Market Overview

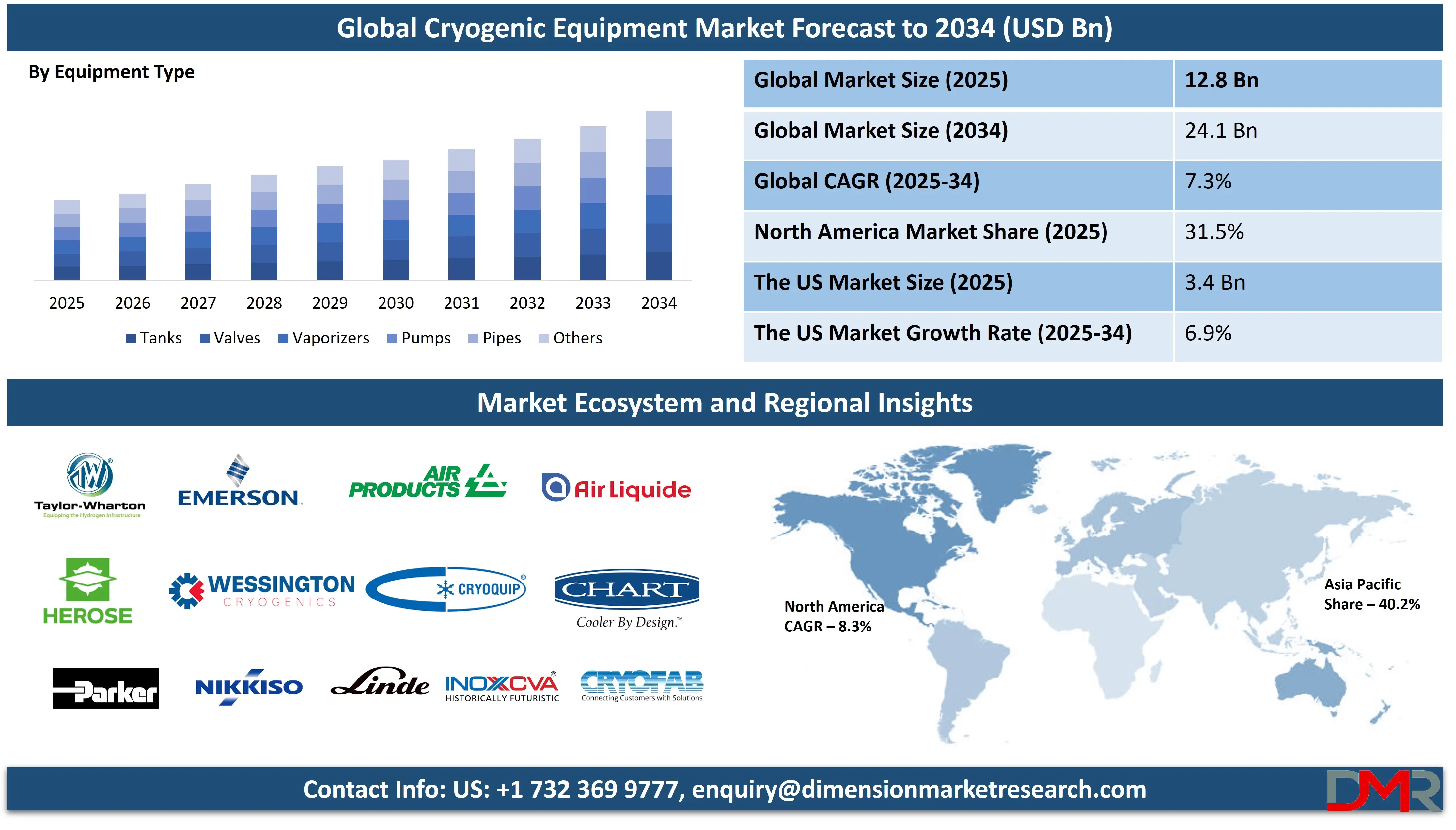

The Global Cryogenic Equipment Market size is projected to reach

USD 12.8 billion in 2025 and grow at a

compound annual growth rate of 7.3% from there until 2034 to reach a value of

USD 24.1 billion.

The global cryogenic equipment market shows strong market expansion because of increasing liquefied gases adoption primarily in the energy, healthcare, and electronics sectors. Cryogenic insulation technology and materials, together with monitoring systems, improve operational reliability and efficiency, so these systems are becoming viable for large-scale deployment. The market undergoes growth expansion due to these two factors: natural gas liquefaction as a clean fuel choice, combined

with emerging economy investments into their energy infrastructure networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Healthcare industry requires increased use of cryogenic equipment for keeping medical gases and biological samples, and vaccines because of the continuous expansion opportunities. The growth of activities in space exploration and semiconductor fabrication creates new opportunities for market expansion. The industrial gas production, together with LNG terminal development in Asia-Pacific and Middle Eastern developing economies, generates new possibilities for both cryogenic system manufacturers and suppliers to pursue business opportunities.

The market operations are constrained by expensive installation and upkeep expenses and complicated security standards for environmental conservation. Supply chain disruptions together with material shortages create substantial risks for operations during the recovery period following pandemic restrictions.

Cryogenic systems will experience their highest market growth in the Asia-Pacific region because of industrial development and growing energy consumption, followed by North America and Europe. The long-term potential of market growth can be built through increased research into hydrogen fuel technology and superconducting systems.

The US Cryogenic Equipment Market

The US cryogenic equipment market is projected to reach a valuation of USD 3.4 billion in 2025. Driven by a compound annual growth rate (CAGR) of 6.9% over the forecast period from 2025 to 2034, the market is expected to expand significantly, attaining an estimated value of USD 6.2 billion by the end of 2034.

The United States market for cryogenic equipment demonstrates significant growth due to its advanced industrial base and technological forefront, together with expanding applications across key sectors. The United States stands among the leading exporters of LNG and actively engages in hydrogen fuel development while serving as the primary driver of the energy industry. Market expansion occurs due to the rising demand for cryogenic valves, pumps, and tanks, which serve shale gas projects along with LNG terminals.

The healthcare industry heavily depends on cryogenic technologies because they maintain pharmaceutical compounds as well as biological materials, along with hospital oxygen supplies. The sustained demand for biomedical research and development within the country increases through major pharmaceutical companies and institutions such as the NIH, combined with biomedical research funding from the federal government. The defense sector, together with aerospace operations, uses cryogenic fuels as they power both missiles and satellites, respectively. Multiple innovation centers, together with manufacturing clusters located throughout Texas, California, and Pennsylvania, work to establish excellent business environments.

The United States obtains its demographic edge from its experienced industrial workers, who are accompanied by increasing medical service requirements. The adoption of renewable energy, especially green hydrogen, offers long-term opportunities. The support provided by government funding toward clean energy developments and advanced manufacturing activities helps drive innovation within cryogenic technology. Leading companies operating in the field, such as Chart Industries and Air Products, make the U.S. market a core element of the worldwide cryogenic system while strengthening the competitive structure and boosting supply chain stability.

The European Cryogenic Equipment Market

In 2025, the European cryogenic equipment market is estimated to be worth USD 2.25 billion. Sustained by increasing demand across critical sectors, the market is forecast to grow at a CAGR of 5.0%, reaching approximately USD 3.49 billion by the year 2034.

The European markets for cryogenic equipment operate under powerful regulatory standards, combined with eco-friendly energy policies together with sophisticated healthcare institutions. The European economic sector for hydrogen stands first, while initiatives under the EU Hydrogen Strategy boost the requirements for solutions regarding cryogenic storage and transport systems. German and French, and Dutch infrastructure development includes investments to build LNG and hydrogen infrastructure projects.

Europe operates a well-developed healthcare industry that depends on cryogenic systems to store oxygen, along with handling vaccine logistics and conducting laboratory research. Cryogenic gases serve the food and beverage industry for freezing methods and packaging applications, thus enhancing the market's aspect. Cryogenic vaporizers combined with pipes and tanks serve as essential equipment across metallurgy and manufacturing processes throughout the region because of their superior engineering capability.

European companies operated by Linde alongside Air Liquide contribute significantly to industry technological growth and market stabilization. The well-educated population, along with increased environmental awareness, drives renewable technology adoption since many renewable technologies procure cryogenic substances.

Members of the EU use funding programs alongside collective research and development efforts across states to drive innovation. High operational expenses notwithstanding, Europe provides an attractive environment because of its tight quality protocols along with regulatory consistency for high-end cryogenic systems. The region maintains investments in sustainable cryogenic applications for industrial and scientific domains through its decarbonization and electrification initiatives.

The Japan Cryogenic Equipment Market

The Japanese market for cryogenic equipment is forecasted to reach USD 768 million in 2025. Accelerated by technological advancements and expanding applications, the industry is projected to grow at a CAGR of 6.0% through 2034, ultimately reaching a value of USD 1.30 billion.

The cryogenic equipment market in Japan demonstrates a strong dedication to exact engineering solutions and advanced production technology, together with energy advancement ability. Japan maintains its position as a global technology leader by using cryogenic systems in superconductors and aerospace industries, as well as semiconductors and energy operations. Through the push to decrease carbon emissions, Japan has significantly raised investments across hydrogen infrastructure components such as storage systems and fueling technology.

Japan maintains an advanced healthcare system that depends more and more frequently on cryogenic technologies to safeguard pharmaceuticals, in addition to blood samples and medical gases. Japan requires cryogenic solutions as an essential part in its space exploration program and scientific research activities, particularly through telescope applications and MRI technology. Japan dedicates cryogenic pumps and valves to semiconductor manufacturing in its essential electronics sector.

The combination of Kawasaki Heavy Industries and international competitors maintains strong domestic market positions due to government support for clean technology and industrial research initiatives.

The aging demographics in Japan create healthcare growth through the expansion of services, while the high-tech industrial labor prospects drive the nation forward. Both public entities and private sector organizations form partnerships that support the swift implementation of state-of-the-art technology solutions.

Disaster-resilient infrastructure within Japan makes it possible to utilize secure and efficient cryogenic systems in emergency energy supply and medical readiness situations. Japan maintains its status as an Asian strategic center for cryogenic equipment development and deployment because of the harmonious relationship between policy research and industrial activities.

Global Cryogenic Equipment Market: Key Takeaways

- The Global Market Size Insights: The Global Cryogenic Equipment Market size is estimated to have a value of USD 12.8 billion in 2025 and is expected to reach USD 24.1 billion by the end of 2034

- The US Market Size Insights: The US Cryogenic Equipment Market is projected to be valued at USD 3.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.2 billion in 2034 at a CAGR of 6.9%.

- Regional Market Insights: Asia Pacific is expected to have the largest market share in the Global Cryogenic Equipment Market with a share of about 40.2% in 2025.

- Key Players: Some of the major key players in the Global Cryogenic Equipment Market are Linde, Air Liquide, Air Products, Chart Industries, Cryofab, INOX India, Cryoquip, Nikkiso, Wessington, Herose, Emerson, Parker Hannifin, and many others.

- Global Market Growth Rate Insights: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

Global Cryogenic Equipment Market: Use Cases

- LNG Storage & Transport: The safety of liquefied natural gas (LNG) transportation depends upon the combination of cryogenic tanks and pipes, along with valves, since LNG needs to remain below -162°C. Such systems provide vital support for international energy markets, particularly valuable during the process of shifting to cleaner power sources. Modern energy logistics depend heavily on cryogenic infrastructure since the world increases its LNG consumption through decarbonization actions and energy security needs.

- Medical Cold Chain: Healthcare facilities, together with biobanks as well as pharmaceutical companies, depend on cryogenic freezers and dewars, and vessels to store their vital temperature-sensitive healthcare materials such as vaccines and blood plasma and stem cells, and organ transplants. These systems ensure biological protection and prevent deterioration, thus remaining essential for medicine-based emergencies and advanced medical treatments, and global health supply operations throughout pandemic responses and mRNA vaccine deliveries.

- Semiconductor Manufacturing: Semiconductor production processes need extremely clean areas that maintain cold conditions, achieved through vacuum pumps combined with gases like nitrogen and helium. The resulting technologies function to minimize system temperature variations and reduce particles within manufacturing environments, and maintain steady production conditions. Cryogenic systems play an essential role in electronics manufacturing development as chip production scales down.

- Space Propulsion Systems: Space exploration requires cryogenic technology because it enables propellant storage and delivery of liquid oxygen and liquid hydrogen at freezing temperatures. The combustion efficiency, coupled with a high energy density of cryogenic fuels, leads to extended missions and heavier possible payloads for space exploration. Mission success heavily depends on cryogenic equipment because space companies steadily increase their lunar exploration and satellite deployment, and commercial space travel activities.

- Metal Processing: Applied in metallurgy, cryogenic applications accomplish three primary processes, such as cryo-hardening and shrink fitting, and controlled thermal cycling to produce improved strength and wear resistance along with precisely manufactured components. The production sector of the aerospace and automotive industries and machine manufacturing implements these methods frequently. The applications of cryogenic treatment reduce residual stress and distortion, which leads to increased product reliability and extended service life for critical applications..

Global Cryogenic Equipment Market: Stats & Facts

- U.S. Energy Information Administration (EIA): In 2023, U.S. LNG exports exceeded 10 billion cubic feet per day, underscoring the country’s growing need for advanced cryogenic systems to support the secure handling, storage, and overseas shipment of natural gas.

- International Energy Agency (IEA): Hydrogen output could climb to 130 million tonnes by 2030, with surging green hydrogen initiatives boosting global investment in cryogenic pipelines and containers designed to safely store and move supercooled liquid hydrogen over long distances.

- Air Liquide Sustainability Report 2023: In 2023, Air Liquide dedicated over €1 billion to decarbonization and hydrogen development, with cryogenic liquefaction, storage, and transport infrastructure forming a critical part of its long-term strategy to deliver clean, low-carbon industrial solutions.

- World Health Organization (WHO): The COVID-19 crisis caused a dramatic surge in medical oxygen needs, requiring hospitals across various nations to install expanded cryogenic tanks and delivery systems to meet the heightened demand for life-saving liquid oxygen supplies.

- NASA: Cryogenic fuels like liquid hydrogen and oxygen are essential for space missions, with NASA relying on precise cryogenic infrastructure to manage the extreme cooling, safe containment, and fueling of spacecraft under the Artemis and other exploration programs.

- U.S. Department of Energy (DOE): The DOE’s $750 million investment in 2023 supported hydrogen hubs and infrastructure, where cryogenic components used in liquefying and moving hydrogen were designated as vital to developing a national hydrogen economy and meeting clean energy goals.

- International Gas Union (IGU): Liquefied natural gas now makes up more than 13% of global gas commerce, with the sector dependent on cryogenic engineering to ensure safe, efficient storage, transport, and regasification of LNG across international supply chains.

Global Cryogenic Equipment Market: Market Dynamics

Driving Factors in the Global Cryogenic Equipment Market

Surge in LNG Demand and Infrastructure DevelopmentLiquefied natural gas (LNG) demand acts as the main expansion catalyst that drives the cryogenic equipment market development. The switch to cleaner alternatives of coal and oil is driving countries toward LNG as their main interim fuel choice. Tanks, together with valves and pumps, together with vaporizers are necessary cryogenic equipment for all stages of LNG liquefaction, transportation, and regasification processes.

The countries of China and India, together with Germany, construct LNG terminals and supply chains through government policy support and international business partnerships. The increasing number of marine vessels and heavy transport vehicles that switch to LNG-fueled engines drives up demand for mobile and stationary cryogenic systems. U.S. and Qatar, as the world's leading LNG export nations, continue to expand their natural gas value chain operations, which lead to intensified development of cryogenic storage and shipping solutions.

Growth in Healthcare and Biomedical Applications

Cryogenic equipment functions as a core component in healthcare facilities and the life sciences because these applications need it for vaccine storage and biological specimens, organ transplants, as well as medical gas preservation. The COVID-19 pandemic led healthcare facilities worldwide to focus on cryogenic freezers and oxygen tanks when they needed to increase their cold storage capabilities. Advanced biotechnology, gene therapy, and cell-based treatments require ultracold temperature storage facilities, thereby increasing their importance.

The preservation of cells with integrity and the prevention of contamination depend on using cryogenic containers in clinical areas. Cryogenic technologies enable both the proper functioning of MRI devices and other diagnostic equipment. The widening accessibility of global healthcare demands reliable and efficient cryogenic solutions because developing economies are increasing their need for these systems.

Restraints in the Global Cryogenic Equipment Market

High Capital and Maintenance Costs

The cryogenic equipment market faces its primary challenge in the form of substantial installation costs, together with operational expenses. The engineering process requires systems to work under harsh pressures and temperatures, with stainless steel and nickel alloys and vacuum-insulated panels as specialized materials. Advanced engineering specifications alongside specialized materials enhance capital costs by creating the need for leak prevention systems and thermal insulation, thus making cryogenic systems expensive to produce.

The operation process needs specialized personnel following strict safety rules, which results in increased maintenance expenses. Small to medium enterprise owners have trouble funding new or updated cryogenic systems because they lack funding or expertise in regions lacking financial or technical resources. Cost barriers stop many organizations from selecting cryogenic systems, particularly in developing nations.

Regulatory Complexity and Safety Concerns

Strict regulatory rules oversee cryogenic equipment due to its danger as a vessel of liquefied gases. Each geographical territory demands specific regulations that determine all aspects from equipment verification to storage procedures and both operational pressure limits and transport safety protocols. The complicated array of regulatory rules that manufacturers and operators need to follow presents obstacles during their operations.

Additionally, the risk of leaks, pressure buildup, and frostbite incidents necessitates rigorous safety training, inspections, and compliance measures. The noncompliance with regulatory needs will result in operational halts, along with regulatory penalties and environmental destruction. The time needed for developing new products while project delays and elevated total ownership costs serve as major market restrictions.

Opportunities in the Global Cryogenic Equipment Market

Expansion of the Hydrogen Economy and Fuel Infrastructure

The global shift toward hydrogen fuel produces extensive market possibilities for equipment that operates in sub-zero temperatures. Cryogenic conditions at temperature levels below -253°C are necessary to liquefy hydrogen before it can be distributed. Because countries pledge their commitment to reaching net-zero emissions, they dedicate significant financial resources toward hydrogen production facilities and liquefaction plants, together with the creation of refueling stations and storage networks requiring state-of-the-art cryogenic systems.

These upcoming hydrogen ecosystems provide an opportunity for companies that specialize in producing cryogenic pumps, tanks, and vaporizers to support their development. Modern hydrogen infrastructure growth receives a speedup from funding through organizations like the European Union and the U.S. Department of Energy, and the Japanese government, in addition to public-private consortia. The sector for cryogenic equipment technology has established itself as a rapidly evolving market segment.

Rise of Cryogenics in Quantum Computing and Space Exploration

Current aerospace research and quantum computing operations, as well as particle physics applications, heavily depend on advanced cryogenic systems. Engineers cool quantum computers down to sub-zero levels for quantum coherence while requiring highly stable cryogenic systems. Technology companies combined with research facilities direct money into developing future cryostats as well as helium refrigeration units and superconducting environments.

Space agencies utilize liquid hydrogen along with oxygen as their cryogenic propellants for powering rockets, together with space satellites. Expanded space exploration now includes private companies, including SpaceX and Blue Origin, which drives up demand for specialized cryogenic hardware systems. Specialty high-growth market segments present beneficial commercial potential for manufacturers of cryogenic equipment who want to both expand their business scope and bring forward innovative solutions.

Trends in the Global Cryogenic Equipment Market

Transition Toward Clean Energy and Hydrogen Economy

The gradual rise in the adoption of clean power systems combined with hydrogen economic models represents a significant market development. Implementing clean energy sources, including hydrogen and liquefied natural gas (LNG), stands as the most prominent trend in the cryogenic equipment market worldwide. Governments, together with corporations, direct their attention toward energy system decarbonization through provisioning crucial support from cryogenic equipment that manages ultra-low temperature fuel transportation and storage networks.

A rapid increase in demand for cryogenic tanks and vaporizers, as well as pipelines, has emerged because of expanding large-scale hydrogen production and distribution networks, especially in Europe and the U.S. Japan and South Korea. The equipment requires advanced insulation systems and materials to function with cryogenic fuels at -253°C temperatures, which drives continuous innovation for safety and insulation materials. The integration of cryogenic logistics occurs under national and regional hydrogen plans totaling billions of dollars that combine renewable energy elements within their framework.

Integration of Smart Technologies and AutomationThe adoption of automation technology together with intelligent systems represents an important emerging trend in cryogenic system management. The adoption of

Internet of Things (IoT)-enabled sensors, together with real-time monitoring software as well as remote diagnostic systems, has become widespread among operators from various industries to enhance performance, safety, and maintenance.

The implementation of automatic cryogenic systems eliminates operator mistakes and provides steady temperature operations in crucial fields, including pharmaceuticals, as well as LNG regasification terminals, together with superconducting environmental conditions. Artificial intelligence systems, together with predictive analytics, are used to detect equipment failures in advance, thereby reducing equipment downtime. The smart systems help businesses achieve environmental safety standards through continuous emissions and pressure monitoring capabilities. Digital transformation keeps reshaping industrial sectors such that cryogenic equipment becomes progressively smarter and more efficient, and integrated systems.

Global Cryogenic Equipment Market: Research Scope and Analysis

By Equipment Type Analysis

Tanks are projected to dominate the equipment type segment in the cryogenic equipment market due to their critical function within low-temperature storage of liquefied gases. Tanks maintain their position as the leading equipment type in the cryogenic equipment market as the storage and distribution of nitrogen, oxygen, and LNG gases as liquids require the utilization of cryogenic tanks, which ensures safe extended-distance transportation of these substances. The extensive number of industries utilizing long-term cryogenic storage creates this dominance because tanks serve as the main equipment storage solution.

The LNG market expansion leads to increased demand for cryogenic tanks because it requires powerful and large-scale storage systems. Increased worldwide importance of LNG as a clean energy source drives the necessity for tanks that provide a reliable distribution system. Cryogenic storage tanks made to high standards remain essential for protecting safety and avoiding leaks during medical and industrial applications, which utilize nitrogen and oxygen as well as other liquefied gases.

Platform enhancements involving tank materials, along with insulation development and construction methods, have transformed cryogenic tanks into more technologically advanced and cost-efficient solutions. The dominance of tanks in the market continues because industries need reliable, long-lasting solutions. Tanks maintain their position as the main equipment type in the cryogenic market since they serve as fundamental components for safeguarding significant cryogenic substance quantities at sub-zero temperatures.

By Cryogen Type Analysis

The global market forecast suggests that nitrogen will dominate the cryogen type segment because of its extensive industrial usage, along with its wide range of applications. The Earth's atmosphere contains nitrogen abundantly at affordable prices so it functions as the basic cryogen selection for numerous industrial as well as medical and scientific operations. The inert quality of liquid nitrogen makes it vital for operations having controlled environments in multiple crucial sectors.

Liquid nitrogen functions as a vital element in healthcare by enabling both cryopreservation and surgical procedures known as cryosurgery that damage unnecessary tissues. The storage needs of biological samples and vaccines depend on nitrogen support for successful medical cold chain systems as well as tissue bank operations.

Liquid nitrogen enables flash-freezing of food products while it extends their shelf life through its application in the food and beverage industry to maintain product quality. Nitrogen plays key roles in electronics production for semiconductor manufacturing as well as supplying inert atmospheres for different chemical reactive operations.

The widespread application of nitrogen for metal production and cooling and inerting processes establishes its dominance since it is extensively used in industrial operations. The abundant uses and low cost together with the wide applicability of liquid nitrogen ensure its title as the primary cryogenic solution across established and emerging sectors within the cryogenic equipment market.

By Application Analysis

The storage application leads the global cryogenic equipment market because proper storage maintains gas viability along with safety levels. Storage systems operate at low temperatures to preserve gases such as nitrogen and oxygen and LNG because they need to remain stable as liquids for industrial and medical, and energy applications. The market for cryogenic equipment depends on storage applications because they provide an essential stable supply of vital gases, which ranks as the primary application.

Increased LNG use as an energy source serves as one essential factor that drives storage applications to dominate the market. The rapid construction of LNG infrastructure takes place across countries to satisfy increasing energy requirements during their shift towards renewable power systems. The safe, long-term, efficient storage of LNG requires state-of-the-art cryogenic solutions because of these operational needs. The healthcare field maintains expanding demand for cryogenic storage that supports vaccines, together with biological specimens and medical gases, due to population aging and enhancements in biotechnological developments.

Industrial operations involved with metal fabrication, together with food freezing applications and chemical manufacturing, depend on stable cryogenic fluid storage while making the need for cryogenic storage systems more critical. All aspects of storage tank development, including insulation technology and safety measures for cryogens, work together to enhance storage solution performance, which secures their position as leaders within the cryogenic equipment industry.

By End-User Industry Analysis

The oil and gas industry is projected to dominate the end-user industry in the global cryogenic equipment market, primarily due to its heavy reliance on cryogenic technologies for the storage, transportation, and liquefaction of natural gas. The oil and gas sector is experiencing rapid growth in liquefied natural gas (LNG) production and distribution, as countries transition to cleaner energy sources and aim to reduce carbon emissions. Cryogenic equipment, including tanks, valves, vaporizers, and pumps, is essential in safely storing and transporting LNG, which requires extremely low temperatures to maintain its liquid state.

Furthermore, cryogenic technologies are pivotal in the extraction and refinement processes of natural gas and crude oil. Nitrogen, used for purging pipelines and as an inerting gas during oil drilling, also plays a significant role in ensuring safety and efficiency in these operations. As LNG becomes an increasingly important part of the global energy mix, the demand for cryogenic equipment in oil and gas applications will continue to rise.

The oil and gas industry’s large-scale infrastructure projects, such as LNG terminals and storage facilities, require specialized cryogenic equipment to meet both safety and efficiency standards. Additionally, the growth in offshore and deepwater oil drilling operations, where cryogenic systems are used to maintain the integrity of equipment under extreme conditions, further drives the sector's dominance in the market. As global energy demand rises and the oil and gas industry invests in cleaner energy technologies, cryogenic equipment remains critical to the industry's ongoing evolution and growth.

The Global Cryogenic Equipment Market Report is segmented on the basis of the following

By Equipment Type

- Tanks

- Valves

- Vaporizers

- Pumps

- Pipes

- Others

By Cryogen Type

- Nitrogen

- Oxygen

- Argon

- Liquefied Natural Gas (LNG)

- Hydrogen

- Helium

- Others

By Application

- Storage

- Transportation

- Distribution

- Processing

By End-Use Industry

- Oil & Gas

- Energy & Power

- Metallurgy

- Electronics

- Healthcare (Medical & Pharmaceuticals)

- Chemical

- Food & Beverage

- Others

Global Cryogenic Equipment Market: Regional Analysis

Region with the Highest Market Share in the Cryogenic Equipment Market

Asia-Pacific is projected to dominate the global cryogenic equipment market as it commands over

40.2% of market share in 2025, due to its strong industrial base, rapid urbanization, and increasing energy demand. The region is home to some of the largest LNG producers and consumers, including countries like China, India, and Japan, which rely heavily on cryogenic technologies for energy storage and transportation. China, as the largest consumer of LNG, is investing heavily in LNG infrastructure, propelling demand for cryogenic tanks, pumps, and vaporizers. Additionally, Asia-Pacific is the epicenter for key manufacturing sectors such as electronics, pharmaceuticals, and chemicals, where cryogenic equipment is used for freezing, preservation, and material handling.

Furthermore, Japan and South Korea's push for hydrogen infrastructure, along with government initiatives in clean energy, adds to the market's growth. As countries in the region prioritize industrialization and infrastructure development, cryogenic equipment is essential in supporting these advancements, thereby maintaining Asia-Pacific’s dominance. With the expansion of healthcare and food processing sectors, the need for cryogenic storage and transportation systems will continue to grow, ensuring Asia-Pacific’s long-term market leadership.

Region with the Highest CAGR in the Cryogenic Equipment Market

North America is projected to experience the highest compound annual growth rate (CAGR) in the cryogenic equipment market due to a combination of increasing investments in clean energy, advancements in hydrogen infrastructure, and expanding LNG infrastructure. The United States, as a leading producer of natural gas and LNG, is seeing significant demand for cryogenic technologies to support the liquefaction, storage, and transportation of LNG. Additionally, the region's focus on renewable energy and hydrogen solutions is driving growth, with companies investing heavily in cryogenic storage systems for hydrogen production, storage, and distribution.

The oil and gas industry in North America is also a significant driver, with advancements in offshore drilling and deepwater exploration requiring specialized cryogenic equipment. The adoption of smart technologies, automation, and digital solutions in cryogenic systems further contributes to market growth. These trends, combined with government policies and private-sector investment in energy infrastructure, are pushing North America to lead the market in terms of CAGR, positioning it as a rapidly evolving hub for cryogenic equipment technologies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cryogenic Equipment Market: Competitive Landscape

The competitive landscape of the global cryogenic equipment market is characterized by the presence of several prominent players who are driving innovation, technological advancements, and expanding their market presence. Leading companies like Air Liquide, Linde Group, Cryogenic Systems, Chart Industries, and McDermott International dominate the market, offering a wide range of cryogenic solutions including tanks, vaporizers, pumps, and valves. These companies focus on strategic mergers, acquisitions, and partnerships to strengthen their portfolios and market presence, particularly in the high-demand LNG and hydrogen sectors.

The industry is marked by continuous R&D investments aimed at improving the efficiency, safety, and scalability of cryogenic systems. Companies are also increasingly investing in smart and automated cryogenic solutions, which help improve operational efficiency and reduce maintenance costs. With the growing focus on clean energy, the demand for cryogenic technologies for hydrogen production, storage, and transportation is creating new growth opportunities for manufacturers.

In addition to large players, several regional and niche market players are capitalizing on specialized applications in healthcare, aerospace, and food and beverage industries. As the market continues to expand, competition is expected to intensify, with companies focusing on innovation, sustainability, and customer-specific solutions to maintain a competitive edge.

Some of the prominent players in the Global Cryogenic Equipment Market are:

- Linde plc

- Air Liquide

- Air Products and Chemicals, Inc.

- Chart Industries, Inc.

- Cryofab, Inc.

- INOX India Pvt. Ltd.

- Cryoquip LLC

- Nikkiso Co., Ltd.

- Wessington Cryogenics

- Herose GmbH

- Emerson Electric Co.

- Parker Hannifin Corporation

- VRV S.p.A.

- Fives Group

- IWI Cryogenic Vaporization Systems (IWI Cryo)

- ACME Cryogenics, Inc.

- Taylor-Wharton International LLC

- Technifab Products, Inc.

- Lapesa Grupo Empresarial, S.L.

- Cryostar SAS

- Other Key Players

Recent Developments in the Global Cryogenic Equipment Market

- October 2024: The Korea Institute of Machinery and Materials developed a cryogenic turboexpander capable of cooling gases to -183°C, significantly improving efficiency in the storage and transportation of hydrogen and natural gas across industrial energy systems and infrastructures.

- September 2024: Inox India Ltd. secured patent rights for a new cryogenic cold storage unit, strengthening its competitive edge in the industrial gases sector while advancing technological capabilities for improved thermal insulation and cryogenic preservation applications in domestic and global markets.

- August 2024: Researchers in the GW4 alliance received €2.6 million in funding to launch the region’s first cryo-FIB-SEM, a cryogenic electron microscope enhancing protein imaging and biological sample research through high-resolution analysis under extremely low temperature conditions.

- June 2024: Hypro introduced a new range of cryogenic tanks tailored for safe storage and transportation of liquid oxygen, nitrogen, and carbon dioxide, targeting the growing demand across medical, food processing, and industrial manufacturing applications globally.

- May 2024: Plug Power signed an agreement to deliver five advanced cryogenic trailers to a global industrial gas company in Canada, enhancing distribution capacity for critical cryogenic gases in sectors including healthcare, energy, and heavy manufacturing.

- April 2024: Air Water Inc. acquired UK-based M1 Engineering to expand its European footprint and improve its hydrogen distribution infrastructure, focusing on cryogenic solutions that meet growing demands for cleaner energy transportation technologies and industrial applications.

- July 2023: Chart Industries opened a new manufacturing facility in Alabama, enabling production of the world’s largest shop-built cryogenic tanks, supporting aerospace, hydrogen, and LNG supply chains with expanded capacity and rapid deployment of specialized equipment.

- June 2023: UConn Health obtained $1.5 million in NIH funding to install a cutting-edge cryo-electron microscope, empowering researchers with deeper insight into biomolecular structures through enhanced imaging capabilities under ultra-low temperature conditions.

- May 2023: Cole-Parmer launched the Cryo-Blade, an advanced cryogenic grinding device designed to process biological and chemical samples under ultra-cold conditions, ensuring preservation of molecular integrity for laboratory, pharmaceutical, and academic research applications.

- March 2023: INOXCVA began constructing India’s largest cryogenic equipment facility in Vadodara, investing INR 200 crore to expand production of liquid gas storage and transport systems, reinforcing its domestic and international manufacturing capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 12.8 Bn |

| Forecast Value (2034) |

USD 24.1 Bn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Equipment Type (Tanks, Valves, Vaporizers, Pumps, Pipes, Others), By Cryogen Type (Nitrogen, Oxygen, Argon, LNG, Hydrogen, Helium, Others), By Application (Storage, Transportation, Distribution, Processing), And By End-Use Industry (Oil & Gas, Energy & Power, Metallurgy, Electronics, Healthcare, Chemical, Food & Beverage, Others). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Linde, Air Liquide, Air Products, Chart Industries, Cryofab, INOX India, Cryoquip, Nikkiso, Wessington, Herose, Emerson, Parker Hannifin, VRV, Fives Group, IWI Cryo, ACME Cryogenics, Taylor-Wharton, Technifab, Lapesa, and Cryostar., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|