Market Overview

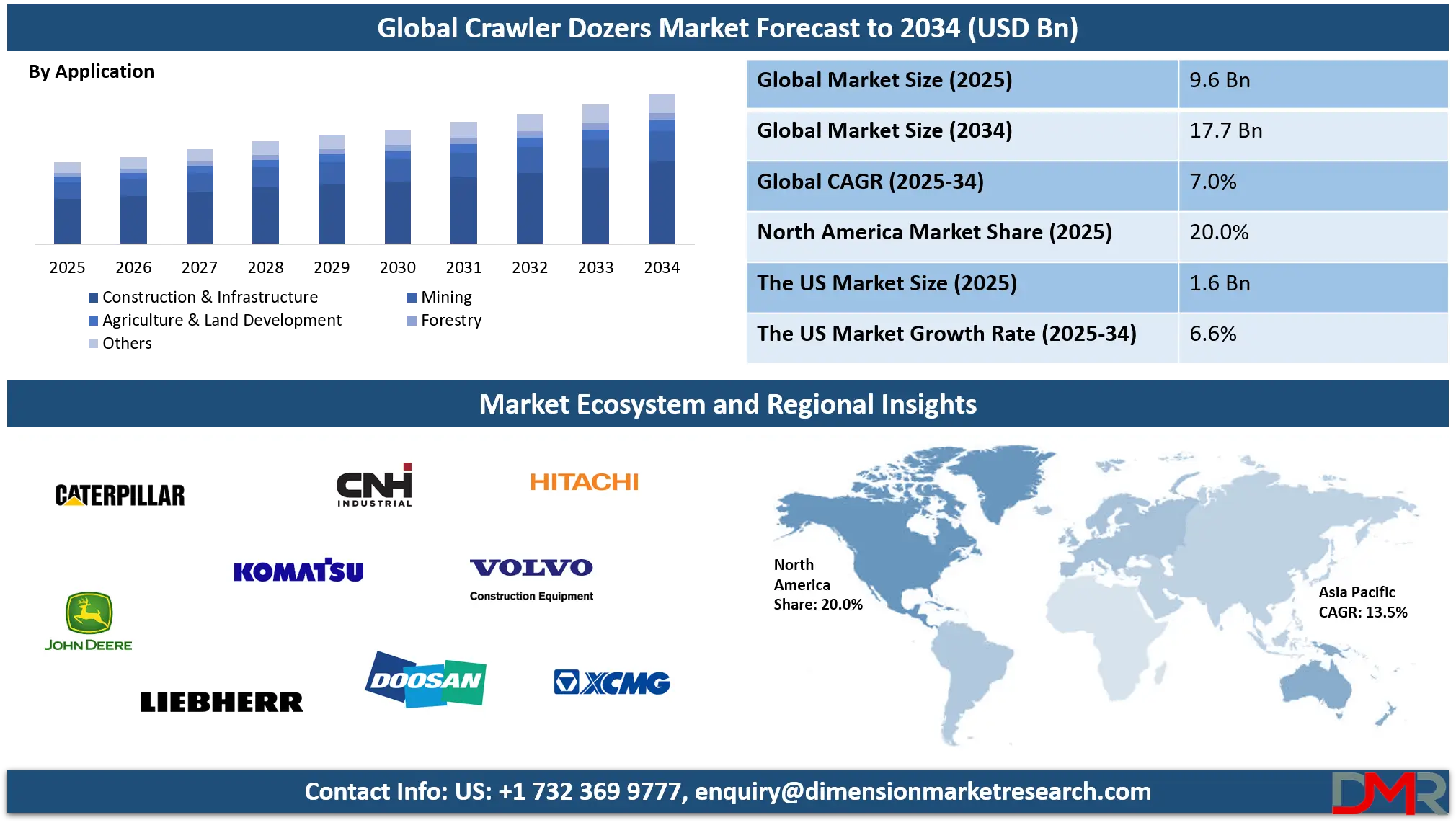

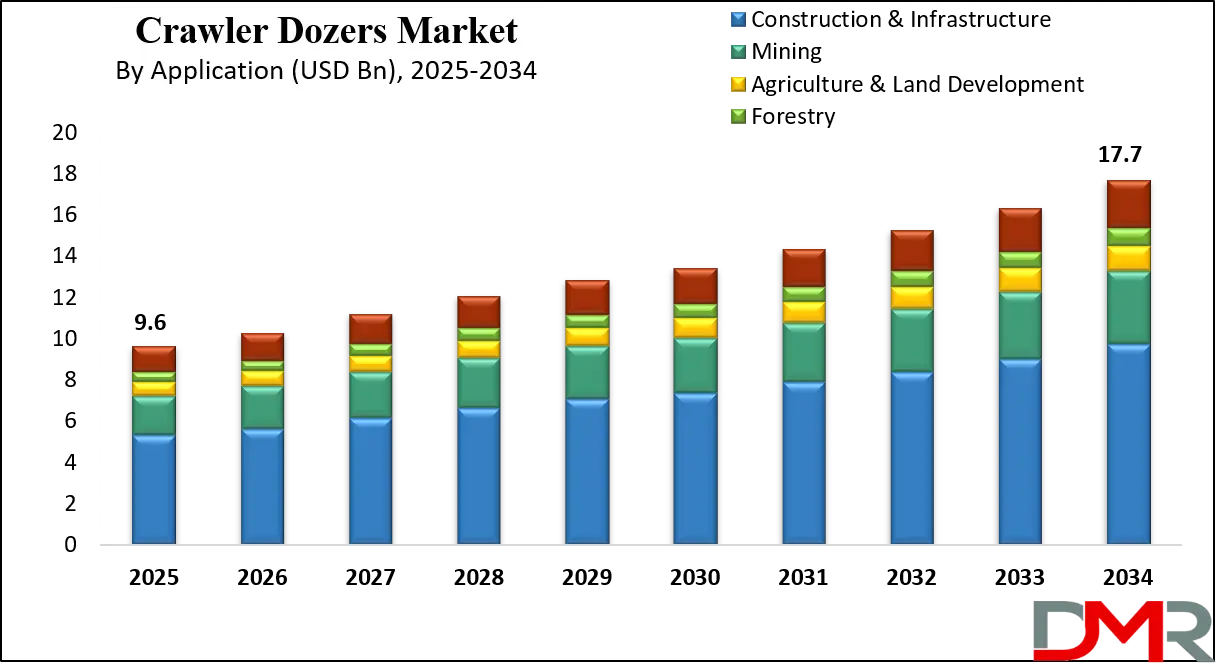

The global crawler dozers market is projected to reach USD 9.6 billion in 2025 and is expected to surpass USD 17.7 billion by 2034, expanding at a CAGR of 7.0%. This growth is driven by increasing infrastructure development, rising mining activities, and the integration of advanced technologies such as GPS-based grade control, telematics, and hybrid power systems across construction and earthmoving applications.

Crawler dozers packaging refers to the structural design, assembly, and shipment methods used to ensure safe transportation and storage of crawler dozers from manufacturing plants to distributors or end users. This packaging process typically includes the use of reinforced wooden crates, moisture-resistant covers, steel frames, and protective coatings to prevent corrosion, mechanical damage, or hydraulic fluid leakage during transit.

Manufacturers also employ modular packaging strategies that allow quick assembly and disassembly, optimizing logistics costs and minimizing handling time. Sustainable packaging materials and eco-friendly rust inhibitors are increasingly being adopted to meet global environmental standards, while digital tracking tags and IoT-enabled shipment monitoring systems are enhancing transparency and supply chain efficiency across international markets.

The global crawler dozers market represents a critical segment within the heavy construction and earthmoving equipment industry, driven by the growing demand for powerful and versatile machines used in large-scale infrastructure, mining, and land development projects. Crawler dozers, equipped with robust tracks and hydraulic blades, are designed to operate efficiently on rough terrain, offering superior traction, stability, and grading precision. The market has experienced steady growth in recent years due to rapid urbanization, expansion of highway and rail networks, and rising investments in mining and quarrying operations across Asia Pacific, North America, and the Middle East.

Technological advancements are transforming the crawler dozers landscape, with manufacturers integrating GPS-based grade control systems, telematics, automated blade controls, and hybrid powertrains to improve fuel efficiency and operational safety. Increasing environmental regulations and the push toward sustainable construction are accelerating the adoption of electric and low-emission crawler dozers, particularly in developed economies. Additionally, the emergence of rental fleets, remote monitoring, and predictive maintenance solutions is reshaping the ownership model of heavy machinery, supporting long-term market expansion across industrial, commercial, and agricultural sectors.

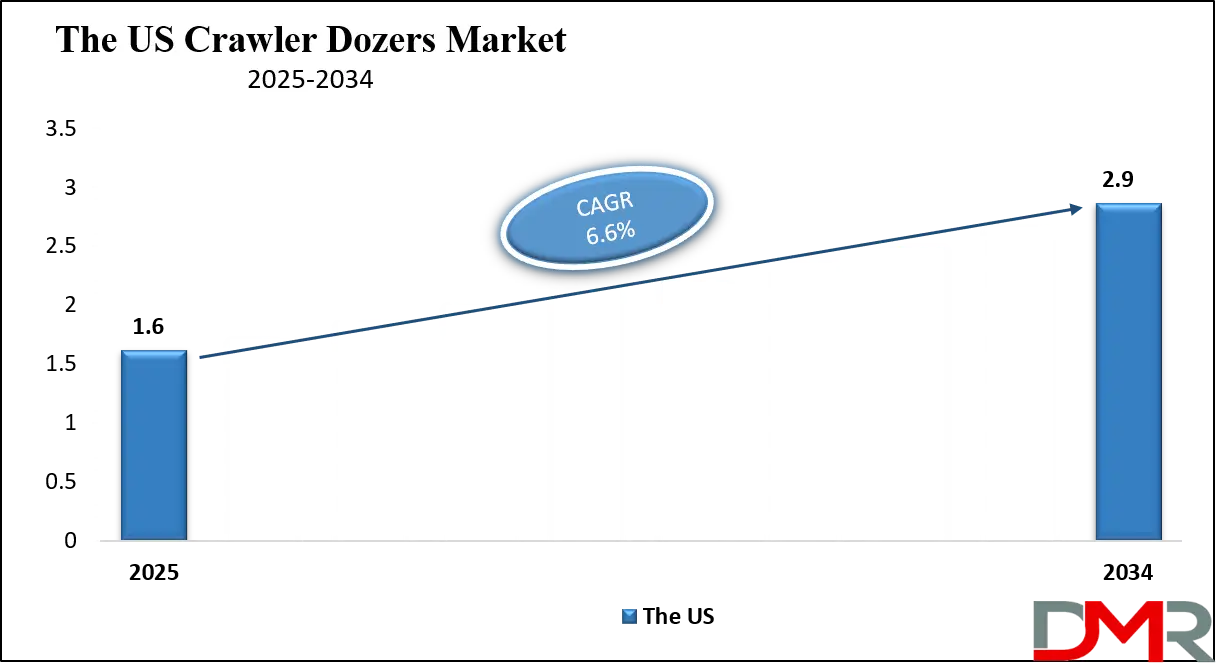

The US Crawler Dozers Market

The US Crawler Dozers Market is projected to be valued at USD 1.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.9 billion in 2034 at a CAGR of 6.6%.

The US crawler dozers market is witnessing steady growth, driven by strong demand from infrastructure development, residential construction, and large-scale mining projects. The country’s ongoing investments in road expansion, energy infrastructure, and industrial facilities are creating a favorable environment for the adoption of high-performance crawler dozers.

Contractors and equipment rental companies are increasingly preferring mid-sized and high-horsepower dozers for their superior traction, durability, and versatility on uneven terrains. In addition, the integration of telematics, GPS grade control systems, and automated blade technologies is improving operational precision and fuel efficiency, reducing downtime, and enhancing overall productivity for construction and earthmoving contractors across the United States.

Sustainability and equipment modernization are emerging as key trends shaping the US crawler dozers industry. Leading manufacturers are introducing hybrid and low-emission crawler dozers that comply with Tier 4 Final and EPA emission standards, aligning with the country’s growing focus on eco-friendly construction equipment. The strong presence of OEMs such as Caterpillar, Deere & Company, and Komatsu, integrated with a robust aftermarket and rental ecosystem, is contributing to market expansion.

Furthermore, the adoption of digital fleet management, predictive maintenance solutions, and remote monitoring systems is enhancing machine lifecycle efficiency and optimizing total cost of ownership. With significant government funding under infrastructure modernization programs and increased urbanization, the US crawler dozers market is poised for consistent growth over the coming decade.

Europe Crawler Dozers Market

The Europe crawler dozers market, valued at approximately USD 1.4 billion in 2025, is witnessing steady growth driven by the region’s strong emphasis on infrastructure modernization, sustainable construction, and equipment automation. Major economies such as Germany, France, and the United Kingdom are investing heavily in transportation networks, renewable energy infrastructure, and urban redevelopment projects, all of which demand powerful and reliable earthmoving machinery.

The region’s strict emission regulations are also encouraging the adoption of low-emission diesel and hybrid crawler dozers, pushing manufacturers to integrate cleaner engines and advanced telematics systems to meet EU standards. Moreover, the shift toward digital job site management, combined with a growing rental equipment culture, is further supporting market expansion among contractors looking for cost-effective and flexible solutions.

With an estimated CAGR of 6.8% through 2034, Europe’s crawler dozers market is expected to evolve rapidly as sustainability and automation become central to construction equipment procurement. The increasing use of GPS-based machine control, AI-assisted performance monitoring, and predictive maintenance technologies is enhancing operational efficiency and reducing downtime across major projects.

Additionally, the focus on rebuilding older infrastructure and expanding renewable energy facilities, such as wind and solar farms, is creating continuous demand for medium and high-horsepower crawler dozers. Regional players are also collaborating with technology firms to develop smart, connected machinery tailored for European construction standards, ensuring that the region remains one of the most technologically progressive markets globally.

Japan Crawler Dozers Market

The Japan crawler dozers market, valued at around USD 500 million in 2025, is poised for consistent expansion supported by steady construction demand, urban redevelopment projects, and a strong focus on automation in heavy machinery. Japan’s mature construction ecosystem is increasingly investing in advanced equipment to address challenges posed by an aging workforce and stringent environmental regulations. Crawler dozers are widely used in roadworks, infrastructure repair, and disaster management projects, where their precision and reliability are highly valued.

The government’s continued emphasis on resilient infrastructure development, especially in earthquake-prone areas, is fostering steady demand for technologically advanced and durable machines. Additionally, Japan’s leadership in robotics and mechatronics is accelerating the integration of semi-autonomous and remote-controlled dozers that enhance productivity and safety across work sites.

With a CAGR of approximately 7.2% projected through 2034, Japan’s crawler dozers market is set to evolve into a technology-driven landscape characterized by innovation and sustainability. Manufacturers are introducing hybrid and low-noise dozer models to comply with strict emission and noise regulations while catering to the country’s sustainability goals. The rapid adoption of smart construction solutions, including AI-based grading systems, 3D machine control, and telematics, is optimizing fuel efficiency and real-time monitoring.

Moreover, collaborations between Japanese equipment manufacturers and global technology providers are enabling the development of next-generation crawler dozers tailored for compact urban environments. This technological momentum, combined with stable construction investments, positions Japan as a key high-tech market within the global crawler dozers industry.

Global Crawler Dozers Market: Key Takeaways

- Market Value: The global Crawler Dozers market size is expected to reach a value of USD 17.7 billion by 2034 from a base value of USD 9.6 billion in 2025 at a CAGR of 7.0%.

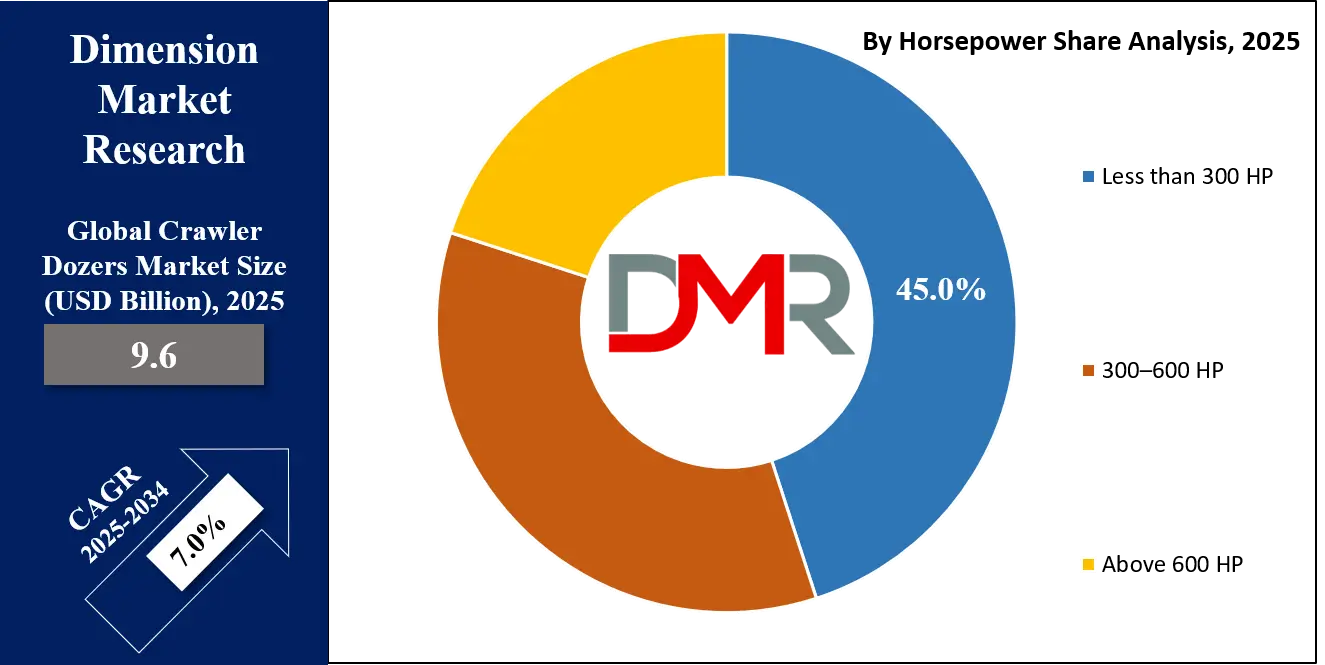

- By Horsepower Segment Analysis: Less than 300 HP dozers are expected to maintain their dominance in the horsepower segment, capturing 45.0% of the total market share in 2025.

- By Size Segment Analysis: Medium Dozers will dominate the size segment, capturing 50.0% of the market share in 2025.

- By Blade Type Segment Analysis: U-Type blades are anticipated to dominate the blade type segment, capturing 30.0% of the total market share in 2025.

- By Propulsion Type Segment Analysis: Diesel-Powered will dominate the propulsion type segment, capturing 95.0% of the market share in 2025.

- By Undercarriage Type Segment Analysis: Standard Undercarriage will account for the maximum share in the undercarriage type segment, capturing 60.0% of the market share in 2025.

- By Sales Channel Segment Analysis: New Equipment Sales will account for the maximum share in the sales channel segment, with a market share of 70.0% in 2025.

- By Application Segment Analysis: Construction & Infrastructure applications will dominate the application segment, capturing 55.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global Crawler Dozers market landscape with 51.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Crawler Dozers market include Caterpillar Inc., Komatsu Ltd., Deere & Company, Liebherr Group, CNH Industrial N.V., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Doosan Infracore Co., Ltd., XCMG Group, Shantui Construction Machinery Co., Ltd., SANY Group, Hyundai Construction Equipment Co., Ltd, and Others.

Global Crawler Dozers Market: Use Cases

- Infrastructure and Road Construction: Crawler dozers play a crucial role in large-scale infrastructure and road construction projects where heavy-duty earthmoving and grading are required. Their powerful engines, wide tracks, and advanced blade control systems enable efficient land leveling, roadbed preparation, and slope grading across challenging terrains. With governments globally increasing investments in highways, bridges, and urban infrastructure, demand for crawler dozers with GPS-based grade control and telematics systems is growing, ensuring higher precision and reduced fuel consumption during long operational cycles.

- Mining and Quarrying Operations: In mining and quarrying applications, crawler dozers are used extensively for overburden removal, site preparation, and haul road maintenance. Their high traction and robust undercarriage design allow efficient movement of heavy materials in rugged, uneven environments. Crawler dozers are also essential for maintaining safe mine surfaces and creating access paths for haul trucks and loaders. The integration of remote monitoring, predictive maintenance, and autonomous control technologies is improving productivity and safety across mining operations, making these machines indispensable for surface mining projects.

- Land Development and Agriculture: Crawler dozers are increasingly utilized in land development and agricultural applications for clearing vegetation, creating irrigation channels, and leveling farmland. Their versatility and high pushing power make them ideal for preparing large tracts of land for construction or cultivation. In the agriculture sector, mid-sized dozers are favored for their fuel efficiency and adaptability, especially in regions investing in farm mechanization. The adoption of eco-friendly crawler dozers with lower emissions is also supporting sustainable agricultural development and land management practices.

- Forestry and Environmental Management: In forestry and environmental management, crawler dozers are employed for clearing trees, building access roads, and restoring land affected by logging or natural disasters. Their superior ground stability and controlled pushing capability make them suitable for working in soft or muddy terrains. Forestry operators increasingly rely on crawler dozers equipped with protective cabins, winches, and attachments for stump removal and reforestation tasks. These machines also support environmental reclamation, soil stabilization, and wildfire mitigation efforts, reinforcing their value in sustainable land-use management.

Impact of Artificial Intelligence on the global Crawler Dozers market

The impact of artificial intelligence (AI) on the global crawler dozers market is becoming increasingly significant as the construction and heavy equipment industries shift toward automation, precision, and efficiency. AI integration is transforming traditional crawler dozers into intelligent, connected machines capable of self-optimizing their performance based on real-time data. Through AI-driven telematics, sensors, and machine learning algorithms, operators can monitor blade position, soil density, and engine load to achieve more accurate grading and reduced fuel consumption. Predictive analytics powered by AI also helps in identifying maintenance needs before equipment failure, minimizing downtime and extending machine life.

In addition, AI is enabling the development of semi-autonomous and fully autonomous crawler dozers that can operate with minimal human intervention, especially in hazardous or remote environments. Leading manufacturers like Caterpillar, Komatsu, and Deere are investing heavily in AI-enabled grade control systems, object detection, and terrain mapping technologies to enhance safety and operational efficiency. The integration of AI with GPS and LiDAR systems allows crawler dozers to adapt to changing site conditions dynamically, improving productivity while reducing material wastage. As sustainability and digitalization continue to shape the construction and mining sectors, the adoption of AI-driven crawler dozers is expected to accelerate, fostering smarter construction practices and creating new opportunities in equipment automation and fleet management.

Global Crawler Dozers Market: Stats & Facts

U.S. Bureau of Labor Statistics (BLS)

- 2023: Total employment in the U.S. construction industry was about 8.0 million.

- 2024–2034 projection (published 2025): Employment of construction equipment operators is projected to grow by 4% over the decade.

Japan — Ministry of Economy, Trade and Industry (METI) — Current Survey of Production / IIP

- 2023: METI’s Current Survey of Production continued to record monthly manufacturing and machinery output trends for equipment-related sectors in 2023.

- 2024 (monthly indices and forecasts available): METI’s indices of industrial production (IIP) and production forecasts for machinery sectors showed ongoing monthly variability through 2024 as manufacturers adjusted production plans.

China — National Bureau of Statistics (NBS) / Investment in Fixed Assets

- 2024: Total investment in fixed assets (excluding rural households) was reported at 51,437.4 billion yuan (annual figure for 2024).

- Jan–May 2025: Investment in fixed assets (excluding rural households) for the first five months was about 19,194.7 billion yuan, up 3.7% year-on-year for that period.

India — Ministry of Statistics & Programme Implementation (MOSPI) / National Accounts (GVA)

- FY 2023-24: Nominal GVA and sectoral statistics published for 2023-24 as baseline values.

- FY 2024-25 (provisional, released 2025): Nominal GVA estimated at ₹300.22 lakh crore for FY2024-25 versus ₹274.13 lakh crore in FY2023-24, showing continued expansion in overall economic activity that supports construction demand.

Global Crawler Dozers Market: Market Dynamics

Global Crawler Dozers Market: Driving Factors

Rising Infrastructure and Construction Investments

The global crawler dozers market is primarily driven by rapid urbanization and substantial investments in large-scale infrastructure projects, including highways, railways, and industrial facilities. Governments across the Asia Pacific, North America, and the Middle East are allocating significant budgets for public infrastructure development, which is boosting the demand for heavy-duty earthmoving equipment. Crawler dozers, known for their high traction and versatility, are extensively used for land clearing, site grading, and foundation preparation. Additionally, the growing adoption of GPS-based grade control and telematics systems is enhancing operational efficiency, making crawler dozers indispensable in modern construction projects.

Expansion of Mining and Resource Extraction Activities

The expansion of surface mining and quarrying operations globally is another key growth driver for the crawler dozers market. These machines are critical for stripping overburden, maintaining haul roads, and leveling mining surfaces. Increasing demand for metals, minerals, and aggregates to support industrialization and clean energy initiatives is pushing mining companies to invest in high-horsepower crawler dozers with improved durability and automation capabilities. The integration of AI-powered monitoring systems and predictive maintenance solutions further improves productivity and reduces operational costs in mining environments.

Global Crawler Dozers Market: Restraints

High Initial and Maintenance Costs

One of the major restraints in the crawler dozers market is the high cost associated with equipment acquisition, maintenance, and spare parts. Advanced crawler dozers equipped with telematics, autonomous control, and emission-compliant engines require substantial upfront investments, which can limit adoption among small and medium-sized contractors. Moreover, the need for skilled operators and regular maintenance increases the total cost of ownership, making rental and leasing options more favorable in cost-sensitive markets.

Stringent Emission Regulations and Environmental Concerns

Stringent environmental regulations concerning diesel engine emissions are posing challenges for crawler dozer manufacturers. Compliance with Tier 4 Final, Stage V, and equivalent emission norms requires costly modifications in engine design, exhaust systems, and after-treatment technologies. The transition toward low-emission or electric crawler dozers also demands significant R&D investment and infrastructure readiness, particularly in developing economies where access to charging facilities remains limited.

Global Crawler Dozers Market: Opportunities

Adoption of Electric and Hybrid Crawler Dozers

The increasing focus on sustainability and emission reduction is creating strong opportunities for electric and hybrid crawler dozers. Manufacturers are investing in alternative powertrain technologies that deliver comparable torque and performance while minimizing fuel consumption and carbon emissions. Growing awareness of green construction practices and government incentives for cleaner equipment adoption are encouraging end-users to transition toward eco-friendly solutions. This trend is particularly strong in regions like Europe and North America, where sustainability standards are driving technological innovation.

Advancements in Autonomous and Smart Construction Equipment

The integration of artificial intelligence, IoT, and automation technologies is opening new avenues in the crawler dozers market. Smart crawler dozers equipped with autonomous grade control, terrain mapping, and obstacle detection systems are revolutionizing construction efficiency. These advancements not only enhance precision and safety but also address the industry’s ongoing labor shortage by reducing dependency on skilled operators. The growing use of digital fleet management and remote monitoring systems is further optimizing performance and asset utilization.

Global Crawler Dozers Market: Trends

Digitalization and Telematics Integration

A major trend reshaping the crawler dozers industry is the rapid digitalization of construction equipment. The adoption of telematics solutions enables real-time monitoring of machine health, location, and fuel efficiency. Fleet managers can now analyze operational data through cloud-based platforms, allowing proactive maintenance scheduling and improved decision-making. This trend is strengthening OEM service models and driving the shift toward data-driven equipment management.

Rise of Rental and Equipment-as-a-Service Models

The increasing popularity of rental and leasing models is transforming the ownership structure of the crawler dozers market. Construction companies prefer renting crawler dozers to reduce capital expenditure and maintenance costs while accessing the latest models with advanced technologies. This shift is encouraging OEMs and rental providers to expand their fleets and offer flexible, contract-based services integrated with digital support and telematics tracking, aligning with the evolving preferences of modern construction businesses.

Global Crawler Dozers Market: Research Scope and Analysis

By Horsepower Analysis

Less than 300 HP crawler dozers are expected to maintain their dominance in the global market, capturing around 45.0% of the total market share in 2025. These low-to-medium horsepower dozers are widely preferred across small and medium construction projects, landscaping, and agricultural land development due to their compact size, fuel efficiency, and lower maintenance costs.

Their versatility in confined spaces and ease of transportation make them a practical choice for urban construction and infrastructure repair activities. Contractors and rental fleets particularly favor this segment as it offers high productivity at an affordable operating cost, while advancements such as hydrostatic transmissions and GPS-assisted control systems have further improved their precision and performance.

Crawler dozers in the 300–600 HP range represent the second-largest segment, serving heavy-duty applications in mining, large infrastructure, and road construction projects. These machines provide an optimal balance between power and maneuverability, making them ideal for large-scale grading, material pushing, and slope management tasks.

The segment’s growth is supported by rising investments in industrial and highway development projects across Asia Pacific and North America, where high-horsepower dozers are in constant demand for their ability to handle tough terrain and heavy loads. Additionally, the integration of advanced telematics, automated blade control, and fuel-efficient engines in mid-range dozers is enhancing productivity, reducing emissions, and strengthening their appeal among contractors focused on long-term operational efficiency.

By Size Analysis

Medium crawler dozers are projected to dominate the global market, accounting for nearly 50.0% of the total share in 2025. These machines offer the perfect balance between power, operational flexibility, and cost efficiency, making them highly suitable for a wide range of construction, road development, and land preparation projects. Medium dozers are particularly favored in urban infrastructure and residential projects where maneuverability and fuel efficiency are crucial.

Their adaptability to different blade types and attachments enhances their functionality for grading, backfilling, and material spreading tasks. The rising adoption of medium-sized dozers by contractors and rental companies is also driven by advancements such as GPS-based grade control systems, telematics, and improved hydraulic performance, which enhance precision and reduce operational downtime across job sites.

Large crawler dozers hold a significant portion of the market and are primarily used in heavy-duty applications such as mining, quarrying, and large-scale earthmoving operations. These high-capacity machines are designed for maximum pushing power, stability, and productivity in challenging terrains and bulk material handling environments. The demand for large dozers is expected to grow steadily due to the expansion of surface mining projects and major infrastructure developments in emerging economies.

Manufacturers are focusing on integrating fuel-efficient engines, intelligent control systems, and enhanced operator comfort features to improve performance and safety. Furthermore, the increasing adoption of automation and semi-autonomous operation capabilities in large dozers is helping operators achieve greater precision and efficiency while minimizing fatigue and operating costs in demanding field conditions.

By Blade Type Analysis

U-Type blades are anticipated to dominate the global crawler dozers market, capturing around 30.0% of the total market share in 2025. These blades are specifically designed for heavy earthmoving and material-handling operations, offering superior capacity and curvature that allow efficient pushing of large volumes of soil, sand, and aggregate over long distances. The deep curvature and high side wings of U-Type blades reduce spillage and enhance load retention, making them ideal for mining, large-scale land clearing, and infrastructure development projects.

Their ability to handle high-resistance materials while maintaining stability and balance increases productivity and reduces cycle times. With the integration of GPS-guided blade control systems and improved hydraulic responsiveness, U-Type blades continue to be the preferred choice for contractors seeking high-performance and durable solutions in challenging terrain conditions.

Combination blades, also known as Semi-U or hybrid blades, represent the second most prominent segment in the market due to their versatility and adaptability across multiple applications. These blades combine the characteristics of straight and U-Type blades, offering both precision in fine grading and efficiency in heavy pushing tasks. Their balanced design provides moderate load capacity with improved maneuverability, making them suitable for general construction, land development, and roadwork operations.

Contractors favor combination blades for their ability to perform efficiently in mixed working environments without frequent blade changes. The growing use of automated control systems and tilt-angle adjustments is further enhancing the accuracy and ease of operation for combination blades, supporting their increasing adoption across medium and large crawler dozers globally.

By Propulsion Type Analysis

Diesel-powered crawler dozers are expected to dominate the propulsion type segment, accounting for nearly 95.0% of the total market share in 2025. These machines remain the industry standard due to their unmatched power output, reliability, and cost-effectiveness across heavy-duty construction, mining, and infrastructure applications. Diesel engines provide the high torque required for pushing and grading on uneven terrains, while their well-established fueling infrastructure ensures operational efficiency in remote areas. Continuous improvements in engine technology, including advanced fuel injection systems and exhaust after-treatment solutions, have significantly reduced emissions and enhanced fuel economy.

Compliance with global emission standards such as Tier 4 Final and Stage V has further strengthened the presence of diesel-powered dozers, allowing manufacturers to deliver cleaner, more efficient machines without compromising performance. The availability of extensive service networks and parts supply chains globally also supports their continued dominance in both developed and developing markets.

Hybrid crawler dozers, although still emerging, are gaining attention as the industry shifts toward sustainable and energy-efficient solutions. These machines combine diesel engines with electric drive systems to optimize power usage, reduce fuel consumption, and minimize greenhouse gas emissions. Hybrid models are particularly appealing for long-hour operations where fuel savings can significantly reduce operating costs over time.

Manufacturers such as Komatsu and Caterpillar are investing in hybrid propulsion technologies that incorporate regenerative braking and smart power management systems to enhance efficiency and performance. The growing emphasis on environmental compliance, integrated with rising fuel prices, is expected to accelerate the adoption of hybrid crawler dozers in the coming years, especially in regions with strong sustainability mandates such as Europe, Japan, and North America.

By Undercarriage Type Analysis

Standard undercarriage crawler dozers are projected to hold the largest share in the market, capturing around 60.0% of the total in 2025. These undercarriages are widely used across general construction, landscaping, and light earthmoving projects due to their simple design, cost-effectiveness, and ease of maintenance. The standard configuration offers a balanced structure that provides reliable traction, stability, and smooth weight distribution on most terrain types.

Contractors favor this design for medium and low-horsepower dozers, as it allows efficient operation with reduced downtime and lower ownership costs. The availability of durable track chains, rollers, and wear-resistant components enhances the service life of standard undercarriages, making them a preferred choice for fleet operators and rental equipment providers seeking long-term value and consistent performance. Advancements in track materials, lubrication systems, and undercarriage monitoring sensors are further improving the operational efficiency and lifespan of standard undercarriage dozers.

Elevated sprocket undercarriages, on the other hand, are primarily used in heavy-duty crawler dozers designed for mining, quarrying, and large-scale construction applications. This design raises the final drive above ground level, minimizing impact from rocks, debris, and rough terrain, which reduces wear and maintenance requirements. Elevated sprocket systems also improve ground clearance and weight balance, offering better traction and smoother operation in demanding environments.

Although they come at a higher initial cost, their superior durability and reduced downtime make them ideal for high-power machines operating under extreme conditions. Manufacturers continue to refine elevated sprocket designs by integrating advanced suspension systems, improved sealing technology, and telematics-enabled diagnostics to extend service intervals and enhance productivity. The rising demand for robust equipment capable of handling challenging terrains is expected to sustain the adoption of elevated sprocket crawler dozers across mining and large infrastructure sectors.

By Sales Channel Analysis

New equipment sales are expected to account for the majority of the crawler dozers market, capturing around 70.0% of the total share in 2025. This dominance is driven by the rising demand for technologically advanced and fuel-efficient models equipped with GPS-based grade control, telematics, and automated blade systems. Construction and mining contractors are increasingly investing in new crawler dozers to enhance operational productivity, meet stringent emission regulations, and reduce long-term maintenance costs.

The rapid pace of infrastructure development across Asia Pacific, North America, and the Middle East is fueling the procurement of new equipment to meet project deadlines and ensure reliability in demanding environments. Additionally, OEMs are offering financing options, extended warranties, and digital monitoring solutions that make purchasing new crawler dozers more attractive for both large enterprises and rental fleet operators.

Aftermarket services and parts represent a critical segment of the crawler dozers market, supporting machine uptime, operational safety, and lifecycle performance. This segment includes maintenance contracts, spare parts supply, component refurbishments, and technical assistance programs offered by OEMs and authorized dealers. As construction and mining projects require continuous operation, the need for timely replacement of undercarriage components, hydraulic systems, and track assemblies is growing steadily.

OEMs are increasingly focusing on predictive maintenance and telematics-driven service models that allow real-time monitoring of equipment health and reduce unexpected breakdowns. The growing emphasis on cost optimization and equipment longevity has also encouraged end-users to rely more on certified aftermarket solutions rather than unbranded parts. This shift is expected to strengthen the aftermarket ecosystem, providing consistent revenue streams for manufacturers and service providers across global markets.

By Application Analysis

Construction and infrastructure applications are projected to dominate the crawler dozers market, capturing about 55.0% of the total share in 2025. The growing number of large-scale infrastructure projects, including highways, railways, airports, and urban redevelopment initiatives, is significantly driving the demand for crawler dozers. These machines are essential for tasks such as land clearing, grading, and site preparation due to their high traction, stability, and earth-moving efficiency. Governments across emerging economies like India, China, and Indonesia are heavily investing in public infrastructure and smart city programs, further fueling equipment demand.

Moreover, the increasing focus on sustainable construction practices has encouraged the use of advanced dozers integrated with GPS-based automation and telematics systems that improve precision and reduce material wastage. The rental market is also thriving as contractors seek flexible solutions to manage short-term project requirements without heavy capital expenditure.

Mining applications form another crucial segment of the crawler dozers market, with steady growth driven by the expansion of surface mining operations across regions like North America, Latin America, and Africa. In the mining sector, crawler dozers play a vital role in overburden removal, haul road maintenance, and reclamation work. Their superior pushing power and durability make them ideal for handling abrasive materials and working in harsh terrains.

As demand for minerals, coal, and metals continues to rise globally, mining companies are investing in high-horsepower crawler dozers equipped with automated control systems and reinforced undercarriages to enhance productivity and safety. Additionally, the integration of AI-based monitoring systems and predictive maintenance tools helps reduce downtime, ensuring continuous and efficient mining operations.

The Crawler Dozers Market Report is segmented on the basis of the following:

By Horsepower

- Less than 300 HP

- 300-600 HP

- Above 600 HP

By Size

- Medium Dozers

- Large Dozers

- Compact Dozers

By Blade Type

- U-Type

- Combination Blades

- Straight (S) Blades

- Universal Blades

- Others

By Propulsion Type

- Diesel-Powered

- Hybrid

- Fully Electric

By Undercarriage Type

- Standard Undercarriage

- Elevated Sprocket

- Heavy-Duty Undercarriage

By Sales Channel

- New Equipment Sales

- Aftermarket Services & Parts

- Rental Equipment

By Application

- Construction & Infrastructure

- Mining

- Agriculture & Land Development

- Forestry

- Others

Global Crawler Dozers Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global crawler dozers market, accounting for 51.0% of total global market revenue in 2025. The region’s dominance is primarily driven by extensive infrastructure development, rapid urbanization, and increasing investments in mining and construction projects across major economies such as China, India, and Japan. Government initiatives like India’s Smart Cities Mission and China’s Belt and Road Initiative are creating substantial demand for heavy-duty earthmoving equipment, including crawler dozers.

The region also benefits from strong domestic manufacturing capabilities and the presence of leading players such as Komatsu, SANY, and XCMG, which offer cost-effective and technologically advanced machinery. Additionally, rising public-private partnerships in road, port, and industrial corridor projects are further accelerating the adoption of crawler dozers across diverse applications, solidifying Asia Pacific’s position as the global market leader.

Region with significant growth

North America is projected to witness significant growth in the global crawler dozers market over the forecast period, driven by the resurgence of large-scale construction, infrastructure rehabilitation, and mining activities. The region’s focus on upgrading aging public infrastructure, including highways, bridges, and energy projects, is fueling demand for high-performance and fuel-efficient crawler dozers. Additionally, the adoption of advanced technologies such as GPS-based grade control systems, telematics, and autonomous operation is improving equipment efficiency and reducing operational costs.

The United States, in particular, is seeing a steady increase in construction spending and renewable energy development, which requires extensive land grading and site preparation. Moreover, the growing trend toward sustainable and emission-compliant machinery is encouraging manufacturers to introduce hybrid and electric dozer models, further supporting market expansion in the North American region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Crawler Dozers Market: Competitive Landscape

The global crawler dozers market is characterized by intense competition, with several international and regional manufacturers focusing on technological innovation, product diversification, and strategic expansion to strengthen their market presence. Companies are increasingly investing in automation, telematics integration, and AI-driven solutions to enhance machine efficiency, precision, and operator safety. The market is witnessing a strong shift toward sustainable and energy-efficient dozers as environmental regulations tighten globally.

Partnerships, mergers, and collaborations are common strategies adopted to expand distribution networks and service offerings across emerging economies. Furthermore, rental and leasing services are becoming a vital growth avenue as contractors seek cost-effective alternatives to equipment ownership. Continuous investment in R&D, integrated with an emphasis on digital monitoring systems and hybrid powertrains, is redefining the competitive landscape, pushing manufacturers to deliver high-performance, durable, and technologically advanced crawler dozers to meet evolving global demand.

Some of the prominent players in the global Crawler Dozers market are:

- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- Liebherr Group

- CNH Industrial N.V.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- Doosan Infracore Co., Ltd.

- XCMG Group

- Shantui Construction Machinery Co., Ltd.

- SANY Group

- Hyundai Construction Equipment Co., Ltd.

- JCB Ltd.

- Case Construction Equipment

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- BEML Limited

- LiuGong Machinery Co., Ltd.

- Terex Corporation

- Bell Equipment Company Ltd.

- Kobelco Construction Machinery Co., Ltd.

- Other Key Players

Global Crawler Dozers Market: Recent Developments

- October 2025: Liebherr Group introduced its advanced G8 Crawler Dozer series, featuring enhanced telematics, improved blade control precision, and AI-based operator assistance systems aimed at boosting productivity and fuel efficiency.

- October 2025: SANY Heavy Industry raised approximately USD 1.59 billion through a secondary listing in Hong Kong to support expansion in global manufacturing facilities and the development of electric and hybrid construction machinery.

- July 2025: HD Hyundai announced the merger of its Hyundai Construction Equipment and Develon divisions into a single construction machinery entity to strengthen its global R&D capabilities and streamline operations across regions.

- June 2025: Lumina Technologies, a California-based electric construction equipment startup, secured Series A funding worth USD 20–40 million to accelerate the production of its autonomous, battery-powered electric bulldozers designed for sustainable earthmoving operations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.6 Bn |

| Forecast Value (2034) |

USD 17.7 Bn |

| CAGR (2025–2034) |

7.0% |

| The US Market Size (2025) |

USD 1.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Horsepower (Less than 300 HP, 300–600 HP, Above 600 HP), By Size (Medium Dozers, Large Dozers, Compact Dozers), By Blade Type (U-Type, Combination Blades, Straight (S) Blades, Universal Blades, Others), By Propulsion Type (Diesel-Powered, Hybrid, Fully Electric), By Undercarriage Type (Standard Undercarriage, Elevated Sprocket, Heavy-Duty Undercarriage), By Sales Channel (New Equipment Sales, Aftermarket Services & Parts, Rental Equipment), and By Application (Construction & Infrastructure, Mining, Agriculture & Land Development, Forestry, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Caterpillar Inc., Komatsu Ltd., Deere & Company, Liebherr Group, CNH Industrial N.V., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Doosan Infracore Co., Ltd., XCMG Group, Shantui Construction Machinery Co., Ltd., SANY Group, Hyundai Construction Equipment Co., Ltd, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Crawler Dozers market size is estimated to have a value of USD 9.6 billion in 2025 and is expected to reach USD 17.7 billion by the end of 2034.

The US Crawler Dozers market is projected to be valued at USD 1.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.9 billion in 2034 at a CAGR of 6.6%.

Asia Pacific is expected to have the largest market share in the global Crawler Dozers market, with a share of about 51.0% in 2025.

Some of the major key players in the global Crawler Dozers market are Caterpillar Inc., Komatsu Ltd., Deere & Company, Liebherr Group, CNH Industrial N.V., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Doosan Infracore Co., Ltd., XCMG Group, Shantui Construction Machinery Co., Ltd., SANY Group, Hyundai Construction Equipment Co., Ltd, and Others.

The market is growing at a CAGR of 7.0 percent over the forecasted period