A core cutter is a tool that is utilized for cutting and drilling into rock, concrete, and other materials, and for creating core specimens. It is used across various industries for various applications like the food & beverage industry, electronics, and more, making it a key component in industrial cutting equipment and precision material testing tools.

Core Cutters Market has witnessed tremendous expansion due to the rising demand for precision and efficient cutting tools across industries including oil & gas, construction, manufacturing, and material testing processes. Core cutters play an essential role in producing accurate cylindrical cuts for drilling operations as well as material testing processes, and are increasingly recognized as part of advanced cutting solutions for industrial applications.

Recent technological innovations are improving both performance and durability of core cutters. Manufacturers are using premium-quality materials and advanced designs to increase cutting efficiency, decrease wear, extend tool lifespan, make them more reliable in challenging environments and increase cutting productivity.

Core cutter demand is driven by industries like mining and construction where precision cutting is necessary for core sampling and geological analysis, as well as exploration and extraction activities in oil and gas sectors that demand robust core-cutting solutions capable of withstanding extreme environments.

Opportunity in the market lies in expanding core cutter usage into emerging sectors like renewable energy and environmental testing, where sustainability and energy efficiency have become global focal points. Eco-friendly projects using core cutters designed specifically to save resources can drive future growth while opening up opportunities for innovative solutions in the market.

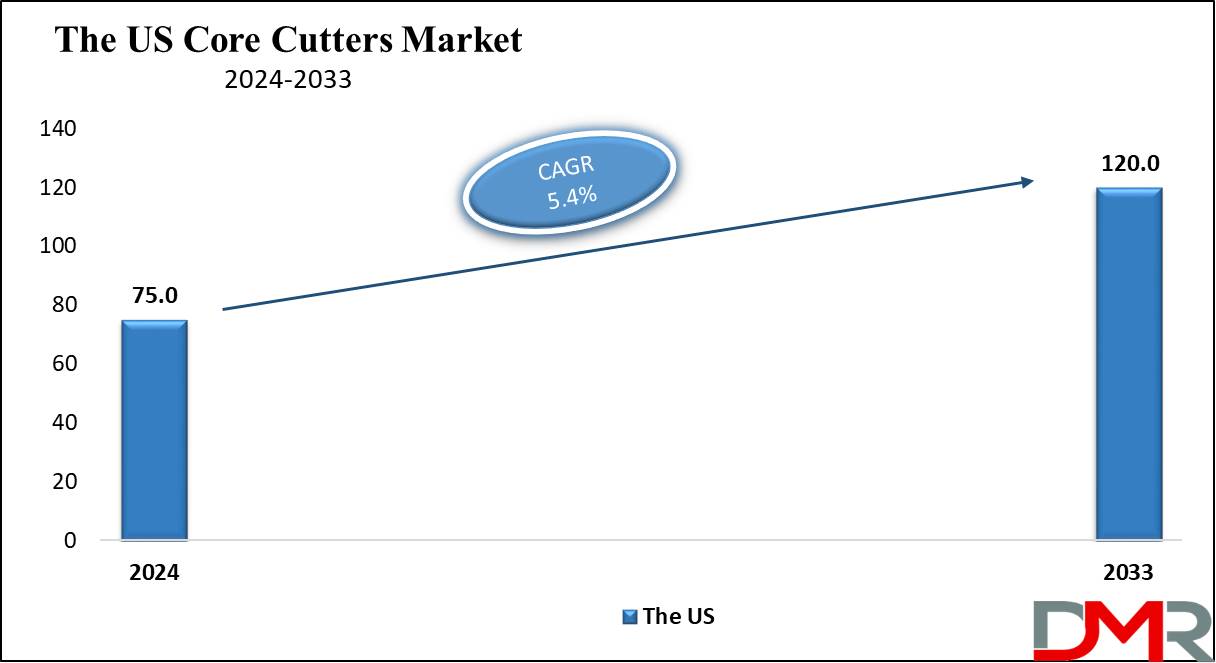

The US Core Cutters Market

The US

Core Cutters Market is projected to reach

USD 75.0 million in 2024 at a compound annual

growth rate of 5.4% over its forecast period.

In the U.S., growth opportunities in the core cutter market stem from expanding infrastructure projects, technological advancements in automation, and rising demand for efficient packaging solutions in industries such as food, beverage, and electronics. In addition, increasing investments in sustainable construction and manufacturing drive the need for precise cutting tools. The integration of

Food Deaerators in food processing further emphasizes the demand for high-precision equipment, positioning the U.S. as a key market for core cutters.

Moreover, in the U.S. core cutter market, growth is driven by advancements in automation and increasing demand from industries such as construction, packaging, and electronics. The adoption of

machine learning technologies further enhances the efficiency and precision of core cutting processes, enabling predictive maintenance and smarter operational control. However, a key restraint is the high initial investment costs for advanced core cutting machines, which can limit adoption among small and medium-sized enterprises, slowing overall market expansion in certain sectors.

Key Takeaways

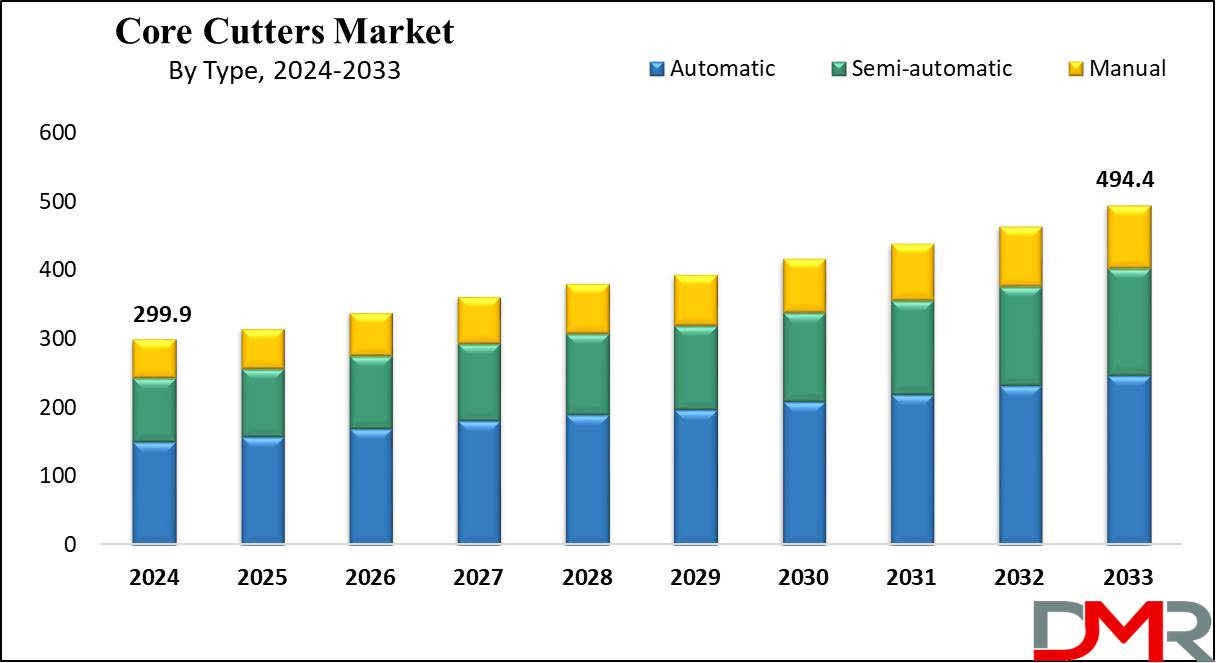

- Market Growth: The Core Cutters Market size is expected to grow by 179.2 million, at a CAGR of 5.7% during the forecasted period of 2025 to 2033.

- By Type: The automatic type is expected to lead in 2024 with a majority & is anticipated to dominate throughout the forecasted period.

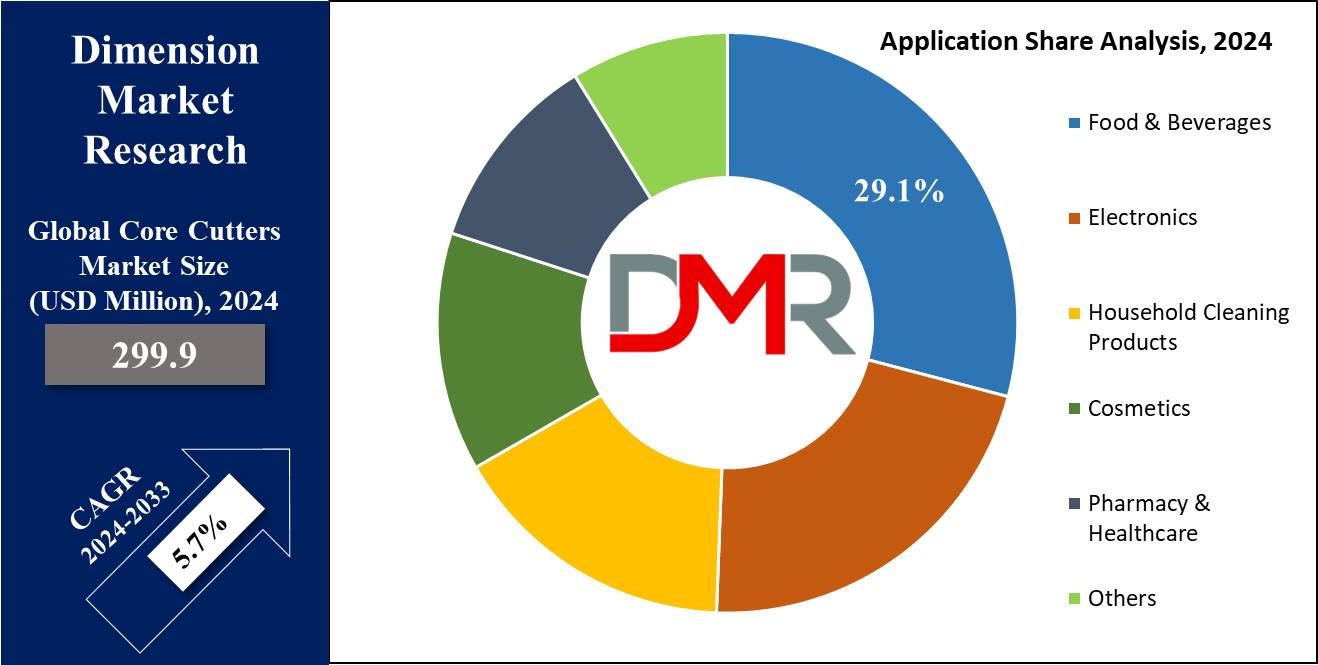

- By Application: The food & beverage sector is expected to get the largest revenue share in 2024 in the Core Cutters Market.

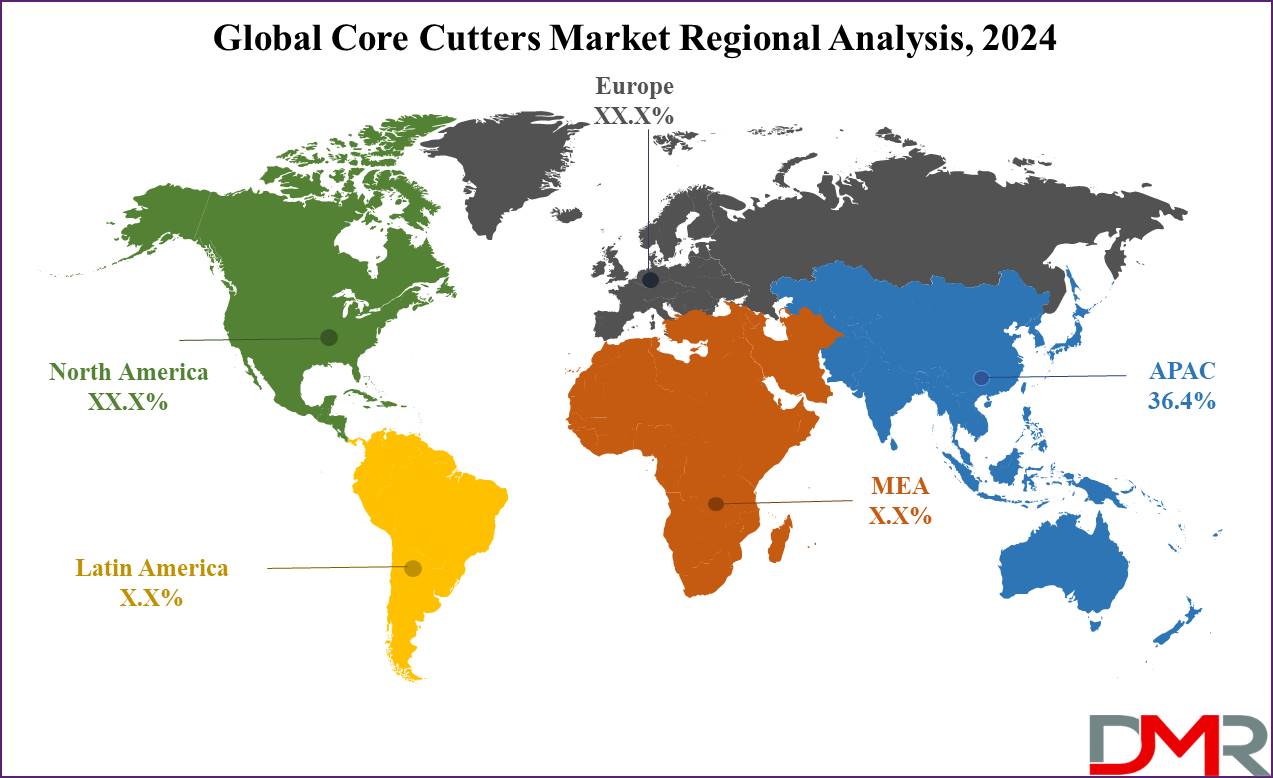

- Regional Insight: Asia Pacific is expected to hold a 36.4% share of revenue in the Global Core Cutters Market in 2024.

- Use Cases: Some of the use cases of Core Cutters include construction & demolition, utility installations, and more.

Use Cases

- Construction & Demolition: Core cutters are commonly used to create accurate holes in concrete, brick, or masonry for installing plumbing, electrical wiring, and HVAC systems in construction or demolition projects.

- Road & Bridge Maintenance: They are important in cutting through concrete surfaces like roads and bridges for repairs, allowing the placement of expansion joints or drainage systems.

- Utility Installations: In the telecommunications & utility sectors, core cutters are used to drill access points for installing underground cables, pipes, and utility lines.

- Test Samples & Structural Analysis: Core cutting machines are utilized to attain core samples from concrete structures for quality testing and analysis in engineering, ensuring compliance with safety standards.

Market Dynamic

Driving Factors

Increasing Infrastructure Development

The growth in global construction activities, like commercial buildings, residential projects, and urban infrastructure development, drives the need for core cutters to support better cutting and drilling in concrete and masonry.

Advancements in Technology

Innovations in core cutting equipment, such as better durability, efficiency, precision, and automation features, are attracting industries like construction, mining, and utilities, boosting the market's growth.

Restraints

High Initial Investment Costs

Core cutting machines, mainly advanced or automated models, can be very costly, making it challenging for small and medium-sized enterprises (SMEs) to adopt them, thus limiting market growth.

Skilled Labor Requirement

Operating core-cutting machines demands skilled labor for accurate and safe handling. A shortage of trained operators or the demand for large training can slow down the adoption of these machines, restricting market expansion.

Opportunities

Emerging Markets & Infrastructure Expansion

Rapid urbanization and infrastructure development in emerging economies present a significant growth opportunity for core cutters, as these regions invest in new construction, utilities, and transportation networks.

Green Construction & Renovation Trends

The higher demand for sustainable and energy-efficient buildings drives opportunities for core cutting in retrofitting and renovating older structures. Core cutters are important for creating openings for modern systems like solar panels, energy-efficient HVAC, and plumbing upgrades.

Trends

Automation & Smart Technology Integration

The adoption of automated and smart core cutting machines equipped with features such as digital controls, remote operation, and real-time performance monitoring is on the rise. This not only enhances precision, reduces labor dependency, and improves overall efficiency in construction projects, but also supports digital health monitoring of the equipment, enabling predictive maintenance, early fault detection, and extended machine lifespan.

Lightweight & Portable Machines

There is a growing trend toward developing lighter and more portable core-cutting machines without compromising power and efficiency. These machines are developed for simple use in confined spaces, making them ideal for smaller construction sites and renovation projects.

Research Scope and Analysis

By Type

The growth of automatic core cutters is playing a key role in the growth of the core cutters market and it is expected to dominate the market in 2024, as these machines, can operate with minimal human intervention, improve precision, and minimize errors during cutting, making them highly effective for construction and industrial projects. Automatic models also save time & labor costs by performing tasks faster & more accurately in comparison to manual systems.

Their user-friendly interface & advanced features, like programmable settings, make them accessible to operators, even with limited technical skills. As industries look to enhance productivity and reduce downtime, the demand for automatic core cutters is growing, driving overall market expansion. Further, semi-automatic core cutters are growing at a steady rate in driving growth in the market by providing a balance between automation & manual control.

These machines help to boost efficiency while still allowing operators to make adjustments as needed, providing more flexibility than fully automatic models. They're more affordable, making them accessible to small and mid-sized companies. By enhancing precision and reducing operator fatigue without the high costs of complete automation, semi-automatic core cutters are appealing to a broader range of users, contributing to market growth.

By Application

The food and beverage industry is anticipated to lead the market growth of the core cutters market in 2024 by requiring better cutting solutions for packaging and processing materials. Core cutters are utilized in the production of packaging, like paper, plastic, and film rolls, which are essential for food wrapping and sealing. In beverage production, they help in cutting cores for labels and other materials.

As the need for packaged food and beverages continues to rise, mainly in response to consumer preferences for convenience, core cutters are becoming increasingly important to maintain efficiency in production and packaging, fueling growth in this sector.

Further, in the electronics industry, core cutters play a vital role in the production of materials like insulation films, circuit boards, and mainly tapes. These materials often come in rolls, and core cutters are used to precisely cut them to the required sizes for further processing.

With the growth in the demand for electronics, from smartphones to advanced

medical devices, the need for effective material processing is increasing, which drives the adoption of core cutters, contributing to the overall market growth in this sector.

The Core Cutters Market Report is segmented on the basis of the following

By Type

- Automatic

- Semi-Automatic

- Manual

By Application

- Food & Beverages

- Electronics

- Household Cleaning Products

- Cosmetics

- Pharmacy & Healthcare

- Others

Regional Analysis

The Asia Pacific region is a major driver of growth in the core cutters market and is projected to lead the market in 2024 with a

share of 36.4% due to rapid industrialization and expanding infrastructure projects in countries like China, India, and Southeast Asia. Also, the boom in the construction, manufacturing, and electronics industries in this region creates a high demand for core cutters to handle materials like concrete, metals, and packaging materials.

In addition, the region's growing population and urbanization are fueling growth in sectors like food and beverage, further increasing the need for core-cutting equipment. With government investments in infrastructure and manufacturing,

Further, North America is also expected to have a significant share of the market due to its well-established construction, automotive, and electronics industries. The region’s focus on advanced manufacturing and infrastructure development drives demand for efficient cutting solutions.

In addition, the rise of smart technologies and automation in the U.S. and Canada boosts the adoption of advanced core cutters. The increasing need for packaging materials in the food and beverage sectors further supports market expansion in North America.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the core cutter market is shaped by both established players & emerging companies providing a range of products, from basic manual machines to advanced automated systems. Companies are aiming at innovation, enhancing machine efficiency, and integrating smart technology to gain a competitive edge.

Price competitiveness is a key factor, with manufacturers balancing between affordable solutions and high-performance models. In addition, the market is seeing better collaboration with industries like construction, electronics, and packaging, as businesses look to meet rising demand with tailored cutting solutions.

Some of the prominent players in the Global Core Cutters are

- Hilti Corp

- Control Group

- Elite Cameron

- Appleton

- Double E Company

- Bosch

- Universal Converting

- Coretech

- Deacro Industries

- Eijkelkamp

- Other Key Players

Recent Developments

- In May 2024, Ethicon launched the ECHELON LINEARTM Cutter, the first linear cutter to market with combined innovative & proprietary technologies of 3D-Stapling Technology and Gripping Surface Technology (GST), which allows greater staple line security and can help surgeons reduce risks and support patient outcomes.

- In May 2024, Kaiser's introduced PROFI cutter, which features finely tuned saw teeth and precise drilling diameter, is perfectly aligned for installing Kaiser boxes. The Trilo technology transforms precision cutting with its trilobular and ensures unparalleled accuracy and extended durability, surpassing traditional round saw blades.

- In November 2023, Reach Robotics engineered a high-force Cutter for the US Navy, which has no issue cutting through the 1.4” diameter orange cable on the first try. Along with it, it can cut through several lines, including 550 cord, an Amsteel blue line, a Kevlar line, and several normal boat handling lines.

- In September 2023, Silhouette America, Inc. launched four new industry-leading craft cutting machines: CAMEO5, CURIO2, CAMEO5 PLUS, and Portrait 4. Each new machine brings with it new tool options and growing capabilities to help crafting enthusiasts, business owners, and anyone else who wants to take their DIY game to the next level. These next-generation crafting machines are unlike any other device currently on the market, for better material diversity, new tool options, and an improved user experience.

- In March 2023, Husqvarna launched a compact, powerful power cutter, K 540i, and a battery plate compactor, LF 60i LAT to expand its offerings in battery-powered machines, as both machines complement the company’s BLi 36 V battery offering, a platform that already assists a wide variety of hardscaping and construction applications.