Market Overview

The

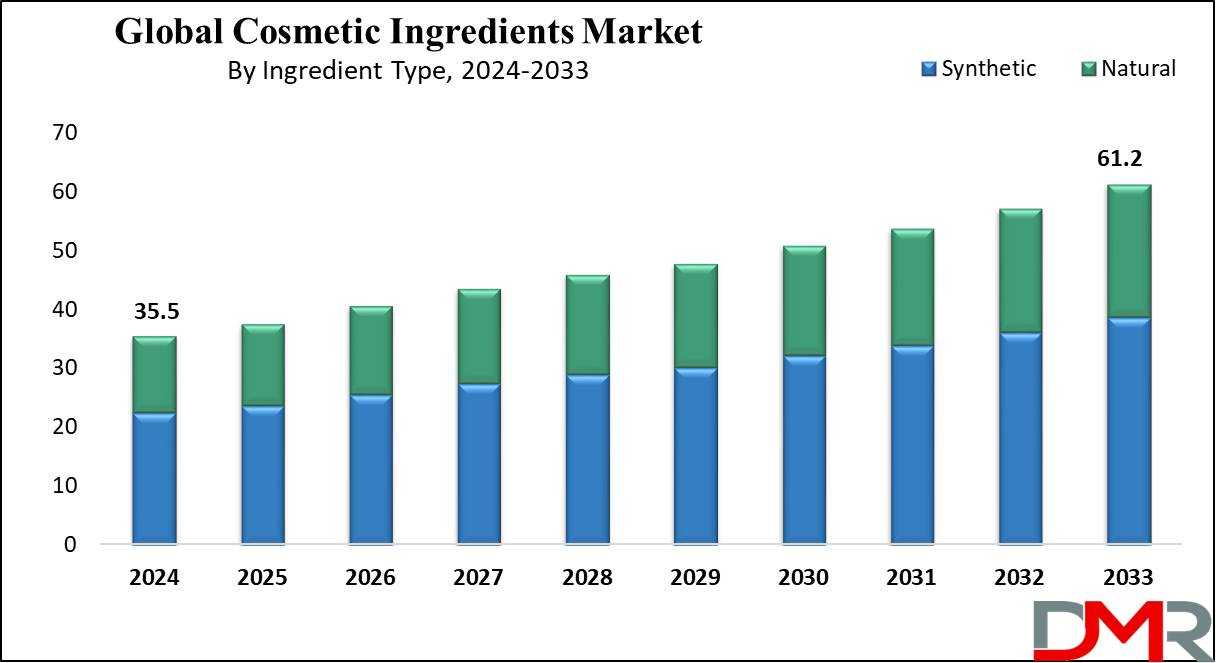

Global Cosmetic Ingredients Market size is expected to reach a

value of USD 35.5 billion in 2024, and it is further anticipated to reach a market

value of USD 61.2 billion by 2033 at a

CAGR of 6.2%.

The global cosmetic ingredient market keeps on showing steady growth; this is partly induced awareness among consumers concerning skincare and personal care. Coupled with innovation in sustainable or natural ingredients, this increasingly aware-of-the-latest beauty and wellness trends surge is the future course as far as the industry takes. Moreover, an increase in disposable incomes in emerging economies fuels consumer spending on premium Cosmetic Products and, hence, requires superior quality ingredients. The trend of personalization in beauty, wherein consumers prefer products personalized to their skin type and choices, has further fueled demand for different and specialized cosmetic ingredients.

Considering the growth in consumer demand for organic and natural beauty products, leading companies have increasingly used clean beauty formulations in order to keep pace with the market trend. This fast segment growth automatically leads to growth in demand for raw materials that will make these sorts of products possible plant-based oils, natural extracts,

Protein Ingredients, and sustainable preservatives.

There is also the priority of environmental sustainability in view, whereby cosmetic industries seek to incorporate ingredients into their formulations that are biodegradable, well-sourced, and 'green'. The millennials and the post-millennials are those who have shown the greatest trend in using such formulations and, as such, have driven

cosmetic companies to make environmental-friendly manufacturing, refill options for packaging, and minimization of generated wastes some of the priorities.

However, there are some challenges the cosmetic ingredients market has to face. The regulatory framework in many countries, especially in the European Union and North America, is getting increasingly strict, which may raise limitations on the use of some ingredients or require additional testing. Increasingly complex regulations, especially regarding the safety and efficacy of new ingredients, may create some problems for manufacturers in terms of compliance and product development timelines. Moreover, premium pricing for raw materials high pricing along with high demands for R&D in innovating the ingredients not only adds extra cost to that but on occasion probably just doesn't work harmoniously with perceived marketplace perceptivity with the pre-determined model of prices.

Several opportunities lie in the market for future growth, especially regarding biotechnology and sustainable sourcing. Biotechnology has given rise to the introduction of bio-based cosmetic ingredients-fermented or even lab-grown alternatives-to become one of the biggest disruptors in the market soon. This is because biotechnological innovations can create sustainable raw materials that are almost similar to their natural counterparts, giving companies a competitive advantage in this fast-changing market. This is further compelled by the increasing consumer demand for safety, efficacy, and environmental sustainability. The booming beauty e-commerce and social influence would further extend the expansion, hence the growth possibility of cosmetic ingredient manufacturers.

The global beauty industry is steadily growing, with consumer spending on beauty products increasing. Americans are spending an average of USD 211.82 annually in 2022. Major beauty brands such as L'Oréal, Unilever, and Estee Lauder have dominated the market and made billions in revenue annually. Social media and e-commerce are leading the growth of the industry. For instance, social media platforms like Instagram have become key drivers of consumer discovery, while 37% of shoppers find new brands through ads, and 66% are influenced by endorsements from influencers.

This sector, particularly since the pandemic, has been driven further upward by online shopping; by 2029, a segment is expected to reach 26.0% of the total global beauty market. Millennials remained the biggest spenders at an average of USD 2,670 annually in expenditure on beauty products, with both Gen Z and Baby Boomers spending less. The companies spent an estimated USD 7.7 billion on ads in 2022 and leaned even more than before on digital media for consumer attention.

The US Cosmetic Ingredients Market

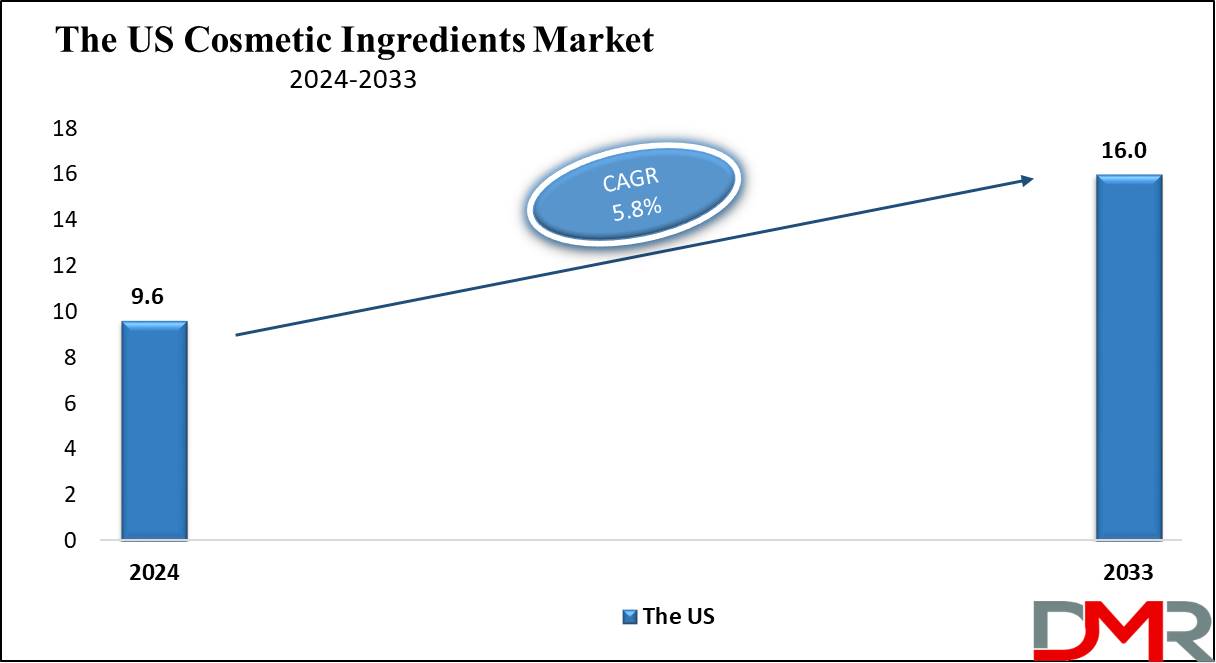

The US Cosmetic Ingredients Market is projected to be valued at USD 9.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 16.0 billion in 2033 at a CAGR of 5.8%.

The U.S. cosmetic ingredients market will continue to witness stable growth on account of the growing demand for more personalized services and sustainable skincare solutions among consumers. Millennial and Gen Z consumers fuel this growth, and as interest in clean and natural beauty products increases, demand will continue to rise for organic and cruelty-free formulations. These are the leading demographics that push for ingredient transparency and product efficacy, looking out for solutions that match health, wellness, and environmental values.

U.S. consumers' high disposable income levels support strong market demand. Consumers willingly spend more for high-quality eco-conscious formulations driving its expansion. E-commerce and social media also play a part in making innovative beauty brands with natural or sustainable ingredients more readily accessible for purchase by consumers.

With America being one of the largest beauty markets worldwide, its continuing role as one of the biggest cosmetic ingredient markets fuels an increasing demand for bio-based and natural cosmetic ingredients such as plant oils, extracts, and sustainable preservatives contributing to further growth of the U.S. cosmetic ingredients market globally.

Cosmetic Ingredients Market: Key Takeaways

- Global Market Value: The Global Cosmetic Ingredients Market size is estimated to have a value of USD 35.5 billion in 2024 and is expected to reach USD 61.2 billion by the end of 2033.

- The US Market Value: The US Cosmetic Ingredients Market is projected to be valued at USD 16.0 billion in 2033 from a base value of USD 9.6 billion in 2024.

- The US Market Growth Rate: It is expected to witness subsequent growth in the upcoming period as it holds at a CAGR of 5.8%.

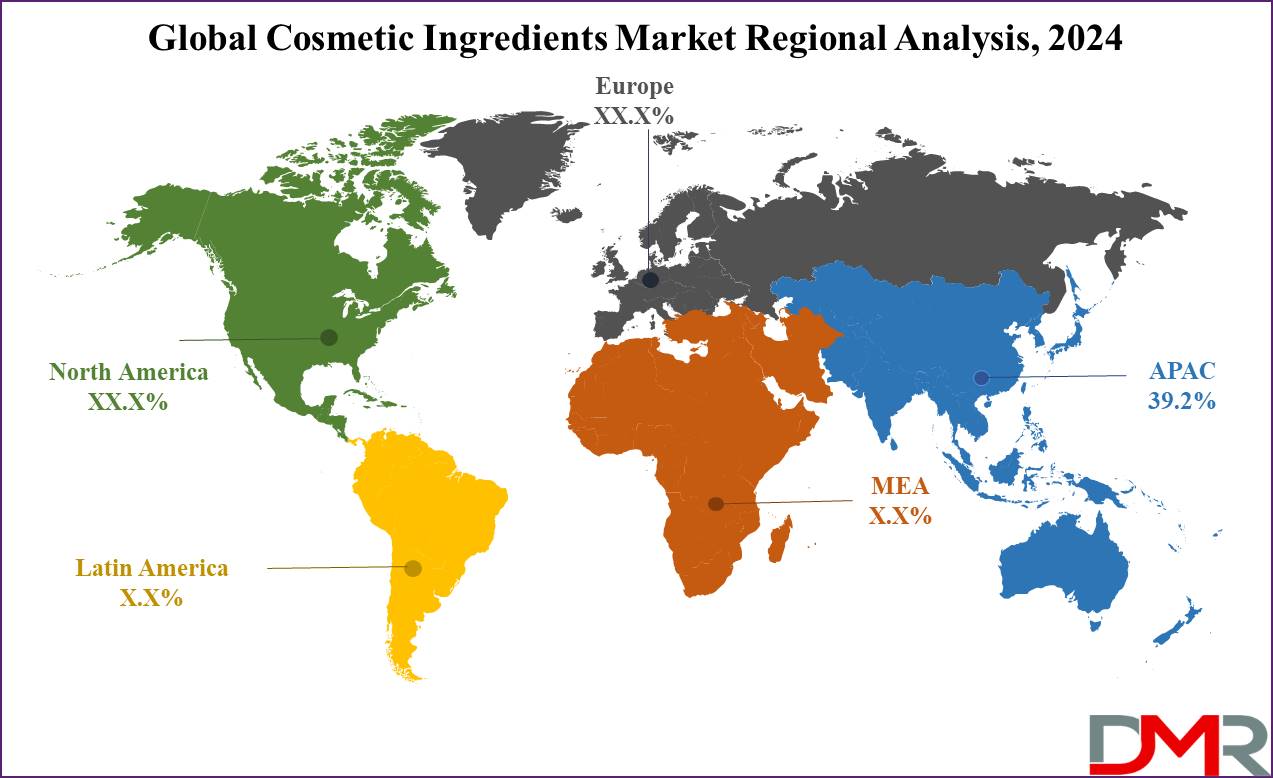

- Regional Analysis: Asia Pacific is expected to have the largest market share in the Global Cosmetic Ingredients Market with a share of about 39.2% in 2024.

- Key Players: Some of the major key players in the global cosmetic ingredient market are BASF SE, Dow Inc., Ashland Global Holdings Inc., Clariant AG, Evonik Industries AG, Solvay SA, and many others.

- Global Growth Rate: The market is growing at a CAGR of 6.2 percent over the forecasted period.

Cosmetic Ingredients Market: Use Cases

- Personalized Skin Care Products: Customized skincare products contain specially blended ingredients designed to address specific skin concerns such as acne, aging, and dryness; providing tailored solutions while increasing user satisfaction through personalized care.

- Natural Cosmetic Formulations: In natural cosmetics, products are crafted using plant oils, extracts, and botanicals sourced from sustainable resources to formulate safe and eco-friendly skincare. In keeping with sustainability goals and consumer preference for chemical-free options for skincare solutions.

- Anti-Aging Products: Anti-aging skincare contains peptides and antioxidants that work in tandem to reduce signs of aging, such as wrinkles and fine lines. This range caters more to mature skin with solutions and makes it look younger.

- Sunscreen Formulations: Advanced sunscreens use mineral-based active ingredients such as zinc oxide and titanium dioxide, which provide effective broad-spectrum UV protection and appeal to increasingly valued skin health, ecological sensitivity, and sensitive skin.

Cosmetic Ingredients Market: Dynamic

Trends in the Cosmetic Ingredients Market

Clean and Sustainable BeautyOne major trend in the global cosmetic ingredients market is an increasing focus on clean, natural, and eco-friendly ingredients. Due to increased consumer awareness regarding environmental and health impacts associated with product usage, more consumers are opting for eco-friendly and ethically sourced ingredients, plant-based alternatives that do not test on animals, cruelty-free alternatives as well as products free from chemicals like parabens and sulfates.

Brands must adapt their offerings to accommodate consumers' likings, thus driving up demand for ingredients that help meet this objective. Environmentally-friendly packaging and transparent ingredient sourcing practices have also become major influences when making purchase decisions, prompting manufacturers to invest more heavily in responsible sourcing practices such as green chemistry. Biodegradable cosmetic ingredients have thus become more accessible.

Personalization and Customization

Another trend transforming the cosmetic ingredients market includes personalized beauty. In an era where technology, AI, and data analytics continuously improve, it has now become easier for brands to offer bespoke skincare and cosmetic products that meet individual skin types, concerns, and preferences. Therefore, this trend increases demand for those ingredients that have the possibility of being tailored for various formulations in order to make certain products more accessible to consumers facing specific skin conditions.

Moreover, the "minimalism" trend, where consumers want fewer but effective ingredients, fueled interest in multi-functional ingredients delivering several skincare benefits from a single product. Brands have also leveraged these trends by designing ingredients that can be blended to build very personalized, targeted solutions; further increasing the allure of customized formulations in the beauty sector.

Growth Drivers in the Cosmetic Ingredients Market

Rising Demand for Anti-Aging Products

Anti-aging skincare still is one of the major growth factors in the global cosmetic ingredients market. Due to the aging of the global population and the rising concern of consumers about wrinkles, fine lines, and skin elasticity, anti-aging active ingredients are increasingly in demand. With a greater tendency toward collagen production, skin hydration, and wrinkle reduction, ingredients such as retinol, peptides, antioxidants, and hyaluronic acid are in great demand.

This demand is significantly higher among baby boomers and millennials who include anti-aging in their skincare routine. As a result, there is a continuous rise in the development and application of these activities in cosmetics, thus driving the market.

Growing Beauty Consciousness Among Consumers

An increasing number of consumers, especially in emerging markets, are increasingly becoming beauty-conscious, thereby increasing demand for innovative cosmetic products. Social media influence, celebrity endorsements, and an increasing number of beauty influencers drive consumer awareness and interest in cosmetics. Therefore, consumers move toward beauty-enhancing and skin-health-improvement products;

hence, most of the ingredients related to their demand show upward trends in demand. Secondly, this is encouraged by an increased rate of spending on self-care and wellness activities that involve beauty and skincare routines. The increasing awareness of beauty is driving the demand for cosmetic ingredients in the global market, and manufacturers are continuously innovating and expanding their ingredient offerings to meet the changing needs of the modern consumer.

Growth Opportunities in the Cosmetic Ingredients Market

Expansion of Organic and Vegan Cosmetics

Growth opportunities in the cosmetic ingredients market would be highly contributed by the worldwide trend towards veganism and organic lifestyles. There is an increased demand by consumers for vegan and organic products without animal-derived ingredients or other chemicals. This is opening new frontiers toward the development of plant-based, cruelty-free ingredients that not only meet ethical consumer demands but also have skin health benefits.

Companies manufacture them by adding organic and vegan-certified ingredients to their formulation, such as plant oils, extracts, and botanicals. Even though most beauty brands increasingly apply this philosophy, the market potential of organic and vegan cosmetic ingredients is very high, especially in regions with rapidly growing environmental awareness, like North America and Europe.

Technological Advancements in Ingredient Development

New opportunities offered by developments in biotechnology and nanotechnology open new frontiers for innovation in the cosmetic ingredients market. Biotechnology made possible the development of ingredients that are bio-fermented, sustainable, and effective, while nanotechnology has enhanced the delivery systems of active ingredients to reach better absorption and efficacy on the skin.

These further advances open the way to making more potent, efficient, and skin-compatible ingredients with wide activity, from anti-aging to acne. In other words, these emerging technologies further facilitate the development of next-generation cosmetic ingredients with superior performance, pointing to new directions in the market.

Restraints in the Cosmetic Ingredients Market

Regulatory Challenges

One of the main constraints within the global cosmetic ingredients market is the growing complexity of regulatory requirements in different regions. Cosmetic ingredients must undergo extensive testing and compliance to fulfill the safety requirements laid down by regulatory bodies, such as the FDA in the U.S. or the European Medicines Agency in Europe. Furthermore, for new ingredients, more safety assessments may be necessary for regulatory authorities, therefore further complicating the approval process in a more complex manner. Some of these regulatory hurdles might slow down innovation increase the costs of cosmetic manufacturers and reduce the market growth for specific cosmetic ingredients.

High Cost of Research and Development

The increasing demand for advanced puts pressure on research and development costs, which in this area is growing under the pressure of increasingly demanding cosmetic ingredients with advanced performances. The development of new ingredients requires an investment in scientific research, tests, and clinical trials that ought to correspond to consumer expectations in effectiveness, sustainability, and safety.

Besides, high costs associated with the sourcing of rare, organic, or special ingredients will also increase the general production cost of cosmetic products, thus making them unaffordable for price-sensitive consumers. This could be the restraint in the growth of the market because R&D costs a lot, and innovation for cosmetic ingredients would likely impact their affordability and accessibility.

Research Scope and Analysis

By Ingredient Type Analysis

With the advancement of technology, synthetic cosmetic ingredients are projected to dominate the global market in this segment, basing their prominence on cost-effectiveness, flexibility, and direct solutions to specific consumer needs. Cosmetic ingredients are designed within the labs, hence controlling their properties with precision. This would mean consistency and stability in the products. It makes the ingredient ideal for producers who are keen on bulk production and product uniformity.

Synthetic ingredients also can be designed to accomplish a variety of functions: humectant, anti-aging, and textural benefits, among others. Or they can be used to boost a cosmetic's performance-such as, making sunscreens more protective or moisturizers more hydrating. Synthetic ingredients are also less expensive than natural ingredients, hence they become the preference of major cosmetic brands that have to maintain low production costs so that their products can be cheaply priced and competitive in the mass market.

Besides, the ability to make synthetic ingredients in bulk means companies can supply global demand for beauty and personal care products, thereby making the latter available in the market. This is a very significant factor in the highly competitive market that expects high quality at cheap prices. Though the demand for natural and organic cosmetics is growing among consumers, synthetic ingredients dominate the market owing to scalability, efficiency, and cost-related benefits that make them indispensable to the industry.

By Product Type Analysis

The dominance of surfactants is anticipated since they play a fundamental role in most cosmetic and personal care formulations, hence making them one of the most dominant product types within the global cosmetic ingredients market. Surfactants are majorly used for their cleansing, emulsifying, and foaming properties; hence, they form an important ingredient in products such as shampoos, body washes, facial cleansers, and lotions. They reduce the surface tension between oil and water, enabling them to clean dirt, oil, and impurities effectively both from skin and hair primary purpose for daily hygiene.

Surfactants are also highly versatile; they can be used across various skin types, formulations, and product categories, hence very important for manufacturers seeking to make a variety of products addressing diverse consumer needs. Greater consumer awareness regarding skin health and hygiene is also driving demand for surfactants, which will afford better performance and smoothness to the skin.

Besides, surfactants will play a vital role in formulating efficient anti-aging and moisturizing formulations, hence their application across product categories in beauty and personal care is also widespread. Extensive applications of surfactants, besides their performance enhancement capability and providing desirable product attributes to the consumer, make them stay in leading positions in the cosmetic ingredients marketplace.

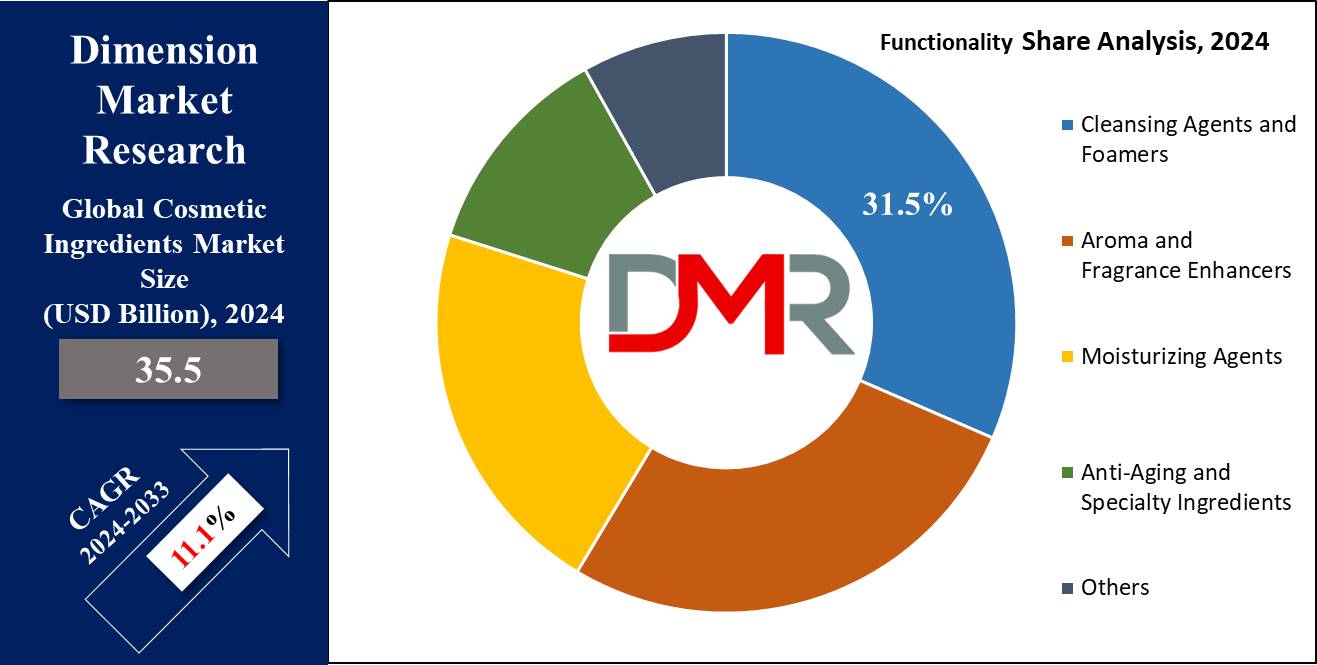

By Functionality Analysis

Cleansing agents and foamers are expected to dominate the cosmetic ingredients market, as they play an indispensable role in personal hygiene and a skincare routine. This ingredient class is necessary in formulating products that can remove dirt, oil, and impurities from skin and hair. Consumers are becoming more particular about skincare and hygiene; this has resulted in substantial demand for cleansing agents and foamers. These ingredients provide the desired foaming action in products such as facial cleaners, body washes, and shampoos, which consumers associate with effective cleaning.

Further, they emulsify and dissolve both water-soluble and oil-based impurities; hence, they find essential applications in a wide range of cosmetic formulations. With growing concern for clean, healthy skin, the demand for products with active cleansing agents and effective foamers has continued at the top of the market. Besides cleansing, such ingredients can also have auxiliary functions, like conditioning for skin texture improvement, maintenance of hydration, and offering a true feel of luxury.

Their versatility allows them to be used in various formulations such as bar soaps, liquid soaps, cleansing wipes, and facial masks. This versatility, along with the rising demand from consumers for effective yet gentle cleansing solutions, has ensured that cleansing agents and foamers remain at the helm of the global cosmetic ingredients market.

By End-User Application Analysis

Skincare is anticipated to dominate the end-user application in the global cosmetic ingredients market, considering the rise in awareness of skin health globally and the urge to retain youthful, glowing skin. For consumers of all age groups, skin care products, including moisturizers, serums, toners, sunscreens, and anti-aging treatments, have become an important part of daily routines. The skin care world keeps on innovating day by day, with ingredient innovations in peptides, hyaluronic acid, retinol, antioxidants, and more, scientifically proven to have a lot of benefits, from hydration improvements up to anti-aging effects.

Consumers are becoming increasingly educated about skincare and are looking to buy products that can support a variety of skin-specific concerns, such as dryness, acne, hyperpigmentation, and wrinkles. This has created a high demand for cosmetic ingredients that can help solve these specific needs. An increase in disposable incomes, especially in emerging economies, together with the growing pollution and other environmental factors affecting skin health, has also contributed to the demand for value-added skin care products.

More and more consumers, especially females, have grown more interested in skincare on their path of building an end through rising social media and beauty influencers. Furthermore, interest has picked up since the self-care movement that underlines skin wellness. The continuous demand for more active, effective, targeted, and innovative skin care products has kept this segment in the lead for cosmetic ingredients.

By Consumer Demographic Analysis

The female demographic is projected to dominate the global cosmetic ingredients market due to women's heightened interest in beauty and personal care products. Traditionally, women have been the largest consumers of cosmetics, with a greater proportion of marketing efforts and product development directed toward female preferences and needs. Women tend to use a wide range of beauty and personal care products, like skin care, hair care, makeup, and fragrances, which are major contributors to the total demand for cosmetic ingredients.

Besides, the changing notion of beauty and growing consciousness regarding skincare and grooming have pushed women to go for wider and more personalized beauty routines. This has resulted in several niche markets such as anti-aging, organic, and sensitive skin products. Besides, female consumers would more likely spend on premium beauty products, hence raising demand for high-class and innovative ingredients.

An increasing trend in self-care and wellness among women influences the market and raises demands for cosmetics that offer not only beauty but also health benefits. As women remain the driving force in the cosmetics industry, manufacturers are striving to produce products that would serve them more precisely, and for that very reason, females remain the strongest segment in the consumption of cosmetic ingredients globally.

The Cosmetic Ingredients Market Report is segmented on the basis of the following

By Ingredient Type

- Synthetic

- Petrochemicals

- Silicones

- Other Synthetic Compounds

- Natural

- Plant-Based Extracts

- Mineral-Based Ingredients

- Animal-Derived Ingredients

- Biotech-Derived

By Product Type

- Surfactant

- Emollient

- Polymer

- Oleo-chemical

- Botanical Extracts

- Herbal Extracts

- Essential Oils

- Active Ingredients

- Retinoids

- Alpha and Beta Hydroxy Acids (AHAs & BHAs)

- Peptides

- Rheology Modifier

- Thickening Agents

- Gelling Agents

- Preservatives

- Synthetic Preservatives

- Natural Preservatives

- Antioxidant

- Vitamins

- Coenzyme Q10

- Plant-Derived Antioxidants

- Emulsifier and Stabilizer

- Others

By Functionality

- Cleansing Agents and Foamers

- Detergents

- Mild Surfactants

- Aroma and Fragrance Enhancers

- Synthetic Fragrances

- Natural Aromatics

- Moisturizing Agents

- Anti-Aging and Specialty Ingredients

- Anti-Wrinkle Agents

- Whitening Agents

- Anti-Pollution Agents

- Others

By End User Application

- Skin Care

- Face Creams and Lotions

- Sunscreens

- Anti-Aging Products

- Oral Care

- Toothpaste

- Mouthwash

- Whitening Agents

- Hair Care

- Shampoos

- Conditioners

- Styling Products

- Hair Colorants

- Makeup and Decorative Cosmetics

- Foundations

- Lipsticks and Glosses

- Mascaras and Eyeliners

- Body Care

- Moisturizers

- Body Wash and Scrubs

- Deodorants and Antiperspirants

By Consumer Demographics

Regional Analysis

Asia Pacific is projected to be the leading contributor in this market as it

holds 39.2% of market share by the end of 2024. The global cosmetic ingredients market due to its large and diversified consumer market, increasing economic prosperity, and rapid advancement of technologies involved in the beautification and care of humans.

More than 4.5 billion people reside within the geographic boundaries of this region, it also presents a disproportionately large share of young, middle-class consumers who will increasingly invest more in products related to personal care and beauty. This huge consumer base creates a huge demand for cosmetic ingredients, from low-volume skin care to high-volume hair care ranges, makeup, and their specific ingredients.

Besides, countries like South Korea, Japan, and China drive innovation for cosmetic products and formulations by setting global trends in skincare and beauty. This has surely raised uncommon and high-quality cosmetic ingredients in demand with the emergence of K-beauty, J-beauty, and Chinese beauty products. These countries strongly believe in skincare routines and natural beauty, so that is where the consumers' interest in products that contain effective and scientifically approved ingredients lies.

Moreover, with improving disposable income, countries such as India and Southeast Asia have experienced increased spending on high-end beauty products, further driving the market.

APAC also has a robust manufacturing infrastructure supporting both local and global cosmetic ingredient suppliers. Competitive production costs have convinced many international companies to set up their manufacturing plants and R&D facilities in the region to meet the increasing demand.

Moreover, regulatory development in countries like South Korea has created an appropriate environment for innovation, which further encourages the development of newer cosmetic ingredients. It is bound to be so, as demand, innovation, and manufacturing infrastructure have come together to ensure dominance for the Asia-Pacific in the global cosmetic ingredients market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global cosmetic ingredients market is very competitive, with a number of major players dominating the landscape: global chemical companies, specialists in beauty ingredients, and emerging local players all play to meet the growing demand for effective, sustainable, and innovative products. The marketplace is dominated by key players that include BASF, Evonik Industries, Clariant, Dow Chemical, and Croda International, with their very large portfolios of functional ingredients and technological expertise supported by substantial global distribution networks.

Many of the companies manufacturing these ingredients also provide surfactants, emulsifiers, and moisturizers. These companies are noted for investing substantial resources in research and development into the development of new cosmetic solutions and improvements to older technologies. Besides large multinational corporations, regional players are also gaining momentum, especially in the Asia-Pacific market, where local beauty standards and consumer preferences are very different from those in Western markets.

Companies like LG Chem and INOLEX are increasing their presence with products to meet the needs of Asian consumers. Further, the trend for small and specialized ingredient manufacturers of organic and natural ingredients has grown hand in hand with the demand for clean and sustainable beauty. The competitive landscape is also shaped by strategic collaborations, partnerships, and acquisitions, whereby leading companies leverage innovation to enhance product offerings and sustain their market positions in an increasingly eco-conscious industry.

Some of the prominent players in the Global Cosmetic Ingredients Market are

- BASF SE

- Dow Inc.

- Ashland Global Holdings Inc.

- Croda International Plc

- Clariant AG

- Evonik Industries AG

- Solvay SA

- Eastman Chemical Company

- Akzo Nobel N.V.

- Givaudan

- Symrise AG

- Lonza Group

- Innospec Inc.

- Other Key Players

Recent Developments

December 2024:

- Investment: BASF has announced a significant investment in its new South Korean production facility, focusing on expanding its sustainable manufacturing of cosmetic ingredients, addressing the growing demand for eco-friendly solutions in beauty.

- Collaboration: Evonik Industries has formed a strategic partnership with a leading Japanese skincare brand, aiming to co-develop advanced cosmetic ingredients that cater to the unique skin care needs of Asian consumers, especially targeting anti-aging solutions.

November 2024:

- Expo: The "Cosmoprof Asia" Expo in Hong Kong showcased a variety of international cosmetic ingredient suppliers, unveiling innovative solutions in both natural and synthetic ingredients, with a focus on clean beauty trends.

- Conference: The "Global Cosmetic Ingredients Conference" in Shanghai brought industry leaders together to discuss sustainable sourcing, exploring future trends in cosmetic ingredient innovations, with a spotlight on eco-friendly, ethical production methods for beauty products.

October 2024:

- Mergers: Clariant acquired a 60% stake in a Chinese cosmetic ingredient manufacturer, expanding its presence in the fast-growing APAC market and enhancing its ability to cater to the region's growing demand for beauty products.

- Investment: Dow Chemical has invested in expanding its research facility in India, focusing on developing eco-friendly cosmetic ingredients that will meet the needs of India's rapidly growing beauty market, driven by increasing consumer demand.

September 2024:

- Collaboration: Croda International partnered with a top South Korean beauty brand to create a new line of anti-aging ingredients, tailored to meet the unique beauty preferences of Korean consumers, who are highly focused on advanced skincare.

- Expo: The "In-Cosmetics Global" Expo in Paris highlighted new sustainability trends in the cosmetic ingredients sector, with key players presenting biodegradable and natural ingredient innovations, focusing on eco-conscious beauty products for modern consumers.

August 2024:

- Mergers: Evonik Industries successfully merged with a leading U.S.-based cosmetic ingredient supplier, expanding its footprint in North America and enhancing its market position in the region's rapidly growing cosmetic and personal care sector.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 35.5 Bn |

| Forecast Value (2033) |

USD 61.2 Bn |

| CAGR (2024-2033) |

6.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 9.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Ingredient Type (Synthetic, Natural), By Product Type (Surfactant, Emollient, Polymer, Oleo-chemical, Botanical Extracts, Active Ingredients, Rheology Modifier, Preservatives, Antioxidant, Emulsifier and Stabilizer, Others), By Functionality (Cleansing Agents and Foamers, Aroma and Fragrance Enhancers, Moisturizing Agents, Anti-Aging and Specialty Ingredients, Others), By End User Application (Skin Care, Oral Care, Hair Care, Makeup and Decorative Cosmetics, Body Care), and By Consumer Demographic (Male, Female, Unisex). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BASF SE, Dow Inc., Ashland Global Holdings Inc., Croda International Plc, Clariant AG, Evonik Industries AG, Solvay SA, Eastman Chemical Company, Akzo Nobel N.V., Givaudan, Symrise AG, Lonza Group, and Innospec Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cosmetic Ingredients Market size is estimated to have a value of USD 35.5 billion in 2024 and is expected to reach USD 61.2 billion by the end of 2033.

The US Cosmetic Ingredients Market is projected to be valued at USD 9.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 16.0 billion in 2033 at a CAGR of 5.8%.

Asia Pacific is expected to have the largest market share in the Global Cosmetic Ingredients Market with a share of about 39.2% in 2024.

Some of the major key players in the Global Cosmetic Ingredients Market are BASF SE, Dow Inc., Ashland Global Holdings Inc., Croda International Plc, Clariant AG, Evonik Industries AG, Solvay SA, and many others.

The market is growing at a CAGR of 6.2 percent over the forecasted period.