Market Overview

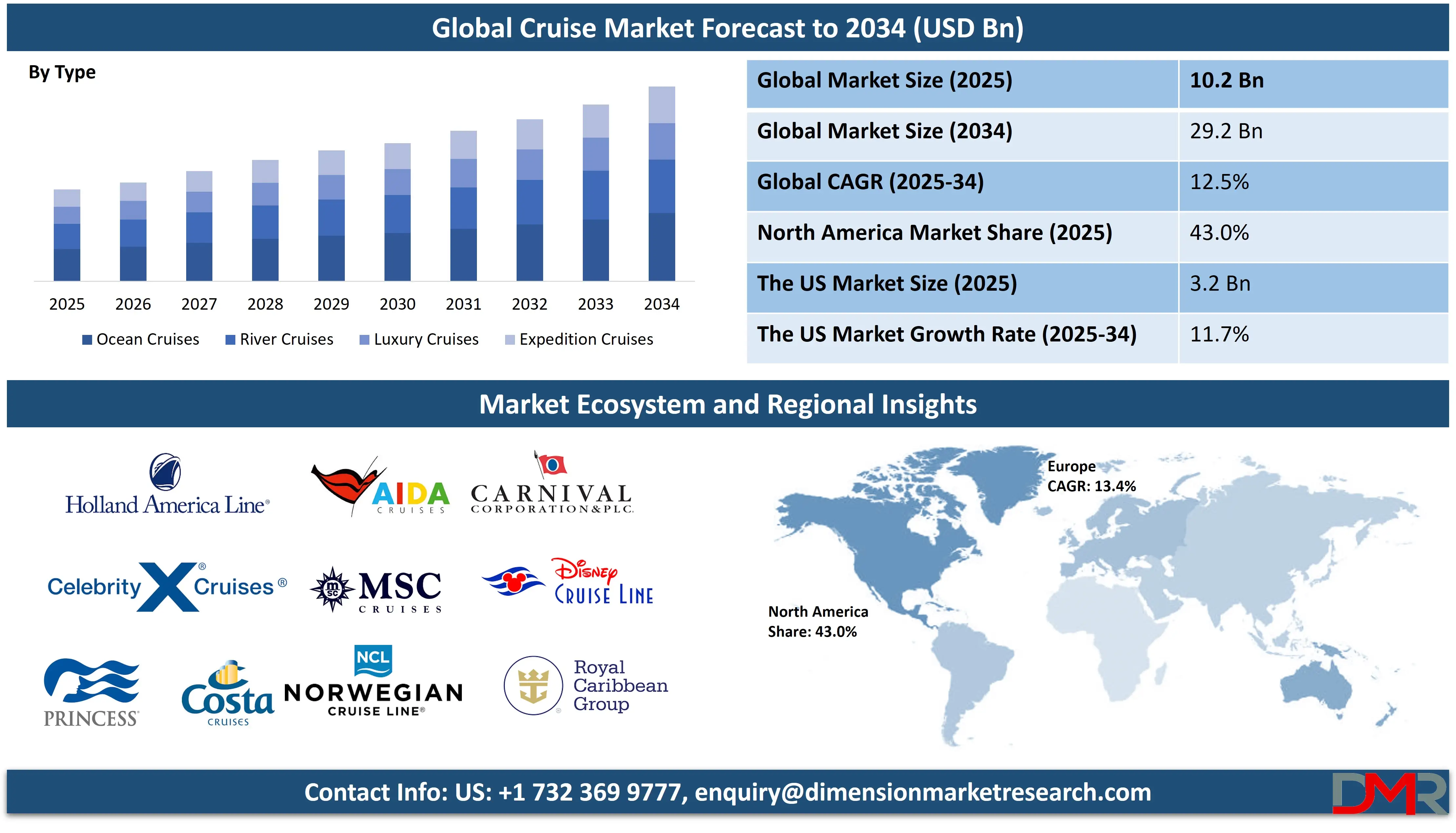

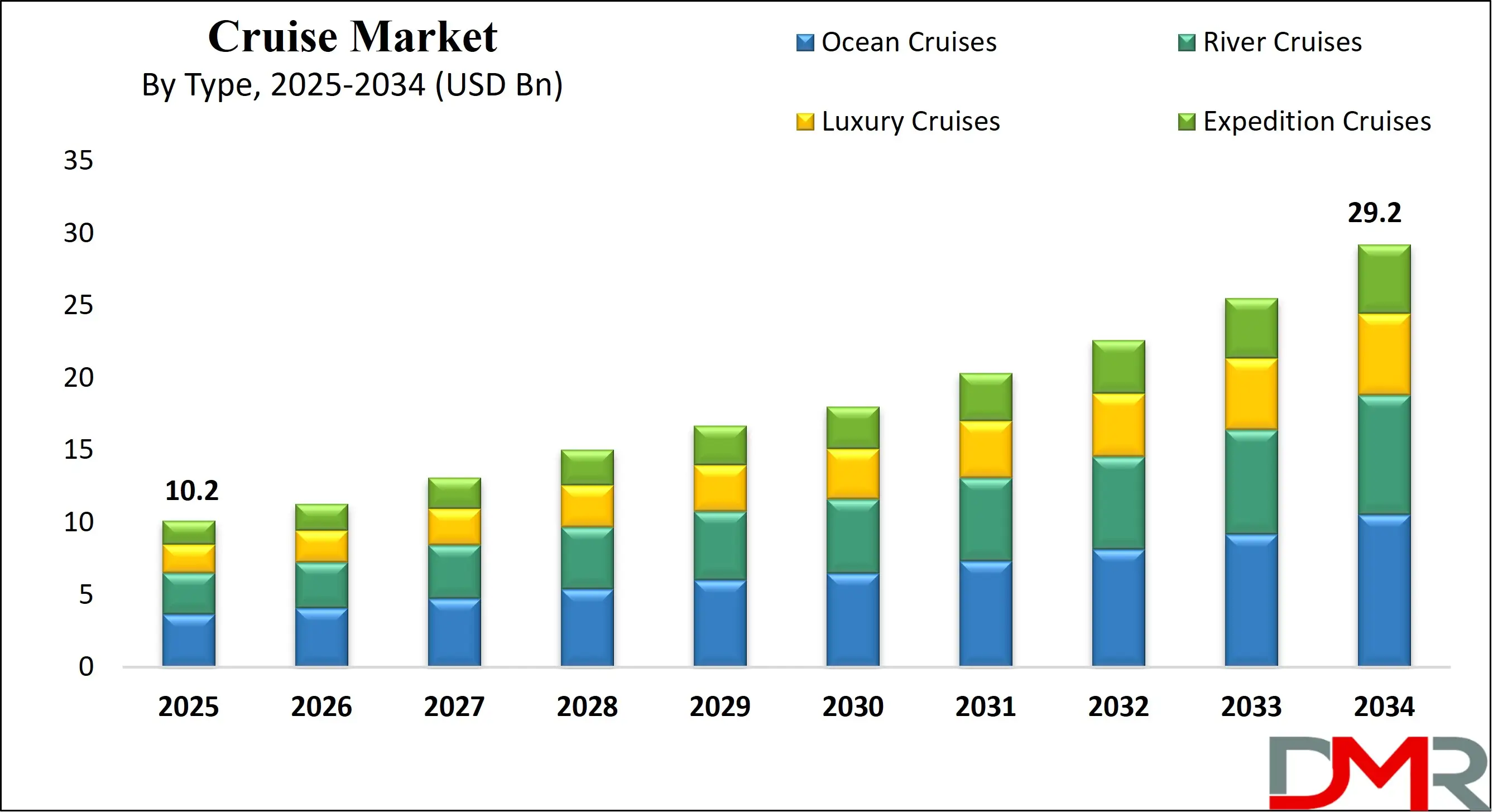

The Global Cruise Market is projected to reach USD 10.2 billion in 2025 and grow at a compound annual growth rate of 12.5% from there until 2034 to reach a value of USD 29.2 billion.

The global cruise market is undergoing a strong resurgence, with passenger volumes surpassing pre-pandemic figures and showing significant promise across both developed and emerging regions. In 2023, the cruise sector saw over 31 million global passengers, driven by a surge in leisure travel, rising disposable incomes, and demand for all-inclusive vacation formats. The industry is evolving rapidly, with growing interest in smaller ships offering expedition-style voyages to unique destinations such as Antarctica, the Arctic, and the Galápagos Islands.

Cruise companies are investing in new vessels powered by cleaner propulsion systems, including liquefied natural gas (LNG) and hybrid-electric engines, reflecting a broader sustainability trend. Digital innovations onboard, such as wearable tech for contactless services and virtual reality experiences, enhance customer engagement. Notably, themed cruises tailored to music lovers, food enthusiasts, and wellness seekers are attracting niche traveler segments.

Market opportunities are vast, especially in Asia-Pacific, where countries like China, India, and Southeast Asian nations are investing in port infrastructure and cruise tourism. There is also increasing demand for river cruises and culturally immersive experiences, especially among millennial and Gen Z travelers seeking authenticity over luxury.

However, the cruise industry continues to face notable restraints. Environmental regulations are tightening, demanding significant retrofitting or fleet upgrades. Additionally, concerns over emissions, marine pollution, and pandemic-related health measures require stringent safety and hygiene protocols. Geopolitical instability can also disrupt key travel corridors.

Nevertheless, the long-term outlook remains positive. With an emphasis on sustainability, personalization, and experiential tourism, the global cruise industry is expected to maintain a strong growth trajectory, supported by diverse offerings and global consumer appetite for sea-based exploration.

The US Cruise Market

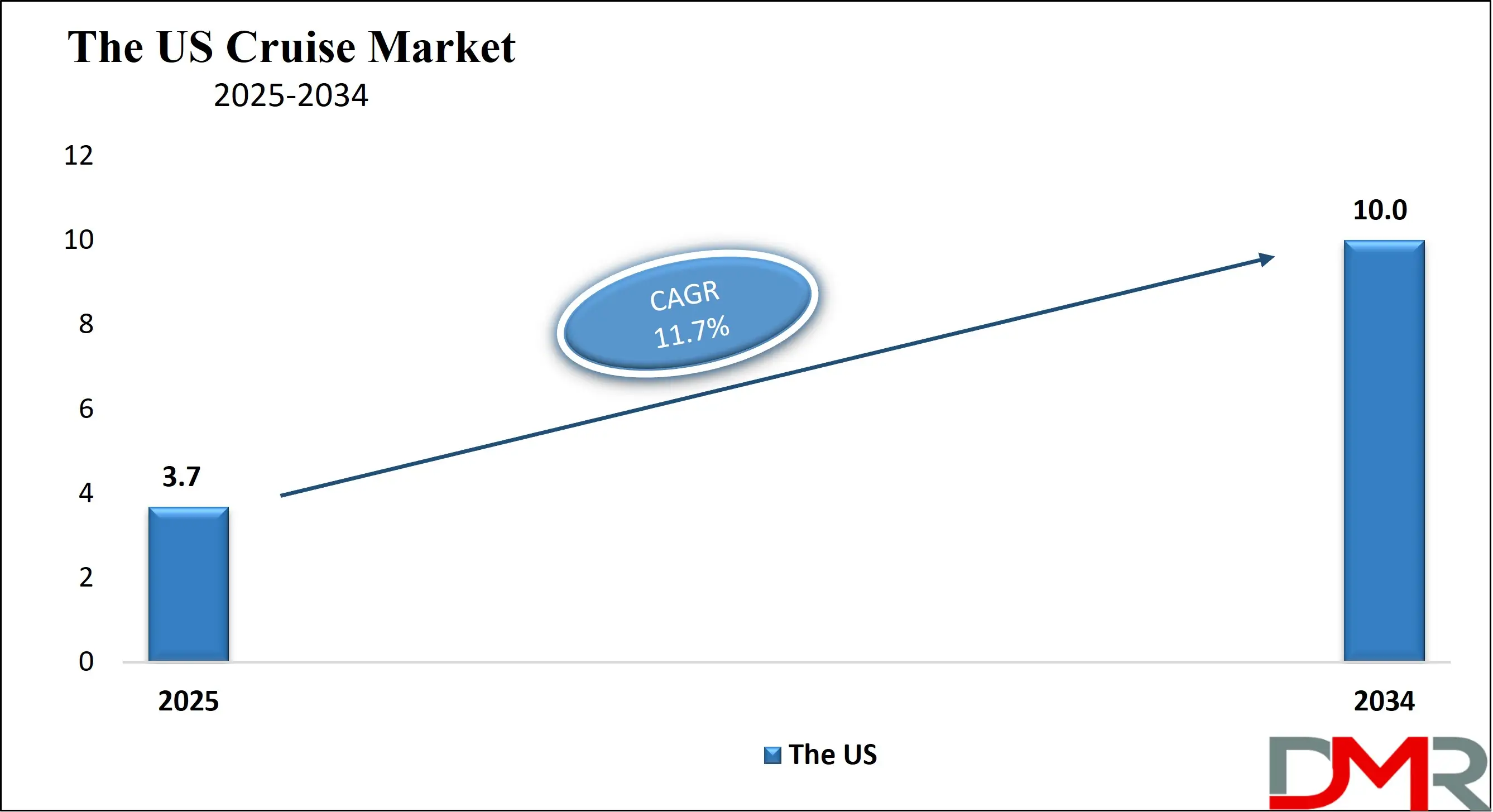

The US Cruise Market is projected to reach USD 3.2 billion in 2025 at a compound annual growth rate of 11.7% over its forecast period.

The United States holds a leading position in the global cruise industry, acting as both a source market and a cruise launch hub. In 2023, U.S. residents made up over half of all global cruise passengers, with Florida’s PortMiami and Port Canaveral ranking among the world’s busiest cruise terminals. This is due in part to the country's vast coastal infrastructure and proximity to attractive cruising destinations like the Caribbean, Alaska, and Mexico.

The U.S. demographic advantage lies in a large middle-class population, a growing retiree base with travel aspirations, and a highly mobile millennial segment seeking unique experiences. According to U.S. Customs and Border Protection, enhanced cruise terminal procedures and biometric systems are improving passenger throughput, reducing delays, and bolstering customer satisfaction.

Cruise operators in the U.S. are focusing on sustainable growth. In alignment with environmental initiatives supported by the U.S. Environmental Protection Agency, cruise lines are transitioning to cleaner fuels and retrofitting older vessels with advanced emission systems. This is a strategic response to consumer demand for greener travel and increasing regulatory expectations.

Moreover, the U.S. government supports domestic maritime tourism through the Maritime Administration (MARAD), which provides grants and loans to upgrade port infrastructure and expand domestic waterborne transport. The Passenger Vessel Services Act (PVSA) also impacts the cruise itineraries that can legally depart and return to U.S. ports, shaping the operational strategies of major cruise lines.

Altogether, a combination of advanced infrastructure, favorable demographics, and governmental support makes the U.S. cruise market dynamic, resilient, and poised for sustainable expansion.

The European Cruise Market

The Europe Cruise Market is estimated to be valued at USD 2.12 billion in 2025 and is further anticipated to reach USD 6.58 billion by 2034 at a CAGR of 13.4%.

Europe remains a vibrant cruise market, fueled by its rich cultural heritage, geographic diversity, and strong port infrastructure. In 2022, more than 5.7 million Europeans chose cruises as their vacation method, with leading homeports in Italy, Spain, Germany, and the UK contributing significantly to passenger volumes. The European cruise network encompasses the Mediterranean, Baltic Sea, and Canary Islands, along with highly popular river routes on the Danube, Rhine, and Seine.

The continent’s demographic advantage lies in its mature population segments and increasing participation from younger travelers. According to Eurostat, Europe's aging population is driving demand for slow-paced, all-inclusive cruise vacations that offer comfort and security, while river cruises appeal to history lovers seeking intimate travel experiences. Meanwhile, younger tourists are showing increasing interest in themed cruises and shorter itineraries.

The cruise industry in Europe is also adopting sustainability at a faster pace. European Union initiatives such as the “Fit for 55” climate package are encouraging ports to offer shore power and cruise lines to adopt alternative fuels like LNG. This transition is complemented by Europe’s port cities collaborating with cruise lines to manage overtourism and minimize environmental impact.

Public transport connectivity, efficient visa policies (such as Schengen zone travel), and favorable exchange rates also contribute to the accessibility and appeal of cruising within Europe. Strong domestic markets, diversified routes, and deep-rooted tourism ecosystems ensure that Europe remains a cornerstone of the global cruise market with robust forward momentum.

The Japan Cruise Market

The Japan Cruise Market is projected to be valued at USD 41.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 82.0 million in 2034 at a CAGR of 8.0%.

Japan’s cruise market is experiencing a revitalized phase, fueled by post-pandemic travel recovery, inbound tourism, and strategic development by national and local governments. As of 2024, Japan has set a new record by welcoming over 37 million international visitors. According to the Japan National Tourism Organization, approximately 2.7 million of these tourists were from the U.S., indicating rising Western interest in Japanese cruising experiences.

Domestic cruising is also rebounding, with a 121% increase in local passenger numbers from 2023. Japanese cruise operators such as NYK Cruises and Mitsui Ocean Cruises are investing in luxury ships to target international audiences, especially from the United States, while foreign cruise lines like Norwegian Cruise Line and Princess Cruises are expanding their itineraries around Japan’s archipelago.

The demographic advantage lies in Japan’s aging but affluent population and a well-developed public transport system, which enables smooth port access. With over 100 cruise ports, including Yokohama, Kobe, Nagasaki, and Okinawa, the country offers diverse routes ranging from cherry blossom sightseeing to UNESCO heritage exploration. The Ministry of Land, Infrastructure, Transport and Tourism has emphasized cruise tourism in its national growth strategies, aiming to surpass pre-pandemic cruise visitor numbers by 2025.

Environmental sustainability is also a focus, with Japanese ports gradually integrating shore power and promoting LNG fuel use. Japan’s meticulous hospitality, safety record, and unique blend of ancient and modern cultures create an unmatched cruising appeal. The nation is poised to emerge as a major player in the Asia-Pacific cruise market in the next few years.

Global Cruise Market: Key Takeaways

- Global Market Share Insights: The Global Cruise Market size is estimated to have a value of USD 10.2 billion in 2025 and is expected to reach USD 29.2 billion by the end of 2034.

- The US Market Share Insights: The US Cruise Market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10.0 billion in 2034 at a CAGR of 11.7%.

- Regional Insights: North America is expected to have the largest market share in the Global Cruise Market with a share of about 43.0% in 2025.

- Key Players Insights: Some of the major key players in the Global Cruise Market are Carnival Corporation & plc, Royal Caribbean Group, Norwegian Cruise Line Holdings Ltd., MSC Cruises, Disney Cruise Line, Princess Cruises, Holland America Line, Celebrity Cruises, Costa Cruises, AIDA Cruises, Cunard Line, P&O Cruises, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.

Global Cruise Market: Use Cases

- Luxury Wellness Retreats: Cruise lines now offer holistic wellness escapes, integrating spa therapies, meditation, detox cuisine, and fitness programs. These wellness cruises cater to affluent travelers seeking rejuvenation while surrounded by the serenity of the open sea, combining luxury with health and mindfulness on tailored itineraries.

- Polar and Expedition Voyages: Expedition cruises are gaining traction among adventure travelers, particularly to remote and pristine environments like Antarctica and the Arctic. These ships are smaller and ice-rated, providing wildlife observation, glaciology lectures, and guided landings, attracting environmentally conscious guests and bucket-list travelers.

- Multigenerational Family Travel: Modern cruise lines cater to families traveling across generations, offering kids' clubs, teen lounges, senior activities, and group excursions. All-inclusive services and onboard entertainment make it easy for grandparents, parents, and children to vacation together, reducing planning stress.

- Floating Conference and MICE Events: Corporate events, incentive trips, and meetings are now hosted on cruise ships, offering a unique venue with built-in accommodation and leisure. Cruise-based MICE (Meetings, Incentives, Conferences, Exhibitions) combines productivity with relaxation, often extending into team-building at exotic ports of call.

- Themed Cultural Cruises: Cruises tailored around cultural themes such as wine, opera, art, or culinary traditions offer curated experiences for niche travelers. Passengers engage in expert-led sessions, tastings, and shore excursions that connect them with local traditions and regional heritage, enhancing cultural immersion.

Global Cruise Market: Stats & Facts

Cruise Lines International Association (CLIA)

- In 2023, the global cruise industry generated a total economic impact of $168.6 billion, marking a 9% increase compared to the pre-pandemic peak in 2019. This reflects a strong post-COVID recovery and consumer confidence in maritime travel.

- The industry supported approximately 1.6 million jobs globally in 2023, of which about 77% were based on land rather than on ships, showing its broader influence beyond the vessel itself.

- Cruise passenger volume reached 31.7 million in 2023, exceeding the 2019 record of 29.7 million passengers, demonstrating the sector’s full recovery.

- In terms of labor income, the global cruise sector contributed $56.9 billion in wages in 2023, showing its significance in supporting livelihoods worldwide.

CLIA – Europe

- In 2023, the European cruise industry contributed around €55.3 billion to the continent’s economies, including direct spending, shipbuilding activity, and indirect services.

- Roughly 400,000 jobs were supported by the European cruise industry in 2023, emphasizing its role in employment creation across tourism, shipbuilding, and services.

- Cruise passenger volume from Europe totaled 8.2 million in 2023, surpassing 2019 figures and making Europe a major source market.

- Germany led as the top European source market with 2.5 million cruise passengers in 2023, followed by the UK and Ireland with 2.28 million, and Italy with 1.18 million.

Japan Ministry of Land, Infrastructure, Transport and Tourism

- Japanese ports recorded 2,479 cruise ship calls in 2024, a 33% increase from the prior year, returning to about 85% of the 2018 peak.

- Inbound cruise visitors to Japan reached 1.44 million in 2024, more than quadrupling from the year before and recovering to 57% of the 2017 record of 2.53 million.

- Of the total port calls in 2024, foreign-based cruise ships accounted for 1,923 visits, while Japanese-based cruise ships contributed 556 calls.

- Top ports in Japan included Hakata with 204 calls, followed by Naha (175), Nagasaki (160), Yokohama (147), and Ishigaki (120), showing regional diversity in cruise traffic.

Norwegian Government and Environmental Policy

- Norway initially set a requirement for zero-emission cruise operations in its World Heritage fjords by 2026. However, due to technological barriers, the deadline was extended to 2032 for large ships.

- Cruise operators in Norway, such as Havila Voyages and Hurtigruten, have invested in green technologies, including battery-electric systems and LNG hybrid models, to meet evolving environmental regulations.

Transport & Environment (Europe)

- In 2023, Carnival Cruise Line’s ships operating in Europe emitted 2.55 million tonnes of CO₂, more than the total emissions of Glasgow, which was recorded at 2.43 million tonnes in 2021.

- MSC Cruises and Norwegian Cruise Line followed with respective emissions of 1.4 million tonnes and 0.84 million tonnes, illustrating the environmental challenge facing the cruise industry.

Venice Municipal Tourism Authorities

- Venice implemented a €5 fee in 2024 for all day-trippers as part of a pilot project to manage over-tourism. This fee was applied across 29 designated peak days to reduce strain on city infrastructure.

- The measure aims to protect Venice's status as a UNESCO World Heritage site by limiting daily visitor inflows and encouraging sustainable tourism.

VisitScotland and Scottish Government

- In 2024, Scottish ports welcomed 1.2 million cruise visitors, a substantial increase from 817,000 in 2019, signaling strong cruise-led tourism growth in the region.

- Average per capita spending by cruise passengers in Scotland is estimated at a minimum of £100, contributing significantly to local economies, especially in port towns and rural destinations.

Japan National Tourism Organization and Immigration Bureau

- Japan welcomed 37 million total tourists in 2024, representing a 47% rise from 2023, with a strong contribution from cruise visitors.

- Among these, 2.7 million tourists were from the United States, making American travelers a leading demographic in Japan’s cruise tourism recovery.

- Japan has set goals to welcome more than 2.5 million international cruise passengers and over 2,000 vessel visits annually from 2025 onwards, exceeding pre-COVID benchmarks.

WorldMetrics Organization

- Globally, the cruise industry supports over 1.18 million jobs, encompassing roles on ships, in ports, travel agencies, and service sectors.

- Europe’s cruise-related economy is valued at €117 billion annually, underscoring the sector’s economic clout in the region.

- The industry generates an estimated $25.9 billion in wages per year across all regions.

- Average staffing on a modern cruise ship includes around 1,100 crew members, with higher numbers on mega vessels.

- Annual port fees and charges from cruise lines total approximately $120 million worldwide.

- Royal Caribbean operates the world’s largest fleet with 25 active cruise ships.

- The MedCruise network represents more than 140 ports throughout the Mediterranean, facilitating connectivity across southern Europe and North Africa.

- The cruise workforce includes over 250,000 Filipino seafarers, reflecting their dominance in maritime employment.

- Florida alone receives $15.7 billion in economic value annually from cruise activities, including port operations and tourism.

- In 2021, cruise companies contributed about $150 million to global charitable and relief organizations.

ZipDo Education Cruise Data (Aggregated Public Sources)

- The Caribbean remains the top cruise destination globally, drawing 35% of all cruise itineraries due to its climate and diverse port offerings.

- The global cruise industry contributed $150.4 billion in economic output in 2019, showing long-term resilience.

- Cruise passengers spend an average of $459 during each port visit, benefiting local restaurants, souvenir shops, and excursion operators.

- The average cost of a cruise vacation in 2019 was approximately $1,793 per passenger, including travel, accommodations, and onboard purchases.

- More than 100 new cruise ships are scheduled for delivery worldwide by 2027, reflecting rising demand and fleet modernization.

- By 2027, the global cruise market is projected to approach a value of $274.4 billion, driven by new routes, luxury offerings, and emerging demographics.

- Cruise operations contribute approximately 0.5% of global carbon emissions in the transport sector, prompting green investment.

- A large cruise ship consumes over 3.5 million gallons of fuel weekly, showcasing the scale and energy intensity of modern vessels.

Global Cruise Market: Market Dynamic

Driving Factors in the Global Cruise Market

Expanding Middle-Class Population and Rising Disposable Income Globally

One of the most significant growth drivers for the global cruise market is the continued expansion of the global middle class, especially in emerging economies across Asia-Pacific, Latin America, and parts of Africa. As per World Bank and OECD projections, billions of people are entering income brackets that support leisure travel and discretionary spending.

This socioeconomic shift is boosting demand for affordable luxury and all-inclusive travel options, making cruise vacations an attractive proposition for first-time international travelers. In countries like India, China, Brazil, and Indonesia, rising income levels, improved access to passports, and increased flight connectivity to cruise ports are accelerating cruise adoption.

Additionally, cruise operators are localizing marketing strategies and port itineraries to attract regional tourists. Asian cruises now cater to culinary preferences, language support, and entertainment tailored to Chinese, Indian, and Southeast Asian cultures. Budget-friendly itineraries, shorter cruises, and fly-cruise packages are being introduced to reduce entry barriers.

As this new consumer class grows in both size and confidence, it is fundamentally reshaping the industry’s revenue structure. Furthermore, the rise in dual-income households and a cultural shift towards experience-based spending rather than material acquisitions are fueling the demand for cruise-based vacations. This structural consumer evolution represents a long-term driver that sustains steady, scalable growth across diverse geographies and income groups.

Infrastructure Development in Port Cities and Emerging Cruise Hubs

The development and modernization of port infrastructure globally are playing a pivotal role in boosting cruise market expansion. Governments and private stakeholders are investing heavily in expanding existing ports and developing new cruise terminals that can accommodate mega-ships and streamline passenger logistics.

Ports across Southeast Asia, the Mediterranean, the Caribbean, and Latin America are upgrading docking facilities, improving customs clearance operations, and enhancing tourism zones to cater to cruise visitors. This trend is not just limited to major metropolitan cities but also includes tier-2 ports, river cruise docks, and heritage coastline cities that are being integrated into broader cruise itineraries. Countries like Vietnam, the Philippines, Morocco, and Croatia are seeing increased cruise calls due to such developments.

These improvements reduce turnaround times, enhance tourist experiences, and support multiple ship operations per day, which increases port revenue and boosts regional economies. Additionally, infrastructure investments promote homeporting, where cruises start and end in the same port, allowing passengers to explore port cities and contribute more to local tourism.

The increased port readiness has enabled cruise lines to expand itineraries to previously underutilized routes, fostering decentralization of cruise tourism. As port accessibility and capacity grow globally, the cruise industry benefits from a more dynamic network of destination offerings and operational efficiencies.

Restraints in the Global Cruise Market

Environmental Regulations and Emission Control Costs

Tightening environmental regulations imposed by international maritime bodies and coastal governments are increasingly challenging the economic feasibility of cruise operations. The International Maritime Organization (IMO) mandates reductions in sulfur oxide emissions and calls for zero-carbon vessels by 2050.

This requires heavy investment in new propulsion systems, fuel alternatives like LNG, and retrofitting existing fleets with scrubbers or exhaust treatment systems. These compliance-related expenditures can stretch into hundreds of millions of dollars per vessel, placing significant financial strain on cruise operators.

Moreover, certain popular destinations such as Norway’s fjords and parts of Alaska are imposing restrictions on older, diesel-powered ships, effectively narrowing the scope of itinerary planning. Additional burdens arise from compliance with local waste disposal laws, noise regulations, and port-level environmental certifications. The complexity of adhering to multilayered regulations across different jurisdictions reduces operational agility and can increase voyage costs.

Cruise lines must also deal with negative media coverage and activist scrutiny related to marine pollution, coral reef damage, and high per-capita emissions compared to other forms of tourism. Public perception issues can impact brand equity and market penetration, especially among younger and environmentally conscious travelers. While green technology offers solutions, the capital-intensive transition is a formidable constraint for both established players and new entrants.

High Vulnerability to Global Shocks and Health Crises

The cruise industry is highly sensitive to global disruptions such as pandemics, geopolitical tensions, and natural disasters, making it a volatile sector. The COVID-19 pandemic exposed this vulnerability when cruise operations came to a near standstill worldwide for more than a year. Subsequent health and safety regulations, capacity restrictions, and frequent changes to port access rules increased operational complexity and costs.

Even in recovery, outbreaks of viruses like norovirus and influenza aboard cruise ships lead to negative media coverage and public concern, prompting cancellations and reputational damage. Political instability in certain regions also forces rerouting or cancellation of itineraries, affecting both revenue and customer satisfaction.

Furthermore, natural calamities such as hurricanes, typhoons, and tsunamis pose risks to ship operations and passenger safety, often leading to logistical chaos and increased insurance premiums. Cruise ships are also subject to cybersecurity threats as they digitize services, adding another layer of vulnerability.

Additionally, inflation, oil price volatility, and fluctuating foreign exchange rates affect profitability, particularly for international operations. These unpredictable variables create a fragile operating environment that demands continuous adaptation, robust risk management strategies, and strong crisis communication frameworks. The capital-intensive nature of the cruise industry leaves limited flexibility for rapid pivots during global shocks, thereby hindering consistent growth momentum.

Opportunities in the Global Cruise Market

Integration of Green Technologies and Sustainable Fuel Alternatives

One of the most promising growth opportunities in the cruise market lies in embracing green technologies and sustainable propulsion systems. Regulatory pressure from IMO 2030/2050 decarbonization goals and national mandates is compelling cruise operators to invest in LNG-powered ships, hybrid propulsion systems, and shore-to-ship power solutions.

Adoption of advanced wastewater treatment, carbon capture technologies, and exhaust gas cleaning systems is also a critical initiative. These sustainability upgrades not only reduce operational carbon footprints but also enhance the environmental brand reputation of cruise operators. Moreover, as eco-conscious travelers increasingly prioritize sustainability in travel decisions, companies that position themselves as green pioneers can gain competitive differentiation and market share.

Many cruise lines are integrating photovoltaic solar panels, wind-assisted propulsion, and battery-electric technologies in new builds. There is also growing interest in hydrogen and methanol as long-term fuel solutions. Port cities offering green bunkering infrastructure are likely to become preferred destinations. Additionally, collaborations with clean-tech companies, universities, and public institutions can accelerate the commercialization of emission-free cruising technologies.

These efforts open up new investment channels from ESG-focused funds and green bonds, further supporting growth. As regulatory frameworks tighten and environmental accountability becomes integral to the cruise industry’s license to operate, green innovation becomes both a moral imperative and a substantial commercial opportunity.

Expansion into Untapped Regions and Thematic Cruises

Geographical diversification into underexplored regions presents a vast opportunity for cruise lines to broaden their reach and develop new revenue streams. Destinations such as the Indian Ocean, the Red Sea, West Africa, and the inland rivers of South America are emerging as promising cruise corridors due to their rich biodiversity, cultural heritage, and growing geopolitical stability. These regions also face less saturation, giving cruise lines the advantage of first-mover status. Moreover, cruise itineraries built around specific themes such as wellness, culinary journeys, music festivals, history, and wildlife safaris are increasingly appealing to niche travelers.

Thematic cruises allow for premium pricing, high occupancy rates, and tailored experiences that enhance passenger satisfaction and loyalty. Educational cruises and corporate retreats are also growing segments, especially post-pandemic, as companies seek immersive bonding experiences. Further opportunities exist in repositioning cruises seasonally between hemispheres to optimize fleet utilization.

Cruise lines are also exploring cross-border, multi-modal packages that integrate rail, air, and cruise segments for seamless experiences. Additionally, enhanced visa frameworks, government tourism incentives, and bilateral agreements are helping reduce barriers to entry in new destinations. As technology improves navigation and satellite connectivity, even remote destinations become viable, allowing cruise lines to tap into the next frontier of global exploration and travel personalization.

Trends in the Global Cruise Market

Integration of Smart Technologies and IoT for Enhanced Passenger Experience

Cruise liners are embracing smart technology and IoT solutions to modernize passenger experiences and improve operational efficiency. From facial recognition during embarkation to wearable wristbands for keyless cabin entry, the implementation of digital tools is revolutionizing convenience and personalization at sea.

Smart cabins with AI-enabled controls for lighting, temperature, and entertainment systems are becoming common across new builds and retrofits. Furthermore, real-time data analytics help cruise operators predict passenger behavior, improve service delivery, and offer personalized recommendations for onboard dining, excursions, or wellness activities. The trend reflects a broader shift in maritime tourism toward digital transformation and hyper-personalized service delivery.

Operators are also adopting advanced maintenance systems and predictive analytics to reduce downtime and mechanical failure. This growing trend aligns with consumer expectations for tech-enabled travel and fosters loyalty by providing seamless, intuitive experiences. Additionally, smart waste management systems and automated fuel monitoring enhance sustainability initiatives. As younger, tech-savvy travelers enter the cruise market, digital-first experiences are not just added luxuries but competitive necessities.

The trend also opens avenues for ancillary revenue through app-based purchases, AI-powered tour suggestions, and subscription models. In this era, the cruise sector is aligning with the broader travel industry trend of data-driven personalization and automation to create efficient, engaging, and eco-conscious voyage experiences.

Rise of Expedition Cruises and Niche Destinations

Expedition cruising has emerged as one of the most prominent trends, driven by growing interest in remote, less-traveled destinations and immersive cultural or ecological experiences. Unlike traditional cruise offerings centered around mass tourism hubs, expedition cruises focus on Arctic voyages, Antarctic exploration, Galápagos expeditions, and remote archipelagos in the South Pacific or Southeast Asia.

The market is responding to traveler demand for sustainable tourism, unique environments, and educational engagement, particularly from millennials and Gen X consumers prioritizing experience over luxury. Ships used for expedition cruising are typically smaller and ice-class certified, equipped with zodiac boats and staffed with naturalists, geologists, and historians who enhance the learning element of the voyage.

Cruise lines are launching purpose-built vessels tailored for polar travel and expanding itineraries into biodiversity hotspots. The rise in climate-conscious consumers has made these cruises more appealing, especially as operators emphasize minimal impact and carbon-neutral practices. This trend allows cruise companies to differentiate themselves from competitors by offering boutique-style, high-value products that cater to smaller groups of adventure-seeking passengers.

Moreover, as demand for bucket-list travel grows post-pandemic, expedition cruises position themselves at the intersection of luxury, adventure, and sustainability, delivering highly personalized and exclusive experiences. This trend also supports year-round operations and mitigates seasonality challenges typically seen in traditional cruise markets.

Global Cruise Market: Research Scope and Analysis

By Type Analysis

Ocean cruises are projected to dominate the global cruise market due to their large-scale capacity, extensive itinerary options, and long-standing consumer popularity. These cruises offer the unique ability to traverse international waters and access a wide array of ports spanning multiple continents, including the Caribbean, Mediterranean, Alaska, South Pacific, and Northern Europe. Their popularity is amplified by the immersive, all-inclusive vacation model they deliver, combining lodging, dining, entertainment, and leisure activities aboard a single vessel.

Ocean cruises are typically conducted on mega-ships that accommodate thousands of passengers, offering economies of scale that reduce the cost per traveler and maximize onboard revenue through casinos, shopping arcades, specialty restaurants, and shore excursion packages.

Moreover, ocean cruises cater to a broad demographic from families and retirees to honeymooners and solo travelers by providing tiered experiences ranging from standard cabins to ultra-luxury suites. Their ability to host themed journeys such as cultural expeditions, music festivals at sea, and family-oriented voyages enhances their versatility and consumer appeal. The development of new-generation ocean liners equipped with advanced stabilizers, eco-friendly fuel systems, and AI-powered personalization features continues to attract both new and repeat travelers.

Ocean cruising also benefits from superior brand recognition and expansive global marketing efforts by major operators. Ports across the world have prioritized infrastructure upgrades to accommodate these large vessels, which further fuels their market reach. With greater itinerary flexibility, longer durations, and a well-established brand reputation, ocean cruises continue to be the cornerstone of the cruise industry, maintaining dominance in volume, revenue, and global consumer preference.

By Propulsion Type Analysis

Diesel-powered cruise ships are anticipated to hold the dominant position in the propulsion type segment due to their widespread deployment, reliability, and established operational infrastructure. As the most traditional and mature form of marine propulsion, diesel engines provide an efficient and cost-effective means to power large vessels across extended voyages. The vast majority of the existing global cruise fleet relies on diesel propulsion, making it the industry standard. This dominance is reinforced by the comprehensive maintenance knowledge, availability of spare parts, and skilled labor force associated with diesel systems, which ensures smoother operations and fewer technical disruptions at sea.

Diesel propulsion offers consistent speed, robust power delivery, and fuel efficiency, especially for long-haul ocean voyages that require sustained cruising over international waters. Most mega-ships, which are central to the revenue model of leading cruise lines, rely on multiple diesel engines working in tandem to meet both propulsion and auxiliary power needs. The ability to adjust engine loads for different weather conditions and distances allows diesel-powered ships to operate with a degree of adaptability not always available in emerging propulsion alternatives like LNG, hybrid-electric, or hydrogen systems.

Furthermore, innovations such as scrubber systems and energy recovery technologies have made diesel propulsion more environmentally compliant, addressing regulatory concerns without necessitating a complete overhaul. Given the high capital investment needed to transition to newer systems and the logistical challenges of alternative fuel availability at ports, diesel-powered ships remain the backbone of cruise operations globally. Until green technologies reach mass adoption and scalability, diesel propulsion will continue to lead due to its practicality, infrastructure readiness, and proven track record.

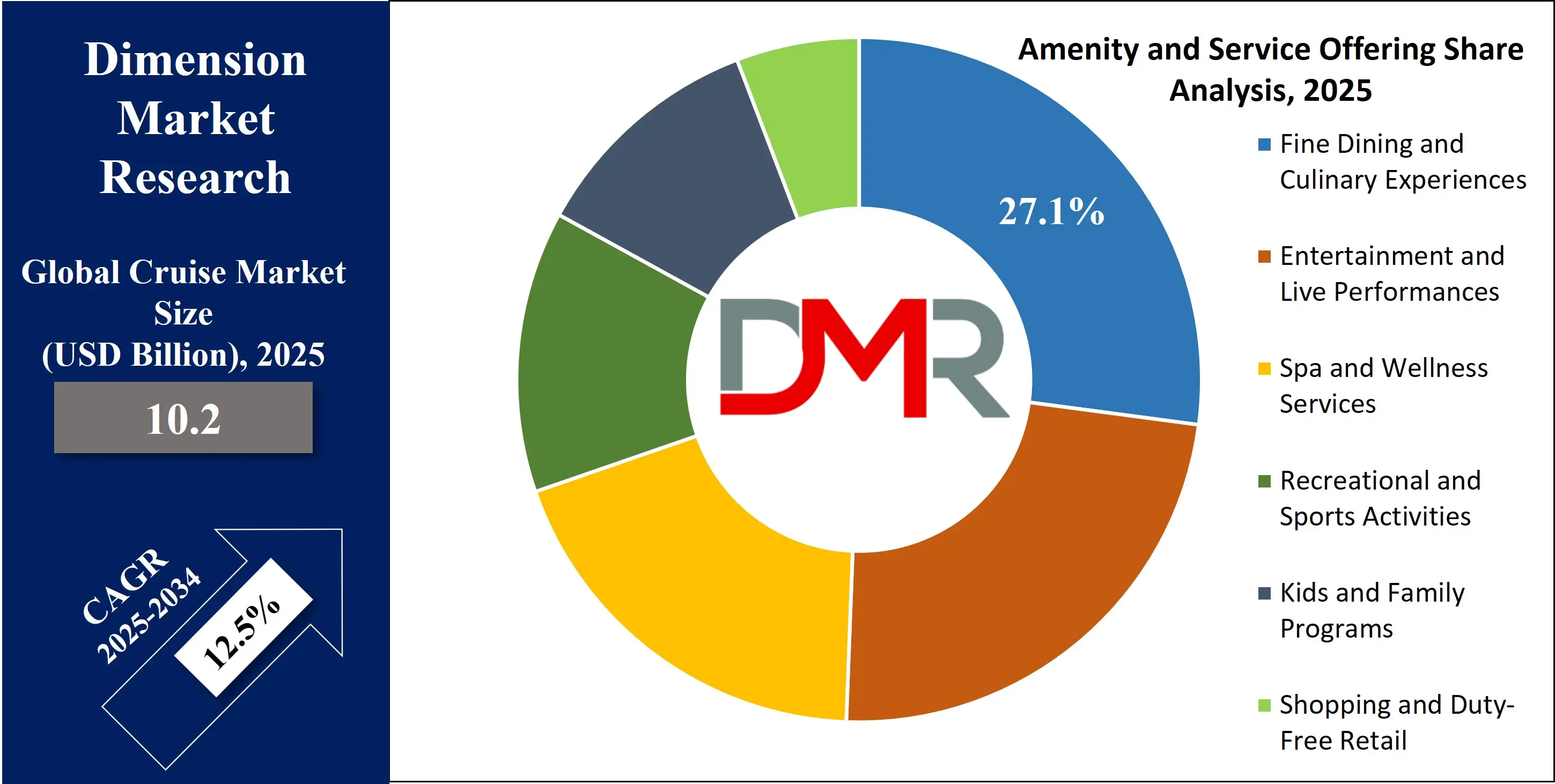

By Amenity and Service Offerings Analysis

Fine dining and culinary experiences are expected to dominate the amenity and service offerings segment because food remains a central element of the cruise experience, shaping passenger satisfaction, brand loyalty, and overall value perception. Onboard dining has evolved far beyond buffet-style offerings, with modern cruise lines showcasing multi-course gourmet meals, celebrity chef partnerships, regional specialties, and dietary customization. The all-inclusive nature of cruise dining makes passengers perceive high culinary value, elevating food service from a utility to a luxury experience. Fine dining also helps cruise brands differentiate themselves in a competitive marketplace by offering exclusive, themed, and reservation-only restaurants.

Culinary experiences serve as a cultural gateway, enabling passengers to explore international cuisines without disembarking. This appeals especially to food lovers, luxury travelers, and cruise tourists seeking immersive onboard experiences. Many ships now include wine-tasting rooms, chef’s tables, cooking classes, and farm-to-ship menus featuring locally sourced ingredients from port destinations. These offerings not only generate ancillary revenue but also boost onboard engagement and guest satisfaction.

From Asian fusion and Mediterranean feasts to vegan tasting menus and sustainable seafood platters, cruise lines invest heavily in kitchen talent and dining innovation. Fine dining also plays a vital role in themed voyages such as food and wine cruises, which attract niche markets and offer higher per-passenger spending. In an industry where word-of-mouth, reviews, and repeat bookings are crucial, exceptional dining ensures lasting impressions. This amenity category thus not only fulfills a basic need but also elevates cruising into a gourmet journey, making it the most influential service segment in terms of passenger experience and brand distinction.

By End User Analysis

Solo travelers are projected to emerge as a dominant end-user group within the cruise market due to shifting travel trends, increased social acceptance of solo adventures, and evolving cruise experiences designed specifically to cater to individuals traveling alone. This segment, which includes millennials, digital nomads, single seniors, and divorced or widowed individuals, is growing as people seek personal fulfillment, autonomy, and bucket-list adventures without the need for travel companions. Cruise operators are responding by eliminating single supplements, offering studio cabins, and developing solo-friendly social programs that foster connection while respecting independence.

The rise of solo travel aligns with broader societal changes such as delayed marriage, increasing individual wealth, and a prioritization of self-care and exploration. Cruises offer a secure and structured environment that provides solo travelers with the perfect balance of freedom and community. Onboard activities like group fitness classes, hobby workshops, networking dinners, and interest-based excursions provide ample opportunity for socialization. At the same time, solo cruisers can enjoy personal space through private cabins, self-guided tours, and quiet zones.

Cruise companies are actively designing loyalty programs and promotional packages targeting solo guests, including discounted fares and exclusive meet-ups. Technological innovations such as AI-enabled matchmaking apps for dining companions or shore tour buddies are also improving the solo cruise experience. As this demographic continues to grow in both volume and spending power, cruise lines are positioning themselves to capture a larger share by tailoring experiences that resonate with the solo travel ethos of freedom, flexibility, and discovery. The segment’s profitability and loyalty potential make it a powerful driver of growth and innovation across the industry.

The Global Cruise Market Report is segmented on the basis of the following

By Type

- Ocean Cruises

- River Cruises

- Expedition Cruises

- Luxury Cruises

By Propulsion Type

- Diesel-Powered Cruise Ships

- LNG-Powered Cruise Ships

- Hybrid Cruise Ships

- Electric Cruise Ships

By Amenity and Service Offerings

- Fine Dining and Culinary Experiences

- Entertainment and Live Performances

- Spa and Wellness Services

- Recreational and Sports Activities

- Kids and Family Programs

- Shopping and Duty-Free Retail

By End User

- Solo Travelers

- Families

- Business Travelers

Global Cruise Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global cruise market as it holds 43.0% of the total revenue by the end of 20225, due to a combination of favorable geography, robust infrastructure, and a deeply embedded cruise culture. The United States, particularly Florida, is home to some of the world’s busiest cruise ports, such as PortMiami, Port Canaveral, and Port Everglades, which serve as major departure hubs for cruises across the Caribbean, Central America, and transatlantic routes. The proximity of tropical destinations to U.S. ports enhances accessibility and shortens travel time, making cruising a convenient vacation choice for millions of Americans.

Additionally, North America benefits from a strong domestic demand base. Cruise Lines International Association (CLIA) reports that the U.S. accounts for the largest share of global cruise passengers annually. High disposable incomes, a tradition of family vacations, and a growing retiree population contribute to repeat bookings and longer voyage preferences. The region also leads in cruise innovation, with North American cruise lines investing heavily in technologically advanced vessels and onboard experiences. Strong marketing ecosystems, loyalty programs, and aggressive brand expansion by major players like Carnival, Royal Caribbean, and Norwegian further reinforce North America’s market leadership. Regulatory support and seamless integration of cruise operations with tourism boards also facilitate sustained growth.

Region with the Highest CAGR

Europe is witnessing the highest compound annual growth rate (CAGR) in the global cruise industry due to expanding port infrastructure, diversified itineraries, and rising intra-regional tourism. European countries such as Italy, Spain, France, and Greece offer rich cultural heritage, historical landmarks, and scenic coastal cities, making them ideal for both short and extended cruise itineraries. The increasing popularity of river cruises on the Danube, Rhine, and Seine also contributes significantly to market acceleration.

Europe's Schengen Zone and efficient transport connectivity make cross-border cruising hassle-free, attracting travelers from both within the continent and abroad. Additionally, rising disposable incomes in Eastern Europe and growing cruise interest in non-traditional markets such as Poland and the Czech Republic are boosting passenger volumes. Green tourism initiatives and environmental regulations are also prompting cruise operators to introduce modern, fuel-efficient ships tailored to European environmental standards. The segment’s growth is further fueled by small and mid-size cruise lines offering personalized experiences in niche destinations, resulting in heightened demand and sustained CAGR leadership.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cruise Market: Competitive Landscape

The global cruise market is characterized by a highly consolidated competitive landscape dominated by a few major players that collectively command a significant share of the global fleet and passenger traffic. Carnival Corporation & plc, Royal Caribbean Group, and Norwegian Cruise Line Holdings Ltd. represent the “big three” of the industry, operating numerous brands across various market tiers: luxury, premium, and mainstream. These companies invest heavily in fleet modernization, themed voyages, technology integration, and destination development to maintain their competitive edge.

Carnival leads in passenger capacity, operating brands such as Princess Cruises, Costa, and AIDA, while Royal Caribbean has carved out a strong niche with technologically innovative ships and immersive onboard experiences. Norwegian Cruise Line emphasizes freestyle cruising and boutique travel models, especially appealing to solo and young travelers.

Emerging players like MSC Cruises and Viking Cruises are expanding aggressively, particularly in Europe and Asia. These brands are differentiating through regional itineraries, sustainability commitments, and cultural immersion packages. Niche operators such as Seabourn and Silversea target the ultra-luxury segment with personalized services and expedition-style voyages. As consumer preferences evolve, competition is intensifying around experiential travel, green propulsion technologies, and diversified cruise formats, including river, expedition, and adventure cruises.

Some of the prominent players in the Global Cruise Market are

- Carnival Corporation & plc

- Royal Caribbean Group

- Norwegian Cruise Line Holdings Ltd.

- MSC Cruises

- Disney Cruise Line

- Princess Cruises

- Holland America Line

- Celebrity Cruises

- Costa Cruises

- AIDA Cruises

- Cunard Line

- P&O Cruises

- Seabourn Cruise Line

- Silversea Cruises

- Viking Cruises

- Azamara

- Oceania Cruises

- Regent Seven Seas Cruises

- Windstar Cruises

- Hurtigruten Expeditions

- Other Key Players

Recent Developments in the Global Cruise Market

April 2025

- Seatrade Cruise Global 2025: Held from April 7–10 in Miami Beach, this premier event for the cruise industry will feature discussions on sustainability, technology, itinerary planning, and luxury cruising, attracting over 11,000 attendees.

- Net Zero Maritime 2025 Conference: Scheduled for April 23–24 in Gothenburg, Sweden, this conference will focus on the maritime industry's path to decarbonization, exploring alternative fuels, emission reduction strategies, and technological advancements.

March 2025

- Norwegian Cruise Line's Investment in Great Stirrup Cay: Announced plans for a new two-ship pier at Great Stirrup Cay, set to open in late 2025, enhancing guest experience and increasing capacity from approximately 400,000 guests in 2024 to over one million in 2026.

January 2025

- FITUR Cruises 2025: Held from January 22–26 in Madrid, this event highlighted the cruise industry's achievements and future prospects, featuring the Cruceroadicto Awards and various networking activities.

December 2024

- Year in Review: Top Cruise Stories of 2024: Highlights included the launch of ten new cruise ships, the return of Western cruise lines to China, and significant ship orders by major cruise corporations, indicating a robust recovery and growth in the industry.

November 2024

- Cruise Forward Summit 2024: Held from November 6–8 in Miami, this summit brought together global cruise industry leaders to discuss sustainability, innovation, and strategic collaborations shaping the future of maritime travel.

April 2024

- Norwegian Cruise Line's Largest Ship Order: Placed an order for eight new vessels to be delivered between 2026 and 2036, marking the largest ship order in its history to meet rising demand for cruise travel.

- Cruise Saudi at Seatrade Cruise Global 2024: Participated in the event to showcase achievements and plans for developing a thriving cruise ecosystem in Saudi Arabia, emphasizing sustainable actions and products.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.2 Bn |

| Forecast Value (2034) |

USD 29.2 Bn |

| CAGR (2025–2034) |

12.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Ocean Cruises, River Cruises, Expedition Cruises, Luxury Cruises), By Propulsion Type (Diesel-Powered Cruise Ships, LNG-Powered Cruise Ships, Hybrid Cruise Ships, Electric Cruise Ships), By Amenity and Service Offerings (Fine Dining and Culinary Experiences, Entertainment and Live Performances, Spa and Wellness Services, Recreational and Sports Activities, Kids and Family Programs, Shopping and Duty-Free Retail), By End User (Solo Travelers, Families, Business Travelers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Carnival Corporation & plc, Royal Caribbean Group, Norwegian Cruise Line Holdings Ltd., MSC Cruises, Disney Cruise Line, Princess Cruises, Holland America Line, Celebrity Cruises, Costa Cruises, AIDA Cruises, Cunard Line, P&O Cruises, Seabourn Cruise Line, Silversea Cruises, Viking Cruises, Azamara, Oceania Cruises, Regent Seven Seas Cruises, Windstar Cruises, Hurtigruten Expeditions, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cruise Market size is estimated to have a value of USD 10.2 billion in 2025 and is expected to reach USD 29.2 billion by the end of 2034.

The US Cruise Market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10.0 billion in 2034 at a CAGR of 11.7%.

North America is expected to have the largest market share in the Global Cruise Market with a share of about 43.0% in 2025.

Some of the major key players in the Global Cruise Market are Carnival Corporation & plc, Royal Caribbean Group, Norwegian Cruise Line Holdings Ltd., MSC Cruises, Disney Cruise Line, Princess Cruises, Holland America Line, Celebrity Cruises, Costa Cruises, AIDA Cruises, Cunard Line, P&O Cruises, and many others.

The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.