.

Compound semiconductors, unlike traditional semiconductors like silicon, consist of multiple elements. Gallium arsenide (GaAs) or indium phosphide (InP) compound semiconductors have special properties that allows them to quickly handle high-frequency signals and power efficiently; making them particularly effective at handling 5G networks,

electric vehicles, solar panels, satellite communications, and LEDs/laser diodes commonly found in smartphones or fiber-optic cables.

Compound semiconductors have seen growth in demand since the advent of new technologies. 5G wireless networks, electric vehicle production growth, and renewable energy expansion have all driven interest in these materials. Compound semiconductors excel over silicon when exposed to extreme conditions like temperature or radiation exposure, making them suitable for space, military and industrial uses as well. Their ability to work efficiently at higher speeds and power levels gives compound semiconductors an edge when used in advanced electronic systems.

They have seen increased importance due to various global trends. One such trend is the increased need for energy-efficient electronics; as individuals and industries strive to reduce energy waste, devices built from compound semiconductors become more appealing as they provide greater power while using less energy. Another significant development is the rise of advanced driver assistance systems in cars which rely on sensors and communication technologies made of compound semiconductors - both trends are expected to continue increasing the prominence of these materials even further.

Recent events have prompted many countries to increase domestic production of compound semiconductors to decrease dependence on imports and secure supply chains, especially as global tensions and trade issues demonstrate just how fragile supply chains can be. Governments have even included compound semiconductors as essential for future competitiveness in technology and defense sectors in their strategic plans; major companies have announced new partnerships or investments in research to speed innovation in this space.

Industry participants have also noticed an upswing in interest from companies that had traditionally relied solely on silicon; now expanding into compound semiconductors to meet customer demands, new startups are emerging with innovative concepts to enhance performance and cost, larger players are ramping up production while research centers and universities look into ways of making compound semiconductors more reliable and easier to manufacture.

Compound semiconductors have grown highly crucial as modern technology progresses. Their ability to enable faster, smaller, and more energy-efficient devices makes them essential components in future innovations. Furthermore, as demand for high-performance electronics increases, so too does their need for superior materials like these - compound semiconductors look set to play an increasingly prominent role in shaping electronics across many different industries in future decades.

The US Compound Semiconductor Market

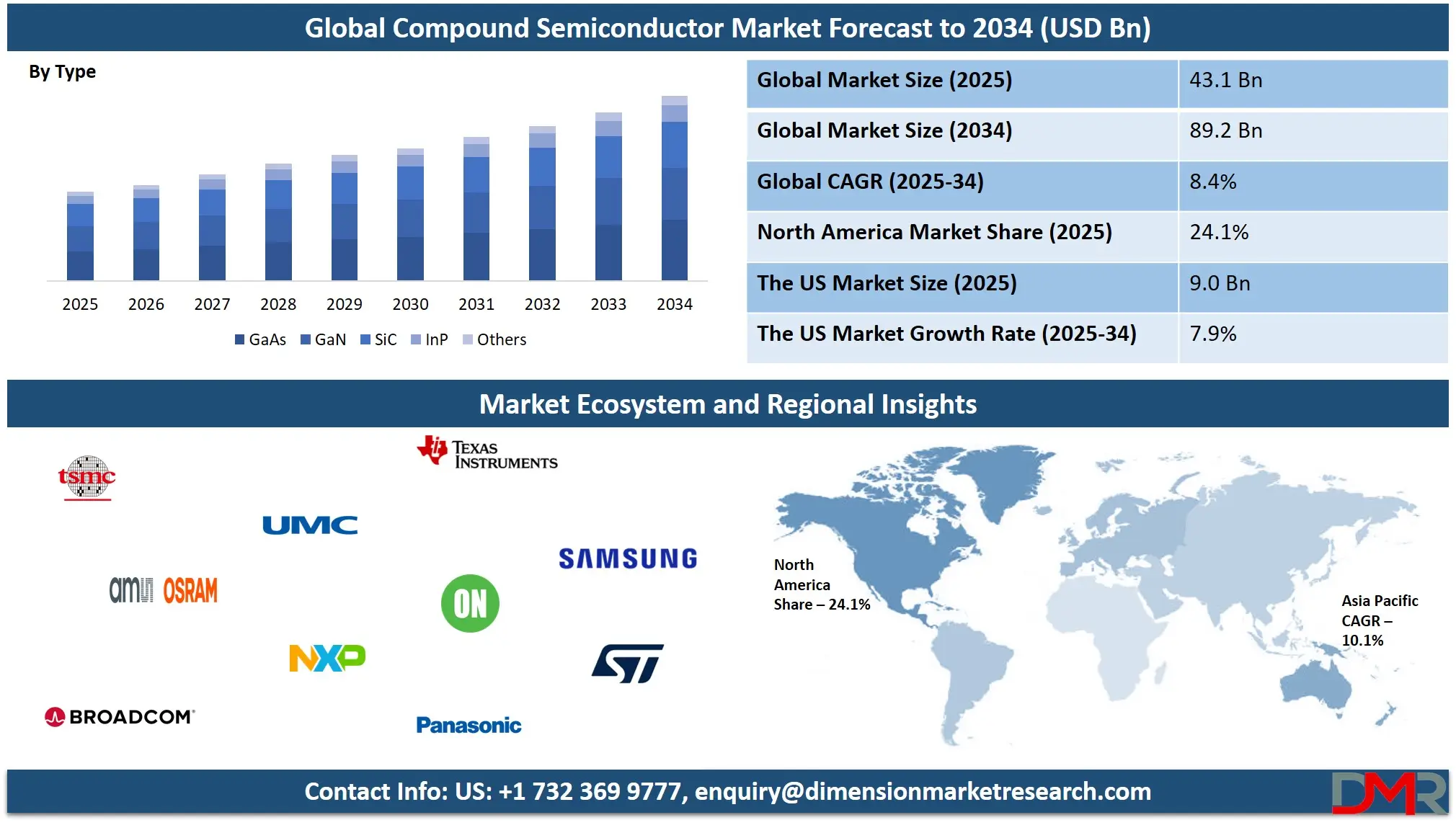

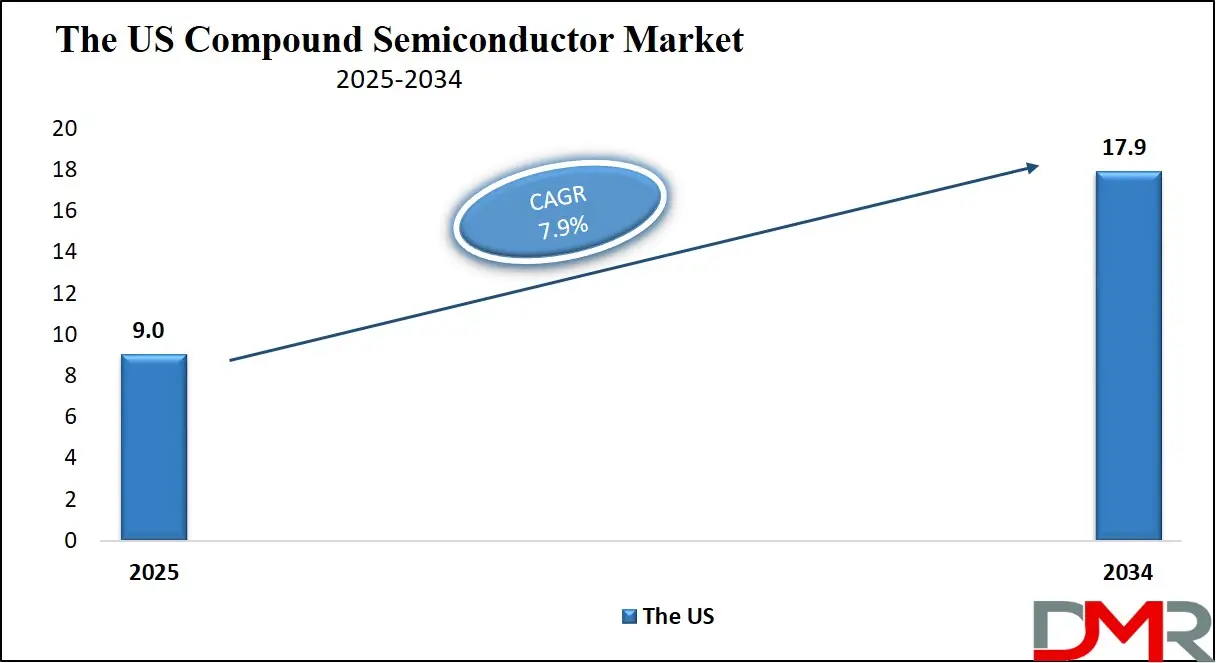

The US Compound Semiconductor Market is projected to reach USD 9.0 billion in 2025 at a compound annual growth rate of 7.9% over its forecast period.

The US compound semiconductor market presents significant growth opportunities driven by advancements in 5G, electric vehicles, and power electronics. Increasing demand for high-performance devices in communications, automotive, and renewable energy sectors, coupled with innovation in materials like GaN and SiC, positions the U.S. as a key player in driving the global market forward.

Further, the market is driven by the growing demand for high-performance devices in sectors like telecommunications, automotive, and power electronics. Advancements in 5G and electric vehicles fuel this growth. However, challenges such as the high cost of production and reliance on foreign supply chains pose significant restraints, hindering the full potential of market expansion despite technological advancements and increasing applications.

Compound Semiconductor Market: Key Takeaways

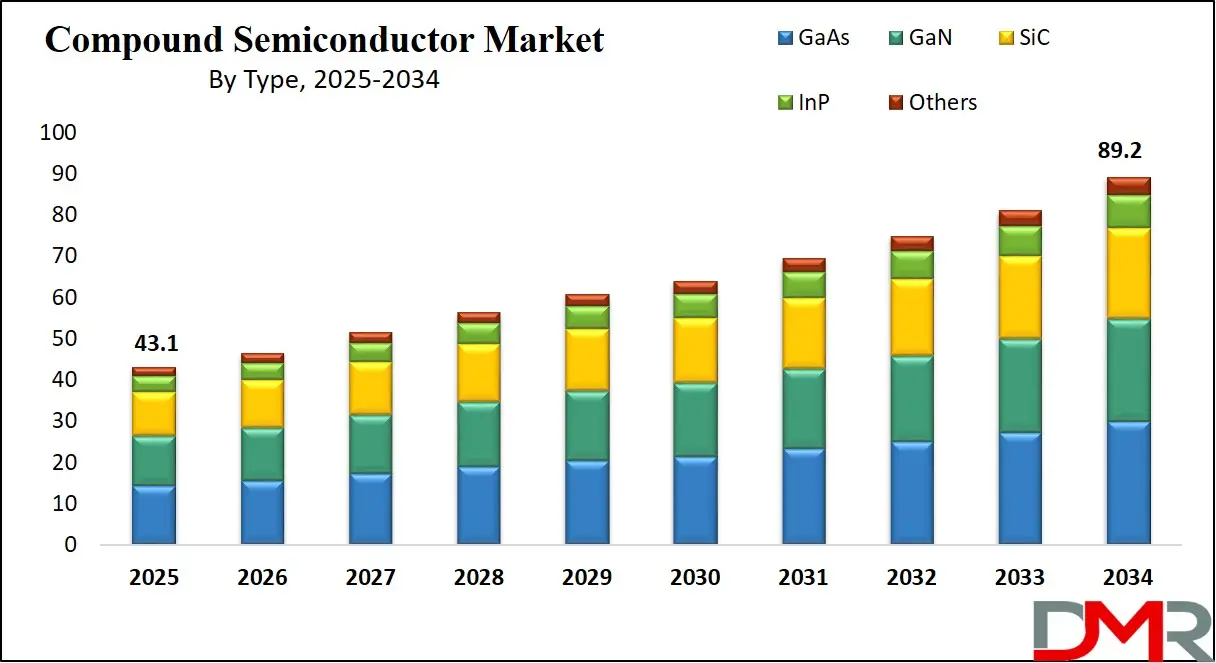

- Market Growth: The Compound Semiconductor Market size is expected to grow by 42.8 billion, at a CAGR of 8.4%, during the forecasted period of 2026 to 2034.

- By Type: The GaAs segment is anticipated to get the majority share of the Compound Semiconductor Market in 2025.

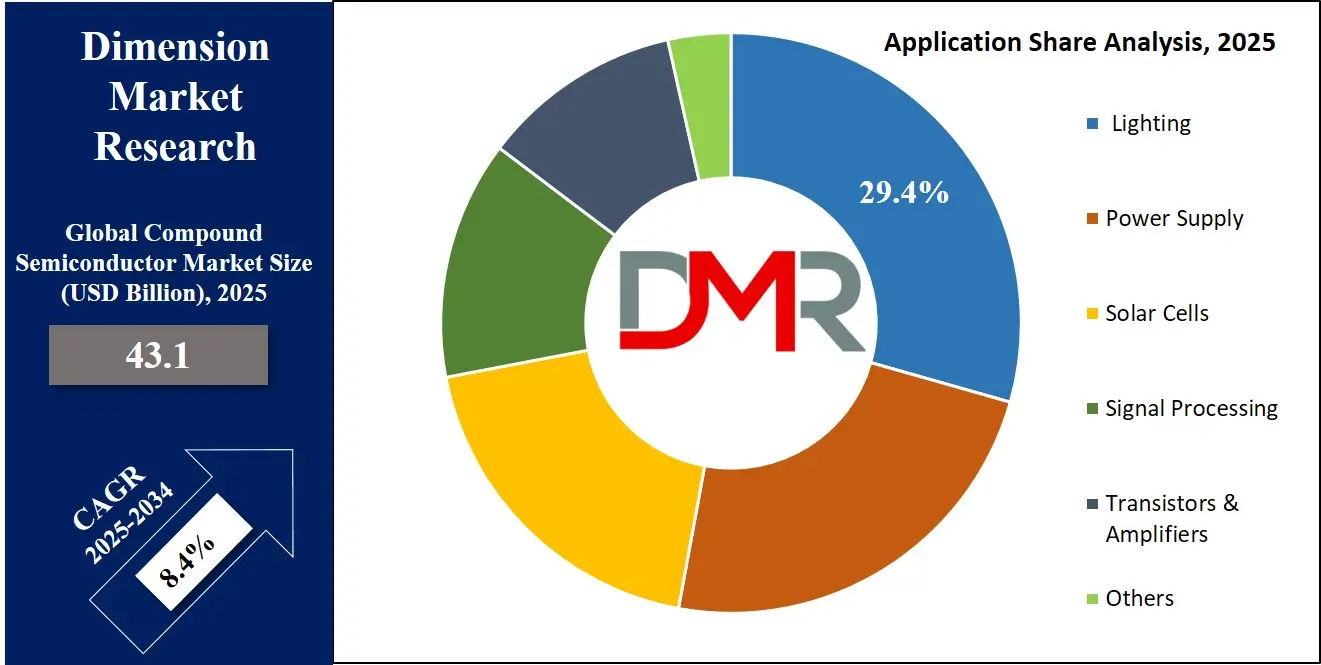

- By Application: The lighting segment is expected to get the largest revenue share in 2025 in the Compound Semiconductor Market.

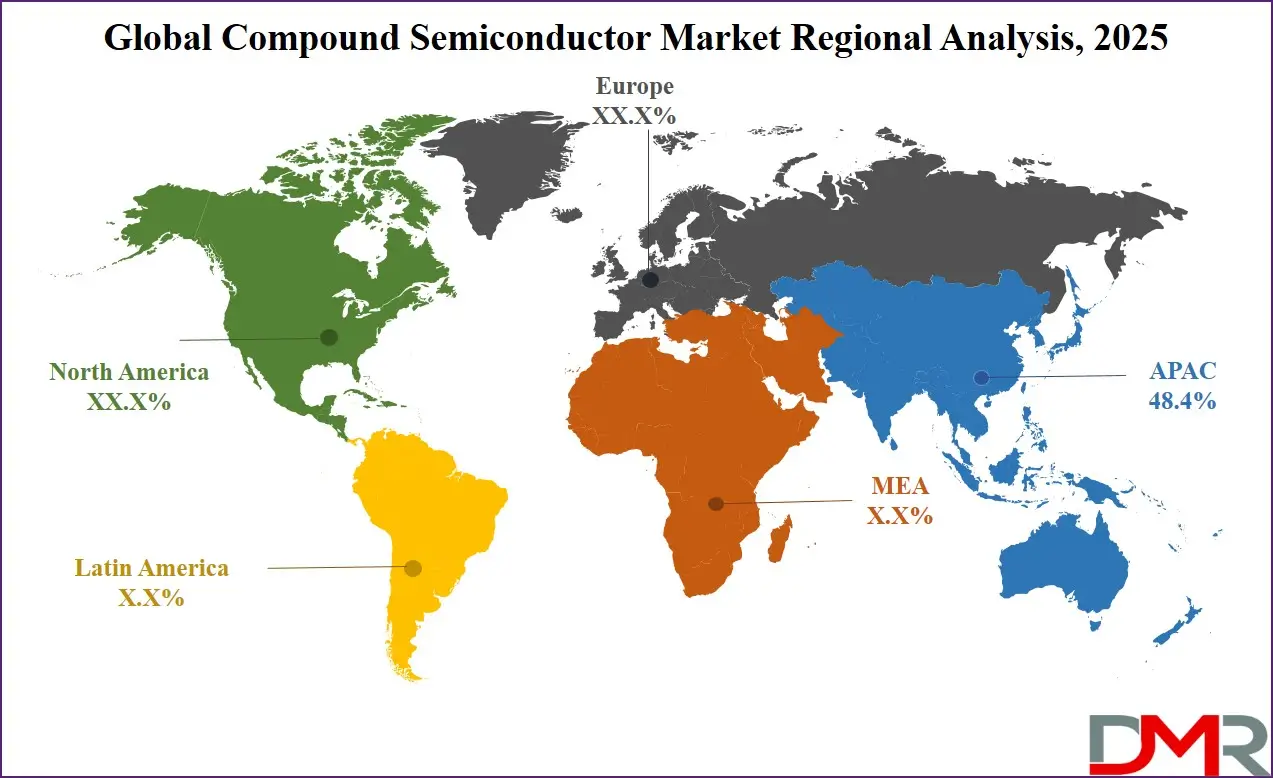

- Regional Insight: Asia Pacific is expected to hold a 48.4% share of revenue in the Global Compound Semiconductor Market in 2025.

- Use Cases: Some of the use cases of Compound Semiconductor include renewable energy systems, defense & aerospace, and more.

Compound Semiconductor Market: Use Cases

- 5G and Wireless Communication: Compound semiconductors are broadly used in high-frequency components for 5G networks. They allow quick data transmission and better signal quality, making them essential for mobile infrastructure and devices.

- Electric Vehicles and Charging Systems: These materials are vital for power electronics in electric vehicles. They help minimize energy loss and heat, leading to more efficient charging systems and extended driving range.

- Renewable Energy Systems: In solar inverters and wind energy systems, compound semiconductors enhance energy conversion efficiency, which makes renewable power systems more reliable and cost-effective.

- Defense and Aerospace: They are used in radar systems, satellite communication, and advanced sensing technologies. Their ability to operate at high temperatures and frequencies makes them ideal for harsh environments.

Stats & Facts

According to the Semiconductor Industry Association (SIA)

- The U.S. semiconductor industry experienced a major rebound after the 1980s, when it lost nineteen percentage points of global market share due to intense Japanese competition and economic recession. By 1997, U.S. firms had regained global leadership with a 50% share and retained a 50.2% share of the global market as of 2023, maintaining dominance in microprocessors, advanced device technologies, and overall sales leadership in all major global markets.

- The U.S. semiconductor industry invested a total of USD 107.5 billion in R&D and capital expenditures in 2023, including spending by fabless firms. This reflects a compound annual growth rate of 5.9% from 2001 to 2023, showing that U.S. firms have continued investing aggressively to stay ahead in a technology-driven and cyclical market.

- In 2023, semiconductor exports from the United States reached USD 52.7 billion, making semiconductors the sixth-largest category of U.S. exports after refined oil, crude oil, airline services, natural gas, and automobiles. Among all electronics-related exports, semiconductors accounted for the largest portion.

- Investment per employee by U.S. semiconductor firms, combining R&D and capital expenditures, grew from over USD 100,000 in 2001 to USD 223,500 in 2023. Despite economic slowdowns in 2001, 2009, and 2010, per-employee investment continued to rise in the long term, with an average annual growth rate of approximately 3.3%.

- The U.S. semiconductor sector has outpaced other U.S. manufacturing industries in R&D intensity, with annual research and development expenditures exceeding 15% of total sales consistently over the past two decades—a rate unmatched by other major manufacturing sectors.

- From 2001 to 2023, R&D investment by U.S. semiconductor companies grew at a compound annual rate of 6.7%, reaching USD 59.3 billion in 2023. This growth trend underscores the industry’s commitment to innovation, even during downturns like those in 2001–2002 and 2008–2009, when sales fell but R&D spending remained relatively stable.

- The U.S. semiconductor industry has continued to lead the world in several high-value areas such as microprocessors, design, process technologies, and advanced product segments. In 2023, logic, memory, analog, and microprocessor units (MPUs) accounted for 75% of global semiconductor sales.

- Despite the dramatic 1980s decline due to Japanese competition and illegal dumping, U.S. semiconductor firms rebounded by focusing on high-tech segments and R&D, recapturing the global lead by 1997 and holding 50.2% of worldwide sales in 2023. Other national semiconductor industries had market shares between 7% and 15%.

- The U.S. industry’s commitment to capital investment has remained strong even in years of declining sales, such as 2001–2002. Industry-wide investment rates have hovered around 30% of sales, driven by the need for increasingly complex designs and more advanced manufacturing tools to stay on the leading edge of miniaturization and performance.

- U.S.-based semiconductor firms have consistently led global markets in both design and process innovations, aided by continued capital expenditures and technological development. This consistent leadership has allowed them to maintain top sales positions in every major national and regional semiconductor market in 2023.

- R&D spending in 2001 and 2002 surged even as revenues dropped due to the dot-com bust, demonstrating a long-term strategy prioritizing technological advancement. Conversely, in 2003–2004 and 2020–2021, R&D intensity dipped not because of budget cuts but because revenue grew unexpectedly fast, lowering R&D as a percentage of sales.

- Capital and R&D investment levels in the U.S. semiconductor industry have remained relatively stable about sales, indicating a disciplined approach to long-term innovation despite the market’s natural cycles of boom and bust.

- Fabless companies have played a significant role in U.S. industry expenditures, contributing to the $107.5 billion total investment in 2023, which covers both plant development and advanced research for next-gen devices.

- Since regaining leadership in 1997, U.S. semiconductor firms have sustained their top position by developing cutting-edge process technologies and investing in state-of-the-art production equipment, staying ahead in global competition through consistent long-term investment strategies.

- Semiconductor industry technology has evolved rapidly, requiring firms to deploy more sophisticated designs and production processes. U.S. firms have kept pace with these demands through continued investments that support the scaling down of device feature sizes and the scaling up of processing capabilities.

Market Dynamic

Driving Factors in the Compound Semiconductor Market

Rising Demand for High-Speed, High-Frequency Applications

One of the main growth drivers for the compound semiconductor market is rising demand for devices that operate at both high speeds and frequencies. Technologies such as 5G, satellite communication and advanced radar systems require components that can process large volumes of data quickly with minimal latency or power loss. Compound semiconductors such as gallium nitride (GaN) and gallium arsenide (GaAs) excel under these conditions, offering faster switching speeds and superior thermal performance compared to traditional silicon semiconductors.

As such, these compounds make them suitable for use in base stations, mobile devices, and communication satellites. As

digital infrastructure expands around the globe, especially in heavily populated regions, demand for reliable, efficient and high-performance semiconductors has steadily increased - an upward trend likely accelerated by next-gen wireless networks globally.

As Electric Vehicles and Green Energy Solutions Proliferate

A significant driver of the compound semiconductor market today is the surge in EV sales and the shift toward renewable energy solutions. Silicon carbide (SiC) and GaN compound semiconductors have become an indispensable component in electric vehicle (EV) powertrains, charging stations and battery management systems due to their superior efficiency and ability to handle high voltages.

Reduce energy losses, improve thermal performance, and make smaller, lighter power systems, which is key for increasing vehicle range while decreasing costs. Solar inverters and wind turbines also use these advanced semiconductor materials to maximize energy conversion efficiency, helping maximize output from renewable sources. As governments and industries invest in clean energy and sustainable mobility initiatives, the demand for such advanced semiconductors should increase considerably.

Restraints in the Compound Semiconductor Market

High Production Costs and Complex Manufacturing Process

One of the major restraints in the compound semiconductor market is the high cost of production and the complexity involved in manufacturing these materials. Unlike traditional silicon semiconductors, compound materials like GaN, GaAs, and SiC need specialized equipment, cleanroom environments, and highly controlled processes. These factors make fabrication more expensive and technically demanding.

In addition, the yield rates for compound semiconductors are often lower than for silicon, which further drives up costs. This can deter smaller players from entering the market and make it harder to scale production. As a result, the high manufacturing expenses can limit widespread adoption, mainly in cost-sensitive applications or developing regions where pricing is a major concern.

Limited Availability of Raw Materials and Supply Chain Challenges

The compound

semiconductor market also faces challenges related to the limited availability of raw materials and associated supply chain issues. Key elements like gallium, indium, and silicon carbide are not as abundant as silicon and are sometimes sourced from a few regions globally, which increases the risk of supply disruptions due to geopolitical tensions, export restrictions, or mining limitations.

Additionally, the refining and purification of these materials are complex and resource-intensive, which can create bottlenecks in production. These constraints can affect the stability of supply and pricing, especially when demand surges. As industries increasingly rely on these semiconductors for high-performance applications, securing a steady and sustainable material supply becomes a growing concern.

Opportunities in the Compound Semiconductor Market

Rising Demand for High-Frequency and High-Power Applications

One of the key opportunities for the compound semiconductor market lies in its growing use in high-frequency and high-power applications. These semiconductors are well-suited for technologies such as 5G communication, radar systems, satellite communication, and power electronics due to their superior electron mobility and thermal conductivity. As the global rollout of 5G networks accelerates, the demand for high-performance components that can handle greater bandwidth and power is increasing rapidly.

Compound semiconductors provide the speed & efficiency needed for these systems to function reliably. Their ability to operate at higher voltages and frequencies compared to silicon makes them ideal for next-generation wireless infrastructure and defense-related systems. This expanding scope opens up new growth avenues across both commercial and military sectors.

Emerging Applications in Green Technologies and Electric Mobility

Another significant opportunity for compound semiconductors is their growing use in clean energy and electric mobility solutions. These materials are becoming essential in electric vehicles (EVs), renewable energy systems, and smart grid applications because of their efficiency in power conversion and heat resistance.

As global efforts to reduce carbon emissions gain momentum, industries are turning to technologies that can optimize energy use and support sustainability goals. Compound semiconductors play a vital role in increasing the efficiency of EV powertrains, inverters, and fast-charging systems. Similarly, in solar and wind energy installations, they help improve power management and reduce energy loss. Their importance in enabling efficient energy systems creates strong market potential as demand for eco-friendly technologies continues to grow.

Trends in the Compound Semiconductor Market

Integration of Compound Semiconductors in Consumer Electronics

A recent trend in the compound semiconductor market is its growth in integration into everyday consumer electronics. As devices become smarter and more connected, there is a greater demand for components that can deliver high-speed performance, energy efficiency, and miniaturization. Compound semiconductors, mainly materials like gallium arsenide and gallium nitride, are being used in smartphones, wearables, and Wi-Fi routers for faster signal processing and better battery performance.

With features such as facial recognition, augmented reality, and advanced sensors becoming more common, the role of compound semiconductors in enabling these functionalities is growing. This trend reflects the industry's shift toward improving user experience through high-performing yet compact components.

Adoption in Advanced Automotive Systems and Autonomous Vehicles

Another strong trend is the adoption of compound semiconductors in modern automotive systems, especially in electric and autonomous vehicles. These materials are used in radar, LiDAR, power management systems, and onboard chargers, owing to their efficiency in managing high voltages and frequencies. The evolution of smart vehicles requires real-time data processing and low energy loss, which compound semiconductors can support effectively.

As automakers invest heavily in autonomous driving technologies and greener transportation, the demand for these semiconductors is expected to rise. This trend not only supports safer, smarter mobility but also highlights the transition of automotive electronics from traditional silicon to more advanced materials.

Research Scope and Analysis

By Type Analysis

Gallium Arsenide (GaAs) is projected to lead the compound semiconductor market in 2025 with an estimated market share of 33.3%, which is driven by GaAs's superior efficiency, higher electron mobility, and faster switching speeds compared to traditional silicon. These properties make GaAs particularly well-suited for high-frequency applications like mobile communications, radar systems, and satellite technologies. The ongoing expansion of wireless infrastructure, especially the rollout of 5G networks and advanced RF components, is further fueling the demand for GaAs. As the need for high-performance, next-generation electronic devices continues to rise, GaAs is expected to remain a cornerstone material in the compound semiconductor industry.

Indium Phosphide (InP), meanwhile, is also expected to witness robust growth in the compound semiconductor segment over the forecast period. Known for its exceptional performance in high-speed and high-frequency environments, InP is increasingly used in optical communication systems and fiber optics.

Its role in enabling faster and more efficient data transmission makes it critical to the infrastructure supporting high-speed internet and 5G connectivity. InP's capability to operate at higher frequencies with lower noise characteristics makes it particularly valuable in telecommunications and aerospace applications. As adoption of advanced electronics continues to surge, InP is emerging as a pivotal material contributing to the evolution of communication technologies.

By Wafer Size Analysis

Wafer sizes above 150 mm are expected to dominate the compound semiconductor market in 2025, with an estimated market share of 55.1%. These larger wafers are instrumental in enhancing production efficiency by enabling the fabrication of a greater number of chips per batch, which in turn supports reducing manufacturing costs and boosts output. Their scalability and suitability for high-performance applications make them particularly valuable in the production of devices for 5G communications, electric vehicles, and renewable energy systems.

As industries increasingly demand faster, more power-efficient technologies, the ability of larger wafer sizes to support high-volume manufacturing without compromising quality makes them a preferred option for leading manufacturers. This growing demand is accelerating the adoption of above 150 mm, reinforcing their pivotal role in the compound semiconductor market’s cost-effective and scalable expansion.

Wafer sizes less than 100 mm are also projected to experience notable growth in the compound semiconductor market over the forecast period. These smaller wafers are primarily utilized in research and development settings, as well as in low-volume production where precision, customization, and flexibility are paramount.

They are particularly suited to specialized applications including military-grade electronics, advanced sensor technologies, and niche medical devices. The smaller form factor allows for enhanced control in prototyping and testing, enabling innovators to fine-tune new technologies before transitioning to large-scale production. Their cost-effectiveness and adaptability make them an attractive option for startups, academic institutions, and R&D labs, fostering progress in emerging technologies and contributing to innovation across the sector.

By Product Analysis

Power electronics are expected to lead the compound semiconductor market in 2025, with an estimated market share of 31.5%. These materials, particularly silicon carbide (SiC) and gallium nitride (GaN), are fundamental to improving the efficiency and performance of power devices. Compound semiconductors are crucial in power electronics for their ability to manage high voltages, currents, and temperatures more effectively than traditional silicon-based components.

These properties make them indispensable in applications such as electric vehicles (EVs), renewable energy systems, and industrial machinery. The ability of compound semiconductors to operate at higher frequencies and temperatures contributes to faster charging, enhanced energy efficiency, and longer-lasting power systems. As industries increasingly prioritize cleaner and more efficient energy solutions, compound semiconductors are playing a pivotal role in driving these advancements, positioning them as a key technology in the growing power electronics market.

Photovoltaic technology is also expected to experience significant growth over the forecast period, driven by the rising demand for renewable energy solutions. Compound semiconductors are vital in enhancing the efficiency and energy conversion rates of solar panels, helping to improve their overall performance. As the global shift towards sustainable energy intensifies, the role of compound semiconductors in photovoltaic systems is becoming even more critical, further fueling the market's expansion. This growing adoption of compound semiconductors in solar technology underscores their importance in achieving a more sustainable and energy-efficient future.

By Material Type Analysis

N-type compound semiconductors are projected to lead the compound semiconductor market in 2025, holding an estimated market share of 61.5%. These semiconductors conduct current via electrons, which have higher mobility than holes, making N-type materials highly efficient for high-speed and high-frequency applications. Their superior performance characteristics make them indispensable in critical technologies such as RF amplifiers, power electronics, and optoelectronic devices.

N-type semiconductors are particularly well-suited for next-generation innovations including 5G infrastructure, electric vehicles, and renewable energy systems due to their ability to handle high voltage and current with excellent stability. As industries prioritize speed, efficiency, and durability in their electronic components, N-type materials are becoming increasingly essential. Their central role in high-performance applications, coupled with continuous technological advancements and growing industrial demand, is cementing their position as a cornerstone of the expanding compound semiconductor market.

P-type compound semiconductors are also expected to experience robust growth over the forecast period, driven by their complementary function in building complete electronic circuits alongside N-type materials. These semiconductors transport current using holes and are fundamental in the fabrication of devices such as diodes, transistors, and integrated circuits. P-type materials are widely applied in power management systems, sensors, and LED technologies.

As the demand for balanced and efficient electronics continues to rise, particularly in consumer devices and automotive systems, the importance of P-type semiconductors is becoming more pronounced. Their expanding role in enabling functional and energy-efficient electronic systems is contributing significantly to the overall advancement of the compound semiconductor market.

By Technology Analysis

Power electronics are projected to play a central role in the compound semiconductor market in 2025, with an estimated market share of 31.9%. This technology relies heavily on compound semiconductors like gallium nitride (GaN) and silicon carbide (SiC) to enhance the efficiency, speed, and thermal management of power systems. These materials are becoming increasingly integral to applications in electric vehicles, renewable energy grids, and industrial machinery.

Their superior ability to manage high voltages, currents, and temperatures makes them essential for modern power systems, which demand higher performance and reliability. As industries continue to prioritize sustainability and energy efficiency, power electronics powered by compound semiconductors are driving significant growth in the market, solidifying their position as a key enabler of future technological advancements.

Photonics devices are also playing a significant role in the growth of the compound semiconductor market. These devices, including lasers, light-emitting diodes (LEDs), and optical sensors, are crucial for applications in telecommunications, data processing, and medical technologies. Compound semiconductors enhance the performance of these devices by improving light efficiency and enabling faster processing speeds. As the demand for high-speed communication and precise optical devices rises, the use of photonics devices continues to expand, further contributing to the growth of the compound semiconductor market. This trend underscores the increasing importance of compound semiconductors in the development of cutting-edge technologies across various industries.

By Application Analysis

Lighting applications are expected to lead the compound semiconductor market in 2025, with an estimated market share of 29.4%. This segment is thriving due to the widespread adoption of compound semiconductors in LED lighting, where materials like gallium nitride (GaN) deliver high brightness, excellent energy efficiency, and longer operational life compared to conventional lighting technologies. These advantages have made compound semiconductors a key component in lighting systems used across residential, commercial, automotive, and public infrastructure settings.

The global transition toward energy-efficient solutions is further propelling the demand for LED lighting, in turn driving the need for compound semiconductor materials. Their ability to perform reliably in high-temperature environments and their compact form factor make them ideal for innovative lighting applications. As smart lighting systems and IoT-connected devices become increasingly prevalent in homes and urban developments, the role of compound semiconductors in lighting is expected to grow even stronger, reinforcing their impact on both the lighting industry and the broader semiconductor landscape.

Transistors and amplifiers are also anticipated to show substantial growth in the compound semiconductor market over the forecast period. This growth is fueled by the increasing demand for high-speed communications and next-generation electronic devices. Compound semiconductors are particularly well-suited for RF and microwave transistors, which are critical for applications in wireless communications, radar technology, and satellite systems.

Their superior performance at high frequencies and elevated temperatures makes them ideal for use in power amplifiers that must maintain signal integrity across challenging conditions. With the continued global deployment of 5G networks and the proliferation of connected devices, the need for efficient, high-performance transistors and amplifiers is accelerating. This rising demand highlights the strategic importance of compound semiconductors in enabling advanced communication technologies and expanding the capabilities of modern electronics.

By End User Industry Analysis

The automotive industry is projected to lead the compound semiconductor market in 2025, with an estimated market share of 24.6%. These materials are playing a pivotal role in transforming the automotive sector, particularly with the rise of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication technologies. Compound semiconductors like silicon carbide (SiC) and gallium nitride (GaN) are integral to manufacturing components that offer enhanced power efficiency and reliability, especially under high-temperature conditions. This makes them ideal for electric drivetrains and fast-charging systems in EVs.

As the automotive industry accelerates its transition toward cleaner, more sustainable transportation, car manufacturers are increasingly turning to these materials to optimize battery performance and reduce charging times. Additionally, compound semiconductors are essential in the development of sensors and cameras that enable safety features such as lane detection and collision avoidance. With the continued electrification and connectivity of vehicles, compound semiconductors are becoming central to the evolution of smarter, more efficient automobiles.

The healthcare sector is also expected to see significant growth in the compound semiconductor market over the forecast period, driven by the increasing adoption of these materials in advanced medical technologies. Compound semiconductors enable crucial advancements in diagnostic equipment and wearable health devices, offering high-resolution imaging, rapid data processing, and enhanced sensor sensitivity.

These characteristics are vital in the performance of tools such as MRI scanners, patient monitoring systems, and other medical imaging technologies. As healthcare technology continues to evolve and demands for faster, more accurate diagnostics rise, the need for efficient, high-performance semiconductor materials will continue to grow, solidifying their role in the future of healthcare innovation.

The Compound Semiconductor Market Report is segmented on the basis of the following:

By Type

By Wafer Size

- Less than 100 mm

- 100 mm to 150 mm

- Above 150 mm

By Product

- Power Electronics

- RF Devices

- Optoelectronics

- Photovoltaic Devices

- Others

By Material Type

By Technology

- Power Electronics

- RF and Microwave

- Photonic Devices

- Quantum Devices

By Application

- Lighting

- Power Supply

- Solar Cells

- Signal Processing

- Transistors & Amplifiers

- Others

By End User Industry

- Automotive

- Consumer Electronics

- Aerospace & Defense

- Industrial

- Healthcare

- IT & Telecommunication

- Energy & Power

Regional Analysis

Leading Region in the Compound Semiconductor Market

In 2025, Asia Pacific will be leading with a share of

48.3% it will play a major role in the growth of the compound semiconductor market, as it benefits from strong government support, large-scale manufacturing infrastructure, and a growing number of electronics and telecom industries. Countries like China, Japan, South Korea, and Taiwan are heavily investing in next-generation technologies such as 5G, electric vehicles, renewable energy, and advanced consumer electronics, all of which rely on compound semiconductors for higher efficiency and performance. Local demand is also booming due to a tech-savvy population and fast digital transformation.

The region's ability to produce at scale and its access to raw materials strengthen its position even further. . The growing adoption of compound semiconductors in power electronics, automotive applications, and wireless communication equipment is accelerating the market. With strong R&D activity and low production costs, Asia Pacific continues to attract global players looking to expand in high-growth segments. This makes the region a key engine for future market expansion.

Fastest Growing Region in the Compound Semiconductor Market

Latin America is experiencing significant growth in the compound semiconductor market and is expected to see the same over the forecast period. The region's increasing adoption of advanced technologies in sectors like telecommunications, automotive, and renewable energy is driving demand for high-performance components. With growing investments in smart grids, electric vehicles, and 5G infrastructure, Latin America is becoming an attractive market for compound semiconductors. Countries like Brazil and Mexico are leading in manufacturing and R&D efforts, supported by government initiatives to promote tech innovation. As industries in the region continue to modernize and integrate more sophisticated electronics, the role of compound semiconductors is becoming increasingly vital, fueling market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

As demand from industries like telecom, automotive, energy, and consumer electronics surges, the compound semiconductor market is becoming more intensely competitive. Established companies and new players alike are entering this space to develop faster and more energy-efficient materials and devices for technologies like 5G, electric vehicles, solar power, and smart devices. Competition amongst these players can be fierce, their motivation often being improved performance in these technologies.

Businesses and governments alike are rapidly investing in innovation, manufacturing process improvements and expanding production capacity to meet rising global demands. At the same time, countries are investing in local supply chains to reduce import dependence, leading to new partnerships, research initiatives, and global expansion efforts in an ever more dynamic market, creating more dynamic markets where the race for dominance continues.

Some of the prominent players in the Global Compound Semiconductor are:

- TSMC

- UMC

- Texas Instruments

- Samsung

- Ams OSRAM

- On Semiconductor

- STMicroelectronics

- NXP Semiconductor

- Broadcom

- GaN Systems

- Panasonic Corp

- Renesas Electronics

- Toshiba Corp

- Renesas Electronics

- SMIC

- IQE

- AXT

- Epistar Corp

- Sony Corp

- Hitachi Ltd

- Analog Devices

- Other Key Players

Recent Developments

- In March 2025, NextGen signed an MoU to establish a INR 10,000 CR compound semiconductor fab and opto-electronics facility. US-based Jabil India also inked an agreement with the Gujarat government to set up a silicon photonics manufacturing factory with an investment of INR 1,000 CR. A significant tripartite agreement was signed between Tata Electronics, Taiwan’s PSMC, and Himax Technologies for a semiconductor chip manufacturing facility in Dholera. Additionally, Taiwan Surface Mounting Technology (TSMT) committed over INR 500 CR to set up an Electronics Manufacturing Services (EMS) unit, generating 1,000 new jobs.

- In March 2025, Sivers Semiconductors unveiled a partnership with WIN Semiconductor to enhance production of Sivers Semiconductors' proprietary high-power DFB lasers and laser arrays technology, which creates the way for high-volume manufacturing of critical components for coarse wavelength division multiplexing (CWDM) and dense wavelength division multiplexing (DWDM) applications.

- In September 2024, Innovate UK, part of UK Research and Innovation, announced invested GBP 11.5 million across 16 projects to improve and scale up semiconductor manufacturing and supply chains, as it aims to scale up semiconductor manufacturing within the UK, improve supply chain resilience within the UK, establish innovations and new manufacturing techniques, expand capability or performance of existing manufacturing techniques, encourage relationships between product designers and manufacturers to develop new manufacturing techniques or expand capability, and promote new collaborations across industry and academia

- In May 2024, Zoho announced its plan to enter chipmaking and is looking for incentives from the federal government, two sources with direct knowledge of the proposal said, with one of them pegging the investment plan at USD 700 million. Further, semiconductors are a key plank of India's business agenda, with a USD 10 billion package in place to boost the industry as it hopes to compete with countries such as Taiwan in a few years.