This growth is largely driven by the rising incidence of chronic venous disorders, lymphedema, and diabetic ulcers, particularly among the aging population. As awareness around vascular health and the need for effective wound care management grows, so does the demand for compression garments, pneumatic compression devices, and multilayer bandaging systems.

Compression therapy is a clinically proven method that involves the application of external pressure to specific areas of the body, primarily the limbs, to improve blood circulation and reduce fluid buildup. It is widely used in the treatment of various vascular and lymphatic conditions such as lymphedema, varicose veins, chronic venous insufficiency, and deep vein thrombosis. This therapy relies on medical-grade compression garments, multilayer bandages, and intermittent pneumatic compression devices to promote venous return and minimize venous stasis.

By facilitating efficient blood flow and preventing fluid accumulation, compression therapy aids in faster wound healing, particularly in cases of venous leg ulcers and diabetic foot ulcers. It is also commonly prescribed after surgical procedures to reduce the risk of thromboembolic events and improve recovery outcomes. The growing preference for non-invasive, cost-effective treatment options has further boosted the adoption of compression therapy in both clinical and home settings across the world.

The global compression therapy market is experiencing significant growth, primarily fueled by the rising prevalence of chronic conditions linked to poor circulation and vascular dysfunction. An aging global population, integrated with the surge in lifestyle diseases such as obesity, diabetes, and hypertension, has led to a higher incidence of venous and lymphatic disorders that require long-term management.

Patients are turning to compression therapy as a first-line treatment due to its ability to alleviate symptoms, improve mobility, and reduce complications without relying heavily on pharmaceuticals or surgical intervention. The rising awareness of early intervention in vascular care and the growing demand for patient-centric solutions have created strong momentum for the market.

Technology advancements in compression products are playing a pivotal role in shaping the future of the market. Manufacturers are innovating with breathable fabrics, adjustable compression levels, and wearable compression systems that offer enhanced comfort and therapeutic effectiveness. Smart compression devices integrated with digital monitoring tools are gaining popularity, especially among home care users seeking convenience and real-time feedback. In addition, the expansion of

telehealth services and remote patient management is making compression therapy more accessible to a wider patient population.

These innovations, along with favorable reimbursement policies in several developed economies, are encouraging healthcare providers to recommend compression therapy as part of holistic care for chronic wounds, post-operative recovery, and sports-related injuries.

The US Compression Therapy Market

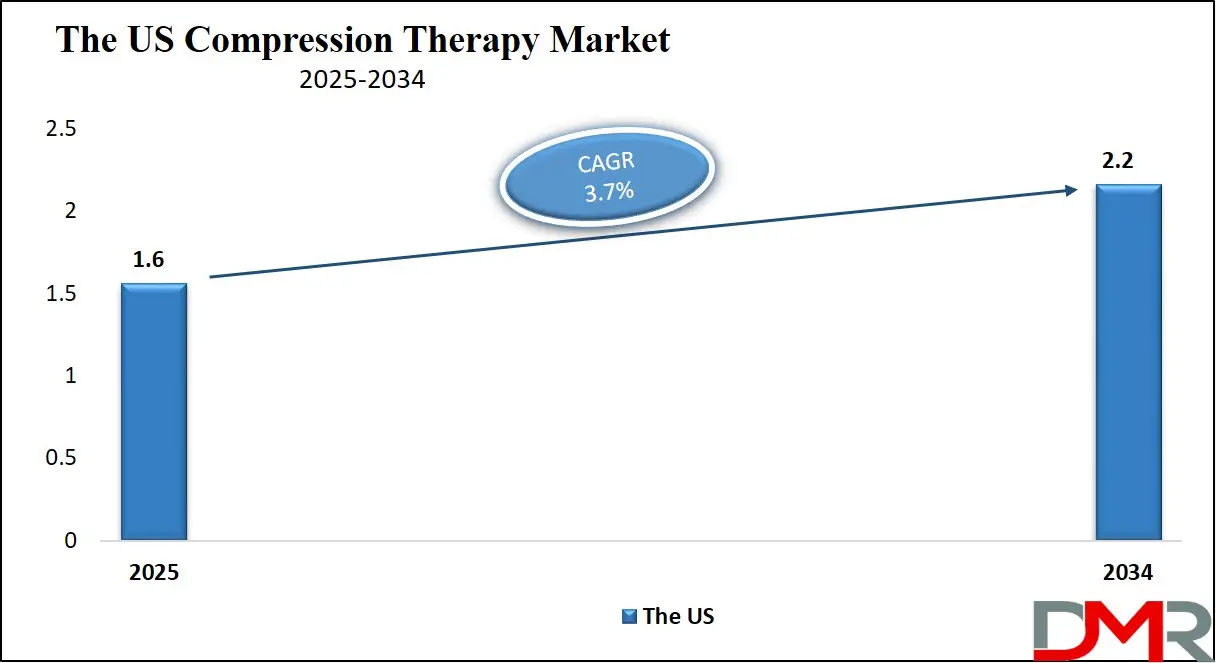

The U.S. Compression Therapy Market size is projected to be valued at USD 1.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.2 billion in 2034 at a CAGR of 3.7%.

The U.S. compression therapy market is witnessing strong momentum, driven by the rising prevalence of chronic venous insufficiency, lymphedema, and other circulatory disorders. With an aging population and a growing number of individuals affected by sedentary lifestyles and obesity, the demand for non-invasive therapeutic solutions is escalating.

Compression garments such as gradient compression stockings, wraps, and socks are widely recommended by healthcare providers for improving venous return and preventing complications like deep vein thrombosis. In parallel, intermittent pneumatic compression devices are gaining traction in both hospital settings and home care, especially for post-surgical recovery and the prevention of leg ulcers.

The growing burden of diabetic foot ulcers and vascular complications has made compression therapy a critical component in chronic wound management. Physicians and wound care specialists are integrating compression-based protocols into treatment plans to accelerate healing and reduce the recurrence of ulcers. In rehabilitation centers and physical therapy clinics, the use of compression sleeves and bandages is becoming standard practice for treating sports injuries, joint swelling, and post-traumatic edema. The U.S. healthcare ecosystem, which emphasizes early intervention and outpatient care, has created a favorable environment for the widespread adoption of compression therapy solutions.

The European Compression Therapy Market

The European compression therapy market is projected to reach approximately

USD 1.3 billion in 2025, with an anticipated

CAGR of 3.5% during the forecast period. This growth is driven by several factors, including the region's aging population, growing prevalence of chronic venous diseases, and advancements in healthcare infrastructure.

One of the primary drivers of the European compression therapy market is the region’s aging population. As Europe has one of the most rapidly aging populations globally, the demand for compression therapy products, such as compression stockings, bandages, and pneumatic compression devices, continues to grow. Older adults are more prone to conditions like varicose veins, venous leg ulcers, and lymphedema, which often require long-term management through compression therapy. With a substantial portion of the population over the age of 60, especially in countries like Germany, Italy, and France, the demand for effective and comfortable compression therapy solutions is expected to rise.

Moreover, the growing awareness of vascular health and chronic venous disease in Europe is contributing to the expansion of the market. Medical professionals, patients, and caregivers are becoming more aware of the benefits of compression therapy, not only as a treatment but also as a preventive measure for individuals at risk of developing circulatory issues. This shift in healthcare mindset is pushing for better adoption rates of compression garments and devices across the continent.

The Japan Compression Therapy Market

The compression therapy market in Japan is projected to reach a market size of USD 0.3 billion in 2025, with an expected CAGR of 4.5% during the forecast period. This growth is driven by several factors, including the country’s rapidly aging population, growing prevalence of chronic venous conditions, and the rising awareness of the benefits of compression therapy.

One of the primary drivers for the growth of the compression therapy market in Japan is its aging population. Japan has one of the oldest populations in the world, with a significant portion of the population aged 65 and older. As the elderly population grows, the demand for products that can manage chronic conditions such as varicose veins, lymphedema, and deep vein thrombosis (DVT) is growing. Older adults are more susceptible to these vascular conditions, and as a result, compression therapy is becoming a critical part of their management plans. The demand for compression stockings, bandages, and pneumatic compression devices is expected to rise as more elderly individuals seek effective solutions to alleviate symptoms of these conditions.

Additionally, Japan’s well-developed healthcare infrastructure plays a pivotal role in driving market growth. With advanced medical technology and high standards of care, Japanese consumers and healthcare professionals are adopting medical-grade compression therapy products. Hospitals, clinics, and rehabilitation centers across Japan are integrating compression therapy into their treatment protocols for conditions related to poor blood circulation, leading to a higher adoption rate of these products.

Global Compression Therapy Market: Key Takeaways

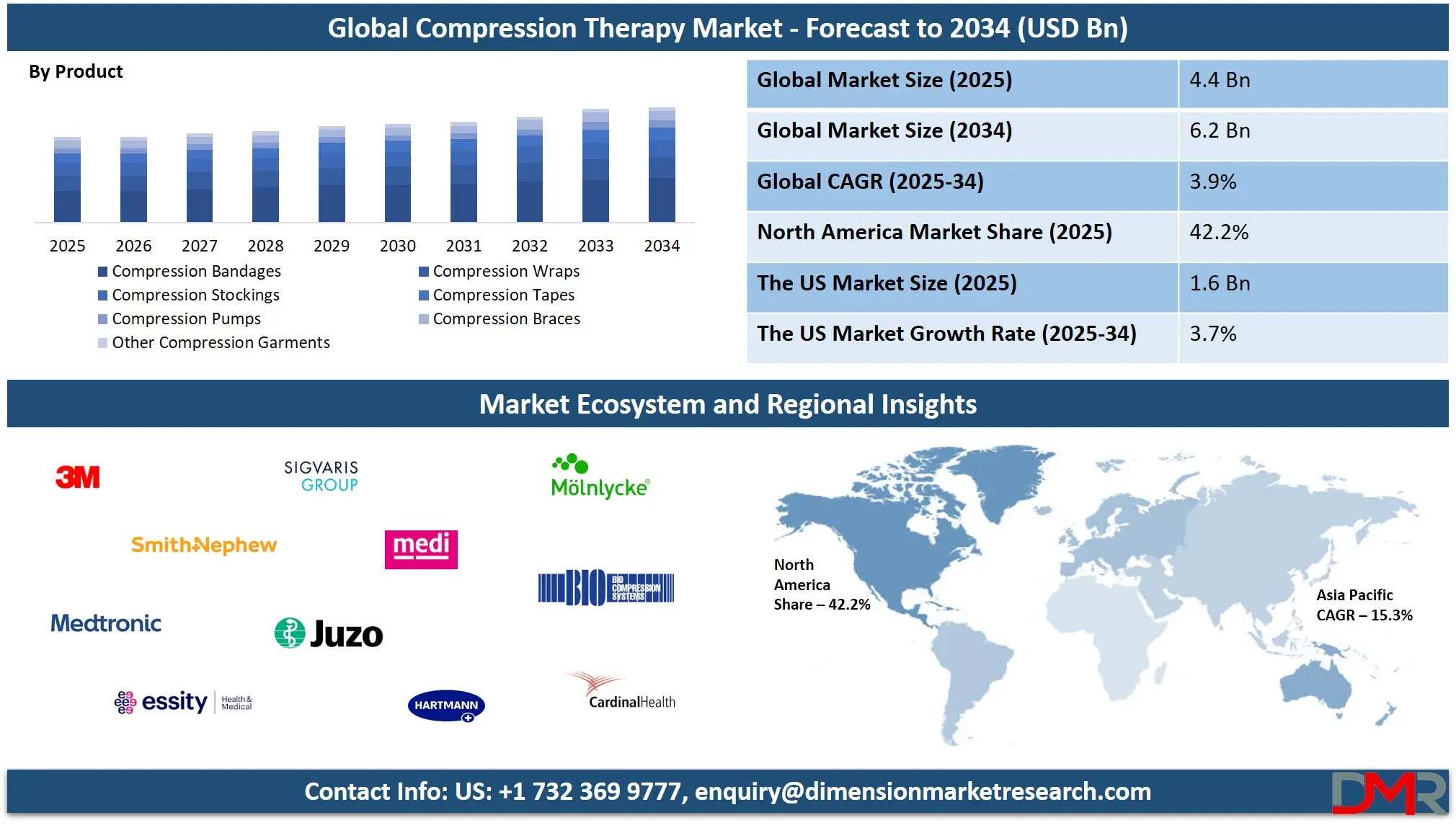

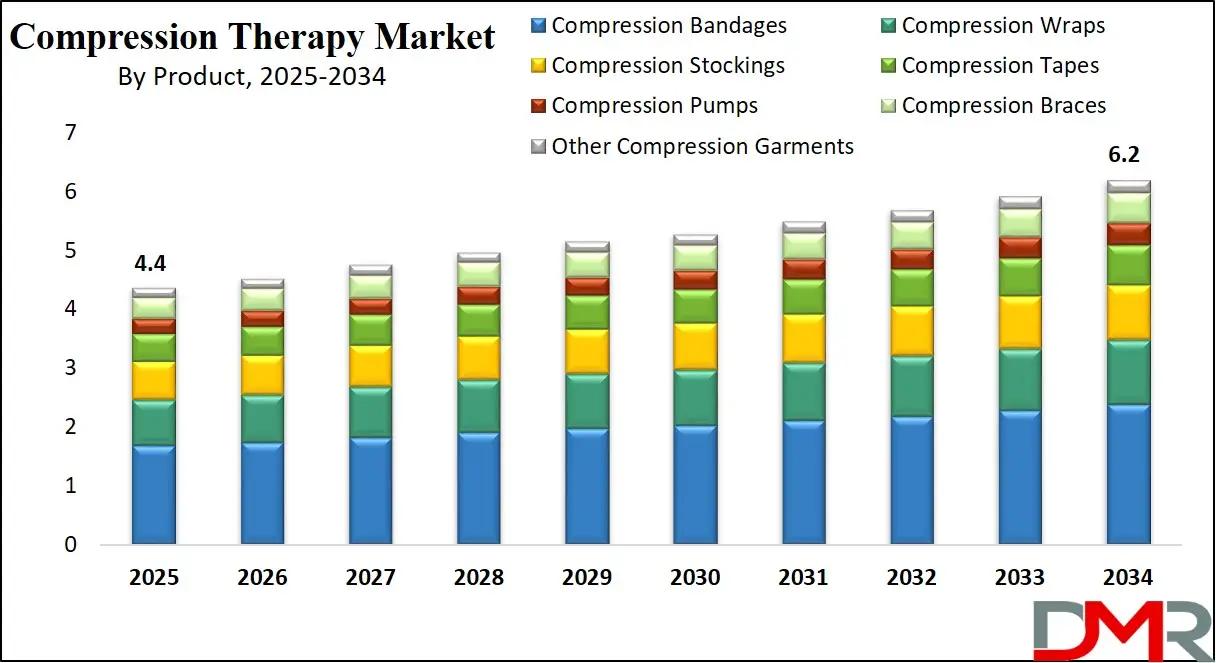

- Market Value: The global compression therapy size is expected to reach a value of USD 6.2 billion by 2034 from a base value of USD 4.4 billion in 2025 at a CAGR of 3.9%.

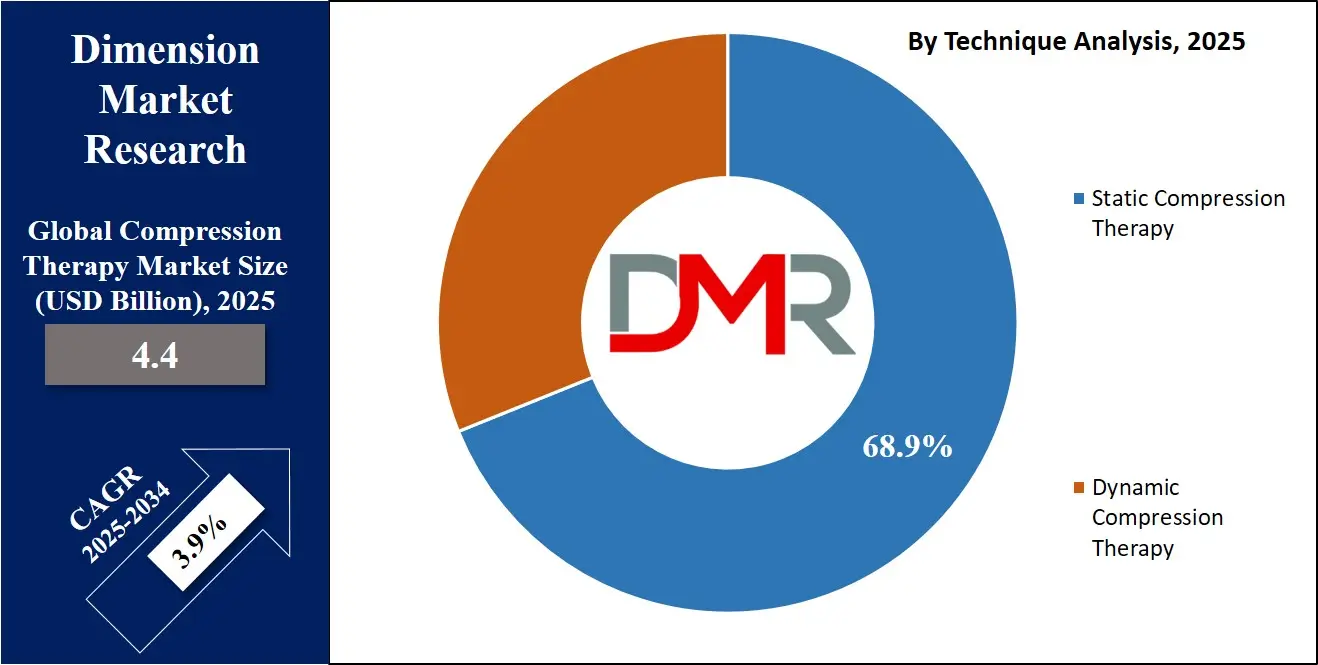

- By Technique Segment Analysis: Static Compression Therapy is expected to maintain its dominance in the technique segment, capturing 68.9% of the total market share in 2025.

- By Product Type Segment Analysis: Compression Bandages are poised to consolidate their dominance in the product type segment, capturing 38.2% of the total market share in 2025.

- By Application Segment Analysis: Varicose Veins treatment applications are anticipated to maintain their dominance in the application type segment, capturing 34.5% of the total market share in 2025.

- By Distribution Channel Type Segment Analysis: Hospitals and Clinics are poised to consolidate their dominance in the distribution channel type segment, capturing 52.8% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global compression therapy market landscape with 42.2% of total global market revenue in 2025.

- Key Players: Some key players in the global compression therapy market are 3M, Smith & Nephew, Medtronic, BSN Medical (Essity), Sigvaris Group, medi GmbH & Co. KG, Juzo (Julius Zorn GmbH), Paul Hartmann AG, Mölnlycke Health Care AB, Bio Compression Systems, Inc., Cardinal Health, Tactile Systems Technology, Inc. (Tactile Medical), Arjo, Thuasne Group, DJO Global (Enovis), Sanyleg S.r.l., Gottfried Medical, Inc., Devon Medical Products, BTL Industries, Talley Group Ltd, and Other Key Players.

Global Compression Therapy Market: Use Cases

- Chronic Venous Insufficiency and Venous Leg Ulcer Management: Compression therapy is a first-line treatment for patients suffering from chronic venous insufficiency and venous leg ulcers. These conditions often arise due to malfunctioning venous valves that lead to blood pooling in the lower extremities. By applying graduated pressure through compression stockings, bandages, or wraps, the therapy promotes efficient venous return, reduces edema, and supports tissue regeneration. Multilayer compression systems and medical-grade compression garments are frequently used in both hospital and outpatient wound care clinics to accelerate healing and prevent ulcer recurrence. The growing burden of vascular diseases and the demand for cost-effective, non-invasive therapies are making compression therapy an essential part of chronic wound management across global healthcare systems.

- Lymphedema Treatment and Lymphatic Drainage: Compression therapy plays a vital role in the treatment of lymphedema, a condition characterized by the accumulation of lymphatic fluid, leading to swelling typically in the arms or legs. Patients suffering from primary or secondary lymphedema, often due to cancer treatment or lymph node removal, benefit from the use of compression sleeves, wraps, and pneumatic compression devices. These tools assist in fluid mobilization and help prevent tissue hardening and infections. Manual lymphatic drainage combined with intermittent pneumatic compression is becoming a standard care protocol in physical therapy and rehabilitation centers. As awareness of lymphedema grows globally, so does the adoption of therapeutic compression solutions to enhance mobility and improve patient quality of life.

- Post-Surgical Recovery and Thromboprophylaxis: Post-operative patients, particularly those recovering from orthopedic surgeries or prolonged immobility, are at high risk of developing deep vein thrombosis (DVT). Compression therapy, particularly through the use of pneumatic compression devices and anti-embolism stockings, is widely used for thromboprophylaxis. By stimulating circulation and preventing blood stasis, these devices lower the risk of clot formation. In surgical wards and intensive care units, healthcare providers implement compression therapy as part of Enhanced Recovery After Surgery (ERAS) protocols. This not only improves outcomes but also reduces hospital stay durations and associated healthcare costs. The increased focus on post-surgical care and patient safety is significantly driving the demand for compression solutions in perioperative settings.

- Sports Medicine and Injury Rehabilitation: Compression therapy has become an integral part of modern sports medicine and physical rehabilitation. Athletes and active individuals use compression garments such as calf sleeves, arm sleeves, and ankle wraps to manage soft tissue injuries, reduce muscle fatigue, and enhance recovery after intense physical activity. These garments aid in reducing lactic acid buildup and improving oxygen delivery to muscles. In cases of ligament injuries or sprains, compression bandages help control inflammation and stabilize the affected area. The growing emphasis on performance optimization and injury prevention in professional and recreational sports is boosting the use of therapeutic compression as a non-pharmacologic recovery aid. With wearable technology and smart fabrics entering the market, the integration of compression therapy in sports recovery is only expected to expand further.

Global Compression Therapy Market: Stats & Facts

- Centers for Disease Control and Prevention (CDC), United States

- Deep Vein Thrombosis (DVT): Affects up to 900,000 people annually in the U.S.

- Chronic Venous Insufficiency (CVI): Affects more than 25 million people in the U.S.

- Diabetes Prevalence: 38.4 million people, or 11.6% of the U.S. population, have diabetes.

- Healthcare Spending: U.S. healthcare spending grew by 4.1% in 2022, reaching USD 4.5 trillion.

- National Institutes of Health (NIH), United States

- Peripheral Artery Disease (PAD): Prevalence increased from 11.3 million in 1995 to an estimated 26 million in 2020.

- America’s Health Rankings

- Aging Population: Approximately 58 million adults aged 65 and above currently reside in the U.S., constituting around 17.3% of the nation's population.

- Centers for Medicare & Medicaid Services (CMS), United States

- Healthcare Spending: By July 2024, U.S. healthcare spending grew by 4.1% in 2022, reaching USD 4.5 trillion or USD 13,493 per person.

- Lymphatic Education & Research Network (LE&RN), United States

- Lymphedema Prevalence: Approximately 10 million Americans suffer from lymphedema.

- National Center for Biotechnology Information (NCBI), United States

- Lymphedema Global Prevalence: Affects approximately 250 million patients worldwide.

- Venous Leg Ulcer Prevalence: Affects around 1.5% of the general population and up to 5% of the geriatric population.

- National Highway Traffic Safety Administration (NHTSA), United States

- Motor Vehicle Accidents: An estimated 20,175 people died in motor vehicle crashes in 2022, an increase of about 0.5% from 2021.

- U.S. Food and Drug Administration (FDA), United States

- Product Approvals: In April 2023, Airos Medical, Inc. received U.S. FDA 510(k) clearance to market their AIROS 8P Sequential Compression Therapy garment system and device.

- National Health Service (NHS), United Kingdom

- Compression Therapy Guidelines: The NHS provides guidelines on the use of compression therapy for conditions like venous leg ulcers and lymphedema.

- Compression Bandage Usage: Recommends the use of multi-layered compression bandages for effective management of venous leg ulcers.

- Australian Government Department of Health

- Chronic Venous Disease: The department acknowledges chronic venous disease as a significant health issue, recommending compression therapy as a primary treatment.

- Lymphedema Management: Supports the use of compression garments in the management of lymphedema.

- World Health Organization (WHO)

- Chronic Diseases: Highlights the increasing global burden of chronic diseases, including those requiring compression therapy.

- Healthcare Access: Emphasizes the need for equitable access to healthcare services, including treatments like compression therapy.

- Healthcare Expenditure: Reports on the rising healthcare expenditure across EU member states, impacting the adoption of various treatments, including compression therapy.

- Regulatory Standards: Sets regulatory standards for medical devices, including compression therapy products, ensuring safety and efficacy.

- Public Health Agency of Canada

- Chronic Disease Management: Supports the use of compression therapy in managing chronic diseases prevalent in the Canadian population.

- Healthcare Guidelines: Provides guidelines on the use of compression therapy for conditions like venous leg ulcers and lymphedema.

- National Institute for Health and Care Excellence (NICE), United Kingdom

- Compression Therapy Recommendations: Recommends compression therapy as a first-line treatment for venous leg ulcers.

- Cost-Effectiveness Analysis: Conducts cost-effectiveness analyses to support the use of compression therapy in the NHS.

- Medical Device Regulations: Regulates medical devices, including compression therapy products, ensuring they meet safety and efficacy standards.

- Public Health Initiatives: Supports public health initiatives that promote awareness and use of compression therapy for chronic conditions.

- Australian Institute of Health and Welfare (AIHW)

- Chronic Disease Data: Provides data on the prevalence of chronic diseases in Australia, underscoring the need for treatments like compression therapy.

- Healthcare Utilization: Reports on healthcare utilization patterns, including the use of compression therapy services.

- Ministry of Health, Labour and Welfare (MHLW), Japan

- Aging Population Statistics: Reports on the aging population in Japan, highlighting the increased need for healthcare services, including compression therapy.

- Healthcare Policy: Develops healthcare policies that support the use of compression therapy for managing chronic conditions.

- National Institute of Public Health (NIPH), Japan

- Chronic Disease Prevalence: Monitors the prevalence of chronic diseases in Japan, indicating a growing demand for treatments like compression therapy.

- Health Promotion Programs: Initiates health promotion programs that include education on the benefits of compression therapy.

- Korean Centers for Disease Control and Prevention (KCDC), South Korea

- Chronic Disease Surveillance: Conducts surveillance on chronic diseases, identifying trends that influence the adoption of compression therapy.

- Public Health Guidelines: Issues public health guidelines that incorporate compression therapy for managing certain conditions.

- Indian Council of Medical Research (ICMR), India

- Chronic Disease Research: Conducts research on chronic diseases prevalent in India, informing the need for treatments like compression therapy.

- Healthcare Recommendations: Provides healthcare recommendations that include the use of compression therapy for specific conditions.

- Ministry of Health and Family Welfare, India

- Healthcare Policies: Develops healthcare policies that support the integration of compression therapy into treatment protocols.

- Public Health Campaigns: Launches public health campaigns to raise awareness about the benefits of compression therapy.

- Brazilian Ministry of Health

- Chronic Disease Management: Supports the use of compression therapy in managing chronic diseases prevalent in Brazil.

- Healthcare Access: Works to improve healthcare access, including the availability of compression therapy products.

- National Health Service (NHS), Wales

- Compression Therapy Services: Provides compression therapy services for conditions like venous leg ulcers and lymphedema.

- Patient Support: Offers patient support programs to enhance the effectiveness of compression therapy.

- World Health Organization (WHO)

- Global Health Statistics: Publishes global health statistics that highlight the prevalence of conditions treated with compression therapy.

- Healthcare Standards: Sets international healthcare standards that include the use of compression therapy for certain conditions.

Global Compression Therapy Market: Market Dynamics

Global Compression Therapy Market: Driving Factors

Rising prevalence of chronic venous disorders and lifestyle diseasesAn increase in sedentary lifestyles, obesity, and aging populations has led to a surge in chronic venous insufficiency, varicose veins, and related vascular complications. This has significantly boosted the demand for compression stockings, bandages, and pneumatic compression devices as essential tools for improving venous return and preventing the progression of these conditions.

Growing awareness of early intervention in wound and vascular care

With the rising incidence of diabetic foot ulcers and pressure injuries, healthcare professionals are emphasizing early use of compression therapy to prevent complications and amputations. Hospitals and outpatient clinics are adopting compression solutions as part of chronic wound management protocols, reinforcing its clinical importance.

Global Compression Therapy Market: Restraints

Lack of adherence and discomfort associated with long-term use

Patient non-compliance remains a major barrier to effective compression therapy. Many individuals find compression garments uncomfortable or difficult to wear consistently, especially during warmer climates or extended daily activities, limiting the overall effectiveness of the treatment.

Limited access and affordability in low-resource settings

In several developing regions, high costs and a lack of healthcare infrastructure restrict access to quality compression therapy products. The absence of reimbursement policies and trained professionals further hampers the adoption of compression-based interventions for vascular and lymphatic disorders.

Global Compression Therapy Market: Opportunities

Expansion of home healthcare and self-managed treatment options

The growing preference for home-based care has opened new avenues for compression therapy, particularly with the availability of user-friendly pneumatic compression devices and compression wraps. This trend is enabling patients to manage conditions like lymphedema and post-surgical swelling without frequent clinic visits.

Technological innovations in smart compression systems

The integration of wearable sensors and mobile connectivity into compression garments is creating advanced solutions that monitor pressure levels and patient activity in real time. These smart compression systems are enhancing treatment personalization and compliance, making them attractive to both providers and consumers.

Global Compression Therapy Market: Trends

Increasing adoption of non-invasive and drug-free therapies

As patients and clinicians seek alternatives to surgery and medication, non-invasive options like compression therapy are becoming mainstream in vascular care and physical rehabilitation. This shift is particularly strong among older adults and those managing multiple chronic conditions.

Emphasis on aesthetic and functional design in compression wear

Manufacturers are focusing on producing compression garments that combine medical efficacy with appealing design, breathable fabrics, and ease of use. The rise of compression socks and sleeves for everyday wear reflects a broader trend of therapeutic wearables blending into lifestyle apparel.

Global Compression Therapy Market: Research Scope and Analysis

By Technique Analysis

Static Compression Therapy is projected to maintain a commanding position in the global compression therapy market, accounting for approximately 68.9% of the total market share in 2025. This technique involves the continuous application of consistent pressure to the affected area using compression garments such as stockings, bandages, wraps, and sleeves. It is widely adopted in the management of chronic venous insufficiency, varicose veins, venous leg ulcers, and lymphedema, primarily due to its simplicity, affordability, and high patient compliance in both clinical and home settings.

Static compression enhances venous return, reduces edema, and promotes localized circulation, making it an integral component of long-term vascular health maintenance. Healthcare providers frequently prescribe medical-grade compression stockings for early intervention and to prevent progression of venous disorders, especially in aging populations and those with sedentary lifestyles or underlying metabolic conditions such as diabetes. Static therapy's dominance is further reinforced by the broad range of product types available on the market, including graduated compression garments that offer different pressure levels suited to various severity levels of vascular conditions.

On the other hand, Dynamic Compression Therapy represents a growing yet smaller segment of the market. Unlike static compression, dynamic systems use intermittent pneumatic compression devices (IPCs) that deliver controlled pressure in cycles, mimicking the natural muscle pump function. These devices are primarily used in hospital settings, rehabilitation centers, and in home healthcare environments for patients with severe lymphedema, post-surgical swelling, or those at high risk of thromboembolic events. Dynamic therapy is particularly beneficial in deep tissue stimulation, facilitating the mobilization of interstitial fluid and supporting wound healing in complex cases such as diabetic foot ulcers or chronic non-healing wounds.

Although dynamic compression therapy accounts for a smaller portion of the market, its clinical efficacy and technological evolution are steadily improving its adoption. New-generation IPC devices are becoming more portable, patient-friendly, and integrated with digital tracking, aligning with the broader trend of smart therapeutic wearables.

By Product Analysis

Compression Bandages are projected to retain their leading position in the product type segment, securing an estimated

38.2% of the total market share in 2025. Their dominance is attributed to their widespread clinical usage, cost-effectiveness, and versatility in managing a range of conditions, including venous leg ulcers, chronic venous insufficiency, and post-traumatic swelling. Compression bandages offer controlled, sustained pressure and are particularly effective in wound care management, where they are often used in multilayer compression systems to optimize healing outcomes and reduce the risk of ulcer recurrence.

Their adaptability to different limb shapes and sizes makes them a preferred choice in hospital settings, outpatient clinics, and community care environments. Medical practitioners frequently rely on short-stretch and long-stretch bandages, depending on the specific therapeutic goal, whether it is to maintain high working pressure for ambulatory patients or to provide steady resting pressure during immobility.

Compression bandages are also extensively utilized in lymphatic drainage protocols, especially in the decongestive phase of lymphedema treatment. As awareness around chronic wound care and vascular health continues to grow, these bandages are expected to remain a cornerstone product across both developed and emerging healthcare markets.

On the other hand, Dynamic Compression Wraps are gaining attention as an advanced, patient-centric solution in the compression therapy landscape. These wraps utilize adjustable, often velcro-based systems, allowing patients or caregivers to apply therapeutic pressure with more precision and ease compared to traditional bandages. Unlike static bandages, dynamic wraps can be readjusted throughout the day without needing to be fully removed, enabling better pressure modulation and personalized care. They are especially useful in the maintenance phase of lymphedema therapy, venous reflux management, and in situations where frequent dressing changes are necessary due to exudative wounds.

Dynamic compression wraps are used in home healthcare settings, driven by the rising trend of self-administered treatments and the growing emphasis on ambulatory wound care. These products offer a practical alternative for patients with limited mobility or dexterity, reducing dependence on skilled nursing visits while ensuring consistent therapeutic benefit. Some newer wraps are even integrated with pressure-indication markers and smart textiles, aligning with

digital health trends aimed at improving patient adherence and treatment outcomes.

By Application Analysis

Varicose Veins treatment is expected to remain the leading application in the compression therapy market, accounting for approximately

34.5% of the total market share in 2025. This dominance is largely attributed to the high global prevalence of chronic venous insufficiency and venous reflux disorders, particularly among aging populations, sedentary workers, and individuals with hereditary predispositions. Varicose veins occur when the valves in the veins weaken, causing blood pooling and increased venous pressure, often resulting in pain, swelling, and visible vein bulging.

Compression therapy, particularly through graduated compression stockings and wraps, has proven to be a first-line, non-invasive management approach to alleviate symptoms, improve vascular circulation, and prevent the condition from progressing to more severe forms such as venous leg ulcers. The convenience, affordability, and ease of application associated with compression garments have contributed significantly to their preference among patients and clinicians for treating varicose veins. Furthermore, the integration of compression therapy into lifestyle management, including during travel, pregnancy, or long work hours, has expanded its use in preventive care.

In parallel, Deep Vein Thrombosis (DVT) treatment forms a critical and expanding segment within the compression therapy market. DVT is a serious condition involving the formation of blood clots in deep veins, most commonly in the lower limbs. If left unmanaged, it can lead to pulmonary embolism, which is potentially life-threatening. In both hospital and home care settings, intermittent pneumatic compression (IPC) devices and compression stockings are widely used to prevent and treat DVT, particularly among post-surgical patients, bedridden individuals, and those with limited mobility.

The application of compression therapy in DVT treatment enhances venous return, reduces venous stasis, and helps prevent thromboembolic complications. Hospitals often employ IPC systems during and after surgery to minimize clot formation risk, especially in orthopedic, cardiovascular, and oncological procedures. Additionally, long-term DVT patients benefit from medical-grade compression stockings that support deep vein valve function and prevent the development of post-thrombotic syndrome. As healthcare providers prioritize preventive vascular strategies, the role of compression therapy in DVT prevention and recovery is expanding, supported by clinical guidelines and growing reimbursement coverage.

By Distribution Channel Analysis

Hospitals and Clinics are expected to consolidate their leading role in the distribution channel type segment, securing approximately 52.8% of the market share in 2025. This dominance is primarily driven by the central role these institutions play in the diagnosis, treatment, and post-operative management of complex vascular and lymphatic conditions such as chronic venous insufficiency, venous leg ulcers, deep vein thrombosis (DVT), and lymphedema. Hospitals often serve as the first point of care where compression therapy is introduced under clinical supervision. Medical professionals in these settings typically prescribe pneumatic compression devices, custom-fitted compression garments, or multi-layer bandaging systems based on the patient's severity and treatment stage.

Additionally, clinics and specialized wound care centers provide follow-up and maintenance care, often involving regular application, adjustment, or monitoring of compression therapy solutions. With the integration of smart therapeutic wearables and digitally monitored compression systems, hospitals are leveraging technology to track treatment adherence and optimize patient outcomes. The presence of trained staff, access to insurance reimbursements, and the ability to handle more severe or post-surgical cases further strengthen the position of hospitals and clinics as the preferred distribution point, especially in developed healthcare markets.

In contrast, Pharmacies and Retailers represent a rapidly expanding distribution channel within the compression therapy ecosystem, especially for over-the-counter (OTC) products aimed at mild to moderate venous disorders, preventive care, and wellness applications. Community pharmacies, health and wellness chains, and online retailers have broadened access to graduated compression stockings, knee-high sleeves, and compression socks, making these solutions more accessible to the general population without requiring direct physician supervision.

This channel has become particularly vital for aging individuals, frequent travelers, athletes, and professionals with sedentary work routines who seek to prevent or alleviate symptoms of leg fatigue, swelling, or minor varicosities. Retail availability has also increased awareness around vascular health management and empowered consumers to take a more proactive role in managing their circulatory health. Modern compression products now come in a variety of pressure levels, styles, and colors, appealing to health-conscious consumers looking for comfort and aesthetics. The rise of e-commerce platforms has further fueled market penetration, allowing customers to compare features, access patient reviews, and benefit from home delivery of personalized compression wear.

The Compression Therapy Market Report is segmented on the basis of the following:

By Technique

- Static Compression Therapy

- Dynamic Compression Therapy

By Product

- Compression Bandages

- Compression Wraps

- Compression Stockings

- Class I Compression Stockings

- Class II Compression Stockings

- Class III Compression Stockings

- Compression Tapes

- Compression Pumps

- Compression Braces

- Other Compression Garments

By Application

- Varicose Vein Treatment

- Deep Vein Thrombosis Treatment

- Lymphedema Treatment

- Other Applications

By Distribution Channel

- Pharmacies & Retailers

- E-Commerce Platforms

- Hospitals & Clinics

- Home Care Settings

Global Compression Therapy Market: Regional Analysis

Region with the Largest Revenue Share

North America is poised to lead the global compression therapy market, capturing approximately 42.2% of the total market revenue in 2025. This dominance is primarily driven by a combination of high healthcare spending, advanced healthcare infrastructure, and the widespread prevalence of chronic venous diseases and vascular disorders in the region. The North American market, especially the United States, benefits from the early adoption of advanced medical technologies, which has led to the widespread availability and utilization of compression therapy devices in both hospital settings and outpatient care.

In the U.S., a significant aging population, along with growing rates of diabetes, obesity, and sedentary lifestyles, has resulted in a heightened demand for compression therapy products to manage conditions such as venous leg ulcers, varicose veins, lymphedema, and deep vein thrombosis (DVT). This demand is further supported by strong clinical guidelines, health insurance reimbursements, and the availability of high-quality, FDA-approved compression therapy devices. The healthcare system’s emphasis on preventive care and chronic disease management, alongside a growing awareness of the importance of vascular health, further bolsters market growth.

Region with significant growth

Asia Pacific is expected to experience the highest CAGR (Compound Annual Growth Rate) within the global compression therapy market over the forecast period. This rapid growth can be attributed to a combination of demographic trends, evolving healthcare systems, and growing awareness about vascular health and chronic venous conditions in the region. As Asia-Pacific economies continue to grow, there is a rising demand for healthcare solutions that address chronic venous disorders, lymphedema, venous leg ulcers, and deep vein thrombosis (DVT).

The aging population in countries like Japan, China, and India is a major driving factor for the growth of the compression therapy market in the region. As people age, they are more likely to experience vascular health issues such as varicose veins, which necessitate the use of compression therapy products. Moreover, the urbanization and westernization of lifestyles in many Asian nations are contributing to an increase in lifestyle-related diseases like obesity, diabetes, and sedentary behavior, all of which are known to heighten the risk of developing chronic venous insufficiency and other circulatory problems. This surge in chronic conditions is expected to lead to a greater demand for preventive and therapeutic compression solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Compression Therapy Market: Competitive Landscape

The global compression therapy market is highly competitive, with numerous established and emerging players striving to maintain a strong market presence. Companies like 3M, Smith & Nephew, Medtronic, BSN Medical (Essity), and Cardinal Health dominate the market due to their broad product portfolios, strong brand recognition, and expansive distribution networks. These market leaders are at the forefront of offering a variety of compression therapy solutions such as compression bandages, graduated compression stockings, and pneumatic compression devices.

These companies have been able to secure significant shares of the market by focusing on continuous product development, innovation, and introducing new therapeutic options, including smart compression garments and wearables integrated with digital health platforms. Technological advancements have played a major role in the competition, with several companies focusing on integrating smart technology into their products to improve patient outcomes. The rise of wearable sensors, digital compression garments, and real-time monitoring tools has enhanced treatment efficiency, making compression therapy more accessible and personalized.

Some of the prominent players in the Global Compression Therapy are

- 3M

- Smith & Nephew

- Medtronic

- BSN Medical (Essity)

- Sigvaris Group

- Medi GmbH & Co. KG

- Juzo (Julius Zorn GmbH)

- Paul Hartmann AG

- Mölnlycke Health Care AB

- Bio Compression Systems, Inc.

- Cardinal Health

- Tactile Systems Technology, Inc. (Tactile Medical)

- Arjo

- Thuasne Group

- DJO Global (Enovis)

- Sanyleg S.r.l.

- Gottfried Medical, Inc.

- Devon Medical Products

- BTL Industries

- Talley Group Ltd.

- Other Key Players

Global Compression Therapy Market: Recent Developments

- March 2025: Mölnlycke Health Care AB acquired Cardinal Health’s Wound Care and Surgical Products Division, enhancing its presence in the wound care and compression therapy sectors.

- January 2024: Essity AB (BSN Medical) completed the acquisition of HARTMANN Group’s Medical Compression Garment Business, strengthening its portfolio of medical compression products.

- July 2023: Tactile Systems Technology, Inc. (Tactile Medical) merged with DJO Global (Enovis), expanding its position in the compression therapy and medical device sectors.

- December 2022: 3M acquired Acelity Inc., including its KCI business, bolstering its wound care and compression therapy offerings globally.

- October 2022: Mölnlycke Health Care AB acquired the Medical Compression Garment Division of Sigvaris Group, reinforcing its leadership in the global compression therapy market.

- May 2022: Medtronic agreed to acquire Mazor Robotics, which includes advanced wearable technology used in compression therapy solutions.

Market Overview

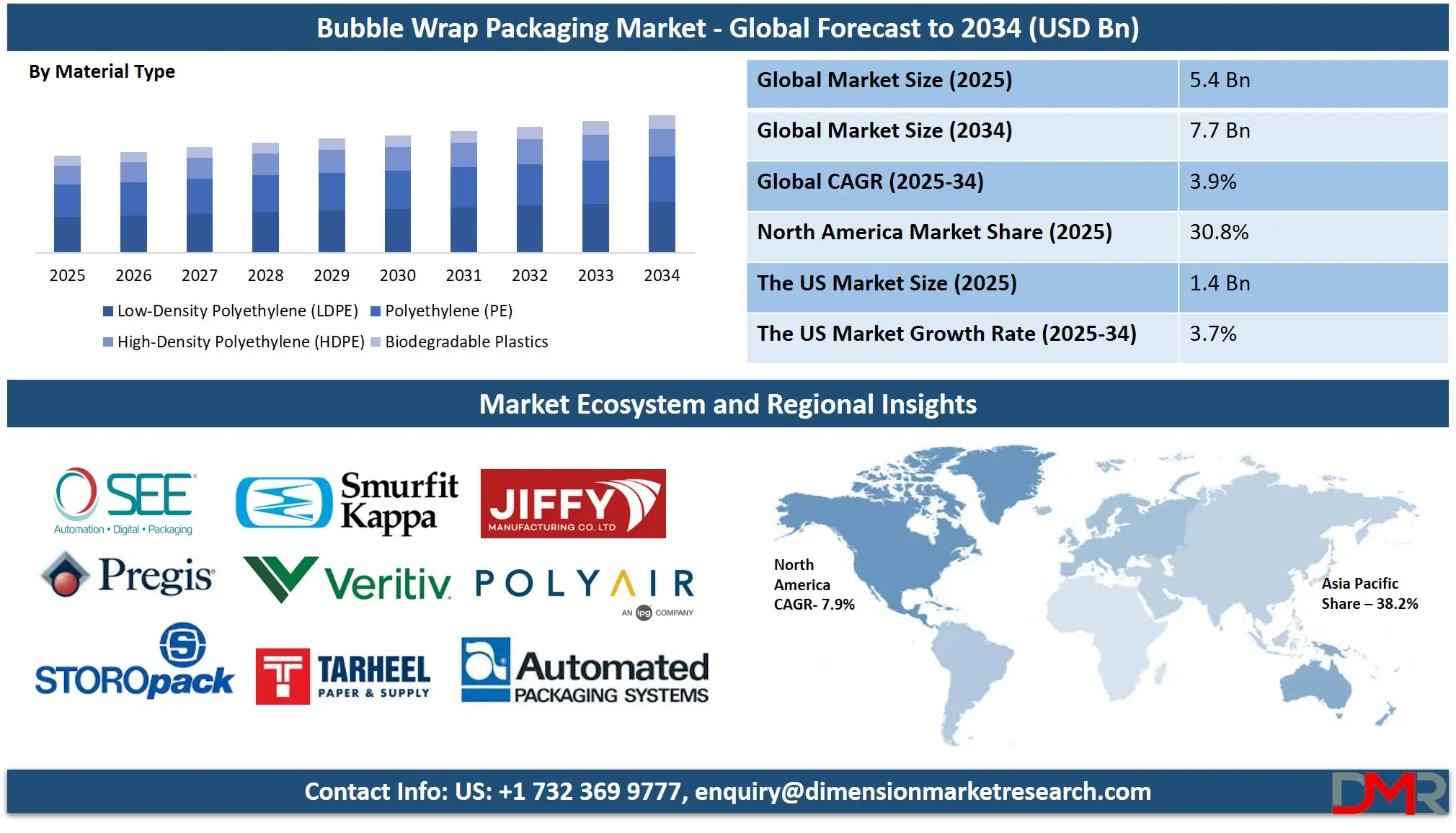

The Global Bubble Wrap Packaging Market is expected to be valued at

USD 5.4 billion in 2025, and it is further anticipated to reach a market value of

USD 7.7 billion by 2034 at a

CAGR of 3.9%.

The global bubble wrap packaging market is an integral component of the protective packaging industry, driven by increasing demand across various sectors such as e-commerce, electronics, pharmaceuticals, and consumer goods. Bubble wrap is an ultra-light yet flexible material used to cushion fragile items during transport. Featuring air-filled pockets to absorb shocks and vibrations to help avoid breakages of delicate products during storage or transportation. As manufacturing technologies advance and more eco-friendly alternatives become popular, they are revolutionizing the bubble wrap packaging market.

Traditional polyethylene bubble wraps are now being replaced with biodegradable and recyclable versions to meet sustainability goals and regulatory requirements. Manufacturers are continually innovating by creating customized bubble wrap designs such as anti-static or perforated options designed specifically for industry needs. Logistics and transportation markets continue to experience tremendous expansion, due to the importance placed on product safety. Yet environmental considerations and a lack of alternative protective packaging materials could potentially affect the future dynamics of this industry.

Globalization and cross-border e-commerce expansion have led to a rise in demand for bubble wrap packaging. Both large-scale retailers and small businesses looking for solutions that ensure their products reach customers safely. Due to its versatility bubble wrap can adapt to different product sizes and fragility levels. It has quickly become the go-to option for businesses that aim to minimize product returns while simultaneously improving customer satisfaction. Its cost-effectiveness and user-friendliness make it an attractive solution for both large manufacturers as well as small enterprises.

Technological innovations within the packaging industry have also played an essential role in expanding and improving the functionality and efficiency of bubble wrap packaging. Advancements such as air retention technology, helping maintain cushioning performance over extended periods, and self-sealing bubble wrap, eliminating additional glues or tapes from its use, have greatly enhanced protective packaging effectiveness. Likewise, advances in automated packaging machinery have simplified wrapping products, streamlining high-volume shipping operations more efficiently, increasing efficiency, and driving market growth.

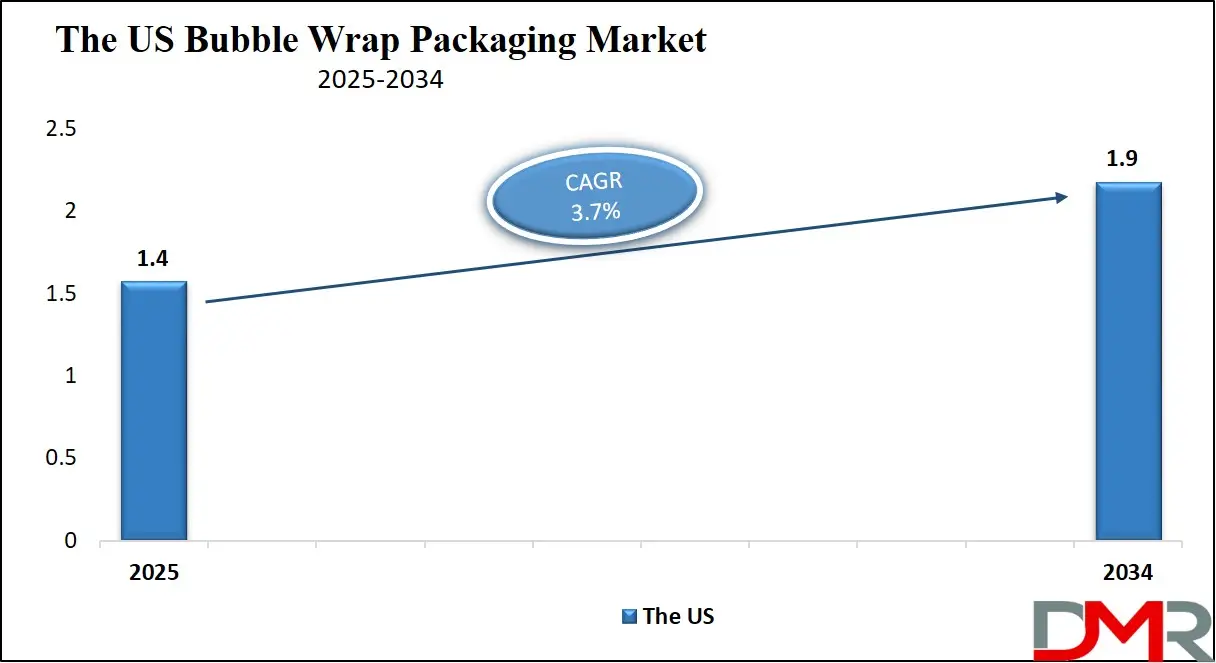

The US Bubble Wrap Packaging Market

The US Bubble Wrap Packaging Market is projected to be valued at USD 1.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.9 billion in 2034 at a CAGR of 3.7%.

The US bubble wrap packaging market is an integral component of its protective packaging industry, driven by rapid e-commerce growth, logistics expansion, and an increasing need for safe product transportation. With the US being one of the world's biggest consumer markets, demand for reliable packaging solutions has increased in industries like electronics, pharmaceuticals, and consumer goods. Bubble wrap packaging, known for its lightweight, cost-effective cushioning properties, and widespread adoption due to online shopping platforms and doorstep delivery preferences, has quickly become an indispensable material in protecting fragile items during shipping and handling operations.

The US bubble wrap packaging market innovations have evolved as companies strive to ensure operational efficiencies and damage-free product delivery. Manufacturers are offering advanced cushioning solutions like self-inflating bubble wrap, high-retention air pockets, and multilayered protective films to increase cushioning performance. Automation integration into packaging lines has greatly simplified wrapping processes, cutting labor costs, and increasing the productivity of high-volume shipping operations.

Businesses seeking packaging solutions that meet specific industry requirements have seen an upsurge in demand for customized bubble wrap options with anti-static qualities for electronic components and perforated rolls for easier handling, such as anti-static versions of anti-static bubble wrap or perforated rolls with perforations for easier handling.

Global Bubble Wrap Packaging Market: Key Takeaways

- Market Value: The global bubble wrap packaging market size is expected to reach a value of USD 7.7 billion by 2034 from a base value of USD 5.4 billion in 2025 at a CAGR of 3.9%.

- By Product Type Segment Analysis: High-Grade Bubble Wraps are anticipated to lead in the product type segment, capturing 32.4% of the market share in 2025.

- By Material Type Segment Analysis: Low-density polyethylene (LDP) is poised to consolidate its market position in the material type segment capturing 37.2% of the total market share in 2025.

- By End-User Type Segment Analysis: E-commerce & Retail is expected to maintain its dominance in the end-user type segment, accounting for 37.4% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global bubble wrap packaging market landscape with 38.2% of total global market revenue in 2025.

- Key Players: Some key players in the global bubble wrap packaging market are Sealed Air Corporation, Pregis Corporation, Storopack Hans Reichenecker GmbH, Smurfit Kappa Group, Veritiv Corporation, and Other Key Players.

Global Bubble Wrap Packaging Market: Use Cases

- E-Commerce and Retail Shipping: The surge in online shopping has significantly increased the demand for bubble wrap packaging to protect fragile items such as electronics, glassware, and cosmetics during transit. Retailers and logistics providers use bubble wrap to minimize damage, reduce return rates, and enhance customer satisfaction by ensuring products arrive in perfect condition.

- Electronics and Semiconductor Protection: Sensitive electronic components and semiconductor devices require anti-static bubble wrap to prevent damage from electrostatic discharge. The protective packaging helps cushion delicate parts during shipping and storage, ensuring that high-value electronics like smartphones, laptops, and circuit boards remain intact.

- Pharmaceutical and Medical Equipment Packaging: Bubble wrap is widely used in the pharmaceutical sector to protect medicines, vials, and medical devices from shocks and temperature variations during transportation. With stringent regulations for product safety, the industry relies on high-quality protective packaging to maintain the integrity of sensitive medical shipments.

- Automotive and Industrial Component Shipping: The automotive and manufacturing industries utilize bubble wrap to safeguard precision parts, machinery, and spare components from physical damage and corrosion during logistics. Heavy-duty bubble wrap with reinforced layers helps protect large, delicate, and high-value industrial products from impact and vibrations.

Global Bubble Wrap Packaging Market: Stats & Facts

- According to Eurostat, the statistical office of the European Union, the recycling rate of packaging waste in the EU stood at 65.4% in 2022, reflecting a slight increase from 64.0% in 2021. This indicates a positive trend towards improved recycling practices within the EU.

- In 2022, the EU generated an average of 150 kg of packaging waste per inhabitant, with Ireland and Italy reporting the highest amounts at 233.8 kg and 232.4 kg per person, respectively. Bulgaria reported the lowest at 78.8 kg per inhabitant.

- The European Commission has proposed new rules aiming to reduce packaging waste by 5.0% by 2030, 10.0% by 2035, and 15.0% by 2040, compared to 2018 levels. These targets are part of broader efforts to make all packaging recyclable in an economically viable way by 2030 and to decrease the use of virgin materials in packaging, aligning with the EU's climate neutrality goals by 2050.

- In the United Kingdom, the Environment Agency's National Packaging Waste Database provides aggregated packaging data reported under the Packaging Waste (Data Reporting) Regulations 2023. This data includes detailed information on packaging materials and types, contributing to the UK's extended producer responsibility initiatives for packaging waste management.

Global Bubble Wrap Packaging Market: Market Dynamic

Global Bubble Wrap Packaging Market: Driving Factors

Rising E-Commerce and Online Retail GrowthE-commerce's rapid expansion has been one of the primary drivers behind the global bubble wrap packaging market's surge. As more consumers opt for online shopping, businesses must focus on secure and efficient packaging solutions to protect goods during transit, with lightweight shock-absorbing properties making bubble wrap an excellent solution. Furthermore, digital marketplaces and internet penetration have further spurred this need for protective packaging across various product categories.

Fulfillment centers and third-party logistics services have led to meeting customer demand for faster and more reliable shipping, necessitating effective protective packaging solutions. E-commerce giants such as Amazon, Alibaba, and Flipkart are investing heavily in innovative packaging strategies to minimize product returns while increasing customer satisfaction.

Growing Demand for Protective Packaging in the Electronics Industry

As global production and consumption of electronic devices continue to expand, demand for bubble wrap packaging has risen. As smartphones, laptops, tablets, and wearables become sophisticated and fragile, manufacturers and retailers are prioritizing protective solutions such as bubble wrap cushioning properties to prevent damage during shipping and handling processes. Its cushioning properties help absorb shocks and vibrations to protect delicate electronic components reaching customers in optimal condition which makes it an integral component in electronics supply chains globally.

Technological advances in electronics have led to smaller, and lighter devices with increased value that require advanced protective packaging solutions. Manufacturers are opting for multi-layered bubble wrap as an efficient means of product safety without adding excessive weight during shipment. Global supply chains continue to expand with a greater need for quality protective packaging shipments driving further growth of this market segment.

Global Bubble Wrap Packaging Market: Restraints

Environmental Concerns and Sustainability Regulations

Traditional bubble wrap is made largely from polyethylene plastic which contributes to environmental pollution, while increasing global awareness about its effect on marine ecosystems and landfills is leading to stricter policies against single-use plastic use, thus decreasing demand for conventional bubble wrap packaging solutions. Many countries and regions, including Europe, North America, and Canada have implemented regulations and initiatives aimed at decreasing plastic consumption while encouraging eco-friendly alternatives.

Policies like plastic bans, extended producer responsibility (EPR), and recycling mandates are encouraging manufacturers to switch towards biodegradable or recyclable bubble wrap materials. However, transitioning away from plastic-based bubble wrap presents costs, production scalability issues, and performance limitations as these alternatives may not provide cushioning and durability comparable to plastic alternatives.

Availability of Alternative Protective Packaging Solutions

The increasing availability and adoption of alternative protective packaging materials represent a serious restraint on the global bubble wrap packaging market. Industries reliant on protective packaging such as e-commerce, electronics, and pharmaceuticals are increasingly exploring options such as molded pulp, foam inserts, corrugated wraps, air pillows, and paper cushioning which often provide similar or superior protection while meeting environmental concerns more effectively than plastic alternatives.

Companies looking to maximize packaging optimization and waste reduction are adopting smart packaging practices with integrated cushioning techniques, decreasing their reliance on standalone protective materials like bubble wrap. Many are investing in advanced packaging solutions requiring minimal void fill or protective layers, further decreasing dependence on traditional cushioning materials like bubble wrap. Meanwhile, advancements in packaging automation and machine learning-driven design enable businesses to use advanced protective solutions, limiting generic bubble wrap usage.

Global Bubble Wrap Packaging Market: Opportunities

Growing Demand for Sustainable and Biodegradable Bubble Wrap

Due to increasing environmental concerns and stricter regulations on plastic waste, demand has skyrocketed for biodegradable, recyclable, and reusable protective solutions like biodegradable bubble wrap made with plant-based resins, recycled polyethylene or compostable materials creating a market opportunity for manufacturers who develop sustainable bubble wrap options made from such eco-friendly sources. Companies are investing heavily in research and development to produce eco-friendly alternatives to bubble wrap that offer similar protective qualities but are better for the environment.

Biodegradable bubble wrap made from materials like cornstarch and recycled paper has seen rapid adoption, giving businesses a greener packaging option without compromising product safety. As more brands commit to sustainable practices to meet corporate social responsibility (CSR) goals and consumer preferences, the adoption of eco-friendly bubble wrap should increase significantly.

Expansion of E-Commerce and Cross-Border Trade

With the continuous rise in online shopping, the demand for protective packaging has increased significantly for fragile or high-value items like electronics, glassware, cosmetics, or pharmaceuticals. Furthermore, logistics providers and retailers require efficient packaging solutions to deliver these goods undamaged to their customers, creating a strong demand for bubble wrap solutions from vendors like Mail Boxes and others. Cross-border trade, driven by increased globalization and improved logistics infrastructure, has further amplified the need for protective packaging.

Direct-to-consumer (DTC) brands and subscription box services have contributed significantly to the expansion of the bubble wrap market. More companies shipping directly to consumers rely on protective packaging solutions such as bubble wrap to enhance unboxing experiences while protecting goods safely. Custom-colored or branded bubble wrap options have become popular among e-commerce businesses looking for ways to add aesthetics while maintaining product protection.

Global Bubble Wrap Packaging Market: Trends

Adoption of Smart and Sustainable Packaging Solutions

Amid mounting environmental concerns and stricter regulations on plastic waste, manufacturers are developing eco-friendly bubble wrap alternatives such as biodegradable, recyclable, and compostable options to meet consumer demands for environmentally responsible packaging while maintaining product safety. Innovations in technology are driving the need for packaging solutions. Self-sealing bubble wrap, air retention technology, and perforated rolls for easier handling have become the highlighted features among businesses seeking efficient packaging solutions.

Manufacturers are exploring innovations such as temperature-sensitive or tamper-evident bubble wrap in industries like pharmaceuticals and electronics where product integrity is crucial. As part of their efforts towards sustainability, many e-commerce and retail businesses are reconsidering their packaging strategies. Businesses are adopting right-sized boxes with minimal waste materials to minimize environmental impact while improving logistics efficiency.

Increased Use of Recyclable and Reusable Bubble Wrap

Many companies are adopting reusable bubble wrap as part of their sustainability initiatives, with logistics providers and retailers adopting models where protective materials like bubble wrap are collected and reused in their supply chain. This trend is particularly evident within industries like electronics, automotive, and industrial equipment where products require sturdy packaging for multiple shipping cycles. Closed-loop recycling systems have only added to this trend.

Packaging manufacturers have started offering take-back programs and partnerships with recycling facilities to ensure used bubble wrap can be processed and repurposed effectively, and some businesses have even experimented with biodegradable additives that help traditional bubble wrap break down more efficiently without leaving behind harmful microplastics. As regulatory bodies push for eco-friendly packaging practices, recyclable and reusable bubble wrap should become increasingly prevalent.

Global Bubble Wrap Packaging Market: Research Scope and Analysis

By Product Type

High-grade bubble wrap is expected to lead the product type segment, accounting for 32.4% of the market share in 2025. This dominance can be attributed to its superior protective qualities, making it the go-to solution for industries that demand enhanced cushioning and durability, such as electronics, pharmaceuticals, and automotive manufacturing which rely heavily on this advanced form of protective wrapping to safeguard fragile goods in transit or storage.

Sectors like these require advanced solutions that offer greater burst resistance as well as multiple layers of cushioning with antistatic or moisture-resistant properties which regular bubble wrap may lack. E-commerce giants and third-party logistics providers are using premium protective packaging materials in their supply chains to reduce product returns while simultaneously improving customer satisfaction.

General Grade Bubble Wraps are expected to experience steady expansion due to rising demand in various industries. General-grade is an economical and versatile packaging solution for businesses without specific protective properties yet still require reliable cushioning. Businesses such as small and medium-sized enterprises (SMEs), local retailers, and consumer goods manufacturers often rely on it as part of everyday packaging needs, which has contributed significantly to its steady market expansion.

Sustainability initiatives within the packaging industry are prompting manufacturers to introduce eco-friendly versions of general-grade bubble wrap. As businesses seek greener packaging alternatives, these eco-friendly options should support the continued growth of this segment while simultaneously addressing environmental concerns.

By Material Type

Low Density Polyethylene (LDP) is poised to consolidate its market position in the material type segment capturing 37.2% of the total market share in 2025. This can be attributed to its superior flexibility, lightweight nature, and superior cushioning properties, making LDPE an ideal material for bubble wrap production. LDPE's soft yet durable structure enhances impact resistance providing reliable protection for fragile items during shipping and storage. LDPE's market leadership can also be attributed to its ease of processing and cost-effectiveness for large-scale production.

Manufacturers favor it due to its compatibility with extrusion processes and ability to create multi-layered bubble wraps with enhanced protective features. Furthermore, its variety of thicknesses makes LDPE suitable for customization based on product protection needs, while its moisture and chemical resistance reinforce its demand in industries needing long-term packaging solutions.

Polyethylene (PE) will experience steady growth due to its widespread usage in protective packaging applications. Polyethylene's versatility and wide availability make it suitable for bubble wrap products of various grades including general-grade and high-performance versions. Demand for lightweight yet strong packaging materials, particularly among e-commerce and logistics businesses, is expected to contribute significantly to the expansion of polyethylene. PE bubble wrap has proven its utility for shipping consumer goods, automotive parts, and industrial equipment for many years, maintaining its relevance within the market. Furthermore, advances in polymer technology have resulted in new formulations offering better puncture resistance, increased clarity, and increased reusability.

By End User

E-Commerce & Retail is projected to maintain its leadership in the end-user segment, capturing 37.4% of the market share in 2025. This growth can be attributed to internet penetration, mobile commerce, and the rise of direct-to-consumer (DTC) brands. As consumers increasingly turn to doorstep delivery for everything from clothing and cosmetics to fragile items like glassware and home decor, protective packaging solutions like bubble wrap have seen unprecedented demand.

Amazon, Alibaba, and Walmart's rapid global expansion has significantly contributed to a rising demand for secure packaging materials such as bubble wrap. Its lightweight structure, cost-effectiveness, and excellent cushioning properties that protect products in transit as well as increasing subscription box popularity have further solidified bubble wrap's role as an invaluable way to ensure product safety.

Electronics & Electricals sector is poised for steady expansion due to the rising global demand for consumer electronics, smart devices, and electrical components. With the increased adoption of smartphones, laptops, tablets, wearables, and other high-value electronic devices by consumers and retailers globally, manufacturers and retailers are prioritizing robust packaging solutions that offer protection from shocks, vibrations, and static damage.

Bubble wrap particularly with its anti-static and high-grade variants plays a pivotal role in protecting delicate electronic components during transport and storage. Due to semiconductor manufacturing expansion, increased exports, online electronics retail sales boom, and the proliferation of the Internet of Things (IoT) and smart home devices, protective packaging solutions for delicate products will continue to increase exponentially.

The Bubble Wrap Packaging Market Report is segmented based on the following

By Technique

- Static Compression Therapy

- Dynamic Compression Therapy

By Product Type

- High-Grade Bubble Wraps

- General Grade Bubble Wraps

- Temperature-controlled Controlled Bubble Wraps

- Limited Grade Bubble Wraps

- Others

By Material

- Low-Density Polyethylene (LDPE)

- Polyethylene

- High-Density Polyethylene (HDPE)

- Biodegradable Plastics

By End-User

- E-Commerce and Retail

- Electronics and Electricals

- Automotive

- Pharmaceuticals and Healthcare

- Food and Beverages

- Industrial Manufacturing

Global Bubble Wrap Packaging Market: Regional Analysis

The region with the largest Revenue Share

Asia Pacific is anticipated to lead the global bubble wrap packaging market landscape with

38.2% of total global market revenue in 2025. The region's dominance can be attributed to rapidly expanding e-commerce industries, increasing industrialization rates, and strong manufacturing bases such as those found in China, India, Japan, and South Korea that are home to many world-leading e-commerce platforms including Alibaba, Flipkart, and Rakuten. Asia Pacific is also home to an expansive electronics and automotive manufacturing industry, serving as a global hub for smartphone, semiconductor, and auto component production.

Domestic manufacturing activities and global supply chains have further contributed to Asia's rising need for quality bubble wrap packaging materials. Urbanization and rising disposable incomes in emerging economies in Southeast Asian nations have driven increased consumer spending on electronics, home appliances, and retail goods. Businesses are investing in efficient packaging solutions to enhance logistics, reduce product damage, and meet customer expectations.

The region with the highest CAGR

North America is poised for steady expansion in the bubble wrap packaging market due to the region's thriving e-commerce, retail, and electronics sectors. Logistics and supply chain infrastructure contribute significantly to North America's growing need for bubble wrap. Businesses focusing on optimizing packaging to minimize damage prevention costs have seen an increasing shift towards innovative protective packaging solutions such as biodegradable or recyclable bubble wrap for cost efficiency.

Sustainability trends are also having a strong influence, with major corporations adopting eco-friendly practices to meet consumer preferences or regulatory requirements. The production of smart devices, wearable, and computing hardware has increased, necessitating high-performance protective packaging materials like bubble wrap to protect delicate components. Industries like electric vehicles (EVs), renewable energy sources, and medical devices also help fuel this demand for bubble wrap to safeguard sensitive components.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Bubble Wrap Packaging Market: Competitive Landscape

The global bubble wrap packaging market is marked by intense competition among its leading companies, each vying for market share through strategic innovations, mergers, and expansions. Notable market players include Sealed Air Corporation, Pregis LLC, Smurfit Kappa, Storopack Hans Reichenecker GmbH, and Veritiv Corporation which all operate with global distribution networks providing their extensive product lines as a resource to serve evolving industry demands such as e-commerce, electronics, automotive manufacturing and pharmaceutical needs.

Sustainability has emerged as a critical differentiator among market players, prompting businesses to develop eco-friendly and recyclable bubble wrap solutions. Sealed Air Corporation led this charge, pioneering biodegradable and recyclable bubble wrap to align with global sustainability trends. Pregis LLC invested heavily in sustainable packaging materials as well as automated systems designed to increase efficiency and reduce waste. Other players such as Smurfit Kappa and Storopack developed paper-based protective packaging alternatives appealing to environmentally conscious consumers while meeting stringent regulations.

Regional dynamics also have a substantial effect on shaping the competitive landscape. While North America and Europe remain bastions for established packaging companies, Asia Pacific is witnessing the rapid emergence of local manufacturers offering cost-effective solutions in price-sensitive markets such as China, India, and South Korea. Market players are turning their focus toward strategic partnerships and acquisitions to strengthen their market standing. Companies are working with logistics providers, retailers, and industrial manufacturers to offer customized protective packaging solutions. Investments in automation and digital packaging technologies have also helped businesses meet demand for fast yet secure packaging solutions quickly.

Some of the prominent players in the global bubble wrap packaging market are

- Sealed Air Corporation

- Pregis Corporation

- Storopack Hans Reichenecker GmbH

- Smurfit Kappa Group

- Veritiv Corporation

- Tarheel Paper & Supply Company

- Jiffy Packaging Co. Ltd.

- Inflatable Packaging, Inc.

- Polyair Inter Pack Inc.

- Automated Packaging Systems, Inc.

- Free-Flow Packaging International, Inc. (FP International)

- Green Packaging Group

- Other Key Players

Recent Developments

- October 2024: Estonian startup RAIKU announced a collaboration with LVMH – Moët Hennessy Louis Vuitton, the world's largest luxury goods conglomerate. This partnership aims to integrate RAIKU's 100.0% natural packaging material into the luxury sector, reflecting a growing trend among high-end brands to adopt eco-friendly materials in their packaging strategies.

- February 2024: Furniture Industries Service (FIS) developed recycled kraft paper bubble wrap to meet consumer demand for environmentally conscious packaging without compromising product protection

- January 2024: Antalis acquired 100 metros of Soluções de Embalagem, Unipessoal, a leading packaging distribution company in Portugal, further expanding its footprint in the European packaging market.

- September 2023: Go Do Good Studio, a material innovation startup based in Pune, India, created a flexible film using algae collected from India's coastal regions, offering a sustainable alternative for various packaging applications.

- August 2023: Ranpak introduced the Wrap 'n Go converter in North America, an easy-to-use, and retail-grade protective honeycomb paper with a self-adjusting tensioning mechanism for smoothness, enhancing packaging efficiency and sustainability.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.4 Bn |

| Forecast Value (2034) |

USD 6.2 Bn |

| CAGR (2025–2034) |

3.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technique (Static Compression Therapy and Dynamic Compression Therapy), By Product (Compression Bandages, Compression Wraps, Compression Stockings, Compression Tapes, Compression Pumps, Compression Braces, and Other Compression Garments), By Application (Varicose Vein Treatment, Deep Vein Thrombosis Treatment, Lymphedema Treatment, and Other Applications), and By Distribution Channel (Pharmacies & Retailers, E-Commerce Platforms, Hospitals & Clinics, and Home Care Settings) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

3M, Smith & Nephew, Medtronic, BSN Medical (Essity), Sigvaris Group, medi GmbH & Co. KG, Juzo (Julius Zorn GmbH), Paul Hartmann AG, Mölnlycke Health Care AB, Bio Compression Systems, Inc., Cardinal Health, Tactile Systems Technology, Inc. (Tactile Medical), Arjo, Thuasne Group, DJO Global (Enovis), Sanyleg S.r.l., Gottfried Medical, Inc., Devon Medical Products, BTL Industries, Talley Group Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|