Market Overview

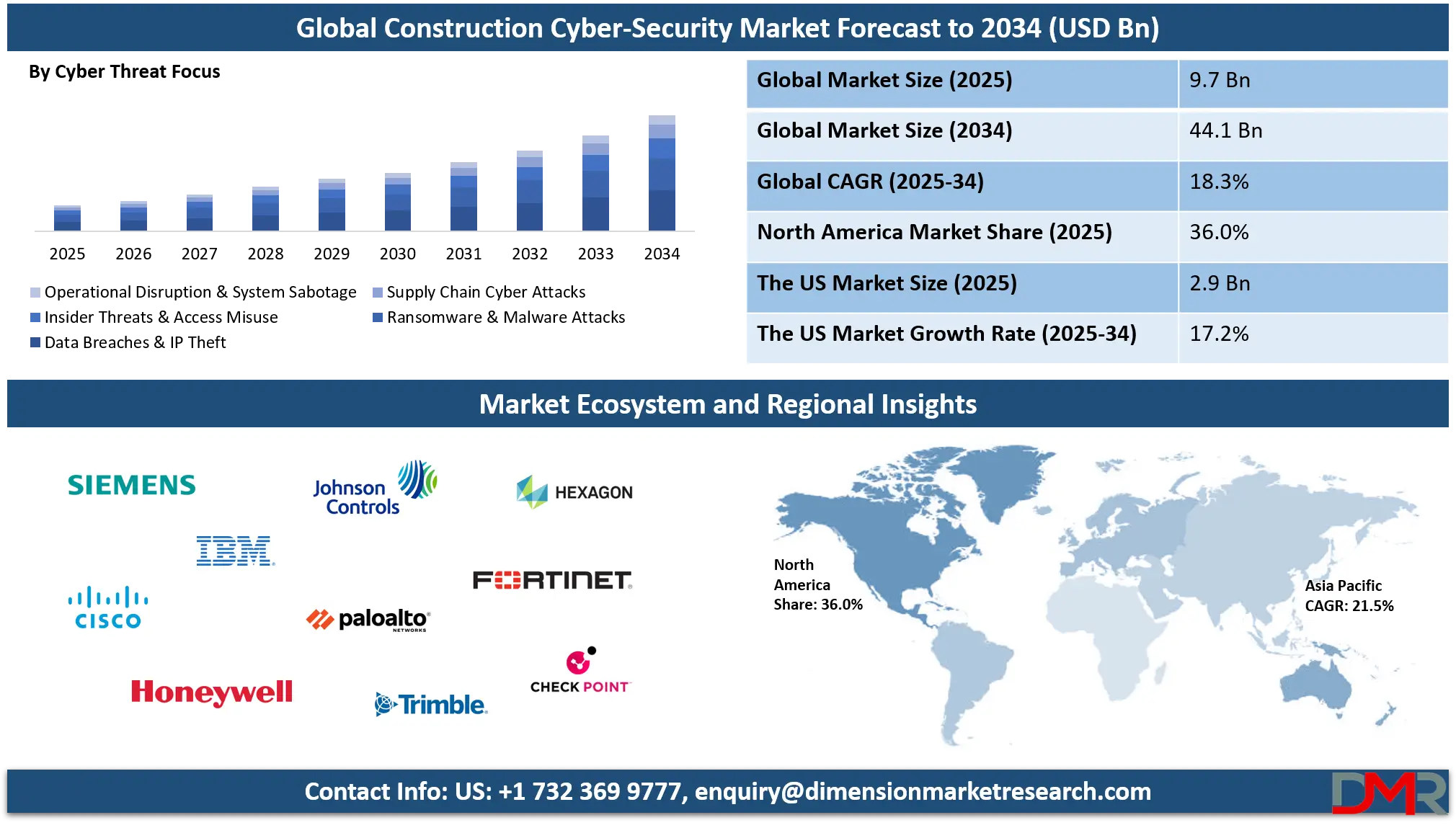

The global construction cyber security market was valued at USD 9.7 billion in 2025 and is projected to reach USD 44.1 billion by 2034, expanding at a CAGR of 18.3%, driven by rising adoption of digital construction platforms, cloud-based security solutions, connected jobsite technologies, and increasing cyber risk across construction networks.

Construction Cyber Security refers to the set of technologies, practices, and services designed to protect digital assets, systems, and data used across construction activities. As construction companies increasingly rely on digital construction platforms, building information modeling, cloud based project management tools, connected equipment, and smart jobsite technologies, cyber risks have expanded significantly. Construction cyber security focuses on safeguarding project data, intellectual property, financial records, connected machinery, and communication networks from threats such as ransomware, data breaches, unauthorized access, and system disruption. It also addresses security across temporary worksites, remote access environments, and multi stakeholder collaboration networks that are common in modern construction projects.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Construction Cyber Security Market represents the globally demand for cyber security solutions and services specifically applied to the construction ecosystem. This market is driven by the rapid digital transformation of construction operations, growing adoption of cloud computing, integration of IoT enabled equipment, and increased use of BIM and

digital twin technologies. Rising cyber incidents targeting construction firms, combined with stricter data protection regulations and contractual security requirements, are pushing contractors, engineering firms, and project owners to invest in network security, application protection, identity management, and operational technology security tailored to construction workflows.

In addition, the global market is shaped by large infrastructure development programs, smart city initiatives, and cross border construction projects that increase cyber exposure and complexity. Demand is expanding across both large enterprises and mid-sized builders as cyber risks extend through supply chains, subcontractors, and third party platforms. Regional growth is influenced by construction digitization maturity, regulatory enforcement, and investment in connected jobsite technologies. As construction becomes more data driven and interconnected, cyber security is evolving from a support function into a core operational requirement within the global construction industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

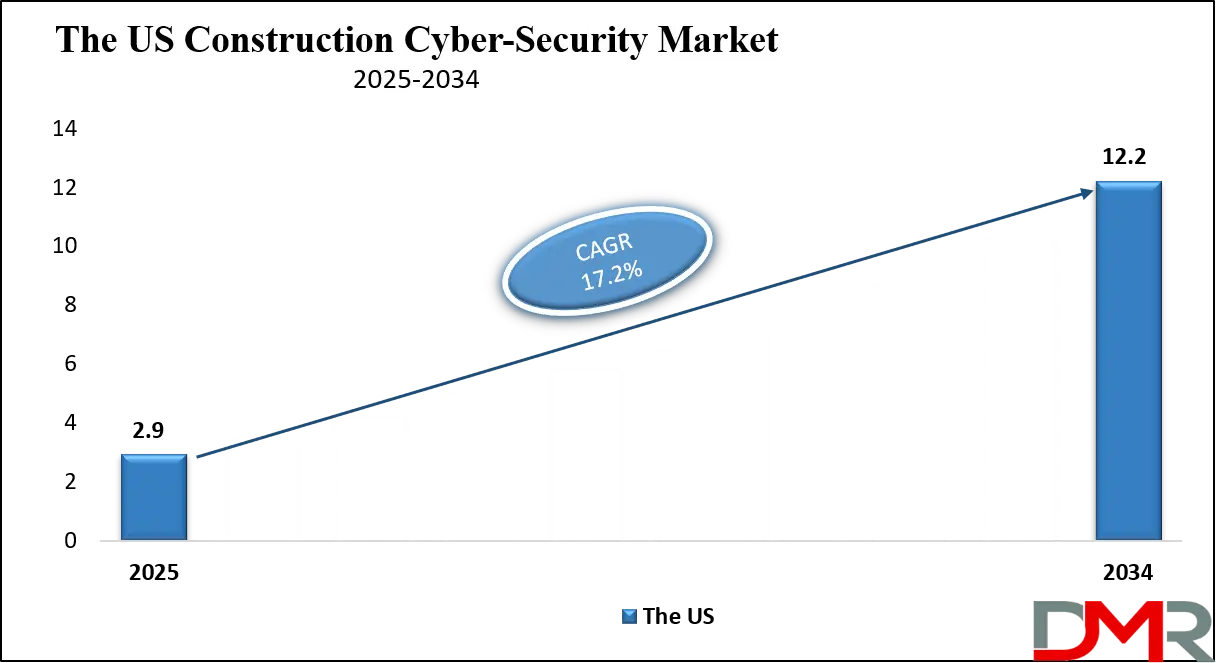

The US Construction Cyber-Security Market

The U.S. Construction Cyber-Security market size was valued at USD 2.9 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 12.2 billion in 2034 at a CAGR of 17.2%.

The US construction cyber security market is experiencing strong growth as construction companies across residential, commercial, and infrastructure segments accelerate digital adoption. Widespread use of cloud based project management platforms, building information modeling systems, remote collaboration tools, and connected construction equipment has increased exposure to cyber threats such as ransomware attacks, data breaches, and unauthorized network access.

Large contractors and engineering firms in the United States are prioritizing network security, identity and access management, endpoint protection, and application security to safeguard sensitive project data, financial information, and intellectual property. Rising compliance requirements related to data privacy, critical infrastructure protection, and federal contracting standards are further reinforcing cyber security investments across the construction ecosystem.

In addition, the growing use of IoT enabled machinery, smart jobsite technologies, and integrated supply chain platforms is expanding the scope of cyber security needs in the US construction sector. Cyber risk management is increasingly focused on protecting operational technology systems, securing third party vendor access, and ensuring safe data exchange between contractors, subcontractors, and project owners. Managed security services and cloud native security solutions are gaining traction as firms seek scalable protection amid labor shortages in cyber expertise. As digital transformation deepens across US construction workflows, cyber security is becoming a strategic priority to ensure operational continuity, regulatory compliance, and long term project resilience.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Construction Cyber-Security Market

The Europe construction cyber security market was approximately valued at USD 2.7 billion in 2025, reflecting significant growth driven by the rapid digitalization of construction operations across the region. Construction firms in Europe are increasingly adopting cloud based project management platforms, building information modeling tools, connected jobsite technologies, and IoT (Internet of Things) enabled machinery to improve operational efficiency and collaboration. This digital transformation has expanded the exposure to cyber threats such as data breaches, ransomware attacks, and intellectual property theft, prompting organizations to invest in advanced network security, endpoint protection, identity and access management, and managed security services tailored to the construction industry.

The market’s growth is further supported by stringent regulatory frameworks and compliance requirements implemented by European authorities to protect sensitive project data, personal information, and critical infrastructure. Large infrastructure projects, urban development initiatives, and smart city programs are increasing the scale and complexity of construction networks, which in turn drives demand for comprehensive cyber security solutions.

Additionally, the integration of third party vendors, subcontractors, and collaborative digital platforms across construction projects has elevated the need for secure data exchange and supply chain protection. The Europe construction cyber security market is expected to grow at a CAGR of 17.0% during the forecast period, reinforcing its position as one of the key regions contributing to the global market expansion.

Japan Construction Cyber-Security Market

The Japan construction cyber security market was valued approximately at USD 58.2 million in 2025, driven by the growing adoption of digital construction technologies and connected jobsite solutions across the country. Construction firms in Japan are increasingly leveraging cloud based project management platforms, building information modeling systems, and IoT enabled machinery to streamline project planning, monitoring, and execution. This digital transformation has exposed construction operations to cyber threats such as data breaches, ransomware attacks, and unauthorized access, prompting companies to invest in advanced network security, endpoint protection, identity management, and secure collaboration tools to safeguard sensitive project and operational data.

Market growth is also supported by government initiatives promoting smart infrastructure, urban development, and industrial automation, which expand the scope of cyber security requirements across construction projects. Additionally, the involvement of multiple stakeholders including subcontractors, suppliers, and technology providers in collaborative digital workflows has increased the importance of supply chain security, compliance, and secure data exchange. As construction projects in Japan become more interconnected and technology driven, the demand for tailored cyber security solutions continues to rise. The Japan construction cyber security market is projected to grow at a CAGR of 15.0% over the forecast period, positioning the country as an emerging contributor to the global market.

Global Construction Cyber-Security Market: Key Takeaways

- Rapid Market Expansion: The global construction cyber security market is witnessing strong growth, projected from USD 9.7 billion in 2025 to USD 44.1 billion by 2034, driven by digital adoption, cloud platforms, and connected jobsite technologies.

- Dominance of Solutions over Services: Solutions capture the largest market share (~65%) as firms prioritize network protection, endpoint security, and identity management, while services support implementation, monitoring, and regulatory compliance.

- Key Threats Shaping Demand: Data breaches, intellectual property theft, ransomware, and malware attacks remain primary cyber risks, pushing construction companies to adopt advanced monitoring, access control, and incident response solutions.

- Regional Leaders and Growth Opportunities: North America leads with 36% market share due to mature digital adoption and regulatory enforcement, while Asia Pacific, including Japan, presents high growth potential driven by urbanization, smart city initiatives, and IoT adoption.

- Strategic Role of AI and Managed Services: Artificial intelligence and managed security services are transforming cyber protection, enabling predictive threat detection, automated response, and enhanced supply chain and operational technology security across construction networks.

Global Construction Cyber-Security Market: Use Cases

- Secure Digital Project Management and Collaboration: Construction companies increasingly rely on cloud based project management platforms to coordinate schedules, costs, designs, and documentation across multiple stakeholders. Cyber security solutions are used to protect sensitive project data, contracts, and financial records from unauthorized access and data breaches. This use case includes secure user authentication, access control, encrypted data sharing, and continuous monitoring of digital construction platforms to ensure safe collaboration between contractors, engineers, and project owners.

- Protection of BIM, CAD, and Design Systems: Building information modeling and computer aided design tools are critical to modern construction planning and execution. Cyber security is applied to safeguard design files, digital twins, and intellectual property from cyber threats such as IP theft, malware, and insider misuse. Application security, identity management, and secure cloud environments help prevent data tampering, protect version control, and ensure the integrity of engineering and architectural systems.

- Connected Jobsite and IoT Equipment Security: The adoption of IoT sensors, smart equipment, autonomous machinery, and remote monitoring systems has increased cyber exposure on construction sites. Cyber security solutions protect connected jobsite networks by securing endpoints, monitoring network traffic, and preventing unauthorized device access. This use case focuses on maintaining operational continuity, protecting operational technology systems, and reducing the risk of cyber induced equipment downtime or safety incidents.

- Supply Chain and Third Party Risk Management: Construction projects involve complex ecosystems of subcontractors, material suppliers, and technology vendors accessing shared digital platforms. Cyber security is used to manage third party access, monitor vendor activity, and secure data exchange across the construction supply chain. This use case helps reduce the risk of supply chain cyber attacks, strengthens compliance, and ensures consistent security standards across all participants in global construction projects.

Impact of Artificial Intelligence on the global Construction Cyber-Security market

The impact of artificial intelligence on the global construction cyber security market is transformative, reshaping how cyber threats are detected, mitigated, and managed within the construction ecosystem. AI-driven analytics and machine learning models enhance the ability to identify abnormal network behavior, predict potential intrusions, and automate responses to cyber attacks in real time. As construction organizations increasingly adopt cloud platforms, building information modeling systems, IoT enabled equipment, and connected jobsite technologies, the volume and complexity of data flows have grown exponentially.

AI aids in continuously scanning these environments to detect patterns that indicate malware, ransomware, unauthorized access attempts, or anomalous user behavior long before human analysts can respond, thereby strengthening overall threat intelligence and reducing incident response times.

In addition, artificial intelligence supports advanced identity and access management by enabling adaptive authentication and risk based access control, ensuring that only verified personnel can access critical digital construction assets and project data. AI powered security orchestration tools streamline the integration of multiple cyber security solutions, allowing for automated patch management, threat prioritization, and predictive maintenance of security infrastructure.

The use of AI also extends to enhancing supply chain protection by analyzing third party vendor risk and identifying weak links in construction collaboration networks. Overall, AI accelerates the evolution of proactive security measures, drives efficiencies in managed security services, and elevates the resilience of construction operations against sophisticated cyber threats.

Global Construction Cyber-Security Market: Stats & Facts

Federal Bureau of Investigation (FBI) Internet Crime Complaint Center (IC3)

- In 2024, the FBI’s IC3 recorded nearly 860,000 cybercrime complaints globally, reflecting pervasive digital threats impacting all sectors.

- Total reported losses from cybercrime in 2024 exceeded USD 16 billion, up roughly 33 % from 2023.

UK Government Agencies (Met Office, Maritime & Coastguard, ONS, DVLA, etc.)

- In 2024, six UK government agencies experienced about 15 million cyber attacks, equating to roughly 40,000 daily threats.

- The Met Office blocked over 5 million phishing emails, nearly double the volume of 2023.

- The UK Atomic Energy Authority intercepted 1.67 million malware and spam messages in 2024.

- The Maritime & Coastguard Agency received 223,589 malicious emails, and the Government Legal Department saw over 1,100 in the same period.

- The Office for National Statistics blocked 485,908 malicious emails in four months, about 5,400 per day.

- Driver and Vehicle Licensing Agency (DVLA) faced 7.1 million attempted DDoS attacks in 2024.

Statista via Government Cyber Incident Data

- Between December 2022 and August 2023, the number of cyber incidents targeting government organizations globally increased by about 60,000, totaling ~100,000 incidents.

- In the period from March–May 2023, there were ~55,000 recorded cyber incidents, showing rapid escalation to 100,000 by later 2023.

National Cyber Security Centre (UK Home Office)

- In the year up to August 2025, the UK’s National Cyber Security Centre recorded 204 nationally significant cyber incidents, representing 48 % of all reported incidents—a marked rise over previous years.

- Between September 2022–August 2023, only 62 nationally significant incidents were reported, showing sharp growth by 2025.

Global Construction Cyber-Security Market: Market Dynamics

Global Construction Cyber-Security Market: Driving Factors

Rapid Digital Transformation in Construction Operations

The widespread adoption of digital technologies such as cloud based project management systems, building information modeling, and integrated collaboration platforms is accelerating the need for robust cyber security solutions. As construction firms increasingly manage sensitive project data and real-time workflows online, the demand for advanced cyber defenses to protect networks, endpoints, and cloud environments is rising sharply. This digital shift is a primary driver for investment in security solutions that safeguard operational technology and information assets.

Increase in Targeted Cyber Attacks and Compliance Pressure

Construction companies are becoming attractive targets for cyber criminals due to the vast amounts of proprietary data, financial records, and intellectual property they handle. Incidents involving ransomware, data breaches, and unauthorized access have highlighted significant vulnerabilities in industry networks. Coupled with stricter regulatory requirements around data protection and contractual obligations for secure information exchange, firms are compelled to strengthen their cyber risk management programs and deploy comprehensive security frameworks.

Global Construction Cyber-Security Market: Restraints

Shortage of Skilled Cyber Security Professionals

A key challenge in the construction cyber security market is the lack of trained professionals capable of managing complex threat landscapes. Many construction firms, especially small and medium enterprises, struggle to recruit and retain talent with expertise in network security, incident response, and security architecture. This skills gap slows the deployment of effective security measures and increases reliance on third party managed services.

High Implementation and Integration Costs

Integrating advanced security tools across diverse construction environments including remote sites, legacy systems, and connected devices can be costly. Smaller firms often find it difficult to justify the upfront expenditure for security platforms, network upgrades, and continuous monitoring solutions. These financial constraints can delay or limit the adoption of comprehensive cyber protections, particularly among subcontractors and regional builders.

Global Construction Cyber-Security Market: Opportunities

Growth in IoT and Smart Site Technologies

The increasing use of IoT sensors, automated equipment, and connected machinery on construction sites presents significant opportunities for security vendors. Protecting these operational technology systems from cyber exploits can generate demand for endpoint protection, network segmentation solutions, and real-time anomaly detection tools. Providers that specialize in securing industrial connectivity and jobsite devices are well positioned to capture this expanding segment.

Expansion of Managed and Cloud Based Security Services

As construction firms seek scalable, cost-effective ways to manage cyber risk, there is growing interest in managed security service offerings and cloud native cyber defenses. These services allow companies to outsource threat monitoring, incident response, and compliance management to specialized providers, reducing the burden on in-house teams. Cloud delivered security also supports remote collaboration and multi-site operations, making it an attractive option for geographically dispersed construction enterprises.

Global Construction Cyber-Security Market: Trends

AI and Machine Learning Powered Threat Detection

An emerging trend in the market is the integration of artificial intelligence and machine learning into security platforms. These technologies enhance the ability to detect sophisticated threats through behavioral analysis, pattern recognition, and predictive analytics. AI enabled tools can automatically correlate large volumes of network and system data, reducing false positives and accelerating response times for cyber incidents.

Emphasis on Zero Trust Security Architectures

Construction firms are increasingly adopting zero trust principles to secure access across networks and devices. This approach requires strict verification of users and endpoints before granting access, moving away from traditional perimeter based security models. Zero trust adoption supports secure remote work, protects cloud services, and limits the spread of breaches, aligning with broader industry efforts to strengthen cyber resilience.

Global Construction Cyber-Security Market: Research Scope and Analysis

By Component Analysis

Solutions are anticipated to dominate the component segment of the construction cyber security market, capturing around 65.0% of the total market share in 2025, primarily due to the growing reliance on digital construction platforms and connected technologies. Construction companies are increasingly investing in cyber security solutions such as network protection, cloud security, endpoint defense, application security, and identity and access management to safeguard sensitive project data, financial information, and intellectual property.

The expansion of cloud based project management systems, building information modeling tools, and IoT enabled jobsite equipment has significantly increased cyber exposure, making integrated security solutions a critical requirement for ensuring data integrity, operational continuity, and secure collaboration across construction ecosystems.

The services segment complements solution adoption by supporting implementation, management, and ongoing optimization of cyber security frameworks within construction organizations. Services in this market include managed security services, threat monitoring, incident response, vulnerability assessments, and compliance advisory tailored to construction workflows and regulatory requirements.

Many construction firms, particularly mid sized and regional players, face limitations in internal cyber expertise, driving demand for outsourced security operations and consulting services. As cyber threats become more sophisticated and construction environments more complex, security services are increasingly valued for maintaining continuous protection, reducing response times, and ensuring long term resilience across construction networks.

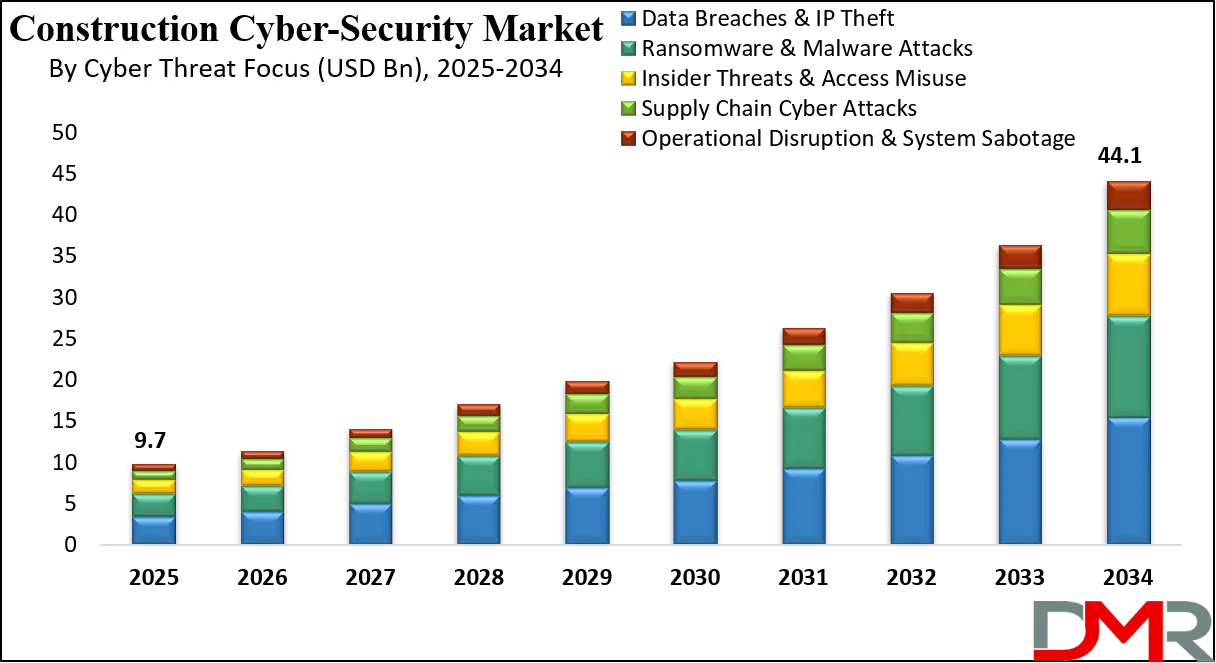

By Cyber Threat Focus Analysis

Data breaches and intellectual property theft are anticipated to dominate the cyber threat focus segment of the construction cyber security market, capturing around 35.0% of the total market share in 2025, as construction firms manage increasing volumes of sensitive digital assets. Project blueprints, building information modeling files, contracts, cost estimates, and client data are now widely stored and shared through cloud platforms and collaborative systems, making them attractive targets for cyber criminals.

Unauthorized access and data leakage can result in financial losses, project delays, legal liabilities, and loss of competitive advantage. As a result, construction companies are prioritizing data protection, access control, encryption, and continuous monitoring solutions to safeguard critical information across multi stakeholder project environments.

Ransomware and malware attacks represent another significant focus area within this segment, driven by the growing frequency and sophistication of cyber attacks targeting construction networks. Cyber criminals exploit vulnerabilities in remote access systems, legacy infrastructure, and connected jobsite technologies to disrupt operations and extort payments.

These attacks can halt project activities, disable equipment, and compromise operational technology systems, leading to costly downtime. To address this risk, construction organizations are investing in advanced threat detection, endpoint security, backup and recovery solutions, and incident response capabilities to strengthen resilience against malware driven disruptions and ensure business continuity.

By Deployment Model Analysis

Cloud based deployment is anticipated to dominate the deployment model segment of the construction cyber security market, capturing around 60.0% of the total market share in 2025, supported by the rapid shift toward digital and cloud enabled construction operations. Construction firms increasingly use cloud platforms for project management, document sharing, building information modeling, and real time collaboration across geographically dispersed teams.

Cloud deployed cyber security solutions offer scalability, centralized visibility, and faster updates, making them well suited for dynamic construction environments with multiple sites and stakeholders. The ability to integrate security controls across cloud applications, remote users, and connected devices further drives adoption, as organizations seek flexible and cost effective protection for evolving digital workflows.

On premises deployment continues to play an important role for construction organizations that manage sensitive data, legacy systems, or critical operational infrastructure. Large enterprises and firms involved in government or defense related projects often prefer on premises security to maintain greater control over data storage, network architecture, and compliance requirements. On premises solutions are also favored in environments with limited connectivity or strict internal security policies. While growth is comparatively slower, on premises deployment remains relevant for construction companies prioritizing data sovereignty, customized security configurations, and direct oversight of cyber security infrastructure.

By Organization Size Analysis

Large construction enterprises are anticipated to dominate the organization size segment of the construction cyber security market, capturing around 70.0% of the total market share in 2025, due to their extensive digital infrastructure and high exposure to cyber risks. These organizations manage large scale projects, complex supply chains, and significant volumes of sensitive project, financial, and client data across multiple locations. The use of advanced digital construction platforms, cloud based collaboration tools, building information modeling systems, and connected equipment increases the need for comprehensive cyber security solutions. Large enterprises also face stricter regulatory, contractual, and client driven security requirements, prompting higher investment in network security, identity management, threat detection, and managed security services.

Small and medium enterprises represent a smaller but growing segment within the market, as digital adoption accelerates across regional builders and specialty contractors. SMEs increasingly rely on cloud based project management tools, mobile applications, and third party platforms, which expose them to cyber threats such as data breaches, phishing, and ransomware. However, limited budgets and lack of in house cyber expertise often restrict their ability to deploy advanced security infrastructure. As a result, SMEs tend to adopt cost effective, cloud delivered security solutions and managed services that offer scalable protection, regulatory support, and improved cyber resilience without high upfront investment.

By Application Area Analysis

Project data and intellectual property protection are anticipated to dominate the application area segment of the construction cyber security market, capturing around 40.0% of the total market share in 2025, as construction firms increasingly rely on digital platforms to store and manage critical project information. Sensitive data such as blueprints, building information modeling files, contracts, cost estimates, and client records are central to project execution and competitive advantage, making them prime targets for cyber attacks.

To safeguard these assets, construction companies are investing in encryption, secure access controls, identity and access management, and continuous monitoring solutions that prevent unauthorized access, data leakage, and intellectual property theft across multi stakeholder and cloud enabled project environments.

Connected jobsite and operational technology security represents another significant application area, driven by the growing use of IoT sensors, smart machinery, autonomous equipment, and remote monitoring systems on construction sites. These technologies improve efficiency and project oversight but also create new cyber vulnerabilities, including potential network intrusions, device manipulation, and operational disruptions.

Construction firms are implementing endpoint protection, network segmentation, real time threat detection, and secure communication protocols to protect connected equipment and operational technology systems. This ensures uninterrupted project activities, enhances safety, and mitigates the risk of costly downtime caused by cyber incidents targeting jobsite technologies.

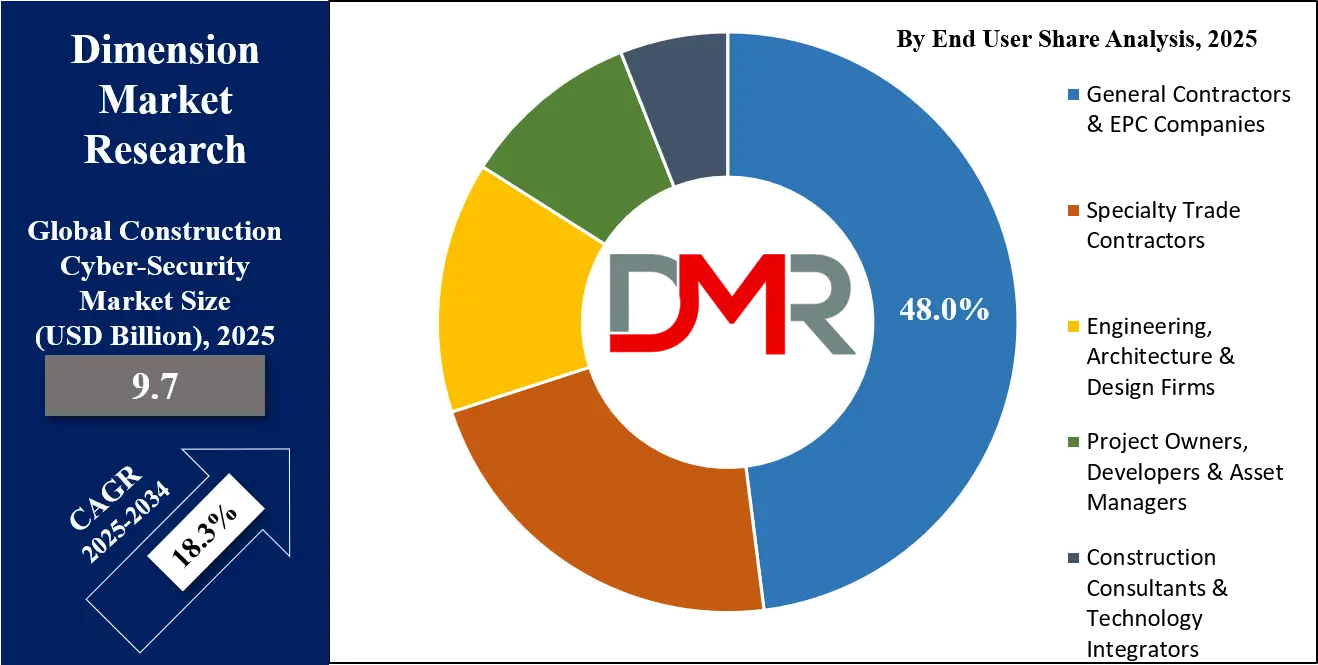

By End User Analysis

General contractors and EPC companies are anticipated to dominate the end user segment of the construction cyber security market, capturing around 48.0% of the total market share in 2025, as they manage large scale projects that involve multiple stakeholders, complex workflows, and vast amounts of sensitive data. These organizations rely heavily on digital construction platforms, cloud based project management systems, and connected equipment to coordinate design, procurement, and execution activities.

The extensive use of collaborative tools and real time data sharing increases exposure to cyber threats such as data breaches, unauthorized access, and ransomware attacks. To mitigate these risks, general contractors and EPC firms are increasingly investing in comprehensive cyber security solutions including network protection, identity management, endpoint security, and managed security services to ensure project continuity, data integrity, and regulatory compliance across their operations.

Specialty trade contractors represent another important end user segment, often operating as subcontractors within larger projects and providing specialized services such as electrical, plumbing, HVAC, or structural work. While their operations may be smaller in scale, they are equally exposed to cyber risks through access to project data, cloud platforms, and communication networks used by the main contractors.

Security solutions for these organizations focus on secure access control, device protection, and compliance support to prevent data leakage and ensure safe collaboration with general contractors and project owners. As specialty trade contractors adopt digital tools and connected devices to improve efficiency, the demand for targeted cyber security measures in this segment continues to grow steadily.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Construction Cyber-Security Market Report is segmented on the basis of the following:

By Component

- Solutions

- Network Protection Platforms

- Cloud & SaaS Security Platforms

- Endpoint & Device Protection Tools

- Application & BIM Security Software

- Identity, Access & Privileged Controls

- Services

- Managed Security Services

- Risk Assessment & Penetration Testing

- Incident Response & Recovery

- Compliance & Cyber Advisory

By Cyber Threat Focus

- Data Breaches & IP Theft

- Ransomware & Malware Attacks

- Insider Threats & Access Misuse

- Supply Chain Cyber Attacks

- Operational Disruption & System Sabotage

By Deployment Model

- Cloud-Based Deployment

- Public Cloud Security

- Hybrid Cloud Security

- On-Premises Deployment

- Enterprise Data Center Security

- Site-Level Security Infrastructure

By Organization Size

- Large Construction Enterprises

- Small & Medium Enterprises (SMEs)

By Application Area

- Project Data & Intellectual Property Protection

- Blueprints, Contracts, Cost Data

- Financial & Client Information

- Connected Jobsite & Operational Technology Security

- IoT Sensors & Smart Equipment

- Autonomous & Remote Machinery

- Supply Chain & Third-Party Risk Security

- Vendor Access Control

- Secure Data Exchange

- Design, BIM & Engineering System Security

- CAD/BIM Platforms

- Digital Twin Environments

- Governance, Compliance & Remote Operations Security

- Regulatory Compliance

- Secure Remote Project Access

By End User

- General Contractors & EPC Companies

- Specialty Trade Contractors

- Engineering, Architecture & Design Firms

- Project Owners, Developers & Asset Managers

- Construction Consultants & Technology Integrators

Global Construction Cyber-Security Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global construction cyber security market, capturing around 36.0% of total market revenue in 2025, driven by the rapid adoption of digital construction technologies, cloud based project management platforms, and connected jobsite equipment across the region. The presence of large construction enterprises, advanced infrastructure projects, and stringent regulatory frameworks for data protection and critical infrastructure security further reinforce market growth.

Additionally, increasing cyber threats targeting sensitive project data, intellectual property, and operational technology systems are prompting organizations to invest heavily in network security, identity management, endpoint protection, and managed security services. The combination of mature digital ecosystems, high technology adoption, and proactive regulatory compliance positions North America as the dominant regional market for construction cyber security solutions and services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the construction cyber security market over the coming years, driven by rapid urbanization, large scale infrastructure projects, and the increasing adoption of digital construction platforms and IoT enabled jobsite technologies. Countries such as China, India, Japan, and Australia are investing heavily in smart city initiatives, high rise developments, and connected construction equipment, which expands the need for robust cyber security solutions.

Rising awareness of data breaches, intellectual property theft, and operational technology vulnerabilities, integrated with growing cloud adoption and regulatory focus on data protection, is fueling demand for network security, endpoint protection, and managed security services across the region. As construction projects become more digital and interconnected, Asia Pacific presents a key growth opportunity for cyber security vendors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Construction Cyber-Security Market: Competitive Landscape

The global construction cyber security market is highly competitive and characterized by continuous innovation in solutions and services to address the growing cyber threat landscape. Vendors are focusing on developing advanced network security, cloud based protections, endpoint defenses, identity and access management, and AI powered threat detection tailored for construction workflows.

The market is witnessing strategic partnerships, technology integrations, and expansion of managed security services to provide scalable, cost effective, and real time protection across multi site construction projects. Companies are also emphasizing regulatory compliance support, supply chain security, and connected jobsite protection to differentiate their offerings, enhance customer trust, and capture a larger share of the expanding global construction cyber security market.

Some of the prominent players in the global Construction Cyber-Security market are:

- Siemens AG

- International Business Machines Corporation (IBM)

- Cisco Systems Inc.

- Honeywell International Inc.

- Johnson Controls International plc

- Palo Alto Networks Inc.

- Hexagon AB

- Fortinet Inc.

- Trimble Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated

- CrowdStrike Holdings Inc.

- Deltek Inc.

- Procore Technologies Inc.

- Rapid7 Inc.

- Tenable Holdings Inc.

- Arctic Wolf Networks Inc.

- Optiv Security Inc.

- eSentire Inc.

- Dragos Inc.

- Other Key Players

Global Construction Cyber-Security Market: Recent Developments

- October 2025: Palo Alto Networks expanded its cybersecurity product portfolio by launching enhanced AI‑driven security offerings, including upgraded cloud risk management and unified threat defense platforms designed to protect enterprise environments against evolving cyberattacks and support automated threat detection across multi‑cloud and hybrid infrastructures.

- September 2025: A major technology provider introduced a unified security store featuring integrated AI‑powered security agents and software‑as‑a‑service tools that streamline deployment of threat protection, identity monitoring, and device security across enterprise environments, reinforcing comprehensive cyber defenses.

- September 2025: A cybersecurity startup focused on device posture management secured USD 65 million in its first funding round led by major venture partners, with proceeds earmarked for global expansion and accelerating development of automated security remediation solutions.

- May 2025: A significant consolidation event took place in the cybersecurity landscape with the acquisition of a specialized threat exposure management startup by a leading enterprise security firm, aimed at broadening automated risk remediation capabilities across cloud and hybrid systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.7 Bn |

| Forecast Value (2034) |

USD 44.1 Bn |

| CAGR (2025–2034) |

18.3% |

| The US Market Size (2025) |

USD 2.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions, Services); By Cyber Threat Focus (Data Breaches & IP Theft, Ransomware & Malware Attacks, Insider Threats & Access Misuse, Supply Chain Cyber Attacks, Operational Disruption & System Sabotage); By Deployment Model (Cloud-Based Deployment, On-Premises Deployment); By Organization Size (Large Construction Enterprises, Small & Medium Enterprises (SMEs)); By Application Area (Project Data & Intellectual Property Protection, Connected Jobsite & Operational Technology Security, Supply Chain & Third-Party Risk Security, Design, BIM & Engineering System Security, Governance, Compliance & Remote Operations Security); By End User (General Contractors & EPC Companies, Specialty Trade Contractors, Engineering, Architecture & Design Firms, Project Owners, Developers & Asset Managers, Construction Consultants & Technology Integrators). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens AG, IBM, Cisco Systems, Honeywell International, Johnson Controls, Palo Alto Networks, Hexagon AB, Fortinet, Trimble, Check Point Software, Trend Micro, CrowdStrike, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Construction Cyber-Security market?

▾ The global Construction Cyber-Security market size was valued at USD 9.7 billion in 2025 and is expected to reach USD 44.1 billion by the end of 2034.

What is the size of the US Construction Cyber-Security market?

▾ The US Construction Cyber-Security market is projected to be valued at USD 2.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.2 billion in 2034 at a CAGR of 17.2%.

Which region accounted for the largest global Construction Cyber-Security market?

▾ North America is expected to have the largest market share in the global Construction Cyber-Security market, with a share of about 36.0% in 2025.

Who are the key players in the global Construction Cyber-Security market?

▾ Some of the major key players in the global Construction Cyber-Security market are Siemens AG, IBM, Cisco Systems, Honeywell International, Johnson Controls, Palo Alto Networks, Hexagon AB, Fortinet, Trimble, Check Point Software, Trend Micro, CrowdStrike, and Others.