Market Overview

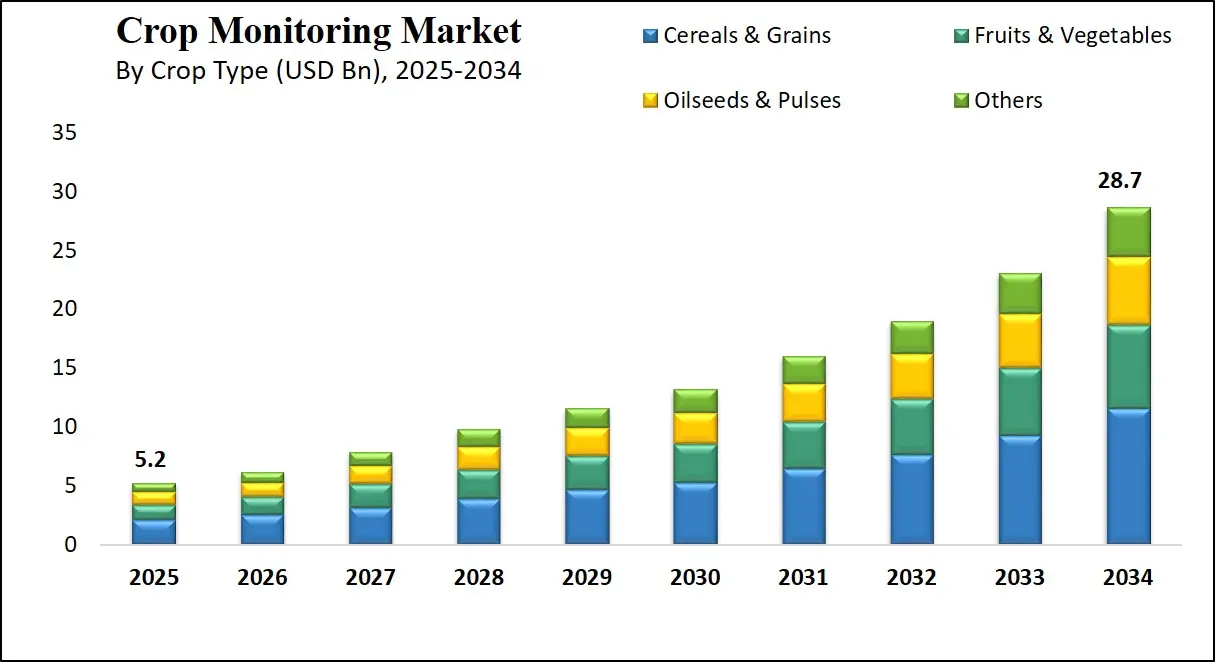

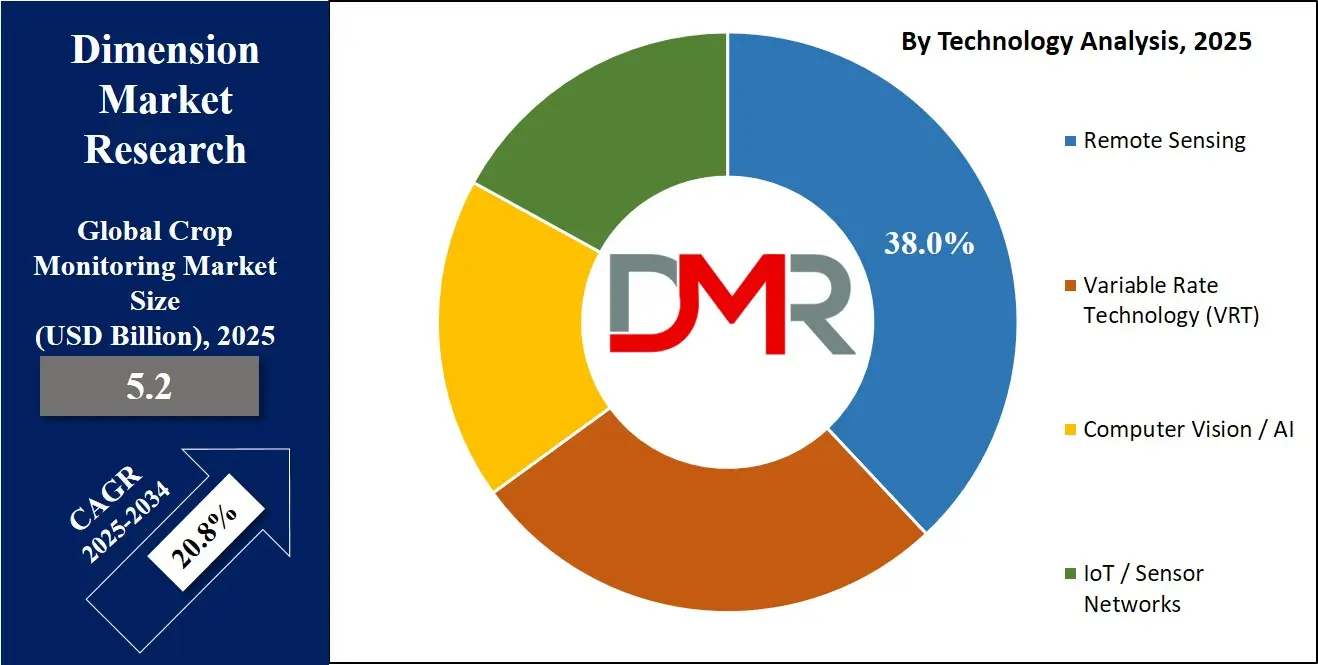

The Global Crop Monitoring Market is projected to reach USD 5.2 billion by 2025 and grow at a robust CAGR of 20.8%, hitting USD 28.7 billion by 2034. This growth is driven by the rising adoption of precision agriculture, remote sensing technologies, IoT-enabled farm solutions, and AI-driven crop analytics. Increasing demand for sustainable farming, yield optimization, and real-time field monitoring are key factors fueling market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Crop monitoring refers to the systematic observation, measurement, and analysis of various parameters related to crop growth, health, and development throughout the farming cycle. It involves the use of modern technologies such as satellite imagery, drones, IoT-based sensors, and remote sensing tools to collect real-time data on soil moisture, crop vigor, pest infestations, nutrient levels, and weather conditions.

The primary objective of crop monitoring is to enhance precision agriculture by enabling informed decision-making, early detection of anomalies, and timely intervention to improve crop yield, resource utilization, and sustainability. By integrating data analytics and artificial intelligence, crop monitoring solutions enable the identification of patterns, forecasting of outcomes, and ensuring optimal crop performance across diverse agricultural environments.

The global crop monitoring market is a rapidly expanding segment of the agritech industry, driven by growing demand for food production, climate-resilient agriculture, and digital agriculture solutions. With technological advancements in geospatial analytics, machine learning, and cloud-based data platforms, this market is witnessing a significant shift from traditional farming practices to data-driven cultivation methods. The adoption of digital agriculture tools is gaining momentum across both developed and emerging economies, supported by favorable government policies, growing awareness of sustainable agriculture, and the rising penetration of smartphones and connectivity in rural areas.

Applications of crop monitoring span from yield prediction and irrigation scheduling to disease detection and input optimization, thereby offering comprehensive visibility into farm operations. As agricultural enterprises and smallholders seek to improve productivity while addressing environmental and operational challenges, the crop monitoring market is poised for robust growth, reflecting a broader transformation in global food systems.

Furthermore, the crop monitoring market is also benefiting from growing investments and collaborations between agritech startups, government agencies, and major agricultural corporations. These partnerships are fostering innovation in sensor technologies, satellite data integration, and AI-powered analytics platforms tailored for real-time crop health assessment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

As climate variability intensifies and arable land becomes scarce, the role of intelligent crop monitoring systems is becoming critical in ensuring food security and promoting regenerative agricultural practices. With the emergence of scalable and user-friendly solutions, even small and medium-sized farmers are gaining access to tools that were once limited to industrial-scale operations, democratizing precision agriculture across the value chain.

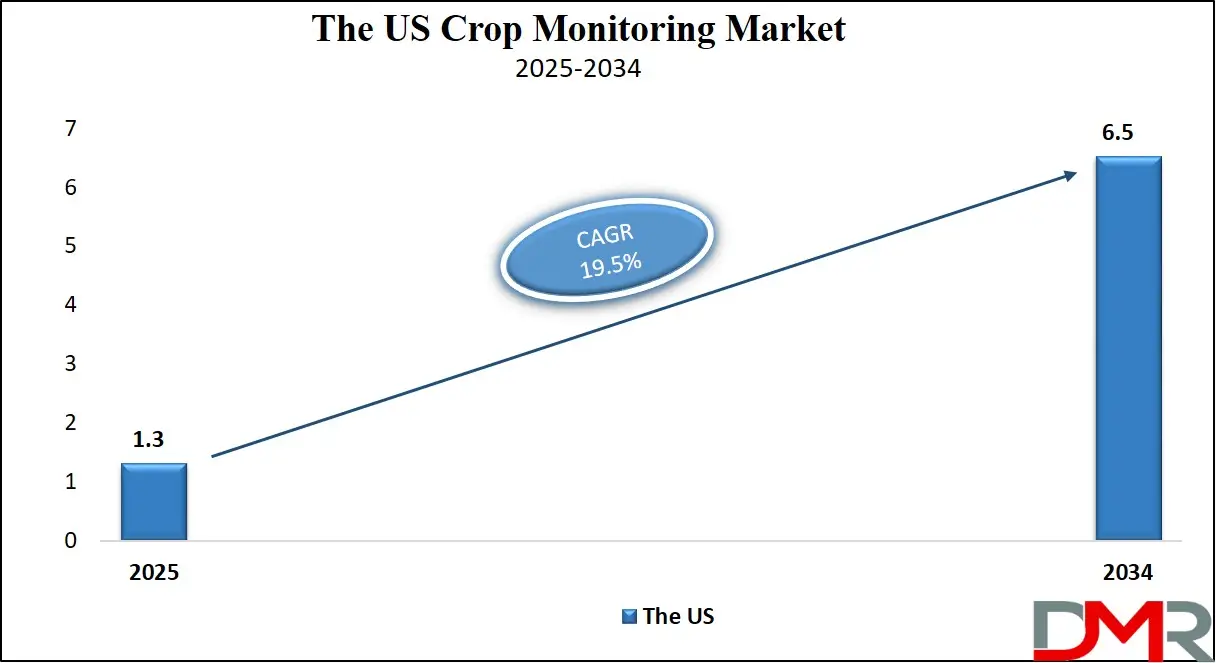

The US Crop Monitoring Market

The U.S. Crop Monitoring Market size is projected to be valued at USD 1.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6.5 billion in 2034 at a CAGR of 19.5%.

The U.S. Crop Monitoring Market is witnessing accelerated growth, fueled by the widespread adoption of precision farming technologies, satellite-based imaging, and AI-powered analytics platforms. With the United States being one of the world’s largest producers of corn, soybean, wheat, and cotton, farmers are investing in smart agriculture tools to boost crop yields, reduce input costs, and combat environmental stressors.

The integration of GPS-enabled field sensors, drones for aerial crop surveillance, and variable rate application (VRA) systems is transforming traditional farming into a data-centric, decision-support process. Additionally, federal support for agricultural digitalization, along with the presence of agritech giants and startups, is further propelling market maturity in the country.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Moreover, growing concerns around climate change, water scarcity, and soil degradation are prompting U.S. farmers to adopt real-time crop health monitoring and predictive analytics for timely interventions. The emergence of cloud-based farm management platforms, integrated with growing smartphone penetration and rural connectivity, is enabling even small and mid-size farmers to leverage advanced crop monitoring systems.

Key applications gaining traction include irrigation optimization, pest and disease detection, nutrient management, and harvest forecasting. As sustainability becomes central to agriculture policy and consumer demand, the U.S. crop monitoring landscape is expected to evolve rapidly, driven by innovations in remote sensing, machine learning algorithms, and agronomic decision support systems.

The Europe Crop Monitoring Market

Europe’s crop monitoring market is projected to reach a valuation of approximately USD 1.4 billion in 2025, underlining the region’s strong foothold in the global digital agriculture landscape. This significant share is largely driven by widespread adoption of precision farming technologies, robust policy support from the European Union, and a high level of mechanization across farming operations. Countries like Germany, France, and the Netherlands have been pioneers in implementing smart agriculture practices, leveraging remote sensing, GIS tools, AI-driven crop analysis, and automated machinery to improve productivity and sustainability.

The European Green Deal and the Common Agricultural Policy (CAP) have played crucial roles in incentivizing farmers to transition from traditional methods to data-intensive, technology-enabled solutions. The demand for efficient resource management and compliance with strict environmental standards has further fueled the uptake of advanced crop monitoring tools.

With a projected CAGR of 18.5% from 2025 to 2034, Europe’s crop monitoring market is poised for robust growth, supported by rising awareness of climate change impacts and the need for resilient food systems. Farmers across Europe are adopting cloud-based platforms, drone technology, and IoT Microcontroller based sensor networks to monitor crop health, soil conditions, and weather variability in real time.

In addition, agritech startups across the region are developing user-friendly digital solutions tailored for both large-scale commercial farms and smaller agricultural enterprises. Integration of AI, big data analytics, and sustainability metrics into farm management platforms is also becoming a defining trend, driving efficiency and transparency across the supply chain. As European agriculture evolves toward regenerative and environmentally conscious practices, the role of advanced crop monitoring solutions will become even more central to meeting production, quality, and compliance objectives.

The Japan Crop Monitoring Market

Japan’s crop monitoring market is estimated to reach around USD 300 million in 2025, reflecting the country’s strategic focus on modernizing its agricultural sector through automation and precision technologies. Despite having limited arable land compared to other leading agricultural nations, Japan has made significant strides in adopting smart farming practices to address challenges such as labor shortages, aging farmer populations, and the need for high-efficiency production on small plots.

The Japanese government has been actively promoting agricultural digitalization through initiatives like the “Smart Agriculture Demonstration Project,” encouraging the integration of drones, multispectral imaging, Advanced IC Substrates, and AI-powered crop health platforms. These technologies are being applied in rice paddies, greenhouses, and specialty crop production, especially in regions like Hokkaido, Nagano, and Shizuoka.

With a projected CAGR of 16.0% from 2025 to 2034, Japan’s crop monitoring market is expected to expand steadily, driven by growing investment in agritech startups and the development of robotics and autonomous farming systems. The country is witnessing a surge in the use of compact monitoring tools that cater to fragmented landholdings, along with cloud-based platforms designed for remote crop analysis and yield forecasting.

Additionally, Japan’s emphasis on producing premium-quality crops, such as fruits and specialty vegetables, makes precise environmental control and monitoring essential. As the government continues to fund technology pilots and private sector collaboration intensifies, Japan is likely to emerge as a regional model for high-tech, data-driven agriculture tailored to small-scale but high-value production systems.

Global Crop Monitoring Market: Key Takeaways

- Market Value: The global crop monitoring market size is expected to reach a value of USD 28.7 billion by 2034 from a base value of USD 5.2 billion in 2025 at a CAGR of 20.8%.

- By Offering Segment Analysis: Hardware offerings are anticipated to dominate the offering segment, capturing 43.0% of the total market share in 2025.

- By Crop Type Segment Analysis: Cereals & Grains are poised to consolidate their dominance in the crop type segment, capturing 40.0% of the total market share in 2025.

- By Farm Size Segment Analysis: Large Farms are expected to maintain their dominance in the farm size segment, capturing 50.0% of the total market share in 2025.

- By Technology Segment Analysis: Remote Sensing technology will lead in the technology segment, capturing 38.0% of the market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment will lead the deployment mode segment, capturing 65.0% of the market share in 2025.

- By Application Segment Analysis: Crop Health Monitoring applications will dominate the application segment, capturing 30.0% of the market share in 2025.

- By End User Segment Analysis: Farmers & Growers are expected to hold the maximum share in the end user segment, capturing 55.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global crop monitoring market landscape with 30.0% of total global market revenue in 2025.

- Key Players: Some key players in the global crop monitoring market are John Deere, Trimble Inc., AGCO Corporation, Raven Industries, Topcon Positioning Systems, BASF Digital Farming (xarvio), Bayer CropScience, Syngenta Group, CNH Industrial (Case IH, New Holland), and Others.

Global Crop Monitoring Market: Use Cases

- Precision Irrigation Management Using Sensor-Based Systems: Modern farms use sensor networks to monitor soil moisture, temperature, and environmental conditions, enabling precise irrigation scheduling. These systems are often integrated with digital platforms that automate water application based on real-time crop requirements.

- Satellite-Based Crop Health Monitoring for Early Threat Detection: Farmers and agribusinesses utilize satellite imagery and drone-based monitoring to assess vegetation health and detect anomalies such as pest infestations, disease outbreaks, or nutrient deficiencies before visible damage occurs.

- Predictive Yield Forecasting through AI and Data Integration: AI-driven platforms analyze historical yield data, crop growth stages, weather patterns, and soil quality to accurately forecast harvest output. These models inform strategic decisions for planting, input planning, and distribution.

- Digital Crop Monitoring for Smallholder Farmer Empowerment: In developing markets, smallholders are using mobile-based crop monitoring apps for field analysis, pest alerts, and real-time agronomic advice. These tools combine satellite data with local weather and crop stage inputs to support farm-level decisions.

Impact of Artificial Intelligence on Crop Monitoring Market

Artificial intelligence is revolutionizing the crop monitoring market by enabling precision agriculture and real-time field insights at an unprecedented scale. AI-powered drones, satellites, and edge sensors collect high-resolution data on crop health, soil moisture, nutrient levels, and pest infestations. Machine learning algorithms then analyze these datasets to detect stress patterns, predict disease outbreaks, and recommend targeted interventions, optimizing fertilizer use, irrigation schedules, and yield forecasts.

Computer vision systems identify plant anomalies leaf by leaf, while predictive analytics helps farmers manage risks associated with weather variability. Overall, AI-driven crop monitoring enhances farm productivity, sustainability, and resource efficiency while reducing environmental impact across large-scale and smallholder operations.

Global Crop Monitoring Market: Stats & Facts

-

U.S. Department of Agriculture (USDA) & U.S. Government Accountability Office (GAO)

- In 2023, 27% of U.S. farms or ranches reported using precision agriculture practices to manage crops or livestock.

- Guidance autosteering systems were used by 70% of large-scale crop-producing farms and 52% of mid-sized farms in 2023.

- Yield monitors, yield maps, and soil maps were deployed on 68% of large-scale crop farms in the U.S.

-

Food and Agriculture Organization (FAO)

- FAO's E-Agriculture initiatives actively promote the use of real-time sensor technology for crop monitoring and precision irrigation.

- FAOSTAT provides open-source agricultural data for over 245 countries, including crop yields, land use, and input consumption.

- FAO reports show that the integration of ICT in agriculture has improved resource use efficiency and environmental sustainability in pilot regions.

- FAO emphasizes that digital crop monitoring can enhance food security in climate-vulnerable countries through early warning systems.

-

GPS.gov (U.S. Department of Commerce)

- GPS-enabled precision agriculture tools support operations like tractor guidance, field mapping, soil sampling, yield mapping, and variable rate applications.

- GPS reduces input waste by enabling accurate placement of seeds and fertilizers in row crops.

- U.S. government agencies highlight that GPS adoption in agriculture helps optimize harvest timing and reduce fuel consumption.

-

United Nations Office for Outer Space Affairs (UNOOSA)

- Satellite data is being globally deployed for agricultural monitoring and early warning systems, especially in drought-prone regions.

- UNOOSA notes that crop monitoring via earth observation supports water management and yield forecasting in countries with limited field-level infrastructure.

- Countries integrating satellite-derived indices (like NDVI) into national crop surveillance programs show improved disaster preparedness and crop insurance outcomes.

Global Crop Monitoring Market: Market Dynamics

Global Crop Monitoring Market: Driving Factors

Rising Demand for Precision Agriculture and Smart Farming

The global crop monitoring market is primarily being driven by the growing reliance on precision agriculture techniques and smart farming practices. As the global population rises and arable land becomes more constrained, farmers are adopting GPS-guided systems, IoT-enabled field sensors, and AI-driven platforms to make timely and informed crop management decisions. These technologies help improve yield quality, reduce input costs, and enable continuous crop health monitoring. The integration of satellite-based imaging, real-time weather tracking, and geospatial analytics further strengthens data-driven farming, enhancing overall productivity and sustainability.

Government Initiatives and Agritech Subsidies

Another key growth driver is the strong support from government bodies and agricultural departments, especially in developing regions. Initiatives aimed at promoting sustainable farming and food security are pushing farmers to adopt digital crop monitoring systems. Subsidized access to precision agriculture tools, cloud-based platforms, and remote sensing services has created an enabling environment for agritech innovation. In countries like India, Brazil, and Kenya, national policies are actively encouraging smallholder farmers to embrace smart agriculture through mobile-based advisory tools, fostering long-term market expansion.

Global Crop Monitoring Market: Restraints

High Upfront Costs and Limited ROI Understanding

Despite the clear benefits, a major restraint limiting adoption is the high initial cost of deploying crop monitoring technologies. Precision farming tools, including drones, automated irrigation systems, and AI-based software, require significant investment, something that may not be feasible for many small- and medium-scale farmers. Moreover, the perceived complexity and uncertainty around return on investment deter many users from transitioning to smart agriculture, particularly in cost-sensitive rural economies where traditional methods still dominate.

Connectivity Gaps and Data Security Concerns

Limited internet connectivity and poor infrastructure in rural and remote areas present another challenge. Real-time crop monitoring depends on seamless cloud connectivity, reliable data transmission, and consistent sensor feedback, all of which are compromised in regions lacking digital infrastructure. In addition to logistical issues, concerns around data ownership, privacy, and the potential misuse of farm-level analytics are coming to light. Many farmers remain cautious about sharing sensitive agricultural data with third-party platforms without clear legal protections or transparency.

Global Crop Monitoring Market: Opportunities

Emergence of Mobile-Based Crop Monitoring Solutions in Developing Regions

The growing penetration of smartphones and mobile internet in rural markets has opened up new opportunities for crop monitoring systems. Agritech startups are leveraging this trend to offer mobile-first solutions that provide localized weather updates, pest alerts, and soil health recommendations. These platforms democratize access to high-end agricultural insights, allowing even smallholder farmers to benefit from digital technologies without investing in expensive hardware. The scalability of these tools positions them as game-changers in regions like Sub-Saharan Africa and Southeast Asia.

Integration of AI, Machine Learning, and Predictive Analytics

As digital agriculture continues to evolve, the integration of artificial intelligence and big data analytics is presenting a transformative opportunity. Predictive models can now anticipate disease outbreaks, suggest input application timing, and forecast yields with high accuracy. This evolution is leading to the development of autonomous decision-making systems that support large-scale farm operations with minimal human intervention. The shift toward predictive and prescriptive analytics is enabling farmers and agribusinesses to minimize risk, maximize resource efficiency, and improve planning at every stage of the crop cycle.

Global Crop Monitoring Market: Trends

Growing Use of Drones and Satellite Imagery for Field Intelligence

One of the most notable trends in the crop monitoring space is the rapid adoption of aerial surveillance technologies. Agricultural drones and satellite-based imaging systems are being used to capture high-resolution visuals of farmlands, detect crop stress, monitor growth patterns, and assess soil variability. These tools offer a bird’s-eye view of crop performance and provide real-time insights that were previously inaccessible through ground-level scouting. As drone prices fall and satellite access becomes more commercially viable, these technologies are quickly becoming standard tools in digital farming.

Rise of Unified Farm Management Platforms

Another emerging trend is the shift toward integrated farm management systems that consolidate various agricultural functions into a single platform. These solutions combine crop monitoring, financial tracking, inventory control, and compliance documentation to offer a comprehensive view of farm operations. By centralizing data, farmers can make smarter decisions, track long-term performance, and align with sustainability goals. These platforms are incorporating regenerative agriculture indicators, such as soil carbon content and biodiversity scores, indicating a broader shift toward environmentally responsible farming.

Global Crop Monitoring Market: Research Scope and Analysis

By Offering Analysis

In the crop monitoring market, hardware offerings are projected to lead the overall market in 2025, accounting for approximately 43.0% of the total share. This dominance is primarily attributed to the widespread deployment of physical devices such as drones, sensors, GPS modules, satellite receivers, and automated weather stations across farms. These tools play a critical role in gathering real-time field data on crop health, soil conditions, weather fluctuations, and pest activity. As the adoption of precision agriculture expands globally, the demand for advanced sensing equipment and aerial surveillance tools continues to grow, especially in large commercial farms where scalability and real-time intelligence are essential.

On the other hand, the software segment, while slightly behind hardware in terms of market share, is witnessing rapid growth driven by the growing need for data interpretation and actionable insights. Crop monitoring software includes platforms that offer features such as yield forecasting, farm analytics dashboards, geospatial mapping, anomaly detection, and decision support systems.

These tools allow farmers and agribusinesses to translate raw field data into strategic actions. The growing adoption of AI and machine learning technologies within these platforms is enhancing their ability to identify patterns, predict crop performance, and automate key farming decisions. With the shift toward integrated farm management and cloud-based agriculture solutions, the software segment is expected to gain further momentum in the coming years.

By Crop Type Analysis

Cereals and grains are set to maintain a dominant position within the crop type segment of the crop monitoring market, accounting for an estimated 40.0% of the total market share in 2025. This dominance is largely driven by the extensive global cultivation of staple crops such as wheat, rice, maize, and barley, which are crucial to both human consumption and livestock feed. Large-scale grain farms, particularly in North America, Asia-Pacific, and parts of Europe, have been early adopters of precision agriculture and digital crop monitoring systems.

These farms leverage satellite imaging, GPS-guided equipment, and soil sensors to manage vast fields efficiently, optimize input usage, and improve yield consistency. Moreover, the economic importance and volume of cereal production create a strong incentive for adopting advanced monitoring tools to mitigate risks such as drought stress, pest infestation, and nutrient deficiency.

Meanwhile, the fruits and vegetables segment is also experiencing significant traction in the crop monitoring landscape, driven by the growing need for quality control, perishability management, and export-grade production. Horticultural crops such as tomatoes, apples, berries, citrus fruits, and leafy greens are highly sensitive to environmental changes, making real-time monitoring critical for ensuring consistent quality and minimizing post-harvest losses.

Farmers growing these crops are adopting sensor-based irrigation systems, disease prediction models, and canopy health imaging to manage production cycles with precision. While fruits and vegetables may not yet surpass cereals in total cultivated area, their higher market value per acre and the demand for premium produce in both domestic and export markets are pushing this segment toward rapid technological adoption.

By Farm Size Analysis

Large farms are projected to continue dominating the farm size segment of the crop monitoring market, with an estimated 50.0% share of the total market in 2025. These farms typically operate on expansive tracts of land, often exceeding 500 acres, and have the financial resources to invest in advanced agricultural technologies. Their large scale of operations demands continuous and efficient monitoring, making tools such as drones, automated machinery, multispectral imaging, and integrated software platforms essential.

Large farms also face higher risks related to weather, disease, and input costs, which further drives their need for real-time data and precision-based decision-making. Additionally, many of these farms are operated by agribusinesses or cooperatives, where economies of scale support the deployment of sophisticated crop monitoring systems across thousands of acres.

In comparison, medium-sized farms, typically ranging between 100 to 500 acres, are steadily growing their adoption of crop monitoring technologies. These farms represent a growing market segment, especially in regions where landholding sizes are gradually consolidating due to economic or policy factors. Medium farms are often family-owned or professionally managed operations that are seeking to boost productivity, reduce input wastage, and improve yield outcomes.

While budget constraints may limit access to the most advanced tools, the availability of cost-effective solutions such as mobile-based monitoring apps, modular sensor kits, and cloud-based analytics platforms is making precision agriculture more accessible to this group. As awareness and digital literacy improve, medium farms are expected to become a key driver of market expansion, particularly in Asia-Pacific and Latin America.

By Technology Analysis

Remote sensing technology is expected to lead the technology segment of the crop monitoring market, capturing around 38.0% of the total market share in 2025. This dominance is driven by the ability of remote sensing tools to provide large-scale, high-frequency monitoring of crop health, soil variability, and field conditions without the need for physical presence in the field. Using satellite imagery, drone-based surveillance, and aerial mapping, remote sensing enables farmers to detect early signs of crop stress, disease outbreaks, water stress, or nutrient deficiencies across expansive farmlands.

The growing availability of high-resolution satellite data and the integration of NDVI and thermal imaging technologies make this method highly valuable for both large and mid-sized farms. Its non-intrusive nature, ability to cover large areas quickly, and compatibility with digital agriculture platforms further enhance its appeal as a primary crop monitoring tool.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Variable Rate Technology, or VRT, is another critical segment within the crop monitoring technology landscape, playing an essential role in optimizing input application. VRT allows farmers to apply seeds, fertilizers, pesticides, and water in varying amounts across different sections of a field, based on localized crop requirements.

This targeted approach reduces input waste, improves soil health, and enhances yield potential by treating each part of the field according to its unique needs. VRT relies on the integration of real-time data from soil sensors, yield monitors, and GPS-based field maps to create prescription maps for precise application. While it may not yet match remote sensing in terms of overall market share, the value VRT brings to resource efficiency, cost savings, and environmental sustainability is making it popular, particularly in regions with high-tech farming infrastructure and supportive precision agriculture policies.

By Deployment Mode Analysis

Cloud-based deployment is projected to dominate the deployment mode segment of the crop monitoring market, accounting for approximately 65.0% of the market share in 2025. This growth is largely driven by the growing demand for flexible, scalable, and remotely accessible crop monitoring solutions. Cloud-based platforms enable farmers and agribusinesses to access real-time data from sensors, drones, and satellite feeds from any location, using internet-connected devices.

These systems allow seamless integration of multiple data streams, such as weather conditions, soil health, and crop growth metrics, into centralized dashboards for analytics and decision-making. Moreover, cloud deployment supports advanced features like AI-driven recommendations, predictive analytics, and continuous software updates without the need for on-site infrastructure. Its lower upfront cost, minimal maintenance requirements, and suitability for multi-farm operations make it the preferred choice for both large-scale and mid-size agricultural enterprises.

In contrast, on-premise deployment remains relevant for certain segments of the agricultural market, particularly where data privacy, limited internet access, or full control over infrastructure is a concern. On-premise solutions involve installing software and hardware locally on a farm or within a cooperative’s facility, which can offer higher customization and tighter security for sensitive data.

This model is commonly adopted by large agribusinesses with dedicated IT teams or in regions where connectivity is unreliable. While on-premise systems typically require higher capital investment and ongoing maintenance, they are still favored by organizations that prioritize data sovereignty, regulatory compliance, or prefer to operate independently of cloud service providers. However, with ongoing advancements in rural connectivity and growing trust in cloud infrastructure, on-premise deployment is expected to see a gradual decline in preference over time.

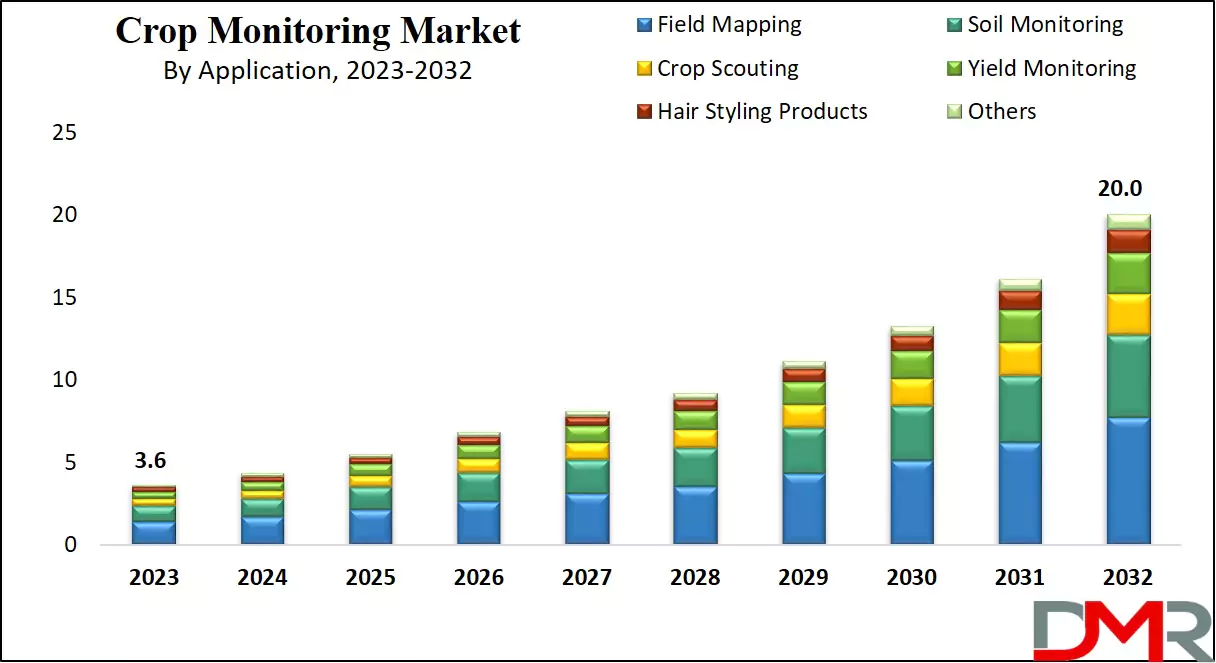

By Application Analysis

Crop health monitoring is anticipated to dominate the application segment of the crop monitoring market, accounting for 30.0% of the total market share in 2025. This application plays a critical role in identifying early signs of disease, pest infestations, and environmental stress that can severely impact yield and quality. By leveraging technologies such as drone imagery, remote sensing, and AI-based image analysis, farmers can detect changes in crop vigor, leaf color, and canopy structure in real time.

This enables timely interventions, such as targeted pesticide application or nutrient supplementation, which not only safeguard the crop but also reduce unnecessary input usage. The growing demand for sustainable farming, integrated with the growing need to maximize yields under challenging climatic conditions, is pushing both large-scale commercial farms and smallholders to adopt advanced crop health monitoring solutions as a core part of their agronomic strategy.

Soil monitoring, while slightly behind in share, represents another vital application area in the crop monitoring ecosystem. Healthy soil is the foundation of productive farming, and technologies that track parameters like moisture content, nutrient levels, pH balance, and organic matter are becoming essential for informed decision-making. Soil sensors, wireless monitoring systems, and cloud-integrated analytics platforms allow farmers to continuously assess the condition of their fields and adjust irrigation, fertilization, and tillage practices accordingly.

This leads to more efficient use of inputs, better root development, and improved crop resilience over time. As sustainable soil management gains attention globally due to concerns around land degradation and food security, the demand for precise and real-time soil monitoring solutions is expected to grow steadily, especially in regions adopting regenerative and conservation agriculture practices.

By End User Analysis

Farmers and growers are projected to hold the largest share in the end-user segment of the crop monitoring market, capturing 55.0% of the market share in 2025. This dominant position stems from their direct involvement in field-level crop management and their growing reliance on precision agriculture technologies to enhance productivity and sustainability. With the rising pressure to increase output while managing input costs and environmental impact, farmers are adopting digital crop monitoring tools such as drones, soil sensors, mobile apps, and GPS-based systems.

These technologies help monitor crop health, forecast yields, manage irrigation, and optimize fertilizer use. The accessibility of mobile-based platforms and cloud-connected devices has particularly accelerated adoption among small and medium-sized farmers, enabling them to make data-driven decisions without requiring high technical expertise or large capital investments.

Agribusinesses, which include large agricultural corporations, input providers, food processing firms, and commodity traders, also represent a significant segment within the crop monitoring market. While their share is smaller than that of individual farmers, these organizations are rapidly integrating advanced monitoring technologies into their supply chains and field operations.

Agribusinesses use crop monitoring platforms not just for field-level optimization, but also for broader applications like remote oversight of contract farms, input performance analysis, and forecasting procurement needs. They are particularly focused on scalability, consistency, and traceability, which are essential for managing large volumes of produce across multiple regions. In many cases, agribusinesses are also investing in proprietary digital platforms and partnering with agritech firms to ensure consistent crop quality and supply chain transparency. As global food systems evolve, the role of agribusinesses in driving technology adoption at scale is expected to grow significantly.

The Crop Monitoring Market Report is segmented on the basis of the following

By Offering

- Hardware

- Software

- Services

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Others

By Farm Size

- Large Farms

- Medium Farms

- Small Farms

By Technology

- Remote Sensing

- Variable Rate Technology (VRT)

- Computer Vision/AI

- IoT/Sensor Networks

By Deployment Mode

By Application

- Crop Health Monitoring

- Soil Monitoring

- Weather Tracking

- Irrigation Management

- Fertilizer & Input Optimization

- Harvest Planning

By End User

- Farmers & Growers

- Agribusinesses

- Government & Research Bodies

- Agri-tech Companies

Global Crop Monitoring Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global crop monitoring market in 2025, accounting for 30.0% of the total market revenue. This dominance is driven by the region’s early adoption of precision agriculture technologies, widespread use of advanced farming equipment, and strong digital infrastructure.

The United States and Canada have been at the forefront of implementing satellite-based crop monitoring, drone surveillance, IoT-enabled field sensors, and cloud-integrated farm management platforms. Supportive government policies, high awareness among farmers, and the presence of key agritech players like John Deere, Trimble, and AGCO further fuel market growth. Additionally, the region’s focus on sustainable farming practices, integrated with investments in smart farming innovations, continues to drive the demand for real-time, data-driven crop management solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

Europe is another region holding a significant share in the global crop monitoring market, supported by strong policy frameworks promoting sustainable agriculture and digital innovation in farming. Countries such as Germany, France, the Netherlands, and the UK are at the forefront of adopting advanced technologies like remote sensing, precision irrigation, and AI-based crop analytics.

The European Union’s Common Agricultural Policy (CAP) has played a key role in incentivizing the use of smart farming tools through subsidies and funding programs. Moreover, the region’s high level of mechanization, growing concerns about environmental sustainability, and strong presence of agritech startups and research institutions contribute to the widespread adoption of crop monitoring systems. Europe's push towards carbon-neutral and climate-resilient agriculture is expected to further accelerate the integration of digital monitoring solutions across both large-scale farms and mid-sized agricultural enterprises.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Crop Monitoring Market: Competitive Landscape

The global competitive landscape of the crop monitoring market is characterized by a mix of established agricultural machinery giants, agritech innovators, and emerging startups, all competing to capture a share of the rapidly growing digital agriculture sector. Leading players such as John Deere, Trimble Inc., AGCO Corporation, and CNH Industrial dominate the space with their integrated hardware-software solutions and expansive global distribution networks. At the same time, technology-driven firms like Climate LLC, Granular, and CropX are pushing innovation with AI-powered analytics platforms, satellite-based monitoring, and sensor-driven field intelligence.

The market is also witnessing increased collaboration between traditional equipment manufacturers and tech startups, resulting in hybrid platforms that offer end-to-end precision farming solutions. Competitive intensity is further fueled by rising investment in agritech, strategic acquisitions, and regional expansions, as companies seek to differentiate themselves through scalability, data accuracy, ease of use, and interoperability with existing farm systems. As sustainability and food security become global priorities, innovation and digital transformation remain at the heart of competition in the crop monitoring landscape.

Some of the prominent players in the global crop monitoring market are

- John Deere

- Trimble Inc.

- AGCO Corporation

- Raven Industries

- Topcon Positioning Systems

- BASF Digital Farming (xarvio)

- Bayer CropScience

- Syngenta Group

- CNH Industrial (Case IH, New Holland)

- Granular Inc.

- PrecisionHawk

- CropX Technologies

- Taranis

- SlantRange

- Prospera Technologies

- Ag Leader Technology

- Gamaya

- FarmLogs

- Sentera

- Other Key Players

Global Crop Monitoring Market: Recent Developments

- June 2025: Netherlands-based agritech venture Doktar received €7.5 million in equity funding to scale its sustainable crop monitoring solution, integrating AI and IoT for real-time field decision support.

- May 2025: Oxford-based agritech firm secured USD 4.5 million in funding to expand its innovative crop monitoring platform, featuring AI-driven data analytics and IoT sensor integration for enhanced field surveillance and yield management.

- March 2025: Swiss agritech startup xFarm Technologies and Brazil’s Checkplant merged to unify expertise in crop field management and monitoring, building a stronger presence in Latin American precision farming.

- February 2025: Maharashtra state in India approved a ₹500 crore Agri-AI policy, funding drone surveillance, smart sensors, and mobile crop monitoring platforms over five years to boost digital agriculture and farm-level intelligence.

- January 2025: India’s hyperspectral satellite startup Pixxel launched three satellites aboard SpaceX, marking the country’s first private deployment. Their imaging system aims to improve agricultural monitoring with high-resolution data, targeting a USD 19 billion remote sensing market by 2029.

- September 2024: CropX acquired New Zealand-based Regen to add precision irrigation and effluent management tools to its agricultural analytics suite, strengthening its position in the crop monitoring solutions space.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.2 Bn |

| Forecast Value (2034) |

USD 28.7 Bn |

| CAGR (2025–2034) |

20.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Hardware, Software, Services), By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Others), By Farm Size (Large Farms, Medium Farms, Small Farms), By Technology (Remote Sensing, Variable Rate Technology (VRT), Computer Vision/AI, IoT/Sensor Networks), By Deployment Mode (Cloud-based, On-Premise), By Application (Crop Health Monitoring, Soil Monitoring, Weather Tracking, Irrigation Management, Fertilizer & Input Optimization, Harvest Planning), and By End User (Farmers & Growers, Agribusinesses, Government & Research Bodies, Agri-tech Companies) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

John Deere, Trimble Inc., AGCO Corporation, Raven Industries, Topcon Positioning Systems, BASF Digital Farming (xarvio), Bayer CropScience, Syngenta Group, CNH Industrial (Case IH, New Holland), and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global crop monitoring market?

▾ The global crop monitoring market size is estimated to have a value of USD 5.2 billion in 2025 and is expected to reach USD 28.7 billion by the end of 2034.

What is the size of the US crop monitoring market?

▾ The US crop monitoring market is projected to be valued at USD 1.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.5 billion in 2034 at a CAGR of 19.5%.

Which region accounted for the largest global crop monitoring market?

▾ North America is expected to have the largest market share in the global crop monitoring market, with a share of about 30.0% in 2025.

Who are the key players in the global crop monitoring market?

▾ Some of the major key players in the global crop monitoring market are John Deere, Trimble Inc., AGCO Corporation, Raven Industries, Topcon Positioning Systems, BASF Digital Farming (xarvio), Bayer CropScience, Syngenta Group, CNH Industrial (Case IH, New Holland), and Others.

What is the growth rate of the global crop monitoring market?

▾ The market is growing at a CAGR of 19.5 percent over the forecasted period.