Commercial displays are the type of displays that are purpose-built for professional settings, serving to showcase media & digital content effectively. Several top brands offer excellent models that allow modern & engaging message communication.

The demand for advanced display technologies, including digital signage and interactive displays, is rapidly increasing across sectors such as retail, hospitality, and corporate environments. LED and OLED technologies are gaining widespread adoption, offering superior resolution and energy efficiency compared to alternatives like LCD displays. Additionally, their use is expanding in events and public spaces for dynamic content delivery.

A key trend driving growth is the industry's focus on sustainability, with manufacturers developing energy-efficient and eco-friendly displays. Micro LED technology has now entered commercial applications, addressing previous scalability challenges, while the digital transformation of customer experiences in emerging markets is accelerating these technological advancements. At the same time, the

industrial display sector is seeing strong growth due to the rising demand for rugged, durable display solutions in manufacturing and production environments.

As businesses upgrade aging display infrastructures in developed markets, opportunities abound as companies focus on upgrading them with IoT integration for interactive environments and connected environments. Companies are taking advantage of these advancements to cater to diverse industry needs by offering tailored solutions that support advertising, branding, and communication goals.

The commercial display market has experienced remarkable expansion with the rise of advanced technologies such as digital signage. Now powering over 60% of retail communication strategies worldwide and improving customer engagement, digital signage now accounts for 60% of retail communication strategies globally; interactive kiosks have gained prominence, especially within hospitality venues where their deployment increased by 35% between 2022-2023; retail applications account for almost 40% of total display installations worldwide.

Large-format displays are an increasingly popular medium for outdoor advertising, used by 85% of urban locations to deliver dynamic content delivery. Video wall installations in corporate sectors have seen an annual increase of 25% due to demand for HD collaborative tools; and LED and OLED technologies have witnessed their adoption rates increasing by 30% as public spaces take notice of their energy efficiency and superior image quality.

Analysts note the rising prominence of digital signage, now accounting for

more than 60% of retail communication globally, and its rapid uptake - showing an

uptick of 30% across public and corporate sectors - of LED and OLED technologies. This growth overlaps with the expanding

3D Display and Electronic Display Market, which are finding new opportunities in both consumer-facing and professional applications.

Market Dynamic

At present, the advertising industry is experiencing growth in the production of ultra-HD content, a significant shift from the past when the devices for creating such content were expensive and had limited use, like

4K TVs, which among advertisers to generate UHD content for many advertising purposes is prompting the requirement for 4K & 8K commercial display products. Moreover, high investments by manufacturers in crafting high-specification products with better energy efficiency are expected to drive market growth.

As energy conservation plays a major role in sustainable business development, there's a growth in demand for energy-saving technologies like OLED & micro-LED.

However, a major decline in year-on-year shipments of monitors & TVs is likely to challenge the growth of the commercial display market. Also, factors that may restrain the market in the forecast period include challenges related to the compatibility of software & hardware in digital signage & connectivity issues.

Research Scope and Analysis

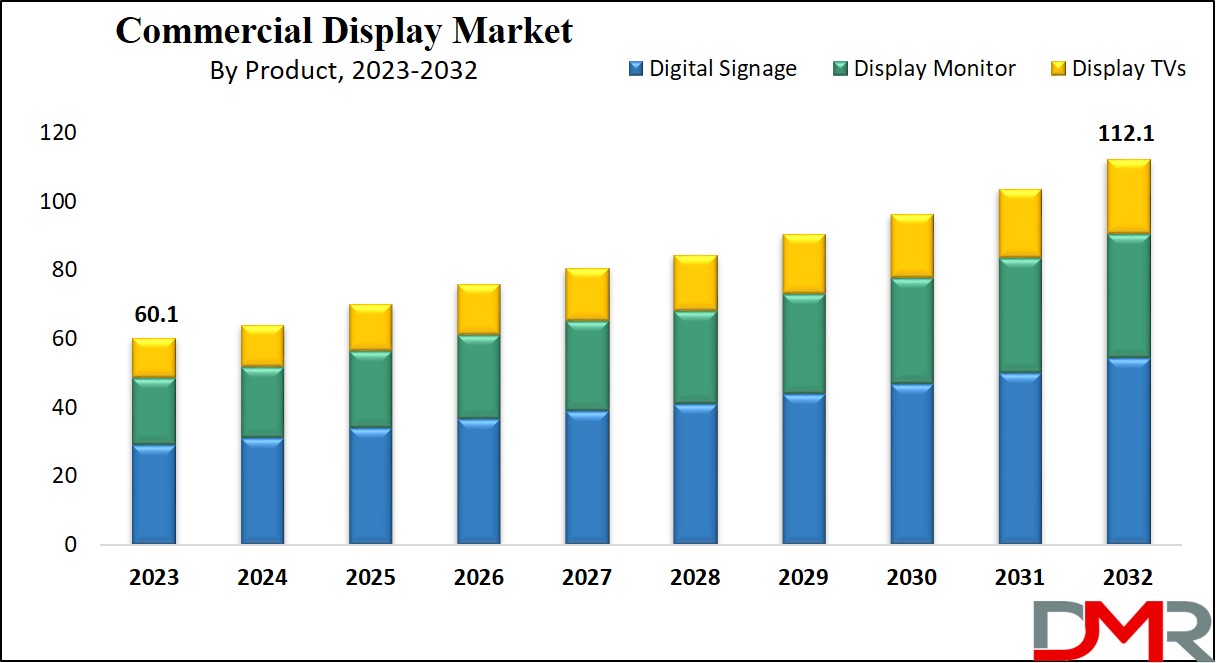

By Product

In terms of products, the market has been divided into digital signage, display monitors, & display TVs. As of 2023, the digital signage segment leads the market & is projected to maintain its dominance in the forecasted years, a site offers various subsets, including video screens, video walls, digital posters, transport LED screens, and kiosks. These products are prevalent in retail environments like shopping malls & supermarkets, and the growing preference for digital display solutions in commercial settings is driving the segment's expansion, with significant growth expected in the coming years.

Moreover, display monitors find large usage in sectors like banking & education, as high demand for monitors below 32 inches in size, yet the use of larger, curved, widescreen monitors for specialized applications like graphic design & media advertising is also on the rise.

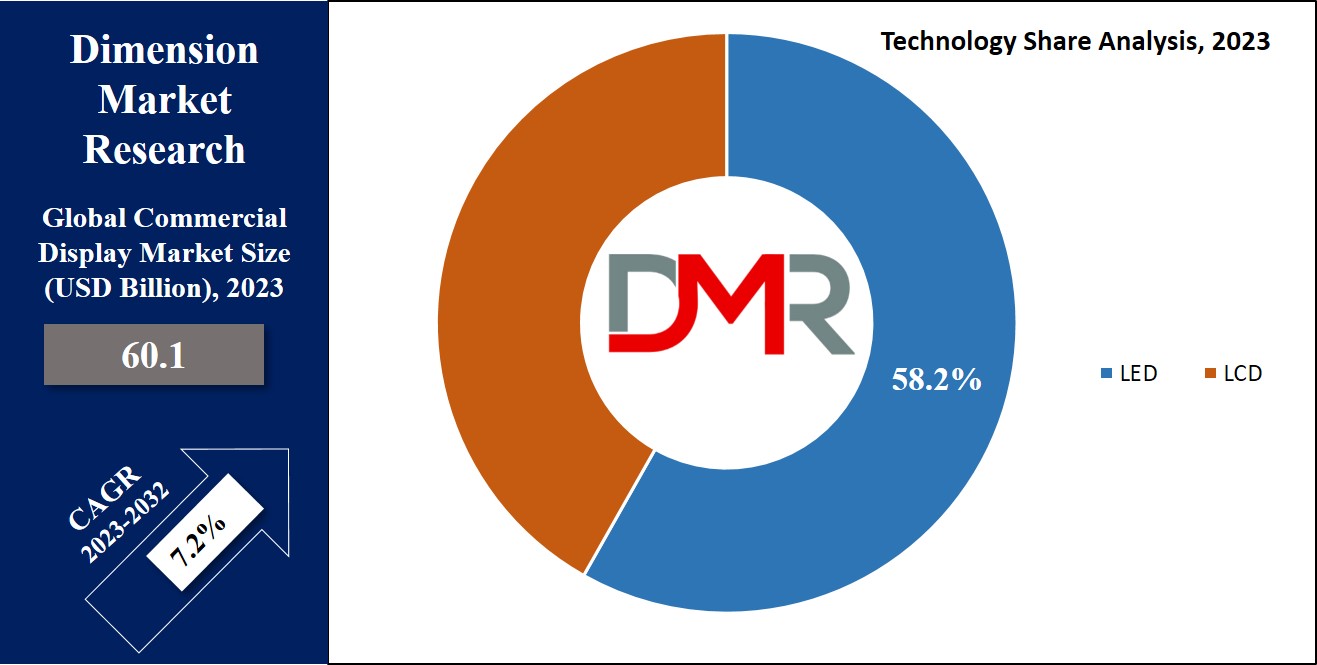

By Technology

The LED segment has asserted its dominance in the market in 2023, securing the highest share of revenue, & is anticipated high growth in the forecasted period. LED displays are highly regarded for their reliability & durability, as they are engineered to withstand challenging environmental conditions, including temperature fluctuations & exposure to dust & moisture, making them an excellent choice for both indoor & outdoor applications. This enhancement ensures consistent performance & a long lifespan.

Also, the LCD segment is expected to notice substantial growth in the coming years. LCD technology delivers a versatile range of display sizes & resolutions suitable for several commercial applications. Whether it's office monitors, large-scale digital signage, point-of-sale displays, or compact handheld devices, LCD panels are available in sizes spanning from a few inches to a few feet, which empowers businesses to select the perfect display size & resolution to align with their specific requirements.

By Component

The commercial display market by components is categorized into hardware, software, & services. The hardware segment leads the market in 2023 & is expected to maintain its dominance in the upcoming years as well, due to a large demand for hardware in comparison to software. Also, hardware components contain cables, displays, accessories, extenders, & installation equipment.

In addition, the software segment also secures a high market share, driven by the introduction of new & advanced software for digital signage.

Meanwhile, the services segment saw increased demand in 2023 compared to the software segment, mainly because of the high maintenance & service requirements for commercial TVs & monitors. The services offered in this segment include display installation in commercial establishments & ensuring seamless connectivity.

By Display Type

Based on the display type the global commercial display market is divided into a flat panel, curved panel, & other panels, where the flat panels claimed the lead in terms of revenue share in 2023. Flat panels have been the preferred choice for users across different commercial sectors for years, mainly due to their affordability and broad availability. The business world has largely embraced flat panel displays since the advent of TFT & LCD technologies, with applications ranging from video walls & digital posters to monitors & TVs.

Further, the curved panel segment is also anticipated to have a high growth during the forecasted period. Curved panels find numerous uses in entertainment, design, automotive, gaming, manufacturing, & more. They are commonly found in smartphones, monitors, TVs, & wearable devices to meet the changing demands of consumers. These design trends are also helping fuel developments in the

Flexible Display Sector.

By Display Size

The commercial display market is segmented by display size, which includes categories like, below 32 inches, 32 to 52 inches, 52 to 75 inches, & above 75 inches. Notably, the below 32-inch segment held the lead in 2023, mainly owing to the compact size of these displays, which makes them highly versatile for a broad range of commercial settings. Businesses in restaurants, retail, hotels, & corporate offices favor these displays for their ability to increase space while delivering impactful content.

Moreover, the above 75-inch segment is anticipated to have significant growth over the forecast period, which is fueled by the increasing adoption of big displays for signage applications in sectors like transportation, retail, and healthcare services.

By Application

The commercial display market is categorized by its various applications, including retail, stadiums & playgrounds, entertainment, hospitality, corporate, banking, education, healthcare, and transportation, of which, the retail sector takes the lead in 2023, driven by the strong demand for digital advertising to market & promote products & services. Retailers are adopting modern advertising techniques, resulting in an increase in the need for commercial-grade TVs &

digital signage.

In addition, the transportation segment is anticipated to have a high growth which is attributed to the expanding transportation sector in developing nations like India, China, & the Philippines. Commercial displays find large use in places like railway stations, airports, metro stations, & bus stops for advertising purposes within the transportation industry. Moreover, advertisers are making large use of digital displays on different modes of transport like cabs, trains, buses, & trams.

The Commercial Display Market Report is segmented on the basis of the following

By Product

- Digital Signage

- Display Monitor

- Display TVs

By Technology

By Component

- Hardware

- Software

- Services

By Display Type

- Curved Panel

- Flat Panel

- Others

By Display Size

- Below 32 inches

- 32 – 52 inches

- 52 – 75 inches

- Above 75 inches

By Application

- Retail

- Hospitality

- Transportation

- Entertainment

- Corporate

- Banking

- Healthcare

- Stadiums & Playground

- Education

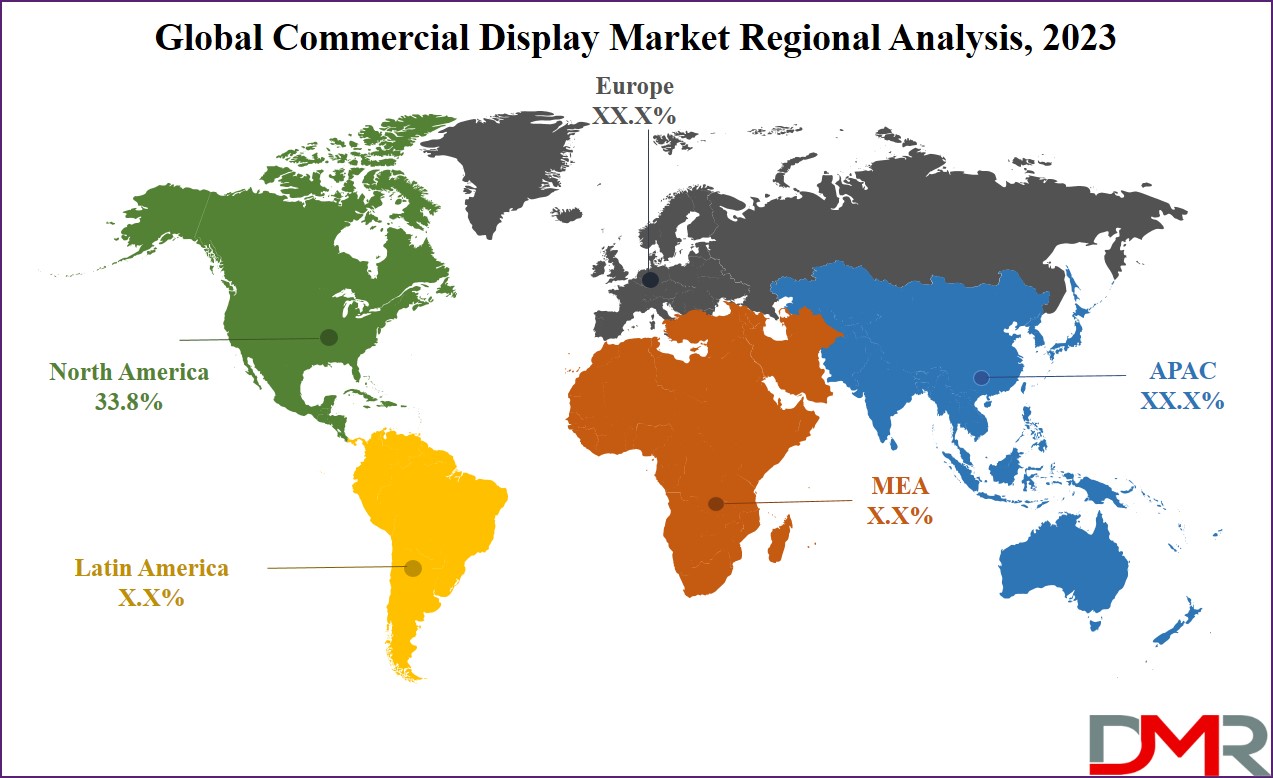

Regional Analysis

North America is the most dominant region in the commercial display market, having

the largest revenue share at 33.8% in 2023, which is attributed to many key players that have built strong customer bases. Moreover, the broad adoption of advanced display solutions across various sectors is anticipated to further boost the market in this region.

Further, in North America, the United States leads the way, driven by growth in environmental concerns encouraging the adoption of energy-efficient technologies like micro-LED & OLED, as the region's proactive approach to large product advertising due to strong market competition has also contributed to the significant market share held by the U.S.

Further, the Asia Pacific region is anticipated to experience rapid growth in the upcoming period, which is driven by the quick urbanization in developing nations & the growth in the usage of commercial displays in the hospitality, healthcare, transportation, & retail sectors. Also, the presence of manufacturers, OEMs, & a large customer base in the region, including key players like Sharp Corp, SAMSUNG, and Panasonic Corp, plays a big role in driving regional market expansion.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Market players are constantly aiming to develop innovative technologies, like transparent panels, to meet the rising demand for advanced displays in transportation, hospitality, & healthcare. Advanced digital signage & TV tech are expected to drive market growth.

Manufacturers are improving their display products by integrating AI-driven solutions, remote hardware, & cutting-edge software to maintain a competitive edge. The market is characterized by the presence of various well-established players that hold a significant market share, thus exerting dominance in the commercial display market.

In November 2022, Sony introduced its latest developments and expansions in the Professional AV partnership network, aimed at bolstering the features of its BRAVIA 4K Professional Displays. By teaming up with reputable partners such as Cisco and Crestron, Sony's goal is to offer end users tailored software solutions that unlock their unique requirements and open up fresh opportunities across different industries.

Some of the prominent players in the global Commercial Display Market are:

- Dell Inc

- Samsung

- LG Display

- Sharp Corp

- Sony Corp

- Cisco System

- Panasonic Corp

- NEC Corp

- CDW Corp

- BOE Technology

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Commercial Display Market

The COVID-19 pandemic & the following economic recession had a huge impact on the commercial display market. With businesses facing financial challenges & decrease in foot traffic, the need for commercial displays, like digital signage and advertising screens, declined. Many companies halted or canceled investments in new display technologies, leading to a slowdown in the market. However, as the world adapted to remote work & online commerce, there was a growth in the need for digital communication solutions, which fueled the demand for displays in sectors like online advertising, e-commerce, & video conferencing, contributing to the market's growth & recovery.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 60.1 Bn |

| Forecast Value (2032) |

USD 112.1 Bn |

| CAGR (2023-2032) |

7.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Digital Signage, Display Monitor, and Display TVs), By Technology (LED and LCD), By Component (Hardware, Software, and Services), By Display Type (Curved Panel, Flat Panel, and Others), By Display Size (Below 32 inches, 32 – 52 inches, 52 – 75 inches, and above 75 inches), By Application (Retail, Hospitality, Transportation, Entertainment, Corporate, Banking, Healthcare, Stadiums & Playground, and Education) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Dell Inc, Samsung, LG Display, Sharp Corp, Sony Corp, Cisco System, Panasonic Corp, NEC Corp, CDW Corp, BOE Technology, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |