Market Overview

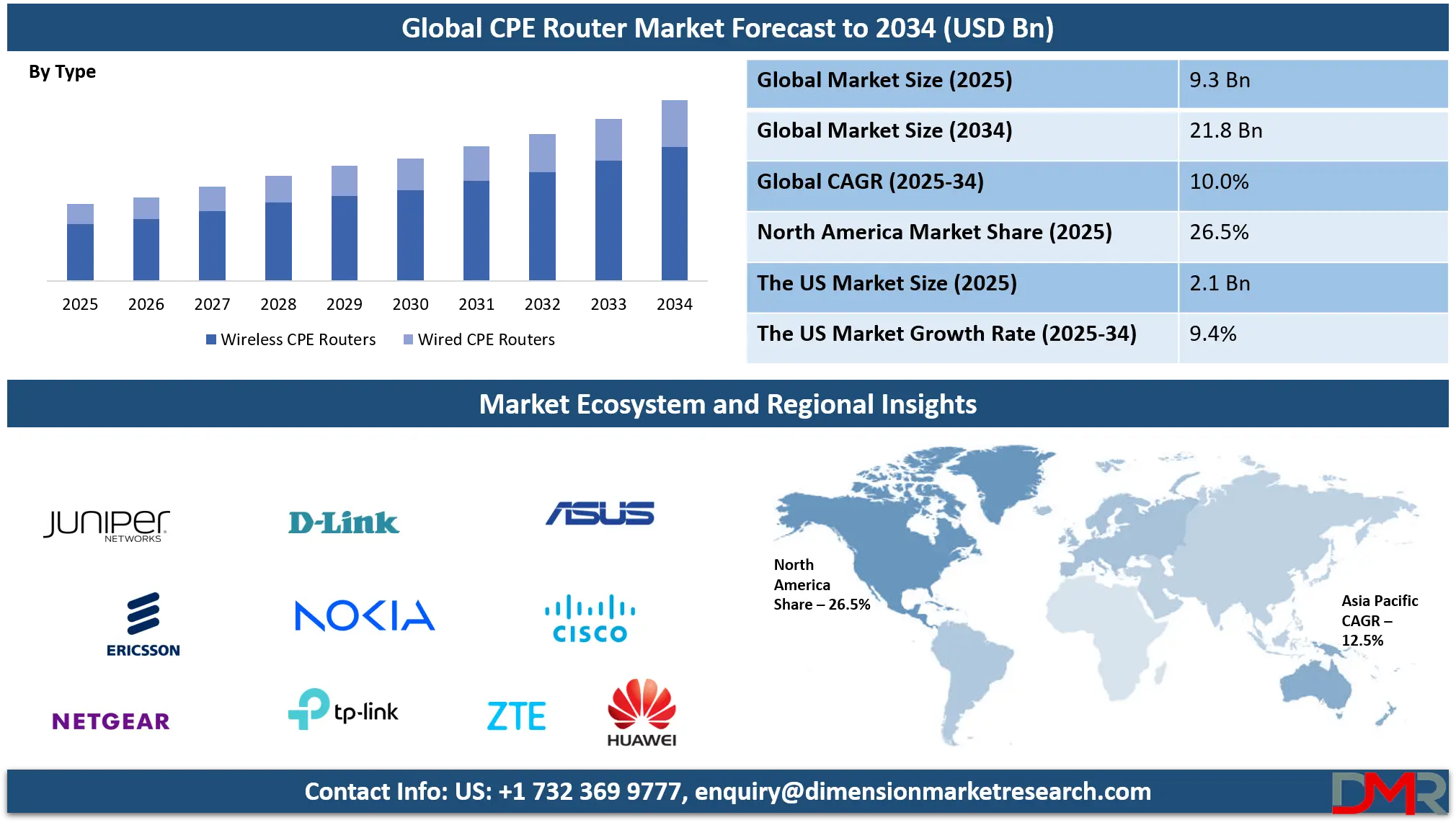

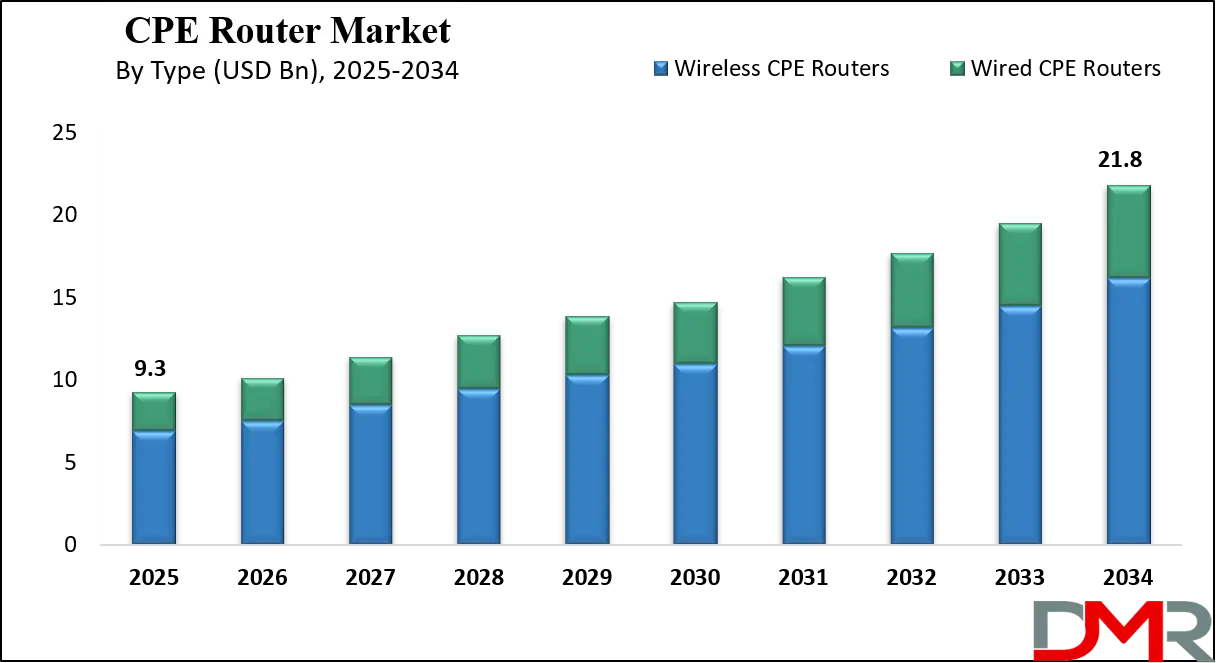

The Global CPE Router Market size is projected to reach USD 9.3 billion in 2025 and grow at a compound annual growth rate of 10.0% from there until 2034 to reach a value of USD 21.8 billion.

A CPE (Customer Premises Equipment) router is a device installed at the user's location—home or office—that connects to the service provider’s network. It acts as a gateway between the internet and connected devices like computers, phones, or smart TVs. These routers handle both wired and wireless internet traffic and often include built-in features like firewalls, parental controls, and support for Wi-Fi 5, 6, or newer standards. CPE routers are critical to delivering internet access, especially in broadband and fiber-to-the-home (FTTH) setups.

The demand for CPE routers has increased due to the growth in the number of internet users, higher data consumption, and growing digital lifestyles. Remote work, online learning, and streaming have created a strong need for reliable internet connections. Service providers are upgrading their infrastructure, pushing for faster and more efficient routers. The roll-out of 5G, fiber optics, and Wi-Fi 6 has also led to a shift in demand toward more advanced CPE routers that can handle high-speed, low-latency connections.

CPE routers have seen major technological upgrades in recent years. Many now support dual-band or tri-band Wi-Fi, beamforming, and mesh networking. Integration of AI for network optimization and remote diagnostics is becoming common. Features like 2.5G and even 10G Ethernet ports, built-in VoIP, and support for smart home ecosystems are also trending. Manufacturers are focusing on making routers more user-friendly with mobile apps and simplified setup processes.

Recent years have seen several important developments in the CPE router market. Many companies are launching 5G CPE routers to meet the growing need for wireless broadband, especially in rural areas. Partnerships between hardware makers and telecom providers are helping speed up deployments. The shift toward open-source and cloud-managed router platforms is allowing service providers more control and flexibility over their networks.

New CPE routers are being designed with energy efficiency and environmental concerns in mind. Manufacturers are using recyclable materials and reducing power consumption. Sleeker designs are replacing bulky models to better suit modern home aesthetics. Compact, wall-mountable, and fanless designs are becoming more common to reduce noise and improve space usage.

CPE routers are now being customized for different regional requirements. For instance, routers in Europe may prioritize fiber support, while in Asia and North America, there's a rising focus on 5G and DOCSIS-based models. Vendors are building multi-band, multilingual, and firmware-upgradable models to suit local markets. This global demand ensures continuous innovation and adaptation in the CPE router space.

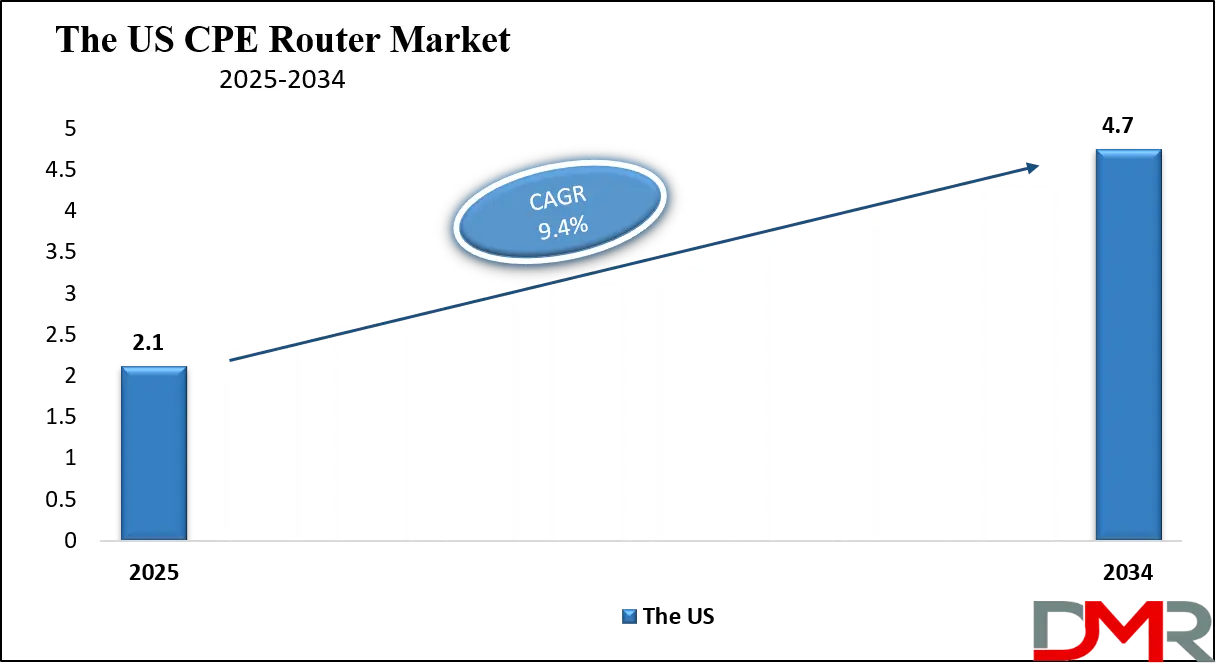

The US CPE Router Market

The US CPE Router Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 9.4% over its forecast period.

The US plays a major role in the CPE router market due to its advanced broadband infrastructure and high internet penetration. With strong demand for high-speed connectivity, the US drives innovation in router technology, including early adoption of Wi-Fi 6, Wi-Fi 7, and 5G CPE solutions. Telecom and cable providers in the US frequently partner with manufacturers to deploy feature-rich routers that meet growing consumer and enterprise needs. The country is also a hub for tech companies that contribute to firmware development, AI integration, and network optimization tools.

Additionally, the US market sets trends in customer experience, pushing for better design, security, and remote management features. Its regulatory standards and large user base influence global CPE router development strategies.

Europe CPE Router Market

Europe CPE Router Market size is projected to reach USD 1.9 billion in 2025 at a compound annual growth rate of 8.6% over its forecast period.

Europe plays a vital role in the CPE router market through its focus on fiber broadband expansion, digital inclusion, and strong regulatory support for open-access networks. Many European countries are rapidly upgrading their internet infrastructure, leading to rising demand for high-performance routers compatible with fiber and gigabit speeds. The region emphasizes sustainability and energy efficiency, encouraging the development of eco-friendly CPE devices.

European service providers often prioritize security, user privacy, and remote management features in router deployments. The market also benefits from strong cross-border cooperation and standardization, which fosters innovation and consistent product quality. Additionally, Europe’s growing interest in smart homes and IoT adoption is driving further need for intelligent, reliable, and easy-to-use CPE router solutions.

Japan CPE Router Market

Japan CPE Router Market size is projected to reach USD 465 million in 2025 at a compound annual growth rate of 10.2% over its forecast period.

Japan plays a key role in the CPE router market due to its advanced technological landscape and high-speed internet infrastructure. With strong government support for nationwide fiber deployment and smart city initiatives, Japan consistently demands cutting-edge CPE routers that support high bandwidth, low latency, and seamless connectivity. The market favors compact, energy-efficient designs tailored for space-constrained urban living.

Japanese consumers also prioritize quality, reliability, and advanced features like Wi-Fi 6/6E, mesh networking, and built-in security. Local manufacturers and telecom providers collaborate closely to develop customized router solutions that meet regional standards and user expectations. Additionally, Japan’s leadership in consumer electronics and innovation helps shape global trends in router performance, smart home integration, and next-generation wireless technologies.

CPE Router Market: Key Takeaways

- Market Growth: The CPE Router Market size is expected to grow by USD 11.7 billion, at a CAGR of 10.0%, during the forecasted period of 2026 to 2034.

- By Type: The Wireless CPE Routers are anticipated to get the majority share of the CPE Router Market in 2025.

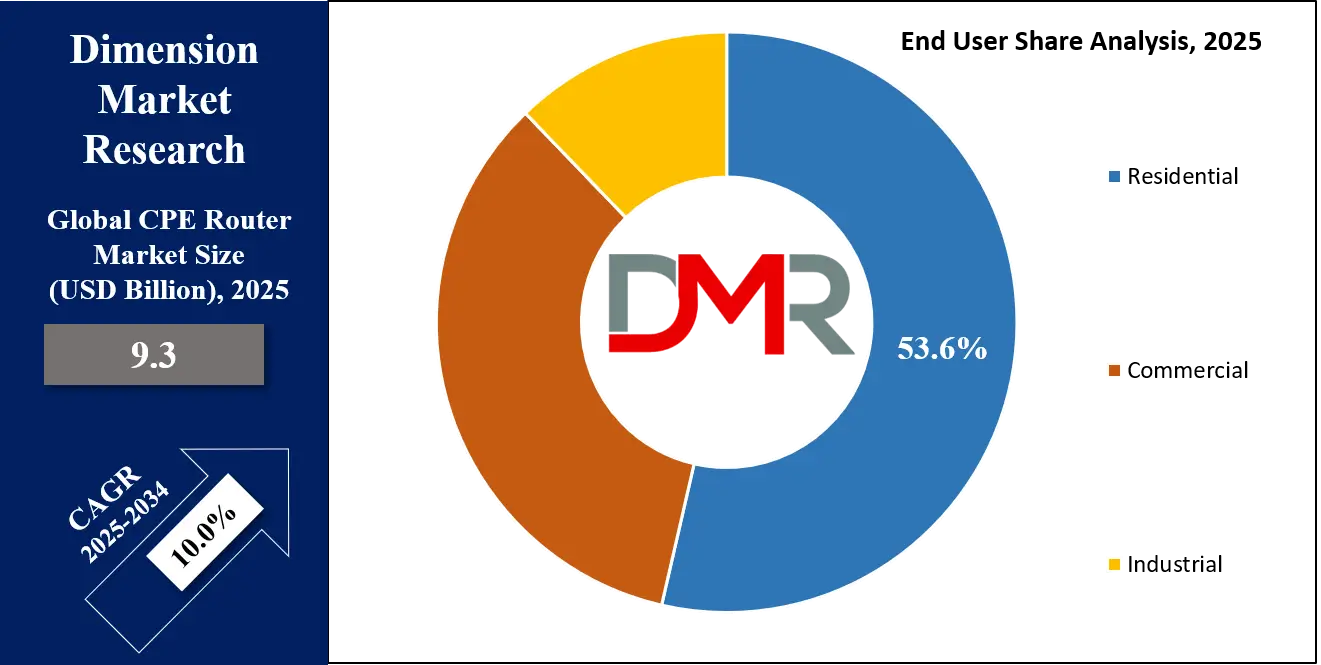

- By End User: The Residential segment is expected to get the largest revenue share in 2025 in the CPE Router Market.

- Regional Insight: Asia Pacific is expected to hold a 38.5% share of revenue in the Global CPE Router Market in 2025.

- Use Cases: Some of the use cases of CPE Router include home internet access, small business networking, and more.

CPE Router Market: Use Cases

- Home Internet Access: CPE routers are widely used in homes to provide stable internet for activities like streaming, gaming, and video calls. They connect to the service provider’s network and distribute internet to multiple devices via Wi-Fi or Ethernet. Advanced models support features like parental controls and smart device integration.

- Small Business Networking: Small businesses use CPE routers to create secure, reliable networks for daily operations. These routers help connect multiple users and devices to the internet, support VoIP services, and often include VPN features for remote access. They ensure smooth operations without the need for complex IT infrastructure.

- Remote and Rural Connectivity: In areas with limited wired internet, CPE routers with 4G or 5G capabilities offer high-speed wireless connectivity. These devices help bridge the digital gap by providing internet access for education, work, and communication where traditional broadband is unavailable. Easy setup makes them ideal for underserved locations.

- Smart Home Integration: Modern CPE routers support smart home ecosystems, enabling control of connected devices like lights, thermostats, and security cameras. They ensure fast, consistent connections across all smart gadgets. With mobile apps, users can monitor usage, manage devices, and optimize network performance from anywhere.

Stats & Facts

- According to IBM:

- The average total cost of a data breach in 2024 is USD 4.88 million, with detection and escalation activities making up the largest chunk, averaging USD 1.58 million. These costs are rising due to increasing threat complexity and longer breach lifecycles.

- Breaches that last over 200 days cost an average of USD 5.46 million, while shorter breach lifecycles save companies about USD 1.39 million. The time to identify and contain breaches dropped slightly, with an average containment period of 64 days and a discovery time of 194 days.

- Phishing continues to be one of the most expensive initial attack vectors, causing average losses of USD 4.88 million, though this was slightly less than in the previous year.

- Organizations with high levels of noncompliance experienced an average breach cost of USD 5.05 million, 12.6 percent higher than others, revealing the financial consequences of not adhering to security standards.

- Breaches using stolen or compromised credentials took the longest to resolve, extending the breach lifecycle to 292 days and requiring an average of 88 days to contain once discovered.

- In 2024, the United States holds the highest average cost of a data breach globally at USD 9.36 million, followed by the Middle East at USD 8.75 million, underlining the heavy financial burden on businesses in developed economies.

- The average cost of a mega breach involving 50 to 60 million records reached USD 375 million in 2024, showing a USD 43 million increase compared to 2023, highlighting the massive financial threat posed by large-scale attacks.

- As per Verizon:

- A staggering 95 percent of data breaches are financially motivated, marking a 24 percent increase since 2019, reflecting the growing profit-driven nature of cybercrime.

- In 2023, 65 percent of data breaches involved external actors, while 35 percent involved insiders, underscoring the need for stronger internal security protocols and access controls.

- Around 70 percent of breaches are linked to organized crime groups, pointing to the industrialization of cyberattacks and the need for coordinated defense strategies.

- Ransomware continues to be a significant threat, accounting for nearly 24 percent of all incidents involving malware, showing how widespread and damaging these attacks have become.

- Web application breaches make up 25 percent of all breaches, primarily caused by stolen credentials and exploitable vulnerabilities, reflecting a growing risk in cloud-first environments.

- According to Varonis:

- Over 64 percent of financial services companies have more than 1,000 sensitive files accessible to all employees, creating massive exposure to potential internal breaches.

- Nearly 40 percent of these organizations have over 10,000 ghost users and 59 percent have more than 500 passwords that never expire, showing significant security gaps in user management.

- A staggering 70 percent of sensitive corporate data is considered stale, while 58 percent of companies identified over 1,000 folders with inconsistent permissions, demonstrating poor file governance.

- Shockingly, only five percent of company folders are protected, leaving critical information vulnerable to both insider threats and external attacks.

- According to Cybersecurity Ventures:

- Cybercrime is projected to cost the global economy USD 10.5 trillion by 2025, increasing at a yearly rate of 15 percent, making it one of the most economically damaging threats worldwide.

- As stated by the University of Maryland:

- A cyberattack is predicted to occur every 39 seconds, highlighting how frequent and relentless these digital threats have become in today’s connected environment.

- As mentioned by Zipdo:

- In response to remote work trends, 91 percent of cybersecurity professionals reported an increase in cyberattacks, showing that shifting work patterns have created new vulnerabilities.

- According to the ITRC:

- Nearly three-quarters of U.S. small business owners reported experiencing at least one cyberattack in 2022, showing how even smaller organizations are frequent targets of cyber threats.

Market Dynamic

Driving Factors in the CPE Router Market

Rising Demand for High-Speed Internet

The growing need for high-speed internet across homes, businesses, and public spaces is a major growth driver for the CPE router market. With the rapid adoption of streaming services, online education, remote work, and smart home devices, users require stable and fast internet connections. CPE routers play a crucial role in enabling these services by managing large volumes of data traffic efficiently.

As broadband subscriptions rise globally, especially in developing regions, the demand for advanced routers continues to grow. The shift toward gigabit internet and fiber-optic connections also boosts the need for compatible and high-performance routers. Additionally, growing awareness of better Wi-Fi experiences encourages users to upgrade outdated equipment, further fueling market expansion.

Expansion of 5G and Fixed Wireless Access (FWA)

The global rollout of 5G networks and major use of fixed wireless access are driving the adoption of next-generation CPE routers. These routers enable high-speed wireless internet without relying on traditional cable or fiber infrastructure, making them especially useful in remote or underserved areas. Service providers are deploying 5G CPE devices to deliver home broadband through cellular networks, offering faster deployment and lower infrastructure costs.

As 5G coverage improves, consumers and businesses are more willing to adopt CPE routers that support 5G bands. These devices also provide better reliability and mobility compared to wired connections, opening new opportunities in both urban and rural markets. The evolution of wireless technology is expected to continue pushing the demand for advanced CPE routers.

Restraints in the CPE Router Market

High Cost of Advanced Routers

One of the key restraints in the CPE router market is the high cost of advanced routers, especially those supporting the latest technologies like Wi-Fi 6, Wi-Fi 7, and 5G Services. These devices are often priced beyond the reach of average consumers in cost-sensitive regions. Small businesses and households may delay upgrading due to budget limitations, preferring to use older models with limited capabilities. The high initial investment required for service providers to deploy upgraded CPE routers at scale also affects adoption rates.

Additionally, the cost of maintenance, updates, and replacements adds to the total ownership expense. This price barrier slows market penetration, especially in emerging markets where affordability is a major concern.

Technical Complexity and Compatibility Issues

Another major challenge in the CPE router market is the technical complexity involved in setup, configuration, and maintenance. Many users struggle with installing or troubleshooting routers, leading to poor user experience and increased support requests. Compatibility issues with older devices, varying internet standards, and different service provider requirements further complicate adoption.

For service providers, managing a diverse range of router models and firmware updates can be operationally challenging. Without seamless plug-and-play experiences, users may be discouraged from upgrading to newer models. This complexity hinders market growth, particularly among less tech-savvy consumers and smaller ISPs with limited support resources.

Opportunities in the CPE Router Market

Growing Smart Home and IoT Integration

The growing adoption of smart home devices and Internet of Things (IoT) solutions provides a major opportunity for the CPE router market. As homes become more connected—with smart TVs, lights, cameras, and appliances—there is a rising need for robust and intelligent routers to manage network traffic efficiently. CPE routers with built-in support for smart home ecosystems and features like device prioritization, security protocols, and app-based control are gaining popularity, which creates opportunities for manufacturers to offer specialized routers designed for smart living.

Moreover, partnerships with home automation brands can help expand product reach. As consumers invest more in connected living, demand for routers that ensure seamless integration and performance will continue to grow.

Expansion in Emerging Markets

Emerging economies provide a significant growth opportunity for the CPE router market due to increasing internet penetration and digital infrastructure development. Governments and private telecom operators are investing heavily in expanding broadband coverage to rural and semi-urban areas, which opens the door for large-scale deployments of cost-effective CPE routers to serve first-time internet users and growing small businesses.

Affordable models tailored to regional needs and simple user interfaces can help companies capture these untapped markets. In addition, the rise of mobile broadband and fixed wireless access solutions in these regions further drives demand for compatible CPE devices. With strategic pricing and localized support, vendors can establish a strong foothold in these expanding markets.

Trends in the CPE Router Market

AI‑Driven Performance and Diagnostics

CPE routers are highly equipped with AI-powered tools for network management and troubleshooting. These smart features can automatically detect weak signals, optimize channel settings, and prioritize device traffic based on usage patterns. Users can access intuitive mobile apps that offer real-time insights and customized recommendations.

Some routers even learn usage behaviors to dynamically improve performance, reducing the need for manual adjustments. This trend helps both consumers and service providers maintain a reliable connection without technical expertise. As automation and predictive diagnostics improve, AI-enabled CPE routers are becoming the go‑to choice for hassle‑free internet access.

Mesh and Outdoor‑Ready Router Systems

A major trend in the market is the growth of mesh and outdoor‑ready CPE solutions designed to cover larger areas with stable Wi‑Fi. Mesh systems use multiple interconnected nodes to eliminate dead spots and ensure easy roaming throughout homes, offices, and even outdoor spaces.

Outdoor‑rated routers and extenders are built to withstand weather conditions, making them ideal for gardens, patios, and small commercial sites. Users benefit from one unified network name, automatic load balancing, and scalable coverage. As property sizes grow and user expectations rise, mesh and ruggedized CPE offerings are meeting the demand for wide‑area, consistent connectivity.

Research Scope and Analysis

By Type Analysis

Wireless CPE router segment is expected to lead the market in 2025 with a 74.2% share, driven by growing demand for flexible and fast internet access without complex wiring. This type is gaining popularity as it supports easy setup, especially in rural and remote areas where wired infrastructure is limited or unavailable. With rising usage of 4G and 5G networks, wireless routers are being widely adopted by households and businesses seeking reliable internet for streaming, online meetings, and smart devices.

The rollout of fixed wireless access solutions and improved LTE connectivity is further pushing the demand for wireless customer premises equipment. These routers are also more portable, often used for temporary setups or mobile use cases, making them ideal for changing user needs. As wireless networks continue to improve in speed and coverage, this segment will remain a key driver of growth in the CPE router market throughout the forecast period.

Wired CPE router segment is projected to witness significant growth over the forecast period, supported by strong demand for stable and high-speed internet connections. Wired routers are commonly used in offices, data centers, and homes where a consistent and secure internet is essential. They are preferred for applications requiring low latency and uninterrupted performance, such as online gaming, video conferencing, and business operations.

Many service providers still rely on wired routers for fiber and DSL broadband connections, offering dependable performance in fixed locations. With increasing rollout of fiber-to-the-home services and higher demand for gigabit speeds, the use of wired customer premises equipment continues to rise. This type is also known for better security and reduced interference compared to wireless options, making it a preferred choice in critical environments. As broadband infrastructure expands, wired routers will continue playing a vital role in the global CPE router market’s growth.

By Technology Analysis

Fiber technology is set to lead the CPE router market in 2025 with a 30.5% share, supported by the growing shift toward high-speed and stable internet connections. As more countries expand fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) networks, demand for CPE routers that support fiber optics continues to rise. These routers are preferred for delivering ultra-fast internet with low latency, ideal for activities like 4K streaming, remote work, cloud computing, and gaming.

Service providers are actively deploying fiber connections in both urban and suburban areas, making fiber-compatible customer premises equipment a top priority. The technology is known for its durability, higher bandwidth, and long-term reliability, which helps reduce service disruptions. With strong government support and infrastructure investments, fiber-backed router adoption is climbing fast, positioning it as a major technology driver in the overall growth of the CPE router market during the forecast period.

5G technology continues to gain momentum and is expected to see significant growth in the CPE router market over the forecast period. As mobile networks evolve, 5G-compatible routers are being used to deliver high-speed wireless internet, especially in areas lacking fixed-line infrastructure. These routers offer enhanced speeds, lower latency, and better bandwidth handling, making them ideal for home users, businesses, and temporary setups.

Telecom operators are rolling out 5G fixed wireless access services, pushing the need for advanced customer premises equipment that can handle strong signal strength and large data volumes. The appeal of plug-and-play installation and portability makes 5G routers attractive for a wide range of users. As 5G coverage improves and device prices become more affordable, this technology will continue driving demand for next-generation routers, supporting the growing need for flexible, high-performance internet access across regions.

By Application Analysis

Broadband internet access will lead the CPE router market in 2025 with a 43.8% share, driven by the growing demand for fast and reliable internet connections at home and in businesses. As more people rely on the internet for streaming, remote work, online education, and cloud-based applications, the need for strong broadband networks continues to grow. CPE routers play a key role in delivering high-speed broadband by connecting end users to fiber, DSL, or cable networks. With governments and telecom companies expanding broadband coverage, especially in suburban and rural regions, more users are being brought online.

These routers help distribute stable internet to multiple devices at once, making them essential in every connected environment. As internet usage increases and expectations for smooth online experiences rise, broadband-focused routers will remain a central part of market growth across various regions throughout the forecast period.

Smart home networking, fueled by the rise of connected devices, is projected to show significant growth in the CPE router market over the forecast period. With more homes using smart TVs, lights, thermostats, cameras, and appliances, there's a growing need for routers that support seamless connectivity across all devices. CPE routers designed for smart home environments offer features like dual-band or tri-band Wi-Fi, device prioritization, and better security controls. These routers ensure smooth communication between devices, even during high network demand.

Consumers are also drawn to user-friendly mobile apps that allow easy setup and monitoring. As smart home adoption continues to rise in urban areas and modern households, routers with advanced home networking features will be in high demand. This shift is creating strong opportunities for growth in the application segment dedicated to connected living and digital lifestyle support.

By End User Analysis

Residential end users are set to lead the CPE router market in 2025 with a 53.6% share, driven by the growing need for high-speed and stable internet in homes. As more people stream content, attend virtual meetings, work remotely, and use smart home devices, demand for reliable customer premises equipment has increased. Households are upgrading to routers that support faster Wi-Fi, broader coverage, and stronger security features. Easy-to-use models with mobile app support and simple installation are especially popular among residential users.

The rise of online education, cloud gaming, and smart appliances further drives the need for advanced CPE routers. In both urban and suburban settings, internet usage continues to grow, making routers a key part of modern living. This shift toward a more connected lifestyle is helping to expand the residential segment and keep it at the center of CPE router market growth in the current year.

Further, industrial sector end users are projected to experience significant growth in the CPE router market over the forecast period due to rising automation and digitization across manufacturing, logistics, and energy sectors. Industrial environments require robust and secure internet connectivity to support connected machinery, IoT sensors, and remote monitoring systems. CPE routers built for industrial use offer durability, advanced network controls, and strong data protection features.

These routers often operate in harsh environments and are built to handle continuous connectivity demands. With industries embracing smart technologies, cloud-based tools, and real-time analytics, the need for reliable and high-performance customer premises equipment is growing. The ability of industrial CPE routers to support private networks, edge computing, and secure remote access is also adding to their value in the evolving industrial landscape.

The CPE Router Market Report is segmented on the basis of the following

By Type

- Wired CPE Routers

- Wireless CPE Routers

- 3G/4G/LTE Routers

- 5G Routers

- Wi-Fi Routers

By Technology

- xDSL

- Fiber (FTTx)

- Cable (DOCSIS)

- LTE

- 5G

- Wi-Fi

By Application

- Broadband Internet Access

- Voice over IP (VoIP)

- IPTV

- Smart Home Networking

- Enterprise Networking

By End User

- Residential

- Commercial

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- Industrial

Regional Analysis

Leading Region in the CPE Router Market

Asia Pacific will be leading the CPE router market in 2025 with a 38.5% share, driven by strong demand for internet access across densely populated countries and rapid digitalization. The region is experiencing fast growth in internet users, expansion of broadband infrastructure, and rising adoption of smart home devices. Countries like China, India, Japan, and South Korea are investing heavily in fiber-optic and 5G networks, creating a strong need for advanced CPE routers. Telecom operators are upgrading equipment to meet higher data traffic and improve service quality.

Additionally, growing remote work, e-learning, and online entertainment are fueling the demand for reliable home networking solutions. The availability of affordable devices and local manufacturing support is also boosting the market. CPE router makers are customizing products to fit regional needs, including multilingual support and compact designs. As internet access continues to expand in both urban and rural areas, Asia Pacific remains a key region for market growth throughout the year.

Fastest Growing Region in the CPE Router Market

Latin America is showing significant growth in the CPE router market over the forecast period due to growth in internet penetration, digital transformation, and rising demand for home and enterprise connectivity. The region is witnessing a large investment in fiber-optic networks and fixed wireless access, which support the need for modern CPE routers with higher bandwidth capabilities.

Telecom providers are expanding services in both urban and underserved rural areas, driving demand for reliable customer premises equipment. With more users relying on streaming, remote work, and online education, the need for fast and stable routers is growing. Local manufacturing, supportive government policies, and affordable pricing are also helping boost market development across Latin America.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The CPE router market is highly competitive, with many players providing numerous products for different internet needs, from basic home use to advanced enterprise setups. Companies compete by offering better speed, wider coverage, and smart features like app-based control, mesh networking, and security tools. Innovation is key, with newer routers supporting the latest Wi-Fi standards, 5G connectivity, and faster wired ports.

Manufacturers are also trying to stand out through better design, energy efficiency, and easier installation. As internet use grows globally, especially in remote and rural areas, competition has increased around price, performance, and compatibility with new technologies. Service providers also play a role by choosing routers that meet customer expectations and support long-term service goals.

Some of the prominent players in the global CPE Router are:

- Huawei Technologies

- ZTE Corporation

- TP-Link Technologies

- Netgear Inc.

- Cisco Systems, Inc.

- Nokia Corporation

- Ericsson

- Fiberhome

- Arris (part of CommScope)

- D-Link Corporation

- Xiaomi Corporation

- ASUS

- Juniper Networks

- Technicolor SA

- Arcadyan Technology

- AVM GmbH

- MikroTik

- DrayTek Corp.

- Belkin International (Linksys)

- Sagemcom

- Other Key Players

Recent Developments

- In May 2025, RouteThis launched RouteThis Self-Install, a CPE-agnostic platform designed to streamline WiFi setup for subscribers while boosting CSAT and minimizing early churn for service providers. The platform utilizes real-time data, AI-driven insights, and intelligent troubleshooting workflows to facilitate seamless self-guided installations, eliminating the need for technician visits or support calls. Further, the solution delivers a superior onboarding experience from day one, offering deep diagnostics and automation to ensure quick, reliable, and continually improving installations.

- In May 2025, Acer introduced new mobile-focused products, including two tablets, the Iconia V12 and Iconia V11, and three 5G connectivity devices: the Connect X6E Plus 5G CPE, Connect M4 Mobile Wi-Fi, and Connect D5 Pro 5G dongle. The Iconia V12 and V11 tablets are designed for students, families, and budget-conscious users, offering a reliable, portable solution for entertainment, multitasking, and daily tasks. These versatile devices provide dependable performance, making them ideal companions for users seeking value and functionality on the go.

- In February 2025, Hitron Technologies Americas announced a partnership with Aprecomm to integrate its AI-powered platform into Hitron’s broadband CPE, including advanced WiFi 7 routers, gateways, and extenders. This collaboration enables broadband service providers to deploy Aprecomm’s cloud-based tools instantly, with minimal setup. As Aprecomm’s exclusive DOCSIS partner in the Americas, Hitron now offers a pre-integrated solution that boosts operational efficiency and enhances customer satisfaction. Service providers can access powerful AI-driven insights to optimize network performance and user experience straight out of the box.

- In October 2024, VistoTek launched two upgraded 5G CPE models—VTK-Q6130G-5G and VTK-Q6131G-5G—offering enhanced performance and flexibility. Powered by the Qualcomm IPQ5018 chip, they deliver faster processing and improved network efficiency. Both models now feature a 2.5G WAN port for high-speed connectivity, making them ideal for demanding internet usage. Supporting global Sub-6GHz 5G, LTE, and 3G bands, they ensure broad compatibility with major telecom operators. A single SIM enables users to access ultra-fast, gigabit-level internet with ease.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.3 Bn |

| Forecast Value (2034) |

USD 21.8 Bn |

| CAGR (2025–2034) |

10.0% |

| The US Market Size (2025) |

USD 2.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Wired CPE Routers and Wireless CPE Routers), By Technology (xDSL, Fiber (FTTx), Cable (DOCSIS), LTE, 5G, and Wi-Fi), By Application (Broadband Internet Access, Voice over IP (VoIP), IPTV, Smart Home Networking, and Enterprise Networking), By End User (Residential, Commercial, and Industrial) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Huawei Technologies, ZTE Corporation, TP-Link Technologies, Netgear Inc., Cisco Systems, Inc., Nokia Corporation, Ericsson, Fiberhome, Arris, D-Link Corporation, Xiaomi Corporation, ASUS, Juniper Networks, Technicolor SA, Arcadyan Technology, AVM GmbH, MikroTik, DrayTek Corp., Belkin International (Linksys), Sagemcom, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global CPE Router Market size is expected to reach a value of USD 9.3 billion in 2025 and is expected to reach USD 21.8 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global CPE Router Market, with a share of about 38.5% in 2025.

The CPE Router Market in the US is expected to reach USD 2.1 billion in 2025.

Some of the major key players in the Global CPE Router Market are Huawei Technologies, ZTE Corporation, TP-Link Technologies, and others

The market is growing at a CAGR of 10.0 percent over the forecasted period.