Market Overview

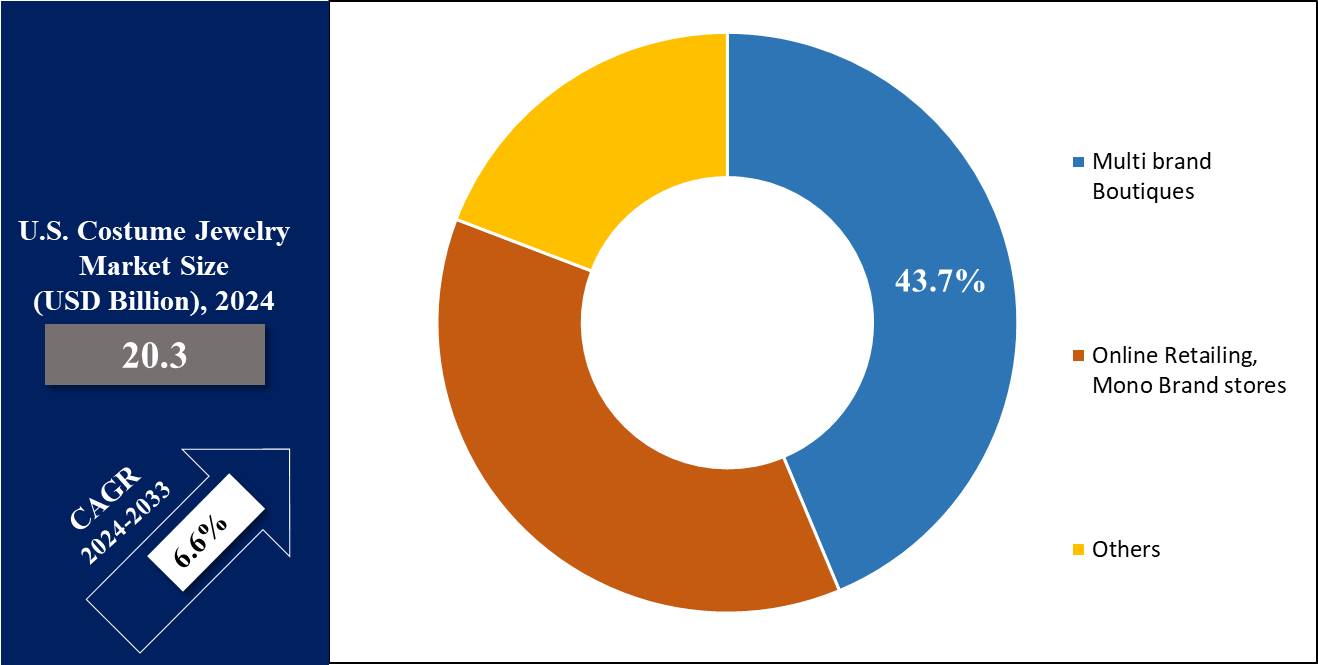

The U.S. Costume Jewelry Market is anticipated to be valued at USD 20.3 billion in 2024 and is further expected to reach USD 36.2 billion by 2033, at a CAGR of 6.6%.

Costume jewelry is an ornamental piece worn with clothing, usually made of low-cost materials instead of expensive metals or stones. It is designed to look fancy like luxury jewelry, but it's not made of real gems or precious metals like gold or silver. Fashion jewelry trends, affordable accessories, and innovative design strategies are shaping the market growth.

It includes several items like necklaces, bracelets, earrings, rings, & hair ornaments which are often made from base metals, such as brass, aluminum, or copper. Beads, rhinestones, plastic, glass, artificial gemstones, and base metals are frequently used to create this jewelry. Increasing adoption of

post-consumer recycled plastics in jewelry components reflects sustainability trends in the U.S. market. This product is available across several fashion and accessory brand stores, department stores, & boutiques. Retail analytics is increasingly used to track customer preferences, optimize inventory, and enhance merchandising strategies.

As per Writer’s Block Live, the costume jewelry market is shaped by dynamic consumer preferences. Notably, 51% of female millennials purchase their own jewelry, reflecting a shift towards self-driven buying behavior. White gold remains a popular choice, favored by 35% of women. Interestingly, the 55 to 64 age demographic exhibits the highest purchase rates for jewelry and watches, highlighting a mature consumer segment's strong demand. Globally, Russia dominates diamond resources with an estimated 650 million carats. On the retailer front, LVMH leads with $54 billion in annual revenue, followed by Chanel at $13.7 billion, showcasing strong market consolidation.

The U.S. costume jewelry market is abuzz with exciting news as leading brands announce a major merger aimed at expanding their global footprint. At a recent press conference, industry leaders highlighted the deal's potential to reshape the market, combining innovative design capabilities and widespread distribution networks.

This strategic alliance is set to enhance customer experiences and drive revenue growth through diversified product offerings. Analysts predict significant opportunities for new entrants and established players, as demand for affordable, stylish accessories continues to rise. With this merger, the industry anticipates stronger competition, advanced sustainability practices—including the integration of post-consumer recycled plastics—and increased consumer engagement.

Key Takeaways

- The U.S. Costume Jewelry Market is anticipated to reach USD 20.3 billion in 2024 and is projected to grow to USD 36.2 billion by 2033, at a CAGR of 6.6%, driven by rising disposable income, fashion trends, and demand for affordable accessories.

- By Product Type, the Earrings & Finger Rings segment is expected to dominate the market with a 33.2% revenue share in 2024, reflecting their popularity for everyday wear and special occasions.

- By Distribution Channel, multi-branded boutiques are projected to lead with a 43.7% revenue share in 2024, offering unique designer items, personalized shopping experiences, and expert guidance. Luxury footwear trends and the growing focus on accessories coordination also influence purchasing behaviors in the market.

- Market growth is fueled by the affordability and customization of costume jewelry, the rise in fashion consciousness, and replication of high-end jewelry designs, while raw material price fluctuations remain a potential restraint.

- Major market players include Chanel S.A., Guess Inc., Gianni Versace S.p.A., Alex and Ani LLC, Pandora A/S, LVMH Moët Hennessy Louis Vuitton SE, Hermes International SA, Hennes & Mauritz AB, ZARA ESPANA SA, and Gucci, competing via innovation, strategic partnerships, and expanded distribution channels.

Use Cases

- Formal Events & Weddings: Allows consumers to look stylish and elegant without the high cost of fine jewelry.

- Fashion Coordination: Enables wearers to match accessories with specific outfits, enhancing overall appearance.

- Theatrical & Costume Plays: Provides affordable, realistic jewelry for performances, enabling accurate character or historical recreations.

- Promotional & Corporate Gifts: Used as giveaways at events, trade shows, or conferences, supporting brand promotion and marketing efforts.

- Everyday Fashion Accessory: Offers versatile, trendy options for daily wear, allowing consumers to experiment with style without significant investment.

Market Dynamic

The U.S. costume jewelry market is rapidly growing as they are less expensive than other fine jewelry and also due to the increasing cost of gold, diamonds, and other precious materials. Another factor that pushes the growth of this market is easy customization and cheaper materials which are affordable for the lower and middle-class consumer.

Manufacturers include stylish colored stone jewelry and many types of costume jewelry at affordable prices, which drives the growth of the market. It also offers replicas of fine pieces of jewelry that require less maintenance, boosting the growth of the market.

Moreover, the market is expected to develop throughout the forecasted period due to a rise in fashion sense, an increase in disposable income, and the adoption of the western culture. However, the increasing price of raw materials used for costume jewelry is hindering the growth of the market.

Research Scope and Analysis

By Product Type

The earrings and fingerings segment is expected to dominate the U.S. costume jewelry market with the largest revenue share of 33.2% in 2024 as they include earrings and fingerings made of cheap material like gems, beads, and brass or nickel. These are popular fashion items for everyday wear as well as special occasions which come in different designs, sizes, and styles to cater to different consumer preferences.

The necklaces and pendants segment is predicted to grow with a high CAGR which includes a range of designs from simple chains to elaborate statement pieces. This segment is impacted by factors like changing fashion trends, cultural influences, and consumer preferences for certain themes. Further, brooches are decorative pins that could be worn on clothing, hats, or bags, driving the growth of this segment.

By Distribution Channel

The multi-branded boutiques as a distribution channel are predicted to dominate the U.S. costume jewelry market with the highest revenue share of 43.7% in 2024 as they carry unique costume jewelry from many known brands and designers. They provide customers with a unique shopping experience centered around designer items, expert craftsmanship, and current fashion.

Further, the online retailing segment is expanding due to its ability to provide customers with convenience and a broad choice of products. Consumers can research and buy jewelry from home, with possibilities for quick shipment and easy returns via e-commerce platforms and online marketplaces. Advanced retail analytics tools are increasingly helping brands optimize inventory, predict trends, and boost customer engagement.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. Costume Jewelry Market Report is segmented based on the following:

By Product Type

- Earrings & finger rings

- Necklace & pendants

- Bracelets & bangles Brooch

- Anklet and Toe Rings

- Others

By Distribution Channel

- Multi brand Boutiques

- Online Retailing & Mono Brand stores

- Others

Competitive Landscape

Major players are competing for market share in the highly saturated U.S. costume jewelry market. These rivals engage in improving strategies like distribution networks, price tactics, product innovation, and attractive design.

The expansion of the market is also impacted by shifting customer tastes, vogue trends, and technological advancement. Market players are working hard to serve a variety of consumer demographics and increase their visibility on the Internet and traditional platforms.

Key players operating in this market are

Chanel S.A,

Guess Inc.,

Gianni Versace S.p.A,

Alex and

Ani,

LLC,

Pandora A/S,

LVMH Moët Hennessy Louis Vuitton SE. Furthermore, businesses often use partnerships, mergers, and acquisitions as tactics to strengthen their position in the constantly evolving and dynamic costume jewelry industry.

Some of the prominent players in the U.S. costume jewelry market are:

- Chanel S.A

- Guess Inc.

- Gianni Versace S.p.A

- Alex and Ani, LLC

- Pandora A/S

- LVMH Moët Hennessy Louis Vuitton SE,

- Hermes International SA

- Hennes & Mauritz Ab

- ZARA ESPANA SA

- Gucci

- Others

Recent Development

- In February 2024, Channel opened its first standalone store in the U.S. dedicated to jewelry and watches.

- In March 2023, Sotheby's announced its inaugural jewelry series, featuring the debut of designs by Brazilian-Lebanese designer Nadine Ghosn as the first guest artist.

- In December 2022, Melorra launched an innovative line called "The Avatar-Inspired Collection" aimed at celebrating contemporary styles and setting a new trend in the jewelry sector.

- In March 2022, Pandora acquired 37 franchise store locations in the US and Canada from Ben Bridge Jeweler, a high-end American watch and jewelry retailer.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 20.3 Bn |

| Forecast Value (2033) |

USD 36.2 Bn |

| CAGR (2023-2032) |

6.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Earrings and finger rings, Necklaces & pendants, Bracelets & bangles Brooch, Anklet, and Toe Rings, and Others), By Distribution Channel (Multi-brand Boutiques, Online Retailing, Mono Brand stores, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Chanel S.A, Guess Inc., Gianni Versace S.p.A, Alex and Ani, LLC, Pandora A/S, LVMH Moët Hennessy Louis Vuitton SE, Hermes International SA, Hennes & Mauritz Ab, ZARA ESPANA SA, and Gucci, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the U.S. Costume Jewelry Market?

▾ The U.S. Costume Jewelry Market size is estimated to have a value of USD 20.3 billion in 2024 and is

expected to reach USD 36.2 billion by the end of 2033.

Who are the key players in the U.S. Costume Jewelry Market?

▾ Some of the major key players in the U.S. Costume Jewelry Market are Chanel S.A, Guess Inc., Gianni

Versace S.p.A, Alex and Ani, LLC, Pandora A/S, LVMH Moët Hennessy Louis Vuitton SE and many others.

What is the growth rate in the U.S. Costume Jewelry Market?

▾ The market is growing at a CAGR of 6.6 percent over the forecasted period.