Market Overview

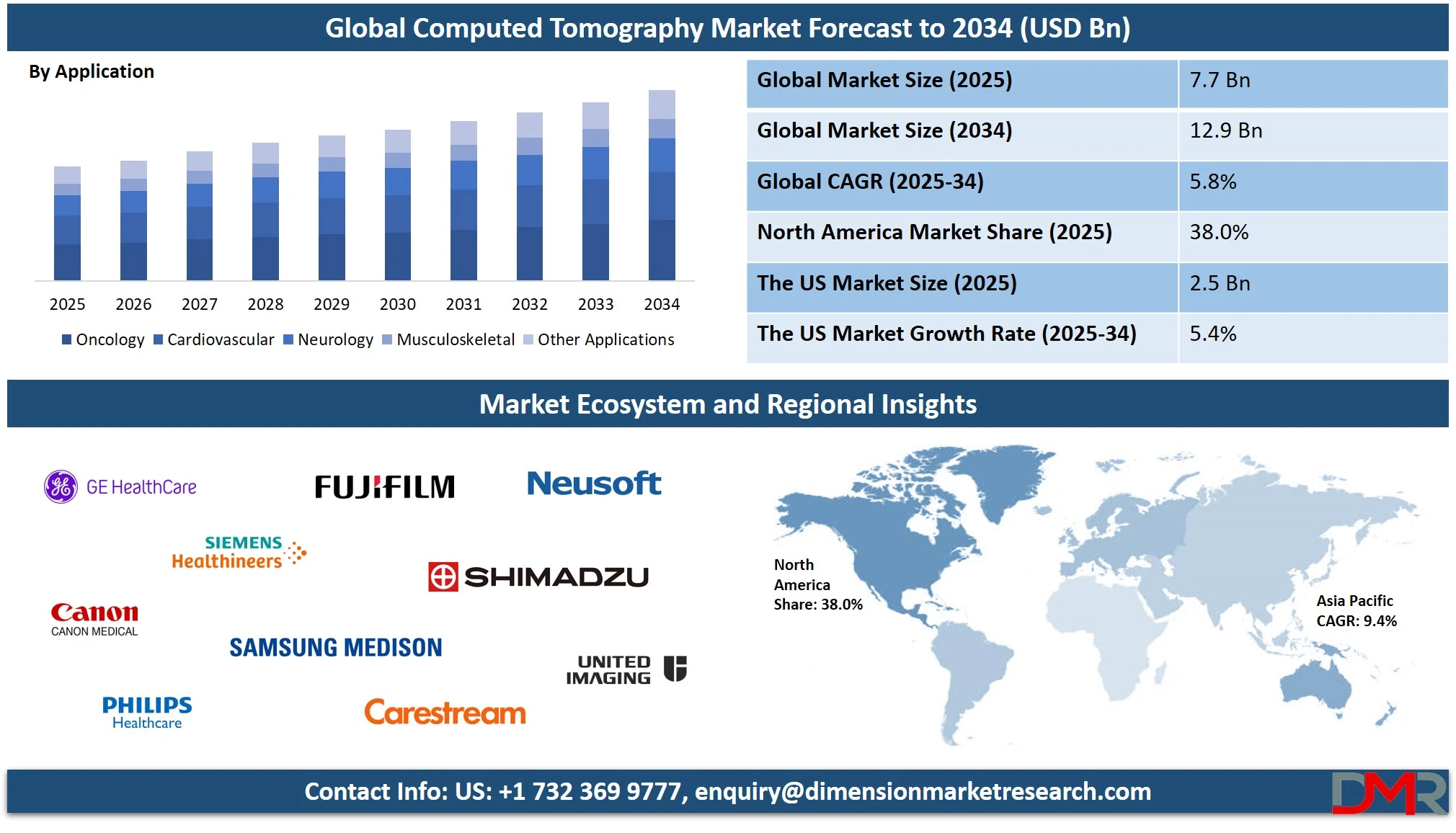

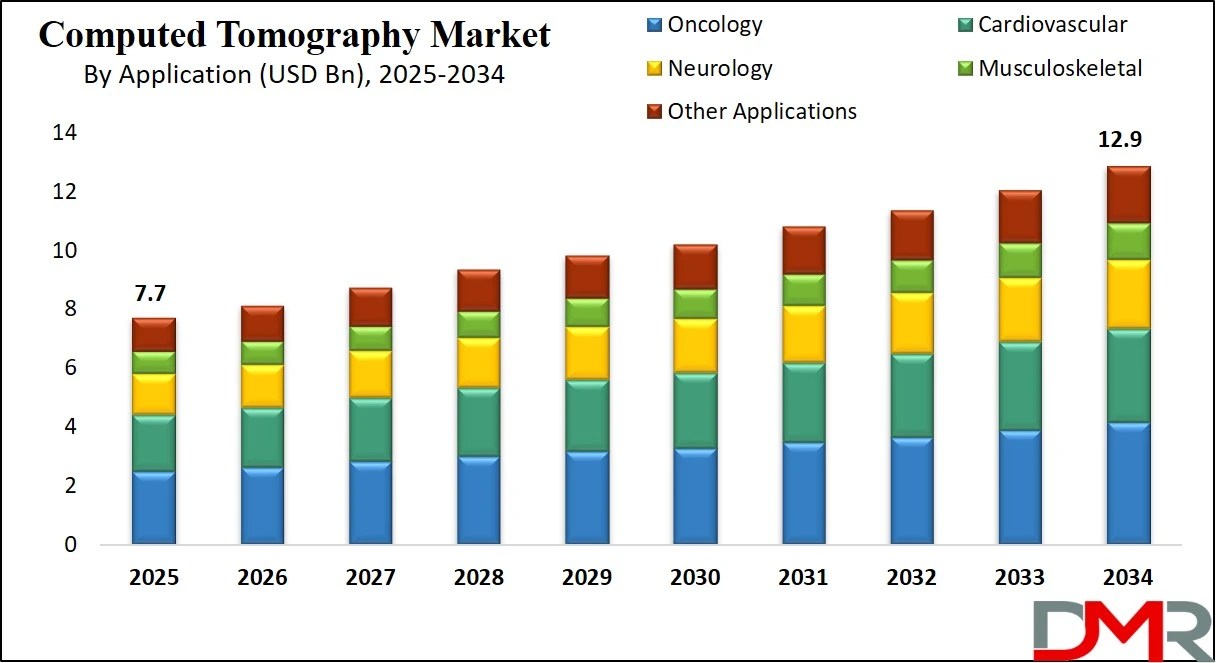

The global computed tomography (CT) market is projected to reach USD 7.7 billion in 2025 and is expected to grow to USD 12.9 billion by 2034, expanding at a CAGR of 5.8%. Growth is driven by rising demand for diagnostic imaging, growing prevalence of chronic diseases, and advancements in CT scanner technology.

Computed Tomography, commonly known as CT, is a sophisticated diagnostic imaging technique that uses computer-processed combinations of multiple X-ray measurements taken from different angles to produce detailed cross-sectional images of the body. This non-invasive technology allows clinicians to visualize bones, blood vessels, and soft tissues with high precision, making it a critical tool in medical diagnostics, treatment planning, and disease monitoring.

CT scans offer faster image acquisition and improved image quality compared to traditional radiography, enabling early detection of conditions such as tumors, cardiovascular diseases, internal injuries, and infections. The integration of advanced features, such as contrast enhancement, 3D reconstruction, and real-time imaging, has expanded CT’s applications in oncology, neurology, cardiology, and trauma care, significantly improving patient outcomes.

The global computed tomography market is experiencing steady growth, driven by the rising prevalence of chronic diseases, technological advancements in imaging modalities, and growing demand for early and accurate diagnosis. The surge in aging populations globally, integrated with a growing emphasis on minimally invasive diagnostic procedures, has fueled the adoption of high-slice CT scanners across hospitals and diagnostic imaging centers.

Additionally, the development of AI-integrated CT systems that enhance image interpretation and workflow efficiency is contributing to market expansion. Emerging economies are also witnessing rapid installation of modern radiology equipment, bridging gaps in healthcare access and strengthening diagnostic infrastructure.

Furthermore, the market is being shaped by the rising integration of cloud-based imaging solutions and teleradiology, which enable remote diagnosis and improve healthcare delivery in rural areas. Environmental concerns around radiation dose management have led to innovations in low-dose CT systems, further enhancing patient safety.

The adoption of portable and point-of-care CT devices in emergency care settings and mobile diagnostic units is also on the rise. With ongoing investments in healthcare modernization, government initiatives for cancer screening, and continuous research in medical imaging, the computed tomography industry is poised for long-term growth across both developed and developing regions.

The US Computed Tomography Market

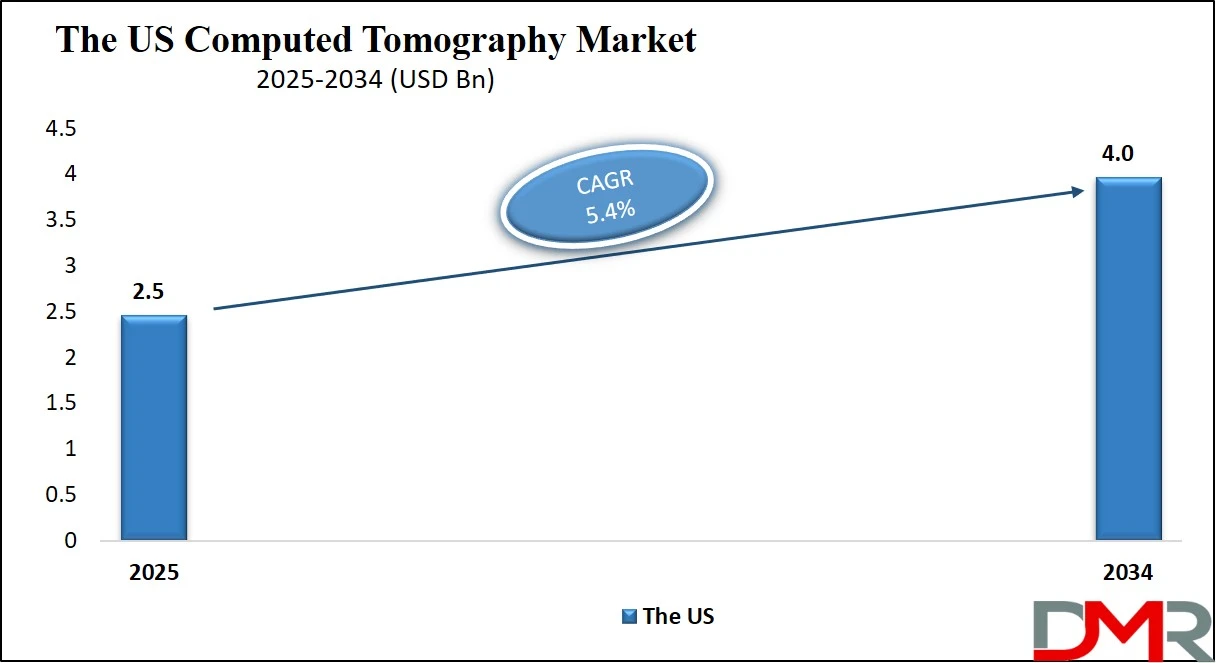

The U.S. Computed Tomography market size is projected to be valued at USD 2.5 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4.0 billion in 2034 at a CAGR of 5.4%.

The United States computed tomography market represents a significant share of the global CT landscape, fueled by a well-established healthcare infrastructure, high adoption of advanced diagnostic imaging technologies, and a growing burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions. The growing demand for early and accurate diagnosis is prompting hospitals, outpatient imaging centers, and emergency care units nationwide to invest in high-slice and multi-slice CT scanners.

Moreover, the integration of AI-assisted image reconstruction, dose optimization features, and dual-energy CT capabilities is enhancing both image quality and diagnostic confidence, especially in complex clinical cases. The country also benefits from favorable reimbursement policies, a high rate of health insurance coverage, and ongoing government support for precision medicine and cancer screening programs, further boosting CT utilization rates.

In addition, the rise in the aging population and the associated increase in age-related conditions are driving continuous CT scan volumes in the U.S. healthcare system. Portable and point-of-care CT systems are gaining traction in intensive care units, trauma centers, and ambulatory surgical centers, enabling real-time imaging and faster clinical decisions.

The U.S. is also witnessing significant growth in teleradiology services and cloud-based imaging platforms, allowing radiologists to interpret CT scans remotely with improved workflow efficiency. Key industry players such as GE HealthCare, Siemens Healthineers, and Canon Medical Systems maintain strong operational footprints in the country, leading to a highly competitive and innovation-driven environment. With continuous advancements in computed tomography technologies and increased investment in healthcare digitization, the U.S. CT market is poised for steady expansion over the coming years.

Europe Computed Tomography Market

In 2025, the Europe computed tomography (CT) market is projected to reach approximately USD 2.1 billion. This strong position is driven by the region’s advanced healthcare infrastructure, early adoption of diagnostic imaging technologies, and growing demand for high-precision, non-invasive diagnostic procedures. Countries such as Germany, France, the United Kingdom, and Italy are leading in terms of CT scanner installations, particularly in public hospitals and cancer care centers.

European healthcare systems benefit from robust public funding and universal health coverage, which supports the integration of next-generation CT systems for oncology, cardiovascular, and neurological imaging. The presence of several global medical imaging leaders and regional manufacturers further strengthens Europe's position in the CT market.

The European CT market is expected to grow at a steady CAGR of 5.3% between 2025 and 2034, supported by the ongoing replacement of aging equipment, increased adoption of AI-powered imaging software, and the growing emphasis on radiation dose optimization. Additionally, rising geriatric populations and an increase in chronic disease prevalence across the continent are contributing to higher demand for advanced diagnostic tools.

Initiatives from the European Union to digitize healthcare and promote early diagnosis and preventive care are also playing a significant role in market expansion. Moreover, the adoption of portable and low-dose CT systems in outpatient and community healthcare settings is gaining momentum, particularly in rural and under-resourced regions, further supporting long-term growth in the region.

Japan Computed Tomography Market

In 2025, the computed tomography (CT) market in Japan is estimated to reach around USD 700 million. Japan is known for having one of the highest densities of CT scanners per capita in the world, a reflection of the country's strong focus on early diagnosis, advanced medical infrastructure, and widespread accessibility to imaging services. Hospitals and diagnostic centers across Japan routinely utilize CT scans for a wide range of clinical applications, including oncology, cardiovascular care, and neurological assessment. The nation's aging population, which is among the largest globally, continues to drive demand for advanced imaging technologies for chronic disease management and preventive health screening.

Despite being a mature market, Japan’s CT segment is expected to grow at a CAGR of 4.5% from 2025 to 2034, supported by ongoing upgrades of older machines to newer, AI-integrated and low-dose CT systems. There is growing emphasis on high-resolution imaging and faster scan times, particularly in busy urban hospitals where efficiency and patient throughput are critical. Domestic manufacturers such as Canon Medical Systems and Fujifilm Holdings continue to innovate and cater to local demand with cutting-edge imaging solutions. Additionally, government support for healthcare digitization and advanced diagnostic capabilities is reinforcing steady growth in the CT market, particularly in tertiary care hospitals and academic medical institutions.

Global Computed Tomography Market: Key Takeaways

- Market Value: The global computed tomography market size is expected to reach a value of USD 12.9 billion by 2034 from a base value of USD 7.7 billion in 2025 at a CAGR of 5.8%.

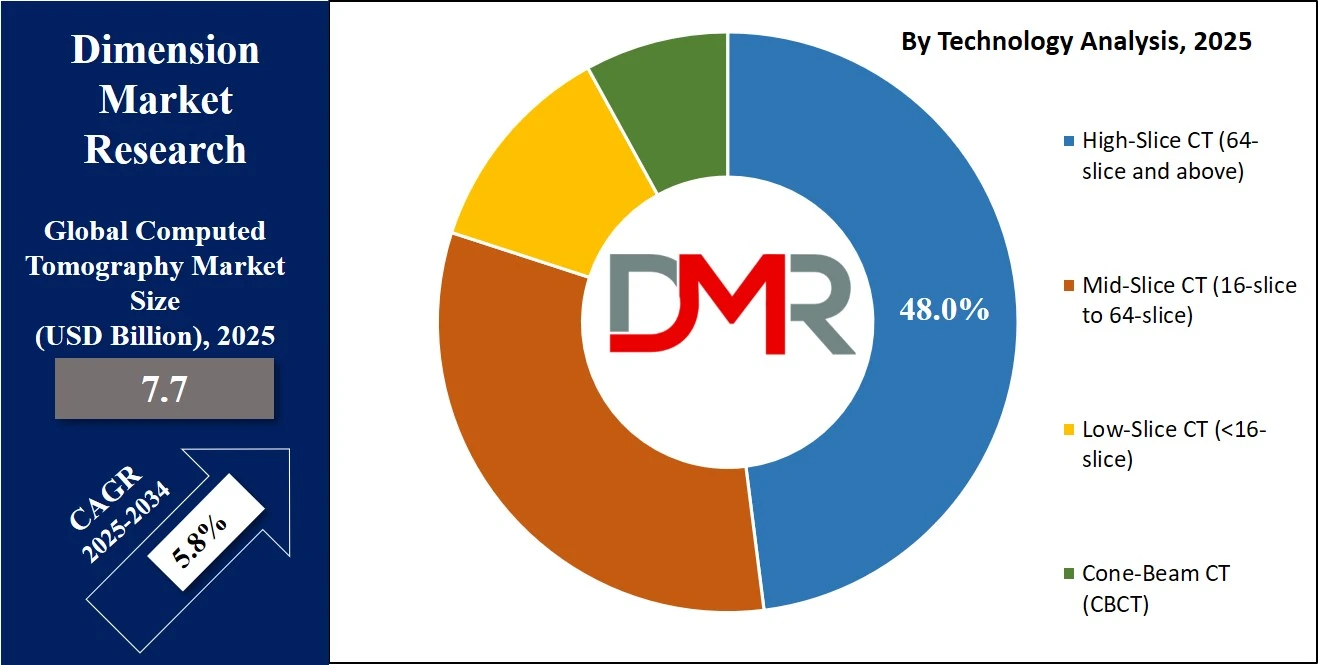

- By Technology Segment Analysis: High-Slices CT (64-slice and above) are anticipated to dominate the technology segment, capturing 48.0% of the total market share in 2025.

- By Architecture Segment Analysis: Stationary Multi-Slice CTs are expected to maintain their dominance in the architecture segment, capturing 83.0% of the total market share in 2025.

- By Modality Segment Analysis: Standalone CT is poised to consolidate its dominance in the modality segment, capturing 65.0% of the market share in 2025.

- By Application Segment Analysis: Oncology will hold the maximum market share in the application segment, capturing 32.0% of the market share in 2025.

- By End User Segment Analysis: Hospitals are expected to consolidate their dominance in the end user segment, capturing 56.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global computed tomography market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global computed tomography market are GE HealthCare, Siemens Healthineers, Canon Medical Systems Corporation, Philips Healthcare, Fujifilm Holdings Corporation, Samsung Medison, Neusoft Medical Systems, Shimadzu Corporation, Carestream Health, Hitachi Healthcare, United Imaging Healthcare, Accuray Incorporated, Konica Minolta, Planmed Oy, CurveBeam AI, Medtronic, Agfa-Gevaert Group, MinFound Medical Systems, and Others.

Global Computed Tomography Market: Use Cases

- Early Detection and Staging of Cancer: Computed tomography is a cornerstone in modern oncology, offering detailed cross-sectional imaging for early cancer detection, accurate staging, and treatment monitoring. It plays a crucial role in identifying tumors in the lungs, liver, pancreas, and colon at early stages when treatment outcomes are more favorable. With high-resolution multi-slice CT scanners, radiologists can detect malignancies as small as a few millimeters, allowing for timely intervention. The use of contrast-enhanced CT scans provides additional clarity in assessing vascular involvement and lymph node enlargement, which are key factors in determining cancer stage. As cancer screening programs expand globally, particularly for high-risk populations such as smokers and the elderly, demand for CT-based imaging continues to grow. Integration with advanced imaging platforms like PET-CT and dual-energy CT also supports comprehensive tumor characterization and personalized treatment planning.

- Cardiac Imaging and Coronary Artery Disease Diagnosis: In cardiology, computed tomography has emerged as a non-invasive alternative to traditional diagnostic methods for evaluating coronary artery disease. Coronary CT angiography allows clinicians to visualize coronary artery anatomy with exceptional clarity, helping detect plaque buildup, arterial blockages, and congenital heart abnormalities. CT calcium scoring is another widely used tool in preventive cardiac care that helps assess the risk of future cardiovascular events. These applications are especially relevant for patients with chest pain or those undergoing risk evaluation before surgery. With the growing prevalence of cardiovascular diseases globally and the growing demand for rapid diagnosis, the adoption of advanced cardiac CT scanners with faster acquisition times and reduced radiation doses is accelerating in both hospital and outpatient settings.

- Neurological Emergency Imaging and Stroke Management: Computed tomography is vital in neurological emergencies, particularly for the rapid diagnosis of stroke, traumatic brain injuries, and intracranial hemorrhages. In stroke care, time is critical, and non-contrast CT scans are often the first imaging tool used to differentiate between ischemic and hemorrhagic stroke. CT angiography and CT perfusion imaging further support clinicians in assessing blood vessel integrity and cerebral blood flow, enabling prompt treatment decisions such as thrombolytic therapy or mechanical thrombectomy. The speed and accuracy of CT imaging make it the preferred choice in emergency departments for patients presenting with altered mental status, seizures, or head trauma. With growing incidences of stroke and neurological disorders globally, hospitals are prioritizing investments in advanced neuroimaging technologies, including portable CT units for faster access to life-saving diagnostics.

- Trauma and Emergency Care Imaging: Computed tomography is a critical imaging modality in trauma care, where rapid and accurate assessment of injuries can significantly influence clinical outcomes. In emergencies involving multiple injuries, whole-body CT scans provide a comprehensive evaluation of the head, chest, abdomen, pelvis, and extremities in a single session. This enables trauma teams to detect internal bleeding, organ lacerations, spinal injuries, and complex fractures without delay. The speed of image acquisition and real-time visualization capabilities offered by modern CT systems are essential in emergency rooms and intensive care units. With the global rise in road accidents, industrial injuries, and sports-related trauma, the demand for high-performance CT scanners in trauma centers is growing. Innovations such as low-dose imaging protocols and AI-assisted image reconstruction are further enhancing the clinical value and safety of CT in emergency settings.

Impact of Artificial Intelligence on Computed Tomography Market

Artificial Intelligence is transforming the global computed tomography market by enhancing imaging precision, accelerating diagnostic workflows, and reducing operational inefficiencies in radiology departments. AI-powered CT imaging systems are now capable of automatically detecting abnormalities such as lung nodules, fractures, and brain hemorrhages with high accuracy.

These tools assist radiologists by flagging suspicious regions, prioritizing critical cases, and reducing the chances of human error. This is particularly beneficial in high-volume settings where timely interpretation is essential for patient care. AI-enabled algorithms are also being used in real-time image reconstruction, producing high-resolution scans faster and with lower radiation doses, significantly improving patient safety and throughput.

Moreover, AI is enabling predictive analytics and clinical decision support systems in CT diagnostics. By analyzing large datasets from previous imaging records and patient histories, machine learning models can identify patterns and offer insights into disease progression, helping clinicians in treatment planning and risk stratification.

In addition, AI integration is streamlining radiology workflow automation from patient positioning and protocol selection to post-processing and reporting resulting in improved consistency and reduced scan-to-diagnosis time. With the ongoing development of cloud-based CT platforms and AI-as-a-service models, even smaller healthcare providers and remote facilities can access advanced diagnostic imaging capabilities. As regulatory approvals for AI-based radiology software increase and healthcare providers adopt value-based care models, AI is set to become an indispensable component of the CT imaging ecosystem globally.

Global Computed Tomography Market: Stats & Facts

World Health Organization (WHO) / Our World in Data

- Global average CT scanners per million population in 2023: 29 units

- Projected global average in 2025: 30 units per million population

- Number of CT units in low-income countries in 2023: below 2 units per million

- Projected access improvement by 2025: nearing 3 units per million

OECD Health Statistics

- Average number of CT scanners per million population across OECD in 2023: 27.5 units

- Projected OECD average by 2025: approximately 29.3 units per million

- CT exams per 1,000 population in OECD countries in 2023: 149 exams

- Projected usage in 2025: 165 exams per 1,000 population

- United States CT units per million population in 2023: 43 units

- Projected U.S. count in 2025: expected to reach 45 units per million

- Japan Ministry of Health, Labour and Welfare

- Number of CT scanners per million population in Japan in 2023: 115 units

- Projected figure for 2025: 118 units per million

- CT scans performed per 1,000 population in 2023: 275 scans

- Projected procedures per 1,000 in 2025: 285 scans

- CT procedures per scanner in Japan in 2023: approx. 2,400

- Projected per-scanner usage in 2025: over 2,500 annually

Eurostat (European Union)

- Total CT units in EU-27 countries in 2023: approximately 12,200 scanners

- Projected count by 2025: over 12,800 scanners

- Germany CT scanner count in 2023: around 2,000 units

- France CT scanner count in 2023: 1,350+ units

- Projected EU CT units per million in 2025: 31 units per million

UK Government / NHS England / RCR Reports

- CT scanners per million in the UK in 2023: 19.5 units

- Projected by 2025: 21.7 units per million

- Annual CT exams performed by NHS England in 2023: ~6.2 million

- Projected CT exams by 2025: over 6.9 million annually

Australia Institute of Health and Welfare (AIHW)

- Number of CT exams per 1,000 people in 2023: 144 scans

- Projected CT use in 2025: approximately 155 scans per 1,000 people

- Total CT machines installed in public hospitals in 2023: 450 units

- Estimated count in 2025: 480 units

Health Canada

- Number of CT scanners in Canada in 2023: 563 units

- Projected number by 2025: 600+ units across the country

Global Computed Tomography Market: Market Dynamics

Global Computed Tomography Market: Driving Factors

Rising Demand for Early Disease Diagnosis and Preventive Imaging

The growing global burden of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders is accelerating the demand for early and accurate diagnosis, significantly driving the computed tomography market. Healthcare systems globally are shifting focus toward preventive care, growing the use of high-resolution CT imaging for early detection and routine health screenings. Multi-slice and high-slice CT scanners offer detailed anatomical views that are essential for timely diagnosis and treatment planning. This rising clinical reliance on advanced diagnostic imaging modalities is fueling investments in modern radiology systems across both developed and emerging healthcare markets.

Technological Advancements in CT Imaging Systems

Continuous innovation in CT technology, including the development of dual-energy CT, spectral imaging, and iterative image reconstruction techniques, is enhancing diagnostic performance while reducing radiation exposure. New-generation CT scanners are integrated with artificial intelligence for faster image processing, noise reduction, and automated anomaly detection, making them more effective and user-friendly. These technological upgrades not only improve clinical outcomes but also reduce scan times, increase patient throughput, and optimize radiologist workflows, making them highly attractive to hospitals and imaging centers seeking to improve operational efficiency.

Global Computed Tomography Market: Restraints

High Installation and Maintenance Costs

One of the primary restraints in the global CT market is the high capital investment required for acquiring and maintaining advanced computed tomography equipment. High-slice and AI-integrated CT scanners come with significant upfront costs, often exceeding the budget limits of small and mid-sized healthcare facilities, especially in low- and middle-income countries. In addition, ongoing maintenance, calibration, and software upgrades increase the total cost of ownership, making it a challenging investment for institutions with limited financial resources.

Concerns over Radiation Exposure

Despite advancements in dose optimization, CT scans still expose patients to higher levels of ionizing radiation compared to other imaging modalities such as ultrasound or MRI. Long-term exposure, particularly in pediatric and oncology patients requiring repeated scans, raises safety concerns among clinicians and patients alike. Regulatory authorities and healthcare organizations are increasingly emphasizing radiation dose management and justification of imaging procedures, which could limit the frequency of CT usage in certain diagnostic pathways, particularly where alternative imaging methods are available.

Global Computed Tomography Market: Opportunities

Expansion of CT Imaging in Emerging Economies

Developing regions in Asia-Pacific, Latin America, and parts of the Middle East and Africa are witnessing rapid improvements in healthcare infrastructure and access to medical imaging. Rising healthcare investments, government-led diagnostic programs, and increased awareness about early disease detection are creating favorable conditions for the adoption of CT systems in rural and semi-urban areas. Manufacturers are also focusing on offering cost-effective, compact CT scanners with cloud connectivity to cater to underserved regions, opening new revenue streams in these fast-growing markets.

Integration of Artificial Intelligence in CT Imaging Workflows

The growing integration of AI and machine learning into CT imaging is creating transformative opportunities in the field of radiology. AI-enhanced CT systems offer automated image segmentation, pathology detection, and workflow optimization, leading to faster diagnosis and improved accuracy. Cloud-based platforms now allow for AI-as-a-service deployment, making it possible even for smaller clinics and diagnostic labs to leverage advanced analytics. The growing number of FDA-approved AI solutions for CT imaging further validates their clinical utility and market potential, particularly in supporting overburdened radiology departments.

Global Computed Tomography Market: Trends

Rise of Portable and Point-of-Care CT Systems

There is a growing trend toward the development and adoption of compact, mobile CT systems designed for use in emergency departments, intensive care units, and field settings. These point-of-care CT scanners enable immediate diagnostics at the bedside, eliminating delays associated with patient transportation to radiology suites. The convenience, speed, and flexibility of portable CT devices are particularly beneficial during trauma care, neurocritical assessments, and pandemic-related scenarios where rapid isolation and scanning are required.

Growth in Cloud-Based Image Sharing and Teleradiology

The growing demand for remote diagnostics and collaborative care has led to the widespread adoption of cloud-based image storage and teleradiology platforms. These systems allow clinicians to access and interpret CT scans in real-time from remote locations, improving access to specialized radiology services in underserved areas. Teleradiology is also helping hospitals manage rising imaging volumes by distributing cases across multiple time zones. As the healthcare industry embraces digital transformation, secure and interoperable cloud imaging solutions are becoming integral to the future of CT-based diagnostics.

Global Computed Tomography Market: Research Scope and Analysis

By Technology Analysis

High-slice CT systems, particularly those with 64 slices and above, are projected to dominate the technology segment of the computed tomography market in 2025, accounting for approximately 48.0% of the total market share. This dominance is primarily driven by their superior imaging capabilities, faster scan times, and ability to produce highly detailed images across multiple anatomical regions.

These systems are widely used in complex diagnostic procedures, including cardiovascular imaging, oncology staging, trauma assessment, and neurological evaluations. Their ability to capture large volumes of data quickly with reduced motion artifacts makes them ideal for high-throughput hospitals, emergency departments, and specialty imaging centers. Additionally, integration with advanced technologies such as iterative reconstruction and artificial intelligence enhances diagnostic accuracy while reducing radiation exposure, further boosting their demand in both developed and emerging healthcare markets.

Mid-slice CT systems, which typically range from 16 to 64 slices, also play a significant role in the global market due to their balanced performance, affordability, and versatility. These systems are widely adopted in diagnostic imaging centers and mid-tier hospitals, offering sufficient image quality for routine examinations such as abdominal scans, chest imaging, and orthopedic evaluations.

While they may not match the advanced capabilities of high-slice CT scanners, mid-slice systems remain popular in regions with budget constraints or lower patient volumes. They offer a cost-effective solution for facilities looking to upgrade from low-slice or legacy CT models without making significant capital investments. As healthcare systems in developing countries continue to expand, the demand for mid-slice CT systems is expected to remain strong, especially in settings where high-end imaging systems may not be financially viable.

By Architecture Analysis

Stationary multi-slice CT systems are anticipated to continue leading the architecture segment of the computed tomography market, holding an estimated 83.0% of the total market share in 2025. These systems are the standard choice for most hospitals and diagnostic imaging centers due to their high-speed scanning capabilities, superior image quality, and ability to handle a broad range of clinical applications. From detailed internal organ imaging to trauma diagnostics and oncology assessments, stationary multi-slice CTs offer versatility and efficiency in routine and advanced imaging procedures.

Their fixed installation allows integration with high-capacity IT systems, enabling seamless workflow and rapid data transfer for radiologists. Additionally, the ongoing enhancements in detector technology, dose-reduction algorithms, and AI-driven automation are making stationary systems more effective and user-friendly, ensuring their continued preference in high-volume medical settings.

C-arm CT systems, while representing a smaller portion of the market, serve a highly specialized function, particularly in interventional radiology and intraoperative imaging. These systems combine the real-time capabilities of fluoroscopy with the cross-sectional imaging of CT, allowing physicians to visualize complex anatomical structures during surgical or interventional procedures.

C-arm CTs are commonly used in neurosurgery, orthopedics, and vascular interventions, where precision and real-time imaging are critical. Unlike stationary systems, C-arm CTs are mobile and offer greater flexibility in operating rooms and hybrid surgical suites. Their role is growing with the growing demand for image-guided minimally invasive procedures, although their market share remains limited due to their niche applications and higher cost of integration in surgical environments.

By Modality Analysis

Standalone CT systems are expected to solidify their dominance in the modality segment of the computed tomography market, accounting for approximately 65.0% of the total market share in 2025. These systems are extensively used in hospitals, diagnostic imaging centers, and specialty clinics due to their comprehensive capabilities, high image resolution, and ability to perform a wide range of clinical scans. Standalone CT units are typically installed in dedicated radiology suites and are ideal for high-volume imaging environments, offering robust features such as multi-slice imaging, advanced reconstruction software, and compatibility with PACS systems for seamless data management.

Their superior performance in diagnosing complex conditions such as tumors, vascular diseases, and internal injuries ensures continued reliance on these systems in primary and tertiary care settings. Additionally, technological advancements such as AI integration and dose reduction features are further enhancing the value and clinical relevance of standalone CT scanners.

Portable CT systems, while representing a smaller portion of the modality segment, are gaining traction for their unique ability to deliver real-time imaging in critical care and emergency settings. These compact and mobile units are designed to be used at the patient’s bedside, particularly in intensive care units, emergency departments, and during surgical procedures where moving the patient to a radiology department is risky or impractical.

Portable CTs are particularly useful in neurocritical care for rapid brain imaging, in trauma units for quick assessments, and in pandemic situations for isolating infected patients during scanning. Though they may not offer the same level of detail as high-end standalone systems, the convenience, speed, and safety offered by portable CT devices are driving their adoption in fast-paced clinical environments. As demand for point-of-care imaging grows, especially in aging populations and remote healthcare settings, the market for portable CT is expected to witness steady growth despite its current smaller share.

By Application Analysis

Oncology is projected to dominate the application segment of the computed tomography market in 2025, accounting for 32.0% of the total market share. The widespread use of CT imaging in cancer diagnosis, staging, and treatment monitoring is a key factor behind this strong market presence. CT scans enable the early detection of tumors in various organs such as the lungs, liver, pancreas, and colon, allowing for prompt and targeted interventions.

In oncology, high-resolution and contrast-enhanced CT imaging plays a critical role in assessing tumor size, location, lymph node involvement, and metastasis. It also supports treatment planning for surgeries, radiation therapy, and chemotherapy by offering clear anatomical insights. As cancer prevalence continues to rise globally and early detection becomes a greater priority in public health initiatives, the demand for advanced CT systems in oncology care is expected to remain high across hospitals, cancer centers, and outpatient imaging facilities.

Cardiovascular imaging is another vital application area in the CT market, contributing significantly to diagnostic advancements in cardiology. CT is extensively used for non-invasive evaluation of coronary artery disease through procedures such as coronary CT angiography, which offers precise visualization of arterial blockages and plaque buildup. The ability to perform calcium scoring also enables risk assessment and preventive care for patients with suspected heart conditions.

Modern CT scanners with high-slice capabilities and fast acquisition times have made cardiac imaging safer, quicker, and more accurate, especially in emergency settings where rapid diagnosis is critical. The growing global burden of heart disease, combined with growing awareness of preventive cardiovascular care, is driving steady adoption of CT imaging in cardiology. As more healthcare providers integrate CT into routine cardiovascular assessments, this segment is expected to witness continued growth, particularly in technologically advanced and aging populations.

By End User Analysis

Hospitals are anticipated to remain the leading end users in the computed tomography market, capturing 56.0% of the total market share in 2025. Their dominance is attributed to the high volume of patient intake, availability of advanced infrastructure, and their ability to manage a broad spectrum of diagnostic imaging needs across departments such as emergency, oncology, cardiology, and neurology.

Hospitals often invest in high-slice and AI-enabled CT systems to ensure rapid, high-precision imaging that supports both routine diagnostics and critical care. In tertiary and specialty hospitals, CT scanners are also integrated into surgical planning, intensive care monitoring, and trauma response workflows, making them indispensable tools in clinical decision-making. Additionally, hospital settings benefit from in-house radiology departments, trained technicians, and access to electronic health record systems, which collectively enhance the efficiency and utilization of CT imaging technology.

Diagnostic imaging centers represent a significant portion of the market and are steadily expanding due to their growing role in outpatient and preventive healthcare services. These centers typically offer cost-effective, quick-turnaround imaging solutions and cater to non-emergency patients seeking scheduled diagnostic procedures. With the growing demand for early disease detection and health screenings, especially for conditions like cancer and cardiovascular disease, imaging centers are seeing higher patient volumes.

Many centers now operate with mid-slice to high-slice CT scanners to deliver accurate and detailed scans while maintaining affordability. Their flexibility, shorter waiting times, and lower operational costs make them a preferred choice for both patients and referring physicians. As healthcare systems continue to decentralize and emphasize outpatient care, the relevance of diagnostic imaging centers in the CT market is expected to rise further, particularly in urban and semi-urban areas.

The Computed Tomography Market Report is segmented on the basis of the following:

By Technology

- High-Slice (64-slice and above)

- Mid-Slice CT (16-slice to 64-slice)

- Low-Slice CT (<16-slice)

- Cone-Beam CT (CBCT)

By Architecture

- O-arm CT

- C-arm CT

- Stationary Multi-Slice CT

By Modality

- Standalone CT

- Portable CT

- Point-of-Care CT

By Application

- Oncology

- Cardiovascular

- Neurology

- Musculoskeletal

- Other Applications

By End User

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutes

Global Computed Tomography Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global computed tomography market in 2025, accounting for 38.0% of total market revenue. This dominance is driven by the region's advanced healthcare infrastructure, high adoption of cutting-edge diagnostic imaging technologies, and the presence of key market players such as GE HealthCare and Siemens Healthineers. The growing prevalence of chronic conditions like cancer, cardiovascular diseases, and neurological disorders continues to fuel the demand for high-slice and AI-integrated CT systems across hospitals and imaging centers.

Additionally, favorable reimbursement frameworks, robust healthcare spending, and ongoing investment in precision diagnostics and digital radiology platforms contribute to North America's strong market position. The expanding use of portable and point-of-care CT devices in emergency and intensive care settings further supports market growth, particularly in the United States, which remains the region’s largest contributor.

Region with significant growth

The Asia-Pacific region is poised to experience significant growth in the global computed tomography market over the coming years, driven by rapidly expanding healthcare infrastructure, rising awareness about early disease diagnosis, and growing government investments in medical imaging technologies. Countries such as China, India, and Southeast Asian nations are witnessing a surge in demand for affordable yet advanced CT systems to address the growing burden of cancer, cardiovascular, and infectious diseases.

The region’s large population base, integrated with improving access to diagnostic services in urban and semi-urban areas, is creating strong market opportunities for both global manufacturers and local players. Moreover, the adoption of AI-powered CT scanners and mobile imaging solutions is accelerating in response to rising healthcare digitization and efforts to bridge the rural-urban diagnostic gap. As a result, Asia-Pacific is emerging as the fastest-growing regional market for computed tomography.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Computed Tomography Market: Competitive Landscape

The global competitive landscape of the computed tomography market is characterized by the strong presence of leading medical imaging companies that continuously innovate to enhance imaging quality, speed, and diagnostic accuracy. Industry giants such as GE HealthCare, Siemens Healthineers, Canon Medical Systems, and Philips Healthcare dominate the market with extensive product portfolios, global distribution networks, and significant investments in AI-driven CT technologies.

These players are actively engaged in strategic collaborations, R&D initiatives, and product launches to maintain a competitive edge in both developed and emerging markets. Meanwhile, companies like Fujifilm Holdings, United Imaging Healthcare, Neusoft Medical Systems, and Shimadzu Corporation are expanding their footprints through affordable and region-specific CT solutions, particularly in high-growth areas like Asia-Pacific and Latin America. The market also includes a growing number of specialized firms focusing on portable CT devices, AI-based image reconstruction, and cloud-integrated diagnostic platforms. This dynamic competitive environment is fostering rapid technological advancement and driving the global adoption of next-generation computed tomography systems.

Some of the prominent players in the global computed tomography market are:

- GE HealthCare

- Siemens Healthineers

- Canon Medical Systems Corporation

- Philips Healthcare

- Fujifilm Holdings Corporation

- Samsung Medison

- Neusoft Medical Systems

- Shimadzu Corporation

- Carestream Health

- Hitachi Healthcare (now part of Fujifilm)

- United Imaging Healthcare

- Accuray Incorporated

- Konica Minolta

- Planmed Oy

- CurveBeam AI

- Medtronic

- Agfa-Gevaert Group

- MinFound Medical Systems

- Vatech Co., Ltd.

- Esaote S.p.A.

- Other Key Players

Global Computed Tomography Market: Recent Developments

- July 2025: Aidoc, a radiology AI company processing CT and other imaging modalities, secured USD 150 million in a funding round led by General Catalyst and Square Peg, bringing its total funding to USD 370 million.

- June 2025: GE HealthCare introduced the Revolution Vibe, an economical coronary CT angiography (CCTA) scanner aimed at outpatient centers, providing high-end cardiac imaging capabilities at lower cost.

- March 2025: Canon Medical Systems announced FDA clearance for AI enhancements to the Aquilion ONE INSIGHT Edition, incorporating the PIQE 1024 matrix and SilverBeam filter for ultra-low-dose, high-resolution CT imaging across more clinical applications.

- March 2025: Siemens Healthineers received FDA clearance for its photon-counting CT Naeotom Alpha class, marking strategic expansion into cutting-edge technology that alters competitive positioning and may lead to future acquisitions in this segment.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.7 Bn |

| Forecast Value (2034) |

USD 12.9 Bn |

| CAGR (2025–2034) |

5.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (High-Slice [64-slice and above], Mid-Slice CT [16-slice to 64-slice], Low-Slice CT [<16-slice], Cone-Beam CT [CBCT]), By Architecture (O-arm CT, C-arm CT, Stationary Multi-Slice CT), By Modality (Standalone CT, Portable CT, Point-of-Care CT), By Application (Oncology, Cardiovascular, Neurology, Musculoskeletal, Other Applications), and By End User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers [ASCs], Research & Academic Institutes) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

GE HealthCare, Siemens Healthineers, Canon Medical Systems Corporation, Philips Healthcare, Fujifilm Holdings Corporation, Samsung Medison, Neusoft Medical Systems, Shimadzu Corporation, Carestream Health, Hitachi Healthcare, United Imaging Healthcare, Accuray Incorporated, Konica Minolta, Planmed Oy, CurveBeam AI, Medtronic, Agfa-Gevaert Group, MinFound Medical Systems, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global computed tomography market size is estimated to have a value of USD 7.7 billion in 2025 and

is expected to reach USD 12.9 billion by the end of 2034.

The US computed tomography market is projected to be valued at USD 2.5 billion in 2025. It is expected

to witness subsequent growth in the upcoming period as it holds USD 4.0 billion in 2034 at a CAGR of

5.4%.

North America is expected to have the largest market share in the global computed tomography market,

with a share of about 38.0% in 2025.

Some of the major key players in the global computed tomography market are GE HealthCare, Siemens

Healthineers, Canon Medical Systems Corporation, Philips Healthcare, Fujifilm Holdings Corporation,

Samsung Medison, Neusoft Medical Systems, Shimadzu Corporation, Carestream Health, Hitachi

Healthcare, United Imaging Healthcare, Accuray Incorporated, Konica Minolta, Planmed Oy, CurveBeam

AI, Medtronic, Agfa-Gevaert Group, MinFound Medical Systems, and Others.

The market is growing at a CAGR of 5.8 percent over the forecasted period.