Market Overview

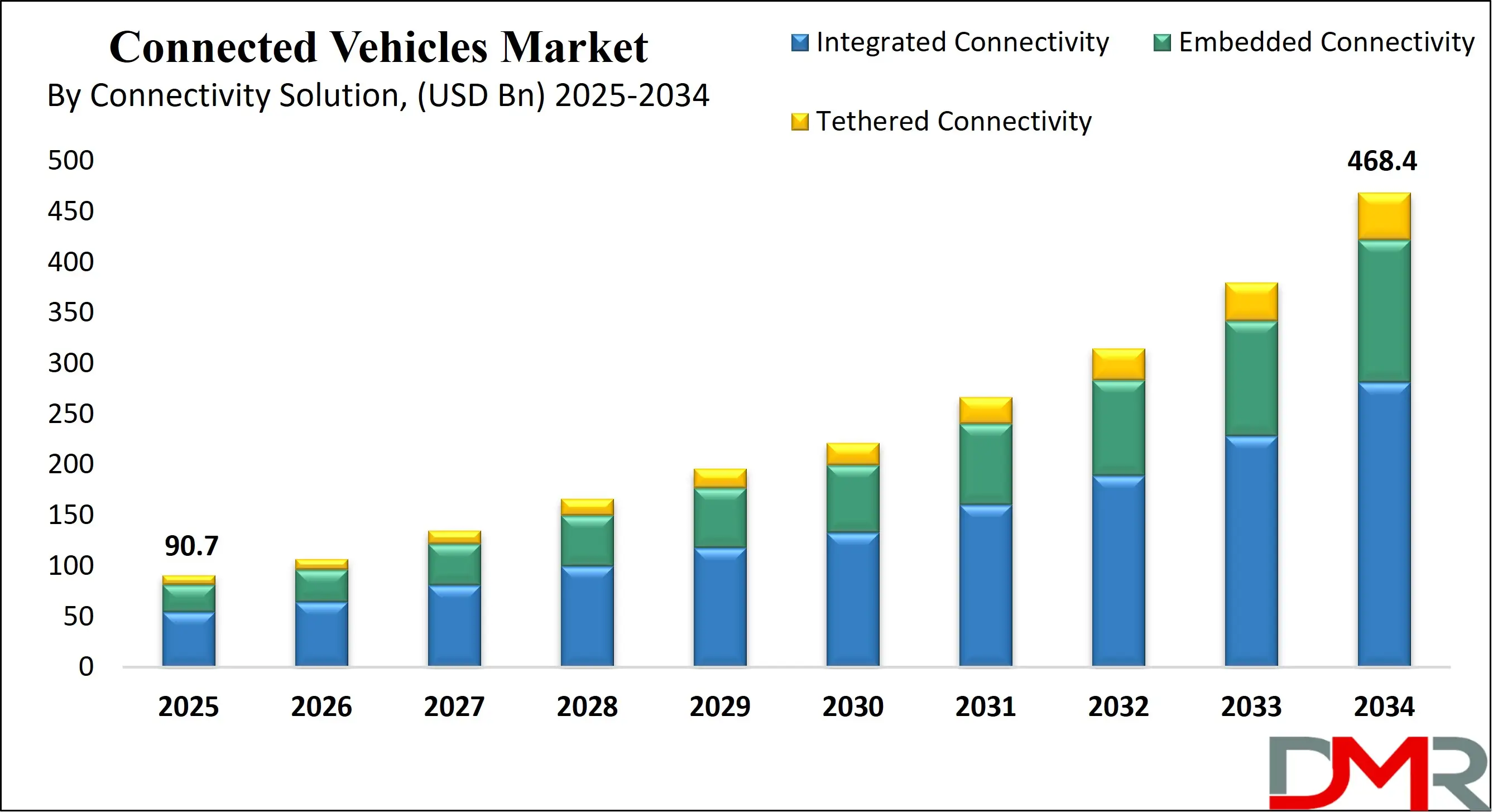

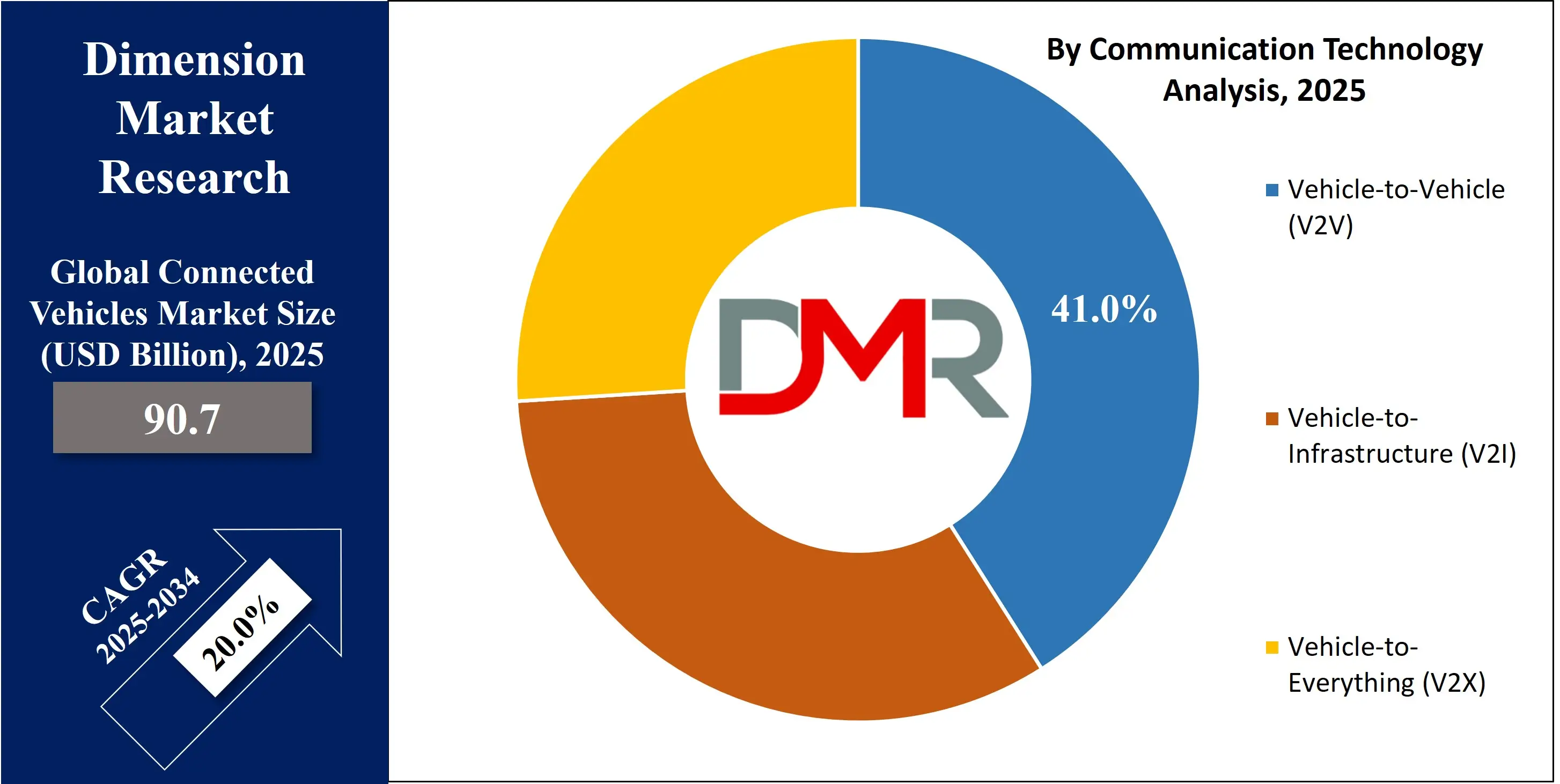

The Global Connected Vehicles Market is projected to grow from USD 90.7 billion in 2025 to USD 468.4 billion by 2034, expanding at a robust CAGR of 20.0%. Driven by growing adoption of vehicle-to-everything technologies, telematics solutions, and advanced driver-assistance systems, the market is witnessing strong demand for smart mobility, real-time vehicle communication, and intelligent transportation solutions across passenger and commercial vehicles globally.

.webp)

Connected Vehicles are modern automobiles equipped with advanced communication technologies that allow them to interact with other vehicles, infrastructure, and external networks. These vehicles use sensors, onboard computers, and wireless communication systems to collect, exchange, and process data in real time. By integrating technologies such as vehicle-to-vehicle communication, vehicle-to-infrastructure communication, and telematics, connected vehicles enhance road safety, optimize traffic management, improve fuel efficiency, and provide drivers with a seamless infotainment and navigation experience. They also play a critical role in enabling autonomous driving capabilities, predictive maintenance, and smart mobility solutions, transforming the traditional automotive landscape into a digitally connected ecosystem.

The global connected vehicles market refers to the international industry focused on the development, deployment, and adoption of vehicles that utilize connectivity technologies to communicate with their environment and external networks. This market encompasses a wide range of solutions including telematics, in-car infotainment systems, advanced driver-assistance systems, and real-time traffic management tools. Growth in this market is driven by growing consumer demand for safer and more convenient driving experiences, government regulations promoting vehicle safety, and the rapid expansion of smart city infrastructure. Automotive manufacturers and technology companies are investing heavily in research and development to enhance vehicle connectivity and integrate next-generation technologies.

Global connected vehicles are not limited to passenger cars but extend to commercial vehicles, trucks, and fleet management solutions, creating opportunities across multiple transportation sectors. The market is characterized by rapid technological innovation, with advancements in 5G, cloud computing, and artificial intelligence enabling seamless vehicle communication and intelligent decision-making. Rising adoption of electric vehicles, telematics services, and autonomous driving technologies further accelerates market growth, while regions such as Asia Pacific, North America, and Europe are emerging as key contributors due to strong infrastructure development, regulatory support, and consumer interest in digital mobility solutions. The industry continues to evolve as collaboration between automotive OEMs, semiconductor manufacturers, software developers, and telecommunication providers strengthens the connected mobility ecosystem.

The US Connected Vehicles Market

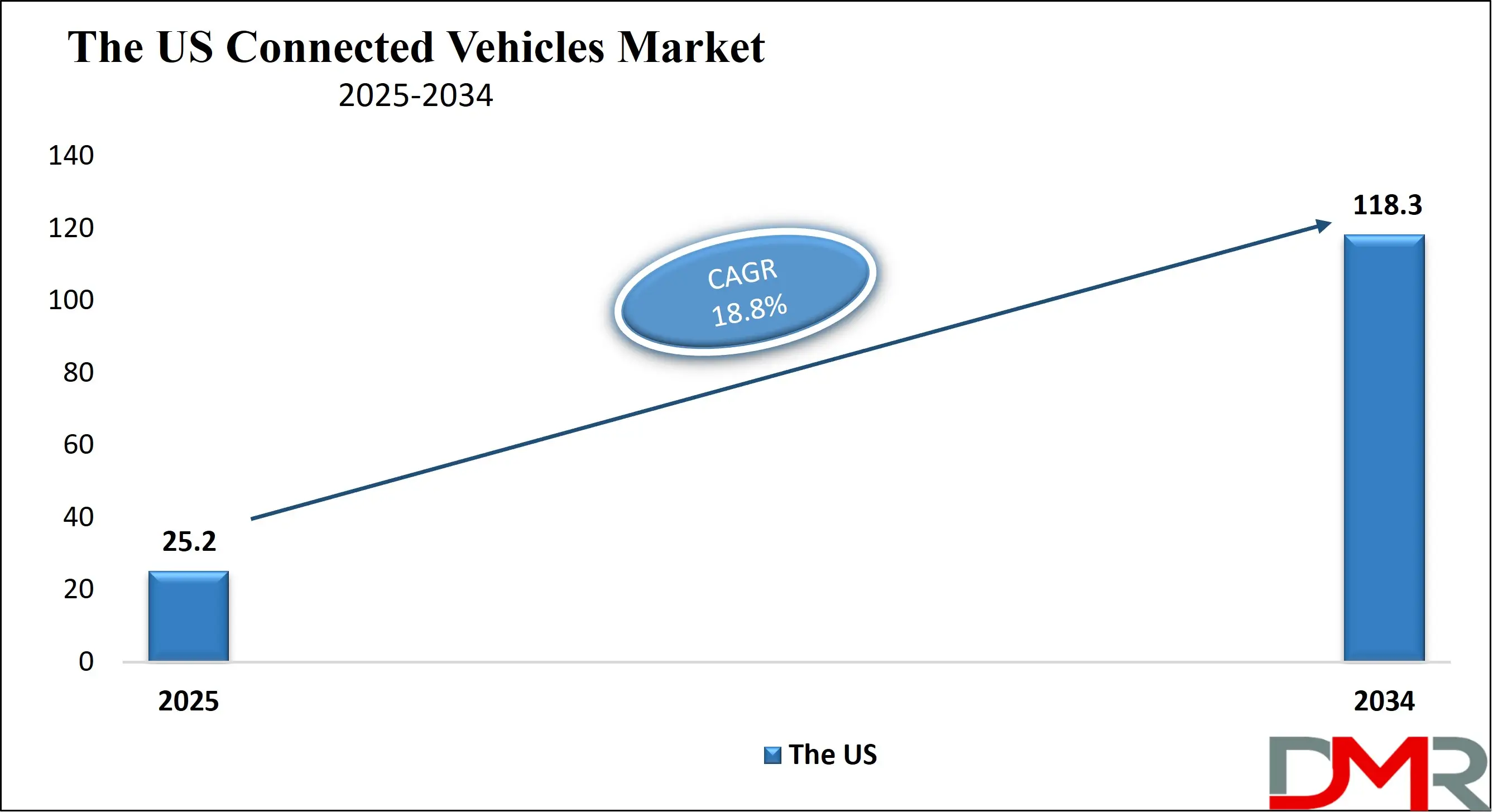

The U.S. Connected Vehicles market size is projected to be valued at USD 25.2 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 118.3 billion in 2034 at a CAGR of 18.8%.

The United States connected vehicles market is one of the most advanced and rapidly growing regions globally, driven by widespread adoption of in-vehicle connectivity solutions, telematics services, and vehicle-to-everything communication technologies. Strong consumer demand for enhanced safety features, real-time traffic information, and infotainment systems is encouraging automotive manufacturers to integrate advanced driver-assistance systems, smart navigation, and cloud-based vehicle management solutions into new models.

In addition, government initiatives and regulatory standards supporting vehicle safety, autonomous driving, and emissions reduction are accelerating the deployment of connected vehicle technologies, creating a favorable environment for both original equipment manufacturers and technology providers. Fleet management, commercial vehicles, and passenger cars are key segments fueling growth in the U.S. connected vehicles market, with extensive investments in 5G networks, artificial intelligence, and machine learning enabling predictive maintenance, remote diagnostics, and smart fleet operations.

Collaboration between automotive OEMs, telecommunication companies, and software developers is strengthening the intelligent transportation ecosystem, promoting innovations in vehicle-to-vehicle and vehicle-to-infrastructure communication. Moreover, rising consumer preference for electric vehicles equipped with connectivity features, over-the-air software updates, and advanced telematics services is further driving market expansion, making the U.S. a central hub for connected mobility solutions in North America.

Europe Connected Vehicles Market

In 2025, the Europe connected vehicles market is projected to reach a value of USD 18.1 billion, reflecting the region’s growing adoption of advanced automotive technologies and connectivity solutions. The market is being driven by growing consumer demand for smart mobility features, such as real-time navigation, in-car infotainment, and advanced driver-assistance systems. Automotive manufacturers across Germany, France, and the UK are investing heavily in vehicle-to-everything communication, telematics platforms, and AI-enabled analytics to enhance safety, efficiency, and overall driving experience, further fueling market growth.

Europe’s growth is also supported by robust government initiatives promoting smart transportation, intelligent traffic management, and autonomous driving technologies. Collaborations between OEMs, technology providers, and telecommunication companies are accelerating the deployment of connected vehicle infrastructure across urban and semi-urban areas. With a projected compound annual growth rate (CAGR) of 17.9%, the region is poised to witness rapid expansion in passenger cars and commercial vehicles equipped with integrated connectivity, cloud-based services, and predictive maintenance solutions, making Europe a key contributor to the global connected vehicles ecosystem.

Japan Connected Vehicles Market

In 2025, the Japan connected vehicles market is projected to reach USD 2.4 billion, reflecting the country’s growing emphasis on advanced automotive technologies and smart mobility solutions. The market is driven by growing consumer demand for vehicles equipped with real-time telematics, infotainment systems, and advanced driver-assistance systems. Japanese automakers are investing heavily in vehicle-to-everything communication, AI-powered analytics, and cloud-based connectivity platforms to enhance road safety, improve driving efficiency, and offer a seamless in-car experience for both passenger and commercial vehicles.

The growth of the connected vehicles market in Japan is also supported by government initiatives promoting autonomous driving, electric vehicles, and intelligent transportation infrastructure. Collaborations between automotive OEMs, technology providers, and telecommunication companies are accelerating the deployment of connected vehicle solutions across urban and semi-urban areas. With a projected compound annual growth rate (CAGR) of 20.4%, Japan is expected to witness rapid adoption of integrated connectivity, predictive maintenance, and smart fleet management solutions, positioning the country as a key player in the global connected vehicles ecosystem.

Global Connected Vehicles Market: Key Takeaways

- Market Value: The global connected vehicles market size is expected to reach a value of USD 468.4 billion by 2034 from a base value of USD 90.7 billion in 2025 at a CAGR of 20.0%.

- By Vehicle Type Analysis: Passenger Cars are anticipated to dominate the vehicle type segment, capturing 75.0% of the total market share in 2025.

- By Communication Technology Segment Analysis: Vehicle-to-Vehicle (V2V) technology is expected to maintain its dominance in the communication technology segment, capturing 41.0% of the total market share in 2025.

- By Connectivity Solution Segment Analysis: Integrated Connectivity will dominate the connectivity solution segment, capturing 60.0% of the market share in 2025.

- By Propulsion Type Segment Analysis: Internal Combustion Engine (ICE) Vehicles will account for the maximum share in the propulsion type segment, capturing 77.0% of the total market value.

- By End-User Segment Analysis: Original Equipment Manufacturers (OEMs) will dominate the end-user segment, capturing 81.0% of the market share in 2025.

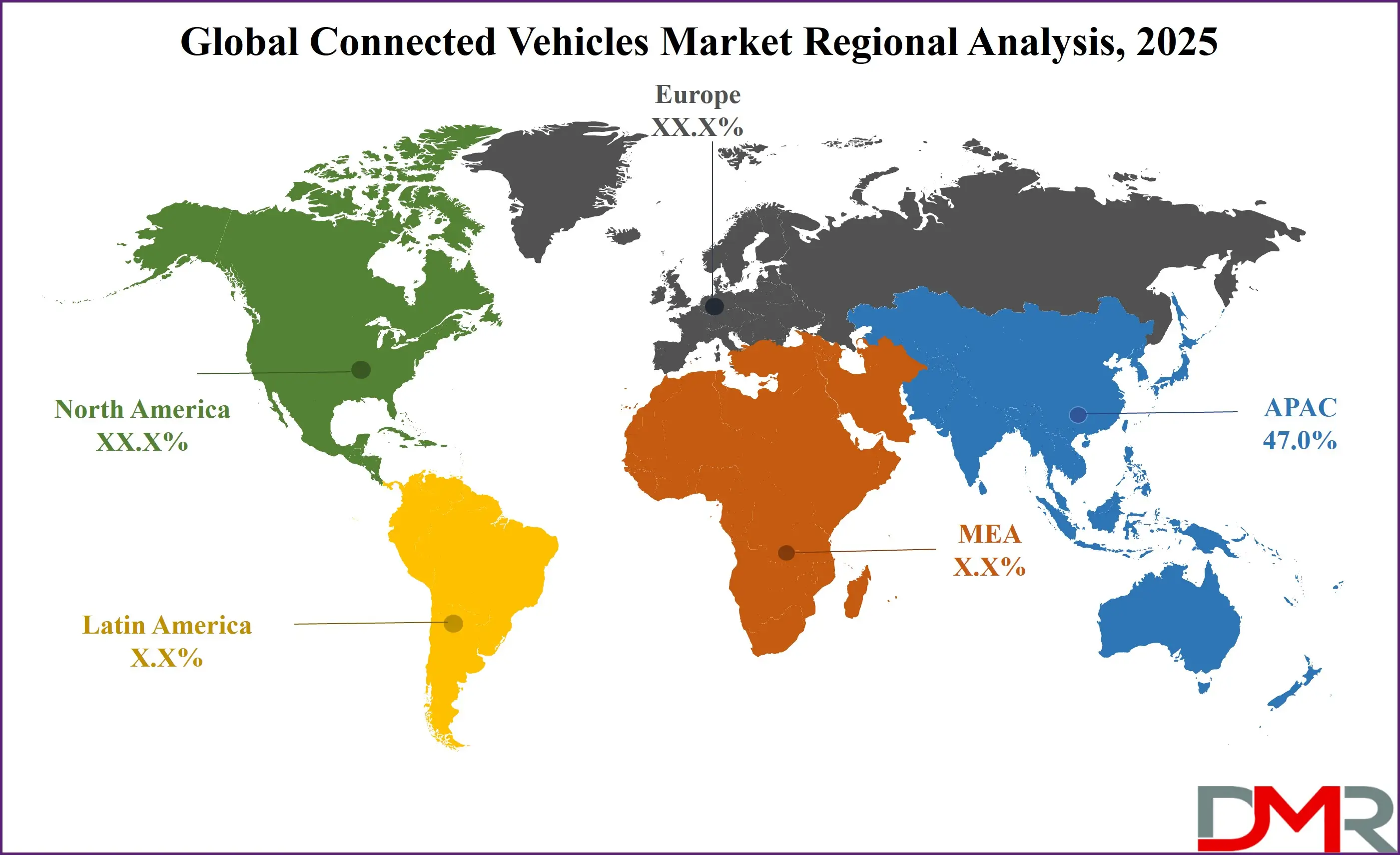

- Regional Analysis: Asia Pacific is anticipated to lead the global connected vehicles market landscape with 47.0% of total global market revenue in 2025.

- Key Players: Some key players in the global connected vehicles market include BMW AG, Audi AG, Mercedes-Benz Group AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Honda Motor Co., Ltd., Hyundai Motor Group, Nissan Motor Co., Ltd., Stellantis N.V., Continental AG, Robert Bosch GmbH, and Others.

Global Connected Vehicles Market: Use Cases

- Real-Time Traffic Management: Connected vehicles leverage vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication to provide real-time traffic updates, route optimization, and congestion management. By exchanging data with traffic signals, road sensors, and other vehicles, connected cars can dynamically adjust routes, reduce travel time, and minimize fuel consumption. This use case also supports smart city initiatives by improving urban mobility, reducing traffic congestion, and enhancing road safety through predictive traffic analysis.

- Advanced Driver-Assistance Systems (ADAS): Connected vehicles integrate ADAS features such as lane departure warning, adaptive cruise control, collision avoidance, and automated parking. These systems rely on real-time telematics data, radar, LiDAR, and cameras to monitor the surrounding environment and provide drivers with actionable alerts or corrective actions. ADAS not only improves safety and reduces accidents but also forms the foundation for autonomous driving and semi-autonomous vehicle applications in both passenger and commercial vehicles.

- Fleet Management and Telematics: Commercial vehicles and logistics operators use connected vehicle solutions for fleet management, predictive maintenance, and remote diagnostics. Telematics platforms collect data on vehicle location, fuel consumption, driver behavior, and engine health, allowing operators to optimize fleet performance, reduce operational costs, and improve delivery efficiency. Integration with cloud computing and AI analytics enables real-time decision-making and supports sustainability goals by minimizing emissions through efficient route planning.

- In-Vehicle Infotainment and Connectivity Services: Connected vehicles offer advanced infotainment solutions, including streaming media, internet access, navigation services, and voice-assisted controls. By integrating smartphone connectivity, cloud-based apps, and over-the-air updates, automakers enhance the driving experience, improve passenger engagement, and create new revenue streams through digital services. This use case also enables personalized experiences, vehicle diagnostics notifications, and seamless integration with smart home or smart city ecosystems.

Impact of Artificial Intelligence on the global Connected Vehicles market

Artificial Intelligence is transforming the global connected vehicles market by enabling smarter, safer, and more efficient mobility solutions. AI-powered algorithms process massive amounts of real-time data from sensors, cameras, and telematics systems to support autonomous driving, predictive maintenance, and advanced driver-assistance systems. Machine learning models enhance route optimization, traffic prediction, and fleet management, while natural language processing improves in-vehicle voice assistants and infotainment services. The integration of AI accelerates innovation in vehicle-to-everything communication, real-time decision-making, and personalized driving experiences, driving growth and competitiveness across the connected mobility ecosystem.

Global Connected Vehicles Market: Stats & Facts

-

United States – U.S. Department of Energy (DOE) and Bureau of Transportation Statistics (BTS)

- In 2024, over 1.5 million plug-in electric vehicles (PEVs) were sold in the U.S., marking a 7% increase from 2023.

- As of August 2025, PEVs accounted for 11.5% of monthly vehicle sales.

- In the first quarter of 2025, nearly 300,000 new electric vehicles (EVs) were sold, representing 7.5% of total new-vehicle sales, a rise from 7% in Q1 2024.

- The U.S. connected vehicle market was valued at approximately USD 60 billion in 2024 and is projected to reach USD 200 billion by 2033.

- In the first half of 2024, more than 730,000 EVs were sold in the U.S., accounting for 9.7% of all light vehicle sales, up from 8.8% in the first half of 2023.

- In 2024, electric vehicles represented 23% of total luxury vehicle sales in the U.S., up from over one-third in 2023 before the reclassification of certain models.

-

Canada – Statistics Canada (2025)

- In the first quarter of 2025, Canada's zero-emission vehicle (ZEV) sales declined by 23% compared to the same quarter in 2024, with ZEVs accounting for 9% of total sales.

- In March 2025, Canada sold 189,259 new motor vehicles, a 9.4% increase from March 2024, primarily driven by a 13.5% rise in light truck sales.

-

Japan – Ministry of Economy, Trade and Industry (METI) (2025)

- Japan plans to expand autonomous driving lanes to fifty locations by 2025 to address the shortage of bus drivers.

- The transport sector accounts for 17.7% of CO2 emissions in Japan, underscoring the need for immediate action toward decarbonization.

-

Europe – European Commission (2025)

- Sales of battery electric vehicles in the EU increased six-fold from 2019 to 2023, with market shares rising from 2.3% to 13.6%.

- In 2023, around 91,000 electric vans were sold in the EU-27, representing 7.7% of the market share.

-

China – Ministry of Industry and Information Technology (2025)

- By 2025, partial and conditional automation vehicles are expected to account for over 50% of new vehicle sales in China.

- The Chinese government aims to have almost all new vehicles equipped with Cellular Vehicle-to-Everything (C-V2X) systems by 2030.

-

India – Ministry of Road Transport and Highways (2025)

- Between 2019 and 2021, sales of electric two-wheelers increased by 422%, three-wheelers by 75%, and four-wheelers by 230%.

- The number of electric buses increased by over 1200% during this period.

-

Singapore – Land Transport Authority (2025)

- In the first half of 2024, new electric car registrations accounted for almost a third of all new car registrations, compared to around 18% in 2023.

- About 18,000 cars, or 2.7% of the total car population, are electric.

Global Connected Vehicles Market: Market Dynamics

Global Connected Vehicles Market: Driving Factors

Rapid Adoption of Vehicle-to-Everything (V2X) Technologies

The growing integration of vehicle-to-vehicle, vehicle-to-infrastructure, and vehicle-to-cloud communication is driving the connected vehicles market. These technologies enhance road safety, enable real-time traffic management, and support autonomous driving applications. Automotive manufacturers are investing heavily in telematics systems, AI-based analytics, and sensor technologies to provide seamless connectivity, improving overall driving experiences for both passenger and commercial vehicles.

Growing Consumer Demand for Smart Mobility and Infotainment

Consumers are increasingly seeking vehicles equipped with advanced driver-assistance systems, infotainment solutions, and telematics services. The demand for real-time navigation, in-car entertainment, cloud-based services, and predictive maintenance is pushing automakers to adopt innovative connectivity solutions. This shift toward digital mobility is strengthening the adoption of electric vehicles and smart fleet management, further fueling market growth globally.

Global Connected Vehicles Market: Restraints

High Infrastructure and Implementation Costs

The deployment of connected vehicle technologies requires significant investment in sensors, telematics platforms, 5G networks, and cloud computing infrastructure. High costs associated with hardware, software, and network integration pose challenges for smaller automotive manufacturers and aftermarket solution providers, limiting widespread adoption in developing regions.

Data Privacy and Cybersecurity Concerns

Connected vehicles generate massive volumes of data, including location, driving behavior, and personal information. Concerns around data privacy, potential cyberattacks, and lack of standardized security protocols can hinder consumer trust and slow market growth. Manufacturers need robust cybersecurity solutions and compliance with data protection regulations to mitigate these risks.

Global Connected Vehicles Market: Opportunities

Expansion of Autonomous and Electric Vehicle Ecosystems

The shift toward autonomous and electric vehicles presents significant opportunities for connected vehicle technologies. AI-enabled telematics, predictive analytics, and V2X communication can optimize battery performance, improve route efficiency, and support autonomous navigation systems, creating a demand for integrated connectivity solutions across multiple vehicle types.

Integration with Smart Cities and Intelligent Transportation Systems

As urban areas adopt smart city initiatives, connected vehicles can play a pivotal role in intelligent traffic management, real-time road monitoring, and public transportation optimization. Collaborations between automotive OEMs, telecommunication companies, and government authorities provide opportunities for developing large-scale vehicle-to-infrastructure networks and advanced mobility solutions.

Global Connected Vehicles Market: Trends

Adoption of Artificial Intelligence and Machine Learning

AI and machine learning are becoming integral to connected vehicles, enabling real-time decision-making, predictive maintenance, and enhanced safety features. These technologies allow vehicles to learn from driving patterns, optimize traffic flow, and improve autonomous driving algorithms, creating smarter and more adaptive mobility solutions.

Growing Investment in 5G and Cloud-Based Telematics

The deployment of 5G networks and cloud computing platforms is accelerating the evolution of connected vehicles. High-speed data transmission supports real-time communication, over-the-air software updates, and seamless integration of infotainment and telematics services. This trend is transforming the automotive industry by enabling smarter fleets, connected infrastructure, and next-generation mobility services.

Global Connected Vehicles Market: Research Scope and Analysis

By Vehicle Type Analysis

In the connected vehicles market, passenger cars are anticipated to dominate the vehicle type segment, capturing 75.0% of the total market share in 2025. This significant lead is fueled by the growing consumer demand for vehicles equipped with advanced infotainment systems, telematics, navigation solutions, and safety features such as lane departure warnings and adaptive cruise control. The integration of vehicle-to-everything communication and cloud-based analytics in passenger cars enhances real-time traffic updates, predictive maintenance, and a seamless driving experience, making them the primary focus for automakers investing in connected vehicle technologies.

Commercial vehicles, although representing a smaller portion of the market, are increasingly adopting connected technologies to improve fleet management, optimize routes, monitor vehicle health, and reduce operational costs. Connectivity solutions in this segment enable logistics companies and public transportation operators to track vehicle location, manage fuel consumption, and ensure driver safety. With the growing emphasis on smart mobility and intelligent transportation systems, commercial vehicles are gradually integrating telematics, AI-driven analytics, and real-time communication tools to enhance operational efficiency and support sustainable transportation solutions.

By Communication Technology Analysis

In the connected vehicles market, Vehicle-to-Vehicle (V2V) technology is expected to maintain its dominance in the communication technology segment, capturing 41.0% of the total market share in 2025. V2V enables real-time exchange of information between vehicles, such as speed, location, and braking status, which helps prevent collisions, improve traffic flow, and enhance overall road safety.

By facilitating seamless communication between cars on the road, V2V technology supports advanced driver-assistance systems, autonomous driving features, and predictive traffic management, making it a critical component in the development of intelligent and safe transportation ecosystems.

Vehicle-to-Infrastructure (V2I) communication, while representing a smaller share of the segment, plays a pivotal role in integrating vehicles with traffic signals, road sensors, and smart city infrastructure.

V2I technology allows vehicles to receive real-time information about road conditions, construction zones, and traffic patterns, enabling better route planning and congestion management. This technology also supports urban mobility solutions, reduces fuel consumption, and enhances the efficiency of public transportation systems, making it an essential part of the broader connected vehicle ecosystem alongside V2V and other telematics solutions.

By Connectivity Solution Analysis

In the connected vehicles market, integrated connectivity is expected to dominate the connectivity solution segment, capturing 60.0% of the market share in 2025. Integrated connectivity solutions combine both hardware and software components within the vehicle, enabling seamless communication with external networks, cloud platforms, and other vehicles. This approach supports real-time telematics, over-the-air software updates, infotainment services, and advanced driver-assistance systems, enhancing safety, efficiency, and the overall driving experience.

Automakers prefer integrated solutions because they ensure better reliability, compatibility with vehicle systems, and compliance with regulatory standards, making them the most widely adopted connectivity option. Embedded connectivity, while representing a smaller portion of the segment, offers a dedicated in-vehicle communication module that is directly built into the vehicle’s system. This solution provides continuous internet access, enabling features such as navigation, remote diagnostics, vehicle tracking, and emergency assistance.

Embedded connectivity supports advanced telematics and predictive maintenance applications, allowing manufacturers and fleet operators to monitor vehicle performance in real time. By offering a stable and secure connection, embedded solutions enhance the functionality of connected vehicles and support the adoption of smart mobility and intelligent transportation systems.

By Propulsion Type Analysis

In the connected vehicles market, Internal Combustion Engine (ICE) vehicles are expected to account for the maximum share in the propulsion type segment, capturing 77.0% of the total market value. The dominance of ICE vehicles is driven by their long-established presence, widespread infrastructure, and affordability compared to electric alternatives. These vehicles are increasingly being equipped with connectivity solutions such as telematics, infotainment systems, predictive maintenance, and vehicle-to-everything communication. The integration of these technologies enhances driving safety, efficiency, and convenience while allowing automakers to meet growing consumer demand for smart mobility features without drastically altering the existing vehicle architecture.

Electric Vehicles (EVs), although representing a smaller share of the segment, are rapidly gaining traction due to the global shift toward sustainable and low-emission transportation. Connected technologies in EVs support battery management, real-time energy monitoring, and route optimization, while telematics and cloud-based platforms enable predictive maintenance and over-the-air software updates. The adoption of connected EVs is further fueled by government incentives, growing charging infrastructure, and consumer preference for environmentally friendly mobility solutions. As EV penetration rises, connectivity features are expected to play a central role in enhancing efficiency, safety, and user experience in electric mobility.

By End-User Analysis

In the connected vehicles market, Original Equipment Manufacturers (OEMs) are expected to dominate the end-user segment, capturing 81.0% of the market share in 2025. OEMs integrate connectivity solutions directly into vehicles during the manufacturing process, ensuring seamless functionality, compatibility, and adherence to regulatory standards. By embedding advanced driver-assistance systems, telematics, infotainment platforms, and vehicle-to-everything communication technologies at the production stage, OEMs provide consumers with a reliable and comprehensive connected driving experience. This approach also allows manufacturers to offer over-the-air software updates, predictive maintenance features, and enhanced safety systems, strengthening brand value and customer loyalty.

The aftermarket segment, while representing a smaller portion of the market, is focused on retrofitting existing vehicles with connectivity solutions. Aftermarket products include telematics devices, infotainment systems, vehicle tracking solutions, and fleet management tools that can be installed post-purchase. This segment caters to consumers and fleet operators who want to upgrade their vehicles with smart mobility features, improve operational efficiency, or enhance vehicle safety. The aftermarket is witnessing steady growth as demand increases for affordable and customizable connected solutions in both passenger and commercial vehicles.

The Connected Vehicles Market Report is segmented on the basis of the following

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Communication Technology

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Everything (V2X)

By Connectivity Solution

- Integrated Connectivity

- Embedded Connectivity

- Tethered Connectivity

By Propulsion Type

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

By End-User

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Global Connected Vehicles Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global connected vehicles market in 2025, accounting for 47.0% of total market revenue. The region’s dominance is driven by rapid urbanization, growing smartphone penetration, and substantial investments in smart city and intelligent transportation infrastructure. Automotive manufacturers in countries such as China, Japan, and South Korea are heavily focusing on integrating advanced connectivity solutions, telematics systems, and vehicle-to-everything communication technologies into passenger and commercial vehicles. Rising consumer demand for safety features, infotainment services, and real-time navigation, along with government initiatives promoting smart mobility and autonomous driving, further strengthen the adoption of connected vehicle technologies across the Asia Pacific region.

Region with significant growth

North America is expected to witness significant growth in the connected vehicles market due to advanced automotive infrastructure, high adoption of electric and autonomous vehicles, and strong consumer demand for telematics and in-vehicle connectivity solutions. The presence of leading automotive OEMs, technology providers, and telecom companies is accelerating the deployment of vehicle-to-everything communication, over-the-air updates, and advanced driver-assistance systems. Supportive government regulations, investments in smart transportation networks, and growing focus on safety and fleet management solutions are further driving market expansion, making North America a key region for connected vehicle innovations and adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Connected Vehicles Market: Competitive Landscape

The global connected vehicles market is moderately fragmented, with key players driving innovation across connectivity, telematics, and V2X technologies. Continental AG, Robert Bosch GmbH, HARMAN International, Qualcomm, and NXP Semiconductors lead the market by offering advanced in-car systems, cloud-based services, and AI-powered solutions. Strategic collaborations and mergers, such as Qualcomm with Amazon and Schaeffler-Vitesco, are accelerating technology development, enhancing infotainment, autonomous driving features, and vehicle connectivity, highlighting the competitive and rapidly evolving nature of the industry.

Some of the prominent players in the global Connected Vehicles market are

- BMW AG

- Audi AG

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motors (GM)

- Tesla Inc.

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Hyundai Motor Group

- Nissan Motor Co., Ltd.

- Stellantis N.V.

- Continental AG

- Robert Bosch GmbH

- Harman International (a subsidiary of Samsung Electronics)

- Qualcomm Incorporated

- NXP Semiconductors N.V.

- Verizon Communications Inc.

- AT&T Inc.

- Vodafone Group Plc

- TomTom International BV

- Other Key Players

Global Connected Vehicles Market: Recent Developments

- September 2025: Nissan began testing a new driver-assistance system developed with UK startup Wayve on its Ariya electric vehicles. The system uses 11 cameras, five radars, and one lidar sensor to provide Level 2 autonomy, handling complex urban environments and enhancing road safety.

- September 2025: Nvidia signed a letter of intent to potentially invest USD 500 million in UK-based autonomous driving startup Wayve. The company uses machine learning to enable autonomous driving with camera-based perception and is expanding operations in the UK, U.S., Germany, and Japan.

- June 2025: Verizon Business launched Edge Transportation Exchange, a V2X communication platform for connected vehicles, enhancing real-time data exchange, traffic efficiency, and vehicle safety.

- January 2024: Stellantis NV acquired AI frameworks, machine learning models, and IP from CloudMade to enhance personalized mobility experiences and accelerate connected vehicle technology development.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 90.7 Bn |

| Forecast Value (2034) |

USD 468.4 Bn |

| CAGR (2025–2034) |

20.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 25.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Vehicle Type (Passenger Cars, Commercial Vehicles), By Communication Technology (Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Vehicle-to-Everything (V2X)), By Connectivity Solution (Integrated Connectivity, Embedded Connectivity, Tethered Connectivity), By Propulsion Type (Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs)), and By End-User (Original Equipment Manufacturers (OEMs), Aftermarket) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BMW AG, Audi AG, Mercedes-Benz Group AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Honda Motor Co., Ltd., Hyundai Motor Group, Nissan Motor Co., Ltd., Stellantis N.V., Continental AG, Robert Bosch GmbH, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global connected vehicles market size is estimated to have a value of USD 90.7 billion in 2025 and is expected to reach USD 468.4 billion by the end of 2034.

The US connected vehicles market is projected to be valued at USD 25.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 118.3 billion in 2034 at a CAGR of 18.8%.

Asia Pacific is expected to have the largest market share in the global connected vehicles market, with a share of about 47.0% in 2025.

Some of the major key players in the global connected vehicles market are BMW AG, Audi AG, Mercedes-Benz Group AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Honda Motor Co., Ltd., Hyundai Motor Group, Nissan Motor Co., Ltd., Stellantis N.V., Continental AG, Robert Bosch GmbH, and Others.

The market is growing at a CAGR of 20.0 percent over the forecast period.