A construction equipment rental facility acts as a hub where the general public can easily access, store, & use large vehicles & machinery majorly used in construction projects. These facilities not only provide the equipment but mostly offer complementary services & additional retail activities related to construction needs, which might include equipment maintenance services, safety gear supply, or even training resources, making a comprehensive & user-friendly resource hub for construction professionals & enthusiasts alike.

The expected growth of the industry in the forecasted period is likely to be driven by developments like equipment service tracking & mapping, as well as digital services that improve automated service processes.

Market Dynamic

The major driver behind the market's growth is the ongoing construction industry, particularly in emerging economies, this growth is due to various opportunities in the residential, non-residential, & infrastructure segments. For instance, the growth in multi-family housing construction is due to the presence of nuclear families & growing investments in projects such as expressways, bridges, metros, smart cities, highways, & roads to help growing urban populations. Additionally, the growth in preference towards automation is anticipated to further fuel market expansion.

However, these systems require significant investments, making them inaccessible to various small builders & contractors. The construction equipment rental service has effectively addressed this challenge by removing the need for complete ownership costs & offering rental alternatives. Renting construction equipment enables businesses to sidestep expenses associated with initial purchase, maintenance, & inventory management.

Key Takeaways:

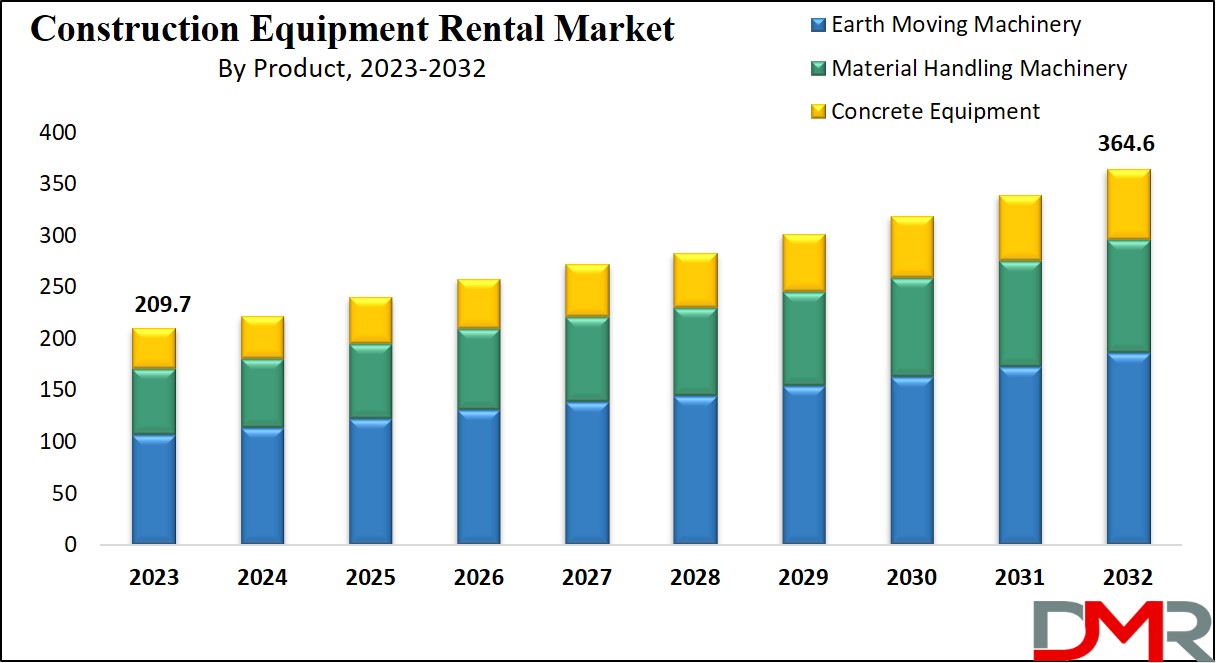

- Robust Market Growth: The market is experiencing significant and sustained growth, projected to surge from USD 209.7 billion in 2023 to USD 364.6 billion by 2032, at a strong Compound Annual Growth Rate (CAGR) of 6.3%.

- Primary Growth Driver: Construction Boom in Emerging Economies: The major catalyst for this growth is the ongoing expansion of the construction industry, particularly in emerging economies. This is fueled by massive investments in residential, commercial, and infrastructure projects like highways, metros, and smart cities.

- Renting Overcomes High Capital Barriers: The high upfront cost of purchasing heavy machinery is a barrier for many small contractors. The rental model effectively solves this by eliminating ownership costs (purchase, maintenance, storage) and providing flexible access to necessary equipment.

- Earthmoving Machinery is the Dominant Segment: In 2023, earthmoving machinery (e.g., excavators, loaders) held the largest market share. Its durability, high performance in tough conditions, and essential role in numerous projects make it the most rented category.

- Concrete Equipment is a Key Growth Segment: The concrete equipment segment is anticipated for major growth, driven by large-scale government infrastructure initiatives—especially road and highway projects—in developing Asia-Pacific nations like China and India.

- North America Leads, But Asia-Pacific is Rising: In 2023, North America was the dominant region, holding a 32.2% share of the global market revenue. However, the Asia-Pacific region is expected to be the fastest-growing market during the forecast period due to massive government infrastructure spending.

- Digitalization is a Key Trend: The industry is embracing digitalization through trends like equipment service tracking, automated processes, and online marketplaces. An example is Maxim Crane Works' launch of an online platform for selling used equipment, reflecting a move towards more efficient, tech-driven services.

Research Scope and Analysis

By Product

The market landscape of 2023 is noticing that the earthmoving machinery sector holds a significant portion of the market share. This is particularly attributed to the escalated use of earthmoving excavators in industries like agriculture, mining, & construction. These industries have noticed significant expansion owing to the substantial contribution of earthmoving excavators. Additionally, there is an increase in trend in the adoption of several other

earthmoving equipment types, including backhoe loaders, crawler excavators, skid-steer loaders, & mini excavators. These machines possess impressive load capacities & better engine performance, making them highly suitable for deployment in challenging operational conditions.

A special trait of earthmoving equipment lies in its ability to grow in demanding work environments. This durability & capability have set them as indispensable tools for various tasks. Mainly, construction businesses & contractors have shown an interest in leasing earthmoving equipment. This shift can be due to the growth in large-scale commercial & residential civil projects. Moreover, this trend has given a major boost to the construction equipment rental market, driving its growth further.

Further, the segment related to concrete equipment is anticipated for a big growth in the forecast period.

The development of strong infrastructure plays a major role in growing trade & commercial activities. Particularly, the connectivity given by roads holds the potential to shape a country's economic prospects. This trend is evident in various developing countries in the Asia Pacific region, including countries like China and India. These nations are placing a strong stress on improving road networks. For instance, China's ambitious "One Belt, One Road" initiative focuses on establishing crucial connections between China & various European countries. This extensive undertaking carries a high price tag of USD 1.3 trillion

Moreover, India is actively investing in road improvement, as highlighted by its new budget for 2022-23. A significant allocation of USD 529.7 billion emphasizes the government's commitment to creating better road links, mainly through the development of new highways, as these governmental commitments to large-scale road & highway projects is expected to boost the demand for concrete equipment. These investments are set to drive the growth of this particular market segment.

The Global Construction Equipment Rental Market Report is segmented on the basis of the following:

By Product

- Earth Moving Machinery

- Backhoe

- Excavators

- Loaders

- Compaction Equipment

- Others

- Material Handling Machinery

- Concrete Equipment

- Concrete Pumps

- Crushers

- Transit Mixer

- Asphalt Pavers

- Batching Plants

Regional Analysis

In 2023, the North American region contains a significant market share, contributing

about 32.2% of the total revenue in the Global Construction Equipment Rental Market. The market landscape of 2022 saw the earthmoving machinery sector holding a significant portion of the market share. This was particularly due to the growth in the use of earthmoving

excavators in industries like agriculture, mining, & construction. These industries have noticed significant expansion owing to the substantial contribution of earthmoving excavators. Additionally, there is an increase in trend in the adoption of several other earthmoving equipment types, including backhoe loaders, crawler excavators, skid-steer loaders, & mini excavators.

These machines possess impressive load capacities & better engine performance, making them highly suitable for deployment in challenging operational conditions. Further, the Asia Pacific region is also anticipated for significant growth in the forecast period. The governments of emerging economies in Asia are making significant funding in infrastructure development, including highways, airports, dams, & special economic zones (SEZs), to improve connectivity, promote trade, & stimulate overall economic growth.

These initiatives have gained the attention of international construction equipment companies, making them significantly invest & establish their presence in the region. Renowned global construction equipment manufacturers such as Caterpillar, Hitachi, Liebherr, & Sumitomo Corporation are constantly offering their products & services in this burgeoning market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The construction equipment rental market noticed significant competitiveness, marked by the participation of various domestic & regional players. This diverse landscape encourages intense competition within the market. One prominent trend driving this industry is the popularity of opting for mergers & acquisitions, as well as the formation of joint ventures. These strategic activities play a major role in shaping the market dynamics, allowing companies to extend their offerings, diversify their portfolios, & access new markets.

For instance, in November 2022, Maxim Crane Works L.P. introduced Maxim MarketplaceTM, an ingenious online platform dedicated to the sale of used equipment. This move comes as the U.S. rental industry leader focuses on refreshing its fleet, containing a range of inventory of cranes & support equipment. In collaboration with Krank, one of the leading software developers in the industry, Maxim Crane Works has unveiled its own state-of-the-art online marketplace for used product sales, providing a modern & efficient channel for buyers & sellers in the construction equipment market.

Some of the prominent players in the Global Construction Equipment Rental Market are:

- Caterpillar

- Loxam

- United Rentals Inc

- Sumitomo Corp

- Cramo Plc

- Maxim Crane Works

- Kanamoto Co Ltd

- Ahern Rentals Inc

- Aktio Corp

- Finning International Inc

- Other Key Players

Recent Developments

- February 2025: United Rentals, Inc. is projected to launch the industry's first fully digital "Rent-to-Own" platform, allowing customers to apply rental payments toward the future purchase of used equipment, thereby capturing a larger share of the secondary market.

- October 2024: United Rentals, Inc. completed the strategic acquisition of a specialized regional rental company, adding over 2,500 units of critical infrastructure and eco-friendly equipment to its fleet and expanding its footprint in the high-growth Southeastern U.S. market.

- July 2024: Herc Holdings Inc. launched its integrated "Herc Pro" digital platform, providing customers with real-time telematics data, predictive maintenance alerts, and automated billing to maximize uptime and operational efficiency across its entire fleet.

- May 2024: Sunbelt Rentals announced a major fleet expansion investment of $500 million to significantly increase its inventory of aerial work platforms and telehandlers, directly addressing the surge in demand from the commercial construction sector.

- March 2024: Loxam Group entered a exclusive pan-European partnership with a leading electric machinery manufacturer to introduce a dedicated fleet of zero-emission excavators and dumpers, aligning with stringent new EU sustainability regulations.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 209.7 Bn |

| Forecast Value (2032) |

USD 364.6 Bn |

| CAGR (2023-2032) |

6.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Earth Moving Machinery (Backhoe, Excavators, Loaders, Compaction Equipment and Others), Material Handling Machinery (Cranes and Dump Trucks) and Concrete Equipment (Concrete Pumps, Crushers, Transit Mixer, Asphalt Pavers and Batching Plants)) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Caterpillar, Loxam, United Rentals Inc, Sumitomo Corp, Cramo Plc, Maxim Crane Works, Kanamoto Co Ltd, Ahern Rentals Inc, Aktio Corp, Finning International Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |