Market Overview

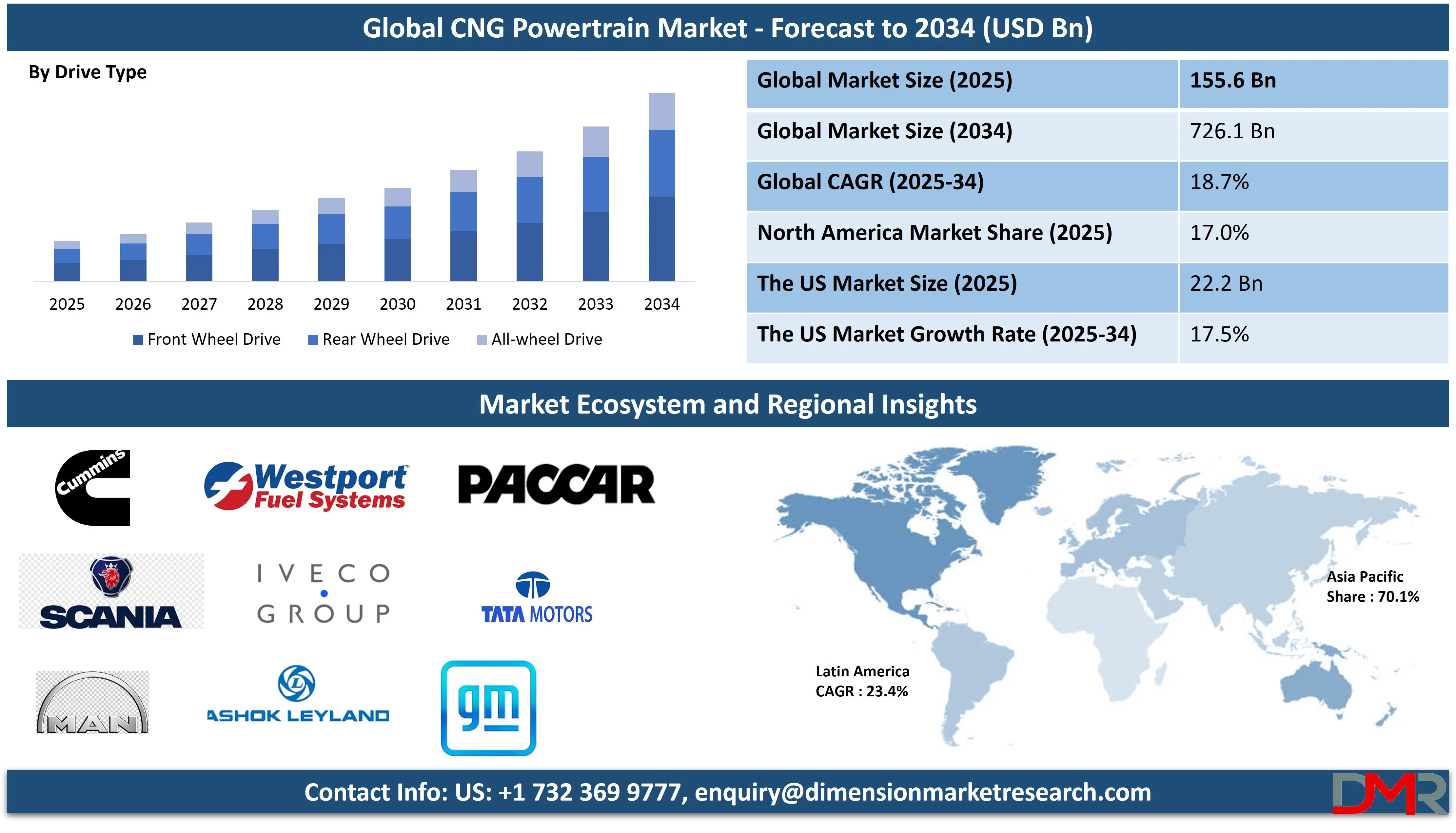

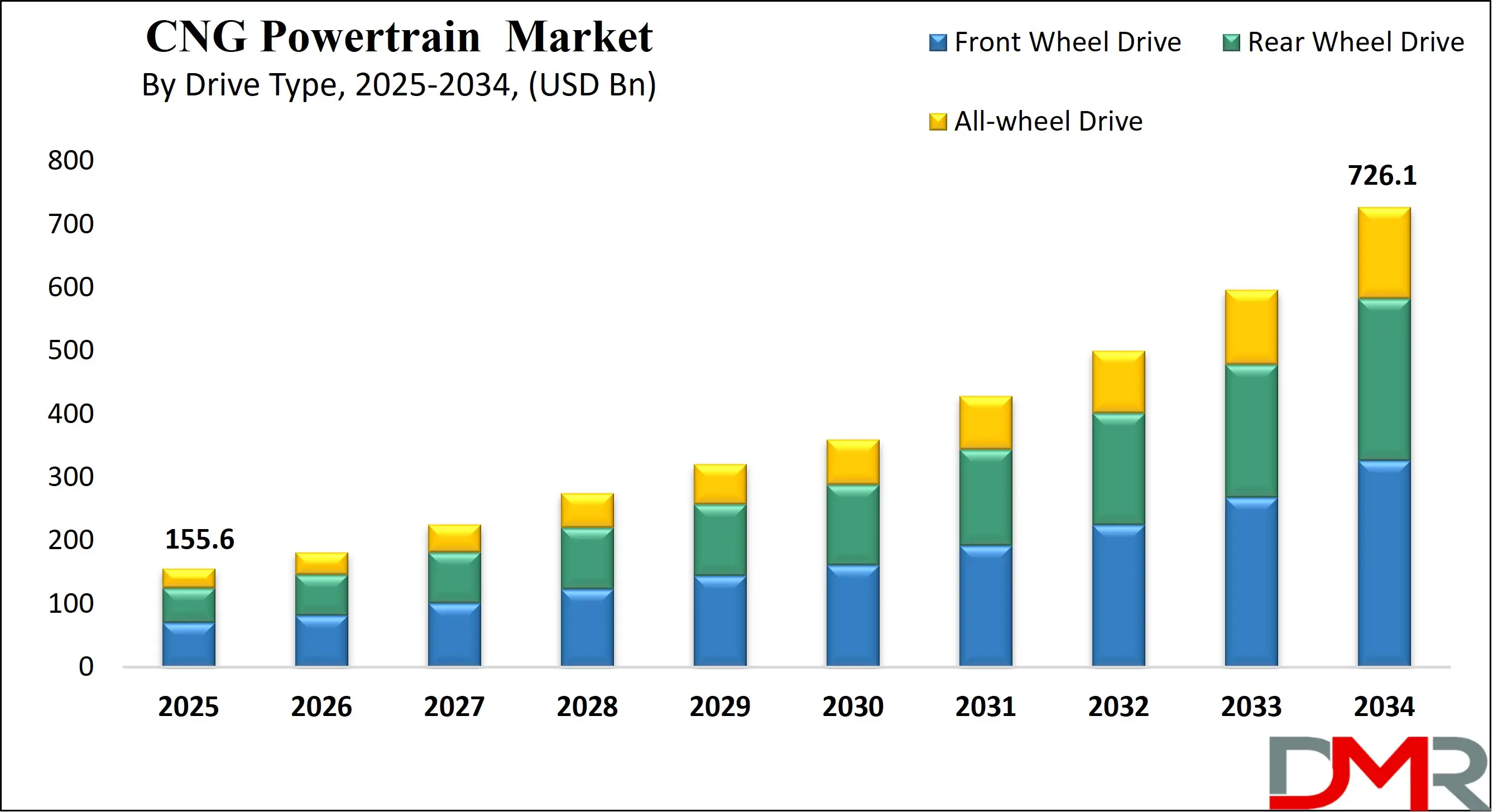

The Global CNG Powertrain Market is predicted to be valued at USD 155.6 billion in 2025 and is expected to grow to USD 726.1 billion by 2034, registering a compound annual growth rate (CAGR) of 18.7% from 2025 to 2034.

A CNG (Compressed Natural Gas) powertrain is a vehicle propulsion system that uses compressed natural gas as fuel instead of gasoline or diesel. It typically includes a CNG storage tank, fuel injectors, engine modifications, and control units designed to handle gas combustion.

Low-carbon propulsion systems like these are increasingly being viewed as transitional solutions toward full electrification. CNG powertrains produce lower emissions of carbon monoxide, nitrogen oxides, and particulate matter, making them environmentally friendly and cost-effective for long-term use.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

They are commonly found in passenger cars, buses, and commercial vehicles. CNG engines operate similarly to gasoline engines but require specialized fuel systems and infrastructure for refueling, making them suitable for regions with established CNG networks and emerging green technology & sustainability initiatives.

The global CNG powertrain market is witnessing significant growth driven by increasing environmental awareness and stringent emission regulations. As governments and industries prioritize low-emission transport solutions, compressed natural gas vehicles are gaining momentum for both commercial and passenger vehicle applications, especially in urban settings where climate risk management and carbon neutrality goals are advancing rapidly.

Automakers are investing in the development of advanced CNG engines, fuel injection systems, and lightweight storage tanks to enhance vehicle performance and fuel efficiency. The adoption of bi-fuel and mono-fuel CNG systems in powertrain architecture has also accelerated, catering to consumer demands for sustainable and economical vehicle alternatives in various transportation sectors. These vehicles complement other technologies like electric car platforms and biofuel-based mobility solutions.

Key market players are forming strategic alliances and expanding their portfolios to integrate CNG-compatible components such as turbochargers, engine control units, and emission control technologies. This collaborative approach supports the wider deployment of CNG propulsion systems across light-duty vehicles, heavy-duty trucks, and public transit fleets, aligning with global efforts to decarbonize the transport sector.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The availability of CNG refueling infrastructure and advancements in engine design are crucial to the continued expansion of the CNG powertrain industry. With supportive policy frameworks, rising fuel prices, and public-private investments in clean mobility, the demand for compressed natural gas vehicles is expected to continue on an upward trajectory, positioning CNG as a viable bridge fuel in the transition to a low-carbon future.

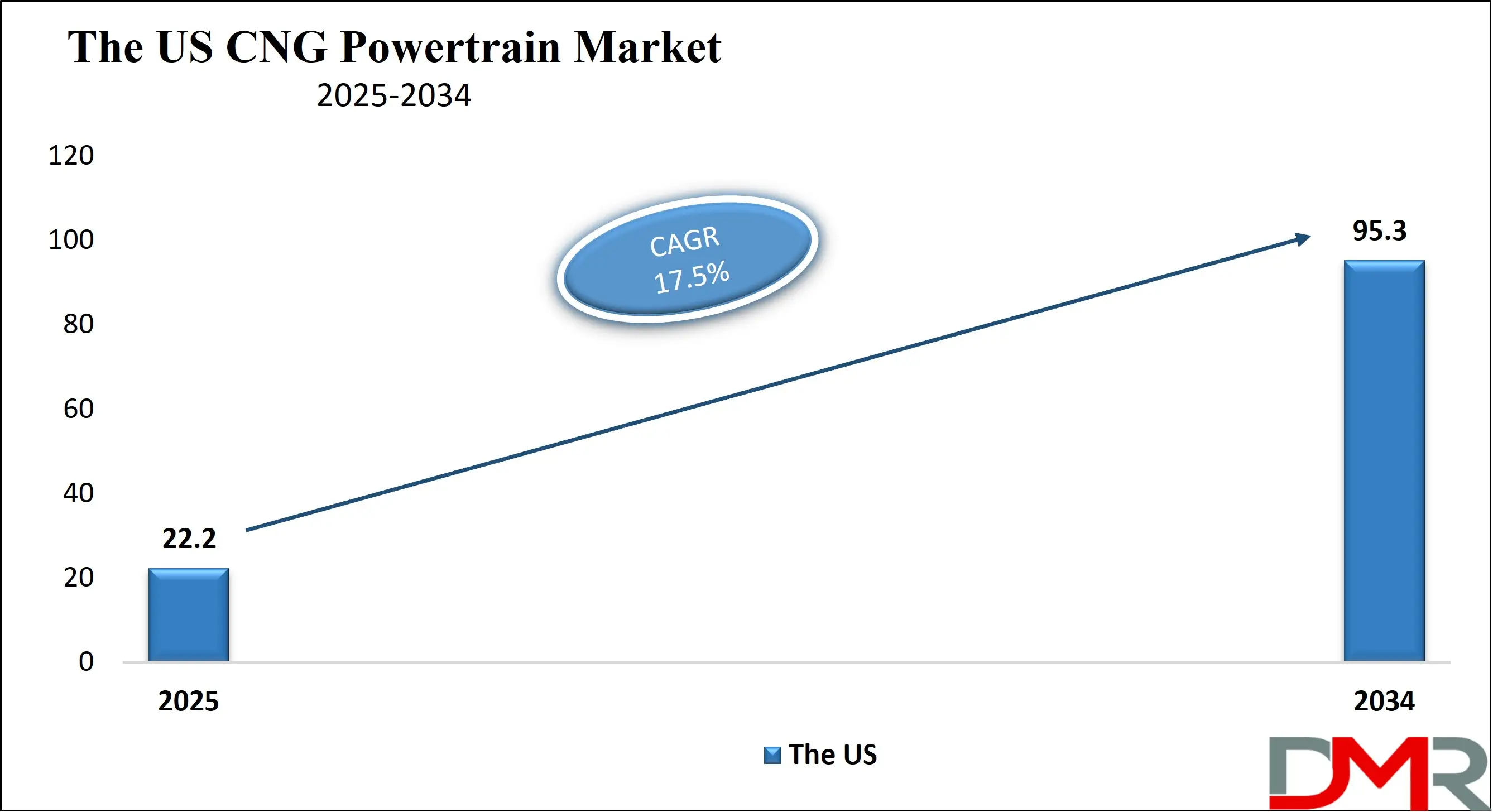

The US CNG Powertrain Market

The US CNG Powertrain Market is projected to be valued at USD 22.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 95.3 billion in 2034 at a CAGR of 17.5%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US CNG powertrain market is driven by strong government support for clean energy transportation and stringent emission regulations. Increasing demand for low-emission alternatives in commercial fleets, especially in logistics and public transport, further propels adoption.

Availability of domestic natural gas sources and the rising fuel cost differential between gasoline and CNG offer economic benefits to fleet operators. The integration of automotive semiconductor technologies is improving CNG engine efficiency and diagnostics. Additionally, infrastructure expansion through public-private partnerships supports easier refueling access.

Key trends shaping the market include the integration of advanced engine control systems to improve fuel efficiency and reduce emissions. Automakers are collaborating with tech firms to optimize CNG-compatible engines using automotive chip innovations and smart diagnostics. Retrofitting of existing internal combustion vehicles with CNG kits is also on the rise, and investments in renewable and synthetic natural gas highlight a shift toward sustainability.

The Japan CNG Powertrain Market

The Japan CNG Powertrain Market is projected to be valued at USD 10.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 35.8 billion in 2034 at a CAGR of 14.0%.

Japan’s CNG powertrain market, valued at USD 10.9 billion in 2025, is driven by its commitment to reducing greenhouse gas emissions and dependency on imported fossil fuels. The government’s emphasis on clean energy transition and the Tokyo Metropolitan Government’s air quality improvement initiatives encourage adoption. Logistics companies are adopting automotive plastic compounding for lighter vehicle components to improve efficiency.

Current trends indicate growing investment in compact and light-duty CNG vehicles tailored for urban logistics and delivery services. Research is also being focused on integrating CNG technology with hybrid systems and electric vehicle battery platforms for better energy utilization. Rising interest in synthetic natural gas and blue hydrogen fuels derived from renewable sources further supports the nation’s sustainability roadmap.

The Europe CNG Powertrain Market

The Europe CNG Powertrain Market is projected to be valued at USD 12.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 38.1 billion in 2034 at a CAGR of 13.0%.

Europe’s CNG powertrain market, valued at USD 12.5 billion in 2025, benefits from rigorous EU carbon neutrality targets and low-emission regulations. Incentives like tax exemptions and low-emission zones encourage CNG adoption. The region’s mature infrastructure, particularly in Germany and Italy, supports a growing network of specialty gas and industrial gas refueling stations.

Emerging trends include the rise of biomethane integration, which aligns with green ammonia initiatives to decarbonize heavy transport. Automakers are launching new CNG variants across passenger and commercial fleets, integrating automotive battery thermal management system technologies to ensure efficiency in hybrid-CNG configurations. Furthermore, industrial automation and smart demand response technologies are enhancing energy optimization across CNG refueling facilities.

CNG Powertrain Market: Key Takeaways

- Market Overview: The global CNG powertrain market is anticipated to be valued at USD 155.6 billion in 2025 and is forecast to expand significantly, reaching USD 726.1 billion by 2034. This growth corresponds to a robust CAGR of 18.7% throughout the forecast period from 2025 to 2034.

- By Drive Type Analysis: Front Wheel Drive systems are expected to take the lead in the global CNG powertrain market by 2025, representing approximately 52.4% of the overall market share.

- By Fuel Type Analysis: Bi-fuel configurations are projected to dominate the market landscape by the end of 2025, accounting for nearly 68.9% of the total share due to their flexibility and efficiency.

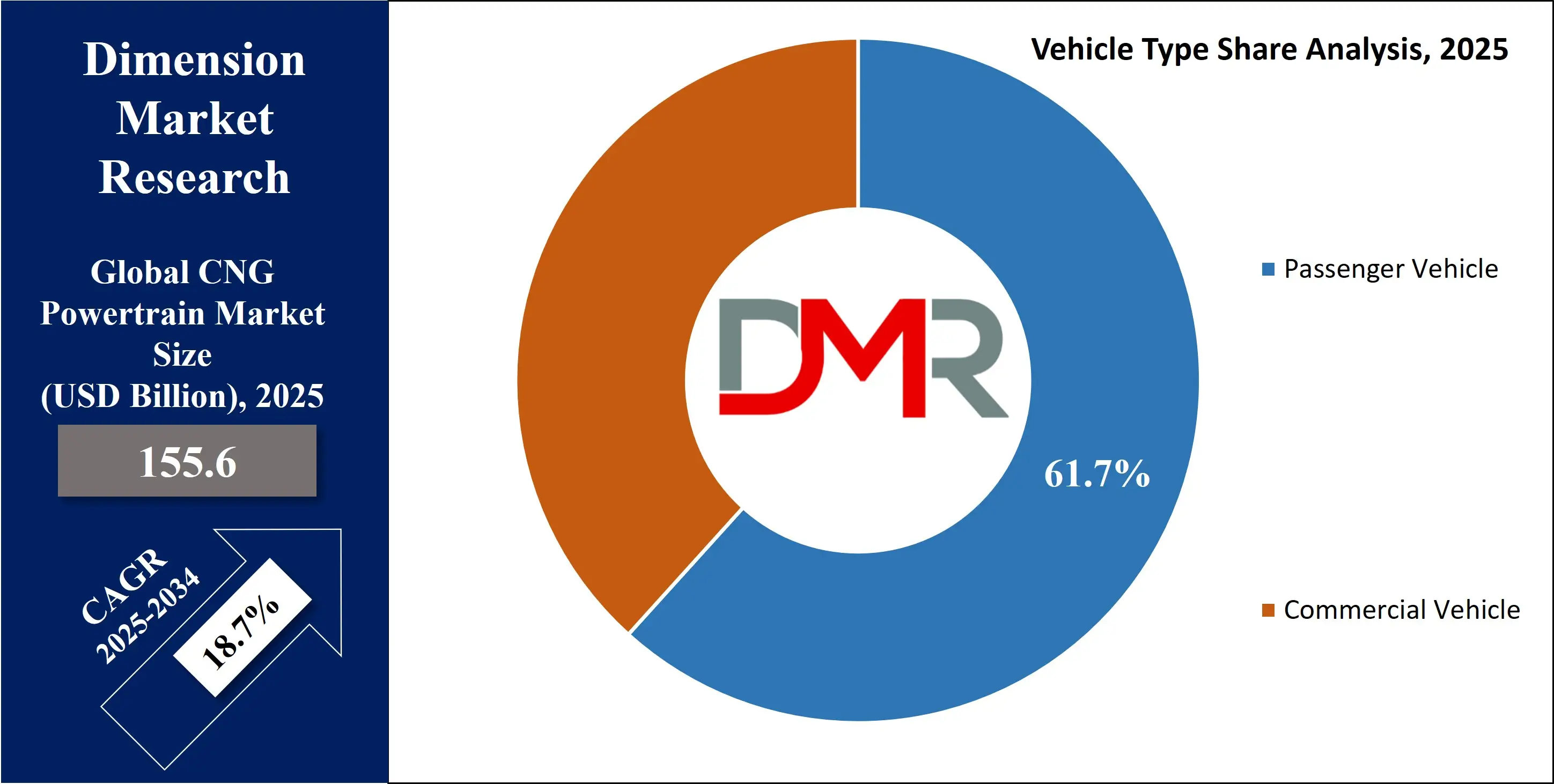

- By Vehicle Type Analysis: Passenger vehicles are set to be the leading segment in the CNG powertrain market by 2025, making up around 61.7% of the global market value.

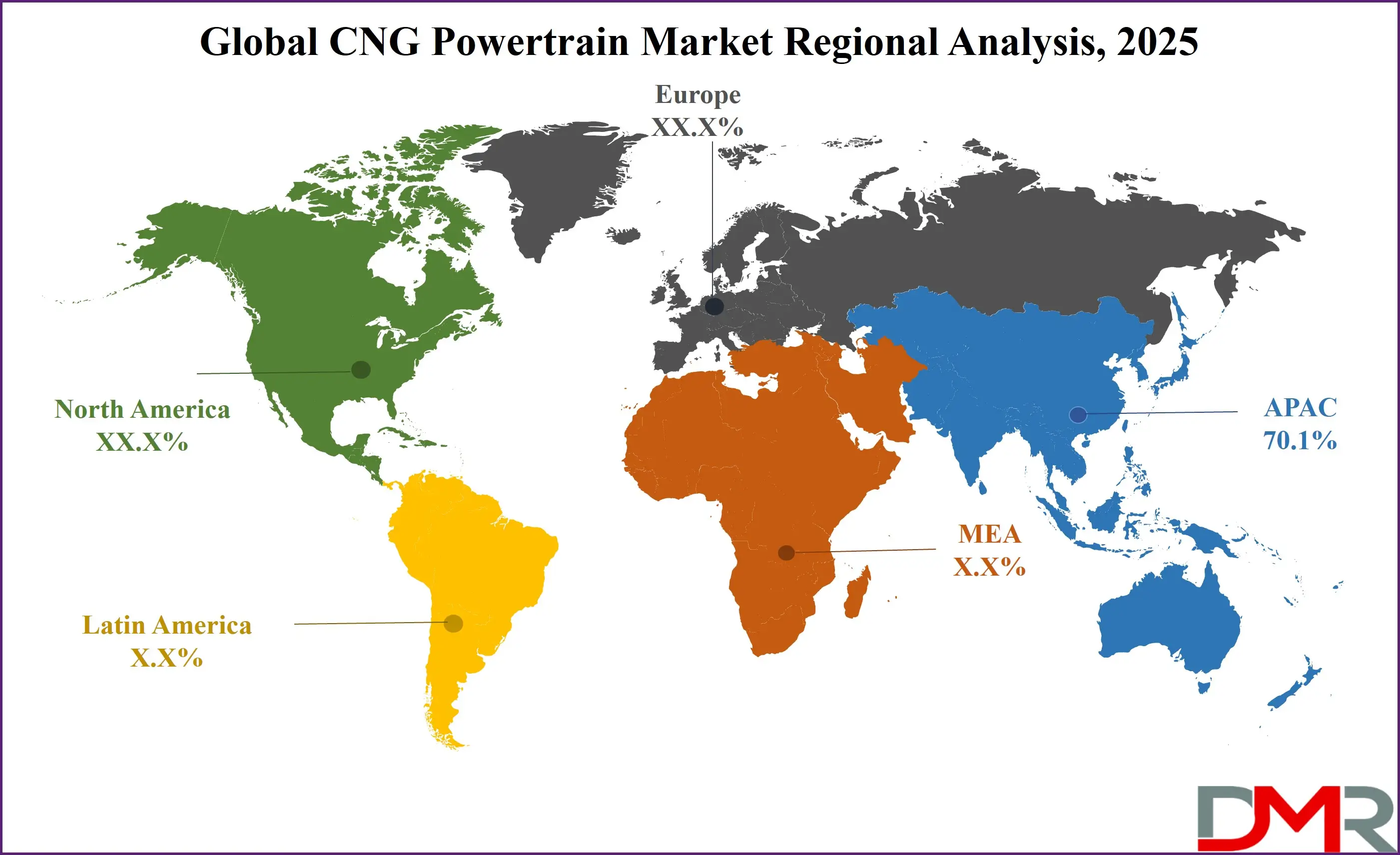

- Region with the Largest Share: Asia-Pacific is anticipated to be the top regional contributor in the global CNG powertrain industry, holding an estimated 70.1% share of the market by the end of 2025.

CNG Powertrain Market: Use Cases

- Public Transportation Fleets: City buses and government-operated transit systems use CNG powertrains to reduce emissions and fuel costs. These vehicles offer a cleaner alternative to diesel-powered buses, improving air quality and promoting sustainable urban mobility while delivering consistent performance in high-mileage, stop-and-go urban routes.

- Commercial Delivery Vehicles: CNG-powered vans and trucks are widely used by logistics and delivery companies for short to medium-haul transportation. These fleets benefit from lower operating costs and fewer emissions, supporting corporate sustainability goals while ensuring reliable delivery performance in congested urban and suburban areas.

- Taxi and Ride-Hailing Services: Taxi operators and ride-hailing platforms integrate CNG powertrains into their vehicle fleets to cut fuel expenses and meet eco-friendly regulations. The long-term cost savings and reduced carbon footprint make CNG vehicles a preferred choice for continuous daily use in city environments.

- Municipal Utility Vehicles: Garbage trucks, maintenance vehicles, and other municipal utility fleets adopt CNG powertrains to align with green city initiatives. These vehicles operate in local jurisdictions and help minimize urban pollution while maintaining the heavy-duty capability required for public service tasks.

- Intercity Buses: CNG-powered long-distance buses offer a more sustainable option for regional travel. These buses cater to environmentally conscious passengers and governments promoting low-emission travel, delivering comfort, fuel efficiency, and reduced environmental impact across long routes.

CNG Powertrain Market: Stats & Facts

- U.S. Department of Energy (DOE): A CNG-powered vehicle can reduce greenhouse gas emissions by up to 20% compared to gasoline-powered vehicles.

- International Energy Agency (IEA): As of recent years, there are more than 28 million natural gas vehicles (NGVs) globally, with a significant share using CNG powertrains.

- California Air Resources Board (CARB): CNG engines emit up to 90% fewer NOx emissions compared to traditional diesel engines.

- U.S. Environmental Protection Agency (EPA): CNG combustion produces approximately 25% less CO₂ per unit of energy than gasoline.

- NGVA Europe (Natural & bio Gas Vehicle Association): In 2024, over 1.5 million vehicles in Europe were running on CNG, supported by more than 4,000 refueling stations.

- Tata Motors (OEM Source): Their CNG passenger vehicles offer up to 30-35% lower running costs compared to petrol models.

- Indian Ministry of Petroleum & Natural Gas: India had over 7,000 CNG stations in operation by mid-2024, showing a 50% increase in 3 years.

- International Association for Natural Gas Vehicles (IANGV): Light-duty CNG vehicles typically have a driving range of 200 to 400 km per tank, depending on tank size and vehicle weight.

- Scania Group (Commercial Vehicle Manufacturer): Their CNG trucks deliver up to 15% lower fuel consumption compared to diesel counterparts when optimized.

- Society of Indian Automobile Manufacturers (SIAM): In FY 2023-24, CNG vehicle sales in India rose by over 40% year-on-year, driven by rising fuel prices and eco-conscious policies.

CNG Powertrain Market: Market Dynamics

Driving Factors in the CNG Powertrain Market

Growing Demand for Cleaner Transportation Alternatives

The rising environmental awareness and tightening emission norms have significantly boosted the adoption of CNG powertrain vehicles. Governments worldwide are promoting clean fuel technologies to combat urban air pollution. Compressed Natural Gas emits fewer pollutants compared to gasoline or diesel, making it ideal for eco-conscious consumers.

The shift towards sustainable mobility has created a strong push for natural gas vehicle (NGV) deployment across light-duty and commercial vehicle fleets. In emerging economies, the cost benefits of CNG fuel are also a compelling factor for mass adoption. With increasing emphasis on low-emission vehicles, the CNG powertrain market is gaining traction among both individual and fleet buyers.

Cost-Effectiveness of CNG as an Automotive Fuel

CNG offers significant savings in fuel costs compared to conventional fuels, making it an attractive option for both personal and commercial vehicle owners. The lower operational cost over the vehicle's lifecycle enhances its appeal in cost-sensitive markets.

This economic advantage, along with rising fuel prices and growing demand for alternative fuel vehicles, is driving interest in CNG-powered cars, vans, and buses. In regions with well-established CNG refueling infrastructure, the total cost of ownership for CNG vehicles remains significantly lower. This affordability strengthens the position of CNG internal combustion engines in the face of rising fuel economy expectations.

Restraints in the CNG Powertrain Market

Limited Refueling Infrastructure in Developing Regions

A significant challenge facing the CNG powertrain market is the lack of adequate CNG fueling stations, particularly in rural and underdeveloped regions. In countries with inconsistent infrastructure investment, vehicle owners face range anxiety and operational limitations.

The dependence on a limited number of urban fueling points discourages widespread adoption of compressed natural gas powertrains, especially for long-distance or intercity travel. Without substantial improvements in natural gas distribution networks, the potential of the market remains underutilized. This infrastructural bottleneck hampers the growth trajectory of alternative fuel mobility solutions like CNG.

Competition from Electrification and Hybrid Technologies

As the global automotive sector moves toward full electrification, CNG powertrains face increasing competition from electric vehicles (EVs) and hybrid models. Governments and automakers are investing heavily in EV charging infrastructure and battery development, drawing attention away from gas-based propulsion systems.

Moreover, the perception of CNG as a transitional solution rather than a long-term clean fuel alternative affects investor interest. With advances in battery range and falling EV costs, consumers may prefer zero-emission vehicles over CNG-powered options, which still emit greenhouse gases. This technological competition could limit future expansion in the compressed natural gas vehicle market.

Opportunities in the CNG Powertrain Market

Government Incentives and Emission Norms Favoring CNG Adoption

Global efforts to reduce greenhouse gas emissions are opening new avenues for CNG vehicle adoption. Governments are offering tax rebates, purchase subsidies, and other policy support for the use of alternative fuel technologies. In countries like India, Italy, and Iran, where CNG infrastructure is improving, public transportation and logistics fleets are rapidly transitioning to CNG-powered vehicles.

Moreover, stricter vehicle emission standards are encouraging manufacturers to invest in fuel-efficient, low-emission CNG powertrains. These supportive regulations and environmental goals create a favorable ecosystem for accelerating the use of natural gas mobility solutions across various transport segments.

Rising Adoption in Commercial and Public Transport Fleets

The commercial vehicle segment is increasingly recognizing the benefits of CNG engines in reducing fuel costs and improving environmental compliance. Urban bus fleets, school transport, delivery vans, and municipal vehicles are progressively switching to CNG for cleaner operations. This trend is particularly strong in regions with heavy traffic congestion and strict emission regulations.

The scalability, low noise levels, and proven safety of CNG combustion engines further enhance their appeal in high-mileage applications. As governments and private operators look to modernize fleets and cut carbon emissions, the CNG vehicle market stands poised to gain substantial momentum.

Trends in the CNG Powertrain Market

Integration of Advanced CNG Powertrain Technologies

Technological advancements in dual-fuel systems, engine optimization, and lightweight materials are enhancing the performance and reliability of CNG powertrains. Automakers are investing in turbocharged CNG engines, onboard diagnostics, and fuel injection improvements to ensure smoother operation and extended vehicle life.

These innovations allow CNG vehicles to deliver performance on par with gasoline counterparts while maintaining lower emissions. The growing R&D investment in clean fuel propulsion technologies is resulting in more efficient, durable, and cost-effective CNG systems. This trend is helping CNG vehicle manufacturers stay competitive amidst evolving fuel technologies.

Expansion of OEM Offerings and Strategic Collaborations

Major automotive OEMs are increasingly introducing factory-fitted CNG variants across different vehicle classes, from hatchbacks to heavy-duty trucks. Collaborations between vehicle manufacturers and energy companies are supporting CNG infrastructure development, including mobile refueling units and micro-stations.

These partnerships aim to enhance the accessibility and reliability of natural gas refueling solutions, especially in underserved markets. This trend reflects a shift from retrofitted to purpose-built CNG vehicles, improving performance, safety, and user experience. As OEMs diversify their alternative fuel portfolios, CNG powertrains are becoming a core component of sustainable mobility strategies.

CNG Powertrain Market: Research Scope and Analysis

By Drive Type Analysis

Front Wheel Drive is projected to dominate the global CNG Powertrain market by the end of 2025, accounting for 52.4% of the total share. Its widespread integration in compact and mid-sized vehicles, especially in urban mobility segments, makes it a preferred choice among automakers. The cost-efficiency of front wheel drive configurations combined with their lighter weight and better fuel economy makes them ideal for CNG engine applications.

Increasing consumer demand for affordable and environmentally sustainable vehicles is propelling the adoption of these layouts. Additionally, the front-wheel layout simplifies the drivetrain, which is crucial for optimizing performance in compressed natural gas vehicle platforms while lowering maintenance costs.

All-wheel Drive is expected to witness the highest CAGR in the global CNG Powertrain market by 2025. As advancements in drivetrain technologies continue, OEMs are actively incorporating AWD systems into alternative fuel vehicles for improved traction and performance in varied terrains.

CNG SUVs and crossover vehicles are gaining attention in emerging markets where off-road and multi-condition capability is needed. The integration of CNG systems with AWD platforms is also attracting fleet operators who require power and stability without compromising on environmental compliance. The rising demand for performance-oriented green vehicles is driving this growth segment.

By Fuel Type Analysis

Bi-fuel systems are expected to lead the global CNG Powertrain market by 2025, holding a 68.9% share. Their dual-fuel capability, which operates on both gasoline and compressed natural gas, offers users flexibility, especially in regions with limited CNG refueling infrastructure.

This hybrid fueling solution reduces range anxiety and provides cost savings over time, making it attractive to consumers and fleet operators alike. Growing environmental concerns, government incentives for low-emission vehicles, and the need for cleaner fuel alternatives are key contributors to the rising popularity of bi-fuel configurations across various automotive classes.

Mono Fuel CNG systems are projected to grow at the highest CAGR in the CNG Powertrain market by 2025. The increasing production of factory-fitted mono-fuel vehicles, especially in Asia-Pacific and Latin America, combined with advances in CNG engine optimization, is driving this growth.

These vehicles are specifically designed to maximize fuel efficiency and performance using only natural gas, making them more cost-effective in the long run. Their lower emissions profile aligns with stricter global emissions norms, encouraging OEMs to ramp up production. Government support in the form of subsidies and tax rebates for eco-friendly vehicles further fuels demand for mono-fuel powertrains.

By Vehicle Type Analysis

Passenger Vehicles are expected to dominate the global CNG Powertrain market by the end of 2025, securing 61.7% of the total market share. Rapid urbanization, rising disposable incomes, and an increasing shift toward environmentally sustainable personal transportation are key contributors to this dominance.

Automakers are actively launching CNG variants across hatchbacks, sedans, and compact SUVs to cater to the growing eco-conscious consumer base. Moreover, advancements in CNG storage and combustion technology have made passenger vehicles more efficient, reliable, and appealing, especially in densely populated and pollution-prone cities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Commercial Vehicles are projected to register the highest CAGR in the global CNG Powertrain market by 2025. With rising fuel prices and strict emission regulations, fleet operators are transitioning toward CNG-powered buses, trucks, and vans to reduce operational costs and carbon footprints.

Public transportation networks in several developing countries are also being upgraded with CNG fleets due to government-backed initiatives and subsidies. Additionally, logistics companies are exploring cleaner fuel alternatives to meet sustainability goals. This shift is accelerating the adoption of CNG in commercial segments across both short-haul and long-haul transportation.

The CNG Powertrain Market Report is segmented based on the following

By Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All-wheel Drive

By Fuel Type

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Regional Analysis

Region with the largest Share

Asia-Pacific is projected to hold the largest share in the global CNG Powertrain market with a revenue share of 70.1% by the end of 2025. The region benefits from a massive population base, rising vehicle production, and government policies encouraging the adoption of cleaner fuels.

Countries like India, China, and Pakistan are heavily investing in natural gas infrastructure and offering strong policy support for CNG vehicles. Rapid urbanization and the increasing need for low-emission public transport are also key drivers.

Moreover, the availability of domestic natural gas reserves and cost advantages over gasoline and diesel make compressed natural gas powertrains an attractive solution for both consumers and fleet operators in the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific is projected to hold the largest share in the global CNG Powertrain market by the end of 2025. The region benefits from a massive population base, rising vehicle production, and government policies encouraging the adoption of cleaner fuels. Countries like India, China, and Pakistan are heavily investing in natural gas infrastructure and offering strong policy support for CNG vehicles.

Rapid urbanization and the increasing need for low-emission public transport are also key drivers. Moreover, the availability of domestic natural gas reserves and cost advantages over gasoline and diesel make compressed natural gas powertrains an attractive solution for both consumers and fleet operators in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in CNG Powertrain Market

- AI-Driven Fuel Management and Emission Reduction: Artificial Intelligence is transforming the CNG powertrain market by enabling smarter fuel management systems. AI-powered sensors and control units optimize the air-fuel ratio, ignition timing, and engine parameters in real-time, improving fuel efficiency and reducing emissions. This intelligent calibration significantly enhances engine performance across varied driving conditions without compromising environmental goals.

- Predictive Maintenance with Machine Learning: Predictive maintenance is another major area influenced by AI integration in CNG vehicles. Machine learning algorithms analyze data from sensors to detect anomalies or signs of wear in engine components before failure occurs. This proactive maintenance approach reduces downtime, increases fleet reliability, and extends the lifespan of powertrain systems, making operations more cost-effective.

- Enhanced Fleet Operations through Driver Behavior Analysis: AI is also improving driver behavior analysis in fleet operations. CNG fleet managers can now use AI-driven telematics to monitor driving patterns, fuel usage, and route efficiency. These insights help in optimizing driving styles, reducing fuel consumption, and enforcing eco-driving habits that align with sustainability targets.

- Intelligent Control in CNG Hybrid Systems: AI contributes to the advancement of CNG hybrid systems. By learning from real-time data, AI can intelligently switch between CNG and other power sources, ensuring optimal performance under different load and terrain conditions. This hybrid strategy allows for more flexible and efficient transportation while supporting the transition toward cleaner mobility solutions.

Competitive Landscape

The global CNG Powertrain market is characterized by a competitive landscape with both global automotive giants and regional players competing for market share. Leading manufacturers such as Fiat Chrysler Automobiles, Suzuki Motor Corporation, Hyundai Motor Company, and Volkswagen AG are heavily investing in compressed natural gas vehicle technologies and expanding their CNG vehicle portfolios. These players are focusing on innovation in fuel-efficient CNG engines, enhanced CNG tank storage systems, and strategic partnerships with infrastructure developers.

Startups and regional OEMs in emerging markets are also entering the fray with cost-effective bi-fuel and mono-fuel vehicle solutions. As governments across the globe tighten emission standards and promote eco-friendly transport, companies are ramping up R&D in alternative fuel technologies. The increasing demand for sustainable mobility solutions is pushing key players to optimize their production lines for CNG-based powertrains.

Moreover, collaborations with energy and gas distribution companies are enabling better access to refueling networks, further supporting the ecosystem. With advancements in CNG injection systems, enhanced performance metrics, and a focus on affordability, the competitive intensity in the natural gas powertrain market is expected to escalate in the coming years.

Some of the prominent players in the Global CNG Powertrain Market are:

- Cummins Inc.

- Westport Fuel Systems Inc.

- Volvo Group

- Tata Motors Limited

- Iveco Group N.V.

- MAN SE

- Scania AB

- Ashok Leyland

- General Motors

- PACCAR Inc.

- CNH Industrial N.V.

- Landi Renzo S.p.A.

- Bosch Mobility Solutions

- Maruti Suzuki India Limited

- Ford Motor Company

- Renault Group

- Dongfeng Motor Corporation

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Volkswagen AG

- Other Key Players

Recent Developments

- In January 2025, Tata Motors launched a new range of heavy-duty CNG powertrain trucks designed for long-haul transportation, enhancing fuel efficiency and reducing carbon emissions across Indian highways.

- In March 2025, Cummins Inc. unveiled its next-gen CNG powertrain engines optimized for commercial fleets in Europe, focusing on cleaner combustion and meeting stringent Euro VII emission norms.

- In June 2025, Ashok Leyland partnered with Indian Oil to pilot CNG-powered intercity buses in southern India, aiming to accelerate adoption of low-emission transport options in Tier-2 cities.

- In February 2024, Westport Fuel Systems announced a joint venture with a Chinese OEM to expand its CNG powertrain technologies for urban buses and delivery vehicles across major Chinese provinces.

- In October 2024, Maruti Suzuki began manufacturing factory-fitted CNG variants of its top-selling hatchbacks with enhanced mileage, targeting eco-conscious urban consumers in India’s top metro cities.

- In July 2024, Iveco launched a new line of natural gas-powered commercial vans in Europe, featuring improved torque and reduced operational costs for last-mile logistics operators.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 155.6 Bn |

| Forecast Value (2034) |

USD 726.1 Bn |

| CAGR (2025–2034) |

18.7% |

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 22.2 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Drive (Front Wheel Drive, Rear Wheel Drive, All-wheel Drive), By Fuel (Mono Fuel and Bi-fuel), By Vehicle (Passenger Vehicle and Commercial Vehicle) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cummins Inc., Westport Fuel Systems Inc., Volvo Group, Tata Motors Limited, Iveco Group N.V., MAN SE, Scania AB, Ashok Leyland, General Motors, PACCAR Inc., CNH Industrial N.V., Landi Renzo S.p.A., Bosch Mobility Solutions, Maruti Suzuki India Limited, Ford Motor Company, Renault Group, Dongfeng Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., Volkswagen AG., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global CNG Powertrain Market?

▾ The Global CNG Powertrain Market size is estimated to have a value of USD 155.6 billion in 2025 and is expected to reach USD 726.1 billion by the end of 2034.

Which region accounted for the largest Global CNG Powertrain Market?

▾ Asia Pacific is expected to be the largest market share for the Global CNG Powertrain Market with a share of about 70.1% in 2025.

Who are the key players in the Global CNG Powertrain Market?

▾ Some of the major key players in the Global CNG Powertrain Market are Cummins Inc., Westport Fuel Systems Inc., Tata Motors Limited., and many others.

What is the growth rate in the Global CNG Powertrain Market?

▾ The market is growing at a CAGR of 18.7% over the forecasted period.

How big is the US CNG Powertrain Market?

▾ The US CNG Powertrain Market size is estimated to have a value of USD 22.2 billion in 2025 and is expected to reach USD 95.3 billion by the end of 2034.