Market Overview

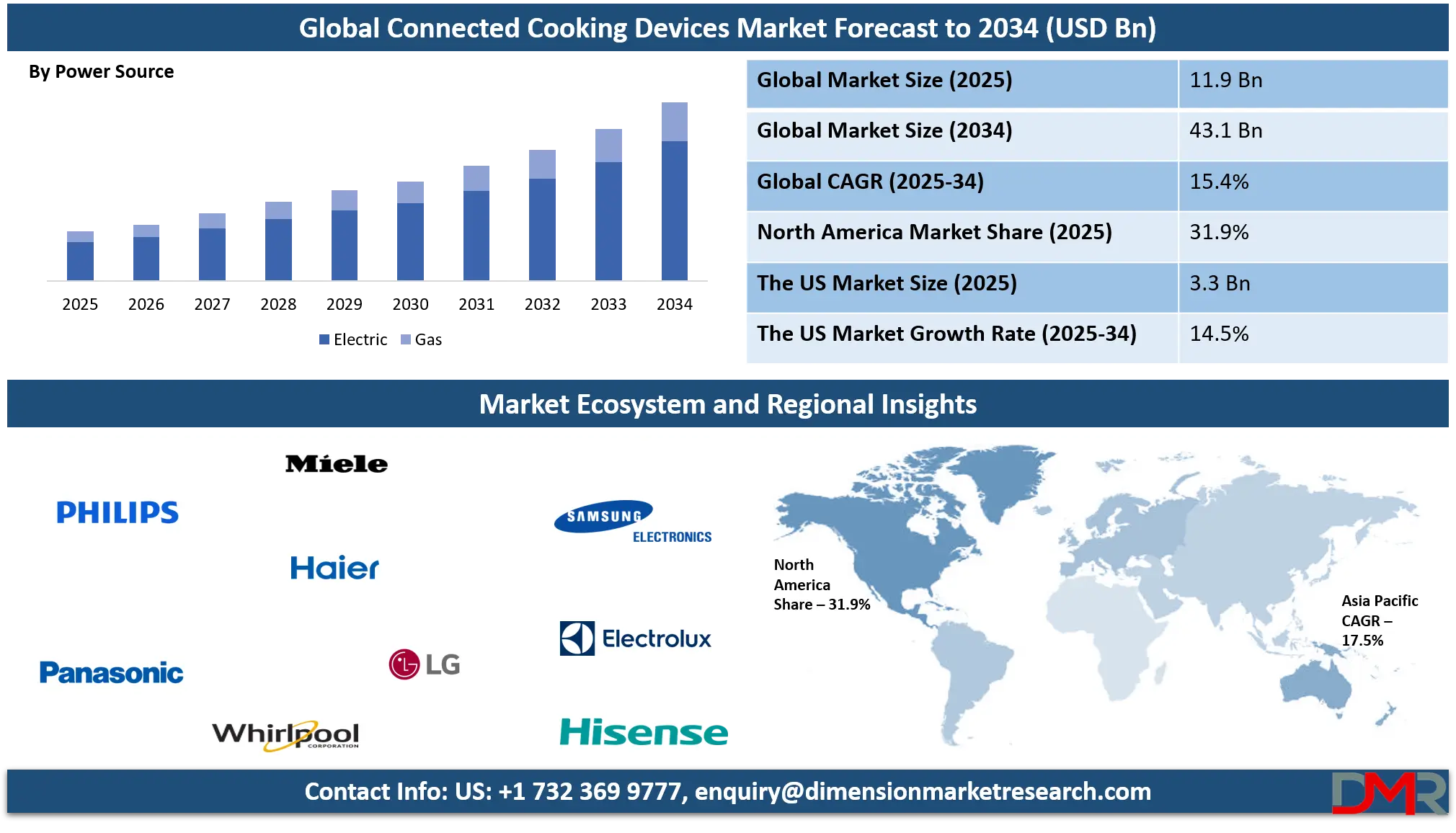

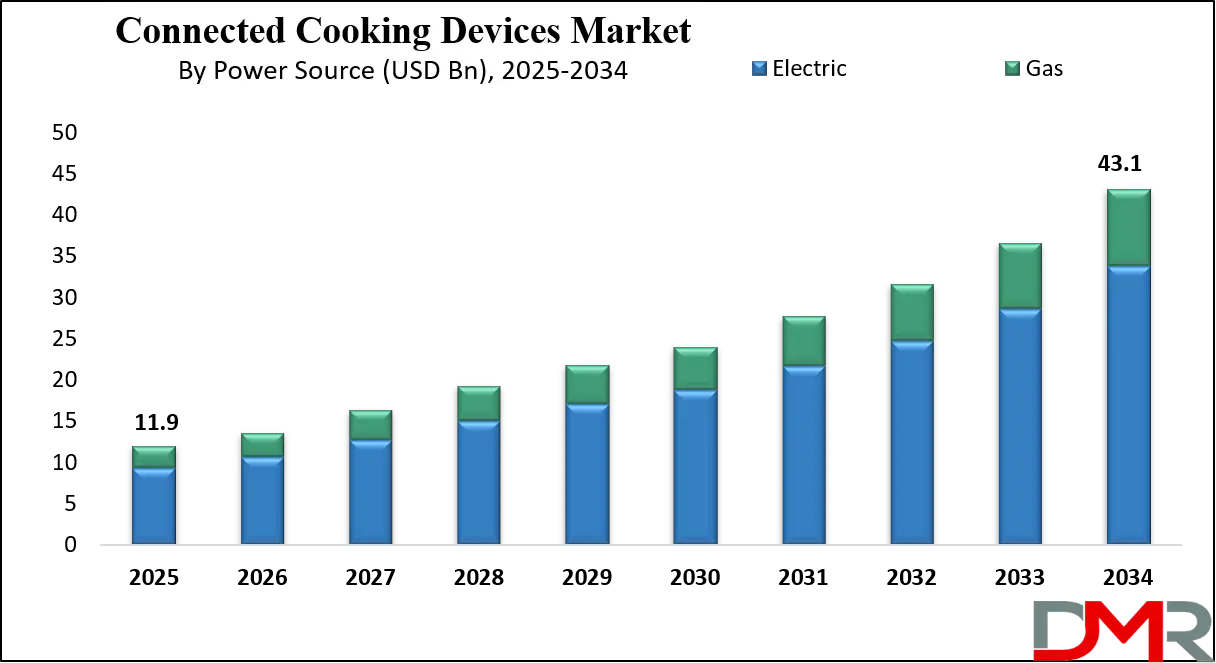

The Global Connected Cooking Devices Market size is projected to reach USD 11.9 billion in 2025 and grow at a compound annual growth rate of 15.4% from there until 2034 to reach a value of USD 43.1 billion

Connected cooking devices are smart kitchen appliances that use internet or Bluetooth technology to interact with other devices, apps, or users. These include smart ovens, cooktops, refrigerators, dishwashers, coffee machines, and kitchen hoods. They allow remote control through smartphones or voice assistants, offer cooking guidance, track food items, and send alerts for tasks like preheating, stirring, or switching off. These devices are part of the broader smart home ecosystem, focusing on making cooking more efficient, personalized, and safe.

The demand for connected cooking devices has been growing steadily as more people look for convenience and better control in the kitchen. Busy lifestyles have increased the need for time-saving tools, and connected appliances help by automating repetitive tasks. Younger households and urban populations especially prefer such devices as they offer both function and style. Increased internet access, growing smartphone usage, and rising awareness of smart home technology have all contributed to rising adoption across households globally.

One major trend in this space is the integration of artificial intelligence and machine learning. Some devices can now learn cooking preferences and make suggestions based on usage patterns. For example, smart ovens can automatically adjust temperature and time based on the type of food placed inside. Voice control using platforms like Amazon Alexa and Google Assistant is also becoming common. Another trend is sustainability, where these devices help reduce energy consumption and food waste through better monitoring and alerts.

Recent years have seen many developments in this industry. Big kitchen brands have collaborated with tech companies to launch new products, combining design with technology. Several companies are developing ecosystems where different appliances in the kitchen can communicate with each other for a seamless cooking experience. For example, a smart refrigerator might suggest recipes based on available ingredients, and send that information directly to a smart oven. These collaborations reflect the shift toward more connected lifestyles.

Consumer interest in health and nutrition has also played a role. Many connected cooking devices come with apps that offer calorie tracking, recipe customization, and cooking tips tailored to dietary needs. This combination of technology and wellness appeals to a growing segment of health-conscious consumers. Cooking shows and food influencers also fuel interest by showcasing these devices in daily use.

As smart homes and Smart Home Systems become more common, connected cooking devices are becoming a central part of modern kitchens. The shift from traditional to connected appliances is not just about convenience; it's about transforming the way people plan, prepare, and enjoy food. These devices offer a mix of automation, personalization, and connectivity that fits into the digital lifestyles of today’s consumers.

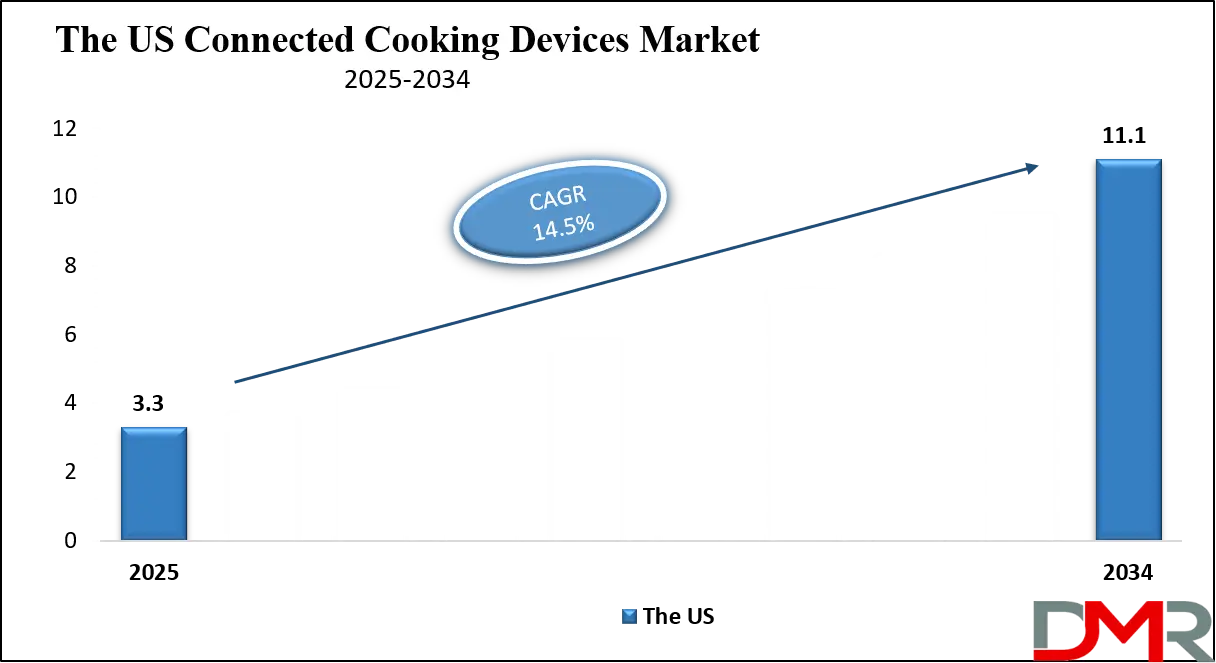

The US Connected Cooking Devices Market

The US Connected Cooking Devices Market size is projected to reach USD 3.3 billion in 2025 at a compound annual growth rate of 14.5% over its forecast period.

The US plays a leading role in the connected cooking devices market due to its strong technology infrastructure, high smart home adoption, and consumer willingness to embrace innovation. US households are early adopters of smart kitchen appliances, driven by convenience, lifestyle upgrades, and energy-saving features. The country’s tech-savvy population, widespread internet access, and integration of voice assistants like Alexa and Google Assistant further boost market growth.

Many key innovations and product launches in this segment originate in the US, often setting global trends. Additionally, rising interest in health-conscious cooking and personalized meal planning fuels demand. With strong support from both established appliance brands and startups, the US continues to be a major driver of innovation and consumption in this market.

Europe Connected Cooking Devices Market

Europe Connected Cooking Devices Market size is projected to reach USD 3.3 billion in 2025 at a compound annual growth rate of 15.0% over its forecast period.

Europe plays a vital role in the connected cooking devices market, driven by strong demand for energy-efficient and sustainable home appliances. European consumers are highly aware of environmental issues and actively seek smart kitchen solutions that help reduce energy use and food waste. The region also benefits from advanced infrastructure, widespread internet access, and growing smart home adoption.

Countries like Germany, the UK, France, and the Netherlands are at the forefront of embracing connected technologies in the kitchen. Strict regulations around energy consumption and appliance standards have further encouraged innovation among manufacturers. In addition, European households often favor compact, multifunctional devices, making smart appliances an ideal fit. This combination of sustainability focus and tech readiness makes Europe a key contributor to market growth.

Japan Connected Cooking Devices Market

Japan Connected Cooking Devices Market size is projected to reach USD 0.6 billion in 2025 at a compound annual growth rate of 16.9% over its forecast period.

Japan holds a significant position in the connected cooking devices market due to its advanced technology landscape and strong consumer interest in innovation. Japanese households are known for adopting compact, high-tech appliances that suit urban living and limited kitchen space. The country's strong electronics industry, combined with a culture that values convenience and precision, supports the development and adoption of smart cooking devices. Many local manufacturers are pioneers in integrating AI, voice control, and automation into everyday kitchen products.

Additionally, Japan’s aging population drives demand for user-friendly, time-saving appliances that enhance safety and ease of use. With a mature consumer base, advanced infrastructure, and focus on quality, Japan continues to shape trends and push innovation in the global smart kitchen market.

Connected Cooking Devices Market: Key Takeaways

- Market Growth: The Connected Cooking Devices Market size is expected to grow by USD 29.5 billion, at a CAGR of 15.4%, during the forecasted period of 2026 to 2034.

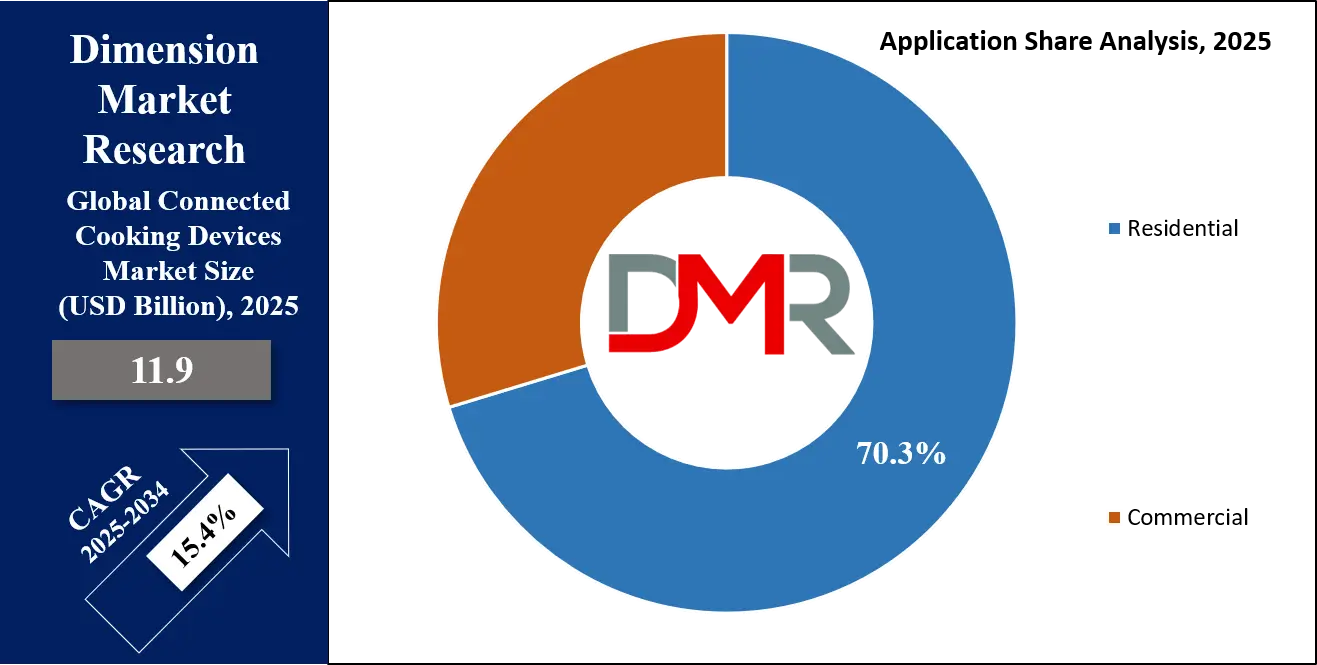

- By Application: The Residential segment is anticipated to get the majority share of the Connected Cooking Devices Market in 2025.

- By Power Source: Electric segment is expected to get the largest revenue share in 2025 in the Connected Cooking Devices Market.

- Regional Insight: North America is expected to hold a 31.9% share of revenue in the Global Connected Cooking Devices Market in 2025.

- Use Cases: Some of the use cases of Connected Cooking Devices include energy efficiency alerts, remote cooking control, and more.

Connected Cooking Devices Market: Use Cases

- Remote Cooking Control: Connected cooking devices allow users to start, stop, or adjust cooking settings from their smartphones. This is helpful when multitasking or managing meals while away from the kitchen. It ensures better time management and adds convenience to daily cooking.

- Personalized Recipe Guidance: Many devices offer step-by-step instructions based on user preferences and dietary needs. The system can adjust temperature and cooking time automatically. This helps even beginners cook complex dishes with confidence.

- Inventory and Expiry Tracking: Smart fridges and pantries can monitor stored ingredients, track expiry dates, and suggest recipes. This reduces food waste and helps with better grocery planning. Users can know what they need before heading to the store.

- Energy Efficiency Alerts: These devices provide real-time energy usage data and suggest ways to reduce consumption. They can notify users if a stove is left on or if a door is open. This promotes safer and more efficient kitchen practices.

Market Dynamic

Driving Factors in the Connected Cooking Devices Market

Rising Smart Home Adoption and Digital Lifestyles

The increasing shift toward smart homes is a major growth driver for the connected cooking devices market. As more households adopt smart lighting, thermostats, and voice assistants, integrating smart kitchen appliances becomes a natural next step. Consumers today seek convenience, control, and automation across all areas of their homes, and the kitchen is no exception.

The ability to operate ovens, coffee makers, and other appliances remotely or through voice commands fits well with digital-first lifestyles. This demand is further supported by the rise in dual-income households and urban living, where time-saving technologies are highly valued. Connected cooking devices not only align with modern living habits but also add to the aesthetic and tech appeal of smart homes.

Growing Focus on Health, Nutrition, and Personalized Cooking

Another strong growth driver is the rising awareness around healthy eating and personalized meal planning. Connected cooking devices often come with built-in apps that suggest recipes based on dietary preferences, calorie goals, or ingredient availability. As more consumers look to manage their health through food, the ability of smart appliances to support customized, nutritious meals gains relevance. These devices can guide users in portion control, reduce reliance on processed food, and help prepare meals with minimal effort.

Additionally, as cooking becomes a hobby for many, especially post-pandemic, tools that enhance creativity while supporting wellness goals are in high demand. This combination of convenience and health-driven features continues to boost market adoption.

Restraints in the Connected Cooking Devices Market

High Initial Costs and Limited Affordability

One of the key restraints in the connected cooking devices market is the high upfront cost of smart kitchen appliances. Compared to traditional cooking devices, connected versions come with premium pricing due to advanced technologies like sensors, connectivity modules, and smart interfaces. This limits their adoption, especially in price-sensitive markets and among lower-income households. Many potential buyers still view these products as luxury items rather than everyday necessities.

Additionally, the cost of setup, installation, and compatible smart home systems further adds to the overall expense. Without broader affordability or cost-effective alternatives, mass adoption remains restricted in many regions, slowing overall market growth.

Concerns Around Data Privacy and Technology Dependence

The use of connected cooking devices raises ongoing concerns about data privacy, user tracking, and over-reliance on technology. These appliances often collect information on usage habits, food choices, and cooking routines, which can lead to hesitation among privacy-conscious users. Fear of data breaches, hacking, or misuse of personal data can deter customers from adopting smart kitchen solutions.

Moreover, the dependence on stable internet connectivity and mobile apps may pose challenges in areas with poor infrastructure. Technical glitches, software updates, or app compatibility issues can also disrupt the user experience. These factors create barriers to trust and limit consumer confidence in fully embracing connected kitchen technologies.

Opportunities in the Connected Cooking Devices Market

Expansion into Emerging Markets with Growing Tech Adoption

One major opportunity for the connected cooking devices market lies in the growing demand from emerging economies. As internet access and smartphone penetration increase across countries in Asia, Latin America, and Africa, more consumers are becoming familiar with smart technologies.

Rising disposable incomes and urbanization in these regions are creating a favorable environment for adopting modern kitchen appliances. With the right pricing strategies and localized marketing, manufacturers can tap into this vast, underserved consumer base. Offering budget-friendly models or flexible financing options can further support growth. As digital infrastructure improves, these regions are expected to play a significant role in driving future market expansion.

Integration with Broader Smart Home and IoT Ecosystems

The continued evolution of smart home ecosystems presents a strong opportunity for connected cooking devices. Integration with voice assistants, home automation systems, and health monitoring apps can add significant value to the user experience. For example, a connected oven that syncs with a fitness tracker or a refrigerator that adjusts suggestions based on dietary apps can appeal to tech-savvy and health-conscious users alike.

As more consumers adopt centralized smart home platforms, demand for interconnected kitchen solutions will likely grow. Companies that offer seamless compatibility, ecosystem-wide control, and data-driven personalization can differentiate themselves and build stronger customer loyalty.

Trends in the Connected Cooking Devices Market

AI-Driven Personalization and Automation in Cooking

A significant trend in the connected cooking devices market is the integration of artificial intelligence (AI) to enhance personalization and automation. Modern appliances, such as smart ovens and refrigerators, are now equipped with AI capabilities that learn user preferences and cooking habits. This allows them to suggest recipes, adjust cooking times, and optimize energy usage automatically, providing a tailored cooking experience.

For instance, smart ovens can monitor internal conditions and adjust settings to ensure perfect results, while smart fridges track food inventory and offer meal suggestions based on available ingredients. This level of personalization not only simplifies meal preparation but also promotes healthier eating habits by accommodating dietary restrictions and preferences.

Emphasis on Sustainability and Energy Efficiency

Another prevailing trend is the focus on sustainability and energy efficiency in connected cooking devices. Manufacturers are designing appliances that consume less energy and reduce food waste, aligning with the growing consumer demand for eco-friendly products. Features such as energy-efficient cooking modes, real-time energy consumption tracking, and inventory management help users make more sustainable choices in the kitchen. For example, smart refrigerators can optimize temperature settings to save energy, and connected ovens can suggest portion sizes to minimize food waste. These advancements not only contribute to environmental conservation but also offer cost savings to consumers, making sustainability a key selling point in the market.

Research Scope and Analysis

By Product Type Analysis

Smart cooking appliances as a product type are expected to lead the connected cooking devices market in 2025 with a share of 27.8%, driven by growing demand for convenience, automation, and personalized cooking. These appliances, including smart ovens, cooktops, and microwaves, allow users to control and monitor cooking through mobile apps and voice assistants. With rising interest in energy efficiency and time-saving features, smart cooking appliances are becoming a preferred choice among tech-savvy consumers.

The ability to integrate with broader smart home systems adds to their appeal. As lifestyles become busier, the ease of remote operation, automated temperature control, and real-time cooking updates are supporting strong market adoption across both developed and emerging regions.

Smart deep fryers as a product type are showing significant growth over the forecast period in the connected cooking devices market, driven by rising consumer interest in home-based, healthier fried food options. These devices often include features like precise temperature control, oil usage monitoring, and cooking presets, making them easy and safe to use. Integration with mobile apps allows users to manage cooking remotely, track recipes, and receive alerts.

Their compact design and energy efficiency suit modern urban kitchens, especially in households looking to reduce manual cooking efforts. With growing awareness around health and food quality, smart deep fryers are gaining popularity across households that want a convenient and connected cooking experience.

By Connectivity Analysis

Wi-Fi as a connectivity segment is set to lead the connected cooking devices market in 2025 with an estimated share of 51.3%, fueled by its ability to offer seamless, long-range communication between appliances and user devices. Wi-Fi-enabled kitchen gadgets allow remote access through mobile apps, making it easier for users to start, pause, or adjust cooking settings from anywhere in the home or even outside.

The reliability and faster data exchange offered by Wi-Fi support advanced functions like recipe suggestions, energy tracking, real-time alerts, and software updates. Its compatibility with smart home ecosystems like voice assistants and hubs also enhances its value. As consumers increasingly prefer appliances that deliver both flexibility and control, Wi-Fi remains the top connectivity choice, contributing greatly to the widespread adoption of connected cooking devices across modern households.

Bluetooth as a connectivity segment is showing significant growth over the forecast period in the connected cooking devices market, mainly due to its simplicity and low-energy usage. It allows short-range communication between appliances and smartphones without the need for complex setup or internet access. This makes Bluetooth a convenient choice for users who want basic control features like turning devices on or off, adjusting temperature, or checking cooking status through an app.

Many smaller or portable connected kitchen products, like smart grills or fryers, favor Bluetooth for its affordability and easy integration. As more consumers look for entry-level smart kitchen experiences without high costs, Bluetooth-based cooking devices continue to gain popularity, especially in compact kitchens and casual user segments.

By Power Source Analysis

Electric as a power source segment is projected to lead the connected cooking devices market in 2025 with an estimated share of 78.2%, supported by growing preference for energy-efficient and user-friendly appliances. Electric-powered devices are easier to integrate with smart technologies like sensors, timers, and wireless connectivity, making them the go-to choice for manufacturers and consumers alike. These appliances allow for precise temperature control, faster heating, and better safety features compared to traditional options.

They also support cleaner cooking, aligning with the increasing demand for eco-friendly solutions. As more households shift toward electric-based cooking systems, driven by smart home adoption and sustainability goals, electric-powered connected cooking devices continue to dominate the market and drive innovation across a wide range of kitchen applications.

The gas as a power source segment is gaining noticeable traction over the forecast period in the connected cooking devices market, especially in regions where gas cooking remains a cultural norm. Connected gas appliances now offer features like flame monitoring, auto shut-off, and smartphone alerts, blending tradition with modern safety and convenience.

This segment appeals to users who prefer the control and familiarity of flame-based cooking while still seeking the benefits of smart technology. Gas-powered smart cooktops and stoves are particularly favored in countries where gas infrastructure is well established. As manufacturers enhance compatibility and efficiency for gas-based devices, this segment is set to experience steady growth among consumers looking for a mix of traditional performance and modern control.

By Distribution Channel Analysis

Online as a distribution channel is projected to lead the connected cooking devices market in 2025 with an estimated share of 61.7%, driven by the rapid growth of e-commerce and changing consumer shopping habits. Buyers prefer the convenience of browsing a wide range of smart kitchen appliances from their homes, supported by detailed product information, reviews, and easy price comparisons. Online platforms often provide access to the latest models, exclusive offers, and flexible delivery options, making them an attractive option for modern consumers.

The increasing role of digital marketing and social media also helps brands reach their audience effectively. As more people rely on online shopping for tech-related products, the digital space continues to shape how connected cooking devices are discovered, researched, and purchased, leading to consistent growth in this distribution segment.

Offline as a distribution channel continues to show significant growth over the forecast period in the connected cooking devices market, especially among consumers who prefer physical store experiences. Many buyers still value the ability to see, touch, and test appliances before making a purchase.

Retail stores, specialty outlets, and brand showrooms provide in-person demonstrations, expert guidance, and immediate support, which builds trust and confidence in smart kitchen products. For high-involvement purchases like connected appliances, face-to-face interaction with trained staff remains important. In emerging markets, offline retail also plays a key role where online access may be limited. This channel continues to be vital in building brand presence and converting hesitant buyers through personal engagement.

By Application Analysis

Residential as an application segment is forecasted to lead the connected cooking devices market in 2025 with an estimated share of 70.3%, backed by rising interest in smart home living and personalized cooking experiences. Homeowners are increasingly adopting connected appliances that offer convenience, remote control, energy efficiency, and safety. These devices help users manage cooking tasks through smartphones or voice assistants, making everyday routines smoother and more efficient.

Growing awareness about healthy eating, food tracking, and meal planning further drives interest in smart ovens, cooktops, fryers, and other connected products. Urban households, in particular, value the time-saving and automation features of these appliances. With more people investing in modern kitchen upgrades, residential usage continues to be the strongest application area driving overall growth of the connected cooking devices market.

Commercial as an application segment is experiencing significant growth over the forecast period in the connected cooking devices market, especially in hotels, restaurants, and catering services. These businesses are turning to smart kitchen solutions to improve cooking accuracy, reduce waste, and streamline operations. Connected appliances help maintain consistent food quality, monitor cooking cycles, and even send alerts when maintenance is needed, reducing downtime.

In fast-paced commercial kitchens, features like remote access, programmable settings, and real-time diagnostics are becoming essential. The ability to track performance and ensure food safety through technology adds value to busy professional environments. As the foodservice industry increasingly embraces digital transformation, connected cooking devices are playing a key role in raising kitchen efficiency and service standards.

By End User Analysis

Household as an end user is expected to lead the connected cooking devices market in 2025 with a projected share of 68.7%, driven by rising interest in smart home solutions and lifestyle convenience. Families and individual users are choosing connected kitchen appliances to make daily cooking easier, safer, and more efficient. These devices offer features like remote control, cooking notifications, voice command compatibility, and preset recipes—all aimed at saving time and effort.

In busy households, connected devices simplify meal preparation, reduce energy usage, and enhance safety with automated shutdown and temperature monitoring. The growing awareness around healthy eating and smart living continues to influence appliance buying decisions. As more people upgrade their homes with digital tools, connected cooking devices are becoming a key part of modern household kitchens.

Catering services as an end user are seeing notable growth over the forecast period in the connected cooking devices market, especially as food businesses seek better control over large-scale operations. These services benefit from connected appliances that support bulk cooking while offering consistency, time management, and reduced errors. Smart cooking devices help staff monitor multiple dishes, maintain quality standards, and follow food safety rules with real-time alerts and reporting.

Integration with digital platforms also allows better scheduling and inventory tracking. For catering companies serving multiple clients, the precision and automation these devices offer help improve speed and reliability. As efficiency and professionalism become top priorities, connected cooking appliances are becoming essential tools in the catering segment.

The Connected Cooking Devices Market Report is segmented on the basis of the following:

By Product Type

- Smart Ovens

- Smart Cooktops

- Smart Microwaves

- Smart Grills

- Smart Deep Fryers

- Smart Rice Cookers

- Smart Steamers

- Smart Pressure Cookers

By Connectivity

- Wi-Fi

- Bluetooth

- Zigbee

- Others

By Power Source

By Distribution Channel

- Online

- Offline

- Specialty Stores

- Supermarkets/Hypermarkets

- Brand Stores

By Application

By End User

- Households

- Hotels & Restaurants

- Catering Services

- Food Chains

Regional Analysis

Leading Region in the Connected Cooking Devices Market

Connected Cooking Devices in North America are estimated to hold a significant share of 31.9% in 2025, making the region one of the key contributors to the market’s growth. This is largely due to high consumer interest in smart home technology and strong infrastructure supporting internet connectivity. Many households in North America prefer appliances that offer convenience, energy efficiency, and personalized cooking experiences. The widespread use of voice assistants and mobile apps helps boost the adoption of connected cooking devices.

Additionally, the region has a large base of tech-savvy consumers who value innovation and ease of use in their kitchen gadgets. With growing awareness about health and sustainability, North American consumers are increasingly turning to smart appliances that help manage food waste and promote healthier cooking. These factors combined are expected to continue driving the growth of connected cooking devices across the region throughout forecast period.

Fastest Growing Region in the Connected Cooking Devices Market

Asia Pacific is showing significant growth in the connected cooking devices market over the forecast period, driven by rising urbanization and increasing adoption of smart home technologies. The region benefits from a growing middle-class population with higher disposable incomes and a strong interest in modern, convenient kitchen appliances. Countries like China, India, Japan, and South Korea are leading this growth due to improved internet connectivity and smartphone penetration.

Consumers in Asia Pacific are increasingly looking for energy-efficient, easy-to-use cooking devices that offer automation and personalized cooking experiences. The expanding e-commerce sector also helps boost the availability and awareness of connected kitchen appliances, supporting steady market growth throughout the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The connected cooking devices market is highly competitive, with many companies focusing on innovation, smart features, and user-friendly designs to stand out. Players are constantly improving product quality, adding voice controls, app connectivity, and AI-based cooking guidance to attract tech-savvy users. The market sees a mix of traditional kitchen appliance makers adapting to smart trends and new tech-driven brands entering with advanced solutions.

Companies compete on factors like design, ease of use, energy efficiency, and compatibility with smart home systems. There is also growing competition around offering personalized cooking experiences and healthy meal support. With rising consumer demand, companies are expanding product lines and reaching out to more regions, while also investing in marketing and partnerships to build brand trust.

Some of the prominent players in the global Connected Cooking Devices are:

- Whirlpool Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Electrolux AB

- Panasonic Corporation

- Haier

- Midea Group

- Breville Group Limited

- Philips

- KitchenAid

- Rational AG

- Tovala

- Miele & Cie. KG

- Breville USA

- Smeg S.p.A.

- Zojirushi Corporation

- Vestel Group

- Hisense Group

- Daewoo Electronics

- Sharp Corporation

- Other Key Players

Recent Developments

- In March 2025, Panasonic introduced the HomeCHEF Connect 4-in-1 Countertop Multi-Oven, combining Microwave, Air Fry, Convection Bake, and Broil functions. Connected to the new Panasonic Kitchen+ app, powered by Fresco, the appliance offers guided cooking with step-by-step instructions and hundreds of curated recipes. Designed for efficiency and ease, the app supports various dietary needs and includes features like autocook presets and live updates. This smart oven helps home cooks save time and enjoy more meaningful moments with family at the dinner table.

- In March 2025, Capstone Companies, Inc. signed a five-year exclusive global license agreement with UK-based T&B Media, Ltd. Under the agreement, T&B will promote, market, sell, distribute, produce, and manufacture Capstone’s Connected Chef kitchen tablet. Capstone will receive a fixed license fee for each unit sold and delivered by T&B. The license is non-transferable and includes a one-year post-termination extension, allowing T&B to sell off remaining inventory after the initial five-year term concludes.

- In February 2025, The Middle by Corporation announced that its Board of Directors had unanimously approved a plan to spin off its food processing business into a separate public company. This move, part of a strategic review, will result in two independent and innovative entities: Middleby RemainCo and Middleby Food Processing. The tax-free spin-off is expected to be finalized by early 2026.

- In December 2024, Samsung Electronics announced the expansion of its advanced screen technology across more home appliances, advancing its “Screens Everywhere” vision. This year, the company is enhancing the kitchen with a new refrigerator featuring a 9” AI Home1 screen and integrating a 7” AI Home1 into the Wall Oven. In the laundry category, the 7” AI Home will now be available in the new Bespoke AI™ Washer and Dryer set. These innovations will be showcased at CES 2025.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.9 Bn |

| Forecast Value (2034) |

USD 43.1 Bn |

| CAGR (2025–2034) |

15.4% |

| The US Market Size (2025) |

USD 3.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Smart Ovens, Smart Cooktops, Smart Microwaves, Smart Grills, Smart Deep Fryers, Smart Rice Cookers, Smart Steamers, and Smart Pressure Cookers), By Connectivity (Wi-Fi, Bluetooth, Zigbee, and Others), By Power Source (Electric and Gas), By Distribution Channel (Online and Offline), By Application (Residential and Commercial), By End User (Households, Hotels & Restaurants, Catering Services, and Food Chains) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Whirlpool Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Electrolux AB, Panasonic Corporation, Haier, Midea Group, Breville Group Limited, Philips, KitchenAid, Rational AG, Tovala, Miele & Cie. KG, Breville USA, Smeg S.p.A., Zojirushi Corporation, Vestel Group, Hisense Group, Daewoo Electronics, Sharp Corporation, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Connected Cooking Devices Market size is expected to reach a value of USD 11.9 billion in 2025 and is expected to reach USD 43.1 billion by the end of 2034.

North America is expected to have the largest market share in the Global Connected Cooking Devices Market, with a share of about 31.9% in 2025.

The Connected Cooking Devices Market in the US is expected to reach USD 3.3 billion in 2025.

Some of the major key players in the Global Connected Cooking Devices Market are Samsung Electronics, LG Electronics, Whirlpool Corporation, and others

The market is growing at a CAGR of 15.4 percent over the forecasted period.