Market Overview

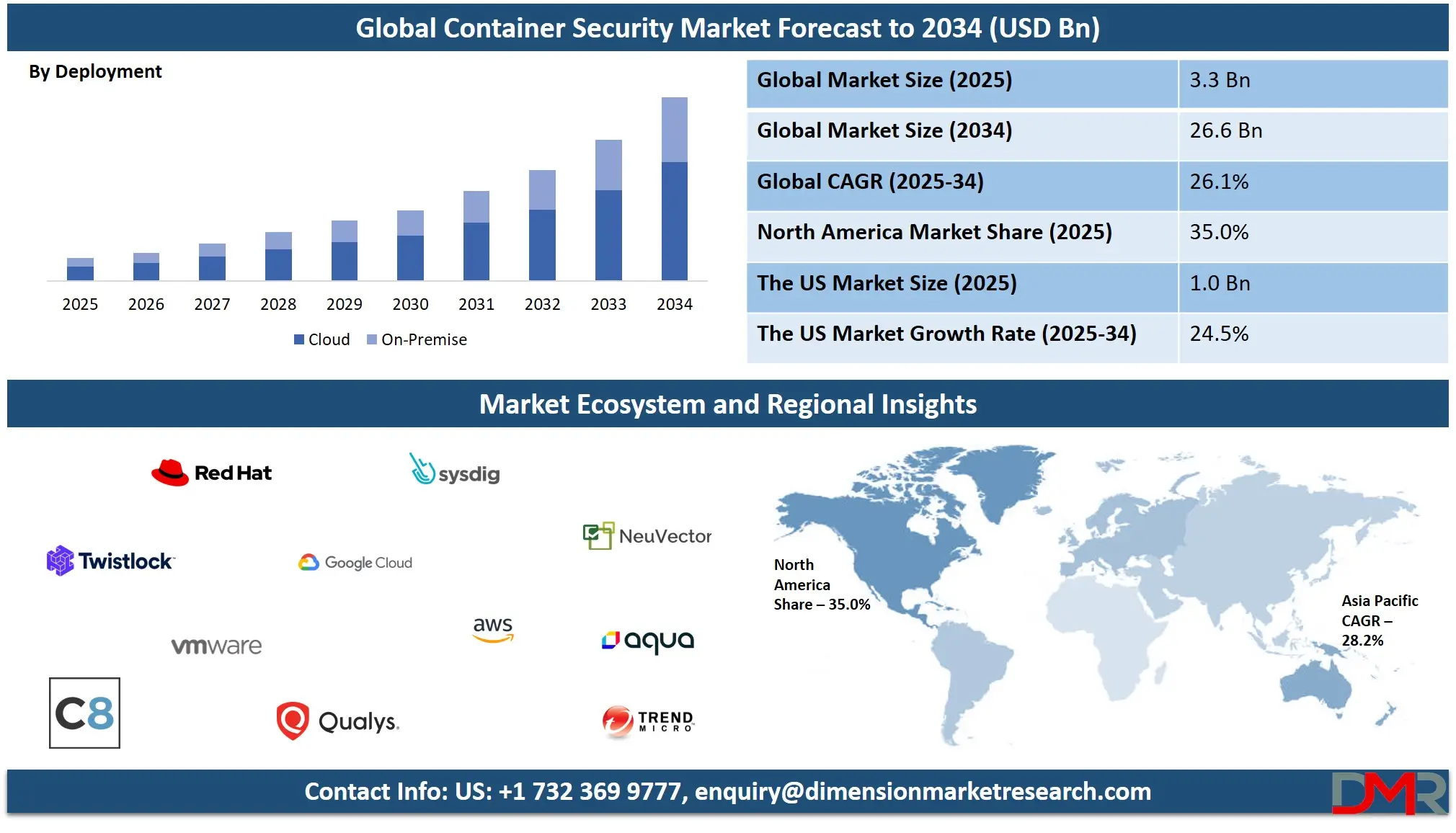

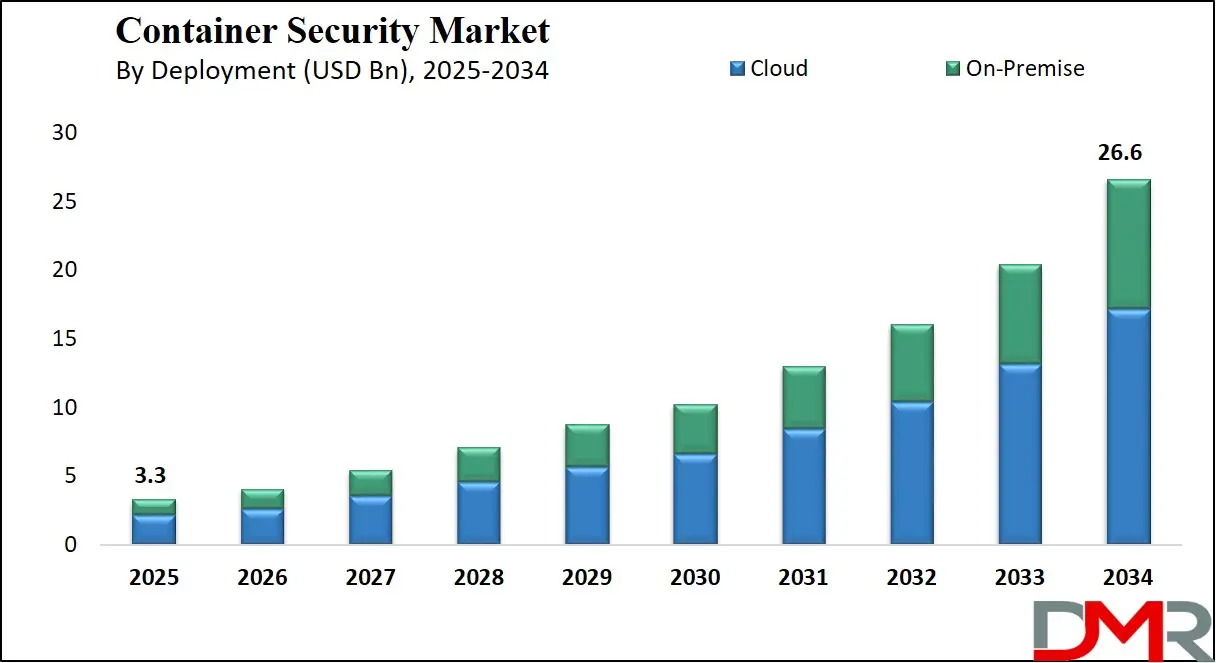

The Global Container Security Market size is projected to reach USD 3.3 billion in 2025 and grow at compound annual growth rate of 26.1% from there until 2034 to reach a value of USD 26.6 billion.

Container security is the process of protecting software containers from threats and vulnerabilities during development, deployment, and runtime. Containers are lightweight units that package an application and its dependencies together, making them easy to move across environments.

As organizations increasingly depend on cloud storage and distributed workloads, the need for advanced security tools becomes critical.While containers offer speed and flexibility, they also introduce new risks, such as exposed secrets, misconfigurations, and weak isolation. Container security involves using tools and practices to scan container images, control access, monitor runtime behavior, and ensure secure configurations in containerized environments. This makes it a vital aspect of modern cloud-native security strategies.

Several trends are shaping the container security landscape. Shift-left security is becoming common, where security is integrated earlier in the software development process. DevSecOps practices are being adopted to bring development, security, and operations teams together.

Tools for container image scanning, runtime protection, and Kubernetes security are evolving quickly. Cloud providers also offer built-in container security features, increasing the focus on secure cloud-native infrastructure. These trends show that security is becoming an essential part of container management.

Several trends are shaping the container security landscape. Shift-left security is becoming common, where security is integrated earlier in the software development process. DevSecOps practices are being adopted to bring development, security, and operations teams together. Tools for container image scanning, runtime protection, and Kubernetes security are evolving quickly. Cloud providers also offer built-in container security features, increasing the focus on secure cloud-native infrastructure. These trends show that security is becoming an essential part of container management, with Security as a Service playing a central role in protecting workloads at scale.

In recent years, incidents have shown the need for stronger container security. Attacks on popular container images in public registries have exposed systems to malware and vulnerabilities. Kubernetes misconfigurations have led to unauthorized access and data leaks. Some high-profile breaches were linked to weak security in cloud-native environments. These events raised awareness across industries and pushed for stricter security practices. Regulations and audits are also influencing how organizations approach container protection.

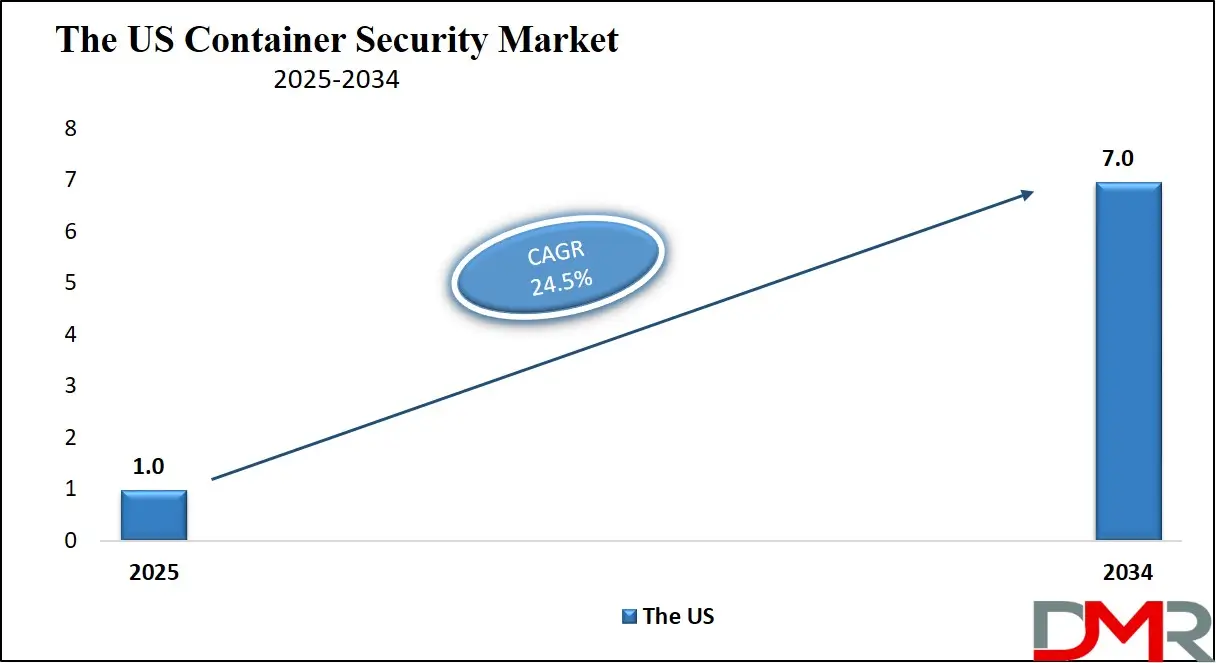

The US Container Security Market

The US Container Security Market size is projected to reach USD 1.0 billion in 2025 at a compound annual growth rate of 24.5% over its forecast period.

The US plays a leading role in the container security market due to its advanced cloud infrastructure, strong tech ecosystem, and early adoption of DevOps and cloud-native technologies. Many innovative container security solutions are developed and launched by US-based firms, driving global standards and best practices.

The presence of major cloud service providers and container orchestration platforms in the US also supports rapid growth in this space. Additionally, the US government and enterprises place high emphasis on cybersecurity, leading to strong demand for robust container protection. With increasing digital transformation across industries and growing concerns over data breaches, the US continues to influence the development, deployment, and evolution of container security technologies globally.

Europe Container Security Market

Europe Container Security Market size is projected to reach USD 762 million in 2025 at a compound annual growth rate of 25.3% over its forecast period.

Europe plays a growing and strategic role in the container security market, driven by strict data protection regulations like GDPR and a rising focus on digital sovereignty. European organizations are increasingly adopting cloud-native technologies, which in turn is boosting demand for container security solutions. Governments and industries across the region are investing in secure IT infrastructure, especially in sectors like finance, healthcare, and manufacturing. Interestingly, parallels can be drawn to industries reliant on Intermediate Bulk Container (IBC) Liner solutions, where compliance and safety are paramount. Similarly, in cybersecurity, strict governance is ensuring trust in digital systems.

The emphasis on compliance, privacy, and secure digital services is pushing both local and international vendors to offer tailored container security tools for European markets. Additionally, partnerships between cybersecurity firms and European enterprises are expanding, fostering innovation and trust. Europe’s commitment to secure digital transformation is making it a significant force in the container security landscape.

Japan Container Security Market

Japan Container Security Market size is projected to reach USD 165 million in 2025 at a compound annual growth rate of 24.8% over its forecast period.

Japan plays a steadily increasing role in the container security market as its industries embrace digital transformation and cloud-native technologies. With a strong background in advanced manufacturing and IT infrastructure, Japan is focusing more on securing its containerized applications across sectors like finance, healthcare, and telecommunications. The country’s emphasis on automation, quality control, and compliance aligns well with the principles of container security.

Japanese organizations are integrating security into development pipelines, adopting DevSecOps, and prioritizing runtime protection. Government initiatives promoting cybersecurity awareness and innovation are further supporting this shift. As businesses modernize their IT environments, the demand for secure container solutions is growing, positioning Japan as a key contributor to the regional and global container security ecosystem.

Container Security Market: Key Takeaways

- Market Growth: The Container Security Market size is expected to grow by USD 22.5 billion, at a CAGR of 26.1%, during the forecasted period of 2026 to 2034.

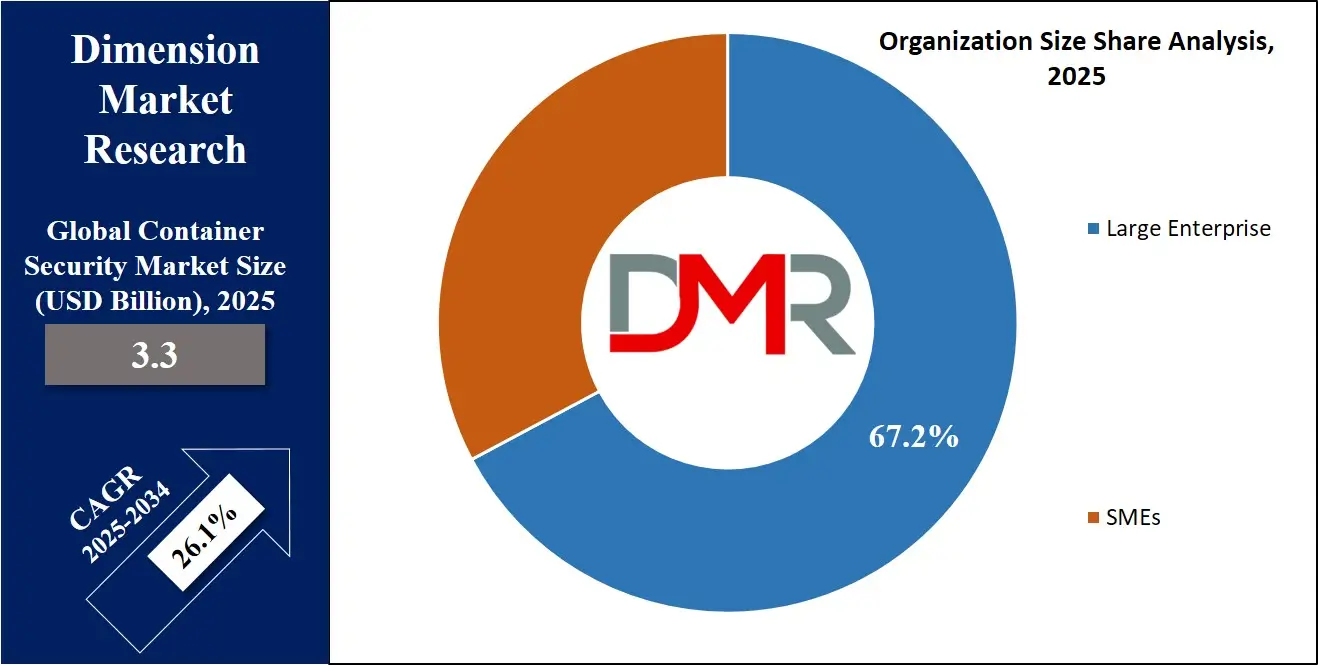

- By Organization Size: The large enterprises are anticipated to get the majority share of the Container Security Market in 2025.

- By Deployment Mode: The Cloud-based segment is expected to get the largest revenue share in 2025 in the Container Security Market.

- Regional Insight: North America is expected to hold a 35.0% share of revenue in the Global Container Security Market in 2025.

- Use Cases: Some of the use cases of Container Security include compliance & governance, secure application development, and more.

Container Security Market: Use Cases

- Secure Application Development: Container security ensures that developers build applications with security in mind from the start. By scanning container images for known vulnerabilities and enforcing secure configurations, it helps prevent risky code or dependencies from entering production environments. This reduces the chances of exploits and supports safer, faster development cycles.

- Protection in Runtime Environments: Once containers are running, container security tools monitor behavior to detect threats like unauthorized access, malware, or suspicious activity. Real-time alerts and automated responses help prevent attacks from spreading. This use case is critical in dynamic environments where containers start, stop, and scale quickly.

- Compliance and Governance: Container security helps organizations meet industry standards and regulations by enforcing policies and maintaining audit trails. It ensures only trusted images are used, access is controlled, and sensitive data is protected. This is essential for businesses in regulated sectors like finance, healthcare, or government.

- DevSecOps Integration: Security tools designed for containers integrate easily into DevOps pipelines, enabling a DevSecOps approach. This allows teams to catch issues early, apply fixes automatically, and maintain agility without sacrificing security. The seamless integration helps developers and security professionals collaborate more effectively.

Market Dynamic

Driving Factors in the Container Security Market

Rising Adoption of Cloud-Native Technologies

One of the biggest growth drivers for the container security market is the rapid shift towards cloud-native architectures. As organizations move away from traditional monolithic applications to microservices-based designs, containers have become the standard for packaging and deploying these services. Platforms like Kubernetes are widely used to orchestrate containers at scale, but they also introduce new security challenges.

This shift has created a strong need for security solutions that can handle container-specific risks, such as image vulnerabilities, configuration drift, and runtime threats. Businesses now require security tools that are built specifically for dynamic, distributed, and multi-cloud environments. As a result, demand is increasing for solutions that secure containers across development, deployment, and production stages.

Increased Focus on DevSecOps and Automation

Another major driver is the growing focus on integrating security into DevOps workflows, also known as DevSecOps. Companies want to release software faster, but without compromising security. This has led to a push for automated security tools that can work seamlessly within CI/CD pipelines.

Container security solutions are now expected to scan images for vulnerabilities, enforce compliance rules, and monitor behavior automatically—all without slowing down development. The rise of automation in security practices not only improves efficiency but also reduces human error. As DevSecOps becomes standard practice, organizations are investing in container security to make sure applications remain secure from the first line of code to deployment.

Restraints in the Container Security Market

Complexity of Managing Container Security Across Environments

One major restraint in the container security market is the complexity involved in managing security across multiple environments. Containers are often deployed in hybrid or multi-cloud setups, where different platforms, tools, and policies must work together. Ensuring consistent security policies across development, staging, and production environments can be challenging.

Misconfigurations, outdated images, and fragmented visibility increase the risk of breaches. For many organizations, especially those new to container technology, managing this complexity requires a steep learning curve and significant internal expertise. Without proper coordination, security gaps may appear that are difficult to detect or fix in time. This complexity can slow down adoption or lead to incomplete security coverage.

Lack of Skilled Professionals and Awareness

Another key restraint is the shortage of professionals with expertise in container security. While containers and Kubernetes are widely used, many IT teams lack the specific skills needed to implement, manage, and monitor security effectively in these environments. Traditional security teams may not fully understand the unique risks that containers pose, such as ephemeral workloads, shared host kernels, and image dependencies.

Additionally, developers may prioritize speed and functionality over security, leading to overlooked vulnerabilities. Without proper training and awareness, even advanced security tools can be underutilized or misconfigured. This talent gap slows down implementation and increases the risk of human error, making it harder for organizations to adopt strong container security practices.

One major restraint in the container security market is the complexity involved in managing security across multiple environments. Containers are often deployed in hybrid or multi-cloud setups, where different platforms, tools, and policies must work together. Ensuring consistent security policies across development, staging, and production environments can be challenging.

Misconfigurations, outdated images, and fragmented visibility increase the risk of breaches. For many organizations, especially those new to container technology, managing this complexity requires a steep learning curve and significant internal expertise. Without proper coordination, security gaps may appear that are difficult to detect or fix in time. This complexity can slow down adoption or lead to incomplete security coverage.

Lack of Skilled Professionals and Awareness

Another key restraint is the shortage of professionals with expertise in container security. While containers and Kubernetes are widely used, many IT teams lack the specific skills needed to implement, manage, and monitor security effectively in these environments. Traditional security teams may not fully understand the unique risks that containers pose, such as ephemeral workloads, shared host kernels, and image dependencies.

Additionally, developers may prioritize speed and functionality over security, leading to overlooked vulnerabilities. Without proper training and awareness, even advanced security tools can be underutilized or misconfigured. This talent gap slows down implementation and increases the risk of human error, making it harder for organizations to adopt strong container security practices.

Opportunities in the Container Security Market

Expansion of AI and Machine Learning in Threat Detection

A major opportunity in the container security market lies in the integration of artificial intelligence (AI) and machine learning (ML) to enhance threat detection and response. As containerized environments generate large volumes of data, AI-driven tools can analyze patterns, detect anomalies, and predict potential attacks more accurately than traditional methods.

These technologies can help identify zero-day vulnerabilities and insider threats by learning from past behaviors. Over time, AI can improve the efficiency of container security solutions by reducing false positives and automating responses. This innovation opens the door for more proactive security strategies. Companies that invest in AI-enabled security tools will be better equipped to protect dynamic and fast-changing container environments.

Growing Demand from Small and Medium Enterprises

The container security market also has a significant opportunity in serving small and medium-sized enterprises. As container technology becomes more accessible and affordable, SMEs are adopting it to improve application deployment speed and scalability. However, many of these organizations lack in-house security expertise and require easy-to-use, cost-effective security solutions.

Vendors that offer simplified container security tools with built-in automation, guided setup, and seamless integration with cloud platforms can tap into this expanding customer base. Providing education, managed services, or bundled offerings tailored to SMEs can further drive adoption. As digital transformation reaches smaller businesses, demand for accessible and scalable container security solutions is expected to grow rapidly.

Trends in the Container Security Market

Cloud‑Native and Hybrid Shielding

Container security is mainly being offered as a cloud‑based service integrated directly into public and hybrid cloud environments. This allows organizations to deploy security capabilities that automatically scale with container workloads, reducing infrastructure overhead. Integrated tools provide seamless image scanning, policy enforcement, and runtime protection tied to the container orchestration layer, such as Kubernetes, so security moves with the workload rather than being bolted on afterwards.

Runtime Behavior and AI‑Driven Detection

Security is shifting from simply scanning container images to monitoring live container behavior. Runtime security uses anomaly detection, behavioral analytics, and AI/ML to spot threats like process hijacking or privilege escalation in real time. This is critical in dynamic container ecosystems where workloads are short‑lived and scale out quickly. Vendors now integrate machine learning models into their platforms to automatically detect deviations and respond within the container lifecycle.

Impact of Artificial Intelligence in Container Security Market

Artificial Intelligence is playing an important role in transforming the container security market by enhancing real-time threat detection, automated response, and predictive analytics. As containers become a central element in modern software development through DevOps and cloud-native architectures, securing these dynamic environments has become increasingly complex.

AI-powered tools can monitor container activity continuously, detect anomalies, and flag potential vulnerabilities with greater speed and accuracy than traditional methods. By leveraging machine learning models, these systems can learn from past incidents, identify patterns, and predict emerging threats. This significantly reduces the response time and minimizes the impact of security breaches, making AI an essential layer in modern container security frameworks.

Furthermore, AI supports scalability and resilience by managing large volumes of data across distributed environments. It enables security solutions to adapt to changing application behaviors, container orchestration systems like Kubernetes, and microservices architectures. Automated policy enforcement and intelligent alert systems also reduce manual workload for security teams, allowing them to focus on critical tasks. However, challenges such as AI model training, false positives, and integration complexities remain.

Still, as AI technologies evolve, they are becoming more accurate, context-aware, and easier to integrate into DevSecOps pipelines. Major enterprises and cloud service providers are increasingly embedding AI into their container security offerings to meet rising demands for robust, adaptive, and proactive security. As a result, AI is not only improving security postures but also driving efficiency and confidence in deploying and scaling containerized applications across industries.

Research Scope and Analysis

By Deployment Analysis

Cloud deployment is set to be the dominating segment in the container security market in 2025, with a share of 64.5%, due to the rising shift of businesses toward cloud-native architectures. As companies move applications to public, private, and hybrid clouds, the need for scalable and flexible container security solutions becomes essential.

Cloud platforms offer built-in tools for vulnerability scanning, image management, and runtime protection, making security easier to manage in dynamic environments. Organizations prefer cloud deployment for faster integration with DevSecOps pipelines and better support for Kubernetes-based workloads.

With the growing adoption of multi-cloud strategies and container orchestration platforms, cloud-based container security is gaining traction. The flexibility to scale resources, respond to threats in real-time, and apply automated policies makes cloud deployment a preferred choice for enterprises looking to secure their containerized applications effectively in today’s fast-changing digital environment.

On-premise deployment is set to experience significant growth over the forecast period as certain industries continue to prioritize full control over their container infrastructure. Sectors like banking, defense, and healthcare often manage sensitive data and prefer local deployment for compliance, privacy, and policy enforcement.

Organizations using on-premise solutions benefit from deeper visibility, tailored security settings, and integration with legacy systems. This deployment model also supports real-time monitoring and control, which is essential in highly regulated environments.

The rise of self-managed Kubernetes and private cloud setups is also encouraging the use of container security tools on-premise. While cloud deployment dominates, on-premise solutions remain vital for businesses that require strict data governance, high-performance infrastructure, and customizable security measures across their containerized workloads.

By Organization Size Analysis

The large enterprise segment is anticipated to lead the container security market in 2025 with a share of 67.2%, driven by complex IT environments and a strong need for advanced cybersecurity. These organizations often operate across multiple regions, manage critical applications, and use cloud-native technologies at scale. To protect sensitive data and ensure compliance, they rely heavily on automated vulnerability scanning, secure image management, and real-time threat detection.

Large enterprises also invest in robust DevSecOps strategies to integrate security into continuous development and deployment pipelines. Their ability to allocate bigger budgets and dedicated security teams allows them to adopt comprehensive container security platforms. As digital transformation continues to accelerate, these businesses are focusing on securing their Kubernetes clusters, hybrid cloud systems, and containerized microservices. This makes container security an essential part of their broader cybersecurity posture and risk management strategies.

SMEs segment is witnessing significant growth in the container security market over the forecast period as more small and medium-sized businesses embrace digital technologies. With growing use of containers and cloud-native platforms, SMEs are recognizing the importance of securing their development pipelines and runtime environments.

While they may have limited resources compared to large enterprises, the availability of affordable, easy-to-use container security tools is enabling them to improve their cybersecurity posture. SMEs are increasingly adopting vulnerability scanning, DevSecOps integration, and automated policy enforcement to protect applications and sensitive data.

Cloud-based container security solutions, in particular, are gaining popularity among SMEs due to their scalability and low management overhead. This growing awareness and adoption of security best practices are helping SMEs close the security gap while supporting innovation and business agility in containerized environments.

By End Use Industry Analysis

The retail industry is expected to lead the container security market in 2025 with a share of 35.8%, driven by the rapid digitalization of operations and increasing reliance on online platforms. Retailers are using containers to deploy scalable e-commerce applications, manage customer data, and improve inventory systems. With high volumes of transactions and sensitive customer information flowing through digital platforms, securing containerized environments becomes critical.

The industry faces constant cyber threats, making real-time monitoring, image scanning, and runtime protection essential. As retailers move to hybrid and multi-cloud models, they seek container security solutions that offer flexibility, automation, and compliance support. Integration of DevSecOps practices allows faster and safer updates to web and mobile platforms. The competitive nature of retail pushes companies to innovate quickly while maintaining trust, making container security a key component of their digital infrastructure and cybersecurity strategies.

IT & Telecom sector is showing strong growth in the container security market over the forecast period as digital transformation accelerates across service delivery and network operations. These companies handle massive volumes of data and rely on containerized applications to support cloud infrastructure, 5G deployments, and customer platforms. With rising concerns around data privacy and system uptime, securing containerized environments is becoming a top priority.

IT and telecom firms are increasingly investing in vulnerability scanning, runtime protection, and secure image lifecycle management to safeguard their services. They are also adopting DevSecOps models to align development, security, and operations. This demand is further supported by the need to meet regulatory compliance and ensure uninterrupted digital experiences for users.

The Container Security Market Report is segmented on the basis of the following:

By Deployment

By Organization Size

By End Use Industry

- BFSI

- IT & Telecom

- Healthcare

- Retail

- Industrial

- Others

Regional Analysis

Leading Region in the Container Security Market

North America will be leading the container security market in 2025 with a share of 35.0%, driven by the region’s strong presence of cloud-native companies and rapid adoption of advanced cybersecurity tools. The demand for container security is growing across industries like banking, healthcare, e-commerce, and technology, where data protection and secure application delivery are top priorities.

Organizations in the US and Canada are actively shifting to DevSecOps practices, bringing security into the development process from the start. The presence of major cloud service providers, along with strict regulations and frequent cyber threats, is pushing businesses to invest more in container security solutions.

In addition, continuous innovation, high awareness, and strong digital infrastructure are supporting the use of vulnerability scanning, image management, and runtime protection tools. As hybrid and multi-cloud environments expand, companies across North America are focusing on securing containerized applications, making the region a key contributor to the global growth of the container security market.

Fastest Growing Region in the Container Security Market

Asia Pacific is showing significant growth in the container security market over the forecast period due to rising cloud adoption, digital transformation, and increased focus on cybersecurity across major economies. Countries like China, India, Japan, and South Korea are seeing rapid development in cloud-native applications and container orchestration platforms, creating a strong need for container security solutions.

Enterprises are increasingly integrating DevSecOps practices and automated vulnerability scanning tools into their software development cycles. As more businesses shift to Kubernetes environments and hybrid cloud setups, the demand for real-time threat detection, secure image management, and runtime protection is expanding. This growth is expected to continue as awareness and investments in secure container infrastructure increase.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The container security market is becoming more competitive as more companies adopt containers to build and run applications. Many security providers are now offering specialized tools that protect containers throughout their entire lifecycle, from development to deployment and runtime. The competition is driven by the growing need for faster, smarter, and more automated security solutions that can handle complex environments like Kubernetes and cloud-native systems.

Some companies focus on scanning container images for vulnerabilities, while others provide tools for monitoring, access control, and threat detection. As demand rises, security platforms are expanding their features and integrating with DevOps workflows. This growing competition is pushing innovation, making container security solutions more advanced, user-friendly, and able to meet the needs of both small teams and large enterprises.

Some of the prominent players in the global Container Security are

- Aqua Security

- Twistlock

- Sysdig

- Trend Micro

- Qualys

- Red Hat / StackRox

- NeuVector

- Anchore

- Tenable

- Docker

- Clair

- Microsoft Defender for Containers

- Google Cloud Security

- AWS (Amazon Web Services)

- Prisma Cloud

- Suse NeuVector

- AccuKnox

- Tigera

- VMware

- Capsule8

- Other Key Players

Recent Developments

- In June 2025, Azul announced a strategic partnership with Chainguard, as this collaboration combines Azul’s top-tier commercial support and curated OpenJDK distributions with Chainguard’s secure Linux distribution, software factory, and container images. Chainguard will create Java container images from source using Azul’s supported OpenJDK build from the Azul Platform Core. This partnership aims to boost developer productivity, reduce engineering effort, and strengthen the security of the software supply chain for enterprises.

- In April 2025, Aqua Security introduced the Container Security Risk Assessment (CSRA), the industry's first free tool designed to reveal real-world risks in active containerized environments. Unlike traditional pre-deployment scans, CSRA focuses on actual runtime behavior, helping security teams identify, prioritize, and reduce risks based on live production data. Powered by Aqua’s behavioral detection engine and backed by a decade of cloud-native threat research, this assessment provides a clear and actionable profile of an organization’s runtime container security posture.

- In March 2025, Docker introduced Docker Hardened Images, a catalog of security-hardened, enterprise-grade container images designed to defend against software supply chain threats. These images help DevOps teams meet security and compliance standards without the burden of securing containers manually. Built specifically with security in mind, they go beyond being minimal versions of existing containers. They offer assurance that image components are untampered and free from malicious code, reducing the risks that come with adding packages and expanding the attack surface during development.

- In August 2024, Checkmarx launched a new Container Security solution as part of its Checkmarx One AppSec platform. This solution improves team efficiency by identifying vulnerabilities early and offering actionable insights within existing development workflows. It integrates Sysdig runtime insights to combine static analysis with real-time monitoring, allowing faster, proactive threat response. Unique in the industry, it also flags malicious packages and shows if they’re active in running containers, giving teams deeper visibility and improving their overall container security posture.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.3 Bn |

| Forecast Value (2034) |

USD 26.6 Bn |

| CAGR (2025–2034) |

26.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Deployment (Cloud and On-Premises), By Organization Size (SMEs and Large Enterprises), By End Use Industry (BFSI, IT & Telecom, Healthcare, Retail, Industrial, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Aqua Security, Twistlock, Sysdig, Trend Micro, Qualys, Red Hat / StackRox, NeuVector, Anchore, Tenable, Docker, Clair, Microsoft Defender for Containers, Google Cloud Security, AWS, Prisma Cloud, Suse NeuVector, AccuKnox, Tigera, VMware, Capsule8, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Container Security Market size is expected to reach a value of USD 3.3 billion in 2025 and is expected to reach USD 26.6 billion by the end of 2034.

North America is expected to have the largest market share in the Global Container Security Market, with a share of about 35.0% in 2025.

The Container Security Market in the US is expected to reach USD 1.0 billion in 2025.

Some of the major key players in the Global Container Security Market areAqua Security, Twistlock, Sysdig, and others

The market is growing at a CAGR of 26.1 percent over the forecasted period.