly precise components with complex geometries, supported by sophisticated CNC systems that integrate multi-axis machining, automation, and digital controls. This established infrastructure allows Japan to sustain steady demand for CNC machines, primarily driven by system upgrades, modernization efforts, and the integration of Industry 4.0 technologies.

The market is expected to grow at a moderate compound annual growth rate of

3.9 percent, indicating a stable yet slower expansion compared to emerging regions. This tempered growth rate reflects Japans already high penetration of CNC technology and the maturity of its manufacturing sector. Instead of rapid market expansion, growth is fueled by incremental innovations, such as the adoption of AI-enhanced machine monitoring, improved energy efficiency, and advanced materials machining capabilities. Furthermore, Japans emphasis on precision manufacturing and quality assurance continues to drive demand for cutting-edge CNC solutions that can meet the rigorous standards of both domestic and global industries.

Global CNC Machine Market: Key Takeaways

- Market Value: The global CNC machine size is expected to reach a value of USD 194.3 billion by 2034 from a base value of USD 79.2 billion in 2025 at a CAGR of 10.5%.

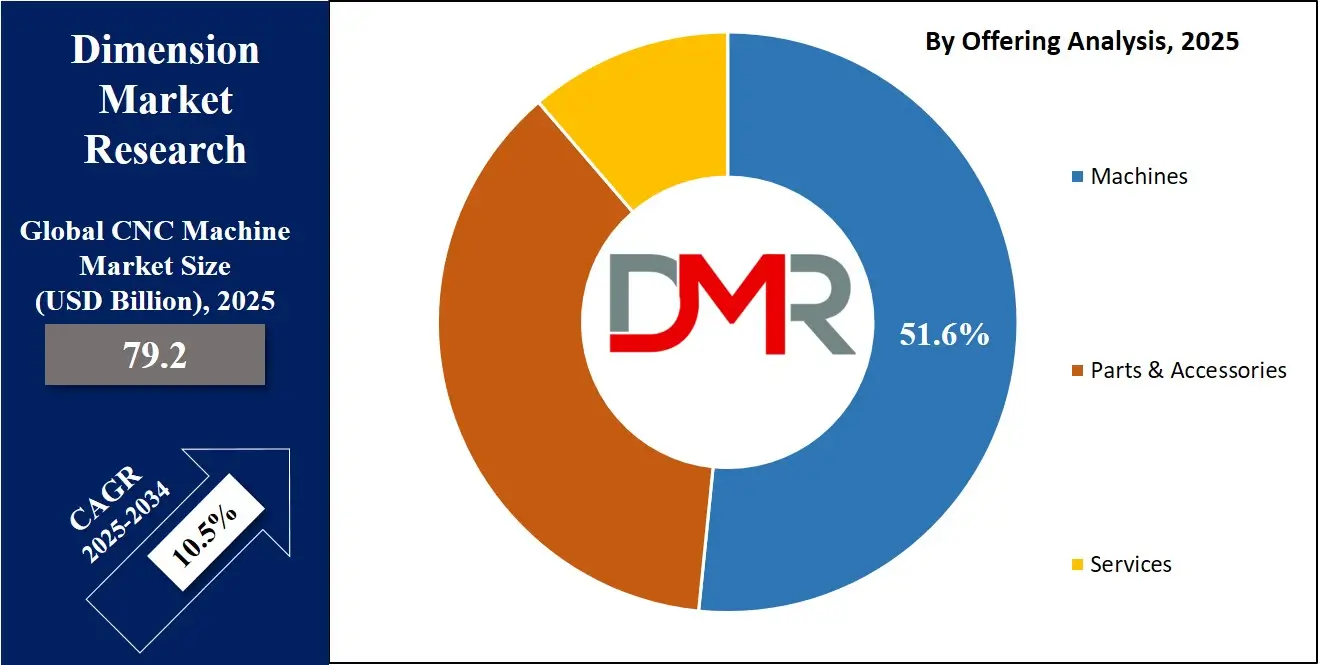

- By Offering Segment Analysis: Machines are poised to consolidate their dominance in the offering type segment, capturing 51.6% of the total market share in 2025.

- By Product Type Segment Analysis: Milling Machines are anticipated to maintain their dominance in the product type segment, capturing 27.8% of the total market share in 2025.

- By End-User Industry Segment Analysis: Automotive & Transportation industries are expected to maintain their dominance in the end-user industry segment, capturing 28.3% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global CNC machine market landscape with 34.9% of total global market revenue in 2025.

- Key Players: Some key players in the global CNC machine market are DMG MORI, Mazak Corporation, Haas Automation, Okuma Corporation, FANUC Corporation, Siemens AG, Mitsubishi Electric Corporation, Hurco Companies, Hyundai WIA, Makino Milling Machine, JTEKT Corporation, GROB-WERKE, Doosan Machine Tools, Dalian Machine Tool Group, Hardinge Inc., Amera-Seiki, Toshiba Machine, Emco Group, Schiess GmbH, Fagor Automation, and Other key players.

Global CNC Machine Market: Use Cases

- Aerospace Component Manufacturing: The aerospace industry relies heavily on CNC machines for producing intricate components with extremely tight tolerances, such as turbine blades, structural wing parts, and engine housings. Multi-axis CNC machining centers, often equipped with high-speed spindles and adaptive control software, are used to fabricate complex geometries from titanium, Inconel, and aluminum alloys. These machines frequently incorporate high-performance processors like Intel Core i7 or AMD Ryzen Embedded, enabling real-time tool path optimization and vibration control. Through integration with digital twin simulations and CAM software, aerospace manufacturers can simulate tool movements, minimize errors, and ensure compliance with strict FAA and EASA standards. These advancements not only streamline workflow but also reduce material waste, downtime, and the risk of critical failure in flight applications.

- Automotive Powertrain and EV Component Production: In the automotive sector, CNC machines are essential for mass-producing engine blocks, transmission systems, and now, electric vehicle components such as battery housings and lightweight aluminum casings. CNC turning centers and horizontal machining centers are combined with robotic arms and conveyors to enable lights-out manufacturing for high-volume production. Using industrial-grade processors and AI-enabled sensors, modern CNC machines can monitor thermal expansion, spindle load, and tool wear in real time. The implementation of Industry 4.0 technologies, including IIoT-enabled dashboards and remote diagnostics, further enhances predictive maintenance and production analytics. Automotive manufacturers benefit from reduced cycle times, improved throughput, and the ability to rapidly retool production lines for different vehicle models and configurations.

- Medical Device Fabrication: CNC machines are being used to manufacture custom surgical instruments, orthopedic implants, and dental prosthetics. This segment demands extreme accuracy and surface finishing, often achieved using 5-axis vertical machining centers or Swiss-style CNC lathes. Advanced CNC machines for medical applications utilize microprocessors with fast data transfer rates and built-in motion control chips to execute high-precision cuts on titanium, stainless steel, and biocompatible polymers. Integration with CAD/CAM platforms allows for the rapid conversion of 3D anatomical scans into production-ready files, enabling patient-specific designs. CNC machining ensures consistent quality in critical applications where accuracy down to the micron is vital for patient safety and regulatory compliance.

- Die and Mold Manufacturing for Consumer Electronics: In consumer electronics manufacturing, CNC machines are essential for producing dies, molds, and enclosures for smartphones, laptops, and wearable devices. High-speed CNC milling machines equipped with linear motors and advanced thermal management systems are used to carve intricate mold cavities with smooth surface finishes. These systems often run on specialized CNC controllers with real-time interpolation and dynamic feed adjustment capabilities. Technologies such as 3D tool compensation and machine learning-based toolpath optimization help manufacturers reduce scrap rates and extend tool life. As the demand for compact, lightweight devices increases, precision machining using ultra-fine tooling and laser-assisted CNC cutting is becoming central to product development in this high-volume, innovation-driven market.

Global CNC Machine Market: Stats & Facts

U.S. Department of Commerce – International Trade Administration (ITA)

- The U.S. manufacturing sector accounted for approximately 11.3% of the GDP in 2023, driving significant demand for CNC machines in precision manufacturing.

- Over 65% of U.S. manufacturing companies utilize CNC technology for improved efficiency and accuracy.

- The automotive manufacturing segment represents about 20% of U.S. CNC machine usage.

- CNC machines contributed to a 15% increase in productivity in U.S. aerospace manufacturing between 2019 and 2024.

European Commission – Eurostat

- Manufacturing accounts for around 16% of the EUs GDP, with CNC machining pivotal to maintaining competitiveness.

- Germany leads Europe in CNC machine adoption, with over 40% of factories equipped with CNC systems as of 2023.

- Investment in digital manufacturing technologies, including CNC, increased by 18% across the EU between 2020 and 2023.

- The EU exports more than 70% of its high-precision machined products globally.

• Japan Ministry of Economy, Trade and Industry (METI)

- Japans manufacturing sector comprises roughly 20% of national GDP, with CNC machines playing a crucial role in automotive and electronics production.

- Approximately 55% of Japanese machine shops use CNC machines for precision engineering.

- Investment in automation technologies including CNC increased by 12% annually from 2018 to 2023.

- The domestic CNC machine market supports over 100,000 jobs in manufacturing and engineering.

China Ministry of Industry and Information Technology (MIIT)

- China is the largest global producer of CNC machines, accounting for over 30% of global manufacturing output.

- The adoption rate of CNC technology in Chinese factories increased by 25% between 2017 and 2022.

- Chinas government invested USD 1.5 billion in smart manufacturing initiatives including CNC automation from 2020 to 2023.

- CNC machining supports over 300,000 manufacturing enterprises across China.

India Ministry of Micro, Small and Medium Enterprises (MSME)

- Indian MSMEs contribute about 30% of the manufacturing output, increasingly integrating CNC machines to boost precision and reduce waste.

- CNC machine adoption in Indian manufacturing grew by 20% from 2019 to 2023.

- The government allocated USD 200 million towards modernization programs encouraging CNC usage in small industries.

- Indias export of CNC-machined components grew by 15% annually over the last five years.

Germany Federal Statistical Office (Destatis)

- Germany accounts for 40% of Europes CNC machine production capacity.

- Precision machinery, including CNC machines, contributed to a 10% rise in Germanys manufacturing export value from 2019 to 2023.

- Over 70% of German machine tool companies are investing in CNC system innovation.

- The manufacturing sectors investment in Industry 4.0 technologies, including CNC, grew by 22% in 2022.

South Korea Ministry of Trade, Industry and Energy (MOTIE)

- South Koreas manufacturing sector, with strong automotive and electronics segments, has a CNC machine adoption rate exceeding 60%.

- Government incentives boosted CNC-related technology R&D investments by 18% from 2020 to 2023.

- CNC machines accounted for over 25% of total capital expenditure in South Koreas precision engineering industry.

- South Korean exports of CNC-machined parts increased by 12% annually between 2018 and 2023.

U.S. Bureau of Labor Statistics (BLS)

- CNC machine operators represented approximately 130,000 jobs in the U.S. manufacturing sector as of 2024.

- Employment in CNC-related manufacturing roles is projected to grow by 8% through 2030 due to rising automation demand.

- The average hourly wage for CNC machinists increased by 5% annually from 2019 to 2024, reflecting skill demand.

- Over 40% of CNC machinists received formal training and certification sponsored by government workforce programs.

Canada Innovation, Science and Economic Development (ISED)

- Canadas manufacturing GDP contribution includes a growing CNC machinery sector, accounting for nearly 5% of total output.

- Adoption of CNC technology in Canadian factories grew by 15% between 2018 and 2023.

- Government programs have invested USD 100 million in CNC training and modernization initiatives.

- CNC machining supports over 40,000 skilled jobs in Canadas manufacturing sector.

Australia Department of Industry, Science and Resources

- CNC machines are used in over 50% of Australias advanced manufacturing facilities.

- The sector contributed 7% to Australias total manufacturing GDP in 2023.

- Investment in Industry 4.0 technologies including CNC systems increased by 20% between 2019 and 2023.

- Government grants and subsidies have accelerated CNC adoption in SMEs by 25% over the past five years.

Global CNC Machine Market: Market Dynamics

Global CNC Machine Market: Driving Factors

Rising Demand for Precision and Complex Machining Across Industries

The growing requirement for ultra-precise parts in industries like aerospace, defense, and medical devices is a major catalyst for CNC machine adoption. With the ability to achieve micron-level accuracy, CNC machines enable the production of geometrically complex components that traditional tools cannot replicate efficiently. Multi-axis CNC systems and automated tool changers enhance this capability further, reducing downtime and enabling uninterrupted operations in high-demand sectors.

Surge in Industrial Automation and Smart Factory Initiatives

As manufacturers embrace Industry 4.0, the integration of CNC machines into smart factory environments is driving market growth. These machines, when connected through IoT platforms, offer real-time monitoring, remote diagnostics, and predictive maintenance. Coupled with CAD/CAM software and AI-powered control systems, modern CNC machines improve productivity, reduce human error, and enhance supply chain responsiveness, especially in high-precision environments like automotive and electronics manufacturing.

Global CNC Machine Market: Restraints

High Initial Investment and Maintenance Costs

Despite long-term operational savings, the upfront capital required to purchase and integrate CNC machinery remains a barrier, particularly for small and medium-sized enterprises. Beyond acquisition, the cost of operator training, complex software licensing, and scheduled maintenance adds financial strain. This challenge can delay modernization plans in price-sensitive markets and slow down the adoption of cutting-edge precision machining solutions.

Shortage of Skilled Workforce and Programming Talent

The CNC market faces a talent gap, especially in developing countries, where access to qualified technicians and CNC programmers remains limited. As CNC machines become more complex with AI and sensor integration, the need for a workforce proficient in CNC coding, G-code language, and machine learning algorithms increases. The skill shortage hampers the full-scale implementation of advanced CNC systems in several industrial zones.

Global CNC Machine Market: Opportunities

Rapid Expansion of EV and Aerospace Manufacturing in Emerging Markets

Emerging economies in Asia-Pacific and Latin America are witnessing a surge in domestic electric vehicle production and aerospace part exports. These sectors require precise metal and composite machining, providing a fertile ground for CNC adoption. Governments in these regions are also supporting industrial digitization through incentives and infrastructure development, encouraging local players to upgrade from conventional machining to CNC-based operations.

Growth in Custom and Low-Volume Manufacturing

The growing trend toward personalized products and on-demand manufacturing presents an opportunity for CNC machine vendors to serve niche, high-margin markets. Sectors like medical implants, luxury components, and prototyping services demand small-batch, custom CNC machining capabilities. With advances in hybrid CNC machines that integrate additive and subtractive processes, manufacturers can now meet these requirements efficiently and cost-effectively.

Global CNC Machine Market: Trends

Integration of AI and Predictive Maintenance in CNC Systems

A key trend reshaping the CNC machine landscape is the incorporation of artificial intelligence for predictive analytics, tool life monitoring, and process optimization. Modern CNC units are now equipped with embedded sensors and edge computing processors to analyze real-time data and anticipate machine wear or operational faults before breakdowns occur. This shift not only minimizes unplanned downtime but also improves lifecycle management and ROI.

Proliferation of Cloud-Based CNC Programming and Remote Monitoring

As manufacturing becomes digital, cloud-connected CNC systems are gaining popularity. These systems allow remote access to machine operations, centralized data storage, and collaborative design iterations from anywhere in the world. Operators and engineers can track production metrics, adjust machining parameters, and update G-code instructions in real-time, significantly boosting agility and reducing lead times in competitive environments.

Global CNC Machine Market: Research Scope and Analysis

By Offering Analysis

In the global CNC machine market, machines are expected to dominate the offering segment by capturing 51.6% of the total market share in 2025. This dominance is driven by the growing demand for high-precision, automated, and high-speed machining solutions across a wide range of industries including automotive, aerospace, and medical device manufacturing. CNC machines, such as milling machines, lathes, routers, and grinding systems, serve as the core of modern production lines and are equipped with advanced technologies like multi-axis motion control, real-time feedback systems, and AI-powered predictive maintenance tools.

Manufacturers are prioritizing the acquisition of fully integrated CNC machines that support seamless CAD/CAM compatibility, energy efficiency, and IoT-enabled smart operations. As global industries shift toward more digitized and connected production ecosystems, the investment in complete CNC machines becomes a strategic priority, especially in large-scale and high-throughput facilities.

On the other hand, the Parts & Accessories segment also holds a critical role in the CNC value chain, catering to both maintenance and customization needs. This category includes essential components such as spindles, motors, servo drives, tool holders, collets, linear guides, and control panels, which are necessary for performance upgrades, replacements, and retrofitting of existing CNC systems. As machines age or technology evolves, industries seek high-precision aftermarket parts to extend machine life, enhance functionality, and reduce downtime.

Moreover, the growing popularity of modular CNC systems allows manufacturers to swap or upgrade components more flexibly, fueling demand for customizable and compatible parts. With a growing focus on sustainability and cost-efficiency, many organizations prefer to upgrade key modules rather than invest in entirely new machines, thus supporting steady growth in the parts and accessories segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Product Type Analysis

In the global CNC machine market, milling machines are projected to retain their leading position within the product type segment, accounting for

27.8% of the total market share in 2025. This continued dominance is driven by their unmatched versatility in shaping a wide range of materials such as metals, plastics, and advanced composites with high precision and operational repeatability.

CNC milling machines are widely adopted across automotive, aerospace, electronics, and tooling industries for tasks including contouring, slotting, gear fabrication, and surface finishing. The growing adoption of advanced technologies like high-speed spindles, multi-axis control, real-time adaptive feed rate optimization, and smart software interfaces has elevated the performance and efficiency of milling operations.

Furthermore, their ability to support both prototyping and mass production in digitally controlled environments aligns perfectly with the rising trend of automated and intelligent manufacturing systems.

On the other hand, machining centers are witnessing strong traction due to their multifunctional capabilities and seamless integration into smart factory ecosystems. These systems are designed to execute multiple operations such as milling, drilling, boring, and tapping within a single setup, significantly reducing changeover time and growing throughput. Vertical and horizontal machining centers are particularly valued in industries that demand high accuracy, complex geometry machining, and minimal downtime.

Equipped with tool magazines, automatic tool changers, and high-performance control units, machining centers offer unmatched productivity and consistency. With the growing shift toward Industry 4.0 practices, these machines now come with real-time process monitoring, cloud-based data sharing, and AI-enhanced diagnostics, making them ideal for high-mix low-volume production setups that demand precision, speed, and flexibility in one integrated platform.

By End-User Industry Analysis

In the global CNC machine market, the automotive and transportation industries are projected to maintain their leading position in the end-user segment, capturing 28.3% of the total market share in 2025. This dominance is fueled by the relentless demand for high-precision components such as engine blocks, transmission parts, brake systems, and chassis components that require complex machining processes.

CNC machines enable manufacturers to achieve the tight tolerances and consistent quality needed to meet rigorous safety and performance standards. Additionally, the ongoing shift towards electric vehicles and autonomous driving technologies is driving innovation in CNC machining, as manufacturers develop lightweight, durable, and highly intricate parts from advanced materials like aluminum alloys and carbon fiber composites. The adoption of automation, robotics, and Industry 4.0 integration within automotive production lines further accelerates CNC machine deployment, enhancing production efficiency, reducing lead times, and supporting just-in-time manufacturing models.

Meanwhile, the energy and power sector also represents a significant end-user segment, leveraging CNC machining for the fabrication of critical components used in renewable energy systems, power generation, and oil and gas infrastructure. This sector demands robust and precision-engineered parts such as turbine blades, compressor components, valve bodies, and drilling equipment that can withstand extreme operating conditions and high stress. CNC machines equipped with multi-axis capabilities and advanced material handling systems are essential for machining hard metals and superalloys commonly used in this industry.

The rising global focus on clean energy solutions like wind, solar, and hydroelectric power is driving demand for specialized CNC machining services that deliver complex geometries and superior surface finishes. Furthermore, energy sector manufacturers are adopting digital CNC platforms integrated with IoT and predictive maintenance technologies to optimize machine uptime and ensure operational reliability in critical infrastructure projects.

The CNC Machine Market Report is segmented on the basis of the following:

By Offering

- Machines

- Parts & Accessories

- Services

By Product Type

- Milling Machines

- Machining Centers

- Lathe Machines

- Laser Machines

- Drilling Machines

- Electrical Discharge Machines

By End-User Industry

- Automotive & Transportation

- Aerospace

- Medical

- Semiconductors

- Capital Goods

- Energy & Power

Global CNC Machine Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is set to lead the global CNC machine market landscape by capturing

34.9% of total global market revenue in 2025, driven by rapid industrialization and the expansion of manufacturing hubs across countries like China, Japan, South Korea, and India. The regions dominance is supported by a growing base of automotive, electronics, aerospace, and heavy machinery manufacturers who rely on CNC machines to meet rising demand for precision and efficiency.

Government initiatives promoting smart manufacturing, automation, and Industry 4.0 adoption further accelerate the deployment of advanced CNC technologies. Additionally, the availability of a skilled workforce combined with cost advantages in production makes Asia Pacific an attractive destination for CNC machine investments. The surge in exports from these manufacturing powerhouses also fuels demand for high-quality machining solutions, reinforcing the regions leadership position in the global CNC machine market.

Region with significant growth

The MEA region is expected to register the highest compound annual growth rate in the global CNC machine market, driven by growing investments in infrastructure development, oil and gas, and aerospace sectors. Rapid urbanization and industrial expansion in countries such as the United Arab Emirates, Saudi Arabia, and South Africa are fueling demand for advanced manufacturing technologies, including CNC machines.

Additionally, government initiatives focused on diversifying economies and promoting industrial automation contribute to accelerated adoption of CNC systems. The regions growing focus on precision engineering and the need for efficient, reliable production solutions further support its robust growth trajectory, making it one of the fastest-growing markets globally for CNC machinery and related technologies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global CNC Machine Market: Competitive Landscape

The global CNC machine market is highly competitive, characterized by the presence of numerous established multinational corporations and innovative emerging players striving to expand their market share through technological advancements and strategic partnerships. Leading companies focus heavily on research and development to introduce state-of-the-art CNC solutions featuring multi-axis capabilities, AI integration, and IoT connectivity that cater to the evolving demands of industries such as automotive, aerospace, and electronics.

Competition also revolves around offering comprehensive after-sales services, customized machining solutions, and scalable automation options to attract a diverse customer base. Additionally, mergers and acquisitions play a crucial role in consolidating market positions, enabling companies to broaden their product portfolios and geographic reach. The intense rivalry drives continuous innovation, cost optimization, and enhanced customer support, making the competitive landscape dynamic and rapidly evolving in response to global manufacturing trends.

Some of the prominent players in the Global CNC Machine Industry are:

- DMG MORI

- Mazak Corporation

- Haas Automation

- Okuma Corporation

- FANUC Corporation

- Siemens AG

- Mitsubishi Electric Corporation

- Hurco Companies, Inc.

- Hyundai WIA

- Makino Milling Machine Co., Ltd.

- JTEKT Corporation

- GROB-WERKE GmbH & Co. KG

- Doosan Machine Tools

- Dalian Machine Tool Group (DMTG)

- Hardinge Inc.

- Amera-Seiki

- Toshiba Machine Co., Ltd.

- Emco Group

- Schiess GmbH

- Fagor Automation

- Other Key Players

Global CNC Machine Market: Recent Developments

- March 2025: DMG MORI acquired a majority stake in a robotics automation firm to enhance smart CNC manufacturing capabilities.

- December 2024: Mazak Corporation completed the acquisition of a European precision tooling company to expand its CNC accessory offerings.

- August 2024: Okuma Corporation merged with a software firm specializing in AI-driven CNC control systems to strengthen Industry 4.0 integration.

- May 2024: FANUC Corporation acquired a sensor technology company to improve predictive maintenance features in its CNC machines.

- February 2024: Siemens AG finalized the acquisition of a digital twin solutions provider to bolster its CNC machine simulation and monitoring portfolio.

- November 2023: Mitsubishi Electric Corporation took over a CNC spindle manufacturer to enhance its core machining product lineup.

- July 2023: Haas Automation acquired a startup focused on cloud-based CNC programming platforms to expand its software services.

- April 2023: Hurco Companies, Inc. merged with a North American CNC retrofitting firm to offer upgraded machining solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 79.2 Bn |

| Forecast Value (2034) |

USD 194.3 Bn |

| CAGR (2025–2034) |

10.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 10.2 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Machines, Parts & Accessories, Services), By Product Type (Milling Machines, Machining Centers, Lathe Machines, Laser Machines, Drilling Machines, Electrical Discharge Machines), and By End-User Industry (Automotive & Transportation, Aerospace, Medical, Semiconductors, Capital Goods, Energy & Power) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

DMG MORI, Mazak Corporation, Haas Automation, Okuma Corporation, FANUC Corporation, Siemens AG, Mitsubishi Electric Corporation, Hurco Companies, Hyundai WIA, Makino Milling Machine, JTEKT Corporation, GROB-WERKE, Doosan Machine Tools, Dalian Machine Tool Group, Hardinge Inc., Amera-Seiki, Toshiba Machine, Emco Group, Schiess GmbH, Fagor Automation, and Other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global CNC machine market?

▾ The global CNC machine market size is estimated to have a value of USD 79.2 billion in 2025 and is expected to reach USD 194.3 billion by the end of 2034.

What is the size of the US CNC machine market?

▾ The US CNC machine market is projected to be valued at USD 10.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.8 billion in 2034 at a CAGR of 9.9%.

Which region accounted for the largest global CNC machine market?

▾ Asia Pacific is expected to have the largest market share in the global CNC machine market, with a share of about 34.9% in 2025.

Who are the key players in the global CNC machine market?

▾ Some of the major key players in the global CNC machine market are DMG MORI, Mazak Corporation, Haas Automation, Okuma Corporation, FANUC Corporation, Siemens AG, Mitsubishi Electric Corporation, Hurco Companies, Hyundai WIA, Makino Milling Machine, JTEKT Corporation, GROB-WERKE, Doosan Machine Tools, Dalian Machine Tool Group, Hardinge Inc., Amera-Seiki, Toshiba Machine, Emco Group, Schiess GmbH, Fagor Automation, and Other key players.

What is the growth rate of the global CNC machine market?

▾ The market is growing at a CAGR of 10.5 percent over the forecasted period.