Market Overview

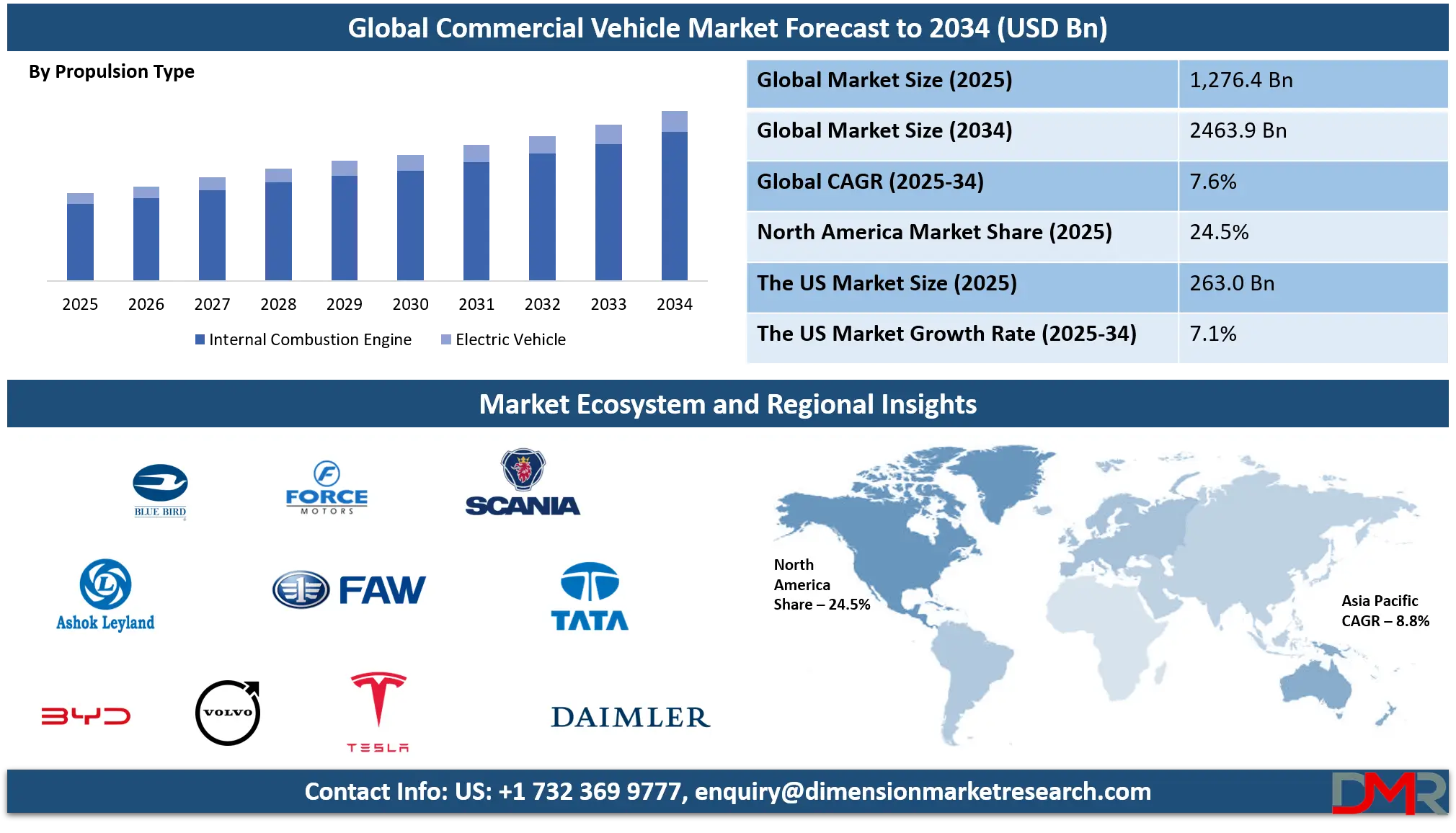

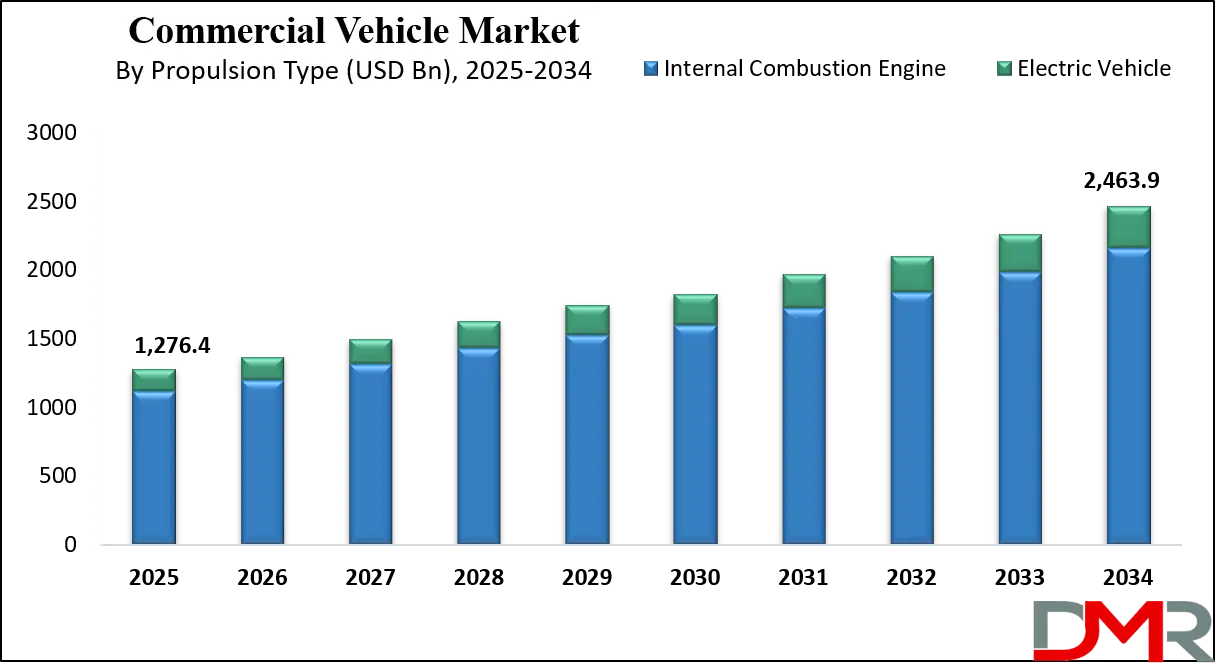

The Global Commercial Vehicle Market size is projected to reach USD 1,276.4 billion in 2025 and grow at a compound annual growth rate of 7.6% from there until 2034 to reach a value of USD 2,463.9 billion

A commercial vehicle is essentially any motor vehicle used for business or income-generating purposes, rather than personal use. This broad category encompasses a wide range of vehicles, from small pickup trucks and vans used for local deliveries to massive heavy-duty trucks for long-haul freight, and even buses for passenger transport. The key differentiator is their role as a tool for economic activity, supporting industries like logistics, construction, public services, and more.

These vehicles are designed with specific functionalities to handle various loads and operational demands, adhering to strict safety and compliance standards that differ significantly from passenger cars. They form the backbone of global trade and commerce, facilitating the movement of raw materials, finished goods, and people, thus playing a crucial role in economic development and employment generation.

The demand for commercial vehicles has been experiencing significant shifts and growth, driven by several underlying factors. A major catalyst is the explosive growth of e-commerce, which necessitates efficient and rapid delivery solutions, particularly for the "last mile." This has boosted the need for lighter commercial vehicles like vans and mini-trucks. Simultaneously, ongoing infrastructure development projects around the world, such as road construction, smart city initiatives, and industrial expansion, continue to drive the demand for heavier vehicles like dump trucks and large cargo carriers.

Urbanization also contributes to this demand, as more people and goods need to be moved within and between cities. Additionally, a steady replacement demand for aging fleets, coupled with evolving government regulations and mandates for cleaner vehicles, further fuels market activity.

Several key trends are reshaping the commercial vehicle landscape. One of the most prominent is the increasing adoption of electric and hybrid commercial vehicles. Driven by a growing focus on sustainability, stricter emission regulations, and government incentives, the transition to cleaner energy sources is accelerating, especially in urban areas for last-mile delivery and public transport.

Another significant trend is the integration of advanced technologies, including telematics and the Internet of Things (IoT). These technologies enable real-time monitoring of vehicle performance, fuel consumption, and driver behavior, leading to improved operational efficiency, reduced costs, and enhanced safety. Predictive maintenance, facilitated by data analytics, is also gaining traction, minimizing downtime and extending vehicle lifespans

Furthermore, the commercial vehicle industry is witnessing a growing emphasis on safety through the implementation of Advanced Driver Assistance Systems (ADAS). Features like lane departure warnings, collision avoidance systems, and automatic braking are becoming more commonplace, aiming to reduce accidents and improve overall road safety.

The development of autonomous driving technology, while still in its nascent stages for widespread commercial use, is also a significant long-term trend, with companies experimenting with self-driving vehicles to enhance efficiency and reduce operational costs. Beyond the vehicles themselves, there's a shift towards more flexible business models, such as commercial vehicle leasing and "fleet-as-a-service," which allow businesses to manage their transportation needs without large upfront capital expenditures.

In recent years, the commercial vehicle market has been influenced by a combination of global and regional events. The COVID-19 pandemic, for instance, initially caused significant disruptions in supply chains and manufacturing, leading to a temporary decline in demand. However, it also accelerated the growth of e-commerce, which subsequently fueled a recovery in certain commercial vehicle segments.

More recently, geopolitical instabilities and economic fluctuations have created uncertainties, impacting production and consumer confidence in some regions. Additionally, ongoing global efforts to combat climate change have intensified regulatory pressures, pushing manufacturers to invest heavily in electric vehicle technology and other alternative fuel solutions, leading to new product launches and collaborations within the industry.

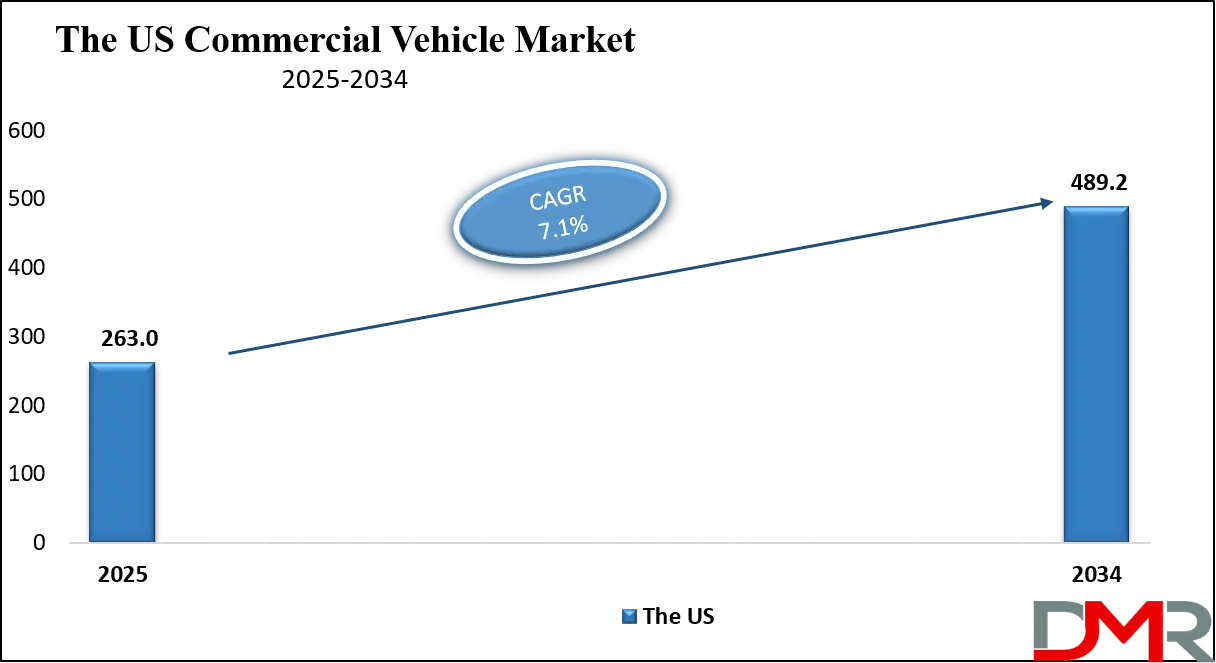

The US Commercial Vehicle Market

The US Commercial Vehicle Market size is projected to reach USD 263.0 billion in 2025 at a compound annual growth rate of 7.1% over its forecast period

The US plays a pivotal role in the global commercial vehicle market, representing a substantial share of overall sales and driving key industry trends. Its large and developed economy, coupled with a vast network of logistics and transportation, generates consistent demand for a wide range of commercial vehicles, from light-duty vans for e-commerce deliveries to heavy-duty trucks for long-haul freight. The US is a major hub for innovation, with significant investments in electric vehicle (EV) technology, autonomous driving solutions, and advanced telematics.

Furthermore, US regulatory frameworks, particularly those related to emissions and safety, often influence global standards and push manufacturers worldwide to develop cleaner and more efficient vehicles. This robust market and its influential trends make the US a crucial player in shaping the future of commercial transportation.

Europe Commercial Vehicle Market

Europe Commercial Vehicle Market size is projected to reach USD 255.3 billion in 2025 at a compound annual growth rate of 7.4% over its forecast period.

Europe stands as a powerhouse in the global commercial vehicle market, driven by its robust manufacturing sector and strong regulatory push for sustainability. Home to major players like Mercedes-Benz, Volvo, MAN, and Scania, Europe not only serves its substantial domestic demand for logistics, construction, and public transport vehicles but also acts as a significant exporter of advanced commercial vehicle technologies.

A key defining characteristic of Europe's role is its ambitious emission standards, such as the Euro series and the recent stricter CO2 reduction targets for heavy-duty vehicles. These regulations are a primary catalyst for innovation, compelling manufacturers to invest heavily in electric, hydrogen, and other alternative fuel powertrains. This focus on green mobility, coupled with advancements in telematics and autonomous driving, positions Europe at the forefront of shaping the future of efficient and sustainable commercial transportation globally.

Japan Commercial Vehicle Market

Japan Commercial Vehicle Market size is projected to reach USD 63.8 billion in 2025 at a compound annual growth rate of 8.0% over its forecast period.

Japan holds a significant position in the global commercial vehicle market, renowned for its strong manufacturing base and pioneering spirit in automotive technology. Home to major players like Toyota (including Hino and Daihatsu), Isuzu, Mitsubishi Fuso, and Nissan, Japan contributes substantially to both domestic and international commercial vehicle sales. Japanese manufacturers are particularly recognized for their focus on fuel efficiency, durability, and advanced engineering, which is highly valued in commercial applications.

Furthermore, Japan is at the forefront of developing sustainable commercial vehicle solutions, with notable advancements in hybrid and electric vehicle technologies. The country's commitment to reducing emissions and promoting eco-friendly transportation drives innovation in this sector. While the domestic market faces challenges like an aging population, Japan's strong export capabilities and continuous investment in R&D ensure its enduring influence on the global commercial vehicle landscape.

Commercial Vehicle Market: Key Takeaways

- Market Growth: The Commercial Vehicle Market size is expected to grow by USD 1,100.7 billion, at a CAGR of 7.6%, during the forecasted period of 2026 to 2034.

- By Propulsion Type: The ICE segment is anticipated to get the majority share of the Commercial Vehicle Market in 2025.

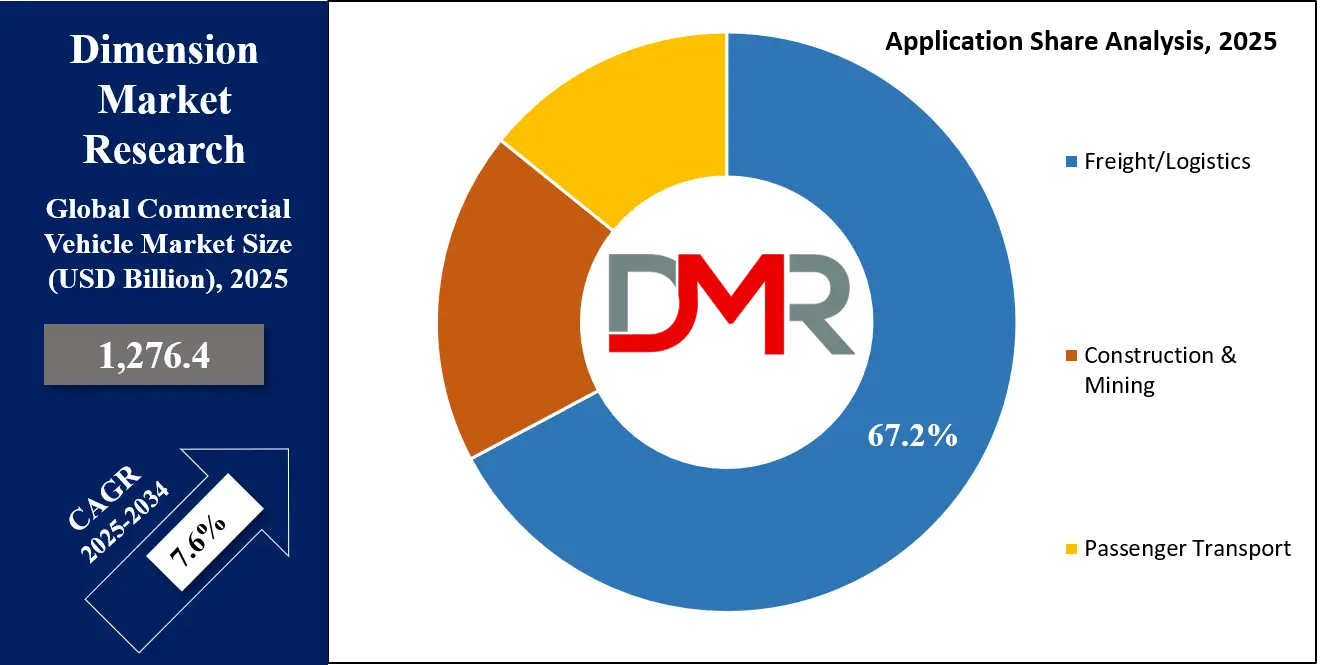

- By Application: The Freight/Logistics segment is expected to get the largest revenue share in 2025 in the Commercial Vehicle Market.

- Regional Insight: Asia Pacific is expected to hold a 42.8% share of revenue in the Global Commercial Vehicle Market in 2025.

- Use Cases: Some of the use cases of Commercial Vehicle include goods transportation, passenger transport, and more.

Commercial Vehicle Market: Use Cases

- Goods Transportation: Commercial vehicles are fundamental to logistics and supply chains, enabling the movement of raw materials to factories and finished products to consumers. This includes a diverse range from light-duty vans for last-mile delivery of e-commerce packages within cities, to heavy-duty trucks and semi-trailers for long-haul inter-state or international freight of bulk goods, manufactured items, and specialized cargo like refrigerated foods or liquids. They ensure that goods reach their destination efficiently and on time, underpinning trade and commerce.

- Passenger Transport: Buses, coaches, and large passenger vans serve as essential modes of public and private transport, moving people for various purposes. This spans urban public transit systems, inter-city travel, school transportation, corporate shuttles, and tourism. These vehicles are designed to safely and comfortably accommodate numerous individuals, reducing traffic congestion and providing accessible mobility solutions for communities.

- Construction and Infrastructure: Specialized commercial vehicles are indispensable for building and maintaining infrastructure. Dump trucks transport aggregates, sand, and debris; cement mixers deliver ready-mix concrete to construction sites; and flatbed trucks haul heavy machinery and oversized construction materials. These vehicles are built to withstand rugged conditions and heavy loads, playing a critical role in urban development, road construction, and mining operations.

- Specialized Services: Beyond standard goods and passenger transport, commercial vehicles are adapted for a wide array of specialized services. This includes emergency vehicles like ambulances and fire trucks, utility vehicles for maintenance and repair services (e.g., electrical, plumbing, telecom), waste management vehicles such as garbage trucks and street sweepers, and mobile service units like food trucks or mobile libraries. These vehicles are customized with specific equipment and features to fulfill their unique operational requirements.

Stats & Facts

- According to SIAM, Commercial Vehicles in India experienced a slight de-growth of (-) 1.2% in Fiscal Year 2024-25 compared to the previous year, although the last quarter of FY 2024-25 did post a positive growth of 1.5%.

- As per ACEA, new EU truck registrations declined by 6.3% in 2024, totaling 327,896 units, with this reduction primarily driven by an 8.5% drop in heavy-truck sales.

- Based on SIAM's analysis of the Vahan Database, total EV registrations across India reached 1.97 million units in FY 2024-25, showing a notable growth of 16.9% when compared to 1.68 million units in FY 2023-24.

- According to ACEA, new EU bus sales saw an increase of 9.2% in 2024 compared to 2023, reaching a total of 35,579 units, with Italy notably experiencing a significant 26.7% growth.

- SIAM data indicates, Electric Passenger Vehicle registrations in India crossed the 1 Lakh unit mark in FY 2024-25, registering a growth of 18.2% over the previous fiscal year.

- As per ACEA, Diesel remained the preferred choice for new EU van buyers in 2024, with registrations rising by 10.5% to 1,340,003 units, increasing its market share by 1.7 percentage points to 84.5%.

- According to SIAM, while the overall trucks segment in India witnessed a slight de-growth, the requirement for freight movement has been suitably served as fleets migrate towards higher Gross Vehicle Weight (GVW) vehicles, supported by the expanding highway network.

- ACEA reports, electrically chargeable van sales in the EU experienced a significant decline of 9.1% in 2024, which reduced their market share to 6.1% from 7.2% the previous year.

- SIAM stated, exports of Commercial Vehicles from India posted a good growth of 23% in FY 2024-25 compared to the previous year, with exports totaling 0.81 Lakh units.

- Based on ACEA figures, new EU electrically chargeable bus registrations rose by 26.8% in 2024, leading to their market share rising from 15.9% to 18.5%, with Italy showing impressive growth of 161.7%.

- According to SIAM, Registration of e-Two Wheelers grew by 21.2% in FY 2024-25 compared to the previous year, reaching 11.5 Lakh units in India.

- ACEA data shows that diesel trucks continued to dominate in the EU in 2024, accounting for 95.1% of new registrations, despite a 6.2% decline in registrations for this fuel type.

Market Dynamic

Driving Factors in the Commercial Vehicle Market

E-commerce Boom and Last-Mile Deliveries

The exponential growth of e-commerce has fundamentally reshaped consumer behavior, leading to an unprecedented demand for efficient and rapid delivery services. This surge in online shopping directly fuels the need for light commercial vehicles (LCVs), such as vans and smaller trucks, which are ideal for navigating urban environments and performing "last-mile" deliveries – the final leg of the journey from a distribution center to the customer's doorstep.

As consumers increasingly expect faster and even same-day deliveries, logistics companies and online retailers are continuously expanding their fleets, driving significant sales in the LCV segment. This trend necessitates agile and adaptable transportation solutions, leading to increased investment in vehicles designed for frequent stops and urban traffic.

Infrastructure Development and Industrialization

Global infrastructure projects, including the construction of new roads, highways, bridges, and industrial parks, are significant catalysts for commercial vehicle demand. These large-scale developments require a constant movement of heavy materials like cement, steel, aggregates, and machinery, directly boosting the sales of heavy-duty trucks, tippers, and specialized construction vehicles.

Furthermore, ongoing industrialization in emerging economies and the expansion of manufacturing facilities create a sustained need for robust transportation networks to move raw materials, components, and finished goods between production sites, warehouses, and distribution centers. Government initiatives and increased capital outlays for infrastructure across various countries continue to provide a strong underlying demand for a wide range of commercial vehicles.

Restraints in the Commercial Vehicle Market

High Costs of Advanced Technologies and Infrastructure

While the commercial vehicle market is seeing a strong push towards electrification and advanced driver-assistance systems (ADAS), the significant upfront cost associated with these technologies acts as a major restraint. Electric commercial vehicles, in particular, come with a higher purchase price due to expensive battery packs and complex power management systems.

Additionally, the widespread adoption of these vehicles is hindered by the lack of sufficient charging and refueling infrastructure, especially in rural areas and along long-haul routes. Investing in and developing this extensive infrastructure requires substantial capital, which can deter fleet operators and governments, slowing down the transition to cleaner and smarter fleets.

Economic Volatility and Regulatory Burdens

The commercial vehicle market is highly susceptible to economic fluctuations and geopolitical tensions. Periods of economic slowdown, inflation, or uncertainty can lead businesses to postpone or reduce investments in new fleet purchases, directly impacting sales volumes.

Furthermore, the industry faces an increasingly complex and stringent regulatory landscape, particularly concerning emission standards and safety norms. While these regulations are crucial for environmental protection and public safety, they impose significant research, development, and compliance costs on manufacturers, which are often passed on to buyers. This can increase the total cost of ownership for commercial vehicles, making it challenging for smaller businesses to upgrade their fleets and comply with evolving mandates.

Opportunities in the Commercial Vehicle Market

Electrification and Alternative Fuels

The accelerating global push towards decarbonization presents a massive opportunity for the commercial vehicle market, particularly in the development and adoption of electric and alternative fuel vehicles. As governments worldwide introduce stricter emission regulations and offer incentives for cleaner transportation, manufacturers are investing heavily in electric trucks, buses, and vans.

This transition not only addresses environmental concerns but also offers long-term operational cost savings for fleet owners due to lower fuel and maintenance expenses. The ongoing advancements in battery technology, increasing charging infrastructure, and the exploration of hydrogen fuel cell technology further expand this opportunity, catering to various commercial applications from last-mile delivery to heavy-duty hauling.

Technological Integration and Data-Driven Solutions

The integration of advanced technologies like telematics, IoT, and artificial intelligence (AI) offers substantial opportunities for enhancing efficiency, safety, and profitability in the commercial vehicle sector. Fleet operators can leverage real-time data from connected vehicles for optimized route planning, predictive maintenance, and improved driver behavior monitoring, leading to significant reductions in fuel consumption and operational downtime.

The growth of autonomous driving technology, while still in its developmental phases for widespread deployment, promises even greater efficiencies in the future, particularly for long-haul logistics. These data-driven solutions also open new revenue streams for vehicle manufacturers and technology providers, moving beyond just selling vehicles to offering comprehensive mobility and logistics services.

Trends in the Commercial Vehicle Market

Accelerated Electrification and Sustainable Practices

In recent years, there has been a significant surge in the development and adoption of electric commercial vehicles, particularly in the light and medium-duty segments. This trend is driven by increasingly stringent global emission regulations, growing environmental consciousness among businesses and consumers, and supportive government incentives and policies.

Manufacturers are rapidly expanding their portfolios to include electric vans, trucks, and buses, especially for urban logistics and public transport, where the benefits of lower operational costs and reduced local emissions are most immediate. This shift also involves a greater focus on overall sustainable practices within the manufacturing process, including the use of recycled materials and energy-efficient production methods, reflecting a broader industry commitment to reducing its carbon footprint.

Enhanced Telematics and Data-Driven Fleet Management

The integration of advanced telematics, IoT (Internet of Things), and AI (Artificial Intelligence) solutions has become a defining recent trend in the commercial vehicle market. Fleet operators are increasingly leveraging these technologies for real-time monitoring of vehicle performance, fuel consumption, driver behavior, and asset tracking.

This data enables highly optimized route planning, predictive maintenance to minimize downtime, and improved safety through features like driver coaching and collision alerts. The rise of sophisticated telematics platforms and "fleet-as-a-service" models allows businesses to gain deeper insights into their operations, leading to significant cost savings, increased efficiency, and better compliance with regulations, thereby transforming traditional fleet management into a highly data-driven process.

Research Scope and Analysis

By Vehicle Type Analysis

Light commercial vehicles (LCVs) are set to lead the commercial vehicle market, with their segment expected to command a significant 57.4% share in 2025. This dominance is primarily driven by the exponential growth of e-commerce and the increasing demand for efficient last-mile delivery solutions globally. LCVs, including vans and pickup trucks, are ideally suited for navigating urban environments and transporting goods directly to consumers' doorsteps.

Their versatility, relatively lower operational costs, and adaptability for various business purposes, such as parcel delivery, small business logistics, and utility services, make them indispensable. Furthermore, the rapid adoption of electric LCVs is providing a strong boost, aligning with sustainability goals and expanding their appeal in urban centers.

Medium and heavy commercial vehicles (M&HCVs) are poised for significant growth over the forecast period in the commercial vehicle market. This segment, encompassing large trucks, buses, and specialized construction equipment, benefits immensely from ongoing global infrastructure development projects and increasing industrialization.

As economies expand and urbanization continues, the demand for efficient transportation of bulk goods, raw materials, and large-scale public transit solutions escalates. Investments in mining, construction, and long-haul freight operations directly translate into a robust need for M&HCVs. The evolving landscape of logistics and supply chain management also necessitates modern, high-capacity vehicles, driving fleet renewal and expansion in this crucial commercial transport sector.

By Propulsion Type Analysis

Internal combustion engines (ICEs) are set to continue their dominance in the commercial vehicle market, with their propulsion type segment anticipated to hold a substantial 87.7% share in 2025. Despite the growing push for electrification, ICE vehicles remain the workhorse of global logistics and transportation due to their proven reliability, extensive refueling infrastructure, and established performance across diverse operational demands.

They offer the necessary power and range for heavy-duty long-haul trucking, off-road construction, and diverse specialized applications where charging infrastructure might be scarce. Continuous advancements in fuel efficiency and emission reduction technologies, coupled with their lower upfront cost compared to electric alternatives, ensure their continued prevalence for the foreseeable future, particularly in regions where electrification is still nascent.

The electric vehicle (EV) propulsion type in the commercial vehicle market is poised for significant growth over the forecast period. This surge is driven by increasing environmental regulations, government incentives promoting zero-emission transportation, and the ongoing global shift towards sustainability.

Electric commercial vehicles, encompassing vans, trucks, and buses, offer advantages such as reduced operational costs through lower fuel and maintenance expenses, quieter operation, and no tailpipe emissions. As battery technology improves, offering greater range and faster charging capabilities, and charging infrastructure expands, EVs are becoming an increasingly viable and attractive option for various commercial applications, especially in urban delivery, public transit, and fleet operations focused on green initiatives.

By Application Analysis

The Freight/Logistics application is poised to be the dominant force in the commercial vehicle market, with its segment anticipated to secure a commanding 67.2% share in 2025. This significant lead is fundamentally driven by the relentless expansion of global trade and the booming e-commerce sector, which necessitate efficient movement of goods across vast distances and for last-mile delivery.

The increasing complexity of global supply chains and the continuous need for optimized distribution networks further solidify the demand for a diverse range of trucks and vans. Logistics companies are heavily investing in modern fleets, including advanced telematics and electric vehicles, to enhance operational efficiency, reduce costs, and meet stringent delivery timelines, making freight transport central to market growth.

Passenger transport, as a crucial application within the commercial vehicle market, will demonstrate significant growth over the forecast period. This expansion stems from increasing urbanization and a growing global population, which collectively boost the demand for robust public transit systems. Buses and coaches play an essential role in connecting urban and rural areas, providing affordable and accessible mobility solutions for commuters and tourists alike.

Furthermore, the rising focus on sustainable urban mobility initiatives and investments in smart city infrastructure are driving the adoption of electric buses, contributing to cleaner public transport and reduced traffic congestion. The tourism sector's recovery also fuels demand for coaches, ensuring continued expansion in this vital segment.

By End Use Industry Analysis

E-commerce and Retail are set to be the primary end-use industries driving the commercial vehicle market, with their segment anticipated to secure a dominant 37.1% share in 2025. The explosion of online shopping and the ever-increasing consumer expectation for rapid home deliveries have directly fueled an unprecedented demand for light commercial vehicles, particularly vans and smaller trucks.

These vehicles are indispensable for efficient last-mile logistics, enabling swift and flexible distribution from warehouses to individual doorsteps. As retailers expand their digital presence and optimize supply chains for faster fulfillment, continuous investment in specialized delivery fleets becomes critical, thereby making this industry a powerful catalyst for commercial vehicle sales and innovation.

Public transport, as a vital end-use industry, is expected to experience significant growth across the commercial vehicle market over the forecast period. Urbanization trends and rising populations globally are consistently increasing the need for efficient and accessible mass transit solutions. This drives demand for a variety of buses, from large city buses to smaller commuter vehicles, which serve as the backbone of urban mobility.

Governments and municipalities are actively investing in modernizing their public transport fleets, often prioritizing the adoption of electric and low-emission buses to improve air quality and achieve sustainability goals. This strategic focus on enhancing urban infrastructure and connectivity ensures a robust and expanding market for commercial vehicles tailored for passenger services.

The Commercial Vehicle Market Report is segmented on the basis of the following:

By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Medium & Heavy Commercial Vehicles (MHCVs)

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

By Application

- Freight/Logistics

- Construction & Mining

- Passenger Transport

By End Use Industry

- E-Commerce & Retail

- Construction

- Public Transport

- Others

Regional Analysis

Leading Region in the Commercial Vehicle Market

The Asia Pacific region is a leading force in the growth of the commercial vehicle market, with the segment estimated to hold a significant 42.8% market share in 2025. This strong position is fueled by rapid industrialization, increasing urbanization, and substantial infrastructure development across key economies like China, India, and ASEAN nations. The booming e-commerce sector further accelerates demand, particularly for light commercial vehicles (LCVs) crucial for last-mile delivery.

Additionally, a rising focus on environmental sustainability is driving the adoption of electric and alternative fuel commercial vehicles, with governments in the region actively promoting green mobility through various initiatives and subsidies. This dynamic environment, coupled with ongoing technological advancements and strong economic growth, ensures Asia Pacific's continued prominence in the global commercial vehicle landscape.

Fastest Growing Region in the Commercial Vehicle Market

Latin America is demonstrating significant growth over the forecast period in the commercial vehicle market. This expansion is largely driven by increasing investments in infrastructure projects, particularly in countries like Brazil and Mexico, which necessitate heavy-duty trucks and construction vehicles. The robust growth of e-commerce across the region is also propelling demand for light commercial vehicles (LCVs) to facilitate efficient last-mile delivery services.

Furthermore, the recovery of commodity markets, including mining and agriculture, contributes to the need for diverse commercial fleets. As economies stabilize and industrialization continues, the region's focus on improving logistics and transportation efficiency will further bolster the commercial vehicle sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The commercial vehicle market is currently experiencing dynamic shifts, driven by global economic trends and technological advancements. While some regions face temporary slowdowns due to factors like elections or economic uncertainties, the overall outlook remains positive. A significant force shaping the market is the booming e-commerce sector, which continues to drive demand for light commercial vehicles crucial for last-mile deliveries.

Concurrently, ongoing infrastructure development worldwide sustains the need for heavy-duty vehicles. The push for sustainability is accelerating the adoption of electric and alternative fuel commercial vehicles, particularly in urban environments. Furthermore, advanced technologies like telematics and driver assistance systems are becoming increasingly vital, enhancing efficiency and safety across all commercial vehicle segments.

Some of the prominent players in the global Commercial Vehicle are:

- Volvo Group

- Daimler Truck

- BYD Auto

- Tesla Inc

- Tata Motors

- FAW Group

- Ashok Leyland

- Scania AN

- IVECO Group

- Nikola Group

- Arrival

- Lion Electric Company

- Force Motors

- Blue Bird Corp

- Indus Motors

- Torsus

- Higer Bus Company

- Piaggio Commercial Vehicles

- Tern Mobility

- Other Key Players

Recent Developments

- In May 2025, Tata Motors with MM Group for Industry and International Trade (MTI), launched its commercial vehicles range in Egypt. Designed to address the country's growing mobility needs across cargo and passenger segments, the diverse portfolio, including Tata Xenon, Ultra T.7, Ultra T.9, Prima 3328.K, Prima 4438.S, Prima 6038.S, and LP 613 bus will support Egypt's infrastructure growth, rising urbanization, and expanding logistics sector. The launch marks a significant step forward in Tata Motors' commitment to the market, combining global expertise with a customer-centric approach to deliver reliable, efficient, and future-ready solutions.

- In April 2025, the Ministry of Road Transport and Highways of India announced its plans to launch safety assessment ratings for trucks and commercial vehicles, similar to the Bharat New Car Assessment Program (BNCAP)

- In October 2024, Model 1 Commercial Vehicles is unveiled a strategic partnership with Mobile Specialty Vehicles, a leading manufacturer of custom specialty vehicles. This collaboration aims to enhance our product lineup and provide our customers with innovative and high-quality transportation solutions. Mobile Specialty Vehicles, known for their ability to design and build custom vehicles for various industries, will now be a key partner in our network, as it will allow us to offer a wider range of specialty vehicles, including mobile medical units, command centers, and other custom-built solutions tailored to our clients' unique needs.

- In June 2024, Tata Motors launched Tata Motors Fleet Verse, a comprehensive digital marketplace for the company’s commercial vehicles, which will facilitate all transactions through Tata Motors’ extensive pan-India dealership network, using a direct-to-dealer payment ecosystem. Also, key features include smart search discovery, product configurator, and more.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,276.4 Bn

|

| Forecast Value (2034) |

USD 2,463.9 Bn |

| CAGR (2025–2034) |

7.6% |

| The US Market Size (2025) |

USD 263.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Vehicle Type (Light Commercial Vehicles (LCVs) and Medium & Heavy Commercial Vehicles (MHCVs)), By Propulsion Type (Internal Combustion Engine (ICE) and Electric), By Application (Freight/Logistics, Construction & Mining, and Passenger Transport), By End Use Industry (E-Commerce & Retail, Construction, Public Transport, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Volvo Group, Daimler Truck, BYD Auto, Tesla Inc , Tata Motors, FAW Group, Ashok Leyland, Scania AN, IVECO Group, Nikola Group, Arrival, Lion Electric Company, Force Motors, Blue Bird Corp, Indus Motors, Torsus, Higer Bus Company, Piaggio Commercial Vehicles, Tern Mobility, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Commercial Vehicle Market size is expected to reach a value of USD 1,276.4 billion in 2025 and is expected to reach USD 2,463.9 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Commercial Vehicle Market, with a share of about 42.8% in 2025.

The Commercial Vehicle Market in the US is expected to reach USD 263.0 billion in 2025.

Some of the major key players in the Global Commercial Vehicle Market are Volvo Group, Daimler Truck, BYD Auto, and others

The market is growing at a CAGR of 7.6 percent over the forecasted period