Market Overview

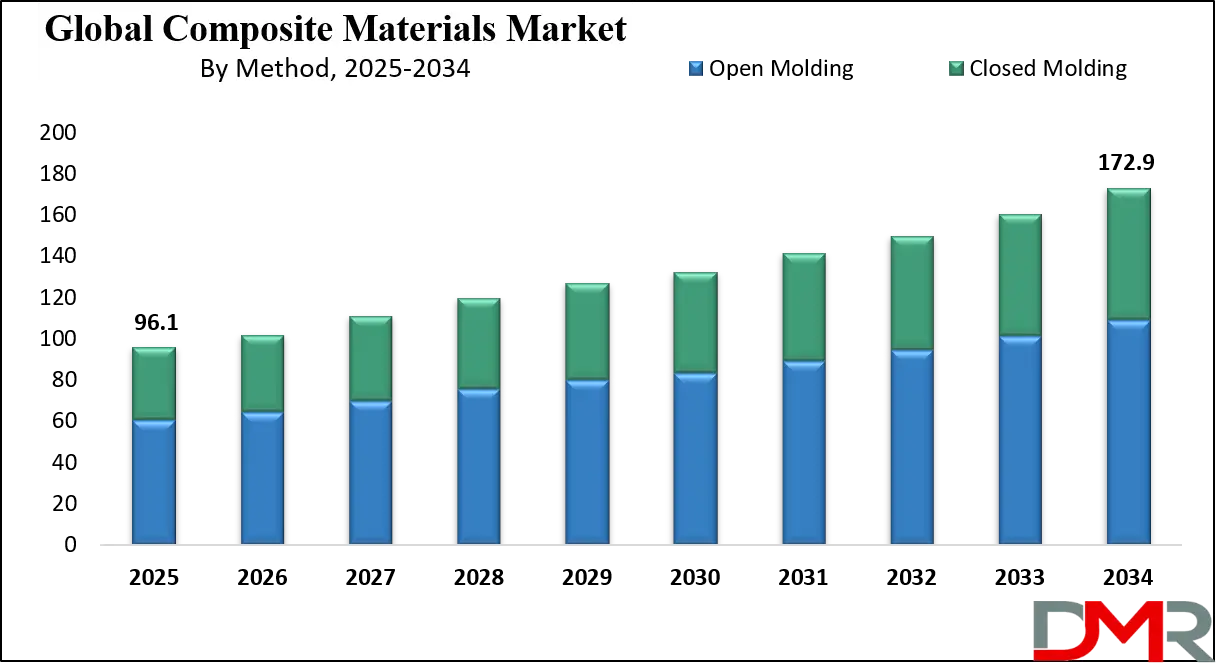

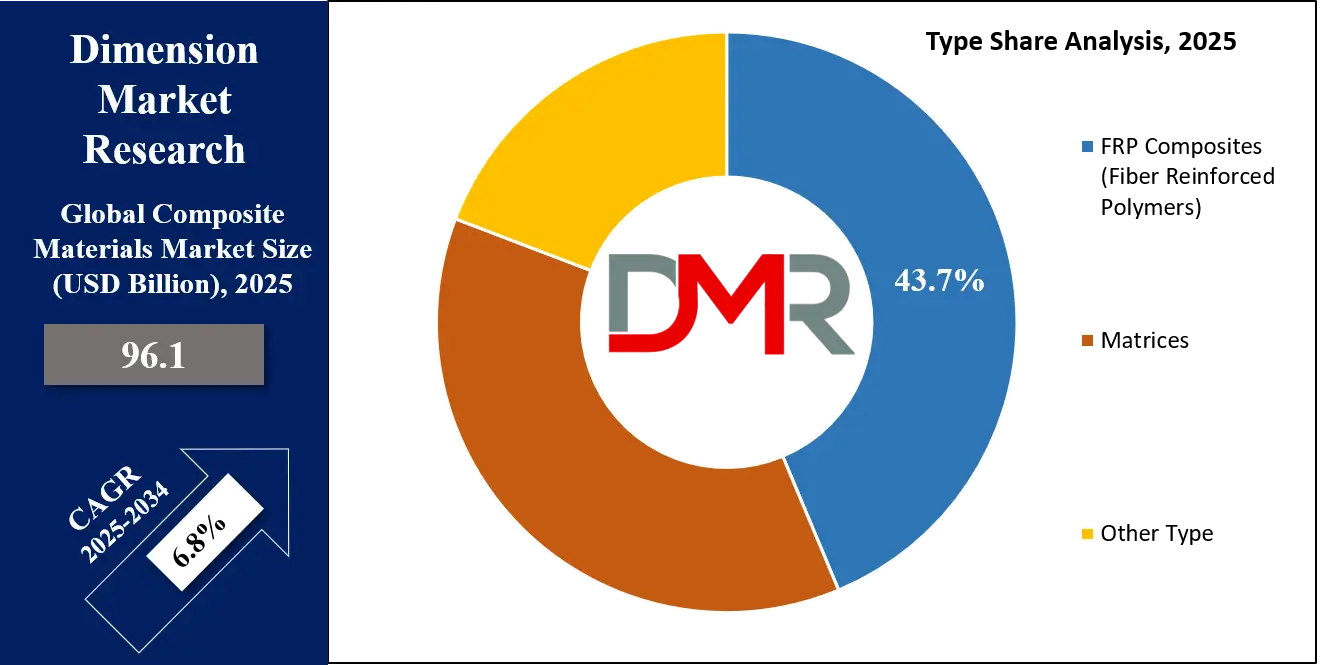

The Global Composite Materials Market size is projected to reach USD 96.1 billion in 2025 and grow at a compound annual growth rate of 6.8% from there until 2034 to reach a value of USD 172.9 billion.

The composite materials sector shows fast-paced expansion because industries seek lightweight and high-performing materials for their operations. The global composite materials market has achieved a significant value in recent years and is forecasted to maintain consistent growth during the prediction timeframe. This market expansion occurs because industries, particularly aerospace and defense, along with automotive manufacturers and builders, have been widely adopting composite materials for their operations. The composite materials outshine traditional materials through their enhanced strength-to-weight ratio and durability, as well as weight-reducing properties, which creates widespread market demand.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The composite materials market is controlled by carbon fiber reinforced polymers alongside glass fiber reinforced polymers, although carbon fiber stands out because of its remarkable strength combined with low weight. The global market continues to use glass fiber materials because they provide affordable performance alongside general application capabilities. The market demonstrates increasing adoption of metal matrix composites, while other advanced composites are gaining popularity because they provide the strength requirements for challenging applications.

The composite materials market splits its divisions according to material type, alongside manufacturing process and end-use industries, and regional sectors. The market position of SGL Carbon SE and other essential market participants strengthens through their substantial research investment into sustainable, environmentally friendly materials creation.

The composite materials industry will experience its maximum growth in aerospace applications based on recent market analysis and forecast for 2023, while automotive and energy applications maintain steady competition. Organizations leading the market achieve maximum profit by developing superior composite material production processes and advancing their technological capabilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Overall, the global composite materials market report provides a comprehensive examination of this industry sector, detailing both opportunities and challenges within it. With market size and forecast indicating sustained growth over the forecast period, the use of composite materials across various industries will likely grow substantially during that time.

The US Composite Materials Market

It is expected that the size of the US composite materials market will reach USD 29.5 billion by 2025 and continue to experience an impressive compound annual growth rate of 6.4% thereafter, reaching a total value of USD 55 billion by the end of 2034.

The United States leads the world in composite materials market operations while fulfilling industry needs across the aerospace sector, along with the automotive sector and construction sector. Lightweight materials adoption trends in the automotive sector, particularly for electric vehicles, serve as a primary market expansion factor. The aerospace industry embraces composites for aircraft components because the rise in fuel-efficient plane demand contributes to market expansion.

Its established manufacturing base, along with many material science research institutions operating within the U.S., gives the country a substantial demographic advantage. Use of sustainable products and environmentally friendly technologies has generated extra market demand for composites that serve wind power applications. The market receives extra growth potential from government initiatives that support electric vehicle production alongside renewable energy project advancement.

More attention on carbon emission reductions and sustainability promotion will ensure composite materials retain their essential role in meeting environmental targets. The United States has a large consumer market that serves as a foundation for extensive research, along with product development and commercialization regarding new composite applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Composite Materials Market

The European composite materials market is projected to reach USD 23.65 billion by 2025 and expand at a compound annual growth rate (CAGR) of 5.6% between then and 2034, eventually reaching an expected market value of USD 40.55 billion.

Europe experiences continuous expansion of its composite materials market, while three important sectors drive this growth: the automotive industry, the aerospace industry, and renewable energy applications. The area proves to be at the forefront of sustainable innovations since composites enable the production of dependable wind turbine blades, which drive efficient wind energy systems.

The automotive industry in Europe utilizes composites as part of its plan to fulfill strict environmental rules designed to reduce CO2 emissions. Europe maintains a sustainable workforce structure combined with industrial research capabilities that drive the development of improved composite resources.

Environmental sustainability initiatives and green technology investments across Europe create favorable market conditions for composite materials due to government support of cleaner energy solutions. Recent studies of the market show that composite materials find their support through national consumption as well as international sales of high-performance materials into different regions.

Lightweighting trends in car manufacturing combined with renewable energy support from authorities create new opportunities to increase composite materials consumption across the region. European manufacturing enterprises allocate significant funds to advanced materials development because they need new and improved composite materials that address modern market requirements.

The Japan Composite Materials Market

By 2025, the Japan composite materials market size is projected to hit USD 4.81 billion with compound annual growth rate projected at 5.8% to reach USD 8.43 billion by 2034.

The Japanese chromatography resin market has positive growth expectations because the pharmaceutical and biotechnology sectors in this region prioritize high-quality resins across various analytical uses. The scientific research infrastructure in Japan contains robust research capability for biotechnology and pharmaceutical developments. The beneficial population demographics have boosted chromatography resin deployment throughout drug creation and protein purification, and biopharmaceutical industrial processes.

The Japanese chromatography resin market is expanding because of technological improvements, together with increased precision medicine activity and profound research and development investments, and the rising demand for biotechnology and medical products because of Japan's aging population. The Japanese chromatography resin market will grow at a moderate but consistent CAGR that prioritizes the development of better separation and efficiency standards through innovative resin creation.

Japanese manufacturers use automated processes combined with digital technologies, which have advanced resin production operations through efficiency increases and cost reduction. The Japanese chromatography resin market will expand continuously while developing tailored innovations because of rising global demand for biopharmaceuticals and advanced analytical testing.

Global Composite Materials Market: Key Takeaways

- Global Market Size Insights: The Global Composite Materials Market size is estimated to have a value of USD 96.1 billion in 2025 and is expected to reach USD 172.9 billion by the end of 2034.

- The US Market Size Insights: The US Composite Materials Market is projected to be valued at USD 29.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 55 billion in 2034 at a CAGR of 6.4%.

- Regional Insights: North America is expected to have the largest market share in the Global Composite Materials Market with a share of about 36.5% in 2025.

- Key Players Insights: Some of the major key players in the Global Composite Materials Market are Hexcel Corporation, Toray Industries, Inc., Teijin Limited, Owens Corning, Mitsubishi Chemical Group, SGL Carbon, Solvay S.A., Huntsman Corporation, BASF SE, Gurit Holding AG, DuPont, SABIC, 3B-the fibreglass company, and many others.

- Global Market Growth Rate: The market is growing at a CAGR of 6.8% over the forecasted period of 2025.

Global Composite Materials Market: Use Cases

- Automotive Industry: Composites are employed to minimize the weight of vehicles, increase fuel efficiency, and enhance safety features. Carbon fiber and fiberglass components are becoming increasingly popular in automotive production, particularly for electric vehicles. These materials play a crucial role in obtaining greater energy efficiency and better crash resistance.

- Aerospace: Composites play a vital role in the aerospace industry for producing lightweight yet strong components such as fuselages and wings, enhancing fuel efficiency and aircraft performance. The aerospace industry is always looking for composites innovations to further minimize weight and maximize structural strength, leading to cost savings.

- Construction: Composites are applied in construction in buildings, bridges, and roads because they have a high strength-to-weight ratio and are resistant to corrosion. Composites have become a preferred option because of the demand for low-maintenance and long-lasting construction materials, even in harsh environmental conditions.

- Wind Energy: Composites play a vital role in wind turbine blades to ensure maximum energy production and increased operating life cycles by improving performance under severe environments. Composites' lightweight yet durable nature positions them as a prime choice to minimize wear and tear on the components of the turbines.

- Sports Equipment: Lightweight sports equipment, including bicycles, tennis racquets, and ski poles, employs composite materials for their weight reduction and extreme force resistance. Such materials facilitate greater control, increased durability, and enhanced performance in competitive and recreational sports equipment.

Global Composite Materials Market: Stats & Facts

- The U.S. Department of Energy states that replacing traditional metals with carbon fiber composites in vehicles could reduce vehicle weight by up to 50%, resulting in a 35% improvement in fuel efficiency.

- Airbus revealed that its A350 XWB aircraft uses 53% composite materials by weight, significantly reducing the aircraft's fuel consumption and CO₂ emissions compared to older models.

- National Renewable Energy Laboratory (NREL) estimates that over 70% of modern wind turbine blades are now constructed using fiberglass composites, with blade lengths exceeding 100 meters.

- Boeing announced that composite materials account for approximately 50% of the primary structure, including the fuselage and wings, in its 787 Dreamliner, contributing to a 20% improvement in fuel efficiency.

- The International Energy Agency (IEA) states that the global wind energy sector, heavily reliant on composites, grew 17% in capacity additions in 2023, reaching over 110 GW of new installations.

- U.S. Environmental Protection Agency (EPA) highlights that composite bridges, made from fiber-reinforced polymers, can last up to 100 years with minimal maintenance compared to 50 years for steel bridges.

- Ford Motor Company reports that using carbon fiber composites in vehicle components, such as hoods and doors, can reduce part weight by up to 60% while improving crash performance.

- The World Economic Forum (WEF) identifies composite materials as a key enabler for sustainable infrastructure development, particularly in the construction of corrosion-resistant bridges, pipelines, and modular housing.

- NASA states that advanced composite materials used in spacecraft structures can reduce overall launch mass by up to 20%, significantly lowering mission costs and increasing payload capacity.

- General Motors confirmed that carbon fiber-reinforced composites helped the Chevrolet Corvette Stingray achieve a 15% weight reduction on key body panels, improving acceleration and fuel economy.

- U.S. Department of Defense (DoD) highlights that modern military vehicles and aircraft using composite armor panels achieve up to 30% weight savings while maintaining superior ballistic protection.

- BMW Group reports that extensive use of carbon fiber composites in the i3 and i8 models reduced vehicle curb weight by approximately 300 kilograms compared to conventional steel-bodied vehicles.

- Stanford University research shows that novel nanoengineered composites can enhance mechanical strength by 40% while maintaining low densities, opening new opportunities for next-generation aerospace and automotive applications.

- European Aviation Safety Agency (EASA) data indicates that over 40% of new commercial aircraft deliveries between 2020 and 2024 feature airframes with composite materials as a primary structural component.

- Massachusetts Institute of Technology (MIT) estimates that adopting composite pipes for water infrastructure could extend system lifespans by up to 70%, drastically cutting replacement costs for municipalities.

- Toyota announced that incorporating carbon fiber-reinforced polymers into select models, including the Lexus LC, improved structural rigidity by 60% while reducing total vehicle weight by over 100 kilograms.

- University of Manchester research highlights that graphene-reinforced composite materials can achieve tensile strengths 50% higher than traditional carbon fiber composites, promising future material breakthroughs.

- Oak Ridge National Laboratory (ORNL) states that high-volume, low-cost production of carbon fiber composites could cut manufacturing costs by up to 50% by 2030 through new precursor technologies and automated systems.

- Fraunhofer Institute for Chemical Technology notes that advancements in thermoplastic composites are expected to lower production costs by 30% over the next five years, encouraging broader use in mass-market automotive applications.

Global Composite Materials Market: Market Dynamics

Driving Factors in the Global Composite Materials Market

Expanding Renewable Energy Sector Accelerating Composite Demand

The global shift towards cleaner forms of energy production, such as wind power, is driving unprecedented increases in composite demand. Modern wind turbine blades are increasingly being constructed using composite materials due to their superior strength, flexibility, and lightweight properties that boost turbine performance and longevity.

As countries invest heavily in renewable energy projects to achieve carbon neutrality goals, large-scale wind farms - both onshore and offshore - have seen rapid expansion. Turbine manufacturers are also increasing blade sizes, necessitating advanced composite materials that can withstand extreme conditions without compromising performance. Thus, the renewable energy sector remains a strong and sustained contributor to composite market expansion well into the next decade.

Growing Investments in Aerospace and Defense Applications

Aerospace and defense companies have long relied upon composite materials for mission-critical applications where weight reduction, durability, and fuel efficiency are of utmost importance. Governments and private players alike are increasing investments in next-generation aircraft, drones, satellites, and military vehicles that incorporate composite technologies.

Modern combat aircraft like the F-35 Lightning II and unmanned aerial vehicles (UAVs) rely heavily on composite materials to improve performance and stealth capabilities. Commercial aviation's recovery post-pandemic is driving new aircraft orders, creating steady demand for high-performance composites. Furthermore, with defense budgets expanding across major economies and military budgets expected to rise accordingly, composite use in military equipment should increase significantly.

Restraints in the Global Composite Materials Market

High Production Costs and Processing Complexity

One of the most significant factors affecting the composite materials market is its prohibitively expensive production costs related to raw materials, labor, and complex manufacturing processes. Carbon fiber production requires significant amounts of energy, special curing requirements, and complex fabrication methods such as autoclave molding; therefore, it has higher final product costs when compared with metals or plastics.

Furthermore, skilled labor, extensive quality controls, and specialized equipment all pose barriers to widespread adoption of composites by many end-users despite their performance benefits. Industries sensitive to material costs, such as construction or consumer goods, may hesitate to adopt composites despite their performance advantages.

Recycling and End-of-Life Management Challenges

While composite materials provide outstanding performance, recycling and end-of-life disposal remain significant challenges. Thermoset composites, which form permanent chemical bonds when cured, can be more difficult to recycle compared to metals or thermoplastics. Current recycling technologies, such as mechanical grinding or pyrolysis, can be expensive and damage the properties of recycled composites, making them less desirable.

Environmental regulations regarding waste management have tightened, placing additional pressure on manufacturers to find viable recycling solutions. Without effective and economical recycling processes, composite materials risk facing regulatory hurdles and environmental concerns that limit their widespread adoption across certain industries.

Opportunities in the Global Composite Materials Market

Penetration of Composites in Emerging Markets and Infrastructure Projects

Emerging economies across Asia-Pacific and Latin America are experiencing rapid urbanization and industrial development, creating unparalleled opportunities for composite material applications. Infrastructure projects such as smart cities, transportation networks, and energy grids increasingly specify composite materials due to their corrosion resistance, low maintenance requirements, and extended service lives.

Composite bridges, pipelines, and construction panels are growing in popularity thanks to their environmental sustainability and economic viability compared to more conventional materials. Thanks to large government initiatives aimed at modernizing infrastructure and encouraging renewable energy use, emerging markets present an excellent opportunity for composite manufacturers looking to expand beyond mature Western economies.

Advancements in Manufacturing Technologies like 3D Printing

Technological advances like additive manufacturing (3D printing) using composite materials offer great new opportunities. 3D printing allows for complex geometries with reduced material wastage and lower production costs while using high-performance composite materials like carbon fiber reinforced polymers. Industries including aerospace, automotive, and healthcare are turning to 3D printed composite parts as a cost-cutting means of creating lightweight applications with precise specifications.

Automation and digitalization in composite fabrication processes are greatly improving production efficiencies while opening doors for mass customization. As manufacturing becomes more cost-competitive, small and medium-sized enterprises (SMEs) will increasingly adopt composite technologies as market access expands and growth accelerates.

Trends in the Global Composite Materials Market

Rising Adoption of Lightweight Materials Across Industries

As companies seek fuel efficiency, lower emissions, and higher performance standards, industries such as automotive, aerospace, and defense are rapidly adopting lightweight composite materials at an accelerating rate. Companies are opting for lighter materials like carbon fiber-reinforced polymers (CFRP) and glass fiber-reinforced plastics (GFRP) in their buildings to increase strength without increasing weight.

Electric vehicle (EV) manufacturers demonstrate an increasing need for composite materials to increase battery range through weight reduction, while aerospace flights like Boeing 787 Dreamliner and Airbus A350 use composite airframes for improved fuel efficiency. Furthermore, as regulatory bodies tighten emission norms worldwide, composites will likely become an integral component of new product designs and an essential material choice.

Surge in Bio-Based and Recyclable Composite Development

Sustainability has become a driving factor of material innovation, sparking greater emphasis on bio-based composites and recyclable solutions. Traditional composite disposal issues have encouraged manufacturers to invest heavily in renewable raw materials, including natural fibers, resins derived from plant oils, and recyclable thermoplastics.

Companies are turning to green composites that deliver similar performance characteristics but with reduced environmental impacts. Governments worldwide are funding research programs on circular economy initiatives to further support this change. Sectors such as automotive, construction, and wind energy all utilize eco-friendly composites in line with corporate social responsibility (CSR) goals to offer not just environmental advantages but also competitive market advantages.

Global Composite Materials Market: Research Scope and Analysis

By Type Analysis

Fiber Reinforced Polymers (FRP) are projected to maintain dominance in the global composite materials market because of their exceptional combination of weight efficiency and durability, as well as their resistance to environmental damage. FRPs continue to dominate critical industries because they maintain both extreme strength and weight minimization properties in aerospace applications, as well as automotive and construction sectors, and energy infrastructure.

FRPs provide superior protection against corrosion than steel or aluminum do thus extending service life while reducing continuing expenses. The structural integrity requirements of demanding industries lead these sectors to select FRP materials since these materials operate effectively within dangerous stress levels and harsh environmental conditions, and elevated temperature environments. Engineers benefit from design flexibility because these materials can be formed into intricate shapes, which leads to better application innovation.

Different industries benefit from the versatility of FRP composites through their ability to use reinforcement fibers, including glass, carbon, and aramid, which enables specific solutions according to performance goals and spending boundaries. The dominance of FRP composites has strengthened because of their increasing application in renewable energy turbines, especially for producing wind turbine rotor blades.

FRP manufacturing technologies benefit from automated fiber placement (AFP) systems and resin transfer molding (RTM) systems, which simplify production while decreasing expenses and improving material quality. The market dominance of FRPs is secure because researchers work to develop biodegradable FRPs and renewable resin-based materials, and these advancements keep FRPs oriented toward global sustainability goals.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Form Analysis

The market segment of fiber tow shapes is projected to remain dominant because this form constitutes the vital basis for making high-performance composite structures. Fiber tow comes with thousands of continuous filaments packed together because it delivers superior mechanical properties which include both high tensile strength and stiffness and light weight characteristics. The material finds its primary use in aerospace along with automotive fields while also serving the sporting goods and industrial sectors because of its vital function under stress conditions.

Through the exact placement of fibers during manufacturing, manufacturers produce composites that achieve the highest strength along their force-bearing directions without adding extra material. The material functions as the basic component necessary for running filament winding alongside pultrusion and weaving applications during manufacturing operations. The development of hybridized and ultra-high-modulus fiber tows through innovations allows their use in applications such as medical devices and hydrogen storage tanks. The ability of fiber tow manufacturing facilities to scale up production while maintaining consistent filament output and adjusting fiber counts (k-value), and achieving automation levels makes it more widely applicable.

Fiber tow adoption will play an increasingly essential role because industries continuously require enhanced products that are lightweight and durable and have lower carbon footprints. Next-generation manufacturing technologies align with this material through automated layups and 3D printing, thus establishing its superior position in the composites value chain.

By Method Analysis

Open molding is projected to stand out as the leading composite manufacturing method because of its low production expenses, yet simple operation, and multiple possible uses. Open molding methods, which use hand lay-up and spray-up, need less tooling and equipment compared to the initial costs of resin transfer molding (RTM) or compression molding systems. Different kinds of manufacturers who operate within small to medium production capacity also find the open molding process highly appealing.

Open molding offers flexibility as an important benefit, which allows manufacturers to produce parts of diverse sizes and complexity while employing different composite materials for applications that span from bathtubs to boat hulls and wind turbine blades. Artisans, together with engineers, can rapidly redesign products while adapting customer needs by making prototypes through this process without needing expensive tool restyling. The basic nature of open molding technology decreases the production time for specific parts, which allows transportation and construction businesses to achieve speedier delivery deadlines.

Technological improvements, such as vacuum bagging and better catalyst systems, have significantly enhanced the mechanical properties, surface finish, and consistency of open-molded parts, addressing traditional drawbacks like voids or inconsistent curing. In emerging markets, where infrastructure and capital investment are limited, open molding remains a preferred choice for producing durable, low-cost composite products. As demand grows for customized and large-scale composite structures, open molding’s adaptability and low entry barrier ensure its continued leadership among fabrication methods.

By Adhesives Analysis

Epoxy adhesives dominate the composite materials market due to their superior bonding strength, versatility, and exceptional chemical and environmental resistance. Epoxies provide high structural performance, ensuring reliable adhesion between different composite layers, metals, and plastics even under extreme mechanical stresses and environmental exposures. This makes them the adhesive of choice for industries requiring critical performance, including aerospace, automotive, marine, and construction.

Their excellent thermal stability and ability to maintain mechanical properties across a wide temperature range add further advantages, especially in applications involving heat or cold exposure. Epoxies are highly customizable manufacturers can tailor their viscosity, cure time, and flexibility to meet diverse manufacturing requirements, whether for fast-setting repairs or precision-controlled bonding processes. Another major reason for epoxy dominance is their compatibility with a broad array of reinforcement materials and resins, allowing manufacturers to maximize design freedom without sacrificing performance.

The rise in lightweighting trends across industries has made high-performance bonding solutions essential, and epoxies meet the challenge by enabling the creation of strong joints without adding excessive weight. Innovations such as toughened epoxy formulations and fast-cure systems have expanded their usability in mass production environments, like automotive assembly lines. As demand for durable, high-strength composite structures grows globally, epoxies will remain the adhesive technology at the forefront of the market.

By Application Analysis

Aerospace dominates the composite materials application market because it demands the highest levels of performance, durability, and weight reduction, all key strengths of composites. In aircraft, satellites, and spacecraft, every kilogram saved translates into significant operational cost savings and efficiency gains. Composite materials such as carbon fiber-reinforced polymers (CFRP) are widely used in fuselages, wings, and interiors to optimize weight while enhancing structural strength and fatigue resistance.

Additionally, composites contribute to better aerodynamics, corrosion resistance, and design flexibility, allowing manufacturers to create more fuel-efficient and innovative aircraft designs. Commercial aviation giants like Boeing and Airbus have adopted composites extensively in new-generation aircraft, with models like the Boeing 787 and Airbus A350 comprising over 50% composite material by weight.

Certification standards of the aerospace sector have led to ongoing advancements in composite technologies, which further drive material adoption in the industry. Lightweight high-performance materials experience increasing demand because the space industry shows rapid growth through the expansion of private sector enterprises and satellite development.

Military aviation, together with drone operations, adopts composites to enhance their stealth capabilities while gaining better maneuverability and improved resilience. The global composite materials market will persistently demonstrate aerospace manufacturer leadership due to composites playing a fundamental role in developing electric aircraft and supersonic jets for the next generation.

The Global Composite Materials Market Report is segmented on the basis of the following:

By Type

- FRP Composites (Fiber Reinforced Polymers)

- Glass Fiber Reinforced Polymers (GFRP)

- Carbon Fiber Reinforced Polymers (CFRP)

- Aramid Fiber Reinforced Polymers (AFRP)

- Others

- Matrices

- Polymer Matrix Composites (PMC)

- Metal Matrix Composites (MMC)

- Ceramic Matrix Composites (CMC)

- Other Type

By Form

- Fiber Tow

- Unidirectional Tape

- Cloth

By Method

- Open Molding

- Hand Lay-Up

- Spray-Up

- Filament Winding

- Closed Molding

- Compression Molding

- Pultrusion

- Reinforced Reaction Injection Molding (RRIM)

- Resin Transfer Molding (RTM)

- Vacuum Bag Molding

- Other Method

By Adhesives

- Epoxies

- Bismaleimide

- Cyanate Ester

- Modified Acrylics

- Polyurethanes

- Silicones

By Application

- Aerospace

- Wind Energy

- Automotive

- Construction

- Electrical

- Sporting Goods

- Pipes & Tanks

- Other Application

Global Composite Materials Market: Regional Analysis

Region with Highest Market Share

The North American region is projected to hold the top position in composite materials as it commands over 36.5% of the total market revenue in 2034 due to its initial technology adoption and strong investment in research and development, combined with critical industries. The United States stands at the forefront of aerospace production, as well as automotive manufacturing and wind energy deployment, and defense operations, while being one of the largest global markets for high-performance composites that include CFRP and GFRP products.

The aerospace giant Boeing, along with Lockheed Martin, as well as General Electric and Ford, represent major commercial users of composite materials because they deploy lightweight solutions to boost efficiency while satisfying stringent government standards. The region maintains a strong framework for innovation that includes institutions, including NASA and Oak Ridge National Laboratory, which advance the development of new composite applications.

Renewable energy promotion efforts by governments, along with efforts to make cars more lightweight through design advancements, drive up composite material usage requirements. The area maintains a superior competitive position because it features a well-developed supply chain infrastructure alongside experienced workers and key composite manufacturers, along with essential suppliers.

Advanced military equipment receives continuous funding from the U.S. defense sector for lightweight and high-strength composite materials, creating long-term market expansion potential. North American dominance in the worldwide composite materials market receives continuous support from various market drivers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia-Pacific region will show the fastest compound annual growth rate for composite materials because of its fast industrial development and increasing infrastructure demand, and expanding aerospace and automotive industries. Thailand, China, and India, along with Japan and South Korea, are actively pouring money into renewable power systems, electric transportation systems, and smart integrated projects that produce considerable demand for strong lightweight composite materials.

The extensive utility of wind turbines across China makes it the world leader in installations, with COMAC and other aerospace firms expanding composite material markets in the nation. Official government support for green construction methods and sustainable technology innovations drives more industries to utilize advanced materials.

Asia-Pacific demonstrates both economic manufacturing capabilities and rising domestic requirements for premium consumer items and transportation products, which support the adoption of composites in product markets. The speed of global market expansion is driven by continuous research and innovation investments, which particularly benefit Japan and South Korea in their pursuit of developing future composite materials.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Composite Materials Market: Competitive Landscape

Key players within the global composite materials market operate in a competitive environment that features numerous market participants while they pursue technological modernization together with strategic partnerships and international market expansion strategies to enhance market dominance. Hexcel Corporation and Toray Industries and SGL Carbon and Owens Corning, and Teijin Limited dominate the market through their complete line of carbon fiber products and glass fiber products and aramid composites, and specialty resins offerings.

The market demands have prompted companies to dedicate investment in automated manufacturing technologies and sustainable bio-composites, and advanced thermoplastic composites operations. The business expansion strategy of strategic mergers and acquisitions serves firms that want to build capabilities and increase their reach across regions. Toray used this strategy to get access to aerospace-grade thermoplastic composite technology through its acquisition of TenCate Advanced Composites.

Produced through strategic partnerships between carbon fiber manufacturers and aerospace enterprises, and automotive manufacturers and renewable energy businesses that develop new advancements. Market competition is influenced by growing interests in recycling technologies, together with circular economy models that shape research and development initiatives. New competitors from startup firms compete through specialized composites that match individual applications, which heightens market competition levels.

Some of the prominent players in the Global Composite Materials Market are:

- Hexcel Corporation

- Toray Industries, Inc.

- Teijin Limited

- Owens Corning

- Mitsubishi Chemical Group

- SGL Carbon

- Solvay S.A.

- Huntsman Corporation

- BASF SE

- Gurit Holding AG

- DuPont

- SABIC

- 3B-the fibreglass company

- Cytec Industries (a part of Solvay)

- Johns Manville (a Berkshire Hathaway company)

- Nippon Graphite Fiber Corporation

- Park Aerospace Corp.

- AOC Resins and Coatings

- U.S. Liner Company

- Saertex GmbH & Co. KG

- Other Key Players

Recent Developments in the Global Composite Materials Market

April 2025

- Hexcel Corporation launched HexTow® HM63, a next-generation carbon fiber composite offering a 15% strength improvement, specifically engineered for aerospace structures and hydrogen storage vessels, aiming to meet rising sustainability and performance demands.

- JEC World 2025 (Paris) featured 1,200+ exhibitors, showcasing breakthroughs in recyclable composites, bio-based resins, automated production techniques, and next-gen thermoplastic materials, marking a major push towards sustainable and digital composite manufacturing ecosystems.

March 2025

- Toray Industries entered a strategic partnership with Airbus to develop thermoplastic composites designed to cut aircraft production time by 30%, enhancing manufacturing efficiency and contributing to lower carbon emissions in aviation.

- SGL Carbon announced a €120 million investment to expand its German carbon fiber facilities, targeting surging automotive, wind energy, and aerospace composite demands across Europe, the U.S., and Asia-Pacific markets.

January 2025

- Owens Corning finalized the $240 million acquisition of Asahi Fiber Glass Co.'s composites division, aiming to strengthen its footprint in Asia-Pacific and broaden its specialty glass fiber and composites offerings globally.

- Composites Innovation Conference 2025 (Tokyo) gathered leading researchers and manufacturers to explore AI-assisted composite design, sustainable thermoplastic composites, and strategies for recycling carbon fiber waste into new manufacturing cycles.

November 2024

- Teijin Limited introduced carbon fiber composite materials engineered specifically for electric vehicle chassis systems, achieving up to a 25% weight reduction compared to aluminum, which will support EV range and efficiency improvements.

- BMW Group invested $100 million into a specialized R&D center to accelerate composite materials integration into next-generation electric vehicles, targeting structural rigidity enhancements and significant lightweighting for improved battery performance.

September 2024

- Solvay entered into a supply agreement with Vertical Aerospace to deliver advanced composite materials tailored for the company’s next-gen electric vertical takeoff and landing (eVTOL) aircraft, supporting lightness, safety, and energy efficiency.

- CAMX 2024 (San Diego) saw record-breaking participation, unveiling major advances in recyclable thermoset composites, additive manufacturing of large composite structures, and new durability standards for automotive and aerospace composite applications.

July 2024

- Mitsubishi Chemical Group announced a $75 million investment to expand carbon fiber production in Sacramento, focusing on rising demand from wind turbine blade manufacturing, aerospace fuselage production, and hydrogen storage tank fabrication.

- University of Manchester launched the Graphene Composites Research Initiative, a collaboration with major industry players to develop graphene-reinforced composites, promising ultra-lightweight and high-strength materials for aviation, defense, and renewable energy sectors.

May 2024

- Daher acquired TriModels, an advanced composites company based in Florida, significantly enhancing its capability to produce high-precision aerospace components for leading American and European aircraft manufacturers seeking lightweight structure solutions.

- WindEurope Annual Event 2024 highlighted cutting-edge research into thermoplastic resin technology for wind turbine blades, underlining industry moves toward sustainable, recyclable composite materials to support massive wind energy infrastructure expansions.

March 2024

- Huntsman Corporation launched the Araldite® series of high-performance composite adhesives, engineered to enhance bonding speed and strength for automated aerospace manufacturing processes, supporting faster production timelines and improved lightweighting initiatives.

- JEC World 2024 (Paris) hosted 40,000+ participants, emphasizing the future of sustainable composites, AI-driven manufacturing, circular economy frameworks, and digital twins in composite design for energy, transportation, and infrastructure sectors.

January 2024

- Archer Aviation and Hexcel Corporation signed a multiyear supply deal for carbon fiber composites for Archer’s eVTOL aircraft, aiming to revolutionize urban air mobility by offering lighter, safer, and more efficient air taxis.

- Composites UK Conference 2024 focused on legislative changes encouraging recyclability, biodegradability, and circular economy adoption in composites across construction, marine, automotive, and aerospace sectors, highlighting rising environmental pressures on material innovation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 96.1 Bn |

| Forecast Value (2034) |

USD 172.9 Bn |

| CAGR (2025–2034) |

6.8% |

| The US Market Size (2025) |

USD 29.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (FRP Composites (Fiber Reinforced Polymers), Matrices, Other Type), By Form (Fiber Tow, Unidirectional Tape, Cloth), By Method (Open Molding, Closed Molding), By Adhesives (Epoxies, Bismaleimide, Cyanate Ester, Modified Acrylics, Polyurethanes, Silicones), By Application (Aerospace, Wind Energy, Automotive, Construction, Electrical, Sporting Goods, Pipes & Tanks, Other Applications)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Hexcel Corporation, Toray Industries Inc., Teijin Limited, Owens Corning, Mitsubishi Chemical Group, SGL Carbon, Solvay S.A., Huntsman Corporation, BASF SE, Gurit Holding AG, DuPont, SABIC, 3B-the fibreglass company, Cytec Industries (a part of Solvay), Johns Manville (a Berkshire Hathaway company), Nippon Graphite Fiber Corporation, Park Aerospace Corp., AOC Resins and Coatings, U.S. Liner Company, Saertex GmbH & Co. KG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Composite Materials Market?

▾ The Global Composite Materials Market size is estimated to have a value of USD 96.1 billion in 2025 and is expected to reach USD 172.9 billion by the end of 2034.

What is the size of the US Composite Materials Market?

▾ The US Composite Materials Market is projected to be valued at USD 29.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 55 billion in 2034 at a CAGR of 6.4%.

Which region accounted for the largest Global Composite Materials Market?

▾ North America is expected to have the largest market share in the Global Composite Materials Market with a share of about 36.5% in 2025.

Who are the key players in the Global Composite Materials Market?

▾ Some of the major key players in the Global Composite Materials Market are Hexcel Corporation, Toray Industries, Inc., Teijin Limited, Owens Corning, Mitsubishi Chemical Group, SGL Carbon, Solvay S.A., Huntsman Corporation, BASF SE, Gurit Holding AG, DuPont, SABIC, 3B-the fibreglass company, and many others.

What is the growth rate in the Global Composite Materials Market in 2025?

▾ The market is growing at a CAGR of 6.8 percent over the forecasted period of 2025.