A Commercial Greenhouse is a controlled environment facility where plants, particularly vegetables, flowers, and herbs, are cultivated under optimized conditions for commercial production. These greenhouses allow growers to control environmental factors like temperature, humidity, light, and soil quality, creating a space where crops can thrive year-round.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Commercial Greenhouse market refers to the sector involved in the construction, operation, and management of these greenhouses, catering to the demand for fresh produce, ornamental plants, and other agricultural products. This market includes the supply of greenhouse materials, technologies, automation systems, and energy solutions that enhance the productivity and sustainability of greenhouse farming.

In 2024, the Commercial Greenhouse market is expected to witness considerable growth, driven by several factors. The increased focus on sustainable farming practices and food security is encouraging the adoption of

greenhouse technologies across the globe. For established players, opportunities lie in expanding into emerging markets where modern agricultural practices are becoming more prevalent.

In addition, leveraging automation and advanced technologies such as artificial intelligence and hydroponics will enhance productivity and energy efficiency. For new and entry-level businesses, there is a significant opportunity in serving niche markets by providing customized greenhouse solutions tailored to smaller-scale operations or specialized crops.

By integrating environmentally friendly technologies, such as renewable energy solutions and water-efficient irrigation systems, these businesses can carve out a competitive edge while meeting the increasing demand for sustainable agriculture.

The Commercial Greenhouse market is currently experiencing several key trends that will shape its development in the coming years. One major trend is the growing adoption of vertical farming and hydroponics. This method of cultivation maximizes the use of available space by growing crops in stacked layers and using water-based nutrient solutions.

As the demand for locally grown food continues to rise, vertical farming presents an attractive solution to urban areas with limited space. Another significant trend is the integration of

smart greenhouse technologies, such as climate control systems, automated irrigation, and crop monitoring sensors. These technologies are not only improving yields but also reducing operational costs and resource consumption, making greenhouse farming more efficient and profitable.

The global commercial greenhouse market is also being shaped by environmental concerns. For example, greenhouse gas emissions are a growing challenge, as seen in Ireland, where emissions from greenhouse activities totaled 55 million tonnes of CO2 equivalent in 2023. However, greenhouses also present a solution to this challenge by enabling carbon-efficient farming practices.

Countries like the Netherlands, where over half of the greenhouse area is dedicated to vegetable production, serve as key examples of how commercial greenhouses can contribute to both economic growth and environmental sustainability. As more nations look for ways to reduce their carbon footprints, adopting greenhouse technologies that minimize energy consumption and use renewable energy sources will be essential for the industry's growth.

The Commercial Greenhouse Market is experiencing structural shifts driven by regional dominance and material preferences. Over 90% of global greenhouses are in China, while only 9% of worldwide greenhouse acreage utilizes glass. As per Housegrail, 54% of greenhouse plants in the U.S. are annual bedding varieties, and just 9% of greenhouse workers are female.

The U.S. leads in greenhouse vegetable production, with 593 producers the highest among all states. These trends highlight increasing investments in controlled-environment agriculture, emphasizing sustainability, efficiency, and advanced cultivation techniques to meet rising food security demands.

Commercial Greenhouse Market Key Takeaways

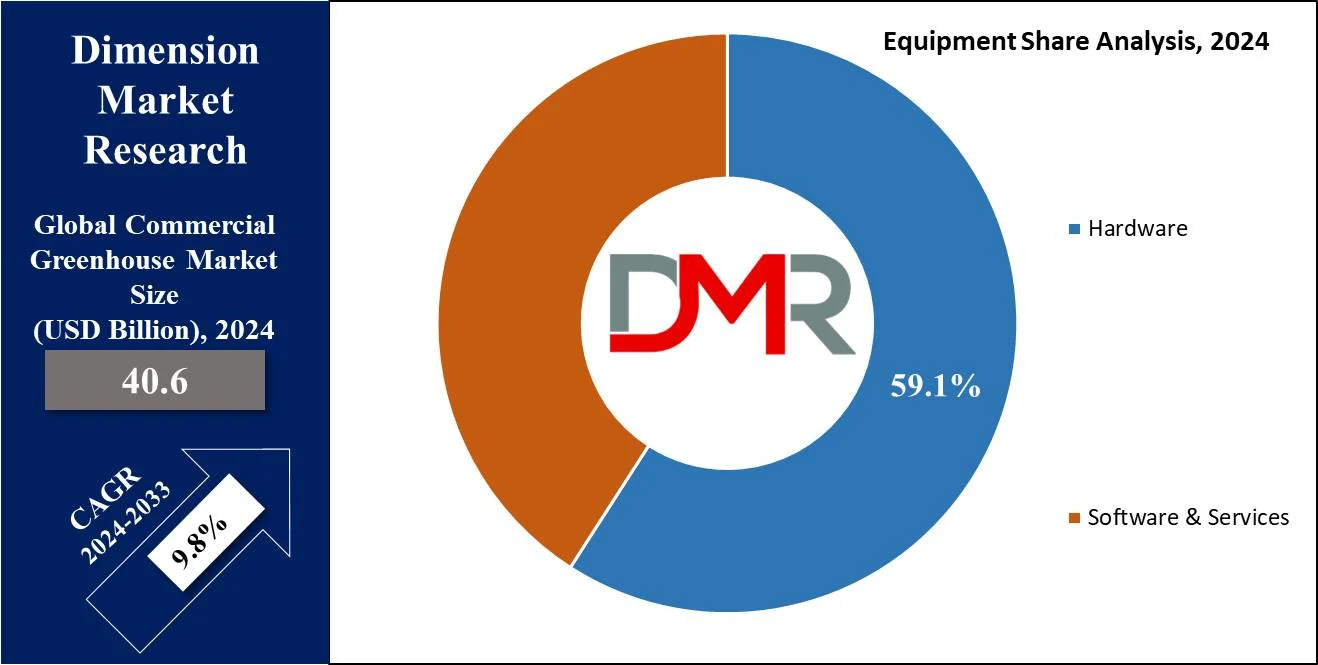

- Hardware is expected to exert its dominance in the global commercial greenhouse market with 59.1% of market share in 2024.

- Glass is projected to dominate this market in the type segment with the highest market share by the end of 2024.

- Based on components the high-tech commercial greenhouses are expected to dominate the global commercial greenhouse market with the highest market share in 2024.

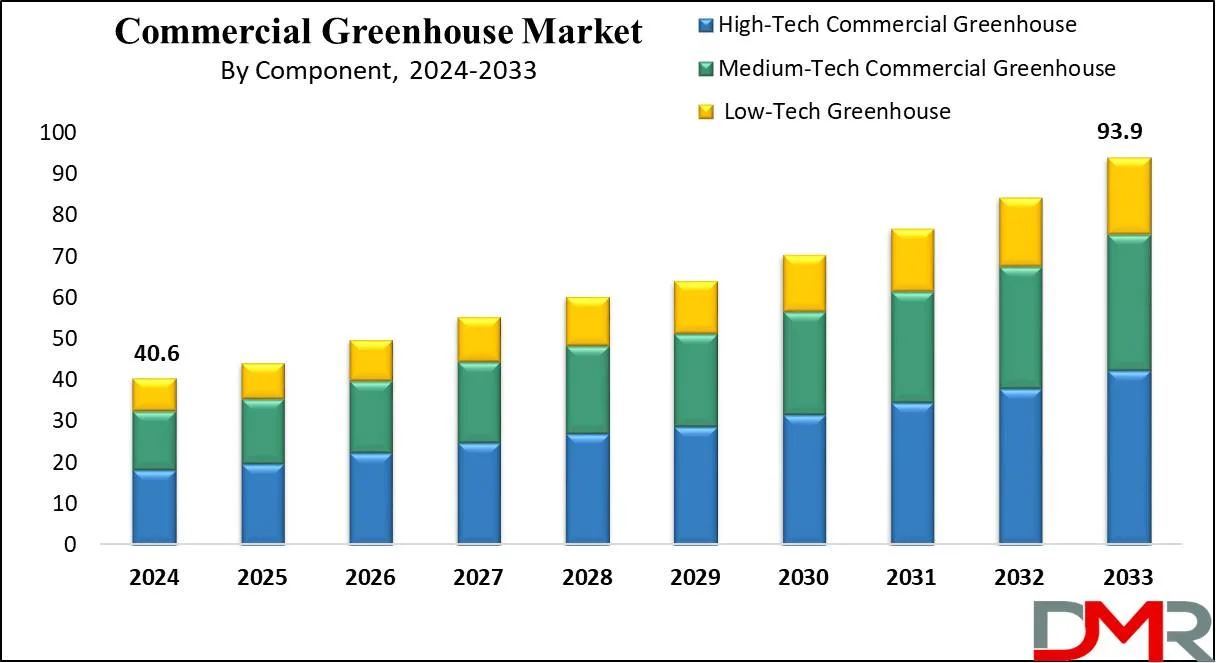

- The Global Commercial Greenhouse Market size is estimated to have a value of USD 40.6 billion in 2024 and is expected to reach USD 93.9 billion by the end of 2033.

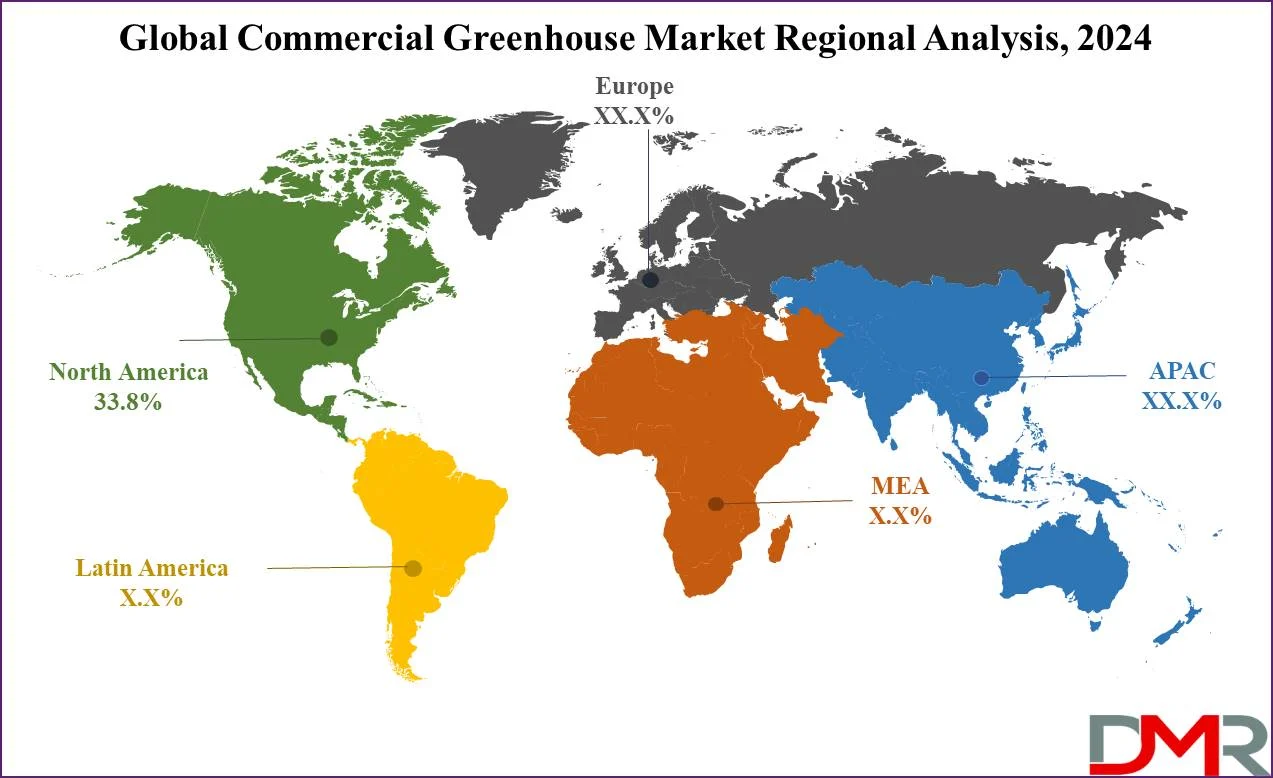

- North America is expected to have the largest market share in the Global Commercial Greenhouse Market with a share of about 33.8% in 2024.

- The market is growing at a CAGR of 9.8 percent over the forecasted period.

Commercial Greenhouse Market Use Cases

- Year-spherical Vegetable Production: Greenhouses permit farmers to domesticate greens no matter seasonal obstacles, ensuring a steady supply and meeting consumers' demand.

- Controlled Environment for Premium Crop Quality: Greenhouses offer optimal conditions for developing commercial crops including tomatoes, making sure high yield.

- Organic Farming: Greenhouses facilitate organic farming practices by minimizing pesticide use, reducing environmental effects, and assembling natural certification requirements.

- Research and Development: Greenhouses serve as managed environments for studies on crop types, developing strategies, and weather resilience, using agricultural innovation.

- Urban Agriculture: Greenhouses enable vertical farming in urban areas, utilizing efficiently and imparting domestically grown produce to urban populations, promoting food safety.

Commercial Greenhouse Market Dynamic

The global industrial greenhouse market is experiencing sturdy growth driven by means of technological improvements, rising need for clean produce, and increasing emphasis on sustainable agriculture. Key factors including advanced weather control systems, LED lighting, and automation technology decorate productivity and resource efficiency in greenhouse operations.

Government assistance, regulatory tasks, and shifting patron choices in the direction of locally sourced, year-spherical produce further drive the marketplace expansion. Economic elements, urbanization, and weather trade also affect market dynamics, driving investments in greenhouse infrastructure.

Additionally, the emergence of vertical farming practices and globalization contribute to market increase and innovation. Overall, the industrial greenhouse marketplace continues to conform, presenting possibilities for growers to meet the developing demand for terrific sustainable food production worldwide.

Research Scope and Analysis

By Equipment

Hardware is expected to exert its dominance in the global commercial greenhouse market with 59.1% of market share in 2024. Hardware dominates the commercial greenhouse device segment by large because it constitutes the bodily additives important for greenhouse operations. This includes systems, climate manipulation systems, irrigation systems, lighting fixtures, sensors, and other mechanical and digital gadgets required for cultivation. The hardware plays an essential role in growing and maintaining the managed surroundings essential for the average plant growth within greenhouses.

Without hardware inclusive of greenhouse structures and weather manipulation systems, growers would now not be able to offer the required conditions for 12 months of spherical cultivation or ensure crop first-class and yield. While software and services complement hardware via offering automation, facts evaluation, and optimization tools, hardware stays the muse upon which greenhouse operations are constructed, therefore its dominance in this phase.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Crop Type

Vegetables are anticipated to dominate the global commercial greenhouse

market in 2024 due to various factors. Vegetables dominate the economic greenhouse market section due to several elements. Firstly, there is a developing demand for clean, regionally grown veggies 12 months-spherical, irrespective of seasonal variations. Greenhouses offer appropriate surroundings for year-round cultivation, ensuring consistent delivery and exceptional veggies irrespective of external conditions.

Additionally, vegetables have incredibly short growing cycles compared to culmination or ornamentals, bearing in mind higher turnover and multiplied profitability in greenhouse operations. Furthermore, the controlled environment supplied through greenhouses enables growers to optimize developing situations, main to better yields, higher best produce, and decreased susceptibility to pests and illnesses. These elements collectively contribute to veggies dominating the economic greenhouse market section.

By Type

Glass is projected to dominate this market in the type segment with the highest market share by the end of 2024. Glass dominates the industrial greenhouse marketplace segment due to its superior quality and benefits for crop cultivation. Glass gives awesome light transmission, permitting the highest quality tiers of daylight to reach plant life for photosynthesis, ensuing a healthier and faster-developing plants.

Additionally, glass affords better insulation, keeping warm inside the greenhouse at some point in colder months and lowering power costs for heating. It additionally offers sturdiness and longevity, requiring minimum maintenance over its lifespan compared to

plastic materials. Moreover, glass offers an extra aesthetic attraction and complements the overall look of the greenhouse, which may be vital for retail and tourist-orientated operations. These benefits make glass the desired preference for industrial greenhouse construction, using its dominance in the market section.

By Component

Based on components the high-tech commercial greenhouses are expected to dominate the global commercial greenhouse market with the highest

market share in 2024.

High-tech business greenhouses dominate the market section because of their superior features and capabilities. These greenhouses employ technologies along with weather-manipulated structures, automatic irrigation, LED lighting fixtures, and far-flung tracking, permitting growers to exactly control environmental conditions and optimize crop growth.

The integration of sensors, information analytics, and synthetic intelligence similarly complements efficiency and productiveness. High-tech greenhouses offer greater control over variables like temperature, humidity, and light, resulting in better yields, advanced crop niches, and resource financial savings. As an end result, growers increasingly prefer excessive-tech solutions for their reliability, precision, and potential to maximize profitability in modern-day business agriculture.

The Commercial Greenhouse Market Report is segmented on the basis of the following:

By Equipment

- Hardware

- Software & Services

By Crop Type

- Vegetables

- Fruits

- Flowers and Ornamentals

- Nursey Crops

- Other

By Type

By Component

- High-Tech Commercial Greenhouse

- Medium-Tech Commercial Greenhouse

- Low-Tech Greenhouse

Commercial Greenhouse Market Regional Analysis

North America is projected to dominate the global

commercial greenhouse market

with 33.8% by the end of 2024. North America stands as a dominant presence within the global commercial greenhouse marketplace because of its superior infrastructure, technological know-how, and favorable regulatory surroundings. Key gamers in this market include Priva Holding B.V., Richel Group, and Argus Controls Systems Ltd. who have a strong presence in this region, presenting cutting-edge answers for greenhouse agriculture.

Additionally, the adoption of greenhouse farming practices is tremendous throughout North America, driven by factors just like the need for spherical produce delivery, changing client needs, and increasing recognition of sustainable agriculture. Government aid and initiatives similarly bolster the increase of the commercial greenhouse in North America, making it a thriving hub for innovation and funding in greenhouse technology and practices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Commercial Greenhouse Market boasts a competitive landscape formed by enterprise leaders like Priva Holding B.V., Richel Group, and Argus Controls Systems Ltd. Priva gives advanced climate control solutions, even as Richel makes a specialty of greenhouse layout and creation.

Argus Controls Systems is a specialist in integrated greenhouse and manipulate structures. Other tremendous gamers include Heliospectra AB, acknowledged for its LED lighting fixtures solutions, and Nexus Corporation, providing greenhouse structures and hydroponic systems. Hoogendoorn Growth Management presents greenhouse automation and climate manipulation systems.

Rough Brothers Inc. (RBI) is a main greenhouse manufacturer, and Certhon gives turnkey greenhouse solutions. This aggressive marketplace flourishes on innovation, with agencies continuously growing superior technologies to meet the developing call for sustainable and efficient greenhouse agriculture.

Some of the prominent players in the Global Commercial Greenhouse Market are

- Berry Global

- Signify Holding

- Heliospectra AB

- Plastika Kritis

- Everlight Electronics

- Richel Group

- Argus Control Systems

- Certhon

- Logiqs BV

- LumiGrow

- Agra-tech, Inc

- Rough Brothers, Inc

- Hort Americas

- Top Greenhouses

- Other Key Players

Recent Development

- In February 2024, Hippo Harvest secured $21M Series B funding led by Standard Investments to expand its sustainable greenhouse platform, promising fresher produce with lower resource usage.

- In January 2024, Centuria Agriculture Fund (CAF) purchases a $21.5 million greenhouse and glasshouse facility in Adelaide Plains, SA, expanding its portfolio to $351 million. Operated by P'Petual Holdings.

- In October 2023, Eden Green Technology expanded with a $40M greenhouse, aiming to triple lettuce production and improve distribution efficiency.

- In February 2023, Source. ag, a Netherlands-based agtech startup, secures $23M in Series A funding to advance AI-driven solutions for sustainable, efficient greenhouse agriculture. Expansion planned.

- In May 2022, Infrascreen raised $1.5m for its nanotech greenhouse material which aims for carbon neutrality, it optimizes natural radiation, reducing energy usage by 20%.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 40.6 Bn |

| Forecast Value (2033) |

USD 93.9 Bn |

| CAGR (2023-2032) |

9.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Equipment (Hardware, and Software & Services), By Crop Type (Vegetables, Fruits, Flowers and Ornamentals, Nursey Crops, and Others), By Type (Glass, and Plastic), By Component (High-Tech Commercial Greenhouse, Medium-Tech Commercial Greenhouse, and Low-Tech Greenhouse) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Berry Global, Signify Holding, Heliospectra AB, Plastika Kritis, Everlight Electronics, Richel Group, Argus Control Systems, Certhon, Logiqs BV, LumiGrow, Agra-tech Inc, Rough Brothers Inc, Hort Americas, Top Greenhouses, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |